UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2021

GRUPO AEROPORTUARIO DEL CENTRO NORTE, S.A.B. DE C.V.

(CENTRAL NORTH AIRPORT GROUP)

_________________________________________________________________

(Translation of Registrant’s Name Into English)

México

_________________________________________________________________

(Jurisdiction of incorporation or organization)

Torre Latitud, L501, Piso 5

Av. Lázaro Cárdenas 2225

Col. Valle Oriente, San Pedro Garza García

Nuevo León, México

_________________________________________________________________

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

OMA Announces First Quarter 2021

Operating and Financial Results

Mexico City, Mexico, April 27, 2021— Mexican airport operator Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known as OMA (NASDAQ: OMAB; BMV: OMA), today reported its unaudited, consolidated financial and operating results for the first quarter 2021.

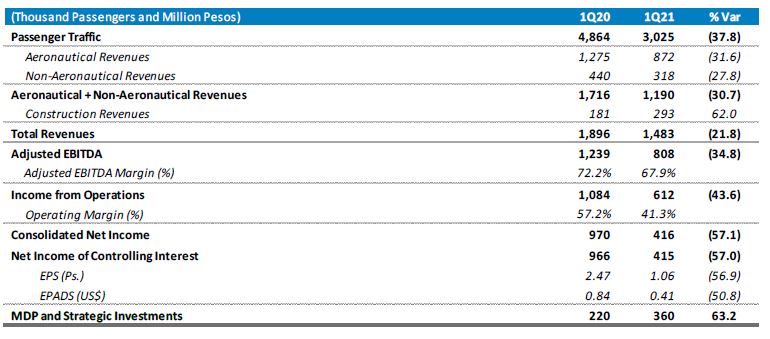

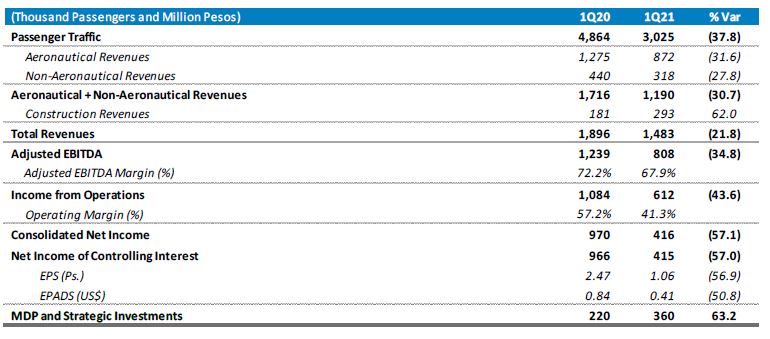

Summary

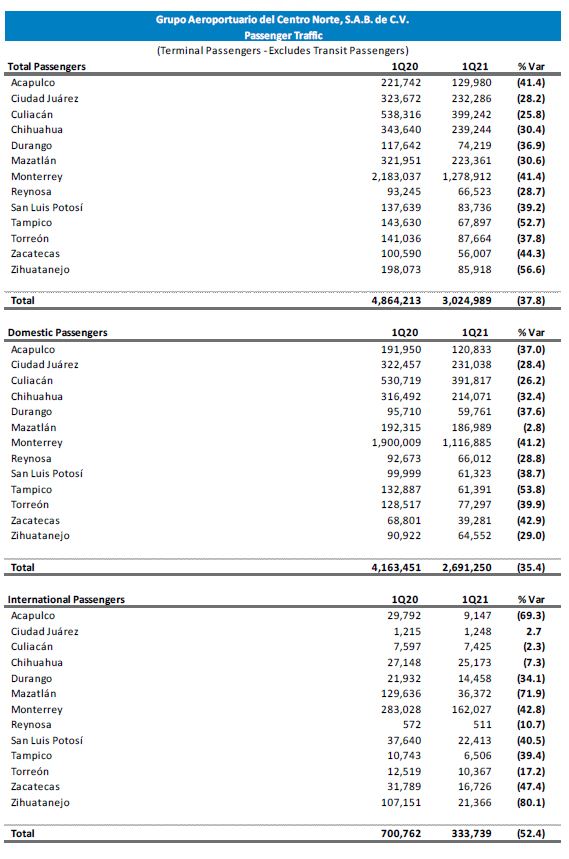

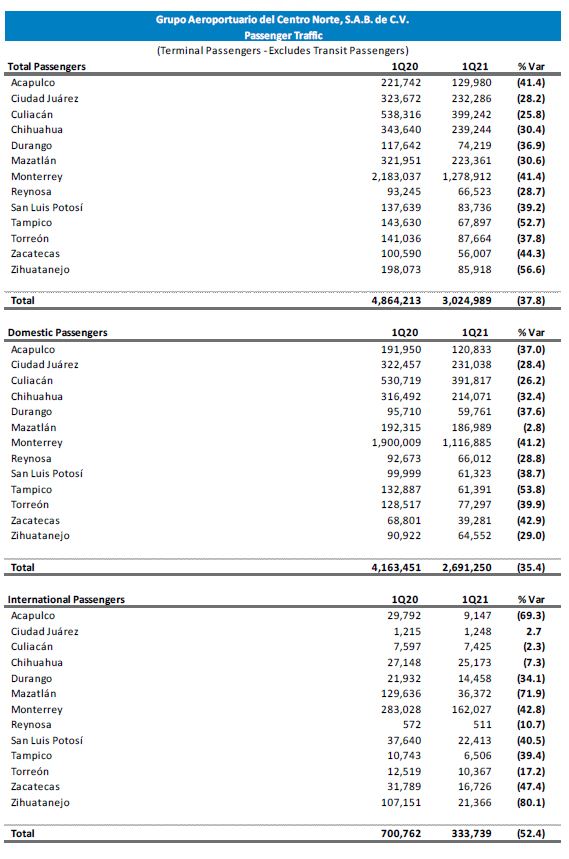

| ■ | Passenger traffic decreased 37.8%, reaching 3.0 million passengers. The airports with the lowest decline in passengers, in percentage terms, compared to 1Q20 were Culiacán, Ciudad Juárez and Reynosa. |

