- PBCT Dashboard

- Financials

- Filings

- Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

People's United Financial (PBCT) 425Business combination disclosure

Filed: 21 Jan 11, 12:00am

EXHIBIT 99.2

Investor Presentation dated January 21, 2011

Fourth Quarter 2010 Earnings Review and Acquisition Announcement - Danvers Bancorp (DNBK) January 21, 2011 |

1 Certain comments made in the course of this presentation by People's United Financial are forward- looking in nature. These include all statements about People's United Financial's operating results or financial position for periods ending or on dates occurring after December 31, 2010 and usually use words such as "expect", "anticipate", "believe", and similar expressions. These comments represent management's current beliefs, based upon information available to it at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United Financial's actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United Financial include, but are not limited to: (1) failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; (2) failure of the shareholders of Danvers Bancorp to approve the merger agreement; (3) failure to obtain governmental approvals for the merger; (4) disruptions to the parties’ businesses as a result of the announcement and pendency of the merger; (5) costs or difficulties related to the integration of the businesses following the merger with Danvers Bancorp and recent acquisitions; (6) changes in general, national or regional economic conditions; (7) the risk that the anticipated benefits, cost savings and any other savings from the transaction may not be fully realized or may take longer than expected to realize (8) changes in loan default and charge-off rates; (9) reductions in deposit levels necessitating increased borrowings to fund loans and investments; (10) changes in interest rates or credit availability; (11) possible changes in regulation resulting from or relating to the recently enacted financial reform legislation; (12) changes in levels of income and expense in noninterest income and expense related activities; (13) competition and its effect on pricing, spending, third-party relationships and revenues. Forward Looking Statement |

2 Agenda Fourth Quarter 2010 Results Integration Update Acquisition of Danvers Bancorp (DNBK) Q&A |

3 Net income of $32.0 million, or $0.09 per share Operating income of $36.7 million, or $0.10 per share, excluding primarily merger-related expenses Net interest margin of 3.85%; up 12 bps from Q3 2010 Net charge-offs to average loans decreased to 0.28% from 0.57% in Q3 2010 NPAs as a percentage of originated loans, REO and repossessed assets fell to 2.07% from 2.18% as of Q3 2010 Organic loan growth of $221MM Fourth Quarter 2010 Results Overview |

4 Smithtown and RiverBank transactions closed Nov. 30, 2010 Boston branches, Prudential Center and Financial District, opened mid- December in 2010 Jeff Tengel became new head of Commercial Banking effective January 1, 2011 following Brian Dreyer’s retirement at the end of 2010 Repurchased $114 million of stock in 4Q10 (8.7 million shares at an average price of $13.08) 2.9 million shares remain under initial share repurchase authorization Board of Directors has authorized an additional 5% share repurchase program, approximately 17.5 million shares Recent Initiatives |

