A Premium Brand Investor Presentation February 2020 Exhibit 99.1

Forward-Looking Statement Certain statements contained in this presentation are forward-looking in nature. These include all statements about People's United Financial, Inc. (“People’s United”) plans, objectives, expectations and other statements that are not historical facts, and usually use words such as "expect," "anticipate," "believe," "should" and similar expressions. Such statements represent management's current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United’s actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United include, but are not limited to: (1) changes in general, international, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and revenues; (9) the successful integration of acquisitions; and (10) changes in regulation resulting from or relating to financial reform legislation. People's United does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

A Premium Brand Leading market position in one of the best commercial banking markets in the U.S. Customer centric approach to banking Diversified portfolio of products & services Relationship profitability focus Consistent and sustainable earnings growth Exceptional risk management & asset quality Consistent cash return of capital to shareholders Unwavering commitment to building a strong banking franchise for the long-term

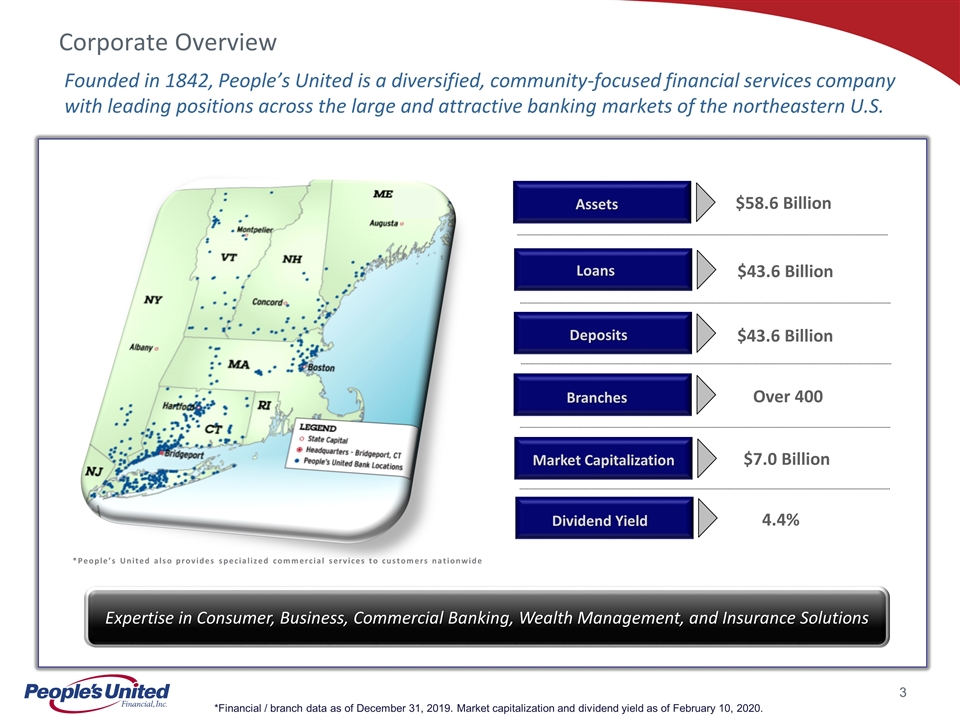

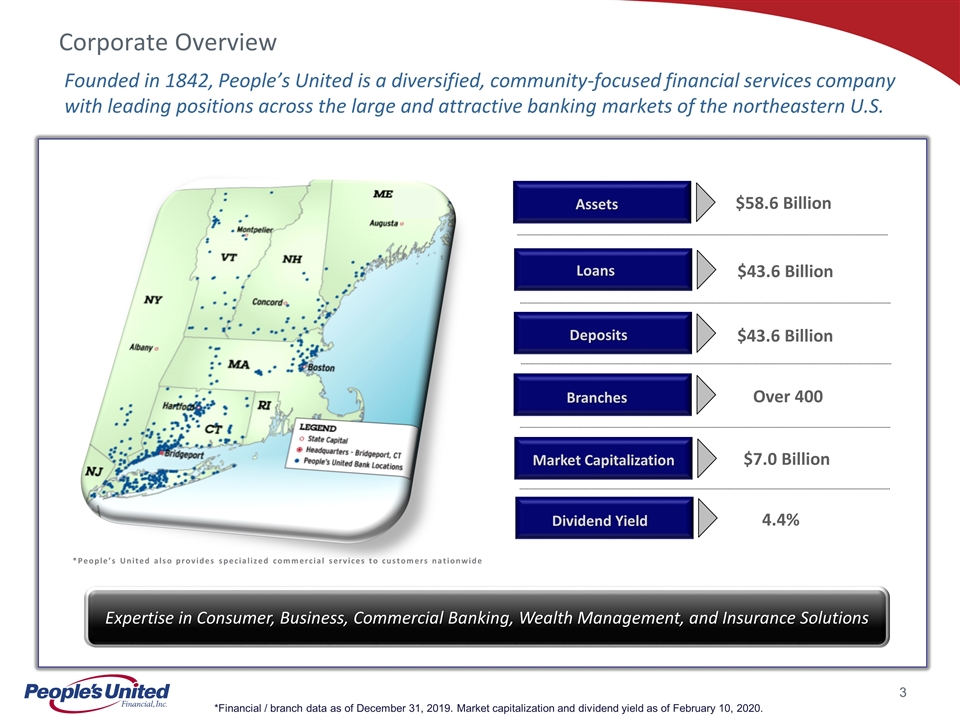

Founded in 1842, People’s United is a diversified, community-focused financial services company with leading positions across the large and attractive banking markets of the northeastern U.S. Expertise in Consumer, Business, Commercial Banking, Wealth Management, and Insurance Solutions Assets Loans Deposits Branches Market Capitalization $58.6 Billion $43.6 Billion Dividend Yield $43.6 Billion Over 400 $7.0 Billion 4.4% *Financial / branch data as of December 31, 2019. Market capitalization and dividend yield as of February 10, 2020. Corporate Overview *People’s United also provides specialized commercial services to customers nationwide

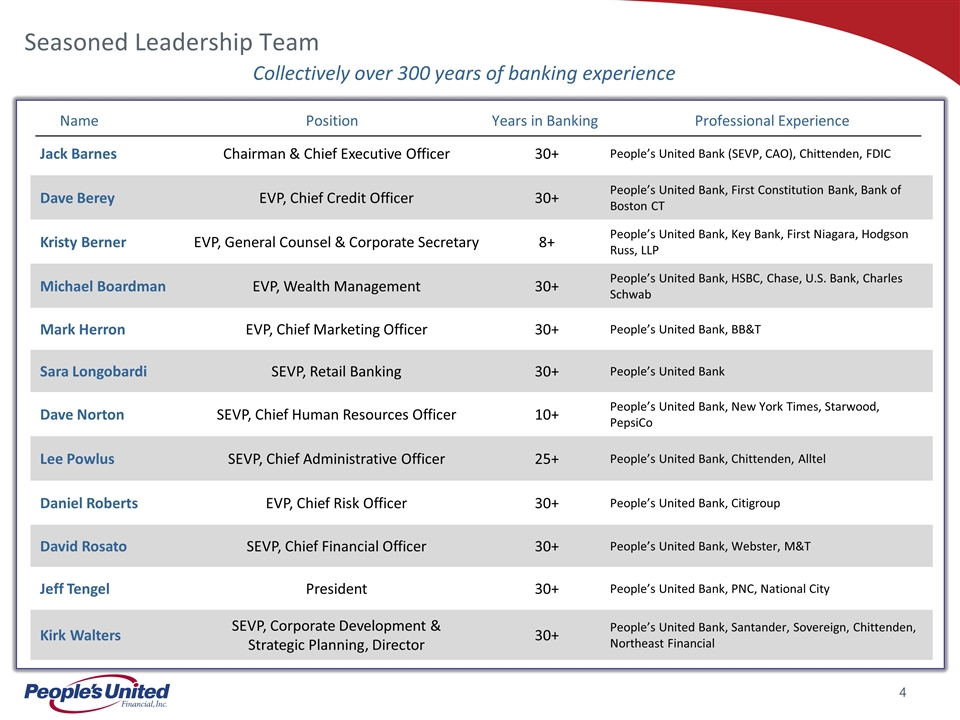

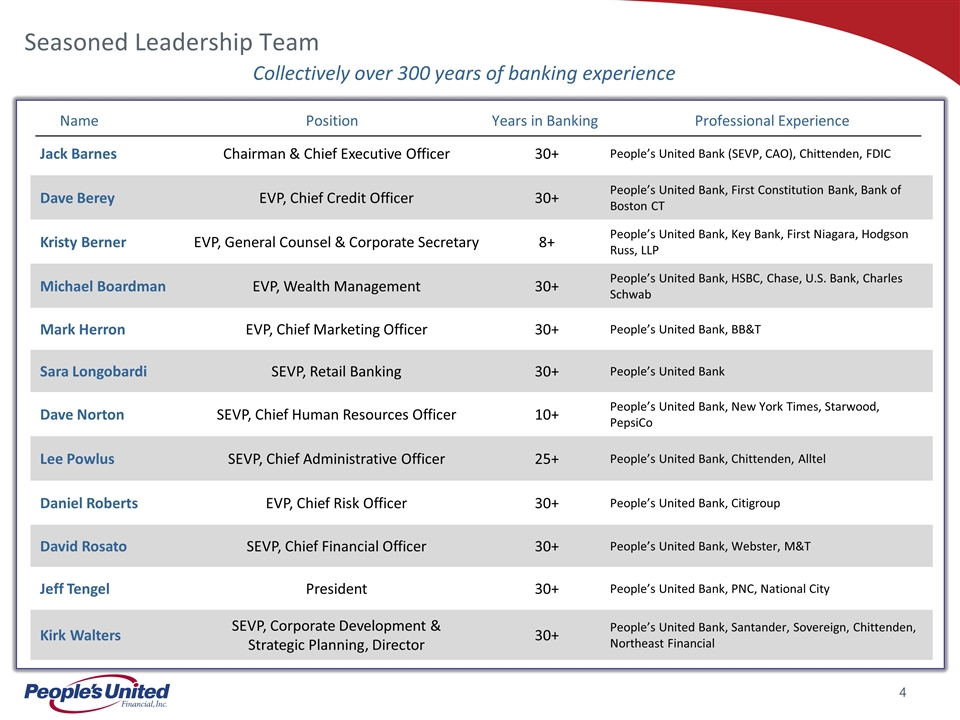

Seasoned Leadership Team Collectively over 300 years of banking experience Jack Barnes Chairman & Chief Executive Officer 30+ People’s United Bank (SEVP, CAO), Chittenden, FDIC Dave Berey EVP, Chief Credit Officer 30+ People’s United Bank, First Constitution Bank, Bank of Boston CT Kristy Berner EVP, General Counsel & Corporate Secretary 8+ People’s United Bank, Key Bank, First Niagara, Hodgson Russ, LLP Michael Boardman EVP, Wealth Management 30+ People’s United Bank, HSBC, Chase, U.S. Bank, Charles Schwab Mark Herron EVP, Chief Marketing Officer 30+ People’s United Bank, BB&T Sara Longobardi SEVP, Retail Banking 30+ People’s United Bank Dave Norton SEVP, Chief Human Resources Officer 10+ People’s United Bank, New York Times, Starwood, PepsiCo Lee Powlus SEVP, Chief Administrative Officer 25+ People’s United Bank, Chittenden, Alltel Daniel Roberts EVP, Chief Risk Officer 30+ People’s United Bank, Citigroup David Rosato SEVP, Chief Financial Officer 30+ People’s United Bank, Webster, M&T Jeff Tengel President 30+ People’s United Bank, PNC, National City Kirk Walters SEVP, Corporate Development & Strategic Planning, Director 30+ People’s United Bank, Santander, Sovereign, Chittenden, Northeast Financial Name Position Years in Banking Professional Experience

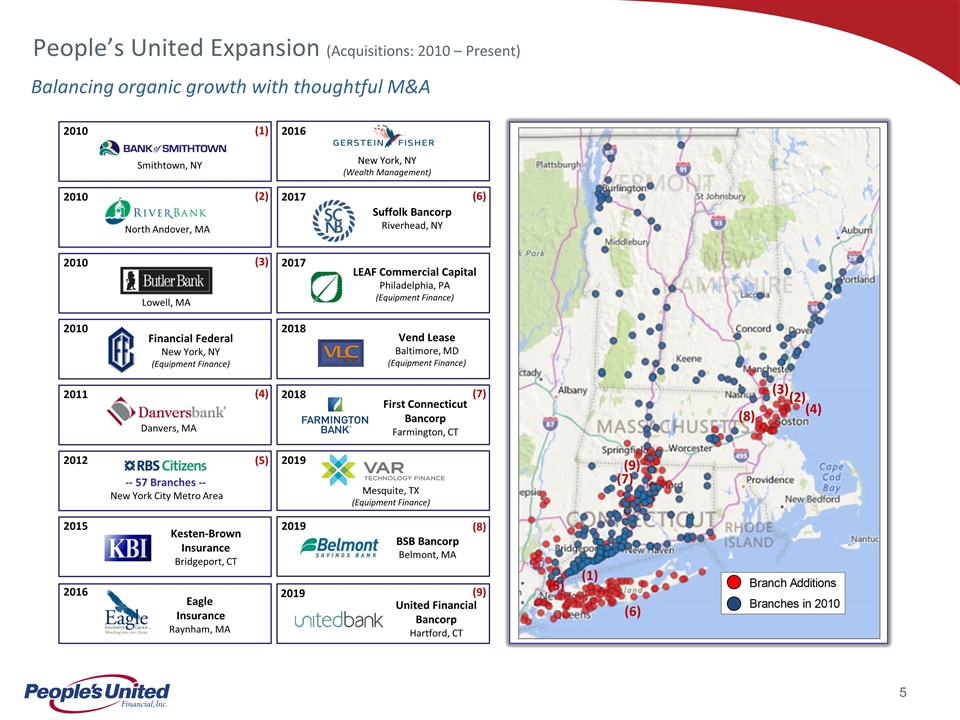

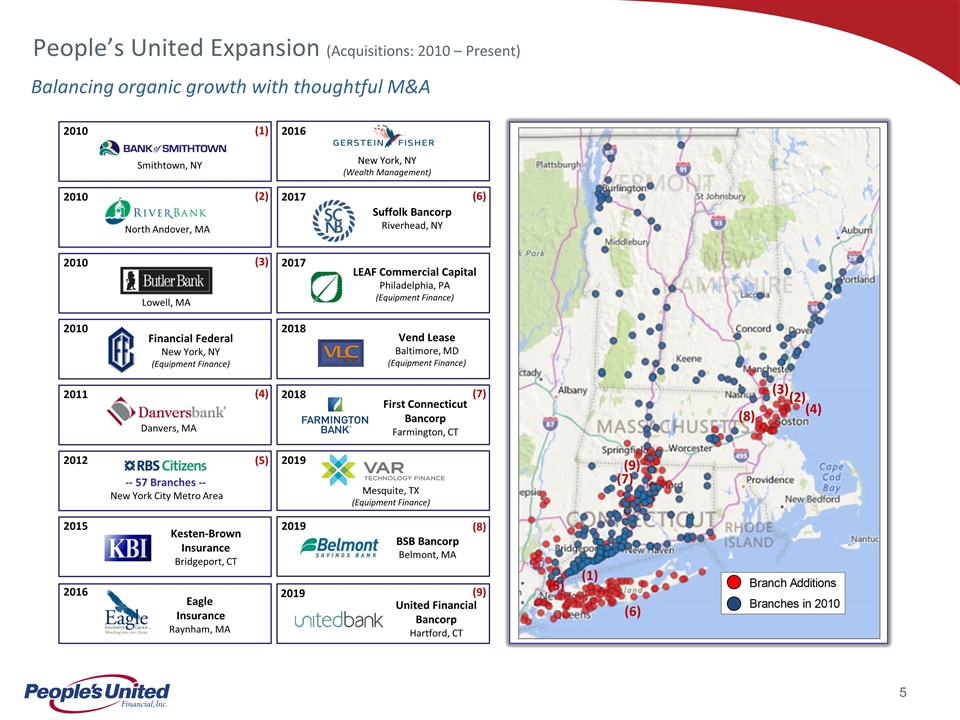

c People’s United Expansion (Acquisitions: 2010 – Present) Balancing organic growth with thoughtful M&A Financial Federal New York, NY (Equipment Finance) 2010 Smithtown, NY 2010 North Andover, MA 2010 2010 Lowell, MA 2011 Danvers, MA 2012 -- 57 Branches -- New York City Metro Area 2015 Kesten-Brown Insurance Bridgeport, CT 2016 New York, NY (Wealth Management) 2016 Eagle Insurance Raynham, MA 2017 Suffolk Bancorp Riverhead, NY LEAF Commercial Capital Philadelphia, PA (Equipment Finance) 2017 Vend Lease Baltimore, MD (Equipment Finance) 2018 First Connecticut Bancorp Farmington, CT 2018 2019 BSB Bancorp Belmont, MA 2019 (1) (1) (2) (2) (3) (3) (4) (4) (5) (5) (6) (6) (7) (8) (7) (8) Mesquite, TX (Equipment Finance) (9) (9) United Financial Bancorp Hartford, CT 2019

Long-term relationships with customers; average tenure of our top 25 relationships is over 16 years Local decision making; customers relationships are with local management Single point of contact with customers; break down silos to present a full range of solutions comparable to that of larger banks Senior management frequently interacts with customers Reputation and word-of-mouth referrals often drive new business Broad distribution: over 400 branches across six states, over 550 ATMs Enhanced mobile device and online driven offerings Call center operations locally located in Bridgeport, CT and Burlington, VT Long History of Relationship Management Since 2009, People’s United has received 49 Greenwich Excellence and Best Brand Awards Greenwich Associates is the leading global provider of local market intelligence and advisory services to the banking industry. Our ability to build deep, multi-product relationships not only satisfies the needs of customers, but also improves the Company’s profitability

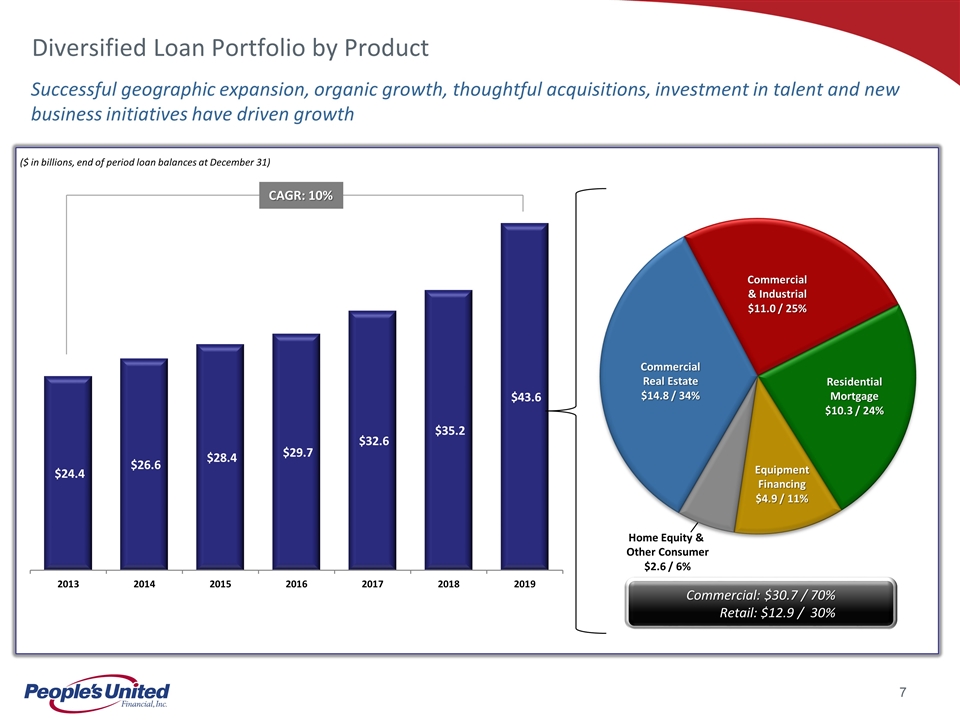

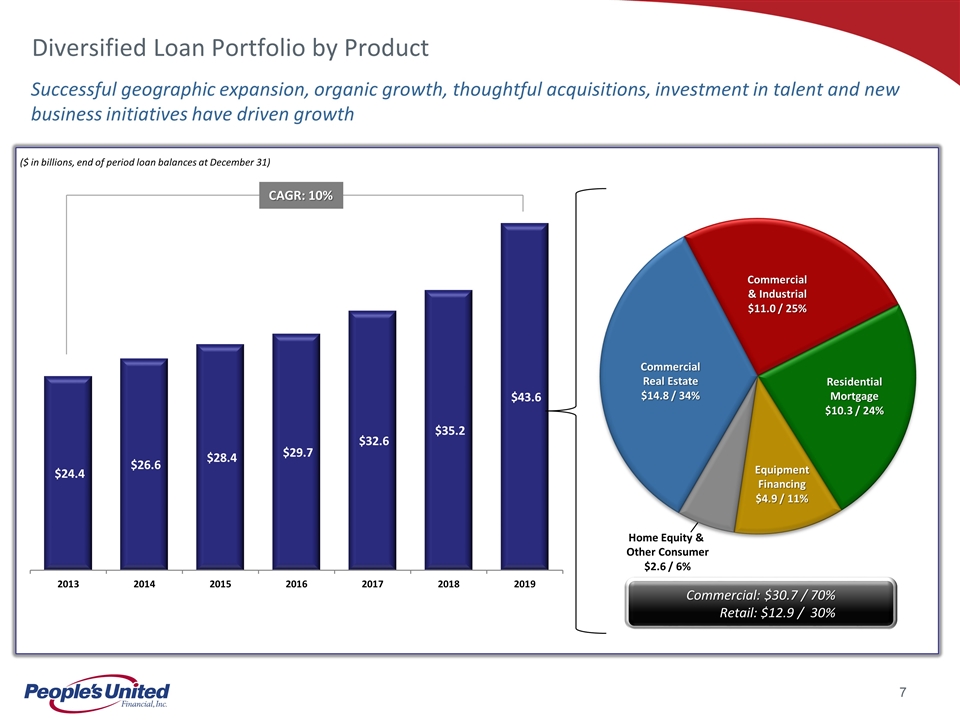

c Diversified Loan Portfolio by Product CAGR: 10% Commercial Real Estate $14.8 / 34% Equipment Financing $4.9 / 11% Residential Mortgage $10.3 / 24% Commercial & Industrial $11.0 / 25% Home Equity & Other Consumer $2.6 / 6% Successful geographic expansion, organic growth, thoughtful acquisitions, investment in talent and new business initiatives have driven growth ($ in billions, end of period loan balances at December 31) Commercial: $30.7 / 70% Retail: $12.9 / 30%

