UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended December 31, 2008 | |

| |

or | |

|

|

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-52294

AMERICAN DG ENERGY INC.

(Exact name of Registrant as specified in its charter)

Delaware |

| 04-3569304 |

(State of incorporation or organization) |

| (IRS Employer Identification No.) |

|

|

|

45 First Avenue |

|

|

Waltham, Massachusetts |

| 02451 |

(Address of Principal Executive Offices) |

| (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (781) 622-1120

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class |

| Name of each exchange on which registered |

Common Stock, $0.001 par value |

| OTC Bulletin Board |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or an amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company x |

(Do not check if a smaller reporting company) |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of June 30, 2008, the aggregate market value of the voting shares of the registrant held by non-affiliates on the OTC Bulletin Board was approximately $19,733,695 based on a closing price per share of $1.43. For purposes of this calculation, an aggregate of 20,119,709 shares of common stock held directly or by affiliates of the directors and officers of the registrant have been included in the number of shares held by affiliates.

As of March 20, 2009 the registrant’s shares of common stock outstanding were: 34,034,496.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by in Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference from our definitive Proxy Statement for our 2009 Annual Meeting of Shareholders scheduled to be held on May 29, 2009.

WARNING CONCERNING FORWARD-LOOKING STATEMENTS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER FEDERAL SECURITIES LAWS. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, AND ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS.

WE GENERALLY IDENTIFY FORWARD-LOOKING STATEMENTS BY TERMINOLOGY SUCH AS “MAY,” “WILL,” “SHOULD,” “EXPECTS,” “PLANS,” “ANTICIPATES,” “COULD,” “INTENDS,” “TARGET,” “PROJECTS,” “CONTEMPLATES,” “BELIEVES,” “ESTIMATES,” “PREDICTS,” “POTENTIAL” OR “CONTINUE” OR THE NEGATIVE OF THESE TERMS OR OTHER SIMILAR WORDS. THESE STATEMENTS ARE ONLY PREDICTIONS. THE OUTCOME OF THE EVENTS DESCRIBED IN THESE FORWARD-LOOKING STATEMENTS IS SUBJECT TO KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE OUR, OUR CUSTOMERS’ OR OUR INDUSTRY’S ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS, TO DIFFER.

THIS REPORT ALSO CONTAINS MARKET DATA RELATED TO OUR BUSINESS AND INDUSTRY. THESE MARKET DATA INCLUDE PROJECTIONS THAT ARE BASED ON A NUMBER OF ASSUMPTIONS. IF THESE ASSUMPTIONS TURN OUT TO BE INCORRECT, ACTUAL RESULTS MAY DIFFER FROM THE PROJECTIONS BASED ON THESE ASSUMPTIONS. AS A RESULT, OUR MARKETS MAY NOT GROW AT THE RATES PROJECTED BY THESE DATA, OR AT ALL. THE FAILURE OF THESE MARKETS TO GROW AT THESE PROJECTED RATES MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION AND THE MARKET PRICE OF OUR COMMON STOCK.

SEE “ITEM 1A. RISK FACTORS,” “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” AND “BUSINESS,” AS WELL AS OTHER SECTIONS IN THIS REPORT, THAT DISCUSS SOME OF THE FACTORS THAT COULD CONTRIBUTE TO THESE DIFFERENCES. THE FORWARD-LOOKING STATEMENTS MADE IN THIS ANNUAL REPORT ON FORM 10-K RELATE ONLY TO EVENTS AS OF THE DATE OF WHICH THE STATEMENTS ARE MADE. EXCEPT AS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR RELEASE ANY FORWARD- LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

AMERICAN DG ENERGY INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2008

1

General

American DG Energy Inc. (“American DG Energy”, the “company”, “we”, “our” or “us”) distributes, owns and operates clean, on-site energy systems that produce electricity, hot water, heat and cooling. Our business model is to own the equipment that we install at customers’ facilities and to sell the energy produced by these systems to the customers on a long-term contractual basis. We call this business the American DG Energy “On-Site Utility”.

We offer natural gas powered cogeneration systems that are highly reliable and energy efficient. Our cogeneration systems produce electricity from an internal combustion engine driving a generator, while the heat from the engine and exhaust is recovered and typically used to produce heat and hot water for use at the site. We also distribute and operate water chiller systems for building cooling applications that operate in a similar manner, except that the engine’s power drives a large air-conditioning compressor while recovering heat for hot water. Cogeneration systems reduce the amount of electricity that the customer must purchase from the local utility and produce valuable heat and hot water for the site to use as required. By simultaneously providing electricity, hot water and heat, cogeneration systems also have a significant, positive impact on the environment by reducing the carbon or CO2 produced by offsetting the traditional energy supplied by the electric grid and conventional hot water boilers.

Distributed Generation of electricity or DG, or often referred to as cogeneration systems, or combined heat and power systems, or CHP, is an attractive option for reducing energy costs and increasing the reliability of available energy. DG has been successfully implemented by others in large industrial installations over 10 Megawatts, or MW, where the market has been growing for several years, and is increasingly being accepted in smaller size units because of technology improvements, increased energy costs and better DG economics. We believe that our target market (users of up to 1 MW) has been barely penetrated and that the reduced reliability of the utility grid, increasing cost pressures experienced by energy users, advances in new, low cost technologies and DG-favorable legislation and regulation at the state and federal level will drive our near-term growth and penetration into our target market. The company maintains a website at www.americandg.com, but our website address included in this Annual Report on Form 10-K is a textual reference only and the information in the website is not incorporated by reference into this Annual Report on Form 10-K.

The company was incorporated as a Delaware corporation on July 24, 2001 to install, own, operate and maintain complete DG systems and other complementary systems at customer sites and sell electricity, hot water, heat and cooling energy under long-term contracts at prices guaranteed to the customer to be below conventional utility rates. As of December 31, 2008, we had installed energy systems, representing approximately 4,240 kilowatts, or kW, 32.4 million British thermal units, or MMBtu’s, of heat and hot water and 600 tons of cooling. kW is a measure of electricity generated, MMBtu is a measure of heat generated and a ton is a measure of cooling generated. Due to the high efficiency CHP systems, the Environmental Protection Agency, or EPA, has recognized them as a means to improve the environment. We have estimated that our currently installed energy systems running at 100% capacity have the potential to produce approximately 24,200 metric tons of carbon equivalents, less than typical separate heat and power systems, resulting in emissions reductions equivalent to planting 6,600 acres of forest or removing the emissions of 4,100 automobiles.

