UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21975 |

|

Allianz RCM Global EcoTrends (sm) Fund |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas, New York, New York | | 10105 |

(Address of principal executive offices) | | (Zip code) |

|

Lawrence G. Altadonna - 1345 Avenue of the Americas, New York, New York 10105 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-739-3371 | |

|

Date of fiscal year end: | November 30, 2008 | |

|

Date of reporting period: | May 31, 2008 | |

| | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders

| Contents | |

| | |

| Letter to Shareholders | 1 |

| | |

| Fund Insights/Performance & Statistics | 2 |

| | |

| Schedule of Investments | 3-5 |

| | |

| Statement of Assets and Liabilities | 6 |

| | |

| Statement of Operations | 7 |

| | |

| Statement of Changes in Net Assets | 8 |

| | |

| Notes to Financial Statements | 9-13 |

| | |

| Financial Highlights | 14 |

| | |

| Proxy Voting Policies & Procedures | 15 |

| | |

| | |

|

|

Allianz RCM Global EcoTrendsSM Fund Letter to Shareholders

July 15, 2008

Dear Shareholder:

We are pleased to provide you with the semiannual report for the Allianz RCM Global EcoTrendsSM Fund (the “Fund”) for the six-month period ended May 31, 2008.

Global equity markets declined through the period as economic slowing and tightening credit conditions dampened investor sentiment.

Please refer to the following pages for specific information on the Fund. If you have any questions regarding this report, we encourage you to contact your financial advisor or call the Fund’s shareholder servicing agent at (800) 835-3401 You can also visit on our Web site at www.allianzinvestors.com.

Together with Allianz Global Investors Fund Management LLC, the Fund’s investment manager, and Allianz Global Investors Advisory GmbH and RCM Capital Management LLC, the Fund’s sub-advisers, we thank you for investing with us.

We remain dedicated to serving your investment needs.

Sincerely,

|

|

| |

Hans W. Kertess | Brian S. Shlissel |

| |

Chairman | President & Chief Executive Officer |

5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 1

Allianz RCM Global EcoTrendsSM Fund Fund Insights/Performance & Statistics

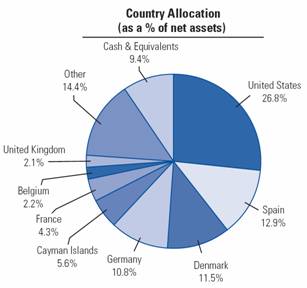

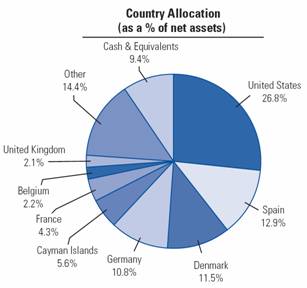

· | The Fund underperformed its benchmark, the FTSE Environmental Technology Index (the “ET 50”) during the six-month period ended May 31, 2008. In a negative absolute return environment, the Fund returned (4.14)% versus (1 .73)% for the ET 50. |

· | As a bottom-up stock driven portfolio, stock selection at an industry level was impacted negatively through the Fund’s holdings in support services, technology hardware and electricity companies. At the country level, stock selection in the United States, Australia and Denmark also detracted from performance. |

· | In terms of positive contributors, stock selection in the electronic and electrical equipment industry contributed in excess of 170 basis points to performance, while exposure to chemical and industrial engineering companies also added value. |

· | Iberdrola, the wind energy company, was the largest contributor to performance during the six- month period, adding over 0.5% to performance. EDF, Kingspan Group and Hansen Transmissions were also positive contributors. The largest detractor from performance during the reporting period was LDK Solar, manufacturer of multi-crystalline solar wafers for use in the production of solar cells. The Fund’s underweight positions in Novozymes and Vestas Wind Systems also adversely affected total return. |

| | Without | | With | |

Total Return(1): | | Sales Charge | | Sales Charge | |

Six Months | | (4.14 | )% | | (8.46 | )% | |

1 year | | 22.77 | % | | 17.25 | % | |

Commencement of Operations (1/31/07 to 5/31/08) | | 34.65 | % | | 22.77 | % | |

(1) Past performance is no guarantee of future results. Total return is calculated by subtracting the value of an investment in the Fund at the beginning of the specified period from the value at the end of the period and dividing the remainder by the value of the investment at the beginning of the period and expressing the result as a percentage. The calculation assumes that all of the Fund’s income dividends and capital gain distributions, if any, have been reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total return without sales charge does not reflect broker commissions or sales charges. Total return with sales charge reflects the Fund’s 4.5% maximum initial sales charge. Total return for a period of less than one year is not annualized. Total return for a period of more than one year represents the average annual total return.

An investment in the Fund involves risk, including the loss of principal. Total return, yield and net asset value will fluctuate with changes in market conditions. This data is provided for information only and is not intended for trading purposes. Net asset value is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily.

There is no guarantee the Fund will achieve its investment objective. While the Fund may invest in companies of any size, it may often invest a substantial portion of its assets in securities of smaller companies, including newly formed and early stage companies. The Fund may invest without limit in illiquid securities to the extent consistent with its share repurchase policies. Investors should note that the Fund is designed to provide exposure to a relatively narrow group of sectors and should be considered as only one element of a complete investment program.

