QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on December 12, 2006

Registration No.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TravelCenters of America LLC

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 5541

(Primary Standard Industrial

Classification Code Number) | | 20-5701514

(I.R.S. Employer

Identification Number) |

400 Centre Street

Newton, MA 02458

(617) 964-8389

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

John G. Murray, President

c/o Hospitality Properties Trust

400 Centre Street

Newton, Massachusetts 02458

(617) 964-8389

(Name, address, including zip code, telephone number,

including area code, of agent for service) |

|

Copy to:

William J. Curry, Esq.

Edwin L. Miller, Jr., Esq.

Sullivan & Worcester LLP

One Post Office Square

Boston, Massachusetts 02109

(617) 338-2800 |

Approximate date of commencement of proposed distribution to the public:As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

| | Proposed Maximum Aggregate Offering Price(1)

| | Amount of Registration Fee

|

|---|

|

| Common Shares | | $341,770,000 | | $36,570 |

|

- (1)

- Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act, and assumes that the value of the shares to be issued in the spin off described herein will be equal to the currently estimated net book value of the registrant at the time of the spin off.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be distributed until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 12, 2006

PROSPECTUS

Distribution by Hospitality Properties Trust

to its Shareholders of

All Outstanding Common Shares of

TravelCenters of America LLC

We are furnishing this prospectus to the shareholders of Hospitality Properties Trust, or Hospitality Trust, a Maryland real estate investment trust. We are currently a wholly owned subsidiary of Hospitality Trust. Hospitality Trust will distribute all of our outstanding common shares as a special distribution to its shareholders. This distribution is contingent upon the closing of Hospitality Trust's acquisition of TravelCenters of America, Inc.

Shareholders of Hospitality Trust will receive one of our shares for every ten Hospitality Trust common shares owned on , 2007. The distribution will be made on or about , 2007.

We have applied for the listing of our common shares on the American Stock Exchange, or AMEX, under the symbol "TA". Hospitality Trust common shares will continue to trade on the New York Stock Exchange, or NYSE, under the symbol "HPT". This distribution of our common shares is the first public distribution of our shares. Accordingly, we can provide no assurance to you as to what the market price of our shares may be.

Investment in our shares involves risks. You should read this entire prospectus carefully, including the section entitled "Risk Factors" that begins on page 9 of this prospectus, which describes the material risks.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2007.

TABLE OF CONTENTS

| | Page

|

|---|

| Questions and Answers About the Spin Off | | ii |

| Summary | | 1 |

| Risk Factors | | 9 |

| The Spin Off | | 14 |

| Dividend Policy | | 17 |

| Capitalization | | 17 |

| The Company | | 17 |

| Selected Historical Financial Information | | 34 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 35 |

| Management | | 48 |

| Security Ownership After the Spin Off | | 56 |

| Certain Relationships | | 58 |

| Federal Income Tax Considerations | | 59 |

| Shares Eligible for Future Sale | | 68 |

| Description of our Limited Liability Company Agreement | | 68 |

| Anti-Takeover Provisions | | 77 |

| Liability of Shareholders for Breach of Restrictions on Ownership | | 77 |

| Transfer Agent and Registrar | | 78 |

| Plan of Distribution | | 78 |

| Legal Matters | | 78 |

| Experts | | 78 |

| Where You Can Find More Information | | 78 |

| Index to Financial Statements and Schedules | | F-1 |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. Neither we nor Hospitality Trust has authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We and Hospitality Trust believe that the information contained in this prospectus is accurate as of the date on the cover. Changes may occur after that date, and we and Hospitality Trust do not expect to update this information except as required by applicable law.

At the present time we are, and until the time of the acquisition by Hospitality Trust of TravelCenters of America, Inc. we will be, a shell entity that has nominal assets and no liabilities, and is wholly owned by Hospitality Trust. TravelCenters of America, Inc. will become wholly owned by us after Hospitality Trust acquires it. We will then restructure the business of TravelCenters of America, Inc., after which Hospitality Trust will complete the spin off described herein. After the spin off we will continue the business of TravelCenters of America, Inc. but because of the restructuring, the business as conducted by us will be materially different than the business as it was historically conducted.

Some of the descriptive material in this prospectus refers to the assets, liabilities, operations, results, activities or other attributes of the historical business conducted by TravelCenters of America, Inc. as if it had been conducted by us. For example, "our brands", "our assets" or similar words have been used in historical or current contexts to describe those matters which, while clearly attributable to our predecessor, will have continuing relevance to us after the acquisition, the restructuring and the spin off. However, because our business as a whole will be materially different following the restructuring and spin off from the business historically conducted by TravelCenters of America, Inc., none of these references are intended to imply that the historical business, financial position, results of operations or cash flows are indicative of our business, financial position, results of operations or cash flows at any future date or for any future period.

i

QUESTIONS AND ANSWERS ABOUT THE SPIN OFF

- Q:

- How many common shares of TravelCenters of America LLC will I receive?

A: Hospitality Trust will distribute to you one of our common shares for every ten common shares of Hospitality Trust you own on , 2007, the distribution record date.

- Q:

- What are shares of TravelCenters worth?

A: The value of our shares will be determined by their trading price after the spin off. We do not know what the trading price will be and we can provide no assurance as to value.

- Q:

- What will Hospitality Trust do after the spin off?

A: Hospitality Trust will continue to operate as a real estate investment trust, or REIT. Immediately after the spin off, Hospitality Trust will own 146 travel centers leased to us and 310 hotels. In the future, Hospitality Trust may purchase additional properties, and some of these additional properties may be leased to us.

- Q:

- Will the spin off affect my cash distributions from Hospitality Trust?

A: No. Hospitality Trust expects to continue quarterly cash distributions of $0.74/share ($2.96/share per year). We do not expect to make distributions to our shareholders in the foreseeable future.

- Q:

- Will TravelCenters shares be listed on a stock exchange?

A: Yes. We have applied for the listing of our common shares on the AMEX under the trading symbol "TA".

- Q:

- Will my Hospitality Trust shares continue to be listed on an exchange?

A: Yes. Hospitality Trust's common shares will continue to be listed on the NYSE under the symbol "HPT". The number of Hospitality Trust common shares you own will not change as a result of the spin off.

- Q:

- What are the tax consequences to me of the spin off?

A: Your initial tax basis in the shares that you receive in the spin off will be determined by their trading price at the time of the spin off. The spin off will be a taxable distribution and a portion of the value you receive will be treated for tax purposes as ordinary income, capital gains or a reduction in your tax basis in your Hospitality Trust shares. Hospitality Trust will notify you after year end 2007 of the tax attributes of this spin off on Internal Revenue Service, or IRS, Form 1099.

- Q:

- Are there any unusual tax consequences to me arising from the fact that TravelCenters of America LLC is organized as a limited liability company?

A: No. Despite the legal structure of our organization, we will be a corporation for U.S. federal income tax purposes.

- Q:

- What do I have to do to receive my TravelCenters shares?

A: No action by you is required. If your Hospitality Trust common shares are held in a brokerage account, our common shares will be credited to that account. If you hold Hospitality Trust common shares in certificated or book entry form, your ownership of our shares will be recorded in the books of our transfer agent and a statement evidencing your ownership will be mailed to you. We will not issue certificates representing our common shares. No cash distributions will be paid and fractional shares will be recorded on the books of our transfer agent as necessary.

ii

SUMMARY

References in this prospectus to "we", "us", "our", the "company" or "TravelCenters" mean TravelCenters of America LLC and its subsidiaries. References in this prospectus to "Hospitality Trust" mean Hospitality Properties Trust and its subsidiaries.

