Investor Presentation May 2017 NASDAQ: PBCT Exhibit 99.1

Forward-Looking Statement Certain statements contained in this presentation are forward-looking in nature. These include all statements about People's United Financial's plans, objectives, expectations and other statements that are not historical facts, and usually use words such as "expect," "anticipate," "believe," "should" and similar expressions. Such statements represent management's current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United Financial's actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United Financial include, but are not limited to: (1) changes in general, international, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and revenues; (9) the successful integration of acquisitions; and (10) changes in regulation resulting from or relating to financial reform legislation. People's United Financial does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PBCT: Compelling Investment Opportunity Leading market position in one of the best commercial banking markets in the U.S. Significant growth runway within existing markets – expanding in two of the largest MSAs in the U.S. New York City #1 and Boston #10 Ability to maintain pristine credit quality Average annual net charge-offs/average loans since 2007 have been 18bps Improving profitability Compound annual growth of 11% in full year earnings per common share since 2011 First quarter 2017 net income of $70.8 million, up 13% vs. prior year quarter, or 5% on a per common share basis Low operating risk profile Consistently profitable throughout the credit cycle Straightforward and diversified portfolio of products – no complex financial exposures Robust liquidity Strong deposit market share in most core markets Unused FHLB of Boston borrowing capacity of $7.0 billion at March 31, 2017 Continued capital deployment via organic growth and dividends Compound annual loan growth of over 7% since year-end 2011 Dividend yield of approximately 4.0%

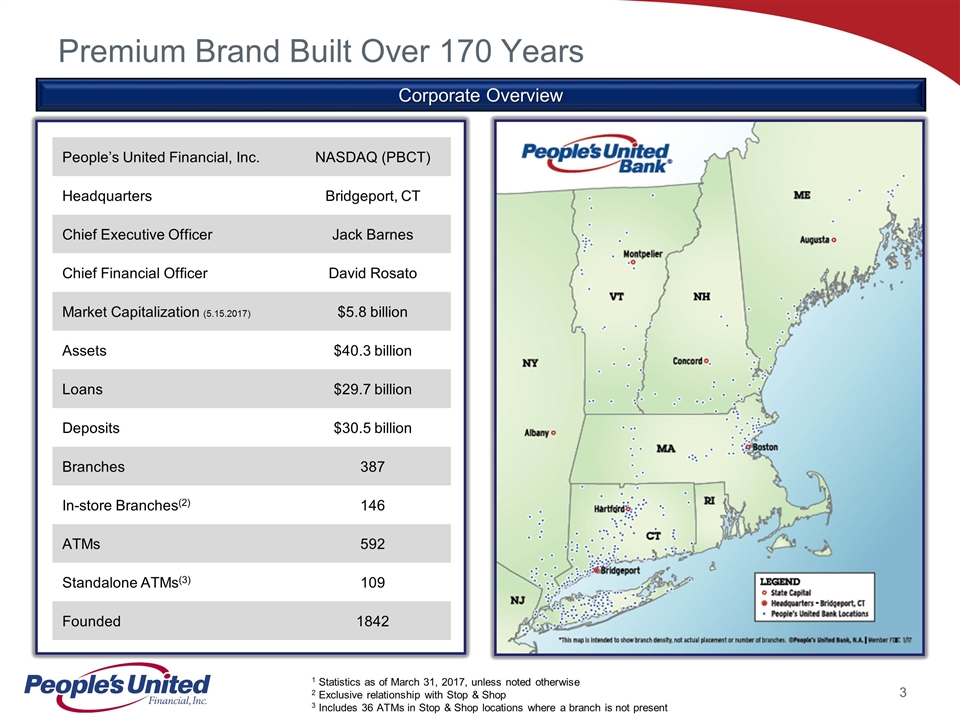

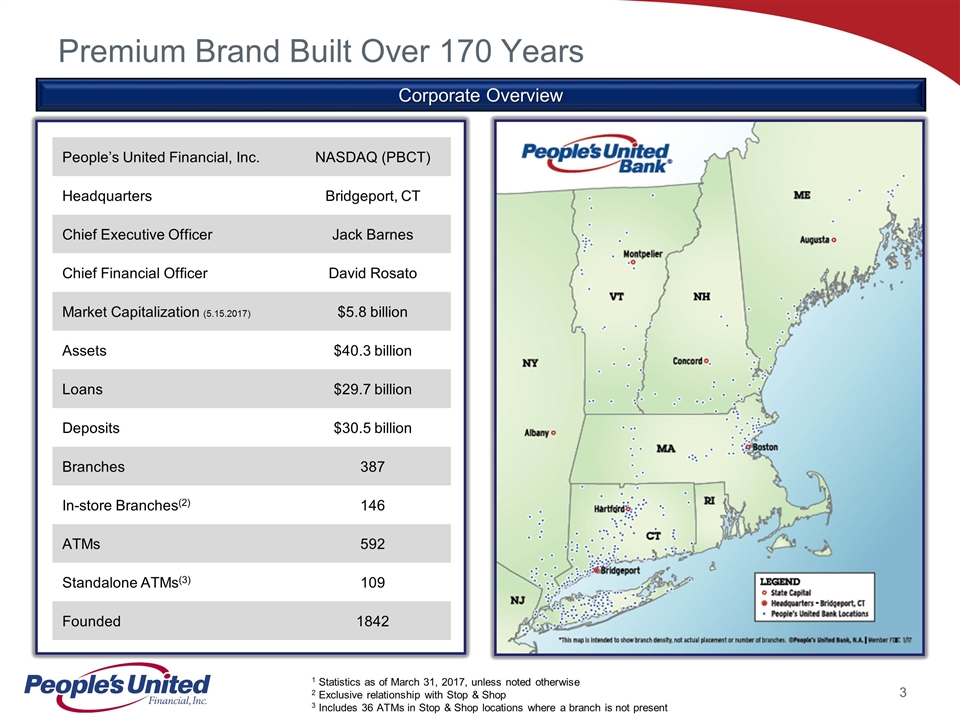

Premium Brand Built Over 170 Years Corporate Overview People’s United Financial, Inc. NASDAQ (PBCT) Headquarters Bridgeport, CT Chief Executive Officer Jack Barnes Chief Financial Officer David Rosato Market Capitalization (5.15.2017) $5.8 billion Assets $40.3 billion Loans $29.7 billion Deposits $30.5 billion Branches 387 In-store Branches(2) 146 ATMs 592 Standalone ATMs(3) 109 Founded 1842 1 Statistics as of March 31, 2017, unless noted otherwise 2 Exclusive relationship with Stop & Shop 3 Includes 36 ATMs in Stop & Shop locations where a branch is not present

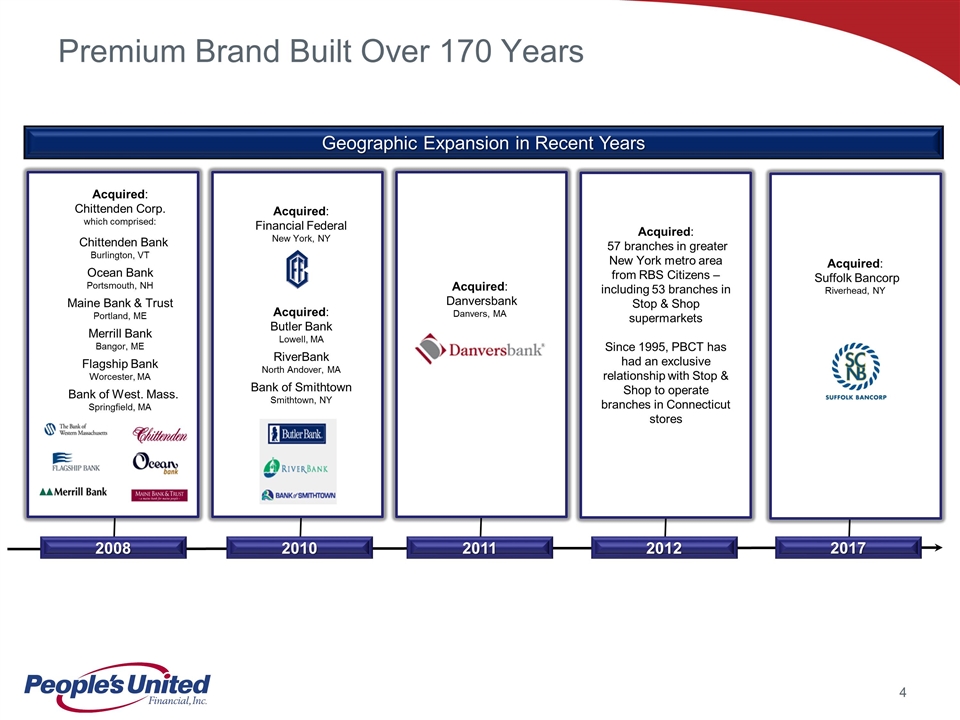

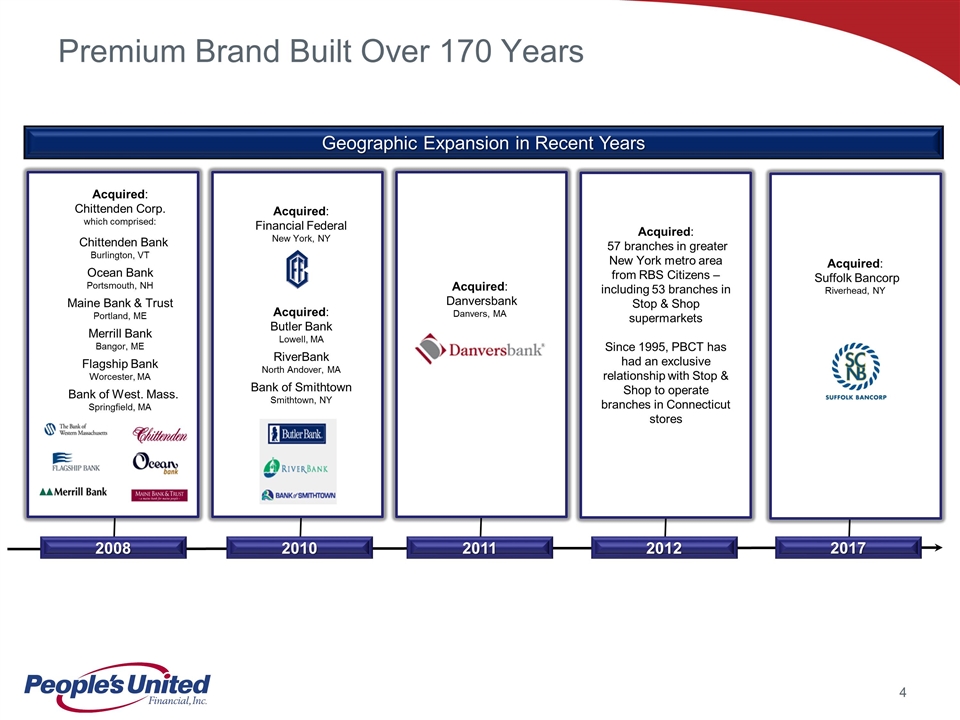

2017 2010 2011 2012 2008 Premium Brand Built Over 170 Years Acquired: Chittenden Corp. which comprised: Chittenden Bank Burlington, VT Ocean Bank Portsmouth, NH Maine Bank & Trust Portland, ME Merrill Bank Bangor, ME Flagship Bank Worcester, MA Bank of West. Mass. Springfield, MA Acquired: 57 branches in greater New York metro area from RBS Citizens – including 53 branches in Stop & Shop supermarkets Since 1995, PBCT has had an exclusive relationship with Stop & Shop to operate branches in Connecticut stores Acquired: Danversbank Danvers, MA Geographic Expansion in Recent Years Acquired: Financial Federal New York, NY Acquired: Butler Bank Lowell, MA RiverBank North Andover, MA Bank of Smithtown Smithtown, NY Acquired: Suffolk Bancorp Riverhead, NY

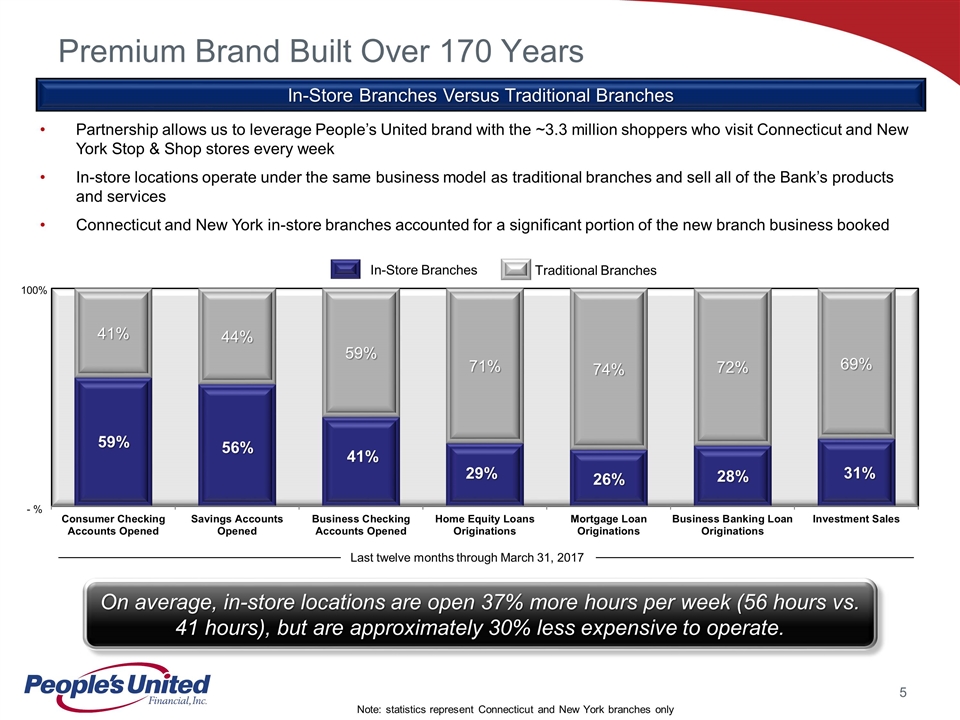

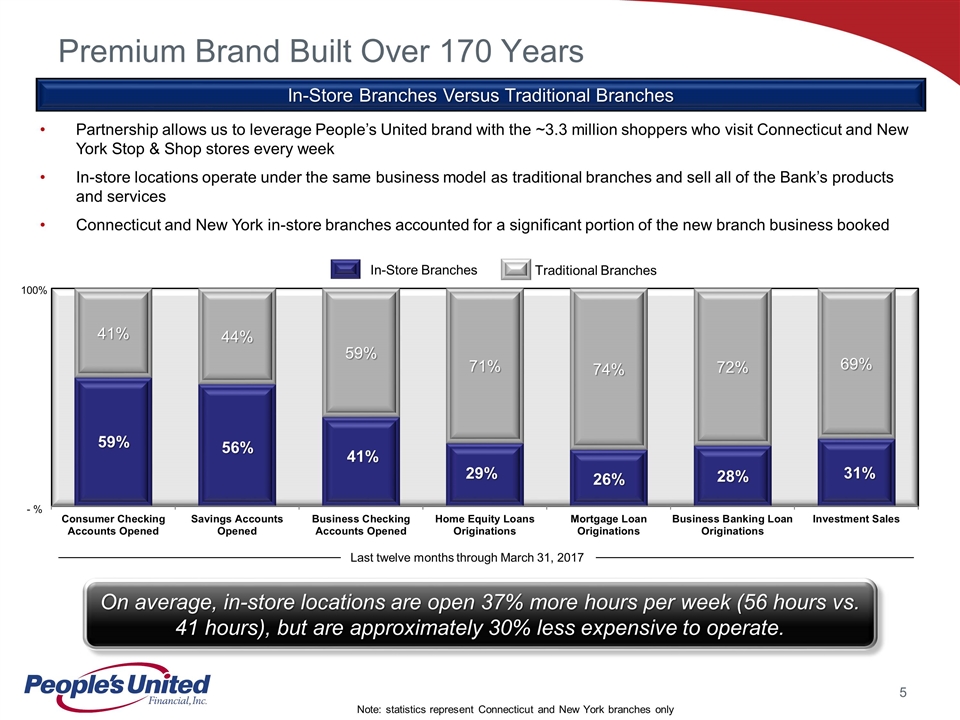

Premium Brand Built Over 170 Years In-Store Branches Versus Traditional Branches Partnership allows us to leverage People’s United brand with the ~3.3 million shoppers who visit Connecticut and New York Stop & Shop stores every week In-store locations operate under the same business model as traditional branches and sell all of the Bank’s products and services Connecticut and New York in-store branches accounted for a significant portion of the new branch business booked Note: statistics represent Connecticut and New York branches only On average, in-store locations are open 37% more hours per week (56 hours vs. 41 hours), but are approximately 30% less expensive to operate. Last twelve months through March 31, 2017 In-Store Branches Traditional Branches 100% - %

Jack Barnes President & CEO, Director 30+ People’s United Bank (SEVP, CAO), Chittenden, FDIC Galan Daukas SEVP Wealth Management 30+ People’s United Bank, Washington Trust, The Managers Funds, Harbor Capital Mgmt Sara Longobardi SEVP Retail Banking 25+ People’s United Bank Dave Norton SEVP & Chief HR Officer 5+ People’s United Bank, New York Times, Starwood, PepsiCo Lee Powlus SEVP & Chief Administrative Officer 25+ People’s United Bank, Chittenden, Alltel David Rosato SEVP & CFO 30+ People’s United Bank, Webster, M&T Chantal Simon SEVP & Chief Risk Officer 25+ People’s United Bank, Merrill Lynch US Bank, Lazard Freres & Co. Jeff Tengel SEVP Commercial Banking 30+ People’s United Bank, PNC, National City Bob Trautmann SEVP & General Counsel 20+ People’s United Bank, Tyler Cooper & Alcorn Kirk Walters SEVP Corporate Development, Director 25+ People’s United Bank, Santander, Sovereign, Chittenden, Northeast Financial Name Position Years in Banking Professional Experience Experienced Leadership Team

