***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission. |

| Exhibit 10.2 |

| |

| Maddocks |

| |

Date January 9, 2014 | Lawyers |

| Level 1 |

| 40 Macquarie Street |

| Barton ACT 2600 Australia |

| |

| Telephone 61 2 6230 1349 |

| Facsimile 61 2 6230 1479 |

| |

| info@maddocks.com.au |

| www.maddocks.com.au |

| |

| |

| |

Deed of Variation to Funding Deed (and Notice of Waiver) | |

| |

| |

| Australian Renewable Energy Agency | |

| ABN 35 931 927 899 | |

| | |

| and | |

| | |

| Victorian Wave Partners Pty Ltd | |

| ACN 136 578 044 | |

| ABN 25 136 578 044 | |

| | |

| | |

| | Interstate offices |

| | Melbourne Sydney |

| | |

| | Affiliated offices around the world through the |

| | Advoc network - www.advoc.com |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Table of Contents

1. | Definitions | 4 |

| | | |

| 2. | Effect of the Australian Renewable Energy Agency (Consequential Amendments and Transitional Provisions) Act 2011 | 4 |

| | | |

| 3. | Variation of Funding Deed | 4 |

| | | |

| 4. | Notice of Waiver | 5 |

| | | |

| 5. | General | 5 |

| | | |

| | 5.1 | Amendment | 5 |

| | 5.2 | Entire understanding | 5 |

| | 5.3 | Further assurance | 5 |

| | 5.4 | Legal costs and expenses | 5 |

| | 5.5 | Waiver and exercise of rights | 5 |

| | 5.6 | Rule of construction | 6 |

| | | | |

| | 6.1 | Governing law and jurisdiction | 6 |

| | 6.2 | Commencement of this Deed | 6 |

| | 6.3 | Persons | 6 |

| | 6.4 | Joint and several | 6 |

| | 6.5 | Legislation | 6 |

| | 6.6 | This Deed, clauses and headings | 7 |

| | 6.7 | Severance | 7 |

| | 6.8 | Counterparts | 7 |

| | 6.9 | Currency | 7 |

| | 6.10 | Number and gender | 7 |

| | | |

| Schedule 1 Variation to Funding Deed | 9 |

| | Variation to Funding Deed | 9 |

| | | |

Annexure 1 | Eligible Expenditure Guidelines | 17 |

| | | |

| Annexure 2 | Schedule 2 - Recipient and consortium details (clause 11) | 20 |

| | | | |

| | 1 | Recipient – ownership and group structure details | 20 |

| | 2 | Project Participants | 21 |

| | 3 | Project Participants – Recipient ownership and group structure details | 21 |

| | | | |

| Annexure 3 | Schedule 3, Items 3, 4 and 522 | 22 |

| | | |

| | 3 | Project Budget | 22 |

| | 4 | Authorisations – Stage 1 (clause 6.5) | 23 |

| | 5 | Insurance Requirements (clause 19.3) | 25 |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Table of Contents

(continued)

| Annexure 4 | Schedule 4 - Key Personnel and Approved Subcontractors | 26 |

| | 1 Key Personnel | 27 |

| | 2 Approved Subcontractors | 27 |

| | | |

| Annexure 5 | Schedule 5 - Payment Milestones and Schedule | 28 |

| | | |

| Annexure 6 | Schedule 6 – Reports (clause 13.3) | 31 |

| | | |

| Annexure 7 | Attachment A – Project Description | 32 |

| | 1 Project Objectives | 32 |

| | 2 Project Details | 32 |

| | 3 Project Location | 33 |

| | | |

| Annexure 8 | Knowledge Sharing Plan | 44 |

| | | |

| Schedule 2 | Notice of Waiver | 49 |

| | | |

| Schedule 3 | Teaming Agreement | 50 |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Deed of Variation to Funding Deed (and Notice of Waiver)

Dated January 9, 2014

Parties

Name | Australian Renewable Energy Agency ABN 35 931 927 899 |

| | |

Address | Level 1, NewActon Nishi, 2 Phillip Law Street Canberra 2601 |

| | |

Facsimile | 61 2 6243 7037 |

| | |

Email | [withheld] |

| | |

Contact | Portfolio Team Leader, Renewable Futures |

| | |

Short name | ARENA |

Name | Victorian Wave Partners Pty Ltd ACN 136 578 044 |

| | |

Address | Level 33, 360 Collins Street Melbourne 3000 |

| | |

Facsimile | -- |

| | |

Email | [withheld] |

| | |

Contact | [withheld] |

| | |

Short name | Recipient |

Background

This Deed is made in the following context:

A. | The Renewable Energy Demonstration Program (Program) was a program designed and administered by DRET. |

B. | The objective of the program was to accelerate the commercialisation and deployment of new renewable energy technologies for power generation in Australia by assisting the demonstration of these technologies on a commercial scale, as described in the Renewable Energy Demonstration Program Information Guide. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

C. | The Recipient was successful in obtaining funding from DRET under theProgram for theproject (the development of a 19 megawatt ocean energy demonstration power station in coastal waters near Portland, Victoria). |

D. | DRET agreed to provide thegrant funds to the Recipient for the purposes theproject, subject to the terms and conditions of the Funding Deed, which commenced on 9 September 2010. |

E. | Since the parties entered into the Funding Deed, there have been a number of administrative changes and other developments relevant to the status and progress of theproject. |

Conditions Precedent

F. | A number of conditions precedent are set out in clause 2.1(e) and Schedule 1 of the Funding Deed (Conditions Precedent). The Recipient is required to satisfy allConditions Precedent under the Funding Deed before DRET is obliged to pay any grant funds or other monies. |

G. | At the date of this Deed of Variation and Notice of Waiver (Deed): |

| | G.1 | the Recipient has not satisfiedCondition Precedent 2 norCondition Precedent 3 in Schedule 1. |

| | G.2 | the Recipient has satisfied the remainingConditions Precedent in the Funding Deed. |

| | G.3 | the Recipient has not received anygrant funds or other monies from DRET. |

Transfer of Funding Deed and Program administration from DRET to ARENA

H. | On 1 July 2012, pursuant to theAustralian Renewable Energy Agency (Consequential Amendments and Transitional Provisions)Act 2011, ARENA become responsible for the administration of committed projects and measures from initiatives formerly administered by DRET, including the project. |

Change in Recipient’s ownership structure

I. | The Recipient’s ownership structure has changed since the commencement of the Funding Deed. |

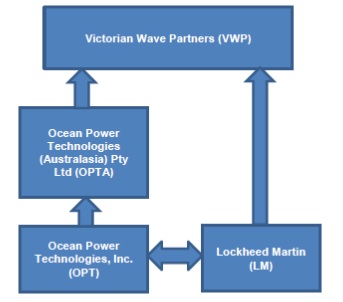

J. | In 2012, majority shareholder Leighton Infrastructure Investments Pty Ltd through its parent company Leighton Contractors Pty Ltd (Leighton), ceased its involvement with the Recipient and transferred its interest in the Recipient to Ocean Power Technologies (Australasia) Pty Ltd (OPTA) via a Share Sale agreement dated 30 March 2012 (such that, on and after that date, the Recipient became a wholly owned subsidiary of OPTA). |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

K. | Following the Share Sale, DRET andLeighton executed a Deed of Termination and Release, under which Leighton was released from its obligations under, or relating to, the Deed of Guarantee that was entered into by the parties on 12 October 2010 andLeighton ceased to be aproject participant under the Funding Deed. |