| ■ | Capital investments and major maintenance included in the Master Development Plans (MDPs) plus strategic investments were Ps.360 million for the quarter. |

| ■ | OMA becomes the first airport operator to place a Green Bond in the Mexican market and the only one with an outstanding Green Bond in Latin America. On April 16, 2021, OMA completed its issuance of Ps.3,500 million in long-term notes (certificados bursátiles) in the Mexican market through two tranches. One of the tranches was issued as a Green Bond. On April 19, OMA prepaid the Ps.3,000 million Notes (ticker: OMA14). |

OMA will hold its 1Q20 earnings conference call on April 28, 2021 at 11 am Eastern time, 10 am Mexico City time.

Call 1-877-407-9208 toll-free from the U.S. or 1-201-493-6784 from outside the U.S. The conference ID is 13719107. The conference call will also be available by webcast at http://ir.oma.aero/events.cfm.

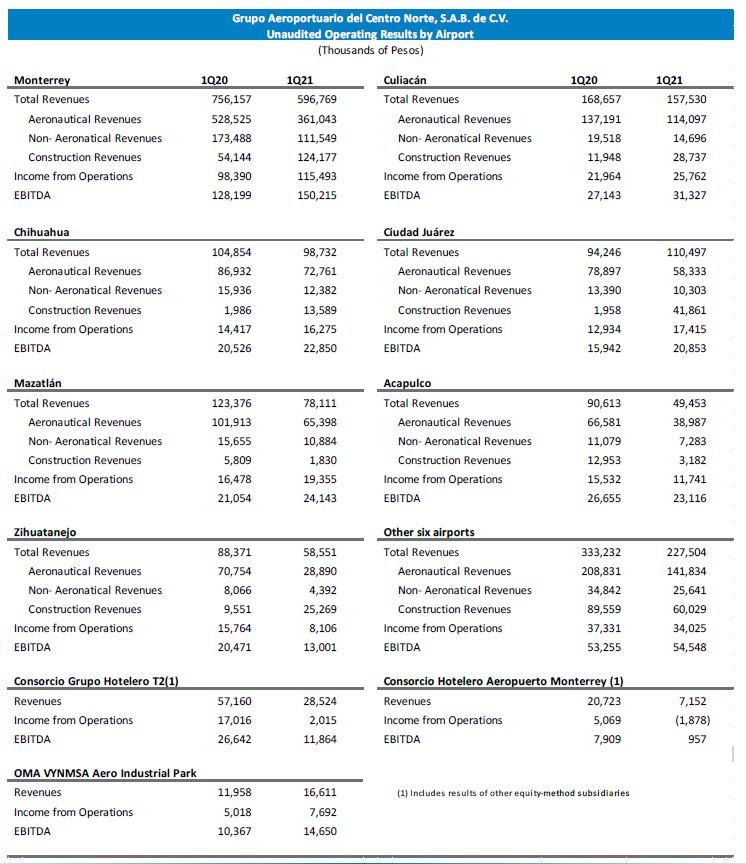

1Q21 Operating Results

Operations, Passengers, and Cargo

During the quarter, there were no new route openings or definitive cancellations. The number of seats offered decreased 37.5% compared to the same quarter of the previous year, due mainly to the number of routes suspended by the airlines.

Total passenger traffic decreased 37.8%. Of total traffic, 89.0% was domestic and 11.0% was international.

Domestic passenger traffic decreased 35.4% and international passenger traffic decreased 52.4%, which reflects restrictions on air travel in the international market.

The airports with the largest contribution to passenger traffic decline were:

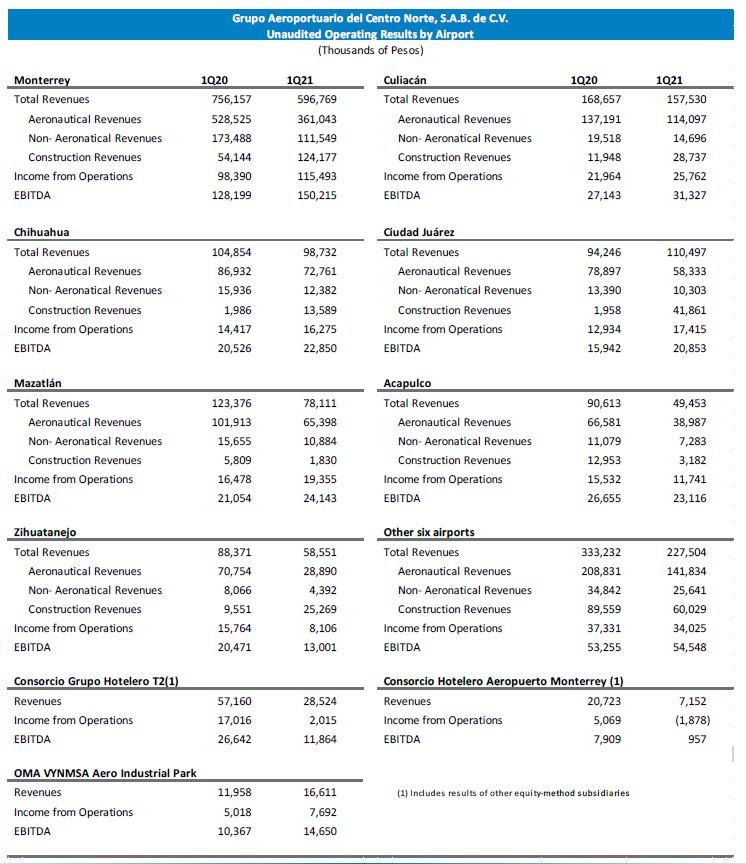

| ■ | Monterrey (-41.4%), on its Mexico City, Guadalajara, and Querétaro routes. |

