UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21977

Invesco Exchange-Traded Fund Trust II

(Exact name of registrant as specified in charter)

3500 Lacey Road

Downers Grove, IL 60515

(Address of principal executive offices) (Zip code)

Anna Paglia

President

3500 Lacey Road

Downers Grove, IL 60515

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-983-0903

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

| (b) | Not applicable. |

|

Invesco Annual Report to Shareholders | |||

| October 31, 2022 | ||||

| PBTP | Invesco PureBetaSM 0-5 Yr US TIPS ETF | |||

| PBDM | Invesco PureBetaSM FTSE Developed ex-North America ETF | |||

| PBEE | Invesco PureBetaSM FTSE Emerging Markets ETF | |||

| 2 |

|

Domestic Equity

The fiscal year ended October 31, 2022 began with continued volatility in equity markets in the fourth quarter of 2021 amid substantial inflation and the emergence of a new COVID-19 variant. Pandemic-related supply chain disruption and labor shortages intensified during the quarter, resulting in broadly higher input costs for companies and consumers alike. Additionally, the price of oil rose,1 causing higher gas prices for consumers, and the Consumer Price Index (CPI) reported for November 2021 increased 0.8%, resulting in a 6.8% increase over the prior 12 months, the highest since 1982.2 To combat inflation, the US Federal Reserve (the Fed) announced the potential for three or more interest rate increases in 2022. With solid corporate earnings and optimism about the COVID-19 Omicron variant reporting milder symptoms, stocks rallied at the 2021 year-end.

Equity markets declined in the first quarter of 2022 amid volatility sparked by Russia’s invasion of Ukraine, rising commodity prices, rampant global inflation and the Fed’s shift toward tighter monetary policy. Russia’s invasion exacerbated inflation pressures, disrupting already strained supply chains and increasing shortages of oil, gas and raw materials. The price of oil rose sharply, with crude prices reaching their highest price per barrel since 2008.1 Inflation continued to be a top concern for consumers, investors and the Fed. To combat inflation, the Fed raised the federal funds rate by one-quarter percentage point in March and the Fed indicated it would “taper” its asset purchase program quickly.3

As the war in Ukraine continued and corporate earnings in high-profile names like Netflix reported slowing growth and profits, the equity markets sold off for much of April 2022. The downward direction of the equity markets continued into the second quarter of 2022 amid record inflation, rising interest rates and an increasing likelihood of a US recession. Driven by higher food and energy prices, the CPI rose by yet another 40-year high to 8.6% for the 12 months ended May 2022.2 Oil prices peaked near $122 per barrel in early June, resulting in skyrocketing gasoline prices; the national average price reached a record high above $5 per gallon in early June.1 To tame inflation, the Fed raised the benchmark federal funds rate three more times, by 0.50% in May, by 0.75% in June and another 0.75% in July, which were the largest increases in nearly 30 years.3 US equity markets rose in July and much of August until Fed chairman Jerome Powell’s hawkish comments at an economic policy symposium held in Jackson Hole, Wyoming sparked a sharp selloff at month-end. The Fed reiterated that it would continue taking aggressive action to curb inflation, even though such measures could “bring pain to households and businesses,” and the Fed raised the benchmark federal funds rate by another 0.75% in September.3

After experiencing a sharp drop in September 2022, US equity markets rebounded in October with strong gains, despite mixed data on the economy and corporate earnings. Inflation data

reported in October came in higher than expected; however, the labor market remained strong, with payroll employment gains and a decline in the unemployment rate to a near record low of 3.5% in September.2 The initial estimate of third quarter real gross domestic product showed an increase of 2.6% (annualized) after falling in the prior two quarters, but the headline number masked a drop in demand and investment. Corporate earnings were generally in line with expectations, but many companies’ forward earnings guidance was weaker than expected.

In this environment, US stocks had negative double-digit returns for the fiscal year ended October 31, 2022 of -14.61%, as measured by the S&P 500 Index.4

| 1 | Source: Bloomberg LP |

| 2 | Source: US Bureau of Labor Statistics |

| 3 | Source: US Federal Reserve |

| 4 | Source: Lipper Inc. |

Global Equity

At the beginning of the fiscal year ended October 31, 2022, developed global equity markets were mostly positive, despite rising inflation and the emergence of Omicron, a new COVID-19 variant. Pandemic-related supply chain disruptions and labor shortages intensified at the end of 2021, resulting in broadly higher costs for companies and consumers. Emerging market equities declined due in part to COVID-19 concerns and China’s ongoing regulatory tightening in the private education and technology sectors and slowing economic growth.

Global equity markets declined in the first half of 2022 amid volatility sparked by Russia’s invasion of Ukraine, rising commodity prices, rampant global inflation and central banks shifting toward tighter monetary policy. Russia’s invasion exacerbated inflationary pressures, disrupting already strained supply chains, and increasing shortages of oil, gas and raw materials, with the price of oil rising sharply.

Inflation headwinds continued into the third quarter of 2022. The US Federal Reserve (the Fed), the European Central Bank and the Bank of England all raised interest rates. In contrast, the People’s Bank of China lowered its policy rate and the Bank of Japan kept rates the same. Emerging market equities, hampered by the strong US dollar, underperformed developed market equities.

During October 2022, developed market equities rebounded and were in positive territory. Developed market equities outperformed emerging market equities, which declined primarily driven by weakness in China as Chinese markets reacted to the reappointment of President Xi and his authority, with no signs of the country’s zero-COVID-19 policy being relaxed. Despite the rebound in October for developed market equities, at the end of the fiscal year, trailing one-year returns for developed market equities and emerging market equities were both in negative territory.

| 3 |

|

The Market Environment (continued)

Fixed Income

In the fourth quarter of 2021, concerns about inflation heightened as US inflation rose 7%,1 its highest level in nearly 40 years. Though the US Federal Reserve (the Fed) left policy rates unchanged during the quarter, the Fed indicated its accommodative policies were coming to an end in 2022 through a willingness to raise interest rates to combat inflation and the announced reduction of its monthly bond purchase program. Additionally, US interest rate moves and inflation risk significantly affected fixed income valuations during the quarter. The two-year Treasury yield rose moderately from 0.27% to 0.73%, while the 10-year increased slightly from 1.48% to 1.52% during the quarter.2 The yield curve, as measured by the yield differential between two- and 10-year Treasuries, flattened during the quarter.

At the beginning of 2022, geopolitical and economic tensions between Ukraine and Russia culminated with the latter invading Ukrainian territory. World leaders levied sanctions against Russia that had material effects on its fixed income markets, particularly sovereign debt and corporates, and levels of liquidity. The Russia-Ukraine war exacerbated inflationary pressures while also exerting downward pressure on economic growth through a surge in commodity/energy prices. Additionally, surges of COVID-19 in China exacerbated supply chain issues and aggravated inflation. During the second quarter of 2022, the two-year Treasury yield rose significantly from 0.78% to 2.28%, while the 10-year increased slightly from 1.63% to 2.32%.2

In the second quarter of 2022, the macro backdrop of tightening financial conditions and slowing economic growth was negative for credit asset classes. Inflation, as measured by the Consumer Price Index, increased further to 9.1% and fixed income markets experienced significant negative performance as all bond sectors felt the impact of rising interest rates with negative performance ranging from -0.9% (Bloomberg Asset-Backed Securities) to -9.8% (Bloomberg US Corporate High Yield).3 Credit spreads increased across all major credit-sensitive sectors, reflecting anticipation of an economic slowdown and increasing concerns about recession risk, with corporate spreads ending the second quarter above their long-term historical average. The Fed continued its rapid tightening of monetary policy in an effort to combat inflation via higher interest rates while simultaneously engineering a soft landing so as to not push the economy into a recession. The Fed aggressively raised its key Fed funds rate during the fiscal year, including a 0.50% hike in May, and three 0.75% hikes in June, July and November, the largest hikes since 1994, to a target Fed funds rate of 3.75-4.00%, the highest since 2008.4 At their November 2022 meeting, the Fed signaled that its hawkish policies would continue, though a slowing of the pace of rate increases was likely. While rates remained elevated across all maturities on the yield curve, the two-year Treasury rates increased from 2.92% to 4.51% during the fiscal year, while

10-year Treasury rates increased from 2.98% to 4.10%.2 At the end of the fiscal year, the yield curve remained inverted, which historically has been an indicator of a potential recession.

| 1 | Source: US Bureau of Labor Statistics |

| 2 | Source: US Department of the Treasury |

| 3 | Source: Bloomberg |

| 4 | Source: Federal Reserve of Economic Data |

| 4 |

|

As an index fund, the Invesco PureBetaSM 0-5 Yr US TIPS ETF (the “Fund”) is passively managed and seeks to track the investment results (before fees and expenses) of the ICE BofA 0-5 Year US Inflation-Linked Treasury IndexSM (the “Index”). The Fund generally will invest at least 80% of its total assets in the components that comprise the Index.

Strictly in accordance with its guidelines and mandated procedures, ICE Data Indices, LLC (the “Index Provider”) compiles, maintains and calculates the Index, which is designed to measure the performance of the shorter maturity subset of the U.S. Treasury Inflation-Protected Securities (“TIPS”) market, represented by TIPS with a remaining maturity of at least one month and less than five years. TIPS are U.S. dollar-denominated, U.S. government debt securities that are publicly offered for sale in the United States. TIPS are “inflation-linked”, meaning that their principal and interest payments are tied to inflation (as measured by the Consumer Price Index). TIPS are issued by the U.S. Treasury, and their payments are supported by the full faith and credit of the United States.

To qualify for inclusion in the Index, securities must have: (i) at least one month but less than five years remaining term to final maturity; (ii) at least 18 months to maturity when issued; (iii) a minimum amount outstanding of $1 billion; and (iv) meet certain additional inclusion criteria detailed below. Original issue zero coupon bonds may be included in the Index, and the amounts outstanding of qualifying coupon securities are not reduced by any portions that have been stripped. Index constituents are market capitalization- weighted. The Fund generally invests in all of the securities comprising its Index in proportion to their weightings in the Index.

During the fiscal year ended October 31, 2022, on a market price basis, the Fund returned (2.78)%. On a net asset value (“NAV”) basis, the Fund returned (2.79)%. During the same time period, the Index returned (2.67)%. During the fiscal year, the Fund fully replicated the components of the Index; therefore, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses as well as trading costs incurred by the Fund during the period.

