UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 9, 2008

ANGSTROM TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

000-52661

(Commission File Number)

N/A

(IRS Employer Identification No.)

25 Drydock Ave 7th floor, Boston, MA 02210

(Address of principal executive offices and Zip Code)

617.695.0137

Registrant’s telephone number, including area code

228 Bonis Avenue, # PH3, Scarborough, ON M1T 3W4

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

- 2 -

FORWARD LOOKING STATEMENTS

This current report contains forward-looking statements as that term is defined in thePrivate Securities Litigation Reform Actof 1995. These statements relate to future events or our future results of operation or future financial performance, including, but not limited to, the following: statements relating to our ability to raise sufficient capital to finance our planned operations, our ability to develop brand recognition with resellers and consumers, develop our current and future products, increase sales and our estimates of cash expenditures for the next 12 months. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “intends”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” or the negative of these terms or other comparable terminology . These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” on page 8 of this current report, which may cause our or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that we may issue in the future. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms “we”, “us”, the “Company” and “ATC” refer to Angstrom Technologies Corp. and its Subsidiaries.

| |

Item 1.01 | Entry Into a Material Definitive Agreement |

The information set forth under Item 2.01 of this Current Report on Form 8-K is also responsive to this item and is hereby incorporated into this Item 1.01 by reference.

| |

Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On February 20, 2008, we entered into a letter of intent with Angstrom Microsystems Inc. (“AMI”) and all of the stockholders of AMI, for the purpose of acquiring all of the issued and outstanding shares of AMI. Pursuant to the terms of the Letter of Intent, subject to the entry into a definitive agreement between the parties, stockholders of AMI would receive 1.1 shares of our common stock for each AMI share held.

On March 27, 2008, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with AMI and Angstrom Acquisition Corp. (“Angstrom Sub”), a private Delaware corporation formed for the purpose of acquiring all of the outstanding shares of AMI thereby merging Angstrom Sub and resulting in “Angstrom Microsystems Inc.” being a direct, wholly-owned subsidiary of Angstrom. Under the terms of the Merger Agreement we agreed to issue up to 6,927,816 shares of our common stock to the shareholders of AMI on a basis of 1.1 Angstrom shares to for each 1 AMI share held. Closing of the Merger Agreement was subject to, among other things, the following terms and conditions:

- 3 -

| | |

| (i) | From the date of the execution of the Merger Agreement, AMI must carry out its business in the ordinary course consistent with past practice and is not permitted without the consent of Angstrom, to: enter into other agreements, modify its incorporating documents, declare or pay any dividends, sell or lease or encumber its assets, issue, deliver or sell any of its shares, incur any additional indebtedness, grant severance or termination pay to directors, officers or employees, commence a lawsuit, make any changes in respect of its taxes, and discharge any liabilities or claims other than in the ordinary course of business; |

| (ii) | AMI obtaining the requisite approval of the Merger Agreement by its stockholders; |

| (iii) | AMI having delivered to Angstrom all financial statements required under applicable regulations of the SEC; |

| (iv) | Angstrom adopting an Incentive Stock Option Plan and granting certain options to the employees of AMI; |

| (v) | Angstrom appointing the following as directors of the Company: Lalit Jain, Nand Todi and To-Hon Lam; |

| (vi) | Angstrom entering into an employment agreement with Lalit Jain to act as an executive officer of Angstrom; |

| (vii) | All of the shareholders of AMI (the “AMI Shareholders”) entering into a lock-up agreement pursuant to which all of the Angstrom shares of common stock to be issued to the AMI shareholders will be restricted from resale for a period of two years following closing of the transaction; and |

| (viii) | Lalit Jain licensing rights under certain provisional patent applications, filed under in his name, to Angstrom for a nominal price. |

| | |

Following completion of all of the above conditions on April 9, 2008, Angstrom Sub was merged into AMI with AMI being the sole surviving entity under the name “Angstrom Microsystems Inc.” and ATC being the sole shareholder of the surviving entity. Upon due delivery of an executed letter of transmittal, accredited investor certificate and old AMI share certificate, AMI stockholders shall receive up to an aggregate of 6,927,816 shares of our common stock representing approximately 30% of the issued and outstanding shares of the Company after issuance of the shares.Also in connection with the closing of the Merger Agreement, the Company issued 734,470 options to employees of AMI pursuant to the 2008 Incentive Stock Option Plan adopted by the Company at closing.we are terminating these options and granting new Company ones.

Pursuant to the terms of the Merger Agreement, all of the shareholders of AMI which are to receive securities of ATC in connection with the merger agree to use their best efforts for a two year period following closing of the transaction (the “Lock-Up Period”), not to directly or indirectly offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of any ATC shares acquired or acquirable by them pursuant to the Merger Agreement. ATC agreed following the Lock-Up Period that it will register the ATC shares issued to the ATC shareholders upon request of at least 90% of the shareholders.

The Merger Agreement supercedes and replaces all prior agreementsbetween the parties. Also in connection with the closing of the acquisition of AMI, we completed a private placement of 1,500,000 units at a price of $1.00 per unit pursuant to Regulation S of the Securities Act of 1933, with each unit consisting of one share and one share purchase warrant entitling the holder to purchase an additional share at a price of $1.20. See “Form 10-SB Information –Management Discussion And Analysis Or Plan Of Operation”, below.

- 4 -

Following the completion of the acquisition of AMI, we are now engaged in the business of software development and computer technology. In connection with the closing of the acquisition of AMI the Company has changed its head office location to 25 Drydock Ave 7th floor, Boston, MA 02210. See “Description of Business”, below.

The summary of the foregoing is qualified in its entirety by reference to the Agreement and Plan of Merger, 2008 Incentive Stock Option Plan, which are included as exhibits to this Current Report.

FORM 10-SB INFORMATION

DESCRIPTION OF BUSINESS

Angstrom Technologies Corp.

Until August 5, 2007, when we gave notice of our termination of our option to acquire rights on the Whitney Lake Claims, we owned an option to earn a 100% interest in 11 mining claims known as the Whitney Lake Claims. With the termination of our option agreement and the closing of our merger with AMI, we are now engaged in the business of software development and computer technology.

Angstrom Microsystems, Inc.

AMI is a server manufacturer and power technology company located in Boston, Massachusetts whose assets include a perpetual license for two liquid cooling provisional patents and certain acceleration software and software technology it has developed internally.

History of Angstrom Microsystems, Inc. Business Development

AMI is a privately held Delaware corporation founded in 2000 with headquarters in Boston, Massachusetts. AMI was started as a rack mounted Server Company that sold generic rack mounted servers with a quality track record. AMI quickly expanded its customer base by selecting and subsequently successfully gaining market share in the Hollywood post-production market.

The sales variability of the Hollywood market posed the next challenge and AMI needed to broaden its customer base even more into different vertical markets. Thus, AMI began developing solutions for problems experienced across a variety of markets; powering and cooling off data center server computers. The larger the data center, the more critical their need in solving these problems.

Unlike other competitors in the rackable server sector, AMI positioned itself as a Green Computing solutions company; environmentally friendly computing that AMI believes can significantly reduce the cost of building and running data centers without the enormous pain of technology changes. AMI has developed and continues to further develop a variety of server products that reduce the power usage in data centers.

