0001378872 ietft2:FTSERAFITMDevelopedExUSMidSmall1500IndexNetMember 2023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Invesco Exchange-Traded Fund Trust II

(Exact name of registrant as specified in charter)

3500 Lacey Road Downers Grove, IL 60515

(Address of principal executive offices) (Zip code)

Brian Hartigan, President

3500 Lacey Road

Downers Grove, IL 60515

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders.

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco 0-5 Yr US TIPS ETF

PBTP | Cboe BZX Exchange, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco 0-5 Yr US TIPS ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco 0-5 Yr US TIPS ETF | $7 | 0.07% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, the U.S. Treasury bond market benefited from relatively lower short-term interest rates. Because the Fund holds the vast majority of its portfolio in U.S. Treasury Inflation-Protected Securities ("TIPS") that have shorter durations, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the ICE BofA 0-5 Year US Inflation-Linked Treasury Index (the “Index”). The Fund generally will invest at least 80% of its total assets in the components that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 6.57%, differed from the return of the Index, 6.63%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Duration Allocations | Bonds with maturities of 3-4 years, followed by bonds with maturities of 2-3 years.

Positions | U.S. Treasury Inflation-Indexed Note, 0.50% coupon, due 01/15/2028, followed by U.S. Treasury Inflation-Indexed Note 0.63% coupon, due 01/15/2026.

What detracted from performance?

Duration Allocations | No maturity durations detracted from the Fund's performance during the period.

Positions | U.S. Treasury Inflation-Indexed Note, 1.63% coupon, due 10/15/2029.

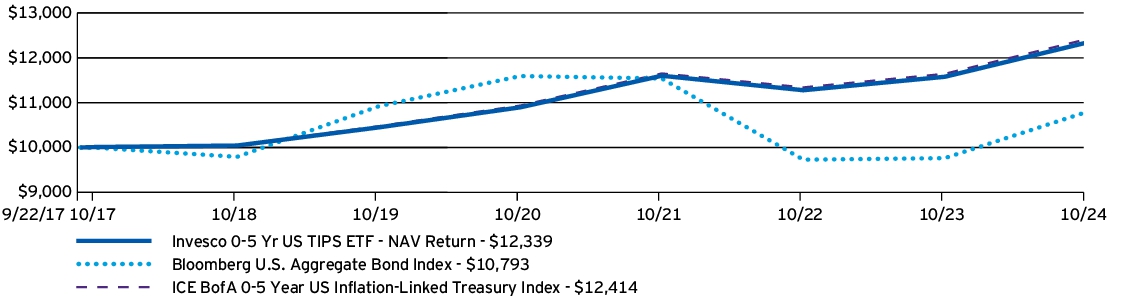

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(09/22/17) |

| Invesco 0-5 Yr US TIPS ETF — NAV Return | 6.57% | 3.38% | 3.00% |

| ICE BofA 0-5 Year US Inflation-Linked Treasury Index | 6.63% | 3.46% | 3.09% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | (0.23)% | 1.08% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA 0-5 Year US Inflation-Linked Treasury Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Prior to July 1, 2022, Index returns reflect no deduction for fees, expenses or taxes. Effective July 1, 2022, Index returns reflect no deduction for taxes, but include transaction costs (as determined and calculated by the index provider), which may be higher of lower than the actual transaction costs incurred by the Fund.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $55,141,655 |

| Total number of portfolio holdings | 28 |

| Total advisory fees paid | $43,257 |

| Portfolio turnover rate | 33% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| U.S. Treasury Inflation - Indexed Notes, 0.63%, 01/15/2026 | 4.88% |

| U.S. Treasury Inflation - Indexed Notes, 0.25%, 01/15/2025 | 4.82% |

| U.S. Treasury Inflation - Indexed Notes, 0.38%, 07/15/2025 | 4.78% |

| U.S. Treasury Inflation - Indexed Notes, 0.38%, 01/15/2027 | 4.31% |

| U.S. Treasury Inflation - Indexed Notes, 0.50%, 01/15/2028 | 4.23% |

| U.S. Treasury Inflation - Indexed Notes, 0.13%, 07/15/2026 | 4.20% |

| U.S. Treasury Inflation - Indexed Bonds, 2.38%, 01/15/2025 | 4.16% |

| U.S. Treasury Inflation - Indexed Notes, 0.13%, 04/15/2026 | 4.14% |

| U.S. Treasury Inflation - Indexed Notes, 0.38%, 07/15/2027 | 4.08% |

| U.S. Treasury Inflation - Indexed Notes, 0.25%, 07/15/2029 | 4.07% |

| * Excluding money market fund holdings, if any. | |

Duration allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF

BLKC | Cboe BZX Exchange, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF | $83 | 0.60% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, digital assets experienced a positive market environment. Since many blockchain-related companies either are exposed to digital asset prices directly or generate revenues from activity in the space, they also benefited from the strong performance of digital assets.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Alerian Galaxy Global Blockchain Equity, Trusts and ETPs Index (the “Index”). The Fund generally will invest at least 80% of its total assets in the securities that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 76.95%, differed from the return of the Index, 76.77%, primarily due to income from the securities lending program in which the Fund participates, partially offset by fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Software industry, followed by the capital markets and semiconductors & semiconductor equipment industries, respectively.

Positions | Grayscale Bitcoin Trust BTC, an exchange-traded fund, and MicroStrategy Inc., Class A, a software company.

What detracted from performance?

Industry Allocations | Technology hardware storage & peripherals industry, followed by the food products and household durables industries, respectively.

Positions | Stronghold Digital Mining, Inc., Class A, a software company, and Canaan, Inc., ADR, a technology hardware storage & peripherals company.

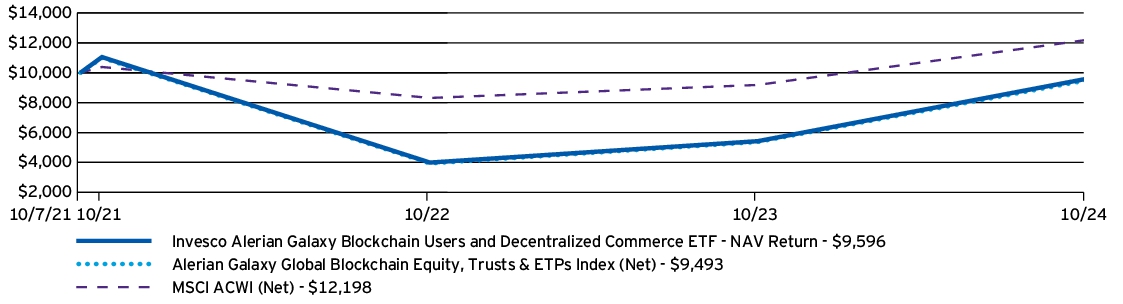

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(10/07/21) |

| Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF — NAV Return | 76.95% | (1.34)% |

| Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index (Net) | 76.77% | (1.68)% |

| MSCI ACWI (Net) | 32.79% | 6.70% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $3,362,725 |

| Total number of portfolio holdings | 69 |

| Total advisory fees paid | $19,333 |

| Portfolio turnover rate | 91% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| iShares Bitcoin Trust | 7.03% |

| Grayscale Bitcoin Trust BTC | 3.62% |

| Fidelity Wise Origin Bitcoin Fund | 3.40% |

| Terawulf, Inc. | 2.14% |

| Hut 8 Corp. | 1.83% |

| Cipher Mining, Inc. | 1.73% |

| MicroStrategy, Inc., Class A | 1.72% |

| SoFi Technologies, Inc. | 1.67% |

| Bit Digital, Inc. | 1.66% |

| Hive Digital Technologies Ltd. | 1.64% |

| * Excluding money market fund holdings, if any. | |

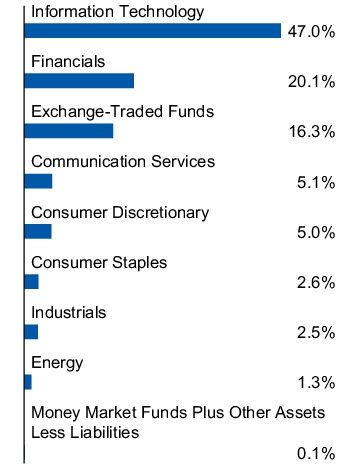

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

The Fund modified its principal risks to reflect that the Fund may obtain investment exposure to cryptocurrencies indirectly through investments in cryptocurrency exchange-traded products.

The Fund's classification changed from non-diversified to diversified, and therefore the Fund is now required to meet certain diversification requirements under the Investment Company Act of 1940.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Alerian Galaxy Crypto Economy ETF

SATO | Cboe BZX Exchange, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Alerian Galaxy Crypto Economy ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Alerian Galaxy Crypto Economy ETF | $96 | 0.60% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, digital assets experienced a positive market environment. Stocks of companies that are materially engaged in the research and development of blockchain technology, cryptocurrency mining, cryptocurrency buying, or cryptocurrency enabling technologies benefited from the strong performance of digital assets.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index (the “Index”). The Fund generally will invest at least 80% of its total assets in the securities that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 121.02%, differed from the return of the Index, 115.99%, primarily due to income from the securities lending program in which the Fund participates, partially offset by fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Software industry, followed by the capital markets and IT services industries, respectively.

