UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 2)

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

DENNY’S CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

OAK STREET CAPITAL MASTER FUND, LTD. OAK STREET CAPITAL MANAGEMENT, LLC DAVID MAKULA PATRICK WALSH DASH ACQUISITIONS LLC JONATHAN DASH SOUNDPOST CAPITAL, LP SOUNDPOST CAPITAL OFFSHORE, LTD. SOUNDPOST ADVISORS, LLC SOUNDPOST PARTNERS, LP SOUNDPOST INVESTMENTS, LLC JAIME LESTER LYRICAL OPPORTUNITY PARTNERS II, L.P. LYRICAL OPPORTUNITY PARTNERS II, LTD. LYRICAL OPPORTUNITY PARTNERS II GP, L.P. LYRICAL CORP III, LLC LYRICAL PARTNERS, L.P. LYRICAL CORP I, LLC JEFFREY KESWIN PATRICK H. ARBOR |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 5, 2010

THE COMMITTEE TO ENHANCE DENNY’S

April [__], 2010

Dear Fellow Stockholder:

The members of The Committee to Enhance Denny’s (the “Committee” or “we”) own an aggregate of 6,245,476 shares of common stock of Denny’s Corporation (the “Company”), representing approximately 6.3% of the outstanding common stock of the Company. We do not believe the current Board of Directors of the Company has acted in your best interests as discussed in further detail in the attached Proxy Statement. We are therefore seeking your support at the annual meeting of stockholders (the “Annual Meeting”) scheduled to be held at 9:00 a.m. on Wednesday, May 19, 2010, at the Company’s Corporate Offices, 203 East Main Street, Spartanburg, South Carolina, for the following:

| 1. | To elect the Committee’s slate of three director nominees to the Board of Directors of the Company in opposition to three of the Company’s incumbent directors whose terms expire at the Annual Meeting, |

| 2. | To consider and vote on a proposal to ratify the selection of KPMG LLP as the independent registered public accounting firm of the Company and its subsidiaries for the year ending December 29, 2010; and |

| 3. | To transact such other business as may properly come before the Annual Meeting. |

Through the attached Proxy Statement, we are soliciting proxies to elect not only our three director nominees, but also the candidates who have been nominated by the Company other than Nelson J. Marchioli, Robert E. Marks and Debra Smithart-Oglesby. This gives stockholders the ability to vote for the total number of directors up for election at the Annual Meeting. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our nominees are elected.

We are not seeking control of the Board of Directors. If elected, our Nominees will represent a minority of the members of the Board of Directors and therefore it is not guaranteed that they will have the ability to enhance stockholder value. We hope that this election contest will result in Nelson J. Marchioli, Robert E. Marks and Debra Smithart-Oglesby NOT being re-elected to the Board of Directors and send a strong message to the remaining incumbent directors that stockholders are not satisfied with the Company’s operating performance and management.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to the stockholders on or about April [_], 2010.

If you have already voted for the incumbent management slate you have every right to change your vote by signing, dating and returning a later dated GOLD proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact MacKenzie Partners, Inc., which is assisting us, at their address and toll-free numbers listed below.

| Thank you for your support, |

| The Committee to Enhance Denny’s |

Jonathan Dash Co-Chairman | David Makula Co-Chairman | Patrick Walsh Co-Chairman |

| If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of the Committee’s proxy materials, please call MacKenzie Partners, Inc. at the phone numbers or email listed below.  105 Madison Avenue New York, New York 10016 (212) 929-5500 (Call Collect) enhancedennys@mackenziepartners.com or CALL TOLL FREE (800) 322-2885 |

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

The attached Proxy Statement and GOLD proxy card are available at

www.[_____].com

2

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 5, 2010

ANNUAL MEETING OF STOCKHOLDERS

OF

DENNY’S CORPORATION

_________________________

PROXY STATEMENT

OF

THE COMMITTEE TO ENHANCE DENNY’S

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

The members of The Committee to Enhance Denny’s (collectively referred to herein as the “Committee” or “we”), who are named as participants in this Proxy Statement, are stockholders of Denny’s Corporation, a Delaware corporation (the “Company”). We are writing to seek your support for the election of our three director nominees to the board of directors of the Company (the “Board”) at the annual meeting of stockholders (the “Annual Meeting”) scheduled to be held at 9:00 a.m. on Wednesday, May 19, 2010, at the Company’s Corporate Offices, 203 East Main Street, Spartanburg, South Carolina, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof. This Proxy Statement and the enclosed GOLD proxy card are first being furnished to stockholders on or about April [_], 2010.

