EXHIBIT 99.1

Presentation Materials dated February 2, 2010

Morgan Stanley US Financial Services Conference 2010 February 2, 2010 |

1 Forward Looking Statement Certain comments made in the course of this presentation by People's United Financial are forward- looking in nature. These include all statements about People's United Financial's operating results or financial position for periods ending or on dates occurring after December 31, 2009 and usually use words such as "expect", "anticipate", "believe", and similar expressions. These comments represent management's current beliefs, based upon information available to it at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United Financial's actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United Financial include, but are not limited to: (1) changes in general, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) residential mortgage and secondary market activity; (7) changes in accounting and regulatory guidance applicable to banks; (8) price levels and conditions in the public securities markets generally; (9) competition and its effect on pricing, spending, third-party relationships and revenues; and (10) the successful integration of acquired companies. People's United Financial does not undertake any obligation to update or revise any forward- looking statements, whether as a result of new information, future events or otherwise. |

2 People’s United Financial, Inc. NASDAQ: PBCT Market Capitalization (1/25/10): $ 5.7 billion, #15 Assets: $ 21.3 billion, #25 Loans: $ 14.1 billion, #25 Deposits: $ 15.4 billion, #22 Branches: ~ 300 ATMs: > 440 Employees (FTE): ~ 4,300 Founded: 1842 Snapshot, as of December 31, 2009 Corporate Overview |

3 People’s United Footprint Diversified footprint with approx. 300 branches and over $15 billion in deposits across six states Considerable scarcity value as the largest independent bank headquartered in New England VT NH Fairfield Ct. CT MA % of Deposits 17 9 35 62 6 Branches 46 31 63 160 19 ME 5 33 Market Share #1 #4 #1 #3 #24 #7 NY 1 4 N/A |

4 Investment Thesis Strong Balance Sheet with Significant Capital Surplus Tangible Capital Ratio of 18.2%, improving to 18.6% pro forma for Financial Federal No Wholesale Borrowings Exceptional credit quality Low level of non-performing assets of 1.44% Combined net charge-off ratio of 0.38% annualized for 4Q, and 0.29% for 2009 full year Significant and low cost deposit market share Cost of deposits continues to decline, at 0.94% for 4Q09 Deposits entirely fund loans Opportunities Abound! Actively evaluating acquisitions Driving organic growth in non-commodity loan products Positioned to leverage earnings growth via our asset sensitive balance sheet We are excited about growth and confident in our position |