The Distribution

| Distributing company | | Hospitality Trust. |

Shares to be distributed |

|

All of our common shares, representing all of our limited liability company interests. Hospitality Trust will not retain any of our shares. The spin off is conditioned on the closing of Hospitality Trust's acquisition discussed below. |

Distribution ratio and record date |

|

One of our common shares will be distributed for every ten common shares of Hospitality Trust owned on the record date of , 2007. No cash distributions will be paid and, if necessary, fractional shares will be distributed. |

No payment required |

|

No holder of Hospitality Trust shares will be required to make any payment, exchange shares or to take any other action in order to receive our common shares. |

Distribution date |

|

The spin off distribution date will be on or about , 2007. |

Federal income tax consequences |

|

Our shares distributed to you in the spin off will be treated for tax purposes like other distributions from Hospitality Trust. The total value of this distribution, as well as your initial tax basis in our shares, will be determined by the trading price of our common shares at the time of the spin off. A portion of the value of this distribution will be taxable to you and the remainder, if any, will be a reduction in your tax basis in your Hospitality Trust shares. |

|

|

Unlike many limited liability companies, we will be a corporation for U.S. federal income tax purposes. |

| | | | | |

1

Hospitality Trust acquisition |

|

In September 2006, Hospitality Trust agreed to acquire through merger TravelCenters of America, Inc. from a group of private investors. The business of TravelCenters of America, Inc. includes the ownership of a substantial amount of real estate, the operation of this real estate as travel centers and other related business activities. Hospitality Trust expects to complete this acquisition in early 2007. The acquisition will be funded with cash; all of the debt of TravelCenters of America, Inc. will be repaid and its existing credit agreement will be terminated. The spin off will not occur if Hospitality Trust does not acquire TravelCenters of America, Inc. |

Restructuring and spin off |

|

Upon closing of its acquisition by Hospitality Trust, TravelCenters of America, Inc. will become our subsidiary. We will restructure the business of TravelCenters of America, Inc. The principal effect of this restructuring will be that Hospitality Trust will become the owner of 146 travel centers now owned by TravelCenters of America, Inc., and we will lease these travel centers from Hospitality Trust after the spin off. Hospitality Trust will also become the owner of the "TravelCenters" and "TA" brand names and certain other assets. We will retain the remaining assets and related liabilities of TravelCenters of America, Inc. and continue its business activities after the spin off. |

Reasons for the spin off |

|

Hospitality Trust is a REIT. We are not a REIT. We were created to conduct the activities of TravelCenters of America, Inc. that cannot be conducted by a REIT under the Internal Revenue Code of 1986, as amended, or IRC. Shareholders who continue to own our common shares and common shares of Hospitality Trust will be able to participate in REIT qualified ownership of real estate in Hospitality Trust, as well as in our business operations. |

Conflicts of interest |

|

We were formed for the benefit of Hospitality Trust and not for our own benefit. Our formation allows Hospitality Trust to acquire and retain ownership of 146 travel centers without adverse tax consequences to Hospitality Trust. Because we were formed to benefit Hospitality Trust, some of our contractual relationships and the terms of our initial business operations may provide more benefits to Hospitality Trust than to us. |

| | | | | |

2

|

|

We will be subject to conflicts of interest, including the following: |

|

|

• |

|

Two of our five directors, Mr. Barry M. Portnoy and Mr. Arthur G. Koumantzelis, are currently trustees of Hospitality Trust, and Mr. Portnoy will remain a trustee of Hospitality Trust after the spin off. Another of our directors, Mr. Thomas M. O'Brien, was an executive officer of Hospitality Trust until 2003. Initially and for the foreseeable future, a substantial majority of our business will be conducted at travel centers which we will lease from Hospitality Trust. |

|

|

• |

|

Mr. Portnoy is the majority owner of Reit Management & Research LLC, or Reit Management. Reit Management is the manager for Hospitality Trust and will also provide services to us. Mr. O'Brien and Mr. John R. Hoadley, our treasurer, are employed by Reit Management, will continue to be so employed after the spin off and will be active in our management. |

|

|

Some of our business may be on terms which are less favorable to us than terms we might have achieved if this history and these conflicts did not exist. |

Distribution agent, transfer agent and registrar |

|

Wells Fargo Bank, N.A., will be the distribution agent, transfer agent and registrar for our shares. |

Listing |

|

There is currently no public market for our shares. We have applied to list our common shares on the AMEX under the symbol "TA". We expect trading will commence on a "when issued" basis on or around the distribution record date. The listing of our shares does not ensure that an active trading market for our shares will be available to you. |

The Company

| |

| |

|

|---|

| General | | We were formed in 2006 under Delaware law as a limited liability company. Immediately after the spin off our principal place of business will be 24601 Center Ridge Road, Westlake, Ohio 44145, and our telephone number will be (440) 808-9100. |

| | | | | |

3

Business |

|

We operate and franchise a nationwide network of 163 hospitality and fuel service areas primarily along the U.S. interstate highway system. Our network includes 162 locations in 40 states in the U.S. and one location in Ontario, Canada. Included in our 163 locations are 146 locations which we will lease from Hospitality Trust, 13 locations owned and operated by franchisees, and four locations that we own or which we lease from or manage for other parties. Our typical location includes: |

|

|

• |

|

over 20 acres of land with parking for 170 tractor trailers and 100 cars; |

|

|

• |

|

a 150 seat, full service restaurant and one to three quick service restaurants, or QSRs, operated as a franchise under various brands; |

|

|

• |

|

a truck repair facility and parts store; |

|

|

• |

|

multiple diesel and gasoline fueling points; and |

|

|

• |

|

a travel and convenience store, game room, lounge and other amenities for professional truck drivers and motorists. |

|

|

In addition, some travel centers include a hotel. |

Growth strategy |

|

We expect to continue many of the growth strategies historically employed by our predecessor, TravelCenters of America, Inc. |

|

|

• |

|

Expansion through Organic Growth. We plan to continue to increase the standardization of the appearance of, and the services available at, our travel centers and to continue our customer loyalty and customer satisfaction programs in order to attract professional truck drivers and motorists to our travel centers. |

|

|

• |

|

Expansion through Acquisition. We may pursue strategic acquisitions. We believe that the financial results achievable at existing travel centers can be improved by adding them to our network. Our predecessor purchased a travel center in Illinois in November 2006 and converted it to the TA brand. We expect to regularly evaluate opportunities to expand our network through acquisitions. |

| | | | | |

4

|

|

• |

|

Expansion through Development. Our development designs combine an efficient site layout with nationally branded QSRs and a wide variety of products and services. Our "prototype" design is generally appropriate for markets in which we can obtain large parcels of land and which have sufficient customer demand to support a full service restaurant. Our "protolite" design requires significantly less land than our prototype design, and enables us to quickly gain a presence in smaller markets. As of September 30, 2006, we owned or had under agreement three parcels of land suitable for development of new travel centers. |

|

|

• |

|

Expansion through Franchising. Opportunities to expand our network may not always be available to us as acquisition or development opportunities. In those cases, we may seek to expand our franchisee network. |

Rights of first refusal |

|

In connection with the spin off, we will give Hospitality Trust or any other public entity affiliate of Reit Management the opportunity to acquire or finance any real estate investments of the types in which those entities invest before we do so. We will also provide Hospitality Trust the right to purchase, lease, mortgage or otherwise finance any interest we own in a travel center before we sell, mortgage or otherwise finance that travel center with another party. At present, we expect that our future business will be focused principally upon leasing, operating, managing, developing, acquiring and franchising travel centers, including additional travel centers which we may lease from Hospitality Trust. |

Initial capitalization |

|

At the time of the spin off our principal assets will be cash, receivables and inventory. Net of trade and other payables, these assets will total about $200 million. We will have no funded debt at the time of the spin off. |

Management |

|

We expect several management employees of TravelCenters of America, Inc. to be named as our officers. We expect to supplement these senior management employees, initially, with senior employees of Reit Management and we will enter an agreement with Reit Management to obtain other services, including certain real estate services and certain services which are required for our operations as a publicly owned company. |