Positions | Grayscale Bitcoin Trust BTC, an exchange-traded fund, and CleanSpark, Inc., a software company.

What detracted from performance?

Industry Allocations | Technology hardware storage & peripherals industry, followed by the industrial conglomerates industry.

Positions | Canaan, Inc., ADR, a technology hardware storage & peripherals company, and Stronghold Digital Mining, Inc., Class A, a software company.

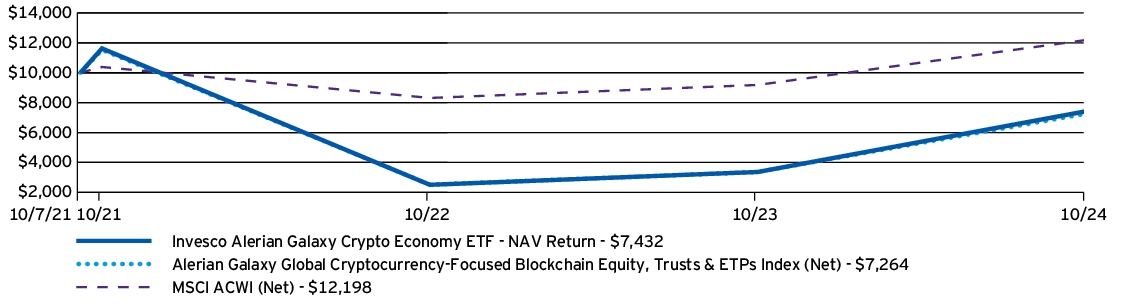

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(10/07/21) |

| Invesco Alerian Galaxy Crypto Economy ETF — NAV Return | 121.02% | (9.23)% |

| Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts & ETPs Index (Net) | 115.99% | (9.91)% |

| MSCI ACWI (Net) | 32.79% | 6.70% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $8,483,768 |

| Total number of portfolio holdings | 49 |

| Total advisory fees paid | $46,595 |

| Portfolio turnover rate | 137% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| iShares Bitcoin Trust | 6.54% |

| Terawulf, Inc. | 4.65% |

| Hut 8 Corp. | 3.98% |

| Cipher Mining, Inc. | 3.77% |

| MicroStrategy, Inc., Class A | 3.74% |

| Bit Digital, Inc. | 3.61% |

| Hive Digital Technologies Ltd. | 3.56% |

| Iris Energy Ltd. | 3.49% |

| Canaan, Inc., ADR | 3.46% |

| CleanSpark, Inc. | 3.44% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

The Fund modified its principal risks to reflect that the Fund may obtain investment exposure to cryptocurrencies indirectly through investments in cryptocurrency exchange-traded products.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco China Technology ETF

CQQQ | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco China Technology ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco China Technology ETF | $73 | 0.66% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, Chinese equities experienced a mostly negative market environment driven largely by weak consumer demand and an ongoing property crisis. However, at the end of the period, the October announcement of broad government stimulus contributed to a sharp recovery in Chinese equities. Given the Fund's focus on Chinese equities, it largely benefited from this market tailwind and finished the period in positive territory.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE China Incl A 25% Technology Capped Index (Net) (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 19.91%, differed from the return of the Index, 20.80%, primarily due to fees and expenses that the Fund incurred during the period as well as the impact of currency depreciation.

What contributed to performance?

Industry Allocations | Interactive media & services industry, followed by the hotels restaurants & leisure industry.

Positions | Meituan, B Shares, a hotels restaurants & leisure company, and Tencent Holdings Ltd., an interactive media & services company.

What detracted from performance?

Industry Allocations | Consumer staples distribution & retail industry, followed by the software industry.

Positions | Sunny Optical Technology Group Co. Ltd., an electronic equipment instruments & components company and Kingdee International Software Group Co. Ltd., a software company.

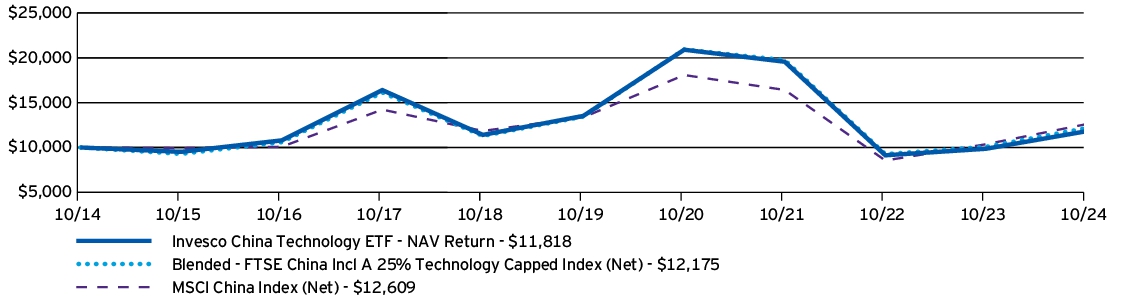

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco China Technology ETF — NAV Return | 19.91% | (2.66)% | 1.68% |

| Blended - FTSE China Incl A 25% Technology Capped Index (Net) | 20.80% | (1.96)% | 1.99% |

| MSCI China Index (Net) | 21.75% | (1.17)% | 2.35% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective after the close of business on May 18, 2018, Guggenheim China Technology ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim China Technology ETF and the Fund.

- The Blended - FTSE China Incl A 25% Technology Capped Index (Net) performance is comprised of the performance of the AlphaShares China Technology Index, the Fund's former underlying index, prior to June 22, 2019, followed by the performance of the Index thereafter.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $767,345,488 |

| Total number of portfolio holdings | 151 |

| Total advisory fees paid | $4,245,036 |

| Portfolio turnover rate | 43% |

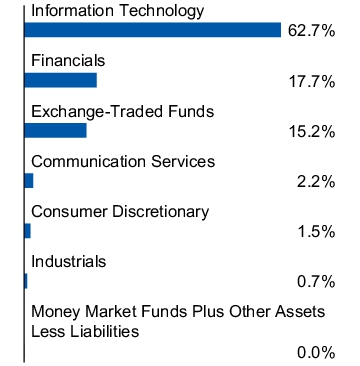

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Meituan, B Shares | 10.15% |

| Tencent Holdings Ltd. | 8.17% |

| PDD Holdings, Inc., ADR | 7.66% |

| Baidu, Inc., A Shares | 5.71% |

| Kuaishou Technology | 5.44% |

| Bilibili, Inc., Z Shares | 4.62% |

| SenseTime Group, Inc., B Shares | 3.55% |

| Sunny Optical Technology Group Co. Ltd. | 3.12% |

| Kingdee International Software Group Co. Ltd. | 2.23% |

| Hygon Information Technology Co. Ltd., A Shares | 2.16% |

| * Excluding money market fund holdings, if any. | |

Industry allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

Effective January 5, 2024, the Fund's annual unitary management fee was reduced to 0.65% of the Fund's average daily net assets.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Dorsey Wright Developed Markets Momentum ETF

PIZ | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Dorsey Wright Developed Markets Momentum ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Dorsey Wright Developed Markets Momentum ETF | $94 | 0.80% |

How Did The Fund Perform During The Period?

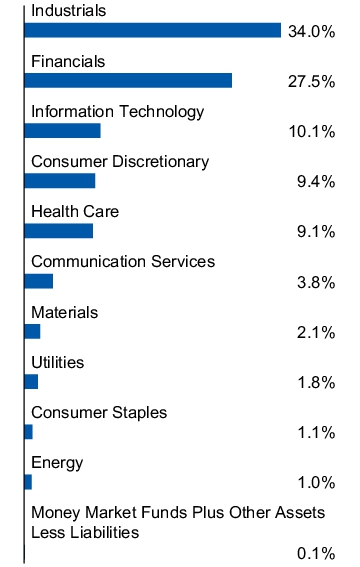

• During the fiscal year ended October 31, 2024, developed market equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. Given the Fund's focus on developed market equities, it largely benefited from the market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dorsey Wright Developed Markets Technical Leaders™ Index (Net) (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 35.67%, differed from the return of the Index, 36.71%, primarily due to the daily compounding of fees during a period of high returns.

What contributed to performance?

Sector Allocations | Industrials sector, followed by the financials sector.

Positions | ASM International N.V., an information technology company (no longer held at fiscal year-end) and Constellation Software, Inc., an information technology company.

What detracted from performance?

Sector Allocations | Energy sector.

Positions | HLB Co., Ltd., a healthcare company (no longer held at fiscal year-end) and Whitecap Resources Inc., and energy company (no longer held at fiscal year-end).