The Fund may also use derivative strategies for investment or hedging purposes. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a fund could not close out a position when it would be most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments.

The Fund is non-diversified and may focus its investments in a small group of companies or industries. The companies in which the Fund invests may have limited operating histories and/or small market capitalizations. The Fund’s substantial exposure to non-U.S. securities, including emerging markets securities, also involves special risks, including political and economic risk and the risk of currency fluctuations; these risks may be enhanced in emerging markets.

The Fund is an interval fund, a type of closed-end fund that limits when investors can sell shares, in part, to give the manager more flexibility in managing the underlying assets. In contrast to an open-end mutual fund, this structure allows the manager to invest a greater portion of the Fund’s assets in smaller, potentially less liquid securities, which are part of the Fund’s investment universe. Under this structure, the Fund will make quarterly offers to repurchase shares in an amount set by its Board of Trustees; thus investors may not be able to sell their shares in the Fund when and/or in the amount that they desire.

2 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08

Allianz RCM Global EcoTrendsSM Fund Schedule of Investments

May 31, 2008 (unaudited)

Shares | | | | Value | |

COMMON STOCK – 90.6% | | | |

| | | |

Australia – 0.6% | | | |

149,417 | | Transpacific Industries Group Ltd. | | $1,150,888 | |

Austria – 0.4% | | | |

11,666 | | Andritz AG | | 788,772 | |

Belgium – 2.2% | | | |

427,487 | | Hansen Transmissions International NV (a) | | 2,459,626 | |

33,316 | | Umicore | | 1,820,223 | |

| | | | 4,279,849 | |

Cayman Islands – 5.6% | | | |

190,600 | | Suntech Power Holdings Co., Ltd. ADR (a) | | 8,108,124 | |

136,300 | | Yingli Green Energy Holding Co., Ltd. ADR (a) | | 2,805,054 | |

| | | | 10,913,178 | |

Denmark – 11.5% | | | |

31,250 | | Novozymes A/S, ClassB | | 3,333,606 | |

137,400 | | Vestas Wind Systems A/S (a) | | 18,888,525 | |

| | | | 22,222,131 | |

Finland – 2.1% | | | |

42,245 | | Fortum Oyj | | 2,044,391 | |

29,264 | | Outotec Oyj | | 2,001,997 | |

| | | | 4,046,388 | |

France – 4.3% | | | |

21,894 | | Bureau Veritas S.A. (a) | | 1,329,241 | |

39,309 | | EDF Energies Nouvelles S.A. | | 2,788,616 | |

13,838 | | Seche Environnement S.A. | | 2,075,893 | |

31,082 | | Veolia Environnement | | 2,213,093 | |

| | | | 8,406,843 | |

Germany – 10.8% | | | |

145,221 | | GEA Group AG | | 5,645,126 | |

8,350 | | Interseroh AG | | 828,683 | |

10,694 | | K& S AG | | 4,995,205 | |

16,263 | | Q-Cells AG (a) | | 1,974,859 | |

24,185 | | Siemens AG | | 2,737,615 | |

37,745 | | Solar World AG | | 1,942,596 | |

11,695 | | Wacker Chemie AG | | 2,804,938 | |

| | | | 20,929,022 | |

India – 1.4% | | | |

403,378 | | Suzlon Energy Ltd. (a) | | 2,624,418 | |

Japan – 2.0% | | | |

28,700 | | Asahi Pretec Corp. | | 879,873 | |

32,200 | | Horiba Ltd. | | 916,090 | |

56,900 | | Kurita Water Industries Ltd. | | 2,099,317 | |

| | | | 3,895,280 | |

Netherlands – 1.0% | | | |

38,400 | | Arcadis NV | | 921,371 | |

28,794 | | Koninklijke (Royal) Philips Electronics NV | | 1,106,125 | |

| | | | 2,027,496 | |

| | | | | | | |

5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 3

Allianz RCM Global EcoTrendsSM Fund Schedule of Investments

May 31, 2008 (unaudited) (continued)