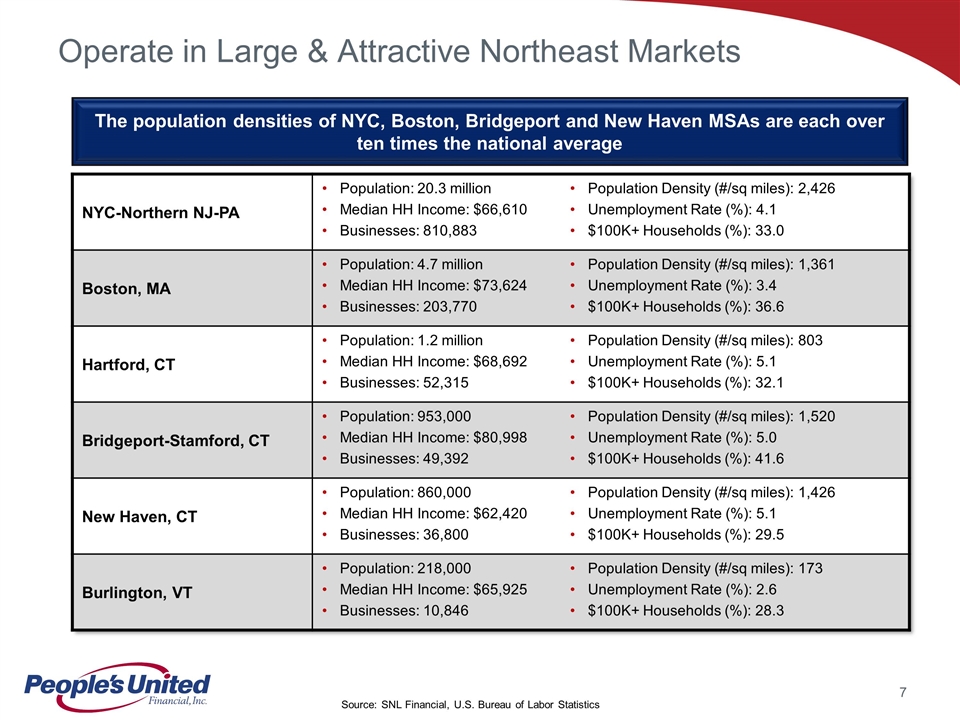

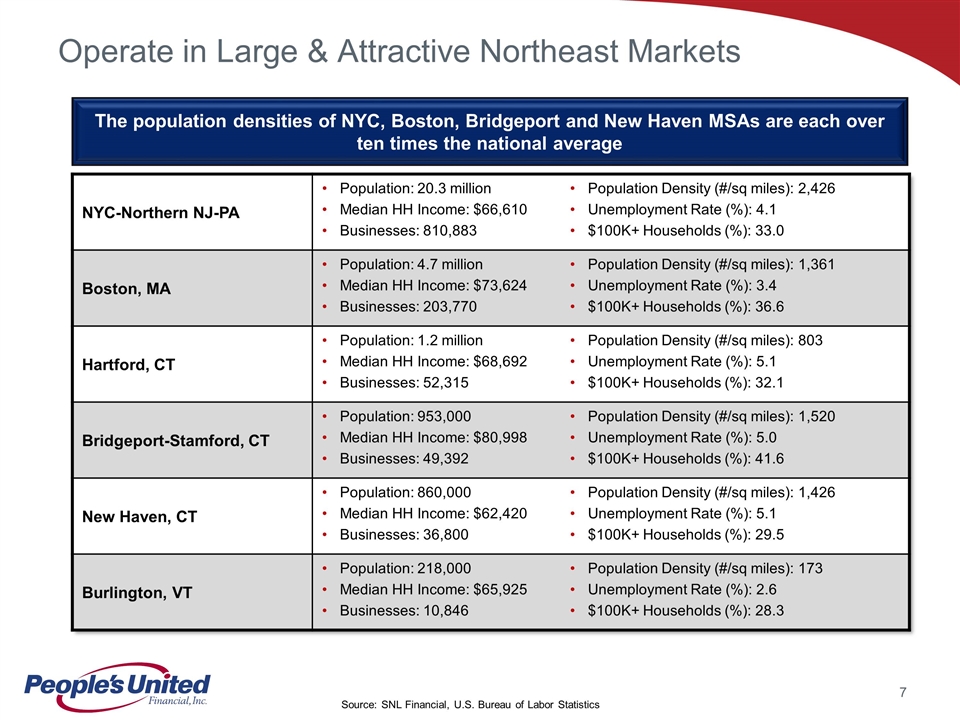

Operate in Large & Attractive Northeast Markets NYC-Northern NJ-PA Population: 20.3 million Median HH Income: $66,610 Businesses: 810,883 Population Density (#/sq miles): 2,426 Unemployment Rate (%): 4.1 $100K+ Households (%): 33.0 Boston, MA Population: 4.7 million Median HH Income: $73,624 Businesses: 203,770 Population Density (#/sq miles): 1,361 Unemployment Rate (%): 3.4 $100K+ Households (%): 36.6 Hartford, CT Population: 1.2 million Median HH Income: $68,692 Businesses: 52,315 Population Density (#/sq miles): 803 Unemployment Rate (%): 5.1 $100K+ Households (%): 32.1 Bridgeport-Stamford, CT Population: 953,000 Median HH Income: $80,998 Businesses: 49,392 Population Density (#/sq miles): 1,520 Unemployment Rate (%): 5.0 $100K+ Households (%): 41.6 New Haven, CT Population: 860,000 Median HH Income: $62,420 Businesses: 36,800 Population Density (#/sq miles): 1,426 Unemployment Rate (%): 5.1 $100K+ Households (%): 29.5 Burlington, VT Population: 218,000 Median HH Income: $65,925 Businesses: 10,846 Population Density (#/sq miles): 173 Unemployment Rate (%): 2.6 $100K+ Households (%): 28.3 Source: SNL Financial, U.S. Bureau of Labor Statistics The population densities of NYC, Boston, Bridgeport and New Haven MSAs are each over ten times the national average

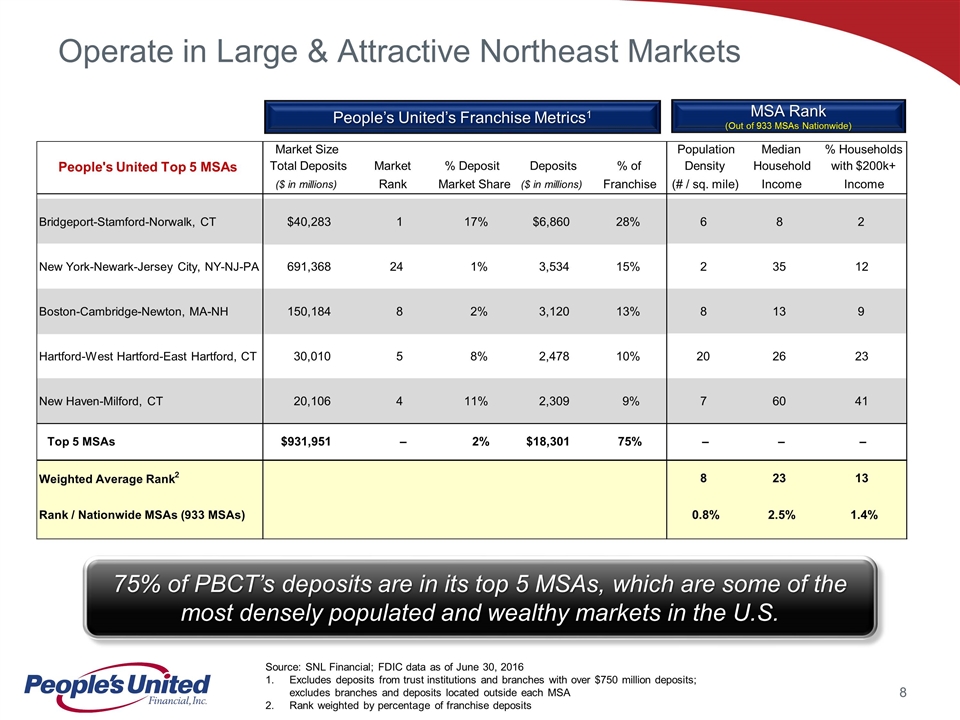

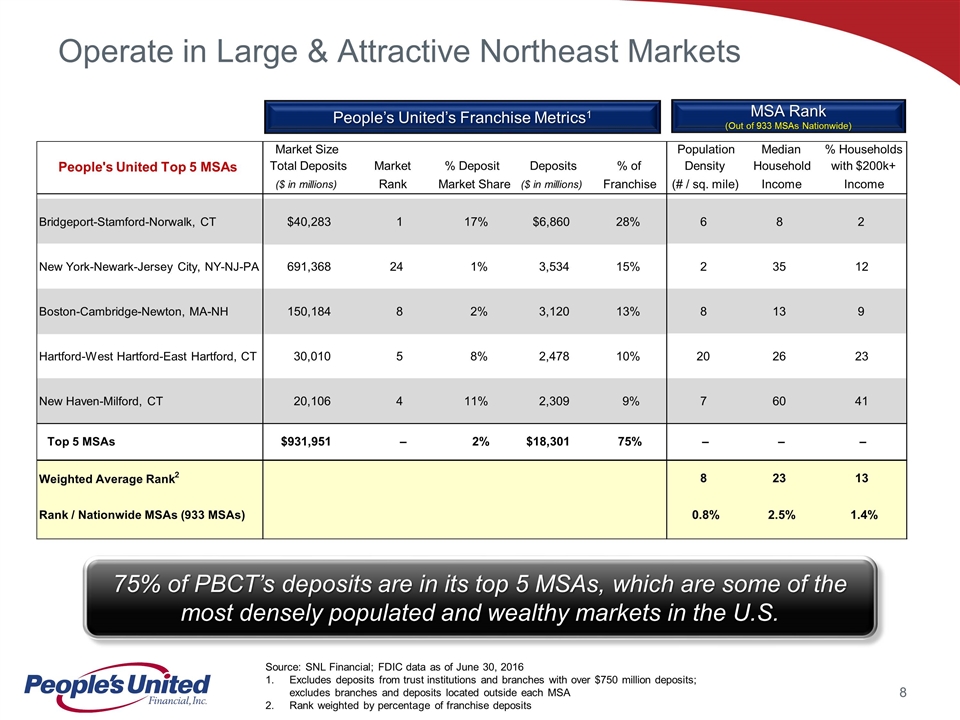

Operate in Large & Attractive Northeast Markets 75% of PBCT’s deposits are in its top 5 MSAs, which are some of the most densely populated and wealthy markets in the U.S. Source: SNL Financial; FDIC data as of June 30, 2016 Excludes deposits from trust institutions and branches with over $750 million deposits; excludes branches and deposits located outside each MSA Rank weighted by percentage of franchise deposits People’s United’s Franchise Metrics1 MSA Rank (Out of 933 MSAs Nationwide) Market Size Population Median % Households People's United Top 5 MSAs Total Deposits Market % Deposit Deposits % of Density Household with $200k+ ($ in millions) Rank Market Share ($ in millions) Franchise (# / sq. mile) Income Income Bridgeport-Stamford-Norwalk, CT $40,283 1 17% $6,860 28% 6 8 2 New York-Newark-Jersey City, NY-NJ-PA 691,368 24 1% 3,534 15% 2 35 12 Boston-Cambridge-Newton, MA-NH 150,184 8 2% 3,120 13% 8 13 9 Hartford-West Hartford-East Hartford, CT 30,010 5 8% 2,478 10% 20 26 23 New Haven-Milford, CT 20,106 4 11% 2,309 9% 7 60 41 Top 5 MSAs $931,951 – 2% $18,301 75% – – – Weighted Average Rank 2 8 23 13 Rank / Nationwide MSAs (933 MSAs) 0.8% 2.5% 1.4%

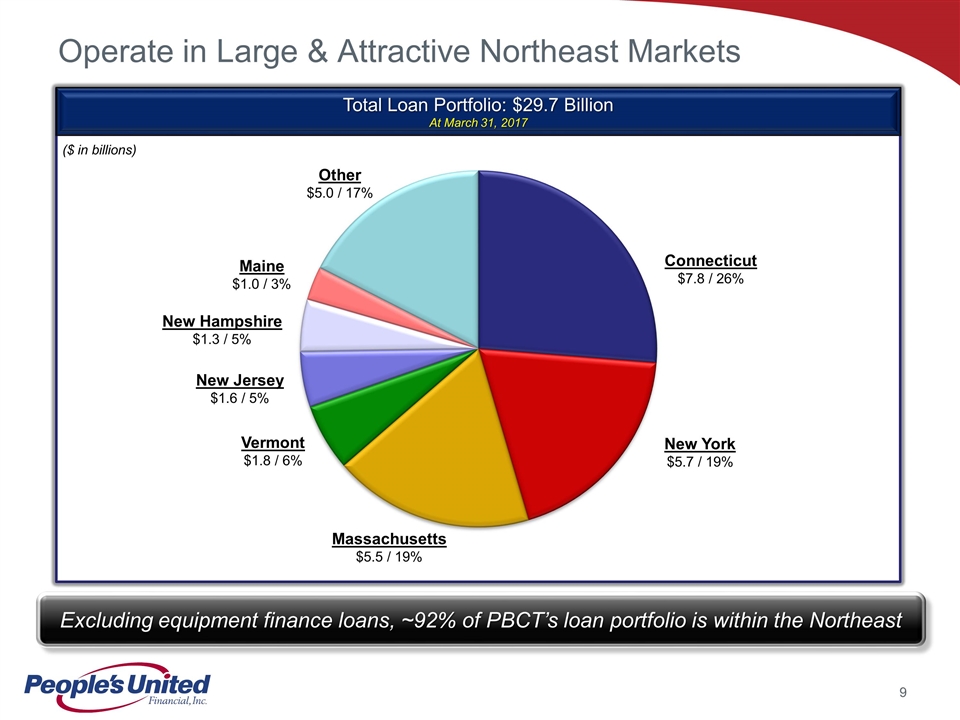

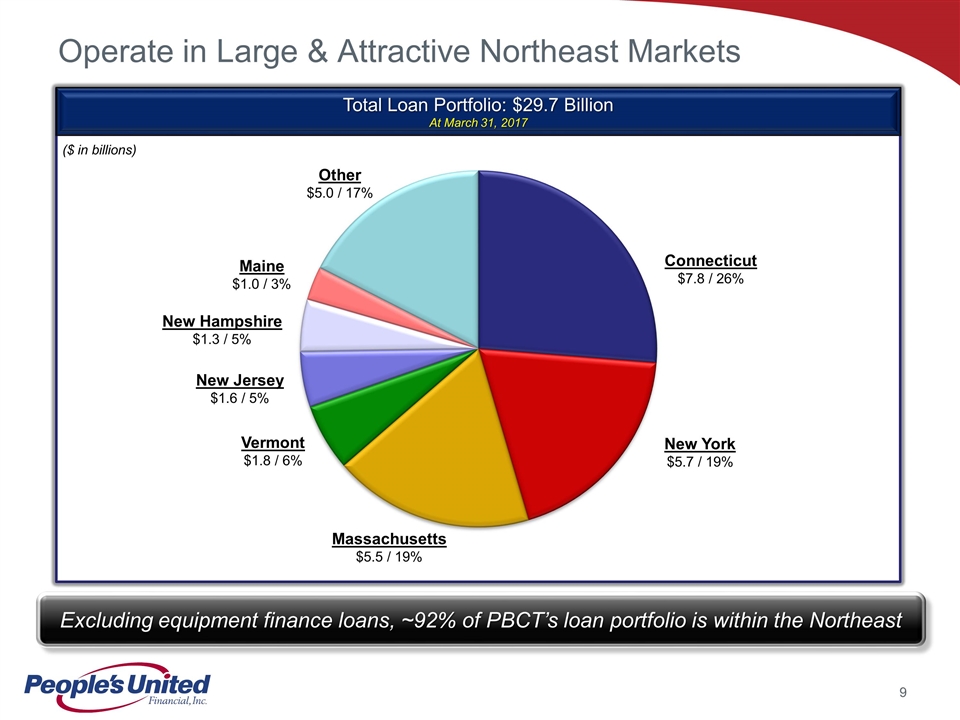

Total Loan Portfolio: $29.7 Billion At March 31, 2017 ($ in billions) Connecticut $7.8 / 26% Massachusetts $5.5 / 19% New Hampshire $1.3 / 5% Other $5.0 / 17% New York $5.7 / 19% Vermont $1.8 / 6% New Jersey $1.6 / 5% Maine $1.0 / 3% Operate in Large & Attractive Northeast Markets Excluding equipment finance loans, ~92% of PBCT’s loan portfolio is within the Northeast

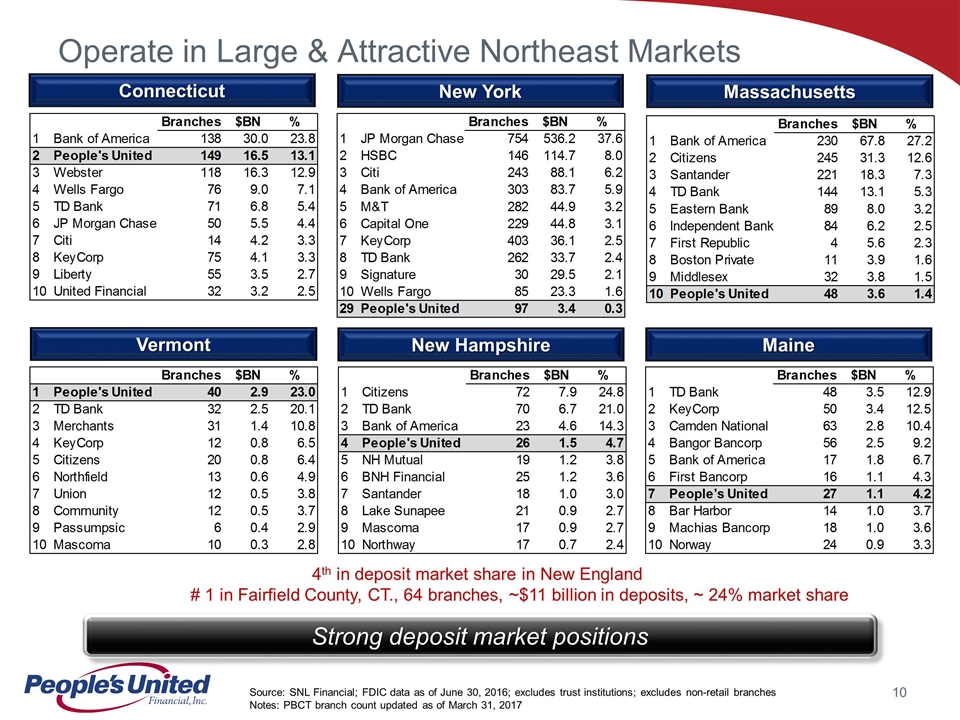

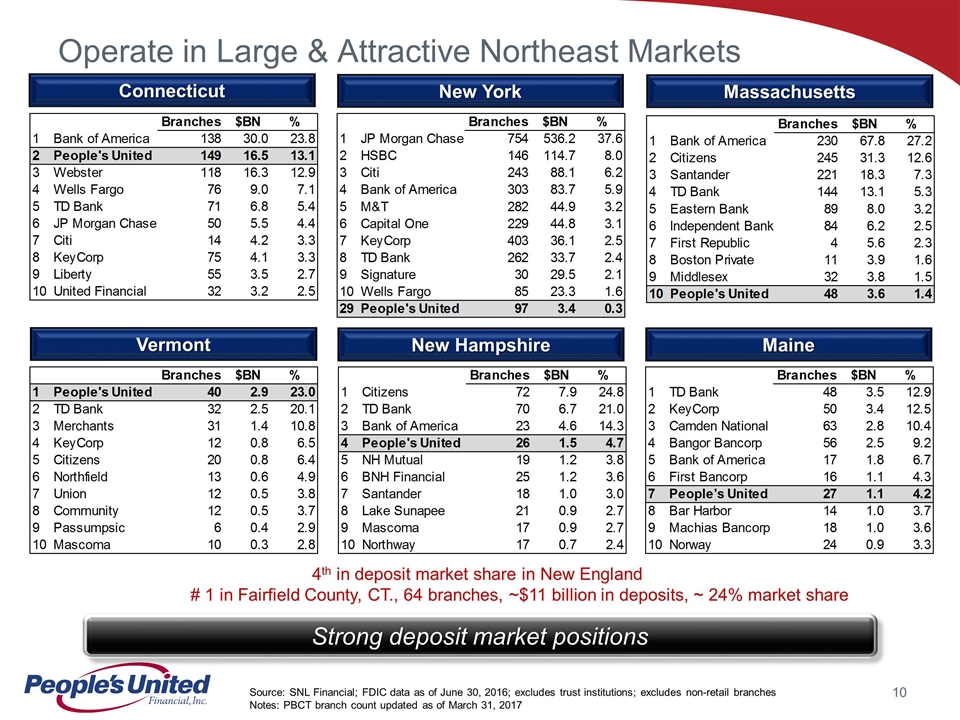

Source: SNL Financial; FDIC data as of June 30, 2016; excludes trust institutions; excludes non-retail branches Notes: PBCT branch count updated as of March 31, 2017 Operate in Large & Attractive Northeast Markets Connecticut Massachusetts Vermont New York New Hampshire Maine 4th in deposit market share in New England # 1 in Fairfield County, CT., 64 branches, ~$11 billion in deposits, ~ 24% market share Strong deposit market positions

