Washington, D.C. 20549

City National Rochdale High Yield Alternative Strategies

Master Fund LLC

Financial Statements

September 30, 2021 (Unaudited)

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Financial Statements

September 30, 2021 (Unaudited)

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Statement of Assets, Liabilities and Members’ Capital

September 30, 2021 (Unaudited)

| ASSETS | | |

| Investments, at fair value (cost $262,589) | | $ | 351,251 | |

| Interest receivable | | | 191 | |

| | | | | |

| Total Assets | | | 351,442 | |

| | | | | |

| LIABILITIES AND MEMBERS’ CAPITAL | | | | |

| Liabilities | | | | |

| Administration fee payable | | | 27,852 | |

| Audit fees payable | | | 25,000 | |

| Legal fees payable | | | 4,532 | |

| Accrued expenses and other liabilities | | | 11,596 | |

| Total Liabilities | | | 68,980 | |

| Total Members’ Capital | | $ | 282,462 | |

The accompanying notes are an integral part of these financial statements.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Statement of Operations

Period Ended September 30, 2021 (Unaudited)

| INVESTMENT INCOME | | |

| Interest income | | $ | 1,307 | |

| | | | | |

| EXPENSES | | | | |

| Legal fees | | | 97,868 | |

| Management fees (see Note 4) | | | 40,623 | |

| Administration fees | | | 54,420 | |

| Proxy solicitation expense | | | 5,549 | |

| Custody fees | | | 3,933 | |

| Audit fees | | | 1,030 | |

| Other expenses | | | 4,724 | |

| | | | | |

| Total Expenses | | | 208,147 | |

| | | | | |

| Net Investment Loss | | | (206,840 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN | | | | |

| ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 1,489,352 | |

| Net change in unrealized depreciation on investments | | | (1,185,641 | ) |

| | | | | |

| Net Realized Gain and Unrealized Gain on Investments | | | 303,711 | |

| | | | | |

| Net Increase in Members’ Capital Resulting from Operations | | $ | 96,871 | |

The accompanying notes are an integral part of these financial statements.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Statements of Changes in Members’ Capital

| | | | | |

| | | Period Ended

September 30, 2021

(Unaudited) | | | Year Ended

March 31, 2021 | |

| | | | | | | |

| FROM OPERATIONS | | | | | | | | |

| Net investment loss | | $ | (206,840 | ) | | $ | (455,782 | ) |

| Net realized gain on investments | | | 1,489,352 | | | | 196,147 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (1,185,641 | ) | | | 6,363,221 | |

| | | | | | | | | |

| Net Increase in Members’ Capital | | | | | | | | |

| Resulting From Operations | | | 96,871 | | | | 6,103,586 | |

| | | | | | | | | |

| DECREASE FROM TRANSACTIONS | | | | | | | | |

| IN MEMBERS’ CAPITAL | | | | | | | | |

| Proceeds from sales of members’ interests (see Note 2) | | | 126,351 | | | | 126,416 | |

| Capital transfers to feeder funds | | | (21,444,758 | ) | | | (1,165,183 | ) |

| Net Decrease from Transactions in Members’ Capital | | | (21,318,407 | ) | | | (1,038,767 | ) |

| | | | | | | | | |

| Total Increase (Decrease) in Members’ Capital | | | (21,221,536 | ) | | | 5,064,819 | |

| | | | | | | | | |

| MEMBERS’ CAPITAL | | | | | | | | |

| | | | | | | | | |

| Beginning of year | | | 21,503,998 | | | | 16,439,179 | |

| | | | | | | | | |

| End of period | | $ | 282,462 | | | $ | 21,503,998 | |

The accompanying notes are an integral part of these financial statements.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Statement of Cash Flows