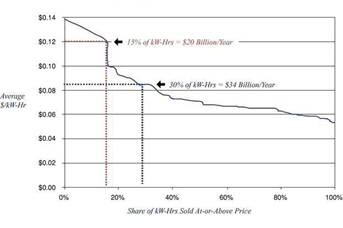

We believe that our primary near-term opportunity for DG energy and equipment sales is where commercial electricity rates exceed $0.12 per kW hour, or kWh, which is predominantly in the Northeast and California. These areas represent approximately 15% of the U.S. commercial power market, with electricity revenues in excess of $20.0 billion per year (see Figure 1 on page 6). Attractive DG economics are currently attainable in applications that include hospitals, nursing homes, multi-tenant residential housing, hotels, schools and colleges, recreational facilities, food processing plants, dairies and other light industrial facilities. Two CHP market analysis reports sponsored by the Energy Information Administration, or EIA, in 2000 detailed the prospective CHP market in the commercial and institutional sectors(1) and in the industrial sectors(2). These data sets were used to estimate the CHP market potential in the 100 kW to 1 MW size range. These target market segments comprise over 163,000 sites totaling 12.2 million kW of prospective DG capacity. This is the equivalent of an $11.7 billion annual electricity market plus a $7.3 billion heat and hot water energy market, for a combined market potential of $19.0 billion.

(1) The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

(2) The Market and Technical Potential for Combined Heat and Power in the Industrial Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

2

We believe that the largest number of potential DG users in the U.S. require less than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are able to design our systems to suit a particular customer’s needs because of our ability to place multiple units at a site. This approach is part of what allows our products and services to meet changing power and cooling demands throughout the day (also from season-to-season) and greatly improves efficiency through a customer’s varying high and low power requirements.

American DG Energy purchases energy equipment from various suppliers. The primary type of equipment used is a natural gas-powered, reciprocating engine provided by Tecogen Inc., or Tecogen. Tecogen is a leading manufacturer of natural gas, engine-driven commercial and industrial cooling and cogeneration systems suitable for a variety of applications, including hospitals, nursing homes and schools.

As power sources that use alternative energy technologies mature to the point that they are both reliable and economical, we will consider employing them to supply energy for our customers. We regularly assess the technical, economic, and reliability issues associated with systems that use solar, micro-turbine or fuel cell technologies to generate power.

Background and Market

The delivery of energy services to commercial and residential customers in the U.S. has evolved over many decades into an inefficient and increasingly unreliable structure. Power for lighting, air conditioning, refrigeration, communications and computing demands comes almost exclusively from centralized power plants serving users through a complex grid of transmission and distribution lines and substations. Even with continuous improvements in central station generation and transmission technologies, today’s power industry is only about 33% efficient(3) meaning that it discharges to the environment roughly twice as much heat as the amount of electrical energy delivered to end-users. Since coal accounts for more than half of all electric power generation, these inefficiencies are a major contributor to rising atmospheric CO2 emissions. As countermeasures are sought to limit global warming, pressures against coal will favor the deployment of alternative energy technologies.

On-site boilers and furnaces burning either natural gas or petroleum distillate fuels produce most thermal energy for space heating and hot water services. This separation of thermal and electrical energy supply services has persisted despite a general recognition that CHP can be significantly more energy efficient than central generation of electricity by itself. Except in large-scale industrial applications (e.g., paper and chemical manufacturing), cogeneration has not attained general acceptance. This was due, in part, to the long-established monopoly-like structure of the regulated utility industry. Also, the technologies previously available for small on-site cogeneration systems were incapable of delivering the reliability, cost and environmental performance necessary to displace or even substantially modify the established power industry structure.

The competitive balance began to change with the passage of the Public Utility Regulatory Policy Act of 1978, a federal statute that has opened the door to gradual deregulation of the energy market by the individual states. In 1979, the accident at Three Mile Island effectively halted the massive program of nuclear power plant construction that had been a centerpiece of the electric generating strategy among U.S. utilities for two decades. Several factors caused utilities’ capital spending to fall drastically, including well publicized cost overruns at nuclear plants, an end to guaranteed financial returns on costly new facilities, and growing uncertainty over which power plant technologies to pursue. Recently, investors have become increasingly reluctant to support the risks of the long-term construction projects required for new conventional generating and distribution facilities.

Because of these factors, electricity reserve margins have declined, and the reliability of service has begun to deteriorate, particularly in regions of high economic growth. Widespread acceptance of computing and communications technologies by consumers and commercial users has further increased the demand for electricity, while also creating new requirements for very high power quality and reliability. At the same time, technological advances in emission control, microprocessors and internet technologies have sharply altered the competitive balance between centralized and DG. These fundamental shifts in economics and requirements are key to the emerging opportunity for DG equipment and services.

The Role of DG

DG, or cogeneration, is the production of two sources or two types of energy (electricity or cooling and heat) from a single energy source (natural gas). We use technology that utilizes a low-cost, mass-produced, internal combustion engine

(3) Energy Information Administration, Voluntary Reporting of Greenhouse Gases, 2004, Section 2, Reducing Emissions from Electric Power, Efficiency Projects: Definitions and Terminology, page 20

3

from General Motors, used primarily in light trucks and sport utility vehicles, that is modified to run on natural gas. The engine spins either a standard generator to produce electricity, or a conventional compressor to produce cooling. For heating, since the working engine generates heat, we capture the byproduct heat with a heat exchanger and utilize the heat for facility applications in the form of space heating and hot water for buildings or industrial facilities. This process is very similar to an automobile, where the engine provides the motion to the automobile and the byproduct heat is used to keep the passengers warm during the winter months. For refrigeration or cooling, standard available equipment uses an electric motor to spin a conventional compressor to make cooling. We replace the electric motor with the same modified engine that runs on natural gas to spin the compressor to run a refrigeration cycle and produce cooling.

DG refers to the application of small-scale energy production systems, including electricity generators, at locations in close proximity to the end-use loads that they serve. Integrated energy systems, operating at user sites but interconnected to existing electric distribution networks, can reduce demand on the nation’s utility grid, increase energy efficiency, avoid the waste inherent in long distance wire and cable transmission of electricity, reduce air pollution and greenhouse gas emissions, and protect against power outages, while, in most cases, significantly lowering utility costs for power users and building operators.

The growing importance of DG as a key component of our future energy supply is underscored by the establishment of a Distributed Energy Program within the U.S. Department of Energy, or the DOE. The DOE has stated its position on this issue as follows:

“...there are two problems at the root of the current power crunch. There is not always enough power generation available to meet peak demand, and existing transmission lines cannot carry all of the electricity needed by consumers.... Distributed Energy resources are the power of choice for providing customers with reliable energy supplies.... These Distributed Energy products and services use natural gas and renewable energy and will be easily interconnected into the nation’s infrastructure for the generation of electricity. Furthermore, our Program works to encourage the expanded use of Distributed Energy technologies in applications with the right combination and occurrence of electrical and thermal demand...”

