August 13, 2010

Via EDGAR

H. Christopher Owings, Assistant Director

Mail Stop 3561

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Re: American DG Energy Inc. (“we” or the “company”)

Registration Statement on Form S-3 filed June 8, 2010 (our “Form S-3”); Form 10-K for the Fiscal Year Ended December 31, 2009 filed March 31, 2010 (our “Form 10-K”); Definitive Proxy Statement on Schedule 14A filed April 30, 2010; Form 10-Q for the Fiscal Quarter Ended March 31, 2010 filed May 13, 2010 (together, the “Filings”)

File No. 001-34493

Response Letter Dated July 16, 2010

Dear Mr. Owings:

The purpose of this letter is to respond to your letter of August 2, 2010 regarding the Filings. For your convenience, your original comments appear in bold text, followed by our response. We will promptly file the amendments described in our response to comment 2 below after the conclusion of the comment process.

Registration Statement on Form S-3

| | 1. | We note your intention to file an amendment to your registration statement on Form S-3 in response to our prior comments. |

Form 10-K for the Fiscal Year Ended December 31, 2010

General

| | 2. | We note your intention to promptly file amendments after the conclusion of the comment process. Please confirm, to the extent you have not already done so, that you will incorporate, to the extent applicable, each response that you have provided to the comments directed at the above Exchange Act filings in your amended filings and indicate which filings you intend to amend. |

| | We will incorporate, to the extent applicable, each response that we have provided to the comments directed at the above Exchange Act filings in amendments to the following: Registration Statement on Form S-3 filed June 8, 2010; Form 10-K for the Fiscal Year Ended December 31, 2009, filed March 31, 2010, including all applicable sections relating to our Definitive Proxy Statement on Schedule 14A filed April 30, 2010; and Form 10-Q for the Fiscal Quarter Ended March 31, 2010, filed May 13, 2010. We will also incorporate your comments on our Form 10-Q for the Fiscal Quarter Ended June 30, 2010, to the extent applicable. |

Securities and Exchange Commission

August 13, 2010

Page 2

Item 1, Business, page 2

General, page 2

| | 3. | We note your response to comment four from our letter dated July 1, 2010. Please provide us a copy of the reports. In addition, please explicitly state, if true, that you created the estimate and describe in greater detail how the estimate was created. |

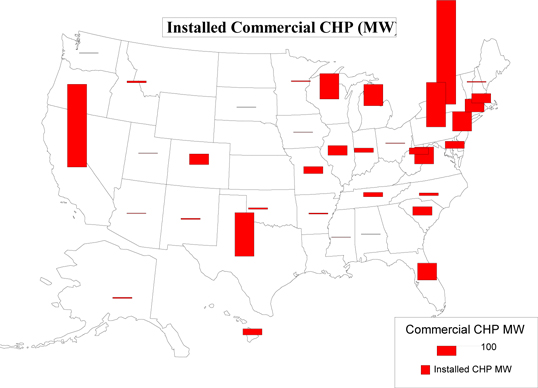

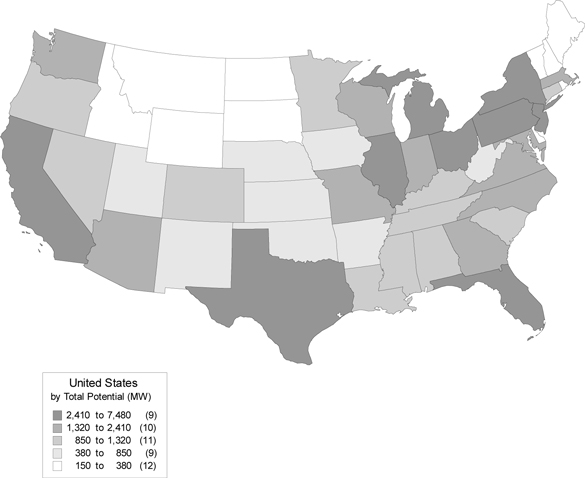

We are providing you with a copy of the “The Market and Technical Potential for Combined Heat and Power in the Industrial Sector” and “The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional Sector” prepared for the Energy Information Administration in January 2000, as Exhibits A and B attached hereto. These data sets were used to estimate the CHP market potential in the 100 kW to 1 MW size range for the hospitality, healthcare, institutional, recreational and light industrial facilities in California, Connecticut, Massachusetts, New Hampshire, New Jersey and New York, which are the states where commercial electricity rates exceed $0.12 per kWh. Based on those rates, those states define our market and comprise over 163,000 sites totaling 12.2 million kW of prospective DG capacity. This is the equivalent of an $11.7 billion annual electricity market plus a $7.3 billion heat and hot water energy market, for a combined market potential of $19 billion. A copy of our analysis is attached hereto as Exhibit C.

Competition, page 9

| | 4. | We note your response to comment nine from our letter dated July 1, 2010. Please revise your intended disclosure to clearly indicate, if true, that the entities you identify are larger than you in terms of revenues, assets and resources or tell us why it is not appropriate for you to do so. |

We will revise our disclosure to clearly indicate that the entities we identify are larger than us in terms of revenues, assets and resources.

Recent Sales of Unregistered Securities, page 15

| | 5. | We note your response to comment 10 from our letter dated July 1, 2010. Please provide us the disclosure that you intend to include in your amended Form 10-K. |

We will amend our Form 10-K to include sales of securities within the past three fiscal years that we did not register under the Securities Act as follows:

Recent Sales of Unregistered Securities

Set forth below is information regarding common stock issued, warrants issued and stock options granted by the company during fiscal years 2007 through 2009. Also included is the consideration, if any, we received and information relating to the section of the Securities Act of 1933, as amended, or the Securities Act, or rule of the SEC, under which exemption from registration was claimed.

Common Stock and Warrants

On March 8, 2007, the company raised $3,004,505 in a private placement of 4,292,150 shares of common stock at a price of $0.70 per share. The private placement was done exclusively by 10 accredited investors, representing 16.5% of the total shares then outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Rule 506 of Regulation D.

Securities and Exchange Commission

August 13, 2010

Page 3

On April 30, 2007, the company raised $1,120,000 in a private placement of 1,600,000 shares of common stock at a price of $0.70 per share. The private placement was done exclusively by 4 accredited investors, representing 5.2% of the total shares then outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Rule 506 of Regulation D.

On June 30, 2007, the company issued to a consultant 100,000 shares of common stock through an option exercise at $0.07 per share, representing 0.3% of the total shares then outstanding. The consultant was an accredited investor, and such transaction was exempt from registration under the Securities Act under Section 4(2).

On October 2, 2007, a holder of the company’s 8% Convertible Debenture elected to convert $50,000 of the outstanding principal amount of the debenture into 59,524 shares of common stock. The investor was an accredited investor, and such transaction was exempt from registration under the Securities Act under Section 4(2).

From December 2003 through December 2005, the company raised $2,236,500 through a private placement of common stock and warrants by issuing 3,195,000 shares of common stock and 3,195,000 warrants, at a price of $0.70 per share. Each warrant represents the right to purchase one share of common stock for a period of three years from the date the warrant was issued. The warrant holders started exercising their warrants in 2006. From February 2008 through December 2008, the company raised $707,000 through the exercise of 1,010,000 warrants at a price of $0.70 per share; such warrants were exercised exclusively by 17 accredited investors, representing 3.1% of the total shares then outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Section 4(2).

In May 2008, two holders of the company’s 8% Convertible Debentures elected to convert $150,000 of the outstanding principal amount of such debentures into 178,572 shares of common stock. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Section 4(2).

On February 24, 2009, the company sold a warrant to purchase shares of the company’s common stock to an accredited investor, for a purchase price of $10,500. The warrant, which expires on February 24, 2012, gives the investor the right but not the obligation to purchase 50,000 shares of the company’s common stock at an exercise price per share of $3.00. The investor was an accredited investor, and such transaction was exempt from registration under the Securities Act under Section 4(2).

On April 23, 2009, the company raised $2,260,000 in a private placement of 1,076,190 shares of common stock at a price of $2.10 per share. The private placement was done exclusively by 5 accredited investors, representing 3.1% of the total shares then outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Rule 506 of Regulation D.

On July 24, 2009, the company raised $3,492,650 in a private placement of 1,663,167 shares of common stock at a price of $2.10 per share. The company also granted the investors the right to purchase additional shares of common stock at a purchase price of $3.10 per share by December 18, 2009, which as of December 31, 2009, have expired unexercised. The private placement was done exclusively by 22 accredited investors, representing 4.7% of the total shares then outstanding. All of such investors were accredited investors, and such transactions were exempt from registration under the Securities Act under Rule 506 of Regulation D.

Securities and Exchange Commission

August 13, 2010

Page 4

On October 1, 2009, the company signed an investor relations consulting agreement with Hayden IR for a period of twelve months. In connection with that agreement the company granted Hayden IR a warrant to purchase 12,000 shares of the company’s common stock at an exercise price per share of $2.98, with one-third vesting on October 1, 2009, one-third vesting on February 1, 2010, and one-third vesting on June 1, 2010, provided that at any such vesting date the agreement is still in effect and Hayden IR has provided all required services to the company. The warrants carry a cashless exercise provision and expire on May 30, 2013. The investor was an accredited investor, and such transaction was exempt from registration under the Securities Act under Section 4(2).

On October 14, 2009, the company raised $525,000 in a private placement of 250,000 shares of common stock at a price of $2.10 per share. The company also granted the investor the right to purchase additional shares of common stock at a purchase price of $3.10 per share by December 18, 2009, which as of December 31, 2009, have expired unexercised. The private placement was done exclusively by an accredited investor, representing 0.7% of the total shares then outstanding. The investor was an accredited investor, and such transaction was exempt from registration under the Securities Act under Section 4(2).

Restricted Stock Grants

On February 20, 2007, the company made restricted stock grants to employees, directors and consultants by permitting them to purchase an aggregate of 737,000 shares of common stock, representing 2.4% of the total shares then outstanding at a price of $0.001 per share. Prior to this transaction the company had 30,309,400 shares of common stock outstanding. Such transaction was exempt from registration under the Securities Act under Section 4(2).

In December 2008, the company made a restricted stock grant to one employee by permitting him to purchase an aggregate of 40,000 shares of common stock, representing 0.1% of the total shares then outstanding at a price of $0.001 per share. Those shares have a vesting schedule of four years. Such transaction was exempt from registration under the Securities Act under Section 4(2).

