UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☑

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2019

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-36498

CELLULAR BIOMEDICINE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 86-1032927 |

| State of Incorporation | | IRS Employer Identification No. |

1345 Avenue of Americas, 15th Floor

New York, New York 10105

(Address of principal executive offices)

(347) 905 5663

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 | CBMG | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period than the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “accelerated filer,” and “large accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of August 1, 2019, there were 20,308,164 and 19,252,665 shares of common stock, par value $.001 per share, issued and outstanding, respectively.

TABLE OF CONTENTS

| PART I FINANCIAL INFORMATION | |

| | | |

| | 3 |

| | | |

| | | 3 |

| | | |

| | | 4

|

| | | |

| | | 5 |

| | | |

| | | 6 |

| | | |

| | | 8 |

| | | |

| | 22 |

| | | |

| | 41 |

| | | |

| | 43 |

| | | |

| PART II OTHER INFORMATION | |

| | | |

| | 44 |

| | | |

| | 44 |

| | | |

| | 46

|

| | | |

| | 46

|

| | | |

| | 46

|

| | | |

| | 46

|

| | | |

| | 47

|

| | | |

| 48

|

PART I – FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements (Unaudited)

CELLULAR BIOMEDICINE GROUP, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF JUNE 30, 2019 AND DECEMBER 31, 2018

| | |

| | |

| | | |

| Assets | | |

| Cash and cash equivalents | $39,713,746 | $52,812,880 |

| Restricted cash | 17,000,000 | - |

| Accounts receivable, less allowance for doubtful accounts of nil and $94,868 as of June 30, 2019 and December 31, 2018, respectively | - | 787 |

| Other receivables | 440,847 | 101,909 |

| 2,262,527 | 1,692,135 |

| Total current assets | 59,417,120 | 54,607,711 |

| | | |

| Investments | 240,000 | 240,000 |

| Property, plant and equipment, net | 19,992,728 | 15,193,761 |

| Right of use | 15,203,003 | 15,938,203 |

| Goodwill | 7,678,789 | 7,678,789 |

| Intangibles, net | 7,868,803 | 7,970,692 |

| Long-term prepaid expenses and other assets | 7,286,803 | 5,952,193 |

| Total assets (1) | $117,687,246 | $107,581,349 |

| | | |

| Liabilities and Stockholders' Equity | | |

| | | |

| Liabilities: | | |

| Short-term debt | $14,546,035 | $- |

| Accounts payable | 1,351,930 | 422,752 |

| Accrued expenses | 1,058,273 | 1,878,926 |

| Taxes payable | 28,950 | 28,950 |

| Other current liabilities | 5,186,335 | 5,710,578 |

| Total current liabilities | 22,171,523 | 8,041,206 |

| | | |

| Other non-current liabilities | 13,338,721 | 14,321,751 |

| Total liabilities (1) | 35,510,244 | 22,362,957 |

| | | |

| Commitments and Contingencies (note 12) | | |

| | | |

| Stockholders' equity: | | |

| Preferred stock, par value $.001, 50,000,000 shares authorized; none issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | - | - |

Common stock, par value $.001, 300,000,000 shares authorized; 20,301,425 and 19,120,781 issued; and 19,245,926 and 18,119,282 outstanding, as of June 30, 2019 and December 31, 2018, respectively

| 20,301 | 19,121 |

| Treasury stock at cost; 1,055,499 and 1,001,499 shares of common stock as of June 30, 2019 and December 31, 2018, respectively | (14,992,694) | (13,953,666) |

| Additional paid in capital | 270,033,960 | 250,604,618 |

| Accumulated deficit | (171,415,974) | (149,982,489) |

| Accumulated other comprehensive loss | (1,468,591) | (1,469,192) |

| Total stockholders' equity | 82,177,002 | 85,218,392 |

| | | |

| Total liabilities and stockholders' equity | $117,687,246 | $107,581,349 |

(1)

The Company’s consolidated assets as of June 30, 2019 and December 31, 2018 included $44,532,828 and $40,254,691, respectively, of assets of variable interest entities, or VIEs, that can only be used to settle obligations of the VIEs. Each of the following amounts represent the balances as of June 30, 2019 and December 31, 2018, respectively. These assets include cash and cash equivalents of $861,817 and $2,376,974; other receivables of $70,097 and $61,722; prepaid expenses of $2,164,997 and $1,497,072; property, plant and equipment, net, of $19,335,743 and $14,280,949; right of use of $14,721,084 and $15,431,554; intangibles of $1,307,398 and $1,412,375; and long-term prepaid expenses and other assets of $6,071,692 and $5,194,045. The Company’s consolidated liabilities as of June 30, 2019 and December 31, 2018 included $33,421,139 and $20,548,793, respectively, of liabilities of the VIEs whose creditors have no recourse to the Company. These liabilities include short-term debt of $14,546,035 and nil; accounts payable of $1,318,249 and $359,980; other payables of $3,917,065 and $4,937,541; payroll accrual of $718,740 and $1,367,658, which mainly includes bonus accrual of $714,505 and $1,358,709; deferred income of nil and $6,280; and other non-current liabilities of $12,921,050 and $13,877,334. See further description in Note 3, Variable Interest Entities.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CELLULAR BIOMEDICINE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2019 AND 2018

| | For the Three Months Ended | |

| | | |

| | | | | |

| | | | | |

| Net sales and revenue | $- | $77,313 | $49,265 | $128,274 |

| | | | | |

| Operating expenses: | | | | |

| Cost of sales | - | 54,393 | 8,087 | 76,693 |

| General and administrative | 3,180,709 | 3,121,695 | 6,628,443 | 6,310,492 |

| Selling and marketing | 41,252 | 92,880 | 83,512 | 167,465 |

| Research and development | 9,062,526 | 6,166,556 | 15,030,622 | 11,440,507 |

| Impairment of long-term investments | - | 29,424 | - | 29,424 |

| Total operating expenses | 12,284,487 | 9,464,948 | 21,750,664 | 18,024,581 |

| Operating loss | (12,284,487) | (9,387,635) | (21,701,399) | (17,896,307) |

| | | | | |

| Other income : | | | | |

| Interest income, net | 182,017 | 116,835 | 279,051 | 122,284 |

| Other income (expense), net | 7,123 | 84,724 | (7,387) | 93,924 |

| Total other income | 189,140 | 201,559 | 271,664 | 216,208 |

| Loss before taxes | (12,095,347) | (9,186,076) | (21,429,735) | (17,680,099) |

| | | | | |

| Income taxes provision | (1,350) | - | (3,750) | (2,400) |

| Net loss | $(12,096,697) | $(9,186,076) | $(21,433,485) | $(17,682,499) |

| Other comprehensive income (loss): | | | | |

| Cumulative translation adjustment | (395,525) | (1,120,722) | 601 | (302,361) |

| Total other comprehensive income (loss): | (395,525) | (1,120,722) | 601 | (302,361) |

| Comprehensive loss | $(12,492,222) | $(10,306,798) | $(21,432,884) | $(17,984,860) |

| | | | | |

| Net loss per share : | | | | |

| Basic and diluted | $(0.63) | $(0.53) | $(1.15) | $(1.03) |

| Weighted average common shares outstanding: | | | | |

| Basic and diluted | 19,223,113 | 17,487,184 | 18,690,729 | 17,116,944 |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CELLULAR BIOMEDICINE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE SIX MONTHS ENDED JUNE 30, 2019 AND 2018