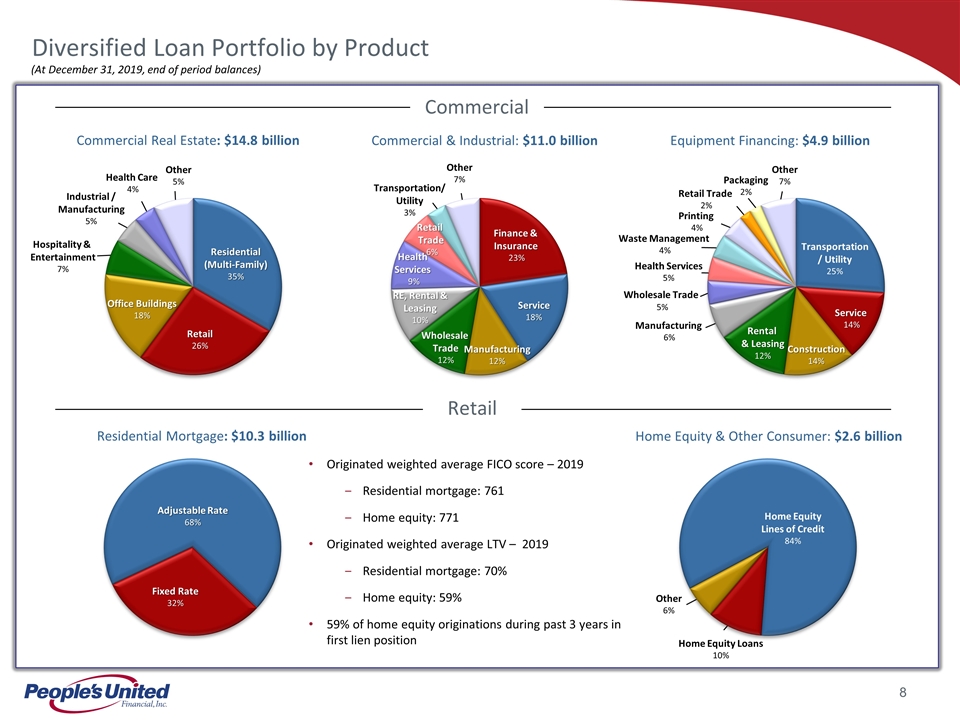

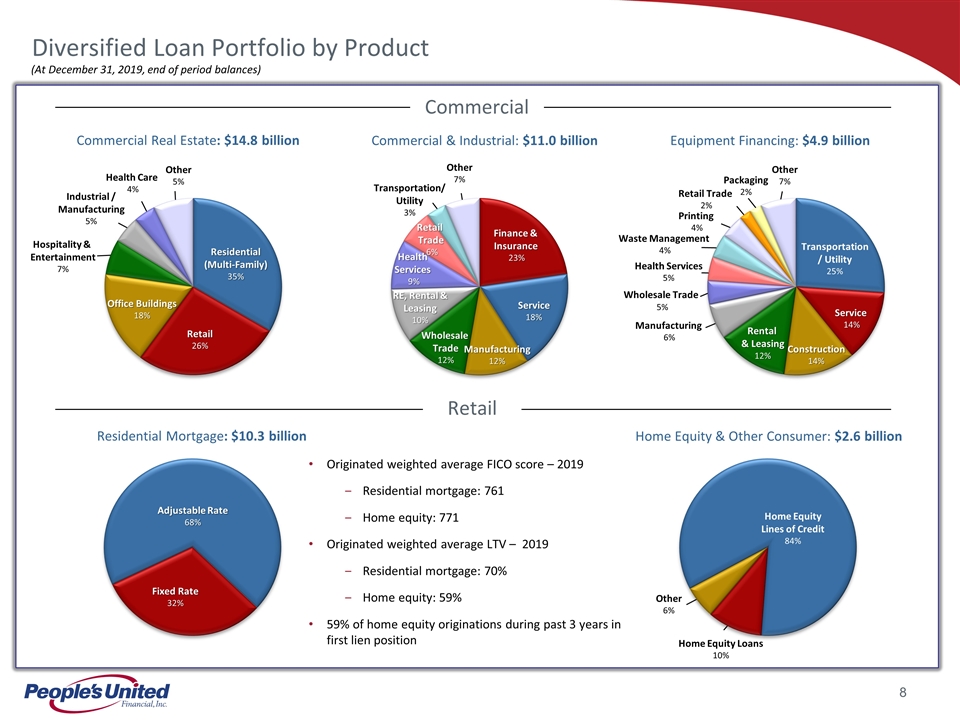

c Home Equity Loans 10% Other 6% Packaging 2% Manufacturing 6% Wholesale Trade 5% Hospitality & Entertainment 7% Health Services 5% Other 7% Transportation/ Utility 3% (At December 31, 2019, end of period balances) Residential (Multi-Family) 35% Retail 26% Office Buildings 18% Other 5% Health Care 4% Industrial / Manufacturing 5% Finance & Insurance 23% Service 18% Manufacturing 12% Wholesale Trade 12% Retail Trade 6% Transportation / Utility 25% Construction 14% Rental & Leasing 12% Service 14% RE, Rental & Leasing 10% Diversified Loan Portfolio by Product Commercial Real Estate: $14.8 billion Commercial & Industrial: $11.0 billion Equipment Financing: $4.9 billion Residential Mortgage: $10.3 billion Home Equity & Other Consumer: $2.6 billion Health Services 9% Other 7% Originated weighted average FICO score – 2019 Residential mortgage: 761 Home equity: 771 Originated weighted average LTV – 2019 Residential mortgage: 70% Home equity: 59% 59% of home equity originations during past 3 years in first lien position Fixed Rate 32% Adjustable Rate 68% Commercial Retail Home Equity Lines of Credit 84% Printing 4% Waste Management 4% Retail Trade 2%

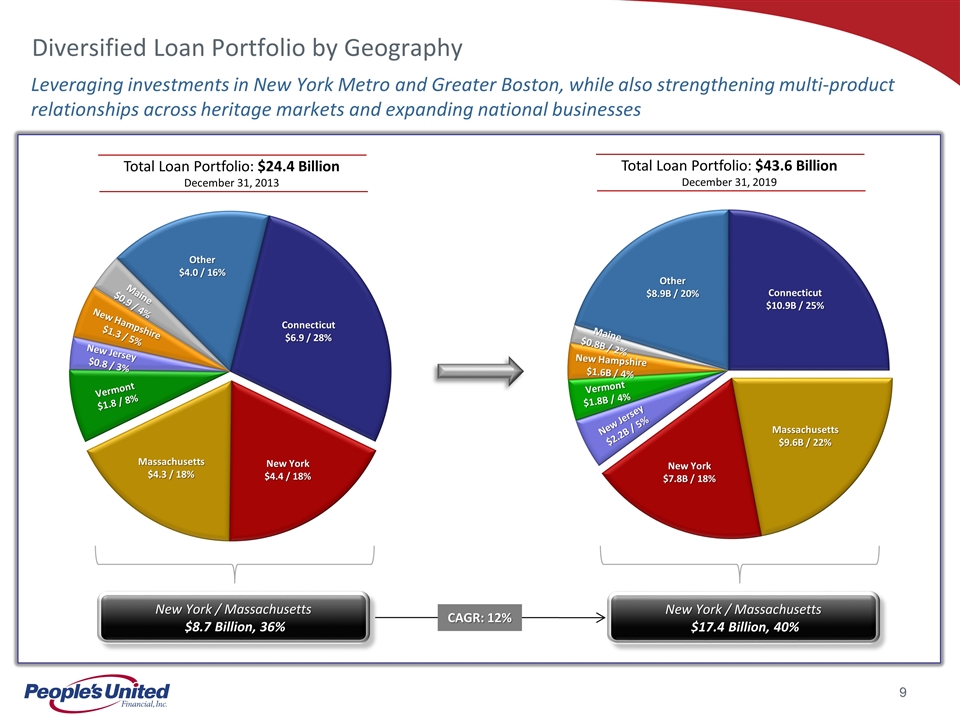

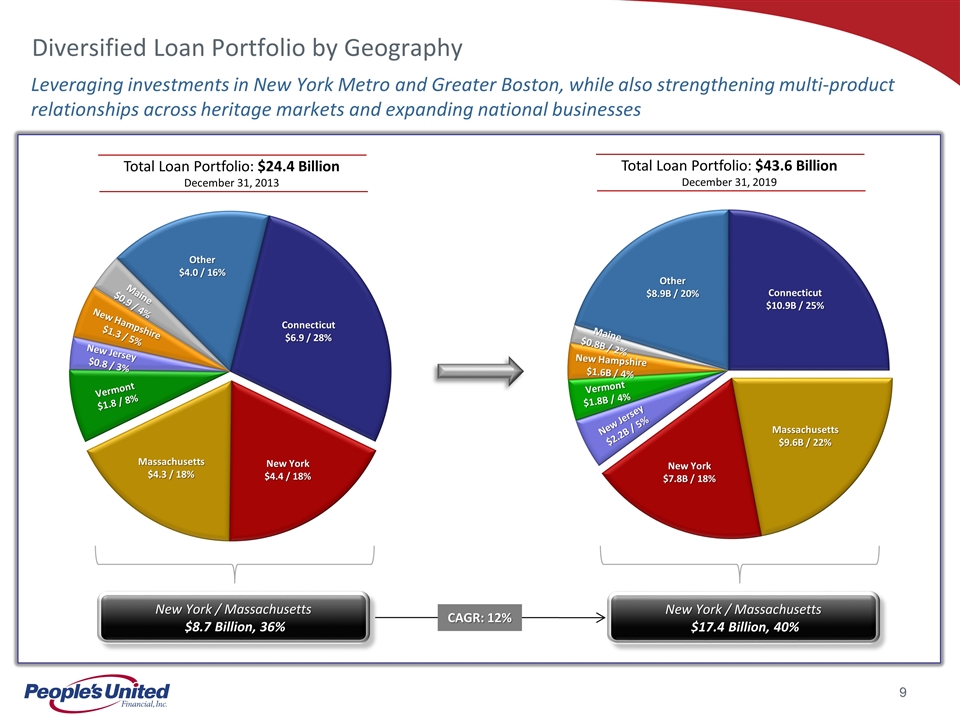

c Leveraging investments in New York Metro and Greater Boston, while also strengthening multi-product relationships across heritage markets and expanding national businesses Total Loan Portfolio: $24.4 Billion December 31, 2013 Total Loan Portfolio: $43.6 Billion December 31, 2019 New York / Massachusetts $8.7 Billion, 36% New York / Massachusetts $17.4 Billion, 40% Connecticut $6.9 / 28% New York $4.4 / 18% Other $4.0 / 16% Massachusetts $4.3 / 18% Vermont $1.8 / 8% New Hampshire $1.3 / 5% New Jersey $0.8 / 3% Maine $0.9 / 4% Connecticut $10.9B / 25% New York $7.8B / 18% Massachusetts $9.6B / 22% Vermont $1.8B / 4% New Jersey $2.2B / 5% New Hampshire $1.6B / 4% CAGR: 12% Maine $0.8B / 2% Other $8.9B / 20% Diversified Loan Portfolio by Geography

c 0.16% PBCT Median, excluding PBCT = 0.53% Source: SNL Financial Sustained Exceptional Asset Quality Remain focused on maintaining exceptional asset quality, which is a result of our conservative and well-defined underwriting approach Sustaining exceptional asset quality is an important lever in building long-term value Average Annual Net Charge-Offs / Average Loans Peer Group Comparison (2008-2019)

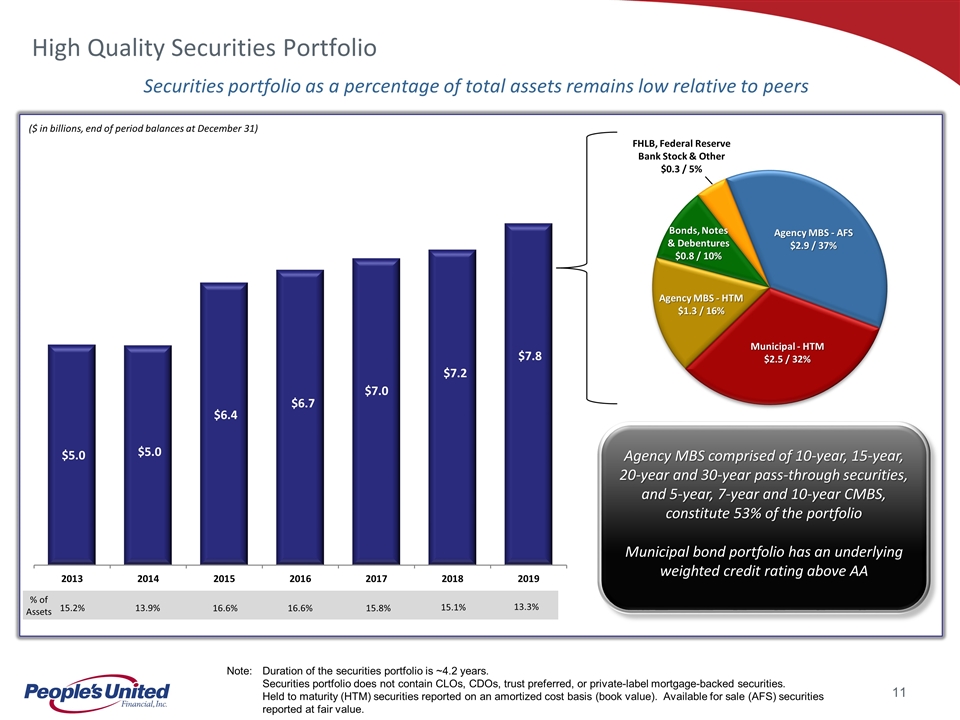

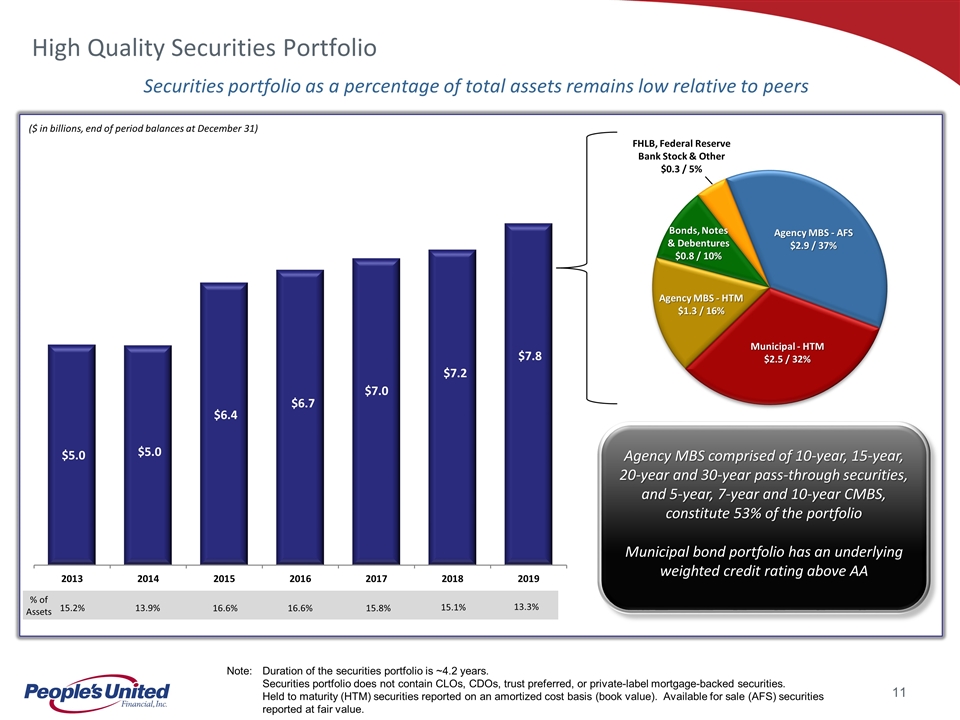

c FHLB, Federal Reserve Bank Stock & Other $0.3 / 5% High Quality Securities Portfolio ($ in billions, end of period balances at December 31) Agency MBS comprised of 10-year, 15-year, 20-year and 30-year pass-through securities, and 5-year, 7-year and 10-year CMBS, constitute 53% of the portfolio Municipal bond portfolio has an underlying weighted credit rating above AA Agency MBS - AFS $2.9 / 37% Municipal - HTM $2.5 / 32% Agency MBS - HTM $1.3 / 16% Bonds, Notes & Debentures $0.8 / 10% 15.1% 15.8% 16.6% 16.6% 13.9% 15.2% % of Assets Note: Duration of the securities portfolio is ~4.2 years. Securities portfolio does not contain CLOs, CDOs, trust preferred, or private-label mortgage-backed securities. Held to maturity (HTM) securities reported on an amortized cost basis (book value). Available for sale (AFS) securities reported at fair value. Securities portfolio as a percentage of total assets remains low relative to peers 13.3%