Until recently, many DG technologies have not been a feasible alternative to traditional energy sources because of economic, technological and regulatory considerations. Even now, many “alternative energy” technologies (such as solar, wind, fuel cells and micro-turbines) have not been sufficiently developed and proven to economically meet the demands of commercial users or the ability to be connected to the existing utility grid.

We supply cogeneration systems that are capable of meeting the demands of commercial users and that can be connected to the existing utility grid. Specific advantages of the company’s on-site DG of multiple energy services, compared with traditional centralized generation and distribution of electricity alone, include the following:

· Greatly increased overall energy efficiency (typically over 80% versus less than 33% for the existing power grid).

· Rapid adaptation to changing demand requirements (e.g., weeks, not years to add new generating capacity where and when it is needed).

· Ability to by-pass transmission line and substation bottlenecks in congested service areas.

· Avoidance of site and right-of-way issues affecting large-scale power generation and distribution projects.

· Clean operation, in the case of natural gas fired reciprocating engines using microprocessor combustion controls and low-cost exhaust catalyst technology developed for automobiles, producing exhaust emissions well below the world’s strictest regional environmental standards (e.g., southern California).

· Rapid economic paybacks for equipment investments, often three to five years when compared to existing utility costs and technologies.

· Relative insensitivity to fuel prices due to high overall efficiencies achieved with cogeneration of electricity and thermal energy services, including the use of waste heat to operate absorption type air conditioning systems (displacing electric-powered cooling capacity at times of peak summer demand).

4

· Reduced vulnerability of multiple de-centralized small-scale generating units compared to the risk of major outages from natural disasters or terrorist attacks against large central-station power plants and long distance transmission lines.

· Ability to remotely monitor, control and dispatch energy services on a real-time basis using advanced switchgear, software, microprocessor and internet modalities. Through our on-site energy products and services, energy users are able to optimize, in real time, the mix of centralized and distributed electricity-generating resources.

The disadvantages of the company’s on-site DG are:

· Cogeneration is a mechanical process and our equipment is susceptible to downtime or failure.

· The base-rate of an electric utility is determined by a certain number of subscribers. DG at a significant scale will reduce the number of subscribers and therefore it may increase the base-rate for the electric utility for its customer base.

· By committing to our long-term agreements, a customer may be forfeiting the opportunity to use more efficient technology that may become available in the future.

Also, DG systems possess significant positive environmental impact. The EPA has created a Combined Heat and Power Partnership to promote the benefits of DG systems. The company is a member of this Partnership. The following statement is found on the EPA web site.

“Combined heat and power systems offer considerable environmental benefits when compared with purchased electricity and onsite-generated heat. By capturing and utilizing heat that would otherwise be wasted from the production of electricity, CHP systems require less fuel than equivalent separate heat and power systems to produce the same amount of energy. Because less fuel is combusted, greenhouse gas emissions, such as carbon dioxide (CO2), as well as criteria air pollutants like nitrogen oxides (NOx) and sulfur dioxide (SO2), are reduced.”

The DG Market Opportunity

We believe that our primary near-term opportunity for DG energy and equipment sales is where commercial electricity rates exceed $0.12 per kWh, which is predominantly in the Northeast and California. These areas represent approximately 15% of the U.S. commercial power market, with electricity revenues in excess of $20 billion per year (see Figure 1. on page 6). Attractive DG economics are currently attainable in applications that include hospitals, nursing homes, multi-tenant residential housing, hotels, schools and colleges, recreational facilities, food processing plants, dairies and other light industrial facilities. Two CHP market analysis reports sponsored by the EIA in 2000 detailed the prospective CHP market in the commercial and institutional sectors(4) and in the industrial sectors(5). These data sets were used to estimate the CHP market potential in the 100 kW to 1 MW size range. These target market segments comprise over 163,000 sites totaling 12.2 million kW of prospective DG capacity. This is the equivalent of an $11.7 billion annual electricity market plus a $7.3 billion heat and hot water energy market, for a combined market potential of $19 billion.

As shown in Figure 1 on page 6, there are substantial variations in the electric rates paid by commercial and institutional customers throughout the U.S. In high-cost regions, monthly payments for energy services supplied by on-site DG projects yield rapid paybacks (e.g., often 3-5 years) on an investment in our systems. An additional 15% of commercial sector electricity, representing annual revenues of $14 billion, is sold at rates between $0.085 and $0.12 per kWh as shown in Figure 1 on page 6. Although paybacks on DG projects would be less rapid in such regions, future rate increases are expected to improve DG economics.

(4) The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

(5) The Market and Technical Potential for Combined Heat and Power in the Industrial Sector; Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation; January 2000

5

Figure 1

The DG Market Opportunity

U.S. Commercial/Institutional Electric Rate Profile

Source: U.S. Energy Information Administration Data [2002]

Business Model

We are a DG onsite energy company that sells energy in the form of electricity, heat, hot water and air conditioning under long-term contracts with commercial, institutional and light industrial customers. We install our systems at no cost to our customers and retain ownership of the system. Because our systems operate at over 80% efficiency (versus less than 33% for the existing power grid), we are able to sell the energy produced by these systems to our customers at prices below their existing cost of electricity (or air conditioning), heat and hot water. Our cogeneration systems consist of natural gas-powered internal combustion engines that drive an electrical generator to produce electricity and that capture the engine heat to produce space heating and hot water. Our energy systems also can be configured to drive a compressor that produces air conditioning and that also captures the engine heat. As of December 31, 2008, we had 56 energy systems operational.

To date, each of our installations runs in conjunction with the electric utility grid and requires standard interconnection approval from the local utility. Our customers use both our energy system and the electric utility grid for their electricity requirements. We typically supply the first 20% to 60% of the building’s electricity requirements while the remaining electricity is supplied by the electric utility grid. Our customers are contractually bound to use the energy we supply.

To date, the price that we have charged our customers is set in our customer contracts at a discount to the price of the building’s local electric utility. For the 20% to 60% portion of the customer’s electricity that we supply, the customer realizes immediate savings on its electric bill. In addition to electricity, we sell our customers the heat and hot water at the same price they were previously paying or at a discount equivalent to their discount from us on electricity. Our air conditioning systems are also priced at a discount so that the customer realizes overall cost savings from the installation.