Dividend policy |

|

We do not expect to pay dividends. |

| | | | | |

5

Risk factors |

|

Your ownership of our common shares will involve the following risks: |

|

|

• |

|

No market exists for our shares; we do not know the price at which our shares will trade. |

|

|

• |

|

Shareholders who receive shares in spin offs often sell those shares; such sales may lower the market price of our shares. |

|

|

• |

|

Our operating margins are small; small changes in our revenues or operating expenses may cause us to experience losses. |

|

|

• |

|

Volatility in the prices at which we buy and sell fuel may cause us to experience losses. |

|

|

• |

|

Interruptions in the availability of fuel may cause us to experience losses. |

|

|

• |

|

If we must pay for fuel before delivery, our working capital requirements may increase. |

|

|

• |

|

We regularly incur environmental clean up costs; these costs may become more than we can afford. |

|

|

• |

|

Our competitors may be able to attract our customers by offering fuel at lower prices than us. |

|

|

• |

|

Our growth strategy depends, in part, upon our ability to buy or develop travel centers and to obtain financing and regulatory approvals, and it may not succeed. |

|

|

• |

|

Our franchisees may become unable to pay the royalties and other amounts due to us. |

|

|

• |

|

Our management team has been recently assembled from Hospitality Trust and its affiliates and from TravelCenters of America, Inc. and it may not be able to work together successfully. |

|

|

• |

|

We may be unable to satisfy reporting requirements for publicly owned companies or we may have to increase our expenses to do so. |

|

|

• |

|

Our continuing relationships with Hospitality Trust and Reit Management may cause conflicts of interest. |

|

|

• |

|

Various provisions in our governing documents and our contracts with Hospitality Trust and Reit Management may prevent a change of control of us. |

6

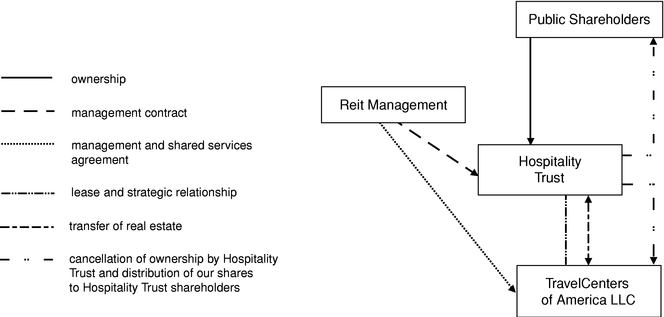

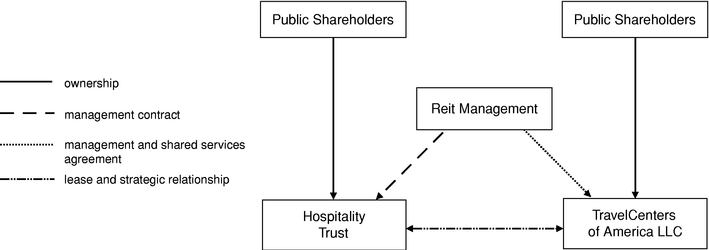

Organization and relationships

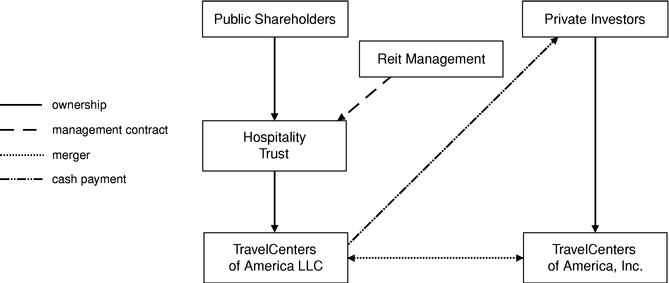

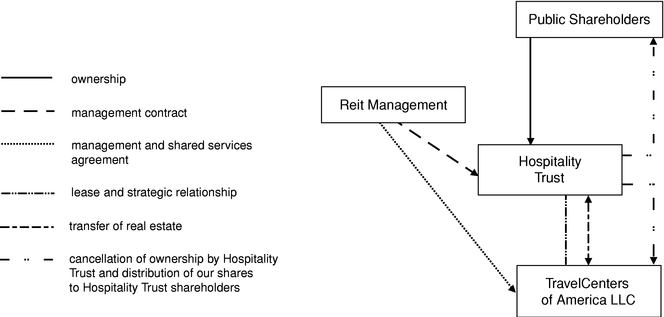

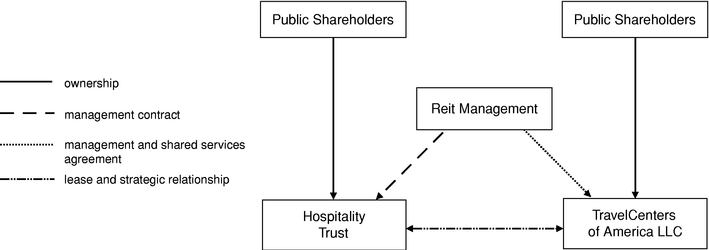

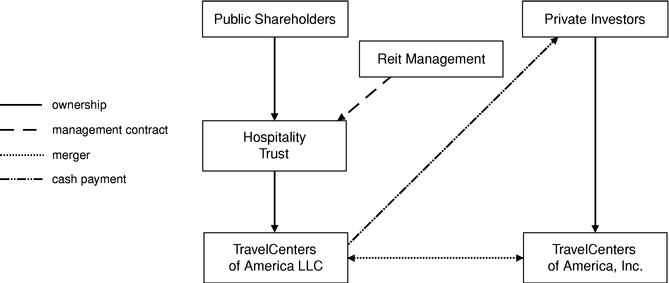

The following charts illustrate the acquisition of TravelCenters of America, Inc. by Hospitality Trust, the reorganization and spin off and the resulting ownership and contractual relationships among us, Hospitality Trust and Reit Management.

The Acquisition

The Reorganization and Spin off

After the Spin off

7

Cautionary Note Regarding Forward Looking Statements

WE HAVE MADE STATEMENTS THAT ARE NOT HISTORICAL FACTS IN THIS PROSPECTUS WHICH CONSTITUTE "FORWARD LOOKING STATEMENTS" AS THAT TERM IS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER FEDERAL SECURITIES LAWS. THESE FORWARD LOOKING STATEMENTS CONCERN:

- •

- OUR ABILITY TO MANAGE EFFECTIVELY THE TRAVEL CENTERS THAT COMPRISE OUR NETWORK;

- •

- OUR ABILITY TO OPERATE AS A PUBLIC COMPANY;

- •

- THE ABILITY OF HOSPITALITY TRUST TO CLOSE ITS ACQUISITION OF TRAVELCENTERS OF AMERICA, INC.;

- •

- OUR ABILITY TO GENERATE CASH FLOW IN EXCESS OF OUR RENT TO HOSPITALITY TRUST AND OUR OTHER OPERATING EXPENSES;

- •

- OUR ABILITY TO ATTRACT AND RETAIN QUALIFIED EMPLOYEES;

- •

- OUR ABILITY TO PROCURE SUFFICIENT FUEL TO SUPPLY OUR CUSTOMERS;

- •

- OUR POLICIES AND PLANS REGARDING OPERATIONS, ACQUISITIONS, DEVELOPMENT ACTIVITIES, FINANCING AND OTHER MATTERS; AND

- •

- OUR ABILITY TO ACCESS CAPITAL MARKETS OR OTHER SOURCES OF FUNDS.

