UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2020

GRUPO AEROPORTUARIO DEL CENTRO NORTE, S.A.B. DE C.V.

(CENTRAL NORTH AIRPORT GROUP)

_________________________________________________________________

(Translation of Registrant’s Name Into English)

México

_________________________________________________________________

(Jurisdiction of incorporation or organization)

Torre Latitud, L501, Piso 5

Av. Lázaro Cárdenas 2225

Col. Valle Oriente, San Pedro Garza García

Nuevo León, México

_________________________________________________________________

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

OMA Announces Third Quarter 2020

Operating and Financial Results

Mexico City, Mexico, October 20, 2020— Mexican airport operator Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known as OMA (NASDAQ: OMAB; BMV: OMA), today reported its unaudited, consolidated financial and operating results for the third quarter 2020.

3Q20 Summary

| ■ | Passenger traffic decreased 62.4%, reaching 2,311 thousand passengers. Passenger traffic showed a recovery during the third quarter compared to the decrease of 90.2% during 2Q20. The airports with the lowest decline in passengers compared to 3Q19 were Mazatlán, Culiacán, Ciudad Juárez, Chihuahua and Zacatecas. |

| ■ | Capital investments and major maintenance included in the Master Development Plans (MDPs) plus strategic investments were Ps. 438 million for the quarter. |

OMA will hold its 3Q20 earnings conference call on October 21, 2020 at 9:30 am Eastern time, 8:30 am Mexico City time.

Conference call registration is available here. Upon registration, you will receive an email with all details to connect to the conference call.

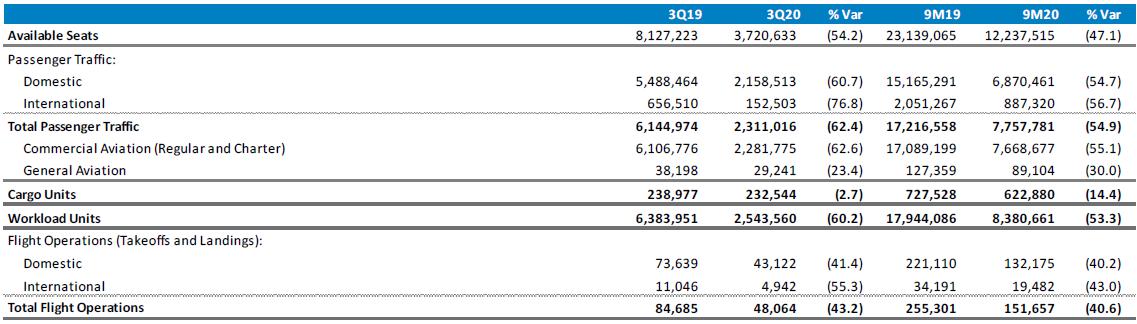

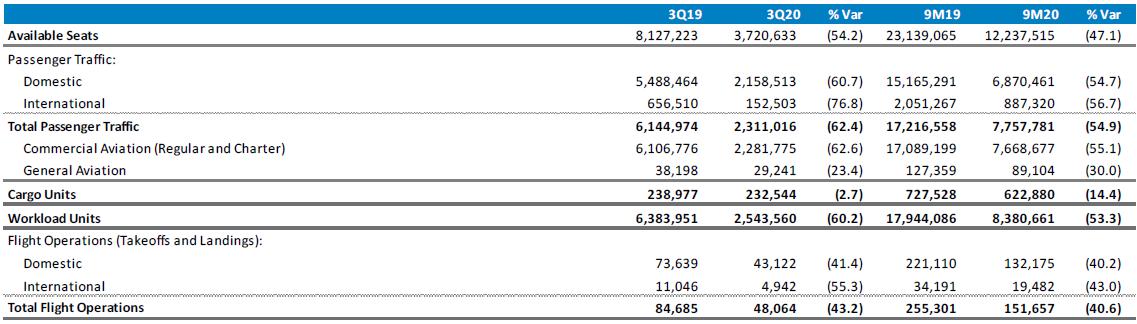

3Q20 Operating Results

Operations, Passengers, and Cargo

During the quarter, there were no new route openings or definitive cancellations. The number of seats offered decreased 54.2% compared to the same quarter of the previous year, due mainly to the number of routes suspended by the airlines.

Total passenger traffic decreased 62.4%. Of total traffic, 93.4% was domestic and 6.6% was international.

Domestic passenger traffic decreased 60.7% and international passenger traffic decreased 76.8%, which reflects restrictions on air travel in the international market.

The airports with the largest contribution to passenger traffic decline were:

| ■ | Monterrey (-65.5%), on its Mexico City, Cancún and Guadalajara routes. |

| ■ | Culiacán (-51.6%), on its Mexico City, Tijuana and Guadalajara routes. |

| ■ | Chihuahua (-58.7%), on its Mexico City, Monterrey and Guadalajara routes. |

| ■ | Ciudad Juárez (-55.2%), mainly on its Mexico City and Guadalajara routes. |

However, the Mazatlán, Culiacán, Ciudad Juárez, Chihuahua and Zacatecas airports showed a better performance in percentage terms than the rest of OMA airports compared to 3Q19.

2

Commercial Operations

The commercial space occupancy rate in the passenger terminals was 90.2% as of September 30, 2020. During the quarter, a total of 623 m2 in commercial spaces were vacated.

Hotel Services

| ■ | The NH Collection Terminal 2 Hotel had a 35.8% occupancy rate. The average room rate was Ps.1,676 per night, during the quarter. |

| ■ | Hilton Garden Inn had an 18.6% occupancy rate. The average room rate was Ps.1,850 per night during the quarter. The hotel had temporarily suspended operations during second quarter and restarted operations on July 6, 2020. |

Freight Logistics Services

| ■ | OMA Carga’s revenues decreased by 12.8% due to lower handling and storage activity related to ground import cargo during the quarter. Total tonnage handled decreased 15.6% to 6,298 metric tons. |

Industrial Services

| ■ | OMA VYNMSA Aero Industrial Park: Revenues reached Ps. 12 million, an increase of 25.5% during the quarter. The increase is due to the expansion of one industrial warehouse, as well as the depreciation of the Mexican peso compared to 3Q19. During the quarter, construction started for a new industrial warehouse, which is expected to be finished by the end of 2020. |