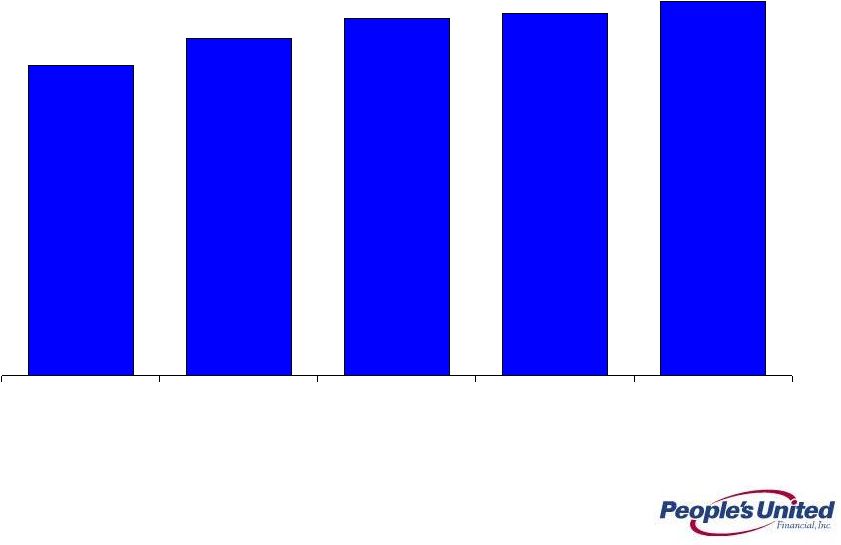

5 Net Interest Margin 5 3.19% 3.47% 3.68% 3.73% 3.85% Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 |

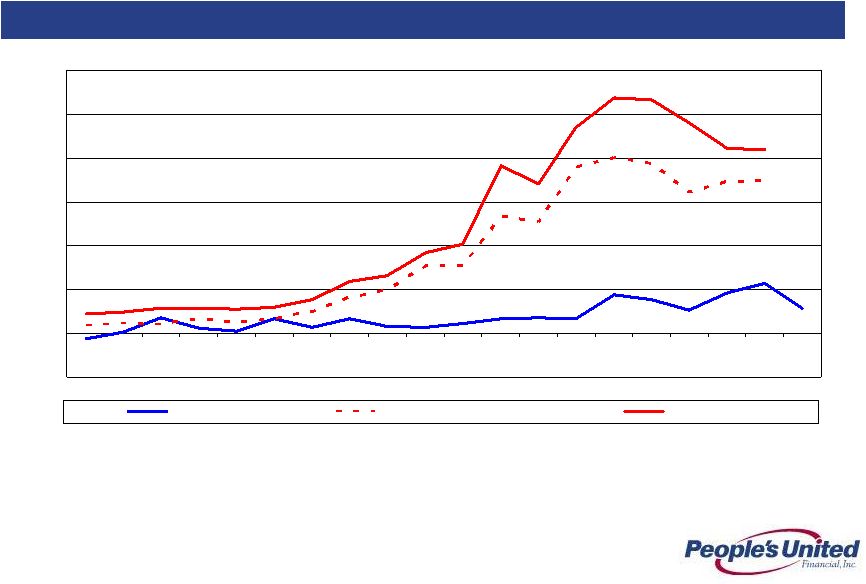

6 2006-2010 0.28 0.57 1.74 2.10 -0.50 0.00 0.50 1.00 1.50 2.00 2.50 3.00 Q1 2006 Q2 2006 Q3 2006 Q4 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 PBCT Peer Group Mean Top 50 Banks Fourth Quarter 2010 Results Net Charge-Offs / Avg. Loans (%) |

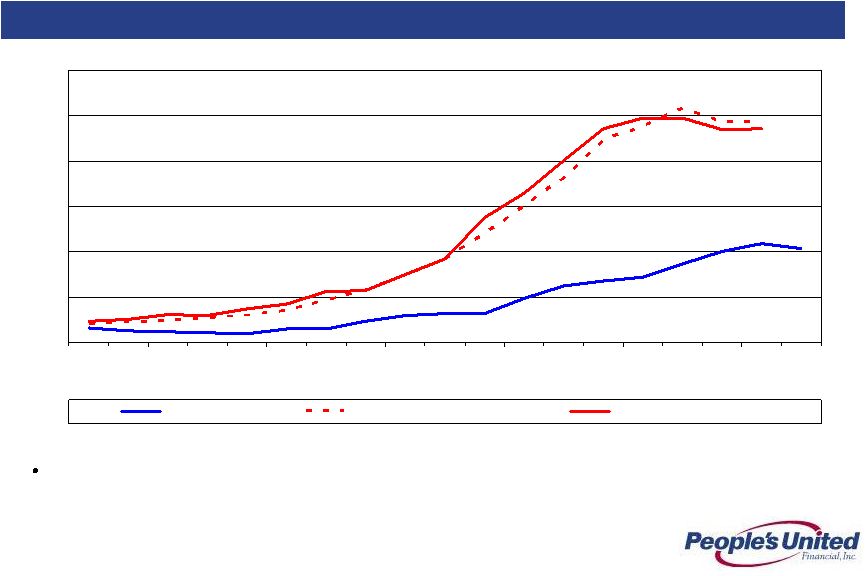

7 2006-2010 2.07 2.18 4.86 4.72 0.00 1.00 2.00 3.00 4.00 5.00 6.00 Q2 2006 Q3 2006 Q4 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 PBCT Peer Group Mean Top 50 Banks by Assets Fourth Quarter 2010 Results NPAs / Loans & REO* (%) Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of our estimate of acquisition-date fair value and/or the existence of an FDIC loss sharing agreement |

8 Loan Growth Organic loan growth resumed with $221MM of growth in Q4 2010 Acquisitions of Smithtown and RiverBank added $2.1BN of loans 8 Total Legacy Commercial real estate 7,306 $ 5,618 $ 1,365 $ 323 $ 5,493 $ 1,813 $ 125 $ Commercial lending 3,096 3,020 40 36 2,922 174 98 PCLC 1,212 1,212 - - 1,185 27 27 PUEF 888 888 - 964 (76) (76) Total Commercial 12,502 10,738 1,405 359 10,564 1,938 174 Residential mortgage 2,838 2,573 141 124 2,474 364 99 Home equity and other loans 2,178 2,125 26 27 2,177 1 (52) Total loans 17,518 $ 15,436 $ 1,572 $ 510 $ 15,215 $ 2,303 221 $ Inc/(Dec) ($'s in millions) Q4 2010 Legacy Smithtown River Q3 2010 |

Integration Update |

10 Focused on Revenue Synergies Throughout the Franchise By Pursuing Best Practices in All Markets Northern New England Retail Banking and Brokerage Enhance our industry leading loyalty by initiating a New Customer Experience program – on-boarding and retention focused Invest in securities and life insurance licensing, product and sales training in retail bank Introduced People’s Securities brokerage model Objective is to increase cross-selling to 4.6 products and services per customer (the current level in Southern NE franchise) from 3.6 products and services (the current level in Northern NE franchise) Upper Middle-Market Commercial Banking Larger corporate lending capabilities >$25MM per loan Insurance brokerage capability Southern New England Build out small business capabilities Market business services: payroll processing, merchant services, business credit card, 401k administration Emphasize private banking and wealth management |

