UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended December 31, 2007 |

| | |

| | Or |

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.: 0-52294

AMERICAN DG ENERGY INC.

(Exact name of registrant as specified in its charter)

Delaware | | 04-3569304 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

American DG Energy Inc. |

45 First Avenue |

Waltham, MA 02451 |

(Address of principal executive offices) |

Registrant’s telephone number, including area code: (781) 622-1120

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or an amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer o | Smaller reporting company x |

| | (Do not check if a smaller reporting company) | |

| | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of the voting shares of the registrant held by non-affiliates is not applicable because our common stock was not yet trading on the Over-the-Counter Bulletin Board as of June 29, 2007.

Number of the registrant’s common shares outstanding as of February 6, 2008: 32,805,924.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by in Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference from our definitive Proxy Statement for our 2008 Annual Meeting of Shareholders scheduled to be held on May 30, 2008.

DISCLAIMER CONCERNING FORWARD LOOKING STATEMENTS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER FEDERAL SECURITIES LAWS. THESE FORWARD LOOKING STATEMENTS ARE BASED ON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, AND MAY NOT OCCUR.ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. SEE ALSO “ITEM 1A. RISK FACTORS.”EXCEPT AS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR RELEASE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

TABLE OF CONTENTS

Part I | | |

| | |

Item 1. | Business | |

| | |

Item 1A. | Risk Factors | |

| | |

Item 1B. | Unresolved Staff Comments | |

| | |

Item 2. | Properties | |

| | |

Item 3. | Legal Proceedings | |

| | |

Item 4. | Submission of Matters to a Vote of Security Holders | |

| | |

Part II | | |

| | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| | |

Item 6. | Selected Financial Data | |

| | |

Item 7. | Management’s Discussion and Analysis of Financial Conditions and Results of Operation | |

| | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| | |

Item 8. | Financial Statements and Supplementary Data | |

| | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| | |

Item 9A(T). | Controls and Procedures | |

| | |

Item 9B. | Other Information | |

| | |

Part III | | |

| | |

Item 10. | Directors, Executive Officers and Corporate Governance | |

| | |

Item 11. | Executive Compensation | |

| | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| | |

Item 13. | Certain Relationships and Related Transactions | |

| | |

Item 14. | Principal Accountant Fees and Services | |

| | |

Part IV | | |

| | |

Item 15. | Exhibits and Financial Statement Schedules | |

| | |

| Signatures | |

| | |

1

PART I

Item 1. Business

General

American DG Energy Inc. (“American DG Energy”, the “company”, “ADGE”, “we”, “our” or “us”) distributes and operates clean, on-site energy systems that produce electricity, hot water, heat and cooling. Our business model is to own the equipment that we install at customers’ facilities and to sell the energy produced by these systems to the customers on a long-term contractual basis. We call this business the American DG Energy “On-Site Utility”.

We offer cogeneration systems that are highly reliable and energy efficient. Our cogeneration systems produce electricity from an internal combustion engine driving a generator, while the heat from the engine and exhaust is recovered and typically used to produce heat and hot water for use at the site. We also distribute and operate water chiller systems for building cooling applications that operate in a similar manner, except that the engine’s power drives a large air-conditioning compressor while recovering heat for hot water. Cogeneration systems reduce the amount of electricity that the customer must purchase from the local utility and produce valuable heat and hot water for the site to use as required. By simultaneously providing electricity, hot water and heat, cogeneration systems also have a significant, positive impact on the environment by reducing the carbon or CO2 produced by offsetting the traditional energy supplied by the electric grid and conventional hot water boilers.

Distributed generation of electricity (“DG” or often referred as cogeneration systems or combined heat and power systems or “CHP”) is an attractive option for reducing energy costs and increasing the reliability of available energy. DG has successfully implemented by others in large industrial installations over 10 Megawatts (“MW”) where the market has been growing for several years, and is increasingly being accepted in smaller size units because of technology improvements, increased energy costs and better DG economics. We believe that our target market (users of up to 1 MW) has been barely penetrated and that the reduced reliability of the utility grid, increasing cost pressures experienced by energy users, advances in new, low cost technologies and DG-favorable legislation and regulation at the state level will drive our near term growth and penetration into our target market. The company maintains a web site at www.americandg.com, but our website is not a part of this annual report.

The company was incorporated as a Delaware corporation on July 24, 2001 to install. As of December 31, 2007, we had installed energy systems, representing approximately 3,645 kW (kilowatts), 29.2 MMBtu’s (million British thermal units) of heat and hot water and 600 tons of cooling. Kilowatt (kW) is a measure of electricity generated, MMBtu is a measure of heat generated and a ton is a measure of cooling generated. On December 14, 2007, the company was presented with a report by the EPA which states that the high efficiency of the company’s CHP projects produced an estimated 7,400 metric tons of carbon equivalents less than typical separate heat and power, resulting in emissions reductions equivalent to planting 2,006 acres of forest or removing the emissions of 1,337 automobiles.

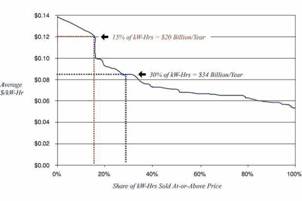

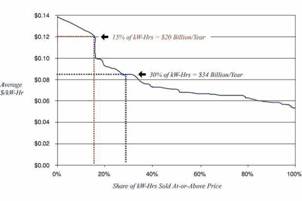

We believe that our primary near-term opportunity for DG energy and equipment sales is where commercial electricity rates exceed $0.12 per kWh, which is predominantly in the Northeast and California. These areas represent approximately 15 percent of the U.S. commercial power market, with electricity revenues in excess of $20 billion per year (see Figure 1. on page 6). Attractive DG economics are currently attainable in applications that include hospitals, nursing homes, multi-tenant residential housing, hotels, schools and colleges, recreational facilities, food processing plants, dairies and other light industrial facilities. Two CHP market analysis reports sponsored by the Energy Information Administration in 2000 detailed the prospective CHP market in the commercial and institutional sectors(1) and in the industrial sectors(2). These data sets were used to estimate the CHP market potential in the 100kW to 1 MW size range. These target market segments comprise over 163,000 sites totaling 12.2 million kW of prospective DG capacity. This is the equivalent of an $11.7 billion annual electricity market plus a $7.3 billion heat and hot water energy market, for a combined market potential of $19.0 billion.