Consolidated Financial Results

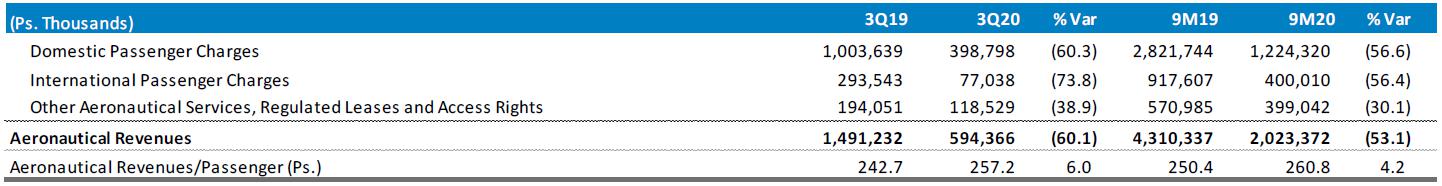

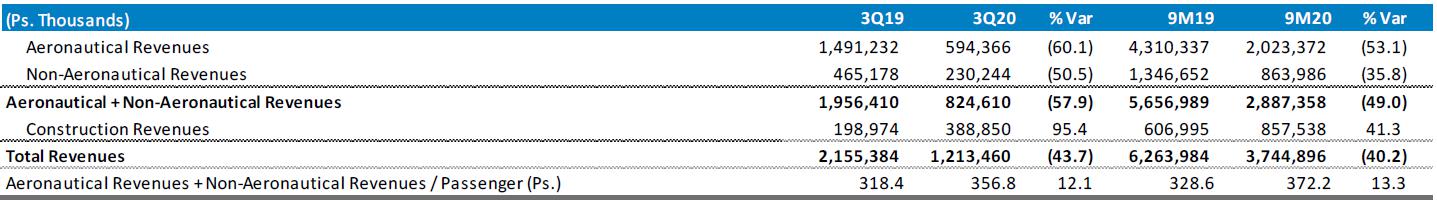

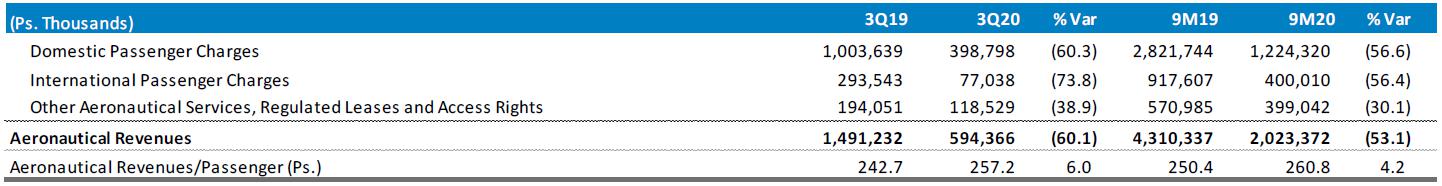

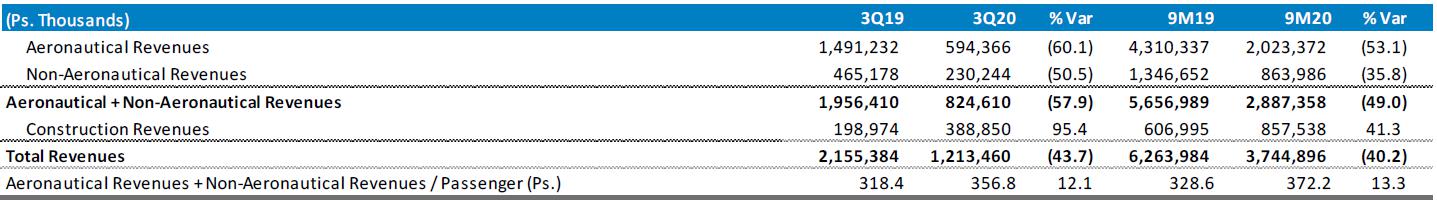

Revenues

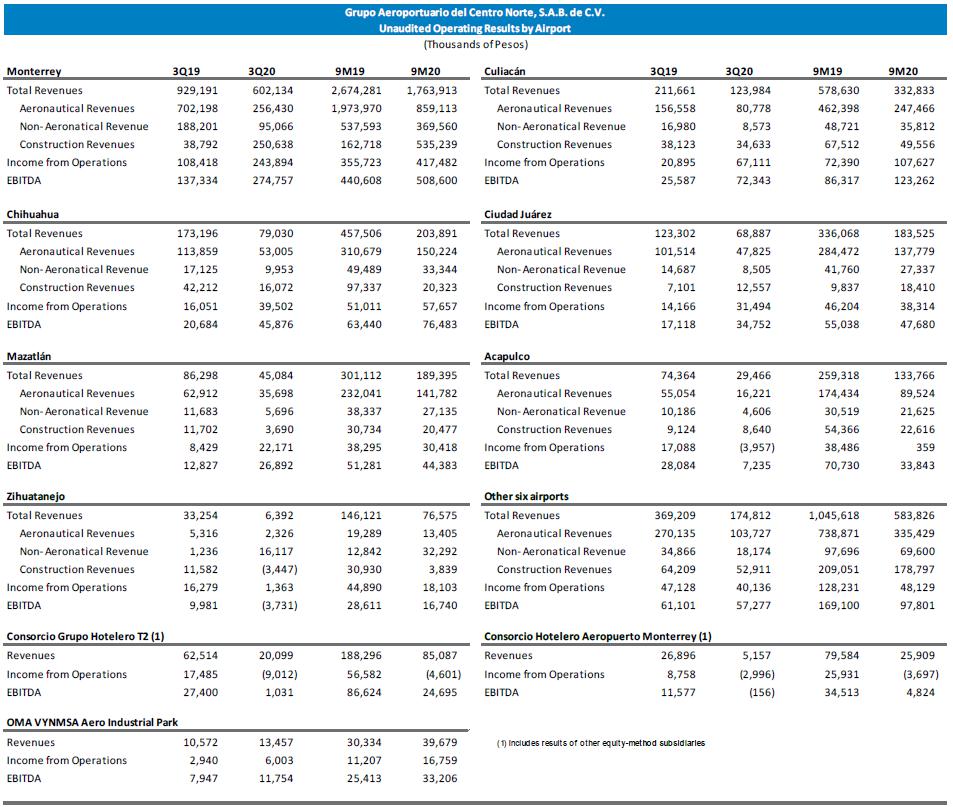

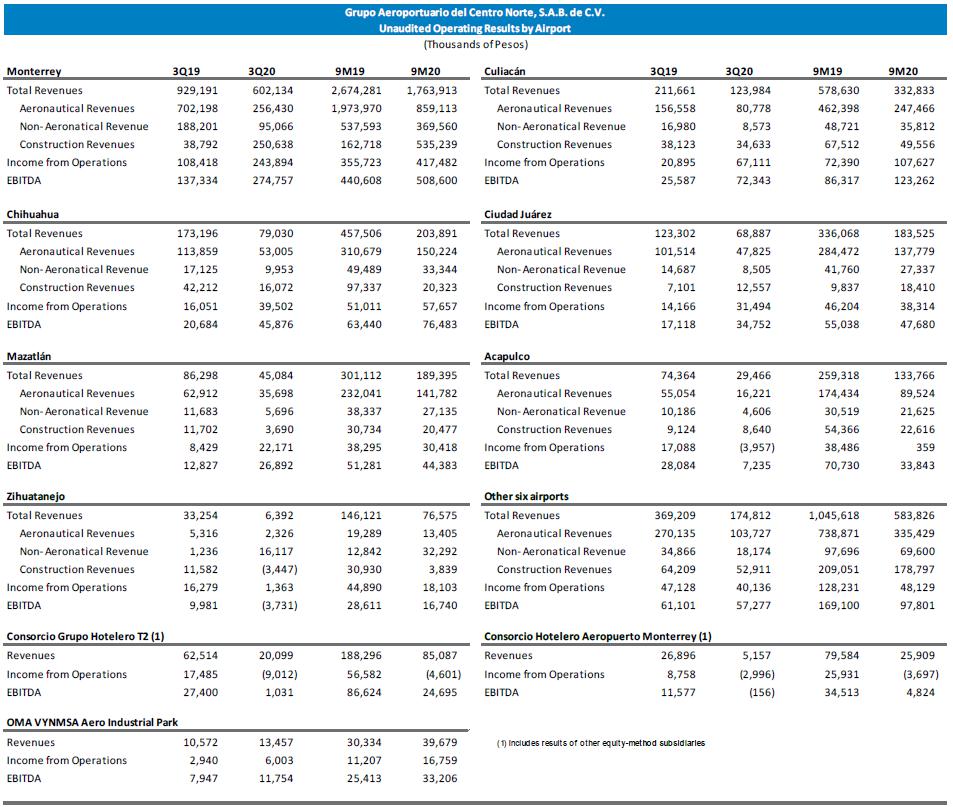

Aeronautical revenues decreased 60.1%.

3

Non-aeronautical revenues decreased 50.5%.

Commercial revenues decreased 58.7%. The line items with the largest variations were:

| ■ | Parking, -66.3%, due to the reduction in short and long stay operations. The decrease in mostly driven by a slower passenger traffic recovery in Monterrey Airport compared to the average of our airports. |

| ■ | Restaurants, Car Rentals and Retail, -72.8%, -50.9% and -68.0%, respectively, given that the majority of revenues in the quarter was related to fixed or minimum rental levels as no participation on sales was generated. Additionally, we implemented new support programs for our tenants for third and fourth quarter of 2020. |

Diversification revenues decreased 43.4%, mainly due to lower revenues from hotel services.

4