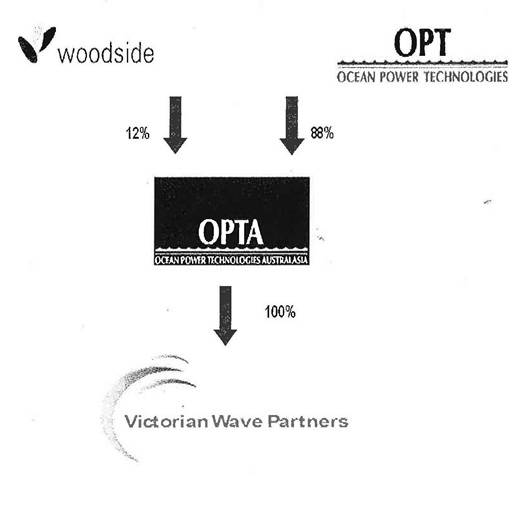

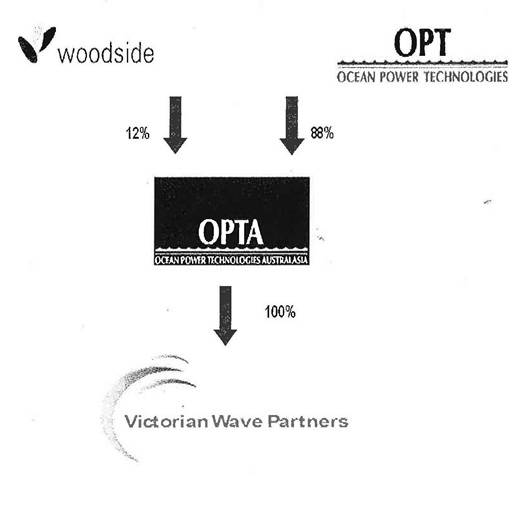

L. | At the date of this Deed, the Recipient is currently 100% owned byOPTA, which, in turn, is owned by Ocean Power Technologies Inc (88% shareholding) and Woodside Energy Ltd (12% shareholding). |

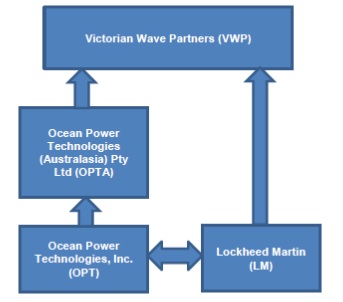

Entry of Lockheed Martin Mission Systems and Sensors into Project

M. | Since the commencement of the Funding Deed, OPTA has sought financial and technical assistance from Lockheed Martin Mission Systems and Sensors (Lockheed Martin) to perform and deliver aspects of theproject. |

N. | Ocean Power Technologies Inc andLockheed Martin executed a Teaming Agreement in July 2012, to formalise the relationship between the parties and the involvement of Lockheed Martin in theproject. Attachment 2 of the Teaming Agreement sets out the responsibilities of the parties in respect of the project elements involvingLockheed Martin. A copy of the Teaming Agreement is attached at Schedule 3. |

O. | Following execution of the Teaming Agreement,Lockheed Martin is now, for the purposes of the Funding Deed, aproject participant and a subcontractor. |

Communications between parties

P. | On 3 December 2012, the Recipient wrote to ARENA to, amongst other things, request a variation to the Funding Deed to restructure certain aspects of theproject (and project delivery) and to reflect change in its ownership structure. |

Q. | On 2 April 2013, ARENA wrote to the Recipient to advise that it agreed to: |

| | Q.1 | restructure theproject and to enter into a Deed of Variation; and |

| | Q.2 | amongst other things, waive the obligation on the Recipient to meetCondition Precedent 2 andCondition Precedent 3 in Schedule 1 of the Funding Deed. |

R. | The purpose of this Deed is to vary the Funding Deed to reflect the changes proposed by the Recipient and approved by ARENA in the abovementioned communications in order to restructure theproject. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

The Parties Agree

In this Deed unless expressed or implied to the contrary:

DRET means the Commonwealth of Australia represented by the former Department of Resources, Energy and Tourism.

effective date means the date of execution of this Deed by ARENA.

Funding Deed means the agreement between the Commonwealth of Australia represented by the former Department of Resources, Energy and Tourism and Victorian Wave Partners dated 9 September 2010 in relation to the Renewable Energy Demonstration Program.

Teaming Agreement means the agreement between Ocean Power Technologies Inc and Lockheed Martin Mission Systems and Sensors dated 27 July 2012.

Terms used in this Deed that are not defined in this clause 1 have the same meaning as in the Funding Deed.

2. | Effect of theAustralian Renewable Energy Agency (Consequential Amendments and Transitional Provisions) Act 2011 |

The parties acknowledge that an effect of theAustralian Renewable Energy Agency (Consequential Amendments and Transitional Provisions)Act 2011 is that on and from the date of that Act:

| | (a) | Commonwealth of Australia represented by the Department of Resources, Energy and Tourism ABN 46 252 861 927 of 51 Allara Street Canberra ACT 2601(Commonwealth) |

| | | | |

| | | | is replaced by |

| | | | |

| | | | Australian Renewable Energy Agency, ABN 35 931 927 899 of 2 Phillip Law Street Canberra ACT 2601 (ARENA) |

| | | | |

| | | | as a party to the Funding Deed; and |

| | | | |

| | (b) | all references to “the Commonwealth” in the Funding Deed, where the reference to the Commonwealth is a reference to it as a party to the Funding Deed, are replaced by references to “ARENA”. |

3. | Variation of Funding Deed |

| | 3.1.1 | In accordance with clause 28.2 of the Funding Deed, the Funding Deed is varied in the manner described in Schedule 1. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

| | 3.1.2 | Unless otherwise stated, the terms and conditions of the Funding Deed remain unchanged and in full force and effect. |

| | 4.1.1 | In accordance with clause 30.5 of the Funding Deed, ARENA waives certain rights created under the Funding Deed, as described in Schedule 2. |

| | 4.1.2 | ARENA agrees to execute and deliver to the Recipient the Notice of Waiver (in the form set out in Schedule 2) on or immediately following the effective date. |

No variation of this Deed is binding unless it is agreed in writing and signed by the Recipient and ARENA.

This Deed contains the entire understanding between the parties as to the subject matter contained in it. All previous agreements, representations, warranties, explanations and commitments, expressed or implied, affecting this subject matter are superseded by this Deed and have no effect.

Each party must promptly execute and deliver all documents and take all other action necessary or desirable to effect, perfect or complete the transactions contemplated by this Deed.

5.4 | Legal costs and expenses |

Each party must pay its own legal costs and expenses in relation to the negotiation, preparation and execution of this Deed and other documents referred to in it, unless expressly stated otherwise.

5.5 | Waiver and exercise of rights |

| | 5.5.1 | A single or partial exercise or waiver of a right relating to this Deed does not prevent any other exercise of that right or the exercise of any other right. |

| | 5.5.2 | No party will be liable for any loss or expenses incurred by another party caused or contributed to by the waiver, exercise, attempted exercise, failure to exercise or delay in the exercise of a right. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

In the interpretation of this Agreement, no rule of construction applies to the disadvantage of the party preparing the document on the basis that it prepared or put forward this Agreement or any part of it.

6.1 | Governing law and jurisdiction |

This Deed is governed by and is to be construed in accordance with the laws of Australian Capital Territory. Each party irrevocably and unconditionally submits to the non-exclusive jurisdiction of the courts of Australian Capital Territory and waives any right to object to proceedings being brought in those courts.

6.2 | Commencement of this Deed |

This Deed commences on theeffective date.

In this Deed, a reference to:

| | 6.3.1 | a person includes a firm, partnership, joint venture, association, corporation or other corporate body; |

| | 6.3.2 | a person includes the legal personal representatives, successors and permitted assigns of that person; and |

| | 6.3.3 | any body which no longer exists or has been reconstituted, renamed, replaced or whose powers or functions have been removed or transferred to another body or agency, is a reference to the body which most closely serves the purposes or objects of the first-mentioned body. |

If a party consists of more than one person, this Deed binds them jointly and each of them severally.

In this Deed, a reference to a statute includes regulations under it and consolidations, amendments, re-enactments or replacements of any of them.

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

6.6 | This Deed, clauses and headings |

In this Deed:

| | 6.6.1 | a reference to this or other document includes the document as varied or replaced regardless of any change in the identity of the parties; |

| | 6.6.2 | a reference to a clause, schedule, appendix or annexure is a reference to a clause, schedule, appendix or annexure in or to this Deed all of which are deemed part of this Deed; |

| | 6.6.3 | a reference to writing includes all modes of representing or reproducing words in a legible, permanent and visible form; |

| | 6.6.4 | headings and sub-headings are inserted for ease of reference only and do not affect the interpretation of this Deed; |

| | 6.6.5 | where an expression is defined, another part of speech or grammatical form of that expression has a corresponding meaning; and |

| | 6.6.6 | Where the expressionincluding orincludes is used it means ‘including but not limited to’ or ‘including without limitation’. |

| | 6.7.1 | If a provision in this Deed is held to be illegal, invalid, void, voidable or unenforceable, that provision must be read down to the extent necessary to ensure that it is not illegal, invalid, void, voidable or unenforceable. |

| | 6.7.2 | If it is not possible to read down a provision as required in this clause, that provision is severable without affecting the validity or enforceability of the remaining part of that provision or the other provisions in this Deed. |

This Deed may be executed in any number of counterparts all of which taken together constitute one instrument.

