Back to Contents

PROSPECTUS SUPPLEMENT DATED 23 February 2007

(to Prospectus dated 13 February 2007) |

$4,936,000,000 Issue 2007-1 Notes

PERMANENT MASTER ISSUER PLC

Issuing Entity

PERMANENT FUNDING (NO. 2) LIMITED | HALIFAX PLC |

Depositor | Sponsor, Seller, Servicer and Cash Manager |

The offering in respect of the issue 2007-1 notes comprises the following series and classes of notes:

Series

|

Class

| |

Initial Principal

Amount

| |

Interest Rate

| |

Price to

Public per

Note

| |

Net Proceeds to

Issuing Entity per

Class of Notes

| | Underwriters’

Management

and

Underwriting

Fee | |

Underwriters’

Selling

Commission

| |

Scheduled

Redemption Dates

| |

Final

Maturity Date

| |

| Series 1 | Class A | | $1,000,000,000 | | 0.02% margin below

one-month USD-LIBOR | | 100 per cent. | | $1,000,000,000 | | 0.0209 per

cent. | | 0.0418 per cent. | | January 2008 | | January 2008 | |

| Series 2 | Class A1 | | $1,500,000,000 | | 0.05% margin over

three-month USD-LIBOR | | 100 per cent. | | $1,500,000,000 | | 0.0209 per

cent. | | 0.0418 per cent. | | January 2010 | | January 2016 | |

| Series 2 | Class A2 | | $1,000,000,000 | | 0.05% margin over

three-month USD-LIBOR | | 100 per cent. | | $1,000,000,000 | | 0.0209 per

cent. | | 0.0418 per cent. | | January 2010 | | January 2016 | |

| Series 4 | Class A | | $1,350,000,000 | | 0.08% margin over

three-month USD-LIBOR | | 100 per cent. | | $1,350,000,000 | | 0.0209 per

cent. | | 0.0418 per cent. | | October 2011 and

January 2012 | | October 2033 | |

| Series 1 | Class B | | $43,000,000 | | 0.05% margin over

three-month USD-LIBOR | | 100 per cent. | | $43,000,000 | | 0.0833 per

cent. | | 0.1667 per cent. | | - | | July 2042 | |

| Series 1 | Class C | | $43,000,000 | | 0.17% margin over

three-month USD-LIBOR | | 100 per cent. | | $43,000,000 | | 0.1333 per

cent. | | 0.2667 per cent. | | - | | July 2042 | |

The above series and classes of notes (the offered notes) are part of the issue 2007-1 notes of Permanent Master Issuer plc.

Interest on, and principal of, the offered notes will be paid on the 15th day of each calendar month (in the case of the series 1 class A notes) and the 15th day of each of January, April, July and October in the case of each other series and class of offered notes, beginning in April 2007 (in the case of the series 1 class A notes) and April 2007 in the case of each other series and class of offered notes.

You should review and consider the discussion under “Risk factors” beginning on page S-16 in this prospectus supplement and on page 38 of the accompanying prospectus before you purchase any notes.

The offered notes will be admitted to the official list maintained by the UK Listing Authority and to trading on the London Stock Exchange’s Gilt Edged and Fixed Interest Market.

The offered notes are not insured or guaranteed by any United States, United Kingdom or any other governmental agency or instrumentality. The offered notes are obligations of Permanent Master Issuer plc only and are not obligations of the sponsor, the Funding 2 security trustee, the issuing entity security trustee, the note trustee, the depositor, any of their affiliates or any other person or entity. The primary asset securing the offered notes is a loan made by Permanent Master Issuer plc to Permanent Funding (No. 2) Limited, which in turn is secured by a beneficial interest in a portfolio of residential mortgage loans secured by properties located in England, Wales and Scotland.

The offered notes will have the benefit of certain internal credit support, such as the availability of reserve funds and subordination of certain note classes to other note classes as described in the summary of this prospectus supplement and under “Credit structure” and “Risk factors” in the prospectus.

The offered notes will also have the benefit of the following derivative instruments: (i) an interest rate swap agreement entered into between Halifax, as interest rate swap provider, and Permanent Funding (No. 2) Limited and (ii) issuing entity swap agreements to be entered into between Permanent Master Issuer plc and each of Credit Suisse (USA), Inc. and Deutsche Bank AG, London Branch, as the issuing entity swap providers in respect of the offered notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the offered notes or determined that this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

The underwriters or affiliates of certain underwriters will pay and subscribe for the offered notes at the price per note stated in the table above. The net proceeds to the issuing entity from the sale of the offered notes is expected to be approximately $4,936,000,000.

Arranger

Underwriters |

Deutsche Bank | Lehman Brothers | UBS Investment Bank |

ABN AMRO | Credit Suisse | Merrill Lynch & Co. |

Back to Contents

Table of Contents

S-2

Back to Contents

S-3

Back to Contents

Important notice about information presented in this prospectus supplement and the accompanying prospectus

We provide information to you about the offered notes in two separate documents that progressively provide more detail: this prospectus supplement and the accompanying prospectus. This prospectus supplement provides the specific terms of the offered notes. The accompanying prospectus provides general information about each series and class of notes issued by Permanent Master Issuer plc, including information on the mortgages trust and the master intercompany loan which is essential to understanding how principal of and interest on the offered notes is expected to be paid. Most of the information provided in the accompanying prospectus does not appear in this prospectus supplement.

The prospectus supplement contains information about the series and classes of notes offered hereby that supplements the information contained in the accompanying prospectus, and you should rely on that supplementary information contained in this prospectus supplement for the particular terms of the offered notes. Consequently, you should carefully read both the accompanying prospectus and this prospectus supplement before you purchase any of the offered notes.

In deciding whether to purchase any offered notes you should rely solely on the information contained in this prospectus supplement and the accompanying prospectus, including information incorporated by reference. We have not authorised anyone to give you different information about the offered notes. The information in this prospectus supplement and the accompanying prospectus is only accurate as of the dates on their respective covers.

This prospectus supplement may be used to offer and sell the offered notes only if accompanied by the prospectus.

Neither this prospectus supplement nor the accompanying prospectus contains all of the information included in the registration statement. The registration statement also includes copies of the various material agreements and other documents referred to in this prospectus supplement and the accompanying prospectus. You may obtain copies of these documents for review. See “Incorporation of certain information by reference” and “Where investors can find more information” in the accompanying prospectus.

We include cross-references in this prospectus supplement and in the accompanying prospectus to captions in these documents where you can find further related information. The preceding Table of Contents and the Table of Contents included in the accompanying prospectus provide the pages on which these captions are located.

To facilitate your review of this prospectus supplement and the accompanying prospectus we have included definitions of certain defined terms used in this prospectus supplement and the accompanying prospectus under the caption “Glossary” in the accompanying prospectus, beginning on page 261. We have also included an index of principal terms on page 293 in the accompanying prospectus. The index of principal terms lists the pages where terms used in this prospectus supplement or the accompanying prospectus are first defined.

References in this prospectus supplement to we, us or the issuing entity mean Permanent Master Issuer plc and references to you mean each potential investor in the offered notes.

S-4

Back to Contents

Forward-looking statements

Some of the statements contained or incorporated by reference in this prospectus supplement and the accompanying prospectus consist of forward-looking statements relating to future economic performance or projections and other financial items. These statements can be identified by the use of forward-looking words such as “may”, “will”, “should”, “expects”, “believes”, “anticipates”, “estimates”, “assumed characteristics”, “structuring assumptions”, “prepayment assumption” or other comparable words.

Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, competition, changes in political, social and economic conditions, regulatory initiatives and compliance with governmental regulations, customer preferences and various other matters, many of which are beyond our control.

Because we cannot predict the future, what actually happens may be very different from what we predict in our forward-looking statements.

S-5

Back to Contents

Summary

This summary highlights selected information from this prospectus supplement and does not contain all of the information you may need to make an informed investment decision. To understand all of the terms of an offering of the offered notes, you should read this entire prospectus supplement and the accompanying prospectus before you purchase any offered notes.