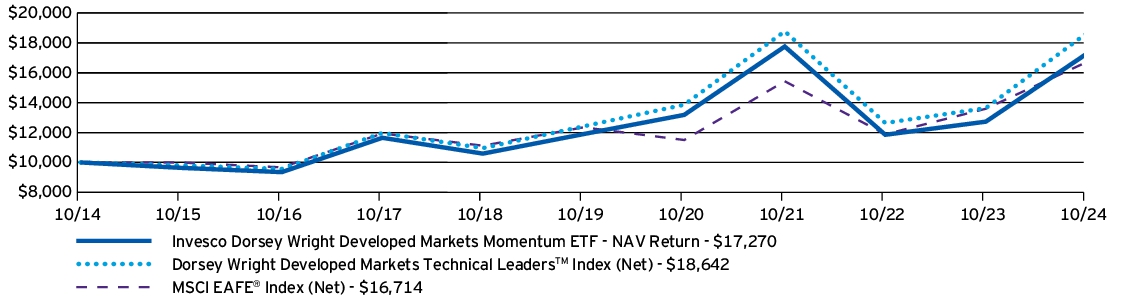

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Dorsey Wright Developed Markets Momentum ETF — NAV Return | 35.67% | 7.74% | 5.62% |

| Dorsey Wright Developed Markets Technical Leaders™ Index (Net) | 36.71% | 8.47% | 6.43% |

| MSCI EAFE® Index (Net) | 22.97% | 6.24% | 5.27% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the Dorsey Wright Developed Markets Technical Leaders™ Index (Net) to the MSCI EAFE® Index (Net) to reflect that the MSCI EAFE® Index (Net) can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $136,210,842 |

| Total number of portfolio holdings | 102 |

| Total advisory fees paid | $1,038,940 |

| Portfolio turnover rate | 114% |

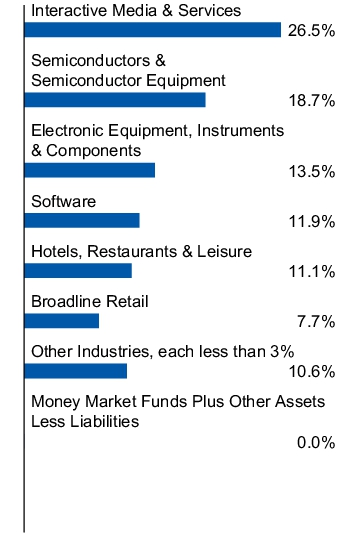

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| InterContinental Hotels Group PLC | 3.04% |

| Constellation Software, Inc. | 2.86% |

| REA Group Ltd. | 2.75% |

| Descartes Systems Group, Inc. (The) | 2.62% |

| Belimo Holding AG | 2.60% |

| Novo Nordisk A/S, Class B | 2.34% |

| Flughafen Zureich AG | 2.34% |

| Dollarama, Inc. | 2.22% |

| Halma PLC | 2.09% |

| Mizrahi Tefahot Bank Ltd. | 2.04% |

| * Excluding money market fund holdings, if any. | |

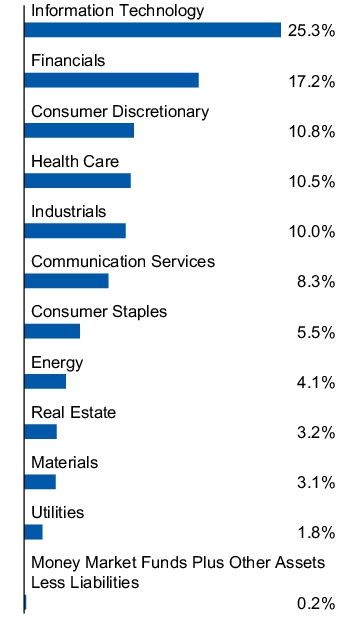

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Dorsey Wright Emerging Markets Momentum ETF

PIE | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Dorsey Wright Emerging Markets Momentum ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Dorsey Wright Emerging Markets Momentum ETF | $98 | 0.90% |

How Did The Fund Perform During The Period?

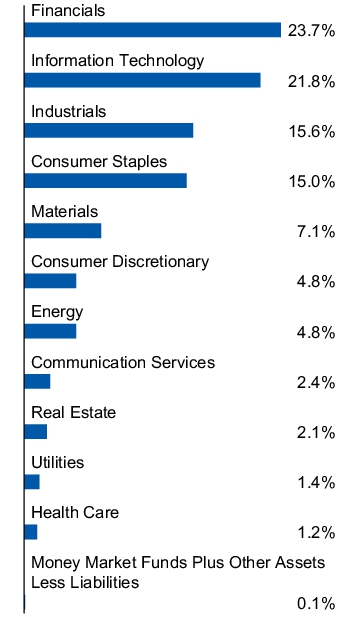

• During the fiscal year ended October 31, 2024, emerging market equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. The Fund's focus on momentum within emerging market equities resulted in underperformance versus the MSCI Emerging Markets Index (Net).

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Dorsey Wright Emerging Markets Technical Leaders™ Index (Net) (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 17.19%, differed from the return of the Index, 20.35%, primarily due to fees and expenses that the Fund incurred during the period along with the impact of foreign fair valuation and sampling.

What contributed to performance?

Sector Allocations | Information technology sector, followed by the consumer staples sector.

Positions | Topco Scientific Co. Ltd., an information technology company and Taiwan Semiconductor Manufacturing Co. Ltd., an information technology company.

What detracted from performance?

Sector Allocations | No sectors detracted from the Fund's performance during the period.

Positions | Turk Traktor ve Ziraat Makineleri A.S., an industrials company (no longer held at fiscal year-end) and Wiwynn Corp., an information technology company (no longer held at fiscal year-end).

How Has The Fund Historically Performed?

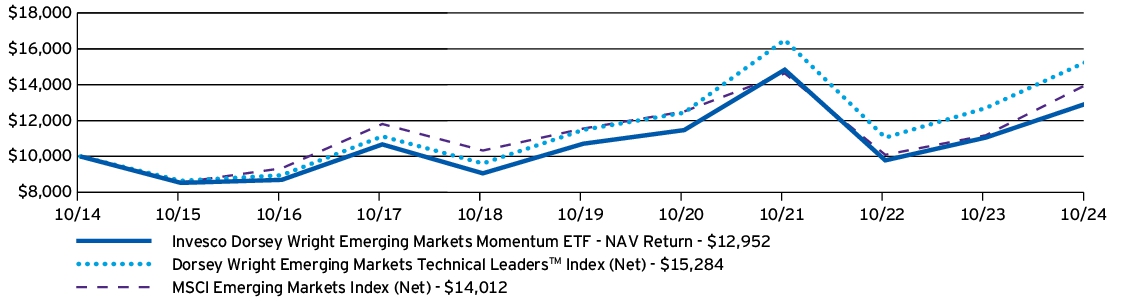

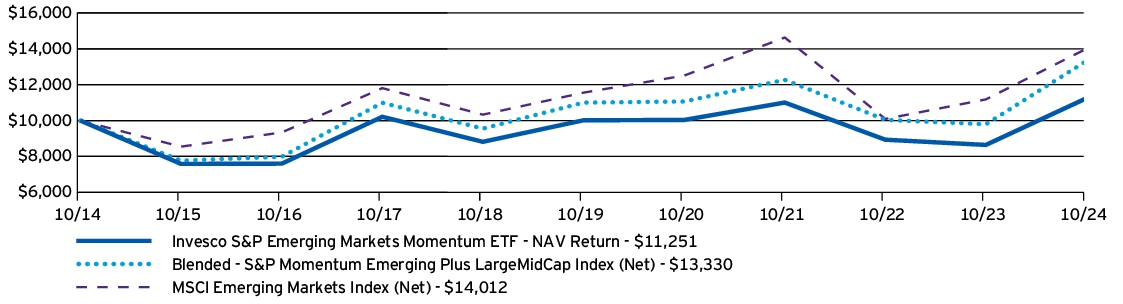

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Dorsey Wright Emerging Markets Momentum ETF — NAV Return | 17.19% | 3.87% | 2.62% |

| Dorsey Wright Emerging Markets Technical Leaders™ Index (Net) | 20.35% | 5.88% | 4.33% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the Dorsey Wright Emerging Markets Technical Leaders™ Index (Net) to the MSCI Emerging Markets Index (Net) to reflect that the MSCI Emerging Markets Index (Net) can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $123,269,342 |

| Total number of portfolio holdings | 101 |

| Total advisory fees paid | $1,156,323 |

| Portfolio turnover rate | 175% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Topco Scientific Co. Ltd. | 3.30% |

| Charoen Pokphand Enterprise (Taiwan) Co. Ltd. | 3.05% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 2.95% |

| Clicks Group Ltd. | 2.53% |

| Shiny Chemical Industrial Co. Ltd. | 2.43% |

| QL Resources Bhd. | 2.39% |

| Lien Hwa Industrial Holdings Corp. | 2.21% |

| Goldsun Building Materials Co. Ltd. | 2.18% |

| China Shenhua Energy Co. Ltd., H Shares | 2.03% |

| Kaori Heat Treatment Co. Ltd. | 1.98% |

| * Excluding money market fund holdings, if any. | |

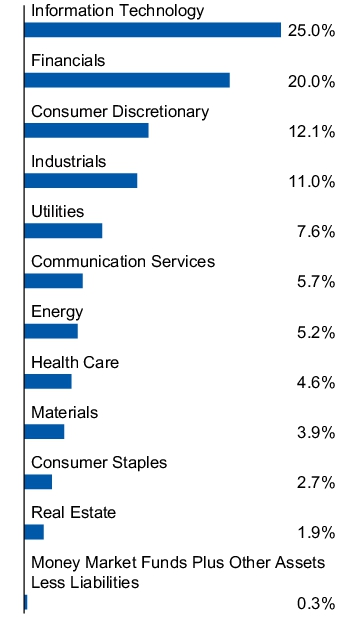

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Emerging Markets Sovereign Debt ETF

PCY | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Emerging Markets Sovereign Debt ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Emerging Markets Sovereign Debt ETF | $56 | 0.50% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, emerging market sovereign debt benefited from relatively lower longer term U.S. interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in emerging market sovereign bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the DBIQ Emerging Markets USD Liquid Balanced Index (the “Index”). The Fund generally will invest at least 80% of its total assets in components that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 23.11%, differed from the return of the Index, 23.56%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Country Allocations | Pakistan bonds, followed by Egypt bonds and El Salvador bonds, respectively.