ALSO, WHENEVER WE USE WORDS SUCH AS "BELIEVE", "EXPECT", "ANTICIPATE", "ESTIMATE" OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. FORWARD LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE EVENTS OR PERFORMANCE AND INVOLVE RISKS AND UNCERTAINTIES. OUR EXPECTED RESULTS MAY NOT BE ACHIEVED, AND ACTUAL RESULTS MAY DIFFER MATERIALLY FROM OUR EXPECTATIONS BECAUSE OF VARIOUS FACTORS, INCLUDING:

- •

- THE STATUS OF THE ECONOMY;

- •

- COMPLIANCE WITH AND CHANGES TO REGULATIONS AND OTHER FACTORS AFFECTING THE FUEL MARKETING INDUSTRY;

- •

- COMPETITION IN THE TRAVEL CENTER INDUSTRY;

- •

- THE STATUS OF CAPITAL MARKETS (INCLUDING PREVAILING INTEREST RATES) AND OUR ABILITY TO OBTAIN FINANCING; AND

- •

- COMPLIANCE WITH AND CHANGES IN FEDERAL, STATE AND LOCAL REGULATIONS, INCLUDING ENVIRONMENTAL REGULATIONS.

INVESTORS SHOULD NOT RELY UPON FORWARD LOOKING STATEMENTS EXCEPT AS STATEMENTS OF OUR PRESENT INTENTIONS OR OF OUR PRESENT BELIEFS OR EXPECTATIONS WHICH MAY OR MAY NOT OCCUR.

OTHER RISKS COULD HAVE A MATERIAL ADVERSE EFFECT ON US, AS DESCRIBED MORE FULLY UNDER "RISK FACTORS".

EXCEPT AS MAY BE REQUIRED BY APPLICABLE LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

8

RISK FACTORS

Ownership of our shares involves various risks. The following are material risks:

Risks from the spin off

There has been no prior market for our common shares.

There has been no prior trading market for our common shares and we cannot predict the price at which our common shares will trade after the spin off. Our share price will be established by the public markets. We expect that our common shares may begin to trade in the public markets on a "when issued" basis on or about the record date. However, if no regular trading market develops for our common shares, you may not be able to sell your shares at what you consider to be a fair price. The market price of our shares may fluctuate significantly and will be influenced by many factors beyond our control.

Substantial sales of our common shares could cause our share price to decline after the spin off.

Some shareholders who receive our common shares in the spin off may sell our shares in the public markets. This may occur because some shareholders of Hospitality Trust who receive our shares are focused upon owning REIT shares and we are not a REIT. The sale of significant amounts of our common shares shortly after the spin off, or the perception in the market that this will occur, may lower the market price of our common shares.

Risks in our business

Our operating margins are narrow.

Our total operating revenues for the nine months ended September 30, 2006, were $3.7 billion; and our cost of goods sold (excluding depreciation) and operating expenses for the same period totalled $3.5 billion. Fuel sales in particular generate low gross margins. Our fuel sales for the nine months ended September 30, 2006, were $3.0 billion and we generated a gross profit on fuel sales of $111 million. A small percentage decline in our future revenues or increase in our future expenses, especially revenues and expenses related to fuel, may have a material adverse effect upon our income or may cause us to experience losses.

The price of fuel can be volatile.

We purchase fuel at rates that fluctuate with market prices and are reset daily. We resell fuel at rates we establish daily. In the future, numerous factors beyond our control, including global demand for fuel and other petroleum products, speculative trading, natural disasters, terrorism, wars or political events in oil producing regions of the world may result in periods of rapid fluctuations in our cost of fuel. When our cost to purchase fuel increases rapidly, we may not be able to increase our fuel sales prices at the same rate as the increase in our fuel costs. When the market price of fuel declines rapidly, the value of any inventory we have may decline, and we may have to sell our fuel inventory for less than what we paid for it. Volatility in the fuel market may have a material adverse effect on our income or cause us to experience losses.

An interruption in our fuel supplies would materially adversely affect our business.

To mitigate the risks arising from fuel price volatility, we generally maintain limited inventories of fuel. In the future, an interruption in our fuel supplies would materially adversely affect our business. Interruptions in fuel supplies may be caused by local conditions, such as a malfunction in a particular pipeline or terminal, or by national or international conditions, such as government rationing, acts of terrorism, war and the like. Any limitation in available fuel supplies which caused a decline in truck

9

freight shipments or which caused a limit on the fuel we can offer for sale may have a material adverse effect on our sales of fuel and non-fuel products and services or may cause us to experience losses.

If we lose our ability to pay for fuel after delivery to us, our working capital requirements will increase.

Our suppliers historically have agreed to permit our predecessor to pay for fuel after it is delivered. These terms may be changed by our suppliers. If our suppliers require us to pay for fuel prior to delivery, the working capital required to operate our business will increase. An increase in our working capital requirements may reduce our financial flexibility, increase our expenses and cause us to experience losses.

Compliance with environmental laws may be costly.

Our business is subject to laws relating to the protection of the environment. The travel centers we operate include fueling areas, truck repair and maintenance facilities and tanks for the storage of petroleum products and other hazardous substances, all of which create the potential for environmental damage. As a result, we regularly incur environmental clean up costs. Our pro forma balance sheet as of September 30, 2006, includes an accrued liability of $11.8 million for environmental remediation costs. Because of the uncertainties associated with environmental expenditures, it is possible that future expenditures could be substantially higher than this amount. Environmental laws expose us to the possibility that we become liable to reimburse the government or third parties for damages and costs they incur in connection with environmental hazards. We cannot predict what environmental legislation or regulations may be enacted or how existing laws or regulations will be administered or interpreted with respect to our products or activities in the future; more stringent laws, more vigorous enforcement policies or stricter interpretation of existing laws in the future could cause us to experience losses.

In addition, under the lease between us and Hospitality Trust, we have agreed to indemnify Hospitality Trust from all environmental liabilities it may incur arising at any of our travel centers during the term of the lease.

Our business is highly competitive.

We compete with numerous other companies which provide fuel and other services to truck drivers and motorists. Some of our competitors have greater financial resources than us and are involved in other aspects of the fuel supply business. These competitors may offer fuel at prices lower than ours to attract customers and they may successfully compete with us for acquisition, development and franchising opportunities.

Our growth strategy may not succeed.

We believe that we will have business opportunities to increase our network of travel centers by acquiring existing travel centers and by developing new travel centers. Future acquisitions and development activities may require significant capital. Although our relationship with Hospitality Trust may provide us a source of capital, Hospitality Trust is under no obligation to make growth capital available to us and we may be unable to access sufficient capital to acquire or develop travel centers. Moreover, our growth strategy will create integration risks. If we make substantial acquisitions or substantially increase our development activities, we may be unable to integrate additional travel centers into our network without substantial costs and disruption. A focus on growth strategies may divert our management's attention away from our existing business and cause it to deteriorate.

We have limited control of our franchisees.

Ten travel centers which we lease from Hospitality Trust are subleased to franchisees. An additional 13 travel centers are owned and operated by franchisees. The rent and royalties we receive

10

from these franchisees represent a significant part of our net income. For the nine month period ended September 30, 2006, the rent and royalty revenues generated from these franchisee relationships was $7.5 million. Various laws and our existing franchise contracts limit the control we may exercise over our franchisees' business activities. A failure by our franchisees to pay rents and royalties to us may have a material adverse effect upon our financial results or may cause us to experience losses.

Risks arising from our formation and certain relationships

We have been recently reorganized.

We are a recently reorganized business. Our board and senior management include persons formerly associated with Hospitality Trust and its affiliates, with Reit Management and with TravelCenters of America, Inc. This management team has no prior experience working together and they may not be able to do so successfully. Although we have implemented a retention bonus plan for executives of TravelCenters of America, Inc., we can provide no assurance that we will in fact retain any or all of these persons.

Our creation was, and our continuing business will be, subject to conflicts of interest with Hospitality Trust and Reit Management.

Our creation was, and our continuing business will be, subject to conflicts of interest, as follows:

- •

- Two of our directors were trustees of Hospitality Trust at the time we were created.