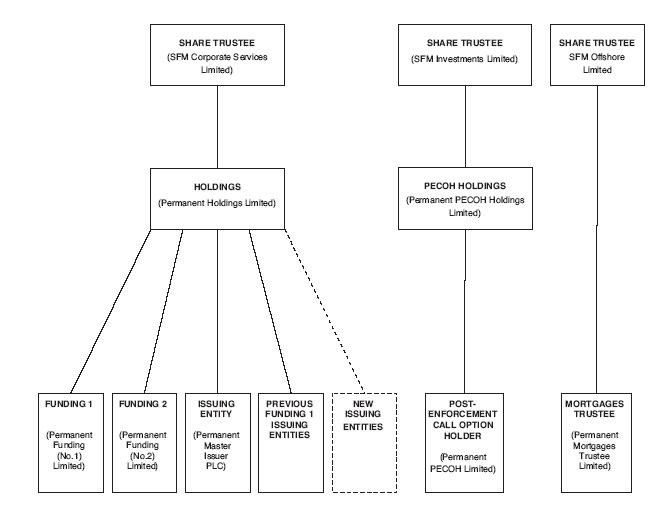

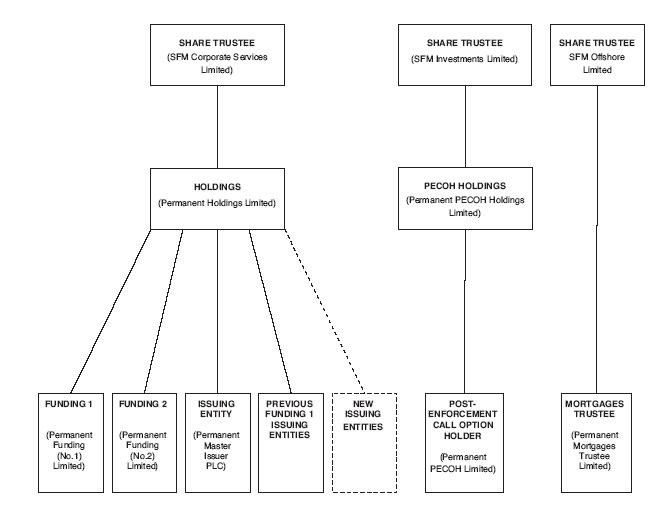

| Issuing entity | | Permanent Master Issuer plc, also referred to in this prospectus supplement as the issuing entity. |

| Offered securities | | The issuing entity will issue the series 1 class A notes, the series 2 class A1 notes, the series 2 class A2 notes, the series 4 class A notes, the series 1 class B notes and the series 1 class C notes (referred to collectively in this prospectus supplement as the offered notes). |

| | The offered notes are part of our issue 2007-1 notes. The offered notes are issued by us, are solely our obligations and are not obligations of the sponsor, the Funding 2 security trustee, the issuing entity security trustee, the note trustee, the depositor, any of their affiliates or any other person or entity. |

| | The issue 2007-1 notes also include other series and classes of notes, which are not being offered hereby. The series and classes of the issue 2007-1 notes not offered hereby are described below under “– Other issuing entity notes”. Only the offered notes are being offered pursuant to the prospectus and this prospectus supplement. Any information contained in this prospectus supplement with respect to notes other than the offered notes is provided only to permit a better understanding of the offered notes. |

| | We expect to issue other series of notes in the future of various classes. These notes may have interest rates, interest payment dates, repayment terms and other characteristics that differ from the offered notes. You will not receive prior notice of any future issuance of notes and will not be asked for your consent to such issuance. However, any future issuance of notes, as well as material changes to the solicitation, credit-granting, underwriting, origination or pool selection criteria used to originate or select new mortgage loans to be sold to the mortgages trust, will be reported in our periodic reports on Form 10-D. You may access such reports as described under “Where investors can find more information” in the accompanying prospectus. |

| Seller, originator, servicer, cash manager and Funding 2 swap provider | | Halifax |

| Depositor | | Permanent Funding (No. 2) Limited, also referred to in this prospectus supplement as Funding 2. |

| Funding 2 security trustee, issuing entity security trustee and note trustee | | The Bank of New York. |

| Issuing entity swap providers | | See “Issuing entity swap providers” in this prospectus supplement for information. |

| Closing date | | On or about 1 March 2007. |

S-6

Back to Contents

| Interest payment dates | | Interest on, and principal of, the offered notes will be paid quarterly on the 15th day of each of January, April, July and October (in the case of the series 2 class A1 notes, the series 2 class A2 notes, the series 4 class A notes, the series 1 class B notes and the series 1 class C notes) in each year up to and including the final maturity date and monthly on the 15th day of each calendar month (in the case of the series 1 class A notes) in each year up to and including the final maturity date or, following the occurrence of a pass-through trigger event, the 15th day of January, April, July and October in each year up to and including the final maturity date (or, in each case, if such day is not a business day, the next succeeding business day) (each, an interest payment date). |

| Initial interest payment date | | In the case of the series 1 class A notes, the interest payment date falling in April 2007 and, in the case of each other series and class of offered notes, the interest payment date falling in April 2007. |

| Interest | | All offered notes (other than the series 1 class A notes) will accrue interest at the annual rate specified on the cover of this prospectus supplement up to (but excluding) the interest payment date falling in January 2013 (the step-up date). From and including the step-up date, the offered notes (other than the series 1 class A notes) will accrue interest at an annual rate as follows: |

| | | Series and class | | Interest rate |

| | | Series 2 class A1 | | Three-month USD LIBOR + 0.10% per annum |

| | | Series 2 class A2 | | Three-month USD LIBOR + 0.10% per annum |

| | | Series 4 class A | | Three-month USD LIBOR + 0.16% per annum |

| | | Series 1 class B | | Three-month USD LIBOR + 0.10% per annum |

| | | Series 1 class C | | Three-month USD LIBOR + 0.34% per annum |

| | Interest will accrue on the offered notes from the closing date and will be calculated on the basis of a day count fraction of actual/360. |

| | On the second London business day prior to the start of each Interest Period (an interest determination date), the rate of interest payable in respect of each series and class of offered notes will be determined by the agent bank as follows: |

| | (a) | | in respect of the first interest period, (i) for the series 1 class A notes, the linear interpolation of one-month USD LIBOR and two-month USD LIBOR, and (ii) for all other series and classes of offered notes, the linear interpolation of one-month USD LIBOR and two-month USD LIBOR (in each case, rounded upwards, if necessary, to five decimal places); and |

| | (b) | | in respect of subsequent interest periods, (i) for the series 1 class A notes, one-month USD LIBOR or, following the occurrence of a Pass-Through Trigger Event, three-month |

S-7

Back to Contents

| | | | USD LIBOR, and (ii) for all other series and classes of offered notes, three-month USD LIBOR in each case by reference to the display as quoted on the Reuters Monitor Money Rates Service at the page designated as LIBOR 01. |

| Principal | | We expect to repay the principal amount outstanding of the series 1 class A notes, the series 2 class A1 notes and the series 2 class A2 notes on the bullet redemption date for each such series and class of offered notes in an amount up to the redemption amount as set forth in this prospectus supplement under “Scheduled redemption dates and bullet redemption dates”. We expect to repay the principal amount outstanding of the series 4 class A notes on the scheduled redemption date for such series and class of offered notes in an amount up to the redemption amount as set forth in this prospectus supplement under “Scheduled redemption dates and bullet redemption dates”. We expect to repay the principal amount outstanding of the series 1 class B notes and the series 1 class C notes on the final maturity date for such classes of offered notes or such earlier date on which payment is received in respect of the corresponding loan tranche. We are obliged to make such payments if we have funds available for that purpose. The class B notes and class C notes of each series will be redeemed in full or in part on each interest payment date falling on or after the interest payment date on which all the notes of such series of a higher rating have been redeemed in full. If the principal amount outstanding of any of the series 1 class A notes, the series 2 class A1 notes, series 2 class A2 notes, series 4 class A notes, the series 1 class B notes and the series 1 class C notes is not repaid in full on the final scheduled redemption date for such series and classes of the offered notes, noteholders generally will not have any remedies against us until the final maturity date of such classes of the offered notes. In that case, any such series and class of the offered notes, subject to the principal payment rules described under “Cashflows – Distribution of Funding 2 available principal receipts – Repayment of loan tranches before a trigger event and before master intercompany loan acceleration or acceleration of all notes” in the accompanying prospectus, will receive payments of the principal to the extent of the shortfall on each interest payment date thereafter in the amounts, and to the extent available, until repaid in full. |

| | Principal of the offered notes may be repaid earlier than expected if a trigger event or a note event of default occurs in respect of these notes. See “Maturity and repayment considerations” in this prospectus supplement, “The mortgages trust – Allocation and distribution of principal receipts on or after the occurrence of a non-asset trigger event but prior to the occurrence of an asset trigger event” and “The mortgages trust – Allocation and distribution of principal receipts on or after the occurrence of an asset trigger event” in the accompanying prospectus. |