This Proxy Statement and the enclosed GOLD proxy card are being furnished by the Committee in connection with the solicitation of proxies from the Company’s stockholders for the following:

| 1. | To elect the Committee’s director nominees, Patrick H. Arbor, Jonathan Dash and David Makula (each a “Nominee” and, collectively, the “Nominees”), to serve as directors of the Company, in opposition to the Company’s incumbent directors whose terms expire at the Annual Meeting, |

| 2. | To consider and vote on a proposal to ratify the selection of KPMG LLP as the independent registered public accounting firm of the Company and its subsidiaries for the year ending December 29, 2010; and |

| 3. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement is soliciting proxies to elect not only our three Nominees, but also the candidates who have been nominated by the Company other than Nelson J. Marchioli, Robert E. Marks and Debra Smithart-Oglesby. This gives stockholders who wish to vote for our three Nominees the ability to vote for a full slate of eight nominees in total.

The members of the Committee are Oak Street Capital Master Fund, Ltd., a Cayman Islands exempted company (“Oak Street Master”), Oak Street Capital Management, LLC, a Delaware limited liability company (“Oak Street Management”), Patrick Walsh, Dash Acquisitions LLC, a Delaware limited liability company (“Dash Acquisitions”), Soundpost Capital, LP, a Delaware limited partnership (“Soundpost Onshore”), Soundpost Capital Offshore, Ltd., a Cayman Islands exempted company (“Soundpost Offshore”), Soundpost Advisors, LLC, a Delaware limited liability company (“Soundpost Advisors”), Soundpost Partners, LP, a Delaware limited partnership (“Soundpost Partners”), Soundpost Investments, LLC, a Delaware limited liability company (“Soundpost Investments”) , Jaime Lester, Lyrical Opportunity Partners II, L.P., a Delaware limited partnership (“Lyrical Onshore”), Lyrical Opportunity Partners II, Ltd., a Cayman Islands exempted company (“Lyrical Offshore”), Lyrical Opportunity Partners II GP, L.P., a Delaware limited partnership (“Lyrical Onshore GP”), Lyrical Corp III, LLC, a Delaware limited liability company (“Lyrical III”), Lyrical Partners, L.P., a Delaware limited partnership (“Lyrical Partners”), Lyrical Corp I, LLC, a Delaware limited liability company (“Lyrical I”), Jeffrey Keswin and the Nominees. The members of the Committee are deemed participants in this proxy solicitation.

The Company has set the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting as March 23, 2010 (the “Record Date”). The mailing address of the principal executive offices of the Company is 203 East Main Street, Spartanburg, South Carolina 29319-0001. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 98,972,213 shares of common stock, par value $0.01 per share (the “Shares”), outstanding and entitled to vote at the Annual Meeting. As of the Record Date, the members of the Committee owned an aggregate of 6,245,476 Shares, which represents approximately 6.3% of the Shares outstanding. The Comm ittee intends to vote such Shares FOR the election of the Nominees and FOR the ratification of the selection of KPMG LLP, as described herein.

THIS SOLICITATION IS BEING MADE BY THE COMMITTEE AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. THE COMMITTEE IS NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH THE COMMITTEE IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

THE COMMITTEE URGES YOU TO SIGN, DATE AND RETURN THE GOLD PROXY CARD IN FAVOR OF THE ELECTION OF ITS NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE FOR EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

This Proxy Statement and GOLD proxy card are available at

www.[_____].com

2

IMPORTANT

Your vote is important, no matter how many Shares you own. We urge you to sign, date, and return the enclosed GOLD proxy card today to vote FOR the election of our Nominees.

| · | If your Shares are registered in your own name, please sign and date the enclosed GOLD proxy card and return it to the Committee, c/o MacKenzie Partners, Inc., in the enclosed envelope today. |

| · | If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with a GOLD voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your Shares on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “against” or “abstain” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to the Committee. Remember, you can vote for our three independent Nominees only on our GOLD proxy card. So please make certain that the latest dated proxy card you return is the GOLD proxy card.

| If you have any questions regarding your proxy, or need assistance in voting your Shares, please call:  105 Madison Avenue New York, New York 10016 (212) 929-5500 (Call Collect) enhancedennys@mackenziepartners.com or CALL TOLL FREE (800) 322-2885 |