For the fiscal year ended October 31, 2022, bonds with maturities of less than 1 year contributed most significantly to the Fund’s return, followed by bonds with maturities of 1 year. Bonds with maturities of 3 & 4 years detracted from the Fund’s return.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended October 31, 2022, included Treasury CPI Note, 0.63% coupon, due 04/15/2023 (portfolio average weight of 6.00%) and Treasury CPI Note, 0.13% coupon, due 01/15/2023 (portfolio average weight of 5.60%). Positions that detracted from the Fund’s return included Treasury CPI Note, 0.38% coupon, due 01/15/2027 (portfolio average weight of

4.80%) and Treasury CPI Note, 0.13% coupon, due 10/15/2026 (portfolio average weight of 4.20%).

| Duration Breakdown (% of the Fund’s Net Assets) as of October 31, 2022 | ||||

| Maturing in 0-5 Years | 99.86 | |||

| Money Market Funds Plus Other Assets Less Liabilities | 0.14 | |||

| Top Ten Fund Holdings* (% of the Fund’s Net Assets) as of October 31, 2022 | ||||

| Security | ||||

| U.S. Treasury Inflation—Indexed Notes, 0.63%, 04/15/2023 | 5.97 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.13%, 01/15/2023 | 5.59 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.38%, 07/15/2023 | 5.55 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.63%, 01/15/2024 | 5.45 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.63%, 01/15/2026 | 5.43 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.13%, 07/15/2024 | 5.35 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.25%, 01/15/2025 | 5.28 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.38%, 07/15/2025 | 5.28 | |||

| U.S. Treasury Inflation—Indexed Notes, 0.38%, 01/15/2027 | 4.79 | |||

| U.S. Treasury Inflation—Indexed Notes, 2.38%, 01/15/2025 | 4.77 | |||

| Total | 53.46 | |||

| * | Excluding money market fund holdings. |

| 5 |

|

Invesco PureBetaSM 0-5 Yr US TIPS ETF (PBTP) (continued)

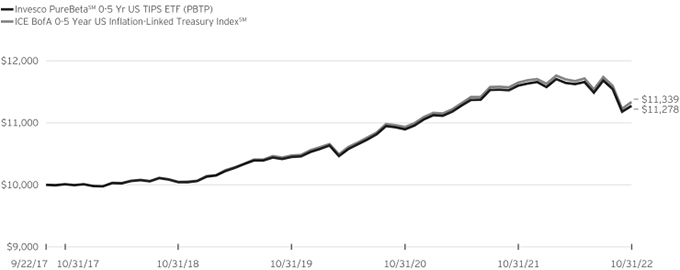

Growth of a $10,000 Investment Since Inception

Fund Performance History as of October 31, 2022

| 1 Year | 3 Years Average | 3 Years Cumulative | 5 Years Average | 5 Years Cumulative | Fund Inception | |||||||||||||||||||||||||||

| Index | Average Annualized | Cumulative | ||||||||||||||||||||||||||||||

| ICE BofA 0-5 Year US Inflation-Linked Treasury IndexSM | (2.67 | )% | 2.69 | % | 8.27 | % | 2.53 | % | 13.29 | % | 2.49 | % | 13.39 | % | ||||||||||||||||||

| Fund | ||||||||||||||||||||||||||||||||

| NAV Return | (2.79 | ) | 2.58 | 7.93 | 2.41 | 12.66 | 2.38 | 12.78 | ||||||||||||||||||||||||

| Market Price Return | (2.78 | ) | 2.59 | 7.97 | 2.43 | 12.73 | 2.40 | 12.88 | ||||||||||||||||||||||||

Fund Inception: September 22, 2017

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See the current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.07% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Performance results for the index stated above are based upon a hypothetical investment in their respective constituent securities. The returns of an index do not represent Fund returns. An investor cannot invest directly in an index. The index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Index and Fund Performance History:

| - | Average Annualized and Cumulative Inception returns for the Fund and index are based on the inception date of the Fund. |

| 6 |

|

| PBDM | Management’s Discussion of Fund Performance | |

| Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM) |

As an index fund, the Invesco PureBetaSM FTSE Developed ex-North America ETF (the “Fund”) is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE Developed ex North America Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

Strictly in accordance with its guidelines and mandated procedures, FTSE International Limited (the “Index Provider”) compiles, maintains and calculates the Index, which is designed to measure the performance of the large- and mid-capitalization segments of equity markets of countries around the world that are classified as developed markets within the country classification definition of the Index Provider, excluding the United States and Canada. The Index Provider defines the large- and mid-capitalization segments as approximately the top 90% of the eligible universe. The Fund generally invests in all of the securities comprising the Index in proportion to their weightings in the Index.

During the fiscal year ended October 31, 2022, on a market price basis, the Fund returned (23.80)%. On a net asset value (“NAV”) basis, the Fund returned (23.71)%. During the same time period, the Index returned (23.81)%. During the fiscal year, the Fund fully replicated the components of the Index; therefore, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to the advantageous dividend tax treatment utilized by the Fund, which was partially offset by fees and operating expenses incurred during the period.

For the fiscal year ended October 31, 2022, the energy sector contributed most significantly to the Fund’s return. The industrials sector detracted most significantly from the Fund’s return, followed by the consumer discretionary and information technology sectors, respectively.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended October 31, 2022, included Shell PLC, an energy company (portfolio average weight of 1.06%), and BP PLC, an energy company (portfolio average weight of 0.57%). Positions that detracted most significantly from the Fund’s return included ASML Holding N.V., an information technology company (portfolio average weight of 1.37%), and Samsung Electronics Co. Ltd., an information technology company (portfolio average weight of 1.46%).

| Sector Breakdown (% of the Fund’s Net Assets) as of October 31, 2022 | ||||

| Financials | 16.88 | |||

| Industrials | 15.59 | |||

| Health Care | 12.76 | |||

| Consumer Discretionary | 10.84 | |||

| Consumer Staples | 10.11 | |||

| Information Technology | 9.69 | |||

| Materials | 7.99 | |||

| Energy | 4.78 | |||

| Communication Services | 4.57 | |||

| Utilities | 3.27 | |||

| Real Estate | 3.06 | |||

| Money Market Funds Plus Other Assets Less Liabilities | 0.46 | |||

| Top Ten Fund Holdings* (% of the Fund’s Net Assets) as of October 31, 2022 | ||||

| Security | ||||

| Nestle S.A. | 2.02 | |||

| Roche Holding AG | 1.59 | |||

| Shell PLC | 1.39 | |||

| Samsung Electronics Co. Ltd. | 1.36 | |||

| ASML Holding N.V. | 1.31 | |||

| AstraZeneca PLC | 1.20 | |||

| Novo Nordisk A/S, Class B | 1.17 | |||

| Toyota Motor Corp. | 1.16 | |||

| Novartis AG | 1.14 | |||

| LVMH Moet Hennessy Louis Vuitton SE | 1.08 | |||

| Total | 13.42 | |||

| * | Excluding money market fund holdings. |

| 7 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM) (continued)

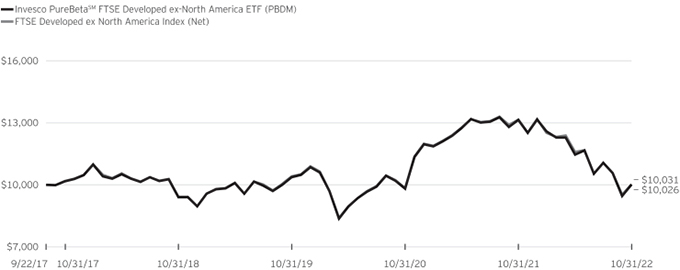

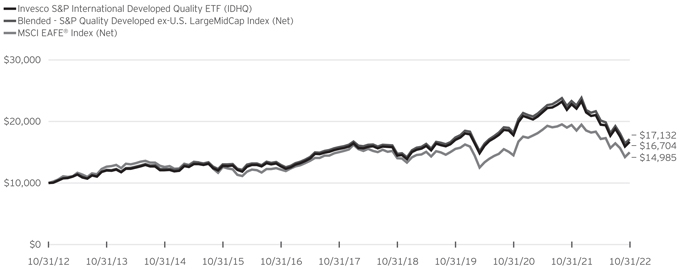

Growth of a $10,000 Investment Since Inception

Fund Performance History as of October 31, 2022

1 Year | 3 Years Average | 3 Years Cumulative | 5 Years Average | 5 Years Cumulative | Fund Inception | |||||||||||||||||||||||||||

| Index | Average Annualized | Cumulative | ||||||||||||||||||||||||||||||

| FTSE Developed ex North America Index (Net) | (23.81 | )% | (1.24 | )% | (3.66 | )% | (0.31 | )% | (1.52 | )% | 0.06 | % | 0.31 | % | ||||||||||||||||||

| Fund | ||||||||||||||||||||||||||||||||

| NAV Return | (23.71 | ) | (1.14 | ) | (3.37 | ) | (0.31 | ) | (1.52 | ) | 0.05 | 0.26 | ||||||||||||||||||||

| Market Price Return | (23.80 | ) | (1.11 | ) | (3.30 | ) | (0.40 | ) | (1.97 | ) | 0.02 | 0.11 | ||||||||||||||||||||

Fund Inception: September 22, 2017

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See the current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.07% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the

redemption or sale of Fund Shares. See invesco.com/ ETFs to find the most recent month-end performance numbers.

Performance results for the index stated above are based upon a hypothetical investment in their respective constituent securities. The returns of an index do not represent Fund returns. An investor cannot invest directly in an index. The index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Index and Fund Performance History:

| - | Average Annualized and Cumulative Inception returns for the Fund and index are based on the inception date of the Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| 8 |

|

| PBEE | Management’s Discussion of Fund Performance | |

| Invesco PureBetaSM FTSE Emerging Markets ETF (PBEE) |

As an index fund, the Invesco PureBetaSM FTSE Emerging Markets ETF (the “Fund”) is passively managed and seeks to track the investment results (before fees and expenses) of the FTSE Emerging Index (the “Index”). The Fund generally will invest at least 90% of its total assets in securities that comprise the Index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the Index.

Strictly in accordance with its guidelines and mandated procedures, FTSE International Limited (the “Index Provider”) compiles, maintains and calculates the Index, which is designed to measure the performance of the large- and mid-capitalization segments of equity markets of countries around the world that are classified as emerging markets within the country classification definition of the Index Provider. The Index Provider defines the large- and mid-capitalization segments as approximately the top 90% of the eligible universe. The Fund does not purchase all of the securities in the Index; instead, the Fund utilizes a “sampling” methodology to seek to achieve its investment objective.

During the fiscal year ended October 31, 2022, on a market price basis, the Fund returned (28.09)%. On a net asset value (“NAV”) basis, the Fund returned (28.46)%. During the same time period, the Index returned (28.39)%. During the fiscal year, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to the impact of the fees and expenses that the Fund incurred during the period.