AMI is a member of Green Grid: www.thegreengrid.org; and an AMD Platinum partner.

Description of Products

Currently, AMI has four products on the market:

1.

AMS LiquiCool™ - AMS LiquiCool is a hardware solution based on liquid cooling that reduces energy needed to drive the infrastructure for AMI servers.

2.

Xfactor Plus™- Xfactor Plus is a software solution used to accelerate the performance of systems. This requires fewer machines and hence significantly lower energy usage.

3.

Angstrom SuperBlades™ used to drive majority of sales ove the past 4 years in the HPC market. These are build-to-order air-cooled blades.

- 5 -

4.

Angstrom titan64 CreatorStations™ --quoerquiet dual soecket AMD Opteron ™ workstations designed for the animation post production industry.

AMS LiquiCool™

Our AMS LiquiCool Technology replaces most of the air-conditioning needed for running computers in data centers by cooling them using a non-conductive liquid that is environmentally friendly. The net effect is the following:

1.

Allows customers to use their existing data center thereby avoiding spending tens of millions of dollars on new data centers.

2.

Gives the customer flexibility to install the computers in non-data center (office) facilities since air-conditioning is no longer a requirement and the computers are virtually silent.

3.

Allows computers to be installed in environmentally challenged areas like thin-aired high altitude (e.g., Denver, Los Alamos) data centers because air is not the primary coolant.

4.

Reduces the cost of air-conditioning by over 80%, amounting to a total monthly data center electricity savings of 25% overall.

Angstrom’s strategy is to initially incorporate its LiquiCooling technology into its own blades but will seek licensing agreements in the next 24 months to integrate its cooling technology into other server manufacturers such as IBM, HP, Dell, EMC and other vendor hardware solutions. Angstrom has already shown rack mounted server cooling solutions to HP and EMC; however, this is not the first solution Angstrom is introducing as a production system as Angstrom blades lend themselves better to being liquid cooled.

What is LiquiCool?

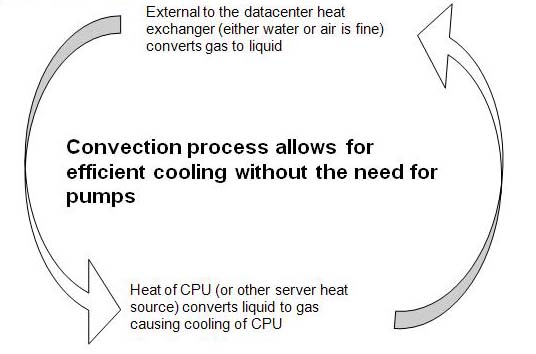

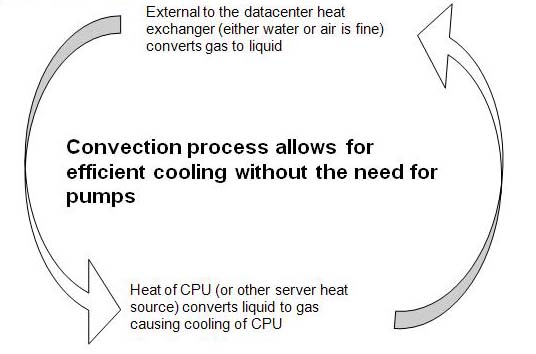

LiquiCool is a way of efficiently cooling constantly heat-generating systems by using a 2-phased liquid/gas. The liquid comes into close proximity of heat and evaporates causing the area around it to cool. This gas is piped to a heat exchanger that cools the gas back into liquid. This liquid goes back to the heat source to start the whole 2-phased process all over again.

- 6 -

How does LiquiCool integrate into a computer blade rack?

Each computer blade has liquid piping that extract heat from the heat sources on the blade. This heat is transferred to the rack, where the liquid within tanks in the rear of the rack evaporate due to this heat. This heated gas is transported away from the rack via piping and returns as liquid via piping. The computer rack has a liquid pipe and a gas pipe coming from a remote heat exchanger; very similar to regular air-conditioning. The key difference from air conditioning is the LiquiCool infrastructure:

1. Does not require a compressor (saving electricity),

2. Is nominally operating at atmospheric pressures, and

3. Cools the computer electronics directly, not requiring air to cool thereby saving electricity.

Anywhere between 5% and 20% of the cooling process will still need to be air cooling but does not need to be air-conditioned cooled because the hotspot in the computer that require serious air-conditioning are LiquiCooled. Computers do not tolerate humidity well so nominal humidity control is needed, though nothing more than what would be needed in an office space.

Angstrom SuperBlade™

Angstrom SuperBlades are build to order blades that are lower in power than many competitors yet highly flexible in design to provide customization for high volume and/or strategically significant customers. These blades come in a variety of CPU flavours – Intel, AMD, Single core, dual core, quad core, single socket, dual socket, quad socket solutions. In addition, Angstrom SuperBlades can be fitted with a variety of PCI-E cards such as GPU cards and low latency fabric (e.g., Infiniband) cards. These blade computers come in a variety of sizes from a 20 blades in a rack to 64 blades per rack, depending on the customer need. Angstrom has deployed SuperBlades in customer sites sich as Blue Sky, ILM, NIH, Pizar and many others.

Titan64 CreatorStation™

Titan64 refers to the use of AMD Opteron™ proccessors in the workstation and can be provided in all flavors of CPU solutions as indicated in the blade section above. CreatorBlades are high performance graphics workstations that are very quiet yet sleek to looks. Angstrom uses the latest graphics cards from Nvidia and ATI in providing the maximum graphical and computing power available today. CreatorStations have been deployed in large numbers at locations such as Blue Sky Studios.

Business Objective

Since AMI shall be developing and deploying advanced liquid cooled solutions, AMI plans to continue its US-based local manufacturing; however, AMI plans to outsource all large manufacturing builds (greater than 1,000 units per month) to China manufacturers. This is expected to allow AMI’s US-based manufacturing facility to focus on prototypes, evaluation units, initial deployments and smaller builds.

Distribution Methods and Marketing Strategy

AMI’s market positioning as a Green computing solutions company allows it to introduce a broad range of technologies to solve these business problems. Currently, AMI has developed liquid cooling and acceleration technologies that it plans to further market directly and through the use of reps and ASPs within a variety of vertical markets.

AMI plans a two prong approach in its marketing strategy:

1.

Hardware: The goal is to attract Tier 1 vendors to use and hence license AMI technology. In order to do this, AMI is currently in talks with several of these companies. AMI plans to deploy its own blades with this technology for the purpose of showcasing its solutions in production environments. Large sales will naturally lead to greater interest by Tier 1 OEMs to integrate LiquiCool into their systems architectures.

- 7 -

2.

Software: The goal is to develop accelerated solutions for verticals that use or plan to use large clusters of computers. By improving performance by 5x - 50x’s; AMI can significantly reduce the number of servers needed to perform the same operations. AMI plans to introduce niche vertcal market focused products that provide an accelerated ‘last mile’ solution.