3

BACKGROUND TO SOLICITATION

| · | The members of the Committee made their respective initial investments in Shares of the Company as follows: |

| § | Oak Street made its initial investment on August 27, 2009 |

| § | Patrick Walsh made his initial investment on August 27, 2009 |

| § | Soundpost made its initial investment on November 25, 2009 |

| § | Lyrical made its initial investment on December 15, 2009 |

| § | Dash Acquisitions made its initial investment on December 21, 2009, and |

| § | Patrick H. Arbor made his initial investment on January 13, 2010 |

| · | In September 2009, Patrick Walsh, a representative of Oak Street Management, had telephone conversations with Enrique Mayor-Mora, the Vice President of Planning and Investor Relations of the Company, regarding the Company’s strategy and operations. During the course of these conversations, Mr. Walsh requested a meeting with Nelson J. Marchioli, the CEO of the Company, in order to discuss the Company’s strategy, operations and other issues. Mr. Mayor-Mora advised Mr. Walsh that Mr. Marchioli was unavailable to meet with Mr. Walsh and suggested that Mr. Walsh contact ICR, the Company’s investor relations company, in order to set up a meeting with Mr. Marchioli. |

| · | In October 2009, Mr. Walsh contacted Brad Cohen of ICR in order to request a meeting with Mr. Marchioli. Mr. Cohen stated that Mr. Marchioli was not available and that Mr. Walsh should contact Mr. Mayor-Mora in order to set up a meeting with Mr. Marchioli. Shortly thereafter, David Makula, a representative of Oak Street Management, called Mr. Mayor-Mora in order to request a meeting with Mr. Marchioli. Mr. Mayor-Mora advised Mr. Makula that Mr. Marchioli was unavailable to meet with Mr. Makula and asked for Mr. Makula’s and Mr. Walsh’s bios. |

| · | During November 2009 and December 2009, Mr. Makula had telephone conversations with representatives of Soundpost Partners and Lyrical Partners to discuss Oak Street Management’s views on the Company. Mr. Makula has known Jaime Lester of Soundpost Partners since September 2005 and Jeffrey Keswin of Lyrical Partners since May 2005. |

| · | On December 2, 2009, Mr. Makula and Mr. Walsh held an initial in-person meeting with Jonathan Dash. The purpose of the meeting was to discuss with Mr. Dash his prior investments in certain restaurant companies and to discuss the restaurant industry in general, including the Company. Representatives of Oak Street Management had followed Mr. Dash’s work in the restaurant industry since 2005. Mr. Walsh had met Mr. Dash for the first time at the 2009 annual meeting of stockholders of The Steak n Shake Company. |

4

| · | On December 15, 2009, Mr. Walsh held an initial in-person meeting with Patrick H. Arbor, a business acquaintance of Mr. Walsh. The purpose of the meeting was to discuss with Mr. Arbor several investment ideas, including an investment in the Company. |

| · | On January 14, 2010, representatives of Oak Street Management held an in-person meeting with Mr. Dash. The purpose of the meeting was to further discuss the restaurant industry in general and the long-term prospects of the restaurant industry, including the Company. |

| · | On January 21, 2010, the Committee members (other than Dash Acquisitions, Jonathan Dash and Patrick H. Arbor) who at the time were members of a Section 13(d) group filed a Schedule 13D with the Securities and Exchange Commission disclosing their collective ownership of in excess of 5% of the outstanding Shares of the Company. |

| · | On February 9, 2010, Mr. Walsh held an in-person meeting with Mr. Arbor to discuss the possibility of Mr. Arbor serving as a candidate on a slate of director nominees to be potentially proposed by Oak Street Management. |

| · | On February 10, 2010, representatives of Oak Street Management held an in-person meeting with Mr. Dash. The purpose of the meeting was to further discuss the restaurant industry in general and the long-term prospects of the restaurant industry, including the Company. |

| · | Between February 11, 2010 and February 17, 2010, representatives of Oak Street Management had telephone discussions with Mr. Dash regarding the possibility of Mr. Dash serving as a candidate on a slate of director nominees to be potentially proposed by Oak Street Management. Oak Street Management believed it was important to include in its slate of nominees a candidate with restaurant industry experience. Throughout the period during which Oak Street Management held discussions with Mr. Dash, Oak Street Management also held discussions with other potential candidates with restaurant industry experience and who would be willing to serve on Oak Street Management’s potential slate of nominees. |

| · | Between February 18, 2010 and March 1, 2010, the Committee members negotiated the Joint Filing and Solicitation Agreement (discussed in further detail below) that would govern the activities, rights and obligations of the parties and all material open issues were not resolved until March 1, 2010. During this time period and prior thereto, Oak Street Management interviewed other potential nominees with restaurant industry experience. |

5

| · | On March 1, 2010, the Joint Filing and Solicitation Agreement was signed and Oak Street Master delivered a letter to the Company nominating Patrick H. Arbor, Jonathan Dash and David Makula. |

| · | On March 5, 2010, Oak Street Master delivered a letter to the Company requesting a stockholder list and other corporate records of the Company under Section 220 of the Delaware General Corporation Law. To date, the Company has furnished the materials requested in the letter. |

| · | On March 31, 2010, Mr. Makula and Mr. Dash called Robert E. Marks, a director of the Company. Mr. Marks did not directly return their call. Instead, members of the investor relations department and the Chief Financial Officer of the Company returned the call and advised Mr. Dash that it was not the policy of the Company for directors to directly respond to calls from stockholders that were not directed through the investor relations department. |

* * * *

6

REASONS FOR OUR SOLICITATION

We believe the Company has failed to create value for its stockholders.