Stock Options

In 2007 the company granted nonqualified options to purchase 1,156,000 shares of the common stock to 7 employees at $0.90 per share. Of those shares 1,130,000 have a vesting schedule of 10 years and 26,000 shares have a vesting schedule of 4 years. The grant of such options was exempt from registration under Rule 701 under the Securities Act.

In December 2008, the company granted nonqualified options to purchase 100,000 shares of the common stock to one employee at $1.95 per share. Those options have a vesting schedule of 4 years and expire in 10 years. The grant of such options was exempt from registration under Rule 701 under the Securities Act.

In February 2009, the company granted nonqualified options to purchase 13,000 shares of the common stock to three employees at $1.82 per share. Those options have a vesting schedule of 4 years and expire in 5 years. The grant of such options was exempt from registration under Rule 701 under the Securities Act.

In July 2009, the company granted nonqualified options to purchase 6,000 shares of the common stock to one employee at $2.95 per share. Those options have a vesting schedule of 4 years and expire in 5 years. The grant of such options was exempt from registration under Rule 701 under the Securities Act.

Securities and Exchange Commission

August 13, 2010

Page 5

No underwriters were involved in the foregoing sales of securities. All purchasers of shares of our convertible debentures and warrants described above represented to us in connection with their purchase that they were accredited investors and made customary investment representations. All of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

| | 6. | We note your response to comment 13 from our letter dated July 1, 2010. When filing your response, please clearly indicate for each transaction whether it was exempt from registration under the Securities Act under section 4(2), Regulation D or both. Also, if applicable, please specify which rule under Regulation D provided the exemption from registration. Please refer to Item 703 of Regulation S-K. |

We will clearly indicate the applicable exemption for each transaction in our amended 10-K as described above in our response to comment 5.

Item 7. Management's Discussion and Analysis of Financial Condition...page 17

Critical Accounting Policies, page 19

Property and Equipment and Depreciation and Amortization, page 20

| | 7. | We note your response to comment 15 from our letter dated July 1, 2010. Please tell us and disclose the amount of deferred income at each balance sheet date and the amount of income recognized related to utility rebates for the fiscal years ended December 31, 2009, and 2008. Further, it appears the up-front cash payments from the utility companies may represent advances for future production. Please explain to us the factors considered in distinguishing whether the incentive payment is applied against the cost of construction or a function of production. We assume you enter into agreements with the utility companies related to the rebates received. Please include in your explanation a summary of the relevant terms of the agreements as they relate to the rebates. We may have further comment. |

We will revise our disclosure as follows:

“The company receives rebates and incentives from various utility companies which are accounted for as a reduction in the book value of the assets. The rebates are payable from the utility to the company and are applied against the cost of construction, therefore reducing the book value of the installation. As a reduction of the facility construction costs, these rebates are treated as an investing activity in the statement of cash flows. When the rebates are a function of production of the DG unit, they are recorded as income over the period of production and treated in the statement of cash flows as an operating activity. The rebates the company receives from the utilities that apply to the cost of construction are one time rebates based on the installed cost, capacity and thermal efficiency of installed unit and are earned upon the installation and inspection by the utility and not related to or subject to adjustment based on the future operating performance of the installed unit. The rebate agreements with utilities are based on standard terms and conditions, the most significant being customer eligibility and post-installation work verification by a specific date. The only rebates that the company has recognized historically on the income statement are related to the company’s participation in demand response programs and are recognized only upon the occurrence of curtailed events of the applicable units. The cumulative amount of rebates applied to the cost of construction was $534,308 and $319,655 as of December 31, 2009 and 2008, respectively. Assuming that the average depreciation lives of the company’s projects is12 to 15 years, the unamortized amount on the company’s balance sheet was $403,065 and $235,815 for the years ended December 31, 2009 and 2008, respectively. The revenue recognized from demand response activity was $17,830 and $11,176 for the years ended December 31, 2009 and 2008, respectively.”

Securities and Exchange Commission

August 13, 2010

Page 6

Liquidity and Capital Resources, page 23

| | 8. | We note your response to comment 20 from our letter dated July 1, 2010. Please clarify if the increase in your accounts payable was due to the fact that you had five sites under construction in 2009 versus two sites in 2008. Currently, your proposed disclosure does not indicate that your accounts payable increased because you have more sites under construction. Also, you state that your accounts payable amount of $455,167 relates to construction-in-process in 2009. Please clarify if $455,167 of your $740,474 in accounts payable was for construction in process or revise your disclosure to clarify the meaning of the statement. |

We will revise the third paragraph under Liquidity and Capital Resources as follows: “Accounts payable increased to $740,474 in 2009, compared to $270,852 at December 31, 2008, providing $469,622 of cash. The increase in accounts payable was a result of having five sites under construction representing 725 kW on December 31, 2009, compared to two sites at December 31, 2008 representing 150 kW. The accounts payable amount of $740,474 includes $455,167 related to construction-in-process that was higher in 2009 due to increase in construction projects.”

Item 9A(T). Controls and Procedures, page 25

| | 9. | We note your response to comment 22 from our letter dated July 1, 2010. Please revise your disclosure to state, in clear and unqualified language, the conclusions reached by your chief executive officer and your chief financial officer on the effectiveness of your disclosure controls and procedures. For example, if true, you can state that your disclosure controls and procedures were effective including consideration of the identified matters, so long as you provide appropriate disclosure explaining how the disclosure controls and procedures were determined to be effective in light of the identified matters. Or, if true, you can state that given the identified matters, your disclosure controls and procedures were not effective. You should not, however, state the conclusion in your current disclosure, which appears to state that your disclosure controls and procedures were effective except for the material weakness you identified. |

We will revise the first paragraph under Item 9A(T) as follows, and will also apply this response in our future filings to the extent applicable:

“Our disclosure controls and procedures are designed to provide reasonable assurance that the control system’s objectives will be met. Our Chief Executive Officer and Chief Financial Officer, after evaluating the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report, or the Evaluation Date, have concluded that as of the Evaluation Date, our disclosure controls and procedures were not effective due to material weakness in financial reporting relating to lack of personnel with a sufficient level of accounting knowledge and a small number of employees dealing with general controls over information technology.

For these purposes, the term disclosure controls and procedures of an issuer means controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.”

Securities and Exchange Commission

August 13, 2010

Page 7

We confirm that our disclosure controls and procedures apply to the accumulation and communication of all information to our management, not just “material information,” and the effectiveness of our disclosure controls and procedures is not limited to only when we are preparing periodic reports.

| 10. | Also, please confirm that in future filings you will either include the entire definition of disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) or confirm that you will omit the definition of disclosure controls and procedures and merely provide your Chief Executive and Chief Financial Officer's determination regarding the effectiveness of your disclosure controls and procedures. |

We confirm that we will include the definition in future filings.

Definitive Proxy Statement on Schedule 14A

Board Leadership structure, page 9

| 11. | We note your response to comment 37 from our letter dated July 1, 2010. Please provide further information on how the separation of your Chief Executive Officer and Chairman of the Board “enhances high-level attention” to your business. |

Our Chairman, Dr. George N. Hatsopoulos is the founder and chairman emeritus of Thermo Electron Corporation, which is now Thermo Fisher Scientific (NYSE: TMO), he has served on the board of the Federal Reserve Bank of Boston, including a term as chairman. He was a member of the Securities and Exchange Commission Advisory Committee on Capital Formation and Regulatory Process, the Advisory Committee of the U.S. Export-Import Bank, and the boards of various corporations and institutions. In 1996, Dr. Hatsopoulos won the John Fritz Medal, which is the highest American award in the engineering profession and presented each year for scientific or industrial achievement in any field of pure or applied science. In 1997 he was awarded the 3rd Annual Heinz Award in Technology, the Economy and Employment. Dr. Hatsopoulos provides “high-level” guidance to our Chief Executive Officer, John N. Hatsopoulos, his brother, in the field of engineering, science, thermodynamics and thermionic energy conversion, which is the basis of our combined heat and power system. Our Chief Executive Officer, John Hatsopoulos, has a background in operations and finance and is responsible for setting the strategic direction for the company and the overall leadership and performance of the company. The Chairman’s role includes high level supervision over the strategic direction of the company, which is the primary responsibility of the Chief Executive Officer. In our case, we have two highly experienced and distinguished individuals performing distinct high level supervisory and executive functions for the company.

Employment Contracts and Termination of Employment and Change...page 14

| | 12. | We note your response to comment 40 from our letter dated July 1, 2010. For each named executive officer, please quantify the stock and option awards that would vest if a change-in control was to occur. |

We will revise our disclosure as follows: “None of our executive officers has an employment contract or change-in-control arrangement, other than stock and option awards that contain certain change-in-control provisions such as accelerated vesting due to acquisition. In the event an acquisition that is not a private transaction occurs while the optionee maintains a business relationship with the company and the option has not fully vested, the option will become exercisable for 100% of the then number of shares as to which it has not vested and such vesting to occur immediately prior to the closing of the acquisition.

Securities and Exchange Commission

August 13, 2010

Page 8

The stock and option awards that would vest for each named executive if a change-in control were to occur are disclosed under our Outstanding Equity Awards at Fiscal Year-End Table. Specifically, as of April 30, 2010, Barry J. Sanders had 504,000 stock options and 117,500 shares of restricted stock that had not vested and Anthony S. Loumidis had 175,000 stock options and 27,500 shares of restricted stock that had not vested.”

Executive Compensation and Other Information, page 12

Executive Officers, page 12

| | 13. | Please revise your disclosure regarding Mr. Loumidis’ business experience to clarify that Tecogen is an affiliate. Please see Item 401(e) of Regulation S-K. |

We will revise our disclosure as follows: “Anthony S. Loumidis has been our Chief Financial Officer since 2004 and our Treasurer since 2001. Mr. Loumidis devotes approximately half of his business time to the affairs of the company. He has been the Chief Financial Officer of GlenRose Instruments Inc., since 2006; GlenRose Instruments provides analytical services to the federal government and its prime contractors. He has also been the Vice President and Treasurer of Tecogen Inc., an affiliate of the company, since 2001; Tecogen is a manufacturer of natural gas, engine-driven commercial and industrial cooling and cogeneration systems. He also has been a Partner and President of Alexandros Partners LLC since 2000; Alexandros Partners is a financial advisory firm providing consulting services to early stage entrepreneurial ventures.”