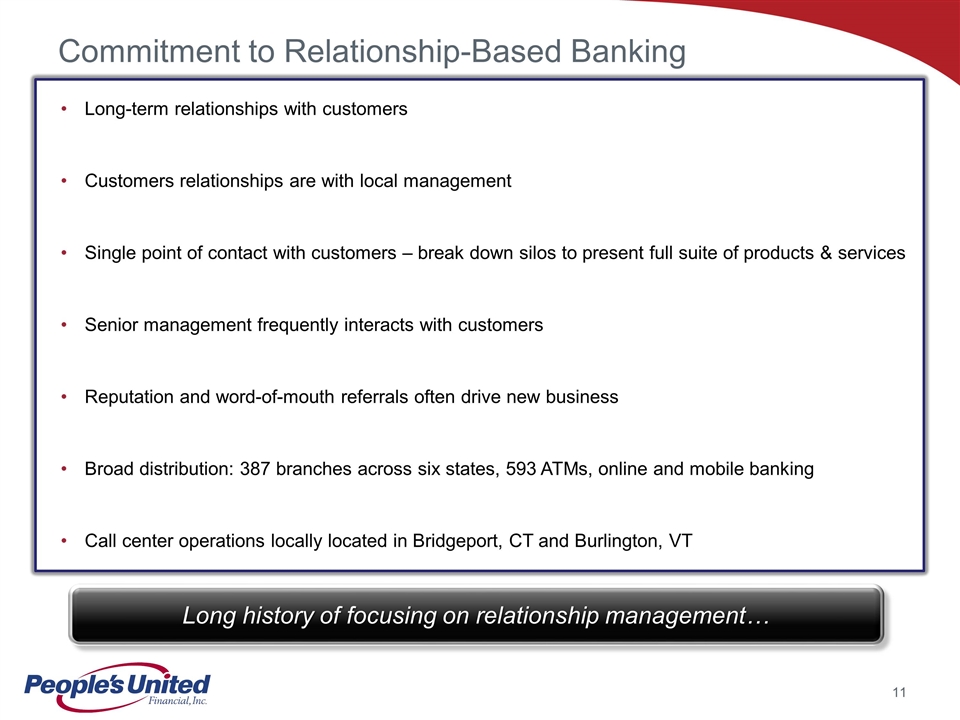

Commitment to Relationship-Based Banking Long history of focusing on relationship management… Long-term relationships with customers Customers relationships are with local management Single point of contact with customers – break down silos to present full suite of products & services Senior management frequently interacts with customers Reputation and word-of-mouth referrals often drive new business Broad distribution: 387 branches across six states, 593 ATMs, online and mobile banking Call center operations locally located in Bridgeport, CT and Burlington, VT

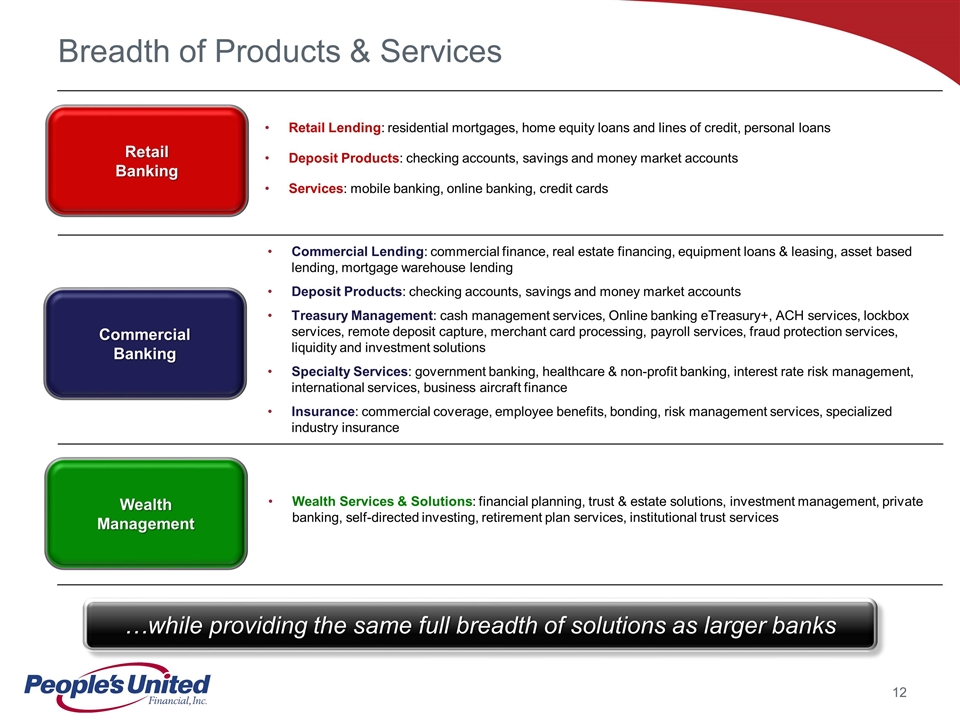

Breadth of Products & Services Commercial Banking Retail Banking Wealth Management …while providing the same full breadth of solutions as larger banks Commercial Lending: commercial finance, real estate financing, equipment loans & leasing, asset based lending, mortgage warehouse lending Deposit Products: checking accounts, savings and money market accounts Treasury Management: cash management services, Online banking eTreasury+, ACH services, lockbox services, remote deposit capture, merchant card processing, payroll services, fraud protection services, liquidity and investment solutions Specialty Services: government banking, healthcare & non-profit banking, interest rate risk management, international services, business aircraft finance Insurance: commercial coverage, employee benefits, bonding, risk management services, specialized industry insurance Retail Lending: residential mortgages, home equity loans and lines of credit, personal loans Deposit Products: checking accounts, savings and money market accounts Services: mobile banking, online banking, credit cards Wealth Services & Solutions: financial planning, trust & estate solutions, investment management, private banking, self-directed investing, retirement plan services, institutional trust services

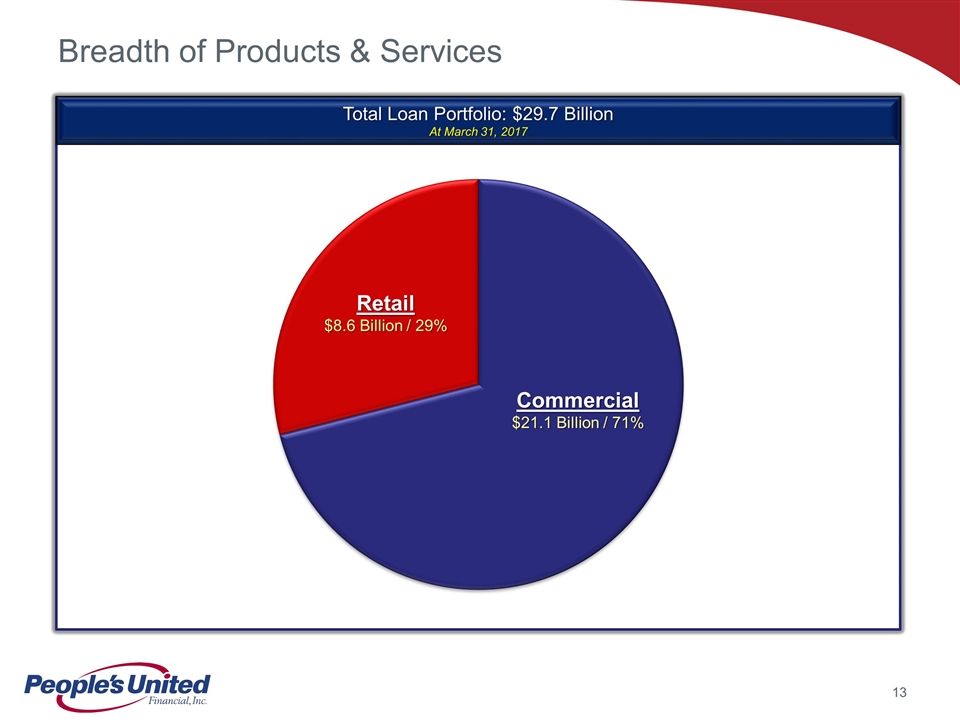

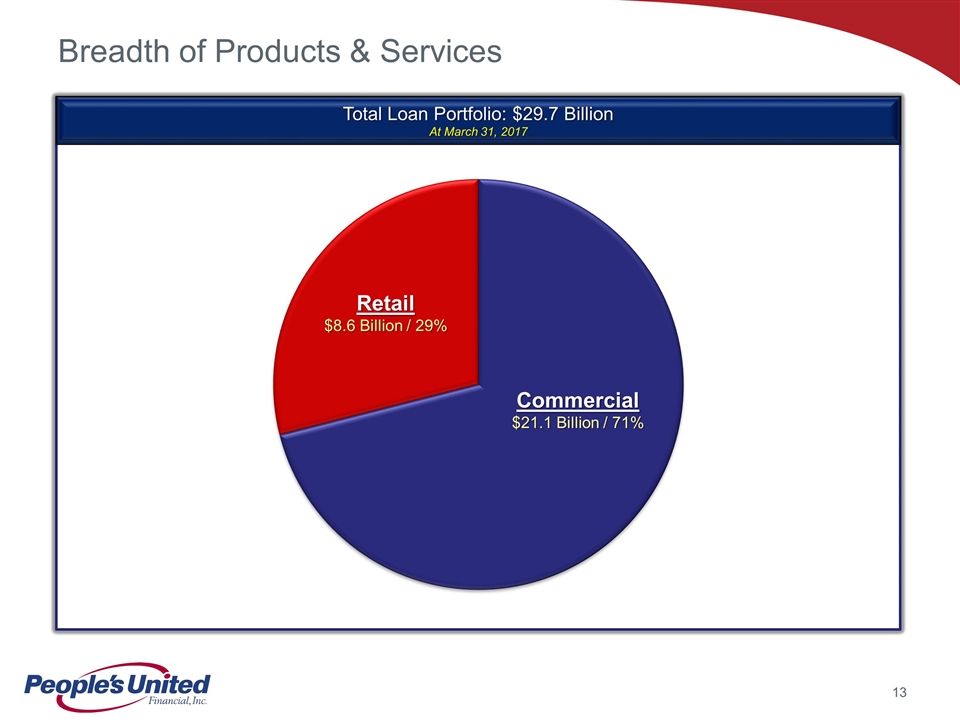

Total Loan Portfolio: $29.7 Billion At March 31, 2017 Commercial $21.1 Billion / 71% Breadth of Products & Services Retail $8.6 Billion / 29%

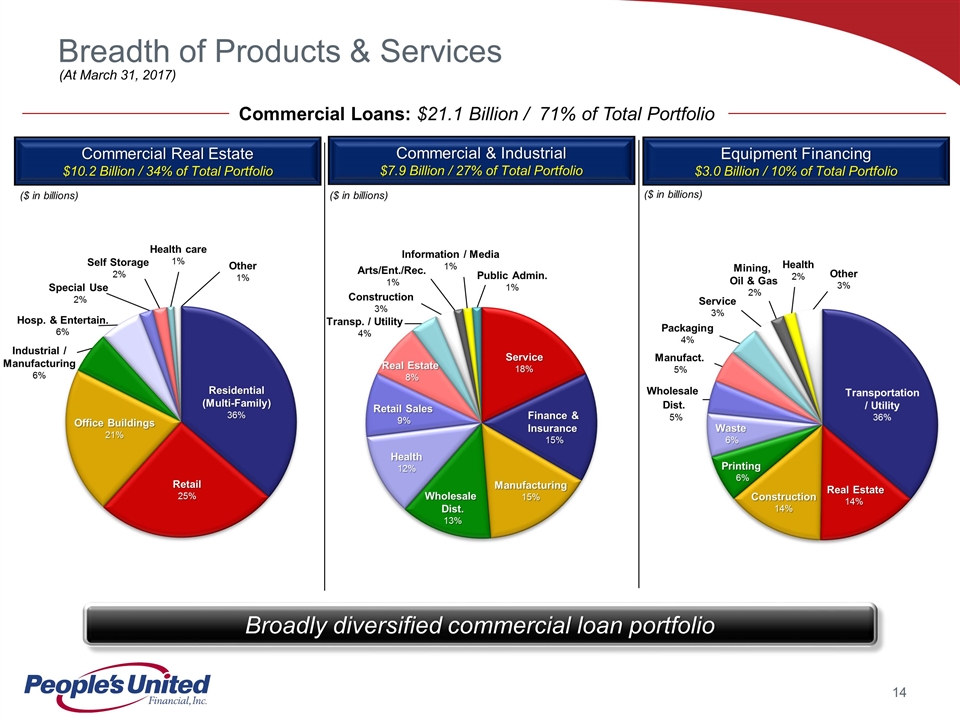

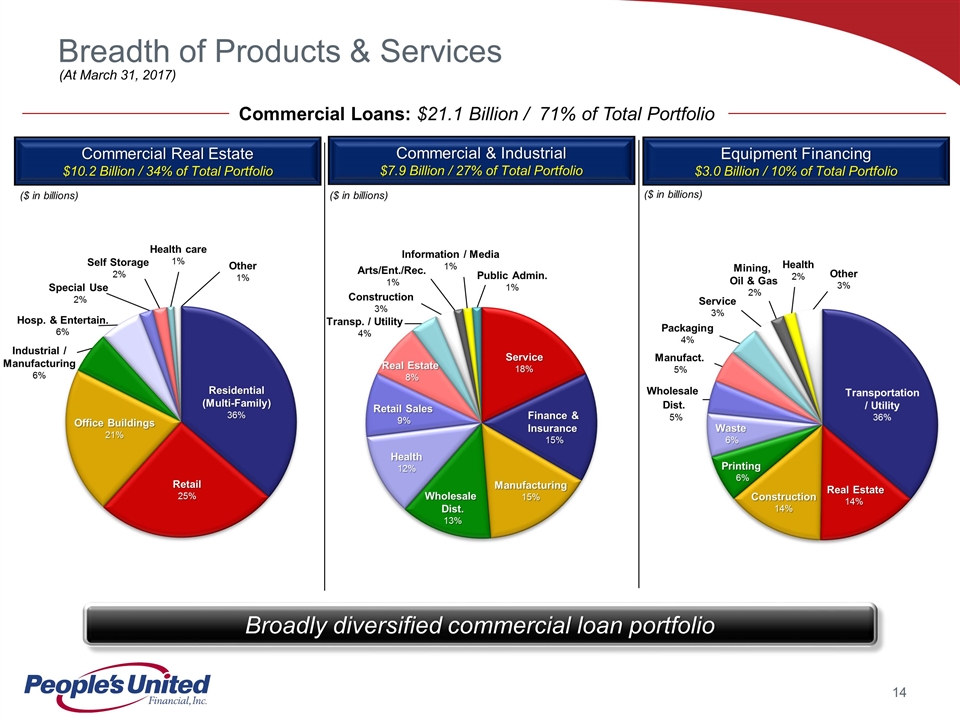

Wholesale Dist. 5% Public Admin. 1% Packaging 4% Service 3% Other 3% Mining, Oil & Gas 2% Manufact. 5% Transp. / Utility 4% Arts/Ent./Rec. 1% Construction 3% Information / Media 1% Hosp. & Entertain. 6% Other 1% Commercial Real Estate $10.2 Billion / 34% of Total Portfolio (At March 31, 2017) Residential (Multi-Family) 36% Commercial & Industrial $7.9 Billion / 27% of Total Portfolio Equipment Financing $3.0 Billion / 10% of Total Portfolio Commercial Loans: $21.1 Billion / 71% of Total Portfolio ($ in billions) ($ in billions) ($ in billions) Retail 25% Office Buildings 21% Health care 1% Self Storage 2% Special Use 2% Industrial / Manufacturing 6% Finance & Insurance 15% Service 18% Manufacturing 15% Wholesale Dist. 13% Health 12% Retail Sales 9% Transportation / Utility 36% Construction 14% Real Estate 14% Waste 6% Printing 6% Breadth of Products & Services Broadly diversified commercial loan portfolio Real Estate 8% Health 2%

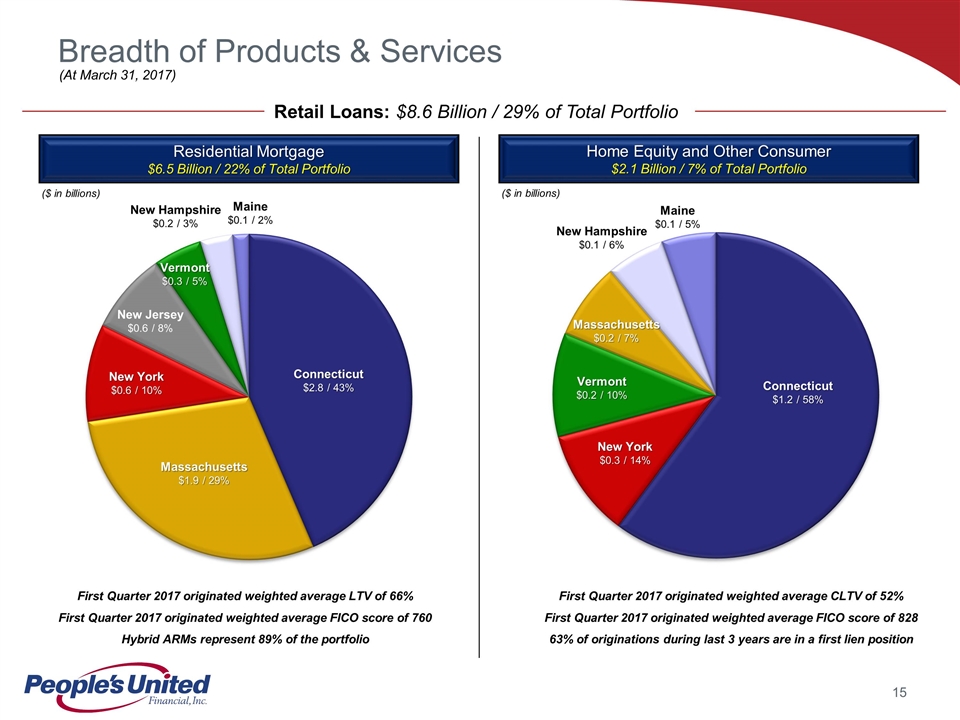

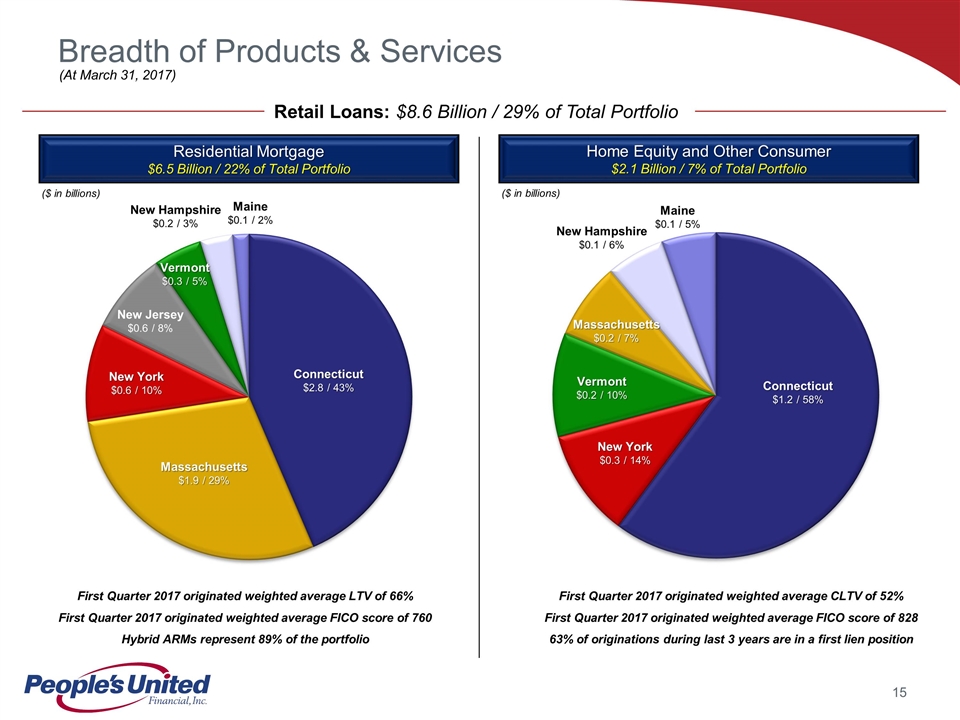

Residential Mortgage $6.5 Billion / 22% of Total Portfolio (At March 31, 2017) Retail Loans: $8.6 Billion / 29% of Total Portfolio ($ in billions) ($ in billions) Home Equity and Other Consumer $2.1 Billion / 7% of Total Portfolio First Quarter 2017 originated weighted average LTV of 66% First Quarter 2017 originated weighted average FICO score of 760 Hybrid ARMs represent 89% of the portfolio First Quarter 2017 originated weighted average CLTV of 52% First Quarter 2017 originated weighted average FICO score of 828 63% of originations during last 3 years are in a first lien position New York $0.6 / 10% Vermont $0.3 / 5% Massachusetts $1.9 / 29% Connecticut $2.8 / 43% Connecticut $1.2 / 58% Vermont $0.2 / 10% New York $0.3 / 14% Massachusetts $0.2 / 7% New Hampshire $0.2 / 3% Maine $0.1 / 2% New Jersey $0.6 / 8% New Hampshire $0.1 / 6% Maine $0.1 / 5% Breadth of Products & Services