(1) The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

(2) The Market and Technical Potential for Combined Heat and Power in the Industrial Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

We believe that the largest number of potential DG users in the United Stated require less than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are able to design our systems to suit a particular customer’s needs because of our ability to place multiple units at a site. This approach is part of what allows our products and services to meet

2

changing power and cooling demands throughout the day (also from season-to-season) and greatly improves efficiency through a customer’s varying high and low power requirements.

American DG Energy purchases energy equipment from various suppliers. The primary type of equipment used is a natural gas-powered, reciprocating engine. As power sources that use alternative energy technologies mature to the point that they are both reliable and economical, we will consider employing them to supply energy for our customers. We regularly assess the technical, economic, and reliability issues associated with systems that use solar, micro-turbine or fuel cell technologies to generate power.

Background and Market

The delivery of energy services to commercial and residential customers in the United States has evolved over many decades into an inefficient and increasingly unreliable structure. Power for lighting, air conditioning, refrigeration, communications and computing demands comes almost exclusively from centralized power plants serving users through a complex grid of transmission and distribution lines and substations. Even with continuous improvements in central station generation and transmission technologies, today’s power industry is only about 33 percent efficient(3) meaning that it discharges to the environment roughly twice as much heat as the amount of electrical energy delivered to end-users. Since coal accounts for more than half of all electric power generation, these inefficiencies are a major contributor to rising atmospheric CO2 emissions. As countermeasures are sought to limit global warming, pressures against coal will favor the deployment of alternative energy technologies.

(3) Energy Information Administration, Voluntary Reporting of Greenhouse Gases, 2004, Section 2, Reducing Emissions from Electric Power, Efficiency Projects: Definitions and Terminology, page 20

On-site boilers and furnaces burning either natural gas or petroleum distillate fuels produce most thermal energy for space heating and hot water services. This separation of thermal and electrical energy supply services has persisted despite a general recognition that the cogeneration of electricity and thermal energy services (a practice also known as CHP) can be significantly more energy efficient than central generation of electricity by itself. Except in large-scale industrial applications (e.g., paper and chemical manufacturing), cogeneration has not attained general acceptance. This was due, in part, to the long-established monopoly-like structure of the regulated utility industry. Also, the technologies previously available for small on-site cogeneration systems were incapable of delivering the reliability, cost and environmental performance necessary to displace or even substantially modify the established power industry structure.

The competitive balance began to change with the passage of the Public Utility Regulatory Policy Act of 1978 (“PURPA”), a federal statute that has opened the door to gradual deregulation of the energy market by the individual states. In 1979, the accident at Three Mile Island effectively halted the massive program of nuclear power plant construction that had been a centerpiece of the electric generating strategy among US utilities for two decades. Several factors caused utilities’ capital spending to fall drastically, including well publicized cost overruns at nuclear plants, an end to guaranteed financial returns on costly new facilities, and growing uncertainty over which power plant technologies to pursue. Recently, investors have become increasingly reluctant to support the risks of the long-term construction projects required for new conventional generating and distribution facilities.

Because of these factors, electricity reserve margins declined, and the reliability of service began to deteriorate, particularly in regions of high economic growth. Widespread acceptance of computing and communications technologies by consumers and commercial users has further increased the demand for electricity, while also creating new requirements for very high power quality and reliability. At the same time, technological advances in emission control, microprocessors and internet technologies have sharply altered the competitive balance between centralized and distributed generation. These fundamental shifts in economics and requirements are key to the emerging opportunity for distributed generation equipment and services.

The Role of Distributed Generation

Distributed generation, or cogeneration, is the production of two sources or two types of energy (electricity or cooling and heat) from a single energy source (natural gas). We use technology that utilizes a low-cost, mass-produced, internal combustion engine from General Motors, used primarily in light trucks and sport utility vehicles that is modified to run on natural gas. The engine spins either a standard generator to produce electricity, or a conventional compressor to produce cooling. For heating, since the working engine generates heat, we capture the byproduct heat with a heat exchanger and utilize the heat for facility applications in the form of space heating and hot water for buildings or industrial facilities. This process is very similar to an automobile, where the engine provides the motion to the automobile and the byproduct heat

3

is used to keep the passengers warm during the winter months. For refrigeration or cooling, standard available equipment uses an electric motor to spin a conventional compressor to make cooling. We replace the electric motor with the same modified engine that runs on natural gas to spin the compressor to run a refrigeration cycle and produce cooling.

Distributed generation, or DG, refers to the application of small-scale energy production systems, including electricity generators, at locations in close proximity to the end-use loads that they serve. Integrated energy systems, operating at user sites but interconnected to existing electric distribution networks, can reduce demand on the nation’s utility grid, increase energy efficiency, reduce air pollution and greenhouse gas emissions, and protect against power outages, while, in most cases, significantly lowering utility costs for power users and building operators.

The growing importance of DG as a key component of our future energy supply is underscored by the establishment of a Distributed Energy Program within the U.S. Department of Energy. The DOE has stated its position on this issue as follows:

“...there are two problems at the root of the current power crunch. There is not always enough power generation available to meet peak demand, and existing transmission lines cannot carry all of the electricity needed by consumers.... Distributed Energy resources are the power of choice for providing customers with reliable energy supplies.... These Distributed Energy products and services use natural gas and renewable energy and will be easily interconnected into the nation’s infrastructure for the generation of electricity. Furthermore, our Program works to encourage the expanded use of Distributed Energy technologies in applications with the right combination and occurrence of electrical and thermal demand...”

Until recently, many DG technologies have not been a feasible alternative to traditional energy sources because of economic, technological and regulatory considerations. Even now, many “alternative energy” technologies (such as solar, wind, fuel cells and micro-turbines) have not been sufficiently developed and proven to economically meet the demands of commercial users or the ability to be connected to the existing utility grid.

We supply cogeneration systems that are capable of meeting the demands of commercial users and that can be connected to the existing utility grid. Specific advantages of the company’s on-site distributed generation of multiple energy services, compared with traditional centralized generation and distribution of electricity alone, include the following:

· Greatly increased overall energy efficiency (typically over 80 percent) versus less than 33 percent for the existing power grid.

· Rapid adaptation to changing demand requirements; e.g., weeks, not years to add new generating capacity where and when it is needed.

