P B C T 1 Building the Premier Regional Bank in the Northeast June 27, 2007 Exhibit 99.2 |

P B C T 2 Forward-Looking Statement This presentation contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward- looking statements are intended to be covered by the safe harbor provisions for forward- looking statements contained in the Private Securities Litigation Reform Act of 1995, and this statement is included for purposes of complying with these safe harbor provisions. These forward-looking statements are based on current plans and expectations, which are subject to a number of risk factors and uncertainties that could cause future results to differ materially from historical performance or future expectations. These differences may be the result of various factors, including, among others: (1) failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; (2) failure of the shareholders of Chittenden Corporation to approve the merger agreement; (3) failure to obtain governmental approvals of the merger, or imposition of adverse regulatory conditions in connection with such approvals; (4) disruptions to the parties’ businesses as a result of the announcement and pendency of the merger; (5) costs or difficulties related to the integration of the businesses following the merger; (6) changes in general, national or regional economic conditions; (7) the risk that the cost savings and any other savings from the transaction may not be fully realized or may take longer than expected to realize (8) changes in loan default and charge-off rates; (9) reductions in deposit levels necessitating increased borrowings to fund loans and investments; (10) changes in interest rates; (11) changes in levels of income and expense in noninterest income and expense related activities; and (12) competition and its effect on pricing, spending, third-party relationships and revenues. For additional factors that may affect future results, please see People’s United’s and Chittenden Corporation’s filings with the Securities and Exchange Commission, including People’s United’s and Chittenden Corporation’s Annual Report on Form 10-K for the year ended December 31, 2006. People’s United and Chittenden Corporation undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or other changes |

P B C T 3 Additional Information about this Transaction and Participants in this Transaction Additional Information About this Transaction In connection with the proposed merger, People’s United will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a proxy statement of Chittenden that also constitutes a prospectus of People’s United. Chittenden will mail the proxy statement/prospectus to its stockholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important information. You may obtain a free copy of the proxy statement/prospectus (when available) and other related documents filed by People’s United and Chittenden with the SEC at the SEC’s website at www.sec.gov. The proxy statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing People’s United website at www.peoples.com under the tab “Investor Relations” and then under the heading “Financial Information” or by accessing Chittenden’s website at www.chittendencorp.com under the tab “Investor Resources – SEC Filings”. Participants in this Transaction People’s United, Chittenden and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Chittenden stockholders in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Chittenden stockholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about the executive officers and directors of People’s United in the final prospectus for its conversion filed with the SEC on March 21, 2007. You can find information about Chittenden’s executive officers and directors in its definitive proxy statement filed with the SEC on March 9, 2007. You can obtain free copies of these documents from People’s United or Chittenden using the contact information above. |

P B C T 4 Transaction Rationale Strategically Compelling • Creates premier regional banking franchise in New England • Combines two high-performing banks with similar balance sheets and businesses • Provides size and scale for future growth Financially Attractive • IRR in excess of People’s United cost of capital (13% IRR) • Significantly accretive to EPS in year 1 • Transaction structure provides People’s United with continued balance sheet and capital flexibility |

P B C T 5 Contiguous or near-contiguous markets Bank-like balance sheet, business model and operating philosophy IRR above People’s United cost of capital Accretive to EPS in year 1 Promises Made… Promises Kept |

P B C T 6 Key Deal Terms Purchase Price per CHZ Share: $37.00 (1) Consideration: 55% cash / 45% stock Pricing Formula: PBCT stock price (1) *1.95*0.45 + $37*0.55 Aggregate Purchase Price: $1.9 billion (2) Premium to Market: 31% (3) Approvals: Regulatory and Chittenden shareholders Termination Fee: $65 million Board Representation: 2 board seats Anticipated Closing: First quarter 2008 Due Diligence: Completed Notes: (1) Purchase price at closing will vary with the movements in PBCT stock price; e.g., if PBCT price at closing is $18.97, the purchase price is $37.00. See Appendix for further detail on pricing mechanics (2) Assumes current shares outstanding of 51 million, including net options (pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07). (3) Based upon June 26, 2007 closing price of CHZ. |

