Think Outside The Grid!

June 2010

ADGE - Europe

2

2

Forward Looking Statements

We have made statements in this presentation that constitute “forward-looking statements” as that

term is defined in the Private Securities Litigation Reform Act of 1995 and other federal securities

laws. These forward-looking statements concern our operations, economic performance, financial

condition, goals, beliefs, future growth strategies, investments objectives, plans and current

expectations. Any statements in this presentation that are not statements of historical fact are

forward-looking statements (including, but not limited to, statements regarding our future financial

performance, statements concerning scaling our business, expected revenue leverage, the

characteristics and growth of markets and customers, our objectives and plans for future

operations, technology developments and products and our expected liquidity and capital

resources). Such forward-looking statements are based on a number of assumptions and involve a

number of risks and uncertainties, and accordingly, actual results could differ materially. Risk

factors that may cause such differences are described in our Securities and Exchange Commission

filings. You should not rely upon forward-looking statements except as statements of our present

intentions and of our present expectations, which may or may not occur. You should read these

cautionary statements as being applicable to all forward-looking statements wherever they appear.

Except as required by law, we undertake no obligation to release publicly the result of any revision

to these forward-looking statements that may be made to reflect events or circumstances after the

date hereof or to reflect the occurrence of unanticipated events.

3

3

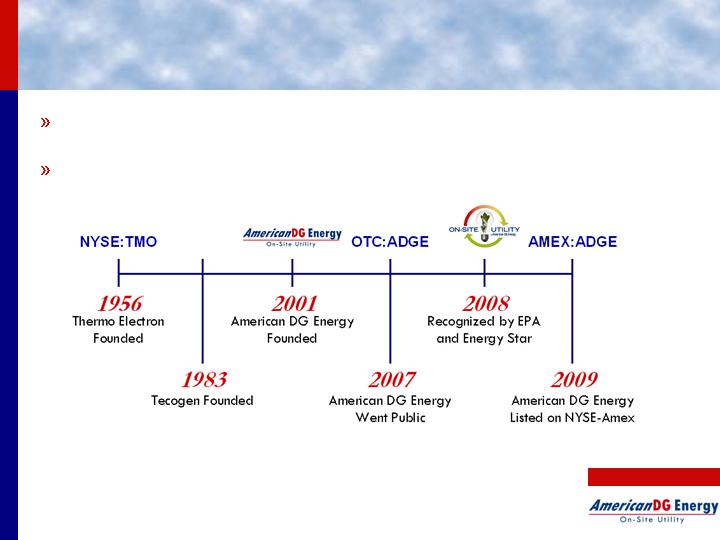

Background at a Glance

Thermo Electron’s market capitalization increased approximately 31%

(on a compounded basis from 1983-1997)

Thermo Electron, now Thermo Fisher Scientific is currently over $20

billion in market capitalization

4

4

Management (US)

Dr. George Hatsopoulos, Chairman of the Board

Co-founder and Chairman Emeritus of Thermo Electron Corporation

John Hatsopoulos, Chief Executive Officer

Co-founder and retired President and Vice Chairman of the Board of Thermo Electron

Corporation

Barry Sanders, President & Chief Operating Officer

Former Executive Vice President of MicroLogic, Inc.

Business Development at Tecogen and Andover Controls

Managed research and development projects for the New York State Energy Research and

Development Authority

Anthony Loumidis, Chief Financial Officer

Chief Financial Officer, Principal Accounting Officer and Treasurer of American DG Energy Inc.

and GlenRose Instruments Inc.

5

5

Board of Directors (US)

Dr. George Hatsopoulos, Chairman of the Board

John Hatsopoulos, Chief Executive Officer

Earl R. Lewis

Chairman of the Board, Chief Executive Officer and President of FLIR Systems Inc.

(NASDAQ:FLIR)

Charles T. Maxwell

Senior Energy Analyst with Weeden & Co.

Deanna M. Petersen

Vice President of Business Development for Shire Human Genetic Therapies

(NASDAQ:SHPGY)

6

6

What We Do

American DG Energy Inc. is a leading On-Site Utility company,

providing highly efficient electricity, heat, hot water, and cooling

energy.