For the fiscal year ended October 31, 2022, no sector contributed positively to the Fund’s return. The consumer discretionary sector detracted most significantly from the Fund’s return, followed by the information technology and communication services sectors, respectively.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended October 31, 2022, included Petroleo Brasileiro S.A., Preference Shares, an energy company (portfolio average weight of 0.47%), and Petroleo Brasileiro S.A., an energy company (portfolio average weight of 0.43%). Positions that detracted most significantly from the Fund’s return included Taiwan Semiconductor Manufacturing Co. Ltd., an information technology company (portfolio average weight of 7.01%) and Tencent Holdings Ltd., a communication services company (portfolio average weight of 4.53%).

| Sector Breakdown (% of the Fund’s Net Assets) as of October 31, 2022 | ||||

| Financials | 22.14 | |||

| Information Technology | 13.61 | |||

| Consumer Discretionary | 11.48 | |||

| Exchange-Traded Funds | 9.42 | |||

| Communication Services | 8.25 | |||

| Materials | 8.12 | |||

| Industrials | 6.62 | |||

| Consumer Staples | 6.19 | |||

| Energy | 5.24 | |||

| Health Care | 3.82 | |||

| Sector Types Each Less Than 3% | 4.97 | |||

| Money Market Funds Plus Other Assets Less Liabilities | 0.14 | |||

| Top Ten Fund Holdings* (% of the Fund’s Net Assets) as of October 31, 2022 | ||||

| Security | ||||

| Taiwan Semiconductor Manufacturing Co. Ltd. | 5.48 | |||

| Invesco India ETF | 4.99 | |||

| iShares MSCI India ETF | 4.44 | |||

| Tencent Holdings Ltd. | 3.06 | |||

| Alibaba Group Holding Ltd. | 2.25 | |||

| Reliance Industries Ltd., GDR | 1.55 | |||

| Meituan, B Shares | 1.26 | |||

| Axis Bank Ltd., GDR | 1.16 | |||

| Larsen & Toubro Ltd., GDR | 1.07 | |||

| Infosys Ltd., ADR | 1.06 | |||

| Total | 26.32 | |||

| * | Excluding money market fund holdings. |

| 9 |

|

Invesco PureBetaSM FTSE Emerging Markets ETF (PBEE) (continued)

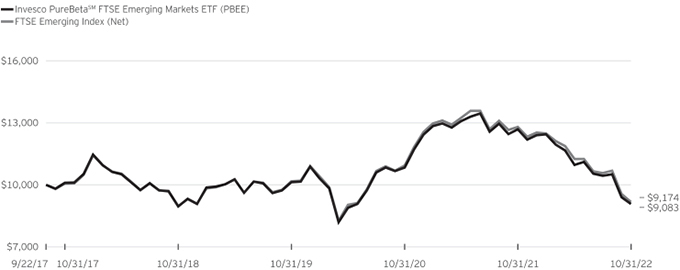

Growth of a $10,000 Investment Since Inception

Fund Performance History as of October 31, 2022

1 Year | 3 Years Average | 3 Years Cumulative | 5 Years Average | 5 Years Cumulative | Fund Inception | |||||||||||||||||||||||||||

| Index | Average Annualized | Cumulative | ||||||||||||||||||||||||||||||

| FTSE Emerging Index (Net) | (28.39 | )% | (3.40 | )% | (9.87 | )% | (1.82 | )% | (8.78 | )% | (1.67 | )% | (8.26 | )% | ||||||||||||||||||

| Fund | ||||||||||||||||||||||||||||||||

| NAV Return | (28.46 | ) | (3.56 | ) | (10.32 | ) | (2.11 | ) | (10.11 | ) | (1.87 | ) | (9.17 | ) | ||||||||||||||||||

| Market Price Return | (28.09 | ) | (3.43 | ) | (9.95 | ) | (2.16 | ) | (10.35 | ) | (2.19 | ) | (10.70 | ) | ||||||||||||||||||

Fund Inception: September 22, 2017

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See the current prospectus for more information. The adviser has contractually agreed to waive a portion of its management fee through August 31, 2024. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.20% (0.16% after fee waiver) includes the unitary management fee of 0.14% and acquired fund fees and expenses of 0.06%. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay

on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Performance results for the index stated above are based upon a hypothetical investment in their respective constituent securities. The returns of an index do not represent Fund returns. An investor cannot invest directly in an index. The index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Index and Fund Performance History:

| - | Average Annualized and Cumulative Inception returns for the Fund and index are based on the inception date of the Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| 10 |

|

Invesco PureBetaSM 0-5 Yr US TIPS ETF (PBTP)

October 31, 2022

| Principal Amount | Value | |||||||

| U.S. Treasury Securities-99.86% |

| |||||||

| U.S. Treasury Inflation — Indexed Notes-99.86%(a) |

| |||||||

0.13%, 01/15/2023 | $ | 6,823,066 | $ | 6,803,215 | ||||

0.63%, 04/15/2023 | 7,304,397 | 7,258,215 | ||||||

0.38%, 07/15/2023 | 6,806,568 | 6,750,406 | ||||||

0.63%, 01/15/2024 | 6,747,197 | 6,636,170 | ||||||

0.50%, 04/15/2024 | 4,898,517 | 4,794,920 | ||||||

0.13%, 07/15/2024 | 6,682,143 | 6,509,663 | ||||||

0.13%, 10/15/2024 | 5,280,666 | 5,123,443 | ||||||

0.25% - 2.38%, 01/15/2025 | 12,386,032 | 12,221,264 | ||||||

0.13%, 04/15/2025 | 5,323,366 | 5,104,029 | ||||||

0.38%, 07/15/2025 | 6,644,451 | 6,419,709 | ||||||

0.13%, 10/15/2025 | 5,098,058 | 4,873,855 | ||||||

0.63% - 2.00%, 01/15/2026 | 10,715,004 | 10,489,562 | ||||||

0.13%, 04/15/2026 | 5,881,716 | 5,547,422 | ||||||

0.13%, 07/15/2026 | 5,946,352 | 5,619,447 | ||||||

0.13%, 10/15/2026 | 5,418,816 | 5,099,281 | ||||||

0.38% - 2.38%, 01/15/2027 | 9,288,331 | 9,026,676 | ||||||

0.13%, 04/15/2027(b) | 5,395,850 | 5,032,371 | ||||||

0.38%, 07/15/2027 | 5,789,564 | 5,465,639 | ||||||

1.63%, 10/15/2027 | 2,694,488 | 2,698,504 | ||||||

|

| |||||||

Total U.S. Treasury Securities | 121,473,791 | |||||||

|

| |||||||

| Shares | ||||||||

| Money Market Funds-0.05% | ||||||||

Invesco Government & Agency Portfolio, Institutional Class, 3.07%(c)(d) | 59,418 | 59,418 | ||||||

|

| |||||||

TOTAL INVESTMENTS IN SECURITIES |

| 121,533,209 | ||||||

|

| |||||||

| Shares | Value | |||||||

| Investments Purchased with Cash Collateral from Securities on Loan |

| |||||||

| Money Market Funds-3.03% |

| |||||||

Invesco Private Government Fund, | 1,031,059 | $ | 1,031,059 | |||||

Invesco Private Prime Fund, 3.28%(c)(d)(e) | 2,651,295 | 2,651,295 | ||||||

|

| |||||||

Total Investments Purchased with Cash Collateral from Securities on Loan | 3,682,354 | |||||||

|

| |||||||

TOTAL INVESTMENTS IN SECURITIES-102.94% |

| 125,215,563 | ||||||

OTHER ASSETS LESS LIABILITIES-(2.94)% |

| (3,580,140 | ) | |||||

|

| |||||||

NET ASSETS-100.00% |

| $ | 121,635,423 | |||||

|

| |||||||

Notes to Schedule of Investments:

| (a) | Principal amount of security and interest payments are adjusted for inflation. See Note 2I. |

| (b) | All or a portion of this security was out on loan at October 31, 2022. |

| (c) | Affiliated issuer. The issuer and/or the Fund is a wholly-owned subsidiary of Invesco Ltd., or is affiliated by having an investment adviser that is under common control of Invesco Ltd. The table below shows the Fund’s transactions in, and earnings from, its investments in affiliates for the fiscal year ended October 31, 2022. |

| Value October 31, 2021 | Purchases at Cost | Proceeds from Sales | Change in Unrealized Appreciation | Realized Gain (Loss) | Value October 31, 2022 | Dividend Income | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investments in Affiliated Money Market Funds: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Invesco Government & Agency Portfolio, Institutional Class | $ | 60,551 | $ | 6,229,923 | $ | (6,231,056 | ) | $ | - | $ | - | $ | 59,418 | $ | 1,730 | ||||||||||||||||||||||||||||||||||||||||

| Investments Purchased with Cash Collateral from Securities on Loan: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Invesco Private Government Fund | 1,543,304 | 32,965,139 | (33,477,384 | ) | - | - | 1,031,059 | 5,592 | * | ||||||||||||||||||||||||||||||||||||||||||||||

| Invesco Private Prime Fund | 3,601,042 | 59,309,355 | (60,256,966 | ) | - | (2,136 | ) | 2,651,295 | 15,802 | * | |||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Total | $ | 5,204,897 | $ | 98,504,417 | $ | (99,965,406 | ) | $ | - | $ | (2,136 | ) | $ | 3,741,772 | $ | 23,124 | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||

| * | Represents the income earned on the investment of cash collateral, which is included in securities lending income on the Statements of Operations. Does not include rebates and fees paid to lending agent or premiums received from borrowers, if any. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 11 |

|

Invesco PureBetaSM 0-5 Yr US TIPS ETF (PBTP)–(continued)

October 31, 2022

| (d) | The rate shown is the 7-day SEC standardized yield as of October 31, 2022. |

| (e) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 2J. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 12 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)