11 Financial Federal Integration Update Financial Federal unit, renamed People’s United Equipment Finance While portfolio loan balances are down, we’re not losing market share as construction market remains depressed Yield and fee income continue to exceed expectations Loss experience has also been better than expected At announcement we had targeted 0% cost savings but through the elimination of headcount and public company expenses we have reduced non-interest expense by 13% The business is well positioned and we are cautiously optimistic about an up-tick in construction activity during the second half of 2011 |

12 Massachusetts Integration Update Butler Bank (Lowell, MA) Retained 93% of deposits since April 2010 closing System conversion scheduled for the first week of February RiverBank (N. Andover, MA) Cost savings of 30% identified at announcement - on track to realize that target Integrated the commercial lending group and actively training branch personnel System conversion scheduled for first week of February De novo branches (Downtown Boston, MA) Early feedback, deposit gathering and lending referral activity has been excellent |

13 Long Island Integration Update Bank of Smithtown (Smithtown, NY) Our brand of banking, with its focus on the customer experience, is being received well on Long Island by customers and employees Initiated de novo C&I effort on Long Island in December Building out Commercial Real Estate Finance (CREF) infrastructure – primary goal is to manage existing portfolio Expanding the workout function System conversion scheduled for June-July time period |

People’s United Financial Announces Acquisition of Danvers Bancorp (DNBK) |

15 Immediately adds desired scale to our existing Boston MSA presence – Pro forma PBCT becomes 7 th largest bank in Massachusetts and Boston MSA – Pro forma PBCT becomes 2 nd largest bank in Essex County, MA Excellent platform for commercial lending growth – Boston is the second largest MSA within our footprint behind New York City MSA – 49% of Danverbanks’ loans are C&l loans – Adds 23 commercial lenders to the 10 we now have based in Boston MSA – Asset-based lending unit can be expanded significantly – Complements our existing Massachusetts and New Hampshire footprint Danvers Bancorp’s CEO, Kevin Bottomley, to join People’s United Board of Directors and act as strategic leader of our Boston growth effort Exceeds People’s United’s financial hurdles – > 15% IRR – Significant operating EPS accretion Transaction Rationale Transaction gives People’s United, New England’s largest independent bank, scale in Boston, New England’s economic center |

16 Solidifying Eastern Massachusetts Footprint Source: SNL Financial *Financials as of 9/30/2010 **Projected change from 2010-2015 Median 2010 HH Income PBCT DNBK Financial Highlights* ($ in millions) DNBK Assets $2,631 Gross Loans 1,745 Deposits 2,040 Branches 28 16.0 16.9 12.4 Projected HHI Growth** $70,905 $70,175 $54,442 $50,000 $57,500 $65,000 $72,500 $80,000 PBCT DNBK Nation |

17 Essex County, MA Massachusetts* Positions People’s United for further growth in Eastern Massachusetts Adds Scale in Targeted Expansion Markets Source: SNL Financial; Deposits data as of 6/30/2010 * Excludes Bank of New York Mellon Deposits Market Branch in Market Share Rank Institution (ST) Count ($M) (%) 1 Bank of America Corp. (NC) 280 44,234 25.4 2 Royal Bank of Scotland Group 257 24,494 14.1 3 Banco Santander SA 230 13,623 7.8 4 Toronto-Dominion Bank 159 8,716 5.0 5 Eastern Bank Corporation (MA) 95 6,162 3.5 6 Independent Bank Corp. (MA) 71 3,702 2.1 Pro Forma 59 3,598 2.1 7 Middlesex Bancorp MHC (MA) 33 3,572 2.1 8 Boston Private Financial (MA) 9 2,375 1.4 9 Berkshire Hills Bancorp Inc. (MA) 37 2,014 1.2 10 Danvers Bancorp Inc. (MA) 28 2,000 1.1 11 Brookline Bancorp Inc. (MA) 26 1,927 1.1 12 Century Bancorp Inc. (MA) 23 1,857 1.1 13 Salem Five Bancorp (MA) 22 1,757 1.0 14 Cambridge Financial Group Inc (MA) 16 1,744 1.0 15 Cape Cod Five Cents Svgs Bk (MA) 15 1,688 1.0 16 People's United Financial Inc. (CT) 31 1,598 0.9 17 Webster Financial Corp. (CT) 24 1,387 0.8 18 First Republic Bank (CA) 2 1,364 0.8 19 Meridian Interstate Bncp (MHC) (MA) 20 1,361 0.8 20 Citigroup Inc. (NY) 31 1,342 0.8 Totals (1-20) 1,409 126,915 72.9 Totals (1-178) 2,214 174,070 100.0 Deposits Market Branch in Market Share Rank Institution (ST) Count ($M) (%) 1 Toronto-Dominion Bank 32 2,034 12.4 Pro Forma 24 2,032 12.3 2 Eastern Bank Corporation (MA) 24 1,674 10.2 3 Salem Five Bancorp (MA) 17 1,573 9.6 4 Banco Santander SA 29 1,573 9.6 5 Danvers Bancorp Inc. (MA) 17 1,539 9.3 6 Bank of America Corp. (NC) 20 1,197 7.3 7 Inst for Svgs in Newburyport (MA) 7 883 5.4 8 Royal Bank of Scotland Group 15 570 3.5 9 People's United Financial Inc. (CT) 7 493 3.0 10 Newburyport Five Cents SB (MA) 7 445 2.7 Totals (1-10) 175 11,981 72.7 Totals (1-41) 258 16,469 100.0 Boston MSA* Deposits Market Branch in Market Share Rank Institution (ST) Count ($M) (%) 1 Bank of America Corp. (NC) 203 40,046 28.9 2 Royal Bank of Scotland Group 214 23,830 17.2 3 Banco Santander SA 165 10,594 7.6 4 Toronto-Dominion Bank 108 6,469 4.7 5 Eastern Bank Corporation (MA) 87 5,878 4.2 6 Middlesex Bancorp MHC (MA) 30 3,479 2.5 Pro Forma 58 3,368 2.4 7 Independent Bank Corp. (MA) 45 2,529 1.8 8 Boston Private Financial (MA) 9 2,375 1.7 9 Danvers Bancorp Inc. (MA) 28 2,000 1.4 10 Brookline Bancorp Inc. (MA) 26 1,927 1.4 15 People's United Financial Inc. (CT) 30 1,368 1.0 Totals (1-10) 915 99,127 71.5 Totals (1-134) 1,512 138,676 100.0 |