Construction revenues represent the value of improvements to concessioned assets. They are equal to construction costs and generate neither a gain nor a loss. Construction revenues and costs are determined based on the advance in the execution of projects in accordance with the airports’ Master Development Programs (MDP), and variations depend on the rate of project execution.

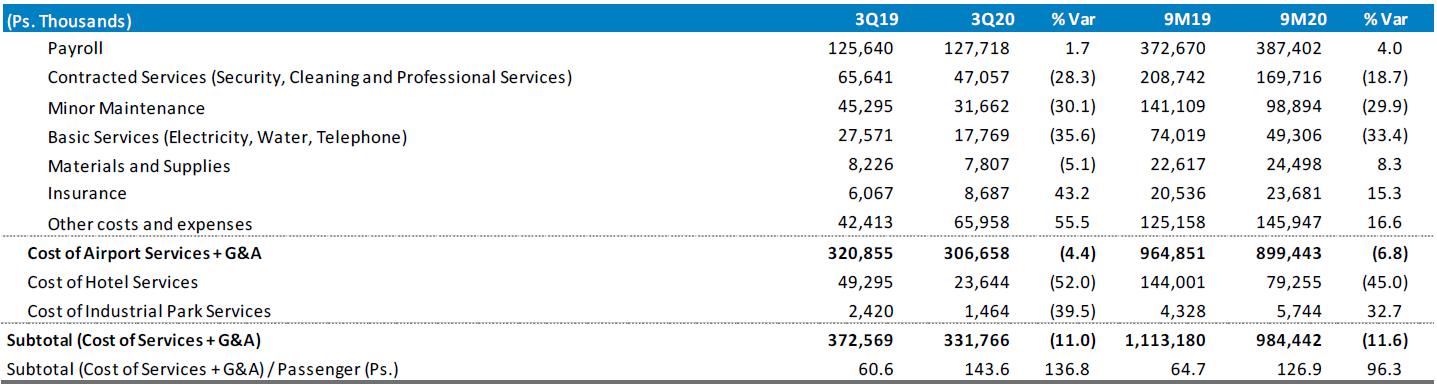

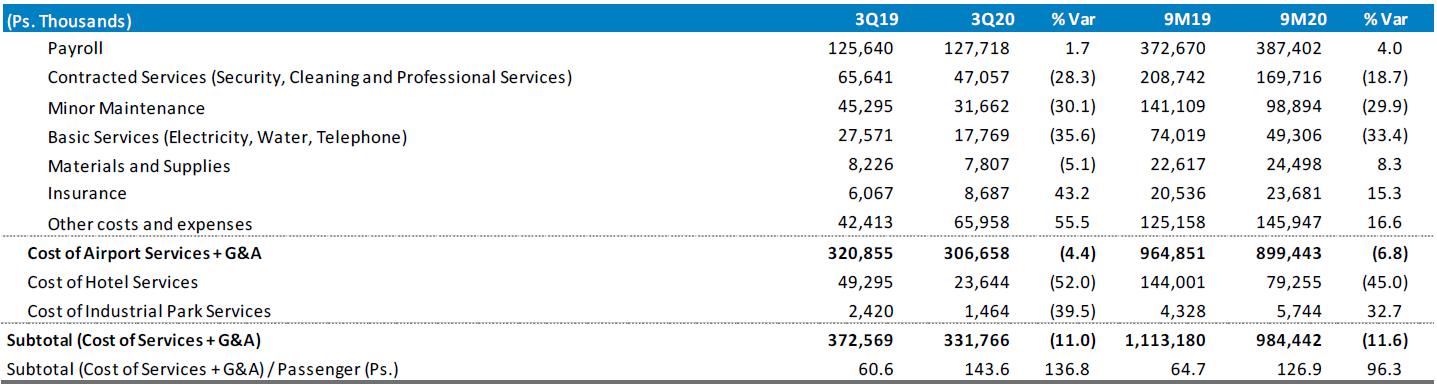

Costs and Operating Expenses

The sum of cost of airport services and general and administrative expenses (G&A) decreased 4.4%, mainly due to lower subcontracted services, minor maintenance and electricity expense, as a result of the cost reduction initiatives implemented by the company. In 3Q20, the Other costs and expenses line item includes approximately Ps. 28 million in severance payments related to reduction of headcount.

The major maintenance provision was Ps.68 million. The outstanding balance of the maintenance provision as of September 30, 2020 was Ps. 1,137 million.

The airport concession tax decreased 56.3% as a result of the decrease in revenues; technical assistance fee decreased 50.2%.

As a result of the foregoing, total operating costs and expenses decreased 10.3%.

5

Operating Income and Adjusted EBITDA

Operating loss was of Ps.255 million, with an operating margin of 21.0%.

Adjusted EBITDA was PS.431 million, with an Adjusted EBITDA margin of 52.3%.