The Committee was formed on March 1, 2010 and as a result we became one of the largest stockholders of the Company, owning an aggregate of 6,245,476 Shares, representing approximately 6.3% of the outstanding Shares. We have one major goal: to maximize the value of the Shares for all stockholders. We believe the Board has failed to maximize stockholder value as a result of poor management, failed growth strategy, high operating expenses and deficient accountability. Specifically, our concerns include, but are not limited to, the following:

| · | Ceding the #1 market position to International House of Pancakes (“IHOP”) |

| · | Failure to grow system-wide restaurants |

| · | Unacceptable declines in key operating trends such as guest traffic |

| · | Inappropriately high general and administrative expenses |

| · | Imprudent capital allocation decisions |

| · | Lack of accountability for management at the Board level, and |

| · | Extremely poor Share price performance |

Denny’s is a terrific iconic American brand and we believe stockholder value can be restored with the help of our highly qualified Nominees, whose qualifications, experience and skills are discussed in further detail below. If elected at the Annual Meeting, the Nominees would seek to work with the other Board members to address the concerns outlined above and discussed in further detail below.

POOR SHARE PRICE PERFORMANCE

We believe the Company’s Share price performance since it emerged from bankruptcy in 1998 demonstrates the Company’s inability to create value for its stockholders.

On January 8, 1998, the day after the Company emerged from bankruptcy, its new shares of Common Stock closed at $9.50 per Share. On December 31, 2009, the Company’s Share price closed at $2.19, resulting in a -76.9% cumulative total stockholder return during this period.

7

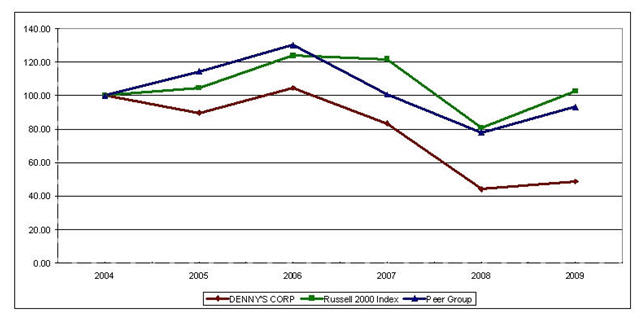

The following graph compares the cumulative total stockholders’ return on the Shares for the five fiscal years ended December 30, 2009 (December 29, 2004 to December 30, 2009) against the cumulative total return of the Russell 2000® Index and a peer group1 selected by the Company.2

As illustrated in this graph, during the prior five fiscal years, an investment in the Company would have lost 51.3% of its value compared to a gain of 2.5% had the same investment been made in the Russell 2000® Index and a loss of just 6.8% had the investment been made in the peer group. While the market volatility associated with last year’s global economic decline may have affected the share prices of a wide range of companies across various industries, including casual family dining, we believe the Company’s historically poor Share price performance demonstrates the Board’s and management’s inability to maximize stockholder value.

| 1 | The peer group consists of 20 public companies that operate in the restaurant industry. The peer group includes the following companies: Burger King Holdings, Inc. (BKC), Bob Evans Farms, Inc. (BOBE), Buffalo Wild Wings, Inc. (BWLD), Cracker Barrel Old Country Store, Inc. (CBRL), O’Charleys Inc. (CHUX), CKE Restaurants, Inc. (CKR), California Pizza Kitchen, Inc. (CPKI), Domino’s Pizza, Inc. (DPZ), Darden Restaurants, Inc. (DRI), Brinker International, Inc. (EAT), DineEquity, Inc. (DIN), Jack In The Box Inc. (JACK), Panera Bread Company (PNRA), Papa John’s International, Inc. (PZZA), Red Robin Gourmet Burgers, Inc. (RRGB), Ruby Tuesday, Inc. (RT), Steak 'n Shake Company (SNS), Sonic Corp. (SONC), Texas Roadhouse, Inc. (TXRH) and Wendy’s/Arby’s Group, Inc. (WEN). |

| 2 | The graph assumes that $100 was invested on December 29, 2004 (the last day of fiscal year 2004) in each of the Shares, the Russell 2000® Index and the peer group and that all dividends were reinvested. The graph is reprinted from the Company’s Form 10-K for the year ended December 30, 2009. |

8

STRATEGIC SHORTFALLS

We believe the Company’s failure to grow the restaurant count has placed it at a competitive disadvantage and has negatively impacted profitability.