P B C T 7 Pricing Multiples in Line PBCT / CHZ (2) Mean of Comparable Transactions (1) Notes: (1) Comparable transactions include selected bank and thrift transactions with deal value greater than $1 billion, announced after January 1, 2004. Source: SNL and FactSet (2) Financial data as of March 31, 2007; pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07; ROA and ROE not pro forma (3) Based on I/B/E/S mean EPS estimate for Q3’07 ($0.50), Q4’07 ($0.52), Q1’08 ($0.50) and Q2’08 ($0.51). Price / NTM EPS (x) 18.2 18.6 Price / Tangible Book Value (x) 4.3 3.7 Core Deposit Premium (%) 26 31 Price / Book Value (x) 2.2 2.6 ROA (%) 1.26 1.08 ROE (%) 12.2 12.0 Financial Performance (3) CHZ Seller Average |

P B C T 8 Overview of Chittenden • Multi-bank holding company headquartered in Burlington, VT • 141 branches in VT, NH, MA, ME and CT through six bank subsidiaries (1) • Assets of $7.6 billion; deposits of $6.2 billion (1) • Three primary business lines: Commercial Banking, Community Banking, Wealth Management – Commercial loans represent 70% of total loans (1) – Core deposits comprise 80% of total funding (1) – $2.4 billion in assets under full discretionary management (1) • Excellent credit quality with net charge-offs averaging 0.14% over the last 5 years Note: (1) Pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 |

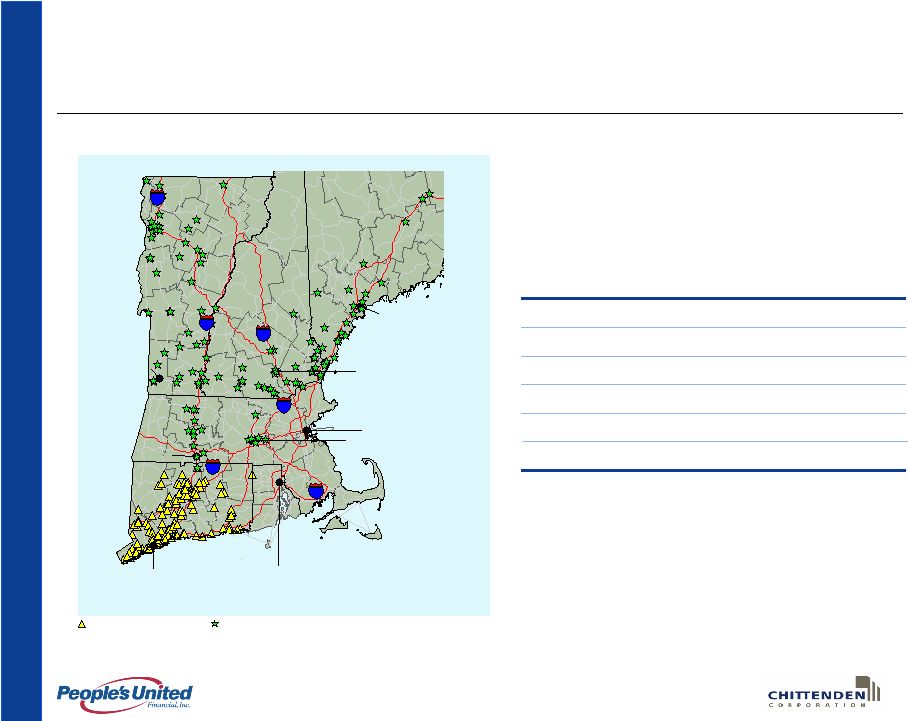

P B C T 9 Expanding Outside CT Note: (1) Pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 • Diversified footprint with 300+ branches and $16 billion in deposits across six states • Considerable scarcity value as only major independent bank with presence across Northeast PBCT (160 Branches) CHZ (141 Branches) NH (1) MA VT CT ME (1) % of Deposits 8 7 18 62 5 Branches 39 20 51 160 30 NY - 1 CT MA RI VT Bridgeport Providence Springfield Worcester Boston Manchester Bennington Burlington Portland NH 89 91 93 195 495 84 |