AMI has historically partnered with AMD and attended tradeshows in their booths with AMI products on display. Angstrom has used AMD marketing and sales assistance in growing the business to date. Moving forward, Angstrom plan to leverage marketing from partners such as Nvidia and other vendors that are amenable to provide Angstrom with such assistance. Angstrom sells products directly in the Unitied States and through a variety of reps and VARs Internationally. Angstrom provides a 1-3 year warranty, depending on the customer’s needs.

Competitive Business Conditions And The Small Business Issuer's Competitive Position In The Industry And Methods Of Competition

Liquid cooling: HP, IBM, Spraycool, Ecobay and most other competitors have two concerns:

1)

Their technology requires water-based cooling within the data center. This is unacceptable to most datacenters because water is a conductor of electricity and damages the data center, severely disrupting operations when a leak occurs; and

2)

The cost of competitors’ liquid cooled solutions often does not meet acceptable criteria for return on investments (ROI).

3)

Any solution that does not use chilled water is currently using liquids whose uses are prohibited throughout most of the world.

Accelerated computing: is an emerging market and Rapid Mind is AMI’s only well-established competitor. Google recently purchased PeakStream, and its products were thereafter discontinued, thus it is no longer a competitor. Unlike any other competitor, AMI develops its software for ‘last mile’ compatibility and is fully backwards compatible with existing customer code bases.

Sources And Availability Of Raw Materials And The Names Of Principal Suppliers

As an early-stage company, AMI is currently reliant upon a small number of customers from which it derives revenues. Management plans to reduce such dependency by expanding the Company’s direct, OEM and retails sales channels.

Intellectual Property And Patent Protection

The company has a perpetual license to two liquid cooling provisional patents;

• First Mover advantage for both its proprietary technologies;

• Where applicable, the company’s unique and proprietary assets are copyrighted;

• Strategic partnership with AMD and current HPC customers.

- 8 -

AMI Patents

| | | |

Title of Invention: | Country: | Status: | Application No./Patent No. |

Memory and Chipset Cooling Device | US | Patent Application | 60/910,460

(non-provisional filed) |

Cooling Computer by Solid Heat Transfer | US | Patent Application | 60/910,463

(non-provisional filed) |

Computer system and computer-implemented process for simultaneous configuration and monitoring of computer network | US | Patent Granted | 6,041,347 |

Network Device for supporting construction of virtual local area networks | US | Patent Granted | 6,047,325 |

Research And Development

During our fiscal years ended December 31, 2007 and 2006, Angstrom did not incur research and development expenses.

Employees

Following the completion of our merger with AMI we currently have 13 employees and consultants other than our directors and officers.

Reports to security holders

We file reports with the Securities and Exchange Commission annual reports, quarterly reports as well as other information we are required to file pursuant to securities laws. You may read and copy materials we file with the SEC at the SEC's Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC which is http://www.sec.gov.

Risk Factors

This Current Report on Form 8-K contains forward-looking statements that include, among other things, statements of business objectives relating to the Company’s business, statements as to the revenue and profitability of the Company and other statements of expectations, belief, business plans and strategies, anticipated developments and other matters that are not historical facts. The Directors caution potential investors that there are risks and uncertainties associated with the investment in the Company and actual events or results may differ materially from those expressed or implied by the statements contained in this prospectus. Potential investors should carefully consider all the information set out in this prospectus and in particular should evaluate the following risks before deciding to invest in the Company.

Technological change and evolving industry standards

The information technology industry is a fast developing industry and it’s characterized by rapidly changing technology, evolving industry standards, emerging competition and frequent introductions of new products and services. If companies in the I/T industry do not keep up with the most up-to-date technologies, they may find it difficult to compete with others who are able to keep abreast of the changes. There is no assurance that the

- 9 -

Company will continue to be able to do so in the future. The Company’s business will be adversely affected if it is unable to successfully introduce new technology and enhancements and respond to rapid technology changes.

The Directors believe that the Company’s ability to compete successfully is also dependent upon the continued compatibility to its technology with products and architectures offered by other companies such as <*>. The introduction of new products or services by the Company or its competitors and any change in industry standards could cause customers to defer or cancel purchases of existing products and services, which may have a material adverse effect on the Company’s business, financial condition and results of operation. In addition, services or technologies developed by others could render the Company’s services or technologies uncompetitive or obsolete. While attention is paid to perceive changed in major trends in the market, the Company is still vulnerable to significant loss die to misinterpretation of market conditions.

Credit line risks

The Company requires credit line to compete deployments that are typically capital intensive. The company may not be able to obtain these credit lines from banks or other financial resources. The Company may not be able to accept orders in such cases, and thus can significantly and negatively affect the sales revenues or margins of the Company.

Implementation of Business Plan may not be successful

The Directors expect that there will be a period of rapid growth in the future as a result of the implementation of the Business Plan. This could place significant strain on the Company’s managerial, operational and financial resources. To accommodate this growth, the Company must implement new or upgrade its existing operating and financial systems, procedures and controls. Failure of the Company to manage its expansion or to obtain adequate financing in a timely manner may result in increased expenses or affect the implementation of the Business Plan and in turn slow down the pace of growth and affect the financial position and profitability of the Company.

Reliance on key management

The Company’s success is, to a substantial extent, attributable to the strategy and vision of its founder and the efforts of certain key members of its management team, in particular, Lalit Jain, CEO and President of Angstrom. The details of the management team are set out in the section headed “Management Team” of this prospectus. In view of his knowledge and experience of the business of the Company, his continued involvement is important to the future prospects of the Company. Should he cease to be involved in the Company’s business operations, the profitability of the Company may be adversely affected.

Risk of infringement of intellectual property by third parties

Mr. Jain has filed U.S. provisional patent applications that he intends to license to the Company. At this point, the Company cannot guarantee whether these provisional patent applications will result in the issuance of a patent or patents.

The Company’s success partially depends on its ability to protect its proprietary technologies and processes. The Company relies upon patents, copyrights, and trade secrets, laws and will also rely upon confidentiality and non-disclosure agreements and other measures to establish and protect its proprietary rights to its technologies, products and services. Such protection may not be able to preclude competitors from infringing the Company’s intellectual property rights in its technologies, products and services. Despite such precaution, it may be possible for a third party to copy or otherwise obtain and use such contents and technologies without the Company’s authorization, or to develop such technology independently. There can also be no assurance that other companies will not obtain patents similar to or challenge the patents obtained by the Company. In addition, policing unauthorized use of the Company’s proprietary co ntents and technology is difficult and there can be no assurance that the steps taken by the Company will prevent misappropriation or infringement of its rights. In addition, legal proceedings may be necessary in the future to enforce the Company’s intellectual property rights, to protect its trade secrets and confidential information or to determine the validity and scope of the proprietary rights of others. This could result in substantial costs and diversion of the Company’s resources and could have a material adverse effect on its

- 10 -

business, financial condition and results of operations. If a significant portion of the Company’s intellectual property is copies, reproduced or used without the Company’s authorization, the Company’s business may be adversely affected.