We believe the perennial decline in the number of Company restaurants has significantly undermined the Company’s ability to stay competitive in the industry and has negatively impacted profitability. According to the Company’s public filings, the Company’s system-wide units peaked ten years ago, at 1,822 restaurants, shortly before Nelson J. Marchioli was appointed CEO in 2001. Over the past decade, the Board oversaw a 15% decline in total system-wide restaurants to 1,551 units as of December 30, 2009, based on the Company’s public filings. This stands in stark contrast to the Company’s closest competitor, IHOP, which during the same timeframe increased system-wide restaurants from 922 units to 1, 456 units as of December 31, 2009, based on the public filings of DineEquity, Inc., the parent company of IHOP (“DineEquity”). We believe the foregone franchise fees that has resulted from the decline of system-wide units has impaired the Company’s competitive position and its profitability.

We believe declines in guest traffic and the Company’s response by raising prices has been detrimental to the business.

We believe the Company needs to improve critical operating trends such as guest traffic – a key barometer of a restaurant’s health. According to data provided during the Company’s conference calls and the Company’s public filings, the Company served approximately 900,000 guests per day in 2005, versus only some 725,000 per day currently, representing a 19% decline. We are deeply concerned that if these guest traffic declines are allowed to persist, the effect on stockholders will be dire.

We are also concerned that management has failed to apply an effective marketing and pricing strategy focused on delivering value to customers. While the Company’s customer attendance has declined, management has responded by consistently raising prices. We believe management’s pricing strategy has been unsuccessful, particularly during the recent economic downturn when price hikes failed to resonate with an ailing consumer and guest count losses accelerated. We view the consistent price increases as an unsustainable strategy. We believe management needs to align the price of the Company’s food with its perceived value.

The Company has recently ceded its historic leadership position in casual family dining to IHOP.

After ten years of pursuing a failed growth strategy, the Company recently ceded its historic leadership in casual family dining to IHOP. Since 2000, IHOP has more than doubled system-wide sales from approximately $1.2 billion to approximately $2.5 billion estimated by us for 2009, based on DineEquity’s public filings. During this same timeframe, the Company’s system-wide sales have been approximately flat. As a result, IHOP’s system-wide sales have now surpassed the Company’s system-wide sales. We believe the Company must strive to recapture its leadership position in the industry in order to remain competitive and maximize stockholder value.

9

OPERATIONAL CONCERNS

We believe the Company has not made proper capital allocation decisions.

One of the main responsibilities of a board of directors of any public company is to properly allocate capital. We believe the Company’s historical capital allocation strategy and balance sheet management have been inadequate. According to the Company’s public filings, the Company invested approximately $150 million in capital expenditures since 2005, principally for store remodeling, repair and maintenance. We believe stockholder value was eroded when management coupled a low return, expensive remodeling program with an ineffective marketing strategy. Clearly, given the declining guest traffic during the same period the Company spent significant capital to make the restaurants more inviting to customers and the poor Share price performance, these capital expenditures failed to produce the desired results. We believe prudent capital allocation decisions must be made on a go forward basis in order for the Company to reclaim its position as a leader in casual family dining.

The Company’s general and administrative expenses have increased despite the decline in the number of system-wide units, including company-owned units.

We also believe that the Board has not done an adequate job controlling expenses. According to the Company’s public filings, management has refranchised or closed approximately 333 locations since 2002. Based on our research of the industry, and conservatively assuming all locations were refranchised, we would expect general and administrative expenses to decline by approximately $20.0 million, or $60,000 per unit. Surprisingly, according to the Company’s public filings, the Company’s general and administrative expenses have actually increased by approximately $7.3 million since 2002. We believe this is attributable to a culture of wasteful spending at the corporate headquarters.

We believe stockholder value will continue to deteriorate unless general and administrative expenses are significantly reduced.

We do not believe the Company has been responsive to the concerns of its franchisees.

During the past few months, representatives of Oak Street Management — David Makula and Patrick Walsh — met with five franchisees (who currently own approximately 125 restaurants), one franchisee operator and members of the Denny’s Franchisee Association. These individuals have indicated that the Board has not been responsive to concerns expressed to it by the Denny’s Franchisee Association and the franchisees. Specifically, certain of these franchisees indicated to Messrs. Makula and Walsh that CEO Nelson J. Marchioli impeded their ability to open new restaurants while IHOP continued to grow and has now surpassed the Company in system-wide sales. Certain of these f ranchisees also indicated that Mr. Marchioli has not implemented an effective and consistent marketing strategy. None of the members of the Denny’s Franchisee Association or the franchisees with whom we have met have indicated to us that the Board has been responsive to the foregoing concerns of the franchisees. We believe the Board must improve its relations with its franchisee base in order to remain competitive and to improve the business.