Since we own and operate the energy systems and since our customers have no investment in the units, our customers benefit from no capital requirements and no operating responsibilities. We operate the energy systems so our customers require no staff and have no energy system responsibilities; they are bound, however, to pay for the energy supplied by the energy systems over the term of the agreement.

Energy and Products Portfolio

We provide a full range of CHP product and energy options. Our primary energy and products are listed below:

· Energy Sales

· Electricity

· Thermal (Hot Water, Heat and Cooling)

· Energy Producing Products

· Cogeneration Packages

· Chillers

· Complementary Energy Equipment (e.g., boilers, etc.)

· Alternative Energy Equipment (e.g., solar, fuel cells, etc.)

· Turnkey Installation Energy Producing Products with Incentives

· Other Revenue Opportunities

6

Energy Sales

For customers seeking an alternative to the outright purchase of CHP equipment, we will install, maintain, finance, own and operate complete on-site CHP systems that supply, on a long-term, contractual basis, electricity and other energy services. We sell the energy to customers at a guaranteed discount rate to the rates charged by conventional utility suppliers. Customers are billed monthly. Our customers benefit from a reduction in their current energy bills without the capital costs and risks associated with owning and operating a cogeneration or chiller system. Also, by outsourcing the management and financing of on-site energy facilities to us, they can reap the economic advantages of DG without the need for retaining specialized in-house staff with skills unrelated to their core business. Customers benefit from our On-Site Utility in a number of ways:

· Guaranteed lower price for energy

· Only pay for the energy they use

· No capital costs for equipment, engineering and installation

· No equipment operating costs for fuel and maintenance

· Immediate cash flow improvement

· Significant green impact by the reduction of carbon produced

· No staffing, operations and equipment responsibility

Our customers pay us for energy produced on site at a rate that is a certain percentage below the rate at which the utility companies provide them electrical and natural gas services. We measure the actual amount of electrical and thermal energy produced, and charge our customers accordingly. We agree to install, operate, maintain and repair our energy systems at our sole cost and expense. We also agree to obtain any necessary permits or regulatory approvals at our sole expense. Our agreements are generally for a term of 15 years, renewable for two additional five years terms upon the mutual agreement of the parties.

In regions where high electricity rates prevail, such as the Northeast, monthly payments for CHP energy services can yield attractive paybacks (e.g. often 3-5 years) on our investments in On-Site Utility projects. The price of natural gas has a minor effect on the financial returns obtained from our energy service contracts because the value of hot water and other thermal services produced from the recovered heat generated by the internal combustion engine in our on-site DG system will increase in proportion to higher fuel costs. This recovered energy, which comprises up to 60 % of the total heating value of fuel supplied to our CHP equipment, displaces fuel that would otherwise be burned in conventional boilers. Each of our customer sites becomes a profit center. The example below presents the energy supplied by two 75 kW cogeneration units and the economics of a typical energy service contract where we supply 80% of the site’s heat and hot water and 45% of the site’s electricity:

|

| Annual |

| Term (15 years) |

| ||

American DG Energy Revenue |

| $ | 284,000 |

| $ | 4,908,000 |

|

American DG Energy Gross Margin |

| $ | 84,000 |

| $ | 1,456,000 |

|

Customer Savings |

| $ | 32,000 |

| $ | 545,000 |

|

The example reflects an American DG Energy investment of $345,000 with a payback in 4 years or a 25% internal rate of return. The example also reflects a 2% of expected annual increase in energy costs that should occur over the 15-year period.

Since inception in 2001 and through December 31, 2008, the company has entered into 43 agreements for the supply of on-site energy services, primarily with healthcare, housing facilities, apartments and athletic facilities in the Northeast.

Energy Producing Products

We typically offer cogeneration units sized to produce 75 kW to 100 kW of electricity and water chillers sized to produce 200 to 400 tons of cooling. For cogeneration, we prefer a modular design approach to allow us to group multiple units together to serve customers with considerably larger power requirements. Often, cogeneration units are conveniently dispersed within a large operation, such as a hospital or campus, serving multiple process heating systems that would

7

otherwise be impractical to serve from a single large machine. The equipment we select often yield overall energy efficiencies in excess of 80% (from our equipment supplier’s specifications).

Many other DG technologies are challenged by technical, economic and reliability issues associated with systems that generate power using solar, micro-turbine or fuel cell technologies, which have not yet proven to be economical for typical customer needs. When alternative energy technologies mature to the point that they are both reliable and economical, we will employ them for the best-fit applications.

Service and Installation

Where appropriate, we utilize the best local service infrastructure for the equipment we deploy. We require long-term maintenance contracts and ongoing parts sales. Our centralized remote monitoring capability allows us to keep track of our equipment in the field. Our installations are performed by local contractors with experience in energy cogeneration systems.

For the occasional customers that want to own the CHP system themselves, we offer our “turn-key” option whereby we provide equipment, systems engineering, installation, interconnect approvals, on-site labor and startup services needed to bring the complete CHP system on-line. For some customers, we are also paid a fee to operate the systems and may receive a portion of the savings generated from the equipment.

Other Funding and Revenue Opportunities

American DG Energy is able to participate in the demand response market and receive payments due to the availability of our energy systems. Demand response programs provide payments for either the reduction of electricity usage or the increase in electricity production during periods of peak usage throughout a utility territory. We have also received grants and incentives from state organizations and natural gas companies for our installed energy systems.

Sales and Marketing

Our On-Site Utility services are sold directly to end-users by our in-house marketing team and by established sales agents and representatives. We offer standardized packages of energy, equipment and services suited to the needs of property owners and operators in healthcare, hospitality, large residential, athletic facilities and certain industrial sites. This includes national accounts and other customer groups having a common set of energy requirements at multiple locations.

Our energy offering is translated into direct financial gain for our clients, and is best appreciated by senior management. These clients recognize the gain in cash flow, the increase in net income and the preservation of capital we offer. As such, our energy sales are focused on reaching these decision makers. Additionally, we have benefited with increased sales and maintenance support through our joint venture, called American DG NY LLC, or ADGNY, with AES-NJ Cogen Co., or AES-NJ, an established developer of small cogeneration systems.

The company is continually expanding its sales efforts by developing joint marketing initiatives with key suppliers to our target industries. Particularly important are our collaborative programs with natural gas utility companies. Since the economic viability of any CHP project is critically dependent upon effective utilization of recovered heat, the insight of the gas supplier to the customer energy profile is particularly effective in prospecting the most cost-effective DG sites in any region.