· Ability to by-pass transmission line and substation bottlenecks in congested service areas.

· Avoidance of site and right-of-way issues affecting large-scale power generation and distribution projects.

· Clean operation, in the case of natural gas fired reciprocating engines using microprocessor combustion controls and low-cost exhaust catalyst technology developed for automobiles, producing exhaust emissions well below the world’s strictest regional environmental standards (e.g., Southern California).

· Rapid economic paybacks for equipment investments, often three to five years when compared to existing utility costs and technologies.

· Relative insensitivity to fuel prices due to high overall efficiencies achieved with cogeneration of electricity and thermal energy services, including the use of waste heat to operate absorption type air conditioning systems (displacing electric-powered cooling capacity at times of peak summer demand).

· Reduced vulnerability of multiple de-centralized small-scale generating units compared to the risk of major outages from natural disasters or terrorist attacks against large central-station power plants and long distance transmission lines.

· Ability to remotely monitor, control and dispatch energy services on a real-time basis using advanced switchgear, software, microprocessor and Internet modalities. Through our onsite energy products and services, energy users are able to optimize, in real time, the mix of centralized and distributed electricity-generating resources.

4

The disadvantages of the company’s on-site distributed generation are:

· Cogeneration is a mechanical process and our equipment is susceptible to downtime or failure.

· The base-rate of an electric utility is determined by a certain number of subscribers. Distributed generation at a significant scale will reduce the number of subscribers and therefore it may increase the base-rate for the electric utility for its customer base.

· By committing to our long-term agreements, a customer may be forfeiting the opportunity to use more efficient technology that may become available in the future.

Also, DG systems possess significant positive environmental impact. The U.S. Environmental Protection Agency (“EPA”) has created a Combined Heat and Power Partnership to promote the benefits of DG systems. The company is a member of this Partnership. The following statement is found on the EPA web site.

“Combined heat and power systems offer considerable environmental benefits when compared with purchased electricity and onsite-generated heat. By capturing and utilizing heat that would otherwise be wasted from the production of electricity, CHP systems require less fuel than equivalent separate heat and power systems to produce the same amount of energy. Because less fuel is combusted, greenhouse gas emissions, such as carbon dioxide (CO2), as well as criteria air pollutants like nitrogen oxides (NOx) and sulfur dioxide (SO2), are reduced.”

The Distributed Generation Market Opportunity

We believe that our primary near-term opportunity for DG energy and equipment sales is where commercial electricity rates exceed $0.12 per kWh, which is predominantly in the Northeast and California. These areas represent approximately 15 percent of the U.S. commercial power market, with electricity revenues in excess of $20 billion per year (see Figure 1. on page 6). Attractive DG economics are currently attainable in applications that include hospitals, nursing homes, multi-tenant residential housing, hotels, schools and colleges, recreational facilities, food processing plants, dairies and other light industrial facilities. Two Combined Heat and Power market analysis reports sponsored by the Energy Information Administration in 2000 detailed the prospective CHP market in the commercial and institutional sectors(4) and in the industrial sectors(5). These data sets were used to estimate the CHP market potential in the 100 kW to 1 MW size range. These target market segments comprise over 163,000 sites totaling 12.2 million kW of prospective DG capacity. This is the equivalent of an $11.7 billion annual electricity market plus a $7.3 billion heat and hot water energy market, for a combined market potential of $19.0 billion.

(4) The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

(5) The Market and Technical Potential for Combined Heat and Power in the Industrial Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

As shown in the graph below, there are substantial variations in the electric rates paid by commercial and institutional customers throughout the U.S. In high-cost regions, monthly payments for energy services supplied by on-site DG projects yield rapid paybacks (e.g. often 3-5 years) on an investment in our systems. An additional 15% of commercial sector electricity, representing annual revenues of $14 billion, is sold at rates between $0.085 and $0.12 per kWh as shown on the graph below. Although paybacks on DG projects would be less rapid in such regions, future rate increases are expected to improve DG economics.

5

Figure 1.

The DG Market Opportunity

U.S. Commercial/Institutional Electric Rate Profile

Source: U.S. Energy Information Administration Data [2002]

Business Model

We are a distributed generation onsite energy company that sells energy in the form of electricity, heat, hot water and air conditioning under long-term contracts with commercial, institutional and light industrial customers. We install our systems at no cost to our customers and retain ownership of the system. Because our systems operate at over 80 percent efficiency (versus less than 33 percent for the existing power grid), we are able to sell the energy produced by these systems to our customers at prices below their existing cost of electricity (or air conditioning), heat and hot water. Our cogeneration systems consist of natural gas-powered internal combustion engines that drive an electrical generator to produce electricity and that capture the engine heat to produce space heating and hot water. Our energy systems also can be configured to drive a compressor that produces air conditioning and that also capture the engine heat. As of December 31, 2007, we had 47 energy systems operational.

To date, each of our installations runs in conjunction with the electric utility grid and requires standard interconnection approval from the local utility. Our customers use both our energy system and the electric utility grid for their electricity requirements. We typically supply the first 20% to 60% of the building’s electricity requirements while the remaining electricity is supplied by the electric utility grid. Our customers are contractually bound to use the energy we supply.

To date, the price that we have charged our customers is set in our customer contracts at a discount to the price of the building’s local electric utility. For the 20% to 60% portion of the customer’s electricity that we supply, the customer realizes immediate savings on its electric bill. In addition to electricity, we sell our customers the heat and hot water at the same price they were previously paying or at a discount equivalent to their discount from us on electricity. Our air conditioning systems are also priced at a discount so that the customer realizes overall cost savings from the installation.

Since we own and operate the energy systems and since our customers have no investment in the units, our customers benefit from no captal requirements and no operating responsibilities. We operate the energy systems so our customers require no staff and have no energy system responsibilities, they are bound, however, to pay for the energy supplied by the energy systems over the term of the agreement.

Energy and Products Portfolio

We provide a full range of DG product and energy options. Our primary energy and products are listed below:

· Energy Sales

o Electricity

o Thermal (Hot Water, Heat and Cooling)

· Energy Producing Products

o Cogeneration Packages

o Chillers

o Complementary Energy Equipment (i.e., boilers, etc.)

6

o Alternative Energy Equipment (i.e., solar, fuel cells, etc.)