Positions | Pakistan Government International Bond, 6.88% coupon, due 12/05/2027, followed by Pakistan Government International Bond, 7.38% coupon, due 04/08/2031.

What detracted from performance?

Country Allocations | No country detracted from the Fund's performance during the period.

Positions | Peruvian Government International Bond, 5.88% coupon, due 08/08/2054, followed by Guatemala Government Bond, 6.55% coupon, due 02/06/2037.

How Has The Fund Historically Performed?

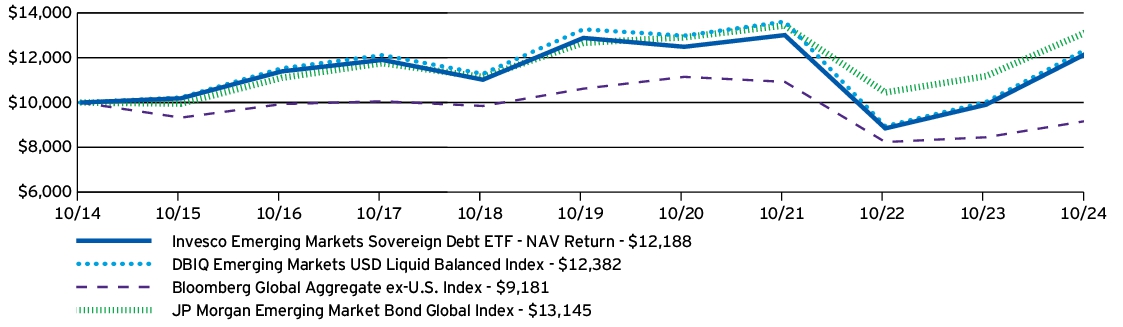

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Emerging Markets Sovereign Debt ETF — NAV Return | 23.11% | (1.10)% | 2.00% |

| DBIQ Emerging Markets USD Liquid Balanced Index | 23.56% | (1.37)% | 2.16% |

| Bloomberg Global Aggregate ex-U.S. Index | 8.65% | (2.87)% | (0.85)% |

| JP Morgan Emerging Market Bond Global Index | 17.62% | 0.75% | 2.77% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the JP Morgan Emerging Market Bond Global Index to the Bloomberg Global Aggregate ex-U.S. Index to reflect that the Bloomberg Global Aggregate ex-U.S. Index can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $1,354,859,071 |

| Total number of portfolio holdings | 94 |

| Total advisory fees paid | $7,281,411 |

| Portfolio turnover rate | 30% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Republic of Kenya Government International Bond, 7.25%, 02/28/2028 | 1.62% |

| Republic of Kenya Government International Bond, 8.25%, 02/28/2048 | 1.61% |

| Kazakhstan Government International Bond, 6.50%, 07/21/2045 | 1.58% |

| Kazakhstan Government International Bond, 4.88%, 10/14/2044 | 1.55% |

| El Salvador Government International Bond, 7.63%, 02/01/2041 | 1.25% |

| Pakistan Government International Bond, 7.38%, 04/08/2031 | 1.21% |

| Pakistan Government International Bond, 6.88%, 12/05/2027 | 1.20% |

| Pakistan Government International Bond, 8.88%, 04/08/2051 | 1.20% |

| El Salvador Government International Bond, 9.50%, 07/15/2052 | 1.17% |

| El Salvador Government International Bond, 8.25%, 04/10/2032 | 1.14% |

| * Excluding money market fund holdings, if any. | |

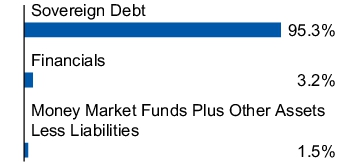

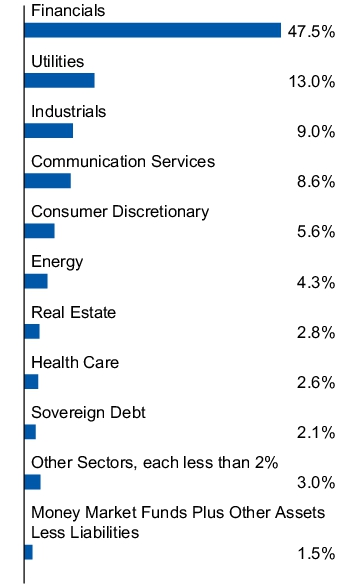

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco FTSE RAFI Developed Markets ex-U.S. ETF

PXF | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco FTSE RAFI Developed Markets ex-U.S. ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco FTSE RAFI Developed Markets ex-U.S. ETF | $50 | 0.45% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, developed market equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. The Fund lagged the broader developed market equity asset class due primarily to its specific security exposures within the information technology sector.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE RAFITM Developed ex U.S. 1000 Index (Net) (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 22.84%, differed from the return of the Index, 23.12%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Sector Allocations | Financials sector, followed by the industrials and materials sectors, respectively.

Positions | HSBC Holdings PLC, a financials company, and Royal Bank of Canada, a financials company.

What detracted from performance?

Sector Allocations | Information technology sector.

Positions | Atos SE, an information technology company (no longer held at fiscal year-end), and BP PLC, an energy company.

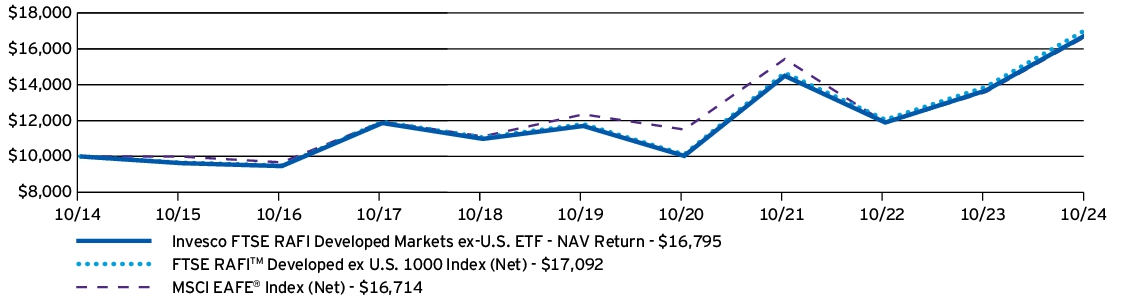

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco FTSE RAFI Developed Markets ex-U.S. ETF — NAV Return | 22.84% | 7.50% | 5.32% |

| FTSE RAFI™ Developed ex U.S. 1000 Index (Net) | 23.12% | 7.68% | 5.51% |

| MSCI EAFE® Index (Net) | 22.97% | 6.24% | 5.27% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the FTSE RAFI™ Developed ex U.S. 1000 Index (Net) to the MSCI EAFE® Index (Net) to reflect that the MSCI EAFE® Index (Net) can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $1,697,209,712 |

| Total number of portfolio holdings | 1,030 |

| Total advisory fees paid | $7,594,617 |

| Portfolio turnover rate | 12% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Shell PLC | 2.34% |

| TotalEnergies SE | 1.24% |

| Samsung Electronics Co. Ltd. | 1.14% |

| Toyota Motor Corp. | 1.00% |

| HSBC Holdings PLC | 1.00% |

| BP PLC | 0.93% |

| Roche Holding AG | 0.92% |

| Royal Bank of Canada | 0.90% |

| BHP Group Ltd. | 0.85% |

| Nestle S.A. | 0.82% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

At a meeting held on December 13, 2024, the Board of Trustees approved changes to the name, investment objective, underlying index, principal investment strategy and annual unitary management fee of the Fund. The Fund’s name will change to Invesco RAFI Developed Markets ex-U.S. ETF, the underlying index will change to RAFITM Fundamental Select Developed ex US 1000 Index (“New Underlying Index”) and the unitary management fee will be reduced to 0.43% of the Fund's average daily net assets. The investment objective of the Fund will change to track the investment results (before fees and expenses) of the New Underlying Index, and the Fund’s principal investment strategy will change to generally invest at least 90% of its total assets in the components of the New Underlying Index. These changes will be effective on March 24, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF

PDN | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF | $54 | 0.49% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, developed market equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. The Fund slightly lagged the broader developed market equity asset class due primarily to its specific security exposures within the financials, consumer staples, and consumer discretionary sectors.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE RAFITM Developed ex US Mid-Small 1500 Index (Net) (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 19.97%, differed from the return of the Index, 20.71%, primarily due to fees and expenses that the Fund incurred during the period as well as the impact of foreign fair valuation, which were partially offset by the favorable dividend tax withholding on foreign securities as well as income from the securities lending program in which the Fund participates.

What contributed to performance?