October 31, 2022

Schedule of Investments

| Shares | Value | |||||||

| Common Stocks & Other Equity Interests-99.54% |

| |||||||

| Australia-8.73% | ||||||||

Adbri Ltd. | 2,452 | $ | 2,469 | |||||

AGL Energy Ltd. | 3,528 | 15,363 | ||||||

Allkem Ltd.(a) | 3,098 | 28,606 | ||||||

ALS Ltd. | 2,575 | 18,837 | ||||||

Altium Ltd. | 584 | 13,223 | ||||||

Alumina Ltd. | 13,530 | 11,680 | ||||||

AMP Ltd.(a) | 17,524 | 14,119 | ||||||

Ampol Ltd. | 1,278 | 22,253 | ||||||

Ansell Ltd. | 690 | 12,456 | ||||||

APA Group | 6,333 | 42,562 | ||||||

Aristocrat Leisure Ltd. | 3,590 | 85,099 | ||||||

ASX Ltd. | 1,039 | 44,979 | ||||||

Atlas Arteria Ltd. | 5,145 | 21,681 | ||||||

Aurizon Holdings Ltd. | 9,472 | 21,926 | ||||||

Australia & New Zealand Banking Group Ltd. | 16,545 | 270,417 | ||||||

Bank of Queensland Ltd.(b) | 3,432 | 16,152 | ||||||

Beach Energy Ltd. | 9,465 | 9,623 | ||||||

Bendigo & Adelaide Bank Ltd.(b) | 2,960 | 17,054 | ||||||

BHP Group Ltd. | 27,015 | 645,384 | ||||||

BlueScope Steel Ltd. | 2,527 | 25,418 | ||||||

Boral Ltd.(b) | 2,158 | 3,974 | ||||||

Brambles Ltd. | 7,451 | 55,650 | ||||||

carsales.com Ltd. | 1,796 | 23,337 | ||||||

Challenger Ltd. | 3,596 | 16,142 | ||||||

Charter Hall Group | 2,529 | 20,926 | ||||||

Cleanaway Waste Management Ltd. | 11,080 | 19,130 | ||||||

Cochlear Ltd. | 343 | 43,803 | ||||||

Coles Group Ltd. | 6,805 | 71,059 | ||||||

Commonwealth Bank of Australia | 9,169 | 613,751 | ||||||

CSL Ltd. | 2,583 | 463,269 | ||||||

CSR Ltd. | 2,603 | 7,707 | ||||||

Deterra Royalties Ltd. | 2,269 | 5,934 | ||||||

Dexus | 5,773 | 28,646 | ||||||

Domain Holdings Australia Ltd. | 1,241 | 2,650 | ||||||

Domino’s Pizza Enterprises Ltd. | 324 | 13,208 | ||||||

Downer EDI Ltd. | 3,696 | 10,612 | ||||||

EBOS Group Ltd. | 847 | 18,452 | ||||||

Endeavour Group Ltd. | 6,805 | 31,113 | ||||||

Evolution Mining Ltd. | 8,988 | 11,955 | ||||||

Flight Centre Travel Group Ltd.(a)(b) | 769 | 8,187 | ||||||

Fortescue Metals Group Ltd. | 8,531 | 80,191 | ||||||

Glencore PLC | 70,271 | 404,128 | ||||||

Goodman Group | 9,836 | 106,924 | ||||||

GPT Group (The) | 10,281 | 28,335 | ||||||

Harvey Norman Holdings Ltd. | 3,178 | 8,454 | ||||||

IDP Education Ltd.(b) | 972 | 18,391 | ||||||

IGO Ltd. | 3,333 | 32,587 | ||||||

Iluka Resources Ltd.(b) | 2,249 | 12,440 | ||||||

Incitec Pivot Ltd. | 10,407 | 24,955 | ||||||

Insignia Financial Ltd. | 3,412 | 6,873 | ||||||

Insurance Australia Group Ltd. | 13,039 | 40,855 | ||||||

James Hardie Industries PLC, CDI | 2,382 | 51,788 | ||||||

JB Hi-Fi Ltd.(b) | 606 | 16,628 | ||||||

Lendlease Corp. Ltd.(b) | 3,689 | 20,499 | ||||||

Lottery Corp. Ltd. (The)(a) | 11,920 | 32,699 | ||||||

Lynas Rare Earths Ltd.(a) | 4,821 | 25,680 | ||||||

Macquarie Group Ltd. | 1,868 | 202,467 | ||||||

| Shares | Value | |||||||

| Australia-(continued) | ||||||||

Magellan Financial Group Ltd.(b) | 748 | $ | 4,750 | |||||

Medibank Pvt. Ltd. | 14,782 | 26,561 | ||||||

Metcash Ltd.(b) | 5,181 | 13,583 | ||||||

Mineral Resources Ltd. | 897 | 41,946 | ||||||

Mirvac Group | 21,111 | 27,944 | ||||||

National Australia Bank Ltd. | 17,054 | 353,546 | ||||||

Newcrest Mining Ltd. | 4,788 | 53,120 | ||||||

NEXTDC Ltd.(a) | 2,430 | 12,928 | ||||||

Northern Star Resources Ltd. | 6,101 | 34,097 | ||||||

Nufarm Ltd. | 2,038 | 7,259 | ||||||

Orica Ltd. | 2,411 | 21,399 | ||||||

Origin Energy Ltd. | 9,424 | 33,566 | ||||||

Orora Ltd. | 4,652 | 9,013 | ||||||

OZ Minerals Ltd. | 1,742 | 26,923 | ||||||

Perpetual Ltd.(b) | 301 | 4,793 | ||||||

Pilbara Minerals Ltd.(a) | 14,101 | 45,896 | ||||||

Platinum Asset Management Ltd. | 2,813 | 3,220 | ||||||

Pro Medicus Ltd.(b) | 217 | 7,746 | ||||||

Qantas Airways Ltd.(a) | 4,460 | 16,655 | ||||||

QBE Insurance Group Ltd. | 7,906 | 61,879 | ||||||

Qube Holdings Ltd. | 8,928 | 15,528 | ||||||

Ramsay Health Care Ltd. | 937 | 35,093 | ||||||

REA Group Ltd. | 270 | 20,993 | ||||||

Reece Ltd. | 1,146 | 11,381 | ||||||

Rio Tinto Ltd. | 1,992 | 112,348 | ||||||

Rio Tinto PLC | 5,854 | 305,794 | ||||||

Santos Ltd. | 16,478 | 81,134 | ||||||

Scentre Group | 27,832 | 51,612 | ||||||

SEEK Ltd. | 1,870 | 25,817 | ||||||

Seven Group Holdings Ltd.(b) | 720 | 8,444 | ||||||

Shopping Centres Australasia Property Group | 5,951 | 10,351 | ||||||

Sierra Rutile Holdings Ltd.(a)(b) | 2,249 | 302 | ||||||

Sonic Healthcare Ltd. | 2,563 | 53,707 | ||||||

South32 Ltd. | 25,031 | 57,622 | ||||||

Star Entertainment Group Ltd. (The)(a) | 4,599 | 8,646 | ||||||

Stockland | 12,801 | 29,468 | ||||||

Suncorp Group Ltd. | 6,773 | 49,417 | ||||||

Tabcorp Holdings Ltd.(b) | 11,157 | 6,885 | ||||||

Telstra Group Ltd.(a) | 22,070 | 55,322 | ||||||

TPG Telecom Ltd.(b) | 1,968 | 6,166 | ||||||

Transurban Group | 16,522 | 140,092 | ||||||

Treasury Wine Estates Ltd. | 3,874 | 32,080 | ||||||

Vicinity Ltd. | 20,218 | 25,146 | ||||||

Washington H Soul Pattinson & Co. Ltd. | 1,428 | 25,513 | ||||||

Wesfarmers Ltd. | 6,080 | 176,742 | ||||||

Westpac Banking Corp. | 18,746 | 289,010 | ||||||

Whitehaven Coal Ltd. | 4,294 | 24,795 | ||||||

WiseTech Global Ltd. | 845 | 31,426 | ||||||

Woodside Energy Group Ltd. | 10,150 | 233,525 | ||||||

Woolworths Group Ltd. | 6,535 | 137,984 | ||||||

Worley Ltd. | 2,003 | 18,277 | ||||||

|

| |||||||

| 6,810,144 | ||||||||

|

| |||||||

| Austria-0.25% | ||||||||

ANDRITZ AG | 361 | 16,791 | ||||||

Erste Group Bank AG | 1,761 | 43,442 | ||||||

Mondi PLC | 2,599 | 43,763 | ||||||

OMV AG | 761 | 35,080 | ||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 13 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)–(continued)

October 31, 2022

| Shares | Value | |||||||

| Austria-(continued) | ||||||||

Raiffeisen Bank International AG | 693 | $ | 9,637 | |||||

Telekom Austria AG | 733 | 4,260 | ||||||

Verbund AG | 354 | 27,728 | ||||||

voestalpine AG | 616 | 13,382 | ||||||

|

| |||||||

| 194,083 | ||||||||

|

| |||||||

| Belgium-0.78% | ||||||||

Ackermans & van Haaren N.V. | 120 | 16,735 | ||||||

Ageas S.A./N.V. | 985 | 34,103 | ||||||

Anheuser-Busch InBev S.A./N.V.(b) | 4,651 | 232,599 | ||||||

D’Ieteren Group | 123 | 20,460 | ||||||

Elia Group S.A./N.V. | 202 | 25,535 | ||||||

Etablissements Franz Colruyt N.V. | 267 | 6,436 | ||||||

Groupe Bruxelles Lambert S.A. | 545 | 40,183 | ||||||

KBC Group N.V. | 1,473 | 73,811 | ||||||

Proximus SADP | 750 | 7,865 | ||||||

Sofina S.A.(b) | 82 | 16,006 | ||||||

Solvay S.A., Class A | 361 | 32,554 | ||||||

UCB S.A. | 648 | 48,879 | ||||||

Umicore S.A.(b) | 1,098 | 36,192 | ||||||

Warehouses De Pauw C.V.A. | 755 | 19,386 | ||||||

|

| |||||||

| 610,744 | ||||||||

|

| |||||||

| Brazil-0.05% | ||||||||

Yara International ASA | 872 | 38,916 | ||||||

|

| |||||||

| Burkina Faso-0.02% | ||||||||

Endeavour Mining PLC | 985 | 17,193 | ||||||

| Cambodia-0.01% | ||||||||

NagaCorp Ltd.(a) | 8,755 | 3,993 | ||||||

|

| |||||||

| Chile-0.03% | ||||||||

Antofagasta PLC(b) | 1,857 | 25,133 | ||||||

|

| |||||||

| China-0.59% | ||||||||

AAC Technologies Holdings, Inc.(a) | 3,807 | 6,974 | ||||||

BOC Hong Kong Holdings Ltd. | 19,114 | 59,413 | ||||||

Budweiser Brewing Co. APAC Ltd.(c) | 8,998 | 18,936 | ||||||

China Travel International Investment Hong Kong Ltd.(a) | 13,198 | 2,051 | ||||||