· Turnkey Installation Energy Producing Products with Incentives

· Other Revenue Opportunities

Energy Sales

For customers seeking an alternative to the outright purchase of DG equipment, we will install, maintain, finance, own and operate complete on-site DG systems that supply, on a long-term, contractual basis, electricity and other energy services. We sell the energy to customers at a guaranteed discount rate to the rates charged by conventional utility suppliers. Customers are billed monthly. Our customers benefit from a reduction in their current energy bills without the capital costs and risks associated with owning and operating a cogeneration or chiller system. Also, by outsourcing the management and financing of on-site energy facilities to us, they can reap the economic advantages of distributed generation without the need for retaining specialized in-house staff with skills unrelated to their core business. Customers benefit from our On-Site Utility in a number of ways:

· Guaranteed lower price for energy

· Only pay for the energy they use

· No capital costs for equipment, engineering and installation

· No equipment operating costs for fuel and maintenance

· Immediate cash flow improvement

· Significant green impact by the reduction of carbon produced

· No staffing, operations and equipment responsibility

Our customers pay us for energy produced on site at a rate that is a certain percentage below the rate at which the utility companies provide them electrical and natural gas services. We measure the actual amount of electrical and thermal energy produced, and charge our customers accordingly. We agree to install, operate, maintain and repair our energy systems at our sole cost and expense. We also agree to obtain any necessary permits or regulatory approvals at our sole expense. Our agreements are generally for a term of 15 years, renewable for two additional five years terms upon the mutual agreement of the parties.

In regions where high electricity rates prevail, such as the Northeast, monthly payments for DG energy services can yield attractive paybacks (e.g. often 3-5 years) on our investments in on-site utility projects. The price of natural gas has a minor effect on the financial returns obtained from our energy service contracts because the value of hot water and other thermal services produced from the recovered heat generated by the internal combustion engine in our on-site DG system will increase in proportion to higher fuel costs. This recovered energy, which comprises up to 60 percent of the total heating value of fuel supplied to our DG equipment, displaces fuel that would otherwise be burned in conventional boilers. Each of our customer sites becomes a profit center. The example below presents the energy supplied by two 75 kW cogeneration units and the economics of a typical energy service contract where we supply 80% of the site’s heat and hot water and 45% of the site’s electricity:

| | Annual | | Term (15 years) | |

American DG Energy Revenue | | $ | 284,000 | | $ | 4,908,000 | |

American DG Energy Gross Margin | | $ | 84,000 | | $ | 1,456,000 | |

Customer Savings | | $ | 32,000 | | $ | 545,000 | |

The example reflects an American DG Energy investment of $345,000 with a payback in 4 years or a 25% internal rate of return (IRR). The example also reflects a 2% of expected annual increase in energy costs that should occur over the 15-year period.

Since inception in 2001 and through December 31, 2007, the company has entered into 42 agreements, for the supply of on-site energy services, primarily with healthcare, housing facilities, apartments and athletic facilities in the Northeast.

Energy Producing Products

We typically offer cogeneration units sized to produce 75 kW of electricity and water chillers sized to produce 200 to 400 tons of cooling. For cogeneration, we prefer a modular design approach to allow us to group multiple units together to serve customers with considerably larger power requirements. Often, cogeneration units are conveniently dispersed within a large operation, such as a hospital or campus, serving multiple process heating systems that would otherwise be impractical

7

to serve from a single large machine. The equipment we select often yield overall energy efficiencies in excess of 80 percent (from our equipment supplier’s specifications).

Many other DG technologies are challenged by technical, economic and reliability issues associated with systems that generate power using solar, micro-turbine or fuel cell technologies, which have not yet proven to be economical for typical customer needs. When alternative energy technologies mature to the point that they are both reliable and economical, we will employ them for the best-fit applications.

Service and Installation

Where appropriate, we utilize the best local service infrastructure for the equipment we deploy. We require long-term maintenance contracts and ongoing parts sales. Our centralized remote monitoring capability allows us to keep track of our equipment in the field. Our installations are performed by local contractors with experience in energy cogeneration systems.

In August 2005, we began offering our customers a “turn-key” option whereby we provide equipment, systems engineering, installation, interconnect approvals, on-site labor and startup services needed to bring the complete DG system on-line. For some customers, we are also paid a fee to operate the systems and may receive a portion of the savings generated from the equipment.

Other Funding and Revenue Opportunities

American DG Energy is able to participate in the Demand Response market and receive payments due to the availability of our energy systems. Demand Response programs provide payments for either the reduction of electricity usage or the increase in electricity production during periods of peak usage through out a utility territory. We have also received grants and incentives from state organizations and natural gas companies for our installed energy systems.

Sales and Marketing

Our on-site utility services are sold directly to end-users by our in-house marketing team and by established sales agents and representatives. We offer standardized packages of energy, equipment and services suited to the needs of property owners in healthcare, hospitality, large residential, athletic facilities and certain industrial sites. This includes national accounts and other customer groups having a common set of energy requirements at multiple locations.

Our energy offering is translated into direct financial gain for our clients, and is best appreciated by senior management. These clients recognize the gain in cash flow, the increase in net income and the preservation of capital we offer. As such, our energy sales are focused on reaching these decision makers. Additionally, we have benefited with increased sales and maintenance support through our joint venture, called American DG NY LLC, with AES-NJ Cogen Co., an established developer of small cogeneration systems.

The company is continually expanding its sales efforts by developing joint marketing initiatives with key suppliers to our target industries. Particularly important are our collaborative programs with natural gas utility companies. Since the economic viability of any DG project is critically dependent upon effective utilization of recovered heat, the insight of the gas supplier to the customer energy profile is particularly effective in prospecting the most cost-effective DG sites in any region.

DG is enjoying growing support among state utility regulators seeking to increase the reliability of electricity supply with cost effective environmentally responsible demand-side resources. New York, New Jersey, Connecticut, and Massachusetts are among the states that encourage DG through inter-connecting standards, incentives and/or supply planning. Unlike large central station power plants, DG investments can be made in small increments and with lead-times as short as just a few months.