P B C T 10 Entry into Attractive New Markets 3.5 2.6 PBCT CHZ Projected Population Growth (%) (1) Market CHZ Deposits (2) ($Bn) Total Population Businesses Median Age Vermont 2.9 620,000 30,000 34 Greater Portland 0.4 470,000 20,000 35 Southern NH / Seacoast 1.4 1,000,000+ 40,000 37 Greater Worcester 0.5 777,000 25,000 36 Greater Springfield 0.6 850,000 23,000 36 Note: (1) 2006 – 2011 projected change weighted by MSA deposits; pro forma for Merrill Merchants Bankshares and Community Bank & Trust Company transactions (2) Pro forma Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 Greater Bangor 0.4 147,000 6,000 37 |

P B C T 11 Compatible Operating Models • Low cost, stable core deposit funding • Emphasis on relationship-driven commercial lending • Strong liquidity position – minimal wholesale leverage • Disciplined loan and deposit pricing • Conservative underwriting standards • Focus on customer experience and convenience • Local bank of choice |

P B C T 12 Low Execution Risk • Multi-bank operating structure to remain in place • Conservative cost savings assumptions • Revenue enhancements identified but not assumed in financial analysis • Experienced combined senior management team • Comprehensive due diligence performed • Compatible cultures and similar approach to business |

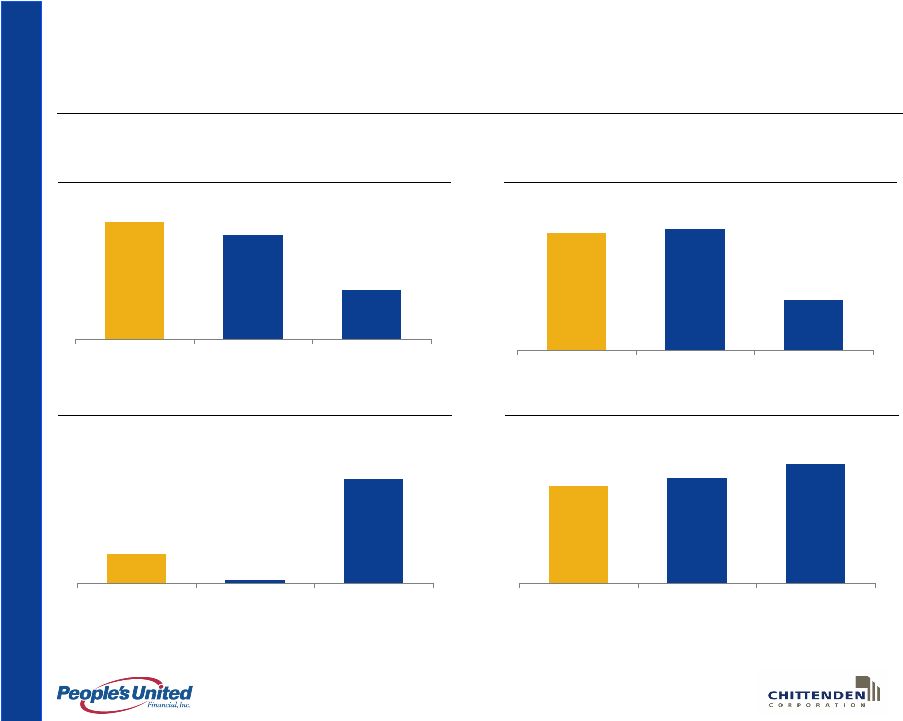

P B C T 13 Superior Profitability and Balance Sheet (1) 3.94 3.44 4.06 CHZ PBCT Peers (2) Notes: (1) At or for the quarter ended March 31, 2007; PBCT profitability ratios not pro forma for second step conversion (2) See Appendix for Peers; Peer data based on SNL Securities 0.6 19.2 5.3 CHZ PBCT Peers Net Interest Margin (%) Borrowings / Assets (%) (2) 93.0 106.0 86.0 CHZ PBCT Peers Loans / Deposits (%) (2) 1.27 1.11 1.26 CHZ PBCT Peers Return on Assets (%) (2) |