In this Deed, a reference to ‘$’ or ‘dollars’ is a reference to Australian dollars.

In this Deed, a reference to:

| | 6.10.1 | the singular includes the plural and vice versa; and |

| | 6.10.2 | a gender includes the other genders. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Signing Page

Executed by the parties

Signed for and on behalf of theAustralian Renewable Energy Agency (ARENA) by its duly authorised delegate in the presence of | | |

| /s/ Fiona McKenna | | /s/ Ivor Frischknecht |

Signature of witness Fiona McKenna | | Signature of delegate Ivor Frischknecht |

Name of witness (print) | | Name of delegate (print) CEO |

| | | Position of delegate (print) |

Executed by Victorian Wave Partners Pty Ltd ABN 25 136 578 044 in accordance with Section 127 of the Corporations Act 2001 in the presence of | | |

| | | |

| /s/ George W. Taylor | | /s/ Charles F. Dunleavy |

| Signature of director | | Signature of director |

George W. Taylor | | Charles F. Dunleavy |

Name of director (print) | | Name of director (print) |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Schedule 1 Variation to Funding Deed

Variation to Funding Deed

The parties agree to vary the Funding Deed as set out below with effect from theeffective date:

1.1 | Insert new clause 5.1(c): |

| | (c) | Notwithstanding clause 5.1(b), ARENA will pay theprogress payments specified inpayment milestone numbers 1, 2, 3, 9, 10 and 11 in Schedule 5 upon execution of the Deed of Variation, by direct credit to the bank account identified by the Recipient under clause 8.1. The execution of the Deed of Variation will be deemed a valid form of payment claim for thoseprogress payments for the purposes of clause 9.1(b)(i) provided that the Recipient also provides to ARENA on the execution date the information required under clause 9.1(b)(ii) and clause 9.1(b)(iii). |

2. | Stage-Gate Requirements |

2.1 | Insert new clause 6.1A: |

6.1A Project Stage Gates

| | (a) | For the purposes of this clause 6.1A, project stage means a stage of the project as shown in schedule 5 - Payment Milestones and Schedule. |

| | (b) | Subject to clause 6.1A(c) and unless otherwise approved by ARENA in writing (such approval to not be unreasonably withheld or delayed), the Recipient: |

| | (i) | must not commence any work or activity associated with apayment milestone related to a futureproject stage; and |

| | (ii) | will not be entitled to submit apayment claim in respect of apayment milestone that is related to a future project stage (regardless of whether or not the relevantpayment milestone was reached prior to theDate of Variation), |

unless and until the Recipient has, to the satisfaction of ARENA:

| | (iii) | completed all relevant work or activity associated with allpayment milestones required to be completed in the existingproject stage; |

| | (iv) | secured, and entered into, apower purchase agreement with a third party for the followingproject stage; |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

| | (v) | complied with the reporting requirements in clause 13.3, including providing all relevant payment milestone reports for the existingproject stage; |

| | (vi) | complied with, and obtained all relevant authorisations associated with the existingproject stage required under, clause 6.5; |

| | (vii) | secured all necessarymatching funding or other project finance required for the followingproject stage; and |

| | (viii) | complied with the requirements of clause 6.1 in carrying out theproject. |

(together the stagegate requirements).

| | (c) | The restriction in clause 6.1A(b)(i) will not apply to any work or activity directly relevant to or associated with the project which, by the nature of the work, relates to both project stage 1 and later project stages and is: |

| | (i) | of such fundamental importance to the project (for example, the attaining and maintaining any and all permits required for the project) that it must be fully completed early in the time line for theproject; and/or |

| | (ii) | in the case of the work that is required for later project stages, more efficiently carried out, both in terms of time and cost, contemporaneously with the work required (within that particular work activity) for project stage 1 (for example, the undertaking of any survey or study required to be undertaken for the purpose of the project, including (but not limited to) environmental effects studies and underwater ocean floor surveys of the project area). |

| | (d) | Within 30 days of completing allstagegate requirements for the relevantproject stage, the Recipient must: |

| | (i) | notify ARENA, in writing, that it has completed thestage gate requirements (stage completion notice); and |

| | (ii) | request approval from ARENA for it to commence work and activities associated with the next project stage (stage gate approval). |

| | (e) | For the purposes of clause 6.1A(d) and obtainingstage gate approval, the Recipient must provide documentary evidence for each completedstage gate requirement and any other supporting information ARENA may request for the purpose of demonstrating the Recipient has completed allstage gate requirements. |

| | (f) | ARENA must, within 30 days of receiving notice and supporting documentation from the Recipient in accordance with clauses 6.1A(d) and (e), either accept or reject the request forstage gate approval by written notice to the Recipient. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

| | (g) | Subject to clause 6.1A(h), if ARENA rejects the request forstage gate approval, the written notice to the Recipient must: |

| | (i) | identify any incomplete stage gate requirements; |

| | (ii) | include ARENA’s reasons for rejecting the request forstage gate approval; and |

| | (iii) | include the date or dates by which the Recipient must: |

| | (A) | complete any incompletestage gate requirements identified by ARENA in the notice; |

| | (B) | otherwise address the reasons that ARENA has given for rejecting the request forstage gate approval; and |

| | (C) | re-submit astage completion notice and request forstage gate approval under clause 6.1A(d). |

| | (h) | If the Recipient fails to obtainstage gate approval for anyproject stage more than twice, ARENA may (in addition to its other remedies) terminate the Funding Deed immediately under clause 22.1(j) by giving the Recipient notice in writing. |

3.1 | Delete clause 16.1 and replace with the following: |

16.1 Payment in excess of funding percentage

| | (a) | For the purposes of this clause 16.1,project stage means a stage of theproject as shown in Schedule 5 - Payment Milestones and Schedule. |

4.1 | Delete clause 19.3 and replace with the following: |

19.3 Insurance

| | (a) | Without in any way limiting or affecting the Recipient’s obligations or liabilities under this deed, the Recipient must effect and maintain insurance policies, or procure that insurance policies are effected and maintained that nominate it as an insured, of the type and for the amounts and time periods specified set out in item 5 of schedule 3. |

| | (b) | Where, in respect of a type of insurance specified in item 5 of schedule 3 the amount of the policy cover to be effected and maintained by the Recipient is stated to be dependent on or determined by reference to the value of the asset or assets to be insured, the Recipient must, if requested or required by the Commonwealth to do so, obtain the prior approval of the Commonwealth to the value of the relevant asset, and the amount of the insurance cover to be effected, before it effects the required insurance policy. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

| | (c) | If requested in writing by the Commonwealth, the Recipient must provide to the Commonwealth such evidence of the currency of each of the insurances referred to item 5 of schedule 3, including by the provision of a copy of the certificate of currency of the relevant policy and a copy of the policy wording, within 14 days of the date of receipt of the request from the Commonwealth. |

| | (d) | The Recipient must have the interest of the Commonwealth in the Project, through the provision of funding to the Recipient under this deed, noted and, at no cost to the Commonwealth, have the Commonwealth recorded as an insured on all insurances (other than the professional indemnity insurance) effected and maintained (as required under clause 19.3(a) and item 5 of schedule 3) under this deed. |

| | (e) | The obligation imposed on the Recipient by clause 19.3(d) will apply in all cases including, without limitation, where the Recipient discharges its obligations under clause 19.3(a) by procuring a third party to effect and maintain the relevant insurances on behalf of the Recipient. |

| | (f) | If for any reason it is not possible for the Recipient to have the interest of the Commonwealth in the Project noted and have the Commonwealth recorded as an insured on all insurances (other than the professional indemnity insurance) as required by clause 19.3(d) either at all or on terms that are commercially acceptable to the Recipient, the Recipient must: |

| | (i) | advise the Commonwealth in writing of its inability to obtain the insurance cover (either at all or on terms acceptable to the Recipient); and |

| | (ii) | provide to the Commonwealth all relevant information concerning its inability to obtain the relevant insurance cover. |

| | (g) | On receipt of a notice from the Recipient under clause 19.3(f) ARENA may determine, in its absolute discretion, what alternative form of insurance (which is commercially available on terms that are reasonable) or other course of action that the Recipient must take to protect the interests of the Commonwealth in the Project. |

| | (h) | The Recipient must notify the Commonwealth immediately of any change in or to its insurances (including but not limited to any change of insurer or of the persons insured or of other details set out in item 5 of schedule 3) or if any insurance cover required under clause 19.3(a) and/or item 5 of schedule 3 is voided, cancelled, withdrawn, not renewed, not maintained or is for any other reason otherwise not current and subsisting. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