10

LACK OF ACCOUNTABILITY

We do not believe the members of the Board have a significant ownership interest in the Company and therefore lack a meaningful economic interest in holding management accountable.

We are concerned that the lack of significant actual ownership of the Shares by the members of the Board may contribute to the Board’s lack of commitment to maximizing stockholder value.

The following table, which is based on disclosure in the Company’s proxy statement in connection with the Annual Meeting, sets forth the beneficial ownership of Shares by the directors of the Company up for election at the Annual Meeting.

| Director | Total | Shares Underlying Derivative Securities1 | Shares Held Outright | |||

| Brenda J. Lauderback | 101,738 | 101,738 | 0 | |||

| Nelson J. Marchioli | 4,838,124 | 1,610,501 | 3,227,623 | |||

| Robert E. Marks | 224,064 | 135,311 | 88,753 | |||

| Louis P. Neeb | 43,929 | 43,929 | 0 | |||

| Donald C. Robinson | 24,110 | 24,110 | 0 | |||

| Donald R. Shepherd | 217,150 | 172,297 | 44,853 | |||

| Debra Smithart-Oglesby | 165,813 | 136,913 | 28,900 | |||

| Laysha Ward | 6,819 | 6,819 | 0 | |||

| Total | 5,621,747 | 2,231,618 | 3,390,129 | |||

| Ownership Percentage | 5.6% | 2.2% | 3.4% | |||

As illustrated in the table above:

| · | The directors’ ownership of Shares held outright (i.e., Shares owned directly by the directors as opposed to Shares issuable to the directors at a future date upon the exercise of stock options or through the conversion of deferred stock units, subject to vesting and other restrictions under the Company’s compensation plans) constitute just 3.4% of the outstanding Shares. |

| · | The independent directors (all directors other than Mr. Marchioli) own outright an aggregate of just 162,506 Shares, or 0.16% of the outstanding Shares. |

| · | Directors Lauderback, Neeb, Robinson and Ward do not even own any Shares outright. |

| 1 | Consists of Shares that such individuals have the right to acquire within 60 days through the exercise of stock options and that such individuals have the vested right to acquire within 60 days through the conversion of deferred stock units upon termination of service as a director of the Company. |

11

As the owner of an aggregate of 6,245,476 Shares, constituting approximately 6.3% of the outstanding Shares, the Committee has a significant investment in the Company. Of these Shares, 1,928,076 Shares are owned outright by Oak Street Master and accounts managed by Oak Street Management, which are controlled by Mr. Makula, 1,202,300 Shares are owned outright by accounts managed by Dash Acquisitions, which is controlled by Mr. Dash, and 65,000 Shares are owned outright by Mr. Arbor and were paid for with his own personal funds. The Committee therefore has a significant economic stake in the Company and the Nominees have a vested personal interest in maximizing stockholder value.

CEO Nelson J. Marchioli has been awarded generous compensation packages despite the Company’s strategic missteps, poor operating performance and dismal Share price performance.

We do not believe Nelson J. Marchioli has been an effective CEO of the Company. As discussed in further detail above, the Company has endured strategic missteps and poor operating performance during Mr. Marchioli’s stewardship. Despite Mr. Marchioli’s lack of effectiveness, he was awarded generous compensation packages. According to the Company’s proxy statement in connection with the Annual Meeting:

| · | During the three years ended December 30, 2009, Mr. Marchioli has received $7.9 million in total compensation, approximately 30% of which constituted salary paid in cash and the remainder of which constituted performance-based bonuses, stock awards and option awards (subject to vesting and other restrictions under the Company’s compensation plans), contributions by the Company to his deferred compensation account and other perquisites. |

| · | Had Mr. Marchioli’s employment with the Company been terminated as of December 30, 2009 by the Company without cause or by Mr. Marchioli for good reason, he would have been entitled to total severance payments and benefits valued at approximately $3.6 million. |

| · | Had Mr. Marchioli’s employment with the Company been terminated as of December 30, 2009 as a result of his death or disability, he (or his family) would have been entitled to total severance payments and benefits valued at approximately $1.8 million. |

| · | Had Mr. Marchioli’s employment with the Company been terminated as of December 30, 2009, following a change of control of the Company, by the Company without cause or by Mr. Marchioli for good reason, he would have been entitled to total severance payments and benefits valued at approximately $6.5 million. |

A public company’s compensation program should be designed to provide a correlation between the financial success of management and the stockholders. During the three years Mr. Marchioli received $7.9 million in total compensation,

| · | Cash Flow from Operations declined by over 33% |

| · | The Share price declined by approximately 53% |

12

We therefore see no correlation between the Company’s poor financial and Share price performance and Mr. Marchioli’s compensation. We believe the generous compensation packages that have been awarded to Mr. Marchioli demonstrates the Board’s failure to hold him accountable to the stockholders.