| | |

| | |

| | | |

| | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

| Net loss | $(21,433,485) | $(17,682,499) |

| Adjustments to reconcile net loss to net cash | | |

| used in operating activities: | | |

| Depreciation and amortization | 2,659,038 | 2,486,145 |

| Loss on disposal of assets | 92,487 | 2,721 |

| Stock based compensation expense | 2,113,535 | 2,477,614 |

| Other than temporary impairment on long-term investments | - | 29,424 |

| Interest expense | 158,430 | - |

| Interest from pledged bank deposits | (317,696) | - |

| Changes in operating assets and liabilities: | | |

| Accounts receivable | 785 | 66,451 |

| Other receivables | (19,821) | 20,006 |

| Prepaid expenses | (572,978) | (579,479) |

| Long-term prepaid expenses and other assets | (978,505) | (649,262) |

| Accounts payable | 333,463 | 114,249 |

| Accrued expenses | (818,327) | (9,892) |

| Deferred income | - | (4,515) |

| Other current liabilities | 205,632 | 166,870 |

| Other non-current liabilities | (74,105) | (93,732) |

| Net cash used in operating activities | (18,651,547) | (13,655,899) |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | |

| Proceeds from disposal of assets | 359 | - |

| Putting six-month deposits with the banks | - | (10,000,000) |

| Purchases of intangibles | (752,449) | (34,172) |

| Purchases of assets | (7,468,850) | (2,167,527) |

| Net cash used in investing activities | (8,220,940) | (12,201,699) |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | |

| Net proceeds from the issuance of common stock | 17,166,199 | 30,506,521 |

| Proceeds from exercise of stock options | 150,788 | 1,165,763 |

| Proceeds from short-term debt | 14,546,035 | - |

| Interest paid | (145,159) | - |

| Repurchase of treasury stock | (1,039,028) | (2,536,064) |

| Net cash provided by financing activities | 30,678,835 | 29,136,220 |

| | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | 94,518 | (61,177) |

| | | |

| INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | 3,900,866 | 3,217,445 |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF PERIOD | 52,812,880 | 21,568,422 |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF PERIOD | $56,713,746 | $24,785,867 |

| | | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | |

| | | |

| Cash paid for income taxes | $3,750 | $2,400 |

| | | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash in condensed consolidated statements of cash flows: |

| Restricted cash | $17,000,000 | $- |

| Cash and cash equivalents | 39,713,746 | 24,785,867

|

| | | |

| Cash, cash equivalents and restricted cash | $56,713,746 | $24,785,867

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CELLULAR BIOMEDICINE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (UNAUDITED)

FOR THE THREE MONTHS ENDED JUNE 30, 2019 AND 2018

| | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| Balance at March 31, 2019 | 20,182,654 | $20,183 | - | $- | (1,055,499) | $(14,992,694) | $267,875,883 | $(159,319,277) | $(1,073,066) | $92,511,029 |

| | | | | | | | | | | |

| Common stock issued with public offering | 77,549 | 78 | - | - | - | - | 1,127,617 | - | - | 1,127,695 |

| Restricted stock grants | 37,467 | 37 | - | - | - | - | 402,264 | - | - | 402,301 |

| Accrual of stock options | - | - | - | - | - | - | 586,672 | - | - | 586,672 |

| Exercise of stock options | 3,755 | 3 | - | - | - | - | 41,524 | - | - | 41,527 |

| Treasury stock purchase | - | - | - | - | - | - | - | - | - | - |

| Foreign currency translation | - | - | - | - | - | - | - | - | (395,525) | (395,525) |

| Net loss | - | - | - | - | - | - | - | (12,096,697) | - | (12,096,697) |

| | | | | | | | | | | |

| Balance at June 30, 2019 | 20,301,425 | $20,301 | - | $- | (1,055,499) | $(14,992,694) | $270,033,960 | $(171,415,974) | $(1,468,591) | $82,177,002 |

| | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| Balance at March 31, 2018 | 17,453,623 | $17,454 | - | $- | (464,256) | $(4,693,597) | $205,102,775 | $(119,533,420) | $428,858 | $81,322,070 |

| | | | | | | | | | | |

| Common stock issued with PPM | - | - | - | - | - | - | (2,149) | - | - | (2,149) |

| Restricted stock grants | 19,771 | 20 | - | - | - | - | 451,550 | - | - | 451,570 |

| Accrual of stock options | - | - | - | - | - | - | 891,163 | - | - | 891,163 |

| Exercise of stock options | 29,844 | 29 | - | - | - | - | 396,011 | - | - | 396,040 |

| Treasury stock purchase | - | - | - | - | (96,512) | (1,820,396) | -

| - | - | (1,820,396) |

| Foreign currency translation | - | - | - | - | - | - | - | - | (1,120,722) | (1,120,722) |

| Net loss | - | - | - | - | - | - | - | (9,186,076) | - | (9,186,076) |

| | | | | | | | | | | |

| Balance at June 30, 2018 | 17,503,238 | $17,503 | - | $- | (560,768) | $(6,513,993) | $206,839,350 | $(128,719,496) | $(691,864) | $70,931,500 |

Note: No dividend was declared for the three months ended June 30, 2019 and 2018.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CELLULAR BIOMEDICINE GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(UNAUDITED)

FOR THE SIX MONTHS ENDED JUNE 30, 2019 AND 2018

| | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| Balance at December 31, 2018 | 19,120,781 | $19,121 | - | $- | (1,001,499) | $(13,953,666) | $250,604,618 | $(149,982,489) | $(1,469,192) | $85,218,392 |

| | | | | | | | | | | |

| Common stock issued with public offering | 1,106,961 | 1,107 | - | - | - | - | 17,165,092 | - | - | 17,166,199 |

| Restricted stock grants | 57,520 | 57 | - | - | - | - | 744,183 | - | - | 744,240 |

| Accrual of stock options | - | - | - | - | - | - | 1,369,295 | - | - | 1,369,295 |

| Exercise of stock options | 16,163 | 16 | - | - | - | - | 150,772 | - | - | 150,788 |

| Treasury stock purchase | - | - | - | - | (54,000) | (1,039,028) | - | - | - | (1,039,028) |

| Foreign currency translation | - | - | - | - | - | - | - | - | 601 | 601 |

| Net loss | - | - | - | - | - | - | - | (21,433,485) | - | (21,433,485) |

| | | | | | | | | | | |

| Balance at June 30, 2019 | 20,301,425 | $20,301 | - | $- | (1,055,499) | $(14,992,694) | $270,033,960 | $(171,415,974) | $(1,468,591) | $82,177,002 |

| | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| Balance at December 31, 2017 | 15,615,558 | $15,616 | - | $- | (426,794) | $(3,977,929) | $172,691,339 | $(111,036,997) | $(389,503) | $57,302,526 |

| | | | | | | | | | | |

| Common stock issued with PPM | 1,719,324 | 1,719 | - | - | - | - | 30,504,802 | - | - | 30,506,521 |

| Restricted stock grants | 36,082 | 36 | - | - | - | - | 881,872 | - | - | 881,908 |

| Accrual of stock options | - | - | - | - | - | - | 1,595,706 | - | - | 1,595,706 |

| Exercise of stock options | 132,274 | 132 | - | - | - | - | 1,165,631 | - | - | 1,165,763 |

| Treasury stock purchase | - | - | - | - | (133,974) | (2,536,064) | -

| - | - | (2,536,064) |

| Foreign currency translation | - | - | - | - | - | - | - | - | (302,361) | (302,361) |

| Net loss | - | - | - | - | - | - | - | (17,682,499) | - | (17,682,499) |

| | | | | | | | | | | |

| Balance at June 30, 2018 | 17,503,238 | $17,503 | - | $- | (560,768) | $(6,513,993) | $206,839,350 | $(128,719,496) | $(691,864) | $70,931,500 |

Note: No dividend was declared for the six months ended June 30, 2019 and 2018.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CELLULAR BIOMEDICINE GROUP, INC.

FOR THE THREE MONTHS ENDED MARCH 31, 2019 AND 2018

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – DESCRIPTION OF BUSINESS

As used in this quarterly report, "we", "us", "our", "CBMG", "Company" or "our company" refers to Cellular Biomedicine Group, Inc. and, unless the context otherwise requires, all of its subsidiaries and variable interest entities.