Sector Allocations | Industrials sector, followed by the financials and materials sectors, respectively.

Positions | SCREEN Holdings Co. Ltd., an information technology company (no longer held at fiscal year-end), and Hanwha Aerospace Co. Ltd., an industrials company.

What detracted from performance?

Sector Allocations | No sectors detracted from the Fund's performance during the period.

Positions | HelloFresh SE, a consumer staples company (no longer held at fiscal year-end), and United Energy Group Ltd., an energy company.

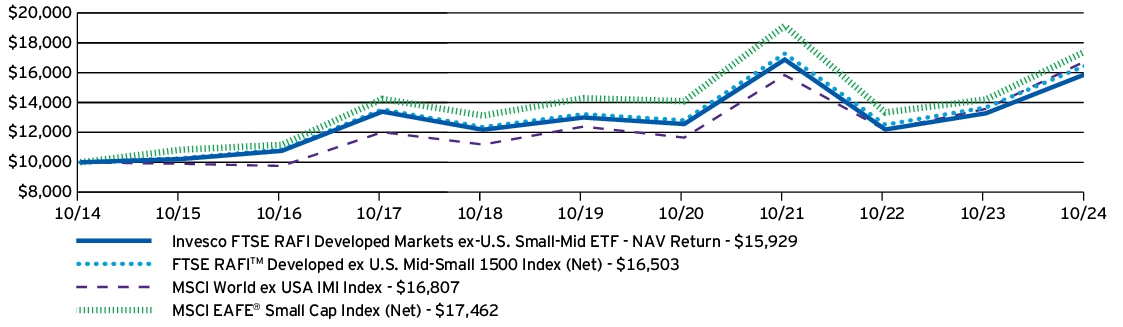

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF — NAV Return | 19.97% | 4.15% | 4.77% |

| FTSE RAFI™ Developed ex U.S. Mid-Small 1500 Index (Net) | 20.71% | 4.53% | 5.14% |

| MSCI World ex USA IMI Index | 23.81% | 6.29% | 5.33% |

| MSCI EAFE® Small Cap Index (Net) | 22.96% | 4.10% | 5.73% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the FTSE RAFI™ Developed ex U.S. Mid-Small 1500 Index (Net) to the MSCI World ex USA IMI Index to reflect that the MSCI World ex USA IMI Index can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $400,740,967 |

| Total number of portfolio holdings | 1,487 |

| Total advisory fees paid | $2,407,883 |

| Portfolio turnover rate | 30% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Doosan Co. Ltd. | 0.28% |

| IAMGOLD Corp. | 0.28% |

| Hanwha Aerospace Co. Ltd. | 0.27% |

| Canadian Western Bank | 0.27% |

| ASICS Corp. | 0.25% |

| Pan American Silver Corp. | 0.25% |

| AAC Technologies Holdings, Inc. | 0.24% |

| Stelco Holdings, Inc. | 0.23% |

| Eldorado Gold Corp. | 0.23% |

| Alps Alpine Co. Ltd. | 0.21% |

| * Excluding money market fund holdings, if any. | |

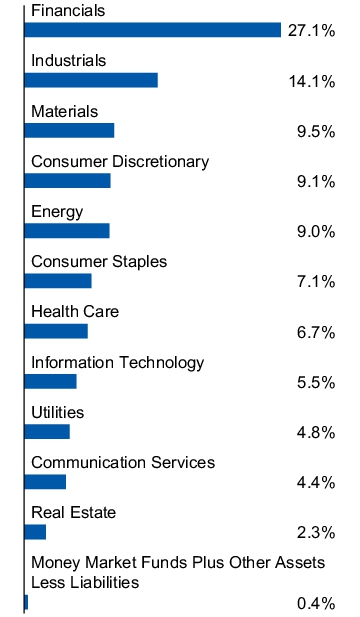

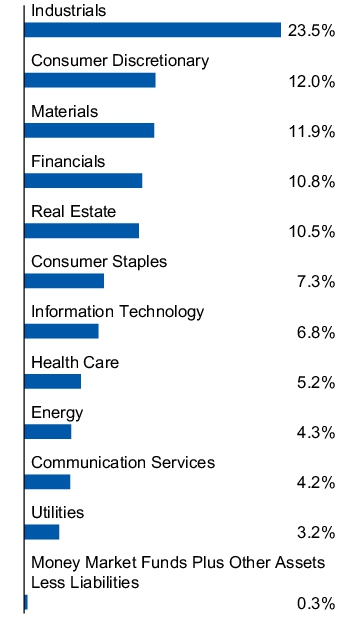

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

At a meeting held on December 13, 2024, the Board of Trustees approved changes to the name, investment objective, underlying index, principal investment strategy and annual unitary management fee of the Fund. The Fund’s name will change to Invesco RAFI Developed Markets ex-U.S. Small-Mid ETF, the underlying index will change to RAFITM Fundamental Select Developed ex US 1500 Index (“New Underlying Index”) and the unitary management fee will be reduced to 0.47% of the Fund's average daily net assets. The investment objective of the Fund will change to track the investment results (before fees and expenses) of the New Underlying Index, and the Fund’s principal investment strategy will change to generally invest at least 90% of its total assets in the components of the New Underlying Index. These changes will be effective on March 24, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco FTSE RAFI Emerging Markets ETF

PXH | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco FTSE RAFI Emerging Markets ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco FTSE RAFI Emerging Markets ETF | $56 | 0.49% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, emerging market equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. The Fund outperformed the broader emerging market equities asset class due primarily to its specific security exposures within the financials sector.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE RAFITM Emerging Index (Net) (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 28.95%, differed from the return of the Index, 31.01%, primarily due to fees and expenses that the Fund incurred during the period as well as the negative impact of foreign fair valuation and capital gains taxes on Indian securities.

What contributed to performance?

Sector Allocations | Financials sector, followed by the information technology and consumer discretionary sectors, respectively.

Positions | Taiwan Semiconductor Manufacturing Co. Ltd., an information technology company, and Tencent Holdings Ltd., a communication services company.

What detracted from performance?

Sector Allocations | Real estate sector.

Positions | Vale S.A., a materials company, and Sasol Ltd., a materials company.

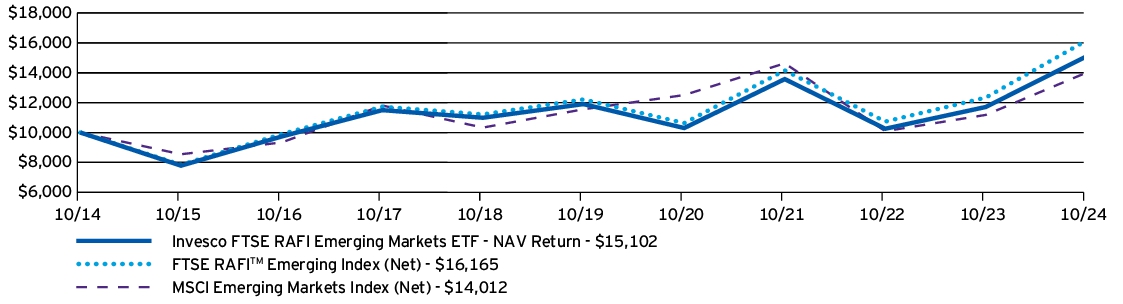

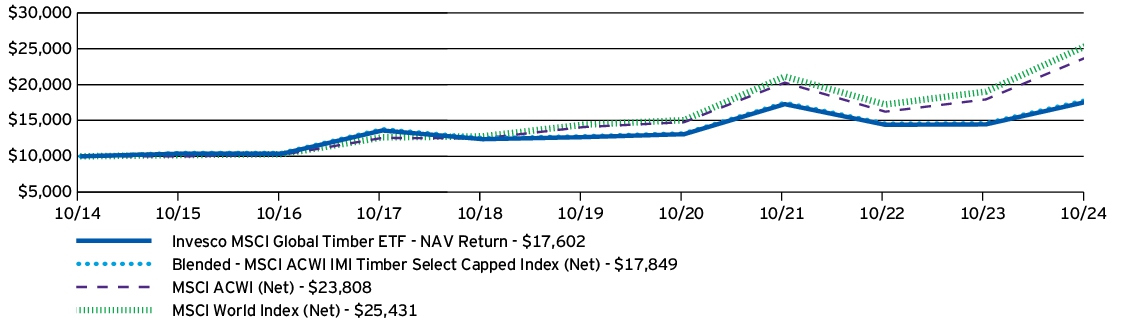

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco FTSE RAFI Emerging Markets ETF — NAV Return | 28.95% | 4.88% | 4.21% |

| FTSE RAFI™ Emerging Index (Net) | 31.01% | 5.76% | 4.92% |

| MSCI Emerging Markets Index (Net) | 25.32% | 3.93% | 3.43% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $1,235,098,816 |

| Total number of portfolio holdings | 419 |

| Total advisory fees paid | $5,952,010 |

| Portfolio turnover rate | 21% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 6.28% |