18 Completed October 2009 Loans $263M Deposits $415M Danvers Bancorp, Inc. Overview ROAA 0.64 ROAE 5.7 Net Interest Margin 3.49 Efficiency Ratio 71.1 TCE / TA 10.01 NPA / (Loans + OREO) 1.10 LLR / Loans 0.95 LTM NCO / Avg. Loans 0.16 Select Balance Sheet Ratios (%) Profitability (%) Source: SNL Financial Financial data as of 9/30/2010 Headquarters Danvers, MA Established March 1850 Branches 28 Conversion Date 12/13/2007 Overview Recent Acquisition: Beverly National Bank Chairman, President & CEO Kevin T. Bottomley Executive VP & COO James J. McCarthy EVP & Chief Lending Officer John O’Neill Executive VP & CFO L. Mark Panella Executive Management Assets $2,631 Net Loans 1,728 Deposits 2,040 Tangible Common Equity 260 Balance Sheet ($MM) |

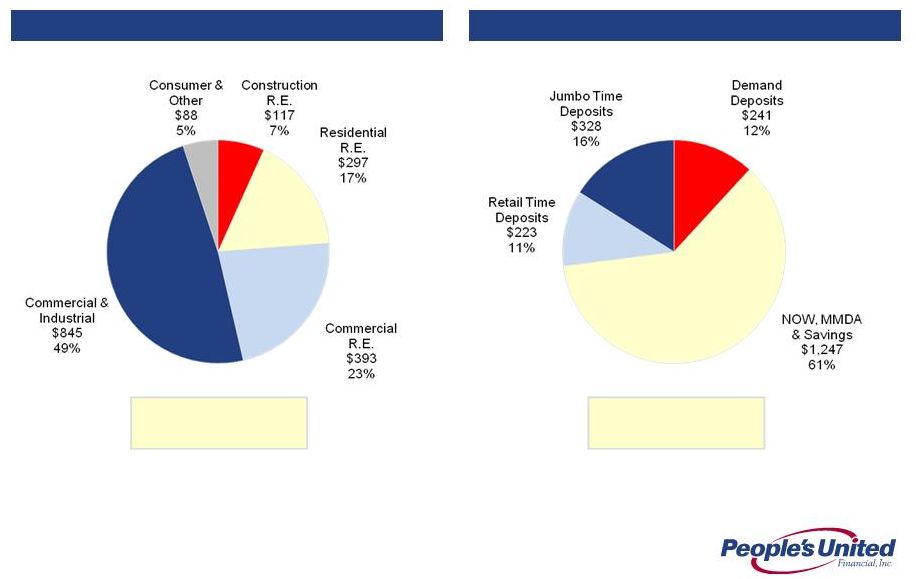

Diversified Loan Portfolio and Attractive Funding Mix Source: Company Financials Financial data as of 9/30/2010 *Excludes loans held for sale ($ in millions) ($ in millions) 19 5.66% $1,741M 1.24% $2,040M Deposits Loans Yield on Loans: Total Loans*: Cost of Deposits: Total Deposits: |