- •

- Upon completion of the spin off we will have five directors, one of whom, Mr. Barry Portnoy, also will be a trustee of Hospitality Trust and the majority owner of Reit Management and one of whom, Mr. Thomas O'Brien, is a former executive officer of Hospitality Trust.

- •

- Mr. O'Brien who will be active in our senior management activities is also an employee of Reit Management. Another Reit Management employee, John R. Hoadley, is our treasurer and will also be active in our senior management activities. Reit Management is the manager for Hospitality Trust and we will purchase various services from Reit Management pursuant to a management and shared services agreement.

These conflicts may have caused, and in the future may cause, adverse effects on our business, including:

- •

- Our lease with Hospitality Trust may be on terms less favorable to us than leases we could have entered as a result of arm's length negotiations.

- •

- The terms of our management and shared services agreement with Reit Management may be less favorable to us than we could have achieved on an arm's length basis; specifically, our payments to Reit Management of 0.6% of our fuel gross margin and 0.6% of our total non-fuel revenues for shared services, equal to $4.7 million on a pro forma basis for the nine months ended September 30, 2006, may be greater than if these services were purchased from third parties.

- •

- Future business dealings between us and Hospitality Trust, Reit Management and their affiliates may be on terms less favorable to us than we could achieve on an arm's length basis.

- •

- We may have to compete with Hospitality Trust, Reit Management and their affiliates for the time and attention of Messrs. Portnoy, O'Brien and Hoadley.

Our lease with Hospitality Trust requires that we indemnify Hospitality Trust from various liabilities.

Our lease with Hospitality Trust requires that we pay for, and indemnify Hospitality Trust from, liabilities associated with the ownership or operation of travel centers which may arise during the term

11

of our lease. Accordingly our business will be subject to all our business operating risks and all the risks associated with real estate including:

- •

- costs associated with uninsured damages, including damages for which insurance may be unavailable or unavailable on commercially reasonable terms;

- •

- costs and damages arising from pending and future litigation;

- •

- costs that may be required for maintenance and repair of the travel centers; and

- •

- costs due to compliance with and changes in laws and other regulations, including environmental laws and the Americans with Disabilities Act.

Our relationships with Hospitality Trust and Reit Management may limit the growth of our business.

In connection with the spin off, we will enter agreements which prohibit us from acquiring or financing real estate in competition with Hospitality Trust or other affiliates of Reit Management, unless those investment opportunities are first offered to Hospitality Trust or those other entities. These restrictions may make it difficult or impossible for us to alter our business strategy to include investments in real estate. Also, because our lease with Hospitality Trust limits our ability to incur debt, ends in 2022 and prohibits ownership of more than 9.8% of our shares by any party, we may be unable to independently finance future growth opportunities.

Ownership limitations and anti-takeover provisions may prevent you from receiving a takeover premium.

Our limited liability company agreement, or LLC agreement, places restrictions on the ability of any person or group to acquire beneficial ownership of more than 9.8% (in number of shares, vote or value, whichever is most restrictive) of any class or series of our equity securities. The terms of our lease with Hospitality Trust and our management and shared services agreement with Reit Management provide that our rights under these agreements may be cancelled by Hospitality Trust and Reit Management, respectively, upon the acquisition by any person or group of more than 9.8% of our voting shares, and upon other change in control events, as defined in those agreements. If the breach of these ownership limitations causes a lease default, shareholders causing the default may become liable to us or to other shareholders for damages. These agreements and other provisions in our limited liability company agreement may increase the difficulty of acquiring control of us by means of a tender offer, open market purchases, a proxy fight or otherwise, if the acquisition is not approved by our board of directors. Other provisions in our governing documents which may deter takeover proposals include the following:

- •

- staggered terms for members of our board of directors;

- •

- the power of our board of directors, without a shareholders' vote, to authorize and issue additional shares and classes or series of shares on terms that it determines;

- •

- a 75% shareholder vote and cause requirements for removal of directors; and

- •

- advance notice procedures with respect to nominations of directors and shareholder proposals.

For any of these reasons, shareholders may be unable to cause a change of control of us or to realize a change of control premium for their common shares.

We may be unable to meet financial reporting and internal control standards for a publicly owned company.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is the process designed by, or under the supervision of, our CEO and CFO, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted

12

accounting principles and includes those policies and procedures that (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and dispositions of assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with the authorization of our management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

In connection with their review of our September 30, 2006, interim financial statements, our predecessor's independent registered public accounting firm identified a control deficiency that represents a material weakness in our predecessor's internal control over financial reporting. A material weakness is a control deficiency, or combination of control deficiencies, that results in a more than remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. Our predecessor did not maintain effective controls over the accuracy of share based compensation expense in conformity with generally accepted accounting principles. Specifically, effective controls were not maintained to ensure the accuracy of expense recognized over the vesting period of certain option awards. This control deficiency resulted in an adjustment to reduce the amounts of the share based compensation expense and additional paid in capital accounts by a material amount and in an adjustment to the related footnote disclosures in our predecessor's interim consolidated financial statements as of, and for the nine months ended, September 30, 2006. Additionally, if not remedied, this control deficiency could result in misstatements of the aforementioned accounts and disclosures that would result in a material misstatement in our annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, our predecessor's management has determined that this control deficiency constitutes a material weakness. Our predecessor's efforts to remediate the aforementioned material weakness in internal control over financial reporting consisted of strengthening processes related to accounting for share based compensation expense.

We may identify material weaknesses in our internal control over financial reporting in the future. Beginning with our Annual Report on Form 10-K for the year ending December 31, 2007, pursuant to Section 404 of the Sarbanes Oxley Act of 2002, our management will be required to assess the effectiveness of our internal control over financial reporting, and we will be required to have our independent registered public accounting firm audit management's assessment and the design and operating effectiveness of our internal control over financial reporting. If our management or our independent registered public accounting firm were to either identify a material weakness or otherwise conclude in their reports that our internal control over financial reporting was not effective, investors could lose confidence in our reported financial information and the value of our stock could be adversely affected which, in turn, could harm our business and have an adverse effect on our future ability to raise capital funds.

13

THE SPIN OFF

Key Dates

Date

| | Activity

|

|---|

| , 2007 | | Prospectus Mailing Date. The date the registration statement of which this prospectus is a part was declared effective by the Securities and Exchange Commission, or SEC. We have mailed this prospectus to you on or about this date. |

, 2007 |

|

Record Date. Upon the closing of Hospitality Trust's acquisition of TravelCenters of America, Inc., Hospitality Trust common shareholders will receive one of our common shares for every ten Hospitality Trust common shares owned of record at the close of business on this date. After our declaration of the record date, a market for our shares may develop before the distribution date and our shares may begin to trade. A market that develops for shares that will be issued in the future is referred to as a "when issued" market. If a "when issued" market develops for our shares, a market may develop for the trading of Hospitality Trust shares which does not include the right to receive the distribution of our shares, which is referred to as a "when issued/ex dividend" market. |

, 2007 |

|

Distribution Date. Upon the closing of Hospitality Trust's acquisition of TravelCenters of America, Inc., all of our common shares will be delivered to the distribution agent on this date, and the spin off will be completed. If you hold Hospitality Trust common shares in a brokerage account, your account will be credited with the number of our common shares to which you are entitled. If you hold Hospitality Trust common shares in certificated or book entry form, your ownership of our shares will be recorded in the books of our transfer agent and a statement will be mailed to you. We will not issue certificates representing our common shares. If a "when issued" and "when issued/ex dividend" market has developed for our shares and for Hospitality Trust shares, it will cease on this date; and thereafter all those shares will trade "regular way". |

Distribution Agent

The distribution agent for the spin off will be Wells Fargo Bank, N.A.