Overview

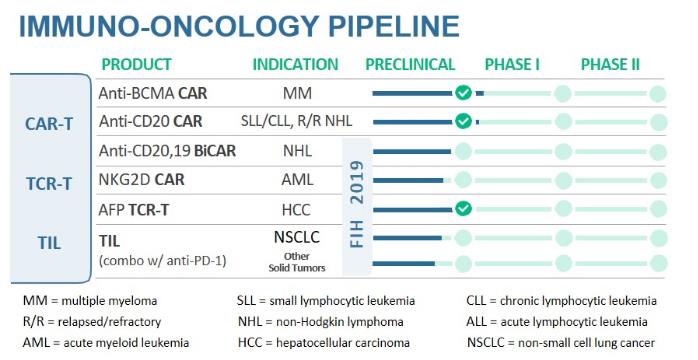

We are a clinical-stage biopharmaceutical company committed to using our proprietary cell-based technologies to develop immunotherapies for the treatment of cancer and stem cell therapies for the treatment of degenerative diseases. We view ourselves as a leader in cell therapy industry through our diverse, multi-target, broad pipeline ranging from immune-oncology, featuring CAR-T, TCR-T and TIL to regenerative medicine. Our focus is to bring our products to market and reduce the manufacturing cycle time, the aggregate cost and ensure quality products of cell therapies. We provide comprehensive and integrated research and manufacturing services throughout the discovery, development and manufacturing spectrum for cell-based technologies. We have two major components to our global strategy. Firstly, we intend on developing our own internal pipeline, focusing on immune cell therapy, regenerative medicine, as well as other innovative biotechnology modalities that can leverage our infrastructure, human capital and intellectual property. Secondly, we plan to partner with leading companies to monetize our innovative technologies outside of China and may also seek to bring their technologies to the China market.

Our end-to-end platform enables discovery, development and manufacturing of cell-based therapies from concept to commercial manufacturing in a cost-efficient manner. The manufacturing and delivery of cell therapies involve complex, integrated processes, comprised of harvesting T cells from patients, T cell isolation, activation, viral vector transduction and GMP grade purification. Our in-house cell therapy manufacturing is comprised of semi-automated, fully closed system and high quality plasmid, serum-free reagents as well as viral vector for our immune-oncology products. Because we are vertically integrated we are able to reduce the aggregate cost of cell therapies. We plan to build out our manufacturing capacity to scale for commercial supply at an economical cost. We hone our manufacturing process in our GMP facilities in China to address cycle time reduction, improved quality assurance and control, efficiency and our therapies’ efficacy.

Our technology includes two major cell platforms:

A.

Immune cell therapy for treatment of a broad range of cancer indications.

i.

Chimeric Antigen Receptor modified T cells (CAR-T); and

i.

T cells with genetic modified, tumor antigen-specific T-cell receptors (TCRs); and

ii.

Next generation neoantigen-reactive, bio-marker based tumor infiltrating lymphocytes (TILs).

B.

Regenerative Medicines using human adipose-derived mesenchymal progenitor cells (haMPC) for treatment of joint diseases.

a.

Allogeneic haMPC on Knee Osteoarthritis; and

b.

Autologous haMPC on Knee Osteoarthritis.

Our primary target market is China, where we believe that our cell-based therapies will be able to help patients with high unmet medical needs. For hematological cancer we:

●

Have initiated patient recruitment in China for our Phase I clinical trial of our B cell maturation antigen, or anti-BCMA, CAR-T therapy for the treatment of multiple myeloma. We have submitted our pre-IND meeting application with the NMPA and are waiting for feedback.

●

Have initiated patient recruitment in China for our Phase 1 investigator initiated clinical trial of anti-CD20 Chimeric Antigen Receptor T-Cell (“CAR-T”) targeting anti-CD19 treated, relapsed diffuse large B-cell lymphoma (“DLBCL”) and small B-cell lymphoma patients.

●

Plan to initiate first-in-human non-Hodgkin lymphoma clinical trials in China for our CD19 and CD20 bi-specific CAR by the fourth quarter of 2019.

For solid tumors we plan to initiate first-in-human:

●

Hepatocellular carcinoma (“HCC”) TCR clinical trials in China within a year; and

●

Non-small cell lung cancer (“NSCLC”) TIL clinical trials in the U.S. within a year.

On the regenerative medicine development we have been approved by the National Medical Products Administration, or NMPA, in China to initiate a Phase II clinical trial of AlloJoin®, our allogenic haMPC therapy for the treatment of knee osteoarthritis, which represents the first stem cell drug application approved by the NMPA for a Phase II clinical trial in knee osteoarthritis since the NMPA clarified its cell therapy regulations in December 2017. Using data from our Phase IIb clinical studies before the NMPA clarified its cell therapy regulations, we have submitted our IND application with the NMPA for our autologous knee osteoarthritis and are awaiting feedback.

When and if the data of our China based, immuno-oncology clinical trials proves to be positive, our intentions are to submit Investigational New Drug (IND) applications with the United States Food and Drug Administration (FDA) in order to conduct clinical trials in the United States.

In addition to our own internal clinical pipelines, we have formed, and plan to continue to seek, partnerships with other cell therapy focused companies as it pertains to building out their technology in the Chinese market. Our comprehensive capabilities have attracted global pharmaceutical companies seeking to improve the efficiency of their drug development. We believe that we are positioned to capture opportunities from the rapid expansion of global pharmaceutical companies by leveraging our focus on cell manufacturing process improvement, which offers the benefits of improving product quality and creates cost savings. Positioned at the forefront of science, we believe our established clinical network in China will enable us to collaborate with those firms as they enter the Chinese market, develop in-house capabilities and infrastructure, and improve efficiency throughout the drug development process.

In September 2018, we executed a License and Collaboration Agreement (hereinafter “Novartis LCA”) with Novartis to manufacture and supply their FDA-approved CAR-T cell therapy product Kymriah® in China. Pursuant to the Novartis LCA agreement, we also granted Novartis a worldwide license to certain of our CAR-T intellectual property for the development, manufacturing and commercialization of CAR-T products. We are entitled to an escalating single digit percentage royalty of Kymriah®’s net sales in China. CBMG is responsible for the costs of bi-directional technology transfers between the two companies. We will receive collaboration payments equal to a single-digit escalating percentage of net sales of Kymriah® in China, subject to certain caps set forth under the Novartis LCA, for sales in diffuse large B-cell lymphoma and pediatric acute lymphoblastic leukemia indications and up to a maximum amount to be agreed upon for sales in other indications. We are also obligated to assist Novartis with the development of Kymriah® in China as Novartis may request and is responsible for a certain percentage of the total development costs for development of Kymriah® in China for indications other than diffuse large B-cell lymphoma and pediatric acute lymphoblastic leukemia indications.

On October 2, 2018, we partnered with the National Cancer Institute (“NCI”) by entering into a non-exclusive license agreement (the “License Agreement”) for 10 patents, pursuant to which we acquired rights to the worldwide development, manufacture and commercialization of autologous, tumor-reactive lymphocyte adoptive cell therapy products, isolated from tumor infiltrating lymphocytes for the treatment of non-small cell lung, stomach, esophagus, colorectal, and head and neck cancer(s) in humans. We agreed to pay certain license fees for such right, including (i) an initial upfront cash payment; (ii) a de minimus non-refundable annual royalty that may be credited against any earned royalties due from net sales; (iii) a small single-digit percentage of net sales of the licensed products, payable on a semi-annual basis, which may be adjusted downward in the event that the Company must pay a license fee to a third party; (iv) an additional small single-digit sublicense fee on the fair market value of any consideration received for granting a sublicense; and (v) milestone payment component tied to certain clinical and commercial developments. We have an unilateral right to terminate the License Agreement. The NCI has the right to terminate the License Agreement if CBMG (i) commits material breach; (ii) fails to use commercially reasonable effort in developing the licensed products or processes; (iii) fails to achieve certain performance benchmarks; (iv) willfully makes a false statement; (v) is not keeping licensed products or processes reasonably available to the public after commercial use; (vi) cannot reasonably satisfy unmet health and safety needs; or (vii) cannot meet certain requirements by federal regulations. The agreement became effective upon execution by both parties and will expire upon the expiration of the last to expire of patent rights licensed pursuant thereto. Other than an initial upfront payment and a de minimus annual royalty payment, the Company has not paid any royalty under the License Agreement as of the date of this report.