Period Ended September 30, 2021 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES | | |

| Net increase in members’ capital resulting from operations | | $ | 96,871 | |

| | | | |

| Adjustments to reconcile net increase in members’ capital resulting from operations to net cash provided by operating activities: | | | | |

| Sales of investments | | | 19,070,467 | |

| Purchases of money market fund | | | (9,823,153 | ) |

| Sales of money market fund | | | 12,348,887 | |

| Net change in unrealized depreciation on investments | | | 1,185,641 | |

| Net realized gain on investments | | | (1,489,352 | ) |

| | | | | |

| Change in Operating Assets and Liabilities: | | | | |

| Interest receivable | | | (123 | ) |

| Management fees payable | | | (28,696 | ) |

| Audit fees payable | | | (34,910 | ) |

| Administration fee payable | | | (9,476 | ) |

| Legal fees payable | | | (3,468 | ) |

| Directors fees payable | | | (150 | ) |

| Accrued expenses and other liabilities | | | 5,869 | |

| | | | | |

| Net Cash provided by Operating Activities | | | 21,318,407 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from sales of members’ interests (see Note 2) | | | 126,351 | |

| Capital transfers to feeder funds | | | (21,444,758 | ) |

| | | | | |

| Net Cash used in Financing Activities | | | (21,318,407 | ) |

| | | | | |

| Net Change in Cash | | | — | |

| | | | | |

| CASH | | | | |

| Beginning of year | | | — | |

| | | | | |

| End of period | | $ | — | |

The accompanying notes are an integral part of these financial statements.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Schedule of Investments

September 30, 2021 (Unaudited)

| | | | | | | | | Redemptions | |

| | | Percentage of

Members’ Capital | | | Cost | | | Fair Value | | | Frequency | | | Notice Period

# of Days | |

| Long-Term Alternative Investment Fund: (1) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Liquidating Position: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| GoldenTree Partners LP (2) | | 71.9 | | | | 114,378 | | | | 203,040 | | | * |

| | * |

|

| (Acquired: 7/2/2007, 8/1/2007, 11/1/2007, 12/3/2007, 2/1/2008, 7/1/2012, and 8/1/2012) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total Long-Term Alternative Investment Fund: | | 71.9 | | | | 114,378 | | | | 203,040 | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Short-Term Investment: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Money Market Fund: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

First American Government Obligations Fund - Class Z, 0.02% (3) | | 52.5 | | | | 148,211 | | | | 148,211 | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total Investments | | 124.4 | % | | $ | 262,589 | | | $ | 351,251 | | | | | | | |

(1) All investments are non-income producing.

(2) Remaining value represents side pocket interests.

(3) 7-day yield at September 30, 2021.

* A side pocket investment has been established for GoldenTree Partners LP. This investment is long-term and illiquid.

The investments in Alternative Investments Funds shown above, representing 71.9% of net assets, have been fair valued in accordance with procedures established by the Board of Directors.

See accompanying Notes to Schedule of Investments.

The accompanying notes are an integral part of these financial statements.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Schedule of Investments, Continued

September 30, 2021 (Unaudited)

Liquidating Positions. Liquidating positions from former investment strategies remain in the Fund due to redemption restrictions placed on the Fund by investment fund managers either at their sole discretion or for other reasons. Such reasons include the magnitude of redemptions requested, portfolio valuation issues and market conditions.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Schedule of Investments, Continued

September 30, 2021 (Unaudited)

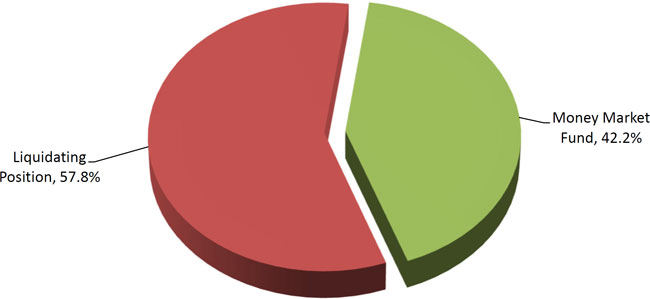

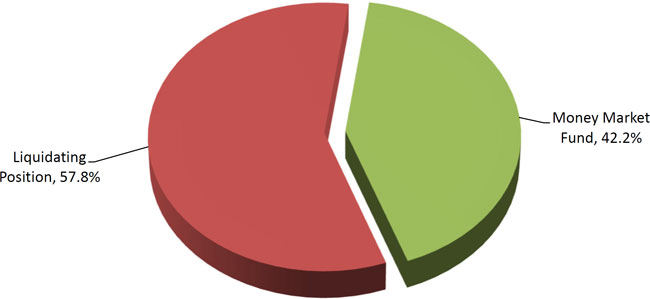

Strategy Allocation Breakdown

(as a % of total investments)