5. | Termination for default |

5.1 | Insert new clause 22.1(j): |

| | (i) | the Recipient fails to obtainstage gate approval more than twice for anyproject stage. |

6. | Funding for project stage 1 |

6.1 | Insert new clause 18A: |

Prior to undertaking any work or activity associated with apayment milestone related toproject stage 1, the Recipient must, warrant to ARENA that:

| | (a) | the Recipient has available to it, whether from its own resources or otherwise, the funding necessary for it to be able to pay all expenditure likely to be incurred in the completion of thepayment milestone which is not covered by thegrant funds; and |

| | (b) | the funding will be available to the Recipient as and when required by it in order to pay all such expenditure related to thepayment milestone when due and payable. |

7.1 | At clause 22.1(a) include the words “and is of material effect” after the words “misleading when made” so that clause 22.1(a) provides: | |

| | | |

| | a representation or warranty made by the Recipient under this deed is incorrect or misleading when made and the incorrect or misleading representation or warranty is of material effect; |

8.1 | Insert new clause 25.5: |

25.5 Knowledge Sharing Plan

In addition to clause 25.3, the Recipient must:

| | (a) | comply with theKnowledge Sharing Plan; |

| | (b) | on each anniversary of theDate of Variation, provide ARENA with, and update theKnowledge Sharing Plan to include, a list of planned knowledge sharing activities over the forward 12 months; |

| | (c) | provide ARENA with any report, paper, or other Material for dissemination, prepared for the purpose of theKnowledge Sharing Plan 15 days before public release (or by the time agreed to by ARENA); and |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

| | (d) | not publicly release any such report, paper or Material without the consent of ARENA which consent will not be unreasonably withheld or delayed. |

8.2 | Insert definition of Knowledge Sharing Plan in clause 31.1: |

| | Knowledge Sharing Planmeans the plan the Recipient is required to provide to ARENA substantially in the form set out in Schedule 8 as updated on each anniversary of the Date of Variation or amended by agreement of the parties from time to time. |

8.3 | Insert new Schedule 8 (Knowledge Sharing Plan) set out at Annexure 8 to this Schedule. |

9. | Definition – Date of Variation |

9.1 | Insert definition of Date of Variation in clause 31.1: |

| | Date of Variationmeans the date on which ARENA provides written notice to the Recipient approving theKnowledge Sharing Plan in accordance with clause 2.1.3 of theDeed of Variation or such other date notified by ARENA to the Recipient under clause 2.1.4(b) of theDeed of Variation. |

10. | Definition – Deed of Variation |

10.1 | Insert definition of Date of Variation in clause 31.1: |

| | Deed of Variationmeans the deed entered into by the parties on or about 31 October 2013 that varies this deed. |

11. | Definition – Eligible Expenditure Guidelines |

11.1 | Delete definition of Eligible Expenditure Guidelines in clause 31.1 and replace with the following: |

| | Eligible Expenditure Guidelinesmeans the guidelines provided to the Recipient on or before theexecution date (included at Schedule 7) as amended from time to time. |

11.2 | Insert guidelines attached at Annexure 1 to this Schedule in Schedule 7 of the Funding Deed. |

12. | Definition – funding percentage |

12.1 | Replace definition of funding percentage in clause 31.1 with: |

| | funding percentagemeans the percentage figure set out in item 4 of Schedule 1, which figure must not exceed [***]. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

13. | Definition – power purchase agreement |

13.1 | Insert definition of power purchase agreement in clause 31.1 |

| | power purchase agreementmeans an agreement entered into by the Recipient (or a Related Body Corporate of the Recipient) with an electricity retailer or other user, distributor, reseller or consumer of electricity for the supply of electricity generated by or a result of the wave energy assets constructed in the course of the Project. |

14.1 | Delete definition of Program in clause 31.1 and replace with the following: |

| | Program means the portfolio of projects and measures for a number of renewable energy and technology types for which ARENA is currently providing financial assistance, that were previously administered by DRET. |

15. | Definition – Program funding |

15.1 | Delete definition of Program funding in clause 31.1 and replace with the following: |

| | Program fundingmeans the funding made available by the Parliament of the Commonwealth of Australia to ARENA in any givenfinancial year which is allocated and administered by ARENA for the purposes of the Program. |

16. | Definition – Program Objectives and Outcomes |

16.1 | Delete definition of Program Objectives and Outcomes in clause 31.1 and replace with the following: |

| | |

| | Program Objectives and Outcomes means the objective of accelerating the commercialisation and deployment of new renewable energy technologies for power generation in Australia by assisting the demonstration of these technologies on a commercial scale, and thereby to contribute to the achievement of the 20 per cent renewable energy target by 2020 and global efforts for climate change mitigation with the intention of achieving the following outcomes: • demonstrating technical and economic viability of renewable energy technologies for power generation through large-scale installations; • supporting the development of a range of renewable energy technologies for power generation in Australia; • enhancing Australia’s international leadership in renewable energy technology for power generation development; and • attracting private sector investment in renewable energy power generation. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

17.1 | Delete the reference to [***] in Item 4 of Schedule 1 and replace with [***]. |

17.2 | Delete Schedule 2 and replace with Schedule 2 attached at Annexure 2 to this Schedule. |

17.3 | Delete item 3, item 4 and item 5 in Schedule 3 and replace with item 3, item 4 and item 5 of Schedule 3 attached at Annexure 3 to this Schedule. |

17.4 | Delete Schedule 4 and replace with Schedule 4 attached at Annexure 4 to this Schedule. |

17.5 | Delete Schedule 5 and replace with Schedule 5 attached at Annexure 5 to this Schedule. |

17.6 | Delete Schedule 6 and replace with Schedule 6 attached at Annexure 6 to this Schedule. |

17.7 | Delete Attachment A to Funding Deed and replace with Attachment A at Annexure 7 to this Schedule. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Annexure 1 Eligible Expenditure Guidelines

These guidelines set out what kind of expenditure is eligible expenditure and what kind of expenditure is ineligible for the project.

These guidelines are to be followed in the regular milestone reporting and annual financial reporting required under the Funding Deed.

Where the Recipient is in any doubt as to the eligibility of elements of project expenditure, it is encouraged to discuss the matter with ARENA. If the Recipient wants particular expenditure that falls outside these guidelines to be considered as eligible, it should have provided supporting information in its application, or if at a later stage during the project, it should provide supporting information within a report.