In order to expedite fulfillment of patient treatment, we have been actively developing technologies and products with strong intellectual property protection. CBMG’s world-wide exclusive license to the T Cell patent rights owned by the Augusta University provides an opportunity to expand the application of CBMG’s cancer therapy-enabling technologies and to initiate clinical trials with leading cancer hospitals. On February 14, 2019, Augusta University granted us an exclusive, world-wide license with sublicense rights to its the patent rights to Human Alpha Fetoprotein-Specific T Cell Receptors. In consideration for the license granted, the Company agreed to pay the university a one-time, non-refundable, non-creditable license fee within 30 days of execution of the license agreement and a single digit percent of running royalty on net sales of the licensed products . The Company also agreed to (a) use its commercially reasonable efforts to develop and conduct such research, development and validation studies as necessary or desirable to obtain all regulatory approvals to manufacture and market the licensed products in at least one country in certain major markets listed in the license agreement, and (b) upon receipt of such approvals, to use commercially reasonable efforts to market, each licensed product in such country. The Company, at its sole expense, has the obligation to fund the costs of all research, development, preclinical and clinical trials, regulatory approval and commercialization of the licensed products. The license agreement will expire upon the termination of the Company’s obligation to pay royalty pursuant to the terms thereof. Upon expiration of the term, the license granted the Company will survive the expiration of the Agreement, and convert to a perpetual, fully paid up license. The Company may terminate the agreement, in its sole discretion, upon thirty (30) days prior written notice to Augusta University and either party may terminate the agreement upon or after the breach of a material provision of the agreement that is not cured within 45 days after notice thereof by the non-breaching party. The Company has not paid any remaining royalty since there have not been any sales of Licensed products as of the date of this report.

Corporate History

Headquartered in New York, the Company is a Delaware biopharmaceutical company focused on developing treatment for cancer and orthopedic diseases for patients in China. We also plan to develop our products targeting solid tumor indications in the United States. The Company started its regenerative medicine business in China in 2009 and expanded to CAR-T therapies in 2014.

NOTE 2 – BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and the rules and regulations of the Securities and Exchange Commission (“SEC”) for reporting on Form 10-Q. Accordingly, they do not include all the information and footnotes required by U.S. GAAP for complete financial statements herein. The unaudited Condensed Consolidated Financial Statements herein should be read in conjunction with the historical consolidated financial statements of the Company for the years ended December 31, 2018 included in our Annual Report on Form 10-K for the year ended December 31, 2018. Operating results for the three and six months ended June 30, 2019 are not necessarily indicative of the results that may be expected for the year ending December 31, 2019.

Principles of Consolidation

Our unaudited condensed consolidated financial statements reflect all adjustments, which are, in the opinion of management, necessary for a fair presentation of our financial position and results of operations. Such adjustments are of a normal recurring nature, unless otherwise noted. The balance sheet as of June 30, 2019 and the results of operations for the three and six months ended June 30, 2019 are not necessarily indicative of the results to be expected for any future period.

Our unaudited condensed consolidated financial statements are prepared in accordance with U.S. GAAP. These accounting principles require us to make certain estimates, judgments and assumptions that affect the reported amounts if assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We believe that the estimates, judgments and assumptions are reasonable, based on information available at the time they are made. Actual results could differ materially from those estimates.

Lease

We determine if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets, other current liabilities, and operating lease liabilities in our consolidated balance sheets.

ROU assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of our leases do not provide an implicit rate, we use our incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. We use the implicit rate when readily determinable. The operating lease ROU asset also includes any lease payments made and excludes lease incentives. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

Investment

Equity investments with or without readily determinable fair values are measured at fair value with changes in the fair value recognized through other income (expense), net.

Recent Accounting Pronouncements

Accounting pronouncements adopted during the six months ended June 30, 2019

In June 2018, the Financial Accounting Standards Board (“FASB”) issued ASU 2018-07, which simplifies several aspects of the accounting for nonemployee share-based payment transactions resulting from expanding the scope of Topic 718, Compensation-Stock Compensation, to include share-based payment transactions for acquiring goods and services from non-employees. Some of the areas for simplification apply only to nonpublic entities. The amendments specify that Topic 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in a grantor’s own operations by issuing share-based payment awards. The amendments also clarify that Topic 718 does not apply to share-based payments used to effectively provide (1) financing to the issuer or (2) awards granted in conjunction with selling goods or services to customers as part of a contract accounted for under Topic 606, Revenue from Contracts with Customers. The amendments in this Update are effective for public business entities for fiscal years beginning after December 15, 2018, including interim periods within that fiscal year. Early adoption is permitted. The adoption of the ASU 2018-07 did not have a material impact on the Company’s consolidated financial statements.

In February 2018, the FASB issued ASU No. 2018-02, “Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income” (“ASU 2018-02”), which provides financial statement preparers with an option to reclassify stranded tax effects within accumulated other comprehensive income to retained earnings in each period in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act (or portion thereof) is recorded. The amendments in this ASU are effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption of ASU 2018-02 is permitted, including adoption in any interim period for the public business entities for reporting periods for which financial statements have not yet been issued. The amendments in this ASU should be applied either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. The adoption of the ASU 2018-02 did not have a material impact on the Company’s consolidated financial statements.

In July 2017, the FASB issued ASU No. 2017-11, “Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Non-controlling Interests with a Scope Exception” (“ASU 2017-11”), which addresses the complexity of accounting for certain financial instruments with down round features. Down round features are features of certain equity-linked instruments (or embedded features) that result in the strike price being reduced on the basis of the pricing of future equity offerings. Current accounting guidance creates cost and complexity for entities that issue financial instruments (such as warrants and convertible instruments) with down round features that require fair value measurement of the entire instrument or conversion option. The amendments in Part I of this ASU are effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The adoption of the ASU 2018-07 did not have a material impact on the Company’s consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842)” (“ASU 2016-02”). The amendments in this update create Topic 842, Leases, and supersede the leases requirements in Topic 840, Leases. Topic 842 specifies the accounting for leases. The objective of Topic 842 is to establish the principles that lessees and lessors shall apply to report useful information to users of financial statements about the amount, timing, and uncertainty of cash flows arising from a lease. The main difference between Topic 842 and Topic 840 is the recognition of lease assets and lease liabilities for those leases classified as operating leases under Topic 840. Topic 842 retains a distinction between finance leases and operating leases. The classification criteria for distinguishing between finance leases and operating leases are substantially similar to the classification criteria for distinguishing between capital leases and operating leases in the previous leases guidance. The result of retaining a distinction between finance leases and operating leases is that under the lessee accounting model in Topic 842, the effect of leases in the statement of comprehensive income and the statement of cash flows is largely unchanged from previous GAAP. The amendments in ASU 2016-02 are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years for public business entities. Early application of the amendments in ASU 2016-02 is permitted. The adoption impact of the ASU 2016-02 on the Company’s consolidated financial statements is illustrated in Note 9.

