- PBCT Dashboard

- Financials

- Filings

- Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

People's United Financial (PBCT) 425Business combination disclosure

Filed: 23 Nov 09, 12:00am

Acquisition of Financial Federal Corporation November 23, 2009 Exhibit 99.2 |

Certain comments made in the course of this presentation by People's United Financial are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and this statement is included for purposes of complying with these safe harbor provisions. These include all statements about People's United Financial's operating results or financial position for periods ending or on dates occurring after September 30, 2009 and usually use words such as "expect", "anticipate", "believe", and similar expressions. These comments represent management's current beliefs, based upon information available to it at the time the statements are made, with regard to the matters addressed. These forward-looking statements are based on current plans and expectations, which are subject to a number of risk factors and uncertainties that could cause future results to differ materially from historical performance or future expectations. These differences may be the result of various factors, including, among others: (1) failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; (2) failure of the shareholders of Financial Federal Corporation to approve the merger agreement; (3) disruptions to the parties’ businesses as a result of the announcement and pendency of the merger; (4) costs or difficulties related to the integration of the businesses following the merger; (5) changes in general, national or regional economic conditions; (6) the risk that the anticipated benefits, cost savings and any other savings from the transaction may not be fully realized or may take longer than expected to realize; (7) changes in loan default and charge-off rates; (8) reductions in deposit levels necessitating increased borrowings to fund loans and investments; (9) changes in interest rates or credit availability; (10) changes in levels of income and expense in noninterest income and expense related activities; and (11) competition and its effect on pricing, spending, third-party relationships and revenues. For additional factors that may affect future results, please see People’s United’s and Financial Federal Corporation’s filings with the Securities and Exchange Commission, including People’s United’s Annual Report on Form 10-K for the year ended December 31, 2008 and Financial Federal Corporation’s Annual Report on Form 10-K for the year ended July 31, 2009. People’s United and Financial Federal Corporation undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or other changes. Forward Looking Statements |

Transaction Summary $11.27 per FIF share Cash Portion Paul Sinsheimer to continue running business Employment agreements in place with key personnel Management Completed Due Diligence First Quarter 2010 Anticipated Closing $26 Million Termination Fee FIF shareholders Approvals $738 million (1) Aggregate Purchase Price Fixed at 1.0 PBCT share per FIF share Exchange Ratio on Stock Portion ~ 60% Stock / ~ 40% Cash Consideration $27.74 (1) (1.0 PBCT share plus $11.27 in cash) Purchase Price per FIF Share 3 (1) Based on a PBCT closing stock price of $16.47 on November 20, 2009 |

Transaction Rationale Strategically Compelling Combines People’s United significant excess liquidity and low cost funding with a premier asset generation platform Significantly expands highly profitable equipment finance business FIF’s platform provides leverage in economic recovery Preserves future acquisition flexibility Retention of key management Conservative credit culture consistent with People’s United underwriting philosophy Financially Compelling IRR greater than 20% Significantly accretive to operating earnings: 25% in 2010 based on consensus estimates Acquisition preserves industry-leading tangible common equity ratio 4 |

Financial Federal Overview Leading Equipment Finance Company Lending to Middle-Market Businesses Across U.S. $1.5 billion in assets with ~200 employees Serves 5,000 customers across 49 states Secured lender 91% of receivables are loans No residual risk Customers are primarily end users, dealers and manufacturers Compete on service, not rate Senior management team with over 30+ years experience 20+ years of consistent profitable financial performance 44% 7% 13% 36% 5 Construction Transportation Refuse Other Focus on Construction, Road Transportation and Refuse Industries Geographic Diversification Southwest: 30% Southeast: 25% Northeast: 19% Central: 13% West: 13% |

Asset Generation Things FIF Does… Secured lending Underwrite all transactions Hold receivables to maturity Focus on middle-market Sell service over rate Tailor products to customer needs Originate loans and finance leases Short to mid-term financings Fixed and floating rate financings Things FIF Does Not… Offer consumer lending Offer unsecured lending Finance large ticket or technology Originate foreign receivables Buy broker paper Computer credit score Outsource servicing Take residual risk 6 Conservative credit culture consistent with People’s United underwriting philosophy |