Chow Tai Fook Jewellery Group Ltd. | 9,309 | 15,938 | ||||||

ESR Group Ltd.(c) | 10,802 | 18,439 | ||||||

HUTCHMED China Ltd.(a) | 2,500 | 4,204 | ||||||

Kerry Logistics Network Ltd. | 1,263 | 2,005 | ||||||

Lenovo Group Ltd. | 39,428 | 31,543 | ||||||

MMG Ltd.(a) | 13,057 | 2,578 | ||||||

Nexteer Automotive Group Ltd.(b) | 4,389 | 2,376 | ||||||

Prosus N.V. | 4,574 | 199,092 | ||||||

Shangri-La Asia Ltd.(a) | 6,527 | 3,609 | ||||||

SITC International Holdings Co. Ltd. | 6,545 | 10,722 | ||||||

Want Want China Holdings Ltd. | 23,387 | 15,373 | ||||||

Wharf Holdings Ltd. (The) | 6,614 | 18,916 | ||||||

Wilmar International Ltd. | 11,302 | 30,989 | ||||||

Xinyi Glass Holdings Ltd. | 10,912 | 14,040 | ||||||

|

| |||||||

| 457,198 | ||||||||

|

| |||||||

| Denmark-2.41% | ||||||||

AP Moller - Maersk A/S, Class A | 15 | 30,030 | ||||||

AP Moller - Maersk A/S, Class B | 28 | 58,583 | ||||||

Carlsberg A/S, Class B | 498 | 58,708 | ||||||

Chr. Hansen Holding A/S | 551 | 30,606 | ||||||

Coloplast A/S, Class B(b) | 714 | 79,622 | ||||||

Danske Bank A/S(b) | 3,534 | 57,050 | ||||||

| Shares | Value | |||||||

| Denmark-(continued) | ||||||||

Demant A/S(a) | 544 | $ | 14,870 | |||||

DSV A/S | 1,005 | 136,089 | ||||||

Genmab A/S(a) | 352 | 135,705 | ||||||

GN Store Nord A/S | 686 | 14,590 | ||||||

H Lundbeck A/S | 1,280 | 4,787 | ||||||

H Lundbeck A/S, Class A(a) | 320 | 1,087 | ||||||

Novo Nordisk A/S, Class B | 8,396 | 912,993 | ||||||

Novozymes A/S, Class B | 1,064 | 55,894 | ||||||

Orsted A/S(c) | 1,010 | 83,320 | ||||||

Pandora A/S | 476 | 25,094 | ||||||

ROCKWOOL A/S, Class B(b) | 34 | 6,771 | ||||||

Royal Unibrew A/S | 253 | 14,453 | ||||||

SimCorp A/S | 213 | 12,725 | ||||||

Tryg A/S | 1,933 | 41,842 | ||||||

Vestas Wind Systems A/S | 5,411 | 106,603 | ||||||

|

| |||||||

| 1,881,422 | ||||||||

|

| |||||||

| Finland-1.25% | ||||||||

Elisa OYJ | 769 | 37,174 | ||||||

Fortum OYJ | 2,314 | 32,579 | ||||||

Huhtamaki OYJ | 498 | 17,891 | ||||||

Kesko OYJ, Class B | 1,445 | 28,135 | ||||||

Kojamo OYJ(b) | 1,045 | 13,602 | ||||||

Kone OYJ, Class B | 2,106 | 86,277 | ||||||

Metso Outotec OYJ(b) | 3,248 | 24,661 | ||||||

Neste OYJ | 2,231 | 97,770 | ||||||

Nokia OYJ(b) | 30,208 | 134,561 | ||||||

Nordea Bank Abp | 19,273 | 184,313 | ||||||

Orion OYJ, Class B | 556 | 25,580 | ||||||

Sampo OYJ, Class A | 2,636 | 120,573 | ||||||

Stora Enso OYJ, Class R | 3,079 | 40,139 | ||||||

UPM-Kymmene OYJ | 2,858 | 95,786 | ||||||

Valmet OYJ(b) | 940 | 21,396 | ||||||

Wartsila OYJ Abp | 2,613 | 17,820 | ||||||

|

| |||||||

| 978,257 | ||||||||

|

| |||||||

| France-9.89% | ||||||||

Accor S.A.(a) | 980 | 23,479 | ||||||

Adevinta ASA, Class B(a) | 1,488 | 10,190 | ||||||

Aeroports de Paris(a)(b) | 152 | 20,589 | ||||||

Air Liquide S.A. | 2,749 | 359,456 | ||||||

Airbus SE | 3,000 | 324,911 | ||||||

ALD S.A.(c) | 432 | 4,611 | ||||||

Alstom S.A.(b) | 1,582 | 32,616 | ||||||

Amundi S.A.(c) | 305 | 14,403 | ||||||

Arkema S.A. | 348 | 27,557 | ||||||

AXA S.A. | 9,946 | 245,754 | ||||||

BioMerieux | 231 | 20,443 | ||||||

BNP Paribas S.A. | 5,753 | 270,056 | ||||||

Bollore SE | 5,298 | 26,522 | ||||||

Bouygues S.A. | 1,141 | 32,568 | ||||||

Bureau Veritas S.A. | 1,521 | 37,687 | ||||||

Capgemini SE | 861 | 141,474 | ||||||

Carrefour S.A.(b) | 3,172 | 51,054 | ||||||

Cie de L’Odet SE | 2 | 2,392 | ||||||

Cie de Saint-Gobain | 2,462 | 100,739 | ||||||

Cie Generale des Etablissements Michelin S.C.A. | 3,752 | 95,711 | ||||||

Covivio | 268 | 14,356 | ||||||

Credit Agricole S.A. | 6,494 | 58,959 | ||||||

Danone S.A. | 3,273 | 162,844 | ||||||

Dassault Aviation S.A. | 124 | 18,432 | ||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 14 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)–(continued)

October 31, 2022

| Shares | Value | |||||||

| France-(continued) | ||||||||

Dassault Systemes SE | 3,569 | $ | 119,756 | |||||

Edenred | 1,337 | 68,661 | ||||||

Eiffage S.A. | 397 | 35,918 | ||||||

Electricite de France S.A. | 3,366 | 39,755 | ||||||

ENGIE S.A. | 8,894 | 115,629 | ||||||

EssilorLuxottica S.A. | 1,598 | 253,254 | ||||||

Eurazeo SE | 260 | 14,853 | ||||||

Euroapi S.A.(a) | 257 | 4,497 | ||||||

Faurecia SE(a) | 833 | 12,448 | ||||||

Gecina S.A. | 276 | 24,619 | ||||||

Getlink SE | 2,441 | 38,673 | ||||||

Hermes International | 166 | 215,009 | ||||||

ICADE | 174 | 6,477 | ||||||

Ipsen S.A. | 180 | 18,502 | ||||||

JCDecaux S.A.(a) | 389 | 4,910 | ||||||

Kering S.A. | 392 | 179,653 | ||||||

Klepierre S.A. | 972 | 19,550 | ||||||

La Francaise des Jeux SAEM(c) | 467 | 15,232 | ||||||

Legrand S.A. | 1,433 | 109,254 | ||||||

L’Oreal S.A. | 1,322 | 415,629 | ||||||

LVMH Moet Hennessy Louis Vuitton SE | 1,337 | 844,391 | ||||||

Neoen S.A.(c) | 234 | 8,169 | ||||||

Orange S.A. | 10,282 | 97,872 | ||||||

Pernod Ricard S.A.(b) | 1,099 | 193,017 | ||||||

Publicis Groupe S.A. | 1,226 | 68,753 | ||||||

Remy Cointreau S.A. | 131 | 20,081 | ||||||

Renault S.A.(a) | 1,030 | 31,731 | ||||||

Rexel S.A. | 1,288 | 23,048 | ||||||

Safran S.A. | 1,874 | 208,777 | ||||||

Sanofi | 5,847 | 504,670 | ||||||

Sartorius Stedim Biotech | 128 | 40,635 | ||||||

Schneider Electric SE | 2,859 | 362,424 | ||||||

SCOR SE | 839 | 12,625 | ||||||

SEB S.A.(b) | 161 | 10,486 | ||||||

Societe Generale S.A. | 4,086 | 93,792 | ||||||

Sodexo S.A. | 467 | 41,420 | ||||||

SOITEC(a) | 133 | 17,082 | ||||||

Somfy S.A. | 42 | 4,475 | ||||||

Teleperformance | 311 | 83,391 | ||||||

Thales S.A. | 538 | 68,407 | ||||||

TotalEnergies SE(b) | 12,698 | 691,509 | ||||||

Ubisoft Entertainment S.A.(a) | 504 | 13,833 | ||||||

Unibail-Rodamco-Westfield(a)(b) | 550 | 26,027 | ||||||

Valeo | 1,288 | 21,246 | ||||||

Veolia Environnement S.A. | 3,352 | 74,840 | ||||||

Vinci S.A. | 2,672 | 246,077 | ||||||

Vivendi SE | 3,762 | 30,801 | ||||||

Wendel SE | 144 | 11,286 | ||||||

Worldline S.A.(a)(c) | 1,303 | 57,076 | ||||||

|

| |||||||

| 7,717,023 | ||||||||

|

| |||||||

| Germany-7.08% | ||||||||

1&1 AG | 247 | 3,257 | ||||||

adidas AG | 901 | 88,142 | ||||||

Allianz SE | 2,191 | 394,550 | ||||||

Aroundtown S.A.(b) | 6,113 | 12,132 | ||||||

BASF SE | 4,925 | 221,161 | ||||||

Bayer AG | 5,291 | 278,307 | ||||||

Bayerische Motoren Werke AG | 1,722 | 135,338 | ||||||

| Shares | Value | |||||||

| Germany-(continued) | ||||||||

Bayerische Motoren Werke AG, Preference Shares | 309 | $ | 22,813 | |||||

Bechtle AG | 432 | 14,944 | ||||||

Beiersdorf AG | 535 | 51,386 | ||||||

Brenntag SE | 830 | 50,401 | ||||||

Carl Zeiss Meditec AG, BR | 196 | 23,740 | ||||||

Commerzbank AG(a) | 5,579 | 44,641 | ||||||

Continental AG | 580 | 30,084 | ||||||

Covestro AG(c) | 966 | 32,882 | ||||||

CTS Eventim AG& Co. KGaA(a) | 315 | 15,050 | ||||||

Daimler Truck Holding AG(a) | 2,250 | 60,042 | ||||||

Deutsche Bank AG | 10,959 | 104,631 | ||||||

Deutsche Boerse AG | 989 | 160,942 | ||||||

Deutsche Lufthansa AG(a) | 3,207 | 22,007 | ||||||

Deutsche Post AG | 5,206 | 184,770 | ||||||

Deutsche Telekom AG | 18,212 | 344,949 | ||||||

Deutsche Wohnen SE | 244 | 4,924 | ||||||

DWS Group GmbH & Co. KGaA(c) | 180 | 4,875 | ||||||

E.ON SE | 11,939 | 100,016 | ||||||

Evonik Industries AG | 1,024 | 18,880 | ||||||

Evotec SE(a) | 826 | 15,768 | ||||||

Fielmann AG | 130 | 4,145 | ||||||

Fraport AG Frankfurt Airport Services Worldwide(a) | 180 | 6,945 | ||||||

Fresenius Medical Care AG& Co. KGaA | 1,089 | 30,115 | ||||||

Fresenius SE & Co. KGaA | 2,188 | 50,387 | ||||||

Fuchs Petrolub SE | 180 | 4,341 | ||||||

Fuchs Petrolub SE, Preference Shares | 373 | 10,691 | ||||||

GEA Group AG | 888 | 31,069 | ||||||

Hannover Rueck SE | 322 | 52,447 | ||||||

HeidelbergCement AG | 776 | 35,779 | ||||||

Hella GmbH & Co. KGaA | 123 | 9,610 | ||||||

HelloFresh SE(a) | 877 | 17,561 | ||||||

Henkel AG& Co. KGaA(b) | 540 | 31,729 | ||||||

Henkel AG& Co. KGaA, Preference Shares | 907 | 57,175 | ||||||

HOCHTIEF AG | 103 | 5,477 | ||||||

Infineon Technologies AG | 6,994 | 170,325 | ||||||

KION Group AG | 420 | 9,327 | ||||||

Knorr-Bremse AG | 355 | 15,985 | ||||||

LANXESS AG | 457 | 15,470 | ||||||

LEG Immobilien SE | 391 | 25,552 | ||||||

Mercedes-Benz Group AG | 4,524 | 262,018 | ||||||

Merck KGaA | 693 | 113,013 | ||||||

METRO AG(a) | 702 | 5,363 | ||||||

MTU Aero Engines AG | 286 | 51,234 | ||||||

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen, Class R | 754 | 199,271 | ||||||