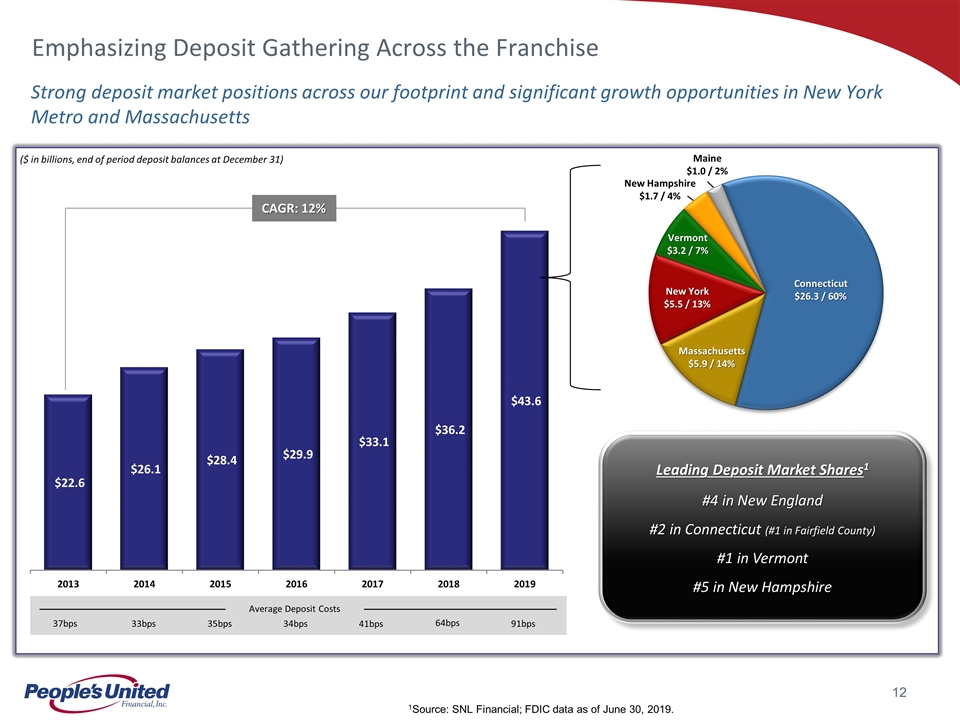

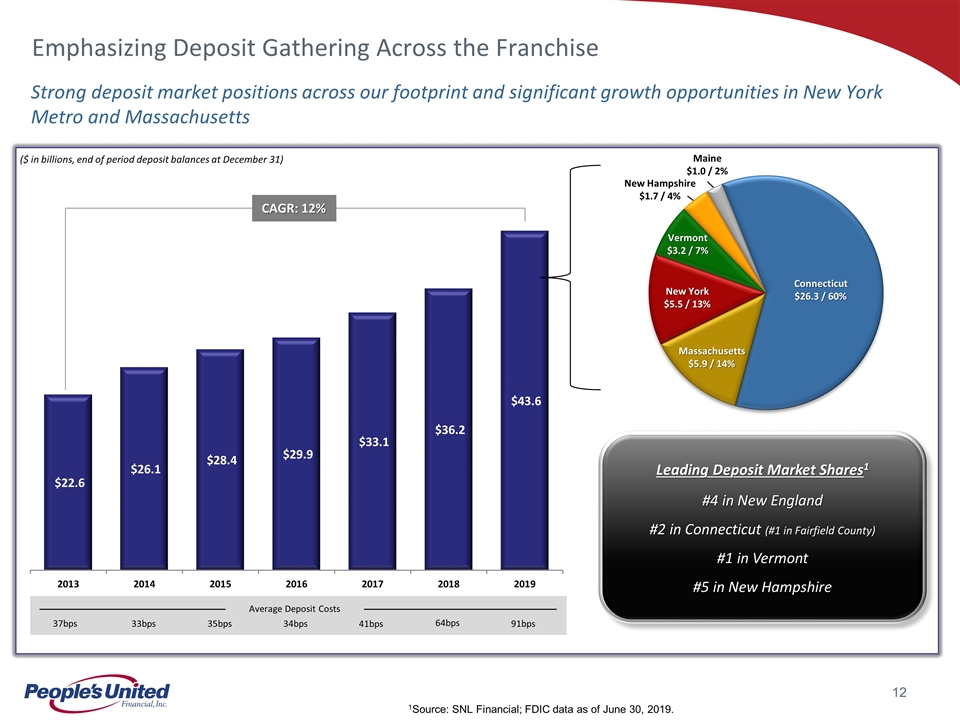

c Emphasizing Deposit Gathering Across the Franchise CAGR: 12% Strong deposit market positions across our footprint and significant growth opportunities in New York Metro and Massachusetts ($ in billions, end of period deposit balances at December 31) Leading Deposit Market Shares1 #4 in New England #2 in Connecticut (#1 in Fairfield County) #1 in Vermont #5 in New Hampshire Connecticut $26.3 / 60% New York $5.5 / 13% Massachusetts $5.9 / 14% Vermont $3.2 / 7% New Hampshire $1.7 / 4% Maine $1.0 / 2% 41bps 1Source: SNL Financial; FDIC data as of June 30, 2019. 34bps 35bps 33bps 37bps 64bps Average Deposit Costs 91bps

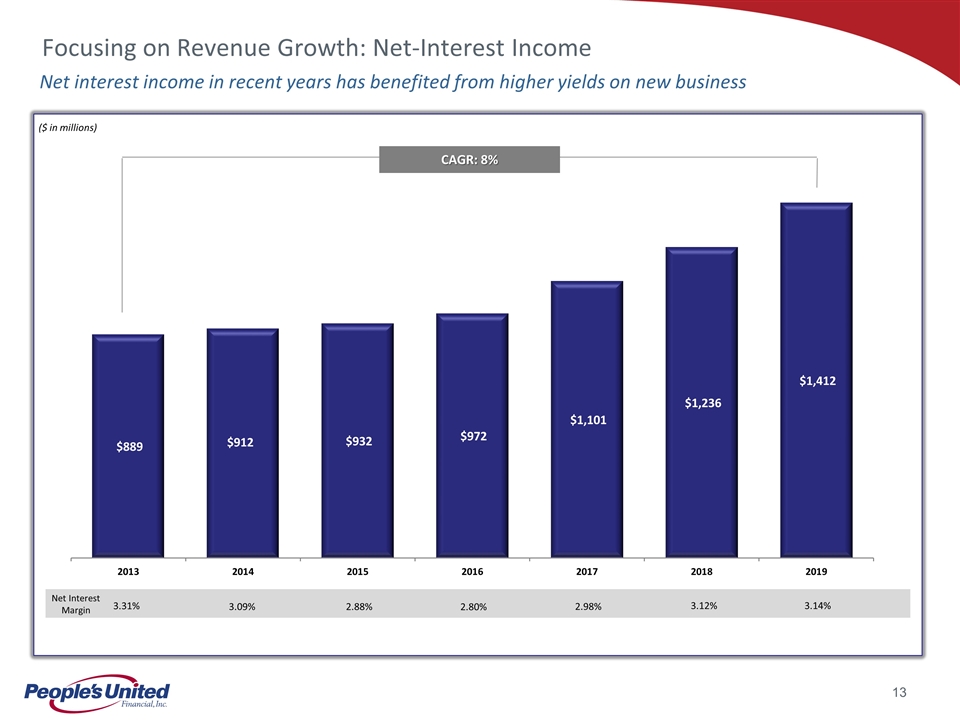

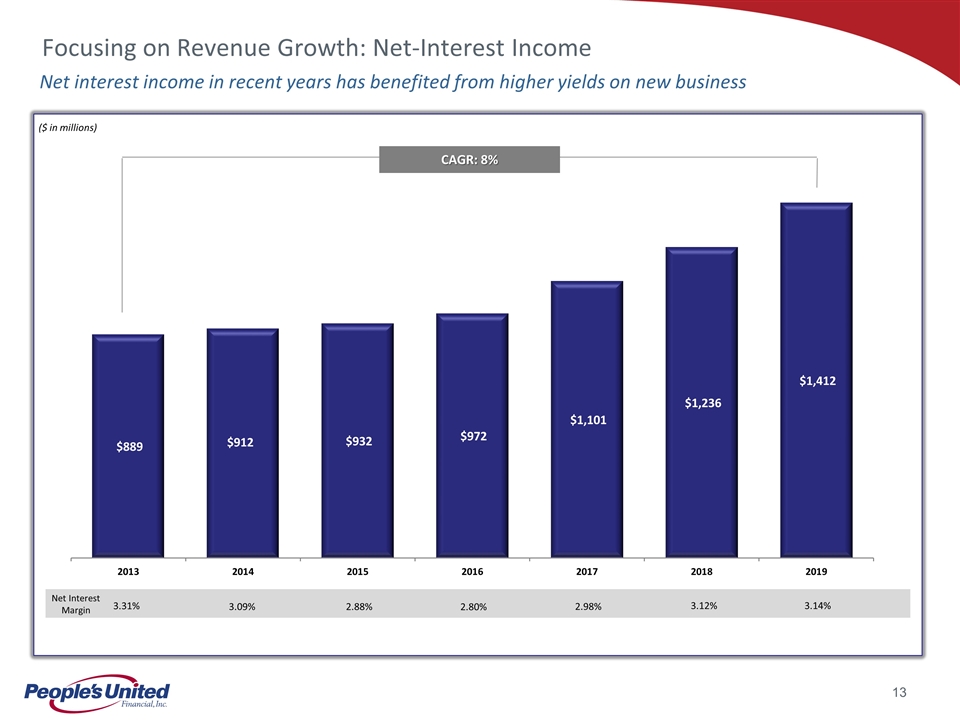

Net interest income in recent years has benefited from higher yields on new business Focusing on Revenue Growth: Net-Interest Income CAGR: 8% ($ in millions) 2.98% 2.88% 3.09% 3.31% Net Interest Margin 2.80% 3.12% 3.14%

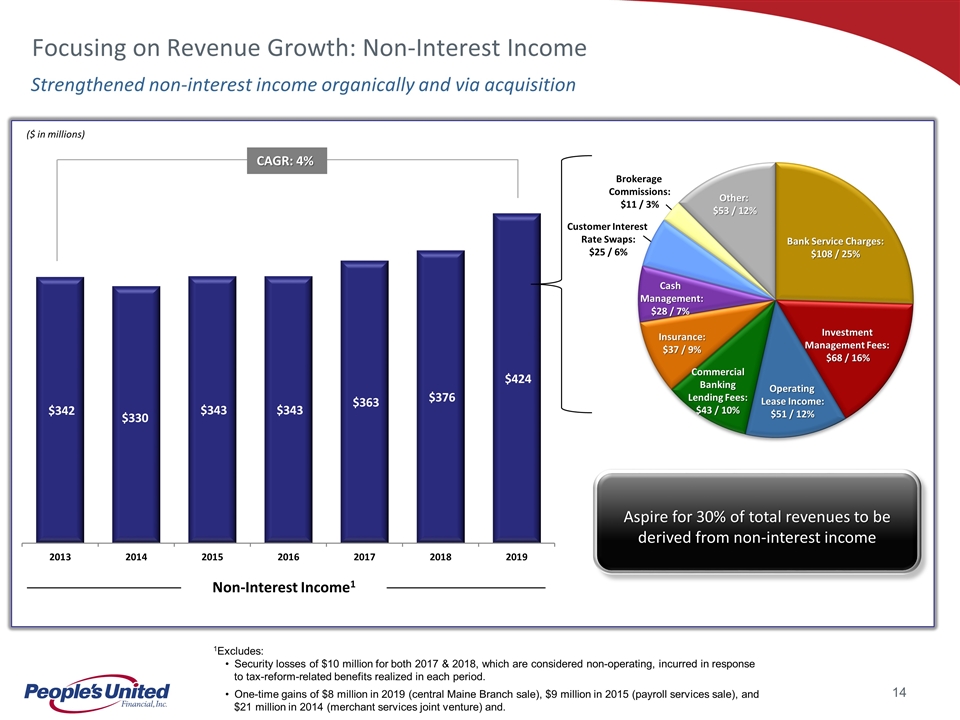

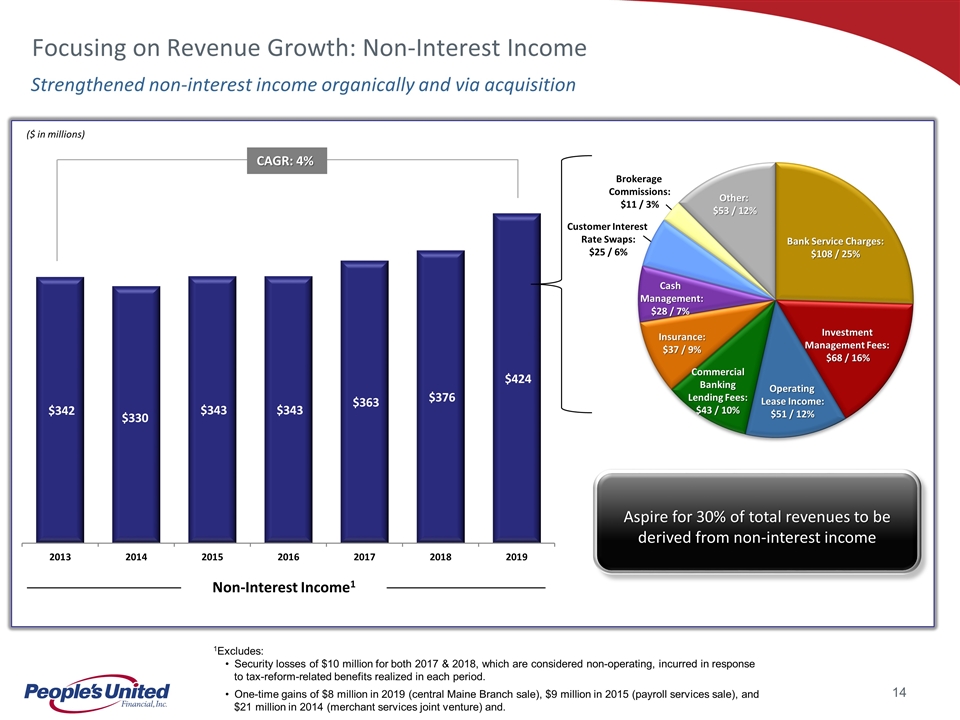

c Strengthened non-interest income organically and via acquisition Focusing on Revenue Growth: Non-Interest Income CAGR: 4% ($ in millions) Aspire for 30% of total revenues to be derived from non-interest income Bank Service Charges: $108 / 25% Operating Lease Income: $51 / 12% Other: $53 / 12% Non-Interest Income1 1Excludes: Security losses of $10 million for both 2017 & 2018, which are considered non-operating, incurred in response to tax-reform-related benefits realized in each period. One-time gains of $8 million in 2019 (central Maine Branch sale), $9 million in 2015 (payroll services sale), and $21 million in 2014 (merchant services joint venture) and. Investment Management Fees: $68 / 16% Commercial Banking Lending Fees: $43 / 10% Insurance: $37 / 9% Cash Management: $28 / 7% Brokerage Commissions: $11 / 3% Customer Interest Rate Swaps: $25 / 6%

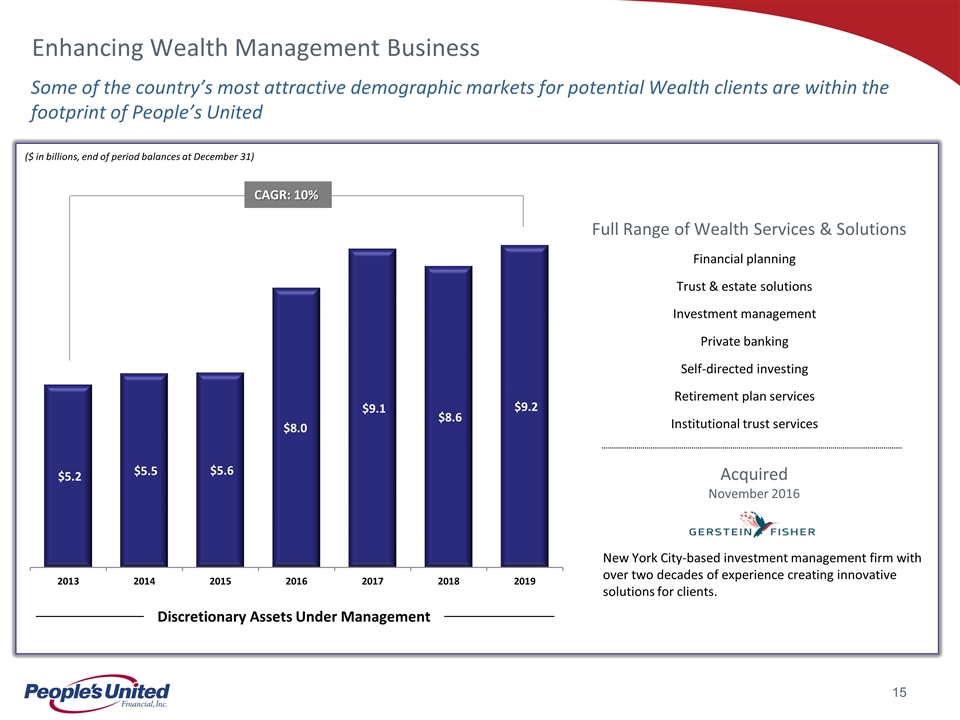

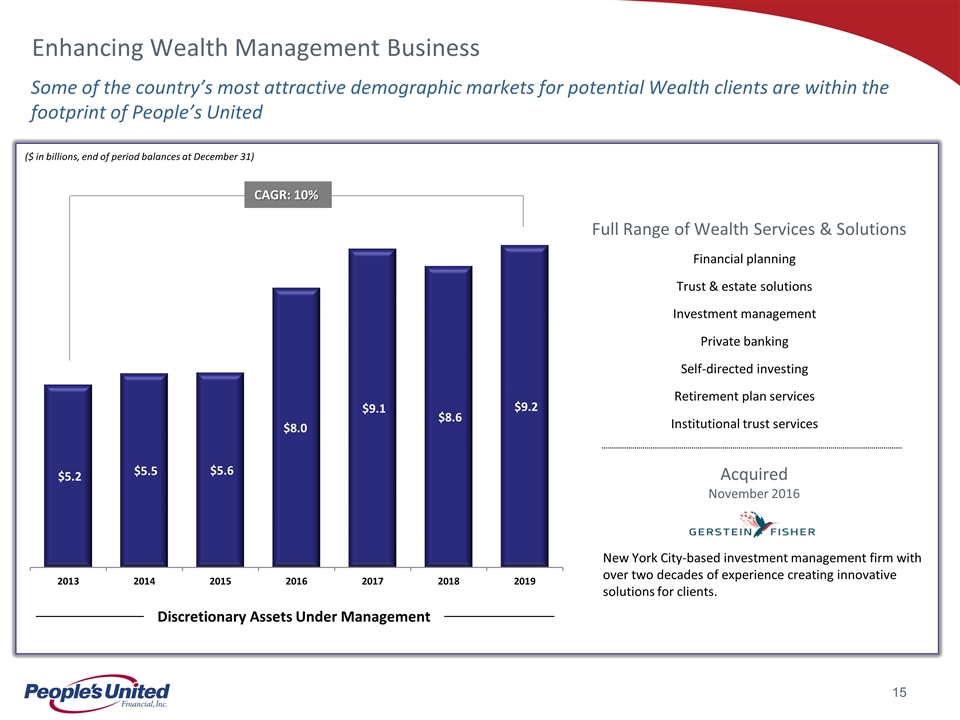

c Enhancing Wealth Management Business CAGR: 10% Discretionary Assets Under Management ($ in billions, end of period balances at December 31) Some of the country’s most attractive demographic markets for potential Wealth clients are within the footprint of People’s United Acquired November 2016 New York City-based investment management firm with over two decades of experience creating innovative solutions for clients. Full Range of Wealth Services & Solutions Financial planning Trust & estate solutions Investment management Private banking Self-directed investing Retirement plan services Institutional trust services