OUR PLAN TO MAXIMIZE STOCKHOLDER VALUE

If elected at the Annual Meeting, our Nominees would seek to work with the other Board members to address the concerns discussed above.

If elected, our Nominees will not have the power by themselves to cause the Board to act in any particular way. In addition, if elected, our Nominees will represent a minority of the members of the Board and therefore it is not guaranteed that they will have the ability to enhance stockholder value. However, subject to their fiduciary duties to the Company and stockholders under applicable law, our Nominees will attempt to influence their fellow directors to act in a manner that we believe is in the best interests of all stockholders. The initiatives that our Nominees would seek to implement are as follows:

| · | Create a pay-for-performance culture that clearly and measurably aligns management’s interests with those of stockholders - The Nominees would review all compensation and benefit plans and agreements of the Company and make recommendations to the Board on how these plans and agreements could be altered so that there is a correlation between the financial success of management and the stockholders. |

| · | Implement a cost structure that provides the Company with a source of competitive advantage - The Nominees would review all significant expenditures of the Company and work to reduce annual operating expenses by at least $15 million. This would be achieved by reducing SG&A costs to levels that are in line with those of the Company’s best-of-breed peers. |

| · | Reverse the declining trend in guest traffic and comparative store sales with an improved price-to-value relationship for the customer - The Nominees would work to increase guest traffic and sales by recommending that the Company align its menu prices with the food’s perceived value. The Nominees would recommend enhancements to the Company’s supply chain in an effort to improve overall food quality throughout the system. The Nominees would also explore cost-effective solutions to improve overall customer satisfaction. |

| · | Rationalize capital expenditures - The Nominees would evaluate ways to reduce capital expenditures to an average of less than $10 million per year. The Nominees believe this could be achieved by forgoing new company-owned restaurant openings in favor of franchisee-owned restaurant openings. Expensive and ineffective store remodeling programs would be discouraged and less expensive aesthetic solutions would be recommended. The Nominees plan on carefully reviewing all capital allocation decisions made by management. |

| · | Halt value-eroding sales of company-owned restaurant units at unreasonably low prices - The Nominees would recommend that the Board halt sales of company-owned restaurant units until restaurant cash flow improves. The Nominees would also seek to prevent restaurant sales at unreasonably low multiples of cash flow. |

| · | Refocus marketing efforts on a consistent value message - The Nominees would seek to implement a more effective marketing program that sends a consistent value message throughout the year and discontinue what the Committee views as marketing gimmicks that send the wrong message and attract the wrong customer base. The Nominees would endeavor to evaluate the effectiveness of all the Company’s marketing initiatives on a continual basis with a view towards protecting, enhancing and capitalizing on the Denny’s brand name. |

| · | Restore system-wide unit growth through franchisee development while improving the Company’s relationship with its franchisees - The Committee believes system-wide unit growth is essential to maximizing stockholder value. The Nominees would explore ways to achieve unit growth by enhancing the franchisee development program, improving the franchisees’ return on investment on new restaurants and improving the Company’s relationship with franchisees. |

At the present time, neither the Committee nor any of the Nominees intends to recommend to the Company that it should replace Nelson J. Marchioli as the CEO of the Company or any other senior executive officer of the Company in furtherance of the Committee’s goals identified above.

13

Our Nominees have the experience and qualifications to address the Company’s strategic, operational and financial deficiencies.

Our Nominees possess the skill sets required to address the Company’s current needs:

| · | Patrick H. Arbor is a director of Macquarie Futures USA Inc., a Futures Commission Merchant and clearing member of the Chicago Mercantile Exchange and other exchanges. Mr. Arbor is a long-time member of the Chicago Board of Trade, the world’s oldest derivatives exchange, and served as its Chairman from 1993 to 1999. During that period, Mr. Arbor also served on the Board of Directors of the National Futures Association. Prior to that, he served as Vice Chairman of the Chicago Board of Trade for three years and as a director of the Chicago Board of Trade for ten years. Mr. Arbor’s extensive experience serving on the Board of Directors of the Chicago Board of Trade and a wide-range of other public and private companies has given him a strong understanding of corporate responsibility and corporate governan ce. |