* * *

We appreciate your comments and welcome the opportunity to discuss with you our responses provided above. Please call me at (781) 622-1117 or our attorney, Edwin Miller of Sullivan & Worcester in Boston, at (617) 338-2447 if you have any questions or require additional information.

| | Sincerely, |

| | | |

| | AMERICAN DG ENERGY INC. |

| | | |

| | /s/ Anthony S. Loumidis |

| | | |

| | By: | Anthony S. Loumidis |

| | | Chief Financial Officer |

cc: Robert Babula, Staff Accountant

Donna Di Silvio, Senior Staff Accountant

Exhibit A

Exhibit B

Exhibit C

American DG Energy Inc. - The DG Market Opportunity

Commercial CHP Market Assessment (1)

| | | MW Potential | |

| | | Hospitality | | | Health Care | | | Institutional | | | Recreational | |

| | | Hotel/Motels | | | Nurs. Homes | | | Hospitals | | | Schools | | | College/Univ. | | | Correctional | | | Museums | | | Health Clubs | |

States | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CA | | | 591.6 | | | | 286.8 | | | | 689.8 | | | | 1,544.9 | | | | 343.7 | | | | 249.6 | | | | 40.9 | | | | 444.3 | |

| CT | | | 32.4 | | | | 169.8 | | | | 115.8 | | | | 178.5 | | | | 48.7 | | | | 48.9 | | | | 4.2 | | | | 74.5 | |

| MA | | | 107.7 | | | | 349.8 | | | | 266.4 | | | | 343.3 | | | | 121.5 | | | | 37.1 | | | | 21.9 | | | | 144.4 | |

| NH | | | 31.1 | | | | 25.8 | | | | 23.5 | | | | 76.3 | | | | 13.6 | | | | 7.2 | | | | 1.4 | | | | 23.0 | |

| NJ | | | 226.8 | | | | 345.1 | | | | 315.1 | | | | 546.0 | | | | 109.5 | | | | 58.8 | | | | 7.1 | | | | 150.6 | |

| NY | | | 359.9 | | | | 820.4 | | | | 692.4 | | | | 1,364.7 | | | | 260.7 | | | | 153.6 | | | | 34.6 | | | | 256.0 | |

| 6 State Total | | | 1,349.5 | | | | 1,997.7 | | | | 2,103.0 | | | | 4,053.7 | | | | 897.7 | | | | 555.2 | | | | 110.1 | | | | 1,092.8 | |

| % US | | | 20 | % | | | 25 | % | | | 24 | % | | | 27 | % | | | 21 | % | | | 20 | % | | | 28 | % | | | 31 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

US | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 100-500 kW | | | 2,642.0 | | | | 1,014.0 | | | | 647.0 | | | | 7,130.0 | | | | 221.0 | | | | 261.0 | | | | 73.0 | | | | 665.0 | |

| 500-1000 kW | | | 627.0 | | | | 2,837.0 | | | | 904.0 | | | | 6,781.0 | | | | 407.0 | | | | 517.0 | | | | 202.0 | | | | 2,839.0 | |

| Total | | | 6,703.0 | | | | 7,993.0 | | | | 8,878.0 | | | | 14,884.0 | | | | 4,250.0 | | | | 2,721.0 | | | | 398.0 | | | | 3,552.0 | |

| % < 1MW | | | 49 | % | | | 48 | % | | | 17 | % | | | 93 | % | | | 15 | % | | | 29 | % | | | 69 | % | | | 99 | % |

| | | MW Potential (100 kW - 1 MW Applications) | |

| | | Hospitality | | | Health Care | | | Institutional | | | Recreational | |

| States | | Hotel/Motels | | | Nurs. Homes | | | Hospitals | | | Schools | | | College/Univ. | | | Correctional | | | Museums | | | Health Clubs | |

| CA | | | 289 | | | | 138 | | | | 121 | | | | 1,444 | | | | 51 | | | | 71 | | | | 28 | | | | 438 | |

| CT | | | 16 | | | | 82 | | | | 20 | | | | 167 | | | | 7 | | | | 14 | | | | 3 | | | | 73 | |

| MA | | | 53 | | | | 169 | | | | 47 | | | | 321 | | | | 18 | | | | 11 | | | | 15 | | | | 142 | |

| NH | | | 15 | | | | 12 | | | | 4 | | | | 71 | | | | 2 | | | | 2 | | | | 1 | | | | 23 | |

| NJ | | | 111 | | | | 166 | | | | 55 | | | | 510 | | | | 16 | | | | 17 | | | | 5 | | | | 149 | |

| NY | | | 176 | | | | 395 | | | | 121 | | | | 1,275 | | | | 39 | | | | 44 | | | | 24 | | | | 253 | |

| 6 State Total | | | 658 | | | | 962 | | | | 367 | | | | 3,789 | | | | 133 | | | | 159 | | | | 76 | | | | 1,078 | |

Industrial CHP Market Assessment (2)

| | | MW Potential | |

| Sector | | 100-1000 kW | | | 6 State Est. | |

| Food | | | 2,683.0 | | | | 671 | |

| Paper | | | 1,167.0 | | | | 292 | |

| Chemicals | | | 1,780.0 | | | | 445 | |

| Plastics | | | 2,772.0 | | | | 693 | |

| Fab. Metals | | | 4,050.0 | | | | 1,013 | |

| Machinery | | | 4,787.0 | | | | 1,197 | |

| Transportation | | | 1,169.0 | | | | 292 | |

| Misc | | | 1,756.0 | | | | 439 | |

| Total | | | | | | | 5,041 | |

| | | | | |

| Total Commercial & Industrial CHP Market in MW | | | 12,263 | |

| Inputs | | | | |

| American DG Energy Inc. CHP System in kW | | | 75 | |

| Potential Sites | | | 163,000 | |

| | | | | |

| Electric | | | | |

| Hours of operation per year | | | 8,000 | |

| Average electric cost per kWh | | $ | 0.12 | |

| kW | | | 12,225,000 | |

| | | | | |

| Thermal | | | | |

| Hours of operation per year | | | 8,000 | |

| Gas cost per therm | | $ | 1.00 | |

| Available heat per unit | | | 4.9 | |

| Displaced boiler efficiency | | | 70 | % |

| Heat utilization efficiency | | | 80 | % |

| | | | | |

| Market Size in Billions | | | | |

| Electric Revenue | | $ | 11.7 | |

| Thermal Revenue | | | 7.3 | |

| Total Revenue | | $ | 19.0 | |

Note (1): The Market and Technical Potential for Combined Heat and Power in the Commercial/Institutional Sector prepared for the Energy Information Administration in January 2000, pages 14, 15, 57 & 58.

Note (2): The Market and Technical Potential for Combined Heat and Power in the Industrial Sector prepared for the

Energy Information Administration in January 2000, pages 37 & 39.

Exhibit A

The Market and Technical Potential

for Combined Heat and Power in the

Industrial Sector

| | Prepared for: |

| | |

| | Energy Information Administration |

| | 1000 Independence Ave., SW |

| | Washington, DC 20585 |

| | Prepared by: |

| | |

| | ONSITE SYCOM Energy |

| | Corporation |

| | 1010 Wisconsin Ave., NW |

| | Suite 340 |

| | Washington, DC 20007 |

January 2000

PREFACE

This report was prepared by ONSITE SYCOM Energy Corporation as an account of work sponsored by the Energy Information Administration. Bruce A. Hedman, Vice President of consulting services at ONSITE SYCOM was the principal investigator for the analysis. ONSITE SYCOM would like to acknowledge T. Crawford Honeycutt and Daniel H. Skelly of the Energy Information Administration for their technical guidance and support in the preparation of this report.

Table of Contents

| 1. CHP Technology Characterization | | 2 |

| 1.1 Performance Characteristics for Commercially Available Equipment | | 4 |

| 1.2 Capital Costs | | 7 |

| 1.3 O&M Costs | | 9 |

| 1.4 Selective Catalytic Reduction (SCR) | | 10 |

| 1.5 Advanced Technology Characteristics | | 11 |

| | | |

| 2. Profile of Existing Industrial CHP | | 16 |

| | | |

| 3. Technical Potential for Industrial CHP | | 32 |

| 3.1 Technical Approach | | 32 |

| 3.2 Estimate of Remaining CHP Potential | | 34 |

| | | |

| 4. Factors Impacting Market Penetration | | 40 |

| | | |

| 5. References | | 43 |

| | | |

| Appendix : CHP Technology Characterization | | 44 |

| 1. Reciprocating Engines | | 46 |

| 2. Steam Turbines | | 52 |

| 3. Combustion Turbines and Combined Cycles | | 55 |

The Market and Technical Potential for Combined Heat and Power in

the Industrial Sector

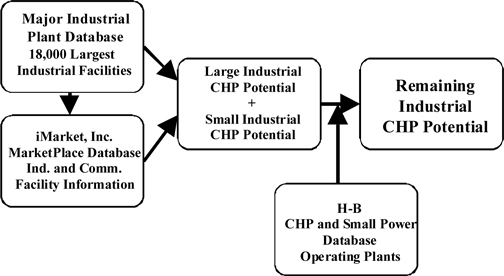

ONSITE SYCOM Energy Corporation (OSEC) is assisting the Energy Information Administration to determine the potential for cogeneration or combined heat and power (CHP) in the industrial market. As part of this effort, OSEC has characterized typical technologies used in industrial CHP, analyzed existing CHP capacity in industrial applications, and developed estimates of additional technical potential for CHP in industry.

This report is organized into four sections as follows:

| 1. | CHP Technology Characterization for the National Energy Modeling System |

| 2. | Existing Industrial CHP |

| 3. | Technical Potential for Industrial CHP |

| 4. | Factors Impacting Market Penetration. |

| ONSITE SYCOM Energy Corporation | 1 | Industrial CHP Assessment |

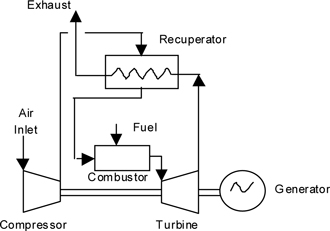

| 1. | CHP Technology Characterization for the National Energy Modeling System |

The National Energy Modeling System (NEMS) is a computer-based, energy-economy modeling system of U.S. energy markets for the midterm period through 2020. NEMS was designed and implemented by the Energy Information Administration (EIA) of the U.S. Department of Energy (DOE). NEMS projects the production, imports, conversion, consumption, and prices of energy, subject to assumptions on macroeconomic and financial factors, world energy markets, resource availability and costs, behavioral and technological choice criteria, cost and performance characteristics of energy technologies, and demographics.