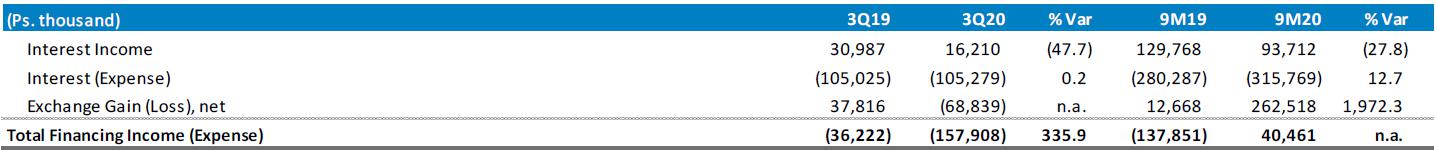

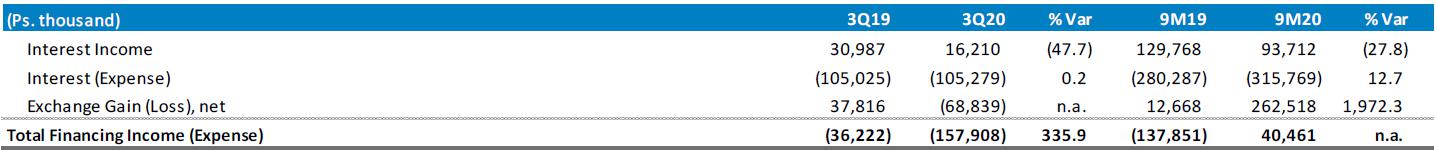

Financing Income, Taxes, and Net Income

Financing Expense was Ps.158 million, mainly due to interest expense and the foreign exchange loss.

Taxes were Ps.28 million, and the effective tax rate was 28.7%.

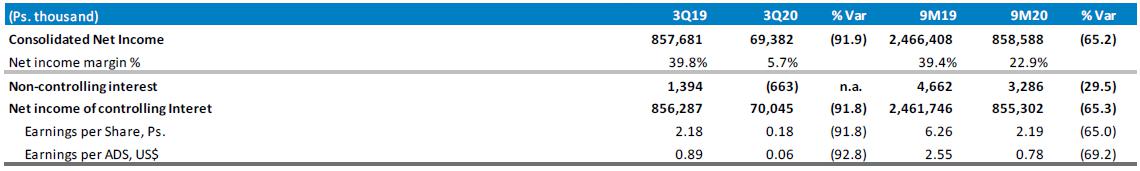

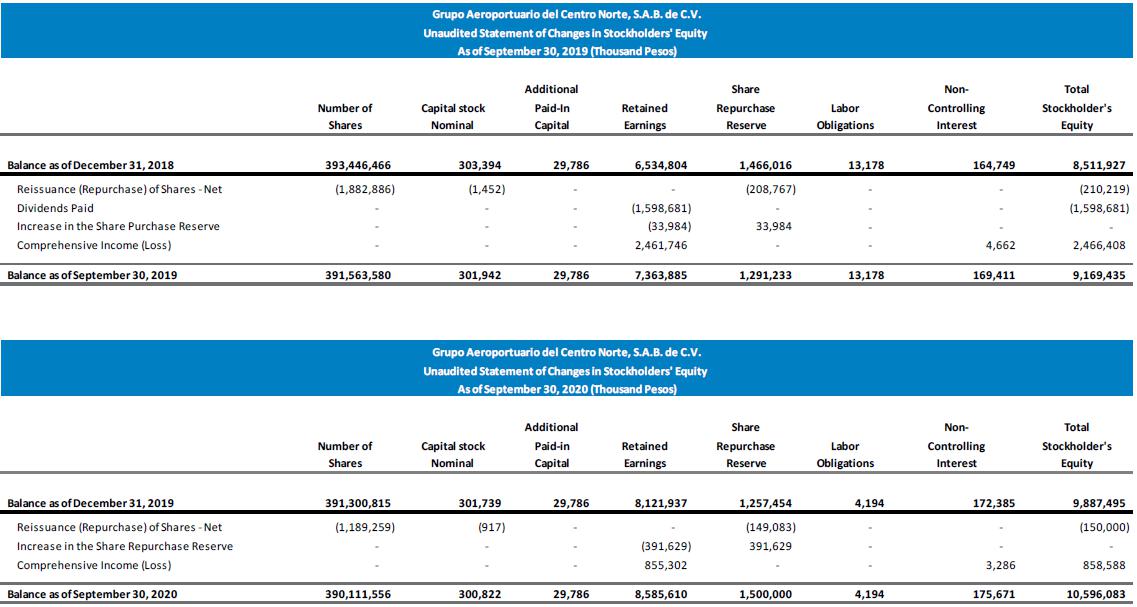

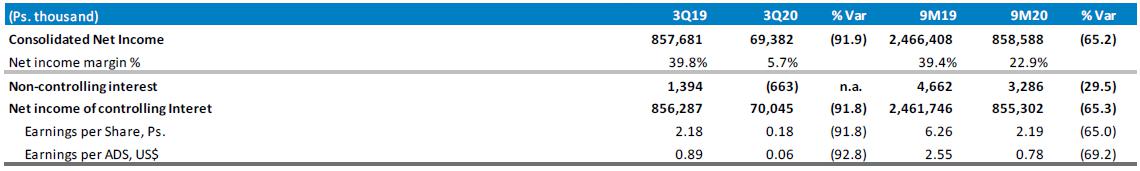

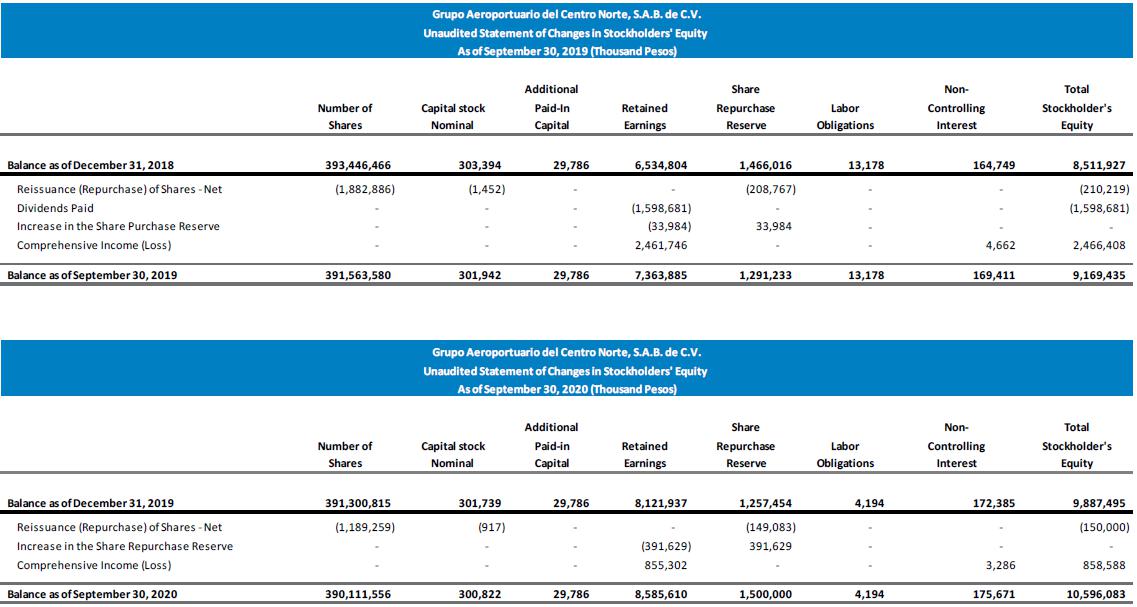

Consolidated net income in the quarter was Ps.69 million.