| ■ | Culiacán (-25.8%), on its Mexico City, Guadalajara and Tijuana routes. |

| ■ | Zihuatanejo (-56.6%), on its Mexico City, Calgary, Los Angeles and Vancouver routes. |

| ■ | Chihuahua (-30.4%), mainly on its Mexico City, Monterrey and Guadalajara routes. |

However, the Culiacán, Ciudad Juárez and Reynosa airports showed a better performance in percentage terms than the rest of the airports compared to 1Q20.

|

| 2 |

Commercial Operations

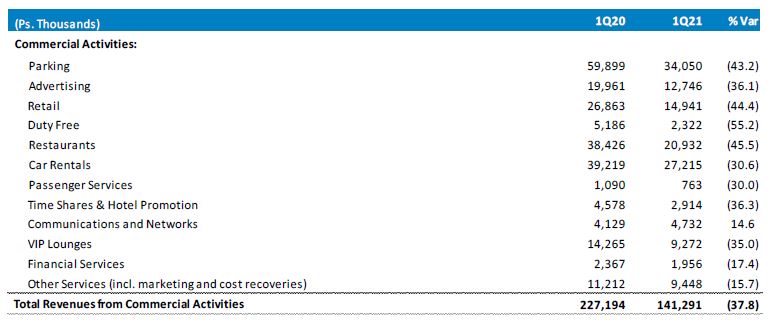

The commercial space occupancy rate in the passenger terminals was 87.1% as of March 31, 2021. During the quarter, a total of 224.8 m2 in commercial spaces were vacated.

Freight Logistics Services

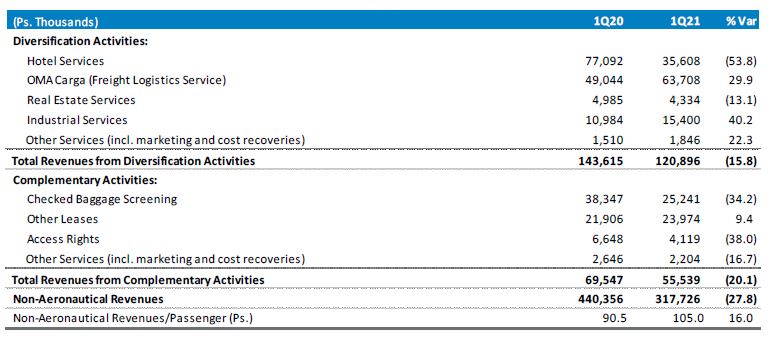

| ■ | OMA Carga’s revenues increased by 29.9% due to higher handling, storage and custody activity related to air import cargo during the quarter. Total tonnage handled increased 26.6% to 8,976 metric tons. |

Hotel Services

| ■ | The NH Collection Terminal 2 Hotel had a 52.9% occupancy rate. The average room rate was Ps.2,049 per night, during the quarter. |

| ■ | Hilton Garden Inn had a 33.6% occupancy rate. The average room rate was Ps.1,810 per night during the quarter. |

Industrial Services

| ■ | OMA VYNMSA Aero Industrial Park: Revenues reached Ps.15 million, an increase of 40.2% compared to 1Q20. The increase is due to additional revenues generated from three warehouses rented during 4Q20. |

Consolidated Financial Results

Revenues

Aeronautical revenues decreased 31.6%.

|

| 3 |

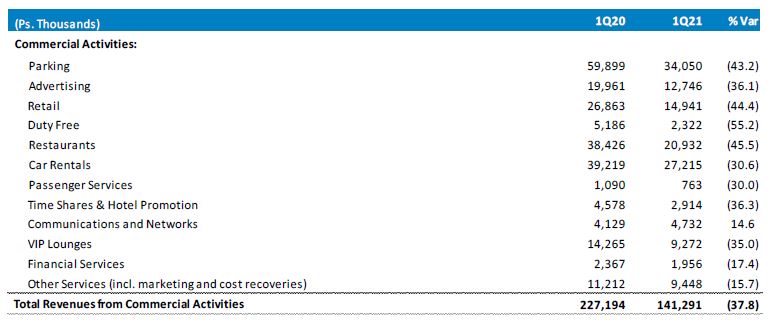

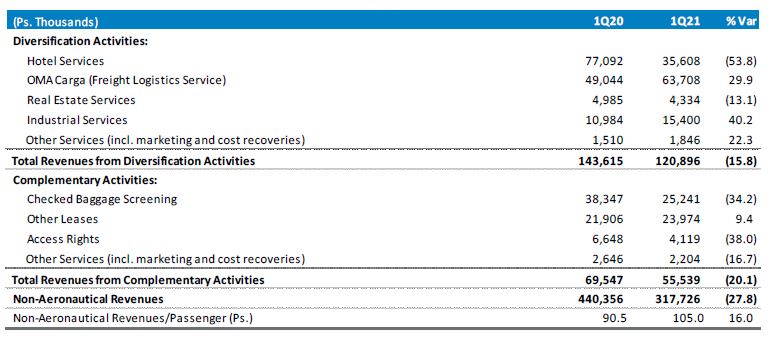

Non-aeronautical revenues decreased 27.8%.