| Alibaba Group Holding Ltd. | 4.78% |

| Tencent Holdings Ltd. | 3.26% |

| Industrial & Commercial Bank of China Ltd., H Shares | 2.65% |

| China Construction Bank Corp., H Shares | 2.51% |

| Ping An Insurance (Group) Co. of China Ltd., H Shares | 2.46% |

| Vale S.A. | 2.04% |

| Petroleo Brasileiro S.A., Preference Shares | 2.01% |

| Bank of China Ltd., H Shares | 1.85% |

| JD.com, Inc., A Shares | 1.79% |

| * Excluding money market fund holdings, if any. | |

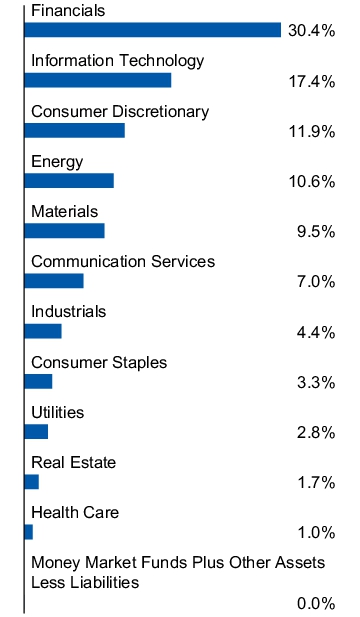

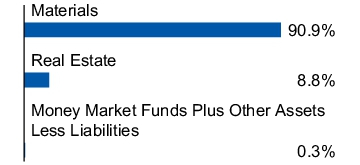

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

At a meeting held on December 13, 2024, the Board of Trustees approved changes to the name, investment objective, underlying index, principal investment strategy and annual unitary management fee of the Fund. The Fund’s name will change to Invesco RAFI Emerging Markets ETF, the underlying index will change to RAFITM Fundamental Select Emerging Markets 350 Index (“New Underlying Index”) and the unitary management fee will be reduced to 0.47% of the Fund's average daily net assets. The investment objective of the Fund will change to track the investment results (before fees and expenses) of the New Underlying Index, and the Fund’s principal investment strategy will change to generally invest at least 90% of its total assets in the components of the New Underlying Index. These changes will be effective on March 24, 2025.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Global Clean Energy ETF

PBD | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Global Clean Energy ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Global Clean Energy ETF | $74 | 0.75% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, clean energy showed signs of a recovery coming into 2024, however, U.S. tariffs on China and profitability concerns with U.S. solar weighed heavily on an already battered industry. Interest rate cuts and a potential bottoming in polysilicon prices created some optimism, but not enough to offset the poor momentum in U.S. solar during the period.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the WilderHill New Energy Global Innovation Index (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, (1.80)%, differed from the return of the Index, (1.50)%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Sub-Industry Allocations | Renewable electricity sub-industry, followed by the heavy electrical equipment and automative retail sub-industries, respectively.

Positions | EVgo, Inc., an automotive retail company, and LS Electric Co. Ltd., an electrical components & equipment company.

What detracted from performance?

Sub-Industry Allocations | Semiconductors sub-industry, followed by the electrical components & equipment and automobile manufacturers sub-industries, respectively.

Positions | Meyer Burger Technology AG, a semiconductors company, and Fisker, Inc., an automobile manufacturers company (no longer held at fiscal year-end).

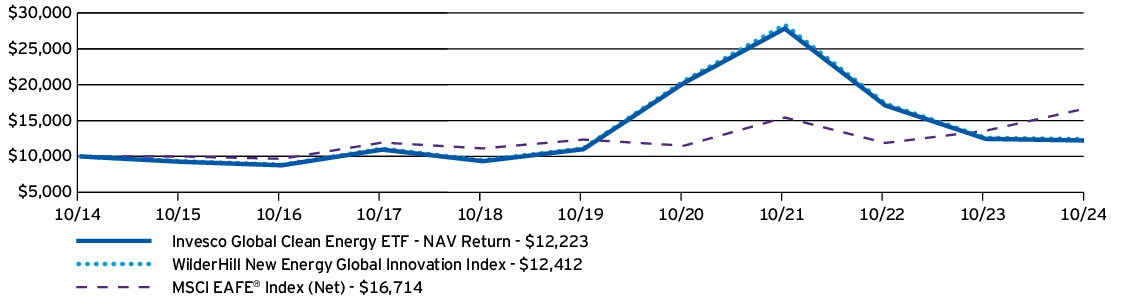

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Global Clean Energy ETF — NAV Return | (1.80)% | 2.11% | 2.03% |

| WilderHill New Energy Global Innovation Index | (1.50)% | 2.18% | 2.18% |

| MSCI EAFE® Index (Net) | 22.97% | 6.24% | 5.27% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $97,273,409 |

| Total number of portfolio holdings | 112 |

| Total advisory fees paid | $910,901 |

| Portfolio turnover rate | 52% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| EVgo, Inc. | 1.98% |

| Eos Energy Enterprises, Inc. | 1.55% |

| XPeng, Inc., ADR | 1.53% |

| JinkoSolar Holding Co. Ltd., ADR | 1.29% |

| Yadea Group Holdings Ltd. | 1.28% |

| Flat Glass Group Co. Ltd., H Shares | 1.25% |

| NIO, Inc., ADR | 1.25% |

| Ganfeng Lithium Group Co. Ltd., H Shares | 1.21% |

| Tianneng Power International Ltd. | 1.16% |

| Xinyi Solar Holdings Ltd. | 1.13% |

| * Excluding money market fund holdings, if any. | |

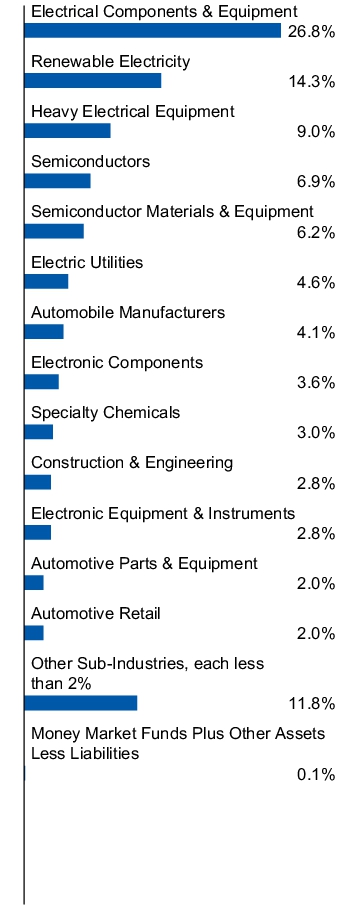

Sub-industry allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Global ex-US High Yield Corporate Bond ETF

PGHY | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Global ex-US High Yield Corporate Bond ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Global ex-US High Yield Corporate Bond ETF | $38 | 0.35% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, the global high yield bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in global high yield bonds outside the United States, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the ICE USD Global High Yield Excluding US Issuers Constrained Index (the “Index”). The Fund generally will invest at least 80% of its total assets in components that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 15.68%, differed from the return of the Index, 16.22%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Sector Allocations | Energy sector, followed by the materials and communication services sectors, respectively.

Positions | Industrial and Commercial Bank of China Ltd., 3.20% coupon, followed by ABRA Global Finance, 5.50% PIK Rate, 6.00% Cash Rate, due 03/02/2028 (no longer held at fiscal year-end).

What detracted from performance?

Sector Allocations | No sectors detracted from the Fund's performance during the period.

Positions | Chelyabinsk Pipe Plant Via Chelpipe Finance DAC, 4.50% coupon, matured on 09/19/2024, followed by Guitar Center Holdings, Inc., Series A, Pfd., 0.00%.

How Has The Fund Historically Performed?

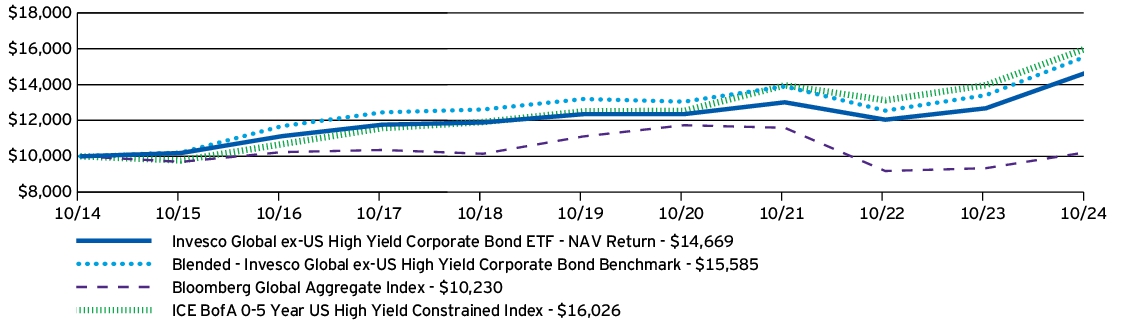

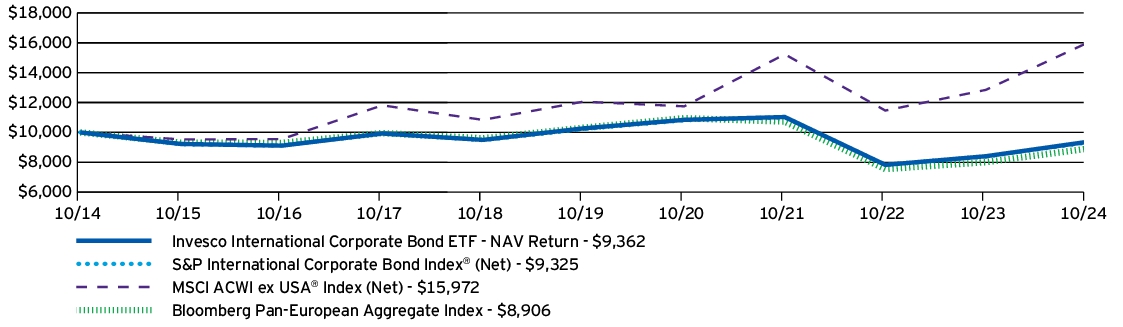

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Global ex-US High Yield Corporate Bond ETF — NAV Return | 15.68% | 3.50% | 3.91% |