A key feature of NEMS is the representation of technology and technology improvement over time. Five of the sectors—residential, commercial, transportation, electricity generation, and refining—include explicit treatment of individual technologies and their characteristics, such as initial cost, operating cost, date of availability, efficiency, and other characteristics specific to the sector.

This section provides a review and update of combined heat and power (CHP) technology choices for the industrial sector. CHP is an established technique within the industrial sector for simultaneously meeting power and process steam requirements. As will be shown in a later section 45,465 MW of CHP power capacity currently exists in the industrial sector (accounting for about 215,000 mmBtu/hr steam capacity). Two key changes in the nation's economic system are occurring that could make CHP more important economically and environmentally – the restructuring of the electric power industry may provide an enhanced economic driver and the efforts to comply with the Kyoto Protocol on global warming may provide an environmental driver for energy efficiency options such as CHP. It is critical, therefore, that NEMS include up-to-date and accurate information on CHP technology cost and performance.

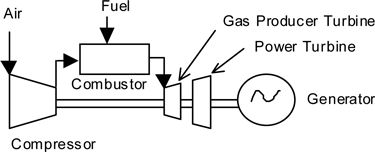

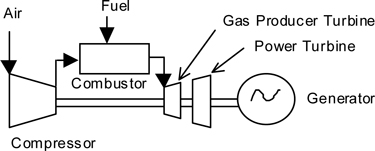

The NEMS cogeneration module of the industrial model is now based on five size categories of gas turbine systems from 1,000 kW to 40,000 kW size as shown in Table 1.1. In this section, OSEC reviews these data and develops independent estimates for performance, equipment and installation costs, and O&M costs for gas turbine systems for input into the NEMS model.

| ONSITE SYCOM Energy Corporation | 2 | Industrial CHP Assessment |

Table 1.1. Existing CHP Cost and Performance Parameters Used in the Industrial Cogeneration Module of NEMS (1997 Costs)

| CHP Cost & Performance Assumptions | | System 1 | | | System 2 | | | System 3 | | | System 4 | | | System 5 | |

| Electricity Capacity (kW) | | | 1,000 | | | | 2,500 | | | | 5,000 | | | | 10,000 | | | | 40,000 | |

| Total Installed Cost ($/kW) | | | 1600 | | | | 1400 | | | | 1200 | | | | 1000 | | | | 950 | |

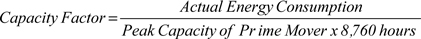

| Capacity Factor | | | 0.8 | | | | 0.8 | | | | 0.8 | | | | 0.8 | | | | 0.8 | |

| Overall Heat Rate (Btus/kWh) HHV | | | 14,217 | | | | 13,132 | | | | 11,263 | | | | 10,515 | | | | 9,749 | |

| Overall Efficiency (%) | | | 70 | | | | 70 | | | | 70 | | | | 75 | | | | 80 | |

| | | | | | | | | | | | | | | | | | | | | |

| Derived Technical Characteristics | | | | | | | | | | | | | | | | | | | | |

| Elec Generating Efficiency (3412/Heat Rate) | | | 24.0 | % | | | 26.0 | % | | | 30.3 | % | | | 32.4 | % | | | 35.0 | % |

| Fuel input (mmBtu/hr) | | | 14.217 | | | | 32.830 | | | | 56.315 | | | | 105.150 | | | | 389.943 | |

| Steam output (mmBtu/hr) | | | 6.540 | | | | 14.451 | | | | 22.361 | | | | 44.743 | | | | 175.474 | |

| Steam Output/Fuel Input | | | 46.0 | % | | | 44.0 | % | | | 39.7 | % | | | 42.6 | % | | | 45.0 | % |

| Power Steam Ratio | | | 0.522 | | | | 0.590 | | | | 0.763 | | | | 0.763 | | | | 0.778 | |

| Net Heat Rate (Btus/kWh) | | | 6,042 | | | | 5,907 | | | | 5,673 | | | | 4,922 | | | | 4,265 | |

| Thermal Output as Fraction of Fuel Input | | | 0.46 | | | | 0.44 | | | | 0.40 | | | | 0.43 | | | | 0.45 | |

| Electric Output as Fraction of Fuel Input | | | 0.24 | | | | 0.26 | | | | 0.30 | | | | 0.32 | | | | 0.35 | |

In general, these estimates provide a reasonable reflection of combustion turbine performance characteristics for use in the model. Overall efficiency levels are within range of commercially available equipment, and the estimates accurately reflect changes in electrical efficiency and overall efficiency as one moves from the smallest size category to the largest. Installed cost estimates, however, are somewhat higher than currently found in the marketplace, particularly for larger turbines systems. Several additional observations are made on this technology data set.

| q | The sizes selected, especially the 1,000 and 2,500 kW sizes, may not reflect a good match between the market and the technology performance. An analysis of existing CHP shows that gas engine driven CHP systems dominate in this size range and also effectively compete with combustion turbines in applications up to 10 MW or more. OSEC has provided cost estimates for 800 kW and 3 MW engine driven systems as part of this analysis. Engine systems provide good electrical efficiency. They are best used in applications that use low-pressure steam or hot water, as the technology is limited in its ability to produce high-pressure steam. |

| q | In addition, 80% of the capacity of industrial CHP systems is made up of large size systems of 50 MW and more. Therefore, OSEC recommends adding a 100 MW system that would better reflect use of these larger applications. |

| ONSITE SYCOM Energy Corporation | 3 | Industrial CHP Assessment |

| q | It is not clear how the NEMS Industrial Cogeneration Module accounts for technological change in CHP technologies. There has been continual improvement in the capacities and heat rates for combustion turbines that will increase the acceptance levels for these technologies by improving the economics of their application. In addition, there is considerable development work underway to further improve the operating and environmental performance envelopes of both combustion turbines and reciprocating engines. These improvements will generally increase the power to steam ratios over time and reduce the environmental impact of these technologies. Since the NEMS module matches the technologies in the database to industrial steam-load, the shifting power to steam ratios may require a rematching of potential sites or a relaxation of the model requirement to use all power on-site. In addition, to the base case technologies, OSEC has provided projections of cost and performance characteristics for improvements in gas engine and gas turbine technologies. |

| q | Some of the proposed CHP Initiatives being discussed by DOE and industry to enhance the use of CHP by U.S. industry are investment tax credits, accelerated siting and permitting, standardized electrical connections, and other measures. It would be helpful if the technology characterizations in the model were of enough detail and flexibility to allow the model to test market response to these and other initiatives. |

| 1.1 | Performance Characteristics for Commercially Available Equipment |

OSEC recommends changing the original five size categories of combustion turbine CHP systems (1, 2.5, 5, 10, 40 MW) to 1, 5, 10, 25 and 40 MW. Expanding the size range at the top end and eliminating the 2.5 MW CHP system better reflects equipment availability and market acceptance of combustion turbines. OSEC has developed performance estimates (heat rate, steam output, etc.) for each of these size ranges based on published data for specific gas turbine systems. Table 1.2 summarizes these performance characteristics. The data in the table were derived from published performance specifications contained in trade publications.1, 2, 3 The heat rates for the listed combustion turbines (CTs) are taken from published data for typical turbines in each size class (the 1 MW size is based on the Solar 1205 kW Saturn 20 gas turbine; the 5 MW system is based on the Solar Taurus 60; the 10 MW system is based on the Solar Mars 100; the 25 MW is based on the GE LM2500; and the 40 MW is based on the GE LM6000). Available thermal energy (steam output) was calculated from published turbine data on steam produced from the selected systems. The estimates are based on an unfired heat recovery steam generator (HRSG) producing dry, saturated steam at 150 psig.

In general, the new calculated technology characteristics do not represent a dramatic change from the existing characteristics shown previously in Table 1.1. The revised capital costs, to be described in detail in the next section, are identical for the 1 MW size and only slightly lower for the 5 MW and 10 MW sizes. The one significant area of difference is a greater than 20% reduction in capital costs for the 40 MW size category ($700/kW versus $950/kW). In addition, the 25 MW size at $770/kW is also a significantly lower cost system compared to the existing 40 MW system. Since much of the market opportunity is in the larger sizes, these lower costs may support a greater potential for market acceptance.

| ONSITE SYCOM Energy Corporation | 4 | Industrial CHP Assessment |

Table 1.2. Revised CHP Performance Parameters Suggested for use in the Cogeneration Module of NEMS

| CHP Cost & Performance Assumptions | | System 1 | | | System 2 | | | System 3 | | | System 4 | | | System 5 | |

| Electricity Capacity (kW) | | | 1,000 | | | | 5,000 | | | | 10,000 | | | | 25,000 | | | | 40,000 | |

| Total Installed Cost (99 $/kW) | | $ | 1,600 | | | $ | 1,075 | | | $ | 965 | | | $ | 770 | | | $ | 700 | |

| Capacity Factor | | | 0.8 | | | | 0.8 | | | | 0.8 | | | | 0.8 | | | | 0.8 | |

| Electric Heat Rate (Btu/kWh), HHV | | | 15,600 | | | | 12,375 | | | | 11,750 | | | | 9,950 | | | | 9,220 | |

| Overall Efficiency (%) | | | 72 | % | | | 73 | % | | | 74 | % | | | 78 | % | | | 78 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Derived Technical Characteristics | | | | | | | | | | | | | | | | | | | | |

| Elec. Generating Efficiency (3412/Heat Rate) | | | 21.9 | % | | | 27.6 | % | | | 29.0 | % | | | 34.3 | % | | | 37.0 | % |

| Fuel Input (mmBtu/hr) | | | 15.60 | | | | 61.88 | | | | 117.50 | | | | 248.75 | | | | 368.80 | |

| Steam Output (mmBtu/hr) | | | 7.82 | | | | 28.11 | | | | 52.83 | | | | 108.72 | | | | 151.18 | |

| Steam Output/Fuel Input | | | 50.1 | % | | | 45.4 | % | | | 45.0 | % | | | 43.7 | % | | | 41.0 | % |

| Power Steam Ratio | | | 0.436 | | | | 0.607 | | | | 0.646 | | | | 0.785 | | | | 0.903 | |

| Net Heat Rate (Btus/kWh) | | | 5825 | | | | 5348 | | | | 5146 | | | | 4514 | | | | 4496 | |

| Thermal Output as Fraction of Fuel Input | | | 0.50 | | | | 0.45 | | | | 0.45 | | | | 0.44 | | | | 0.41 | |

| Electric Output as Fraction of Fuel Input | | | 0.22 | | | | 0.28 | | | | 0.29 | | | | 0.34 | | | | 0.37 | |

As described earlier, the heat rates are taken from published data for popular turbines in each size class.1, 2 All turbine and engine manufacturers quote heat rates in terms of the lower heating value (LHV) of the fuel. On the other hand, the usable energy content of fuels is typically measured on a higher heating value basis (HHV). The energy measurements in EIA publications are also measured in higher heating value. In addition, electric utilities measure power plant heat rates in terms of HHV. For natural gas, the average heat content of natural gas is 1030 Btu/kWh on an HHV basis and 930 Btu/kWh on an LHV basis – or about a 10% difference. Since all of the fuel data in NEMS is based on higher heating values, the manufacturers heat rates were converted to an HHV basis. Heat rates for the revised technologies are somewhat higher in all cases than the original NEMS dataset. Given the continual improvement of combustion turbines in terms of capacity and efficiency over time, we feel that the only rationale for the increase in values for this data set is that the original values were on an LHV basis.