General Principles

The following general principles apply in the consideration of eligible expenditure:

| | ● | Generally accepted accounting principles are to be followed, and it must be possible to track expenditure relating to the project through the Recipient’s accounting system; |

| | ● | Eligible expenditure is expenditure directly related to the undertaking of eligible project activities – eligible project activities are those activities necessary to conduct the project as set out in the project plan; |

| | ● | Where resources are used both on the project and non-project activities elsewhere in the Recipient’s company, the expenditure should be apportioned on a reasonable basis; |

| | ● | Opportunity costs, that is expenditure related to foregone production and downtime arising from the allocation of resources to the project activities, are not eligible; |

| | ● | Related party transactions must be treated on an at cost basis, without mark-up, unless it can be demonstrated that the transaction has been calculated on an arm’s-length basis; |

| | ● | Expenditure is not generally eligible if undertaken prior to the signing of the Funding Deed, or after the specified completion date (or such later date agreed by the parties); and |

| | ● | Eligible expenditure is calculated net of GST and GST is then added to the grant payment due. |

Specific Eligibility Provisions

Eligible expenditureincludes:

| | ● | Contract expenditure in relation to contracts entered into for the purposes of undertaking the activities required for the conduct of the project (subject to the ineligible expenditure constraints below); |

| | ● | Labour expenditure (salaries/wages) including reasonable on-costs for personnel directly employed on the project. Labour on-costs include worker’s compensation insurance, employer contributions to superannuation, recreation and sick leave, long service leave accrual and payroll tax; |

| | ● | Administrative expenses including communications, accommodation, computing , travel, recruitment, printing and stationery, where directly related to the project; |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

| | ● | Plant expenditure for plant installed in the project is allowable at the full delivered cost of the plant to the site of the facility; |

| | ● | Plant expenditure in respect of plant used for the construction of the facility is allowable on the basis of hire/lease costs, or depreciation charges if owned, and related running costs such as rent, light and power and repairs and maintenance; |

| | ● | Expenditure related to Front End Engineering and Design (FEED) activities and the obtaining of approvals related to the project may be allowable (subject to the provisions related to pre-contract expenditure); |

| | ● | Expenditure related to legal, audit and accounting costs related to the project are eligible; |

| | ● | Where the Recipient needs to access specific technology in relation to the project, relevant licence fees or intellectual property purchase costs are eligible expenditure; |

| | ● | Expenditure related to all insurances reasonably and prudently required for the project; |

| | ● | Expenditure (including advisor fees) related to the procurement and execution of a power purchase agreement (or other agreement to a similar effect) (PPA) for the project and such other documentation ancillary to the PPA as may be required for the purpose of giving effect to the PPA. |

Ineligible expenditureincludes:

| | ● | Expenditure related to the general operations and administration of the Recipient’s company; |

| | ● | Expenditure directly related to the raising of funding for the project or to the implementation of joint ventures or other collaborative arrangements involving the Recipient and which related primarily to its financing of the project; |

| | ● | Expenditure in relation to activities that are part of the project but are funded by any other Commonwealth government program, which would lead to the Australian Government funding the same activity more than once. |

| | ● | Expenditure on activities that a local, State, Territory or Australian Government agency has the responsibility to undertake. [For clarity, it is not intended that this clause would result in expenditure incurred in obtaining permits or other approvals or the undertaking of other activities in respect of which a local, State, Territory or Australian Government agency is the responsible body) being ineligible expenditure]; |

| | ● | Expenditure related to obtaining regulations and standards compliance—such as certification and accreditation fees, and other direct payments to regulators including geothermal license retention fees, or to certification or accreditation bodies; |

| | ● | Expenditure on achieving quality control accreditation; |

| | ● | Interest expenditure on loans for new and pre-existing capital items utilised for the project; |

| | ● | Undertaking commercialisation activities—such as sales promotion; and |

| | ● | Expenditure that does not directly support the achievement of the planned outcomes of the project, or is contrary to the spirit or intention of the project and the intentions of the original Renewable Energy Demonstration program that was administered by the Department of Resources, Energy and Tourism. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Comments on Expenditure Items

Labour

Eligible labour expenditure for the project is the gross amount paid or payable to an employee of the Recipient’s company. An employee is a person who is paid a regular salary or wage, out of which regular tax installment deductions are made. Eligible salary includes any components of the employee’s total remuneration package which are itemised on theirPay As You Go (PAYG) Annual Payment Summaries submitted to the Australian Taxation Office (ATO).

It is expected that, in a reporting context, the Recipient will be able to demonstrate, by reference to appropriate records such as timesheets, job cards or diaries, the amount of time spent on approved activities by each employee. Labour costs cannot be claimed based on an estimation of the employee’s worth to the company, where no cash has changed hands.

Contract Expenditure

Eligible contract expenditure is the cost of any agreed project activities performed for the Recipient by another organisation. All project work to be performed must be the subject of a written contract (for example, a letter or purchase order) which specifies the nature of the work to be performed for the client and the applicable fees, charges and other costs payable. The written contract must be entered into prior to commencement of the work undertaken under the contract.

With respect to the project budget submitted at time of application, it is not a requirement for contracts to be in place. However, for major items of contract expenditure (for example, purchases of major items of hardware to be incorporated in the project), the Recipient will be expected to have some form of documentary evidence such as written quotes from suppliers, to substantiate the expenditure included in the project budget.

Where the contractor and the Recipient are not at arm’s length’, the amount assessed for work performed will be an amount considered to be a reasonable charge for that work and contain no unacceptable element of ‘in group profit’. Organisations considered not at arm’s length’ include related companies and companies with common directors and/or shareholders.

Expenditure Prior to Deed

While expenditure is not generally eligible if undertaken prior to the signing of the Funding Deed, the Recipient may be able to claim expenditures incurred prior to execution of a Deed, such as those associated with Front End Engineering and Design (FEED). This expenditure and funding attached to it will be considered by ARENA on a case by case basis.

Accounting Systems

The Recipient is required to have in place suitable accounting systems to provide assurance that the system allows for the separate accurate identification of eligible and ineligible project expenditure and ensures that a clear audit trail is available.

*** | Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission. |

Annexure 2 Schedule 2 - Recipient and consortium details (clause 11)

1 Recipient – ownership and group structure details

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

2 Project Participants

Name ofproject participant | Contribution/role ofproject participant |

Ocean Power Technologies (Australasia) Pty Ltd ABN 19 076 639 211 | 100% equity investor in Victorian Wave Partners Pty Ltd Technology provider |

Lockheed Martin Australia Pty Ltd

ABN 30 008 425 509 Lockheed Mission Systems and Sensors Business

Registered in the State of Maryland, USA IRS Employer Identification No: 52-1893632 | Program management and system integration |

3 Project Participants – Recipient ownership and group structure details

Ocean Power Technologies (Australasia) Pty Ltd (OPTA) - ABN 19 076 639 211

OPTA is a subsidiary of Ocean Power Technologies, Inc. (OPT).

OPTA is 88% owned by OPT and 12% by Woodside Energy.

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Annexure 3 Schedule 3, Items 3, 4 and 5

3 Project Budget

[***] (Budget redacted)

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

4 Authorisations – Stage 1 (clause 6.5)

Authorisationtype/category | Final date for obtaining authorization |

Environment Protection and Biodiversity Conservation Act 1999 | [***] |

Navigational Aids | [***] |

National Energy Regulations (Section 5.2) AEMC (over 5MW) | [***] |

Compliance with the Open Access Regime and NEMCO requirements | [***] |

Coastal Management Act Consents | [***] |

Indigenous Land Use Act Agreement (ILUA) | [***] |

Sea Bed Lease (DEPI) | [***] |

Environmental Effects Statement (DPCD) | [***] |

Shore Crossing Easement | [***] |

Cable Easement | [***] |

Interconnection Agreement with District Network Service Provider | [***] |

Other authorisations as deemed appropriate by relevant local, state and federal authorities | [***] |

Note:

| 1) | The dates listed above are based on reasonable estimates of the time usually required to obtain the relevant authorisations. Circumstances beyond the Recipient’s control may result in one or more authorisations not being obtained by the date shown. |

| 2) | Final dates are predicated on the assumption that the environmental review approval process will not be subject to a public review. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Authorisations – Stages 2 and 3 (clause 6.5)

Authorisation type/category | Final date for obtainingauthorisation |

Environment Protection and Biodiversity Conservation Act 1999 | [***] |

Navigational Aids | [***] |

National Energy Regulations (Section 5.2) AEMC (over 5MW) | [***] |

Compliance with the Open Access Regime and NEMCO requirements | [***] |

Coastal Management Act Consents | [***] |

Indigenous Land Use Act Agreement (ILUA) | [***] |

Sea Bed Lease (DEPI) | [***] |

Environmental Effects Statement (DPCD) | [***] |

Shore Crossing Easement | [***] |

Cable Easement | [***] |

Interconnection Agreement with District Network Service Provider | [***] |

Other authorisations as deemed appropriate by relevant local, state and federal authorities | [***] |

Note:

| 1) | The dates listed above are based on reasonable estimates of the time usually required to obtain the relevant authorisations. Circumstances beyond the Recipient’s control may result in one or more authorisations not being obtained by the date shown. |

| 2) | Final dates are predicated on the assumption that the environmental review approval process will not be subject to a public review. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