Listing and Trading of Our Shares

There is currently no public market for our shares. We have applied for the listing of our common shares on the AMEX under the symbol "TA." A "when issued" market, if one develops, may permit you and others to trade our shares on the AMEX before the shares are distributed.

Until our shares are distributed and an orderly trading market develops, the price of our shares may fluctuate significantly. We expect "regular way" trading on the AMEX to commence on the trading day following the distribution date. The listing of our shares will not ensure that an active trading market will be available to you. Many factors beyond our control will influence the market price of our shares, including the depth and liquidity of the market which develops, investor perception of our business and growth prospects and general market conditions.

14

Background and Reasons for the Spin Off

In order to maintain its status as a REIT for federal income tax purposes, a substantial majority of Hospitality Trust's revenues must be derived from real estate rents and mortgage interest.

In September 2006, Hospitality Trust agreed to acquire by merger TravelCenters of America, Inc. for approximately $1.9 billion. TravelCenters of America, Inc. owns substantial real estate and operates its travel center network and other related businesses. Hospitality Trust cannot operate some of the businesses of TravelCenters of America, Inc. because of limitations applicable to REITs imposed by the IRC. By completing this spin off, Hospitality Trust will be able to own the real estate of 146 travel centers we operate and collect rents from us without incurring any federal income tax on those rents. We have been formed by Hospitality Trust to meet Hospitality Trust's need for a tenant for the travel centers it will continue to own after the spin off. We will be able to lease and operate these properties because we are not a REIT.

For a more detailed discussion of the tax provisions applicable to REITs which underlie the reasons for this spin off, see "Federal Income Tax Considerations".

The Hospitality Trust Acquisition

TravelCenters of America, Inc. will merge with a newly formed subsidiary of Hospitality Trust, and TravelCenters of America, Inc. will be the surviving entity in the merger. Hospitality Trust expects that its acquisition of TravelCenters of America, Inc. will be funded with cash, that TravelCenters of America, Inc.'s debt will be repaid and its credit agreement will be terminated. We expect this transaction to close in early 2007. However, the transaction is subject to certain customary conditions including consents of parties to contracts with TravelCenters of America, Inc. The transaction may be terminated by Hospitality Trust for a material adverse change, as defined in the merger agreement, affecting TravelCenters of America, Inc. Also, the transaction may be terminated by either TravelCenters of America, Inc. or Hospitality Trust:

- •

- if the closing has not occurred prior to June 30, 2007;

- •

- for regulatory reasons; or

- •

- for other reasons customary in transactions of this type.

A copy of the merger agreement between Hospitality Trust and TravelCenters of America, Inc. has been filed as an exhibit to the registration statement of which this prospectus is a part. If you want more information about the merger agreement and the various conditions to closing, you should read the entire merger agreement.

The distribution of our shares is conditioned on the closing of Hospitality Trust's acquisition of Travel Centers of America, Inc.

The Transaction Agreement

In order to govern relations before and after the spin off, prior to the spin off we will enter a transaction agreement with Hospitality Trust and Reit Management. The form of this transaction agreement has been filed as an exhibit to the registration statement of which this prospectus is a part. If you want more information about the actions which have been and will be taken to effect the spin off or about the agreements among us, Hospitality Trust and Reit Management concerning future

15

relations, you should read the entire transaction agreement. The material provisions of the transaction agreement are summarized as follows:

- •

- Simultaneously with Hospitality Trust's closing of its acquisition of TravelCenters of America, Inc., the business of TravelCenters of America, Inc. will be restructured. As a result of the restructuring:

- •

- the real property interests of 146 travel centers which we operate and all trademarks, tradenames and certain other assets held by our predecessor will be transferred to subsidiaries of Hospitality Trust that we do not own;

- •

- we will lease the 146 travel centers owned by Hospitality Trust and we will operate our travel centers business;

- •

- we will continue to own all of our working capital assets (primarily consisting of cash, receivables and inventory) and liabilities (primarily consisting of trade payables and accrued liabilities);

- •

- we will own one travel center in Ontario, Canada, and will lease two travel centers from, and manage one travel center for, owners other than Hospitality Trust; and will be franchisor of 13 travel centers owned and operated by third parties; and will own certain other assets historically owned and used by our predecessor in connection with the travel centers business; and

- •

- Hospitality Trust will contribute cash to us so that the sum of our cash, receivables and inventory, net of trade payables and accrued liabilities, will be about $200 million.

- •

- On the distribution date, Hospitality Trust will distribute all of our shares to its shareholders.

- •

- Our lease with Hospitality Trust will be effective upon completion of the spin off. See "The Company—Our Lease with Hospitality Trust".

- •

- We will enter a management and shared services agreement with Reit Management. See "Management—Management and Shared Services Agreement with Reit Management".

- •

- We will provide Hospitality Trust a right of first refusal to purchase, lease, mortgage or otherwise finance any interest we own in a travel center before we sell, lease, mortgage or otherwise finance that travel center with another party.

- •

- We will grant Hospitality Trust and other affiliates of Reit Management a right of first refusal to acquire or finance any real estate of the types in which they invest before we do.

- •

- We will agree to restrict the ownership of our shares and conduct all of our business activities in a manner which may prevent a change of control of us or a sale of a material portion of our assets. See "Description of Our Shares and Certain Governance Provisions—Restrictions on Share Ownership and Transfer Restrictions".

- •

- We and Hospitality Trust will agree to cooperate in filing tax returns and addressing other tax matters including appropriate allocations of taxable income, expenses and other tax attributes associated with the acquisition and spin off.

- •

- We will agree to indemnify Hospitality Trust for liabilities relating to our business and operations for periods before and after the spin off.

- •

- Hospitality Trust will pay all of the costs and expenses of the spin off and our restructuring.

16

Manner of Effecting the Spin Off

If you hold Hospitality Trust common shares in a brokerage account, our common shares will be credited to your account. If you hold Hospitality Trust common shares in certificated or book entry form with our transfer agent, your ownership of our shares will be recorded on the books of our transfer agent and a statement will be mailed to you. We will not issue certificates representing our common shares. No cash distributions will be paid, and we will issue fractional shares of our common stock in connection with the spin off distribution as necessary. No holder of common shares of Hospitality Trust is required to make any payment, exchange or surrender any shares or take any other action in order to receive our common shares.

DIVIDEND POLICY

We do not expect to pay dividends in the foreseeable future.

CAPITALIZATION

The following table describes our pro forma capitalization as of September 30, 2006, assuming the closing of Hospitality Trust's acquisition of TravelCenters of America, Inc., the related restructuring and the spin off on that date (in 000s).

| | Pro forma for the Hospitality Trust

acquisition, the

restructuring and the spin off

|

|---|

| Capital lease obligations(1) | | $ | 102,628 |

Debt |

|

|

— |

Common equity |

|

|

341,770 |

| | |

|

Total capital |

|

$ |

444,398 |

| | |

|

- (1)

- As a result of our application of Statement of Financial Accounting Standards No. 98 (SFAS 98), which sets forth rules related to sale leaseback transactions, to our expected lease with Hospitality Trust, 13 of the travel centers we expect to lease from Hospitality Trust do not qualify for operating lease treatment, because more than an insignificant portion of these travel centers is sublet to a third party. The amount shown as capital lease obligation will remain on our balance sheet unless and until the subleased portion of these travel centers is reduced to an insignificant level.

THE COMPANY

General

We are a limited liability company formed under Delaware law on October 10, 2006 as a wholly owned subsidiary of Hospitality Trust. Our initial capitalization in a nominal amount was provided by Hospitality Trust on our formation date. Since that time, we have conducted no business activities. As described in more detail elsewhere in this prospectus, Hospitality Trust expects to acquire, indirectly through us, TravelCenters of America, Inc., restructure this acquired business and spin off all of our common shares to the shareholders of Hospitality Trust. Our business will include all of the assets of TravelCenters of America, Inc. not retained by Hospitality Trust, the right and obligation to lease and operate the travel centers retained by Hospitality Trust and cash which Hospitality Trust will contribute to us prior to the spin off.