Thermal energy was calculated from published turbine data on steam available from the selected systems.1, 2, 3 The estimates are based on an unfired heat recovery steam generator (HRSG) producing dry, saturated steam at 150 psig. This represents a change from the original method in the NEMS industrial cogeneration database in which overall efficiency of the system is specified and the thermal energy is calculated as the difference between total efficiency and electric efficiency. The overall efficiency percentages calculated from the published steam tables are somewhat higher than the original data in the smaller size categories and somewhat lower in the larger size turbines.

| ONSITE SYCOM Energy Corporation | 5 | Industrial CHP Assessment |

The derived data in the table show electrical efficiency increases as combustion turbines become larger. As electrical efficiency increases, the absolute quantity of thermal energy available to produce steam decreases and the ratio of power to heat for the CHP system increases. A changing ratio of power to heat impacts project economics and may affect the decisions that customers make in terms of CHP acceptance, sizing, and the need to sell power.

In addition to the revised set of five CT-based CHP systems, OSEC recommends the addition of reciprocating engine systems at the low size end and a large, more efficient system at the high size end. The systems selected for inclusion are an 800 kW engine-driven CHP system, a 3,000 kW engine-driven system, and a 100 MW combined cycle plant. The performance characteristics are shown in Table 1.3 and are derived from published data and manufacturers specifications.1, 2, 4, 5, 6, 7 The 800 kW engine is based on the Caterpillar G3516 gas engine system; the 3000 kW engine is based on the Caterpillar G3616. Capital cost estimates for the engine systems are based on OSEC experience with both Caterpillar and Waukesha engine installations.

Table 1.3. Performance Specifications for Engine-Driven CHP and Combined Cycle Systems

| CHP Cost & Performance Assumptions | | Recip. Engine | | | Recip. Engine | | | Combined Cycle | |

| Electricity Capacity (kW) | | | 800 | | | | 3000 | | | | 100,000 | |

| Total Installed Cost ( $/kW) | | $ | 975 | | | $ | 850 | | | $ | 690 | |

| Capacity Factor | | | 0.8 | | | | 0.8 | | | | 0.9 | |

| Electrical Heat Rate (Btu/kWh), HHV | | | 11,050 | | | | 10,158 | | | | 7,344 | |

| Overall Efficiency (%) | | | 65.0 | % | | | 62.0 | % | | | 65.0 | % |

| | | | | | | | | | | | | |

| Derived Technical Characteristics | | | | | | | | | | | | |

| Elec Generating Efficiency (3412/Heatrate) | | | 30.9 | % | | | 33.6 | % | | | 46.5 | % |

| Fuel Input (mmBtu/hr) | | | 8.840 | | | | 30.473 | | | | 734.444 | |

| Steam Output (mmBtu/hr) | | | 3.002 | | | | 8.658 | | | | 136.160 | |

| Steam Output/Fuel Input | | | 33.9 | % | | | 28.4 | % | | | 18.5 | % |

| Power Steam Ratio | | | 0.909 | | | | 1.182 | | | | 2.506 | |

| Net Heat Rate (Btus/kWh) | | | 6359 | | | | 6551 | | | | 5642 | |

| Thermal Output as Fraction of Fuel Input | | | 0.34 | | | | 0.28 | | | | 0.19 | |

| Electric Output as Fraction of Fuel Input | | | 0.31 | | | | 0.34 | | | | 0.46 | |

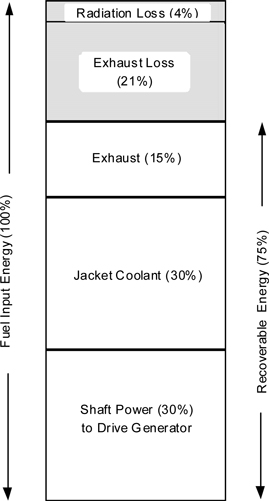

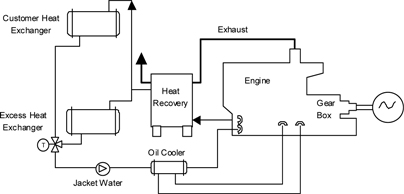

Engine systems can provide higher electrical efficiencies than combustion turbines in small sizes. Because a significant portion of the waste heat from engine systems is rejected in the jacket water at a temperature generally too low to produce high-quality steam, the ability of engine systems to produce steam is limited. Steam can be produced from the engine's exhaust heat in the same manner as from the exhaust of a CT, though the volume of exhaust per unit of electrical output is generally much lower. The jacket water for most systems is suitable only for production of hot water, however, ebullient cooling systems for larger engines are capable of producing low-pressure steam from the jacket water. Engine systems may not serve the needs of some process industries with high-pressure steam requirements, but they are a good choice for many food and manufacturing industries that do not require high-pressure steam but use large quantities of wash water and low-pressure steam. The engine systems shown are producing 15 psig steam yielding overall efficiencies of 65% or less. Systems that can use hot water can provide higher overall efficiencies.

| ONSITE SYCOM Energy Corporation | 6 | Industrial CHP Assessment |

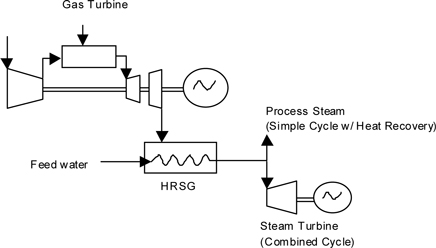

The combined cycle plant is based on two 40 MW LM6000 combustion turbines with heat recovery and a 27 MW steam turbine. The system has an overall electric efficiency of 46.5%. This 12 point increase compared to a simple cycle CT is achieved by diverting to power generation a portion of the thermal energy that otherwise would have been available for process steam use. Consequently, the high electric efficiency of a combined cycle plant is accompanied by only about half of the process steam produced by a simple cycle CT.

This section provides the details on the cost estimates for the revised CHP technology data set. An industrial sized CHP plant is a complex process with many interrelated subsystems. Construction for the larger sizes in the database can take two years or more. The detailed capital costs for the six CT-CHP systems are shown in Table 1.4.

The system is designed around key equipment components. The most important is the turbine-generator set. Prices typically range from $300-400 per kW except for the 1 MW size which is considerably more expensive on a unit cost basis. A heat recovery steam generator (HRSG) is used for heat recovery. The next most important subsystem is the electrical switchgear and controls. After these main components there are still a large number of smaller components such as enclosures or buildings, water treatment systems, piping, pumps, storage tanks, equipment foundations and superstructures, fire suppression systems, and emissions control and monitoring equipment. Site preparation can also be a significant cost for some projects. Labor and materials for plant construction are also a major part of overall costs. The 25 MW CT-CHP plant estimate requires 52,000 labor hours for completion costing $3 million with an additional $1.2 million in material costs. The sum of these costs is termed total process capital in the table. To total process capital must be added engineering, general contractor fees, permitting fees, contingency, and financing costs. In the table, these costs add an additional 20% to total process capital to provide our estimate of total capital cost.

| ONSITE SYCOM Energy Corporation | 7 | Industrial CHP Assessment |

Table 1.4. Capital Cost Estimates for Industrial CHP Plants Based on Combustion Turbines

| Nominal Turbine Capacity MW | | 1 | | | 5 | | | 10 | | | 25 | | | 40 | | | 100* | |

| | | | | | | | | | | | | | | | | | | |

| Combustion Turbines | | $ | 550,000 | | | $ | 2,102,940 | | | $ | 4,319,200 | | | $ | 7,464,960 | | | $ | 14,897,920 | | | $ | 24,000,000 | |

| Steam Turbine Generators | | | | | | | | | | | | | | | | | | | | | | $ | 4,000,000 | |

| Heat Recovery Steam Generators | | $ | 250,000 | | | $ | 350,000 | | | $ | 590,000 | | | $ | 1,020,000 | | | $ | 2,040,000 | | | $ | 7,000,000 | |

| Water Treatment System | | $ | 30,000 | | | $ | 100,000 | | | $ | 150,000 | | | $ | 200,000 | | | $ | 225,000 | | | $ | 750,000 | |

| Electrical Equipment | | $ | 150,000 | | | $ | 375,000 | | | $ | 625,000 | | | $ | 990,000 | | | $ | 1,500,000 | | | $ | 5,600,000 | |

| Other Equipment | | $ | 145,000 | | | $ | 315,000 | | | $ | 575,000 | | | $ | 1,150,000 | | | $ | 1,875,000 | | | $ | 7,000,000 | |

| Total Equipment | | $ | 1,125,000 | | | $ | 3,242,940 | | | $ | 6,259,200 | | | $ | 10,824,960 | | | $ | 20,537,920 | | | $ | 48,350,000 | |

| Materials | | $ | 143,952 | | | $ | 356,723 | | | $ | 688,512 | | | $ | 1,190,746 | | | $ | 2,053,792 | | | $ | 3,626,250 | |

| Labor | | $ | 347,509 | | | $ | 908,023 | | | $ | 1,752,576 | | | $ | 3,030,989 | | | $ | 4,723,722 | | | $ | 9,670,000 | |

| Total Process Capital $ | | $ | 1,616,461 | | | $ | 4,507,686 | | | $ | 8,700,288 | | | $ | 15,046,694 | | | $ | 27,315,434 | | | $ | 61,646,250 | |

| General Facilities Capital $ | | $ | 48,483 | | | $ | 135,231 | | | $ | 261,009 | | | $ | 451,401 | | | $ | 819,463 | | | $ | 1,849,388 | |

| Engineering and Fees $ | | $ | 48,483 | | | $ | 135,231 | | | $ | 261,009 | | | $ | 451,401 | | | $ | 819,463 | | | $ | 1,849,388 | |

| Process Contingency $ | | $ | 48,483 | | | $ | 135,231 | | | $ | 261,009 | | | $ | 451,401 | | | $ | 819,463 | | | $ | 1,849,388 | |

| Project Contingency $ | | $ | 171,305 | | | $ | 477,815 | | | $ | 922,231 | | | $ | 1,594,436 | | | $ | 2,895,436 | | | $ | 6,534,503 | |

| Total Plant Cost $ | | $ | 1,933,215 | | | $ | 5,391,193 | | | $ | 10,405,544 | | | $ | 17,995,847 | | | $ | 32,669,259 | | | $ | 73,728,915 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual Turbine Capacity (kW) | | | 1,205 | | | | 5,007 | | | | 10,798 | | | | 23,328 | | | | 46,556 | | | | 107,000 | |

| Total Plant Cost per net kW $ | | $ | 1,604 | | | $ | 1,076 | | | $ | 964 | | | $ | 771 | | | $ | 702 | | | $ | 689 | |