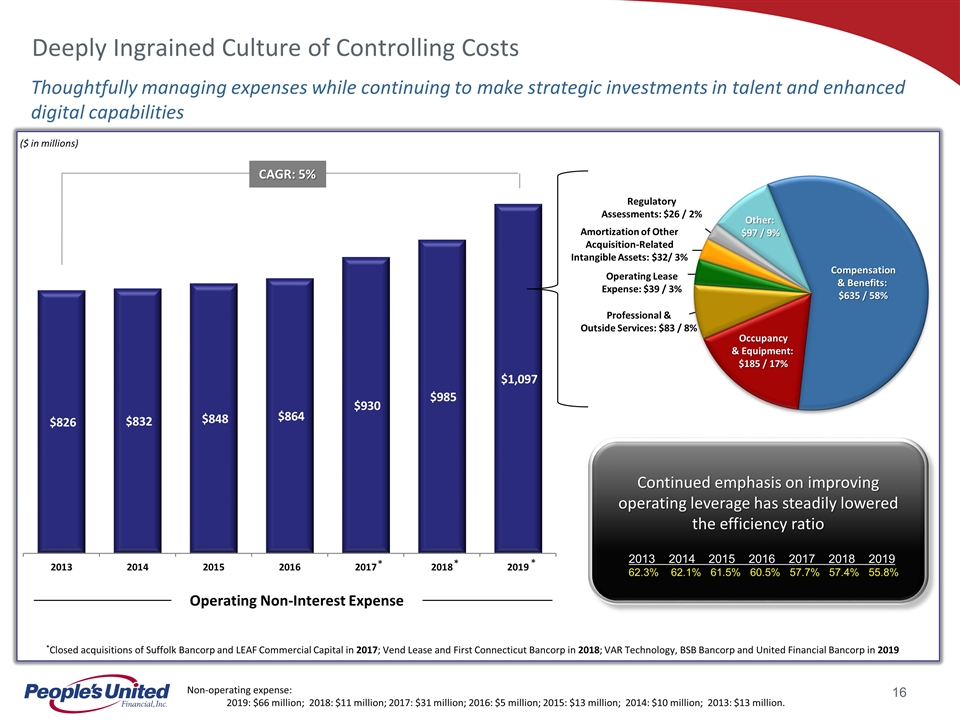

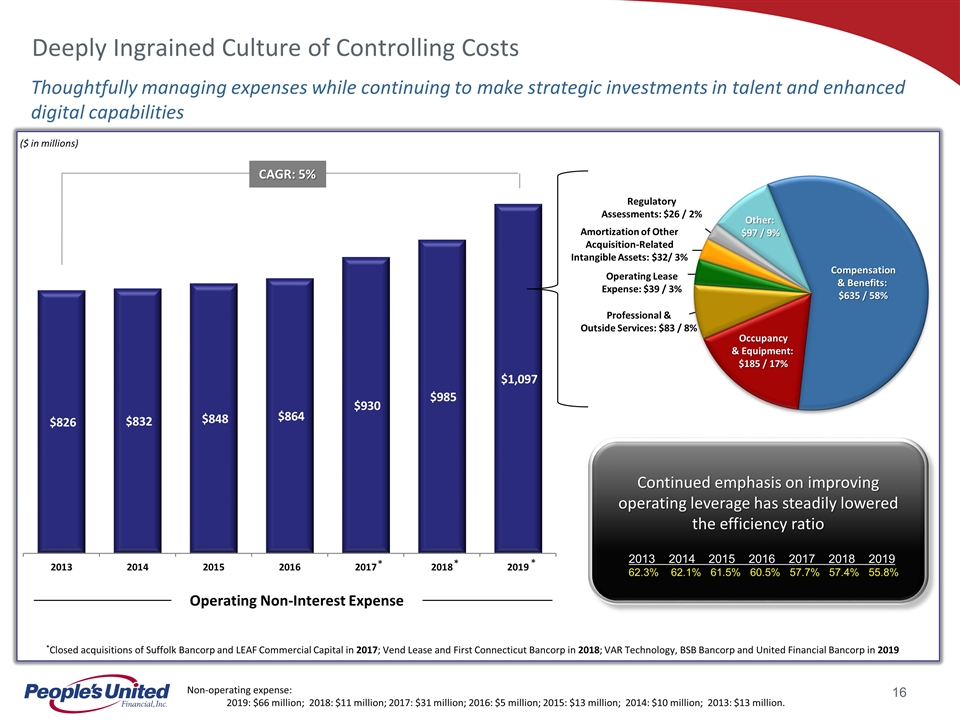

c ($ in millions) Deeply Ingrained Culture of Controlling Costs Thoughtfully managing expenses while continuing to make strategic investments in talent and enhanced digital capabilities *Closed acquisitions of Suffolk Bancorp and LEAF Commercial Capital in 2017; Vend Lease and First Connecticut Bancorp in 2018; VAR Technology, BSB Bancorp and United Financial Bancorp in 2019 CAGR: 5% Continued emphasis on improving operating leverage has steadily lowered the efficiency ratio Compensation & Benefits: $635 / 58% Occupancy & Equipment: $185 / 17% Professional & Outside Services: $83 / 8% Other: $97 / 9% Operating Non-Interest Expense 2013 2014 2015 2016 2017 2018 2019 62.3% 62.1% 61.5% 60.5% 57.7% 57.4% 55.8% Regulatory Assessments: $26 / 2% Operating Lease Expense: $39 / 3% Amortization of Other Acquisition-Related Intangible Assets: $32/ 3% Non-operating expense: 2019: $66 million; 2018: $11 million; 2017: $31 million; 2016: $5 million; 2015: $13 million; 2014: $10 million; 2013: $13 million. * * *

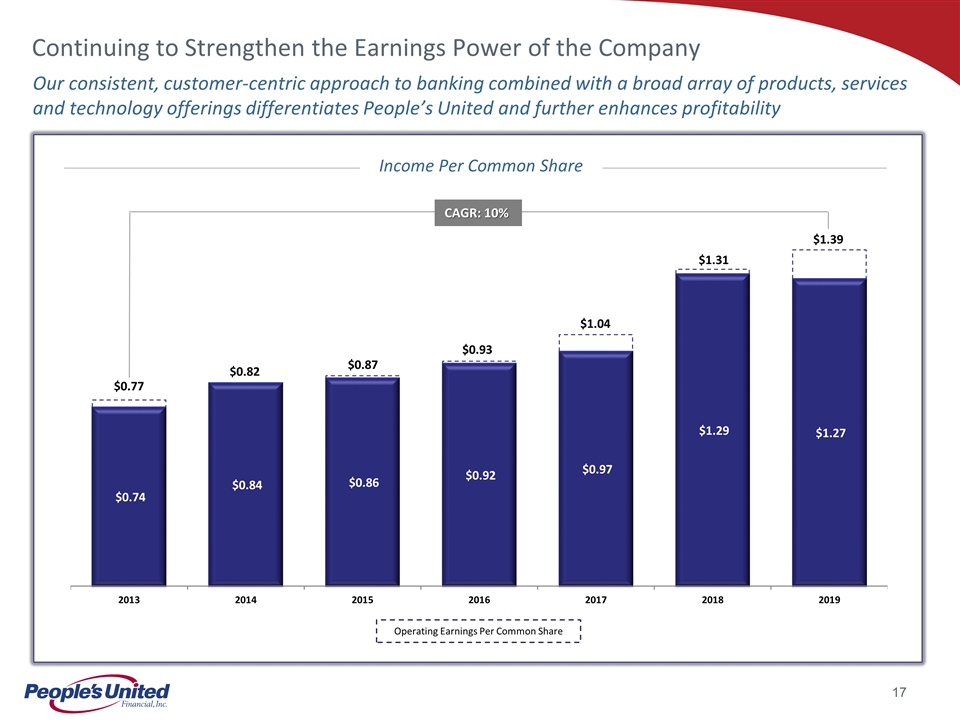

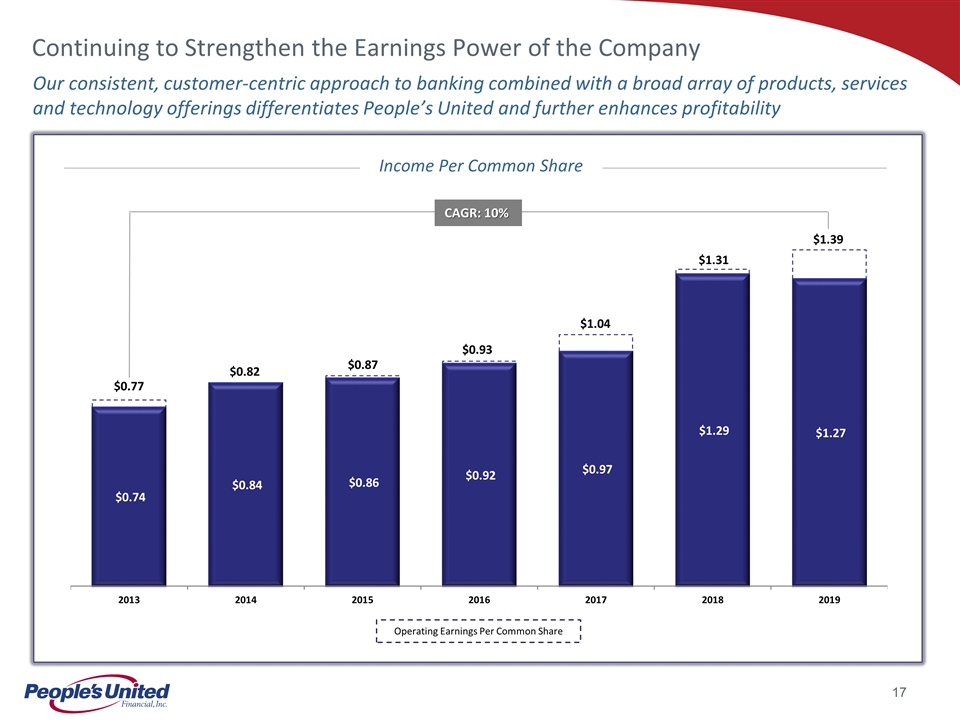

Continuing to Strengthen the Earnings Power of the Company CAGR: 10% Our consistent, customer-centric approach to banking combined with a broad array of products, services and technology offerings differentiates People’s United and further enhances profitability $1.04 Income Per Common Share Operating Earnings Per Common Share $1.31 $1.39 $0.93 $0.87 $0.77 $0.82

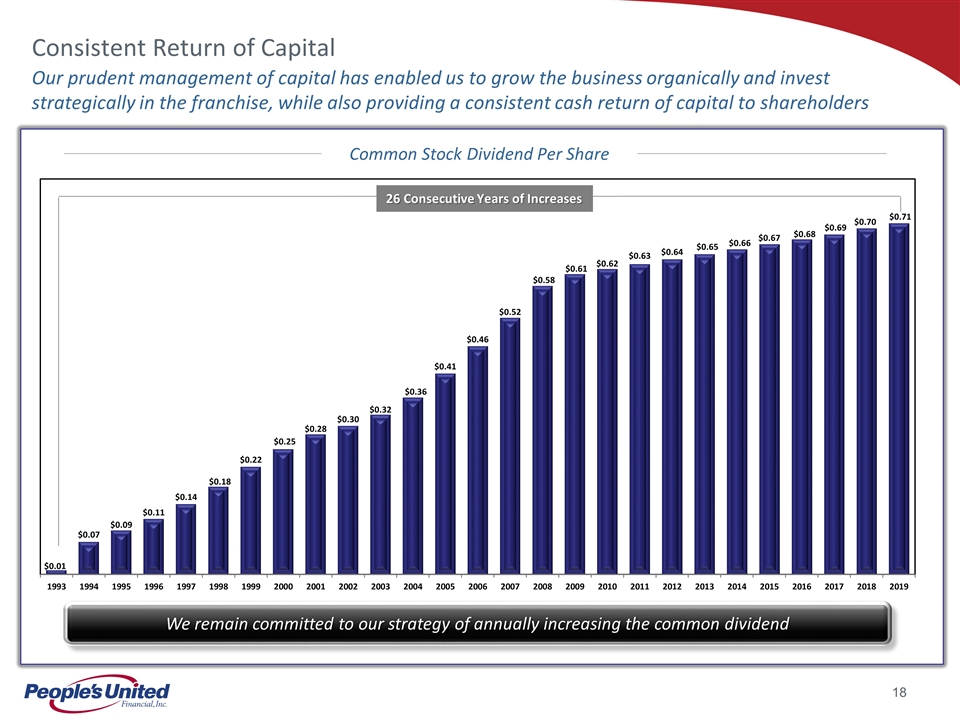

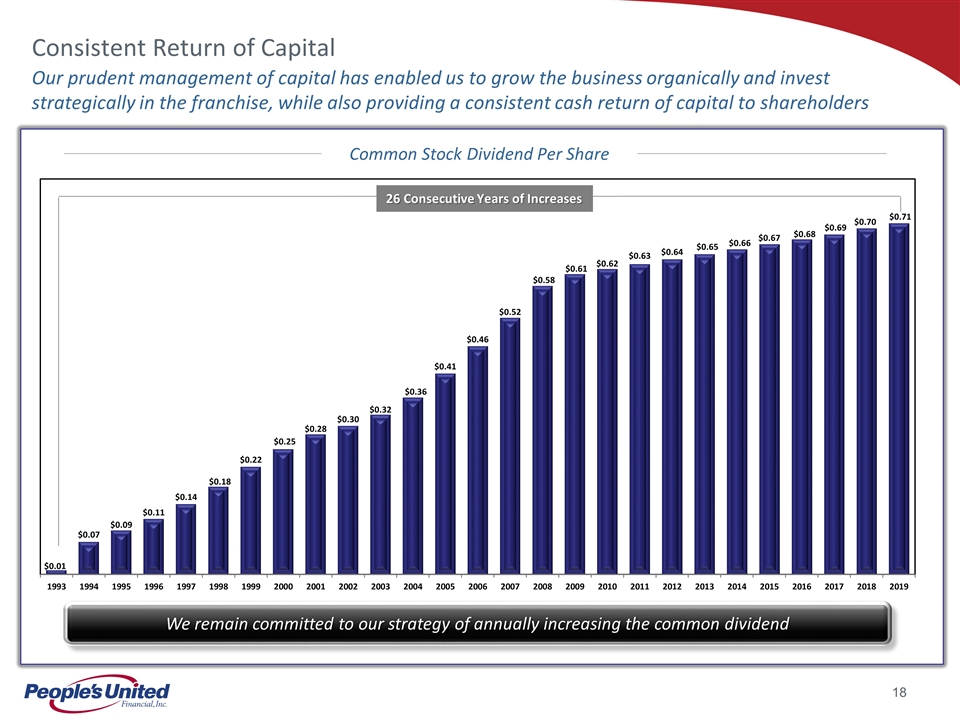

c We remain committed to our strategy of annually increasing the common dividend Consistent Return of Capital Our prudent management of capital has enabled us to grow the business organically and invest strategically in the franchise, while also providing a consistent cash return of capital to shareholders 26 Consecutive Years of Increases Common Stock Dividend Per Share

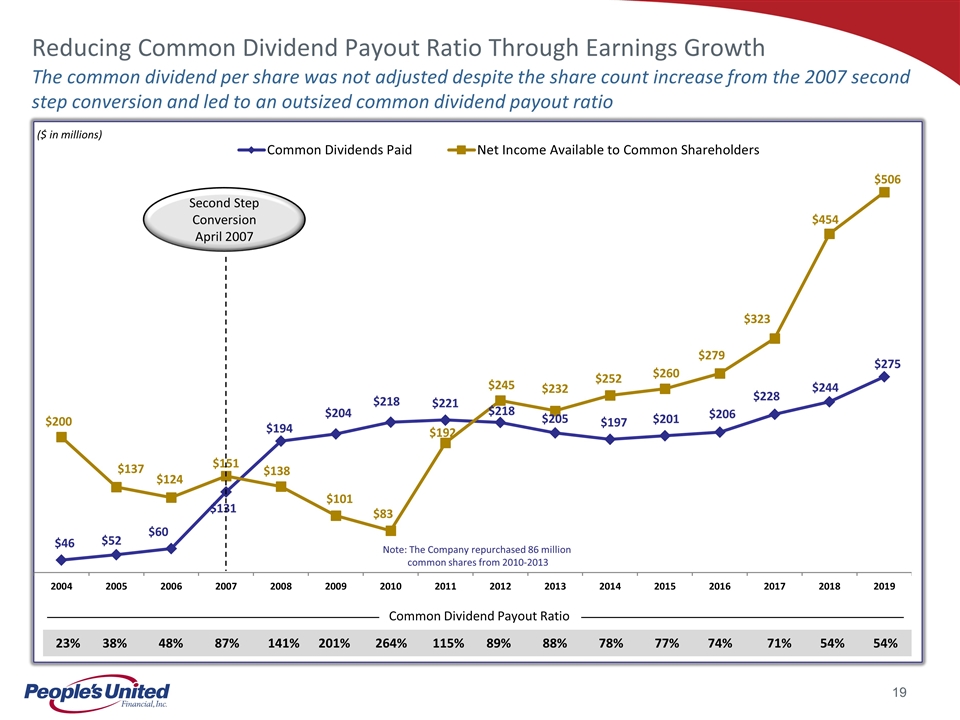

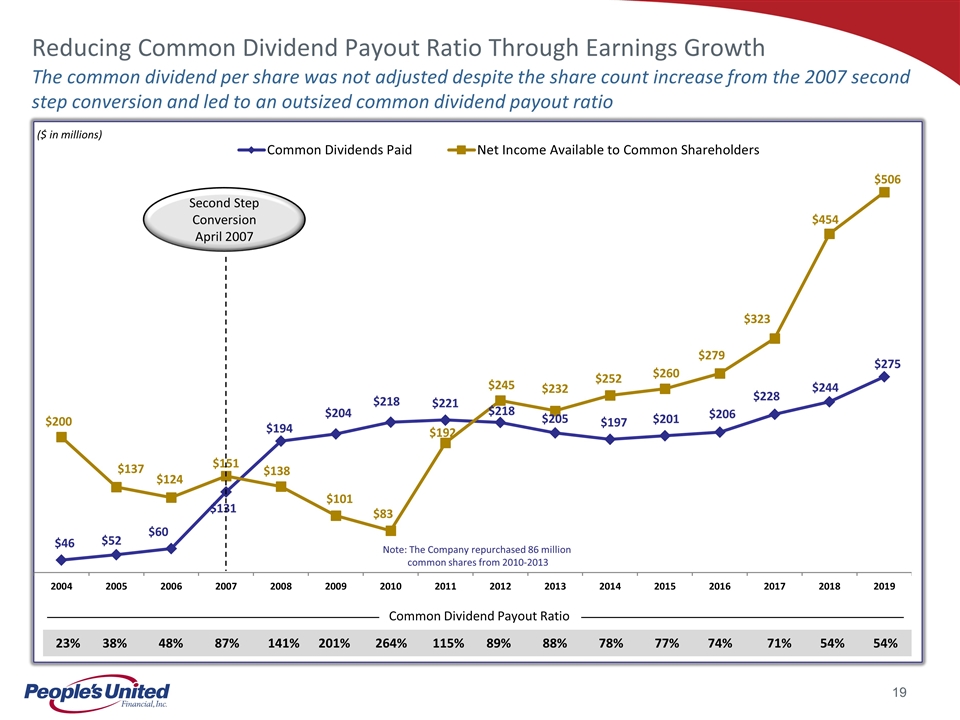

Second Step Conversion April 2007 ($ in millions) The common dividend per share was not adjusted despite the share count increase from the 2007 second step conversion and led to an outsized common dividend payout ratio Reducing Common Dividend Payout Ratio Through Earnings Growth 23% 38% 48% 87% 141% 201% 264% 115% 89% 88% 78% 77% 74% 71% 54% 54% Common Dividend Payout Ratio Note: The Company repurchased 86 million common shares from 2010-2013

c Moving Forward Seaport District Branch – Boston, Massachusetts Penn Station Branch – Manhattan, New York Further expansion in New York Metro and Greater Boston areas, while continuing to strengthen multi-product relationships across heritage markets and grow national businesses Build upon recent acquisitions Accelerate growth in specialized industry verticals such as Healthcare, Franchise Finance, Technology and Not-for-Profit Continue to enhance large-corporate and government banking businesses Introduce new products and product enhancements to better serve customers and further diversify revenue mix Leverage syndications platform to compete on larger transactions Deepen international services capabilities Grow derivatives business Continue to enhance digital capabilities and technology infrastructure Utilize technology to improve efficiencies and customer experience Leverage investments in digital marketing to engage clients, generate qualified leads, build relationships and increase sales productivity Partner with multiple fintechs to continue to build out digital solutions for customers Leverage recently implemented customer relationship management system Improve sales force effectiveness, accelerate referral activity and broaden customer relationships Further strengthen deposit gathering capabilities across the franchise We are committed to provide superior service to clients and remain confident in our ability to deliver value to shareholders

c Shareholder Focused Corporate Governance Structure Diverse Board of Directors with broad experience, expertise and qualifications Ten of the Company’s twelve directors are independent Independent members of Board meet regularly in executive session Each member of Compensation, Nominating and Governance Committee is independent All directors elected annually Election of directors by majority vote, not plurality vote Board conducts annual self evaluation Compensation program for senior executive officers aligned with pay for performance principles Stock ownership guidelines (CEO 5X base salary, other senior executive officers 3X base salary) Incentive compensation clawback policy adopted Prohibition on hedging and pledging