Competition

We believe that the main competition for our DG products is the established electric utility infrastructure. DG is beginning to gain acceptance in regions where energy customers are dissatisfied with the cost and reliability of traditional electricity service. These end-users, together with growing support from state legislatures and regulators are creating a favorable climate for the growth of DG that is overcoming the objections of established utility providers. In our target markets, we compete with large utility companies such as Consolidated Edison in New York City and Westchester County, LIPA in Long Island, New York, Public Service Gas and Electric in New Jersey, and NSTAR in Massachusetts.

8

Engine manufacturers sell DG units that range in size from a few kilowatts to many megawatts in size. Those manufacturers are predominantly greater than 1 MW and include Caterpillar, Cummins, and Waukesha. In many cases, we view these companies as potential suppliers of equipment and not as competitors. For example, we are installing a Waukesha unit at a customer site.

The alternative energy market is emerging rapidly. Many companies are developing alternative and renewable energy sources including solar power, wind power, fuel cells and micro-turbines. Some of the companies in this sector include General Electric, BP, Shell, Sun Edison and Evergreen Solar (in the solar energy space); Plug Power and Fuel Cell Energy (in the fuel cell space); and Capstone, Ingersoll Rand and Elliott Turbomachinery (in the micro-turbine space). The effect of these developing technologies on our business is difficult to predict; however, when their technologies become more viable for our target markets, we may be able to adopt their technologies into our business model.

There are a number of Energy Service Companies (“ESCO’s”) that offer related services. These companies include Siemens, Honeywell and Johnson Controls. In general, these companies seek large, diverse projects for electric demand reduction for campuses that include building lighting and controls, and electricity (in rare occasions) or cooling. Because of their overhead structures, these companies often solicit large projects and stay away from individual properties. Since we focus on smaller projects for energy supply, we are well suited to work in tandem with these companies when the opportunity arises.

There are also a few local emerging cogeneration developers and contractors that are attempting to offer services similar to ours. To be successful, they will need to have the proper experience in equipment and technology, installation contracting, equipment maintenance and operation, site economic evaluation, project financing, and energy sales plus the capability to cover a broad region.

Material Contracts

In January 2007, we extended our 2006 Facilities, Support Services and Business Agreement with Tecogen to provide us with certain office and business support services for a period of one year, renewable annually by mutual agreement. Under the 2007 business agreement we revised the rent allocation whereby Tecogen provides the company with office space and utilities at a flat rate of $2,294 per month. We also share personnel support services with Tecogen. We are allocated our share of the cost of the personnel support services based upon the amount of time spent by such support personnel while working on our behalf. To the extent Tecogen is able to do so under its current plans and policies, Tecogen includes us and our employees in several of its insurance and benefit programs. The costs of these programs are charged to us on an actual cost basis.

Under this agreement, we receive pricing based on a volume discount if we purchase cogeneration and chiller products from Tecogen. For certain sites, we hire Tecogen to service our Tecogen chiller and cogeneration products.

We have sales representation rights to Tecogen’s products and services. In New England, we have exclusive sales representation rights to their cogeneration products. We have granted Tecogen sales representation rights to our on-site utility energy service in California.

Government Regulation

We are not subject to extensive government regulation. We are required to file for local construction permits (electrical, mechanical and the like) and utility interconnects, and we must make various local and state filings related to environmental emissions. Our expenditures for regulatory compliance are not material.

Effective March 7, 2007, there were new air quality and permitting requirements in New Jersey that required adding emission control equipment on our already existing 18 cogeneration systems operating in New Jersey and any new energy systems we install in that state. In order to interpret and comply with the new emission requirements, we retained an independent environmental engineering consultant to review our existing installations, as well as all new construction. Of the existing 18 systems previously identified, a total of 9 systems in two locations were affected by the new regulations. The first location at a hospital has been outfitted with commercially available dry catalyst technology, all permits have been obtained and the project has returned to full capacity and is generating revenue. The second location at a large housing complex was in the final permitting phase at year-end 2007 and we expect a successful return of those units during the second quarter of 2008. The estimated lost revenue from those two locations was approximately $499,000 during 2007.

Employees

As of December 31, 2007, we employed eight active full-time employees and three part-time employees. We believe that our relationship with our employees is satisfactory. None of our employees are represented by a collective bargaining agreement.

9

Item 1A. Risk Factors

The following risk factors should be considered carefully in addition to the other information contained in this report. This report contains forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. These statements are only predictions. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause our, our customers’ or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as other sections in this report, discuss some of the factors that could contribute to these differences.

The forward-looking statements made in this report relate only to events as of the date on which the statements are made. Except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

This report also contains market data related to our business and industry. These market data include projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected rates may have a material adverse effect on our business, results of operations, financial condition and the market price of our Common Stock.

We have incurred losses, and these losses may continue.

We have incurred losses in each of our fiscal years since inception. Losses continued to incure in 2007. There is no assurance that profitability will be achieved in the near term, if at all.

Because unfavorable utility regulations make the installation of our systems more difficult or economic, any slowdown in the utility deregulation process would be an impediment to the growth of our business.

In the past, many electric utility companies have raised opposition to distributed generation, a critical element of our on-site utility business. Such resistance has generally taken the form of unrealistic standards for interconnection, and the use of targeted rate structures as disincentives to combined generation of on-site power and heating-cooling services. A DG company’s ability to obtain reliable and affordable back-up power through interconnection with the grid is essential to our business model. Utility policies and regulations in most states are often not prepared to accommodate widespread onsite generation. These barriers erected by electric utility companies and unfavorable regulations, where applicable, make more difficult or uneconomic our ability to connect to the electric grid at customer sites and are an impediment to the growth of our business. Development of our business could be adversely affected by any slowdown or reversal in the utility deregulation process or by difficulties in negotiating backup power supply agreements with electric providers in the areas where we intend to do business.

Effective March 7, 2007, there were new air quality and permitting requirements in New Jersey that required adding emission control equipment on our already existing 18 cogeneration systems operating in New Jersey and any new energy systems we install in that state. In order to interpret and comply with the new emission requirements, we retained an independent environmental engineering consultant to review our existing installations, as well as all new construction. Of the existing 18 systems previously identified, a total of 9 systems in two locations were affected by the new regulations. The first location at a hospital has been outfitted with commercially available dry catalyst technology, all permits have been obtained and the project has returned to full capacity and is generating revenue. The second location at a large housing complex was in the final permitting phase at year-end 2007.

Our onsite utility concept is largely unproven and may not be accepted by a sufficient number of customers.

