Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

PBCT similar filings

- 26 Nov 12 Other Events

- 29 Oct 12 Certain statements contained in this release are forward-looking in nature. These include all statements

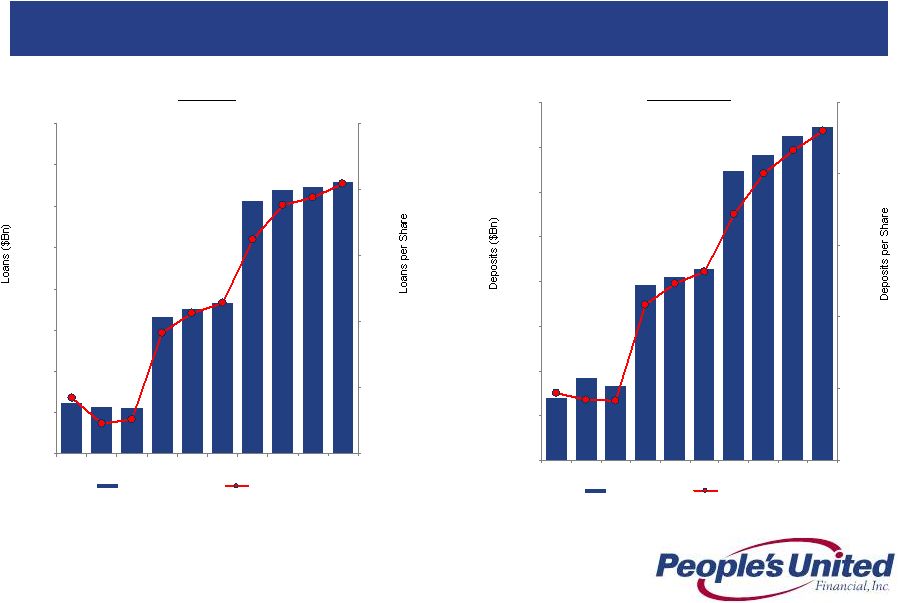

- 19 Oct 12 People’s United Financial Reports Third Quarter Operating Earnings of $0.19 Per Share; Net Income of $0.18 Per Share

- 11 Sep 12 Barclays Global Financial Services Conference

- 31 Jul 12 Certain statements contained in this release are forward-looking in nature. These include all statements

- 20 Jul 12 People’s United Financial Reports Second Quarter Operating Earnings of $0.20 Per Share; Net Income of $0.19 Per Share

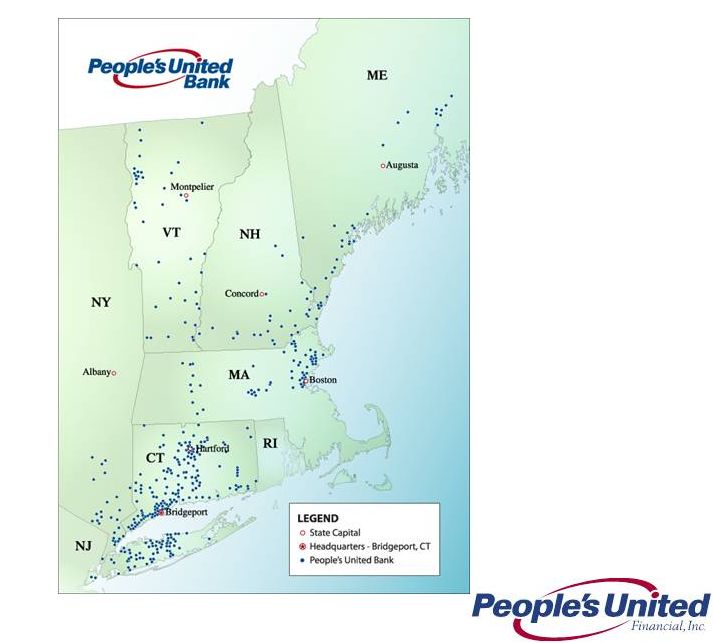

- 25 Jun 12 People’s United Bank Completes Acquisition of 57 Branches In Metro New York Area

Filing view

External links