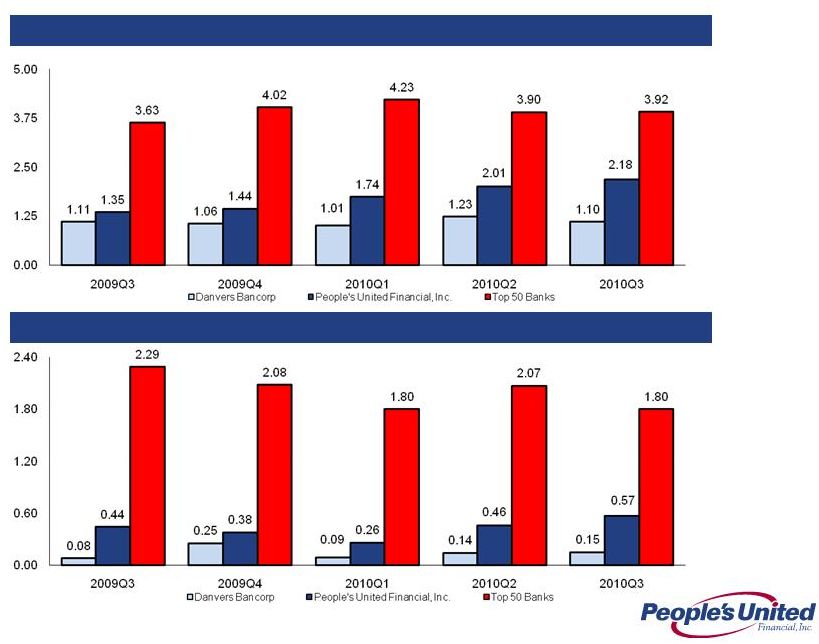

Exceptional Asset Quality 20 NPAs / Loans + OREO (%) NCOs / Average Loans (%) Source: SNL Financial Note: PBCT Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non- performing loans excluded as risk of loss has been considered by virtue of our estimate of acquisition-date fair value and/or the existence of an FDIC loss sharing agreement |

21 Price & Structure • $23.00 • $493MM • 55% stock / 45% cash Summary of Key Terms Price per share: Deal value: Consideration: Pricing Multiples • 38% or ~$20MM after tax (30% excluding ESOP, SERP and restricted stock eliminations) • Identified but not assumed • $44MM after-tax • 1.5% Cost savings: Revenue synergies: Merger-related expenses: Gross Loan mark: Key Assumptions Price / tangible book: Core deposit premium: • 1.86x • 13.9% Closing & Other Extensive due diligence: Approvals: Expected close: Board representation: • Completed • Danvers shareholders; Regulatory approvals • 2 nd quarter 2011 • Kevin Bottomley to join People’s United Board of Directors |

22 Pro Forma Impact * PBCT financials as of 12/31/2010; DNBK financials as of 9/30/2010 ** Balance sheet figures do not include the impact of purchase accounting adjustments ^ Pro forma levels at estimated close of transaction PBCT* DNBK* Pro Forma** Assets ($Bn) 25.0 2.6 27.6 Loans ($Bn) 17.5 1.7 19.2 Deposits ($Bn) 17.9 2.0 19.9 Branches 340 28 368 Tangible common equity ratio 14.1% ~12.0% Tangible book value per share $9.30 ~$8.68 2012 operating EPS accretion ~$0.08 TBV dilution value earn back period ~7 years Internal rate of return >15% ^ ^ |

23 Summary We are excited about growth and confident in our position Competitive Strength Focused on revenue synergies throughout our footprint Further leveraging the brand Conservative underwriting Pro forma Tangible Common Equity Ratio of ~12.0% Efficient capital deployment Closed 4 deals (Financial Federal, Butler, RiverBank and Smithtown) – all above our 15% IRR hurdle - in 2010 Announced the acquisition of Danvers Bancorp – above our 15% IRR hurdle Paid out $218MM in 2010 dividends Repurchased $191MM of stock or 14.3MM shares at a weighted average price of $13.35 Extended period of low interest rates, multi-year de-leveraging process and tougher regulatory environment are encouraging consolidation Significantly more asset sensitive than peers |

Q & A |

Appendix |

26 Quarterly Income Statement 26 $ Fav(unfav) % Net Interest Income 189.8 $ 175.8 $ 147.5 $ 14.0 $ 8% Provision for Loan Losses 10.9 21.8 13.6 10.9 50 Non-Interest Income 75.9 75.9 71.7 - - Non-interest Expense: Operating 199.9 188.9 167.7 (11.0) (6) Non-Operating Expense 7.0 5.3 4.5 (1.7) (31) Total Non-Interest Expense 206.9 194.2 172.2 (12.7) (7) Income Before Taxes 47.9 35.7 33.4 12.2 Net Income 32.0 24.1 24.9 7.9 33 Net Operating Income 36.7 27.7 28.0 9.0 33 Earnings Per Share 0.09 0.07 0.07 0.02 29 Operating Earnings Per Share 0.10 0.08 0.08 0.02 29 vs. Q3 2010 ($'s in millions, except EPS) Q4 2010 Q3 2010 Q4 2009 34 |