DG is enjoying growing support among state utility regulators seeking to increase the reliability of electricity supply with cost effective environmentally responsible demand-side resources. New York, New Jersey, Connecticut and Massachusetts are among the states that encourage DG through inter-connecting standards, incentives and/or supply planning. Unlike large central station power plants, DG investments can be made in small increments and with lead-times as short as just a few months.

The U.S. government has been developing and refining various funding opportunities related to its economic recovery or stimulus initiatives. While the final decision has not been determined as of the date of this Annual Report on Form 10-K, it appears that “shovel ready” projects related to energy and the environment will hold great prominence. Also, there appears to be interest in upgrading government buildings. The company’s CHP systems would fit very well with any of these programs. Other than funding opportunities related to the economic recovery or stimulus initiatives, there does not appear to be any new government regulations that will affect the company.

8

Competition

We believe that the main competition for our DG products is the established electric utility infrastructure. DG is beginning to gain acceptance in regions where energy customers are dissatisfied with the cost and reliability of traditional electricity service. These end-users, together with growing support from state legislatures and regulators, are creating a favorable climate for the growth of DG that is overcoming the objections of established utility providers. In our target markets, we compete with large utility companies such as Consolidated Edison in New York City and Westchester County, Long Island Power Authority in Long Island, New York, Public Service Gas and Electric in New Jersey, and NSTAR and National Grid in Massachusetts.

Engine manufacturers sell DG units that range in size from a few kW’s to many MW’s in size. Those manufacturers are predominantly greater than 1 MW and include Caterpillar, Cummins, and Waukesha. In many cases, we view these companies as potential suppliers of equipment and not as competitors. For example, we are currently installing a Waukesha unit at a customer site.

The alternative energy market is emerging rapidly. Many companies are developing alternative and renewable energy sources including solar power, wind power, fuel cells and micro-turbines. Some of the companies in this sector include General Electric, BP, Shell, Sun Edison and Evergreen Solar (in the solar energy space); Plug Power and Fuel Cell Energy (in the fuel cell space); and Capstone, Ingersoll Rand and Elliott Turbomachinery (in the micro-turbine space). The effect of these developing technologies on our business is difficult to predict; however, when their technologies become more viable for our target markets, we may be able to adopt their technologies into our business model.

There are a number of energy service companies that offer related services. These companies include Siemens, Honeywell and Johnson Controls. In general, these companies seek large, diverse projects for electric demand reduction for campuses that include building lighting and controls, and electricity (in rare occasions) or cooling. Because of their overhead structures, these companies often solicit large projects and stay away from individual properties. Since we focus on smaller projects for energy supply, we are well suited to work in tandem with these companies when the opportunity arises.

There are also a few local emerging cogeneration developers and contractors that are attempting to offer services similar to ours. To be successful, they will need to have the proper experience in equipment and technology, installation contracting, equipment maintenance and operation, site economic evaluation, project financing and energy sales plus the capability to cover a broad region.

Material Contracts

In January 2006, the company entered into the 2006 Facilities, Support Services and Business Agreement, or the Agreement, with Tecogen, to provide the company with certain office and business support services for a period of one year, renewable annually by mutual agreement. The company also shares personnel support services with Tecogen. The company is allocated its share of the cost of the personnel support services based upon the amount of time spent by such support personnel while working on the company’s behalf. To the extent Tecogen is able to do so under its current plans and policies, Tecogen includes the company and its employees in several of its insurance and benefit programs. The costs of these programs are charged to the company on an actual cost basis. Under this agreement, the company receives pricing based on a volume discount if it purchases cogeneration and chiller products from Tecogen. For certain sites, the company hires Tecogen to service its Tecogen chiller and cogeneration products. In January and May 2008, we amended the Agreement with Tecogen. Under the amendments, Tecogen provides the company with office space and utilities at a monthly rate of $2,053 and $2,780, respectively. Subsequent to year-end, on January 2009, the company assumed additional space and amended the office space and utilities to a monthly rate of $4,838.

We have sales representation rights to Tecogen’s products and services. In New England, we have exclusive sales representation rights to their cogeneration products. We have granted Tecogen sales representation rights to our On-Site Utility energy service in California.

Government Regulation

We are not subject to extensive government regulation. We are required to file for local construction permits (electrical, mechanical and the like) and utility interconnects, and we must make various local and state filings related to environmental emissions.

The U.S. government has been developing and refining various funding opportunities related to its economic recovery or stimulus initiatives. While the final decision has not been determined as of the date of this Annual Report on Form 10-K, it appears that “shovel ready” projects related to energy and the environment will hold great prominence. Also,

9

there appears to be interest in upgrading government buildings. The company’s CHP systems would fit very well with any of these programs. Other than funding opportunities related to the economic recovery or stimulus initiatives, there does not appear to be any new government regulations that will affect the company.

Employees

As of December 31, 2008, we employed eleven active full-time employees and two part-time employees. We believe that our relationship with our employees is satisfactory. None of our employees are represented by a collective bargaining agreement.

Our business faces many risks. The risks described below may not be the only risks we face. Additional risks that we do not yet know of, or that we currently think are immaterial, may also impair our business operations or financial results. If any of the events or circumstances described in the following risks occurs, our business, financial condition or results of operations could suffer and the trading price of our common stock could decline. Investors and prospective investors should consider the following risks and the information contained under the heading ”Warning Concerning Forward-Looking Statements” before deciding whether to invest in our securities.

We have incurred losses, and these losses may continue.

We have incurred losses in each of our fiscal years since inception. Losses continued to be incurred in 2008. There is no assurance that profitability will be achieved in the near term, if at all.

Because unfavorable utility regulations make the installation of our systems more difficult or less economical, any slowdown in the utility deregulation process would be an impediment to the growth of our business.

In the past, many electric utility companies have raised opposition to DG, a critical element of our On-Site Utility business. Such resistance has generally taken the form of unrealistic standards for interconnection, and the use of targeted rate structures as disincentives to combined generation of on-site power and heating or cooling services. A DG company’s ability to obtain reliable and affordable back-up power through interconnection with the grid is essential to our business model. Utility policies and regulations in most states are often not prepared to accommodate widespread on-site generation. These barriers erected by electric utility companies and unfavorable regulations, where applicable, make more difficult or uneconomic our ability to connect to the electric grid at customer sites and are an impediment to the growth of our business. Development of our business could be adversely affected by any slowdown or reversal in the utility deregulation process or by difficulties in negotiating backup power supply agreements with electric providers in the areas where we intend to do business.

Our onsite utility concept is largely unproven and may not be accepted by a sufficient number of customers.