Shares | | | | Value | |

| | | | | |

Norway – 1.8% | | | |

118,200 | | Renewable Energy Corp. AS (a) | | $3,493,794 | |

Philippines – 0.9% | | | |

13,120,475 | | PNOC Energy Development Corp. | | 1,681,001 | |

South Korea – 1.4% | | | |

21,358 | | Hyunjin Materials Co., Ltd. | | 924,581 | |

16,273 | | Taewoong Co., Ltd. | | 1,778,090 | |

| | | | 2,702,671 | |

Spain – 12.9% | | | |

38,565 | | Abengoa S.A. | | 1,360,080 | |

5,670 | | Acciona S.A. | | 1,611,223 | |

285,286 | | Gamesa Corp. Tecnologica S.A. | | 14,767,834 | |

1,014,783 | | Iberdrola Renovables S.A. (a) | | 7,274,156 | |

| | | | 25,013,293 | |

Sweden – 0.7% | | | |

81,800 | | Atlas Copco AB, ClassA | | 1,450,430 | |

Switzerland – 2.1% | | | |

123,644 | | ABB Ltd. (a) | | 4,016,548 | |

United Kingdom – 2.1% | | | |

84,569 | | Ceres Power Holdings PLC (a) | | 251,421 | |

440,305 | | RPS Group PLC | | 2,905,957 | |

86,813 | | Spice PLC | | 984,504 | |

| | | | 4,141,882 | |

United States – 26.8% | | | |

33,257 | | Danaher Corp. | | 2,600,032 | |

19,473 | | Donaldson Co., Inc. | | 1,002,470 | |

27,619 | | Energy Conversion Devices, Inc. (a) | | 1,753,254 | |

18,663 | | ESCO Technologies, Inc. (a) | | 961,331 | |

47,548 | | First Solar, Inc. (a) | | 12,720,992 | |

40,143 | | FPL Group, Inc. | | 2,710,455 | |

53,956 | | Itron, Inc. (a) | | 5,265,027 | |

158,442 | | LKQ Corp. (a) | | 3,511,075 | |

54,284 | | Nalco Holding Co. | | 1,320,187 | |

19,595 | | Ormat Technologies, Inc. | | 981,905 | |

41,727 | | Pall Corp. | | 1,702,879 | |

35,266 | | Pentair, Inc. | | 1,320,006 | |

22,794 | | Roper Industries, Inc. | | 1,482,522 | |

142,135 | | Stericycle, Inc. (a) | | 8,286,471 | |

44,886 | | Sunpower Corp., ClassA (a) | | 3,676,163 | |

46,110 | | Thermo Fisher Scientific, Inc. (a) | | 2,721,412 | |

| | | | 52,016,181 | |

Total Common Stock (cost-$140,366,878) | | 175,800,065 | |

| | | | | | | |

4 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08

Allianz RCM Global EcoTrendsSM Fund Schedule of Investments

May 31, 2008 (unaudited) (continued)

Principal

Amount

(000s) | | | | | | Value | |

| | | | | | | |

Repurchase Agreement – 7.7% | | | | | |

$14,883 | | State Street Bank& Trust Co., dated 5/30/08, 1.65%, due 6/2/08, proceeds $14,885,045; collateralized by Fannie Mae, 5.27%,due 11/14/28, valued at $15,184,538 including accrued interest (cost-$14,883,000) | | | | $14,883,000 | |

Total Investments

(cost-$155,249,878)(b) – 98.3% | | | | 190,683,065 | |

Other assets less liabilities – 1.7% | | | | 3,341,575 | |

Net Assets – 100.0% | | | | $194,024,640 | |

| | | | | |

| | | | | |

Notes to Schedule of Investments: |

| |

(a) | Non-income producing. |

(b) | Securities with an aggregate value of $112,870,706, representing 58.2% of net assets, have been valued utilizing modeling tools provided by a third-party vendor, as described in Note 1(a) in the Notes to Financial Statements. |

| |

Glossary: |

ADR - American Depositary Receipt |

| | | | | | | | | | |

See accompanying Notes to Financial Statements. | 5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 5

Allianz RCM Global EcoTrendsSM Fund Statement of Assets and Liabilities

May31, 2008 (unaudited)

| | | |

| | | |

Assets: | | | |

Investments, at value (cost-$155,249,878) | | $190,683,065 | |

Cash (including foreign currency of $3,668,135 with a cost of $3,677,910) | | 3,668,652 | |

Receivable for investments sold | | 1,105,271 | |

Receivable for fund shares issued | | 705,256 | |

Tax reclaims receivable | | 50,119 | |

Dividends and interest receivable | | 40,343 | |

Receivable from Sub-Adviser | | 200 | |

Prepaid expenses | | 37,878 | |

Total Assets | | 196,290,784 | |

| | | |

Liabilities: | | | |

Payable for investments purchased | | 1,928,443 | |

Investment management fee payable | | 158,442 | |

Servicing fee payable | | 39,610 | |

Accrued expenses | | 139,649 | |

Total Liabilities | | 2,266,144 | |

Net Assets | | $194,024,640 | |

| | | |

Net Assets Consist of: | | | |

Common Stock: | | | |

Par value ($0.00001 per share applicable to 5,516,763 shares issued and outstanding) | | $55 | |

Paid-in-capital in excess of par | | 152,063,264 | |

Accumulated net investment loss | | (536,471 | ) |

Accumulated net realized gain on investments | | 7,085,611 | |

Net unrealized appreciation of investments and foreign currency transactions | | 35,412,181 | |

Net Assets | | $194,024,640 | |

Net Asset Value Per Share | | $35.17 | |

6 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08 | See accompanying Notes to Financial Statements.