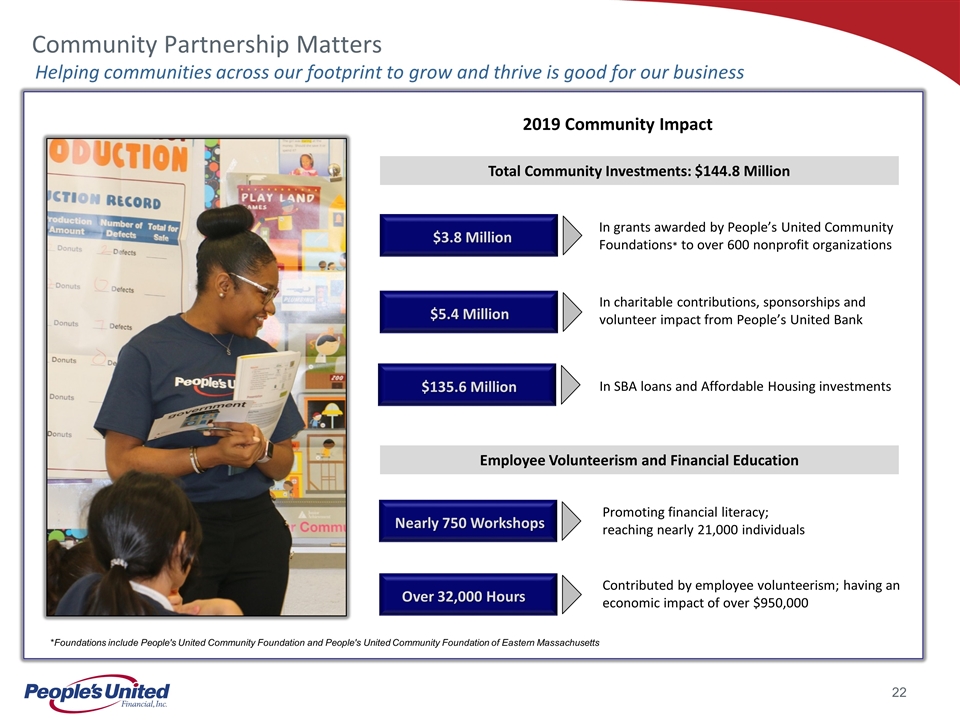

c Helping communities across our footprint to grow and thrive is good for our business Community Partnership Matters $3.8 Million $5.4 Million Nearly 750 Workshops $135.6 Million Over 32,000 Hours In grants awarded by People’s United Community Foundations* to over 600 nonprofit organizations In charitable contributions, sponsorships and volunteer impact from People’s United Bank Promoting financial literacy; reaching nearly 21,000 individuals In SBA loans and Affordable Housing investments Contributed by employee volunteerism; having an economic impact of over $950,000 2019 Community Impact Total Community Investments: $144.8 Million Employee Volunteerism and Financial Education *Foundations include People's United Community Foundation and People's United Community Foundation of Eastern Massachusetts

Fourth Quarter and Full Year 2019 Results

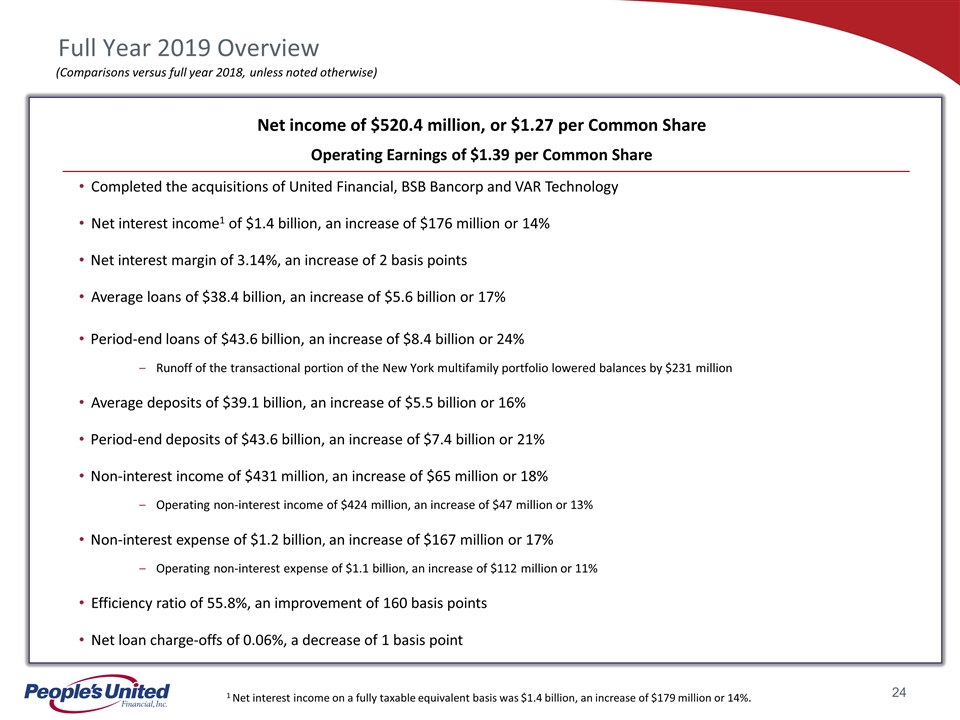

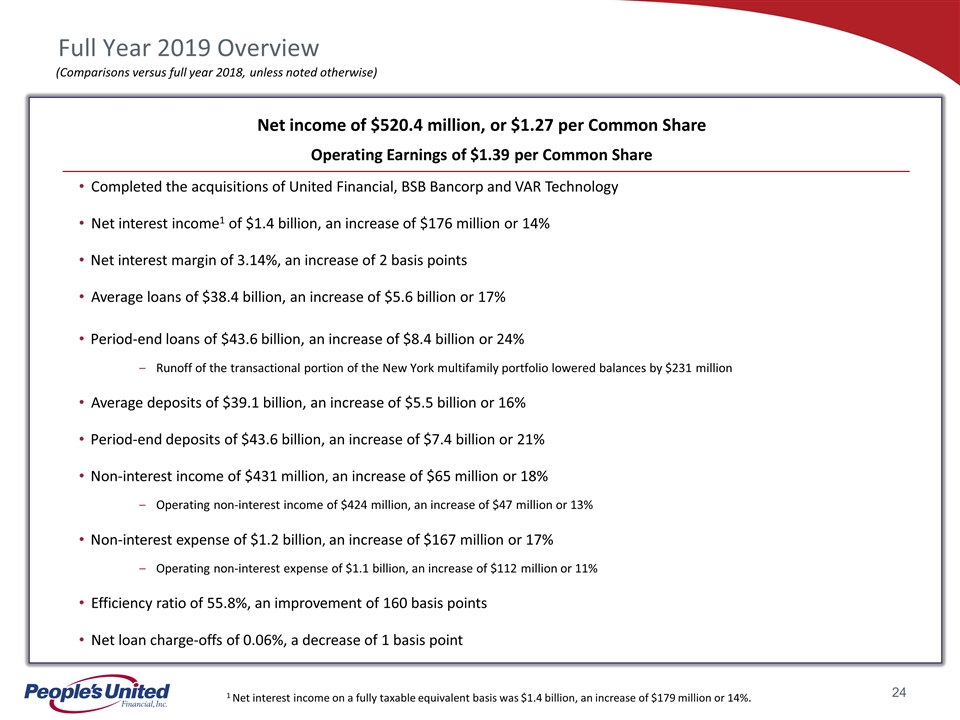

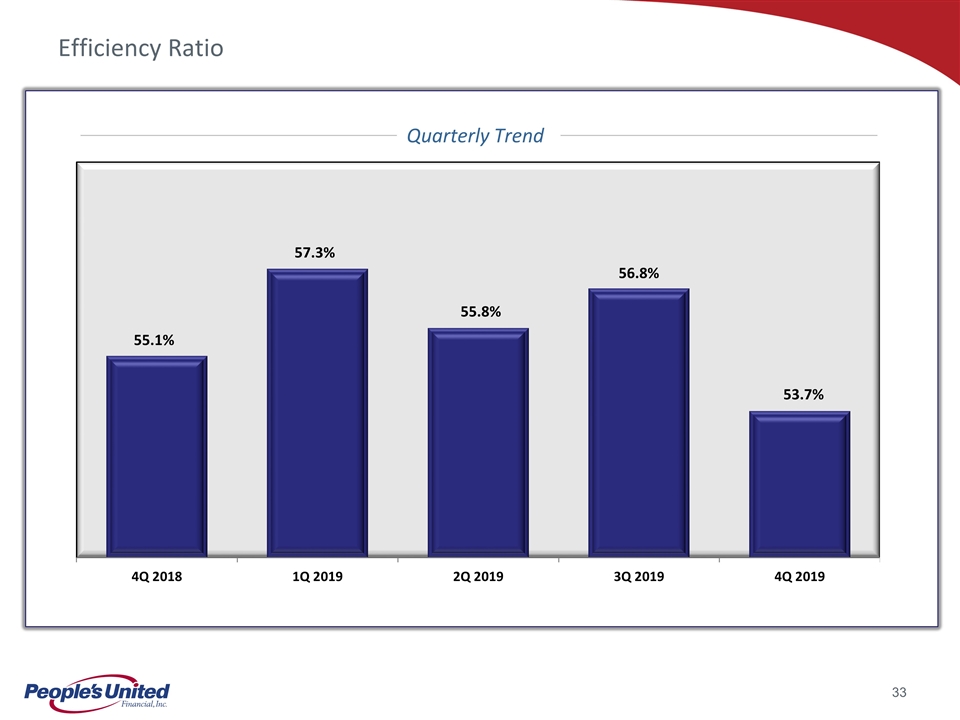

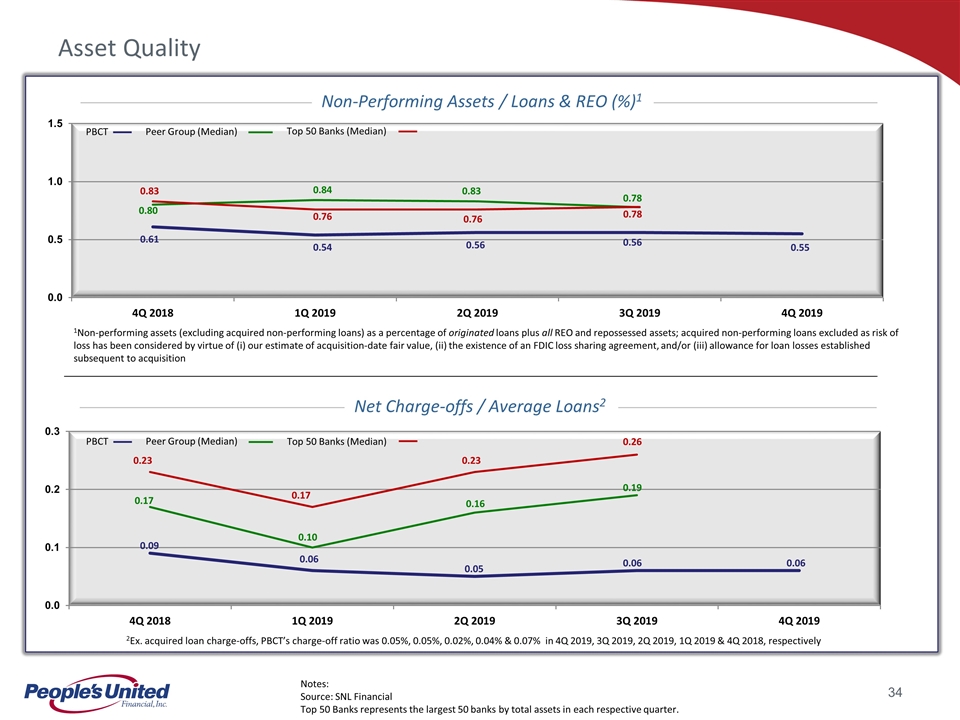

1 Net interest income on a fully taxable equivalent basis was $1.4 billion, an increase of $179 million or 14%. Full Year 2019 Overview Net income of $520.4 million, or $1.27 per Common Share Operating Earnings of $1.39 per Common Share Completed the acquisitions of United Financial, BSB Bancorp and VAR Technology Net interest income1 of $1.4 billion, an increase of $176 million or 14% Net interest margin of 3.14%, an increase of 2 basis points Average loans of $38.4 billion, an increase of $5.6 billion or 17% Period-end loans of $43.6 billion, an increase of $8.4 billion or 24% Runoff of the transactional portion of the New York multifamily portfolio lowered balances by $231 million Average deposits of $39.1 billion, an increase of $5.5 billion or 16% Period-end deposits of $43.6 billion, an increase of $7.4 billion or 21% Non-interest income of $431 million, an increase of $65 million or 18% Operating non-interest income of $424 million, an increase of $47 million or 13% Non-interest expense of $1.2 billion, an increase of $167 million or 17% Operating non-interest expense of $1.1 billion, an increase of $112 million or 11% Efficiency ratio of 55.8%, an improvement of 160 basis points Net loan charge-offs of 0.06%, a decrease of 1 basis point (Comparisons versus full year 2018, unless noted otherwise)

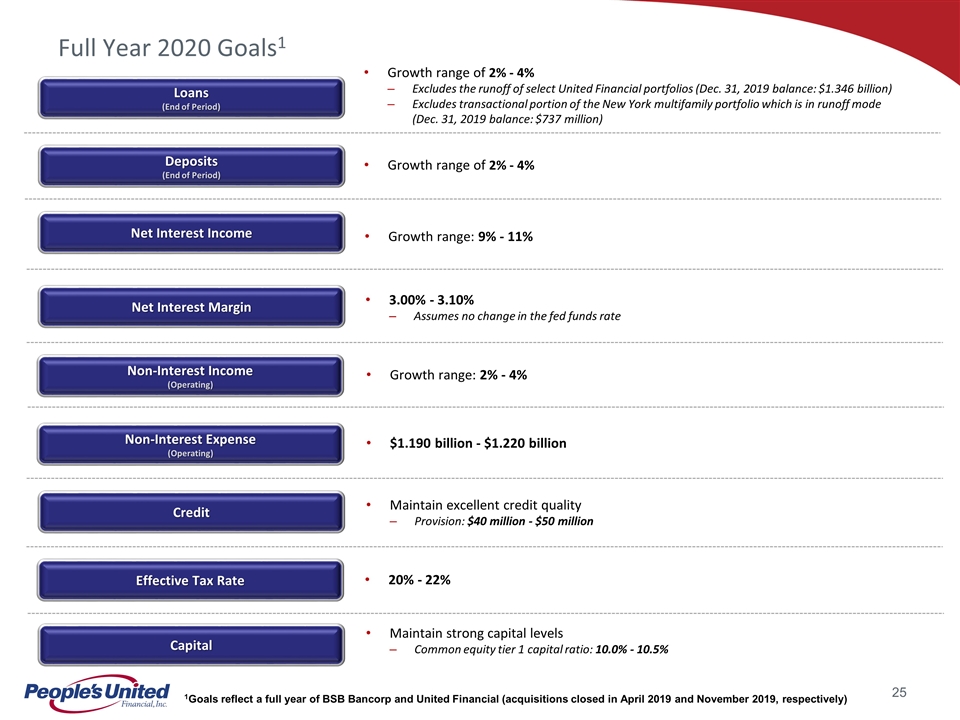

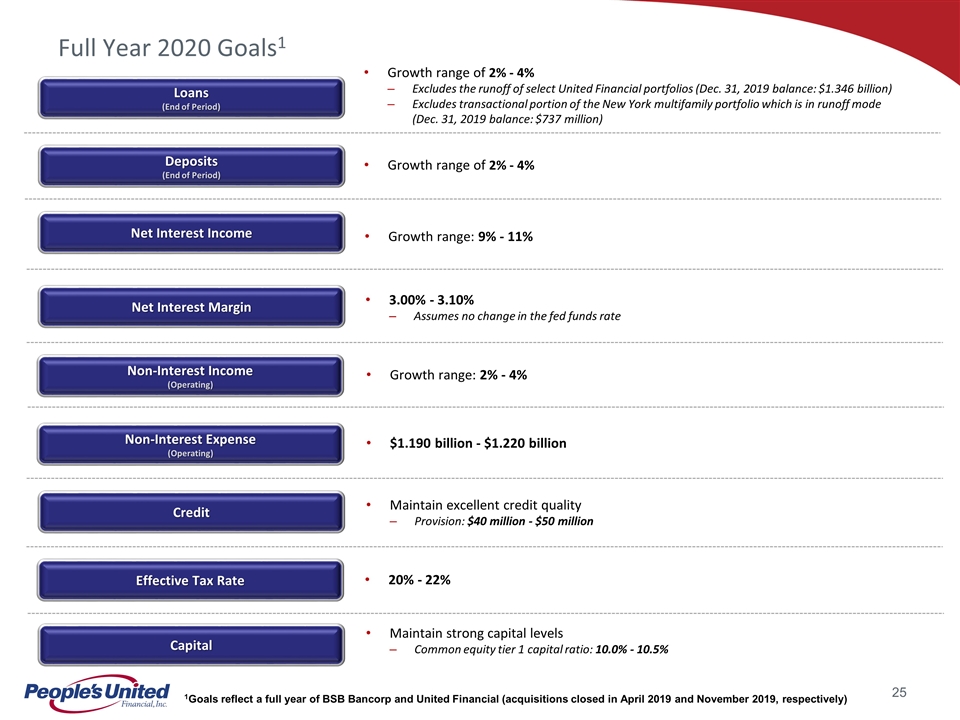

Full Year 2020 Goals1 Net Interest Income Net Interest Margin Non-Interest Expense (Operating) Credit Capital Growth range: 9% - 11% 3.00% - 3.10% Assumes no change in the fed funds rate Growth range: 2% - 4% $1.190 billion - $1.220 billion Maintain excellent credit quality Provision: $40 million - $50 million Maintain strong capital levels Common equity tier 1 capital ratio: 10.0% - 10.5% Growth range of 2% - 4% Excludes the runoff of select United Financial portfolios (Dec. 31, 2019 balance: $1.346 billion) Excludes transactional portion of the New York multifamily portfolio which is in runoff mode (Dec. 31, 2019 balance: $737 million) Effective Tax Rate 20% - 22% Growth range of 2% - 4% Non-Interest Income (Operating) 1Goals reflect a full year of BSB Bancorp and United Financial (acquisitions closed in April 2019 and November 2019, respectively) Loans (End of Period) Deposits (End of Period)