27 Non-Interest Income 27 $ Fav(unfav) % Investment management fees 7.9 $ 7.6 $ 7.9 $ 0.3 $ 4% Insurance revenue 6.9 8.3 7.0 (1.4) (17) Brokerage commissions 2.9 2.8 2.9 0.1 4 Total wealth management 17.7 18.7 17.8 (1.0) (5) Bank service charges 30.7 31.5 32.2 (0.8) (3) Merchant services income 6.4 6.9 6.3 (0.5) (7) Gain on Residential Loan Sales 4.2 2.4 3.0 1.8 76 Net security loss (1.0) - (0.1) (1.0) N/M Operating lease income 5.8 5.4 3.9 0.4 7 Loan Penalties/Late Charges 5.7 4.2 2.1 1.5 36 Other non-interest income 6.4 6.8 6.5 (0.4) (6) Total non-interest income 75.9 75.9 71.7 - - Total ex net security loss 76.9 75.9 71.8 1.0 1 ($'s in millions) Q4 2010 Q3 2010 Q4 2009 vs. Q3 2010 |

28 Non-Interest Expense 28 vs. Q3 2010 $ Increase % Compensation and benefits 98.3 $ 93.2 $ 89.2 $ 5.1 $ 5% Occupancy and equipment 28.1 28.0 28.0 0.1 0 Professional/outside service fees 19.8 18.5 10.0 1.3 7 Other non-interest expense 60.7 54.5 45.0 6.2 11 Total non-interest expense 206.9 194.2 172.2 12.7 7 Non-operating Expense 7.0 5.3 4.5 1.7 31 Operating non-interest expense 199.9 188.9 167.7 11.0 6 Q4 2010 Q3 2010 Q4 2009 ($'s in millions) |

29 Average Earning Assets 29 $ Inc/(Dec) % Commercial real estate 6,054 $ 5,465 $ 5,352 $ 589 $ 11 Commercial lending 5,087 5,096 4,011 (9) (0) Total Commercial 11,141 10,561 9,363 580 5 Residential mortgage 2,611 2,463 2,609 148 6 Home equity and other loans 2,170 2,184 2,259 (14) (1) Total loans 15,922 15,208 14,231 714 5 Investments 3,875 3,748 4,351 127 3 Total earning assets 19,797 18,956 18,582 841 4 vs. Q3 2010 ($'s in millions) Q4 2010 Q3 2010 Q4 2009 |

30 Average Funding Mix 30 $ Inc/(Dec) % Deposits: Non-interest-bearing 3,634 $ 3,432 $ 3,321 $ 202 $ 6% Savings/Now/PMA 8,249 7,930 7,145 319 4 Time 4,648 4,439 4,807 209 5 Total deposits 16,531 15,801 15,273 730 5 Sub-debt / Other borrowings 705 374 343 331 89 Total funding liabilities 17,236 16,175 15,616 1,061 7 Stockholders' equity 5,335 5,404 5,106 (69) (1) Total Funding 22,571 21,579 20,722 992 5 ($'s in millions) Q4 2010 vs. Q3 2010 Q3 2010 Q4 2009 |

31 Non-Performing Assets 31 NPA's - Total 663 $ 371 $ 206 $ - Originated 303 312 206 - Acquired 360 59 N/A Allowance for Loan Losses 173 173 173 NPA's / Total Loans, REO & Repossessed assets - Originated 2.07% 2.18% 1.44% Originated NPL's / Originated Loans 1.68% 1.77% 1.19% Allowance / Originated Loans 1.18% 1.21% 1.21% Allowance / Originated NPL's 70% 69% 102% Net Loan Charge-Offs / Avg Loans 0.28% 0.57% 0.38% ($ in millions) Q4 2010 Q3 2010 Q4 2009 |

32 Home Equity Portfolio Credit Statistics Weighted Average: Loan to value¹ 55% FICO scores¹ 759 Net charge-offs: 0.23% Non-accrual: 0.48% High Quality Consumer Portfolio Ending Balance: $5.0 billion % of Loans: 29% Residential Mortgage Portfolio Credit Statistics Weighted Average: Loan to value¹ 60% FICO scores¹ 726 Net charge-offs: 0.30% Non-accrual: 3.17% 1-4 Family Residential 57% Home Equity Loans & Lines 39% Indirect Auto 3% Other 1% As of December 31, 2010 (1) Excludes the impact of the former Butler Bank, former RiverBank and former Bank of Smithtown |

33 Retail 25% Office 30% Industrial 10% Residential 13% Hospitality 8% Other 11% Land 3% Well Balanced Commercial Portfolio As of December 31, 2010 Ending Balance: $12.5 billion % of Loans: 71% $5.4 billion CRE¹ (1) Excludes portfolios acquired on November 30, 2010 CRE, By Sector Commercial Real Estate 58% General C&I 25% Equip. Fin. 17% |