We target healthcare facilities, multi-family buildings and hotels, and

offer a long-term energy solution at a guaranteed discount to retail

utility prices through long-term (typically 15 year) contracts.

Our services enable cost reductions from Day One, often 10% in

energy costs (operating expenses) for customers, and a growing

base of recurring revenue for ADGE.

Our focus is energy efficiency – “Here and Now”

7

7

Our Customer Value Proposition

Guaranteed lower price for energy

Typically 10% discount on customer’s utility rates

No capital or operating costs

Only pay for energy used

Increased net income

Immediate cash flow improvement

No staffing, operations and equipment

responsibilities

Extends customer boiler life

Provides green energy technology

Combined Heat & Power (CHP)

Fuel (natural gas)

IN

Hot Water & Heat

OUT

Electricity

OUT

8

9

Energy Efficiency (~90%)

Source: Company Estimates

10

Go Green While $aving Green

CHP Reduces CO2 by 607 tons/year *

EPA CHP partner

DOE EPA Energy Star efficiency award winner

Equivalent to:

*Source: EPA CHP calculator on web site; 150 kW, 6,000 Hrs/yr

166 acres

104 cars

Energy Efficiency: Thermal Load

Source: Company Estimates

11

Thermal = Domestic Hot Water, Space Heating, Laundry, Banquet, Heating Pools, Process, etc.

Made By 150 kW CHP

Supplied By Boiler

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

MONTHLY HOT WATER & HEATING LOAD

Energy Efficiency: Electricity Supply

Source: Company Estimates

12

Made By 150 kW CHP

Supplied by Utility Grid

0

50

100

150

200

250

300

350

400

450

500

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

MONTHLY ELECTRICITY DEMAND

13

13

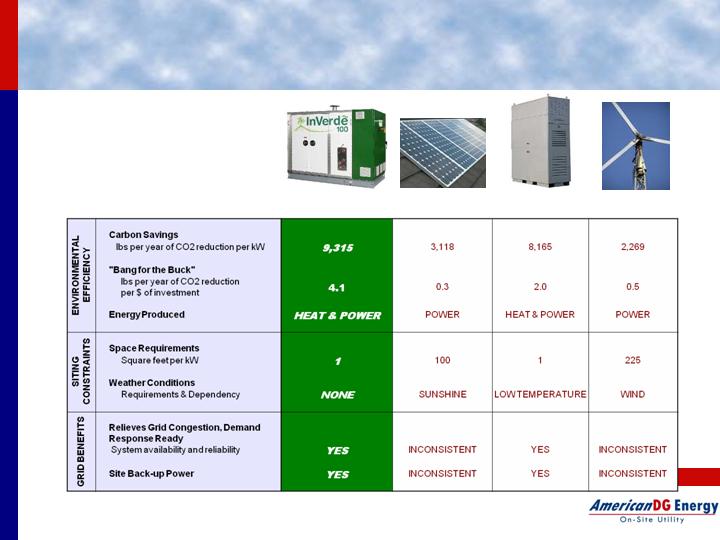

Technology Comparison (100kW systems)

COMBINED HEAT & POWER

SOLAR PV

MICROTURBINE

WIND

Source: Company Estimates

14

14

Technology Comparison (100kW systems)

COMBINED HEAT & POWER

SOLAR PV

MICROTURBINE

WIND

Source: Company Estimates

15

15

Business at a Glance

On-Site Utility (Selling discounted energy)

Electricity, heat, hot water and cooling

Monthly billing

Long term agreements (15 years)

Eligible for - carbon credits trading programs

Demand response program

Own and Operate Energy Systems

Combined, heat and power (CHP), chilled water, with

seamless integration of other alternative energy

technologies

Energy produced at customer’s site - sold “inside fence”

to customer

ADGE finances, designs, installs, maintains, monitors &

optimizes systems

ADGE usually keeps all incentive funding

Turn-key System Sales

We can also sell an installed system if that’s what the

customer wants + Back-end Services

16

16

Market Sizes for CHP Applications

* Sources: 2006/7 ERIC data analysed by BRE; Hotel Data Ltd , July 2009; Sure – FIT High Rise report, June 1, 2007. European Study

into high rise dwelling in the EU 27; Overview of CHP – a country by country analysis – COGEN, July 2009; Cogeneration in Central

and Eastern Europe – COGEN, June 2007, et al.