S-8

Back to Contents

| Bullet redemption dates | | In respect of the series 1 class A notes, the series 2 class A1 notes and the series 2 class A2 notes, the interest payment date on which principal repayments are scheduled to be made are as set forth under “Scheduled redemption dates and bullet redemption dates” in this prospectus supplement. |

| Scheduled redemption dates | | In respect of the series 4 class A notes, the interest payment date on which principal repayments are scheduled to be made as set forth under “Scheduled redemption dates and bullet redemption dates” in this prospectus supplement. |

| Pass-through notes | | In respect of the series 1 class B notes and the series 1 class C notes, principal will be repaid on the final maturity date specified for such classes of offered notes on the cover of this prospectus supplement or such earlier date on which payment is received in respect of the corresponding loan tranche. |

| Issuance of future series and classes of notes | | The offered notes (and any future series and class of notes) issued by us are (and will be) subject to the satisfaction of certain conditions precedent, which are described under “Summary of the notes – Issuance” in the accompanying prospectus. |

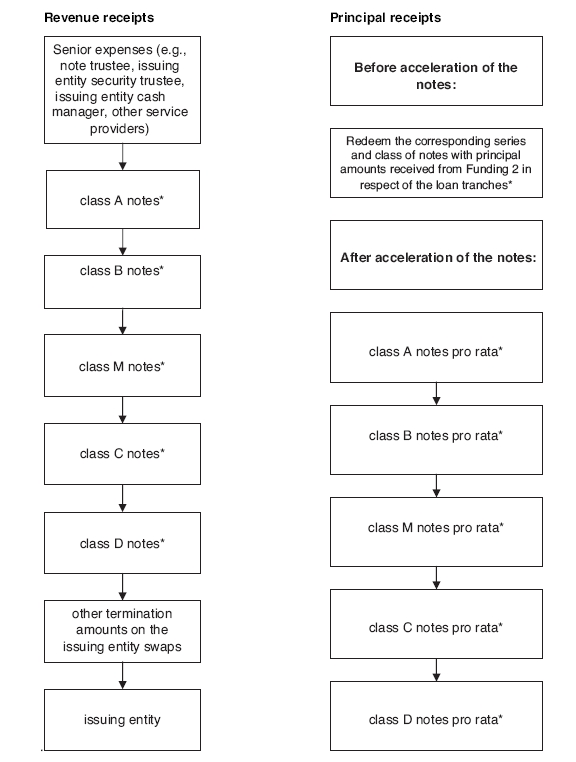

| Subordination and credit enhancement | | Payments of principal of, and interest on, the junior classes of the offered notes are subordinated to payments of principal of, and interest on, the more senior classes of notes. In addition, amounts of principal otherwise available to pay principal of the junior classes of the offered notes may be used to pay interest on more senior classes of notes. See “Summary of prospectus – Summary of the notes – Payment and ranking of the notes” and “Credit structure – Use of Funding 2 principal receipts to pay Funding 2 income deficiency” in the accompanying prospectus. |

| Funding 2 reserve required amount | | £167,700,000. |

| Losses | | Losses on the loans may reduce the amount of principal available to repay principal of the offered notes. Losses on the loans will be allocated to the loan tranches in inverse order of seniority, beginning with the loan tranches corresponding to the class C notes. No losses will be allocated to the loan tranches corresponding to the class A notes until the aggregate amount of losses exceeds the principal amount outstanding of each loan tranche which is junior to the loan tranches corresponding to the class A notes. See “The mortgages trust – Losses” and “Credit structure – Funding 2 principal deficiency ledger” in the accompanying prospectus. |

| Optional redemption by the issuing entity | | We have the right (subject to certain conditions) to redeem the offered notes at their aggregate principal amount outstanding, together with any accrued interest in respect thereof on the following dates: |

| | • | | on any interest payment date on which the aggregate principal amount outstanding of the offered notes and all other series and classes of the issue 2007-1 notes is less than 10 per cent. of the initial outstanding principal amount of the offered notes and all such other series and classes of the issue 2007-1 notes; or |

| | • | | on the interest payment date falling on the step-up date and on any interest payment date thereafter. |

S-9

Back to Contents

| | Further, we may redeem the offered notes for tax and other reasons and in certain other circumstances as more fully described under “Terms and Conditions of the US notes – 5. Redemption, purchase and cancellation” in the accompanying prospectus. |

| Security for the notes | | The offered notes are secured primarily by our rights under the master intercompany loan agreement. In addition, we have granted security for the benefit of noteholders over (among other things) our bank accounts. See “Security for the issuing entity’s obligations” in the accompanying prospectus. |

| The issue 2007-1 loan tranches | | We have entered into a master intercompany loan agreement with Funding 2. The proceeds of the offered notes will fund the relevant issue 2007-1 loan tranches. The principal terms of such issue 2007-1 loan tranches are set out in Annex B to this prospectus supplement. A description of the master intercompany loan is set forth in the accompanying prospectus under “The master intercompany loan agreement”. |

| Note events of default | | The offered notes are subject to certain events of default described under “Terms and Conditions of the US notes – 9. Events of Default” in the accompanying prospectus. |

| Limited resources | | The primary sources of payment for principal of or, interest on, the offered notes are: |

| | • | | repayments of principal of, or interest on, the relevant issue 2007-1 loan tranches of the master intercompany loan; and |

| | • | | funds in the issuer transaction account that are allocable to the offered notes. |

| The mortgages trust | | Each issue 2007-1 loan tranche is a tranche of the master intercompany loan and made by us to Funding 2. Funding 2 will secure its obligation to repay the master intercompany loan by granting security over its beneficial interest in the mortgages trust. The assets of the mortgages trust consist primarily of loans originated by the seller secured over residential property located in England, Wales and Scotland. The loans included in the trust property were randomly selected from the seller’s portfolio of loans that meet the seller’s selection criteria for inclusion in the mortgages trust. These criteria are discussed under “The loans – Introduction” in the accompanying prospectus. The seller has given representations and warranties to the mortgages trustee in the mortgage sale agreement that, among other things, the loans have been originated in accordance with the seller’s lending criteria in effect at the time of origination. If a loan or its related security does not materially comply on the date of its assignment with the representations and warranties given by the seller under the mortgage sale agreement and the seller does not remedy such breach within 20 London business days of becoming aware of the breach, then the mortgages trustee (as directed by Funding 1 or Funding 2 in accordance with the controlling beneficiary deed and with the consent of the Funding 1 security trustee and the Funding 2 security trustee in accordance with the controlling beneficiary deed) will require the seller to repurchase (i) the relevant loan and its related security and (ii) any other loans of the relevant borrower and their related security that are included in the portfolio. |

S-10

Back to Contents

| | The seller may assign new loans and their related security to the mortgages trustee in order to increase or maintain the trust property. The seller may also increase the size of the trust property from time to time in connection with an issue of new notes by us, the proceeds of which are applied ultimately to fund the acquisition (by assignment in the case of English and Welsh loans and Scottish declaration of trust in the case of Scottish loans) of the new loans and their related security by the mortgages trustee, or to comply with the seller’s obligations under the mortgage sale agreement as described under “Sale of the loans and their related security – Sale of loans and their related security to the mortgages trustee on the sale dates” in the accompanying prospectus. |

| | When new loans are assigned to the mortgages trustee, the trust property will increase accordingly. Depending on the circumstances, the increase in the trust property may result in an increase in the seller share of the trust property, the Funding 1 share of the trust property and/or the Funding 2 share of the trust property. For a description of how adjustments are made to the seller share of the trust property, the Funding 1 share of the trust property and the Funding 2 share of the trust property, see “The mortgages trust” in the accompanying prospectus. |

| | As at the closing date for the offered notes, the minimum seller share will be approximately £2,285,000,000. |

| | For the purposes of paragraph (d) of the definition of non-asset trigger event, the aggregate outstanding balance of loans comprising the trust property must from the period up to (but excluding) the interest payment date in July 2009 be at least £35,000,000,000 and during the period from (and including) the interest payment date falling in July 2009 to (but excluding) the interest payment date in April 2010 the aggregate outstanding balance of loans comprising the trust property must be at least £32,000,000 or (in each case) such higher amount as may be required to be maintained as a result of any new Funding 1 issuing entities providing new term advances to Funding 1 and/or the issuing entity advancing new loan tranches to Funding 2 which Funding 1 and/or Funding 2, as the case may be, uses to pay to the seller and/or Funding 1 or Funding 2, as the case may be, for an increase in its share of the trust property and/or to pay the seller for the sale of new loans to the mortgages trustee. See “The mortgages trust – Cash management of trust property – distribution of principal receipts to Funding 2” in the accompanying prospectus. |

| Issuing entity accounts | | The issuing entity transaction account. |

| Other issuing entity notes | | The offered notes are part of the issue 2007-1 notes issued by us. Only the offered notes are being offered by this prospectus supplement and the accompanying prospectus. On or about the closing date, the issuing entity will also issue the series 3 class A notes, the series 5 class A notes, the series 2 class B notes, the series 4 class B notes, the series 2 class C notes and the series 4 class C notes of the issue 2007-1 notes which are not being offered hereby. Any information contained in this prospectus |