Nemetschek SE | 288 | 13,765 | ||||||

Puma SE | 534 | 23,650 | ||||||

Rational AG | 26 | 14,673 | ||||||

Rheinmetall AG | 231 | 37,557 | ||||||

RWE AG | 3,379 | 130,212 | ||||||

SAP SE | 5,955 | 574,849 | ||||||

Sartorius AG | 13 | 3,835 | ||||||

Sartorius AG, Preference Shares | 132 | 46,588 | ||||||

Scout24 SE(c) | 403 | 20,664 | ||||||

Siemens AG | 4,053 | 443,200 | ||||||

Siemens Energy AG(b) | 2,299 | 26,846 | ||||||

Siemens Healthineers AG(c) | 1,487 | 68,458 | ||||||

Sixt SE | 70 | 6,573 | ||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 15 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)–(continued)

October 31, 2022

| Shares | Value | |||||||

| Germany-(continued) | ||||||||

Sixt SE, Preference Shares | 88 | $ | 5,132 | |||||

SUSE S.A.(a) | 193 | 3,414 | ||||||

Symrise AG | 701 | 71,604 | ||||||

Talanx AG | 285 | 10,709 | ||||||

Telefonica Deutschland Holding AG | 4,822 | 10,513 | ||||||

thyssenkrupp AG(a) | 2,600 | 13,702 | ||||||

Traton SE | 268 | 3,345 | ||||||

TUI AG(a)(b) | 6,517 | 9,889 | ||||||

Uniper SE(b) | 469 | 1,405 | ||||||

United Internet AG | 576 | 10,774 | ||||||

Vantage Towers AG | 496 | 13,962 | ||||||

Varta AG(b) | 72 | 1,933 | ||||||

Volkswagen AG | 154 | 26,332 | ||||||

Volkswagen AG, Preference Shares | 1,081 | 138,188 | ||||||

Vonovia SE | 4,277 | 94,689 | ||||||

Wacker Chemie AG | 81 | 9,439 | ||||||

Zalando SE(a)(c) | 1,169 | 26,955 | ||||||

|

| |||||||

| 5,518,516 | ||||||||

|

| |||||||

| Hong Kong-2.22% | ||||||||

AIA Group Ltd. | 64,186 | 486,106 | ||||||

ASMPT Ltd. | 1,741 | 9,581 | ||||||

Bank of East Asia Ltd. (The) | 5,166 | 4,949 | ||||||

Cafe de Coral Holdings Ltd. | 2,159 | 2,519 | ||||||

Cathay Pacific Airways Ltd.(a) | 5,377 | 4,877 | ||||||

Champion REIT | 10,931 | 3,272 | ||||||

CK Asset Holdings Ltd. | 10,388 | 57,433 | ||||||

CK Hutchison Holdings Ltd. | 14,205 | 70,574 | ||||||

CK Infrastructure Holdings Ltd. | 3,296 | 15,662 | ||||||

CLP Holdings Ltd. | 8,739 | 58,669 | ||||||

Dah Sing Banking Group Ltd. | 2,174 | 1,296 | ||||||

Dah Sing Financial Holdings Ltd. | 869 | 1,720 | ||||||

DFI Retail Group Holdings Ltd. | 1,640 | 3,674 | ||||||

Guotai Junan International Holdings Ltd. | 14,111 | 1,007 | ||||||

Haitong International Securities Group | 15,475 | 1,124 | ||||||

Hang Lung Group Ltd. | 4,416 | 5,727 | ||||||

Hang Lung Properties Ltd. | 9,912 | 12,463 | ||||||

Hang Seng Bank Ltd. | 3,926 | 55,265 | ||||||

Henderson Land Development Co. Ltd. | 6,584 | 16,121 | ||||||

Hong Kong & China Gas Co. Ltd. (The) | 57,892 | 44,692 | ||||||

Hong Kong Exchanges & Clearing Ltd. | 6,826 | 181,740 | ||||||

Hongkong Land Holdings Ltd. | 5,954 | 22,923 | ||||||

Huabao International Holdings Ltd. | 5,425 | 2,502 | ||||||

Hutchison Port Holdings Trust, Class U | 27,069 | 4,412 | ||||||

Hutchison Telecommunications Hong Kong Holdings Ltd. | 6,614 | 876 | ||||||

Hysan Development Co. Ltd. | 3,296 | 7,188 | ||||||

Jardine Matheson Holdings Ltd. | 1,015 | 46,710 | ||||||

Johnson Electric Holdings Ltd., Class H | 1,662 | 1,713 | ||||||

Kerry Properties Ltd. | 3,284 | 5,196 | ||||||

Link REIT | 11,336 | 67,006 | ||||||

Man Wah Holdings Ltd. | 8,101 | 4,520 | ||||||

Melco International Development Ltd.(a) | 4,380 | 2,288 | ||||||

MTR Corp. Ltd. | 7,647 | 33,657 | ||||||

New World Development Co. Ltd. | 7,656 | 15,663 | ||||||

NWS Holdings Ltd. | 7,665 | 5,439 | ||||||

Orient Overseas International Ltd. | 700 | 10,228 | ||||||

PCCW Ltd. | 21,985 | 8,402 | ||||||

Power Assets Holdings Ltd. | 7,123 | 34,073 | ||||||

Prudential PLC | 14,790 | 138,067 | ||||||

| Shares | Value | |||||||

| Hong Kong-(continued) | ||||||||

Sino Land Co. Ltd. | 19,416 | $ | 20,752 | |||||

Sun Hung Kai Properties Ltd. | 7,598 | 81,741 | ||||||

Swire Pacific Ltd., Class A | 2,740 | 18,133 | ||||||

Swire Pacific Ltd., Class B | 5,440 | 5,606 | ||||||

Swire Properties Ltd. | 5,703 | 10,956 | ||||||

Techtronic Industries Co. Ltd. | 7,062 | 66,888 | ||||||

United Energy Group Ltd. | 39,446 | 3,819 | ||||||

Vitasoy International Holdings Ltd.(a)(b) | 4,362 | 7,446 | ||||||

VTech Holdings Ltd. | 875 | 4,654 | ||||||

WH Group Ltd. | 41,789 | 21,135 | ||||||

Wharf Real Estate Investment Co. Ltd. | 8,738 | 34,452 | ||||||

Yue Yuen Industrial Holdings Ltd. | 3,844 | 3,908 | ||||||

|

| |||||||

| 1,728,824 | ||||||||

|

| |||||||

| Indonesia-0.01% | ||||||||

First Pacific Co. Ltd. | 13,111 | 3,474 | ||||||

Golden Agri-Resources Ltd. | 34,090 | 6,986 | ||||||

|

| |||||||

| 10,460 | ||||||||

|

| |||||||

| Ireland-0.63% | ||||||||

AIB Group PLC | 4,878 | 14,126 | ||||||

Bank of Ireland Group PLC | 4,896 | 35,305 | ||||||

CRH PLC | 4,115 | 148,246 | ||||||

Flutter Entertainment PLC(a)(b) | 939 | 125,194 | ||||||

Glanbia PLC(b) | 1,008 | 11,646 | ||||||

Kerry Group PLC, Class A | 826 | 71,841 | ||||||

Kingspan Group PLC | 810 | 40,909 | ||||||

Smurfit Kappa Group PLC | 1,391 | 46,028 | ||||||

|

| |||||||

| 493,295 | ||||||||

|

| |||||||

| Israel-0.82% | ||||||||

AFI Properties Ltd. | 89 | 2,681 | ||||||

Airport City Ltd.(a) | 396 | 6,588 | ||||||

Alony Hetz Properties & Investments Ltd. | 576 | 6,792 | ||||||

Amot Investments Ltd. | 756 | 4,597 | ||||||

Ashtrom Group Ltd. | 215 | 4,701 | ||||||

Azrieli Group Ltd. | 216 | 16,086 | ||||||

Bank Hapoalim BM | 7,168 | 69,450 | ||||||

Bank Leumi Le-Israel BM | 8,295 | 79,544 | ||||||

Bezeq The Israeli Telecommunication Corp. Ltd. | 11,482 | 20,416 | ||||||

Big Shopping Centers Ltd. | 72 | 8,113 | ||||||

Delek Group Ltd.(a) | 42 | 6,451 | ||||||

Elbit Systems Ltd. | 143 | 29,059 | ||||||

Elco Ltd. | 51 | 2,956 | ||||||

Electra Ltd. | 10 | 5,846 | ||||||

Energix-Renewable Energies Ltd. | 1,008 | 3,540 | ||||||

Enlight Renewable Energy Ltd.(a) | 4,951 | 10,079 | ||||||

Fattal Holdings 1998 Ltd.(a) | 44 | 4,494 | ||||||

First International Bank of Israel Ltd. (The) | 288 | 12,495 | ||||||

Fox Wizel Ltd. | 37 | 4,531 | ||||||

Gav-Yam Lands Corp. Ltd. | 539 | 4,594 | ||||||

Harel Insurance Investments & Financial Services Ltd. | 612 | 5,919 | ||||||

ICL Group Ltd. | 3,895 | 35,326 | ||||||

Israel Corp. Ltd. (The) | 20 | 8,700 | ||||||

Israel Discount Bank Ltd., Class A | 6,567 | 37,542 | ||||||

Maytronics Ltd. | 251 | 2,720 | ||||||

Melisron Ltd. | 108 | 8,052 | ||||||

Mivne Real Estate KD Ltd. | 3,787 | 11,836 | ||||||

Mizrahi Tefahot Bank Ltd. | 720 | 27,352 | ||||||

Nice Ltd.(a) | 362 | 68,893 | ||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 16 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)–(continued)