Healthcare

Hotels

Housing

kW

Phase 1

UK

1,924

2,450

948

1,234,000

Spain

757

3,368

30,400

7,782,000

Belgium

311

249

442

231,000

Total

2,992

6,067

31,790

9,247,000

Phase 2

Ireland

49

232

n/a

64,000

Italy

1,459

1,653

82,500

19,290,000

Poland

328

239

31,000

7,109,000

Germany

3,499

2,479

12,500

4,223,000

Total

5,335

4,603

126,000

30,686,000

Total

(Phase 1 & 2)

8,327

10,670

157,790

39,933,000

Tecogen/ADGE Installations

Tecogen: Shipped Over 2,000 Systems

17

Areas where electricity costs exceed $0.12 per kWh: Massachusetts, New Hampshire, Connecticut, New York,

New Jersey, California are main targets. Comprise approximately 15% of U.S. commercial power market with

electricity revenues in excess of $19 billion per year *

NY

NJ

MA

ADGE: Operating 70 Systems (as of 6/10)

* Source: The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional

Sector; The Market and Technical Potential for Combined Heat and Power in the Industrial Sector;

Prepared for the Energy Information Administration; Prepared by ONSITE SYCOM Energy Corporation;

January 2000

18

Typical Customer Buildings

19

19

Sales Strategy

On-Site Utility Solution

Sell cash flow and net income (not energy and equipment)

No capital required by customer

No staffing required

Keep it simple

Executive Sales

“C-Level”

Fulfill Government and Environmental Mandate

On-Site Utility is an easy, cost-effective solution

Top 50 Sales

Focus on large property owners in key vertical markets (Hotels, Healthcare & Housing)

20

20

Sales Distribution

Direct

Senior level, sales executives

Proven, “C-Level” Sales

Partners

Experts in targeted, vertical markets

Energy consultants

Engineering design contractors

Key, established suppliers

Advisory Board

Individuals with access to executives at targeted, vertical markets

PCS

Power

Conditioning

System

TecoNet

Control

System

3 Phase AC

Power

Variable

Frequency

Neutral

AC Power

480/3/60 PF

= 1.0 *

Neutral

Generator/PCS

Cooling

Engine Heat

Recovery

Exhaust Heat

Exchanger

Catalytic Converter

Natural Gas

Exhaust

Engine

PMG

Engine

Coolant

Pump

Gen/PCSP

ump

New Technology Developments:

InVerde 100

1.

Only engine-based CHP with inverter on the market

2.

Provides convenience back-up power

3.

Designed for world market

21

22

22

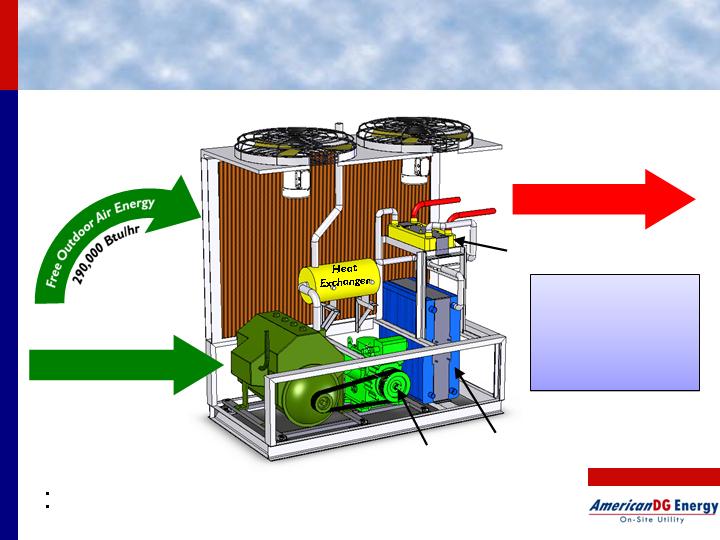

New Technology Developments: Ilios Inc.