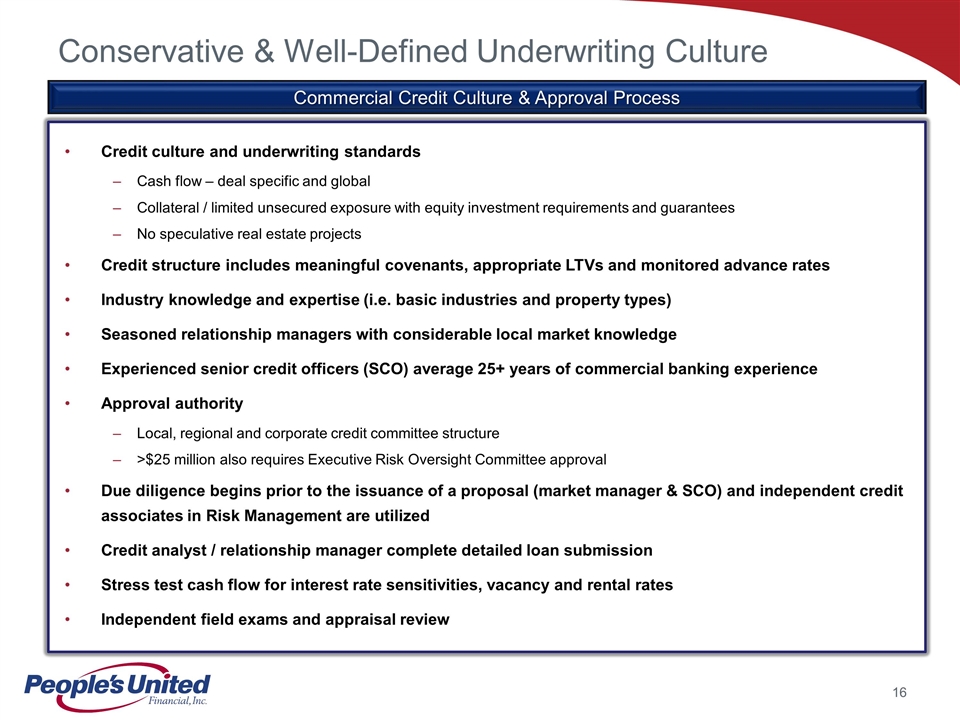

Conservative & Well-Defined Underwriting Culture Credit culture and underwriting standards Cash flow – deal specific and global Collateral / limited unsecured exposure with equity investment requirements and guarantees No speculative real estate projects Credit structure includes meaningful covenants, appropriate LTVs and monitored advance rates Industry knowledge and expertise (i.e. basic industries and property types) Seasoned relationship managers with considerable local market knowledge Experienced senior credit officers (SCO) average 25+ years of commercial banking experience Approval authority Local, regional and corporate credit committee structure >$25 million also requires Executive Risk Oversight Committee approval Due diligence begins prior to the issuance of a proposal (market manager & SCO) and independent credit associates in Risk Management are utilized Credit analyst / relationship manager complete detailed loan submission Stress test cash flow for interest rate sensitivities, vacancy and rental rates Independent field exams and appraisal review Commercial Credit Culture & Approval Process

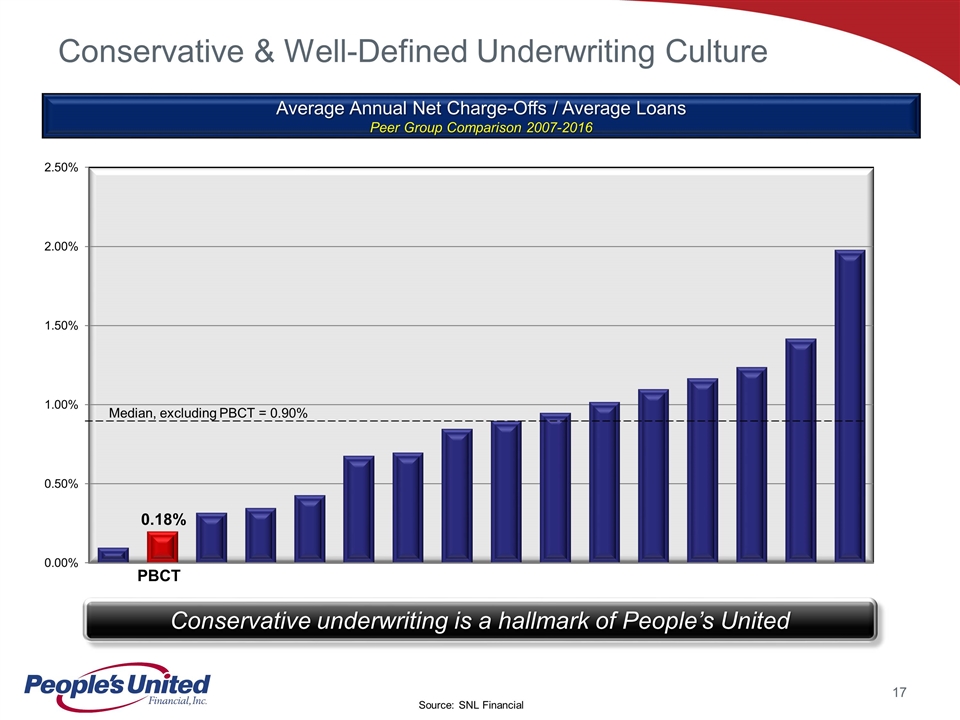

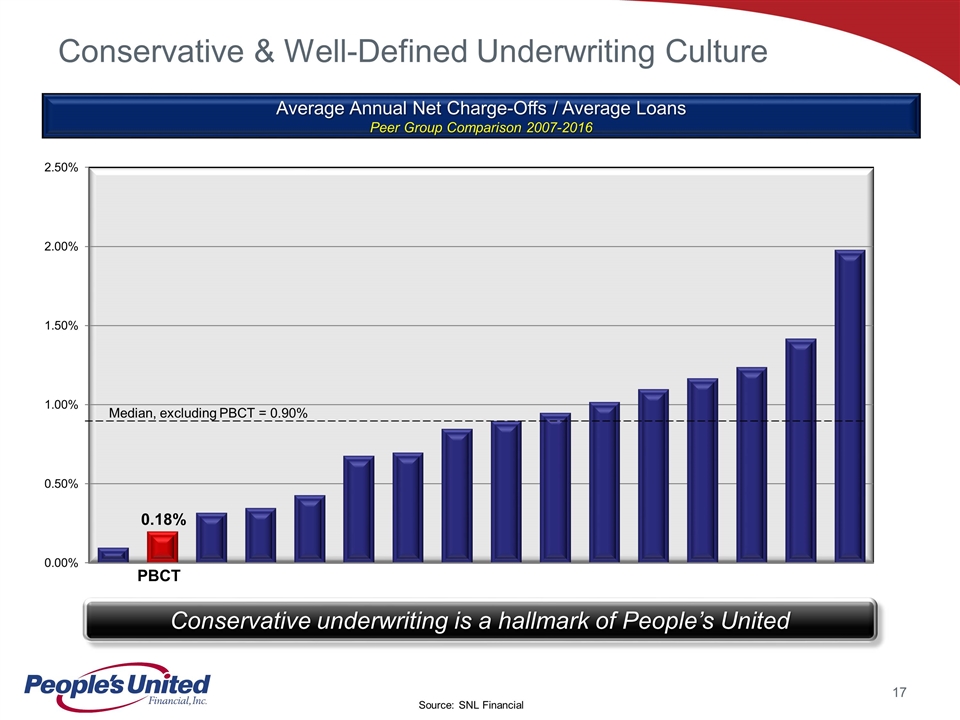

Conservative & Well-Defined Underwriting Culture Conservative underwriting is a hallmark of People’s United Average Annual Net Charge-Offs / Average Loans Peer Group Comparison 2007-2016 0.18% PBCT Median, excluding PBCT = 0.90% Source: SNL Financial

Deep Focus on Expense Management EMOC has been fully operational since November 2011 Committee comprised of the CEO, CFO, Chief Administrative Officer and Chief HR Officer EMOC oversees: Non-interest expense management and implements strategies to attain targeted goals Revenue initiatives that require expenditures and conducts periodic progress reviews Spending requests above $25,000 (or annual spending with a vendor of $75,000 or more) are submitted for approval by business owners and/or finance divisional resources For the purpose of spending limit calculation, all common expenditures are aggregated for approval purposes Staffing models, staffing replacements and additions for mid-level positions and above require approval by the Committee Expense Management Oversight Committee (EMOC) Proactive expense management approach

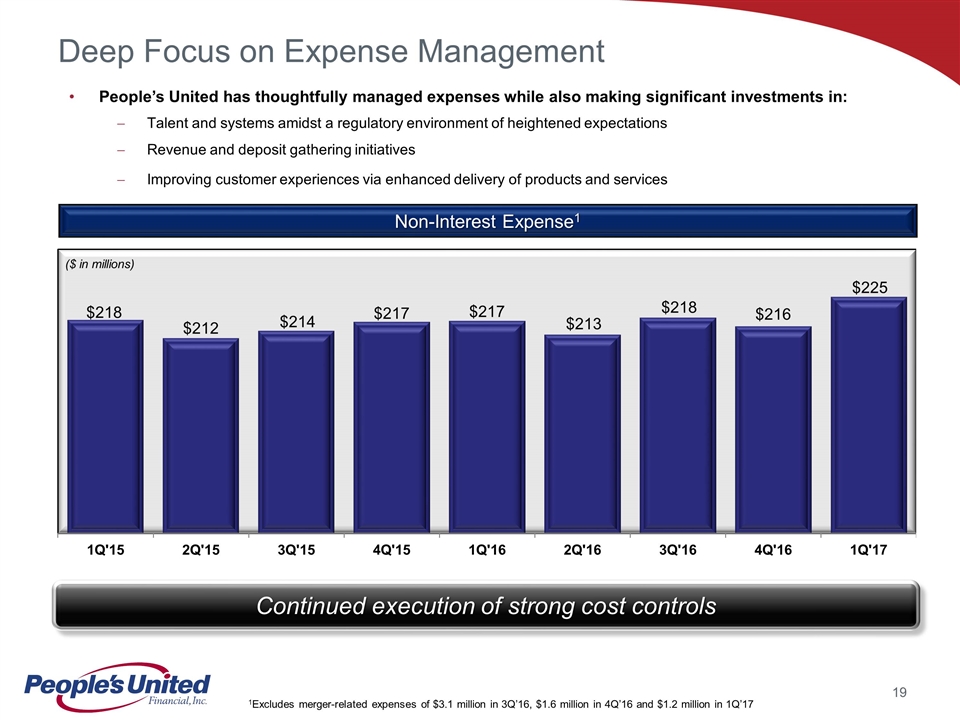

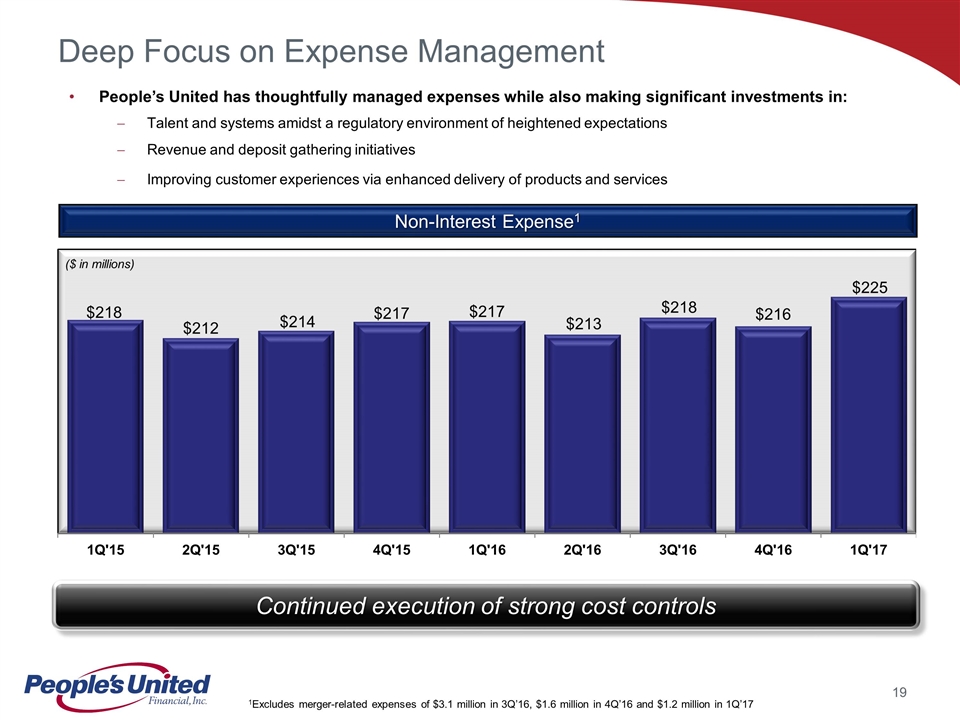

Deep Focus on Expense Management People’s United has thoughtfully managed expenses while also making significant investments in: Talent and systems amidst a regulatory environment of heightened expectations Revenue and deposit gathering initiatives Improving customer experiences via enhanced delivery of products and services Non-Interest Expense1 Continued execution of strong cost controls ($ in millions) 1Excludes merger-related expenses of $3.1 million in 3Q’16, $1.6 million in 4Q’16 and $1.2 million in 1Q’17

Leveraging investments in Massachusetts and New York Building large-corporate and government banking productivity Continuing to leverage investment in asset-based lending Focusing on deposit gathering capabilities Growing insurance and wealth management fee income Increasing momentum in other fee income businesses Delivering interest rate swaps and foreign exchange products to corporate customers Expanding international trade finance Growing commercial banking lending fees Investing in competitive cash management products These significant opportunities expected to provide earnings growth for years to come Significant Opportunities Continuing to grow in our expanded footprint, while deepening presence across heritage markets

Building Strong Banking Franchise for the Long-Term Committed to delivering exceptional service to clients and profitable growth to shareholders Increase focus on relationship profitability Continue to build deep, multi-product relationships Deposit gathering remains a key focus and is reflected in incentive structure Maintain pristine asset quality Control expenses tightly while investing in key infrastructure Remain asset sensitive to position People’s United for additional increases in interest rates