Allianz RCM Global EcoTrendsSM Fund Statement of Operations

Six Months ended May 31, 2008 (unaudited)

| | | |

| | | |

Investment Income: | | | |

Dividends (net of foreign withholding taxes of $97,908) | | $598,471 | |

Interest | | 160,596 | |

Total Investment Income | | 759,067 | |

| | | |

Expenses: | | | |

Investment management fees | | 866,039 | |

Servicing fees | | 216,510 | |

Custodian and accounting agent fees | | 67,160 | |

Legal fees | | 63,600 | |

Shareholder communications | | 38,430 | |

Audit and tax services | | 25,803 | |

Trustees’ fees and expenses | | 7,503 | |

Registration fees | | 4,521 | |

Transfer agent fees | | 3,730 | |

Miscellaneous | | 1,464 | |

Total expenses | | 1,294,760 | |

Less: custody credits on cash balances | | (130 | ) |

Net expenses | | 1,294,630 | |

| | | |

Net Investment Loss | | (535,563 | ) |

| | | |

Realized and Change in Unrealized Gain (Loss): | | | |

Net realized gain (loss) on: | | | |

Investments | | 7,190,610 | |

Foreign currency transactions | | (279,021 | ) |

Payments from Affiliates | | 200 | |

Net change in unrealized appreciation/depreciation of: | | | |

Investments | | (13,615,273 | ) |

Foreign currency transactions | | 18,244 | |

Net realized and change in unrealized loss on investments and foreign currency transactions | | (6,685,240 | ) |

Net Decrease in Net Assets Resulting from Investment Operations | | $(7,220,803 | ) |

See accompanying Notes to Financial Statements. | 5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 7

Allianz RCM Global EcoTrendsSM Fund Statement of Changes in Net Assets |

| | | |

| | Six Months

ended

May 31, 2008

(unaudited) | For the period

January 31, 2007*

through

November 30, 2007 |

| | | | | | |

Investment Operations: | | | | | | |

Net investment loss | | $(535,563 | ) | | $(915,131 | ) |

Net realized gain on investments and foreign currency transactions | | 6,911,589 | | | 2,481,937 | |

Payments from Affiliates | | 200 | | | 13,137 | |

Net change in unrealized appreciation/depreciation of investments and foreign currency transactions | | (13,597,029 | ) | | 49,009,210 | |

Net increase (decrease) resulting from investment operations | | (7,220,803 | ) | | 50,589,153 | |

| | | | | | |

Distributions to Shareholders from Net Realized Gains | | (1,460,046 | ) | | – | |

| | | | | | |

Capital Share Transactions: | | | | | | |

Net proceeds from the sale of common stock | | 39,635,477 | | | 136,255,246 | |

Issued in reinvestment of distributions | | 109,704 | | | – | |

Cost of shares redeemed | | (13,376,468 | ) | | (10,436,116 | ) |

Offering costs charged to paid-in capital in excess of par | | – | | | (171,519 | ) |

Net increase from capital share transactions | | 26,368,713 | | | 125,647,611 | |

Total increase in net assets | | 17,687,864 | | | 176,236,764 | |

| | | | | | |

Net Assets: | | | | | | |

Beginning of period | | 176,336,776 | | | 100,012 | |

End of period (including dividend in excess of net investment income of $908 at November 30, 2007) | | $194,024,640 | | | $176,336,776 | |

| | | | | | |

Shares Issued and Redeemed: | | | | | | |

Issued | | 1,155,244 | | | 5,124,645 | |

Issued in reinvestment of distributions | | 2,914 | | | – | |

Redeemed | | (408,899 | ) | | (361,330 | ) |

Net Increase | | 749,259 | | | 4,763,315 | |

* Commencement of Operations

8 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08 | See accompanying Notes to Financial Statements.

Allianz RCM Global EcoTrendsSM Fund Notes to Financial Statements

1. Organization and Significant Accounting Policies

Allianz RCM Global EcoTrendsSM Fund (“the Fund”) was organized as a Massachusetts business trust on October 19, 2006. Prior to commencing operations on January 31, 2007, the Fund had no operations other than matters relating to its organization and registration as a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, and the sale and issuance of 4,189 shares of $0.00001 par value shares of beneficial interest at an aggregate price of $100,012 to Allianz Global Investors of America L.P (“Allianz Global”). The Fund is a continuously offered, closed-end management investment company that is operated as an “interval fund”. The Fund currently offers Class A shares. Allianz Global Investors Fund Management LLC (the “Investment Manager”) serves as the Fund’s Investment Manager and is an indirect wholly-owned subsidiary of Allianz Global. Allianz Global is an indirect, majority-owned subsidiary of Allianz SE, a publicly traded European insurance and financial services company. The Fund has an unlimited amount of $0.00001 par value common stock authorized.

The Fund issued 3,430,416 shares of common stock in its initial public offering. These shares were all issued at $25.00 per share before an underwriting discount of $1.125 per share. Offering costs of $171,519 (representing $0.05 per share) were offset against the proceeds of the offering and have been charged to paid-in capital in excess of par Subsequent to the initial public offering, the Fund’s common stock was reclassified as Class A shares.

The Fund’s investment objective is to seek long-term growth of capital The Fund pursues its investment objectives by investing in a global portfolio of common stocks and other equity securities that directly or indirectly have exposure to, or otherwise derive benefits from trends in, one or more of the EcoEnergy (e.g., alternative energy and energy efficiency), Pollution Control (e.g., environmental quality, waste management and recycling) and Clean Water (e.g., water treatment and supply) sectors.

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been asserted. However, the Fund expects the risk of any loss to be remote.

In July 2006, the Financial Accounting Standards Board issued Interpretation No 48, “Accounting for Uncertainty in Income Taxes - an Interpretation of FASB Statement No 109” (the “Interpretation”). The Interpretation establishes for all entities, including pass-through entities such as the Fund, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. Fund management has determined that its evaluation of the Interpretation has resulted in no material impact to the Fund’s financial statements at May 31, 2008. The Fund’s federal tax returns for prior fiscal years remain subject to examination by the Internal Revenue Service.