Advanced heating systems for commercial and industrial applications

Efficiency = 485,000/238,000 = 204%

Heat Exchanger

Condenser

Compressor

Engine

Hot Water

Evaporator Coil

Natural Gas

IN

OUT

IN

238,000 Btu/hr

485,000 Btu/hr

Efficiency

= 204%

23

23

Competition

Electric utilities

Lack of entrepreneurial drive and several past failures to enter new businesses

No operational capabilities

Today: ADGE partner

Equipment manufacturers - (ENER-G, Cogenco, SenerTec)

Lack financing capability

Larger systems (footprint and kW)

All are potential suppliers or partners

Local contractors - (Various small contractors)

Small, individual project orientation

ADGE partner opportunity for individual projects

Future acquisition option

24

Revenue Leverage (Example)

Annual*

Term (15 years)

Revenue

£225,000

£3,900,000

Gross margin

£67,000

£1,160,000

Customer savings

£25,000

£435,000

Equipment: 200 kW CHP System

ADGE Investment: £275,000

ADGE Payback*: 4 years

ADGE IRR*: 25%

* Estimated

25

25

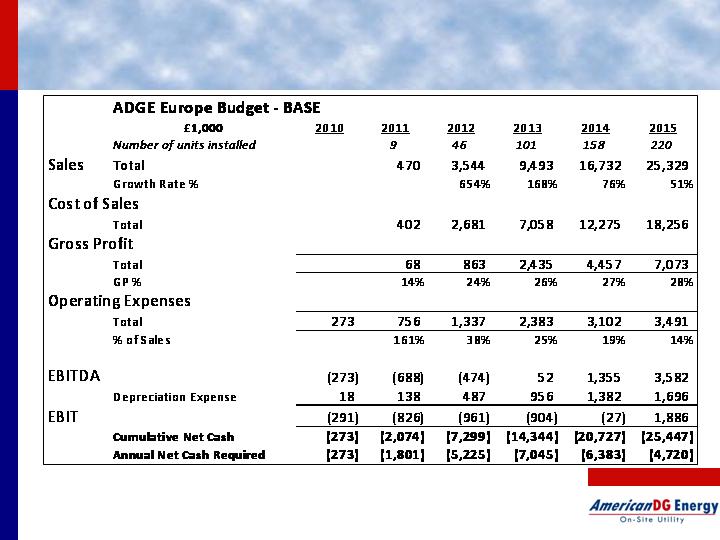

Financial Data – Base*

*Additional capital will be raised through either debt or equity offering(s).

26

26

Financial Data – Upside*

*Additional capital will be raised through either debt or equity offering(s).

27

27

Europe Advantages

Large Market

Major cities with high density of target customers (Hotels, Healthcare & Housing)

Customers Actively Seeking Energy/Environmentally Friendly Solutions

Government mandates

Pro-Government Policies

Active with energy efficiency and technology

Expected to continue

Significant Support Mechanisms

Both capital and operating

Expected to continue

Active Carbon Economy

CHP qualifies

28

28

Europe Advantages (con’t)

Capital Crunch fits On-Site Utility

Availability for project financing is very difficult

Reduced Staffing fits On-Site Utility

Favorable Energy Pricing

Electricity rates are expected to rise

Natural Gas availability and pricing is expected to be stable

Minimal Competition

Focused on larger kW projects

Not active with On-Site Utility solution

Very technical versus business orientation

29

29

Europe Advantages (con’t)

United States Experience

Head start

Available resources

Use back office functions such as system monitoring, billing, etc.

Experienced and Knowledgeable Workforce

Many available candidates

Excellent Technology Fit: Inverde 100 kW

kW size perfect for customer’s buildings

Small footprint will fit into tight spaces

30

30

ADGE Europe - Offering Terms

Entity: ADGE Europe (a subsidiary of American DG Energy Inc.)

Offering Amount: $5 million - $10 million

Type of Security: Common Stock

Shares Outstanding (pre-offering): 10,000,000

American DG Energy Inc.: 9,000,000

Codale Ltd: 1,000,000

Price per Share: TBD

Minimum Investment: $100,000

Use of Proceeds: European Expansion

Country of Incorporation: TBD

ADGE - Europe

31

American DG Energy Inc.

45 First Avenue

Waltham, MA 02451

p: 781.522.6000

f: 781.522.6050

info@americandg.com

www.americandg.com

Thank You