Earnings per share, based on net income of the controlling interest, was Ps.0.18; earnings per ADS was US$0.06. Each ADS represents eight Series B shares.

6

MDP and Strategic Investments

In 3Q20, capital investments and major maintenance works in the MDPs and strategic investments totaled Ps.438 million, comprised of Ps.389 million in improvements to concessioned assets, Ps.10 million in major maintenance, and Ps.39 million in strategic investments.

The most important investment expenditures included:

7

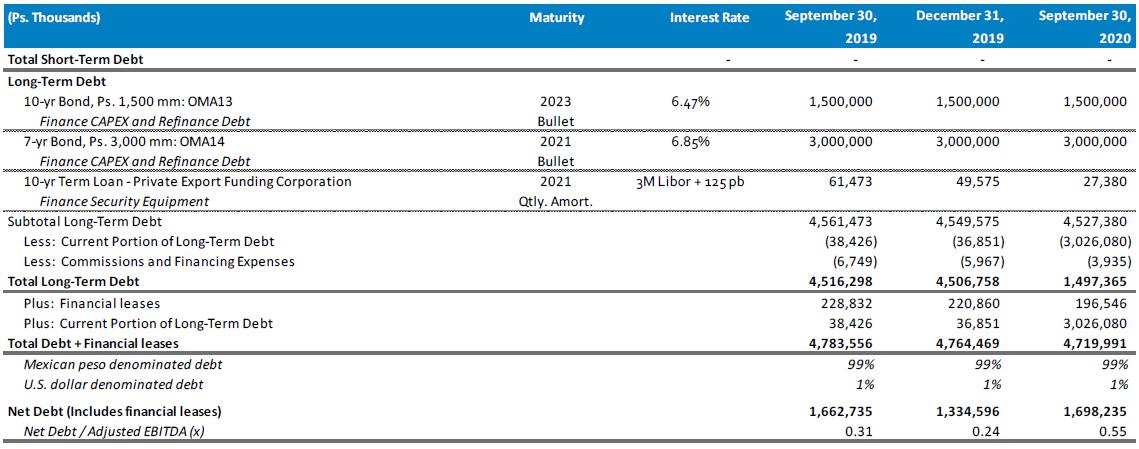

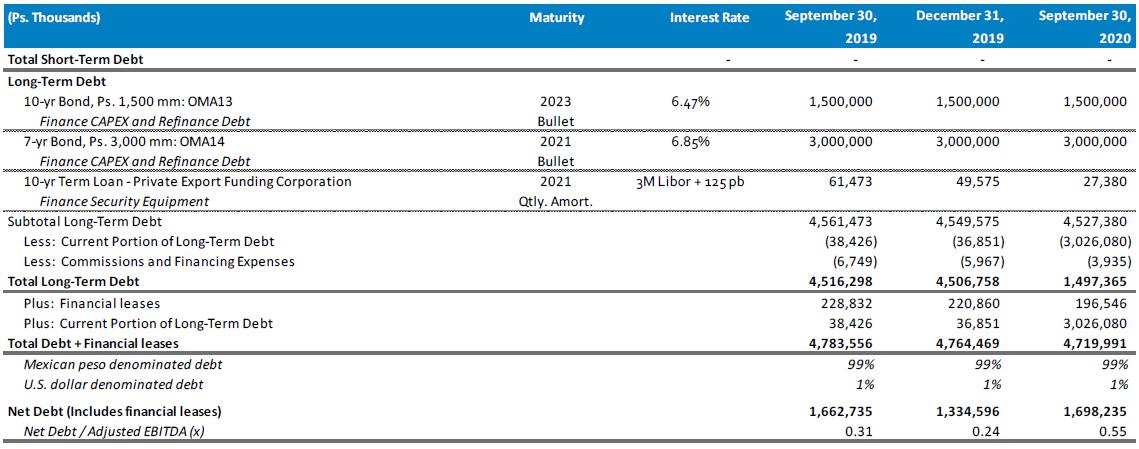

Debt

Derivatives

As of the date of this report, OMA has no financial derivatives exposure.