In developing the Company’s technologies, products and services, the Company has used various technologies or know-how which it believes are in the public domain, license to the Company or its otherwise has the right to use. There can be no assurance, however, that third parties will not institute patent or other intellectual property infringement claims against the Company with respect to such technologies, products and services.

The Directors are not aware of any alleged claims of infringement of patents, copyrights or other intellectual property rights held by third parties in respect of the products manufactured by the Company. Thus, the Directors are not able to ascertain to the intellectual property of others. Intellectual property litigation is expensive and time consuming, and successful infringement claims against the Company may result in substantial monetary liability or disruption to the business of the Company.

Demand for technical and marketing personnel

The success of the Company’s operations lies in its ability to attract and retain employees with the appropriate technical expertise or business experience. A shortage of key staff may reduce the Company’s ability to expand.

Size of competitors

The Company’s competitors are large and more well established – such as IBM, HP and Dell. Marketing of such competitors or introduction of similar products, regardless of Company’s proven superiority in products, can result in a reduction of sales of Company’s products. This may result in an adverse effect to the Company’s business.

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

We are in our early stages of development and face risks associated with a new company in a growth industry. We may not successfully address these risks and uncertainties or successfully implement our operating strategies. If we fail to do so, it could materially harm our business to the point of having to cease operations and could impair the value of our common stock to the point investors may lose their entire investment. Even if we accomplish these objectives, we may not generate positive cash flows or the profits we anticipate in the future.

We will need substantial additional financing in the future to continue operations.

Our ability to continue present operations will be dependent upon our ability to obtain significant external funding. Additional sources of funding have not been established. We are exploring various financing alternatives. There can be no assurance that we will be successful in securing such financing at acceptable terms, if at all. If adequate funds are not available from the foregoing sources, or if we determine it to otherwise be in our best interests, we may consider additional strategic financing options, including sales of assets.

We will rely on third-party suppliers and manufacturers to provide raw materials for and to produce our products, and we will have limited control over these suppliers and manufacturers and may not be able to obtain quality products on a timely basis or in sufficient quantity.

Substantially all of our products will be manufactured by unaffiliated manufacturers. We may not have any long-term contracts with our suppliers or manufacturing sources, and we expect to compete with other companies for raw materials, production and import quota capacity.

There can be no assurance that there will not be a significant disruption in the supply of raw materials from our intended sources or, in the event of a disruption, that we would be able to locate alternative suppliers of materials of comparable quality at an acceptable price, or at all. In addition, we cannot be certain that our unaffiliated manufacturers will be able to fill our orders in a timely manner. If we experience significant increased demand, or need to replace an existing manufacturer, there can be no assurance that additional supplies of

- 11 -

raw materials or additional manufacturing capacity will be available when required on terms that are acceptable to us, or at all, or that any supplier or manufacturer would allocate sufficient capacity to us in order to meet our requirements. In addition, even if we are able to expand existing or find new manufacturing or raw material sources, we may encounter delays in production and added costs as a result of the time it takes to train our suppliers and manufacturers in our methods, products and quality control standards. Any delays, interruption or increased costs in the supply of raw materials or manufacture of our products could have an adverse effect on our ability to meet retail customer and consumer demand for our products and result in lower revenues and net income both in the short and long-term.

In addition, there can be no assurance that our suppliers and manufacturers will continue to provide raw materials and to manufacture products that are consistent with our standards. We may receive shipments of product that fail to conform to our quality control standards. In that event, unless we are able to obtain replacement products in a timely manner, we risk the loss of revenues resulting from the inability to sell those products and related increased administrative and shipping costs. In addition, because we do not control our manufacturers, products that fail to meet our standards or other unauthorized products could end up in the marketplace without our knowledge, which could harm our reputation in the marketplace.

Risks Related to our Business

We operate in a competitive industry and continue to be under the pressure of eroding gross profit margins, which could have a material adverse effect on our business.

The market for the products we intend to develop is very competitive and subject to rapid technological change. The prices for our intended products tend to decrease over their life cycle, which can result in decreased gross profit margins for us. There is also substantial and continuing pressure from customers to reduce their total cost for products. We expend substantial amounts on the value creation services required to remain competitive, retain existing business, and gain new customers, and we must evaluate the expense of those efforts against the impact of price and margin reductions. If we are unable to effectively compete in our industry or are unable to maintain acceptable gross profit margins, our business could be materially adversely affected.

Products developed by us may be found to be defective and, as a result, warranty and/or product liability claims may be asserted against us, which may have a material adverse effect on the company.

We may face claims for damages as a result of defects or failures in our present or future products. Our ability to avoid liabilities, including consequential damages, may be limited as a result of differing factors, such as the inability to exclude such damages due to the laws of some of the countries where we do business. Our business could be materially adversely affected as a result of a significant quality or performance issue in the products developed by us, if we are required to pay for the damages that result.

Products developed by us require proprietary protection

We seek to protect our products through tradenames, trademarks, copyrights and licenses. Despite the efforts of the Company to protect and maintain its proprietary rights, there can be no assurance that the Company will be successful in doing so or that the Company’s competitors will not independently develop or patent products that are substantially equivalent or superior to the Company’s products.

Infringement Could Lead to Costly Litigation and/or the Need to Enter into License Agreements, Which May Result in Increased Operating Expenses

Existing or future infringement claims by or against us may result in costly litigation or require us to license the proprietary rights of third parties, which could have a negative impact on our results of operations, liquidity and profitability.

We believe that our proprietary rights do not infringe upon the proprietary rights of others. As the number of titles in the industry increases, we believe that claims and lawsuits with respect to software infringement will also increase. From time to time, third parties have asserted that some of our titles infringed

- 12 -

their proprietary rights. We have also asserted that third parties have likewise infringed our proprietary rights. These infringement claims have sometimes resulted in litigation by and against us. To date, none of these claims has negatively impacted our ability to develop, publish or distribute our software. We cannot guarantee that future infringement claims will not occur or that they will not negatively impact our ability to develop, publish or distribute our software.

Technology changes rapidly in our business and if we fail to anticipate or successfully implement new technologies or the manner in which people play our games, the quality, timeliness and competitiveness of our products and services will suffer.

Rapid technology changes in our industry require us to anticipate, sometimes years in advance, which technologies we must implement and take advantage of in order to make our products and services competitive in the market. Therefore, we usually start our product development with a range of technical development goals that we hope to be able to achieve. We may not be able to achieve these goals, or our competition may be able to achieve them more quickly and effectively than we can. In either case, our products and services may be technologically inferior to our competitors’, less appealing to consumers, or both. If we cannot achieve our technology goals within the original development schedule of our products and services, then we may delay their release until these technology goals can be achieved, which may delay or reduce revenue and increase our development expenses. Alternatively, we may increase the resources employed in research and developme nt in an attempt to accelerate our development of new technologies, either to preserve our product or service launch schedule or to keep up with our competition, which would increase our development expenses.

From time to time we may become involved in other legal proceedings which could adversely affect us.