The sale of cogeneration and cooling equipment has been successfully carried out for more than a decade. However, our on-site utility concept (i.e., the sale of on-site energy services, rather than equipment) is still in an early stage of implementation. Unresolved issues include the pricing of energy services and the structuring of contracts to provide cost savings to customers and optimum financial returns to us. There is no assurance that we will be successful in developing a profitable on-site utility business model, and failure to do so would have a material adverse effect on our business and financial performance.

10

The economic viability of our projects depends on the price spread between fuel and electricity, and the variability of the prices of these components creates a risk that our projects will be uneconomic.

The economic viability of DG projects is dependent upon the price spread between fuel and electricity prices. Volatility in one component of the spread, the cost of natural gas and other fuels (e.g., propane or distillate oil) can be managed to a greater or lesser extent by means of futures contracts. However, the regional rates charged for both base load and peak electricity services may decline periodically due to excess capacity arising from over-building of utility power plants or recessions in economic activity. Any sustained weakness in electricity prices could significantly limit the market for our cogeneration, cooling equipment and on-site utility energy services.

We may fail to make sales to certain prospective customers because of resistance from facilities management personnel to the outsourcing of their service function.

Any outsourcing of non-core activities by institutional or commercial entities will generally lead to reductions in permanent on-site staff employment. As a result, our proposals to implement on-site utility contracts are likely to encounter strong initial resistance from the facilities managers whose jobs will be threatened by energy outsourcing. The growth of our business will depend upon our ability to overcome such barriers among prospective customers.

Future government regulations, such as increased emissions standards, safety standards and taxes, may adversely impact the economics of our business.

The operation of distributed generation equipment at our customers’ sites may be subject to future changes in federal, state and local laws and regulations (e.g., emissions, safety, taxes, etc.). Any such new or substantially altered rules and standards may adversely affect our revenues, profits and general financial condition.

If we cannot expand our network of skilled technical support personnel, we will be unable to grow our business.

Each additional customer site for our services requires the initial installation and subsequent maintenance and service of equipment to be provided by a team of technicians skilled in a broad range of technologies, including combustion, instrumentation, heat transfer, information processing, microprocessor controls, fluid systems and other elements of distributed generation. If we are unable to recruit, train, motivate, sub-contract, and retain such personnel in each of the regional markets where our business operates we will be unable to grow our business in those markets.

The company operates in highly competitive markets and may be unable to successfully compete against competitors having significantly greater resources and experience.

Our business may be limited by competition from energy services companies arising from the breakup of conventional regulated electric utilities. Such competitors, both in the equipment and energy services sectors, are likely to have far greater financial and other resources than us, and could possess specialized market knowledge with existing channels of access to prospective customer locations. We may be unable to successfully compete against those competitors.

Future technology changes may render obsolete various elements of equipment comprising our on-site utility installations.

We must select equipment for our DG projects so as to achieve attractive operating efficiencies, while avoiding excessive downtimes from the failure of unproven technologies. If we are unable to achieve a proper balance between the cost, efficiency, and reliability of equipment selected for our projects, our growth and profitability will be adversely impacted.

We have limited historical operating results upon which to base projections of future financial performance, making it difficult for prospective investors to assess the value of our stock.

Our experience is primarily on-site energy services, and we have only four years of actual operating experience. These limitations make developing financial projections more difficult. We will expand our business infrastructure based on these projections. If these projections prove to be inaccurate, we will sustain additional losses and will jeopardize the success of our business.

11

We will need to raise additional capital for our business, which will dilute existing shareholders.

Additional financings will be required to implement our overall business plan. We will need additional capital. Equity financings will dilute the percentage ownership of our existing shareholders. Our ability to raise an adequate amount of capital and the terms of any capital that we are able to raise will be dependent upon our progress in implementing demonstration projects and related marketing service development activities. If we do not make adequate progress, we may be unable to raise adequate funds, which will limit our ability to expand our business. If the terms of any equity financings are unfavorable, the dilutive impact on our shareholders might be severe.

We may make acquisitions that could harm our financial performance.

In order to expedite development of our corporate infrastructure, particularly with regard to equipment installation and service functions, we anticipate the future acquisition of complementary businesses. Risks associated with such acquisitions include the disruption of our existing operations, loss of key personnel in the acquired companies, dilution through the issuance of additional securities, assumptions of existing liabilities and commitment to further operating expenses. If any or all of these problems actually occur, acquisitions could negatively impact our financial performance and future stock value.

We are controlled by a small group of majority shareholders, and our minority shareholders will be unable to effect changes in our governance structure or implement actions that require shareholder approval, such as a sale of the company.

George Hatsopoulos and John Hatsopoulos, who are brothers, beneficially own a majority of our outstanding shares of common stock. These stockholders have the ability to control various corporate decisions, including our direction and policies, the election of directors, the content of our charter and bylaws, and the outcome of any other matter requiring shareholder approval, including a merger, consolidation, and sale of substantially all of our assets or other change of control transaction. The concurrence of our minority shareholders will not be required for any of these decisions.

We may be exposed to substantial liability claims if we fail to fulfill our obligations to our customers.

We intend to enter into contracts with large commercial and not-for-profit customers under which we will assume responsibility for meeting a portion of the customers’ building energy demand and equipment installation. We may be exposed to substantial liability claims if we fail to fulfill our obligations to customers. There can be no assurance that we will not be vulnerable to claims by customers and by third parties that are beyond any contractual protections that we are able to negotiate. We may be unable to obtain liability and other insurance on terms and at prices that are commercially acceptable to us. As a result, liability claims could cause us significant financial harm.

Investment in our common stock is subject to price fluctuations which have been significant for development stage companies like us.

Historically, valuations of many companies in the development stage have been highly volatile. The securities of many of these companies have experienced significant price and trading volume fluctuations, unrelated to the operating performance or the prospects of such companies. If the conditions in the equity markets deteriorate, we may be unable to finance our additional funding needs in the private or the public markets. There can be no assurance that any future offering will be consummated or, if consummated, will be at a share price equal or superior to the price paid by our investors even if we meet our technological and marketing goals.

Our common stock is quoted on the OTC Bulletin Board which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTC Bulletin Board. The OTC Bulletin Board is a significantly more limited market than the New York Stock Exchange or NASDAQ system. The quotation of our shares on the OTC Bulletin Board may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system or a stock exchange.