The accompanying notes are an integral part of these financial statements.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

City National Rochdale High Yield Alternative Strategies Master Fund LLC (the “Master Fund”) is a closed-end, non-diversified management investment company that was organized as a limited liability company under the laws of the State of Delaware on September 11, 2006, and serves as a master fund in a master feeder structure. City National Rochdale High Yield Alternative Strategies Fund LLC and City National Rochdale High Yield Alternative Strategies Fund TEI LLC (the “Feeder Funds”, and together with the Master Fund, the “Funds”) serve as the feeder funds in the master feeder structure. At September 30, 2021, the Feeder Funds’ beneficial ownership of the Master Fund’s net assets were 49.86% and 50.14%, respectively. Interests in the Master Fund are issued solely in private placement transactions that do not involve any “public offering” within the meaning of Section 4(a)(2) of the Securities Act of 1933, as amended (the “1933 Act”). Investments in the Master Fund may be made only by U.S. and foreign investment companies, common or commingled trust funds, organizations or trusts described in Sections 401(a) or 501(a) of the Internal Revenue Code of 1986, as amended, or similar organizations or entities that are “accredited investors” within the meaning of Regulation D under the 1933 Act. The Master Fund is an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

City National Rochdale, LLC (the “Manager” or “Adviser”) is the investment adviser to the Master Fund. City National Rochdale, LLC is a subsidiary of City National Bank, and each are wholly-owned subsidiaries of RBC USA Holdco Corporation, a wholly-owned indirect subsidiary of Royal Bank of Canada.

On August 25, 2021, the Board of the Funds approved a Plan of Dissolution and Liquidation for each. The Funds are no longer pursuing the investment objective and have commenced distributing the remaining assets to each investor. As of September 30, 2021, the remaining investment in GoldenTree Partners LP was still pending redemption. In November 2021, the Master Fund received the proceeds from the redemption, and the Feeder Funds made the final liquidating distributions to investors.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Master Fund.

Basis of Presentation and Use of Estimates

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”). The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Investments Valuation

Investments in the Investment Fund is stated and recorded at fair value, as determined in good faith by the Fair Value Committee in accordance with US GAAP using the net asset value (“NAV”) as reported by the management of each respective Investment Fund. FASB guidance provides for the use of NAV as a “practical expedient” for estimating fair value of alternative investments which (a) do not have a readily determinable fair value, and (b) either have the attributes of an investment company or prepare their financial statements consistent with the measurement principles of an investment company. Such values generally represent the Master Fund’s proportionate share of the net assets of the Investment Fund as reported by the Investment Fund managers. Accordingly, the value of the investments in Investment Fund is generally increased by additional contributions to the Investment Fund and the Master Fund’s share of net earnings from the Investment Fund and decreased by distributions from the Investment Fund and the Master Fund’s share of net losses from the Investment Funds.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

| 2. | Significant Accounting Policies (continued) Investment Valuations (continued) |

The Adviser reviews the details of the reported information obtained from the Investment Fund managers and considers: (i) the measurement date of the NAVs provided, (ii) the basis of accounting, and (iii) in instances where the basis of accounting is other than fair value, fair valuation information provided by the Investment Fund managers. The Adviser may make adjustments to the NAVs of Investment Fund to obtain the best estimate of fair value, which is consistent with the measurement principles of an investment company (See Note 3). Any determinations made by the Adviser will be reviewed and approved by the Pricing and Valuation Committee, which has been designated by the Board to make all necessary fair value determinations.

The Master Fund has not maintained any positions in derivative instruments or directly engaged in hedging activities.