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No 161, “Disclosures about Derivative Instruments and Hedging Activities” (“SFAS 161”). SFAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. SFAS 161 requires enhanced disclosures about a fund’s derivative and hedging activities. The Fund’s management is currently evaluating the impact the adoption of SFAS 161 will have on the Fund’s financial statement disclosures.

The following is a summary of significant accounting policies followed by the Fund:

(a) Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Portfolio securities and other financial instruments, for which market quotations are not readily available or if a development/event occurs that may significantly impact the value of a security, are fair valued, in good faith, pursuant to guidelines established by the Board of Trustees or persons acting at their discretion pursuant to procedures approved by the Board of Trustees. The Fund’s investments are valued daily using prices supplied by an independent pricing service or dealer quotations, or by using the last sale price on the exchange that is the primary market for such securities, or the last quoted mean price for those securities for which the over-the-counter market is the primary market or for listed securities in which there were no sales. Independent pricing services use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Short-term securities maturing in 60 days or less are valued at amortized cost, if their

5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 9

Allianz RCM Global EcoTrendsSM Fund Notes to Financial Statements

1. Organization and Significant Accounting Policies (continued)

(a) Valuation of Investments (continued)

original term to maturity was 60 days or less, or by amortizing their value on the 61st day prior to maturity, if the original term to maturity exceeded 60 days. The prices used by the Fund to value securities may differ from the value that would be realized if the securities were sold and these differences could be material to the financial statements. The Fund’s net asset value is normally determined as of the close of regular trading (normally, 4:00 p.m. Eastern time) on the New York Stock Exchange (“NYSE”) on each

day the NYSE is open for business.

The prices of certain portfolio securities or other assets may be determined at a time prior to the close of regular trading on the NYSE. When fair valuing securities, the Fund may, among other things, consider significant events (which may be considered to include changes in the value of U.S. securities or securities indices) that occur after the close of the relevant market and before the time the Fund’s net asset value (“NAV”) is calculated. With respect to certain foreign securities, the Fund may fair value securities using modeling tools provided by third-party vendors. The Fund has retained a statistical research service to assist in determining the fair value of foreign securities. This service utilizes statistics and programs based on historical performance of markets and other economic data to assist in making fair value estimates. Fair value estimates used by the Fund for foreign securities may differ from the value realized from the sale of those securities and the difference could be material to the financial statements. Fair value pricing may require subjective determinations about the value of a security or other asset, and fair values used to determine the Fund’s NAV may differ from quoted or published prices, or from prices that are used by others, for the same investments. In addition, the use of fair value pricing may not always result in adjustments to the prices of securities or other assets held by the Fund.

(b) Fair Value Measurement

Effective December 1, 2007, the Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). This standard clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of the fair value measurements. The three levels of the fair value hierarchy under FAS 157 are described below:

· | Level 1 – quoted prices in active markets for identical investments |

· | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

· | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The valuation techniques used by the Fund to measure fair value during the six months ended May 31, 2008 maximized the use of observable inputs and minimized the use of unobservable inputs. The Fund utilized the following fair value techniques: multi-dimensional relational pricing model and estimated the price that would have prevailed in a liquid market for an international equity given information available at the time of evaluation. At May 31, 2008 the Fund did not hold securities deemed as a Level 3.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used at May 31, 2008 in valuing the Fund’s investments carried at value:

| | Investments in | |

Valuation Inputs | | Securities | |

Level 1 – Quoted Prices | | $62,929,359 | |

Level 2 – Other Significant Observable Inputs | | 127,753,706 | |

Level 3 – Significant Unobservable Inputs | | – | |

Total | | $190,683,065 | |

(c) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date except for certain dividends from foreign securities, where the ex-dividend date may have passed. Such dividends are recorded as soon after the ex-dividend date as the Fund, using reasonable diligence, becomes aware of such dividends. Interest income is recorded on an accrual basis.

10 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08

Allianz RCM Global EcoTrendsSM Fund Notes to Financial Statements

1. Organization and Significant Accounting Policies (continued)

(d) Federal Income Taxes

The Fund intends to distribute all of its taxable income and to comply with the other requirements of the U.S. Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required.

(e) Dividends and Distributions

The Fund will declare dividends and distributions from net investment income and net realized capital gains, if any, annually. The Fund records dividends and distributions to its shareholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from generally accepted accounting principles. These “book-tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal income tax treatment; temporary differences do not require reclassification. To the extent dividends and/or distributions exceed current and accumulated earnings and profits for federal income tax purposes, they are reported as dividends and/or distributions of paid-in capital in excess of par.

(f) Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investments and other assets and liabilities denominated in foreign currency are translated at the prevailing exchange rate on the valuation date; (2) purchases and sales of investments, income and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. The resulting net foreign currency gain or loss is included in the Statement of Operations.

The Fund does not generally isolate that portion of the results of operations arising as a result of changes in the foreign currency exchange rates from the fluctuations arising from changes in the market prices of securities. Accordingly, such foreign currency gain (loss) is included in net realized and change in unrealized gain (loss) on investments.