34 We expect that interest rates will not rise in 2011. However, we do expect rates to rise in 2012 and beyond Given short term interest rates are so low and are expected to remain low this year, we have again added to our securities portfolio For Q3 2010 we were 3.0x as asset sensitive as our peers For every 100bps increase in the Fed Funds rate, our net interest income will increase by ~$40MM on an annualized basis Notes: 1. Analysis is as of 6/30/10 filings 2. Data as of 6/30/10 SEC filings, where exact +100bps shock up scenario data was not provided PBCT interpolated based on data disclosed 3. Data as of 6/30/10 filings, where exact +200bps shock up scenario data was not provided PBCT interpolated based on data disclosed Asset Sensitivity Net Interest Income at Risk 1 Analysis involves PBCT estimates, see notes below Lowest Amongst Highest Amongst Core PBCT Multiple to Scenario Our Peers Our Peers Peer Median PBCT Peer Median Shock Up 100bps 2 -0.6% 4.8% 2.0% 6.0% 3.0x Shock Up 200bps 3 0.4% 9.6% 4.4% 13.3% 3.0x Change in Net Interest Income |

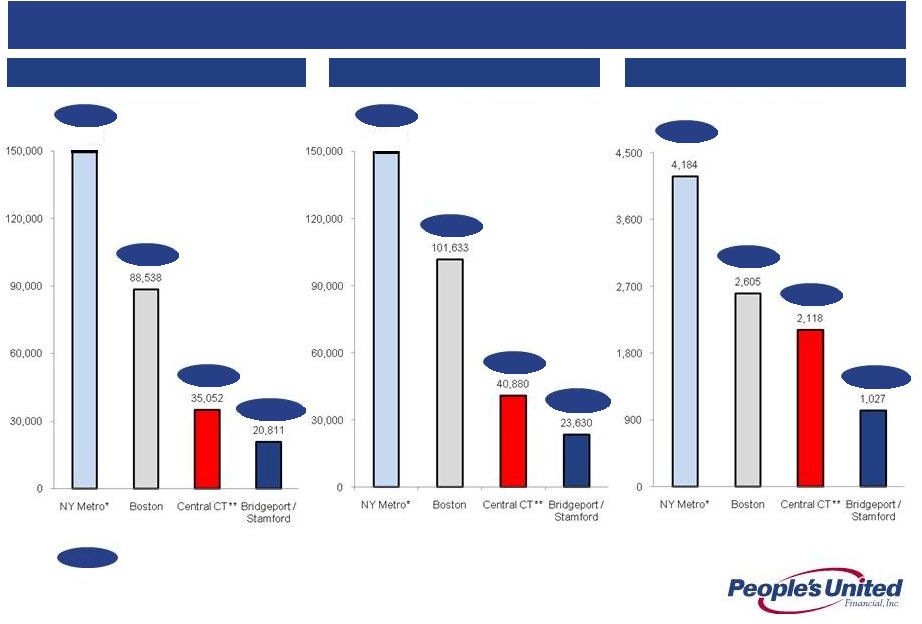

< 20 Employees Commercial Market Opportunity by MSA > 500 Employees < 500 Employees Pro Forma Deposit Market Share Number of firms by size People’s United is growing in NYC Metro and Boston Metro, areas rich with potential commercial, non-commodity relationships 0.2% 2.4% 6.3% 17.8% 0.2% 2.4% 6.3% 17.8% 0.2% 2.4% 6.3% 17.8% 428,577 471,661 Source: SBA firms and employment by MSA 2007 * NY Metro area includes New York, Northern New Jersey, and Long Island MSA ** Central Connecticut includes New Haven and Hartford MSAs 35 |