12

Future sales of common stock by our existing stockholders may cause our stock price to fall.

The market price of our common stock could decline as a result of sales by our existing stockholders of shares of common stock in the market or the perception that these sales could occur. These sales might also make it more difficult for us to sell equity securities at a time and price that we deem appropriate and thus inhibit our ability to raise additional capital when it is needed.

We have never paid dividends on our capital stock, and we do not anticipate paying any cash dividends in the foreseeable future.

We have paid no cash dividends on our capital stock to date and we currently intend to retain our future earnings, if any, to fund the development and growth of our business. In addition, the terms of any future debt or credit facility may preclude us from paying these dividends. As a result, capital appreciation, if any, of our common stock will be your sole source of gain for the foreseeable future.

Because we do not intend to pay cash dividends, our stockholders will receive no current income from holding our stock.

We have never paid or declared any cash dividends. We currently expect to retain earnings for use in the operation and expansion of our business, and therefore do not anticipate paying any cash dividends for the foreseeable future.

Trading of our common stock is restricted by the SEC’S “penny stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define “penny stock” to be any equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and other quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statement showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure and suitability requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our capital stock. Trading of our capital stock is restricted by the SEC’S “penny stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

There has been a material weakness in our financial controls and procedures, which could harm our operating results or cause us to fail to meet our reporting obligations.

As of the end of the period covered by this report, our Chief Executive Officer and Chief Financial Officer have performed an evaluation of controls and procedures and concluded that our controls are effective to give reasonable assurance that the information required to be disclosed by our company in reports that we file under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is recorded, processed, summarized and reported as when required. However, there is a lack of segregation of duties at the company due to the small number of employees dealing with general administrative and financial matters. Furthermore, the company did not have personnel with an appropriate level of accounting knowledge, experience and training in the selection, application and implementation of GAAP as it relates to complex transactions and financial reporting requirements. This constitutes a material weakness in financial reporting. Any failure to implement effective internal controls could harm our operating results or cause us to fail to meet our reporting obligations. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock, and may require us to incur additional costs to improve our internal control system.

13

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our headquarters are located in Waltham, Massachusetts and consist of 1,199 square feet of office and storage space that are leased from Tecogen. The lease expires on March 31, 2009. We believe that our facilities are appropriate and adequate for our current needs.

Item 3. Legal Proceedings

We are not currently a party to any other material litigation, and we are not aware of any pending or threatened litigation against us that could have a material adverse affect on our business, operating results or financial condition.

Item 4. Submission of Matters to a Vote of Security Holders

None.

14

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market

Our common stock is traded on the Over-the-Counter Bulletin Board, under the symbol “ADGE”. Our stock started trading on November 8, 2007. During the period ended December 31, 2007, the high price was $1.25 and the low price was $0.83 as reported by the Over-the-Counter Bulletin Board (“OTC”). OTC market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions.

Holders

As of December 31, 2007, the number of holders of record of the common stock was 107.

Dividends

We have never declared or paid any cash dividends on shares of our capital stock. We currently intend to retain earnings, if any, to fund the development and growth of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, cash needs and growth plans.

Recent Sales of Unregistered Securities

Set forth below is information regarding common stock issued, warrants issued and stock options granted by the company during fiscal year 2007. Also included is the consideration, if any, we received and information relating to the section of the Securities Act of 1933, as amended (the “Securities Act”), or rule of the SEC, under which exemption from registration was claimed.

Common Stock and Warrants

On March 8, 2007, the company raised $3,004,505 in a private placement of 4,292,150 shares of common stock exclusively to accredited investors, representing 16.5% of the total shares then outstanding, at a price of $0.70 per share. Included in those shares are 750,000 shares to Maxwell C.B. Ward, 30,000 shares to Giordano Venzi, 15,000 shares to Fermin Alou, 20,000 shares to Edmond Viedma, 500,000 shares to Christian Levett, 357,150 shares to Berger van Berchem & Co Ltd., 10,000 shares to Athanasios Kyranis, 2,150,000 shares to Nettlestone Enterprises Limited, 100,000 shares to Paris and Aliki Nikolaidis (through the exercise of warrants) and 360,000 shares to Martin C.B. Mellish. Prior to this transaction the company had 26,017,250 shares of common stock outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Section 4(2) and/or Regulation D thereunder.

On April 30, 2007, the company raised $1,120,000 in a private placement of 1,600,000 shares of common stock exclusively to accredited investors, representing 5.2% of the total shares then outstanding, at a price of $0.70 per share. Included in those shares are 1,500,000 shares to Brevan Howard Asset Management, 50,000 shares to Ernest Aloi through the exercise of warrants, 25,000 to Nancy Schachter A/C 7379-1230 through the exercise of warrants and 25,000 to Adam Schachter A/C 7378-8270 through the exercise of warrants. Prior to this transaction the company had 31,046,400 shares of common stock outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Section 4(2) and/or Regulation D thereunder.

On June 30, 2007, the company issued to Joseph P. Kennedy 100,000 shares of common stock through an option exercise at $0.07 per share, representing 0.3% of the total shares then outstanding. Prior to this transaction the company had 32,646,400 shares of common stock outstanding.

On October 2, 2007, Michael H. Carstens, a holder of the company’s 8% Convertible Debenture elected to convert $50,000 of the outstanding principal amount of the debenture into 59,524 shares of common stock. Prior to this transaction the company had 32,746,400 shares of common stock outstanding.

15

Restricted Stock Grants

On February 20, 2007, the company made restricted stock grants to employees, directors and consultants by permitting them to purchase an aggregate of 737,000 shares of common stock, representing 2.4% of the total shares then outstanding at a price of $0.001 per share. Prior to this transaction the company had 30,309,400 shares of common stock outstanding.

Such transactions were exempt from registration under the Securities Act under Section 4(2), Regulation D and/or Rule 701 thereunder.

Stock Options

In 2007 the company granted nonqualified options to purchase 1,156,000 shares of the common stock to 7 employees at $0.90 per share. Of those shares 1,130,000 have a vesting schedule of 10 years and 26,000 shares have a vesting schedule of 4 years. The grant of such options was exempt from registration under Rule 701 under the Securities Act.