First Quarter 2017 Results

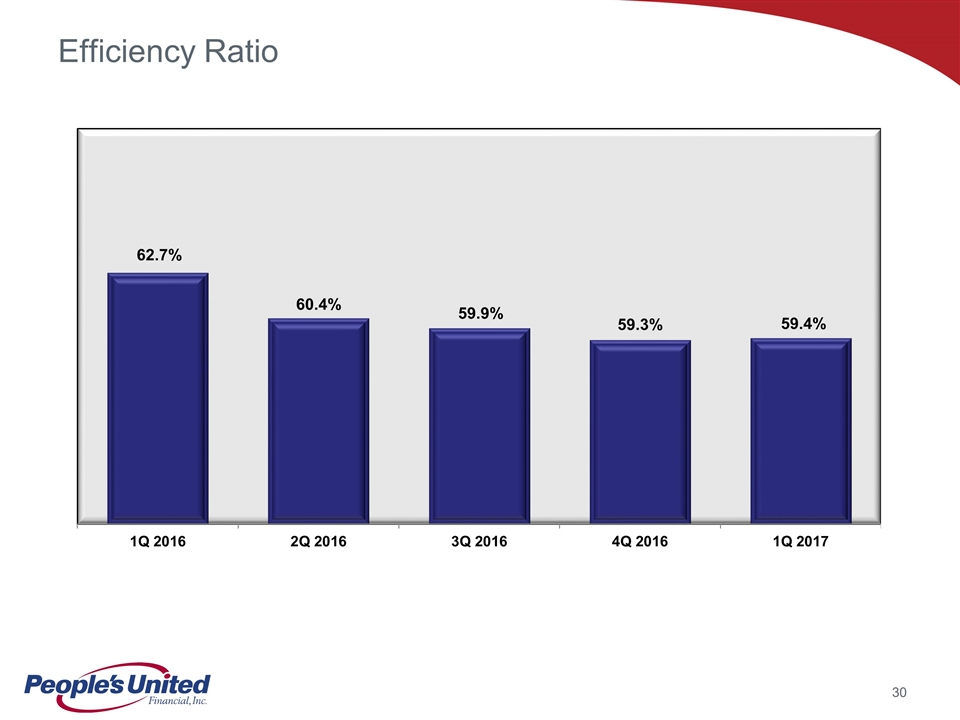

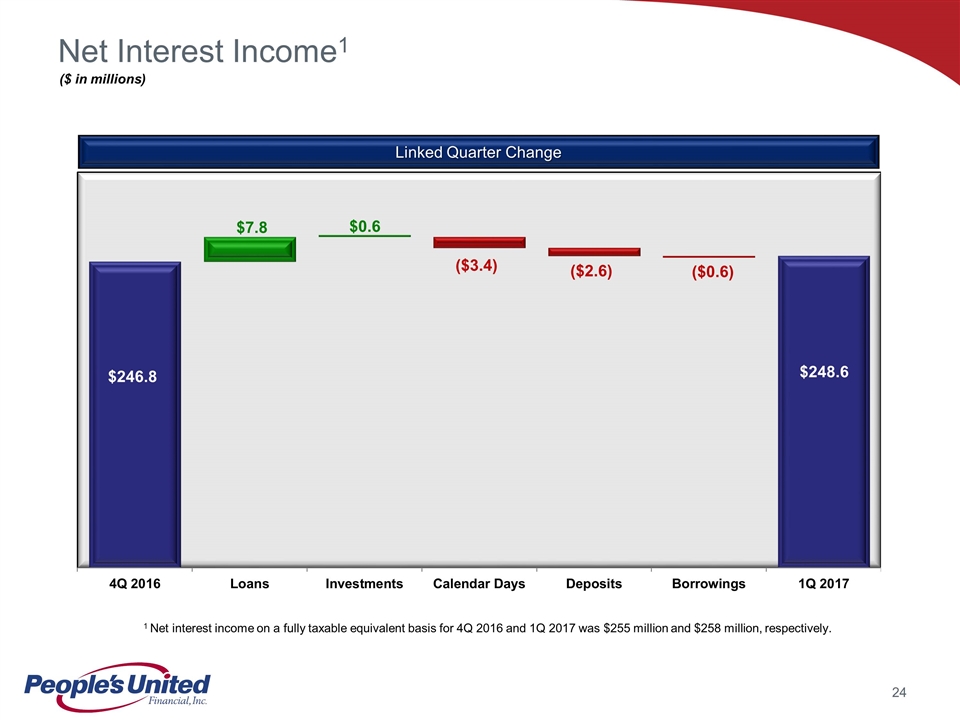

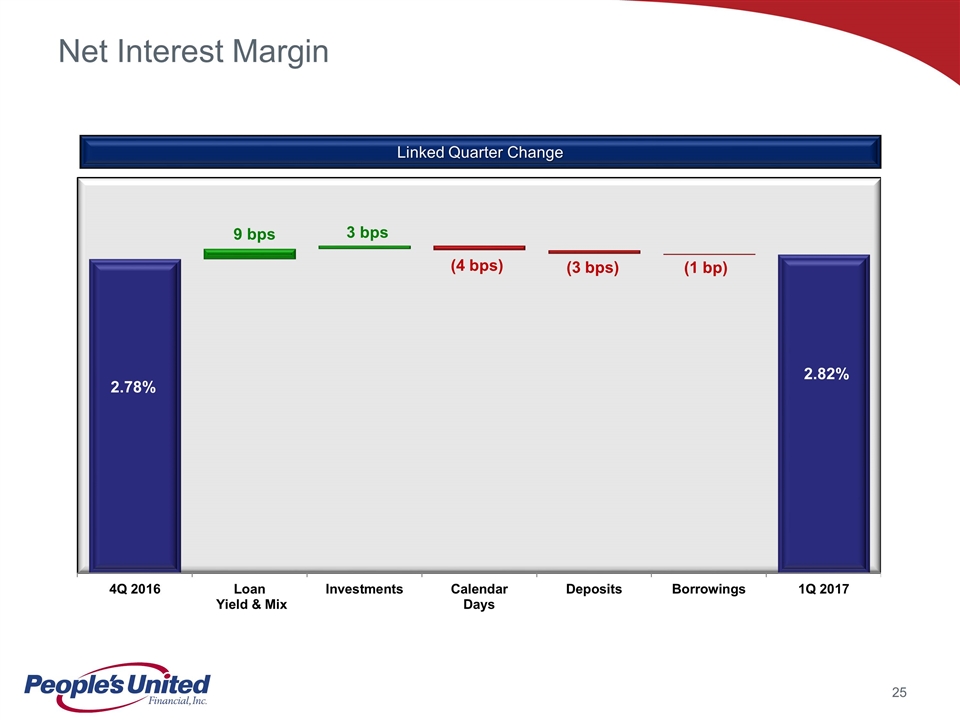

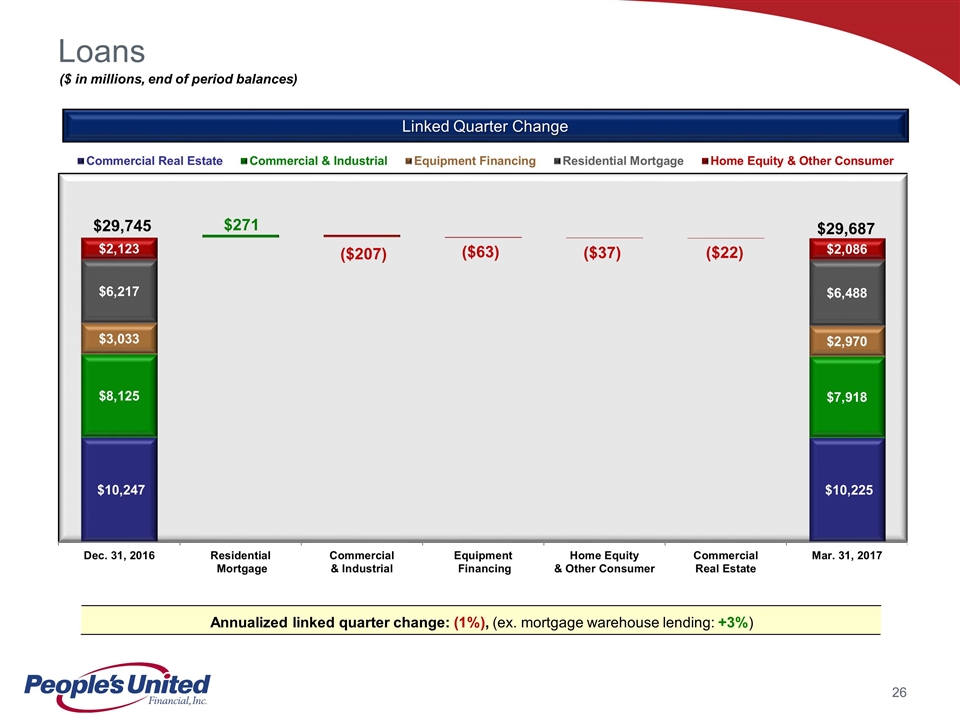

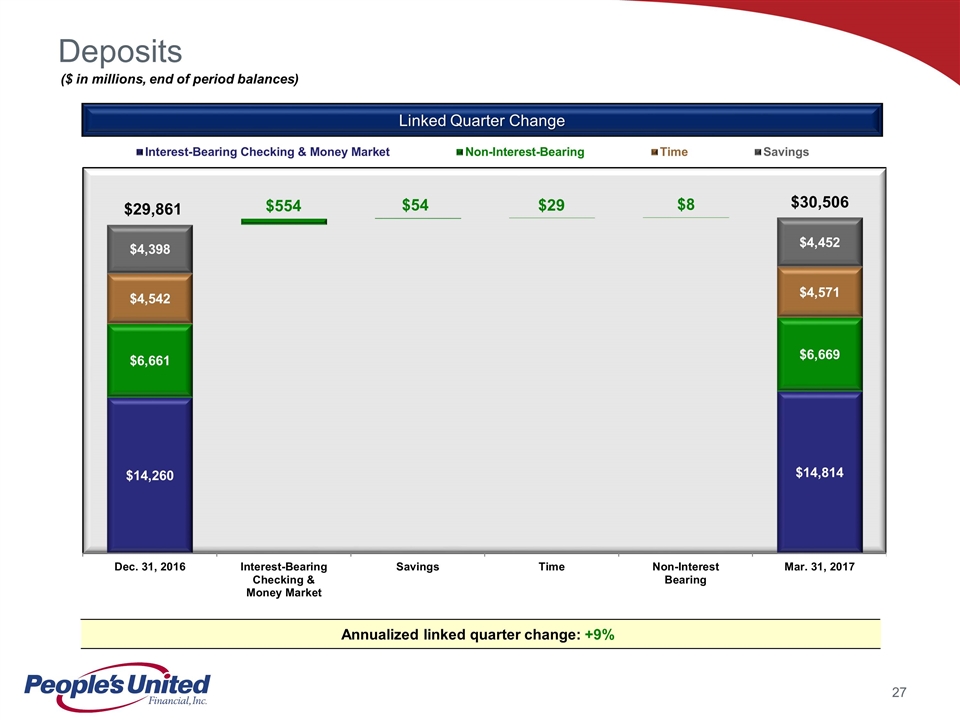

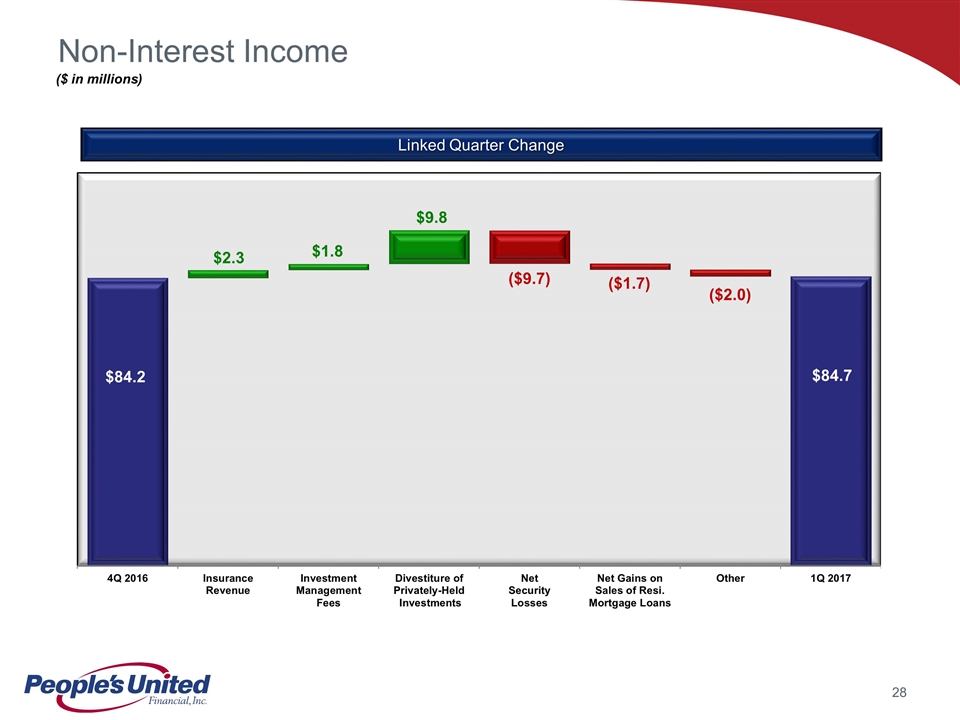

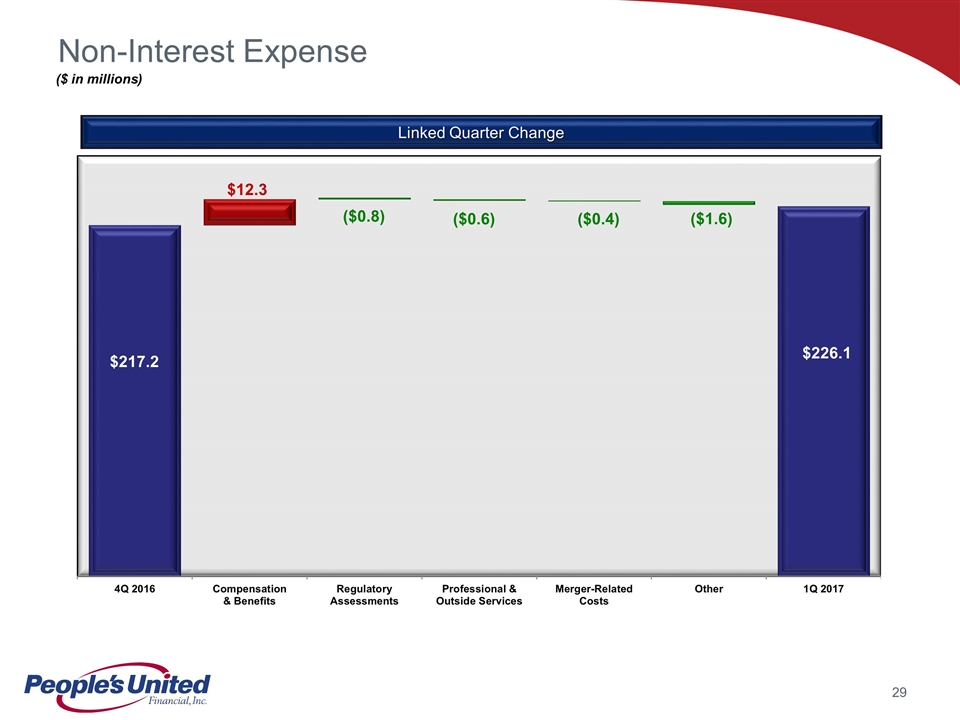

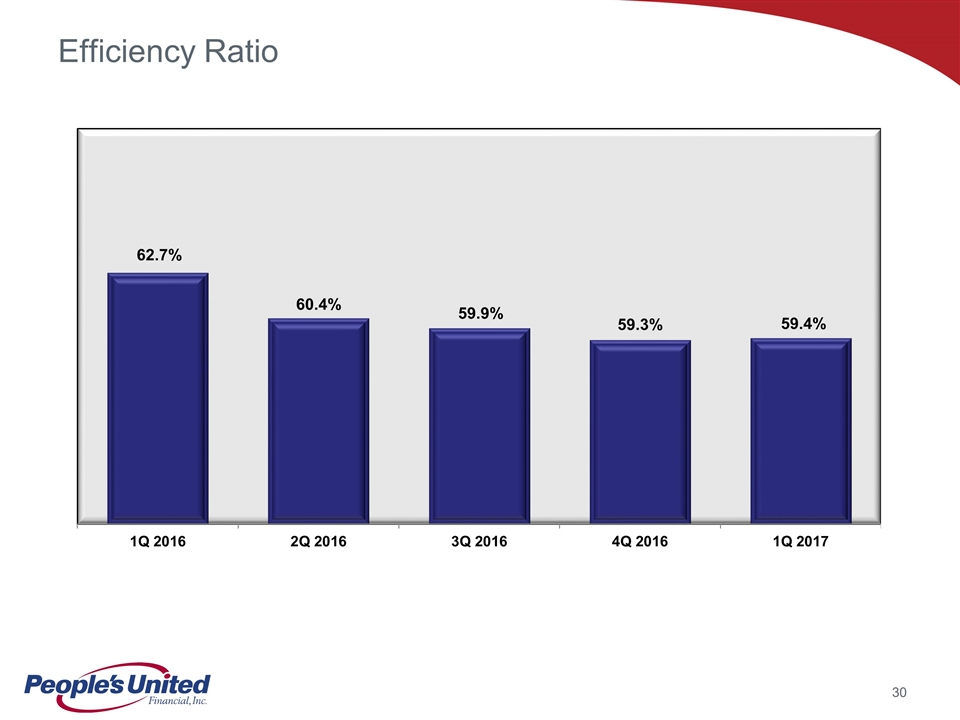

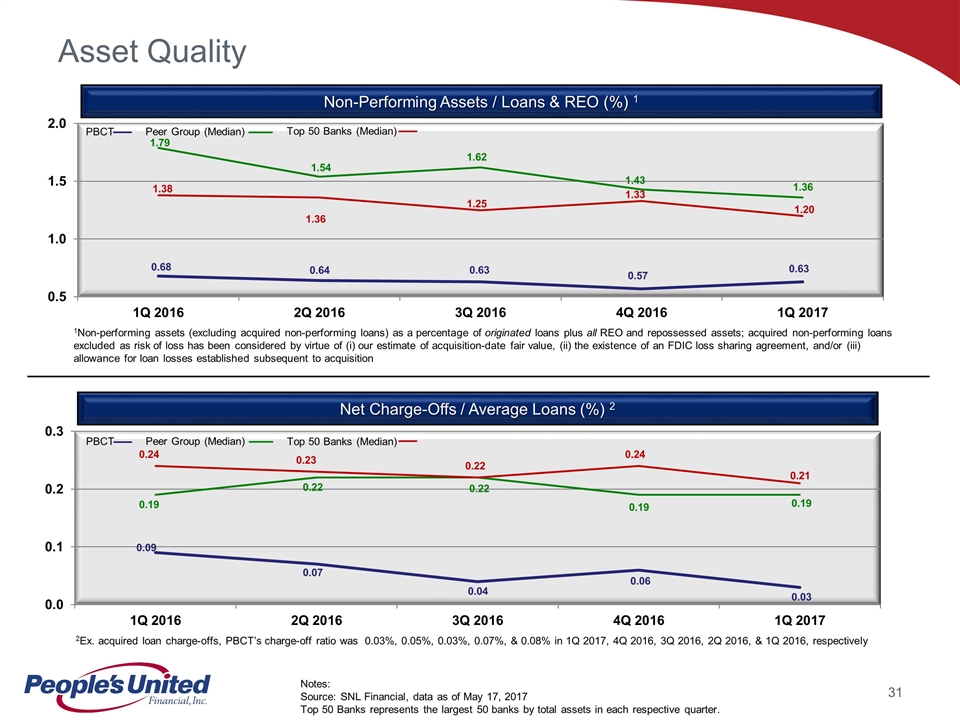

Net Income of $70.8 Million, or $0.22 Per Common Share, Common Dividend Increase Announced Net income decreased $5.1 million or 7%; increased $7.9 million or 13% from 1st quarter 2016 Earnings per common share decreased $0.02; increased $0.01 from 1st quarter 2016 Net interest income1 of $249 million, an increase of $2 million or 1% Net interest margin of 2.82%, an increase of 4 basis points Loan balances decreased $58 million, (1%) annualized rate Excluding mortgage warehouse lending, loan growth of $205 million, 3% annualized growth rate Deposit growth of $645 million, 9% annualized growth rate Non-interest income of $85 million, an increase of $500,000 or 1% Non-interest expense of $226 million, an increase of $9 million or 4% Includes seasonally higher first quarter payroll-related and benefit costs Includes $1.2 million of merger-related costs compared to $1.6 million in the 4th quarter Efficiency ratio of 59.4%, comparable with the fourth quarter; improved from 1st quarter 2016 Net loan charge-offs of 0.03%, an improvement of 3 basis points 1 Net interest income on a fully taxable equivalent basis was $258 million, an increase of 1%. (Comparisons versus fourth quarter 2016, unless noted otherwise) First Quarter 2017 Overview

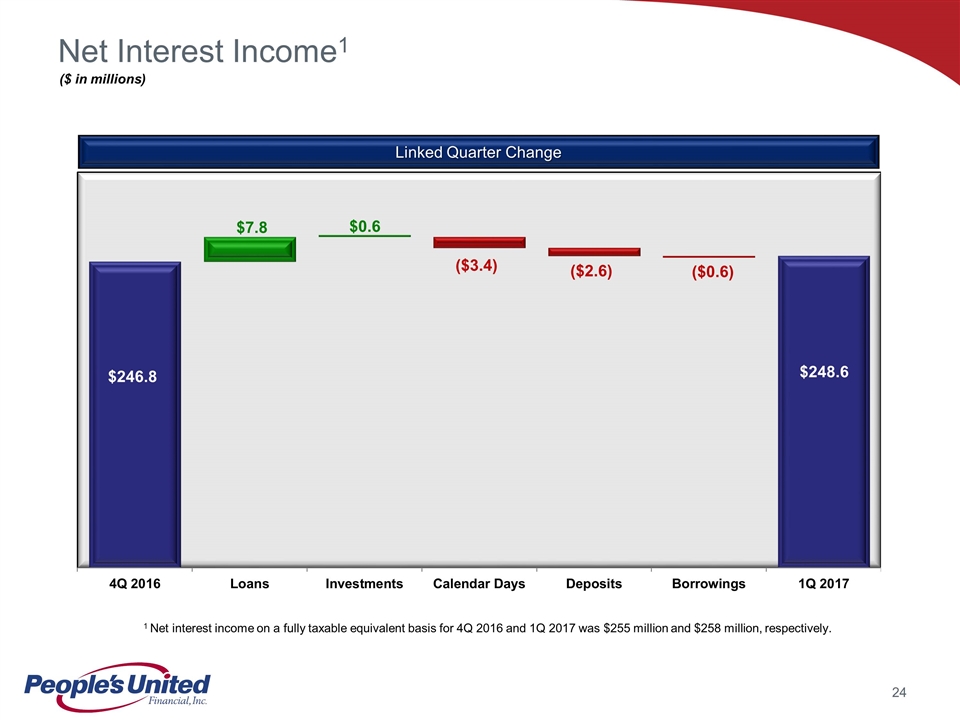

Net Interest Income1 ($ in millions) Linked Quarter Change $246.8 $248.6 1 Net interest income on a fully taxable equivalent basis for 4Q 2016 and 1Q 2017 was $255 million and $258 million, respectively. $7.8 $0.6 ($3.4) ($2.6) ($0.6)