October 31, 2022

| Shares | Value | |||||||

| Israel-(continued) | ||||||||

Nova Ltd.(a) | 145 | $ | 10,691 | |||||

OPC Energy Ltd.(a) | 396 | 4,894 | ||||||

Paz Oil Co. Ltd.(a) | 84 | 10,079 | ||||||

Phoenix Holdings Ltd. (The) | 684 | 7,445 | ||||||

Sapiens International Corp. N.V. | 144 | 2,843 | ||||||

Shapir Engineering and Industry Ltd. | 612 | 5,064 | ||||||

Shikun & Binui Ltd.(a)(b) | 1,149 | 4,582 | ||||||

Shufersal Ltd. | 612 | 4,196 | ||||||

Strauss Group Ltd. | 216 | 5,430 | ||||||

Teva Pharmaceutical Industries Ltd.(a)(b) | 5,417 | 48,668 | ||||||

Tower Semiconductor Ltd.(a) | 576 | 24,745 | ||||||

|

| |||||||

| 637,990 | ||||||||

|

| |||||||

| Italy-1.99% | ||||||||

A2A S.p.A. | 8,114 | 8,998 | ||||||

Amplifon S.p.A.(b) | 684 | 16,995 | ||||||

Assicurazioni Generali S.p.A.(b) | 7,402 | 111,126 | ||||||

Atlantia S.p.A. | 2,878 | 64,228 | ||||||

Banca Mediolanum S.p.A. | 1,289 | 9,657 | ||||||

Buzzi Unicem S.p.A. | 499 | 8,283 | ||||||

Coca-Cola HBC AG(a) | 1,046 | 22,912 | ||||||

Davide Campari-Milano N.V. | 2,650 | 23,818 | ||||||

De’ Longhi S.p.A.(b) | 378 | 6,527 | ||||||

DiaSorin S.p.A.(b) | 121 | 15,822 | ||||||

Enel S.p.A. | 41,815 | 186,761 | ||||||

Eni S.p.A.(b) | 13,085 | 171,408 | ||||||

Ferrari N.V. | 648 | 127,770 | ||||||

FinecoBank Banca Fineco S.p.A. | 3,272 | 44,110 | ||||||

Hera S.p.A. | 4,215 | 10,048 | ||||||

Infrastrutture Wireless Italiane S.p.A.(c) | 1,888 | 16,667 | ||||||

Interpump Group S.p.A. | 431 | 16,690 | ||||||

Intesa Sanpaolo S.p.A.(b) | 89,339 | 170,327 | ||||||

Italgas S.p.A. | 2,626 | 13,535 | ||||||

Leonardo S.p.A. | 2,145 | 17,240 | ||||||

Mediobanca Banca di Credito Finanziario S.p.A.(b) | 3,480 | 31,547 | ||||||

Moncler S.p.A. | 1,093 | 47,197 | ||||||

Nexi S.p.A.(a)(c) | 3,981 | 34,507 | ||||||

Pirelli & C. S.p.A.(c) | 2,624 | 9,902 | ||||||

Poste Italiane S.p.A.(c) | 2,447 | 21,331 | ||||||

PRADA S.p.A. | 2,743 | 12,492 | ||||||

Prysmian S.p.A. | 1,413 | 46,072 | ||||||

Recordati Industria Chimica e Farmaceutica S.p.A. | 519 | 19,508 | ||||||

Reply S.p.A. | 121 | 13,167 | ||||||

Snam S.p.A. | 11,949 | 53,168 | ||||||

Telecom Italia S.p.A.(a)(b) | 57,554 | 11,269 | ||||||

Telecom Italia S.p.A., RSP(a)(b) | 32,353 | 6,187 | ||||||

Terna Rete Elettrica Nazionale S.p.A. | 7,559 | 50,115 | ||||||

UniCredit S.p.A. | 10,530 | 130,591 | ||||||

UnipolSai Assicurazioni S.p.A. | 2,282 | 5,147 | ||||||

|

| |||||||

| 1,555,122 | ||||||||

|

| |||||||

| Japan-22.87% | ||||||||

ABC-Mart, Inc. | 144 | 6,423 | ||||||

Acom Co. Ltd. | 2,010 | 4,395 | ||||||

Activia Properties, Inc. | 4 | 11,855 | ||||||

Advance Residence Investment Corp. | 7 | 16,295 | ||||||

Advantest Corp. | 1,052 | 55,631 | ||||||

Aeon Co. Ltd. | 3,761 | 70,255 | ||||||

AEON Financial Service Co. Ltd. | 648 | 6,348 | ||||||

| Shares | Value | |||||||

| Japan-(continued) | ||||||||

Aeon Mall Co. Ltd. | 684 | $ | 7,441 | |||||

AEON REIT Investment Corp. | 9 | 9,688 | ||||||

AGC, Inc. | 1,008 | 31,637 | ||||||

Aica Kogyo Co. Ltd. | 288 | 6,200 | ||||||

Ain Holdings, Inc. | 144 | 6,055 | ||||||

Air Water, Inc. | 964 | 10,786 | ||||||

Aisin Corp. | 936 | 24,024 | ||||||

Ajinomoto Co., Inc. | 2,576 | 70,988 | ||||||

Alfresa Holdings Corp. | 910 | 10,475 | ||||||

Alps Alpine Co. Ltd. | 1,079 | 9,292 | ||||||

Amada Co. Ltd. | 1,702 | 11,989 | ||||||

Amano Corp. | 360 | 6,169 | ||||||

ANA Holdings, Inc.(a) | 842 | 16,377 | ||||||

Anritsu Corp.(b) | 756 | 7,624 | ||||||

Aozora Bank Ltd. | 648 | 11,148 | ||||||

Ariake Japan Co. Ltd. | 108 | 3,742 | ||||||

As One Corp. | 144 | 6,162 | ||||||

Asahi Group Holdings Ltd. | 2,575 | 72,138 | ||||||

Asahi Intecc Co. Ltd. | 1,044 | 17,799 | ||||||

Asahi Kasei Corp. | 6,588 | 42,307 | ||||||

Asics Corp. | 935 | 14,368 | ||||||

ASKUL Corp. | 216 | 2,260 | ||||||

Astellas Pharma, Inc. | 9,858 | 135,731 | ||||||

Azbil Corp. | 720 | 19,594 | ||||||

AZ-COM MARUWA Holdings, Inc. | 251 | 2,390 | ||||||

Bandai Namco Holdings, Inc. | 1,078 | 71,381 | ||||||

Bank of Kyoto Ltd. (The) | 396 | 14,280 | ||||||

BayCurrent Consulting, Inc. | 720 | 20,297 | ||||||

Benefit One, Inc. | 324 | 4,499 | ||||||

Benesse Holdings, Inc. | 396 | 5,845 | ||||||

Bic Camera, Inc. | 766 | 5,963 | ||||||

BIPROGY, Inc. | 360 | 7,787 | ||||||

Bridgestone Corp. | 3,118 | 112,482 | ||||||

Brother Industries Ltd. | 1,293 | 22,018 | ||||||

Calbee, Inc. | 432 | 8,676 | ||||||

Canon Marketing Japan, Inc. | 252 | 5,324 | ||||||

Canon, Inc.(b) | 5,257 | 111,552 | ||||||

Capcom Co. Ltd. | 1,008 | 28,110 | ||||||

Casio Computer Co. Ltd. | 1,151 | 10,020 | ||||||

Central Japan Railway Co. | 1,006 | 116,854 | ||||||

Chiba Bank Ltd. (The) | 3,224 | 17,635 | ||||||

Chubu Electric Power Co., Inc. | 3,726 | 30,357 | ||||||

Chugai Pharmaceutical Co. Ltd. | 3,473 | 80,613 | ||||||

Chugin Financial Group, Inc. | 874 | 5,269 | ||||||

Chugoku Electric Power Co., Inc. (The) | 1,604 | 7,532 | ||||||

Coca-Cola Bottlers Japan Holdings, Inc. | 730 | 6,601 | ||||||

COMSYS Holdings Corp. | 611 | 10,030 | ||||||

Concordia Financial Group Ltd. | 5,988 | 18,250 | ||||||

Cosmo Energy Holdings Co. Ltd. | 400 | 10,294 | ||||||

Cosmos Pharmaceutical Corp. | 113 | 10,948 | ||||||

Credit Saison Co. Ltd. | 802 | 8,579 | ||||||

CyberAgent, Inc. | 2,099 | 17,285 | ||||||

Dai Nippon Printing Co. Ltd.(b) | 1,389 | 27,876 | ||||||

Daicel Corp. | 1,416 | 8,079 | ||||||

Daido Steel Co. Ltd. | 216 | 5,609 | ||||||

Daifuku Co. Ltd. | 538 | 24,686 | ||||||

Dai-ichi Life Holdings, Inc. | 5,217 | 82,747 | ||||||

Daiichi Sankyo Co. Ltd. | 10,104 | 324,054 | ||||||

Daiichikosho Co. Ltd. | 216 | 6,205 | ||||||

Daikin Industries Ltd. | 1,451 | 218,526 | ||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 17 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)–(continued)