5 Insurance Requirements (clause 19.3)

Insurance type/category | Coverage | When Procured | Amount | Other Requirements |

Third Party / Public liability. | Third party legal liability covering loss or liability arising out of occupation and use of any premises and / or infrastructure associated with the Project. The Policy must cover VWP, OPTA, OPT Inc and the Commonwealth (as the nominated insured persons). | VWP must procure or cause to be procured throughout the term of the Deed. | Limit of a minimum of $50,000,000 per claim, or occurrence giving rise to a claim where occurrence means a single event or series of occurrences if these are linked or occur in connection with one another from one original cause, as the case may be. | Insurance must be effected and maintained with a reputable insurance provider. |

Construction – Material Damage | Loss of or damage to the works under fabrication, construction, local transit (including loading and unloading and transit by barge to the final location of the buoys), installation and testing and commissioning. The Policy must extend to cover any loss or damage caused by contractors or subcontractors for their on-site activities and must extend to any loss or damage caused in the course of remedying any defects in the works in accordance with any maintenance / defects obligations under their contracts and for the length of the Defects Liability period (not exceeding 12 months). | VWP must procure or cause to be procured coverage from the period beginning when site construction and/or fabrication works begin to when any phase or stage is completed and becomes operational (after appropriate testing and commissioning has been completed) or has reached practical completion and handover. Set out below are the project milestones which, once achieved, will signify the conclusion of that stage of the project (and the transition to operational insurance for the respective stage): | At the insured’s option, but at all times to be for an amount in excess of the value of the Project assets at risk. The insurance will be based on an estimated Project value (determined by reference to the construction pricing, which value is then subject to declaration and adjustment at the end of the policy period | Insurance must be effected and maintained with a reputable insurance provider. |

| | The Policy must cover VWP, OPTA, OPT Inc and the Commonwealth (as the nominated insured persons) and contractors and/or subcontractors for their on-site activities. | For Stage 1 – Milestone 28. For Stage 2 – Milestone 40.

For Stage 3 – Milestone 51. | | |

Construction – Liability | Legal liability occurring during the construction and fabrication of the project, including local transit, and storage activities and ancillary activities. The Policy must also extend to cover any liability for personal injury, loss or damage caused by contractors or subcontractors in the course of remedying any defects in the works in accordance with any maintenance / defects obligations under their contract and for the length of the Defects Liability period (not exceeding 12 months). The Policy must cover VWP, OPTA, OPT Inc and the Commonwealth (as the nominated insured persons). | VWP must procure or cause to be procured coverage from the period beginning when site construction and/or fabrication works begin to when any phase or stage is completed and becomes operational (after appropriate testing and commissioning has been completed) or has reached practical completion and handover. Set out below are the project milestones which, once achieved, will signify the conclusion of that stage of the project (and the transition to operational insurance for the respective stage): For Stage 1 – Milestone 28. For Stage 2 – Milestone 40. For Stage 3 – Milestone 51. | Limit of a minimum of $50,000,000 per claim, or occurrence giving rise to a claim where occurrence means a single event or series of occurrences if these are linked or occur in connection with one another from one original cause, as the case may be. | Insurance must be effected and maintained with a reputable insurance provider. |

Operational Coverage (Material Damage) | Loss of or damage to the physical project property / assets of VWP that are the subject of the Funding Deed once those assets are handed over from construction operations (including, but not limited to, the buoys and related infrastructure). The Policy must cover VWP, OPTA, OPT Inc and the Commonwealth (as the nominated insured persons). | VWP must procure or cause to be procured for each stage on practical completion and handover being reached in respect of the stage to the expiry of the Deed. The achievement of the following project milestones will signify the conclusion of that stage of the project (and the transition to operational insurance for the relevant stage): For Stage 1 – Milestone 28. For Stage 2 – Milestone 40. For Stage 3 – Milestone 51. | At the insured’s option, an amount representing replacement value (determined immediately after completion by the final project values plus a provision for inflation or by a separate valuation/ assessment by qualified persons of the cost of rebuild) or maximum foreseeable loss. The loss limit is set to the largest single loss / location or worst case scenario. Modelling by qualified engineers can be performed (if there is a cost benefit to it). | Insurance must be effected and maintained with a reputable insurance provider. |

Operational – Third party liability | Legal liability arising out of the use, operation, or occupation of any site in relation to wave power generators, including associated infrastructure (the insured’s business activities). The policy must cover OPT, OPTA, VWP (as the principal insured parties) and the Commonwealth (to be covered only for their vicarious liability for negligent acts / omissions of VWP). | VWP will procure the policy or cause the policy to be procured for each stage on practical completion and handover being reached in respect of the stage to the expiry of the Deed. The achievement of the following project milestones will signify the conclusion of that stage of the project (and the transition to operational insurance for the relevant stage): For Stage 1 – Milestone 28. For Stage 2 – Milestone 40. For Stage 3 – Milestone 51. | At the insured’s option, with an initial minimum coverage for AUD $50,000,000 per occurrence / in aggregate any one policy year for pollution / product liability / completed operations. For the remainder of the term of the Deed, the policy limit will be reviewed at least annually with the intention that the coverage will be adjusted to reflect the overall stage of the Project and obligations / risks faced by the insured parties in respect of the overall Project. | Insurance must be effected and maintained with a reputable insurance provider. |

Marine Cargo / Transit | Loss of or damage to VWP cargo (or cargo for which VWP is responsible) during transit (unless otherwise covered by the supplier or under the transit section of the Construction – Material damage policy or unless the transits are low value items). The Policy must cover VWP, OPTA, OPT Inc and the Commonwealth (as the nominated insured persons). | VWP must procure or cause to be procured as and when required (i.e. whenever any relevant cargo is being transported by sea or is in transit) throughout the term of the Deed. | At the insured’s option, replacement value of the cargo plus shipping charges. The cost of an item on the purchase invoice plus freight. | Insurance must be effected and maintained with a reputable insurance provider. |

Workers Compensation (and employer’s liability insurance covering employer’s liability at common law (if not covered under statute). | Covering injury or death to employees (including the legal liability of their employer). The Policy must cover VWP and any other related entity of VWP that is an employer and therefore has an insurable interest. [Note: It is not possible under the applicable Victorian legislation to include cross liability clauses or name parties other the employer as an insured.] | VWP must procure or cause to be procured the appropriate workers compensation and employer’s liability insurances for itself and all of its other related entities that employ persons involved in the Project throughout the term of the Deed. | In accordance with the requirements of the applicable legislation. | Insurance must be effected and maintained with a reputable insurance provider. |

| Professional Indemnity | Liability to any third party arising as a result of any negligent act, error or omission in the provision of professional services by OPTA, OPT Inc. or VWP or its independent contractors in the conduct of the Project. The Policy must cover VWP, OPTA, OPT Inc and, if appropriate, its independent contractors. | Before VWP provides professional services in relation to the Project, VWP must put in place appropriate professional indemnity insurance for the term of the Deed and/or seven years after the expiry or termination of this Deed. VWP must require that independent contractors it engages have appropriate and available professional indemnity insurance, public risk and workers compensation (in accordance with law) insurance at the time they commence the provision of services in relation to the Project. | Limit of a minimum of $10,000,000 per claim, or occurrence giving rise to a claim where occurrence means a single event or series of occurrences if these are linked or occur in connection with one another from one original cause, as the case may be. | Insurance must be effected and maintained with a reputable insurance provider. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Annexure 4 Schedule 4 - Key Personnel and Approved Subcontractors

1 Key Personnel

Name of Key Personnel | Description of work/role/responsibilities |

Victorian Wave Partners Pty Ltd (VWP) |

[***] | [***] |

[***] | [***] |

[***] | [***] |

[***] | [***] |

[***] | [***] |

Ocean Power Technologies Inc. (OPT) |

[***] | [***] |

[***] | [***] |

[***] | [***] |

[***] | [***] |

Ocean Power Technologies (Australasia) Pty Ltd (OPTA) |

[***] | [***] |

[***] | [***] |

[***] | [***] |

[***] | [***] |

[***] | [***] |

Lockheed Martin Corporation |

[***] | [***] |

[***] | [***] |

[***] | [***] |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

2 Approved Subcontractors

Name of Approved Subcontractor | Work to be subcontracted | Date for execution of subcontract |