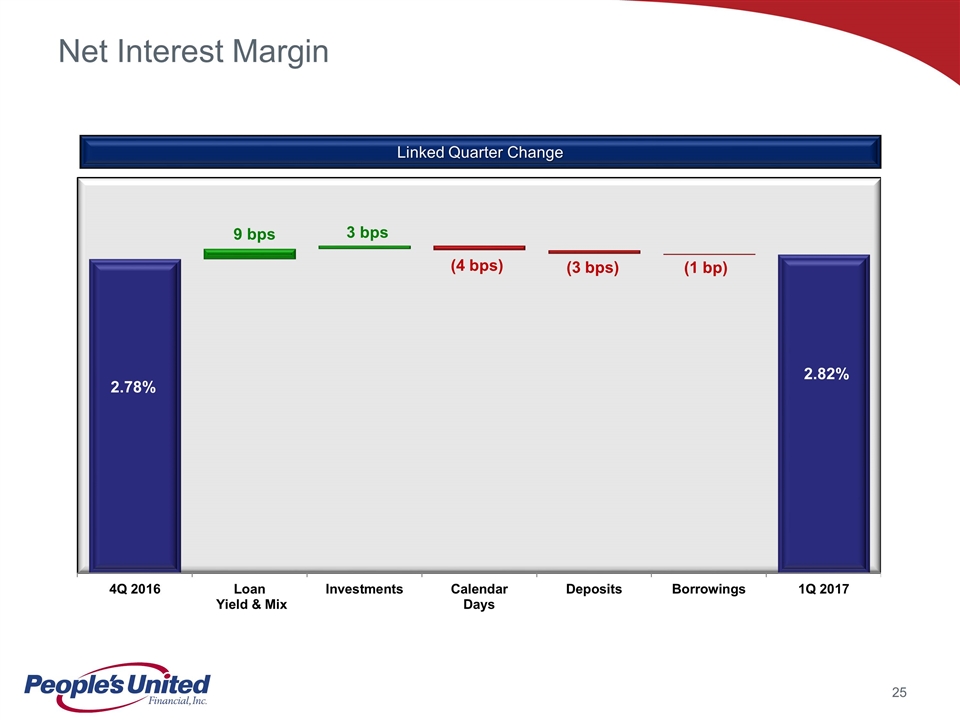

Net Interest Margin Linked Quarter Change 2.78% 2.82% 9 bps (4 bps) (3 bps) (1 bp) 3 bps

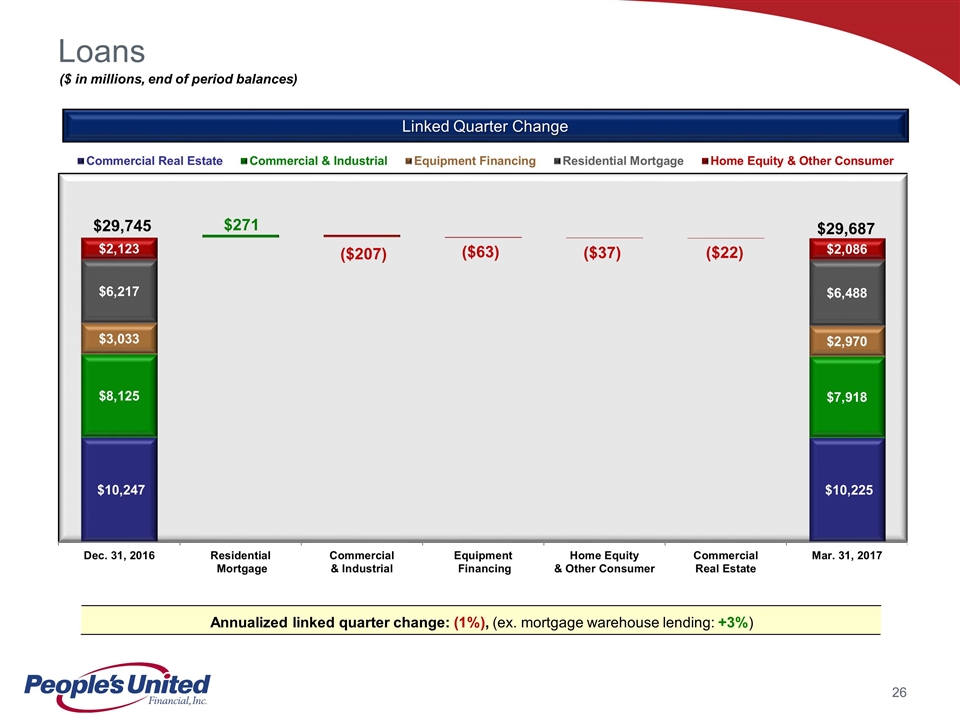

Loans $29,687 ($ in millions, end of period balances) $29,745 Annualized linked quarter change: (1%), (ex. mortgage warehouse lending: +3%) Linked Quarter Change $271 ($207) ($63) ($37) ($22)

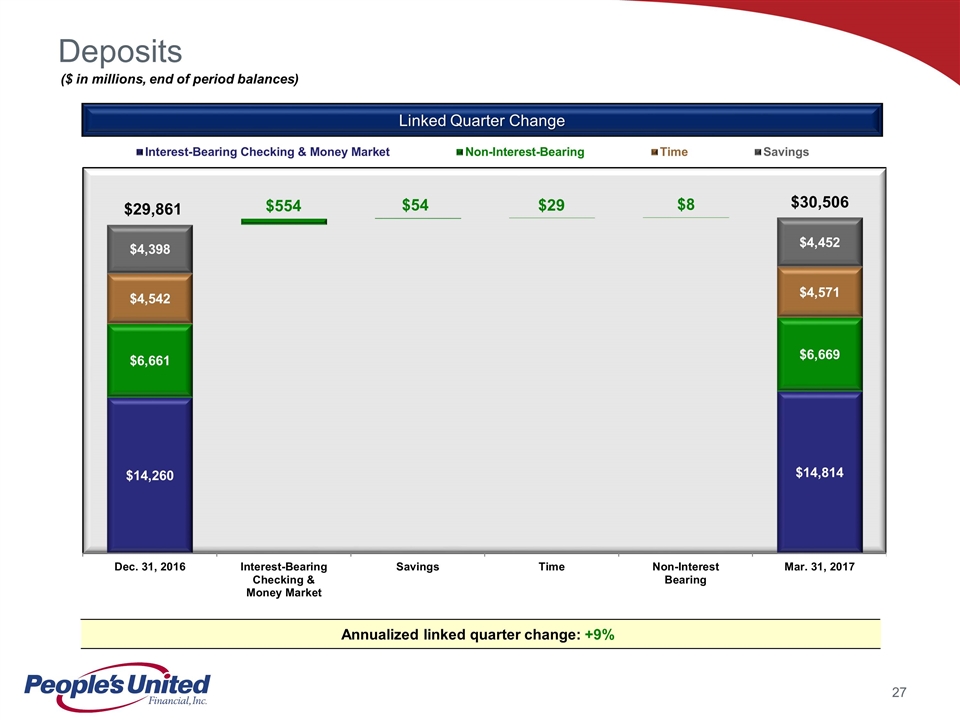

Deposits Linked Quarter Change ($ in millions, end of period balances) Annualized linked quarter change: +9% $30,506 $554 $29,861 $54 $29 $8

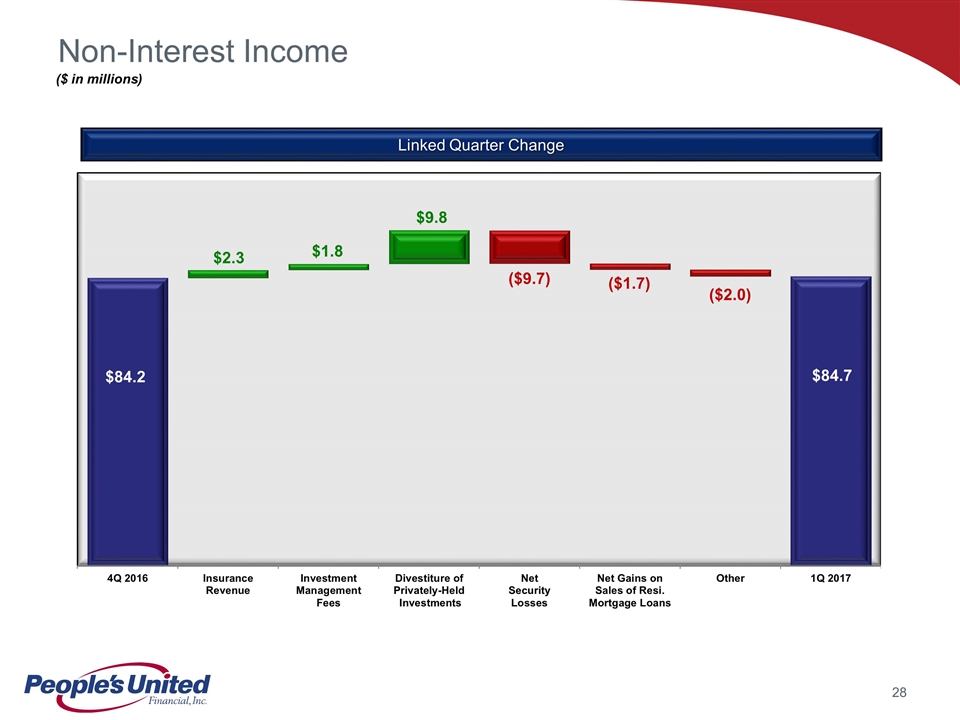

Non-Interest Income ($ in millions) $84.2 $84.7 Linked Quarter Change $9.8 ($9.7) $1.8 $2.3 ($1.7) ($2.0)

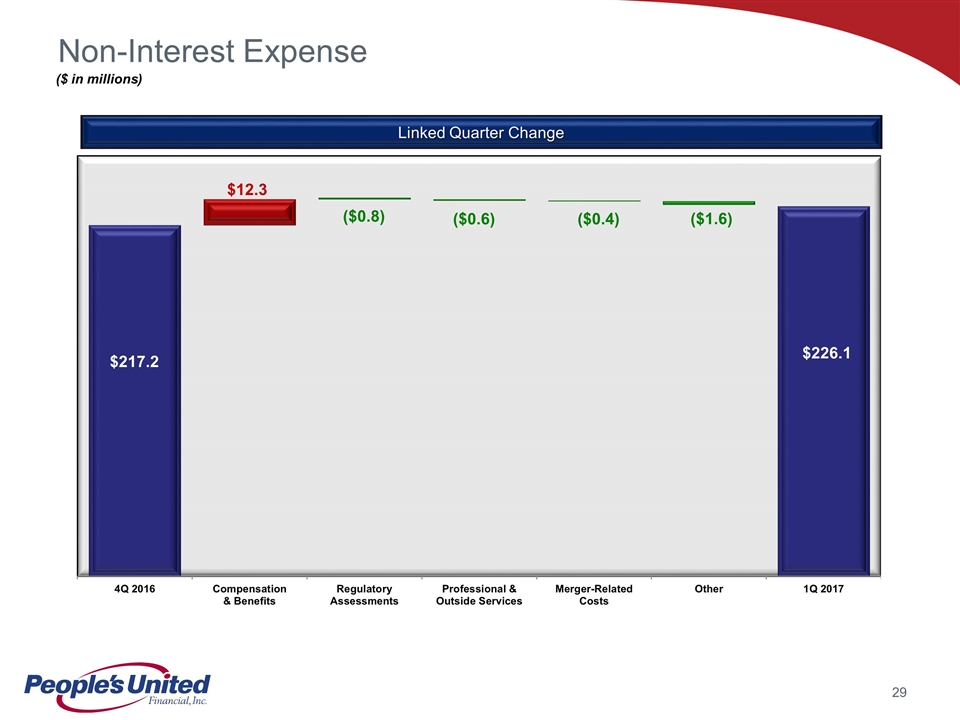

Non-Interest Expense ($ in millions) ($0.8) $226.1 $217.2 Linked Quarter Change $12.3 ($0.6) ($0.4) ($1.6)

Efficiency Ratio

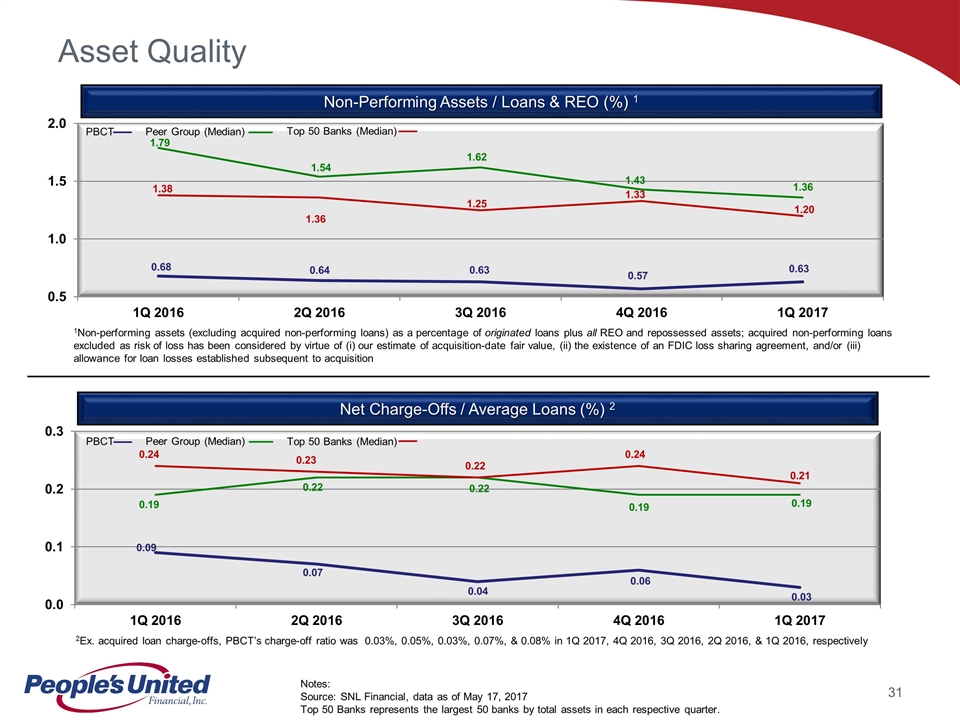

Asset Quality Non-Performing Assets / Loans & REO (%) 1 1Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of (i) our estimate of acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or (iii) allowance for loan losses established subsequent to acquisition Notes: Source: SNL Financial, data as of May 17, 2017 Top 50 Banks represents the largest 50 banks by total assets in each respective quarter. Net Charge-Offs / Average Loans (%) 2 2Ex. acquired loan charge-offs, PBCT’s charge-off ratio was 0.03%, 0.05%, 0.03%, 0.07%, & 0.08% in 1Q 2017, 4Q 2016, 3Q 2016, 2Q 2016, & 1Q 2016, respectively PBCT Peer Group (Median) Top 50 Banks (Median) PBCT Peer Group (Median) Top 50 Banks (Median)