Commercial revenues decreased 37.8%. The line items with the largest variations were:

| ■ | Parking, -43.2%, due to the reduction in operations. The decrease is mostly driven by a slower passenger traffic recovery in Monterrey Airport compared to the average of our airports. |

| ■ | Restaurants, Car Rentals and Retail, -45.5%, -30.6% and -44.4%, respectively, as a result of a decrease in fixed or minimum rents and participation on sales. |

Diversification revenues decreased 15.8%, mainly due to lower revenues from hotel services, which were partially offset by higher revenues from OMA Carga and the OMA VYNMSA aero industrial park.

|

| 4 |

Construction revenues represent the value of improvements to concessioned assets. They are equal to construction costs and generate neither a gain nor a loss. Construction revenues and costs are determined based on the advance in the execution of projects in accordance with the airports’ Master Development Programs (MDP), and variations depend on the rate of project execution.

Costs and Operating Expenses

The sum of cost of airport services and general and administrative expenses (G&A) decreased 11.0%, mainly due to lower security and cleaning costs, lower payroll expenses derived from the reduction of headcount applied during 3Q20, as a result of the cost reduction initiatives implemented by the company during 2020, as well as a lower minor maintenance cost.

|

| 5 |

The major maintenance provision was Ps.78 million, and reflects a higher level of future executions of major maintenance works, pursuant to the Master Development Program for the period 2021-2025. The outstanding balance of the maintenance provision as of March 31, 2021 was Ps. 1,395 million.

The airport concession tax decreased 32.5% as a result of the decrease in revenues; technical assistance fee decreased 37.7%.

As a result of the foregoing, total operating costs and expenses increased 7.2%. Excluding Construction cost, total operating costs and expenses decreased 8.5%

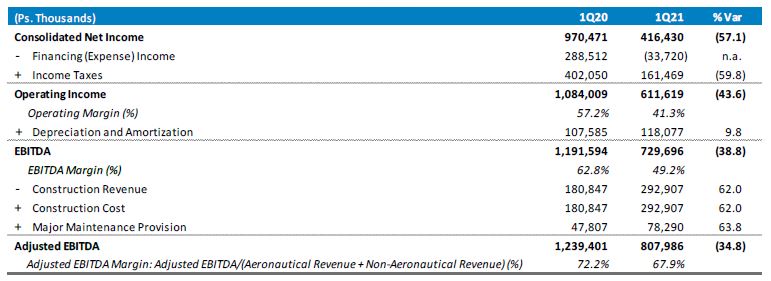

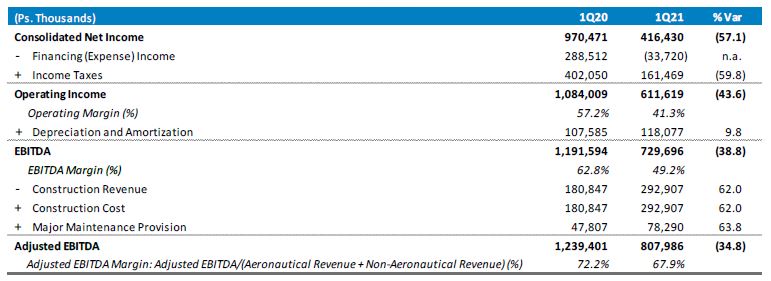

Operating Income and Adjusted EBITDA

Operating Income was Ps.612 million, with an operating margin of 41.3%.

Adjusted EBITDA was Ps.808 million, with an Adjusted EBITDA margin of 67.9%.

|

| 6 |

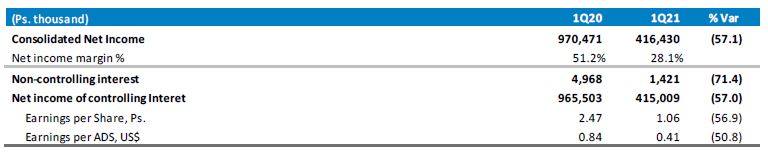

Financing Income, Taxes, and Net Income

Financing Expense was Ps.34 million, mainly due to the interest expense recorded.