| Blended - Invesco Global ex-US High Yield Corporate Bond Benchmark | 16.22% | 3.38% | 4.54% |

| Bloomberg Global Aggregate Index | 9.54% | (1.64)% | 0.23% |

| ICE BofA 0-5 Year US High Yield Constrained Index | 14.72% | 5.08% | 4.83% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective February 28, 2024, the Fund changed its broad-based securities market benchmark from the ICE BofA 0-5 Year US High Yield Constrained Index to the Bloomberg Global Aggregate Index to reflect that the Bloomberg Global Aggregate Index can be considered more broadly representative of the overall applicable securities market.

- The Blended - Invesco Global ex-US High Yield Corporate Bond Benchmark performance is comprised of the performance of the DB Global Short Maturity High Yield Bond Index, the Fund's former underlying index, through August 25, 2023, followed by the performance of the Index thereafter.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $140,520,027 |

| Total number of portfolio holdings | 534 |

| Total advisory fees paid | $472,482 |

| Portfolio turnover rate | 29% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Industrial and Commercial Bank of China Ltd., 3.20%, | 1.44% |

| Samarco Mineracao S.A., 9.00% PIK Rate, 0.50% Cash Rate, 9.00%, 06/30/2031 | 0.88% |

| Teva Pharmaceutical Finance Netherlands III B.V., 3.15%, 10/01/2026 | 0.64% |

| 1011778 BC ULC/New Red Finance, Inc., 4.00%, 10/15/2030 | 0.62% |

| Bank of Communications Co. Ltd., 3.80%, | 0.60% |

| Vodafone Group PLC, 7.00%, 04/04/2079 | 0.58% |

| Rakuten Group, Inc., 9.75%, 04/15/2029 | 0.50% |

| Altice France S.A., 5.13%, 07/15/2029 | 0.48% |

| First Quantum Minerals Ltd., 6.88%, 10/15/2027 | 0.47% |

| Rakuten Group, Inc., 11.25%, 02/15/2027 | 0.46% |

| * Excluding money market fund holdings, if any. | |

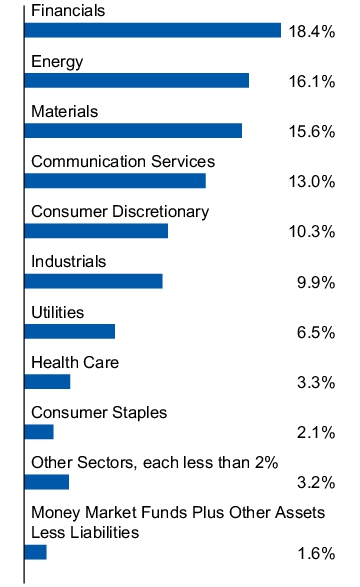

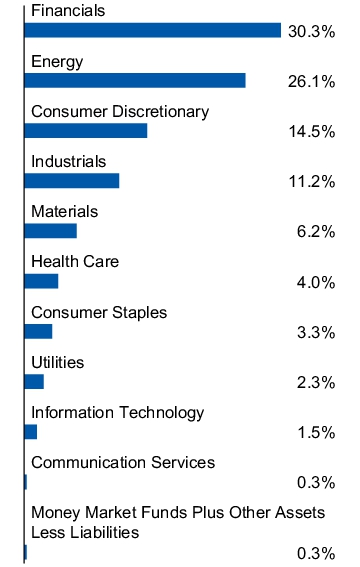

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since October 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

The Fund added portfolio turnover risk to its principal risks to reflect that frequent trading of portfolio securities could result in increased transaction costs, a lower return and increased tax liability.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco Global Water ETF

PIO | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco Global Water ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Global Water ETF | $86 | 0.75% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, global equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. The Fund outperformed the broader global equities asset class primarily due to its overweight allocation to the industrials sector and underweight allocation to the materials sector.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Nasdaq OMX Global WaterTM Index (the “Index”). The Fund generally will invest at least 90% of its total assets in the securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that are based on the securities in the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 28.10%, differed from the return of the Index, 28.59%, primarily due to fees and expenses the Fund incurred during the period.

What contributed to performance?

Sub-Industry Allocations | Industrial machinery & supplies & components sub-industry, followed by the building products and life sciences tools & services sub-industries, respectively.

Positions | Pentair PLC, an industrial machinery & supplies & components company, and Danaher Corp., a life sciences tools and services company (no longer held at fiscal year-end).

What detracted from performance?

Sub-Industry Allocations | Electric utilities sub-industry.

Positions | Nomura Micro Science Co. Ltd., an industrial machinery & supplies & components company, and Core & Main, Inc., a trading companies & distributors company.

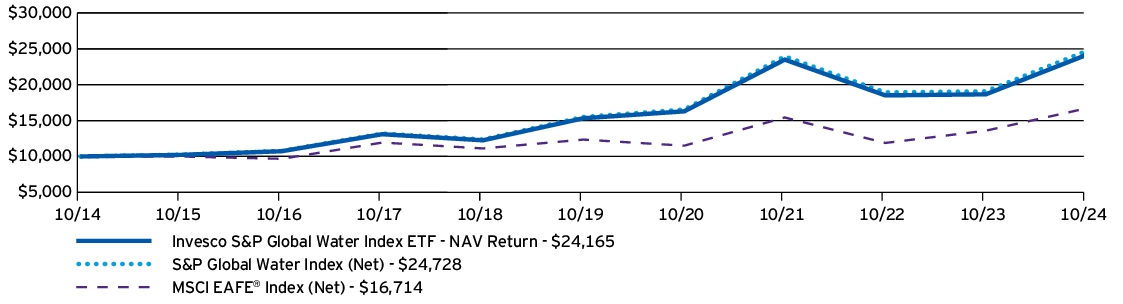

How Has The Fund Historically Performed?

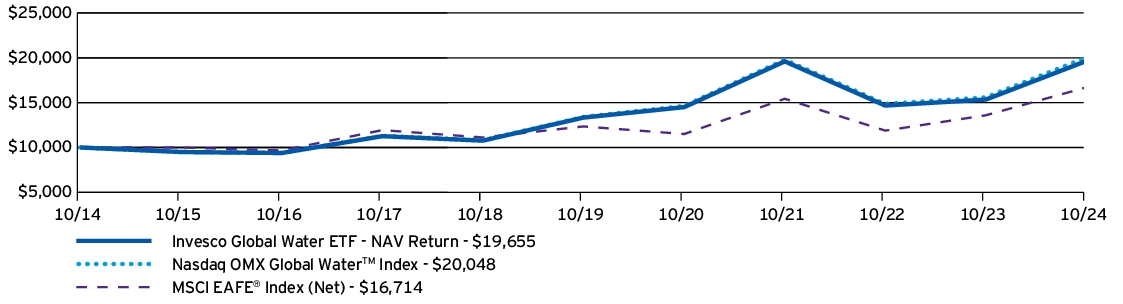

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Global Water ETF — NAV Return | 28.10% | 8.07% | 6.99% |

| Nasdaq OMX Global WaterTM Index | 28.59% | 8.38% | 7.20% |

| MSCI EAFE® Index (Net) | 22.97% | 6.24% | 5.27% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $269,681,504 |

| Total number of portfolio holdings | 41 |

| Total advisory fees paid | $2,082,675 |

| Portfolio turnover rate | 48% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| Pentair PLC | 9.29% |

| Ecolab, Inc. | 8.07% |

| Roper Technologies, Inc. | 8.07% |

| Cia de Saneamento Basico do Estado de Sao Paulo SABESP, ADR | 7.91% |

| Veolia Environnement S.A. | 5.08% |

| Ebara Corp. | 4.73% |

| Geberit AG | 4.07% |

| Xylem, Inc. | 3.67% |

| Veralto Corp. | 3.59% |

| Waters Corp. | 3.27% |

| * Excluding money market fund holdings, if any. | |

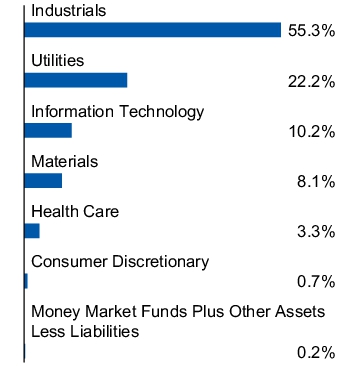

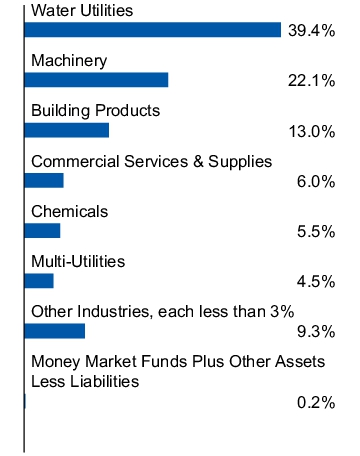

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco International BuyBack AchieversTM ETF

IPKW | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about Invesco International BuyBack AchieversTM ETF (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year ?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco International BuyBack AchieversTM ETF | $63 | 0.55% |

How Did The Fund Perform During The Period?