The sale of cogeneration and cooling equipment has been successfully carried out for more than a decade. However, our On-Site Utility concept (i.e., the sale of on-site energy services, rather than equipment) is still in an early stage of implementation. Unresolved issues include the pricing of energy services and the structuring of contracts to provide cost savings to customers and optimum financial returns to us. There is no assurance that we will be successful in developing a profitable On-Site Utility business model, and failure to do so would have a material adverse effect on our business and financial performance.

The economic viability of our projects depends on the price spread between fuel and electricity, and the variability of the prices of these components creates a risk that our projects will be uneconomic.

The economic viability of DG projects is dependent upon the price spread between fuel and electricity prices. Volatility in one component of the spread, the cost of natural gas and other fuels (e.g., propane or distillate oil) can be managed to a greater or lesser extent by means of futures contracts. However, the regional rates charged for both base load and peak electricity services may decline periodically due to excess capacity arising from over-building of utility power plants or recessions in economic activity. Any sustained weakness in electricity prices could significantly limit the market for our cogeneration, cooling equipment and On-Site Utility energy services.

10

We may fail to make sales to certain prospective customers because of resistance from facilities management personnel to the outsourcing of their service function.

Any outsourcing of non-core activities by institutional or commercial entities will generally lead to reductions in permanent on-site staff employment. As a result, our proposals to implement On-Site Utility contracts are likely to encounter strong initial resistance from the facilities managers whose jobs will be threatened by energy outsourcing. The growth of our business will depend upon our ability to overcome such barriers among prospective customers.

Future government regulations, such as increased emissions standards, safety standards and taxes, may adversely impact the economics of our business.

The operation of DG equipment at our customers’ sites may be subject to future changes in federal, state and local laws and regulations (e.g., emissions, safety, taxes, etc.). Any such new or substantially altered rules and standards may adversely affect our revenues, profits and general financial condition.

If we cannot expand our network of skilled technical support personnel, we will be unable to grow our business.

Each additional customer site for our services requires the initial installation and subsequent maintenance and service of equipment to be provided by a team of technicians skilled in a broad range of technologies, including combustion, instrumentation, heat transfer, information processing, microprocessor controls, fluid systems and other elements of DG. If we are unable to recruit, train, motivate, sub-contract, and retain such personnel in each of the regional markets where our business operates we will be unable to grow our business in those markets.

The company operates in highly competitive markets and may be unable to successfully compete against competitors having significantly greater resources and experience.

Our business may be limited by competition from energy services companies arising from the breakup of conventional regulated electric utilities. Such competitors, both in the equipment and energy services sectors, are likely to have far greater financial and other resources than us, and could possess specialized market knowledge with existing channels of access to prospective customer locations. We may be unable to successfully compete against those competitors.

Future technology changes may render obsolete various elements of equipment comprising our On-Site Utility installations.

We must select equipment for our DG projects so as to achieve attractive operating efficiencies, while avoiding excessive downtimes from the failure of unproven technologies. If we are unable to achieve a proper balance between the cost, efficiency and reliability of equipment selected for our projects, our growth and profitability will be adversely impacted.

We have limited historical operating results upon which to base projections of future financial performance, making it difficult for prospective investors to assess the value of our stock.

Our experience is primarily on-site energy services, and we have only a few years of actual operating experience. These limitations make developing financial projections more difficult. We will expand our business infrastructure based on these projections. If these projections prove to be inaccurate, we will sustain additional losses and will jeopardize the success of our business.

We will need to raise additional capital for our business, which will dilute existing shareholders.

Additional financings will be required to implement our overall business plan. We will need additional capital. Equity financings will dilute the percentage ownership of our existing shareholders. Our ability to raise an adequate amount of capital and the terms of any capital that we are able to raise will be dependent upon our progress in implementing demonstration projects and related marketing service development activities. If we do not make adequate progress, we may be unable to raise adequate funds, which will limit our ability to expand our business. If the terms of any equity financings are unfavorable, the dilutive impact on our shareholders might be severe.

We may make acquisitions that could harm our financial performance.

In order to expedite development of our corporate infrastructure, particularly with regard to equipment installation and service functions, we anticipate the future acquisition of complementary businesses. Risks associated with such acquisitions include the disruption of our existing operations, loss of key personnel in the acquired companies, dilution through the issuance of additional securities, assumptions of existing liabilities and commitment to further operating expenses. If any or all of these problems actually occur, acquisitions could negatively impact our financial performance and future stock value.

11

We are controlled by a small group of majority shareholders, and our minority shareholders will be unable to effect changes in our governance structure or implement actions that require shareholder approval, such as a sale of the company.

George Hatsopoulos and John Hatsopoulos, who are brothers, beneficially own a majority of our outstanding shares of common stock. These stockholders have the ability to control various corporate decisions, including our direction and policies, the election of directors, the content of our charter and bylaws and the outcome of any other matter requiring shareholder approval, including a merger, consolidation and sale of substantially all of our assets or other change of control transaction. The concurrence of our minority shareholders will not be required for any of these decisions.

We may be exposed to substantial liability claims if we fail to fulfill our obligations to our customers.

We enter into contracts with large commercial and not-for-profit customers under which we will assume responsibility for meeting a portion of the customers’ building energy demand and equipment installation. We may be exposed to substantial liability claims if we fail to fulfill our obligations to customers. There can be no assurance that we will not be vulnerable to claims by customers and by third parties that are beyond any contractual protections that we are able to negotiate. We may be unable to obtain liability and other insurance on terms and at prices that are commercially acceptable to us. As a result, liability claims could cause us significant financial harm.

Investment in our common stock is subject to price fluctuations which have been significant for development stage companies like us.

Historically, valuations of many companies in the development stage have been highly volatile. The securities of many of these companies have experienced significant price and trading volume fluctuations, unrelated to the operating performance or the prospects of such companies. If the conditions in the equity markets further deteriorate, we may be unable to finance our additional funding needs in the private or the public markets. There can be no assurance that any future offering will be consummated or, if consummated, will be at a share price equal or superior to the price paid by our investors even if we meet our technological and marketing goals.

Our common stock is quoted on the OTC Bulletin Board, or OTCBB, which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTCBB. The OTCBB is a regulated quotation service that displays real-time quotes, last-sale prices and volume information in over-the-counter equity securities. An over-the-counter equity security generally is any equity that is not listed or traded on NASDAQ or a national securities exchange. The OTCBB is a significantly more limited market than the New York Stock Exchange or NASDAQ system. The quotation of our shares on the OTCBB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future. Trading in stock quoted on the OTCBB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. Moreover, the OTCBB is not a stock exchange, and trading of securities on the OTCBB is often more sporadic than the trading of securities listed on a quotation system or a stock exchange.