* Combined Cycle system

Combustion turbine costs are based on published specifications1 and package prices.2 The total installed cost estimation is based on the use of a proprietary cost and performance model – SOAPP-CT.25 – (for State-of-the-Art Power Plant, combustion turbine).3 The model output was adjusted based on OSEC engineering judgment and experience and input from vendors and packagers. 8, 9

| ONSITE SYCOM Energy Corporation | 8 | Industrial CHP Assessment |

The O&M costs presented in Table 1-5 includes operating labor (distinguished between unmanned and 24 hour manned facilities) and total maintenance costs including routine inspections and procedures and major overhauls. O&M costs presented in Table 1-5 are based on 8,000 operating hours expressed in terms of annual electricity generation. Fixed costs are based on an interpolation of manufacturers' estimates. The variable component of the O&M cost represents the inspections and overhaul procedures that are normally conducted by the prime mover OEM through a service agreement usually based on run hours. It is recognized, however, that there is a fixed component aspect to OEM service agreements as well. However, for purposes of clarity, the information is presented as a variable cost. Consumables primarily include an estimate for water and chemicals that are consumed in proportion to electric capacity.

Gas Turbines

O&M costs presented in Table 1-5 are based on gas turbine manufacturer estimates for service contracts consisting of routine inspections and scheduled overhauls of the turbine generator set.8,10 Routine maintenance practices include on-line running maintenance, predictive maintenance, plotting trends, performance testing, fuel consumption, heat rate, vibration analysis, and preventive maintenance procedures.

Routine inspections are required to insure that the turbine is free of excessive vibration due to worn bearings, rotors and damaged blade tips. Inspections generally include on-site hot gas path borescope inspections and non-destructive component testing using dye penetrant and magnetic particle techniques to ensure the integrity of components. The combustion path is inspected for fuel nozzle cleanliness and wear along with the integrity of other hot gas path components.

A gas turbine overhaul is typically a complete inspection and rebuild of components to restore the gas turbine to original or current (upgraded) performance standards. A typical overhaul consists of dimensional inspections, product upgrades and testing of the turbine and compressor, rotor removal, inspection of thrust and journal bearings, blade inspection and clearances and setting packing seals.

Gas turbine maintenance costs can vary significantly depending on the quality and diligence of the preventative maintenance program and operating conditions. Although gas turbines can be cycled, maintenance costs can triple for a gas turbine that is cycled every hour versus a turbine that is operated for intervals of a 1000 hours or more. In addition, operating the turbine over the rated capacity for significant periods of time will dramatically increase the number of hot path inspections and overhauls. Gas turbines that operate for extended periods on liquid fuels will experience higher than average overhaul intervals.

| ONSITE SYCOM Energy Corporation | 9 | Industrial CHP Assessment |

O&M costs presented in Table 1-5 are based on engine manufacturer estimates for service contracts consisting of routine inspections and scheduled overhauls of the engine generator set.4,5,11 Engine service is comprised of routine inspections/adjustments and periodic replacement of engine oil, coolant and spark plugs. An oil analysis is part of most preventative maintenance programs to monitor engine wear. A top-end overhaul is generally recommended between 12,000-15,000 hours of operation that entails a cylinder head and turbocharger rebuild. A major overhaul is performed after 24,000-30,000 hours of operation and involves piston/liner replacement, crankshaft inspection, bearings and seals.

Table 1-5. O&M Cost Estimate

| | | Gas Turbines | | | Reciprocating Engine | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| O&M Costs ($/kWh) | | 1 MW | | | 5 MW | | | 10 MW | | | 25 MW | | | 40 MW | | | 100 MW* | | | 800 kW | | | 3000 kW | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Variable (service contract) | | | 0.0045 | | | | 0.0045 | | | | 0.0045 | | | | 0.0040 | | | | 0.0035 | | | | 0.0030 | | | | 0.0100 | | | | 0.0100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Variable (consumables) | | | 0.0001 | | | | 0.0001 | | | | 0.0001 | | | | 0.0001 | | | | 0.0001 | | | | 0.0003 | | | | 0.00015 | | | | 0.00015 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed ($/kW-yr) | | | 40 | | | | 10 | | | | 7.5 | | | | 6 | | | | 5 | | | | 3 | | | | 4 | | | | 1.5 | |

| ($/kWh) | | | 0.0050 | | | | 0.0013 | | | | 0.0009 | | | | 0.0008 | | | | 0.0006 | | | | 0.0003 | | | | 0.0005 | | | | 0.0002 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total O&M ($/kWh) | | | 0.0096 | | | | 0.0059 | | | | 0.0055 | | | | 0.0049 | | | | 0.0042 | | | | 0.0036 | | | | 0.0107 | | | | 0.0103 | |

* Combined Cycle System

1.4 Selective Catalytic Reduction (SCR)

Selective catalytic reduction (SCR) is a commonly employed emission control system for gas turbines where NOx emissions below 10 ppm are mandated by local air quality districts. Installation of such systems can be a significant cost impact especially in the smaller capacity gas turbines. For this reason the cost of SCR systems is treated separately in this report. SCR costs have dropped considerably in the last two years according a leading manufacturer due to more efficient designs and lower design costs. Operating costs have also been reduced through innovations such as using hot flue gas to pre-heat ammonia injection air to lower the power requirements. Conventional SCR must be placed between sections of the HRSG so that the catalyst is not damaged by excessive exhaust gas temperature. The cost estimate shown below does not include the cost to retrofit the HRSG since this cost is highly project and design dependent. Capital and annual costs are shown in the following table based on “Cost Analysis of NOx Control Alternatives for Stationary Gas Turbines”, November, 1999, prepared by ONSITE SYCOM Energy Corp. for U.S. DOE.12

As shown in Table 1.6, SCR capital costs can add between $20-$82/kW to unit capital costs – representing 5-15% of the installed cost depending on the electric capacity of the project. The cost impact is greatest for smaller gas turbine projects. In a similar manner, costs to operate and maintain SCR systems can be a significant addition to the annual non-fuel operating budget, as shown in Table 1.7.

| ONSITE SYCOM Energy Corporation | 10 | Industrial CHP Assessment |

Table 1.6 SCR Capital Cost Summary

| Gas Turbines | | Electric Capacity (kW) | | | SCR Capital Cost ($) | | | SCR Capital Cost ($/kW) | |

| | | | | | | | | | |

| System 1 | | | 1,000 | | | | N/A | | | | N/A | |

| System 2 | | | 5,000 | | | $ | 460,000 | | | $ | 92 | |

| System 3 | | | 10,000 | | | $ | 658,000 | * | | $ | 66 | |

| System 4 | | | 25,000 | | | $ | 1,200,000 | | | $ | 48 | |

| System 5 | | | 40,000 | | | $ | 1,526,000 | * | | $ | 38 | |

| System 6 | | | 100,000 | | | $ | 2,700,000 | * | | $ | 27 | |

*Costs interpolated from smaller and larger engineering estimates

Table 1.7 SCR Annual Cost Summary

Gas Turbines | | Electric Capacity (kW) | | | SCR Operating Cost ($) | | | SCR Maint Labor & Matl Cost ($) | | | SCR Electric Penalty, | | | SCR Ammonia, Catalyst Costs ($) | | | SCR Ovhd, Insurance, Taxes Costs ($) | | | SCR Total Annual Costs ($) | | | SCR Total Annual Costs assuming 6,000 hours ($/kWh) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| System 1 | | | 1,000 | | | | | | | | | | | | | | | | | | | | | Not economic | |

| System 2 | | | 5,000 | | | $ | 15,000 | | | $ | 26,000 | | | $ | 13,000 | | | $ | 20,000 | * | | $ | 45,000 | | | $ | 119,000 | | | | .0040 | |

| System 3* | | | 10,000 | | | $ | 15,000 | | | $ | 26,000 | | | $ | 25,000 | | | $ | 40,000 | * | | $ | 55,000 | | | $ | 161,000 | | | | .0027 | |

| System 4 | | | 25,000 | | | $ | 15,000 | | | $ | 26,000 | | | $ | 60,000 | | | $ | 80,000 | | | $ | 75,000 | | | $ | 256,000 | | | | .0017 | |

| System 5* | | | 40,000 | | | $ | 15,000 | | | $ | 26,000 | | | $ | 100,000 | | | $ | 150,000 | * | | $ | 90,000 | | | $ | 381,000 | | | | .0016 | |

| System 6* | | | 100,000 | | | $ | 15,000 | | | $ | 26,000 | | | $ | 250,000 | | | $ | 350,000 | * | | $ | 135,000 | | | $ | 776,000 | | | | .0013 | |

*Costs interpolated from smaller and larger engineering estimates

SCR systems generally must be installed with continuous emissions monitoring system (CEMS). These systems generally cost about $250,000 per CT-HRSG train. This added cost adds significantly to the costs for smaller systems.