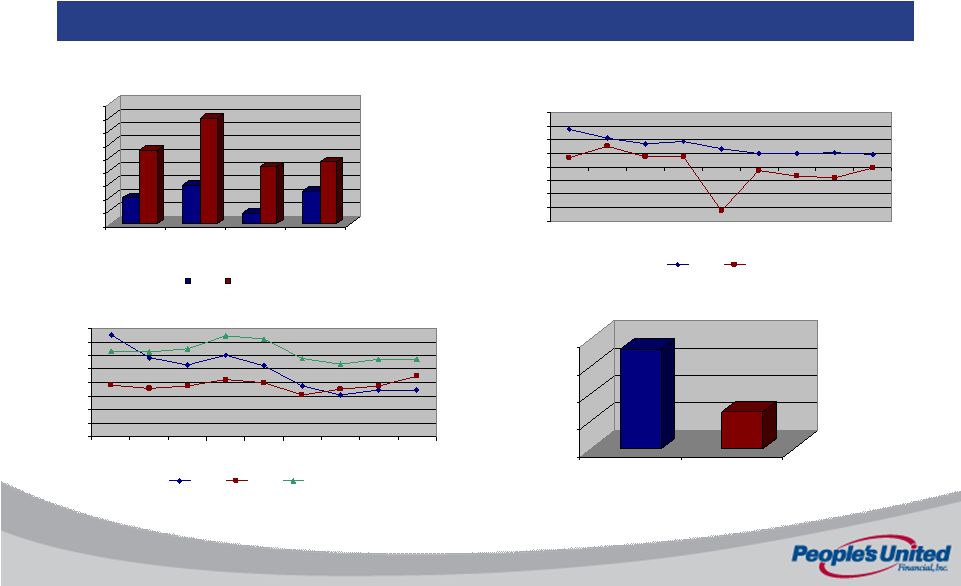

5 18.2% 6.9% 0.00% 5.00% 10.00% 15.00% 20.00% PBCT Peers 2.50 2.70 2.90 3.10 3.30 3.50 3.70 3.90 4.10 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 PBCT Peers PBCT Core Peer Comparison As of December 31, 2009 On all important measures, People’s United remains stronger than peers Net Interest Margin Return on Average Assets Tang. Equity / Tang. Assets Asset Quality -2.00 -1.50 -1.00 -0.50 0.00 0.50 1.00 1.50 2.00 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 PBCT Peers 0.97% 2.77% 1.44% 3.94% 0.38% 2.13% 1.21% 2.32% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% NPAs / Assets NPAs / Loans + REO NCOs / Loans Allowance / Loans PBCT Peers |

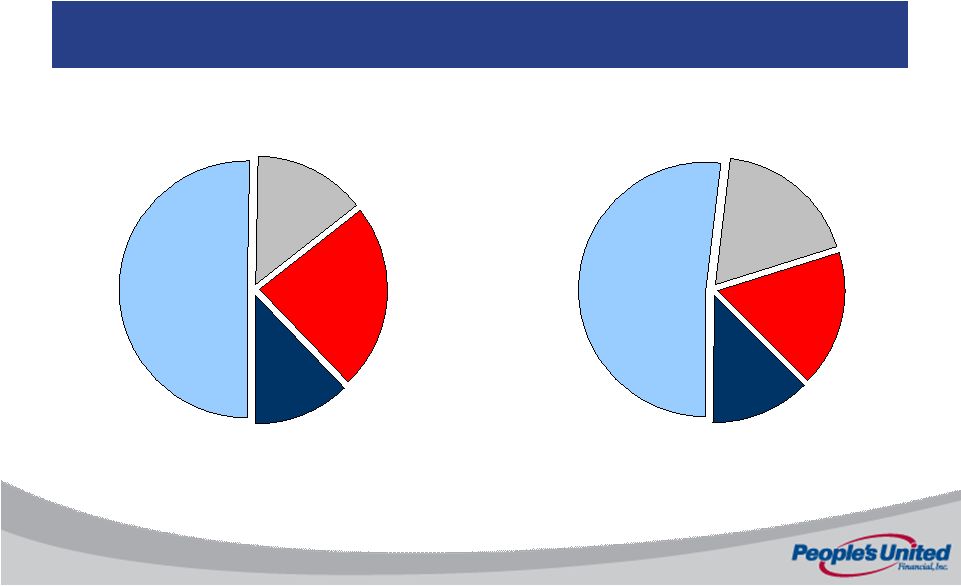

6 Average Earnings Asset Mix 4Q 08 Home Equity 13% Securities & Investments 17% Commercial Banking 52% Residential Mortgage 18% 4Q 09 Home Equity 12% Securities & Investments 23% Commercial Banking 50% Residential Mortgage 14% We remain focused on growing core commercial and consumer lending, while excess capital is safely held in liquid investments $9,363 $2,609 $4,351 $2,259 $9,003 $3,190 $3,003 $2,178 |

7 Average Funding Mix Our assets are funded nearly entirely with deposits and equity, which reinforces our fortress balance sheet. 4Q 08 Interest- bearing Deposits 56% Demand Deposits 16% Stockholders’ Equity 26% 4Q 09 Interest- bearing Deposits 58% Stockholders’ Equity 25% Demand Deposits 16% Sub-debt / Other 2% Sub-debt / Other 2% Cost of Deposits = 0.94% Cost of Deposits = 1.55% |