Accounting pronouncements not yet effective to adopt

In August 2018, the FASB issued Accounting Standards Update (“ASU”) No. 2018-13, Fair Value Measurement (Topic 820), which eliminates, adds and modifies certain disclosure requirements for fair value measurements. The modified standard eliminates the requirement to disclose changes in unrealized gains and losses included in earnings for recurring Level 3 fair value measurements and requires changes in unrealized gains and losses be included in other comprehensive income for recurring Level 3 fair value measurements of instruments. The standard also requires the disclosure of the range and weighted average used to develop significant unobservable inputs and how weighted average is calculated for recurring and nonrecurring Level 3 fair value measurements. The amendment is effective for fiscal years beginning after December 15, 2019 and interim periods within that fiscal year with early adoption permitted. We do not expect the standard to have a material impact on our consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-04, “Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment” (“ASU 2017-04”), which removes Step 2 from the goodwill impairment test. An entity will apply a one-step quantitative test and record the amount of goodwill impairment as the excess of a reporting unit's carrying amount over its fair value, not to exceed the total amount of goodwill allocated to the reporting unit. The new guidance does not amend the optional qualitative assessment of goodwill impairment. Public business entity that is a U.S. Securitiesand Exchange Commission filer should adopt the amendments in this ASU for its annual or any interim goodwill impairment test in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. We are currently evaluating the impact of the adoption of ASU 2017-04 on our consolidated financial statements.

In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”). Financial Instruments—Credit Losses (Topic 326) amends guideline on reporting credit losses for assets held at amortized cost basis and available-for-sale debt securities. For assets held at amortized cost basis, Topic 326 eliminates the probable initial recognition threshold in current GAAP and, instead, requires an entity to reflect its current estimate of all expected credit losses. The allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial assets to present the net amount expected to be collected. For available-for-sale debt securities, credit losses should be measured in a manner similar to current GAAP, however Topic 326 will require that credit losses be presented as an allowance rather than as a write-down. ASU 2016-13 affects entities holding financial assets and net investment in leases that are not accounted for at fair value through net income. The amendments affect loans, debt securities, trade receivables, net investments in leases, off balance sheet credit exposures, reinsurance receivables, and any other financial assets not excluded from the scope that have the contractual right to receive cash. The amendments in this ASU will be effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. We are currently evaluating the impact of the adoption of ASU 2016-13 on our consolidated financial statements.

NOTE 3 – VARIABLE INTEREST ENTITIES

VIEs are those entities in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the Company is the primary beneficiary of the entity. Cellular Biomedicine Group Ltd (Shanghai) (“CBMG Shanghai”) and all of its subsidiaries are variable interest entities (VIEs), through which the Company conducts stem cell and immune therapy research and clinical trials in China. The registered shareholders of CBMG Shanghai are Lu Junfeng and Chen Mingzhe, who together own 100% of the equity interests in CBMG Shanghai. The initial capitalization and operating expenses of CBMG Shanghai are funded by our wholly foreign-owned enterprise (“WFOE”), Cellular Biomedicine Group Ltd. (Wuxi) (“CBMG Wuxi”). The registered capital of CBMG Shanghai is ten million RMB and was incorporated on October 19, 2011. Agreen Biotech Co. Ltd. (“AG”) was 100% acquired by CBMG Shanghai in September 2014. AG was incorporated on April 27, 2011 and its registered capital is five million RMB. In January 2017, CBMG Shanghai established two fully owned subsidiaries - Wuxi Cellular Biopharmaceutical Group Ltd. (“Wuxi SBM”) and Shanghai Cellular Biopharmaceutical Group Ltd (“Shanghai SBM”), which are located in Wuxi and Shanghai respectively.

In February 2012, CBMG Wuxi provided financing to CBMG Shanghai in the amount of $1,587,075 for working capital purposes. In conjunction with the provided financing, exclusive option agreements were executed granting CBMG Wuxi the irrevocable and exclusive right to convert the unpaid portion of the provided financing into equity interest of CBMG Shanghai at CBMG Wuxi’s sole and absolute discretion. CBMG Wuxi and CBMG Shanghai additionally executed a business cooperation agreement whereby CBMG Wuxi is to provide CBMG Shanghai with technical and business support, consulting services, and other commercial services. The shareholders of CBMG Shanghai pledged their equity interest in CBMG Shanghai as collateral in the event CBMG Shanghai does not perform its obligations under the business cooperation agreement.

The Company has determined it is the primary beneficiary of CBMG Shanghai by reference to the power and benefits criterion under ASC Topic 810, Consolidation. This determination was reached after considering the financing provided by CBMG Wuxi to CBMG Shanghai is convertible into equity interest of CBMG Shanghai and the business cooperation agreement grants the Company and its officers the power to manage and make decisions that affect the operation of CBMG Shanghai.

There are substantial uncertainties regarding the interpretation, application and enforcement of PRC laws and regulations, including but not limited to the laws and regulations governing our business or the enforcement and performance of our contractual arrangements. See Risk Factors below regarding “Risks Related to Our Structure” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018.

As the primary beneficiary of CBMG Shanghai and its subsidiaries, the Company consolidates in its financial statements the financial position, results of operations, and cash flows of CBMG Shanghai and its subsidiaries, and all intercompany balances and transactions between the Company and CBMG Shanghai and its subsidiaries are eliminated in the consolidated financial statements.

The Company has aggregated the financial information of CBMG Shanghai and its subsidiaries in the table below. The aggregate carrying value of assets and liabilities of CBMG Shanghai and its subsidiaries (after elimination of intercompany transactions and balances) in the Company’s condensed consolidated balance sheets as of June 30, 2019 and December 31, 2018 are as follows:

| | | |

| | | |

| Assets | | |

| Cash | $861,817 | $2,376,974 |

| Other receivables | 70,097 | 61,722 |

| Prepaid expenses | 2,164,997 | 1,497,072 |

| Total current assets | 3,096,911 | 3,935,768 |

| | | |

| Property, plant and equipment, net | 19,335,743 | 14,280,949 |

| Right of use | 14,721,084 | 15,431,554 |

| Intangibles | 1,307,398 | 1,412,375 |

Long-term prepaid expenses and other assets | 6,071,692 | 5,194,045 |

| Total assets | $44,532,828 | $40,254,691 |

| | | |

| Liabilities | | |

| Short-term debt | $14,546,035 | $- |

| Accounts payable | 1,318,249 | 359,980 |

| Other payables | 3,917,065 | 4,937,541 |

| Accrued payroll * | 718,740 | 1,367,658 |

| Deferred income | - | 6,280 |

| Total current liabilities | $20,500,089 | $6,671,459 |

| | | |

| Other non-current liabilities | 12,921,050 | 13,877,334 |

| Total liabilities | $33,421,139 | $20,548,793 |

* Accrued payroll mainly includes bonus accrual of $714,505 and $1,358,709 as of June 30, 2019 and December 31, 2018, respectively.

NOTE 4 – RESTRICTED CASH AND SHORT-TERM DEBT

On January 19, 2019, Shanghai Cellular Biopharmaceutical Group Ltd., a wholly owned subsidiary of the Company (“SH SBM”) entered into a credit agreement (the “Credit Agreement”) with China Merchants Bank, Shanghai Branch (the “Merchants Bank”). Pursuant to the Credit Agreement, the Merchants Bank agreed to extend credit of up to RMB 100 million (approximately $14.5 million) to SH SBM via revolving and/or one-time credit lines. The types of credit available under the Credit Agreement, include, but not limited to, working capital loans, trade financing, commercial draft acceptance, letters of guarantee and derivative transactions. The credit period under the Credit Agreement runs until December 30, 2019. As of June 30, 2019, all $14.5 million had been drawn down under the Credit Agreement.

Pursuant to the Credit Agreement, SH SBM will enter into a supplemental agreement with the Merchants Bank prior to the applicable drawdown that will set forth the terms of each borrowing thereunder (except for working capital loans), including principal, interest rate, term of loan and use of borrowing proceeds. With regard to working capital loans to be provided pursuant to the Credit Agreement, SH SBM shall submit a withdrawal application that includes the principal amount needed, purposes of the loan and a proposed quarterly interest rate and term of the loan for the Merchants Bank’s review and approval. The terms approved by the bank will govern such working capital loans. The bank has the right to adjust the interest rate for working capital loans from time to time based on changes in national policy, changes in interest rate published by the People’s Bank of China, credit market conditions and the bank’s credit policies. Upon SH SBM’s non-compliance with the agreed use of loan proceeds, the interest rate for the amount of loan proceeds improperly used will be the original rate plus 100% starting on the first day of such use. If SH SBM fails to pay a working capital loan on time, an extra 50% interest will be charged on the outstanding balances starting on the first day of such default.