| 1.5 | Advanced Technology Characteristics |

The cost and performance for small power generation technologies has been continually improving. Both reciprocating engine systems and combustion turbines have increased efficiency, reduced capital cost, and reduced emissions. Over the twenty year forecast period of the NEMS model, it is reasonable to expect additional evolutionary improvement in the selected technologies. In addition, advances in emerging technologies such as fuel cells could provide for a significant industrial market opportunity in the latter part of the forecast period. There are several classes of improvements that should be considered:

| ONSITE SYCOM Energy Corporation | 11 | Industrial CHP Assessment |

| q | System heat rates are declining due to advances in materials and design. These have occurred over time and may accelerate with the use of ceramic materials |

| q | Heat recovery within combustion turbines such as in a recuperated cycle or through the implementation of combined cycle operation can significantly increase electric efficiency. |

| q | Emissions control can be improved either through the use of catalytic combustion or other means that would allow operation of these systems more economically than with the current generation of SCR technology. |

| q | More effective packaging and integration of systems and controls can reduce the cost of the basic components and also minimize the on-site cost of installation. Particularly in the smaller system sizes, the modular approach can greatly reduce site costs. |

| q | Streamlined siting, interconnection, and permitting procedures are another area that will reduce the cost of installing CHP plants. This area combines policy and technology in that it requires changes in government policy that will allow changes in technology and reductions in lead times. |

The following improvements are projected for this area:

| q | Small and large gas engines will reach higher efficiencies approaching the efficiencies of diesel cycle engines. |

| q | Small turbines will improve efficiencies as a result of improved materials that can withstand higher temperatures and recuperation that raises overall electric efficiencies from 29% to 37%. |

| q | The larger industrial turbine efficiencies are increased using combined cycle technology to provide electric efficiencies of 50% or higher. Currently, the largest state-of-the-art combined cycle systems can achieve electric efficiencies approaching 60%. |

| q | Package costs for engines and turbines will be reduced by 10-25%. |

| q | Interconnect costs will be cut in half for all technologies. This change has a greater importance in the smallest sizes rather than in the medium to large industrial size categories |

| q | Selective catalytic reduction costs cut in half or eliminated altogether through the use of catalytic combustion. |

| q | Contractor markups will be reduced across the board to reflect a high volume competitive market |

| q | Construction lead times will be reduced by 6 months resulting in lower carry charges for interest during construction |

| q | Capital costs for the basic combustion turbine generator package and heat recovery generator will be reduced by 10% |

Tables 1.8 and 1.9 present a comparison of current technology and expected 2020 technology for reciprocating engines and combustion turbines respectively.

| ONSITE SYCOM Energy Corporation | 12 | Industrial CHP Assessment |

Table 1-8 Current and Advanced Reciprocating Engine System Characteristics

| CHP Cost & Performance Assumptions | | 800 kW Recip Engine | | | 3000 kW Recip Engine | |

| Year | | Current | | | 2020 | | | Current | | | 2020 | |

| Total Installed Cost ( $/kW) | | $ | 975 | | | $ | 690 | | | $ | 850 | | | $ | 710 | |

| O&M Costs ($/kWh) | | | 0.0107 | | | | 0.009 | | | | 0.0103 | | | | 0.009 | |

| Electrical Heat Rate (Btu/kWh), HHV | | | 11,050 | | | | 9,382 | | | | 10,158 | | | | 8,982 | |

| Overall Efficiency (%) | | | 65.0 | % | | | 66.2 | % | | | 62.0 | % | | | 66.0 | % |

| | | | | | | | | | | | | | | | | |

| Derived Technical Characteristics | | | | | | | | | | | | | | | | |

| Elec Generating Efficiency (3412/Heatrate) | | | 30.9 | % | | | 36.5 | % | | | 33.6 | % | | | 38.0 | % |

| Fuel Input (mmBtu/hr) | | | 8.840 | | | | 7.506 | | | | 30.473 | | | | 26.946 | |

| Steam Output (mmBtu/hr) | | | 3.002 | | | | 2.493 | | | | 8.658 | | | | 7.543 | |

| Steam Output/Fuel Input | | | 33.9 | % | | | 33.1 | % | | | 28.4 | % | | | 28.0 | % |

| Power Steam Ratio | | | 0.909 | | | | 1.095 | | | | 1.182 | | | | 1.357 | |

| Net Heat Rate (Btus/kWh) | | | 6359 | | | | 5487 | | | | 6551 | | | | 5839 | |

| Thermal Output as Fraction of Fuel Input | | | 0.34 | | | | 0.33 | | | | 0.28 | | | | 0.28 | |

| Electric Output as Fraction of Fuel Input | | | 0.31 | | | | 0.37 | | | | 0.34 | | | | 0.38 | |

The 800 kW gas engine system is based on the Caterpillar G3516 engine system. The advanced performance was based on target specifications for a high performance system being developed by the Gas Research Institute and Caterpillar. The 3000 kW size is based on the Caterpillar G3616. The base case specifications are based on the current product performance. The advanced system is based on preliminary goals of the Advanced Reciprocating Engine System (ARES) program.7, 13

| ONSITE SYCOM Energy Corporation | 13 | Industrial CHP Assessment |

Table 1-8 Current and Advanced Combustion Turbine System Characteristics

CHP Cost & Performance Assumptions | | 1 MW Comb Turbine | | | 5 MW Comb Turbine | | | 10 MW Comb Turbine | |

| Year | | Current | | | 2020 | | | Current | | | 2020 | | | Current | | | 2020 | |

| Total Installed Cost ( $/kW) | | $ | 1,600 | | | $ | 1,340 | | | $ | 1,075 | | | $ | 950 | | | $ | 965 | | | $ | 830 | |

| O&M Costs ($/kWh) | | | 0.0096 | | | | 0.008 | | | | 0.0059 | | | | 0.0049 | | | | 0.0055 | | | | 0.0046 | |

| Electrical Heat Rate (Btu/kWh), HHV | | | 15,600 | | | | 12,375 | | | | 12,375 | | | | 9,605 | | | | 11,750 | | | | 9,054 | |

| Overall Efficiency (%) | | | 72.0 | % | | | 73.0 | % | | | 73.0 | % | | | 74.0 | % | | | 74.0 | % | | | 74.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Derived Technical Characteristics | | | | | | | | | | | | | | | | | | | | | | | | |

| Elec Generating Efficiency (3412/Heatrate) | | | 21.9 | % | | | 27.6 | % | | | 27.6 | % | | | 35.5 | % | | | 29.0 | % | | | 37.7 | % |

| Fuel Input (mmBtu/hr) | | | 15.60 | | | | 12.38 | | | | 61.88 | | | | 48.03 | | | | 117.50 | | | | 90.54 | |

| Steam Output (mmBtu/hr) | | | 7.82 | | | | 5.622 | | | | 28.11 | | | | 18.55 | | | | 52.83 | | | | 32.80 | |

| Steam Output/Fuel Input | | | 50.1 | % | | | 45.4 | % | | | 45.4 | % | | | 38.6 | % | | | 45.0 | % | | | 36.2 | % |

| Power Steam Ratio | | | 0.436 | | | | 0.607 | | | | 0.607 | | | | 0.920 | | | | 0.646 | | | | 1.041 | |

| Net Heat Rate (Btus/kWh) | | | 5825 | | | | 5348 | | | | 5348 | | | | 4967 | | | | 5146 | | | | 4954 | |

| Thermal Output as Fraction of Fuel Input | | | 0.50 | | | | 0.45 | | | | 0.45 | | | | 0.39 | | | | 0.45 | | | | 0.36 | |

| Electric Output as Fraction of Fuel Input | | | 0.22 | | | | 0.28 | | | | 0.28 | | | | 0.36 | | | | 0.29 | | | | 0.38 | |

| ONSITE SYCOM Energy Corporation | 14 | Industrial CHP Assessment |

Table 1-8 (continued) Current and Advanced Combustion Turbine System Characteristics

| CHP Cost & Performance Assumptions | | 25 MW Comb Turbine | | | 40 MW Comb Turbine | |

| Year | | Current | | | 2020 | | | Current | | | 2020 | |

| Total Installed Cost ( $/kW) | | $ | 770 | | | $ | 675 | | | $ | 700 | | | $ | 625 | |

| O&M Costs ($/kWh) | | | 0.0049 | | | | 0.0043 | | | | 0.0042 | | | | 0.0040 | |

| Electrical Heat Rate (Btu/kWh), HHV | | | 9,950 | | | | 8,745 | | | | 9,220 | | | | 8,530 | |

| Overall Efficiency (%) | | | 78.0 | % | | | 74.0 | % | | | 78.0 | % | | | 72.0 | % |

| | | | | | | | | | | | | | | | | |

| Derived Technical Characteristics | | | | | | | | | | | | | | | | |

| Elec Generating Efficiency (3412/Heatrate) | | | 34.3 | % | | | 39.0 | % | | | 37.0 | % | | | 40.0 | % |

| Fuel Input (mmBtu/hr) | | | 248.75 | | | | 218.63 | | | | 368.80 | | | | 341.20 | |

| Steam Output (mmBtu/hr) | | | 108.72 | | | | 76.52 | | | | 151.18 | | | | 109.18 | |

| Steam Output/Fuel Input | | | 43.7 | % | | | 35.0 | % | | | 41.0 | % | | | 32.0 | % |

| Power Steam Ratio | | | 0.785 | | | | 1.114 | | | | 0.903 | | | | 1.125 | |

| Net Heat Rate (Btus/kWh) | | | 4514 | | | | 4919 | | | | 4514 | | | | 5118 | |

| Thermal Output as Fraction of Fuel Input | | | 0.44 | | | | 0.35 | | | | 0.41 | | | | 0.32 | |

| Electric Output as Fraction of Fuel Input | | | 0.34 | | | | 0.39 | | | | 0.37 | | | | 0.40 | |

The base case 1 MW size is based on the Solar Turbines 1205 kW Saturn 20 gas turbine; the 5 MW system is based on the Solar Taurus 60; the 10 MW system is based on the Solar Mars 100; the base case 25 MW system is based on the GE LM2500; the base case 40 MW system is based on the GE LM6000. The advanced case 1 MW system is based on a qualitative assessment of potential efficiency improvement based on recuperation. The advanced 5 MW system is based on the 4.2 MW Solar Mercury 50, a recuperated turbine system that was the successful product of the DOE Advanced Turbine System program. The advanced 10 MW system is based on the Mitsui SB60 (17.7 MW) combined cycle turbine system. Advanced 25, and 40 MW systems are based on qualitative assessments of potential improvements based on the use of ceramic components and advanced combustors.

| ONSITE SYCOM Energy Corporation | 15 | Industrial CHP Assessment |

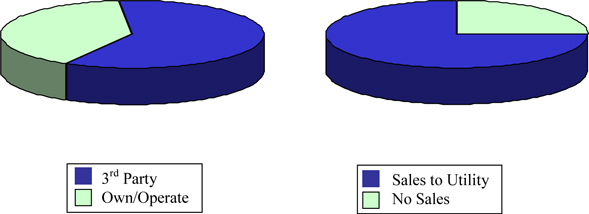

2. Profile of Existing Industrial CHP

An analysis of the most recent update to the Hagler Bailly Independent Power Data Base (HBI) was conducted to develop a profile of existing cogeneration activity in the industrial sector. 14 OSEC has not found any single database that contains a complete listing of existing CHP and independent power facilities (i.e., coverage of small systems in the HBI database is incomplete). However, OSEC considers the HBI data as the best available and has worked with it extensively over the past two years to understand its content and to enhance its coverage and value. The profile was developed to understand the technologies and applications that comprise existing CHP capacity and to provide insight into projections of future market development. The HBI database includes information for each CHP site including technology, fuel use, electrical capacity (MW), ownership and sell-back of power to the grid. Steam capacity was calculated based on typical power to heat ratios of the technology used at each site.