Future sales of common stock by our existing stockholders may cause our stock price to fall.

The market price of our common stock could decline as a result of sales by our existing stockholders of shares of common stock in the market or the perception that these sales could occur. These sales might also make it more difficult for us to sell equity securities at a time and price that we deem appropriate and thus inhibit our ability to raise additional capital when it is needed.

Because we do not intend to pay cash dividends, our stockholders will receive no current income from holding our stock.

We have paid no cash dividends on our capital stock to date and we currently intend to retain our future earnings, if any, to fund the development and growth of our business. In addition, the terms of any future debt or credit facility may preclude us from paying these dividends. As a result, capital appreciation, if any, of our common stock will be your sole source of gain for the foreseeable future. We currently expect to retain earnings for use in the operation and expansion of our business, and therefore do not anticipate paying any cash dividends for the foreseeable future.

12

Our ability to access capital for the repayment of debts and for future growth is limited as the financial markets are currently in a period of disruption and recession and the company does not expect these conditions to improve in the near future.

Currently and throughout 2008, the financial markets have experienced very difficult conditions and volatility as well as significant adverse trends. The deteriorating conditions in these markets have resulted in a decrease in availability of corporate credit and liquidity and have led indirectly to the insolvency, closure or acquisition of a number of major financial institutions and have contributed to further consolidation within the financial services industry. A continued recession or a depression could adversely affect the financial condition and results of operations of the company. More specifically, these market conditions could also adversely affect the amount of revenue we report, require us to increase our allowances for losses, result in impairment charges and valuation allowances that decrease our net income and equity, and reduce our cash flows from operations. Furthermore, our ability to continue to access capital could be impacted by various factors including general market conditions and the continuing slowdown in the economy, interest rates, the perception of our potential future earnings and cash distributions, any unwillingness on the part of lenders to make loans to us and any deterioration in the financial position of lenders that might make them unable to meet their obligations to us.

Trading of our common stock is restricted by the Securities and Exchange Commission’s, or the SEC’s, “penny stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and other quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statement showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure and suitability requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our capital stock. Trading of our capital stock is restricted by the SEC’s “penny stock” regulations which may limit a stockholder’s ability to buy and sell our stock.

There has been a material weakness in our financial controls and procedures, which could harm our operating results or cause us to fail to meet our reporting obligations.

As of the end of the period covered by this report, our Chief Executive Officer and Chief Financial Officer have performed an evaluation of controls and procedures and concluded that our controls are effective to give reasonable assurance that the information required to be disclosed by our company in reports that we file under the Securities Exchange Act of 1934, as amended, or the Exchange Act, is recorded, processed, summarized and reported as when required. However, there is a lack of segregation of duties at the company due to the small number of employees dealing with general administrative and financial matters. Furthermore, the company did not have personnel with an appropriate level of accounting knowledge, experience and training in the selection, application and implementation of U.S. Generally Accepted Accounting Principles, or GAAP, as it relates to complex transactions and financial reporting requirements. This constitutes a material weakness in financial reporting. Any failure to implement effective internal controls could harm our operating results or cause us to fail to meet our reporting obligations. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock, and may require us to incur additional costs to improve our internal control system.

13

Item 1B. Unresolved Staff Comments.

None.

Our headquarters are located in Waltham, Massachusetts and consist of 2,702 square feet of office and storage space that are leased from Tecogen. The lease expires on March 31, 2014. We believe that our facilities are appropriate and adequate for our current needs.

We are not currently a party to any material litigation, and we are not aware of any pending or threatened litigation against us that could have a material adverse affect on our business, operating results or financial condition.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

14

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market

Our common stock started trading on November 8, 2007 on the OTCBB under the symbol “ADGE”. OTCBB market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions. During the period ended December 31, 2007, the high price was $1.25 and the low price was $0.83 as reported by the OTCBB. The following table sets forth the high and low per share sales prices for our common stock for each of the quarters in the period beginning January 1, 2008 through December 31, 2008 as reported by the OTCBB.

Quarter Ended |

| High |

| Low |

| ||

|

|

|

|

|

| ||

March 31, 2008 |

| $ | 1.09 |

| $ | 0.73 |

|

June 30, 2008 |

| $ | 1.92 |

| $ | 1.01 |

|

September 30, 2008 |

| $ | 2.05 |

| $ | 1.35 |

|

December 31, 2008 |

| $ | 2.31 |

| $ | 1.65 |

|

The closing price of our common stock as reported on the OTCBB on March 16, 2009 was $1.70.

Holders

As of March 16, 2009, there were approximately 71 holders of record of our common stock. As of March 16, 2009, there were approximately 243 beneficial holders of our common stock.

Dividends

We have never declared or paid any cash dividends on shares of our common stock. We currently intend to retain earnings, if any, to fund the development and growth of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, cash needs and growth plans.

Recent Sales of Unregistered Securities

Set forth below is information regarding common stock issued, warrants issued and stock options granted by the company during fiscal year 2008. Also included is the consideration, if any, we received and information relating to the section of the Securities Act of 1933, as amended, or the Securities Act, or rule of the SEC, under which exemption from registration was claimed.

Common Stock and Warrants

In 2008, the company raised $707,000 through the exercise of 1,010,000 warrants at a price of $0.70 per share. The warrant exercises were done exclusively by 17 accredited investors, representing 3.1% of the total shares then outstanding.

In 2008, two holders of the company’s 8% Convertible Debenture, elected to convert $150,000 of the outstanding principal amount of the debenture into 178,572 shares of common stock.

On February 24, 2009, the company sold a warrant to purchase shares of the company’s common stock to an accredited investor, for a purchase price of $10,500. The warrant, which expires on February 24, 2012, gives the investor the right but not the obligation to purchase 50,000 shares of the company’s common stock at an exercise price per share of $3.00.

All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Section 4(2) and/or Regulation D thereunder.

15

Restricted Stock Grants

In December 2008, the company made a restricted stock grant to one employee by permitting him to purchase an aggregate of 40,000 shares of common stock, representing 0.1% of the total shares then outstanding at a price of $0.001 per share. Those shares have a vesting schedule of four years.

Such transactions were exempt from registration under the Securities Act under Section 4(2), Regulation D and/or Rule 701 thereunder.

Stock Options

In December 2008, the company granted nonqualified options to purchase 100,000 shares of the common stock to one employee at $1.95 per share. Those options have a vesting schedule of 4 years and expire in 10 years. The grant of such options was exempt from registration under Rule 701 under the Securities Act.