Pursuant to a pledge agreement which became enforceable upon execution of the Credit Agreement, Cellular Biomedicine Group Ltd. (HK), a wholly owned subsidiary of the Company (“CBMG HK”), provided a guarantee of SH SBM’s obligations under the Credit Agreement. In connection with such guarantee, CBMG HK deposited $17,000,000 into its account at the Merchants Bank for a 12-month period starting January 7, 2019 and also granted Merchants Bank a security interest in the cash deposited.

The details of the bank borrowings as of June 30, 2019 and December 31, 2018 are as follows:

| | | | | | |

| Lender | | | | | |

| | | | | | |

| Merchants Bank | January 21, 2019 ~ January 31, 2019 | January 21, 2020 ~ January 31, 2020 | 4.785% | $3,547,982 | $- |

| Merchants Bank | February 22, 2019 ~ June 24, 2019 | February 22, 2020 ~ June 24, 2020 | 4.35% | 10,998,053 | - |

| | | | |

| | | $14,546,035 | $- |

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT

As of June 30, 2019 and December 31, 2018, property, plant and equipment, carried at cost, consisted of the following:

| Fixed Asset Details | | |

| | | |

| | | |

| Office equipment | $142,608 | $101,608 |

| Manufacturing equipment | 10,001,694 | 7,636,905 |

| Computer equipment | 523,880 | 426,507 |

| Leasehold improvements | 13,645,548 | 12,861,186 |

| Construction work in process | 3,640,924 | 1,030,760 |

| | 27,954,654 | 22,056,966 |

| Less: accumulated depreciation | (7,961,926) | (6,863,205) |

| | $19,992,728 | $15,193,761 |

For the three and six months ended June 30, 2019, depreciation expense was $967,215 and $1,939,071, respectively, as compared to $861,084 and $1,587,702 for the three and six months ended June 30, 2018, respectively.

NOTE 6 – INVESTMENTS

The Company’s investments represent the investment in equity securities listed in Over-The-Counter (“OTC”) markets of the United States of America:

June 30, 2019 and December 31, 2018 | | Gross Unrealized Gains/(losses) | Gross Unrealized Losses more than 12 months | Gross Unrealized Losses less than 12 months | |

| | | | | | |

| Equity position in Arem Pacific Corporation | $480,000 | $- | $(240,000) | $- | $240,000 |

There were no unrealized holding gains or losses for the investments that were recognized in other comprehensive income for the three and six months ended June 30, 2019 and 2018.

NOTE 7 – FAIR VALUE ACCOUNTING

The Company has adopted ASC Topic 820, Fair Value Measurement and Disclosure, which defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. It does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. It establishes a three-level valuation hierarchy of valuation techniques based on observable and unobservable inputs, which may be used to measure fair value and include the following:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Classification within the hierarchy is determined based on the lowest level of input that is significant to the fair value measurement.

The carrying value of financial items of the Company including cash and cash equivalents, accounts receivable, other receivables, accounts payable and accrued liabilities, approximate their fair values due to their short-term nature and are classified within Level 1 of the fair value hierarchy. The Company’s investments are classified within Level 2 of the fair value hierarchy because of the limited trading of the three stocks traded in OTC market.

Assets measured at fair value within Level 2 on a recurring basis as of June 30, 2019 and December 31, 2018 are summarized as follows:

| | As of June 30, 2019 and December 31, 2018 |

| | Fair Value Measurements at Reporting Date Using: |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Assets: | | | | |

| Equity position in Arem Pacific Corporation | $240,000 | $- | $240,000 | $- |

No shares were acquired in the six months ended June 30, 2019 and 2018.

As of June 30, 2019 and December 31, 2018, the Company holds 8,000,000 shares in Arem Pacific Corporation (“ARPC”), 2,942,350 shares in Alpha Lujo, Inc. (“ALEV”) and 2,057,131 shares in Wonder International Education and Investment Group Corporation (“Wonder”), respectively. Full impairment has been provided for shares of ALEV and Wonder. All investments held by the Company at June 30, 2019 and December 31, 2018 have been valued based on level 2 inputs due to the limited trading of these companies.

NOTE 8 – INTANGIBLE ASSETS

Intangible assets that are subject to amortization are reviewed for potential impairment whenever events or circumstances indicate that carrying amounts may not be recoverable. Assets not subject to amortization are tested for impairment at least annually. The Company evaluates the continuing value of the intangibles at each balance sheet date and records write-downs if the continuing value has become impaired. An impairment is determined to exist if the anticipated undiscounted future cash flow attributable to the asset is less than its carrying value. The asset is then reduced to the net present value of the anticipated future cash flow.

Most of our intellectual properties are developed internally. Because we do not capitalize our research and development expenses related to our home-grown intellectual properties, as of June 30, 2019, the intellectual properties acquired from the Agreen acquisition still accounted for the majority of the net book value of our intangible assets. We continue to apply the acquired Agreen intellectual properties in our immune-oncology research and development activities. As such there is no impairment on the continued use of the acquired Agreen intellectual properties.

As of June 30, 2019 and December 31, 2018, intangible assets, net consisted of the following:

| Patents & knowhow & license | | |

| | | |

| Cost basis | $18,177,242 | $17,580,368 |

| Less: accumulated amortization | (7,637,030) | (6,950,656) |

| Less: impairment | (2,884,896) | (2,884,896) |

| | $7,655,316 | $7,744,816 |

| Software | | |

| | | |

| Cost basis | $359,167 | $340,918 |

| Less: accumulated amortization | (145,680) | (115,042) |

| | $213,487 | $225,876 |

| | | |

| Total intangibles, net | $7,868,803 | $7,970,692 |

All software is provided by a third party vendor, is not internally developed, and has an estimated useful life of five years. Patents and knowhow are amortized using an estimated useful life of three to ten years. Amortization expense for the three and six months ended June 30, 2019 was $362,124 and $719,967, respectively, and amortization expense for the three and six months ended June 30, 2018 was $449,573 and $898,443, respectively.

Estimated amortization expense for each of the ensuing years are as follows for the years ending June 30:

| |

| 2020 | $1,445,625 |

| 2021 | 1,440,062 |

| 2022 | 1,430,994 |

| 2023 | 1,423,374 |

| 2024 and thereafter | 2,128,748 |

| | $7,868,803 |

NOTE 9 – LEASES

The Company leases facilities and equipment under non-cancellable operating lease agreements. These facilities and equipment are located in the United States, Hong Kong and China. The Company recognizes rental expense on a straight-line basis over the life of the lease period. Lease expense under operating leases for the three and six months ended June 30, 2019 was approximately $754,572 and $1,517,262, respectively, as compared to $981,423 and $1,948,855 for the three and six months ended June 30, 2018, respectively.

The Company has elected to apply the short-term lease exception to all leases of one year or less. As such, the Company applied the guidance in ASC 842 to its corporate office and equipment leases and has determined that these should be classified as operating leases. Consequently, as a result of the adoption of ASC 842, the Company recognized an operating liability with a corresponding Right-Of-Use (“ROU”) asset of the same amounts based on the present value of the minimum rental payments of such leases. As of December 31, 2018, the ROU asset has a balance of $15,938,203 which is included in other non-current assets in the consolidated balance sheets and current liabilities and non-current liabilities relating to the ROU asset were $1,874,270, and $14,063,933, respectively which are included in accrued liabilities and other non-current liabilities in the consolidated balance sheets, respectively. The discount rate used for leases accounted under ASC 842 is the Company’s estimated borrowing rate of 5%.