(g) Repurchase Agreements

The Fund enters into transactions with its custodian bank or securities brokerage firms whereby it purchases securities under agreements to resell at an agreed upon price and date (“repurchase agreements”). Such agreements are carried at the contract amount in the financial statements. Collateral pledged (the securities received), which consists primarily of U.S. government obligations and asset-backed securities, are held by the custodian bank until maturity of the repurchase agreement. Provisions of the repurchase agreements and the procedures adopted by the Fund require that the market value of the collateral, including accrued interest thereon, is sufficient in the event of default by the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited.

(h) Custody Credits on Cash Balances

The Fund benefits from an expense offset arrangement with its custodian bank whereby uninvested cash balances earn credits which reduce monthly custodian and accounting agent expenses. Had these cash balances been invested in income producing securities, they would have generated income for the Fund.

(i) Concentration of Risk

The Fund may have elements of risk, not typically associated with investments in the U.S., due to concentrated investments in specific industries or investments in foreign issuers located in a specific country or region. Such concentrations may subject the Fund to additional risks resulting from future political or economic conditions in such country or region and the possible imposition of adverse governmental laws of currency exchange restrictions affecting such country or region, which could cause the securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies.

2. Investment Manager/Sub-Adviser/Distributor

The Fund has entered into an Investment Management Agreement (the “Agreement”) with the Investment Manager. Subject to the supervision of the Fund’s Board of Trustees, the Investment Manager is responsible for managing, either directly or through others selected by it, the Fund’s investment activities, business affairs and administrative matters. Pursuant to the Agreement, the Investment Manager receives an annual fee, payable monthly, at an annual rate of 1.00% of the Fund’s average daily total managed assets. Total managed assets means the total assets of the Fund

5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 11

Allianz RCM Global EcoTrendsSM Fund Notes to Financial Statements

2. Investment Manager/Sub-Adviser/Distributor (continued)

(including assets attributable to any preferred shares and borrowings that may be outstanding) minus accrued liabilities (other than liabilities representing borrowings). The Investment Manager has retained its affiliate, RCM Capital Management LLC (“RCM”), to manage the Fund’s investments. RCM has, in turn, retained an affiliated investment management firm, Allianz Global Investors Advisory GmbH (“AGIA”), (collectively with RCM the “Sub- Advisers”), to conduct day-to-day portfolio management of the Fund Subject to the supervision of the Investment Manager, the Sub-Advisers makes all of the Fund’s investment decisions. For their services, pursuant to Sub-Advisory agreements, the Investment Manager and not the Fund pays the Sub-Advisers a monthly fee.

The Fund’s Distributor is Allianz Global Investors Distributors LLC (the “Distributor”), an affiliate of the Investment Manager and the Sub-Advisers. The Fund pays the Distributor an ongoing shareholder servicing fee in connection for the services the Distributor renders and the expenses it bears in connection with services rendered to Fund Shareholders and the maintenance of Shareholder Accounts. These fees are made at a maximum annual rate of 0.25%, calculated as a percentage of the Fund’s average daily net assets attributable to Class A shares.

3. Investment in Securities

For the six months ended May 31, 2008, purchases and sales of investments, other than short-term securities and U.S. government obligations, were $72,351,608 and $46,175,024, respectively.

4. Quarterly Repurchase Offers

The Fund has adopted the following fundamental policies with respect to repurchase offers, changeable only by a majority vote of the outstanding voting securities of the Fund:

· | The Fund will make repurchase offers at periodic intervals pursuant to Rule 23c-3 under the 1940 Act, as such Rule may be amended from time to time and as interpreted by the Securities & Exchange Commission (“SEC”) or other regulatory authorities having jurisdiction from time to time, and in accordance with any exemptive relief granted by the SEC. |

| |

· | The periodic intervals between repurchase request deadlines (as defined in Rule 23c-3) shall be three months, provided that the intervals shall be one month if the Fund applies and receives an exemptive order from the SEC permitting such shorter intervals; |

| |

· | The repurchase request deadlines (as defined in Rule 23c-3) for repurchase offers shall be the fifth business day of the months of March, June, September and December, or otherwise the fifth business day or each month if the Fund makes monthly repurchase offers; and |

| |

· | Each repurchase pricing date (as defined in Rule 23c-3) shall not be later than the 14th day after the preceeding repurchase request deadline (or the next business day if the 14th is not a business day. |

On a quarterly basis, the Fund’s Board will determine the number of shares that the Fund will offer to repurchase in a particular repurchase offer. The repurchase offer amount will be at least 5% but not more than 25% of the shares outstanding on the repurchase request deadline. The repurchase price is the net asset value on the repurchase pricing date. If shareholders tender more than the repurchase offer amount for a particular repurchase offer, the Fund may repurchase up to an additional 2% of the shares outstanding on the repurchase request deadline.