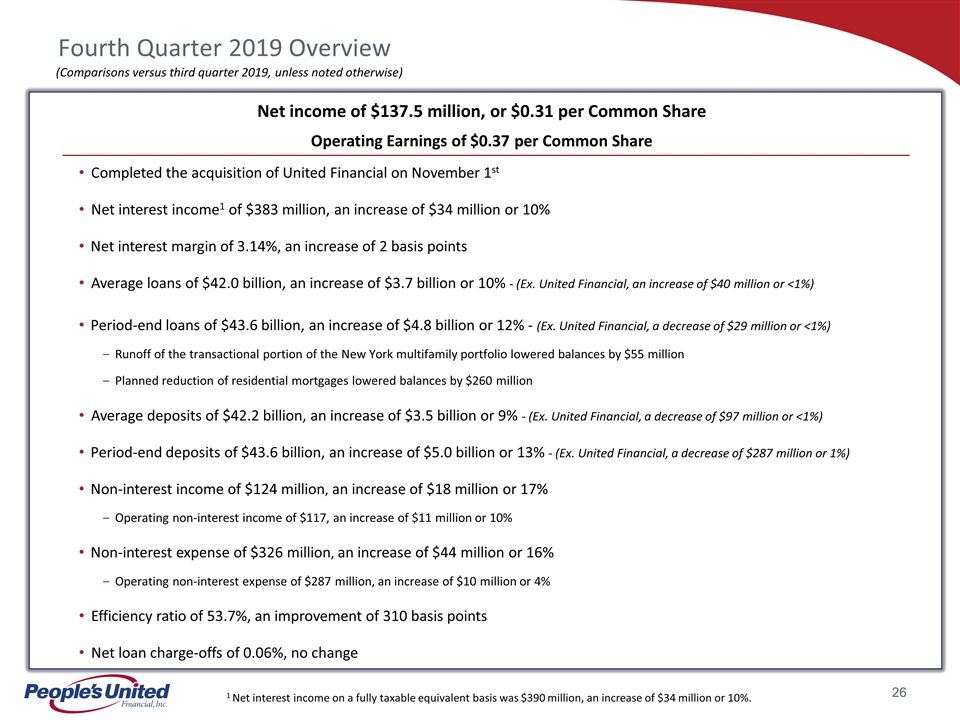

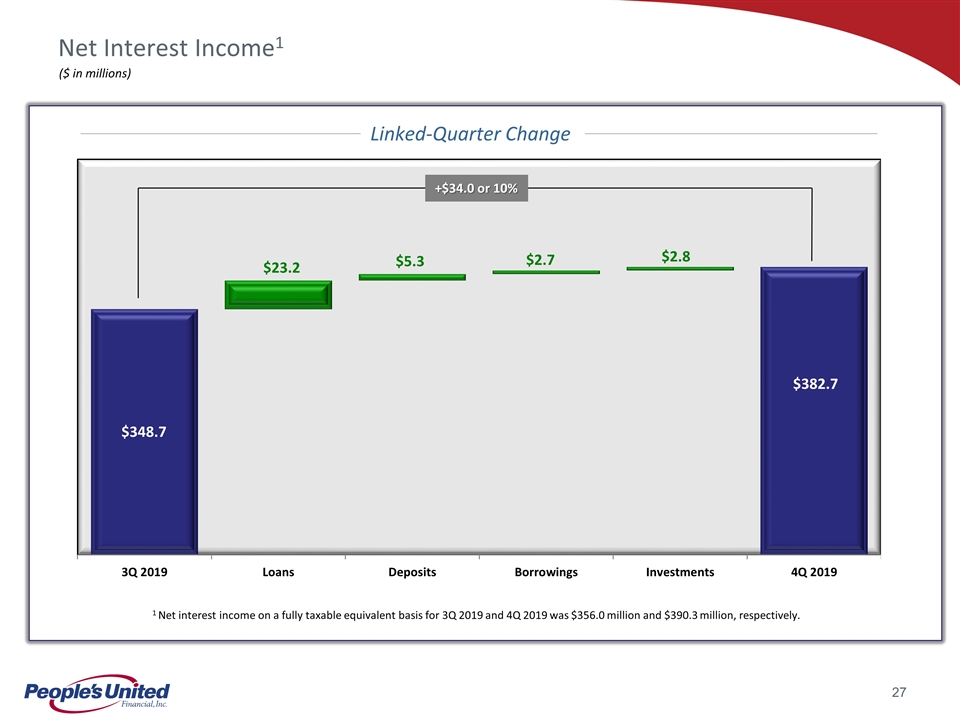

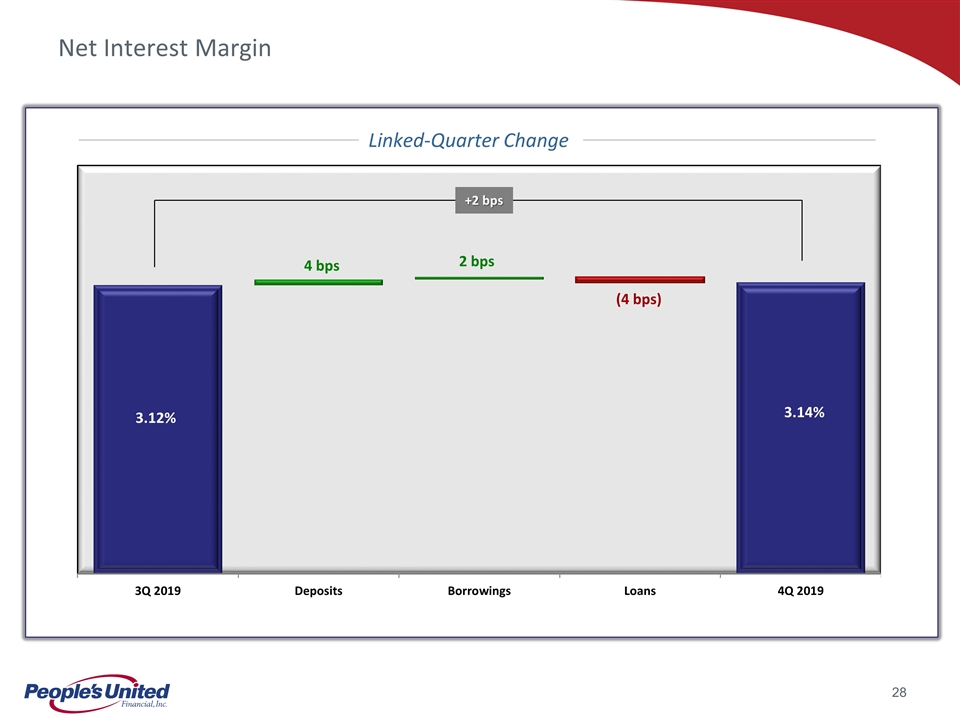

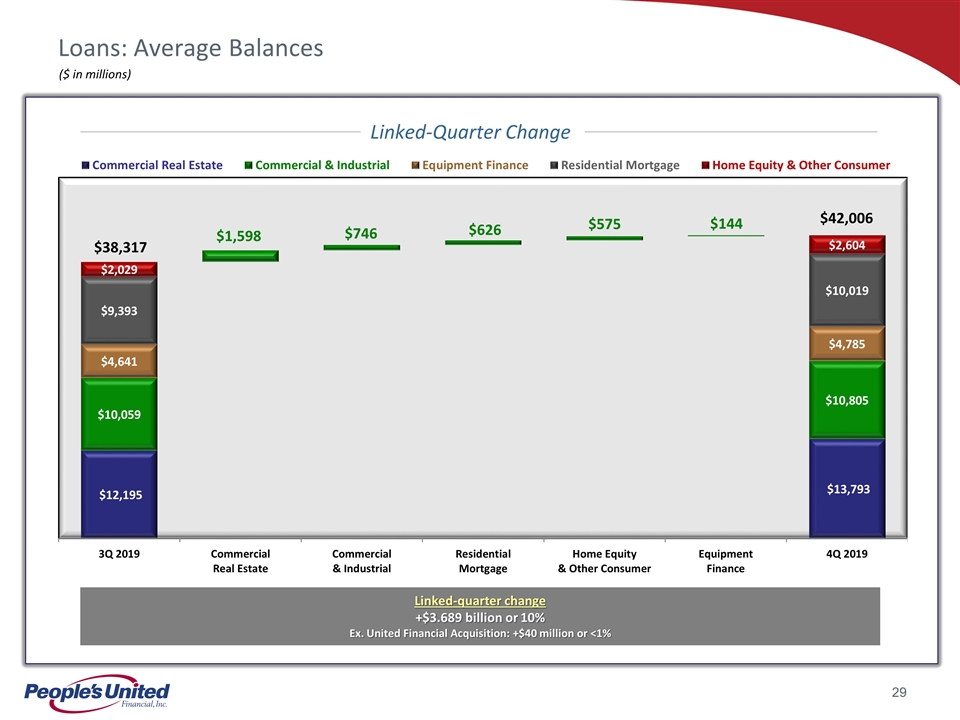

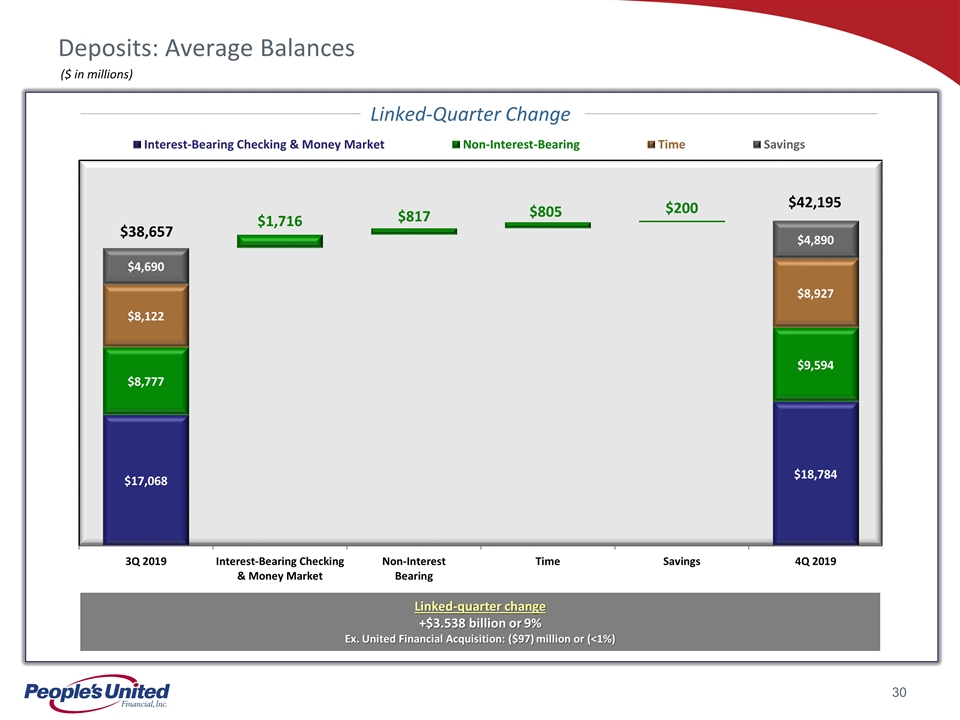

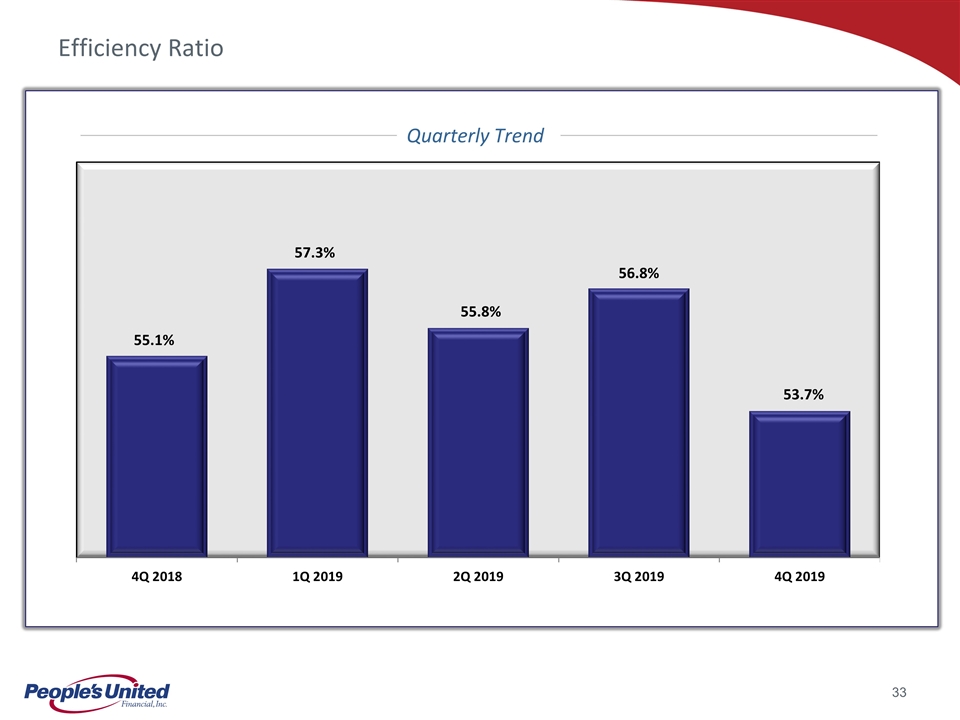

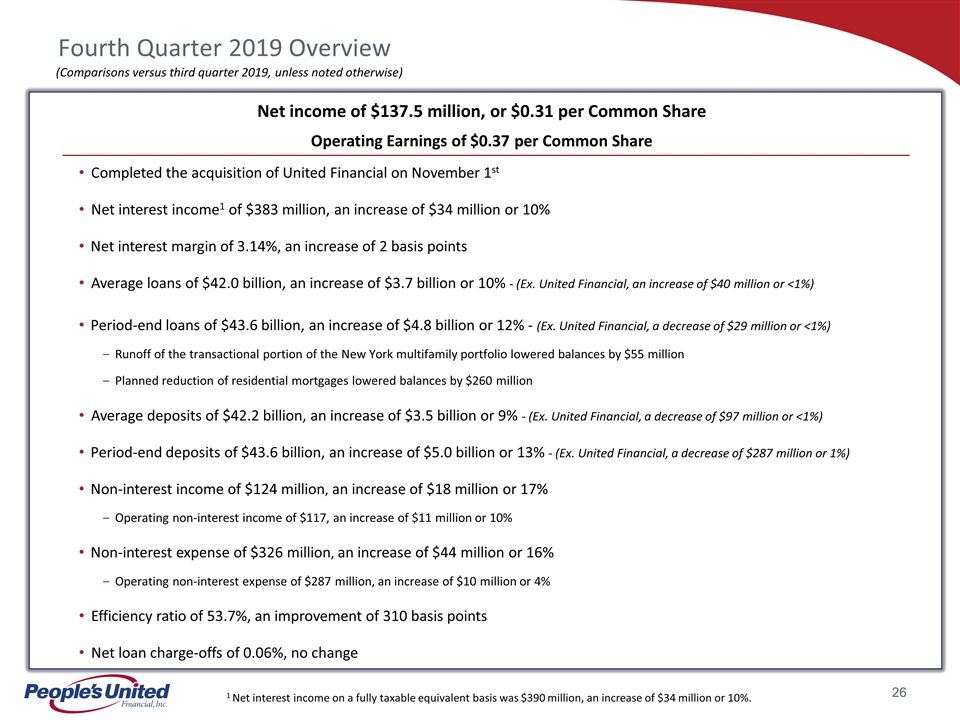

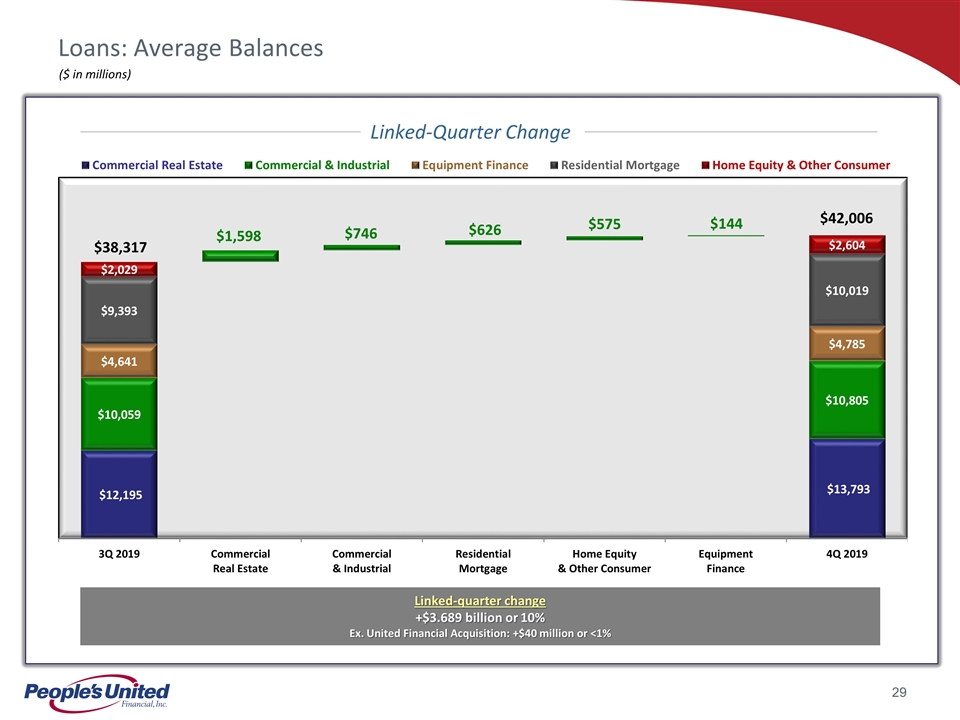

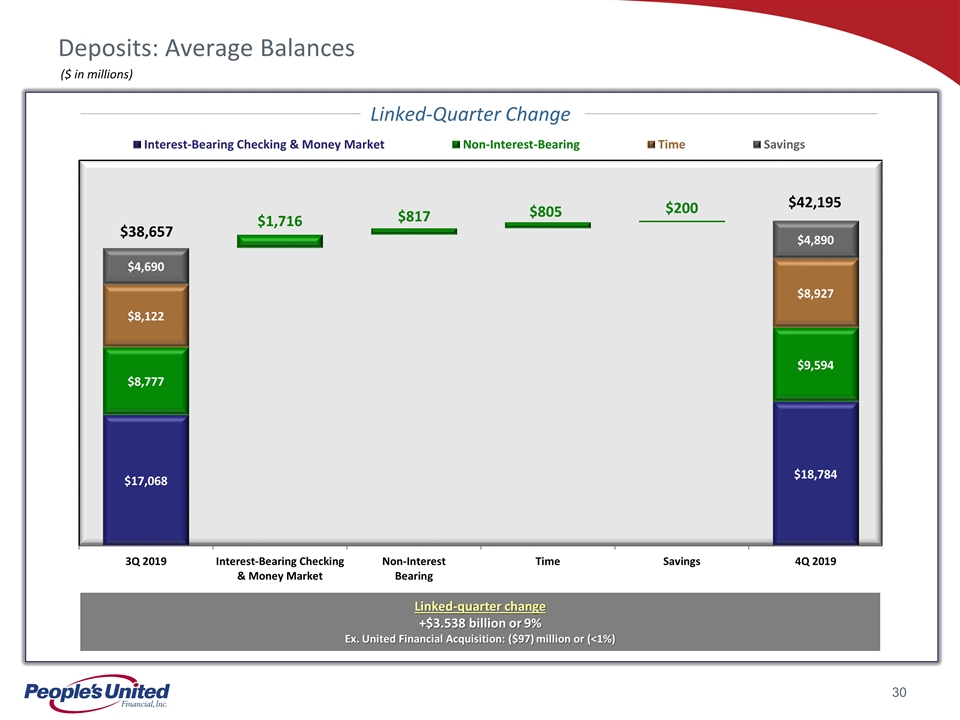

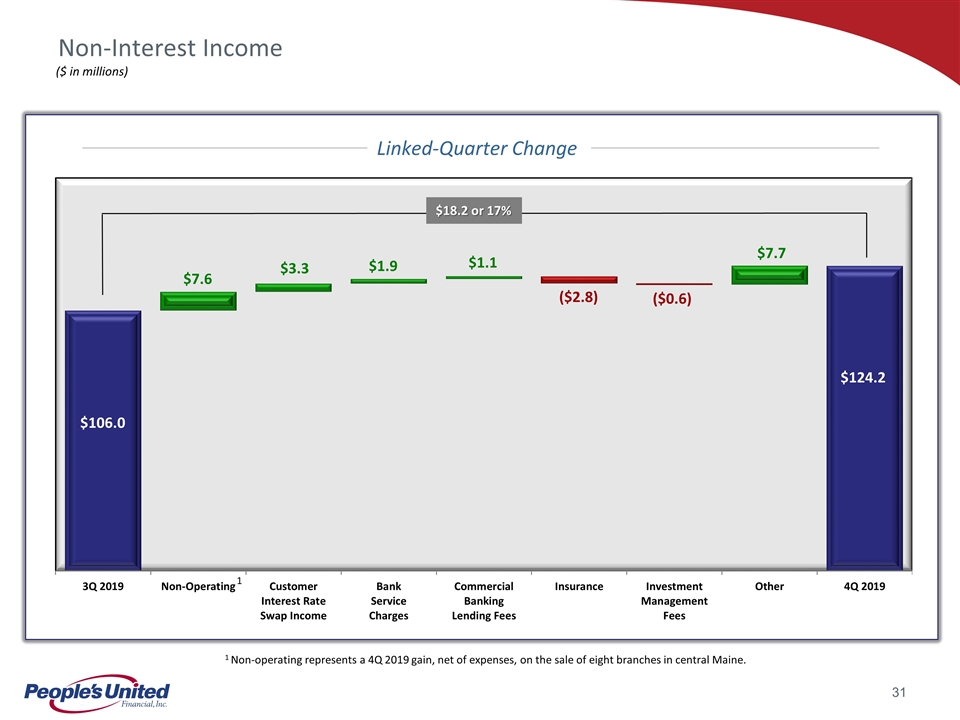

1 Net interest income on a fully taxable equivalent basis was $390 million, an increase of $34 million or 10%. Fourth Quarter 2019 Overview Net income of $137.5 million, or $0.31 per Common Share Operating Earnings of $0.37 per Common Share Completed the acquisition of United Financial on November 1st Net interest income1 of $383 million, an increase of $34 million or 10% Net interest margin of 3.14%, an increase of 2 basis points Average loans of $42.0 billion, an increase of $3.7 billion or 10% - (Ex. United Financial, an increase of $40 million or <1%) Period-end loans of $43.6 billion, an increase of $4.8 billion or 12% - (Ex. United Financial, a decrease of $29 million or <1%) Runoff of the transactional portion of the New York multifamily portfolio lowered balances by $55 million Planned reduction of residential mortgages lowered balances by $260 million Average deposits of $42.2 billion, an increase of $3.5 billion or 9% - (Ex. United Financial, a decrease of $97 million or <1%) Period-end deposits of $43.6 billion, an increase of $5.0 billion or 13% - (Ex. United Financial, a decrease of $287 million or 1%) Non-interest income of $124 million, an increase of $18 million or 17% Operating non-interest income of $117, an increase of $11 million or 10% Non-interest expense of $326 million, an increase of $44 million or 16% Operating non-interest expense of $287 million, an increase of $10 million or 4% Efficiency ratio of 53.7%, an improvement of 310 basis points Net loan charge-offs of 0.06%, no change (Comparisons versus third quarter 2019, unless noted otherwise)