17

Business Overview

We operate and franchise travel centers primarily along the U.S. interstate highway system. Our customers include long haul trucking fleets and their drivers, independent truck drivers and motorists. At December 11, 2006, our geographically diversified network included 163 travel centers located in 40 states in the U.S. and the province of Ontario, Canada. Many of our travel centers were originally developed more than 25 years ago when prime real estate locations along the interstate highway system were more readily available than they are today, a factor which we believe would make it difficult to replicate a network such as ours. We believe that our nationwide network provides an advantage to long haul trucking fleets by enabling them to reduce the number of their suppliers by routing their trucks within our network from coast to coast.

We offer a broad range of products and services, including diesel fuel and gasoline, truck repair and maintenance services, full service restaurants, more than 20 different QSR brands, travel and convenience stores and other driver amenities.

The U.S. travel center and truck stop industry in which we operate consists of travel centers, truck stops, diesel fuel outlets and similar properties designed to meet the needs of long haul trucking fleets and their drivers, independent truck drivers and motorists. According to the National Association of Truck Stop Operators, or "NATSO", the travel center and truck stop industry is highly fragmented, with in excess of 3,000 travel centers and truck stops located on or near interstate highways nationwide.

History of our Predecessor

TravelCenters of America, Inc., or our predecessor, was formed in December 1992 by a group of institutional investors. In April 1993 our predecessor acquired the travel center assets of Unocal Corporation, or Unocal. The Unocal network included 139 travel centers, of which 95 were leased to operators, 42 were franchisee operated and two were operated by our predecessor. The Unocal network operated principally as a fuel wholesaler and franchisor.

In December 1993 our predecessor acquired the travel center assets of The British Petroleum Company plc., or BP. The BP network included 38 company operated and six franchisee operated travel centers. In contrast to the Unocal network, the BP network operated principally as an owner operator of travel centers.

In January 1997 our predecessor restructured its operating strategy to align the operation of the then 122 travel center Unocal network and the then 49 travel center BP network into a single network operated under the "TravelCenters of America" and "TA" brand names.

Network Development

Since 1997 a number of steps have increased the consistency of our brands and otherwise made our network more appealing to potential customers. During that period, our predecessor:

- •

- acquired 50 travel centers, including three multi-property acquisitions of more than ten travel centers;

- •

- designed, developed and constructed five travel centers;

- •

- took over the operations of 51 travel centers which we previously leased to third parties;

- •

- razed and rebuilt eight travel centers;

- •

- reduced the net number of franchised travel centers by 22; and

- •

- sold or closed 41 travel centers which were duplicative or nonstrategic.

18

Re-imaging Program. Since 1997 our predecessor has pursued a capital program to upgrade, rebrand and otherwise re-image our travel centers. Through September 30, 2006, re-image projects have been completed at 40 of our travel centers at an average investment of $2.1 million each. These re-image projects typically include the addition of standardized architectural features to building facades, expansion of the square footage of travel and convenience stores, addition of a food court with two or three QSRs, renovation of showers and restrooms and updates to our full service restaurants. Also, through September 30, 2006, smaller scale re-image projects, which typically do not involve expansion of the building or addition of a food court, at another 78 travel centers have been completed at an average cost of $0.3 million each.

Freightliner Agreement. Since 1999 our predecessor has been party to an agreement with Freightliner LLC, a DaimlerChrysler company. Freightliner is the leading manufacturer of heavy trucks in North America. We are an authorized provider of repair work and specified warranty repairs to Freightliner's customers through the Freightliner ServicePoint Program®. Our truck maintenance and repair facilities are part of Freightliner's 24 hour customer assistance database for emergency and roadside repair referrals and we have access to Freightliner's parts distribution, service and technical information systems.

Maintenance and Repair Capacity Expansion Program. Since 2004 our predecessor has built additional truck maintenance and repair bays at existing travel centers in our network. We believe that additional maintenance and repair bays increase the revenue generating capacity of our maintenance and repair facilities by increasing productivity and reducing customer wait times. The number of our maintenance and repair bays has increased since 2004 by about 100 bays to over 400 bays at September 30, 2006.

Our Growth Strategy

Expansion through Organic Growth. We plan to continue the standardization of our travel centers and to increase the services we offer to attract professional truck drivers and motorists. We have identified eight additional travel centers that we operate that we intend to re-image and one travel center which we intend to raze and rebuild over the next two to three years. We have also identified travel centers at which we believe we can add 40 maintenance and repair bays during that same time period. We believe that we have other opportunities to increase our revenues, including, but not limited to, the expansion of the number of gasoline lanes at several of our travel centers to increase the number of gasoline customers serviced simultaneously, continued investment in our capital improvement program to keep our properties efficient and appealing to customers and continuing our customer loyalty and customer satisfaction programs.

Expansion through Acquisition. There are locations along the U.S. and Canadian interstate highway system that we consider to be strategic but in which we do not have an adequate presence. We believe that our existing network affords us the opportunity to make acquisitions of travel centers that may benefit from becoming part of our network, and we intend to pursue such acquisitions. Our predecessor purchased a travel center in Illinois in November 2006 and converted it to the TA brand. Although we have not identified other specific acquisition opportunities at this time, we regularly evaluate opportunities to expand our network through acquisitions, some of which may be significant in size. We expect that some or all of these acquisitions will be made by Hospitality Trust and that the acquired travel centers will be leased to us.

Expansion through Development. We plan to continue expansion of our network by building new travel centers. We have developed a "prototype" design and a smaller "protolite" design to standardize new travel centers. The prototype and protolite designs combine efficient site plans with nationally branded QSRs and offer a broad range of products and services. Since 1999 our predecessor has constructed seven travel centers in the prototype design and five travel centers in the protolite design.

19

Our prototype design is generally appropriate for markets in which we can obtain large parcels of land and which have sufficient demand to support a full service restaurant. In contrast, our protolite design requires significantly less land and enables us to quickly gain a presence in certain markets at lower costs. As of September 30, 2006, we owned two parcels of land, one in Texas and one in California, on which development of new travel centers has begun. We also have a third parcel of land in Texas under agreement for acquisition; if we acquire this parcel, we intend to build a new travel center on it for opening in 2008.

Expansion through Franchising. In some cases, we may find that opportunities to expand our network are not available to us as development or acquisition opportunities. In those cases, we may seek to expand our franchisee network.

Our Network

We expect that upon completion of the spin off our travel center network will consist of:

- •

- 136 travel centers leased from Hospitality Trust and operated by us;

- •

- ten travel centers leased from Hospitality Trust and subleased to and operated by our franchisees;

- •

- one travel center that we operate on a site we own in Canada;

- •

- three travel centers that we operate on sites owned by parties other than Hospitality Trust; and

- •

- 13 travel centers that are owned and operated by our franchisees.

Our typical travel center contains:

- •

- over 20 acres of land with parking for 170 tractor trailers and 100 cars;

- •

- a 150 seat, full service restaurant and one to three QSRs that we operate as a franchisee under various brands;

- •

- a truck repair facility and parts store;

- •

- multiple diesel and gasoline fueling points; and

- •

- a travel and convenience store, game room, lounge and other amenities for professional truck drivers and motorists.

In addition, some travel centers include a hotel.

Our travel centers are designed to appeal to drivers whether they seek a quick stop or a more extended visit. Substantially all of our travel centers are full service sites located on or near an interstate highway and offer fuel and non-fuel products and services 24 hours per day, 365 days per year.

Properties. The physical layouts of the travel centers in our network vary from site to site. The majority of the developed acreage at our travel centers consists of truck and car fuel islands, separate truck and car parking lots, a main building, which contains a full service restaurant and one or more QSRs, a travel and convenience store, a truck maintenance and repair shop and other amenities.