S-11

Back to Contents

| | supplement with respect to the issue 2007-1 notes other than the offered notes is provided only to permit a better understanding of the offered notes. |

| | As of the closing date, the aggregate principal amount outstanding of notes issued by us (converted, where applicable, into sterling at the applicable specified currency exchange rate), including the offered notes, will be: |

| | As used herein, specified currency exchange rate means, in relation to a series and class of notes, the exchange rate specified in the issuing entity swap agreement relating to such series and class of notes or, if the related issuing entity swap agreement has been terminated, the applicable spot rate. |

| | As of the date of this prospectus supplement, the aggregate principal amount outstanding of notes issued by each Funding 1 issuing entity identified below (converted, where applicable, into sterling at the applicable currency exchange rate) is: |

| | (1) | | Permanent Financing (No. 1) plc, £1,588,000,000; |

| | (2) | | Permanent Financing (No. 2) plc, £1,986,538,000; |

| | (3) | | Permanent Financing (No. 3) plc, £2,706,900,000; |

| | (4) | | Permanent Financing (No. 4) plc, £5,246,082,000; |

| | (5) | | Permanent Financing (No. 5) plc, £3,036,070,750; |

| | (6) | | Permanent Financing (No. 6) plc, £3,273,114,000; |

| | (7) | | Permanent Financing (No. 7) plc, £3,502,097,000; |

| | (8) | | Permanent Financing (No. 8) plc, £3,685,920,000; and |

| | (9) | | Permanent Financing (No. 9) plc, £4,572,690,000. |

| | We are not a Funding 1 issuing entity. For a description of the Funding 1 issuing entities, see “Funding 1 issuing entities” in the accompanying prospectus. |

| Use of proceeds | | The gross proceeds from the issue of the issue 2007-1 notes will equal approximately $8,599,825,705 and (after exchanging, where applicable, the proceeds of the notes for sterling, calculated by reference to the applicable specified currency exchange rate) will be used by the issuing entity to make available loan tranches to Funding 2 pursuant to the terms of the master intercompany loan agreement. Funding 2 will use the gross proceeds of each loan tranche to increase its share of the trust property (which will result in a corresponding decrease in the seller’s share of the trust property) on the closing date. |

| Stock exchange listing | | The offered notes will be admitted to the Official List maintained by the UK Listing Authority and to trading on the London Stock Exchange plc’s Gilt Edged and Fixed Interest Market. |

| Ratings | | It is a condition of the issuance of the offered notes that they be assigned on the closing date the following ratings by S&P, Moody’s and Fitch, respectively: |

S-12

Back to Contents

| Class | Ratings |

| Class A (in respect of the series 1 class A notes only) | A-1+/P-1/F-1+ |

| Class A (other than the series 1 class A notes) | AAA/Aaa/AAA |

| Class B | AA/Aa3/AA |

| Class C | BBB/Baa2/BBB |

| | See “Summary of prospectus – Summary of the notes – Issuance” and “Risk Factors – Ratings assigned to the notes may be lowered or withdrawn after you purchase the notes, which may lower the market value of the notes” in the accompanying prospectus. |

| Funding 2 swap | | The loans in the portfolio pay interest at a variety of rates, for example at rates linked either to the seller’s standard variable rate or linked to an interest rate other than the seller’s standard variable rate as specified in the accompanying prospectus. The amount of mortgages trust available revenue receipts that Funding 2 receives on the portfolio will fluctuate according to (among other things) the interest rates applicable to the loans in the mortgages trust. The amount of interest payable by Funding 2 to us under the loan tranches advanced pursuant to the master intercompany loan agreement, from which amount we will fund, among other things, our payment obligations under the issuing entity swap agreements and the notes, will generally be calculated by reference to an interest rate based upon three-month sterling LIBOR. |

| | To hedge its exposure against the possible variance between the foregoing interest rates, Funding 2 has entered into an interest rate swap agreement with the Funding 2 swap provider on the programme date. See “The swap agreements – The Funding 2 swap” in the accompanying prospectus. |

| Issuing entity swaps | | In respect of each series and class of offered notes, we will enter into a currency swap transaction (the issuing entity swaps) with an issuing entity swap provider in order to hedge against any variance between the interest received by us under the master intercompany loan agreement, which will be calculated by reference to three-month sterling LIBOR, and the interest which is payable on the offered notes, which will be calculated by reference to three-month USD-LIBOR (in the cases of each series and class of offered notes other than the series 1 class A notes) and one-month USD-LIBOR (in the case of the series 1 class A notes) or, following the occurrence of a pass through trigger event, three-month USD-LIBOR and to hedge against fluctuations in the exchange rate in respect of principal received under the master intercompany loan agreement, which will be paid in sterling, and principal which we are obliged to repay in dollars on the offered notes which will be payable in dollars. See “The issuing entity swap providers” in this prospectus supplement and “The swap agreements – The issuing entity currency swaps” in the accompanying prospectus. |

| Start-up loan | | Pursuant to the start-up loan agreement, Halifax (in its capacity as the start-up loan provider) has agreed to make available to Funding 2 a start-up loan on the closing date. At any time after |

S-13

Back to Contents

| | the closing date additional start-up loans may be made available to Funding 2 by the start-up loan provider or other entities. Each start-up loan will be used to fund (in whole or in part) the Funding 2 general reserve fund and to meet the costs and expenses incurred by Funding 2 and us as more fully described under “Credit structure – Start-up loan agreements” in the accompanying prospectus. On the closing date, the start-up loan provider will make available to Funding 2 the start-up loan, the principal terms of which are set out in Annex D to this prospectus supplement. The terms of the existing start-up loan are also set out in Annex D to this prospectus supplement. |

| Denominations | | The offered notes will be issued in minimum denominations of $100,000 and integral multiples of $1,000 in excess thereof. |

| Material United States tax consequences | | As more fully discussed in the accompanying prospectus, in the opinion of Allen & Overy LLP, our US federal income tax counsel, although there is no authority on the treatment of instruments substantially similar to the offered notes, the series 1 class A notes, the series 2 class A1 notes, the series 2 class A2 notes, the series 4 class A notes and the series 1 class B notes will be treated as debt for US federal income tax purposes and the series 1 class C notes should be treated as debt for US federal income tax purposes. The series 1 class A notes will be treated as short-term obligations for US federal income tax purposes, the consequences of which are described under “United States federal income taxation – Qualified Stated Interest and Original Issue Discount” in the accompanying prospectus. Further, in the opinion of Allen & Overy LLP, assuming compliance with the transaction documents, the mortgages trustee acting in its capacity as trustee of the mortgages trust, Funding 2 and the issuing entity will not be subject to US federal income tax. See “United States federal income taxation” in the accompanying prospectus. |

| ERISA considerations for investors | | The offered notes will be eligible for purchase by employee benefit and other plans subject to Section 406 of ERISA or Section 4975 of the Code and by governmental plans that are subject to any state, local or other federal law of the United States that is substantially similar to Section 406 of ERISA or Section 4975 of the Code, subject to consideration of the issues described in the accompanying prospectus under “ERISA considerations���. |

| United States legal investment considerations | | None of the offered notes is a “mortgage related security” under the United States Secondary Mortgage Market Enhancement Act of 1984, as amended. See “United States legal investment considerations” in the accompanying prospectus. |

| Payment and delivery | | No later than the closing date, we will (a) cause the global note for each of the offered notes to be registered in the name of Cede & Co., as nominee for DTC, for credit on the closing date to the account of the lead underwriters with DTC or to such other account with DTC as the lead underwriters may direct and (b) deliver the global note for each of the offered notes duly executed on our behalf and authenticated in accordance with the paying agent and agent bank agreement to Citibank, N.A., as custodian for DTC. |

S-14

Back to Contents

| | Against delivery of the offered notes (i) the underwriters will pay to the lead underwriters the gross underwriting proceeds for the offered notes and (ii) the lead underwriters will pay to us or to a third party, as directed by us, the gross underwriting proceeds for the offered notes. |

| Clearing and settlement | | It is expected that on the closing date the offered notes will be accepted for clearance through DTC, Clearstream, Luxembourg and Euroclear under the following CUSIP numbers, common codes and ISINs: |

| | Class of notes | | CUSIP | | ISIN | | Common code |

| | series 1 class A notes | | 71419GAH3 | | US71419GAH39 | | 28910312 |

| | series 2 class A1 notes | | 71419GAJ9 | | US71419GAJ94 | | 28918941 |

| | series 2 class A2 notes | | 71419GAK6 | | US71419GAK67 | | 28919026 |

| | series 4 class A notes | | 71419GAL4 | | US71419GAL41 | | 28919115 |

| | series 1 class B notes | | 71419GAM2 | | US71419GAM24 | | 28919182 |

| | series 1 class C notes | | 71419GAN0 | | US71419GAN07 | | 28919263 |

| Reports to noteholders | | The cash manager will prepare annual and monthly reports that will contain information about the offered notes as more fully described under “Reports to noteholders” in the accompanying prospectus. |

| | The issuing entity will file with the SEC annual reports on Form 10-K, periodic reports on Form 10-D and reports on Form 8-K about the mortgages trust. See “Where investors can find more information” in the accompanying prospectus. |

| Product switches | | For the purposes of paragraph (c) of the definition of product switch, (see “Sale of loans and their related security – Product switches” in the accompanying prospectus) any variation to the maturity date of a loan must not extend beyond June 2040 while any loan tranche under the master intercompany loan is outstanding. |