Fair Value Measurements

The Master Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, and a discussion of changes in valuation techniques and related inputs during the year. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources, and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Master Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

| 2. | Significant Accounting Policies (continued) Fair Value Measurements (continued) |

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Master Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

Investments measured using the NAV as a practical expedient are not classified within the fair value hierarchy.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. See Note 3 – Investments.

Investment Income Recognition

Purchases and sales of securities are recorded on a trade-date basis. Realized gains and losses on Investment Fund is recognized using the specific identification method. Interest income is recorded on the accrual basis. Realized and unrealized gains and losses are included in the determination of income.

Fund Expenses

The expenses of the Master Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; management fees; costs of computing the Master Fund’s NAV; costs of insurance; registration expenses; due diligence expenses; travel and related expenses; expenses of meetings of the Board and officers; all expenses with respect to communications to members; and other types of expenses as may be approved from time to time by the Board.

Income Taxes

The Master Fund’s tax year end is December 31. The Master Fund is treated as a partnership for Federal income tax purposes. Each member is responsible for the tax liability or benefit relating to such member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

The Master Fund has adopted authoritative guidance on uncertain tax positions. The Master Fund recognizes the effect of tax positions when they are more likely than not of being sustained. Management is not aware of any exposure to uncertain tax positions that could require accrual or which could affect the Master Fund’s liquidity or future cash flows. As of September 30, 2021 the Master Fund’s tax years 2019 through 2021 remain open and subject to examination by relevant taxing authorities.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

| 2. | Significant Accounting Policies (continued) Subsequent Events |

Management has evaluated the Master Fund’s related events and transactions through the date the financial statements were available to be issued. As disclosed in Note 1, the Master Fund ceased operation and liquidated after the remaining assets were distributed to investors in the Feeder Funds.

Capital Accounts

Net profits or net losses of the Master Fund for each month are allocated to the capital accounts of each investor (each, a “Member”) as of the last day of each month in accordance with Members’ respective investment percentages of the Master Fund. Net profits or net losses are measured as the net change in the value of the net assets of the Master Fund during a fiscal period, before giving effect to any repurchases of interests in the Master Fund, and excluding the amount of any items to be allocated to the capital accounts of the Members of the Master Fund, other than in accordance with the Members’ respective investment percentages.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

The following are the classes of investments grouped by the fair value hierarchy for those investments measured at fair value on a recurring basis at September 30, 2021:

| Description | | Quoted Prices

in Active

Markets for

Identical Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| | | | | | | | | | | | | | | | | |

| Alternative Investment Fund | | $ | — | | | $ | 203,040 | | | $ | — | | | $ | 203,040 | |

| Short-Term Investment - Money Market Fund | | | 126,415 | | | | — | | | | — | | | | 126,415 | |

| Total Investments | | $ | 126,415 | | | $ | 203,040 | | | $ | — | | | | 329,455 | |

The GoldenTree Partners LP investment was valued at the estimated proceeds provided by the underlying manager.

| 4. | Commitments and Other Related Party Transactions

Management Fees |

Under the supervision of the Master Fund’s Board and pursuant to an investment management agreement (“Investment Management Agreement”), the Manager, an investment adviser registered under the Investment Advisers Act of 1940, as amended, serves as the investment manager for the Master Fund. The Manager is authorized, subject to the approval of the Master Fund’s Board, to retain one or more other organizations, including its affiliates, to provide any or all of the services required to be provided by the Manager to the Master Fund or to assist in providing those services.

The Master Fund paid the Manager an investment management fee at an annual rate equal to 0.75% of the Master Fund’s net assets, computed at each month-end, including assets attributable to the Manager (or its affiliates) and before giving effect to any repurchases by the Master Fund of Member interests. The investment management fee is accrued monthly and paid to the Manager out of the Master Fund’s assets. The management fee was discontinued with the approval of the Plan of Liquidation and Dissolution.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

| 4. | Commitments and Other Related Party Transactions (continued)

Administration Fee |

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“the Administrator”) acts as the administrator for the Master Fund and the Feeder Funds (collectively, the “Funds”) under an administration agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Funds; prepares reports and materials to be supplied to the Members of the Feeder Funds; monitors the activities of the Funds’ custodian, transfer agent and accountants; coordinates the preparation and payment of the Funds’ expenses and reviews the Funds’ expense accruals. For its services, the Administrator receives a monthly fee from the Master Fund at an annual rate of 0.12% for the first $150 million, 0.10% for the next $150 million and 0.08% thereafter of average net assets, with a minimum annual fee of $100,000.