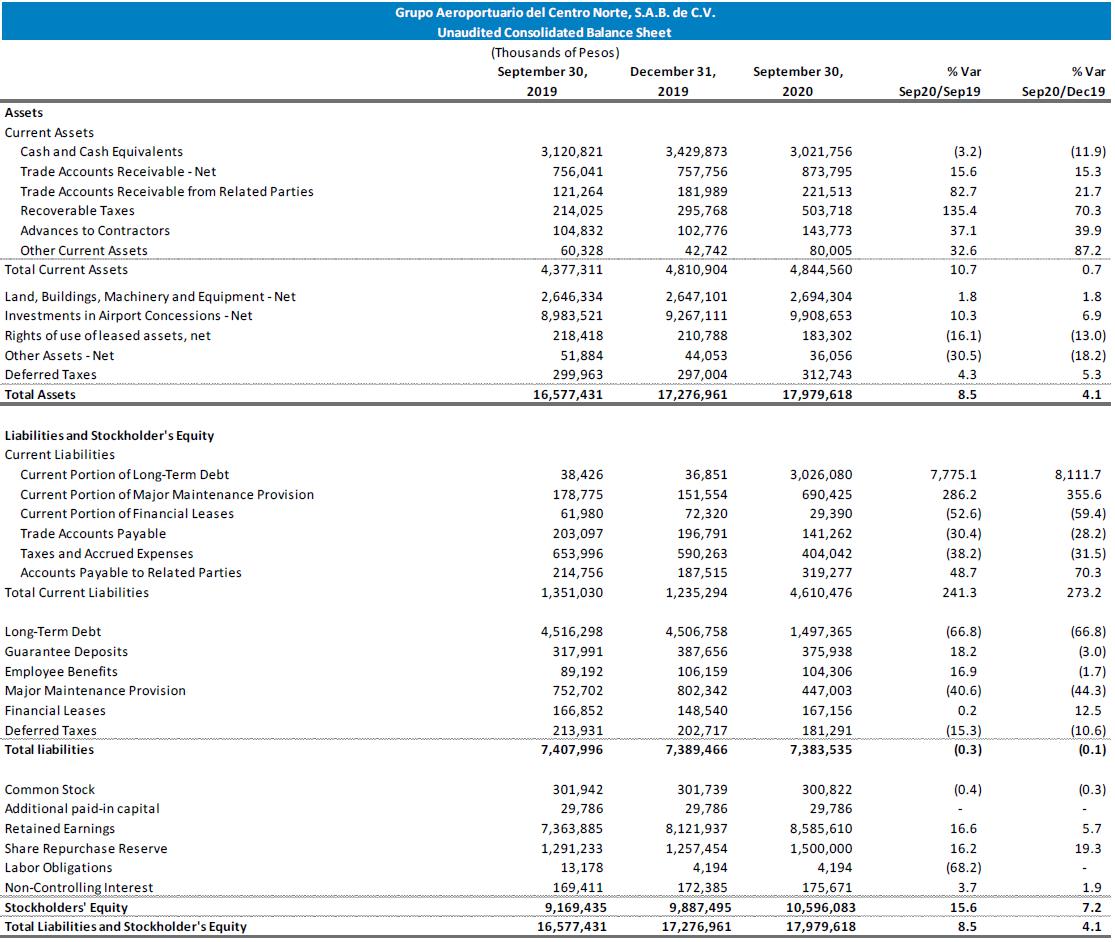

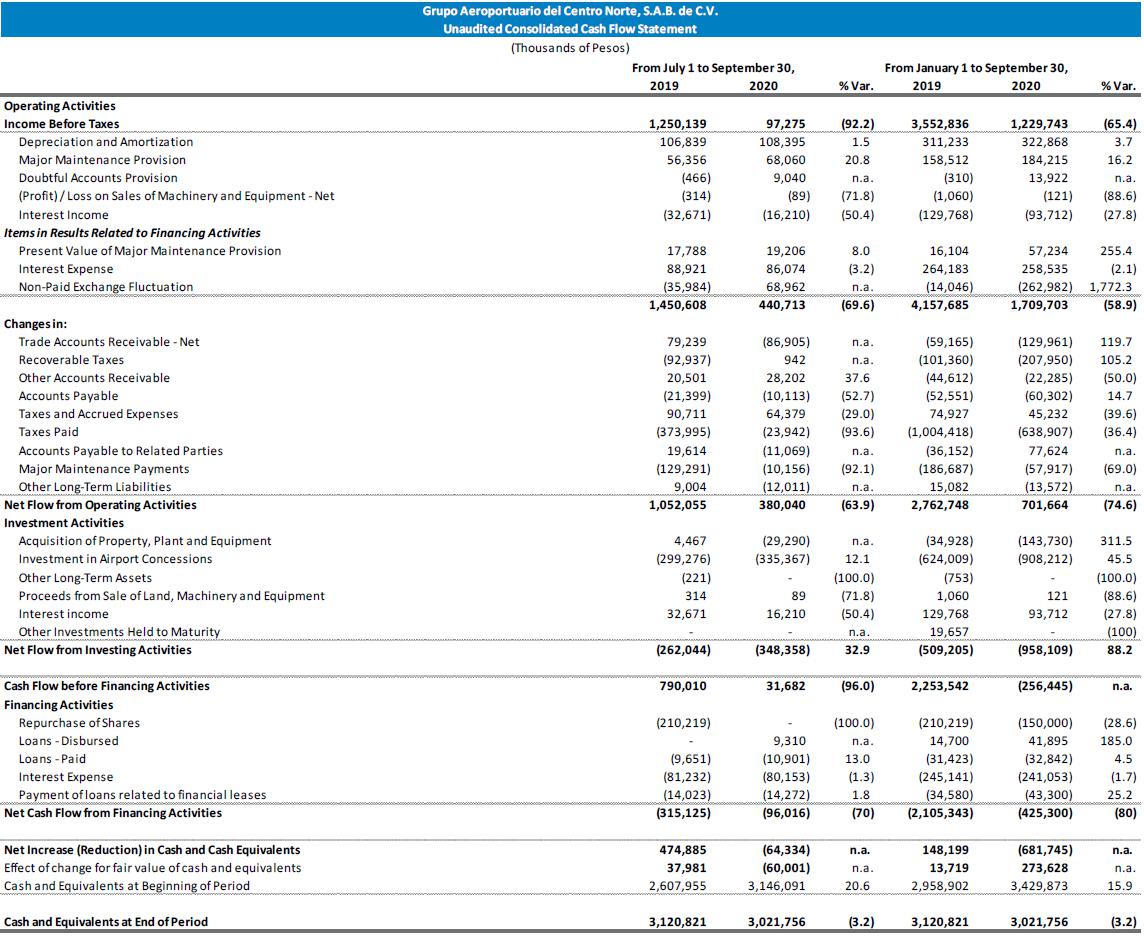

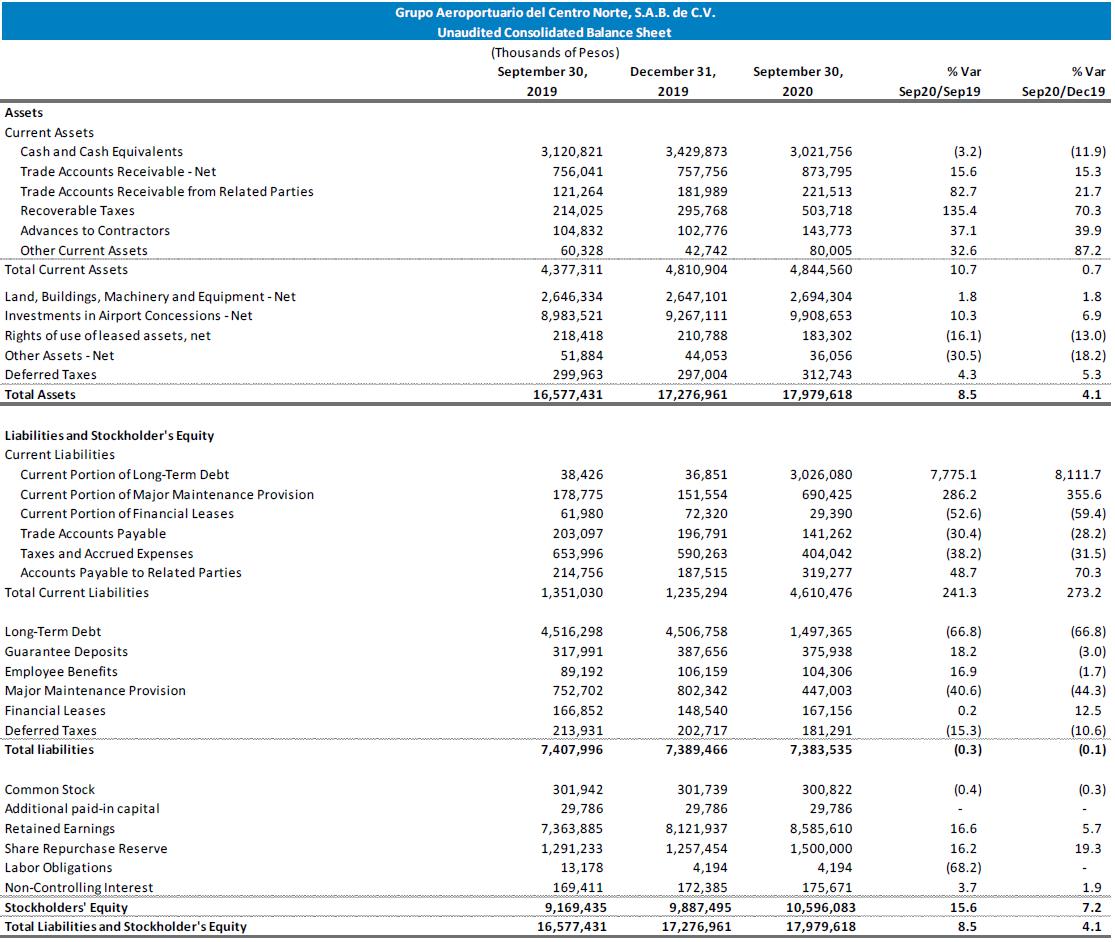

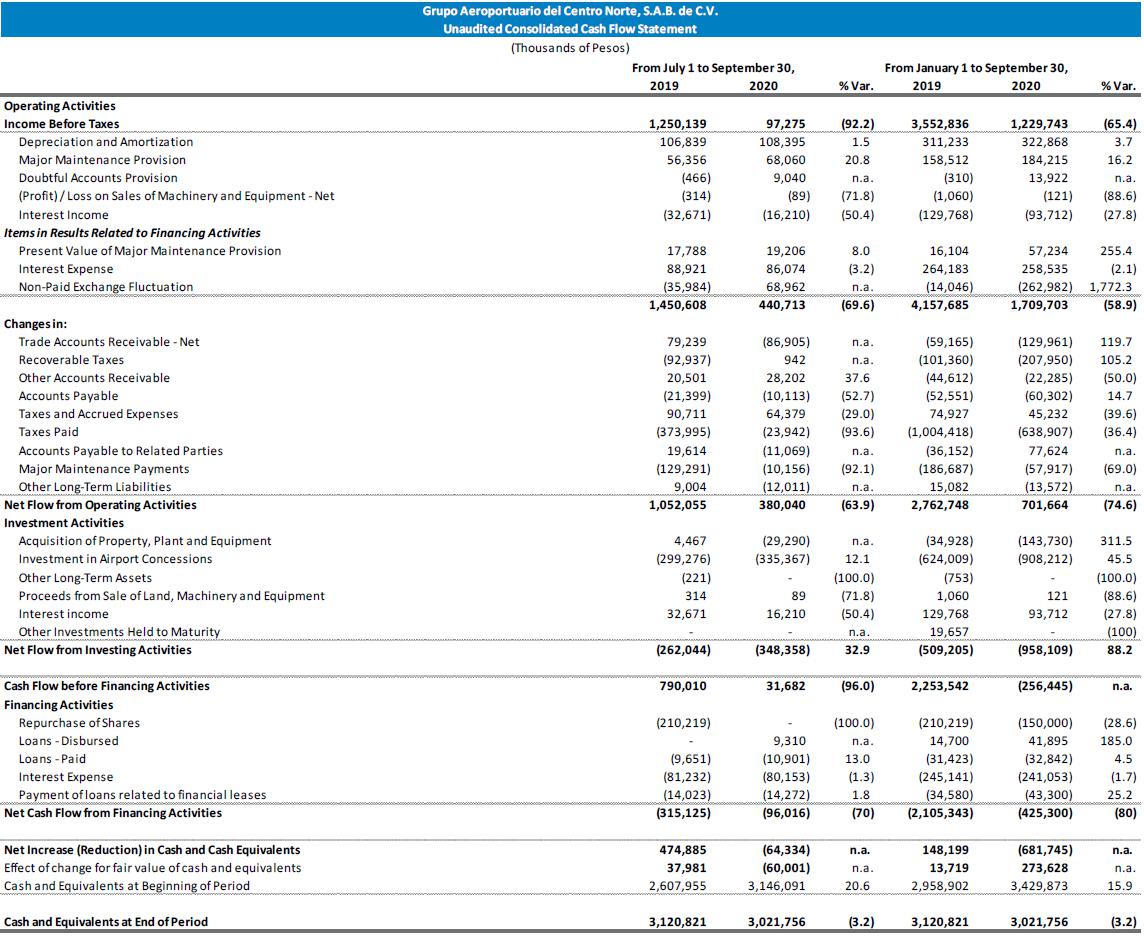

Cash Flow Statement

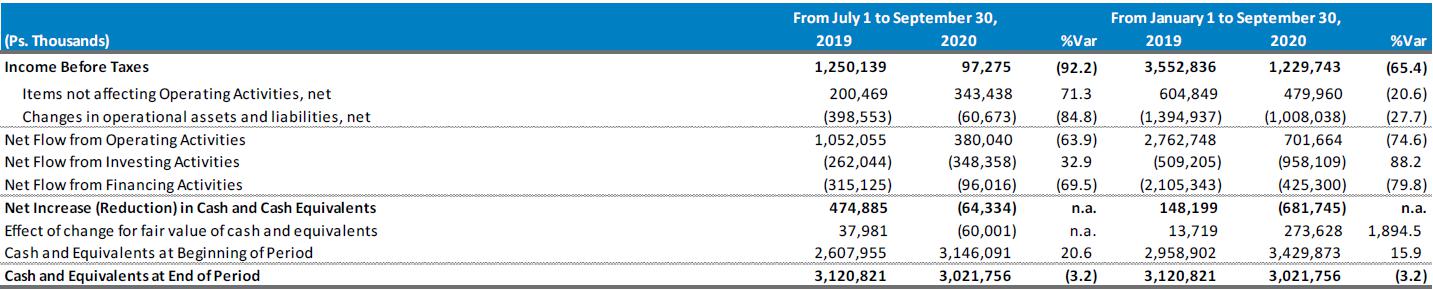

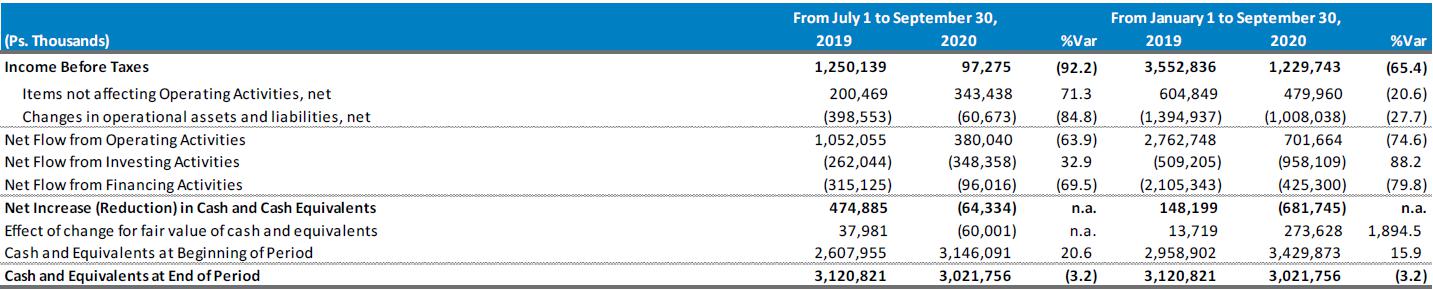

In 3Q20, cash flows from operating activities generated cash of Ps.380 million, compared to a cash generation of Ps.1,052 million in the same period of 2019. The decrease in cash generation was mainly due to the lower income before taxes.