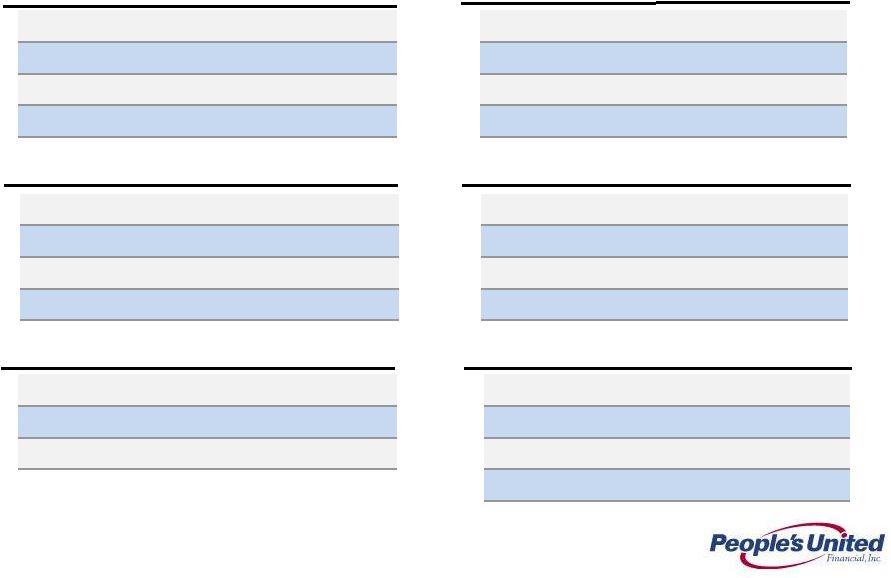

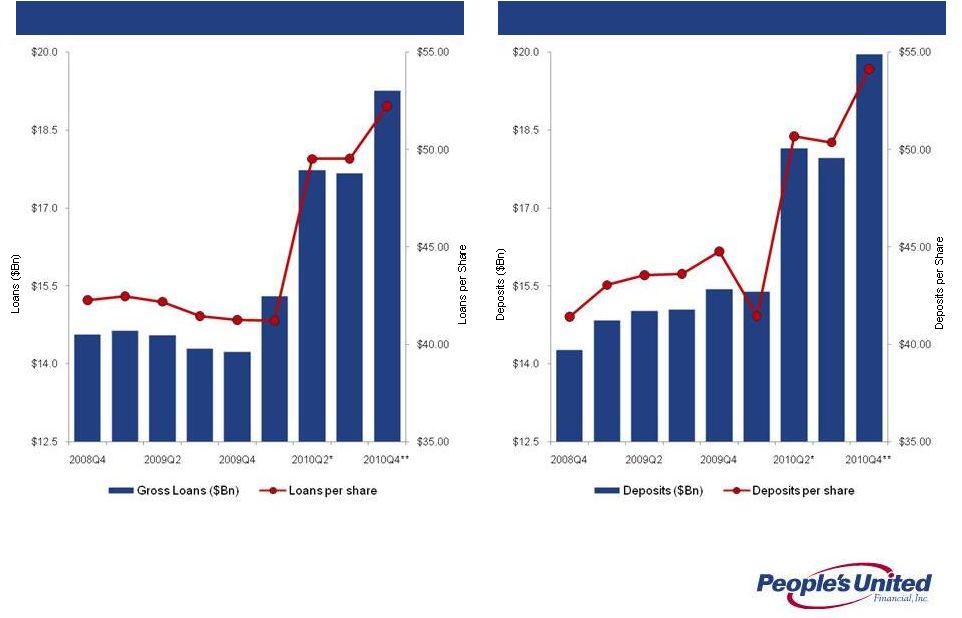

36 Loans and Deposits Source: SNL Financial * Pro forma for SMTB & LSBX acquisitions ** Pro forma for DNBK acquisition Loans Deposits |

37 Peer Group Company Name Ticker State 1 Associated Banc-Corp ASBC WI 2 Astoria Financial Corporation AF NY 3 BOK Financial Corporation BOKF OK 4 City National Corporation CYN CA 5 Comerica Incorporated CMA TX 6 Commerce Bancshares, Inc. CBSH MO 7 Cullen/Frost Bankers, Inc. CFR TX 8 First Horizon National Corporation FHN TN 9 Flagstar Bancorp, Inc. FBC MI 10 Fulton Financial Corporation FULT PA 11 Hudson City Bancorp, Inc. HCBK NJ 12 M&T Bank Corporation MTB NY 13 Marshall & Ilsley Corporation MI WI 14 New York Community Bancorp, Inc. NYB NY 15 Synovus Financial Corp. SNV GA 16 TCF Financial Corporation TCB MN 17 Valley National Bancorp VLY NJ 18 Webster Financial Corporation WBS CT 19 Zions Bancorporation ZION UT |

38 Additional Information Participants in the Transaction People’s United, Danvers Bancorp and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Danvers Bancorp stockholders in favor of the merger with Danvers Bancorp. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Danvers Bancorp stockholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about the executive officers and directors of People’s United in its Annual Report on Form 10-K for the year ended December 31, 2009 and in its definitive proxy statement filed with the SEC on March 23, 2010. You can find information about Danvers Bancorp’s executive officers and directors in its Annual Report on Form 10-K for the year ended December 31, 2009 and in its definitive proxy statement filed with the SEC on April 16, 2010. You can obtain free copies of these documents from People’s United or Danvers Bancorp using the contact information above. In connection with the proposed merger with Danvers Bancorp, Inc. (“Danvers Bancorp”), People’s United will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a proxy statement of Danvers Bancorp that also constitutes a prospectus of People’s United. Danvers Bancorp will mail the proxy statement/prospectus to its stockholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important information. You may obtain a free copy of the proxy statement/prospectus (when available) and other related documents filed by People’s United and Danvers Bancorp with the SEC at the SEC’s website at www.sec.gov. The proxy statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing People’s United website at www.peoples.com under the tab “Investor Relations” and then under the heading “Financial Information” or by accessing Danvers Bancorp’s website at www.danversbank.com under the tab “Investor Relations” and then under the heading “SEC Filings”. |

For more information, investors may contact: Peter Goulding, CFA peter.goulding@peoples.com (203) 338-6799 |