We are currently party to a number of legal proceedings listed below under the heading “Legal Proceedings”. There is no assurance that the outcome of our pending legal proceedings will be as expected and we could suffer significant losses due to any unfavourable judgments rendered in connection with the pending litigation. In addition we may become from time to time, subject to further legal proceedings, claims, litigation and government investigations or inquiries, which could be expensive, lengthy, and disruptive to normal business operations. The outcome of any legal proceedings, claims, litigation, investigations or inquiries may be difficult to predict and could have a material adverse effect on our business, operating results, or financial condition.

Fluctuations in Quarterly Operating Results Lead to Unpredictability of Revenue and Earnings

The timing of the release of our hardware and software products can cause material quarterly revenue and earnings fluctuations. A significant portion of revenue in any quarter may be derived from sales of new products introduced in that quarter or shipped in the immediately preceding quarter. If we are unable to begin volume shipments of a significant new product during the scheduled quarter our revenue and earnings will be negatively affected in that period. In addition, because a majority of the unit sales for a product typically occur in the first thirty to one hundred twenty days following its introduction, revenue and earnings may increase significantly in a period in which a major product is introduced and may decline in the following period or in a period in which there are no major product introductions.

Quarterly operating results also may be materially impacted by factors, including the level of market acceptance or demand for products and the level of development and/or promotion expenses for a product. Consequently, if net revenue in a period is below expectations, our operating results and financial position in that period are likely to be negatively affected, as has occurred in the past.

Risks Related to our Securities

Our common stock may be affected by limited trading volume and may fluctuate significantly.

- 13 -

There has been no public market for our common stock and there can be no assurance an active trading market for our common stock will develop. This could adversely affect our shareholders’ ability to sell our common stock in short time periods or possibly at all. Our stock price could fluctuate significantly in the future based upon any number of factors such as: general stock market trends; announcements of developments related to our business; fluctuations in our operating results; announcements of technological innovations, new products or enhancements by us or our competitors; general conditions in the markets we serve; general conditions in the U.S. or world economy; developments in patents or other intellectual property rights; the performance of our eligible portfolio companies; and developments in our relationships with our customers and suppliers. Substantial fluctuations in our stock price could significantly reduce the price of our s tock.

Our common stock is traded on the "Over-the-Counter Bulletin Board," which may make it more difficult for investors to resell their shares due to suitability requirements.

Our common stock is currently quoted for trading on Over the Counter Bulletin Board (OTCBB) where we expect it to remain in the foreseeable future. Broker-dealers often decline to trade in OTCBB stocks given the market for such securities are often limited, the stocks are more volatile, and the risk to investors is greater. These factors may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of their shares. This could cause our stock price to decline.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Plan Of Operation

Over the next twelve months, we plan to continue in some cases and finish in other cases, development of our software and hardware products. In addition, we intend to expand our sales force by direct hiring and/or strategic acquisitions. Angstrom plans to continue building its Green Computing brand and market it at tradeshows, publications and through partners.

Cash Requirements

Over the next 12 months we anticipate that we will incur the following operating expenses:

| | | |

Expense | | Amount | |

Office space | $ | 140,000 | |

Professional fees | $ | 250,000 | |

Travel expenses | $ | 80,000 | |

General and administrative | $ | 100,000 | |

Employee Salaries | $ | 800,000 | |

Marketing and Sales | $ | 960,000 | |

Research and Development | $ | 1,000,000 | |

Consulting Fees | $ | 450,000 | |

Total | $ | 3,780,000 | |

Our estimated expenses over the next twelve months are approximately $3,780,000 and our cash position as at March 27, 2008 is $13,364. We will need additional funds to meet our working capital requirements over the twelve month period ending March 31, 2009. We will also need additional funding in the event we complete our merger with AMI. Following the closing of our private placement of 1,250,000 units of our securities on April 10, 2008 we have raised an additional $1,250,000 for our operating expenses. We anticipate that we will have to raise additional funds through private placements of our equity securities and/or debt financing to complete our business plan. There is no assurance that the financing will be completed as planned or at all. We have not been successful raising the funding necessary to proceed with our business plan. Further, we believe that our company may have difficulties raising capital until we locate a prospective business opportunity through which we can pursue our plan of operation. If we are unable to secure adequate capital to continue our acquisition efforts, our shareholders may lose some or all of their investment and our business may fail.

- 14 -

AMI Summary Financial Information

AMI financial information as of and for the years ended December 31, 2007 and December 31, 2006:

| |

| As at Dec. 31,

2007

(Audited) ($) |

Balance Sheet Information | |

Total Assets | 422,966 |

Liabilities | 2,864,141 |

Total Stockholders’ Equity (Deficit) | (2,441,175) |

| | |

Statement of Operations and

Statement of Cash Flows Information |

For the year ended

Dec 31, 2007

(Audited) ‘

($) |

For the year ended

Dec 31, 2006

(Audited)

($) |

Sales | 1,900,951 | 3,666,165 |

Cost of Sales | 1,396,052 | 2,613,252 |

Expenses | (444,809) | (466,442) |

Net Loss for the Period | (296,695) | (471,235) |

Cash provided by (used in) Operating Activities | (71,263) | (231,254) |

Cash provided by (used in) Investing Activities | (15,179) | - |

Cash provided by (used in) Financing Activities | 100,000 | - |

Liquidity and Capital Resources

Working Capital

| | | | | |

| |

Year Ended

December 31, 2007

| |

Year Ended

December 31, 2006 |

Percentage Increase/ (Decrease) |

Current Assets | $ | 18,456 | $ | 13,259 | 39.2% |

Current Liabilities | | 213,423 | | 86,852 | (145.7%) |

Working Capital | | (194,967) | | (73,593) | (169.9%) |

Cash Flows

| | | | | |

| | Year Ended

December 31, 2007 | | Year Ended

December 31, 2006 |

Percentage Increase/ (Decrease) |

Cash flow from operating activities | $ | (145,987) | $ | (43,758) | (233.6%) |

Cash flow used in investing activities | | Nil | | Nil | Nil |

Cash provided by financing activities | | 150,892 | | 36,588 | 312.4% |

Foreign exchange effect on cash | | Nil | | 438 | (100%) |

Net increase (decrease) in cash | | 4,905 | | (6,732) | 172.8% |

- 15 -

The ability of our company to meet our financial liabilities and commitments is primarily dependent upon the continued issuance of equity to new shareholders, and our ability to achieve and maintain profitable operations.

Management believes that our company's cash and cash equivalents and cash flows from operating activities will not be sufficient to meet our working capital requirements for the next twelve month period. We estimate that we will require an estimated additional $2,500,000 over the next twelve month period to fund our operating cash shortfall. Our company plans to raise the capital required to satisfy our immediate short-term needs and additional capital required to meet our estimated funding requirements for the next twelve months primarily through the private placement of our equity securities. There are no assurances that we will be able to obtain funds required for our continued operation. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will not be able to meet our other obligations as they become due and we will be forced to scale down or perhaps even cease the operation of our business.