No underwriters were involved in the foregoing sales of securities. All purchasers of shares of our convertible debentures and warrants described above represented to us in connection with their purchase that they were accredited investors and made customary investment representations. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

Rule 144

Under Rule 144 under the Securities Act, as recently amended, in general, a person who is not deemed to have been one of our affiliates at any time during the 90 days preceding a sale, and who has beneficially owned shares of our Common Stock for more than six months but less than one year would be entitled to sell an unlimited number of shares. Sales under Rule 144 during this time period are still subject to the requirement that current public information is available about us for at least 90 days prior to the sale. After such person beneficially owns shares of our Common Stock for a period of one year or more, the person is entitled to sell an unlimited number of shares without complying with the public information requirement or any of the other provisions of Rule 144. As of February 15, 2008, all of our shares of Common Stock held by non-affiliates were eligible for resale under amended Rule 144.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operation

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and related notes appearing elsewhere in this report. Some of the information contained in this discussion and analysis or set forth elsewhere in this report, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Risk Factors” section beginning on page 10 of this report for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

We derive sales from selling energy in the form of electricity, heat, hot water and cooling to our customers under long-term energy sales agreements (with a typical term of 10 to 15 years). The energy systems are owned by us and are installed in our customers’ buildings. Each month we obtain readings from our energy meters to determine the amount of energy produced for each customer. We multiply these readings by the appropriate published price of energy (electricity, natural gas or oil) from our customer’s local energy utility, to derive the value of our monthly energy sale, less the applicable negotiated discount. Our revenues per customer on a monthly basis vary based on the amount of energy produced by our energy systems and the published price of energy (electricity, natural gas or oil) from our customer’s local energy utility that month. Our revenues commence as new energy systems become operational. As of December 31, 2007, we had 47 energy systems operational.

As a by-product of our energy business, in some cases the customer may choose to have us construct the system for them rather than have it owned by American DG Energy. In this case we account for revenue and costs using the percentage-of-completion method of accounting. Under the percentage-of-completion method of accounting, revenues are recognized by applying percentages of completion to the total estimated revenues for the respective contracts. Costs are

16

recognized as incurred. The percentages of completion are determined by relating the actual cost of work performed to date to the current estimated total cost at completion of the respective contracts. When the estimate on a contract indicates a loss, the company’s policy is to record the entire expected loss, regardless of the percentage of completion. In certain instances, revenue from unresolved claims is recorded when, in the opinion of management, realization of such revenue is probable and can be reliably estimated, only to the extent of actual costs incurred. Otherwise, revenue from claims is recorded in the year in which such claims are resolved. Costs and estimated earnings in excess of related billings represents the excess of contract costs and profit recognized to date on the percentage-of-completion accounting method over billings to date on certain contracts. Billings in excess of related costs and estimated earnings represents the excess of billings to date over the amount of contract costs and profits recognized to date on the percentage-of-completion accounting method for certain contracts. Customers may buy out their long term obligation under energy contracts and purchase the underlying equipment from the company. Any resulting gain on these transactions is recognized over the payment period in the accompanying consolidated statements of operations. Revenues from operation and maintenance services, including shared savings are recorded when provided and verified.

We have experienced total net losses since inception of approximately $7.4 million. For the foreseeable future, we expect to experience continuing operating losses and negative cash flows from operations as our management executes our current business plan. The cash and cash equivalents available at December 31, 2007 will provide sufficient working capital to meet our anticipated expenditures including installations of new equipment for the next twelve months; however, as we continue to grow our business by adding more energy systems, the cash requirements will increase. We believe that our cash and cash equivalents available at December 31, 2007 and our ability to control certain costs, including those related to general and administrative expenses will enable us to meet our anticipated cash expenditures through January 1, 2009. Beyond January 1, 2009, we may need to raise additional capital through a debt financing or equity offering to meet our operating and capital needs. There can be no assurance, however, that we will be successful in our fundraising efforts or that additional funds will be available on acceptable terms, if at all.

In 2007, we raised approximately $4.1 million through a private placement of our common stock and the exercise of various warrants and stock options. If we are unable to raise additional capital in 2009 we may need to terminate certain of our employees and adjust our current business plan. Financial considerations may cause us to modify planned deployment of new energy systems and we may decide to suspend installations until we are able to secure additional working capital. We will evaluate possible acquisitions of, or investments in, businesses, technologies and products that are complementary to our business, however, we currently have no such discussions.

The company’s operations are comprised of one business segment. Our business is selling energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements. The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with statements and notes thereto appearing elsewhere herein.

Recent Accounting Pronouncements

In September 2006, the FASB issued FAS No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 establishes a common definition of fair value to be used whenever GAAP requires (or permits) assets or liabilities to be measured at fair value, and does not expand the use of fair value in any new circumstances. It also requires expanded disclosure about the extent to which companies measure assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value measurements on earnings. In addition, in February 2007, the FASB issued FAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities-including an amendment of FASB Statement No. 115” (“FAS 159”). FAS 159 expands the use of fair value accounting but does not affect existing standards that require assets or liabilities to be carried at fair value. Under FAS 159, a company may elect to use fair value to measure most financial assets and liabilities and any changes in fair value are recognized in earnings. The fair value election is irrevocable and generally made on an instrument-by-instrument basis, even if a company has similar instruments that it elects not to measure based on fair value. Both FAS 157 and FAS 159 will be effective for the company on January 1, 2008. On February 12, 2008, the FASB issued proposed FASB Staff Position No. FAS No. 157-2, “Effective Date of FASB Statement No. 157” which defers the effective date for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis (that is, at least annually) to fiscal years beginning after November 15, 2008. The company does not expect the adoption of FAS 157 and FAS 159 will have a material impact on its consolidated financial statements in 2008.

17

In December 2007, the FASB issued FAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements—an amendment of Accounting Research Bulletin No. 51” (“FAS 160”). FAS 160 clarifies the classification in a company’s consolidated balance sheet and the accounting for and disclosure of transactions between the company and holders of noncontrolling interests. FAS 160 is effective for the company January 1, 2009. Early adoption is not permitted. The company does not expect the adoption of FAS 160 to have a material impact on its consolidated financial statements.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, the reported amounts of revenues and expenses during the reporting period, and the disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates. Management believes the following critical accounting policies involve more significant judgments and estimates used in the preparation of our consolidated financial statements.

Partnerships, Joint Ventures and Entities under Common Control