P B C T 14 Low Cost Funding Sources Noninterest-Bearing Deposits Borrowings Interest-Bearing Deposits Cost of Funds Chittenden 16 6 78 2.60 People’s United 23 1 76 2.38 Peers (2) 11 24 62 3.32 As a % of Total Funding (1) Advantage Over Peers 94bp – 72bp Notes: (1) Based on average balances for the quarter ended March 31, 2007; total funding defined as total deposits plus borrowings (2) See Appendix for Peers; Peer data based on SNL Securities |

P B C T 15 Conservative Financial Assumptions • 55% cash / 45% stock consideration • Net income estimates based on I/B/E/S mean EPS • $38MM pre-tax cost-savings (approximately 18% of CHZ noninterest expense); 50% realized in 2008, 100% thereafter • After-tax restructuring charge of $38MM • Pre-tax cost of cash of 5.25% • Core Deposit Intangibles at 2.75% of deposits amortized over 10 years, sum-of-the-years-digits • Chittenden pro forma for Merrill Merchants Bankshares and the pending acquisition of Community Bank & Trust Company |

P B C T 16 Illustrative Financial Impact – Significant Accretion Acquisition Adjustments (After-Tax) Add-back of CHZ Existing Intangible Amortization PBCT Estimated EPS (Based on I/B/E/S) (1) CHZ Estimated EPS (Based on I/B/E/S) (2) PBCT Net Income CHZ Net Income Combined Net Income Cost Savings (18% of CHZ NIE) – 100% Phase-in Illustrative Financing Cost (5.25% Pre-Tax Cost of Cash) CDI (2.75% of Deposits Sum-of-the-Years-Digits over 10 Years) Pro Forma Net Income Pro Forma Shares Pro Forma EPS ($) EPS Accretion / (Dilution) to I/B/E/S Estimate (%) 2007E with 100% Cost Saves (Illustrative) 0.70 1.92 204 96 300 25 (36) (20) 271 334 0.81 15.7 ($MM, Except per Share Amounts) 3 Notes: (1) Excludes impact of funding charitable foundation (2) Adjusted to exclude impact of investment portfolio transactions announced on 5/16/07 |

P B C T 17 IRR Exceeds Cost of Capital IRR (%) Total Flows Terminal Value – Synergies (4) Terminal Value – Company (4) A/T Synergies Dividends (3) A/T Restructuring Charge Aggregate Price (1) 2,740 454 2,139 30 117 139 29 110 130 28 102 122 27 96 102 13 89 13 (1,884) 30 (38) (1,875) 2012 2011 2010 2009 2008 2007 Projections Notes: (1) Assumes purchase price of $36.77 per share based on closing price of PBCT as of June 26, 2007 (2) Assumes I/B/E/S mean EPS of $2.11 in 2008 grown at 8% thereafter (3) Assumes target tangible common equity ratio of 6.0% (4) Assumes terminal multiple of 14.5x estimated 2013 earnings adjusted for incremental opportunity cost of additional dividends Net Income (2) 144 133 123 114 106 |

P B C T 18 Conclusion: A Compelling Transaction Expanding into New Markets Meets All Financial and Strategic Criteria Low Risk Execution • Diversifies franchise outside of Connecticut • Preserves strategic value – unique Northeast footprint • Platform for additional de novo and acquisition-driven growth • Combines two high performing, commercial-oriented banks • Contiguous and near-contiguous markets • IRR in excess of cost of capital • Accretive to EPS in year 1 • Track record of disciplined execution and superior operating performance at both banks • Chittenden multi-bank operating structure to continue • Minimal employee/customer disruption – no planned branch closures • Conservative cost savings assumptions |

P B C T 19 Appendix |

P B C T 20 Commercial Oriented Loan Mix 13 28 27 32 (%) 1,947 4,133 4,028 4,740 ($MM) 14 20 26 40 (%) 1,285 1,822 2,440 3,764 ($MM) 12 42 29 18 (%) 662 2,311 1,588 976 ($MM) 14,847 9,310 5,537 Total Consumer Commercial Real Estate Commercial Residential Mortgage Loan Type (1) Combined PBCT CHZ (2) Notes: (1) At March 31, 2007. (2) Pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 |

