Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

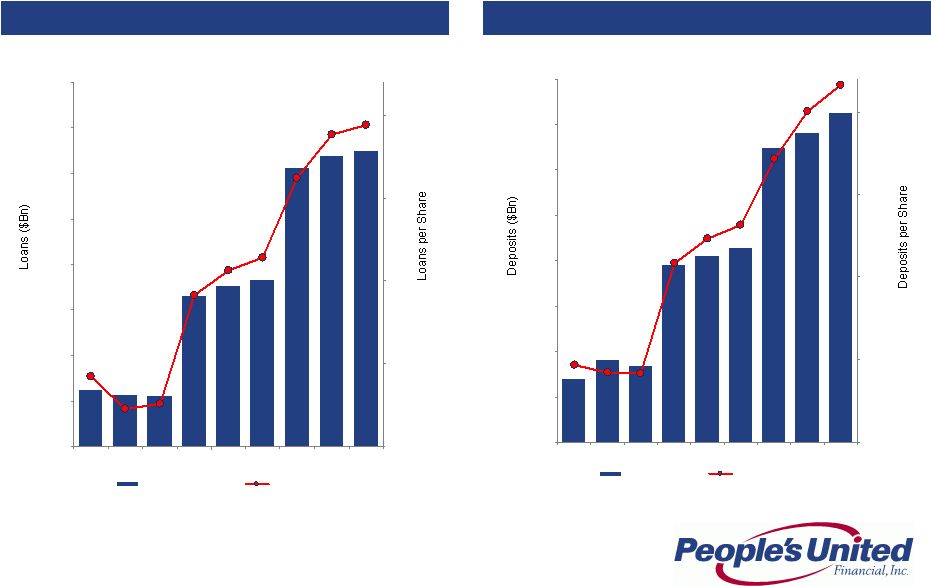

PBCT similar filings

- 25 Jun 12 People’s United Bank Completes Acquisition of 57 Branches In Metro New York Area

- 8 Jun 12 Investor Presentation dated June 2012

- 30 Apr 12 Investor Presentation dated May 2012

- 20 Apr 12 People’s United Financial Reports First Quarter Operating Earnings of $0.18 Per Share; Net Income of $0.17 Per Share; Announces Dividend Increase

- 28 Feb 12 People’s United Bank to Acquire Select Citizens Bank Branches and Deposits In New York State

- 20 Jan 12 People’s United Financial Reports Fourth Quarter Operating Earnings of $0.17 Per Share and Net Income of $0.12 Per Share

- 21 Oct 11 Results of Operations and Financial Condition

Filing view

External links