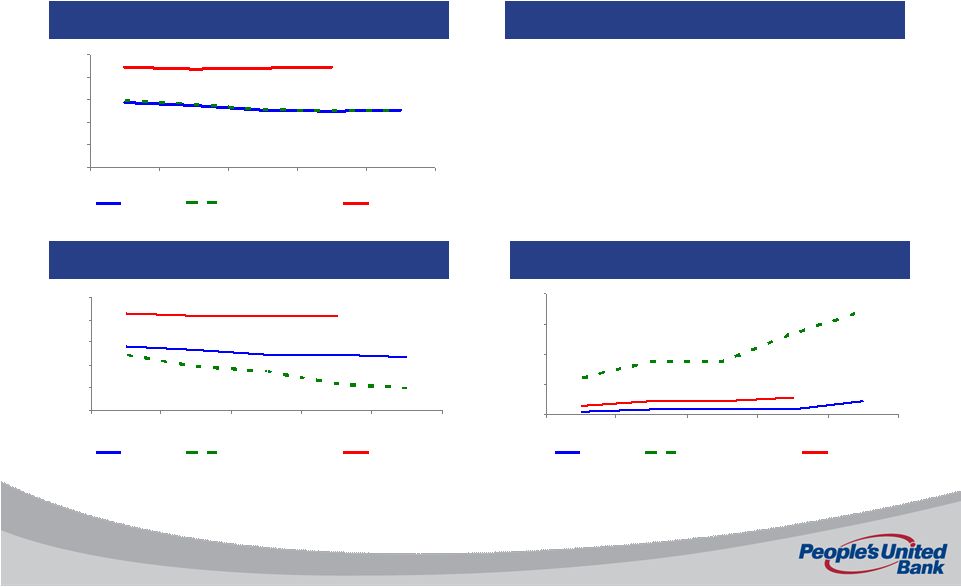

Strong Risk-Adjusted Returns Yields on Loans (%) Yield on Loans Less NCOs (%) Commentary • FIF’s portfolio earns significantly higher yields • Demonstrates ability to compete on service rather than rate • Combined balance sheet will improve net interest margin (~35bp improvement) • Strong risk-adjusted returns demonstrates FIF has not sacrificed asset quality to generate high loan yields 0.00 2.00 4.00 6.00 8.00 10.00 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 0.00 2.00 4.00 6.00 8.00 10.00 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 (1) Peer group consists of BKX Index excluding trust banks 0.00 1.00 2.00 3.00 4.00 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 NCOs / Avg. Loans (%) PBCT Peer Group Mean FIF PBCT Peer Group Mean FIF PBCT Peer Group Mean FIF 7 (1) (1) (1) |