There is substantial doubt about our ability to continue as a going concern as the continuation of our business is dependent upon obtaining further long-term financing, successful and sufficient market acceptance of our products and achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

Recent Private Placements

On April 10, 2008, we closed a private placement to 3 subscribers consisting of 1,250,000 units of our securities at a price of $1.00 per unit for aggregate proceeds of $1,250,000. Each unit consists of (i) one common share, (ii) one share purchase warrant entitling the holder thereof to purchase one common share for a period of 24 months commencing from the closing of the private placement, at an exercise price of $1.20 per common share. Proceeds of the offering are intended to be used for working capital to meet continued operating expenses. The private placement was conducted in an offshore transactions relying on Regulation S of the Securities Act of 1933. None of the subscribers were U.S. persons, as defined in Regulation S. No directed selling efforts were made in the United States by the Company, any of their respective affiliates or any person acting on behalf of any of the foregoing. We implemented the applicable offering restrictions required by Regul ation S by including a legend on all offering materials and documents which stated that the shares have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States or to US persons unless the shares are registered under the Securities Act of 1933, or an exemption from the registration requirements of the Securities Act of 1933 is available. The offering materials and documents also contained a statement that hedging transactions involving the shares may not be conducted unless in compliance with the Securities Act of 1933.

On January 25, 2008, we closed a private placement of 2,100,000 units (post two for one forward split) at a purchase price of $0.04 per unit (post split), for gross proceeds of $84,000. Each unit consisted of one common share and one common share purchase warrant exercisable for a period of two years from closing at an exercise price of $0.06 (post-split). We issued all of the 2,100,000 units to 3 subscribers who represented to us that they were not “U.S. persons” (as that term is defined in Regulation S promulgated under the Securities Act of 1933) relying on the exemption from registration provided by Regulation S and/or Section 4(2) of the Securities Act of 1933.

Off-balance Sheet Arrangements

We have no off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is deemed by our management to be material to investors.

Critical Accounting Policies

We have identified certain accounting policies, described below, that are the most important to the portrayal of our current financial condition and results of operations.

- 16 -

Revenue recognition

The Company recognizes revenue in accordance with the provision of the Securities and Exchange Commission Staff Accounting Bulletin ("SAB") No. 104 which establishes guidance in applying generally accepted accounting principles to revenue recognition in financial statements. SAB No. 104 requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services rendered; (3) the price to the buyer is fixed and determinable; and (4) collectability is reasonably assured.

The Company has entered into consigned inventory agreements with several customers. For products shipped under consigned inventory agreements, the Company recognizes revenue when the customer notifies the Company that they have taken possession of the product from the consigned inventory and all other criteria stated above have been met.

Research and development

All costs of research and development activities are expensed as incurred.

Description of Property

Our administrative office address and our mailing address is 228 Bonis Avenue, #PH3, Scarborough, Ontario, Canada M1T 3W4 and our telephone number is 416.727.8889. Mr. Pang, our sole director and officer, currently provides this space to us free of charge. This space may not be available to us free of charge in the future. Following the completion of the merger with AMI we have changed our head office to 25 Drydock Ave 7th floor, Boston, MA 02210. We are presently negotiating the terms of a long term lease for this space.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of April 9, 2008, there were 16,052,000 shares of our common stock outstanding. The following table sets forth certain information known to us with respect to the beneficial ownership of our common stock as of that date by (i) each of our directors, (ii) each of our executive officers, and (iii) all of our directors and executive officers as a group. Except as set forth in the table below, there is no person known to us who beneficially owns more than 5% of our common stock. The number of shares beneficially owned is determined under rules of the Securities and Exchange Commission and the information is not necessarily indicative of beneficial ownership for any other purpose.

| | |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(1) |

Alpha Pang

228 Bonis Avenue, #PH3

Scarborough, Ontario Canada M1T 3W4 | 3,950,000 | 24.6% |

Directors and Executive Officers as a group | 3,950,000 | 24.6% |

5% Stockholders |

Alpha Pang

228 Bonis Avenue, #PH3

Scarborough, Ontario Canada M1T 3W4 | 3,950,000 | 24.6% |

Balboa International Asociada S.A. MMG Tower 53 St. Panama | 900,000 | 5.6% |

- 17 -

| | |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(1) |

Penson Financial Services Canada Inc. 360 St Jacques Quest 11th Floor Montreal, Quebec H2Y 1P5 | 1,395,900 | 8.7% |

(1)

Based on 16,052,000 shares of common stock issued and outstanding as of April 9, 2008. Except as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days are deemed outstanding for the purposes of computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for the purposes of computing the percentage ownership of any other person.

DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

As at April 9, 2008, our directors and executive officers, their age, positions held, are as follows:

| | | |

Name | Position Held with our Company | Age | Date First

Elected or Appointed |

Alpha Pang | President, Chief Financial Officer, Treasurer and Director | 50 | September 10, 2007 |

Lalit Jain | Chief Executive Officer and Director | 39 | April 8, 2008(1) |

Nand Todi | Director | 62 | (1) |

To Hon Lam | Director | 49 | (1) |

Notes:

(1)

Each of the appointments of Messers. Jain, Todi and Lam to the board of directors of Angstrom will not be

effected until 10 days following the mailing of a Schedule 14(f) to all shareholders of Angstrom. Lalit Jain was appointed as CEO effective April 9, 2008.

Business Experience

The following is a brief account of the education and business experience of directors, executive officers and new appointees during the past five years.

Alpha Pang – President, Secretary, Treasurer and Director

On September 10, 2007, we appointed Alpha Pang to our board of directors and as our President, Chief Executive Officer, Secretary and Treasurer. Mr. Pang is an entrepreneur with various business experience including trading, real estate, brokerage, investment banking and business consultation. Mr. Pang has served as an independent director for start-up public companies listed on Canadian stock exchanges. Since 2001, Mr. Pang has been the Managing Director, Far East Market of Harbour Capital Management Group (1999) Inc., which provides business consultation and syndication of investment funds for start up companies. Mr. Pang also serves as a director for Talware Networx Inc., YSV Ventures Inc., both companies listed on the TSX Venture Exchange and Renforth Resources Inc. a company currently in the process of being listed on the TSX Venture Exchange.

- 18 -

Lalit Jain – Director and Chief Executive Officer

Lalit Jain is President and CEO of Angstrom Microsystems, Inc., a Boston-based high performance Green computing company addressing the needs of large data centers such as animation, special-effects rendering and scientific computing solutions. Mr. Jain as taken Angstrom from it's inception to one of the top rendering computer companies in Hollywood with clients including Pixar, ILM, Sony Imageworks, and Rhythm & Hues.

Mr. Jain graduated from MIT (class of 1990) with degrees in electrical engineering and computer science. Mr. Jain is a leader in the high performance computing market and has worked for a variety of companies including PictureTel and IBM. Previous to Angstrom, Mr. Jain founded Unified Access Communications, a network security company that sold firewalls to companies like Cingular Wireless and Fleet Bank. He is currently introducing cooling and power technologies that make the data center more efficient.

Nand Todi -- Director

Nand Todi founder President and CEO of Penn Manufacturing. Mr . Todi is a graduate of the world renowned Indian Institute of Technology (IIT) in Madras.