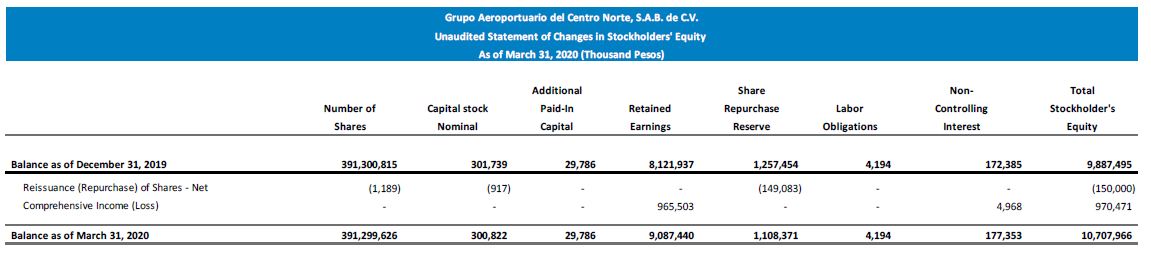

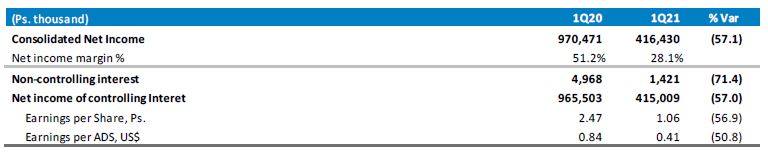

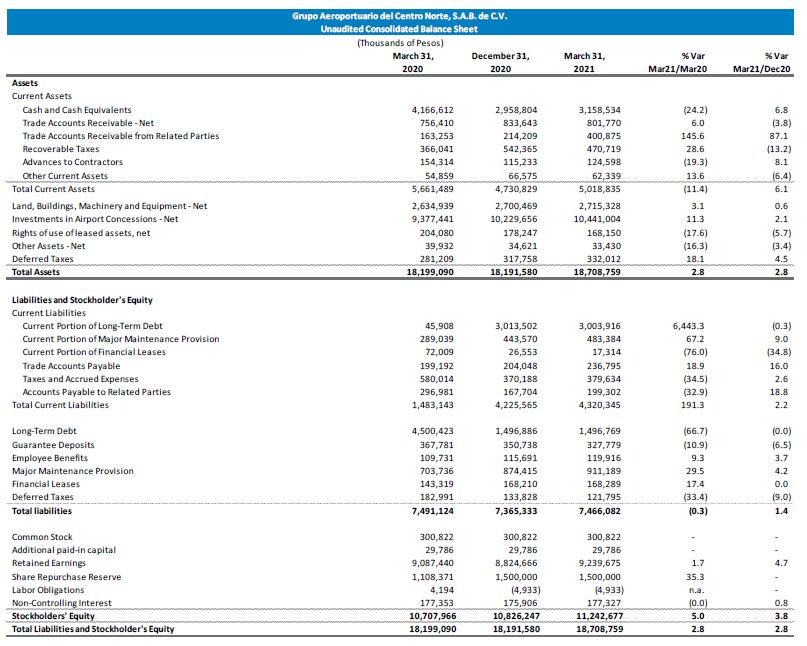

Consolidated net income in the quarter was Ps.416 million.

Earnings per share, based on net income of the controlling interest, was Ps.1.06; earnings per ADS was US$0.41. Each ADS represents eight Series B shares.

|

| 7 |

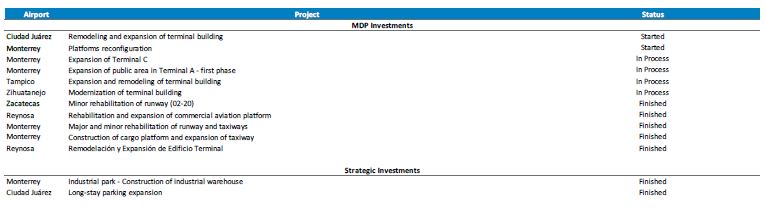

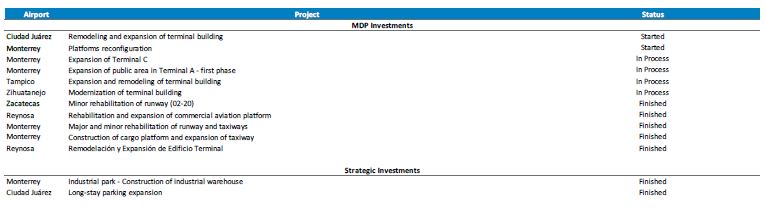

MDP and Strategic Investments

In 1Q21, capital investments and major maintenance works in the MDPs and strategic investments totaled Ps.360 million, comprised of Ps.293 million in improvements to concessioned assets, Ps.28 million in major maintenance, and Ps.39 million in strategic investments.

The most important investment expenditures included:

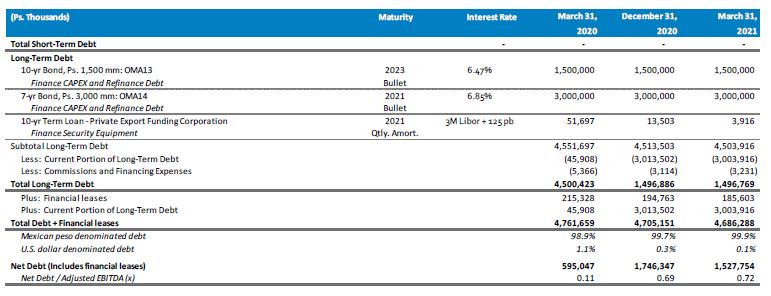

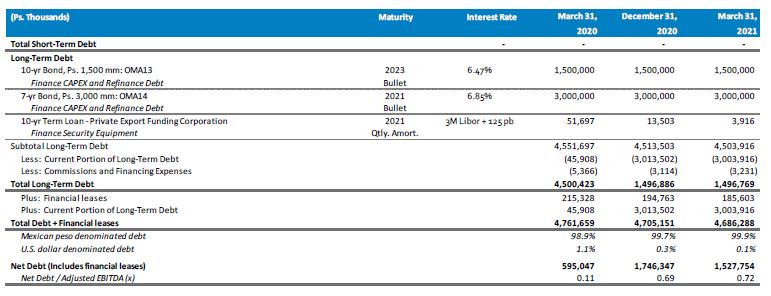

Debt

Derivatives

As of the date of this report, OMA has no financial derivatives exposure.