8 Commercial Banking Average core Commercial lending increased 2% annualized in 4Q09 Loan pricing has improved as competitors pull back Fee income growth initiatives are underway Experienced management team provides local knowledge and decision making, successfully attracting talent and customers from competitors People’s United remains focused on growing core middle market commercial loans and deposits |

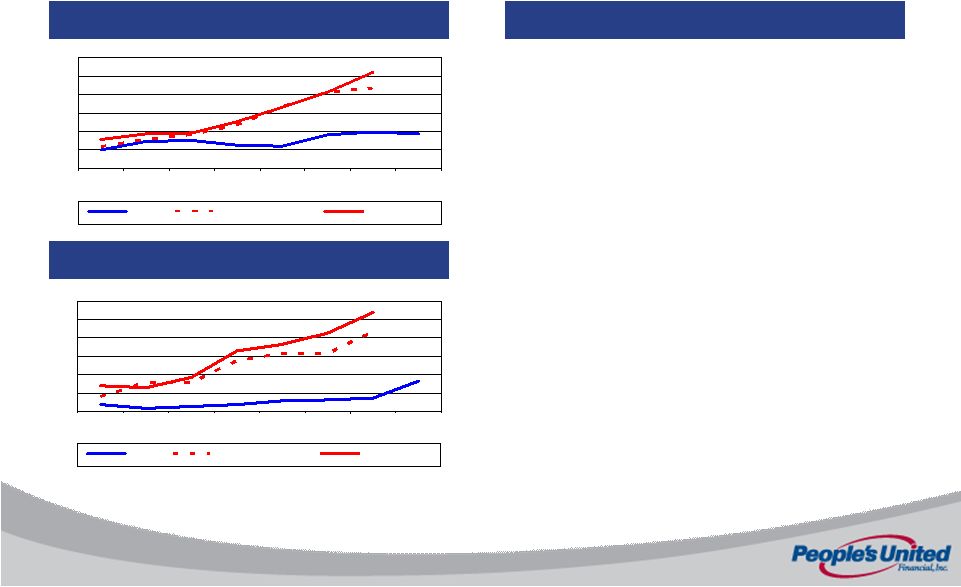

9 Commercial & Industrial Loans Historical Credit Performance NPLs (%) NCOs (%) Commentary • Portfolio remains well diversified • Continue to see growth in core middle market segment • Equipment Finance arm focused on mission critical equipment with good resale values • Core portfolio is all self-originated, with rigorous underwriting and ongoing credit administration 0.94 0.99 2.16 2.59 0.00 0.50 1.00 1.50 2.00 2.50 3.00 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks 0.82 0.35 2.16 2.68 0.00 0.50 1.00 1.50 2.00 2.50 3.00 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks |

10 Commercial Real Estate Loans Historical Credit Performance Commentary • CRE portfolio totals $5.4BN, 95% was originated by us, $270MM represents shared national credits, which we fully underwrote • All CRE loans are underwritten on a cash flow basis • Portfolio is well diversified • Construction portfolio down to $819MM down over 11% from $925MM at 12/31/08 • Florida construction represents less than $17MM of loans NPLs (%) NCOs (%) 1.34 1.49 3.26 4.05 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks 0.12 0.58 0.55 1.14 0.00 0.25 0.50 0.75 1.00 1.25 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks |

11 Retail & Small Business |

12 Retail & Small Business Relationship and service focus translates to low deposit rates Highly developed model in southern New England Core deposit gathering Multiple products and cross selling – 4.6 products per customer #1 deposit market share in Fairfield County Westchester, NY expansion over the past 2 years now represents 5 branches and over $270 million of deposits Retail-focused branch experience rolling out in northern New England Increase penetration from 3.0 products per customer Deposit pricing discipline and high-quality consumer lending expansion will allow a continued focus on margin management |