Investing activities used cash of Ps.348 million in the third quarter. Outflows are mainly related to construction works executed during 2Q20. Financing activities generated an outflow of Ps.96 million, mainly due to interest paid of Ps.80 million.

Cash decreased Ps.64 million in 3Q20, to Ps.3,022 million as of September 30, 2020.

8

COVID-19 Update

During 3Q20, passenger traffic had a gradual recovery compared to 2Q20, and in line with the increased capacity offered by Mexican airlines, as well as the reactivation of economic activities allowed, according to the epidemiological risk traffic light system stablished by the Mexican Federal Government. Total passenger traffic reached 2.3 million during 3Q20, an increase of 297% versus 2Q20. As of the date of this report, 7 states in which OMA operates are in orange, per the traffic light, while 2 are in yellow. Economic activities and domestic travel, mainly to regional and tourist destinations, have been gradually reactivated.

OMA expects passenger traffic to continue to evolve positively in the following months, as airlines continue to increase their seats offered through an increase in frequencies and the reactivation of routes that are currently temporarily suspended. As of September 30, 2020, OMA had 117 origin-destination routes in operation, compared to 74 origin-destination routes in operation as of June 30, 2020 and 147 as of September 30, 2019.

Additionally, it is important to mention that OMA airports continue to apply and communicate the health measures that have been implemented and we work in coordination with the health and aeronautical authorities of the country, in order to look after the health of passengers, our personnel and service providers. Additionally, OMA seeks that these measures be certified by the different local and international organizations that establish and recommend them, and that way, support the recovery of passenger confidence.

Relevant Events in the Quarter

The World Travel and Tourism Council grants OMA the “Safe Travels” seal for its 13 airports. The World Travel and Tourism Council (WTTC) awarded the “Safe Travels” seal to the group's 13 airports, thanks to the actions and protocols implemented to provide its users with facilities with high standards of sanitary security in order to mitigate the risk of infection of COVID-19 in each of its terminal buildings.

Monterrey Airport certified with the Airport Health Accreditation given by Airports Council International (“ACI”). This recognition certifies compliance with global health standards including those of ACI and ICAO recommendations, for passengers, authorities and users at the Monterrey airport.

9

10

11

12

13

14

15

Notes to the Financial Information

Financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”), and presented in accordance with IAS 34 “Interim Financial Reporting.” For more information, please refer to our Quarterly Financial Information submitted to the Mexican Stock Exchange (www.bmv.com.mx)

Unless stated otherwise, all comparisons of operating or financial results are made with respect to the comparable prior year period. The exchange rates used to convert foreign currency amounts were Ps. 19.6808 as of September 30, 2019, Ps.18.8727 as of December 31, 2019 and Ps. 22.3598 as of September 30, 2020.

Construction revenue, construction cost: IFRIC 12 “Service Concession Arrangements” addresses how service concession operators should account for the obligations they undertake and rights they receive in service concession arrangements. The concession contracts for each of OMA’s airport subsidiaries establishes that the concessionaire is obligated to carry out improvements to the infrastructure transferred in exchange for the rights over the concession granted by the Federal Government. The latter will receive all the assets at the end of the concession period. As a result the concessionaire should recognize, using the percentage of completion method, the revenues and costs associated with the improvements to the concessioned assets. The amount of the revenues and costs so recognized should be the price that the concessionaire pays or would pay in an arm’s length transaction for the execution of the works or the purchase of machinery and equipment, with no profit recognized for the construction or improvement. The application of IFRIC 12 does not affect operating income, net income, or EBITDA, but does affect calculations of margins based on total revenues.

Capital investments: includes investments in fixed assets (including investments in land, machinery, and equipment) and improvements to concessioned properties under the Master Development Plan (MDP) plus strategic investments.

Strategic Investments: Refers only to those capital investments additional to the Master Development Program.

Passengers and Terminal passengers: All references to passenger traffic volumes are to Terminal passengers, which includes passengers on the three types of aviation (commercial, charter, and general aviation), and excludes passengers in transit.

Adjusted EBITDA and Adjusted EBITDA margin: OMA defines Adjusted EBITDA as EBITDA less construction revenue plus construction expense and maintenance provision. We calculate the Adjusted EBITDA margin as Adjusted EBITDA divided by the sum of aeronautical revenue and non-aeronautical revenue. Construction revenue and construction cost do not affect cash flow generation and the maintenance provision corresponds to capital investments. OMA defines EBITDA as net income minus net comprehensive financing income, taxes, and depreciation and amortization. Neither Adjusted EBITDA nor EBITDA should be considered as an alternative to net income as an indicator of our operating performance, or as an alternative to cash flow as an indicator of liquidity. It should be noted that neither Adjusted EBITDA nor EBITDA is defined under IFRS, and may be calculated differently by different companies.

16

Analyst Coverage

In accordance with the requirements of the Mexican Stock Exchange, the analysts covering OMA are:

This report may contain forward-looking information and statements. Forward-looking statements are statements that are not historical facts. These statements are only predictions based on our current information and expectations and projections about future events. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “target,” “estimate,” or similar expressions. While OMA's management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and are generally beyond the control of OMA, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include, but are not limited to, those discussed in our most recent annual report filed on Form 20-F under the caption “Risk Factors.” OMA undertakes no obligation to update publicly its forward-looking statements, whether as a result of new information, future events, or otherwise.

About OMA

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known as OMA, operates 13 international airports in nine states of central and northern Mexico. OMA’s airports serve Monterrey, Mexico’s third largest metropolitan area, the tourist destinations of Acapulco, Mazatlán, and Zihuatanejo, and nine other regional centers and border cities. OMA also operates the NH Collection Hotel inside Terminal 2 of the Mexico City airport and the Hilton Garden Inn at the Monterrey airport. OMA employs over 1,000 persons in order to offer passengers and clients airport and commercial services in facilities that comply with all applicable international safety and security measures. OMA is listed on the Mexican Stock Exchange (OMA) and on the NASDAQ Global Select Market (OMAB). For more information, visit:

| · | Webpage http://ir.oma.aero |

| · | Twitter http://twitter.com/OMAeropuertos |

| · | Facebook https://www.facebook.com/OMAeropuertos |

17

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. |

| | |

| By: | /s/ Ruffo Pérez Pliego | |

| | Ruffo Pérez Pliego |

| | Chief Financial Officer |

Dated October 21, 2020