P B C T 21 Strong Core Deposit Base 4 35 21 16,191 643 5,608 3,326 6 37 23 9,968 643 3,695 2,333 – 31 16 6,223 – 1,913 993 Total Deposits Escrow Funds Time 41 6,616 33 3,298 53 3,318 Savings, Interest-Bearing Checking and Money Market Non-Interest-Bearing (%) ($MM) (%) ($MM) (%) ($MM) Deposit Type (1) Combined PBCT CHZ (2) Notes: (1) At March 31, 2007. (2) Pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 |

P B C T 22 Conservative Credit Culture Notes: (1) At March 31, 2007; not pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 (2) See Appendix for Peers; Peer data based on SNL Securities. Reserves / Loans (%) Reserves / NPAs + 90s (%) NCOs / Avg. Loans (%) NPAs / Assets (%) CHZ 1.34 235 0.08 0.36 PBCT 0.80 384 0.01 0.17 Peers (2) 1.00 194 0.14 0.32 Metric (1) |

P B C T 23 Pro Forma Balance Sheet Equity / Assets Borrowings / Assets Securities / Assets Loans / Deposits Key Ratios Total Equity Shareholders’ Equity Total Liabilities Other Liabilities Borrowings Deposits Liabilities Total Assets Other Assets Intangibles Loans Securities and S-T Investments Assets ($MM) 23.3 2 14 92 5,172 17,051 341 520 16,191 22,223 1,302 1,646 14,847 4,429 PBCT Pro Forma 10.9 16 89 827 6,748 78 447 6,223 7,575 418 395 5,537 1,225 CHZ Standalone (3) 29.8 21 93 4,355 10,243 203 73 9,968 14,598 922 105 9,310 4,262 PBCT Post-Conversion 11.7 1 1 93 1,359 10,243 203 73 9,968 11,602 902 105 9,310 1,286 PBCT 3/31/07 Tang. Com. Eq. / Tang. Assets 17.1 6.0 29.3 10.9 6 1 Adjustments 2,996 (2) 2,976 20 (1) Notes: (1) Deferred tax benefit related to contribution to charitable foundation (2) Net of adjustments related to ESOP, RRP, MHC capital contribution and charitable foundation. RRP must be approved by shareholders (3) Pro forma for Merrill Merchants Bankshares which closed on 5/31/07 and the pending acquisition of Community Bank & Trust Company announced on 6/4/07 |

P B C T 24 Exchange Ratio Illustration 24.00 23.00 22.00 21.00 20.00 18.71 19.00 18.00 17.00 16.00 Hypothetical PBCT Stock Price (1) 0.49 0.50 0.51 0.52 0.54 0.55 0.55 0.56 0.58 0.59 Approximate Percent of Primary Shares Receiving Cash 0.51 0.50 0.49 0.48 0.46 0.45 0.45 0.44 0.42 0.41 Approximate Percent of Primary Shares Receiving Stock 41.41 40.53 39.66 38.78 37.90 36.77 37.02 36.15 35.27 34.39 Value of Consideration per CHZ Share (2) 1.725 1.762 1.803 1.847 1.895 1.965 1.949 2.008 2.075 2.149 Implied Exchange Ratio for CHZ Holders Electing Stock at Closing % Cash % Stock Purchase Price per Share Current PBCT Price Pricing Formula = $37*0.55 + 0.45*1.95*PBCT average stock price 5 days prior to Closing Date Notes: (1) Based on the average of PBCT closing share price for the five day period prior to the effective time. (2) See Pricing Formula above. 55.0 45.0 37.00 18.71 |

P B C T 25 Peer Group Composition • Peer group includes banks and thrifts with market values from $2 – 11Bn in the Northeast, Mid-Atlantic and Midwest regions (1) • Peer group members: – Sovereign Bancorp (Thrift) – Comerica (Bank) – Hudson City (Thrift) – Commerce Bancorp (Bank) – Huntington (Bank) – New York Community (Thrift) – Associated Banc-Corp (Bank) – TCF Financial (Bank) – Commerce Bancshares (MO) (Bank) – Valley National (Bank) – Wilmington Trust (Bank) – Astoria (Thrift) – Fulton Financial (Bank) – Webster Financial (Bank) Note: (1) Excludes Sky Financial and Investors Financial Services given pending ownership changes; also excludes MHCs |