13 Residential Loans Historical Credit Performance NPLs (%) NCOs (%) Commentary • Low LTV at origination • Current FICO of 724 • Stopped portfolioing residential mortgages in 2006 • Of the $52.7MM in NPLs, approximately two-thirds have current LTV of <90% • Strength of original underwriting should continue to minimize loss content in NPAs 2.07 1.88 2.43 3.11 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks 0.18 0.37 1.39 1.72 0.00 0.50 1.00 1.50 2.00 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks |

14 Home Equity Historical Credit Performance Commentary NPLs (%) NCOs (%) 0.37 0.16 1.89 2.26 0.00 0.50 1.00 1.50 2.00 2.50 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks • As of Q4 2009, Home Equity loans stood at $2.0BN, flat from Q3 2009 levels • Q4 2009 utilization rate was 48.2%, compared to Q3 2009 rate of 47.5% • Asset quality in terms of both NPAs and NCOs remains low • While volume has slowed, Home Equity remains an important part of our retail relationships 0.29 0.28 0.99 1.24 0.00 0.50 1.00 1.50 2.00 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 PBCT Peer Group Mean Top 50 Banks |

15 Wealth Management Offer a full array of services to businesses and individuals Expand brokerage and asset management across the People's United footprint Continue to grow individual and business relationships through private banking, brokerage and retirement planning services Focus on offering insurance services to commercial customers Assets managed and administered totaled $16.1 billion Wealth Management offers significant growth potential as services are expanded across the franchise |

16 Net Interest Margin The core margin remained stable in 4Q as net repricing benefits of both assets and liabilities were offset by continued deposit growth . 4Q08 1Q09 2Q09 3Q09 4Q09 3.94% 3.66% 3.58% 3.65% 3.65% 3.55% 3.25% 3.12% 3.19% 3.19% 1.25% 0.78% 0.25% 0.25% 0.25% |

17 We expect that interest rates will not rise in 2010. However, they could, and we do expect rates to rise in 2011 and beyond Given short term interest rates are 0-25bps, we are not taking asymmetrical risk with our securities book Only $750 million of 15 year agency MBS of a $21BN asset balance sheet is subject to mark-to-market risk which impacts equity For every 100bps increase in the Fed Funds rate, our net interest income will increase by $50MM on an annualized basis Asset Sensitivity Earnings Leveraged to Inevitable Fed Tightening Net Interest Income at Risk Analysis involves PBCT estimates. See notes below. Scenario Lowest of Peers Highest of Peers Peer Average PBCT Pro Forma (includes FIF) Mulitple to Peer Average - Pro Forma PBCT Shock Up 100bps -2.4% 5.0% 1.0% 7.6% 7.3x Shock Up 200bps -4.8% 8.4% 2.3% 17.3% 7.6x Change in Net Interest Income for: Notes: 1 Data as of 9/30/09 10-Q SEC filings. 5 banks included enough data to use directly in the +100bps shock scenario. PBCT interpolated based on data disclosed for 11 other banks. 3 banks within our peer group did not provide enough data to be included in this analysis 2 Data as of 9/30/09 filings 10-Q SEC filings. 4 banks included enough data to use directly in the +200bps shock scenario. PBCT interpolated based on data disclosed for 12 other banks. 3 banks within our peer group did not provide enough data to be included in this analysis |