To-Hon Lam – Director

To-Hon Lam co-founded Perfisans Networks Inc. in February 2001 and has acted as its President and CEO since inception and presently acting as Director of IC Design. Prior to Perfisans, he successfully launched Matrox Toronto Design Center specializing in multi-million gate graphics and video processors. Mr. Lam has managed over 100 software and hardware projects. He was the co- founder and Director of Engineering with SiconVideo where he has employed from 1999 through February 2001. He also worked with ATI Technologies, where he designed several state of the art application specific integrated circuits (ASIC). ATI is currently a leader in the graphic chip design industry. Mr. Lam brings with him over 20+ years of engineering and design management experience with ASIC technologies.

Bhavini Patel

As Controller, Mrs. Patel has managed AMI’s finances while acting as the chief purchasing agent. She has enabled Angstrom to provide quality products at a reasonable price.

Being an entrepreneur herself, Bhavini has started and operated several companies, including those in the Internet and hospitality spaces. Mrs. Patel has the experience necessary to manage the finances of a just-in-time manufacturing company.

Family Relationships

There are no family relationships between any director or executive officer.

Involvement in Certain Legal Proceedings

Other than as disclosed below, we know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

1.

Xyratex Technology Ltd. v. Angstrom Microsystems, Inc., Suffolk Superior Court, C.A. No. 06-4938-F (filed 11/29/06). This is a default judgment against AMI in the amount of $33,489.44 exclusive of interest and costs.

2.

Cooljag U.S.A. v. Angstrom Microsystems, Inc., Boston Municipal Court, docket number 07-01-CV -002041. This is a default judgment against AMI in the amount of $14,997.74, exclusive of interest and costs.

3.

Tester v. Angstrom Microsystems, Inc., San Diego County, Calif. Superior Court, Case No. 07-2007-00054558. This is a default judgment against AMI in San Diego County, Calif. Superior Court in the amount of $17,100 exclusive of interest and costs.

- 19 -

4.

Zip Ship, Inc. v. Angstrom Microsystems, Inc.

This is a consent judgment against the company in the amount of $8,106.66 arising from unpaid invoices.

5.

Integrated Dynamic Metals Corporation and J & J Machine Company, LLC v. Angstrom Microsystems, Inc. and Lalit Jain., Boston Municipal Court, C.A. No. 08 01 CV 000958. The suit is an action for goods and labor sold and delivered. The plaintiffs are demanding judgment in the total amount of $16,678.02.

6.

Mercury Business Services, Inc. v. Angstrom Microsystems, Inc., Boston Municipal Court, C.A. No. 08 01 CV 001241. The suit is an action for goods and labor sold and delivered. The plaintiff is demanding judgment in the total amount of $4,684.74.

7.

Decisione Corporation v. Angstrom Microsystems, Inc., Boston Municipal Court, C.A. No. 07 01 CV 6414. The suit is an action for goods and labor sold and delivered. The plaintiff is demanding judgment in the total amount of $6,770.54.

8.

Mike OConnell d/b/a K2 Logistics v. Angstrom Microsystems, Inc. and Lalit Jain, Boston Municipal Court, C.A. No. 08 05 SC 169. The plaintiff seeks compensation for the provision of transportation services for under $2,000.

Unasserted Claims and Assessments

Flextronics

Flextronics, through counsel, made a written demand for payment in the amount of $28,375.00 for unpaid invoices.

University of Utah

University of Utah, through its general counsel, made written demand on Angstrom claiming that on or about October 18, 2006, Angstrom received an erroneous double payment from the University in the amount of $14,100.00.

AirTrans Logistics, Inc.

This vendor made demand on Angstrom for goods sold and delivered in the amount of $11,127.25. Accordingly, by letter dated March 12, 2008, this vendor made demand on Angstrom for $10,627.25, and has threatened the institution of suit.

Our directors, executive officers and control persons have not been involved in any of the following events during the past five years:

| | |

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

- 20 -

EXECUTIVE COMPENSATION

The following table contains the particulars of compensation paid to the following persons:

(a)

our principal executive officer;

(b)

each of our two most highly compensated executive officers who were serving as executive officers at the end of the year ended December 31, 2007 who had total compensation exceeding $100,000; and

(c)

up to two additional individuals for whom disclosure would have been provided under (b) but for the fact that the individual was not serving as our executive officer at the end of the most recently completed financial year, who we will collectively refer to as the named executive officers, of our years ended December 31, 2007 and 2006.

| | | | | | | | | |

SUMMARY COMPENSATION TABLE |

Name

and Principal Position | Year | Salary

($) | Bonus

($) | Stock Awards

($) | Option Awards

($) | Non-Equity Incentive Plan Compensa-tion

($) | Change in Pension

Value and Nonqualified Deferred Compensation Earnings

($) | All

Other Compensa-tion

($) | Total

($) |

Alpha Pang(1)

President, Chief Financial Officer and Treasurer and Director | 2007

2006

| 10,500

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| 10,500

Nil

|

Fiore Aliperti(2)

FormerPresident, Chief Executive Officer, Secretary, Treasurer and Director | 2007

2006

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

| Nil

Nil

|

(1)

Mr. Pang was appointed, president, chief financial officer, treasurer and director on September 10, 2007.

(2)

Effective October 11, 2007 Fiore Aliperti resigned as director and officer of the Company. The resignation was effected 10 days after the filing of a Schedule 14F-1, which was filed with the SEC on October 1, 2007.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth for each named executive officer certain information concerning the outstanding equity awards as of December 31, 2007.

- 21 -

| | | | | | | | | |

| Option Awards | Stock Awards |

Name | Number of Securities Underlying Unexercised Options Exercisable | Number

of

Securities Underlying Unexercised Options Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price | Option Expiration Date | Number

of

Shares

or Units

of Stock that

Have Not Vested | Market Value

of

Shares or Units of Stock that Have Not Vested | Equity Incentive Plan Awards : Number of Unearned Shares, Units or Other Rights that Have Not Vested | Equity Incentive Plan Awards : Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested |

| Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Compensation of Directors

The particulars of compensation paid to our directors for our year ended December 31, 2007, are set out in the following director compensation table:

| | | | | | | | | |

Name |

Year | Fees Earned or Paid in Cash

($) | Stock Awards

($) | Option Awards

($) | Non-Equity Incentive

Plan Compensation

($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All

Other Compensation

($) | Total

($) |

Alpha Pang(1) | 2007 | 10,500 | Nil | Nil | Nil | Nil | Nil | 10,500 |

Fiore Aliperti(2)

| 2007 | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

John R. Poloni(2) | 2007 | 4,500 | Nil | Nil | Nil | Nil | Nil | 4,500 |

| (1) | Mr. Pang was appointed a director of our company on September 10, 2007. |

| (2) |

Effective October 11, 2007 Fiore Aliperti and John Poloni resigned as directors and officers of the Company. Their respective resignations were effected 10 days after the filing of a Schedule 14F-1, which was filed with the SEC on October 1, 2007. |

We did not pay other cash compensation for services rendered as a director in the year ended December 31, 2007. We may, however, determine to compensate our directors in the future. Directors are entitled to reimbursement of expenses incurred in attending meetings. In addition, our directors are entitled to participate in our stock option plan.