|

| 8 |

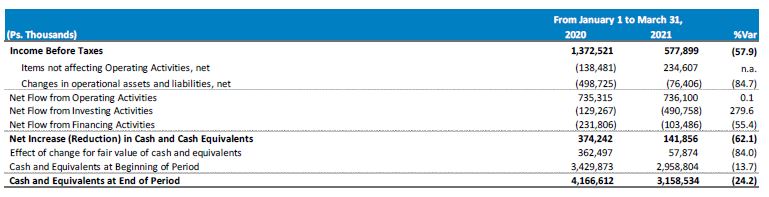

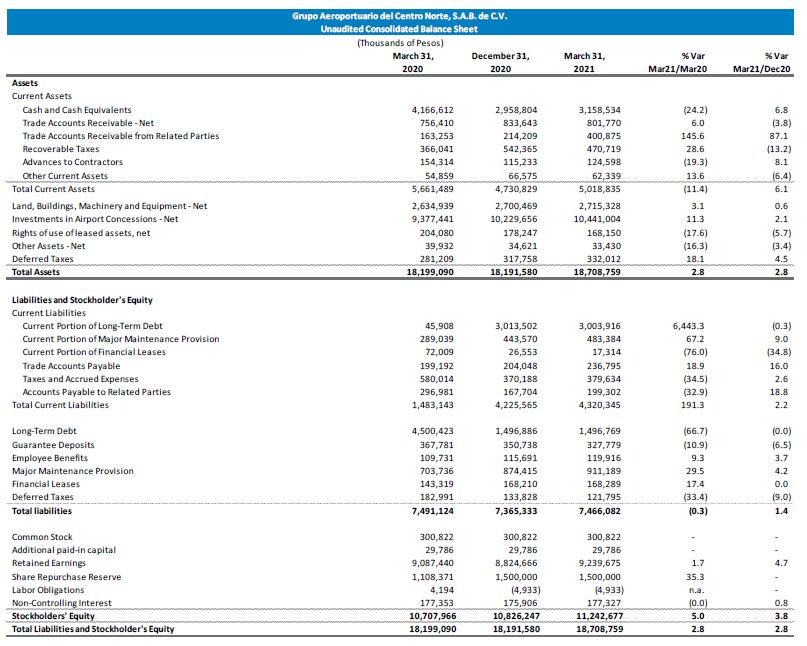

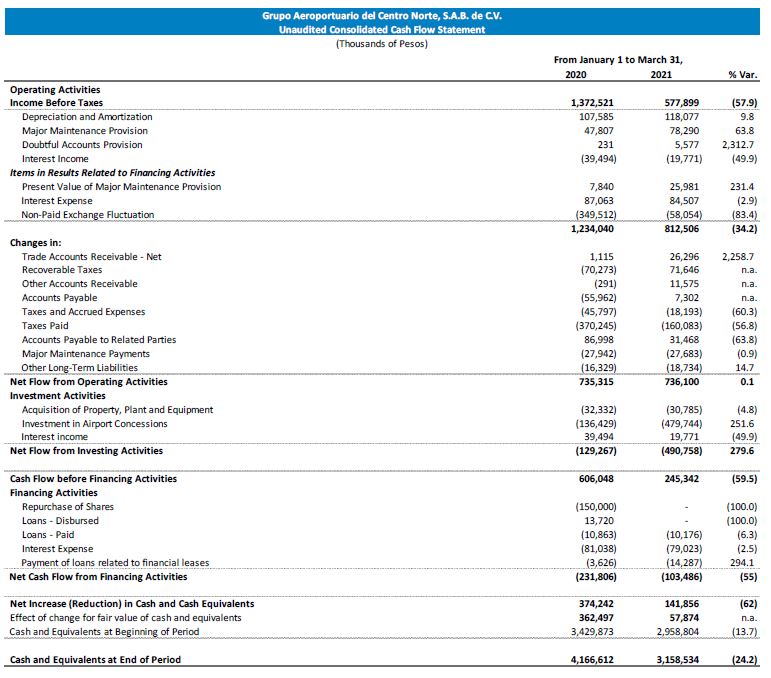

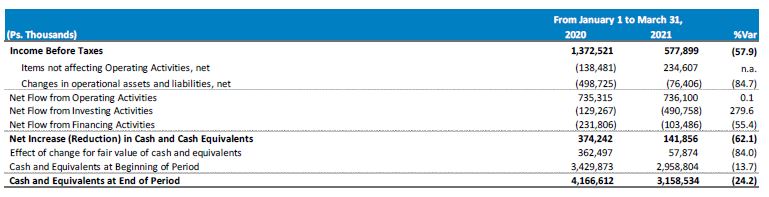

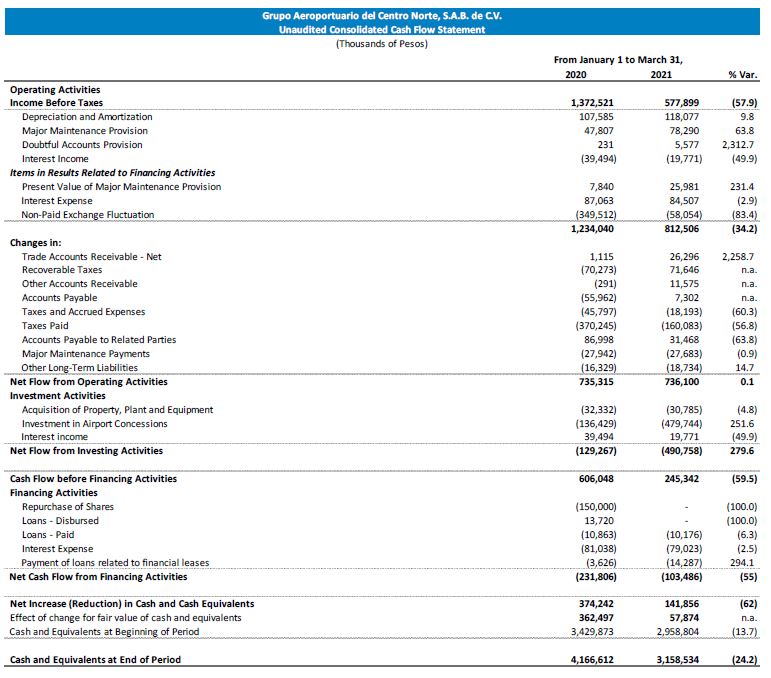

Cash Flow Statement

In 1Q21, cash flows from operating activities generated cash of Ps.736 million, in line with the same period of 2020. The lower income before taxes was partially offset by a lower tax payments, compared to 1Q20.

Investing activities used cash of Ps.491 million in the first quarter. Financing activities generated an outflow of Ps.103 million, mainly due to interest paid of Ps.79 million.

The net increase in cash resulting from operating, investing and financing activities was Ps. 142 million. However, due to the effect of the appreciation of the Mexican peso against the U.S. dollar in the quarter, which resulted in an impact of Ps.58 million, the Cash and Cash Equivalents balance at March 31, 2021 was Ps.3,159 million.

COVID-19 Update

Passenger traffic during January was affected by the uncertainty generated from a second wave of worldwide contagions from COVID-19 and the return to red (maximum risk) in several states of the country, including Nuevo León and Mexico City. Since January, Canada suspended flights to Mexico, which adversely affected winter season in Zihuatanejo and Mazatlán. Also, the United States required negative COVID-19 test results for all inbound passengers traveling by air since January 26, 2021. Both restrictions remain outstanding as of the date of this report.

Beginning in February, the level of contagions began to recede, and the epidemiological risk light system was adjusted accordingly; during March, the recovery path was again observed, with passenger traffic decreasing 3.0%, compared to the same period of 2020, and increasing 53.4% versus February, 2021. As a result, total passenger traffic reached 3.0 million during 1Q21, a decrease of 8.5% versus 4Q20. Additionally, as of March 31, 2021, OMA had 128 origin-destination routes in operation, compared to 140 origin-destination routes as of December 31, 2020, and 183 as of December 31, 2019. As of the date of this report, 1 state in which OMA operates remains in orange, while 7 states are in yellow and 1 is in green.

|

| 9 |

Relevant Events

OMA’s Annual General Shareholders’ Meeting . The Meeting, held on April 21, 2021, approved, among other matters, the declaration and payment of a cash dividend to shareholders of up to $2,000´000,000.00 (Two billion Pesos and 00/100), and delegated to the Board of Directors the power to determine the amount to be paid out, which will come from accumulated earnings, as well as the date or dates and forms of payment. The declaration of the aforementioned dividend will become effective as of the date the Board makes its determination.