Lockheed Martin | Engineering Services | 31 July 2013 |

Lockheed Martin | Component Fabrication | 1 November 2013 |

OPTA | Technology provider | 31 July 2013 |

OPTA | Component Fabrication | 1 November 2013 |

Brookfield Financial | Financial Advisor | 12 November 2012 |

Shane O’Kane | Financial Advisor | 5 June 2013 |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Annexure 5 Schedule 5 - Payment Milestones and Schedule

Stage #1 Payment Milestones and Schedule

Payment

milestone

No. | Payment milestone

(clause 31.1) | Payment milestonedue date (clauses 6.1(a), 6.4 and 22.3(a)(ii)) | Payment claimandpayment milestone report due date (clause 9.1(a) and schedule 6) | Payment criteria (clause 9.1(b)(ii)) | Supporting documentation and other evidence required (clause 9.1(b)(iii)) | Budgeted Expenditure

$ | Progress payment amount

$

(clause 5.1(b)) | Funding % |

Stage #1 Project Development |

[***] (Chart data redacted – six pages) |

STAGE 1 – TOTAL EXPENDITURE AND PAYMENTS | 42,637,012 | 21,318,506 | |

Notes:

1) EPC costs and risk contingencies are amortised over the payment milestones.

2) Payment milestones comprising of a number of sub-milestones have been aggregated for convenience, and hence in the event that one of the sub-milestones is not achieved on time, it will not prejudice payment of the other sub-milestones.

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Stage #2 Payment Milestones and Schedule

Payment

milestone

No. | Payment milestone

(clause 31.1) | Payment milestonedue date (clauses 6.1(a), 6.4 and 22.3(a)(ii)) | Payment claimandpayment milestone report due date (clause 9.1(a) and schedule 6) | Payment criteria (clause 9.1(b)(ii)) | Supporting documentation and other evidence required (clause 9.1(b)(iii)) | Budgeted Expenditure

$ | Progress payment amount

$

(clause 5.1(b)) | Funding % |

Stage #2 Project Development |

[***] (Chart data redacted – three pages) |

| | | | |

Notes:

| | 1) | EPC costs and risk contingencies are amortised over the payment milestones. |

| | 2) | Payment milestones comprising of a number of sub-milestones have been aggregated for convenience, and hence in the event that one of the sub-milestones is not achieved on time, it will not prejudice payment of the other sub-milestones. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Stage #3 Payment Milestones and Schedule

Payment

milestone

No. | Payment milestone

(clause 31.1) | Payment milestonedue date (clauses 6.1(a), 6.4 and 22.3(a)(ii)) | Payment claimandpayment milestone report due date (clause 9.1(a) and schedule 6) | Payment criteria (clause 9.1(b)(ii)) | Supporting documentation and other evidence required (clause 9.1(b)(iii)) | Budgeted Expenditure

$ | Progress payment amount

$

(clause 5.1(b)) | Funding % |

Stage #3 Project Development |

[***] (Chart data redacted – three pages) |

Notes:

| | 1) | EPC costs and risk contingencies are amortised over the payment milestones. |

| | 2) | Payment milestones comprising of a number of sub-milestones have been aggregated for convenience, and hence in the event that one of the sub-milestones is not achieved on time, it will not prejudice payment of the other sub-milestones. |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Annexure 6 | Schedule 6 – Reports (clause 13.3) |

Title of report | Form and content requirements for report | Subject to financial audit (clause 13.3(b))? | Date for submission of report |

Payment Milestone Report | The Recipient must provide Payment Milestone Reports following the completion of eachpayment milestone. Payment Milestone Reports must be in the format, and contain the details required by, the template report provided by ARENA from time to time. Payment Milestone Reports must include information relating to thepayment milestone and progress during the reporting period (such as proof of completed activities). This includes, but is not limited to: - a description and analysis of the technical progress of the Project; - evidence (including, where possible, pictorial evidence) that the activities within the Payment Milestone have been achieved; - any major issues or developments which have arisen in the course of achieving the Milestone and the effect they will have on the Project; - any proposed changes to the Project; - a comprehensive summary of the knowledge sharing activities completed in accordance with the Knowledge Sharing Plan during the period; - an update of community consultations undertaken by the Recipient under the Community Consultation Plan, and any significant issues that have arisen during these consultations, in accordance with clause 6.11; and - evidence that the budgeted eligible expenditure for the Payment Milestone has been disbursed. | No | on each due date in schedule 5 |

Annual Financial Audit Report | The Recipient must provide Financial Audit Reports at the end of eachfinancial year during theproject period. Annual Financial Audit Reports must be in the format, and contain the details required by, the template report provided by ARENA from time to time. Annual Financial Audit Reports are to be audited by a qualified accountant who satisfies the preconditions set out in clause 13.3. | Yes | within 90 days of the end of eachfinancial year during theproject period, and also onproject completion |

Annual update to Payment Milestone Reports and current description ofproject | The Recipient must provide an update of the Payment Milestone Reports and a current description of theproject at the end of eachfinancial year during theproject period. Updates must be in the format, and contain the details required by, the template provided by ARENA from time to time. | No | within 90 days after the end of eachfinancial year during theproject period |

End of Project Report and Financial Audit Report | The Recipient must provide the End of Project Report and Financial Audit Report at the completion of theproject. The End of Project Report and Financial Audit Report must be in the format, and contain the details required by, the template reports provided by ARENAfrom time to time. | Yes | 12 weeks afterproject completion |

Post Project Reports | The Recipient must provide Post Project Reports one, two and five years after project completion. These reports are designed to track how the initial commercialisation of the technology progresses following the completion of theproject. Post Project Reports must be in the format, and contain the details required by, the template report provided by ARENA from time to time. | No | one, two and five years afterproject completion |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Annexure 7 Attachment A – Project Description

19MW (62.5MW peak) Victorian Wave Power Demonstration Project

PROJECT OVERVIEW

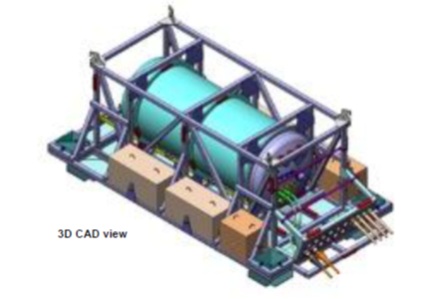

The Recipient plans a staged construction and deployment of Ocean Power Technologies Inc.’s PowerBuoys® (PBs) in Portland, off the Victorian Coast totalling 19MW (average) 62.5MW (peak) of installed capacity.

Theproject plans to utilise existing fabrication and marine support infrastructure in Australia to bring a major new source of renewable energy to the country and business opportunity to the industrial base. The Recipient considers theproject will be of sufficient size to demonstrate the efficient harvesting of clean energy from Australia’s abundant wave resource and demonstrate a clear path to economically competitive green power based on volume production, technology advancement and supplier innovation.