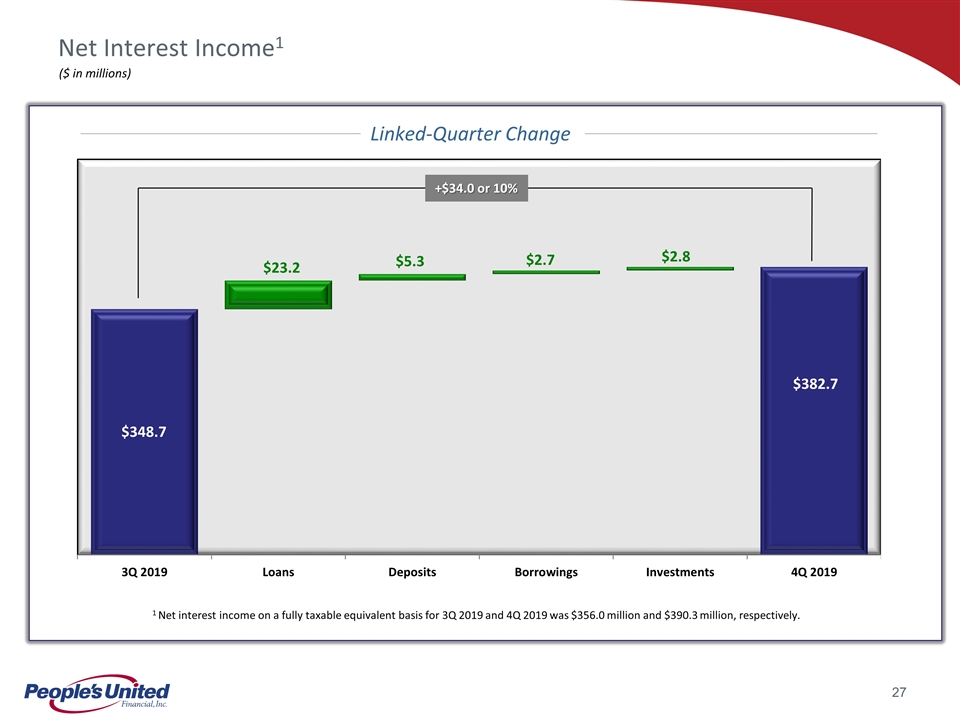

Net Interest Income1 ($ in millions) $348.7 $382.7 1 Net interest income on a fully taxable equivalent basis for 3Q 2019 and 4Q 2019 was $356.0 million and $390.3 million, respectively. +$34.0 or 10% Linked-Quarter Change $23.2 $5.3 $2.7 $2.8

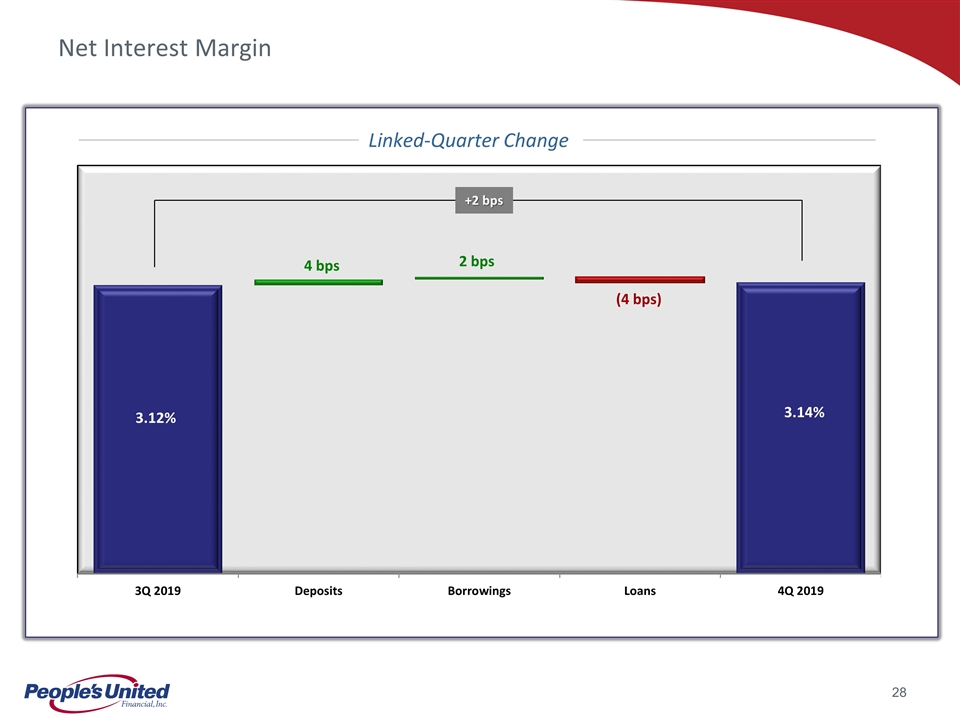

Net Interest Margin 3.12% 3.14% +2 bps Linked-Quarter Change 4 bps 2 bps (4 bps)

Loans: Average Balances $42,006 ($ in millions) $38,317 Linked-Quarter Change Linked-quarter change +$3.689 billion or 10% Ex. United Financial Acquisition: +$40 million or <1% $1,598 $746 $626 $575 $144

Deposits: Average Balances ($ in millions) $42,195 $38,657 Linked-Quarter Change Linked-quarter change +$3.538 billion or 9% Ex. United Financial Acquisition: ($97) million or (<1%) $1,716 $817 $805 $200

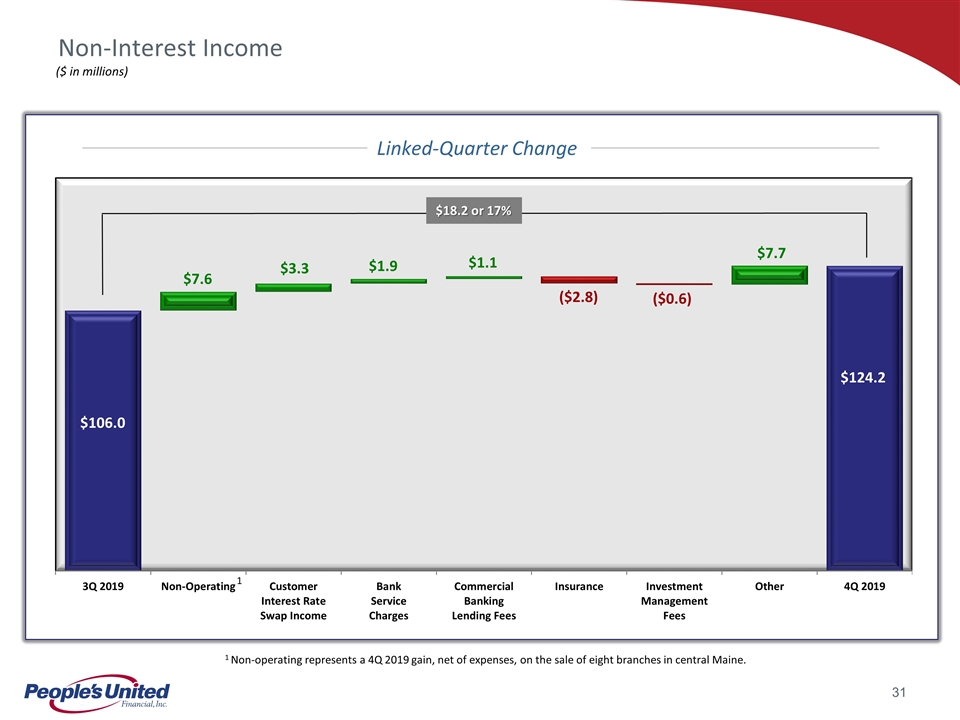

Non-Interest Income ($ in millions) $106.0 $124.2 $18.2 or 17% Linked-Quarter Change 1 Non-operating represents a 4Q 2019 gain, net of expenses, on the sale of eight branches in central Maine. $7.6 1 $3.3 $1.9 $1.1 $7.7 ($2.8) ($0.6)

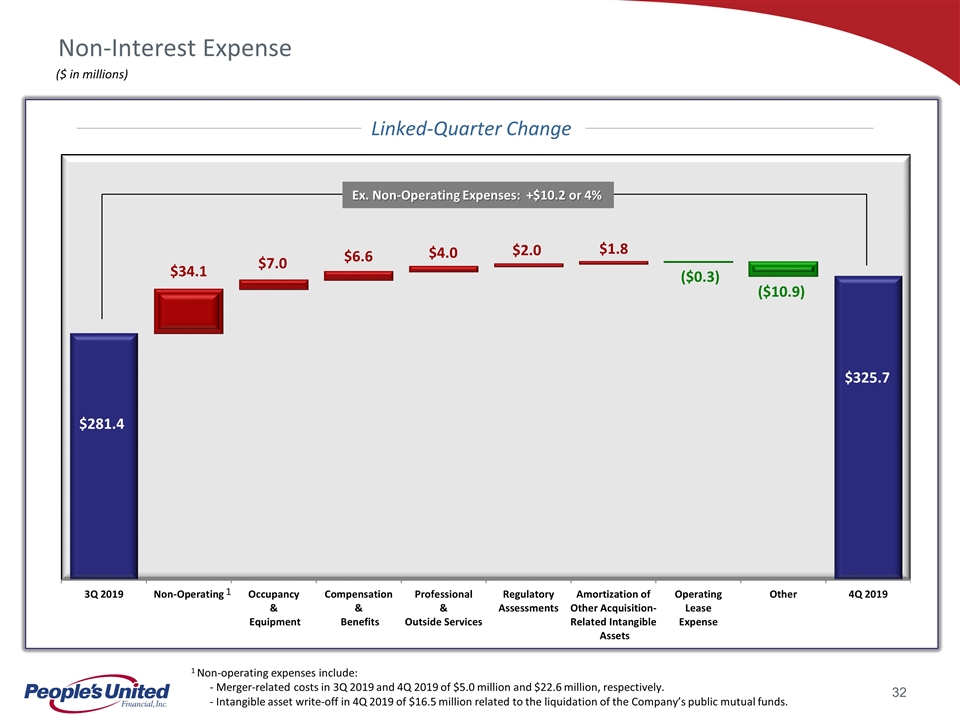

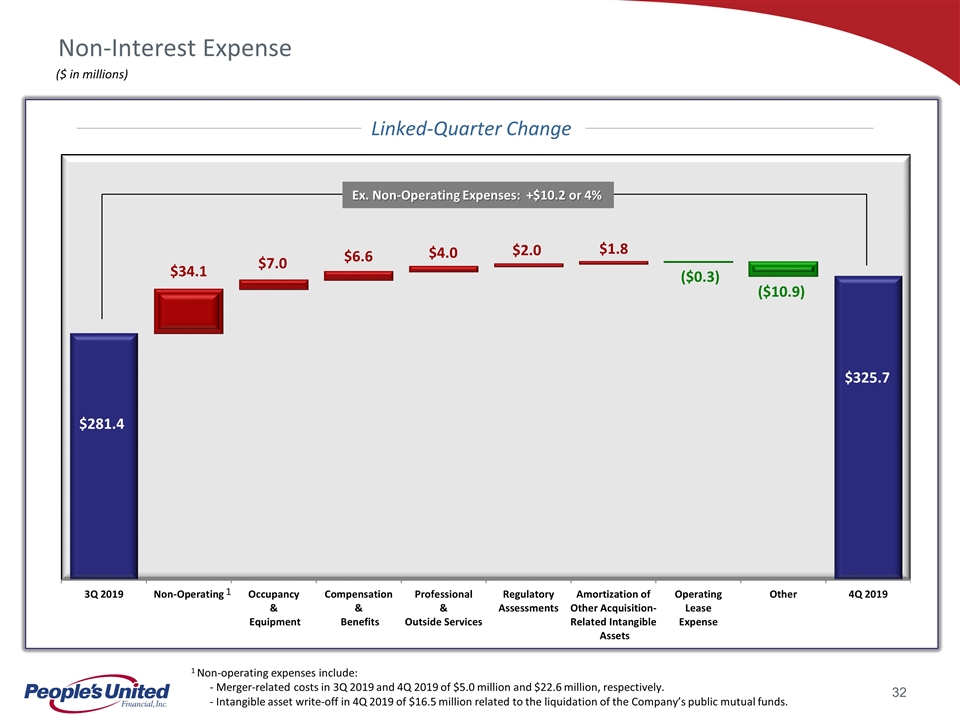

Non-Interest Expense ($ in millions) $325.7 $281.4 Ex. Non-Operating Expenses: +$10.2 or 4% Linked-Quarter Change $34.1 1 1 Non-operating expenses include: - Merger-related costs in 3Q 2019 and 4Q 2019 of $5.0 million and $22.6 million, respectively. - Intangible asset write-off in 4Q 2019 of $16.5 million related to the liquidation of the Company’s public mutual funds. $7.0 $6.6 $4.0 $2.0 $1.8 ($0.3) ($10.9)

Efficiency Ratio Quarterly Trend

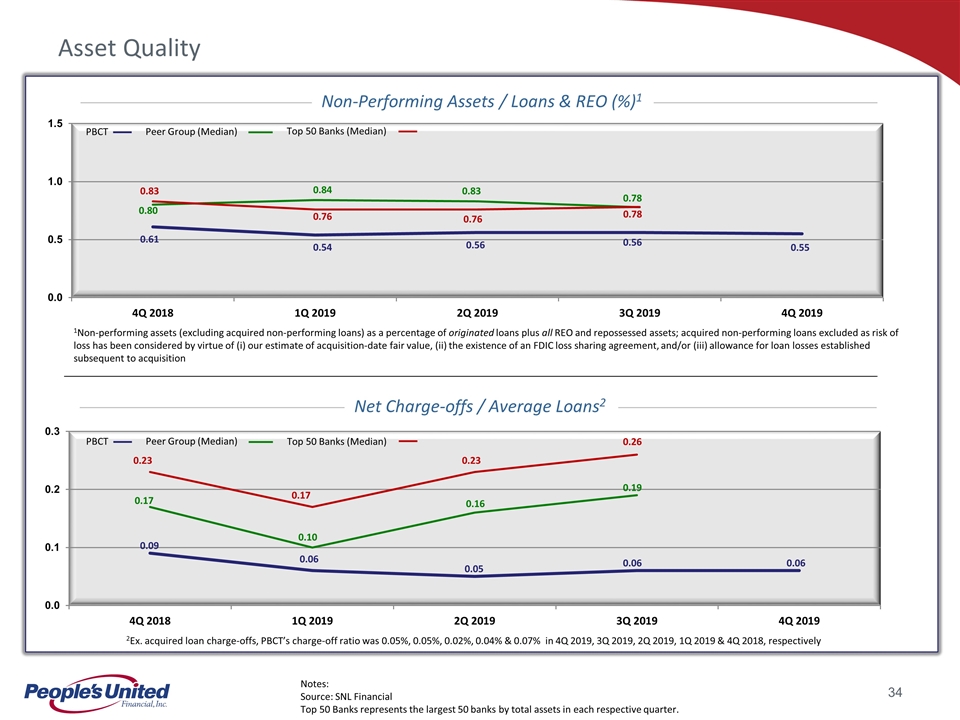

Asset Quality 1Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of (i) our estimate of acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or (iii) allowance for loan losses established subsequent to acquisition Notes: Source: SNL Financial Top 50 Banks represents the largest 50 banks by total assets in each respective quarter. 2Ex. acquired loan charge-offs, PBCT’s charge-off ratio was 0.05%, 0.05%, 0.02%, 0.04% & 0.07% in 4Q 2019, 3Q 2019, 2Q 2019, 1Q 2019 & 4Q 2018, respectively PBCT Peer Group (Median) Top 50 Banks (Median) PBCT Peer Group (Median) Top 50 Banks (Median) Non-Performing Assets / Loans & REO (%)1 Net Charge-offs / Average Loans2

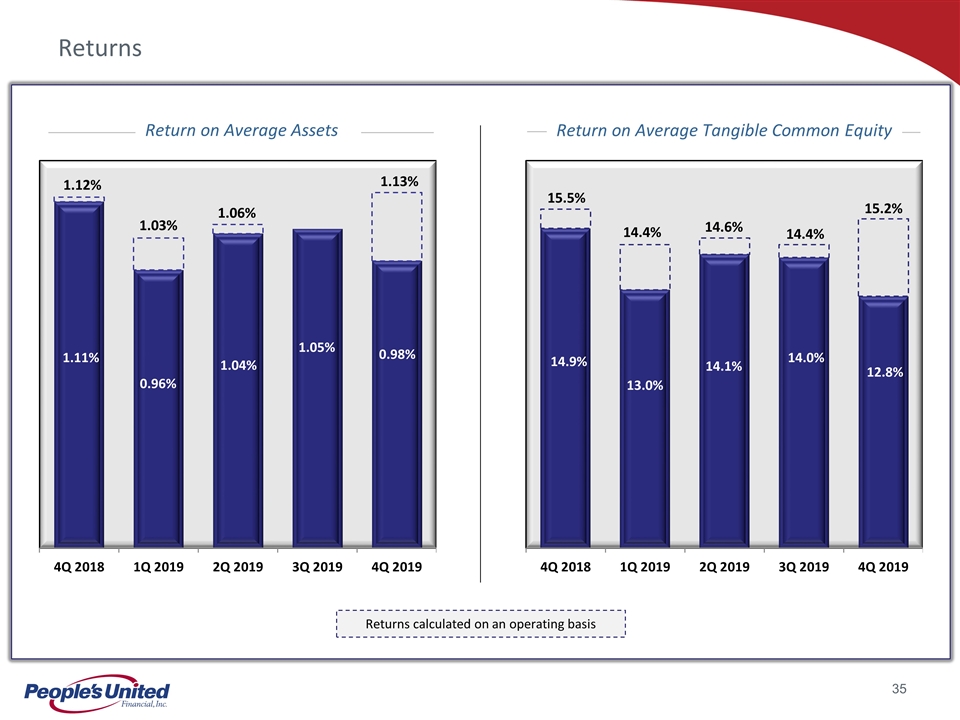

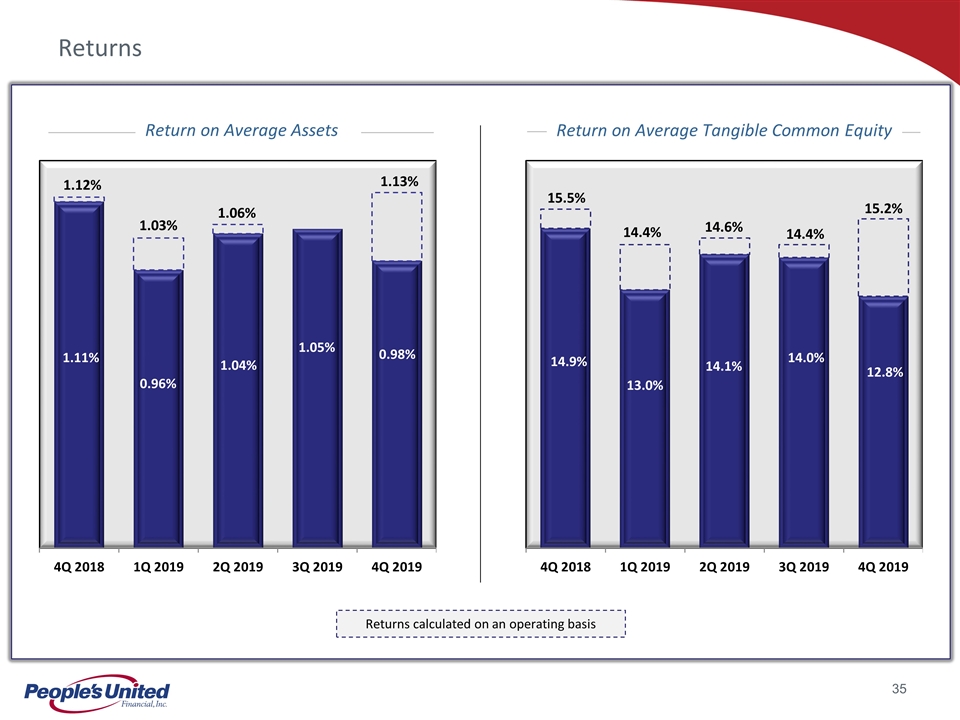

Returns Return on Average Assets Return on Average Tangible Common Equity Returns calculated on an operating basis 14.4% 1.03% 14.6% 1.06% 14.4% 1.12% 15.5% 1.13% 15.2%