Expense Reimbursement

The Manager has contractually agreed to limit the current operating expenses of each of the Feeder Funds, including the operating expenses allocated to each of the Feeder Funds by the Master Fund, to an annual rate, expressed as a percentage of each Fund’s average annual net assets, of 1.75%. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. A Feeder Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time such payments are proposed. As of September 30, 2021, previously reimbursed expenses are no longer available for recoupment by the Manger with respect to the Feeder Funds.

Indemnifications

In the ordinary course of business, the Master Fund enters into contracts that contain a variety of indemnifications. The Master Fund’s maximum exposure under these arrangements is unknown. However, the Master Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Notes to Financial Statements

September 30, 2021 (Unaudited)

| 5. | Investment Risks and Uncertainties |

Alternative investments consist of non-traditional, not readily marketable investments, some of which may be structured as offshore limited partnerships, venture capital funds, hedge funds, private equity funds and common trust funds. The underlying investments of such funds, whether invested in stock or other securities, are generally not currently traded in a public market and typically are subject to restrictions on resale. Values determined by investment managers and general partners of underlying securities that are thinly traded or not traded in an active market may be based on historical cost, appraisals, a review of the investees’ financial results, financial condition and prospects, together with comparisons to similar companies for which quoted market prices are available, or other estimates that require varying degrees of judgment.

Investments are carried at fair value provided by the respective alternative investment’s management. Because of the inherent uncertainty of valuations, the estimated fair values may differ significantly from the values that would have been used had a ready market for such investments existed or had such investments been liquidated, and those differences could be material.

The recent global outbreak of COVID-19 has disrupted economic markets and the prolonged economic impact is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Master Fund’s investments.

| 6. | Concentration, Liquidity and Off-Balance Sheet Risk |

The Master Fund invests primarily in Investment Funds that are not registered under the 1940 Act and that invest in and actively trade securities and other financial instruments using different strategies and investment techniques, including leverage, which may involve significant risks. These Investment Fund may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Investment Fund may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility.

| 7. | Investment Transactions |

For the period ended September 30, 2021 (excluding short-term securities), the aggregate sales of investments were $19,070,467.

City National Rochdale High Yield Alternative Strategies Master Fund LLC

Financial Highlights

| | | Six Months Ended

September 30, 2021

(Unaudited) | | Year Ended

March 31, 2021 | | Year Ended

March 31, 2020 | | Year Ended

March 31, 2019 | | Year Ended

March 31, 2018 | | Year Ended

March 31, 2017 |

| TOTAL RETURN - NET | | | — | | | | 38.24 | % | | | (33.79 | %) | | | (0.50 | %) | | | 9.41 | % | | | 13.53 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets, end of year ($000’s) | | $ | 282 | | | $ | 21,504 | | | $ | 16,439 | | | $ | 29,084 | | | $ | 35,148 | | | $ | 38,378 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 31.79 | % | | | 31.93 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of Net Investment Loss to Average Net Assets | | | (2.29 | %) (1)* | | | (2.24 | %)* | | | (1.44 | %) | | | (1.35 | %) | | | (1.42 | %) | | | (1.81 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of Expenses to Average Net Assets | | | 2.30 | % (1)* | | | 2.25 | %* | | | 1.64 | % | | | 1.52 | % | | | 1.53 | % | | | 1.86 | % |

(1) Annualized

* Includes proxy solicitation expenses of 0.10% and 0.08% for the six months ended September 30, 2021 and year ended March 31, 2021, respectively, that are not subject to the contractual expense cap of 1.75% for each of the Feeder Funds. (See Note 4)

Total return is calculated for all Members taken as a whole and an individual Member’s return may vary from these Master Fund returns based on the timing of capital transactions.

Total returns do not include the effect of any sales load.