S-15

Back to Contents

Risk factors

The principal risks associated with an investment in the offered notes are set out in the “Risk factors” section of the accompanying prospectus. These risks are material to an investment in the offered notes and in the issuing entity. This section sets out certain additional risk factors associated with an investment in the offered notes. If you are considering purchasing any of the offered notes, you should carefully read and think about all the information contained in this prospectus supplement (including the additional risk factors set out below) and the accompanying prospectus (including the “Risk factors” section) prior to making any investment decision.

| Restrictions on transfers of the offered notes; lack of liquidity |

The offered notes are a new issue of securities for which there is currently no market. Neither the issuing entity nor the underwriters intend to create a market for the offered notes. Accordingly, no assurance can be given as to the development or liquidity of any market for the offered notes. Because of the restrictions on transfers of the offered notes, investors must be able to bear the risks of their investment in the offered notes for an indefinite period of time.

| You may not be able to sell the offered notes |

There currently is no secondary market for the offered notes. If no secondary market develops, you may not be able to sell the offered notes prior to their maturity. The issuing entity cannot offer any assurance that a secondary market will develop or, if one does develop, that it will continue to exist.

S-16

Back to Contents

US dollar presentation

Unless otherwise stated in this prospectus supplement, any translations of sterling into US dollars have been made at the rate of £1 = US$1.9385, which was the closing buying rate in the City of New York for cable transfers in sterling per US$1.00 as certified for customs purposes by the Federal Reserve Bank of New York on 8 January 2007. Use of this rate does not mean that sterling amounts actually represent those US dollar amounts or could be converted into US dollars at that rate at any particular time.

References throughout this prospectus supplement to £, pounds or sterling are to the lawful currency for the time being of the United Kingdom of Great Britain and Northern Ireland.

References throughout this prospectus supplement to $, US$, USD, US dollars or dollars are to the lawful currency of the United States of America.

Sterling/US dollar exchange rate history

| 1 January 2007 through

9 February | | Years ended 31 December

| |

| 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

|

| |

| |

| |

| |

| |

| |

| |

| Last(1) | 1.9512 | | 1.9586 | | 1.7188 | | 1.9160 | | 1.7842 | | 1.6095 | | 1.4543 | |

| Average(2) | 1.9599 | | 1.8434 | | 1.8204 | | 1.8330 | | 1.6347 | | 1.5025 | | 1.4396 | |

| High | 1.9847 | | 1.9794 | | 1.9292 | | 1.9482 | | 1.7842 | | 1.6095 | | 1.5045 | |

| Low | 1.9305 | | 1.7256 | | 1.7138 | | 1.7544 | | 1.5500 | | 1.4074 | | 1.3730 | |

| (1) | The closing exchange rate on the last operating business day of each of the periods indicated, years commencing from 1 January or the next operating business day. |

| (2) | Average daily exchange rate during the period. |

| Source: Bloomberg – Close of Business Mid Price |

S-17

Back to Contents

Scheduled redemption dates and bullet redemption dates

The scheduled amortisation instalment or the redemption amounts, as applicable, for each series and class of the offered notes set out below for the interest payment dates set out below is equal to the corresponding stated amount below.

Series and class |

Type of note | | Scheduled redemption date

or bullet redemption date | | Scheduled amortisation

instalment or redemption amount | |

|

| |

| |

| |

| | | | | (£) | | ($ | ) |

| | | | |

| |

| |

| Series 1 class A | bullet | | January 2008 | | 512,170,000 | | 1,000,000,000 | |

| Series 2 class A1 | bullet | | January 2010 | | 768,250,000 | | 1,500,000,000 | |

| Series 2 class A2 | bullet | | January 2010 | | 512,170,000 | | 1,000,000,000 | |

| Series 4 class A | scheduled | | October 2011 and January 2012 | | 345,715,000

345,715,000 | | 675,000,000

675,000,000 | |

| Series 1 class B | pass-through | | N.A | | N.A | | N.A | |

| Series 1 class C | pass-through | | N.A | | N.A | | N.A | |

S-18

Back to Contents

Maturity and repayment considerations

The average lives of each class of the offered notes cannot be stated, as the actual rate of repayment of the loans and redemption of the mortgages and a number of other relevant factors are unknown. However, calculations of the possible average lives of each class of the offered notes can be made based on certain assumptions. The assumptions used to calculate the possible average lives of each class of the offered notes in the following table include that:

| (1) | neither the issuing entity security nor the Funding 2 security has been enforced; |

| (2) | the seller is not in breach of the terms of the mortgage sale agreement; |

| (3) | the seller sells no new loans to the mortgages trustee after the closing date and the loans are assumed to amortise in accordance with the assumed constant payment rate indicated in the table below (subject to assumption (4) below); |

| (4) | the seller sells to the mortgages trustee sufficient new loans and their related security (i) in the period up to (but excluding) the interest payment date in July 2009, such that the aggregate principal amount outstanding of loans in the portfolio at any time is not less than £35,000,000,000 and (ii) during the period from (and including) the interest payment date in July 2009 to (but excluding) the interest payment date in April 2010, such that the aggregate principal amount outstanding of the loans in the portfolio at any time is not less than £32,000,000,000 or (in each case) such higher amount as may be required to be maintained as a result of any new Funding 1 issuing entities providing new term advances to Funding 1 and/or the issuing entity advancing new loan tranches to Funding 2 which Funding 1 and/or Funding 2, as the case may be, uses to pay to the seller and/or Funding 1 or Funding 2, as the case may be, for an increase in its share of the trust property and/or to pay the seller for the sale of new loans to the mortgages trustee; |

| (5) | neither an asset trigger event nor a non-asset trigger event occurs; |

| (6) | no event occurs that would cause payments on scheduled amortisation loan tranches or pass-through loan tranches to be deferred (unless such advances are deferred in accordance with Rule (1)(B) or Rule (1)(C) as set out in “Cashflows – Rule (1) – Repayment deferrals” in the accompanying prospectus); |

| (7) | the annualised CPR as at the closing date is assumed to be the same as the various assumed rates in the table below; |

| (8) | there is a balance of £0.00 in the Funding 2 cash accumulation ledger at the closing date and a balance of £0.00 in the Funding 1 cash accumulation ledger at the closing date; |

| (9) | the issuing entity exercises its option to redeem the offered notes (not including the series 1 class A notes) on the step-up date relating to the offered notes; and |

| (10) | the closing date is 1 March 2007. |

S-19

Back to Contents

| CPR and possible average lives of each series and class of offered notes (in years) |

Based upon the foregoing assumptions, the approximate average life in years of each series and claim of offered notes, at various assumed rates of repayment of the loans, would be as follows:

| Constant payment rate(1) (per annum) | series 1

class A

notes | | series 2

class A1

notes | | series 2 class A2 notes | | series 4

class A

notes | | series 1

class B

notes | | series 1

class C

notes | |

|

| |

| |

| |

| |

| |

| |

| 5 per cent. | 0.90 | | 3.47 | | 3.47 | | 5.88 | | 5.88 | | 5.88 | |

| 10 per cent. | 0.88 | | 2.88 | | 2.88 | | 4.75 | | 5.88 | | 5.88 | |

| 15 per cent. | 0.88 | | 2.88 | | 2.88 | | 4.75 | | 0.88 | | 0.88 | |

| 20 per cent. | 0.88 | | 2.88 | | 2.88 | | 4.75 | | 0.88 | | 0.88 | |

| 25 per cent. | 0.88 | | 2.88 | | 2.88 | | 4.75 | | 0.88 | | 0.88 | |

| 30 per cent. | 0.88 | | 2.88 | | 2.88 | | 4.75 | | 0.88 | | 0.88 | |

| 35 per cent. | 0.88 | | 2.88 | | 2.88 | | 4.75 | | 0.88 | | 0.88 | |

| (1) | Includes both scheduled and unscheduled payments. |

Assumptions (1), (2), (3), (4), (5), (6), (9) and (10) relate to circumstances which are not predictable. No assurance can be given that the issuing entity will be in a position to redeem the offered notes (other than the series 1 class A notes) on the step-up date for the offered notes. If the issuing entity does not so exercise its option to redeem, then the average lives of the then outstanding notes would be extended.