Quantitative information regarding the Company’s leases is as follows:

The components of lease expense were as follows:

| | For the Three Months Ended | |

| | | |

| | | | | |

| Lease cost | | | | |

| Operating lease cost | 708,700 | 673,318 | 1,415,880 | 1,340,057 |

| Short-term lease cost | 45,872 | 308,105 | 101,382 | 608,798 |

| Total lease cost | 754,572 | 981,423 | 1,517,262 | 1,948,855 |

Supplemental cash flow information related to leases was as follows:

| | For the Three Months Ended | |

| | | |

| | | | | |

Cash paid for the amounts included in the measurement of lease liabilities for operating leases: | | | | |

| Operating cashflows | 1,261,990 | 1,171,460 | 2,530,983 | 2,342,921 |

Supplemental balance sheet information related to leases was as follows:

| | | | | |

| | | | | |

| Operating lease right-of-use assets | 15,203,003 | 15,938,203 |

|

|

| Other current liabilities | 2,047,563 | 1,874,270 | | |

| Other non-current liabilities | 13,155,440 | 14,063,933 | | |

| | | | | |

| Weighted Average Remaining Lease Term (in years): Operating leases | 7.2 | 7.7 | | |

| | | | | |

| Weighted Average Discount Rate: Operating leases | 5% | 5% | | |

As of June 30, 2019, the Company has the following future minimum lease payments due under the foregoing lease agreements:

| Years ending June 30, | |

| 2020 | $3,003,619 |

| 2021 | 2,595,802 |

| 2022 | 2,445,577 |

| 2023 | 2,500,736 |

| 2024 and thereafter | 8,165,048 |

| | |

| | $18,710,782 |

NOTE 10 – RELATED PARTY TRANSACTIONS

The Company advanced petty cash to officers for business travel purpose. As of June 30, 2019 and December 31, 2018, other receivables due from officers for business travel purpose was nil.

NOTE 11 – EQUITY

ASC Topic 505 Equity paragraph 505-50-30-6 establishes that share-based payment transactions with nonemployees shall be measured at the fair value of the consideration received or the fair value of the equity instruments issued, whichever is more reliably measurable.

On January 30, 2018 and February 5, 2018, the Company entered into securities purchase agreements with certain investors pursuant to which the Company agreed to sell, and the investors agreed to purchase from the Company, an aggregate of 1,719,324 shares of the Company’s common stock, par value $0.001 per share, at $17.80 per share, for total gross proceeds of approximately $30.6 million. The transaction closed on February 5, 2018.

On September 25, 2018, the Company entered into a share purchase agreement with Novartis Pharma AG (“Novartis”) pursuant to which the Company agreed to sell, and Novartis agreed to purchase from the Company, an aggregate of 1,458,257 shares of the Company’s common stock, par value $0.001 per share, at a share price of $27.43 per share, for total gross proceeds of approximately $40 million (“Novartis Investment”). The transaction closed on September 26, 2018. No warrant or other encumbered instruments were issued in connection with the Novartis Investment, and the share price paid represented the fair value of the issued common stock.

On March 21, 2019, the Company entered into an underwriting agreement with Cantor Fitzgerald & Co. and Robert W. Baird & Co. Incorporated, as representatives of the several underwriters set forth therein (collectively, the “Underwriters”), relating to an underwritten public offering of 1,029,412 shares of the Company’s common stock, par value $0.001 per share, at an offering price to the public of $17.00 per share. Under the terms of the Underwriting Agreement, the Company granted the Underwriters a 30-day option to purchase up to an additional 154,411 shares of Common Stock. The offering was closed on March 25, 2019 and the Company received net proceeds of approximately $16 million. On April 2, 2019, the underwriters partially exercised their option and purchased an additional 77,549 shares of Common Stock for a net proceeds of approximately $1.2 million.

During the three and six months ended June 30, 2019, the Company expensed $586,672 and $1,369,295 associated with unvested option awards and $402,301 and $744,240 associated with restricted common stock issuances, respectively. During the three and six months ended June 30, 2018, the Company expensed $891,163 and $1,595,706 associated with unvested option awards and $451,570 and $881,908 associated with restricted common stock issuances, respectively.

During the three and six months ended June 30, 2019, options for 3,755 and 16,163 underlying shares were exercised on a cash basis, 3,755 and 16,163 shares of the Company’s common stock were issued accordingly. During the three and six months ended June 30, 2018, options for 29,844 and 132,274 underlying shares were exercised on a cash basis, 29,844 and 132,274 shares of the Company’s common stock were issued accordingly.

During the three and six months ended June 30, 2019, 37,467 and 57,520 of the Company's restricted common stock were issued to directors, employees and advisors respectively. During the three and six months ended June 30, 2018, 19,771 and 36,082 of the Company's restricted common stock were issued to directors, employees and advisors respectively.

As previously disclosed on a Current Report on Form 8-K filed on June 1, 2017, the Company authorized a share repurchase program (the “2017 Share Repurchase Program”), pursuant to which the Company may, from time to time, purchase shares of its common stock for an aggregate purchase price not to exceed $10 million under which approximately $6.52 million in shares of common stock were repurchased. On October 10, 2018, the Company commenced a share repurchase program (the “2018 Share Repurchase Program”), pursuant to which the Company may, from time to time, purchase shares of its common stock for an aggregate purchase price not to exceed approximately $8.48 million. We completed all of our repurchase plans on March 31, 2019 for a grand total of 1,055,499 shares for a total sum of $14.99 million.

For the three and six months ended June 30, 2019, the Company repurchased nil and 54,000 shares of the Company’s common stock with the total cost of nil and $1,039,028 , respectively. For the three and six months ended June 30, 2018, the Company repurchased 96,512 and 133,974 shares of the Company’s common stock with the total cost of $1,820,396 and $2,536,064, respectively. Details are as follows:

| | Total number of shares purchased | Average price paid per share |

| | | |

| Treasury stock as of December 31, 2018 | 1,001,499 | $13.93 |

| Repurchased from January 1, 2019 to March 31, 2019 | 54,000 | $19.24 |

| Repurchased from April 1, 2019 to June 30, 2019 | - | $- |

| | | |

| Treasury stock as of June 30, 2019 | 1,055,499 | $14.20 |

NOTE 12 – COMMITMENTS AND CONTINGENCIES

Capital commitments

As of June 30, 2019, the capital commitments of the Company are summarized as follows:

| | |

| | |

| Contracts for acquisition of equipment and facility improvement being or to be executed | $1,544,629 |

NOTE 13 – STOCK BASED COMPENSATION

Our stock-based compensation arrangements include grants of stock options and restricted stock awards under the Stock Option Plan (the “2009 Plan”,“2011 Plan”, “2013 Plan” and the “2014 Plan”), and certain awards granted outside of these plans. The compensation cost that has been charged against income related to stock options for the three and six months ended June 30, 2019 was $586,672 and $1,369,295, respectively, and for the three and six months ended June 30, 2018 was $891,163 and $1,595,706, respectively. The compensation cost that has been charged against income related to restricted stock awards for the three and six months ended June 30, 2019 was $402,301 and $744,240, respectively, and for the three and six months ended June 30, 2018 was $451,570 and $881,908, respectively.

As of June 30, 2019, there was $3,177,918 all unrecognized compensation cost related to an aggregate of 324,495 of non-vested stock option awards and $3,794,821 related to an aggregate of 274,031 of non-vested restricted stock awards. These costs are expected to be recognized over a weighted-average period of 1.5 years for the stock options awards and 1.5 years for the restricted stock awards.

During the three and six months ended June 30, 2019, the Company issued options to purchase an aggregate of 40,907 shares of the Company’s common stock under the Plans. The grant date fair value of these options was $487,918 using Black-Scholes option valuation models with the following assumptions: exercise price equal to the grant date stock price or average selling prices over the 30-business day period preceding the date of grant ranging from $16.17 to $17.13, volatility ranging from 87.38% to 88.03%, expected life of 6.0 years, and risk-free rate ranging from 1.91% to 2.36%. The Company is expensing these options on a straight-line basis over the requisite service period.