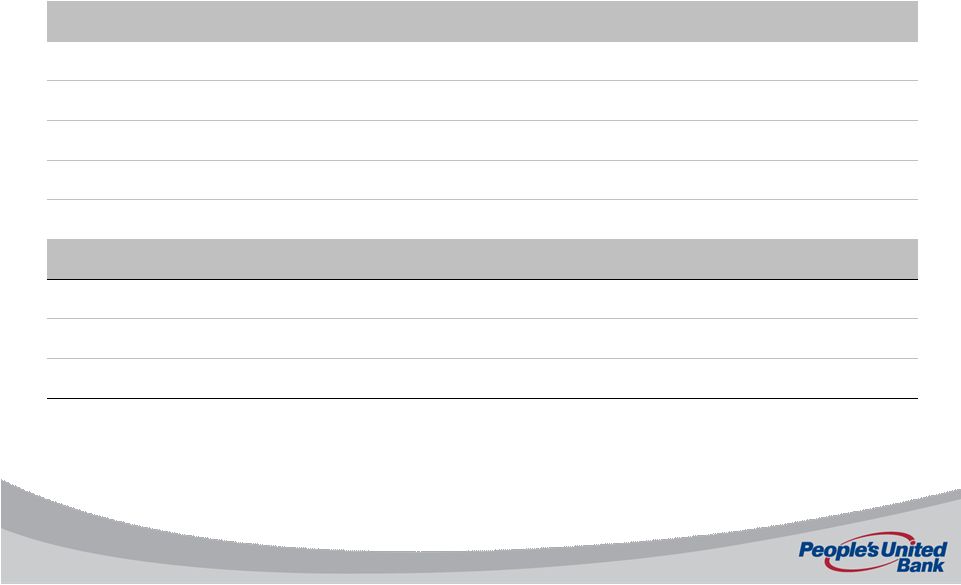

Significantly Accretive to Earnings EPS Accretion / (Dilution) $MM Pro Forma Operating Earnings Adjustments (1) 25% Operating EPS accretion $0.39 PBCT Wall Street EPS $0.49 Pro forma operating EPS 178 Pro forma net income 9 Net benefit of repaying borrowings and opportunity cost of cash (2) 0 Cost savings 37 FIF 2010 standalone net income (Wall Street consensus) 132 PBCT 2010 standalone net income (Wall Street consensus) (1) Pro forma operating earnings adjustments assume full year impact. Excludes estimated one-time pre-tax expenses of ~$55 million, which includes prepayment penalty to repay borrowings (2) 100% of FIF’s borrowings repaid at a positive pre-tax spread of ~1.8% 8 |

Maintaining Industry Leading Capital Ratios $10.19 $17.04 $10.71 Tangible book value per share 5.5 0.4 5.1 Common equity 18.6% 0.6 15.1 20.8 1.1 1.5 0.2 14.3 4.0 PBCT 9/30/09 29.2% 1.1 - 1.5 - - - 1.5 - FIF 7/31/09 21.3 Total assets Pro Forma (1) Balance Sheet ($Bn) 19.0% Tangible common / tangible assets 0.7 Other liabilities 15.1 Deposits 1.2 Other assets 1.8 Intangibles 0.2 Loan loss reserve 15.8 Loans 2.7 Cash and securities 9 (1) Pro forma for $80 million pre-tax loan mark ($54 million net of FIF loan loss reserves) and repayment of FIF’s borrowings Accretive to Tangible Common Equity Ratio |

Conclusion: A Compelling Transaction Expansion Meets All Financial and Strategic Criteria Platform for growth; leverage in economic recovery Diversifies franchise Preserves strategic flexibility Combines our significant excess liquidity and low cost funding with a premier asset generation platform IRR greater than 20% Maintains strong tangible common equity ratio Significantly accretive to operating earnings in 2010 Retention of key management Minimal employee / customer disruption No cost savings assumed Low Risk Execution |

Information about the Transaction In connection with the proposed merger, People’s United will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a proxy statement of Financial Federal that also constitutes a prospectus of People’s United. Financial Federal will mail the proxy statement/prospectus to its stockholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important information. You may obtain a free copy of the proxy statement/prospectus (when available) and other related documents filed by People’s United and Financial Federal with the SEC at the SEC’s website at www.sec.gov. The proxy statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing People’s United website at www.peoples.com under the tab “Investor Relations” and then under the heading “Financial Information” or by accessing Financial Federal’s website at www.financialfederal.com under the tab “Investor Relations – SEC Filings”. People’s United, Financial Federal and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Financial Federal stockholders in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Financial Federal stockholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about the executive officers and directors of People’s United in its Annual Report on Form 10-K for the year ended December 31, 2008 and in its definitive proxy statement filed with the SEC on March 25, 2009. You can find information about Financial Federal’s executive officers and directors in its Annual Report on Form 10-K for the year ended July 31, 2009 and in its definitive proxy statement filed with the SEC on November 5, 2009. You can obtain free copies of these documents from People’s United or Financial Federal using the contact information above. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. |

For more information, investors may contact: Jared Shaw jared.shaw@peoples.com (203) 338-4130 |