Product and Service Offering. We offer diverse products and services to complement our diesel fuel business, including:

- •

- Gasoline. We sell branded and unbranded gasoline. Of the 163 travel centers in our network as of December 11, 2006, branded gasoline is offered at 118 travel centers and unbranded gasoline is offered at 32 travel centers. Only 13 of our travel centers do not sell gasoline.

20

- •

- Full Service Restaurants and QSRs. Most of our travel centers have both full service restaurants and QSRs that offer customers a wide variety of nationally recognized branded food choices. The substantial majority of our full service restaurants are operated under the "Country Pride®," "Buckhorn Family Restaurants®" and "Fork in the Road®" brands, which we have the right to use under our lease, and offer menu table service and buffets. We also offer more than 20 different brands of QSRs, including Arby's®, Burger King®, Pizza Hut®, Popeye's Chicken & Biscuits®, Sbarro®, Starbuck's Coffee®, Subway® and Taco Bell®. As of September 30, 2006, 149 of our travel centers included a full service restaurant, 114 of our travel centers offered at least one branded QSR and there were a total of 223 QSRs in our network. The restaurants in travel centers we operate are staffed by our employees.

- •

- Truck Repair and Maintenance Shops. All but four of our network travel centers have truck repair and maintenance shops. The typical repair and maintenance shop has between two and six service bays and a parts storage room and is staffed by our mechanics. These shops generally operate 24 hours per day, 365 days per year, and offer extensive maintenance and emergency repair and road services, ranging from basic services such as oil changes and tire repair to specialty services such as diagnostics and repair of air conditioning, air brake and electrical systems. Our work is backed by a warranty honored at all of our repair and maintenance facilities. As described above, our truck repair and maintenance facilities provide certain warranty work on Freightliner brand trucks through our participation in the Freightliner ServicePoint® program.

- •

- Travel and Convenience Stores. Each of our travel centers has a travel and convenience store which offers merchandise to truck drivers, motorists, recreational vehicle operators and bus drivers and passengers. Each travel and convenience store has a selection of over 4,000 items, including food and snack items, beverages, non-prescription drug and beauty aids, batteries, automobile accessories, and music and video products. In addition to complete travel and convenience store offerings, the stores sell items specifically designed for the truck driver's on the road lifestyle, including laundry supplies, clothing and truck accessories. Most of our stores also have a "to go" snack bar as an additional food offering.

- •

- Additional Driver Services. We believe that trucking fleets can improve the retention and recruitment of truck drivers by directing them to visit high quality, full service travel centers. We strive to provide a consistently high level of service and amenities to professional truck drivers at all of our travel centers, making our network an attractive choice for trucking fleets. Most of our travel centers provide truck drivers with access to specialized business services, including an information center where drivers can send and receive faxes, overnight mail and other communications and a banking desk where drivers can cash checks and receive funds transfers from fleet operators. The typical travel center also has a video game room, a laundry area with washers and dryers, private shower areas and areas designated for truck drivers only, including a television room with a video player and comfortable seating for drivers.

- •

- Marketing. We offer truck drivers a "loyal fueler" program, called the RoadKing ClubSM, that is similar to the frequent flyer programs offered by airlines. Drivers receive a point for each gallon of diesel fuel purchased and each dollar spent on selected non-fuel products and services. These points can be redeemed for discounts on non-fuel products and services at any of our travel centers. We publish a bi-monthly magazine called "Road KingSM" which includes articles and advertising of interest to professional truck drivers.

- •

- Hotels. Our network includes 21 travel centers that offer hotels with an average capacity of 38 rooms. Generally, these hotels are operated under franchise contracts with nationally branded chains, including Days Inn®, HoJo Inn®, Knight's Inn®, Rodeway® and Travelodge®. Because many newer trucks used for long distance freight are equipped with sleeping areas, we are

21

Operations

Fuel supply. We purchase diesel fuel from various suppliers at rates that fluctuate with market prices and generally are reset daily, and resell fuel to our customers at prices that we establish daily. By establishing supply relationships with an average of four to five alternate suppliers per location, we believe we are able to effectively create competition for our purchases among various diesel fuel suppliers on a daily basis. We also believe that purchasing arrangements with multiple diesel fuel suppliers may help us avoid product outages during times of diesel fuel supply disruptions. We have a single source of supply for gasoline at most of our travel centers that offer branded gasoline; our travel centers selling unbranded gasoline generally purchase gasoline from multiple sources.

Generally our fuel purchases are delivered directly from suppliers' terminals to our travel centers. We do not contract to purchase substantial quantities of fuel to keep as inventory. Therefore we are exposed to price increases and interruptions in supply. We generally have less than three days of diesel fuel inventory at our travel centers. We believe our exposure to market price increases for diesel fuel is mitigated by the significant percentage of our total diesel fuel sales volume that is sold under pricing formulas that are indexed to market prices, which reset daily. We do not engage in any fixed price fuel contracts with customers. We may engage, from time to time, in a minimal level of hedging of the price of our fuel purchases with futures and other derivative instruments that primarily are traded on the New York Mercantile Exchange. We had no derivative instruments as of September 30, 2006.

Non-fuel products supply. We have many sources for the large variety of non-fuel products that we sell. We have developed strategic relationships with several suppliers of key non-fuel products, including Freightliner LLC for truck parts, Bridgestone/Firestone Tire Sales Company for truck tires and ExxonMobil for Mobil brand lubricants and oils. We believe that our relationships with these and our other suppliers are satisfactory.

Centralized purchasing and distribution. We maintain a distribution center near Nashville, Tennessee with 85,000 square feet of space. Our distribution center distributes a variety of non-fuel and non-perishable products to our travel center network using a combination of contract carriers and our fleet of trucks and trailers. We believe we realize cost savings by using our consolidated purchasing power to negotiate volume discounts with our suppliers and that using our own national distribution center helps us control shipping charges.

Our Travel Centers

Our travel centers are geographically diversified, located in 39 states in the U.S. and in Ontario, Canada. The travel centers we operate and their significant services and amenities are generally described in the chart below. Each of these properties will be owned by Hospitality Trust and leased by us.

City

| | State

| | Total

acres

| | Building

area

| | Car

parking

spaces

| | Truck

parking

spaces

| | Gasoline

lanes

| | #

Diesel

lanes

| | Store

sales

area

| | Full

service

restaurant

| | Truck

repair

facility

| | QSRs

| | Hotel

|

|---|

| Mobile | | AL | | 15 | | 16,685 | | 77 | | 89 | | * | | 6 | | 1,722 | | * | | * | | | | |

| Tuscaloosa | | AL | | 15 | | 28,619 | | 140 | | 151 | | * | | 10 | | 2,491 | | * | �� | * | | * | | |

| Prescott | | AR | | 26 | | 19,202 | | 144 | | 292 | | * | | 10 | | 2,500 | | * | | * | | * | | |

| West Memphis | | AR | | 47 | | 21,895 | | 76 | | 170 | | * | | 8 | | 2,660 | | * | | * | | * | | |

| Eloy | | AZ | | 22 | | 26,269 | | 87 | | 234 | | * | | 12 | | 2,820 | | * | | * | | * | | |

22

| Kingman | | AZ | | 28 | | 13,231 | | 100 | | 115 | | * | | 9 | | 2,100 | | * | | * | | * | | |

| Tonopah | | AZ | | 53 | | 21,475 | | 80 | | 407 | | * | | 12 | | 3,000 | | * | | * | | * | | |

| Willcox | | AZ | | 21 | | 16,459 | | 75 | | 229 | | * | | 8 | | 2,600 | | * | | * | | * | | |

| Barstow | | CA | | 25 | | 24,654 | | 122 | | 303 | | * | | 16 | | 3,500 | | * | | * | | * | | |