October 31, 2022

| Shares | Value | |||||||

| Japan-(continued) | ||||||||

Daio Paper Corp. | 431 | $ | 3,184 | |||||

Daito Trust Construction Co. Ltd. | 359 | 35,529 | ||||||

Daiwa House Industry Co. Ltd. | 3,403 | 68,960 | ||||||

Daiwa House REIT Investment Corp. | 11 | 22,202 | ||||||

Daiwa Office Investment Corp. | 1 | 4,723 | ||||||

Daiwa Securities Group, Inc. | 7,810 | 30,476 | ||||||

Daiwa Securities Living Investments Corp. | 11 | 8,540 | ||||||

DeNA Co. Ltd. | 469 | 6,125 | ||||||

Denka Co. Ltd. | 468 | 10,847 | ||||||

Denso Corp. | 2,394 | 119,028 | ||||||

Dentsu Group, Inc. | 1,085 | 33,834 | ||||||

Descente Ltd. | 195 | 4,697 | ||||||

DIC Corp. | 468 | 7,865 | ||||||

Disco Corp. | 144 | 34,587 | ||||||

DMG Mori Co. Ltd. | 576 | 6,685 | ||||||

Dowa Holdings Co. Ltd. | 252 | 8,028 | ||||||

East Japan Railway Co | 1,983 | 107,265 | ||||||

Ebara Corp. | 504 | 16,429 | ||||||

Eisai Co. Ltd. | 1,451 | 87,606 | ||||||

Electric Power Development Co. Ltd. | 838 | 11,659 | ||||||

ENEOS Holdings, Inc. | 15,606 | 51,427 | ||||||

EXEO Group, Inc. | 504 | 7,389 | ||||||

Ezaki Glico Co. Ltd. | 288 | 6,481 | ||||||

Fancl Corp. | 360 | 6,833 | ||||||

FANUC Corp. | 1,043 | 137,747 | ||||||

Fast Retailing Co. Ltd. | 276 | 154,104 | ||||||

Food & Life Cos. Ltd. | 576 | 9,723 | ||||||

FP Corp. | 251 | 5,986 | ||||||

Frontier Real Estate Investment Corp. | 3 | 10,596 | ||||||

Fuji Electric Co. Ltd. | 648 | 25,112 | ||||||

Fuji Kyuko Co. Ltd. | 98 | 3,033 | ||||||

Fuji Media Holdings, Inc. | 252 | 1,755 | ||||||

Fuji Oil Holdings, Inc. | 252 | 3,969 | ||||||

FUJIFILM Holdings Corp. | 1,944 | 89,186 | ||||||

Fujitsu General Ltd. | 324 | 7,411 | ||||||

Fujitsu Ltd. | 992 | 114,293 | ||||||

Fukuoka Financial Group, Inc. | 828 | 14,060 | ||||||

Furukawa Electric Co. Ltd. | 360 | 5,561 | ||||||

Fuyo General Lease Co. Ltd. | 108 | 6,002 | ||||||

GLP J-Reit | 23 | 23,846 | ||||||

GMO Internet Group, Inc. | 324 | 5,604 | ||||||

GMO Payment Gateway, Inc. | 216 | 15,593 | ||||||

GOLDWIN, Inc. | 181 | 9,474 | ||||||

GS Yuasa Corp. | 432 | 6,589 | ||||||

GungHo Online Entertainment, Inc. | 180 | 2,668 | ||||||

H.U. Group Holdings, Inc. | 288 | 5,367 | ||||||

Hachijuni Bank Ltd. (The) | 2,385 | 7,606 | ||||||

Hakuhodo DY Holdings, Inc. | 1,294 | 10,935 | ||||||

Hamamatsu Photonics K.K. | 684 | 31,017 | ||||||

Hankyu Hanshin Holdings, Inc. | 1,186 | 35,229 | ||||||

Haseko Corp. | 1,415 | 14,585 | ||||||

Heiwa Corp. | 288 | 4,650 | ||||||

Hikari Tsushin, Inc. | 108 | 13,057 | ||||||

Hino Motors Ltd. | 1,460 | 6,070 | ||||||

Hirogin Holdings, Inc. | 1,604 | 6,615 | ||||||

Hirose Electric Co. Ltd. | 180 | 23,385 | ||||||

Hisamitsu Pharmaceutical Co., Inc. | 396 | 9,778 | ||||||

Hitachi Construction Machinery Co. Ltd. | 612 | 11,998 | ||||||

Hitachi Ltd. | 4,959 | 225,538 | ||||||

Hitachi Metals Ltd.(a) | 1,041 | 15,212 | ||||||

| Shares | Value | |||||||

| Japan-(continued) | ||||||||

Hitachi Transport System Ltd. | 179 | $ | 10,706 | |||||

Honda Motor Co. Ltd. | 9,080 | 206,054 | ||||||

Horiba Ltd. | 216 | 8,894 | ||||||

Hoshizaki Corp. | 576 | 16,528 | ||||||

House Foods Group, Inc. | 396 | 7,415 | ||||||

Hoya Corp. | 1,905 | 177,831 | ||||||

Hulic Co. Ltd. | 2,261 | 16,429 | ||||||

Ibiden Co. Ltd. | 576 | 19,493 | ||||||

Idemitsu Kosan Co. Ltd. | 1,272 | 27,813 | ||||||

IHI Corp. | 684 | 15,278 | ||||||

Iida Group Holdings Co. Ltd. | 792 | 11,009 | ||||||

Industrial & Infrastructure Fund Investment Corp. | 10 | 10,563 | ||||||

Information Services International-Dentsu Ltd. | 109 | 3,340 | ||||||

INFRONEER Holdings, Inc. | 1,339 | 9,297 | ||||||

Inpex Corp. | 5,298 | 54,108 | ||||||

Internet Initiative Japan, Inc. | 576 | 9,060 | ||||||

Isetan Mitsukoshi Holdings Ltd. | 1,821 | 16,172 | ||||||

Isuzu Motors Ltd. | 2,791 | 32,748 | ||||||

Ito En Ltd. | 289 | 10,208 | ||||||

ITOCHU Corp.(b) | 7,140 | 184,895 | ||||||

Itochu Techno-Solutions Corp. | 538 | 12,488 | ||||||

Itoham Yonekyu Holdings, Inc. | 756 | 3,382 | ||||||

Iwatani Corp. | 253 | 9,328 | ||||||

Iyogin Holdings, Inc. | 1,496 | 7,015 | ||||||

Izumi Co. Ltd. | 216 | 4,358 | ||||||

J. Front Retailing Co. Ltd. | 1,319 | 10,667 | ||||||

Japan Airlines Co. Ltd.(a) | 794 | 14,824 | ||||||

Japan Airport Terminal Co. Ltd.(a) | 252 | 10,817 | ||||||

Japan Aviation Electronics Industry Ltd. | 252 | 3,932 | ||||||

Japan Exchange Group, Inc. | 2,792 | 36,695 | ||||||

Japan Hotel REIT Investment Corp. | 25 | 13,170 | ||||||

Japan Logistics Fund, Inc. | 5 | 10,714 | ||||||

Japan Metropolitan Fund Investment Corp. | 36 | 26,521 | ||||||

Japan Post Bank Co. Ltd. | 2,143 | 14,274 | ||||||

Japan Post Holdings Co. Ltd. | 11,604 | 78,039 | ||||||

Japan Post Insurance Co. Ltd.(b) | 1,079 | 15,949 | ||||||

Japan Prime Realty Investment Corp. | 5 | 13,574 | ||||||

Japan Real Estate Investment Corp. | 7 | 29,340 | ||||||

Japan Steel Works Ltd. (The) | 292 | 6,041 | ||||||

Japan Tobacco, Inc. | 6,390 | 105,930 | ||||||

JCR Pharmaceuticals Co. Ltd. | 288 | 4,292 | ||||||

Jeol Ltd. | 217 | 7,971 | ||||||

JFE Holdings, Inc. | 2,719 | 24,934 | ||||||

JGC Holdings Corp. | 1,139 | 13,732 | ||||||

JMDC, Inc. | 100 | 3,559 | ||||||

JSR Corp. | 972 | 18,533 | ||||||

JTEKT Corp. | 1,211 | 8,555 | ||||||

JustSystems Corp. | 180 | 3,803 | ||||||

Kadokawa Corp. | 531 | 9,546 | ||||||

Kagome Co. Ltd. | 432 | 8,644 | ||||||

Kajima Corp. | 2,323 | 21,896 | ||||||

Kakaku.com, Inc. | 718 | 12,178 | ||||||

Kaken Pharmaceutical Co. Ltd. | 180 | 4,608 | ||||||

Kamigumi Co. Ltd. | 476 | 9,057 | ||||||

Kandenko Co. Ltd. | 576 | 3,240 | ||||||

Kaneka Corp. | 324 | 8,044 | ||||||

Kansai Electric Power Co., Inc. (The) | 3,883 | 29,442 | ||||||

Kansai Paint Co. Ltd. | 944 | 12,321 | ||||||

Kao Corp. | 2,429 | 91,352 | ||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| 18 |

|

Invesco PureBetaSM FTSE Developed ex-North America ETF (PBDM)–(continued)

October 31, 2022

| Shares | Value | |||||||

| Japan-(continued) | ||||||||

Katitas Co. Ltd. | 292 | $ | 6,552 | |||||

Kawasaki Heavy Industries Ltd. | 828 | 14,072 | ||||||

Kawasaki Kisen Kaisha Ltd.(b) | 1,299 | 19,760 | ||||||

KDDI Corp. | 8,810 | 260,504 | ||||||

Keihan Holdings Co. Ltd. | 540 | 13,896 | ||||||

Keikyu Corp. | 1,319 | 13,551 | ||||||

Keio Corp. | 646 | 22,687 | ||||||

Keisei Electric Railway Co. Ltd.(b) | 755 | 20,064 | ||||||

Kenedix Office Investment Corp. | 4 | 9,110 | ||||||

Kewpie Corp. | 575 | 9,087 | ||||||

Keyence Corp. | 1,072 | 406,197 | ||||||

Kikkoman Corp. | 1,006 | 54,688 | ||||||

Kinden Corp. | 682 | 6,947 | ||||||

Kintetsu Group Holdings Co. Ltd. | 1,008 | 34,112 | ||||||

Kirin Holdings Co. Ltd. | 3,998 | 58,893 | ||||||

Kobayashi Pharmaceutical Co. Ltd.(b) | 324 | 17,221 | ||||||

Kobe Bussan Co. Ltd.(b) | 737 | 16,041 | ||||||

Kobe Steel Ltd. | 1,737 | 7,129 | ||||||

Koei Tecmo Holdings Co. Ltd. | 862 | 13,037 | ||||||

Koito Manufacturing Co. Ltd. | 1,224 | 17,409 | ||||||

Kokuyo Co. Ltd. | 468 | 5,812 | ||||||

Komatsu Ltd. | 4,925 | 94,368 | ||||||

Konami Group Corp. | 504 | 22,142 | ||||||

Konica Minolta, Inc. | 2,442 | 7,443 | ||||||

Kose Corp. | 144 | 14,406 | ||||||

Kotobuki Spirits Co. Ltd. | 108 | 5,544 | ||||||

K’s Holdings Corp. | 838 | 6,574 | ||||||

Kubota Corp. | 5,760 | 80,470 | ||||||

Kuraray Co. Ltd. | 1,883 | 12,960 | ||||||

Kurita Water Industries Ltd. | 610 | 22,408 | ||||||

Kusuri no Aoki Holdings Co. Ltd. | 72 | 3,478 | ||||||

Kyocera Corp. | 1,601 | 80,150 | ||||||

Kyowa Kirin Co. Ltd. | 1,365 | 32,188 | ||||||

Kyudenko Corp. | 216 | 4,592 | ||||||

Kyushu Electric Power Co., Inc. | 2,478 | 12,287 | ||||||

Kyushu Financial Group, Inc. | 1,949 | 4,930 | ||||||

Kyushu Railway Co. | 802 | 16,781 | ||||||

LaSalle Logiport REIT | 10 | 10,677 | ||||||

Lasertec Corp. | 431 | 61,735 | ||||||

Lawson, Inc. | 252 | 8,053 | ||||||

Lintec Corp. | 288 | 4,325 | ||||||

Lion Corp. | 1,279 | 12,942 | ||||||

Lixil Corp. | 1,350 | 20,445 | ||||||

M3, Inc. | 2,275 | 68,050 | ||||||

Mabuchi Motor Co. Ltd. | 288 | 7,828 | ||||||

Makita Corp. | 1,343 | 24,577 | ||||||

Mani, Inc. | 324 | 4,730 | ||||||

Marubeni Corp. | 8,398 | 73,621 | ||||||

Marui Group Co. Ltd. | 1,016 | 16,774 | ||||||