For the six months ended May 31, 2008, the Fund extended two repurchase offers:

| | | | | | Number of |

Repurchase | | Repurchase | | % of Class A | | Class A |

Request Deadline | | Offer % | | Shares Tendered* | | Shares Tendered* |

December 7, 2007 | | 25% | | 2.93% | | 140,285 |

March 7, 2008 | | 25% | | 4.98% | | 268,614 |

* | Since the repurchase offers were not over-subscribed beyond the repurchase offer amounts and due to the limited number of shares tendered, the Fund did not have to consider whether to repurchase an additional amount of shares, (not to exceed 2% of the shares outstanding) and did not need to repurchase any shares on a pro-rata basis as described in the Prospectus and Repurchase Request Form. |

12 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08

Allianz RCM Global EcoTrendsSM Fund Notes to Financial Statements

5. Income Tax Information

The cost basis of portfolio securities of $155,249,878 is substantially the same for both federal income tax and financial reporting purposes. Aggregated gross unrealized appreciation for securities in which there is an excess value over tax cost is $38,937,531; aggregate gross unrealized depreciation for securities in which there is an excess of tax cost over value is $3,504,344; net unrealized appreciation for federal income tax purposes is $35,433,187.

6. Payments from Affiliates

During the six months ended May 31, 2008, the Sub-Adviser reimbursed the Fund $200 (less than $.005 per share) for realized losses resulting from a trading error.

7. Legal Proceedings

In June and September 2004, the Investment Manager and certain of its affiliates (including Allianz Global Investors Distributors LLC, PEA Capital LLC (“PEA”) and Allianz Global) agreed to settle, without admitting or denying the allegations, claims brought by the Securities and Exchange Commission (the “Commission”) and the New Jersey Attorney General alleging violations of federal and state securities laws with respect to certain open-end funds for which the Investment Manager serves as investment adviser. The settlements related to an alleged “market timing” arrangement in certain open-end funds formerly sub-advised by PEA. The Investment Manager and its affiliates agreed to pay a total of $68 million to settle the claims. In addition to monetary payments, the settling parties agreed to undertake certain corporate governance, compliance and disclosure reforms related to market timing, and consented to cease and desist orders and censures. Subsequent to these events, PEA deregistered as an investment adviser and dissolved. None of the settlements alleged that any inappropriate activity took place with respect to the Fund.

Since February 2004, the Investment Manager and certain of its affiliates and their employees have been named as defendants in a number of pending lawsuits, concerning “market timing,” which allege the same or similar conduct underlying the regulatory settlements discussed above. The market timing lawsuits have been consolidated in a multi-district litigation proceeding in the U.S. District Court for the District of Maryland. Any potential resolution of these matters may include, but not be limited to, judgments or settlements for damages against the Investment Manager or its affiliates or related injunctions.

The Investment Manager and the Sub-Advisers believe that these matters are not likely to have a material adverse effect on the Funds or on their ability to perform their respective investment advisory activities relating to the Funds.

The foregoing speaks only as of the date hereof.

8. Appointment of New Trustee

In May 2008, the Fund’s Board of Trustees appointed Diana L. Taylor as a Trustee.

5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 13

Allianz RCM Global EcoTrendsSM Fund Financial Highlights For a share of common stock outstanding throughout each period. |

| | | |

| | Six months

ended

May 31, 2008

(unaudited) | For the period

January 31, 2007*

through

November 30, 2007 |

| | | | | | |

Net asset value, beginning of period | | $36.99 | | | $23.88 | ** |

Investment Operations: | | | | | | |

| | | | | | |

Net investment loss | | (0.10 | ) | | (0.19 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | | (1.41 | ) | | 13.35 | |

Total income (loss) from investment operations | | (1.51 | ) | | 13.16 | |

Distributions from net realized capital gains | | (0.31 | ) | | – | |

Capital Share Transactions: | | | | | | |

| | | | | | |

Offering costs charged to paid-in capital in excess of par | | – | | | (0.05 | ) |

Net asset value, end of period | | $35.17 | | | $36.99 | |

Total Investment Return (1) | | (4.14 | )% | | 54.90 | % |

RATIOS/SUPPLEMENTAL DATA: | | | | | | |

| | | | | | |

Net assets end of period (000s) | | $194,025 | | | $176,337 | |

Ratio of net expenses to average net assets (2)(3) | | 1.50 | % | | 1.78 | % |

Ratio of net investment loss to average net assets (3) | | (0.62 | )% | | (0.96 | )% |

Portfolio turnover | | 28 | % | | 27 | % |

* | Commencement of operations. |

** | Initial public offering price of $25.00 per share less underwriting discount of $1.125 per share. |

(1) | Total investment return is calculated assuming a purchase of a share of common stock on the first day of the period and a sale of a share of common stock on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions or sales charges. Total investment return for a period of less than one year is not annualized. |

(2) | Inclusive of expenses offset by custody credits earned on cash balances at the custodian bank. (See note 1(h) in Notes to Financial Statements). |

(3) | Annualized. |

14 Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report | 5.31.08 | See accompanying Notes to Financial Statements.

Allianz RCM Global EcoTrendsSM Fund Proxy Voting Policies & Procedures (unaudited)

Proxy Voting Policies & Procedures:

A description of the policies and procedures that the Fund has adopted to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies relating to portfolio securities held during the most recent 12-month period ended June 30, 2007 is available (i) without charge, upon request, by calling the Fund’s shareholder servicing agent at (888) 877-4626; (ii) on the Fund’s website at www.allianzinvestors.com/closedendfunds; and (iii) on the Securities and Exchange Commission’s website at www.sec.gov.