OMA completes issuance of Green Bonds. On April 16, 2021, OMA announced the successful completion of its issuance of Ps.3,500 million in long-term notes (certificados bursátiles) in the Mexican market through two tranches issued jointly as part of a program to issue long-term notes. One of the tranches was placed as a Green Bond. After this transaction, OMA becomes the first airport operator to place a Green Bond in the Mexican market and the only one with an outstanding Green Bond in Latin America. The issuances are as follows:

| ■ | Ps.1,000 million in 5-year Green Notes (ticker: OMA21V) at a variable rate of TIIE 28 + 75 basis points. The Green Notes pay interest every 28 days, and principal amount will be paid at maturity on April 10, 2026. |

| ■ | Ps.2,500 million in 7-year Notes (ticker: OMA21-2) at a fixed rate of 7.83%. The notes pay interest every 182 days, and principal amount will be paid at maturity on April 7, 2028. |

Proceeds were used to prepay long-term notes for Ps.3,000 million, and will fund eligible green projects, such as renewable energy and energy efficiency projects.

OMA inaugurates Reynosa airport’s new terminal building. In February, 2021, OMA inaugurated the new terminal building of the Reynosa airport, which had a total investment of Ps.335 million and has an area of 7,286 m2. With this terminal, the airport’s capacity grew threefold to 900,000 passengers per year.

|

| 10 |

|

| 11 |

|

| 12 |

|

| 13 |

|

| 14 |

|

| 15 |

|

| 16 |

Notes to the Financial Information

Financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”), and presented in accordance with IAS 34 “Interim Financial Reporting.” For more information, please refer to our Quarterly Financial Information submitted to the Mexican Stock Exchange (www.bmv.com.mx)

Unless stated otherwise, all comparisons of operating or financial results are made with respect to the comparable prior year period. The exchange rates used to convert foreign currency amounts were Ps.23.5122 as of March 31, 2020, Ps. 19.9352 as of December 31, 2020, and Ps.20.6025 as of March 31, 2021.

Construction revenue, construction cost: IFRIC 12 “Service Concession Arrangements” addresses how service concession operators should account for the obligations they undertake and rights they receive in service concession arrangements. The concession contracts for each of OMA’s airport subsidiaries establishes that the concessionaire is obligated to carry out improvements to the infrastructure transferred in exchange for the rights over the concession granted by the Federal Government. The latter will receive all the assets at the end of the concession period. As a result the concessionaire should recognize, using the percentage of completion method, the revenues and costs associated with the improvements to the concessioned assets. The amount of the revenues and costs so recognized should be the price that the concessionaire pays or would pay in an arm’s length transaction for the execution of the works or the purchase of machinery and equipment, with no profit recognized for the construction or improvement. The application of IFRIC 12 does not affect operating income, net income, or EBITDA, but does affect calculations of margins based on total revenues.