The ratios of expenses to average net assets do not include expenses of the Investment Funds in which the Master Fund invests.

The expense ratios are calculated for all Members taken as a whole. The computation of such ratios based on the amount of expenses assessed to an individual Member’s capital may vary from these ratios based on the timing of capital transactions.

The ratios above do not include the proportionate share of income or loss from their investments in other funds.

The accompanying notes are an integral part of these financial statements.

Additional Information

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Master Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-800-245-9888; and (ii) on the SEC’s website at www.sec.gov.

Portfolio Holdings Disclosure

The Master Fund will file its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room. For information about the operation of the Public Reference Room, please call 1-800-SEC-0330.

NOTICE OF PRIVACY PRINCIPLES

The City National Rochdale funds and their affiliates know our shareholders expect and rely upon us to maintain the confidentiality and privacy of all of the information about them in our possession and control. Maintaining the trust and confidence of our shareholders is our highest priority. The funds have adopted a Privacy Policy to guide our conduct when we collect, use, maintain or release nonpublic personal information from our shareholders and prospective shareholders. Certain information regarding the Privacy Policy is summarized below.

We will obey all applicable laws respecting the privacy of nonpublic personal information and will comply with the obligations of the law respecting nonpublic personal information provided to us. A fund may obtain nonpublic personal information from and about its shareholders and prospective shareholders from different sources, including the following: (i) information we receive from shareholders and prospective shareholders directly or through their financial intermediaries, on subscription agreements, forms or other documents; (ii) information about shareholder transactions with the fund, its affiliates, or others; (iii) information about a shareholder’s transactions with nonaffiliated third parties; (iv) information from or about a shareholder collected online; and (v) information we receive from a consumer reporting agency. We collect, use and retain the information, including nonpublic personal information, about our shareholders and prospective shareholders that we believe is necessary for us to, among other things, understand and better meet their financial needs and requests, administer and maintain their accounts, provide them with our products and services, anticipate their future needs, protect them and us from fraud or unauthorized transactions, and meet legal requirements.

We may share information regarding our shareholders with our affiliates as permitted by law because some of our products and services are delivered through or in conjunction with our affiliates. We instruct our colleagues and applicable affiliates to limit the availability of all shareholder information within their respective organizations to those colleagues responsible for servicing the needs of the shareholder and those colleagues who reasonably need such information to perform their duties and as required or permitted by law.

We do provide shareholder information, including nonpublic personal information, to our vendors and other outside service providers whom we use when appropriate or necessary to perform and enhance our shareholder services. When we provide shareholder information to anyone outside our organization, we only do so as required or permitted by law. We require all of our vendors and service providers who receive shareholder information from us to agree to maintain the information in confidence, to limit the use and dissemination of the information to the purpose for which it is provided and to abide by the law. To the extent permitted by law, we undertake to advise a shareholder of any government or other legal process served on us requiring disclosure of information about that shareholder.

We generally limit our disclosure of nonpublic personal information to third parties to the following circumstances: (i) when requested to do so by the shareholder; (ii) when necessary, in our opinion, to effect, administer, or enforce a shareholder initiated transaction or a shareholder request for a product or service; and (iii) when required or permitted to do so by law or regulation, including authorized requests from government agencies and if we are the victim of fraud or otherwise suffer loss caused by the unlawful act of the shareholder.

We maintain physical, electronic, and procedural safeguards that are designed to guard all shareholder information. In addition, we educate all our colleagues about the Privacy Policy and their obligations to maintain confidentiality and privacy of shareholder information as summarized in this Notice and we take appropriate disciplinary measures to enforce these obligations.

A full copy of the funds’ Privacy Policy is available upon request from the fund. Should you have any questions regarding the Privacy Policy, please contact your investment professional or the funds at (888) 889-0799.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

(a) Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

(b) Not applicable.

Not applicable since the Fund invests exclusively in non-voting securities.

Not applicable for semi-annual reports.

Not applicable.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

The registrant did not engage in securities lending activities during the fiscal period reported on this Form N-CSR.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Thomas A. Galvin, Principal Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Thomas A. Galvin, Principal Executive Officer