• During the fiscal year ended October 31, 2024, global equities experienced a mostly positive market environment due to strong global economic growth and broadly accommodative central banks. The Fund outperformed the broader global equities asset class due primarily to its specific security exposures within the consumer discretionary, financials and consumer staples sectors.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Nasdaq International BuyBack AchieversTM Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index.

• For the fiscal year ended October 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 28.26%, differed from the return of the Index, 29.02%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Sector Allocations | Financials sector, followed by the consumer discretionary and industrials sectors, respectively.

Positions | UniCredit S.p.A., a financials company, and Barclays PLC, a financials company (no longer held at fiscal year-end).

What detracted from performance?

Sector Allocations | No sectors detracted from the Fund's performance during the period.

Positions | BP PLC, an energy company, and Vale S.A., a materials company (no longer held at fiscal year-end).

How Has The Fund Historically Performed?

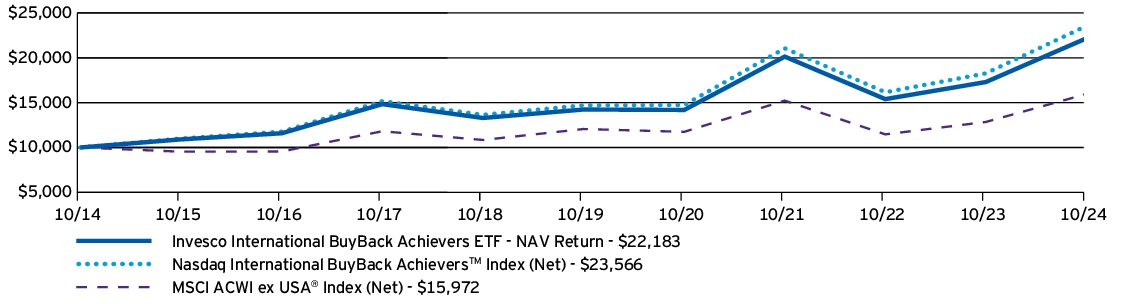

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco International BuyBack AchieversTM ETF — NAV Return | 28.26% | 9.28% | 8.29% |

| Nasdaq International BuyBack Achievers™ Index (Net) | 29.02% | 9.89% | 8.95% |

| MSCI ACWI ex USA® Index (Net) | 24.33% | 5.78% | 4.79% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of October 31, 2024)

| Fund net assets | $91,099,711 |

| Total number of portfolio holdings | 111 |

| Total advisory fees paid | $461,529 |

| Portfolio turnover rate | 93% |

What Comprised The Fund's Holdings?

(as of October 31, 2024)

Top ten holdings*

(% of net assets)

| CRH PLC | 5.36% |

| Shell PLC | 5.26% |

| UniCredit S.p.A. | 5.19% |

| BNP Paribas S.A. | 5.12% |

| TotalEnergies SE | 4.93% |

| ING Groep N.V. | 4.84% |

| BP PLC | 4.76% |

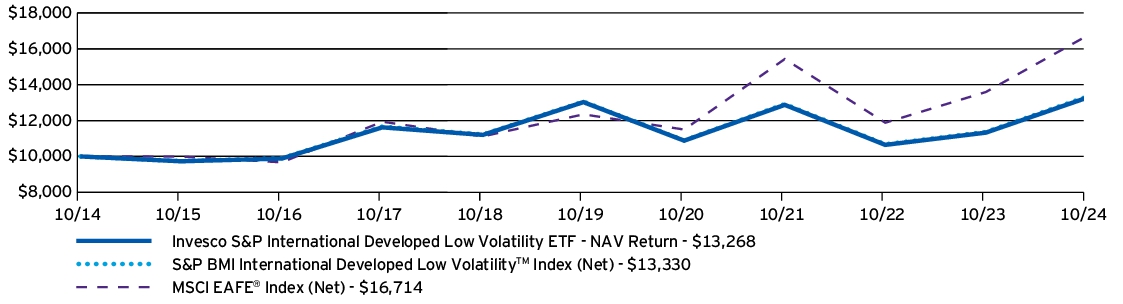

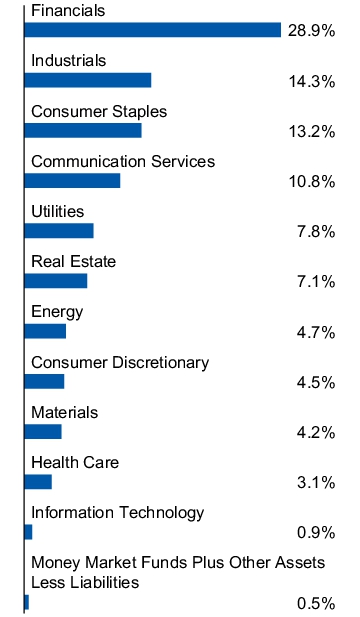

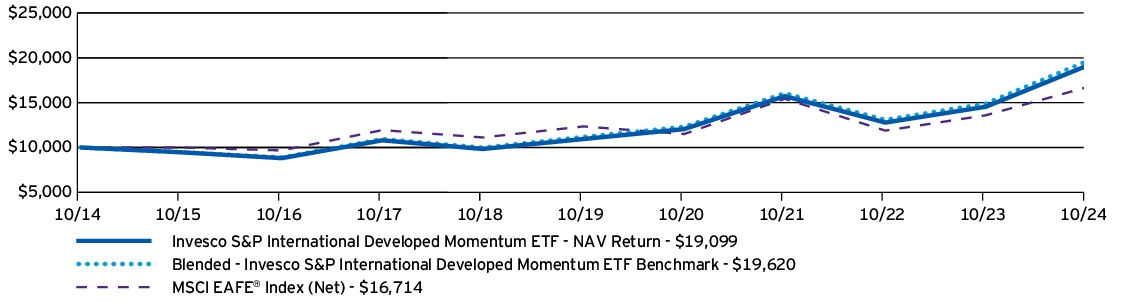

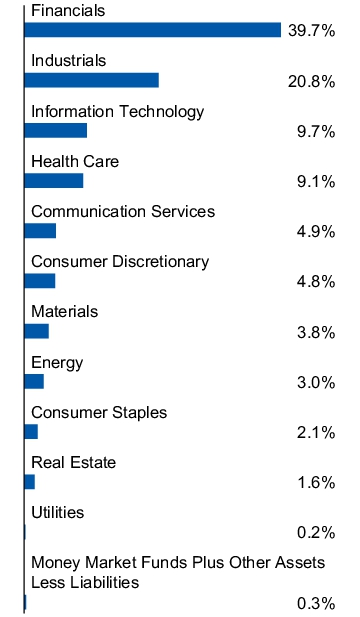

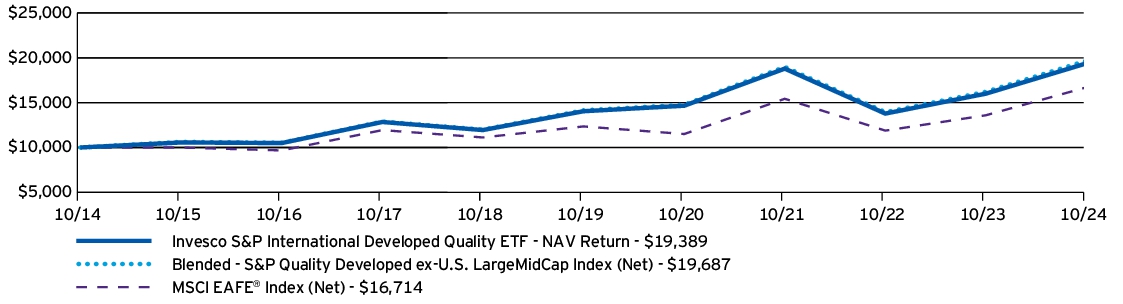

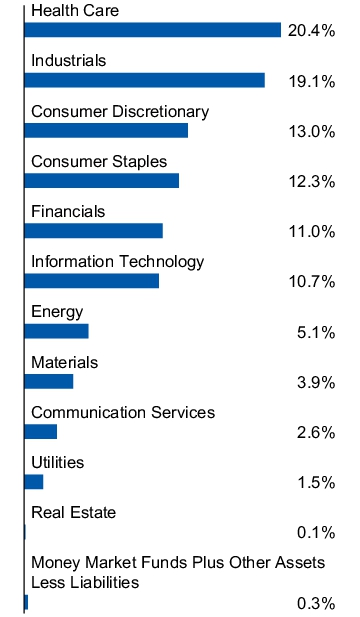

| Alibaba Group Holding Ltd. | 4.43% |