5.31.08 | Allianz RCM Global EcoTrendsSM Fund Semi-Annual Report 15

Trustees and Principal Officers | | |

Hans W. Kertess | | Brian S. Shlissel |

Trustee, Chairman of the Board of Trustees | | President & Chief Executive Officer |

Paul Belica | | Lawrence G. Altadonna |

Trustee | | Treasurer, Principal Financial & Accounting Officer |

Robert E. Connor | | Thomas J. Fuccillo |

Trustee | | Vice President, Secretary & Chief Legal Officer |

John J. Dalessandro II | | Scott Whisten |

Trustee | | Assistant Treasurer |

John C. Maney | | Youse E. Guia |

Trustee | | Chief Compliance Officer |

William B. Ogden, IV | | William V. Healey |

Trustee | | Assistant Secretary |

R. Peter Sullivan III | | Richard H. Kirk |

Trustee | | Assistant Secretary |

Diana L. Taylor | | Kathleen A. Chapman |

Trustee | | Assistant Secretary |

| | Lagan Srivastava |

| | Assistant Secretary |

| | Richard J. Cochran |

| | Assistant Treasurer |

Investment Manager

Allianz Global Investors Fund Management LLC

1345 Avenue of the Americas

New York, NY 10105

Sub-Advisers

RCM Capital Management Company LLC

4 Embarcadero Center,

San Francisco, CA 94111

Allianz Global Investors Advisory GmbH

Mainzer Landstrasse 11-13

Frankfurt-am-Main, Germany

Distributor

Allianz Global Investors Distributors LLC

1345 Avenue of the Americas

New York, NY 10105

Custodian & Accounting Agent

State Street Bank & Trust Co.

801 Pennsylvania

Kansas City, MO 64105-1307

Transfer Agent, Dividend Paying Agent and Registrar

PNC Global Investment Servicing

P.O. Box 43027

Providence, RI 02940-3027

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

300 Madison Avenue

New York, NY 10017

Legal Counsel

Ropes & Gray LLP

One International Place

Boston, MA 02210-2624

This report, including the financial information herein, is transmitted to the shareholders of Allianz RCM Global EcoTrendsSM Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

The financial information included herein is taken from the records of the Fund without examination by an independent registered public accounting firm, who did not express an opinion hereon.

In addition, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and related SEC rules, the Fund’s principal executive and principal financial officer made quarterly certifications, included in filings with the SEC on Form N-Q relating to, among other things, the Fund’s disclosure controls and procedures and internal control over financial reporting, as applicable.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of its fiscal year on Form N-Q. The Fund’s Form N-Qs are available on the SEC’s website at www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The information on Form N-Q is also available on the Fund’s website at www.allianzinvestors.com.

ITEM 2. CODE OF ETHICS

Not required in this filing.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT

Not required in this filing.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Not required in this filing.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANT

Not required in this filing.

ITEM 6. SCHEDULE OF INVESTMENTS

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not required in this filing.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES

Not required in this filing.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED COMPANIES

PERIOD | | TOTAL

NUMBER OF

SHARES

PURCHASED | | AVERAGE

PRICE PAID

PER SHARE | | TOTAL NUMBER

OF

SHARES

PURCHASED

AS PART OF

PUBLICLY

ANNOUNCED

PLANS

OR PROGRAMS | | MAXIMUM NUMBER OF

SHARES THAT MAY

YET

BE

PURCHASED UNDER

THE

PLANS

OR PROGRAMS | |

| | | | | | | | | |

December 2007 | | N/A | | N/A | | 2,914 | | N/A | |

January 2008 | | N/A | | N/A | | N/A | | N/A | |

February 2008 | | N/A | | N/A | | N/A | | N/A | |

March 2008 | | N/A | | N/A | | N/A | | N/A | |

April 2008 | | N/A | | N/A | | N/A | | N/A | |

May 2008 | | N/A | | N/A | | N/A | | N/A | |

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There have been no material changes to the procedures by which shareholders may recommend nominees to the Fund’s Board of Directors since the Fund last provided disclosure in response to this item.

ITEM 11. CONTROLS AND PROCEDURES

(a) The registrant’s President and Chief Executive Officer and Treasurer, Principal Financial & Accounting Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-2(c) under the Act (17 CFR 270.30a-3(c))), as amended are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this document.

(b) There were no significant changes over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d))) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrants control over financial reporting.

ITEM 12. EXHIBITS

(a) (1) Exhibit 99 Cert. - Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

(b) Exhibit 99.906 Cert. - Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Allianz RCM Global Eco Trends (sm) Fund . |

|

|

By | /s/ Brian S. Shlissel | |

| President and Chief Executive Officer | |

| |

Date August 6, 2008 | |

| |

|

By | /s/ Lawrence G. Altadonna | |

| Treasurer, Principal Financial & Accounting

Officer | |

| |

Date August 6, 2008 | |

| | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By | /s/ Brian S. Shlissel | |

| President and Chief Executive Officer | |

| |

Date August 6, 2008 |

|

| |

By | /s/ Lawrence G. Altadonna | |

| Treasurer, Principal Financial & Accounting

Officer | |

|

Date August 6, 2008 |