| Nature of security – fixed charge | 150 | |

Nature of security – floating charge | 150 | | | Enforcement | 151 | |

| Issuing entity post-enforcement priority of payments | 151 | |

| New issuing entity secured creditors | 152 | |

Appointment, powers, responsibilities and liabilities of the issuing entity security

trustee | 152 | |

| Issuing entity security trustee’s fees and expenses | 153 | |

| Retirement and removal | 153 | |

| Additional provisions of the issuing entity deed of charge | 154 | |

| Trust Indenture Act prevails | 155 | |

| Governing law | 155 | |

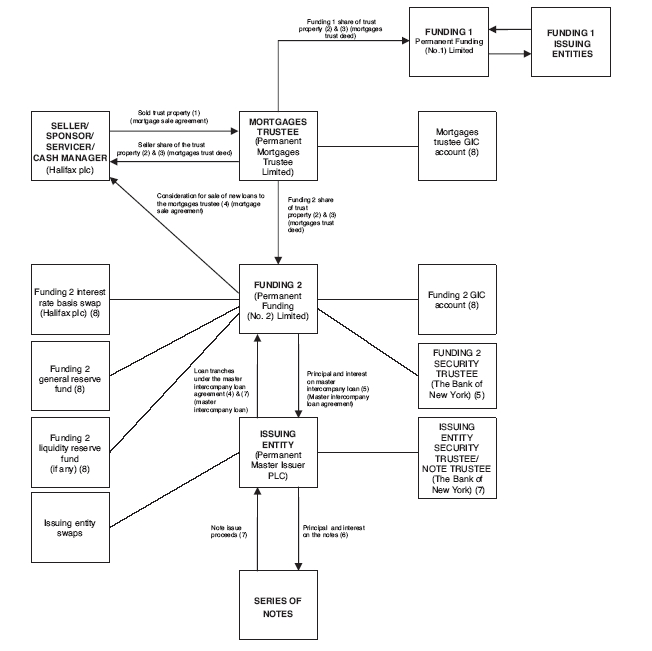

| Cashflows | 156 | |

| Definition of Funding 2 available revenue receipts | 156 | |

Distribution of Funding 2 available revenue receipts before master intercompany loan

acceleration | 157 | |

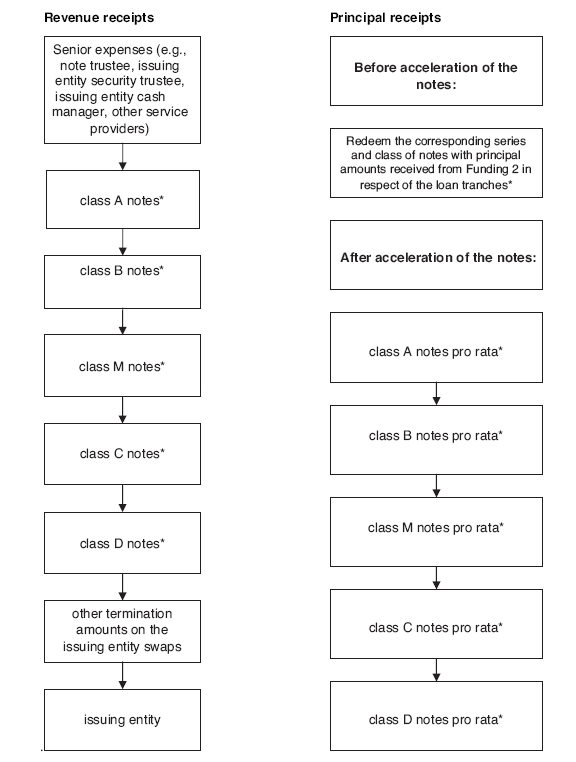

| Definition of issuing entity revenue receipts | 159 | |

| Distribution of issuing entity revenue receipts before note acceleration | 159 | |

Distribution of issuing entity revenue receipts after note acceleration but before

master intercompany loan acceleration | 162 | |

| Distribution of Funding 2 available principal receipts | 162 | |

| Payment of principal receipts to Funding 2 by the mortgages trustee | 162 | |

| Definition of Funding 2 available principal receipts | 162 | |

| Due and payable dates of loan tranches | 163 | |

Repayment of loan tranches before a trigger event and before master intercompany

loan acceleration or acceleration of all notes | 164 | |

| Rule (1) – Repayment deferrals | 164 | |

| Rule (2) – Repayment of payable pass-through loan tranches after a step-up date | 167 | |

Repayment of loan tranches after a non-asset trigger event but before master

intercompany loan acceleration or acceleration of all notes | 167 | |

Repayment of loan tranches after an asset trigger event but before master

intercompany loan acceleration notice or acceleration of all notes | 168 | |

Repayment of loan tranches after acceleration of all notes but before master

intercompany loan acceleration | 169 | |

Repayment of loan tranches when Funding 2 receives the amount outstanding under

the master intercompany loan | 169 | |

| Definition of issuing entity principal receipts | 170 | |

| Distribution of issuing entity principal receipts before note acceleration | 170 | |

Distribution of issuing entity principal receipts after note acceleration but before

master intercompany loan acceleration | 171 | |

Distribution of Funding 2 principal receipts and Funding 2 revenue receipts following

master intercompany loan acceleration | 172 | |

Distribution of issuing entity principal receipts and issuing entity revenue receipts

following note acceleration and master intercompany loan acceleration | 174 | |

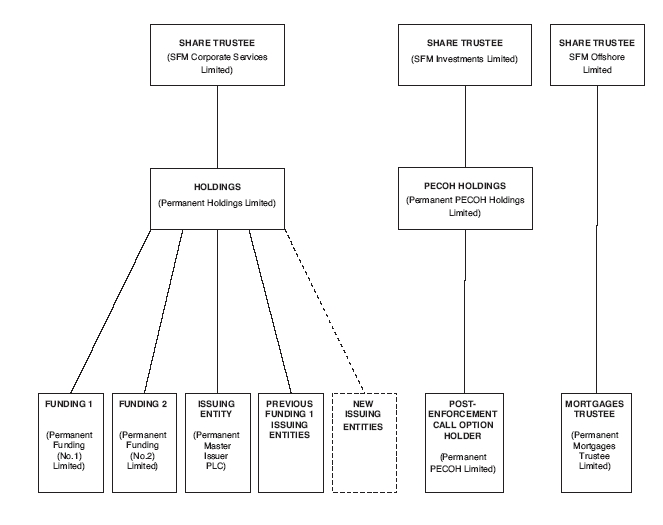

| Credit structure | 177 | |

| Credit support for the notes provided by Funding 2 available revenue receipts | 177 | |

| Level of arrears experienced | 178 | |

| Use of Funding 2 principal receipts to pay Funding 2 income deficiency | 178 | |

| Funding 2 general reserve fund | 178 | |

| Funding 2 principal deficiency ledger | 179 | |

| Issuing entity available funds | 180 | |

Priority of payments among the class A notes, the class B notes, the class M notes,

the class C notes and the class D notes | 181 | |

| Mortgages trustee GIC account/Funding 2 GIC account | 181 | |

| Funding 2 liquidity reserve fund | 182 | |

| Funding 2 start-up loan agreements | 183 | |