The average lives of the offered notes are subject to factors largely outside the control of the issuing entity and consequently no assurance can be given that these assumptions and estimates will prove in any way to be realistic and they must therefore be viewed with considerable caution. For more information in relation to the risks involved in the use of these estimated average lives, see “Risk factors – The yield to maturity of the notes may be adversely affected by prepayments or redemptions on the loans” in the accompanying prospectus.

S-20

Back to Contents

Funding 2 swap provider

Information in respect of the Funding 2 swap provider and the Funding 2 swap is provided in the accompanying prospectus under the heading “The swap agreements – The Funding 2 swap”.

The sponsor has determined that the significance percentage for the Funding 2 swap in respect of the offered notes is less than 10%.

The significance percentage of the Funding 2 swap is the percentage equivalent of (1) the amount of a reasonable good-faith estimate of maximum probable exposure (made in substantially the same manner as that used in the sponsor’s internal risk management process in respect of similar derivative instruments) divided by (2) the aggregate principal balance of the loans in the portfolio.

S-21

Back to Contents

Issuing entity swap providers

The sponsor has determined that the significance percentage for the issuing entity swaps in respect of the offered notes is 20% or more.

The significance percentage of the issuing entity swaps in respect of the offered notes is the percentage equivalent of (1) the amount of a reasonable good-faith estimate of maximum probable exposure (made in substantially the same manner as that used in the sponsor’s internal risk management process in respect of similar derivative instruments) divided by (2) the aggregate principal amount of such classes of offered notes.

| The issuing entity swap providers in respect of the offered notes |

| Deutsche Bank Aktiengesellschaft |

Deutsche Bank Aktiengesellschaft (Deutsche Bank or the Bank) is a banking institution and a stock corporation incorporated under the laws of Germany under registration number HRB 30 000. The Bank has its registered office in Frankfurt am Main, Germany. It maintains its head office at Taunusanlage 12, 60325 Frankfurt am Main. Deutsche Bank originated from the reunification of Norddeutsche Bank Aktiengesellschaft, Hamburg, Rheinisch-Westfälische Bank Aktiengesellschaft, Duesseldorf and Süddeutsche Bank Aktiengesellschaft, Munich; pursuant to the Law on the Regional Scope of Credit Institutions, these had been disincorporated in 1952 from Deutsche Bank which was founded in 1870. The merger and the name were entered in the Commercial Register of the District Court Frankfurt am Main on 2 May 1957.

The Bank is the parent company of a group consisting of banks, capital market companies, fund management companies, a real estate finance company, instalment financing companies, research and consultancy companies and other domestic and foreign companies (the Deutsche Bank Group).

Deutsche Bank AG, London Branch is the issuing entity swap provider in respect of the series 4 class A notes. Deutsche Bank AG, London Branch is the London branch of Deutsche Bank. On January 12, 1973, Deutsche Bank filed in the United Kingdom the documents required pursuant to section 407 of the Companies Act 1948 to establish a place of business within Great Britain. On January 14, 1993, Deutsche Bank registered under Schedule 21A to the Companies Act 1985 as having established a branch (Registration No. BR000005) in England and Wales. Deutsche Bank AG, London Branch is an authorized person for the purposes of section 19 of the Financial Services and Markets Act 2000. In the United Kingdom, it conducts wholesale banking business and through its Private Wealth Management division, it provides holistic wealth management advice and integrated financial solutions for wealthy individuals, their families and selected institutions.

As of 30 September 2006, Deutsche Bank’s issued share capital amounted to EUR 1,334,735,508.48 consisting of 521,381,058 ordinary shares of no par value. The shares are fully paid up and in registered form. The shares are listed for trading and official quotation on all the German Stock Exchanges. They are also listed on the New York Stock Exchange. The Management Board has decided to pursue delisting on certain stock exchanges other than Germany and New York in order to benefit from the integration of financial markets. In respect of the stock exchanges Amsterdam, Brussels, London, Luxembourg, Paris, Vienna, Zurich and Tokyo, this decision has been completely implemented.

As of 30 September 2006, Deutsche Bank Group had total assets of EUR 1,096,546 million, total liabilities of EUR 1,065,496 million and total shareholders’ equity of EUR 31,050 million on the basis of United States Generally Accepted Accounting Principles (U.S. GAAP).

Deutsche Bank’s long-term senior debt has been assigned a rating of AA- (outlook positive) by Standard & Poor’s, Aa3 (outlook stable) by Moody’s and AA- (outlook stable) by Fitch.

Deutsche Bank is subject to the informational requirements of the Exchange Act, and in accordance therewith, files and submits reports and other information with the SEC. Deutsche Bank’s SEC filings and submissions are available to the public over the Internet at the SEC’s web

S-22

Back to Contents

site at http://www.sec.gov under File Number 0001-15242. You may also read and copy any document filed with the SEC at the SEC’s public reference rooms in Washington, D.C., New York, New York and Chicago, Illinois. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms.

We hereby incorporate the following documents, which Deutsche Bank has previously filed with or furnished to the SEC, into this prospectus and encourage you to review them:

| • | Deutsche Bank’s Annual Report on Form 20-F for the Year Ended 31 December 2005, which was filed with the SEC on 23 March 2006. |

| • | Deutsche Bank’s Reports on Form 6-K containing its Interim Reports for the Quarters Ended 31 March, 30 June and 30 September 2006, which were furnished to the SEC on 3 May, 2 August and 1 November 2006, respectively. |

| • | Deutsche Bank’s Report on Form 6-K containing its unaudited preliminary consolidated statement of income for the period ended on 31 December 2006, which was furnished to the SEC on 2 February 2006. |

The following documents Deutsche Bank files with or furnishes to the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and before the later of (1) the completion of the offering of the securities described in this prospectus and (2) the termination of the reporting obligations of the issuing entity in respect of the offered notes under the Exchange Act shall be incorporated by reference in this prospectus from the date of filing of such documents:

| • | Deutsche Bank’s most recent Annual Report on Form 20-F. |

| • | Any Report on Form 6-K furnished by Deutsche Bank to the SEC on Form 6-K after its most recent Annual Report on Form 20-F containing (i) any Interim Report of Deutsche Bank or (ii) the unaudited preliminary consolidated statement of income of Deutsche Bank for the period ended on the prior year-end. |

| Independent Registered Public Accounting Firm |

Because we are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future filings may modify or supersede some of the information included or incorporated in this prospectus.

The consolidated financial statements of Deutsche Bank and its subsidiaries as of 31 December 2005 and 2004, and for each of the years in the three-year period ended 31 December 2005, which were prepared in accordance with U.S. GAAP, are incorporated by reference herein in reliance upon the audit report of KPMG Deutsche Treuhand-Gesellschaft Aktiengesellschaft Wirtschaftsprüfungsgesellschaft (KPMG), Marie-Curie-Strasse 30, D-60439 Frankfurt am Main, Germany, independent registered public accounting firm, given upon the authority of said firm as experts in auditing and accounting.

The audit report of KPMG refers to the fact that Deutsche Bank Aktiengesellschaft adopted FASB Interpretation No. 46, “Consolidation of Variable Interest Entities” and Statement of Financial Accounting Standards No. 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity” during 2003.

Except for the information provided in the preceeding twelve paragraphs, Deutsche Bank AG, London Branch and any affiliate entity described in this section (in its capacity as an issuing entity swap provider) have not been involved in the preparation of, and do not accept responsibility for, this prospectus supplement.

| Credit Suisse (USA), Inc. |

Credit Suisse (USA), Inc. has only supplied the information in the following eight paragraphs for inclusion in this prospectus supplement.

Credit Suisse (USA), Inc. is the issuing entity swap provider in respect of the series 1 class A notes, the series 2 class A1 notes, the series 2 class A2 notes, the series 1 class B notes and the series 1 class C notes.

S-23

Back to Contents

Credit Suisse (USA), Inc., a Delaware corporation, and its subsidiaries (CSUSA) are an integrated investment bank serving institutional, corporate, government and high-net-worth individual clients. CSUSA’s products and services include securities underwriting; sales and trading; financial advisory services; private equity investments; full-service brokerage services; derivatives and risk management products; asset management; and research. CSUSA is an indirect wholly-owned subsidiary of Credit Suisse, a Swiss bank, and Credit Suisse Group, a global financial services company domiciled in Switzerland. CSUSA is a direct wholly-owned subsidiary of Credit Suisse Holdings (USA), Inc., a Delaware corporation. CSUSA’s principal subsidiary is Credit Suisse Securities (USA) LLC, Credit Suisse Group’s principal U.S. registered broker-dealer. Effective 16 January 2006, CSUSA changed its name from Credit Suisse First Boston (USA), Inc. to Credit Suisse (USA), Inc.