Capital investments: includes investments in fixed assets (including investments in land, machinery, and equipment) and improvements to concessioned properties under the Master Development Plan (MDP) plus strategic investments.

Strategic Investments: Refers only to those capital investments additional to the Master Development Program.

Passengers and Terminal passengers: All references to passenger traffic volumes are to Terminal passengers, which includes passengers on the three types of aviation (commercial, charter, and general aviation), and excludes passengers in transit.

Adjusted EBITDA and Adjusted EBITDA margin: OMA defines Adjusted EBITDA as EBITDA less construction revenue plus construction expense and maintenance provision. We calculate the Adjusted EBITDA margin as Adjusted EBITDA divided by the sum of aeronautical revenue and non-aeronautical revenue. Construction revenue and construction cost do not affect cash flow generation and the maintenance provision corresponds to capital investments. OMA defines EBITDA as net income minus net comprehensive financing income, taxes, and depreciation and amortization. Neither Adjusted EBITDA nor EBITDA should be considered as an alternative to net income as an indicator of our operating performance, or as an alternative to cash flow as an indicator of liquidity. It should be noted that neither Adjusted EBITDA nor EBITDA is defined under IFRS, and may be calculated differently by different companies.

|

| 17 |

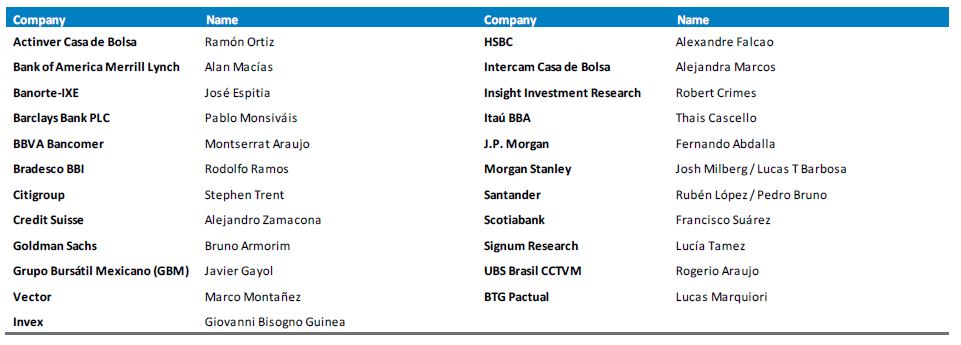

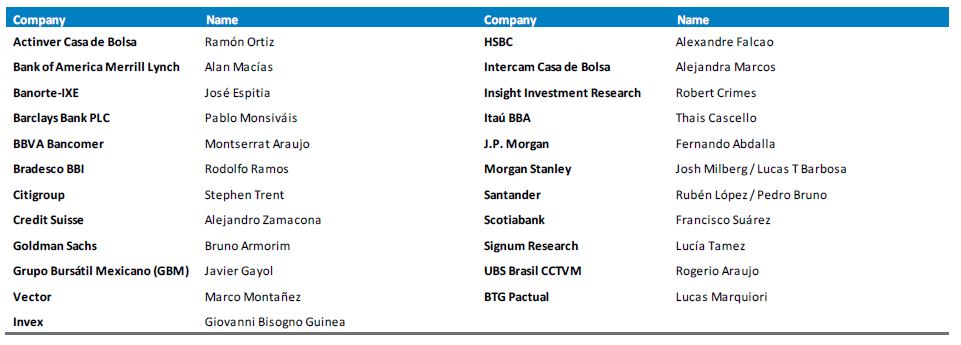

Analyst Coverage

In accordance with the requirements of the Mexican Stock Exchange, the analysts covering OMA are:

This report may contain forward-looking information and statements. Forward-looking statements are statements that are not historical facts. These statements are only predictions based on our current information and expectations and projections about future events. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “target,” “estimate,” or similar expressions. While OMA's management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and are generally beyond the control of OMA, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include, but are not limited to, those discussed in our most recent annual report filed on Form 20-F under the caption “Risk Factors.” OMA undertakes no obligation to update publicly its forward-looking statements, whether as a result of new information, future events, or otherwise.

About OMA

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known as OMA, operates 13 international airports in nine states of central and northern Mexico. OMA’s airports serve Monterrey, Mexico’s third largest metropolitan area, the tourist destinations of Acapulco, Mazatlán, and Zihuatanejo, and nine other regional centers and border cities. OMA also operates the NH Collection Hotel inside Terminal 2 of the Mexico City airport and the Hilton Garden Inn at the Monterrey airport. OMA employs over 1,000 persons in order to offer passengers and clients airport and commercial services in facilities that comply with all applicable international safety and security measures. OMA is listed on the Mexican Stock Exchange (OMA) and on the NASDAQ Global Select Market (OMAB). For more information, visit:

| · | Webpage http://ir.oma.aero |

| · | Twitter http://twitter.com/OMAeropuertos |

| · | Facebook https://www.facebook.com/OMAeropuertos |

|

| 18 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. |

| | |

| By: | /s/ Ruffo Pérez Pliego | |

| | Ruffo Pérez Pliego |

| | Chief Financial Officer |

Dated April 27, 2021