We have no formal plan for compensating our directors for their service in their capacity as directors, although such directors are expected in the future to receive stock options to purchase common shares as awarded by our Board of Directors or (as to future stock options) a compensation committee which may be established. Directors are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of our board of directors. Our board of directors may award special remuneration to any director undertaking any special services on our behalf other than services ordinarily required of a director. No director received and/or accrued any compensation for their services as a director, including committee participation and/or special assignments.

- 22 -

There are no arrangements or plans in which we provide pension, retirement or similar benefits for our current directors or current executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our current directors or current executive officers, except that stock options may be granted at the discretion of the board of directors or a committee thereof.

We reimburse our directors for expenses incurred in connection with attending board meetings. We have not paid any director's fees or other cash compensation for services rendered as a director since our inception.

We have no formal plan for compensating our directors for their service in their capacity as directors, although such directors are expected in the future to receive stock options to purchase common shares as awarded by our board of directors or (as to future stock options) a compensation committee which may be established. Directors are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of our board of directors. Our board of directors may award special remuneration to any director undertaking any special services on our behalf other than services ordinarily required of a director. No director received and/or accrued any compensation for their services as a director, including committee participation and/or special assignments.

Long-Term Incentive Plans

As at December 31, 2007 there were no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers, except that our directors and executive officers may receive stock options at the discretion of our board of directors. We do not have any material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of our board of directors.

As at December 31, 2007 we had no plans or arrangements in respect of remuneration received or that may be received by our executive officers to compensate such officers in the event of termination of employment (as a result of resignation, retirement, change of control) or a change of responsibilities following a change of control, where the value of such compensation exceeds $60,000 per executive officer.

Stock Options/SAR Grants

There were no grants of stock options or stock appreciation rights to any officers, directors, consultants or employees of our company during the fiscal year ended December 31 2007.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Values

There were no stock options outstanding as at December 31, 2007.

Directors Compensation

We reimburse our directors for expenses incurred in connection with attending board meetings but did not pay director's fees or other cash compensation for services rendered as a director in the year ended December 31, 2007.

Report on Executive Compensation

Our compensation program for our executive officers is administered and reviewed by our board of directors. Historically, executive compensation consists of a combination of base salary and bonuses. Individual compensation levels are designed to reflect individual responsibilities, performance and experience, as well as the performance of our company. The determination of discretionary bonuses is based on various factors, including implementation of our business plan, acquisition of assets, development of corporate opportunities and completion of financing.

- 23 -

EQUITY COMPENSATION PLANS

On April 8, 2008, our board of directors adopted our 2008 Incentive Stock Option Plan (the “Plan”). Under the Plan, options to acquire shares of common stock and issuance of shares of common stock underlying options may be granted to directors, officers, consultants and employees of AMI. A total of 10,000,000 shares of common stock are authorized for issuance under the Plan. The Plan is administered by our Board of Directors or by a committee of two or more non-employee directors appointed by our Board of Directors (the "Plan Administrator"). Subject to the provisions of the Plan, the Plan Administrator has full and final authority to grant the awards of stock options and to determine the terms and conditions of the awards and the number of shares to be issued pursuant thereto.

Options granted under the Plan may be either "incentive stock options," which qualify for special tax treatment under the Internal Revenue Code of 1986, as amended, (the "Code"), nonqualified stock options or restricted shares.

All of the AMI employees and members of our Board of Directors are eligible to be granted options. Individuals who have rendered or are expected to render advisory or consulting services to us are also eligible to receive options. The exact terms of the option granted are contained in an option agreement between us and the person to whom such option is granted. Eligible employees are not required to pay anything to receive options.

In connection with the Merger Agreement, on April 8, 2008 we issued the following options to the employees of AMI:

| | |

Name and Address | Number of Number of ATC Options received on Closing, each option exercisable for one share of ATC |

Exercise Price of ATC Options to be received on Closing |

Bhavini Patel | 290,400 | $0.20 |

Jiajie Lin | 21,175 | $0.20 |

Lalit Jain | 302,500 | $0.25 |

Dilip Patel | 16,940 | $0.20 |

Nand Todi | 19,360 | $0.20 |

Ali Benamara | 36,300 | $0.20 |

Eric Chen | 12,100 | $0.20 |

Lilong Xin | 6,050 | $0.20 |

Rachel Sun | 12,100 | $0.20 |

Shao, Hua Shao | 1,210 | $0.20 |

Zhan, Fei Jaing | 1,210 | $0.20 |

Deng, Bi Hong | 1,210 | $0.20 |

Jaing, Weijun | 1,210 | $0.20 |

Sang, Koon Lau | 605 | $0.20 |

Xin You | 6,050 | $0.20 |

Mark Brown | 6,050 | $0.20 |

Total | 734,470 | |

The exercise price of the Options was determined as the equivalent of the fair market value of shares of common stock of Angstrom Sub at the time of Closing of the Merger.

- 24 -

The following table sets forth certain information concerning all equity compensation plans previously approved by stockholders and all previous equity compensation plans not previously approved by stockholders, as of the most recently completed fiscal year.

EQUITY COMPENSATION PLAN INFORMATION AS AT DECEMBER 31, 2007

| | | |

| | | Number of securities |

| | | remaining available for |

| Number of securities to | Weighted-average | issuance under equity |

| be issued upon exercise | exercise price of | compensation plans |

| of outstanding options, | outstanding options, | (excluding securities |

| warrants and rights | warrants and rights | reflected in column (a)) |

Plan Category | (a) | (b) | (c) |

Equity Compensation Plans

approved by security holders | Nil | N/A | N/A |

Equity Compensation Plans

not approved by security

holders | Nil | N/A | N/A |

Total | Nil | N/A | N/A |

Employment Contracts

Other than as described below, we are not party to any employment contracts with our officers and directors. Pursuant to the terms of our Merger Agreement with AMI we agreed to assume the following employment agreements of AMI:

In connection with the closing of the Merger Agreement we entered into an employment agreement dated as of April 3, 2008 with Lalit Jain pursuant to which Mr. Jain agreed to act as our Chief Executive Officer in consideration of which we agreed to pay Mr. Jain an annual salary of $150,000, a monthly automobile allowance of $500 and an executive bonus in an amount determined by the board of directors in their discretion. Provided that the Company achieves gross sales of $10,000,000 Mr. Jain is entitled to a minimum bonus of $150,000. The agreement is for an initial three year term which is renewable on 45 days notice by Mr. Jain for an additional year. The agreement may be terminated by the Company for “cause” as defined in the agreement, on three business days notice and Mr. Jain may terminate the agreement on three business days notice for “good reason” as such term is defined in the agreement.

Also in connection with the entry into an employment agreement with Mr. Jain, the Company agreed to issue up 3,700,000 options at an exercise price of $0.50 per share to Mr. Jain which vest upon the Company reaching certain milestones which are set out in the schedules to the option agreement.

DIRECTOR INDEPENDENCE

Our common stock is quoted on the OTC bulletin board interdealer quotation system, which does not have director independence requirements. Under NASDAQ rule 4200(a)(15), a director is not considered to be independent if he or she is also an executive officer or employee of the corporation. Our sole director, Alpha Pang, is also our chief executive officer, president and treasurer, as a result, we do not have any independent directors.