CSUSA is subject to the informational requirements of the Exchange Act and in accordance therewith, files and submits reports and other information with the SEC. CSUSA’s SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. The public may also read and copy any document filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

This prospectus supplement incorporates by reference the following items which CSUSA has previously filed with the SEC:

| • | the consolidated statements of financial condition of CSUSA as of 31 December 2005 and 2004, and the related consolidated statements of income, changes in stockholder’s equity and cash flows for each of the years in the three-year period ended 31 December 2005, which appear in CSUSA’s Annual Report on Form 10-K for the year ended 31 December 2005, filed with the SEC on 20 March 2006; and |

| • | the condensed consolidated statement of financial condition of CSUSA as of 30 September 2006, the related condensed consolidated statements of income for the three and nine-month periods ended 30 September 2006 and 2005, and the related condensed consolidated statements of changes in stockholder’s equity and cash flows for the nine-month periods ended 30 September 2006 and 2005 contained in CSUSA’s Quarterly Report on Form 10-Q for the quarterly period ended 30 September 2006, filed with the SEC on 14 November 2006. |

In addition, all documents filed by CSUSA pursuant to Section 13(a) or 15(d) of the Exchange Act after the date of this prospectus supplement and before the later of (i) the completion of the offer of the securities described in this prospectus supplement and (ii) the termination of the reporting obligations of the issuing entity with respect to the offered notes under the Exchange Act shall be incorporated by reference in this prospectus supplement.

As of the date of this prospectus supplement CSUSA has been assigned a senior unsecured debt rating of “AA-(stable outlook)” by Standard & Poor’s, a senior debt rating of “Aa3 (stable outlook)” by Moody’s and a long-term rating of “AA-(stable outlook)” by Fitch. These ratings are assigned by credit rating agencies, which may raise, lower or withdraw their ratings or place CSUSA on “credit watch” with positive or negative implications at any time.

The consolidated financial statements of CSUSA as of 31 December 2005 and 2004, and for each of the years in the three-year period ended 31 December 2005, which are incorporated by reference herein, have been audited by KPMG LLP (KPMG), an independent registered public accounting firm as set forth in their audit report dated 20 March 2006. Such consolidated financial statements are incorporated herein by reference in reliance upon such report, given upon the authority of said firm as experts in accounting and auditing. The audit report referred to above contains an explanatory paragraph that refers to changes in accounting for share-based compensation and variable interest entities.

With respect to the unaudited interim financial information for CSUSA for the periods ended 30 September 2006 and 2005, incorporated by reference herein, KPMG has reported that they applied limited procedures in accordance with professional standards for a review of such information. However, their separate report included in CSUSA’s Quarterly Report on Form 10-Q

S-24

Back to Contents

for the quarter ended 30 September 2006, and incorporated by reference herein, states that they did not audit and they do not express an opinion on that interim financial information. Accordingly, the degree of reliance on their report on such information should be restricted in light of the limited nature of the review procedures applied. KPMG are not subject to the liability provisions of Section 11 of the Securities Act for their report on the unaudited interim financial information because that report is not a “report” or a “part” of the registration statement prepared or certified by the accountants within the meaning of Sections 7 and 11 of the Securities Act.

Information in respect of the issuing entity swaps is provided in the accompanying prospectus under the heading “The swap agreements – The issuing entity swaps”.

S-25

Back to Contents

Underwriting

We have agreed to sell, and Deutsche Bank Securities Inc., Lehman Brothers Inc. and UBS Securities LLC (the lead underwriters) and the other underwriters for the offered notes listed in the following table have agreed to purchase, the principal amount of those offered notes listed in that table. The terms of these purchases are governed by an underwriting agreement among us, the lead underwriters and the underwriters.

| Underwriters of the series 1 class A notes | Principal

amount of the

series 1 class

A notes | |

|

| |

| UBS Securities LLC | $333,000,000 | |

| Deutsche Bank Securities Inc. | $333,000,000 | |

| Lehman Brothers Inc. | $334,000,000 | |

| ABN AMRO Bank N.V., London Branch. | — | |

| Credit Suisse Securities (Europe) Limited. | — | |

| Merrill Lynch Pierce, Fenner & Smith Incorporated | — | |

|

| |

| Total: | $1,000,000,000 | |

|

| |

| Underwriters of the series 2 class A1 notes | Principal

amount of the

series 2 class

A1 notes | |

|

| |

| UBS Securities LLC | $500,000,000 | |

| Deutsche Bank Securities Inc. | $500,000,000 | |

| Lehman Brothers Inc. | $500,000,000 | |

| ABN AMRO Bank N.V., London Branch. | — | |

| Credit Suisse Securities (Europe) Limited. | — | |

| Merrill Lynch Pierce, Fenner & Smith Incorporated | — | |

|

| |

| Total: | $1,500,000,000 | |

|

| |

| Underwriters of the series 2 class A2 notes | Principal

amount of the

series 2 class

A2 notes | |

|

| |

| UBS Securities LLC | $333,000,000 | |

| Deutsche Bank Securities Inc. | $334,000,000 | |

| Lehman Brothers Inc. | $333,000,000 | |

|

| |

| Total: | $1,000,000,000 | |

|

| |

| Underwriters of the series 4 class A notes | Principal

amount of the

series 4 class

A notes | |

|

| |

| UBS Securities LLC | $450,000,000 | |

| | | |

S-26

Back to Contents

| Underwriters of the series 4 class A notes | Principal

amount of the

series 4 class

A notes | |

|

| |

| Deutsche Bank Securities Inc. | $450,000,000 | |

| Lehman Brothers Inc. | $450,000,000 | |

| ABN AMRO Bank N.V., London Branch | — | |

| Credit Suisse Securities (Europe) Limited | — | |

| Merrill Lynch Pierce, Fenner & Smith Incorporated | — | |

|

| |

| Total: | $1,350,000,000 | |

|

| |

| Underwriters of the series 1 class B notes | Principal

amount of the

series 1 class

B notes | |

|

| |

| UBS Securities LLC | $21,500,000 | |

| Lehman Brothers Inc. | $21,500,000 | |

|

| |

| Total: | $43,000,000 | |

|

| |

| Underwriters of the series 1 class C notes | Principal

amount of the

series 1 class

C notes | |

|

| |

| UBS Securities LLC | $21,500,000 | |

| Lehman Brothers Inc. | $21,500,000 | |

|

| |

| Total: | $43,000,000 | |

|

| |

The price to the public as a percentage of the principal balance of the offered notes will be 100 per cent.

S-27

Back to Contents

We have agreed to pay to the underwriters in respect of each class of offered notes a selling commission and a management and underwriting fee (in each case based on the aggregate principal amount of such class of offered notes) as set forth in the table below:

| Series and class of offered notes | Management and

underwriting fee | | Selling

commission | |

|

| |

| |

| series 1 class A | 0.0209 per cent. | | 0.0418 per cent. | |

| series 2 class A1 | 0.0209 per cent. | | 0.0418 per cent. | |

| series 2 class A2 | 0.0209 per cent. | | 0.0418 per cent. | |

| series 4 class A | 0.0209 per cent. | | 0.0418 per cent. | |

| series 1 class B | 0.0833 per cent. | | 0.1667 per cent. | |

| series 1 class C | 0.1333 per cent. | | 0.2667 per cent. | |

|

| |

| |

The issuing entity has agreed to pay an aggregate fee of £60,000 to ABN AMRO Bank N.V., London Branch, Credit Suisse Securities (Europe) Limited and Merrill Lynch Pierce, Fenner & Smith Incorporated, for their services in connection with the issuance of the notes.

The lead underwriters of the offered notes have advised us that the underwriters propose initially to offer the offered notes to the public at the offering price stated on the cover page of this prospectus supplement and to some dealers at that price less a concession not in excess of 0.0209 per cent. per series 1 class A note, series 2 class A1 note, series 2 class A2 note and series 4 class A note, 0.0833 per cent. per series 1 class B note and 0.1333 per cent. per series 1 class C note. The underwriters may allow, and those dealers may re-allow, a concession not in excess of 0.0418 per cent. per series 1 class A note, series 2 class A1 note, series 2 class A2 note and series 4 class A note, 0.1667 per cent. per series 1 class B note and 0.2667 per cent. per series 1 class C note to certain other brokers and dealers.

Additional out-of-pocket expenses (other than the commissions and fees stated above) solely in relation to the offered notes are estimated to be approximately $1,600,000.