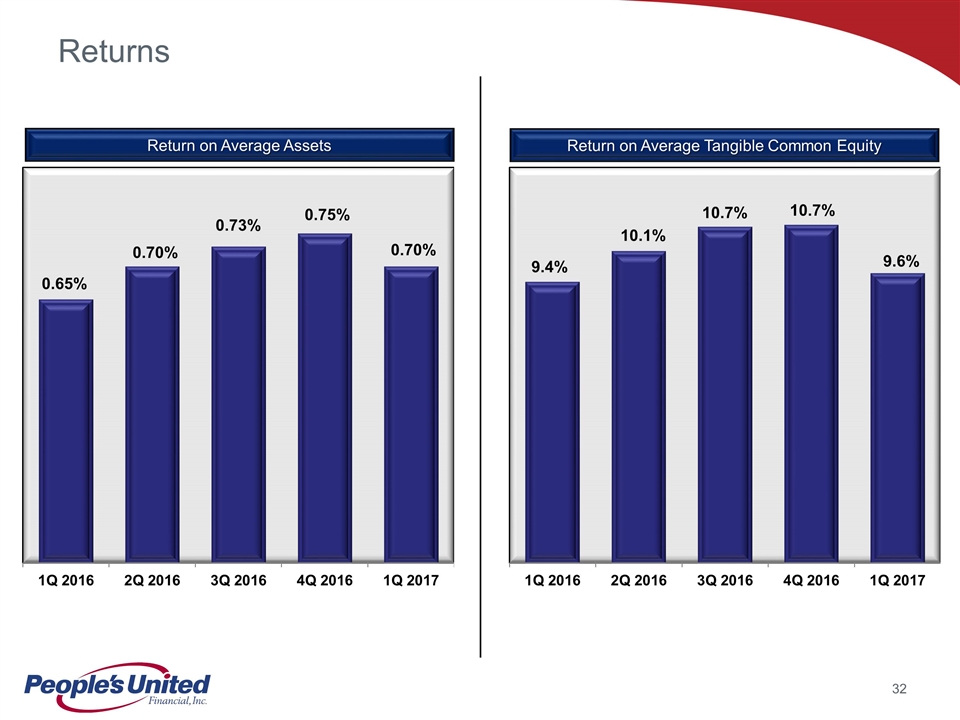

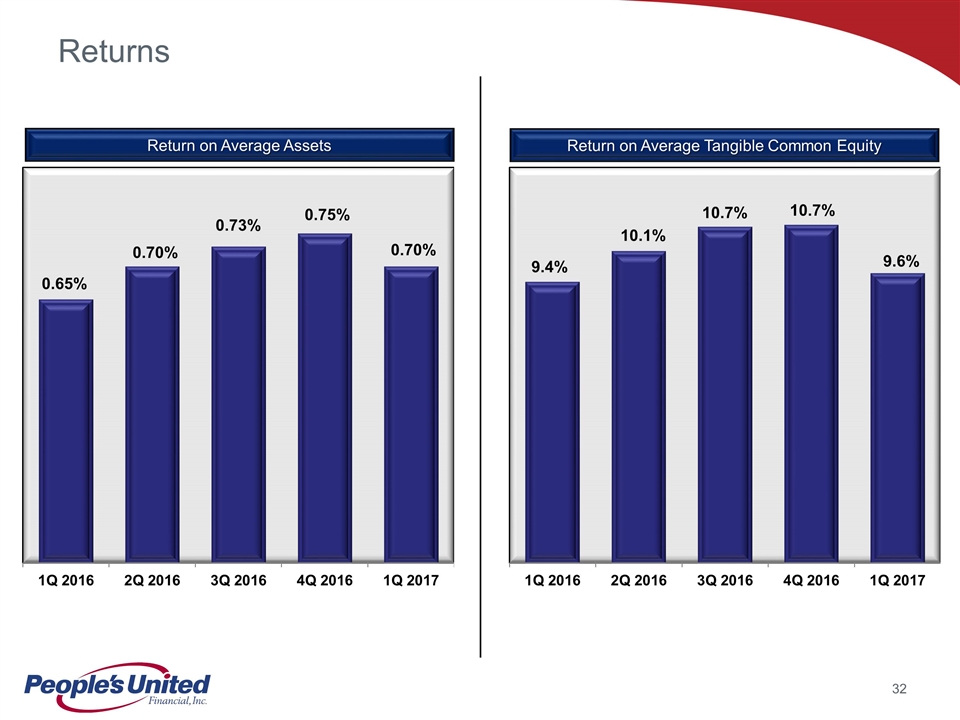

Returns Return on Average Assets Return on Average Tangible Common Equity

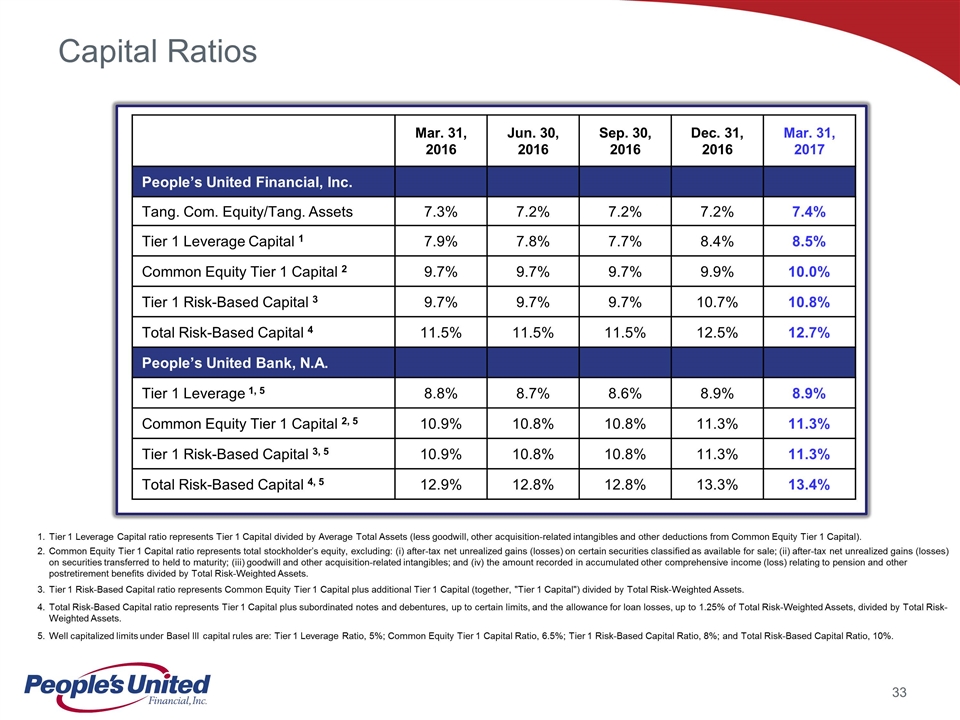

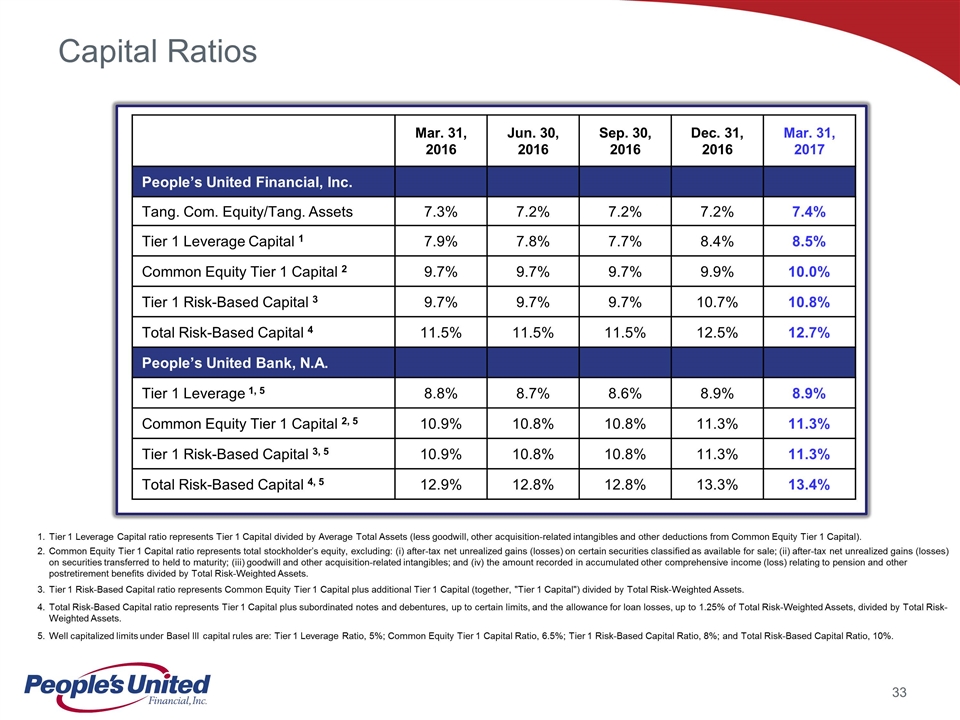

Capital Ratios Tier 1 Leverage Capital ratio represents Tier 1 Capital divided by Average Total Assets (less goodwill, other acquisition-related intangibles and other deductions from Common Equity Tier 1 Capital). Common Equity Tier 1 Capital ratio represents total stockholder’s equity, excluding: (i) after-tax net unrealized gains (losses) on certain securities classified as available for sale; (ii) after-tax net unrealized gains (losses) on securities transferred to held to maturity; (iii) goodwill and other acquisition-related intangibles; and (iv) the amount recorded in accumulated other comprehensive income (loss) relating to pension and other postretirement benefits divided by Total Risk-Weighted Assets. Tier 1 Risk-Based Capital ratio represents Common Equity Tier 1 Capital plus additional Tier 1 Capital (together, "Tier 1 Capital") divided by Total Risk-Weighted Assets. Total Risk-Based Capital ratio represents Tier 1 Capital plus subordinated notes and debentures, up to certain limits, and the allowance for loan losses, up to 1.25% of Total Risk-Weighted Assets, divided by Total Risk-Weighted Assets. Well capitalized limits under Basel III capital rules are: Tier 1 Leverage Ratio, 5%; Common Equity Tier 1 Capital Ratio, 6.5%; Tier 1 Risk-Based Capital Ratio, 8%; and Total Risk-Based Capital Ratio, 10%. Mar. 31, 2016 Jun. 30, 2016 Sep. 30, 2016 Dec. 31, 2016 Mar. 31, 2017 People’s United Financial, Inc. Tang. Com. Equity/Tang. Assets 7.3% 7.2% 7.2% 7.2% 7.4% Tier 1 Leverage Capital 1 7.9% 7.8% 7.7% 8.4% 8.5% Common Equity Tier 1 Capital 2 9.7% 9.7% 9.7% 9.9% 10.0% Tier 1 Risk-Based Capital 3 9.7% 9.7% 9.7% 10.7% 10.8% Total Risk-Based Capital 4 11.5% 11.5% 11.5% 12.5% 12.7% People’s United Bank, N.A. Tier 1 Leverage 1, 5 8.8% 8.7% 8.6% 8.9% 8.9% Common Equity Tier 1 Capital 2, 5 10.9% 10.8% 10.8% 11.3% 11.3% Tier 1 Risk-Based Capital 3, 5 10.9% 10.8% 10.8% 11.3% 11.3% Total Risk-Based Capital 4, 5 12.9% 12.8% 12.8% 13.3% 13.4%

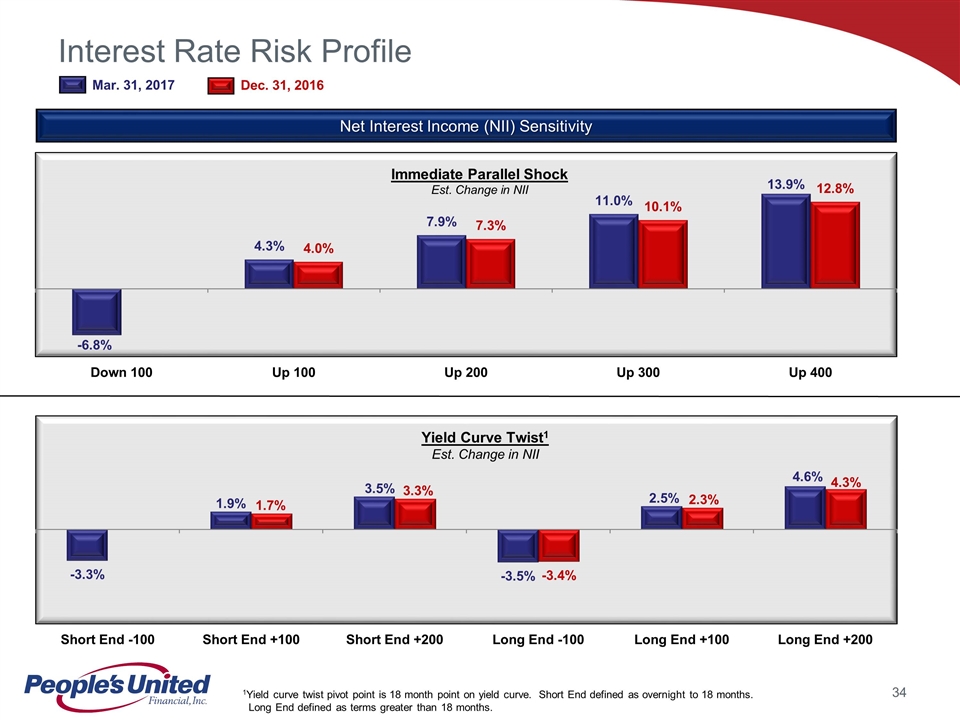

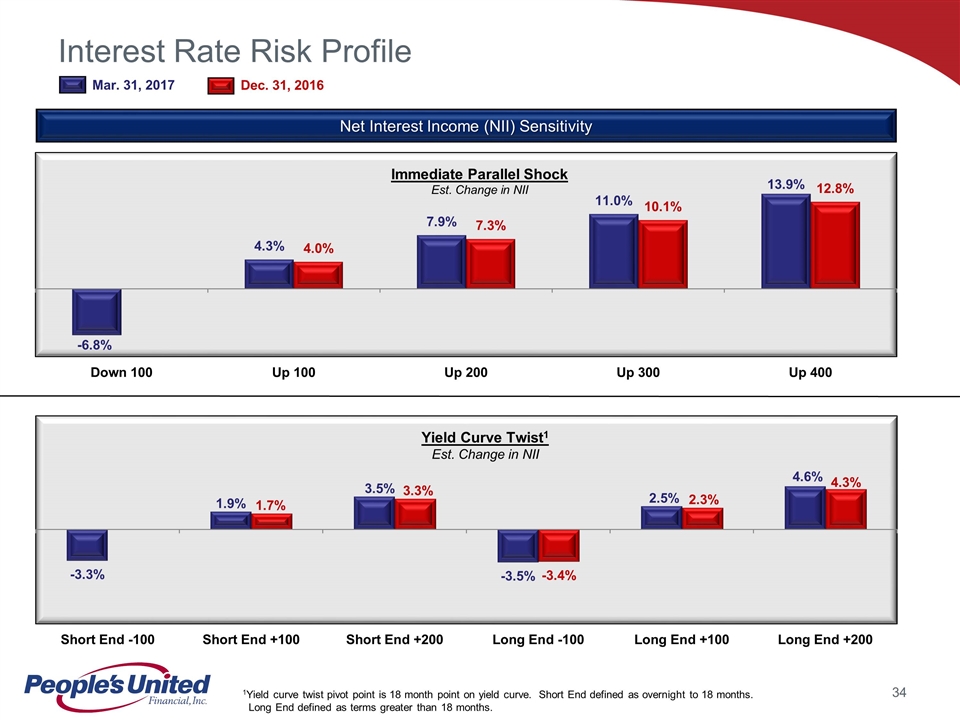

Interest Rate Risk Profile Net Interest Income (NII) Sensitivity 1Yield curve twist pivot point is 18 month point on yield curve. Short End defined as overnight to 18 months. Long End defined as terms greater than 18 months. Immediate Parallel Shock Est. Change in NII Yield Curve Twist1 Est. Change in NII Mar. 31, 2017 Dec. 31, 2016

Appendix

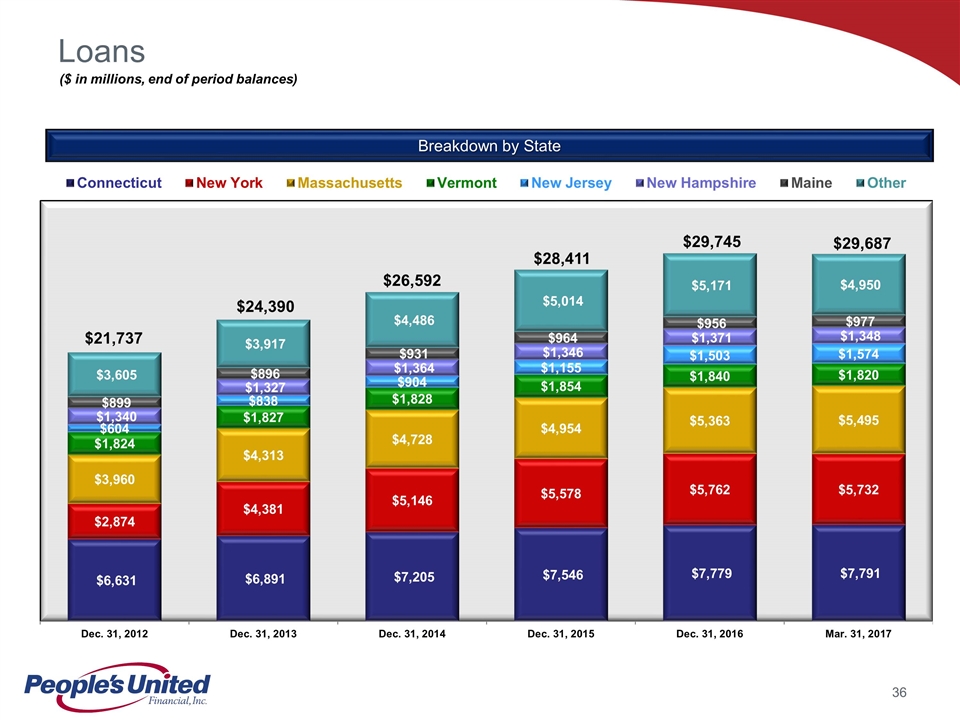

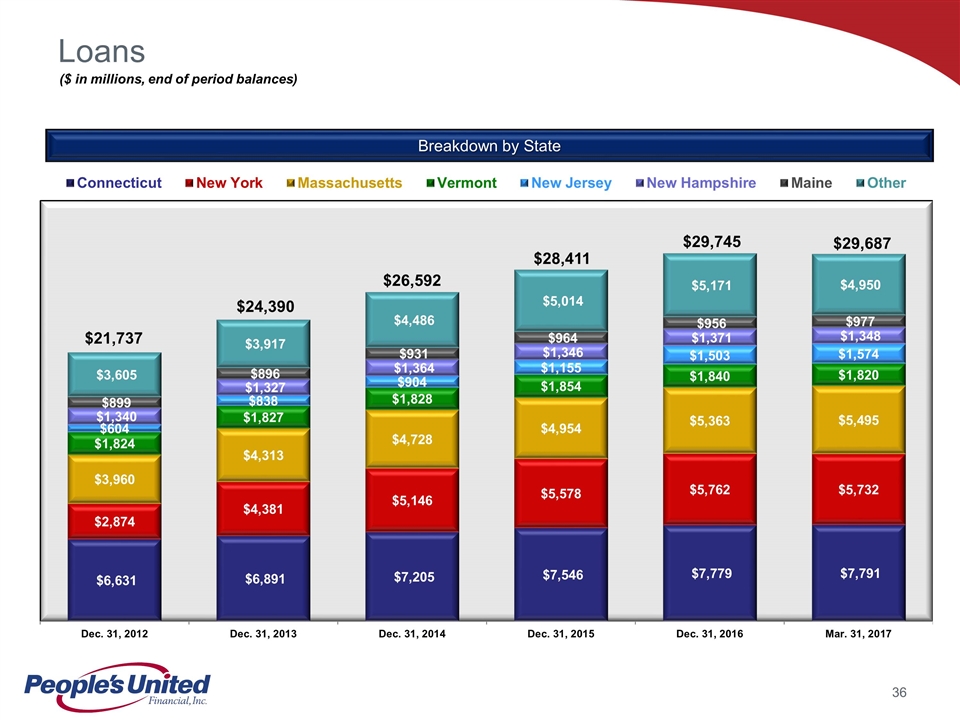

Loans ($ in millions, end of period balances) Breakdown by State $21,737 $24,390 $26,592 $29,745 $29,687 $28,411

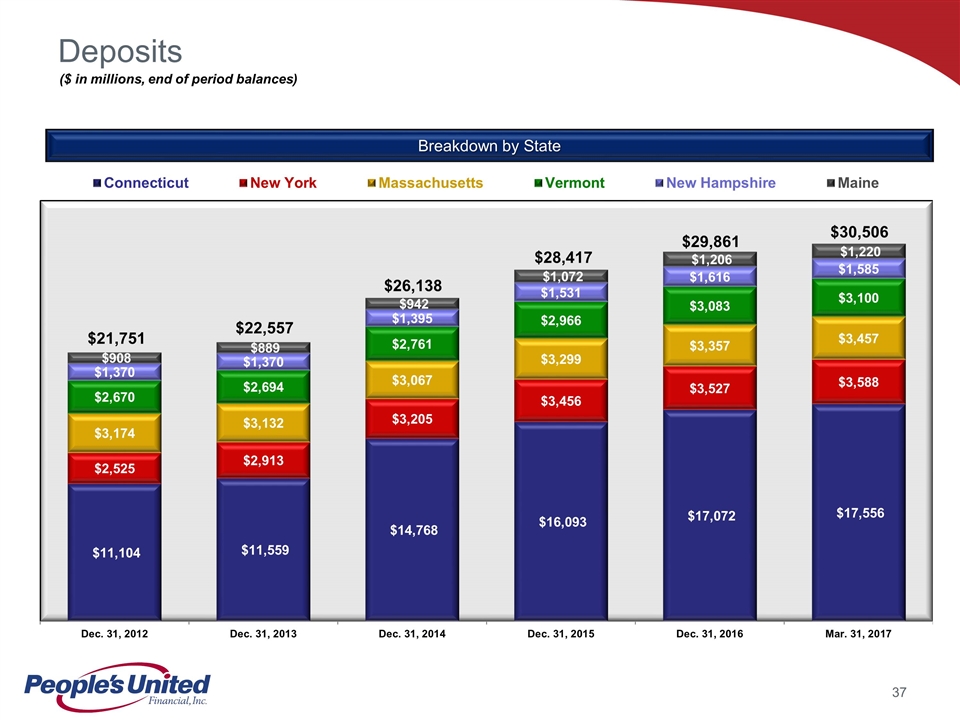

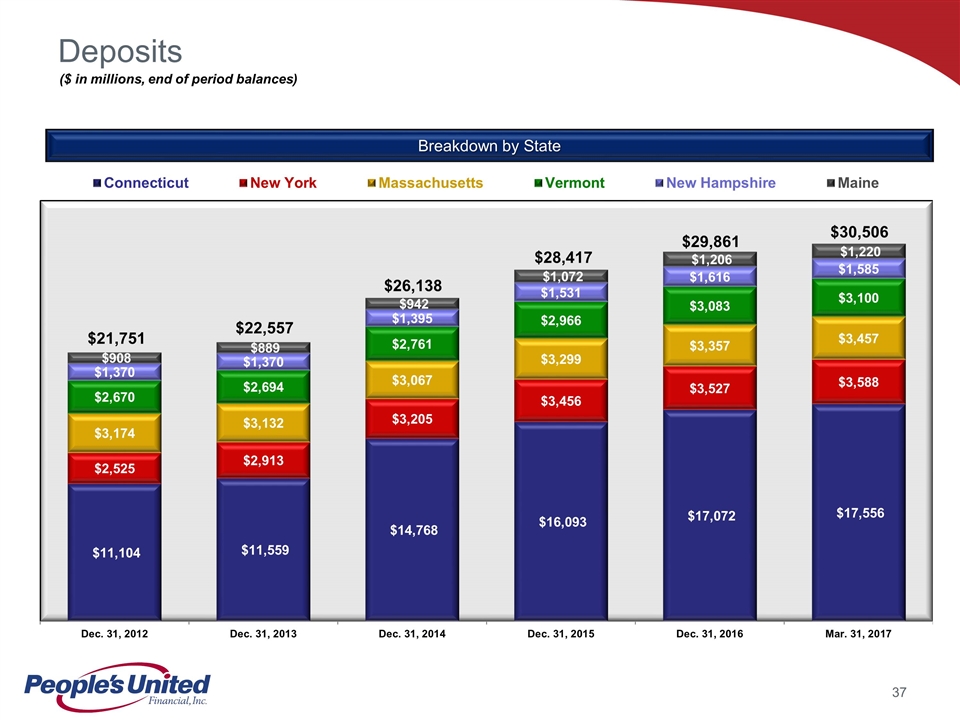

Deposits ($ in millions, end of period balances) Breakdown by State $21,751 $22,557 $26,138 $29,861 $30,506 $28,417