1 Project Objectives

The main purpose of the project is to demonstrate that large scale, commercially viable wave power stations can be built, permitted, and operated in an environmentally responsible manner. This would include:

| | • | Practicality and efficiency of wave energy production with an array of wave energy converters |

| | • | Benefits to the industrial base from establishing a wave power industry |

| | • | Wave power economics, including capital expenses and operations / maintenance expenses |

| | • | Clear path of cost reductions at each stage of the 3 development stages |

| | • | Usage of electricity generated from wave power by power off takers / utilities |

| | • | Potential of wave power to the industry (financiers, power producers, asset owners, suppliers and power users) at a scale to attract further interest |

2 Project Details

Proposed location | Portland, Victoria, Australia |

| | |

Total Generating Capacity | 19 megawatts average (62.5MW peak generator power) |

| | |

PowerBuoy Specification | PB Mark 3.3 (formerly PB150) and PB Mark 4 Series (formerly PB500) |

| | |

Application | Grid connected |

| | |

Deployment Stages | • Stage 1 – 0.5MW (2.5MW peak generator power) generated from [***] PowerBuoys • Stage 2 – 5.0MW (17MW peak generator power) generated from [***] PowerBuoys • Stage 3 – 13.5MW (43MW peak generator power) generated from [***] PowerBuoys |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

Major Components | • PowerBuoys Mark 3.3 (Stage 1) • PowerBuoys Mark 4.1 and 4.2 (Stages 2 and 3) • Undersea Substation Pods (USP) • Submarine power cable from USP to surf zone • Buried cable from surf zone to on shore substation • Onshore substation • Power line to end user substation |

| | |

Manufacture and Assembly | Substantial employment will be generated in Australia through the fabrication of major items and the integration and final assembly of components. |

| | |

Deployment | Deployment of the PowerBuoys, anchoring systems, USPs, etc., and upgrades to power line route infrastructure would be accomplished using Australian expertise. |

| | |

Operation | The grid connected power station would require local support to service and maintain the equipment over 25 year of operations. |

| | |

3 Project Location

The proposed location of the project is off the coast of Victoria, near the city of Portland and encompasses:

| | • | Offshore location and cable route to shore indicated by the areas shown in the following diagram with Stage 1 located in south east corner of Nelson Bay and Stages 2 and 3 located within Nelson Bay |

| | • | Operating areas located within the 3.0 nautical mile limit |

| | • | Cable route extending northwards running parallel to the eastern side of Cape Sir William Grant |

| | • | Onshore facilities on Cape Sir William Grant land in an area that is vested in the Port of Portland Authority |

| | • | Power line route from the onshore substation is yet to be determined and will be dependent upon which entity enters into a Power Purchase Agreement with VWP |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

TECHNOLOGY OVERVIEW

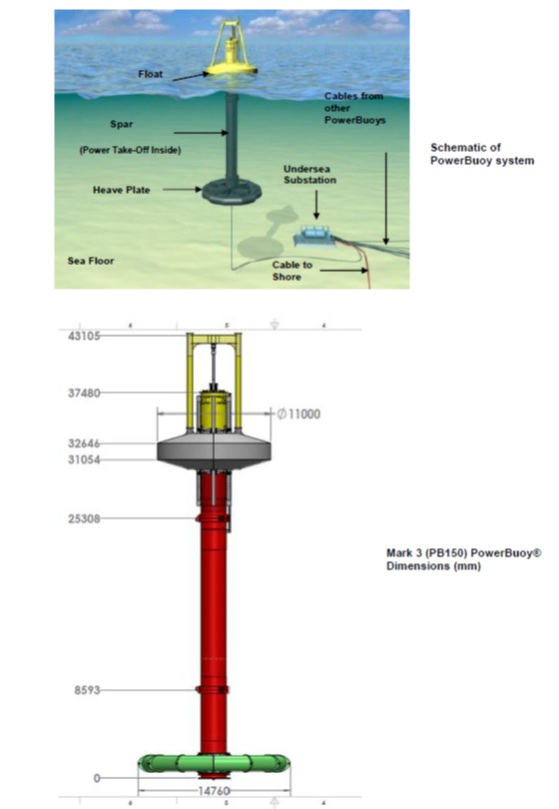

OPT PowerBuoy System

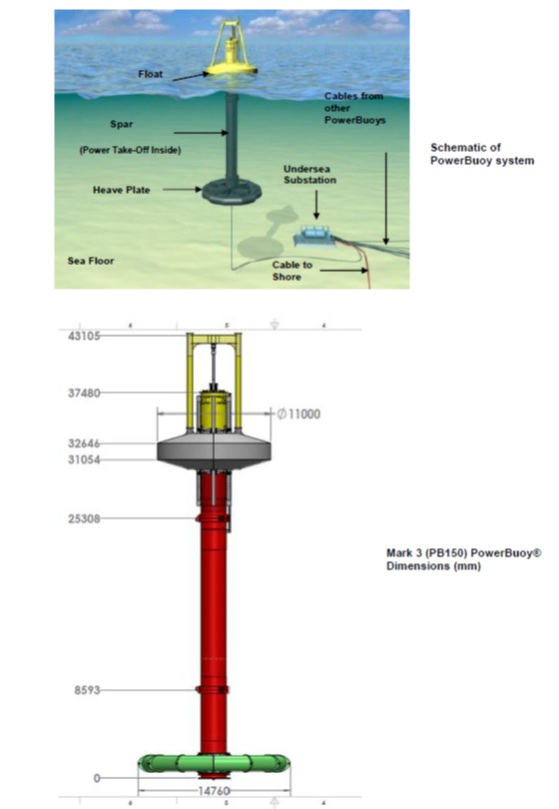

OPT has over 68 US patents issued or pending related to wave energy conversion and the company’s proprietary technology. OPT’s standard PowerBuoy is a semi-submerged floating buoy, consisting of a spar, surrounded by a moving toroidal float, moored with a single or three-point anchor system.

The rising and falling of the waves offshore causes the buoy to move freely up and down. The resultant mechanical stroking is converted via a sophisticated power take-off to drive an electrical generator. The generated wave power is transmitted ashore via an underwater power cable.

The power station has a very low surface profile and would be barely visible from shore. Sensors on the PowerBuoy continuously monitor the performance of the various subsystems and surrounding ocean environment. Data is transmitted to shore in real time.

In the event of very large oncoming waves, the system automatically locks up and ceases power production. When the wave heights return to normal, the system unlocks and recommences energy conversion and transmission of the electrical power ashore.

Features of the PowerBuoy technology include:

• | PowerBuoy technology based on ocean-going buoys |

• | Capacity factor of 30-45% versus solar and wind capacity factors of 10%-35% |

• | Environmentally benign & non-polluting |

• | No exhaust gases, no noise, minimal visibility from shore, safe for sea life |

• | Scalable to high capacity power stations (100MW+) |

• | Extensive in-ocean experience, including successfully withstanding hurricanes, winter storms and tsunamis |

• | Generates power with wave heights between 1.5 and 7 metres |

• | Electronic “tuning” capability to optimize power output in changing wave conditions |

| | |

| • | Typically configured in two to three row arrays |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

PowerBuoy Ratings

The following table demonstrates the peak generator ratings and the projected power ratings for the Portland, Victoria wave climate.

OPT has also elected to change its PowerBuoy nomenclature to highlight enhancements made in OPT’s utility PowerBuoy product line, and to bring its characterisation in line with solar and wind systems.

Project Stage | Nomenclature | [***] | [***] | [***] |

| | Previous | New | | | |

1 | PB150 | PB Mark 3.3 | [***] | [***] | [***] |

2 | PB500 | PB Mark 4.1 | [***] | [***] | [***] |

3 | PB500 | PB Mark 4.2 | [***] | [***] | [***] |

Total | | | | [***] | [***] |

Third Party Validation

• | OPT’s technology has received more testing & validation by independent parties than any other wave energy company |

• | Certification by Lloyd’s Register of PowerBuoy Mark 3 (PB150) structure and mooring system |

• | Independent Environmental Assessments in Hawaii under direction of US Navy, and by US Department of Energy (DoE) for Reedsport, Oregon, Project - both resulted in “Finding of No Significant Impact” (highest rating) |

• | Grid connection certified by Intertek (IEEE and UL standards) |

• | PowerBuoys insured by Lloyd’s syndicates for nearly 15 years for property loss and third party liability |

• | US DoE has assessed PowerBuoy Mark 3 (PB150) as highest-rated wave energy system for commercial readiness – Technology Readiness Level (TRL) of 7 to 8 (maximum = 9) |

***Indicates a portion of the exhibit has been omitted based on a request for confidential treatment submitted to the Securities and Exchange Commission. The omitted portions have been filed separately with the Commission.

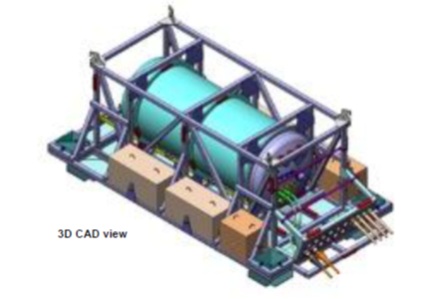

Undersea Substation Pod

• | Ocean Power Technologies has developed an innovative Undersea Substation Pod (USP) as a cost-effective, environmentally responsible means of networking and transmitting offshore power and data to onshore electric utility grids. |