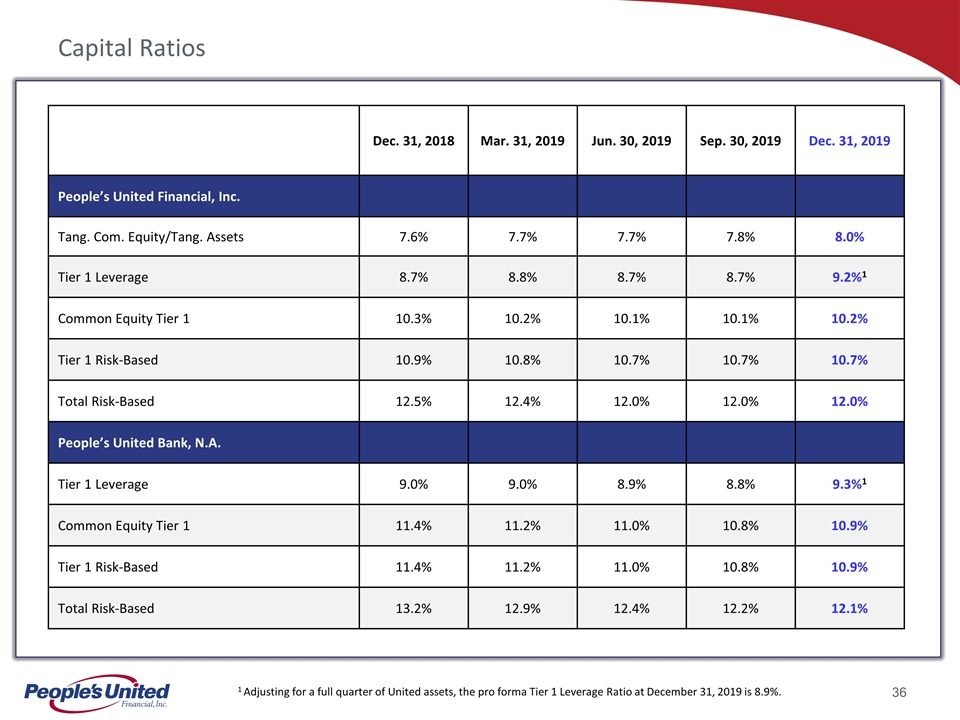

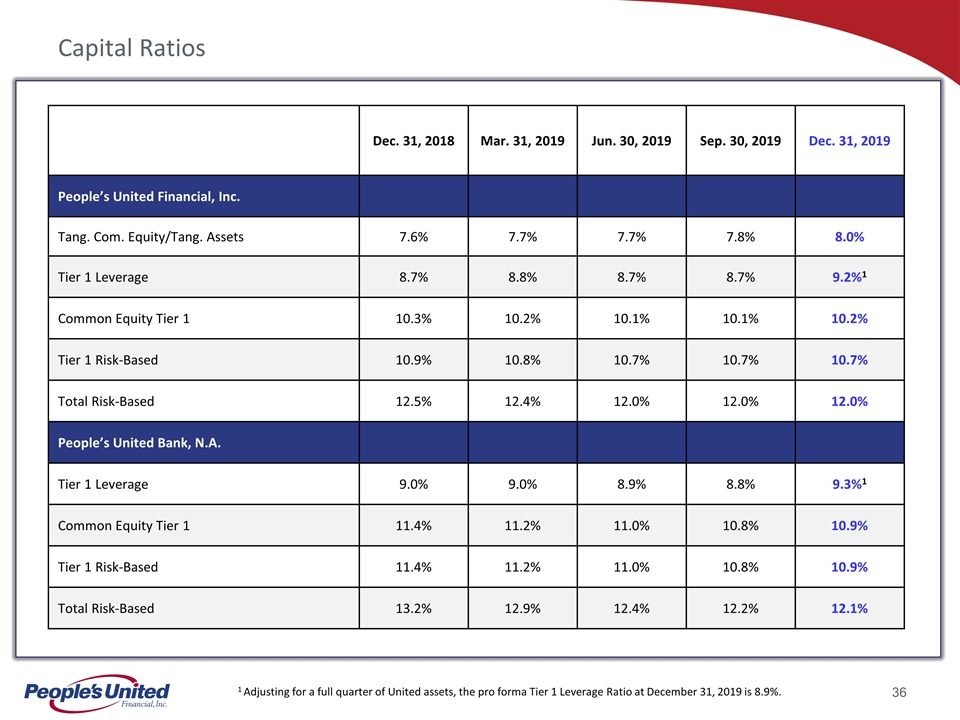

Capital Ratios Dec. 31, 2018 Mar. 31, 2019 Jun. 30, 2019 Sep. 30, 2019 Dec. 31, 2019 People’s United Financial, Inc. Tang. Com. Equity/Tang. Assets 7.6% 7.7% 7.7% 7.8% 8.0% Tier 1 Leverage 8.7% 8.8% 8.7% 8.7% 9.2%1 Common Equity Tier 1 10.3% 10.2% 10.1% 10.1% 10.2% Tier 1 Risk-Based 10.9% 10.8% 10.7% 10.7% 10.7% Total Risk-Based 12.5% 12.4% 12.0% 12.0% 12.0% People’s United Bank, N.A. Tier 1 Leverage 9.0% 9.0% 8.9% 8.8% 9.3%1 Common Equity Tier 1 11.4% 11.2% 11.0% 10.8% 10.9% Tier 1 Risk-Based 11.4% 11.2% 11.0% 10.8% 10.9% Total Risk-Based 13.2% 12.9% 12.4% 12.2% 12.1% 1 Adjusting for a full quarter of United assets, the pro forma Tier 1 Leverage Ratio at December 31, 2019 is 8.9%.

Appendix

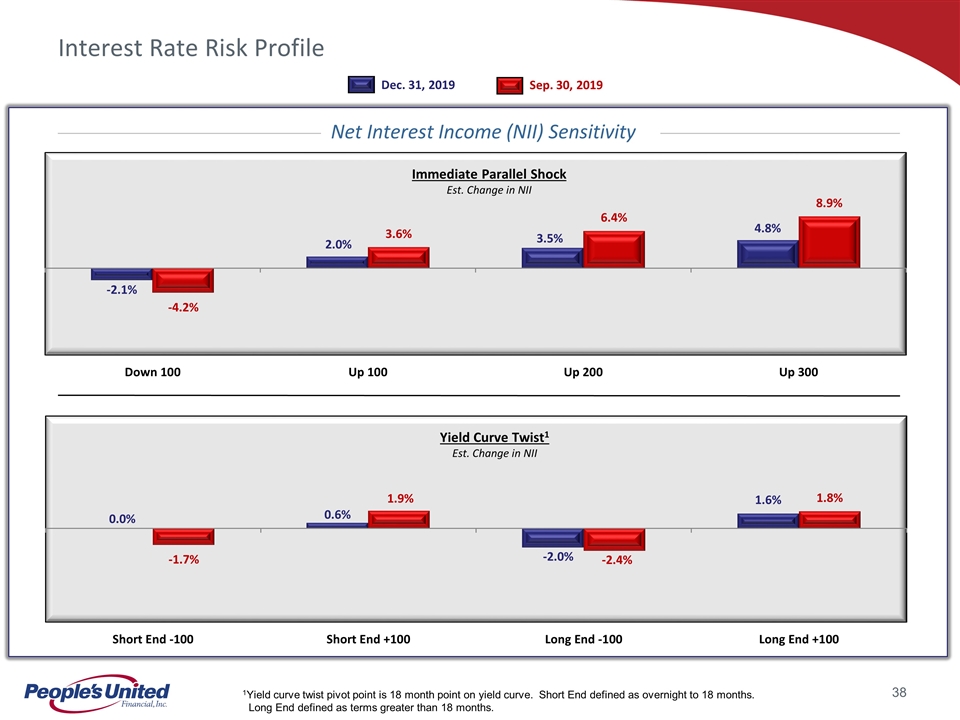

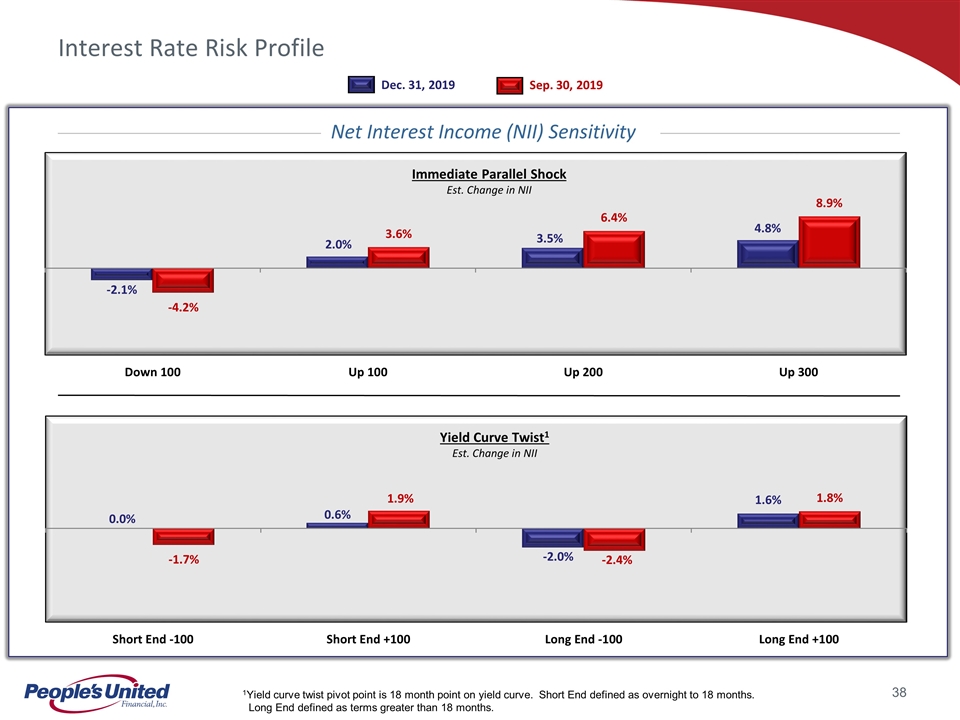

Interest Rate Risk Profile 1Yield curve twist pivot point is 18 month point on yield curve. Short End defined as overnight to 18 months. Long End defined as terms greater than 18 months. Immediate Parallel Shock Est. Change in NII Yield Curve Twist1 Est. Change in NII Dec. 31, 2019 Sep. 30, 2019 Net Interest Income (NII) Sensitivity

Loans By State $24,390 $26,592 $29,745 $32,575 $28,411 ($ in millions, end of period balances) State Breakdown $35,241 $43,596

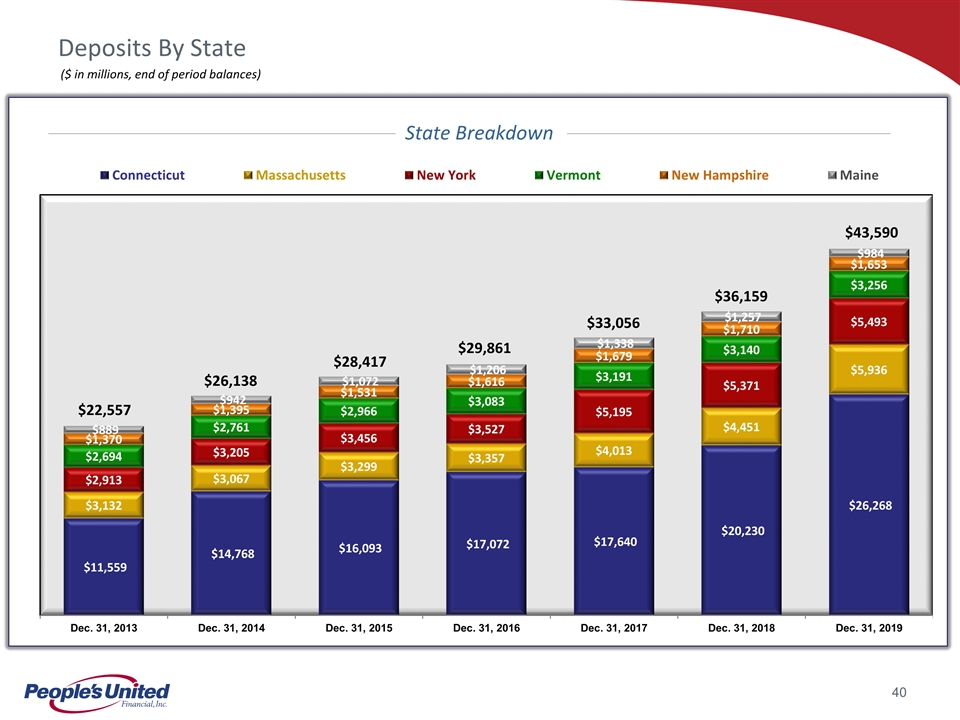

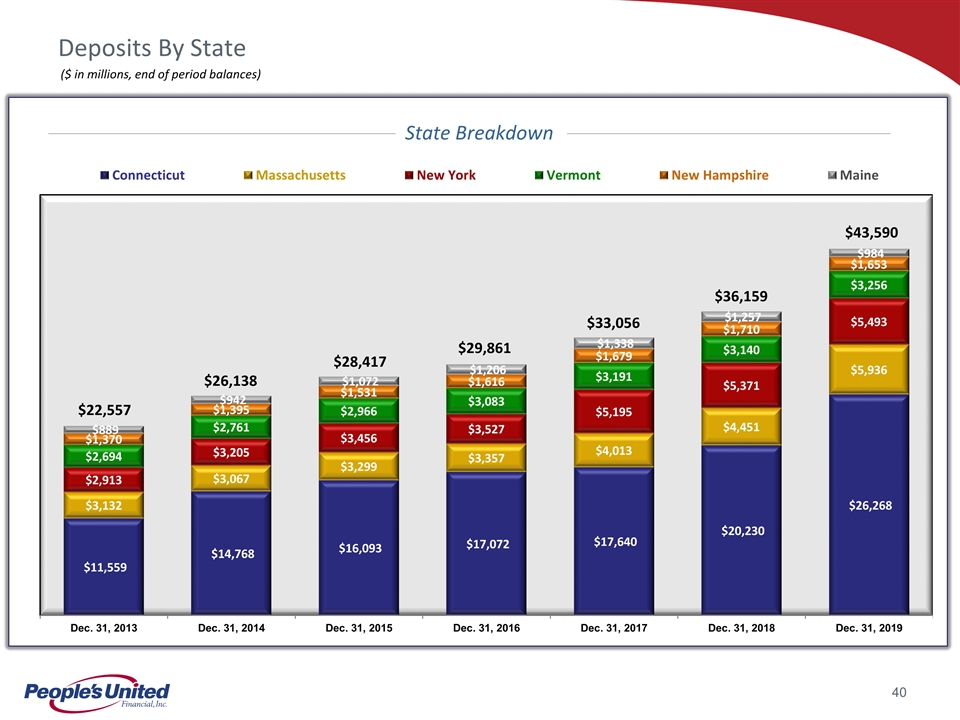

Deposits By State $22,557 $26,138 $29,861 $33,056 $28,417 ($ in millions, end of period balances) State Breakdown $36,159 $43,590

Asset Quality Originated Portfolio Coverage Detail as of December 31, 2019 Note – ALLLs: Commercial: $217 million, Retail: $29 million, Total: $246 million. ALLLs / Loans NPLs / Loans ALLLs / NPLs

Peer Group Firm Ticker City State 1 Associated Banc-Corp ASB Green Bay WI 2 BankUnited Inc. BKU Miami Lakes FL 3 Citizens Financial Group, Inc. CFG Providence RI 4 Comerica Inc. CMA Dallas TX 5 First Horizon National Corp. FHN Memphis TN 6 F.N.B. Corp. FNB Pittsburgh PA 7 Huntington Bancshares, Inc. HBAN Columbus OH 8 KeyCorp KEY Cleveland OH 9 M&T Bank Corp. MTB Buffalo NY 10 New York Community Bancorp NYCB Westbury NY 11 Signature Bank SBNY New York NY 12 Sterling Bancorp STL Montebello NY 13 Valley National Bancorp VLY Wayne NJ 14 Webster Financial Corp. WBS Waterbury CT 15 Zions Bancorp. ZION Salt Lake City UT

Non-GAAP Financial Measures and Reconciliation to GAAP In addition to evaluating People’s United Financial Inc. ("People's United") results of operations in accordance with U.S. generally accepted accounting principles (“GAAP”), management routinely supplements its evaluation with an analysis of certain non-GAAP financial measures, such as the efficiency and tangible common equity ratios, tangible book value per common share and operating earnings metrics. Management believes these non-GAAP financial measures provide information useful to investors in understanding People’s United’s underlying operating performance and trends, and facilitates comparisons with the performance of other financial institutions. Further, the efficiency ratio and operating earnings metrics are used by management in its assessment of financial performance, including non-interest expense control, while the tangible common equity ratio and tangible book value per common share are used to analyze the relative strength of People’s United’s capital position. The efficiency ratio, which represents an approximate measure of the cost required by People’s United to generate a dollar of revenue, is the ratio of (i) total non-interest expense (excluding operating lease expense, goodwill impairment charges, amortization of other acquisition-related intangible assets, losses on real estate assets and non-recurring expenses, (the numerator) to (ii) net interest income on a fully taxable equivalent ("FTE") basis plus total non-interest income (including the FTE adjustment on bank-owned life insurance ("BOLI") income, the netting of operating lease expense and excluding gains and losses on sales of assets other than residential mortgage loans and acquired loans, and non-recurring income) (the denominator). People’s United generally considers an item of income or expense to be non-recurring if it is not similar to an item of income or expense of a type incurred within the last two years and is not similar to an item of income or expense of a type reasonably expected to be incurred within the following two years.

Non-GAAP Financial Measures and Reconciliation to GAAP Operating earnings exclude from net income available to common shareholders those items that management considers to be of such a non-recurring or infrequent nature that, by excluding such items (net of income taxes), People’s United’s results can be measured and assessed on a more consistent basis from period to period. Items excluded from operating earnings, which include, but are not limited to: (i) non-recurring gains/losses; (ii) merger-related expenses, including acquisition integration and other costs; (iii) writedowns of banking house assets and related lease termination costs; (iv) severance-related costs; and (v) charges related to executive-level management separation costs, are generally also excluded when calculating the efficiency ratio. Effective in 2016, recurring writedowns of banking house assets and certain severance-related costs are no longer considered to be non-operating expenses. Operating earnings per common share is derived by determining the per common share impact of the respective adjustments to arrive at operating earnings and adding (subtracting) such amounts to (from) earnings per common share, as reported. Operating return on average assets is calculated by dividing operating earnings (annualized) by average total assets. Operating return on average tangible common equity is calculated by dividing operating earnings (annualized) by average tangible common equity. The operating common dividend payout ratio is calculated by dividing common dividends paid by operating earnings for the respective period. The tangible common equity ratio is the ratio of (i) tangible common equity (total stockholders’ equity less preferred stock, goodwill and other acquisition-related intangible assets) (the numerator) to (ii) tangible assets (total assets less goodwill and other acquisition-related intangible assets) (the denominator). Tangible book value per common share is calculated by dividing tangible common equity by common shares (total common shares issued, less common shares classified as treasury shares and unallocated Employee Stock Ownership Plan ("ESOP") common shares). In light of diversity in presentation among financial institutions, the methodologies used by People’s United for determining the non-GAAP financial measures discussed above may differ from those used by other financial institutions.

For more information, investors may contact: Andrew S. Hersom (203) 338-4581 andrew.hersom@ peoples.com