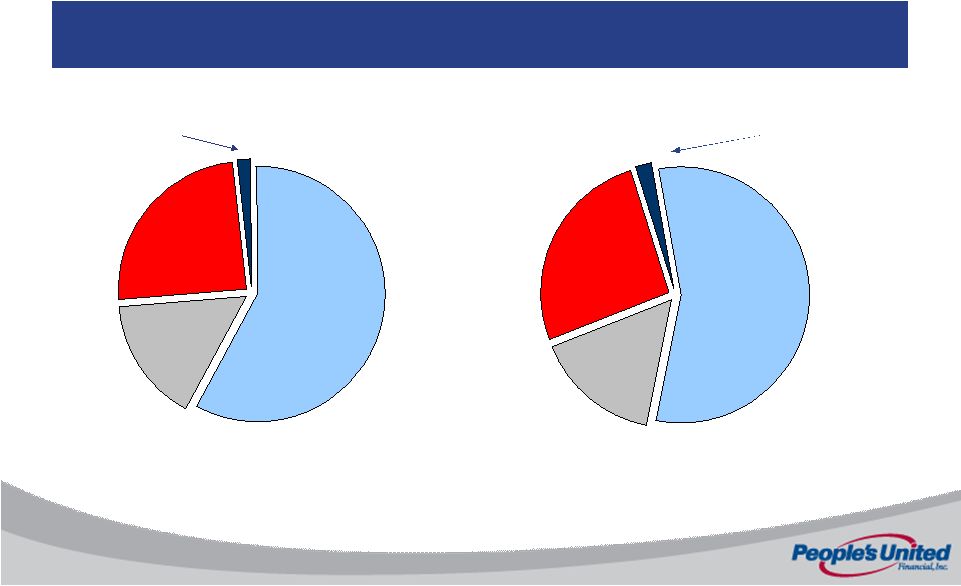

18 Leading Equipment Finance Company Lending to Middle-Market Businesses Across U.S. $1.5 billion in assets with ~200 employees Serves 5,000 customers across 49 states Secured lender 91% of receivables are loans No residual risk Customers are primarily end users, dealers and manufacturers Compete on service, not rate Senior management team with over 30+ years experience 20+ years of consistent profitable financial performance 44% 7% 13% 36% Construction Transportation Refuse Other Focus on Construction, Road Transportation and Refuse Industries Geographic Diversification Southwest: 30% Southeast: 25% Northeast: 19% Central: 13% West: 13% Financial Federal Overview * * As of October 31, 2009 |

19 Strategically Compelling, Not Distracting Combines People’s United significant excess liquidity and low cost funding with a premier asset generation platform Significantly expands highly profitable equipment finance business FIF’s platform provides leverage in economic recovery Retention of key management Conservative credit culture consistent with People’s United underwriting philosophy Limited integration risk will not distract us from continuing to focus on FDIC and whole bank opportunities Financially Compelling IRR greater than 20% Significantly accretive to operating earnings: 25% through the cycle based on consensus estimates Tangible book value dilution payback period conservatively less than 4 years Acquisition preserves industry-leading tangible common equity ratio Financial Federal Acquisition Transaction Rationale |

20 Evolving Acquisition Strategy Our preference remains whole bank transactions: Commercially-oriented franchises with a strong core deposit base Attractive markets of the Northeast United States, including contiguous, in- market and new markets FDIC assisted deals in geographies where we could establish or enhance a strong market share Primary deal hurdles: IRR substantially higher than our cost of capital Significantly enhances our long-term earnings power Attractive upside/downside return profile Our Approach: Patient and Opportunistic |

21 Announced opportunistic acquisition of Financial Federal Look forward to taking additional market share in equipment finance industry Conducted due diligence on several franchises and evaluated many traditional bank opportunities Continue to evaluate alternative and creative strategies to help move the ball along with “open” transactions Actively participating in the FDIC resolution process, and look forward to completing a “closed” FDIC assisted transaction Continue measured de novo expansion into attractive contiguous markets Continue to use our capital and brand to lend to our existing and new customers Capital Deployment Activities |

22 Conclusion Shareholders are protected by continued strength in underwriting and asset quality Significant capital reserves will be used primarily to fund future growth Management remains aligned with shareholders in building long-term value Will continue to maintain focus on driving financial performance People’s United remains committed to continuing to increase shareholder value |

For more information, investors may contact: Jared Shaw jared.shaw@peoples.com (203) 338-4130 |