No underwriters were involved in the foregoing sales of securities. All purchasers of shares of our convertible debentures and warrants described above represented to us in connection with their purchase that they were accredited investors and made customary investment representations. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

Rule 144

Under Rule 144 under the Securities Act, in general, a person who is not deemed to have been one of our affiliates at any time during the 90 days preceding a sale, and who has beneficially owned shares of our common stock for more than six months but less than one year would be entitled to sell an unlimited number of shares. Sales under Rule 144 during this time period are still subject to the requirement that current public information is available about us for at least 90 days prior to the sale. After such person beneficially owns shares of our common stock for a period of one year or more, the person is entitled to sell an unlimited number of shares without complying with the public information requirement or any of the other provisions of Rule 144. As of March 20, 2009, 843,572 shares of common stock held by non-affiliates were eligible for resale under amended Rule 144.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and related notes appearing elsewhere in this Annual Report on Form 10-K. Some of the information contained in this discussion and analysis or set forth elsewhere in this Annual Report on Form 10-K, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. You should review “Item 1A. Risk Factors” beginning on page 10 of this Annual Report on Form 10-K for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Recently, there has been a slowdown in the economy, a decline in the availability of financing from the capital markets, and a widening of credit spreads which has, or may in the future, adversely affect us to varying degrees. Such conditions may impact our ability to meet obligations to our suppliers and other third parties. These market conditions could also adversely affect the amount of revenue we report, require us to increase our allowances for losses, result in impairment charges and valuation allowances that decrease our net income and equity, and reduce our cash flows from operations. In addition, these conditions or events could impair our credit rating and our ability to raise additional capital.

Overview

We derive sales from selling energy in the form of electricity, heat, hot water and cooling to our customers under long-term energy sales agreements (with a typical term of 10 to 15 years). The energy systems are owned by us and are installed in our customers’ buildings. Each month we obtain readings from our energy meters to determine the amount of energy produced for each customer. We multiply these readings by the appropriate published price of energy (electricity, natural gas or oil) from our customers’ local energy utility, to derive the value of our monthly energy sale, less the applicable negotiated discount. Our revenues per customer on a monthly basis vary based on the amount of energy produced by our energy systems and the published price of energy (electricity, natural gas or oil) from our customers’ local energy utility that month. Our revenues commence as new energy systems become operational. As of December 31, 2008, we had 56 energy systems operational.

16

As a by-product of our energy business, in some cases the customer may choose to have us construct the system for them rather than have it owned by American DG Energy. In this case, we account for revenue and costs using the percentage-of-completion method of accounting. Under the percentage-of-completion method of accounting, revenues are recognized by applying percentages of completion to the total estimated revenues for the respective contracts. Costs are recognized as incurred. The percentages of completion are determined by relating the actual cost of work performed to date to the current estimated total cost at completion of the respective contracts. When the estimate on a contract indicates a loss, the company’s policy is to record the entire expected loss, regardless of the percentage of completion. In certain instances, revenue from unresolved claims is recorded when, in the opinion of management, realization of such revenue is probable and can be reliably estimated, only to the extent of actual costs incurred. Otherwise, revenue from claims is recorded in the year in which such claims are resolved. Costs and estimated earnings in excess of related billings represents the excess of contract costs and profit recognized to date on the percentage-of-completion accounting method over billings to date on certain contracts. Billings in excess of related costs and estimated earnings represents the excess of billings to date over the amount of contract costs and profits recognized to date on the percentage-of-completion accounting method for certain contracts. Customers may buy out their long-term obligation under energy contracts and purchase the underlying equipment from the company. Any resulting gain on these transactions is recognized over the payment period in the accompanying consolidated statements of operations. Revenues from operation and maintenance services, including shared savings are recorded when provided and verified.

We have experienced total net losses since inception of approximately $9.7 million. For the foreseeable future, we expect to experience continuing operating losses and negative cash flows from operations as our management executes our current business plan. The cash and cash equivalents available at December 31, 2008 will provide sufficient working capital to meet our anticipated expenditures including installations of new equipment for the next twelve months; however, as we continue to grow our business by adding more energy systems, the cash requirements will increase. We believe that our cash and cash equivalents available at December 31, 2008 and our ability to control certain costs, including those related to general and administrative expenses, will enable us to meet our anticipated cash expenditures through January 1, 2010. Beyond January 1, 2010, we may need to raise additional capital through a debt financing or equity offering to meet our operating and capital needs. There can be no assurance, however, that we will be successful in our fundraising efforts or that additional funds will be available on acceptable terms, if at all.

In 2008, we raised $707,000 through the exercise of various warrants. If we are unable to raise additional capital in 2010 we may need to terminate certain of our employees and adjust our current business plan. Financial considerations may cause us to modify planned deployment of new energy systems and we may decide to suspend installations until we are able to secure additional working capital. We will evaluate possible acquisitions of, or investments in, businesses, technologies and products that are complementary to our business; however, we are not currently engaged in such discussions.

The company’s operations are comprised of one business segment. Our business is selling energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board, or FASB, issued Statement of Financial Accounting Standards No. 141(R) “Business Combinations”, or SFAS No. 141(R), which requires changes in the accounting and reporting of business acquisitions. The statement requires an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in purchased entities, measured at their fair values at the date of acquisition based upon the definition of fair value outlined in Statement of Financial Accounting Standards No. 157, or SFAS No. 157. SFAS No. 141(R) is effective for the company for acquisitions that occur beginning in 2009. The effects of SFAS No. 141(R) on our financial statements will depend on the extent that the company makes business acquisitions in the future.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, “Noncontrolling Interests in Consolidated Financial Statements an Amendment of ARB No. 51”, or SFAS No. 160, which requires changes in the accounting and reporting of noncontrolling interests in a subsidiary, also known as minority interest. The statement clarifies that a minority interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. SFAS No. 160 is effective for the company at the beginning of 2009. The company is continuing to review provisions of SFAS No. 160 which is effective the first quarter of fiscal 2009, and expects this new accounting standard to result in changes in the presentation of minority interests in the financial statements consistent with the new standard.

17

In February 2008, the FASB issued FASB Staff Position No. 157-2, or FSP No. 157-2, which delays the effective date of SFAS No. 157 for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). SFAS No. 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements. FSP No. 157-2 partially defers the effective date of SFAS No. 157 to fiscal years beginning after November 15, 2008, and interim periods within those fiscal years for items within the scope of this FSP No. 157-2. The adoption of SFAS No. 157 for all nonfinancial assets and nonfinancial liabilities is effective for us beginning January 1, 2009. The company does not expect SFAS No. 157 to have a material impact on its results of operations and financial condition.