Deutsche Bank AG, London Branch, who is acting as the issuing entity swap provider in respect of the series 4 class A offered notes, is an affiliate of Deutsche Bank Securities Inc., one of the underwriters for the offered notes.

S-28

Back to Contents

Legal matters

Certain matters of English law and United States law regarding the notes, including matters relating to the validity of the issuance of the notes, will be provided to Halifax, Funding 2 and the issuing entity by Allen & Overy LLP. Certain legal matters of United States law regarding matters of United States federal income tax with respect to the offered notes will be provided to Halifax, Funding 2 and the issuing entity by Allen & Overy LLP. Certain matters of English law and United States law will be provided to the underwriters by Sidley Austin (UK) LLP.

S-29

Back to Contents

ANNEX A-1

Statistical information on the portfolio

The cut-off date mortgage portfolio

The information provided in this Annex A-1 constitutes an integral part of this prospectus supplement and is incorporated by reference into this prospectus supplement.

The statistical and other information contained herein has been compiled by reference to the loans in the portfolio as at the cut-off date that, subject as provided, are expected to indirectly secure the offered notes and all other notes of the issuing entity and the Funding 1 issuing entities as at 8 January 2007 (the cut-off date). The US dollar figures set forth in the tables below have been calculated based on the currency exchange rate of £1 = $1.9385 and have been rounded to the nearest cent. following their conversion from sterling. Columns stating percentage amounts may not add up to 100% due to rounding. A loan will have been removed from any new portfolio (which comprises a portion of the portfolio as at the cut-off date) if, in the period up to (and including) the assignment date relating to such new portfolio, the loan is repaid in full or if the loan does not comply with the terms of the mortgage sale agreement on or about the applicable assignment date. Once such loans are removed, the seller will then randomly select from the loans remaining in the new portfolio those loans to be assigned on the applicable assignment date once the determination has been made as to the anticipated principal balances of the notes to be issued and the corresponding size of the trust that would be required ultimately to support payments on the offered notes and all other notes of the issuing entity and the Funding 1 issuing entities. The loans in the mortgages trust are selected on the basis of the seller’s selection criteria for inclusion in the mortgages trust. The material aspects of the seller’s lending criteria are described under “The loans – Underwriting” and “The loans – Lending criteria” in the accompanying prospectus. Standardised credit scoring is not used in the UK mortgage market. For an indication of the credit quality of borrowers in respect of the loans, investors may refer to such lending c riteria and to the historical performance of the loans in the mortgages trust in this Annex A-1 and in Annex F. One significant indicator of obligor credit quality is arrears and losses. The information presented under “Delinquency and loss experience of the portfolio” on page S-37 in this Annex A-1 reflects the arrears and repossession experience for loans serviced by Halifax in the portfolio, including loans that were contained in the portfolio since the inception of the mortgages trust and loans expected to be transferred to the mortgages trust on the closing date. All of the loans in the table were originated by Halifax, but not all of the loans form part of the portfolio. Halifax services all of the loans it originates. Any material change to the seller’s lending criteria, which could lead to arrears and losses deviating from the historical experience presented in the table under “Delinquency and loss experience of the portfolio (including loans which previously formed part of the portfolio)”, will be reported by the seller on periodic reports filed with the SEC on Form 10-D. It is not expected that the characteristics of the portfolio as at the closing date will differ materially from the characteristics of the portfolio. Except as otherwise indicated, these tables have been prepared using the current balance as at the cut-off date, which includes all principal and accrued interest for the loans in the portfolio.

The expected portfolio as at the cut-off date consisted of 621,126 mortgage accounts, comprising loans originated by Halifax and secured over properties located in England, Wales and Scotland and having an aggregate outstanding principal balance of £47,726,375,333.81 or $92,517,578,584.59 as at that date. The loans in the expected portfolio as at the cut-off date were originated by the seller between February 1996 and 31 August 2006.

As at 1 February 2007, HVR 1 was 7.25% per annum, HVR 2 was 6.5% per annum and the Halifax flexible variable rate was 6.40% per annum.

Approximately 2.10% of the aggregate outstanding principal balance of the loans in the portfolio as at the cut-off date were extended to the relevant borrowers in connection with the purchase by those borrowers of properties from local authorities or certain other landlords under the “right-to-buy” schemes governed by the Housing Act 1985 (as amended by the Housing Act

S-30

Back to Contents

2004) or (as applicable) the Housing (Scotland) Act 1987 (as amended by the Housing (Scotland) Act 2001).

| • | the Funding 1 share of the trust property will be approximately £26,790,000,000, representing approximately 58.62% of the trust property; |

| • | the Funding 2 share of the trust property will be approximately £9,847,000,000, representing approximately 21.55% of the trust property; and |

| • | the seller share of the trust property will be approximately £9,063,000,000, representing approximately 19.83% of the trust property. |

The actual amounts of the Funding 2 share of the trust property, the Funding 1 share of the trust property and the seller share of the trust property as at the closing date will not be determined until the day before the closing date which will be after the date of this prospectus supplement.

| Outstanding balances as at the cut-off date |

The following table shows the range of outstanding mortgage account balances (including capitalised interest, capitalised high LTV fees, insurance fees, booking fees and valuation fees) as at the cut-off date.

| Range of outstanding balances as at the cut-off date* | | Aggregate

outstanding

balance as at the

cut-off date (£) | | Aggregate

outstanding

balance as at the

cut-off date ($) | | % of

total | | Number

of

mortgage

accounts | | % of

total | |

| |

| |

| |

| |

| |

| |

| £0 – £24,999.99 | | £1,445,526,681.80 | | $2,802,153,472.67 | | 3.03 | % | 101,753 | | 16.38 | % |

| £25,000 – £49,999.99 | | £5,634,397,034.69 | | $10,922,278,651.75 | | 11.81 | % | 151,158 | | 24.34 | % |

| £50,000 – £74,999.99 | | £7,400,701,269.71 | | $14,346,259,411.33 | | 15.51 | % | 119,389 | | 19.22 | % |

| £75,000 – £99,999.99 | | £7,646,126,761.33 | | $14,822,016,726.84 | | 16.02 | % | 88,174 | | 14.20 | % |

| £100,000 – £124,999.99 | | £6,542,660,758.01 | | $12,682,947,879.40 | | 13.71 | % | 58,543 | | 9.43 | % |

| £125,000 – £149,999.99 | | £5,160,105,296.68 | | $10,002,864,117.61 | | 10.81 | % | 37,786 | | 6.08 | % |

| £150,000 – £174,999.99 | | £3,563,899,217.84 | | $6,908,618,633.78 | | 7.47 | % | 22,092 | | 3.56 | % |

| £175,000 – £199,999.99 | | £2,564,655,029.94 | | $4,971,583,775.54 | | 5.37 | % | 13,747 | | 2.21 | % |

| £200,000 – £224,999.99 | | £1,856,182,200.70 | | $3,598,209,196.06 | | 3.89 | % | 8,762 | | 1.41 | % |

| £225,000 – £249,999.99 | | £1,364,140,213.81 | | $2,644,385,804.47 | | 2.86 | % | 5,753 | | 0.93 | % |

| £250,000 – £299,999.99 | | £1,743,575,381.31 | | $3,379,920,876.67 | | 3.65 | % | 6,398 | | 1.03 | % |

| £300,000 – £349,999.99 | | £1,110,155,692.28 | | $2,152,036,809.48 | | 2.33 | % | 3,435 | | 0.55 | % |

| £350,000 – £399,999.99 | | £729,402,796.84 | | $1,413,947,321.67 | | 1.53 | % | 1,952 | | 0.31 | % |

| £400,000 – £449,999.99 | | £594,204,513.00 | | $1,151,865,448.45 | | 1.25 | % | 1,401 | | 0.23 | % |

| £450,000 – £500,000 | | £370,642,485.87 | | $718,490,458.87 | | 0.78 | % | 783 | | 0.13 | % |

| |

| |

| |

| |

| |

| |

| Totals | | £47,726,375,333.81 | | $92,517,578,584.59 | | 100.00 | % | 621,126 | | 100.00 | % |

| |

| |

| |

| |

| |

| |

| * | Including capitalised interest, capitalised high LTV fees, insurance fees, booking fees and valuation fees. |

The largest mortgage account (including capitalised interest, capitalised high LTV fees, insurance fees, booking fees and valuation fees) had an outstanding current balance as at the cut-off date of £499,950.57 or $969,154.18 and the smallest mortgage account had an outstanding current balance as at the cut-off date of £0.01 or $0.02. The weighted average current balance (including capitalised interest, capitalised high LTV fees, insurance fees, booking fees and valuation fees) as at the cut-off date was approximately £128,386.37 or $248,876.98.

S-31