During the three months ended June 30, 2018, the Company issued options to purchase an aggregate of 160,089 shares of the Company’s common stock under the Plans. The grant date fair value of these options was $2,180,036 using Black-Scholes option valuation models with the following assumptions: exercise price equal to the grant date stock price or average selling prices over the 30-business day period preceding the date of grant ranging from $17.4 to $20.65, volatility ranging from 65.99% to 90.21%, expected life of 6.0 years, and risk-free rate ranging from 2.61% to 2.96%. The Company is expensing these options on a straight-line basis over the requisite service period.

During the six months ended June 30, 2018, the Company issued options to purchase an aggregate of 190,682 shares of the Company’s common stock to officers, directors and employees under the Plans. The grant date fair value of these options was $2,600,715 using Black-Scholes option valuation models with the following assumptions: exercise price equal to the grant date stock price or average selling prices over the 30-business day period preceding the date of grant ranging from $14.5 to $21.8, volatility ranging from 65.99% to 90.43%, expected life of 6.0 years, and risk-free rate ranging from 2.33% to 2.96%. The Company is expensing these options on a straight-line basis over the requisite service period.

The following table summarizes stock option activity as of June 30, 2019 and December 31, 2018 and for the six months ended June 30, 2019:

| | | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value |

| | | | | |

| Outstanding at December 31, 2018 | 1,828,866 | $12.41 | 6.5 | $11,496,058 |

| Grants | 40,907 | | | |

| Forfeitures | (47,305) | | | |

| Exercises | (16,163) | | | |

| Outstanding at June 30, 2019 | 1,806,305 | $12.38 | 6.0 | $9,854,732 |

| | | | | |

| Vested and exercisable at June 30, 2019 | 1,481,810 | $11.83 | 5.5 | $9,027,148 |

| | | | |

| | | | | |

| | | | | |

| $3.00 - $4.95 | 185,547 | 185,547 | |

| | $5.00 - $9.19 | 454,164 | 432,484 | |

| | $9.20 - $15.00 | 513,615 | 372,305 | |

| | $15.01 - $20.00 | 497,979 | 358,474 | |

| | $20.10+ | 155,000 | 133,000 | |

| | | 1,806,305 | 1,481,810 | |

The aggregate intrinsic value for stock options outstanding is defined as the positive difference between the fair market value of our common stock and the exercise price of the stock options.

Cash received from option exercises under all share-based compensation arrangements for the three and six months ended June 30, 2019 was $41,527 and $150,788, respectively, as compared to $396,040 and $1,165,763 for the three and six months ended June 30, 2018, respectively.

The Company adopted ASU 2018-07 on January 1, 2019, and the stock-based compensation expense for grants before the adoption of ASU 2018-07 is based on the grant date fair value as of December 31, 2018, which was the last business day before the Company adopted ASU 2018-07, for all nonemployee awards that have not vested as of December 31, 2018. The cumulative-effect adjustment to retained earnings as of January 1, 2019 was immaterial to the financial statements as a whole. Accordingly, the Company did not record this adjustment as of January 1, 2019. Furthermore, for future nonemployee awards, compensation expense is based on the market value of the shares at the grant date.

NOTE 14 – NET LOSS PER SHARE

Basic and diluted net loss per common share is computed on the basis of our weighted average number of common shares outstanding, as determined by using the calculations outlined below:

| | For the Three Months Ended | |

| | | |

| | | | | |

| | | | | |

| Net loss | $(12,096,697) | $(9,186,076) | $(21,433,485) | $(17,682,499) |

| | | | | |

| Weighted average shares of common stock | 19,223,113 | 17,487,184 | 18,690,729 | 17,116,944 |

| Dilutive effect of stock options | - | - | - | - |

| Restricted stock vested not issued | - | - | - | - |

| Common stock and common stock equivalents | 19,223,113 | 17,487,184 | 18,690,729 | 17,116,944 |

| | | | | |

| Net loss per basic and diluted share | $(0.63) | $(0.53) | $(1.15) | $(1.03) |

For the three and six months ended June 30, 2019 and 2018, the effect of conversion and exercise of the Company’s outstanding options are excluded from the calculations of dilutive net income (loss) per share as their effects would have been anti-dilutive since the Company had generated losses for the three and six months ended June 30, 2019 and 2018.

NOTE 15 – INCOME TAXES

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period during which such rates are enacted.

The Company considers all available evidence to determine whether it is more likely than not that some portion or all of the deferred tax assets will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become realizable. Management considers the scheduled reversal of deferred tax liabilities (including the impact of available carryback and carry-forward periods), and projected taxable income in assessing the realizability of deferred tax assets. In making such judgments, significant weight is given to evidence that can be objectively verified. Based on all available evidence, in particular our three-year historical cumulative losses, recent operating losses and U.S. pre-tax loss for the three and six months ended June 30, 2019, we recorded a valuation allowance against our U.S. and China net deferred tax assets.

In each period since inception, the Company has recorded a valuation allowance for the full amount of net deferred tax assets, as the realization of deferred tax assets is uncertain. As a result, the Company has not recorded any federal or state income tax benefit in the consolidated statements of operations and comprehensive income (loss).

On December 22, 2017, US President signed tax reform bill (Tax Cut and Jobs Act (H.R.1)). Pursuant to this new Act, non-operating loss carry back period is eliminated and an indefinite carry forward period is permitted.

The Company's effective tax rate differs from statutory rates of 21% for U.S. federal income tax purposes, 15% ~ 25% for Chinese income tax purpose and 16.5% for Hong Kong income tax purposes due to the effects of the valuation allowance and certain permanent differences as it pertains to book-tax differences in the value of client shares received for services.

Pursuant to the Corporate Income Tax Law of the PRC, all of the Company’s PRC subsidiaries are liable to PRC Corporate Income Taxes (“CIT”) at a rate of 25% except for CBMG Shanghai and Shanghai SBM.

According to Guoshuihan 2009 No. 203, if an entity is certified as an “advanced and new technology enterprise”, it is entitled to a preferential income tax rate of 15%. CBMG Shanghai obtained the certificate of “advanced and new technology enterprise” dated October 30, 2015 with an effective period of three years and the provision for PRC corporate income tax for CBMG Shanghai is calculated by applying the income tax rate of 15% from 2015. CBMG Shanghai re-applied and Shanghai SBM applied for the certificate of “advanced and new technology enterprise” in 2018. Both of them received approval on November 27, 2018. On August 23, 2018, State Administration of Taxation (“SAT”) issued a Bulletin on Enterprise Income Tax Issues Related to the Extension of Loss Carry-forward Period for Advanced and New Technology Enterprises and Small and Medium-sized Technology Enterprises (“Bulletin 45”). According to the Bulletin 45, an enterprise that obtains the two type of qualification in 2018, is allowed to carry forward all its prior year loss incurred between 2013 and 2017 to up to ten years instead of five years. The same requirement applies to the enterprise obtaining the qualification after 2018.

As of June 30, 2019, all the deferred income tax expense is offset by changes in the valuation allowance pertaining to the Company's existing net operating loss carryforwards due to the unpredictability of future profit streams prior to the expiration of the tax losses.

NOTE 16 – SEGMENT INFORMATION

The Company is engaged in the development of new treatments for cancerous and degenerative diseases utilizing proprietary cell-based technologies, which have been organized as one reporting segment as they have substantially similar economic characteristic since they have similar nature and economic characteristics. The Company’s principle operating decision maker, the Chief Executive Officer, receives and reviews the result of the operation for all major cell platforms as a whole when making decisions about allocating resources and assessing performance of the Company. In accordance with FASB ASC 280-10, the Company is not required to report the segment information.

NOTE 17 – SUBSEQUENT EVENTS

None.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis summarizes the significant factors affecting our results of operations, financial condition and liquidity position for the three and six months ended June 30, 2019 and 2018, and should be read in conjunction with our unaudited condensed consolidated financial statements and related notes included elsewhere in this filing.