CHP installations in the following industries were reviewed:

| SIC | | Industry |

| 01 | | Agriculture - Crops |

| 07 | | Agriculture - Services |

| 11 | | Metal Mining |

| 12 | | Coal Mining |

| 14 | | Mining - nonmetallic Minerals |

| 20 | | Food & Kindred Products |

| 21 | | Tobacco Products |

| 22 | | Textile Mill Products |

| 23 | | Apparel |

| 24 | | Lumber & Wood Products |

| 25 | | Furniture & Fixtures |

| 26 | | Paper & Allied Products |

| 27 | | Printing & Publishing |

| 28 | | Chemicals & Allied Products |

| 29 | | Petroleum Refining and Related Industries |

| 30 | | Rubber & Misc. Plastic Products |

| 31 | | Leather & Leather Products |

| 32 | | Stone, Clay, Glass and Concrete |

| 33 | | Primary Metals |

| 34 | | Fabricated Metal Products |

| 35 | | Industrial & Commercial Machinery |

| 36 | | Electronic & Other Electrical Equipment |

| 37 | | Transportation Equipment |

| 38 | | Measuring, Analyzing and Controlling Instruments |

| 39 | | Miscellaneous Manufacturing Industries |

| ONSITE SYCOM Energy Corporation | 16 | Industrial CHP Assessment |

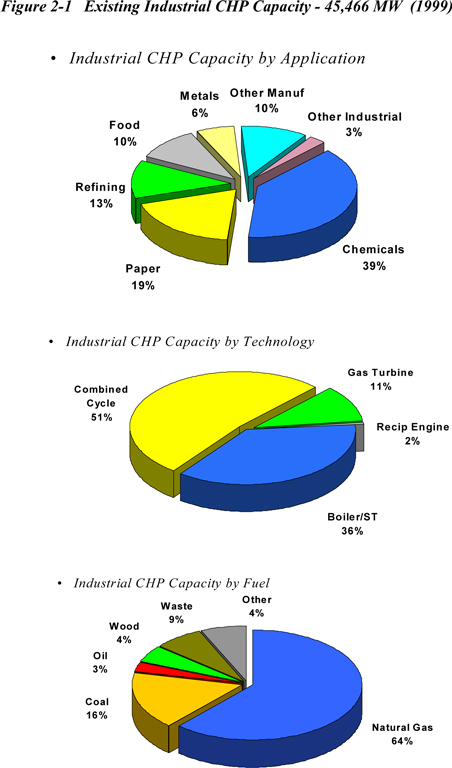

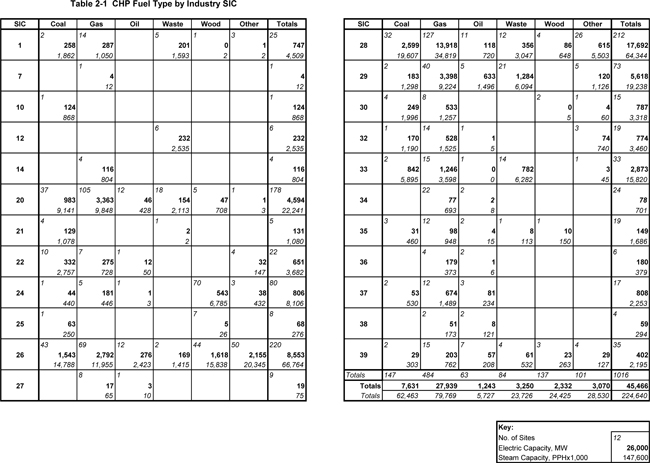

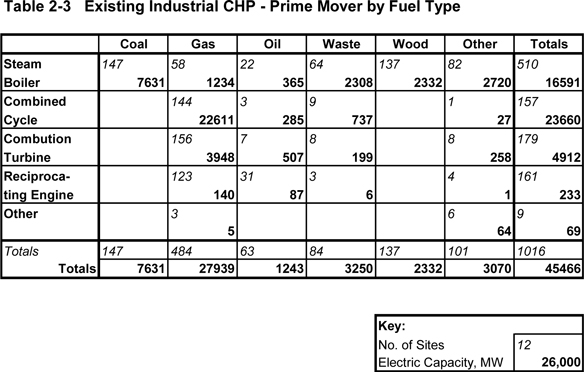

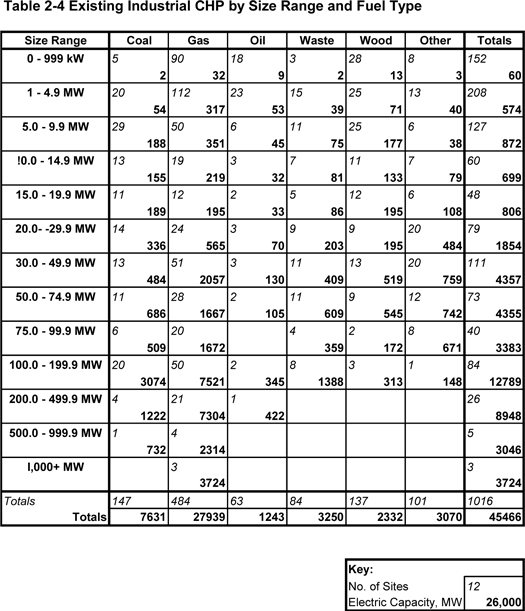

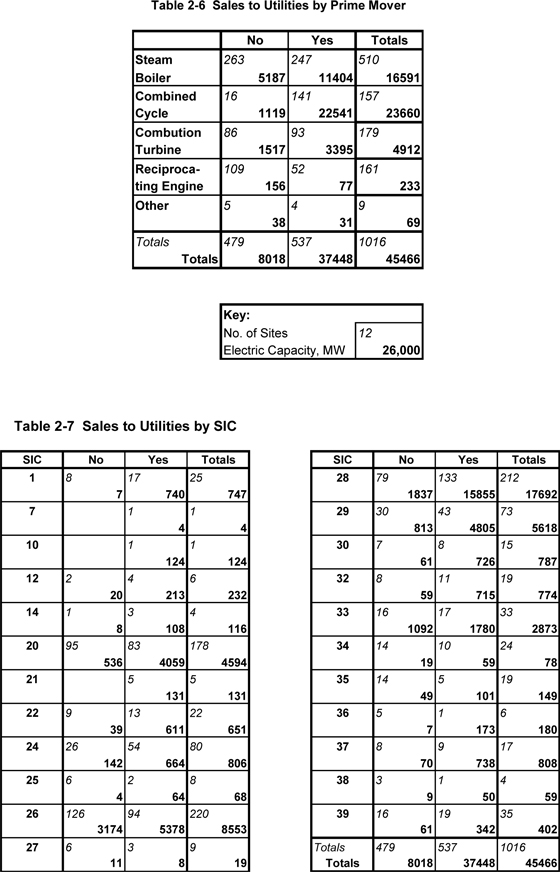

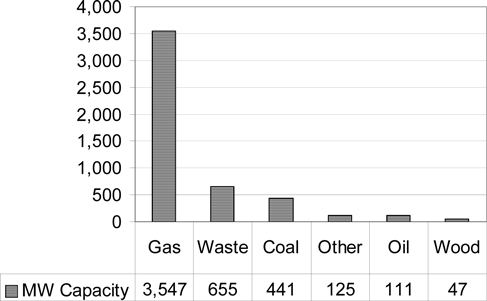

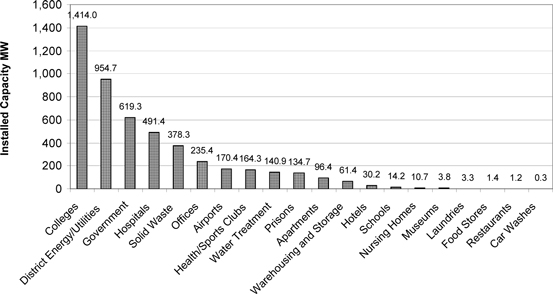

As of the end of mid-1999, these industries had 1,016 CHP facilities with a total electrical capacity of 45,500 MW and an estimated cogenerated steam capacity of 225,000,000 pounds of steam/hour (225,000 million Btu/hour). Manufacturing industries (SIC 20-39) represented 44,242 MW at 980 sites (216,000 million Btu/hour steam capacity). Major conclusions from the database include:

| ¨ | Existing CHP capacity is concentrated in a few industries - CHP facilities can be found in all manufacturing industries except Apparel Manufacturing and Leather and Tanning (SICs 21 and 31). However, SIC Groups 26, 28 and 29 (Paper and Allied Products, Chemicals and Allied Products, and Petroleum Refining and related Products) combined represent more than two thirds of the total electric and steam capacities at existing CHP installations. (Figure 2-1 and Table 2-1) Note that SIC 26 has approximately the same steam capacity as SIC 28 but only half the electrical capacity, a reflection of the types of cogeneration systems employed. (Table 2-2) SIC 26 has relied primarily on boiler/steam turbine systems with low power to heat ratios; SIC 28 CHP capacity is primarily combustion turbine and combined cycle systems that have much higher power to heat ratios. |