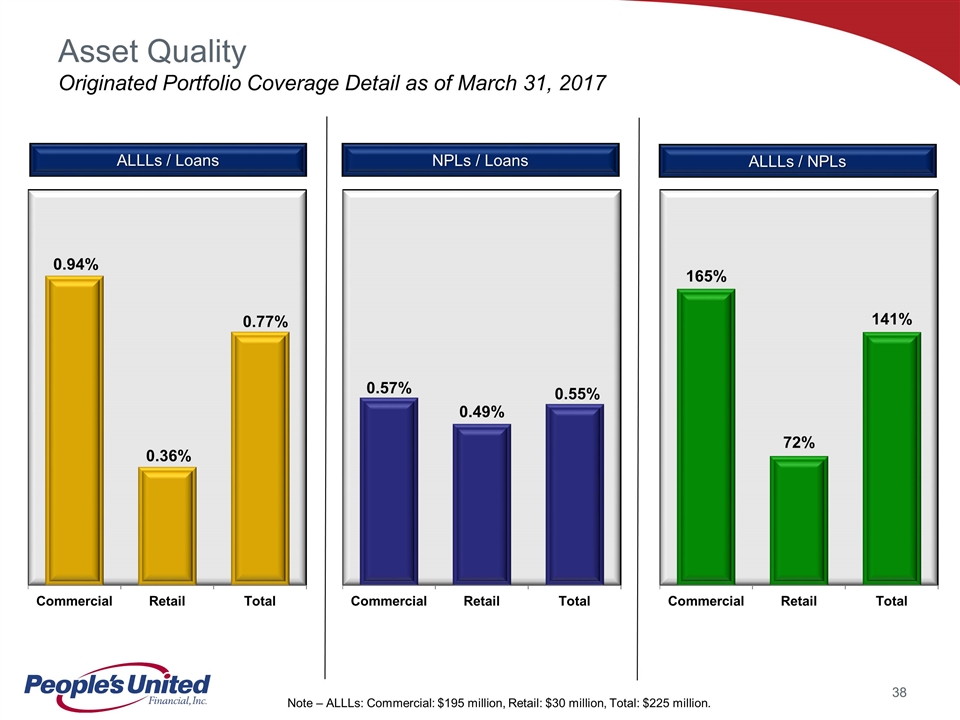

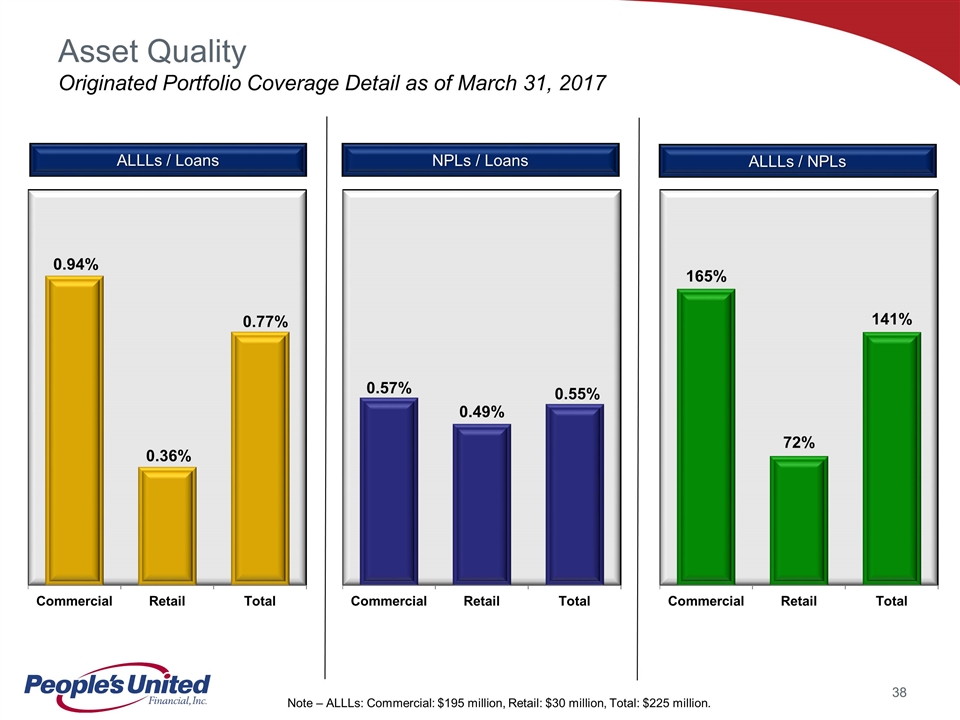

Asset Quality Originated Portfolio Coverage Detail as of March 31, 2017 ALLLs / Loans NPLs / Loans ALLLs / NPLs Note – ALLLs: Commercial: $195 million, Retail: $30 million, Total: $225 million.

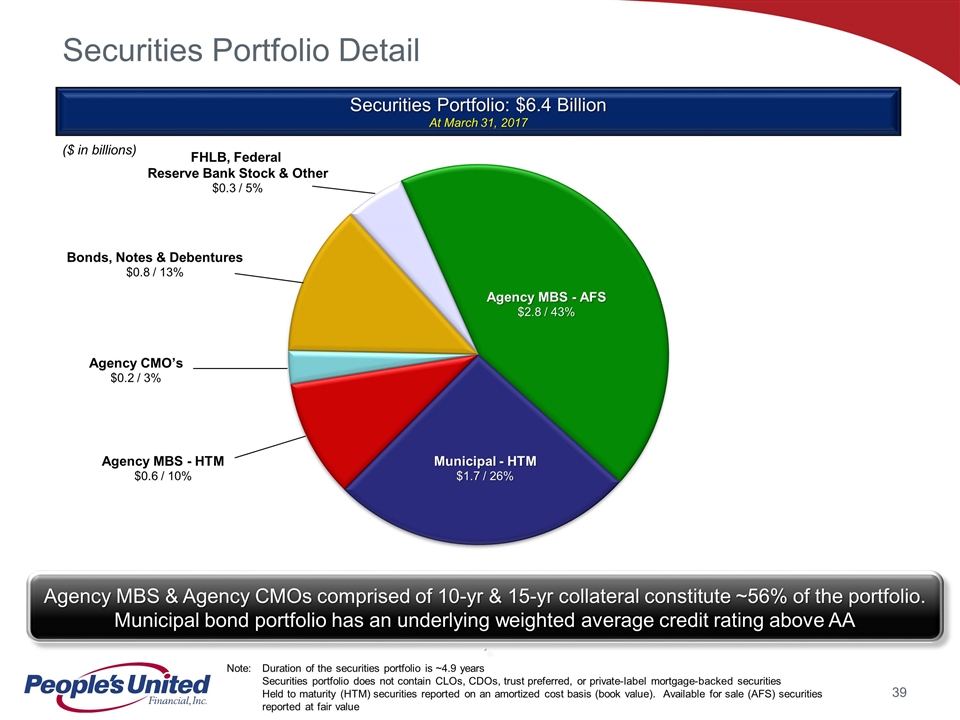

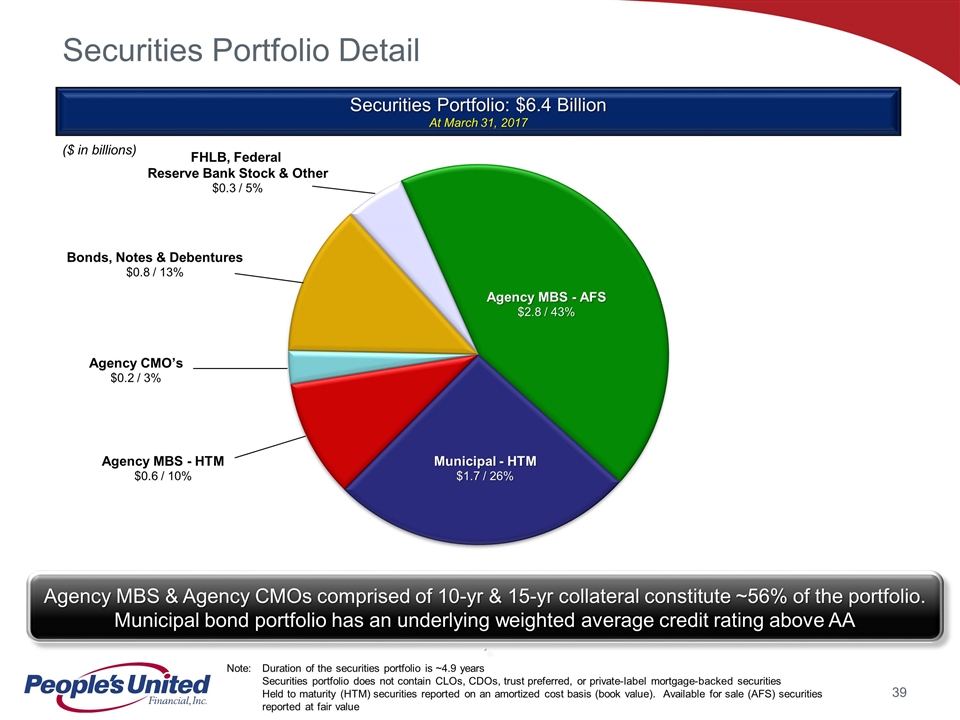

Bonds, Notes & Debentures $0.8 / 13% Securities Portfolio Detail Note: Duration of the securities portfolio is ~4.9 years Securities portfolio does not contain CLOs, CDOs, trust preferred, or private-label mortgage-backed securities Held to maturity (HTM) securities reported on an amortized cost basis (book value). Available for sale (AFS) securities reported at fair value Agency MBS & Agency CMOs comprised of 10-yr & 15-yr collateral constitute ~56% of the portfolio. Municipal bond portfolio has an underlying weighted average credit rating above AA . Securities Portfolio: $6.4 Billion At March 31, 2017 ($ in billions) FHLB, Federal Reserve Bank Stock & Other $0.3 / 5% Agency MBS - HTM $0.6 / 10% Agency MBS - AFS $2.8 / 43% Agency CMO’s $0.2 / 3% Municipal - HTM $1.7 / 26%

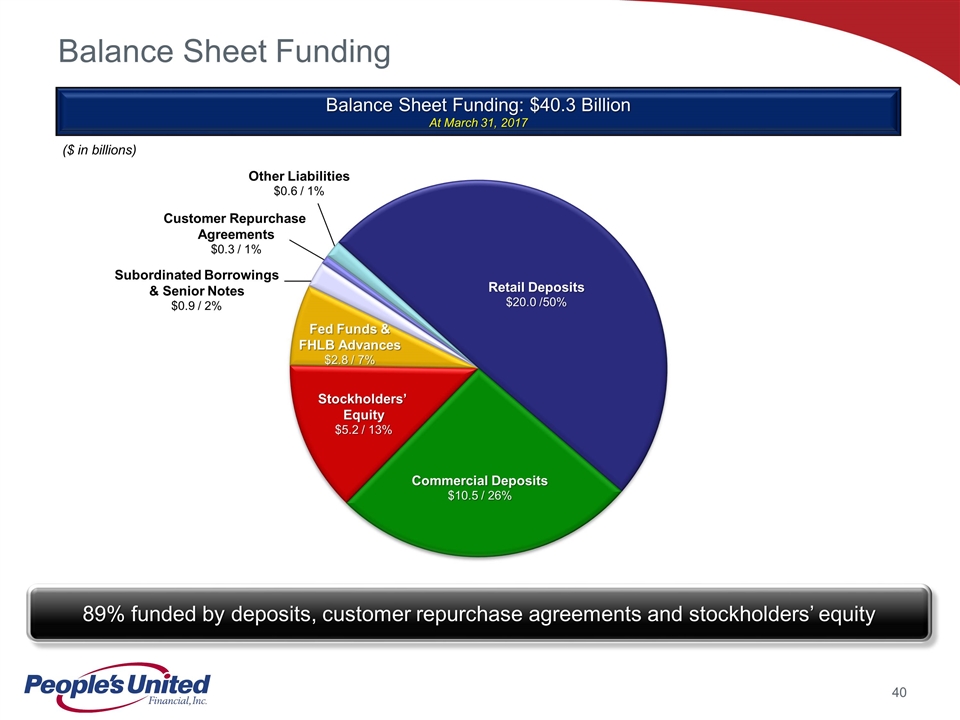

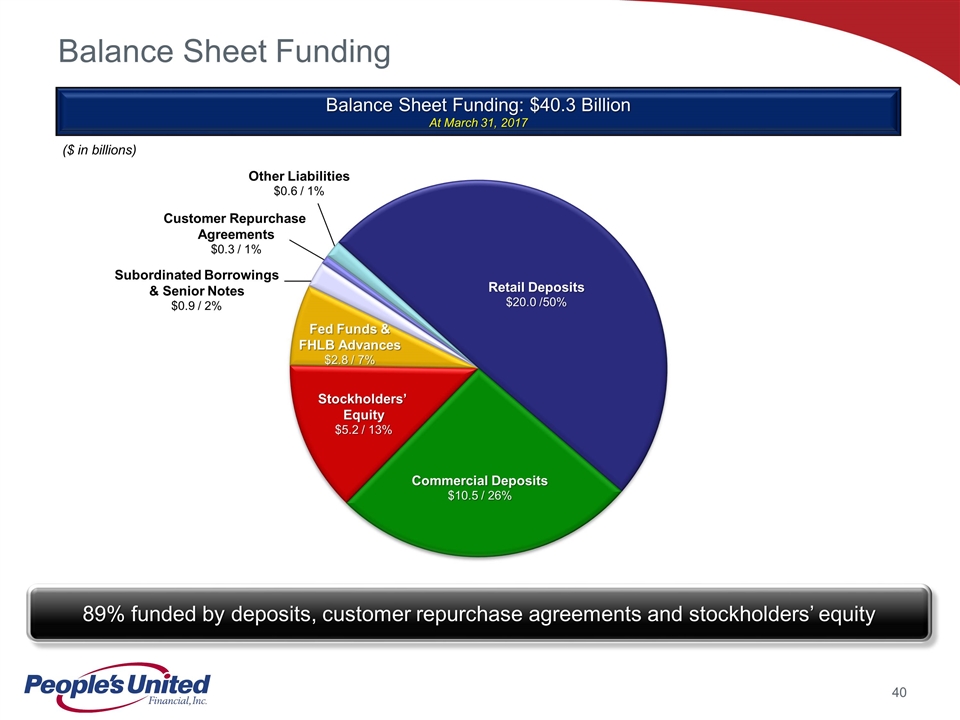

Customer Repurchase Agreements $0.3 / 1% Balance Sheet Funding 89% funded by deposits, customer repurchase agreements and stockholders’ equity Balance Sheet Funding: $40.3 Billion At March 31, 2017 ($ in billions) Retail Deposits $20.0 /50% Commercial Deposits $10.5 / 26% Stockholders’ Equity $5.2 / 13% Fed Funds & FHLB Advances $2.8 / 7% Subordinated Borrowings & Senior Notes $0.9 / 2% Other Liabilities $0.6 / 1%

Peer Group Firm Ticker City State 1 Associated ASB Green Bay WI 2 Citizens CFG Providence RI 3 Comerica CMA Dallas TX 4 Cullen/Frost CFR San Antonio TX 5 East West EWBC Pasadena CA 6 First Horizon FHN Memphis TN 7 Huntington HBAN Columbus OH 8 KeyCorp KEY Cleveland OH 9 M&T MTB Buffalo NY 10 New York Community NYCB Westbury NY 11 Signature SBNY New York NY 12 Synovus SNV Columbus GA 13 Umpqua UMPQ Portland OR 14 Webster WBS Waterbury CT 15 Zions ZION Salt Lake City UT

Non-GAAP Financial Measures and Reconciliation to GAAP In addition to evaluating People’s United Financial Inc. ("People's United") results of operations in accordance with U.S. generally accepted accounting principles (“GAAP”), management routinely supplements its evaluation with an analysis of certain non-GAAP financial measures, such as the efficiency and tangible common equity ratios, tangible book value per common share and operating earnings metrics. Management believes these non-GAAP financial measures provide information useful to investors in understanding People’s United’s underlying operating performance and trends, and facilitates comparisons with the performance of other financial institutions. Further, the efficiency ratio and operating earnings metrics are used by management in its assessment of financial performance, including non-interest expense control, while the tangible common equity ratio and tangible book value per common share are used to analyze the relative strength of People’s United’s capital position. The efficiency ratio, which represents an approximate measure of the cost required by People’s United to generate a dollar of revenue, is the ratio of (i) total non-interest expense (excluding operating lease expense, goodwill impairment charges, amortization of other acquisition-related intangible assets, losses on real estate assets and non-recurring expenses (the numerator) to (ii) net interest income on a fully taxable equivalent ("FTE") basis plus total non-interest income (including the FTE adjustment on bank-owned life insurance ("BOLI") income, the netting of operating lease expense and excluding gains and losses on sales of assets other than residential mortgage loans and acquired loans, and non-recurring income) (the denominator). People’s United generally considers an item of income or expense to be non-recurring if it is not similar to an item of income or expense of a type incurred within the last two years and is not similar to an item of income or expense of a type reasonably expected to be incurred within the following two years.

Non-GAAP Financial Measures and Reconciliation to GAAP Operating earnings exclude from net income available to common shareholders those items that management considers to be of such a non-recurring or infrequent nature that, by excluding such items (net of income taxes), People’s United’s results can be measured and assessed on a more consistent basis from period to period. Items excluded from operating earnings, which include, but are not limited to: (i) non-recurring gains/losses; (ii) merger-related expenses, including acquisition integration and other costs; (iii) writedowns of banking house assets and related lease termination costs; (iv) severance-related costs; and (v) charges related to executive-level management separation costs, are generally also excluded when calculating the efficiency ratio. Effective in 2016, recurring writedowns of banking house assets and certain severance-related costs are no longer considered to be non-operating expenses. Operating earnings per common share is derived by determining the per common share impact of the respective adjustments to arrive at operating earnings and adding (subtracting) such amounts to (from) earnings per common share, as reported. Operating return on average assets is calculated by dividing operating earnings (annualized) by average total assets. Operating return on average tangible common equity is calculated by dividing operating earnings (annualized) by average tangible common equity. The operating common dividend payout ratio is calculated by dividing common dividends paid by operating earnings for the respective period. The tangible common equity ratio is the ratio of (i) tangible common equity (total stockholders’ equity less preferred stock, goodwill and other acquisition-related intangible assets) (the numerator) to (ii) tangible assets (total assets less goodwill and other acquisition-related intangible assets) (the denominator). Tangible book value per common share is calculated by dividing tangible common equity by common shares (total common shares issued, less common shares classified as treasury shares and unallocated Employee Stock Ownership Plan ("ESOP") common shares). In light of diversity in presentation among financial institutions, the methodologies used by People’s United for determining the non-GAAP financial measures discussed above may differ from those used by other financial institutions.

For more information, investors may contact: Andrew S. Hersom (203) 338-4581 andrew.hersom@ peoples.com NASDAQ: PBCT