| · | Jonathan Dash is the President of Dash Acquisitions, an investment management firm. He is a director of Western Sizzlin Corporation, a restaurant chain with 102 restaurants. He served until recently as a consultant to The Steak n Shake Company, a publicly-traded restaurant chain with 485 restaurants. Mr. Dash helped to revitalize the Steak n Shake brand and reverse a long history of negative sales comparisons that culminated in double digit positive same store sales comparisons for the prior two fiscal quarters. Mr. Dash brings valuable experience in the restaurant business due to his significant roles in helping revitalize the marketing, supply chain and research and development departments of Steak n Shake. |

| · | David Makula is the Founder and Managing Member of Oak Street Management, an investment management firm. He was previously a Research Analyst with Coghill Capital Management, LLC, an investment management firm. He also served as an Investment Banker for Salomon Smith Barney, where he focused on mergers and acquisitions across a variety of sectors. Mr. Makula holds a CPA certificate from the State of Illinois. He brings significant capital markets experience and he will work to address the Company’s capital allocation and other financial issues. |

Our Nominees have no affiliation with the Board or the management team responsible for the Company’s existing strategy. We believe this lack of affiliation will allow our Nominees to address the strategic, operational and financial issues facing the Company without a bias towards preserving the current roles of management and the Board. Further, the members of the Committee are in a position to gain only if the long-term value of the Company’s Shares is maximized. Therefore, our perspective is directly aligned with other long-term stockholders of the Company.

14

ELECTION OF DIRECTORS

The Board is currently composed of eight directors whose terms expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our Nominees in opposition to three of the Company’s director nominees, Nelson J. Marchioli, Robert E. Marks and Debra Smithart-Oglesby. Your vote to elect our Nominees will have the legal effect of replacing three incumbent directors of the Company with our Nominees. If elected, our Nominees will represent a minority of the members of the Board and therefore it is not guaranteed that they will have the ability to enhance stockholder value.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. This information also includes for each of the Nominees the specific experience, qualifications, attributes and skills that led the Committee to conclude that the Nominees should serve as directors of the Company. This information has been furnished to us by the Nominees. The Nominees are citizens of the United States of America.

Patrick H. Arbor (Age 73) has served as a director of Macquarie Futures USA Inc., a Futures Commission Merchant and clearing member of the Chicago Mercantile Exchange and other exchanges, since September 2008. He has served as a director of First Chicago Bank and Trust Company, a $1.2 billion community bank, since February 2008. He has also served as a director of Western New Independent States Enterprise Fund, a public/private equity investment bank serving Belarus, Ukraine and Moldova, since 1994. Mr. Arbor is a long-time member of the Chicago Board of Trade (“CBOT”), the world’s oldest derivatives exchange, serving as the organization’s Chairman from 1993 to 1999. During that period, Mr. Arbor also served on t he Board of Directors of the National Futures Association. Prior to that, he served as Vice Chairman of the CBOT for three years and as a director of the CBOT for ten years. Mr. Arbor served as a director of Merriman Curhan Ford Group, Inc., a financial services firm, from February 2001 to May 2009. He served as Chairman of United Financial Holdings, Inc., a bank holding company, from 2000 to September 2008. Mr. Arbor was a principal of the trading firm of Shatkin-Arbor & Co. from 1992 to September 2008. He served as a director of United Community Bank, a $260 million community bank, from 2000 to September 2008. He served as a director of Rock Island Specialist Group, Chicago Stock Exchange, from 2000 to 2004. Mr. Arbor’s other exchange memberships include the Chicago Board Options Exchange, the Mid-America Commodity Exchange and the Chicago Stock Exchange. Mr. Arbor’s extensive experience serving on the B oard of Directors of a wide-range of public and private companies has given him a strong understanding of corporate responsibility and corporate governance. Mr. Arbor received a B.S. in Finance and Economics from Loyola University. The principal business address of Mr. Arbor is c/o Chicago Board of Trade, 141 West Jackson Boulevard, Suite 300, Chicago, Illinois 60604. As of the date hereof, Mr. Arbor directly owns 65,000 Shares. For information regarding purchases and sales during the past two years by Mr. Arbor of securities of the Company, see Schedule I.

15

Jonathan Dash (Age 30) has served as the President of Dash Acquisitions, an investment management firm, since April 2005. He has served since March 2006 as a director of Western Sizzlin Corporation, a restaurant chain with 102 restaurants. He served as a consultant to The Steak n Shake Company, a publicly-traded restaurant chain with 485 restaurants, from September 2008 to March 2010. Mr. Dash, working under the Chairman and CEO, helped to revitalize the Steak n Shake brand and reverse a long history of negative sales comparisons that culminated in double digit positive same store sales comparisons for the prior two fiscal quarters. Mr. Dash brings valuable experience in the restaurant business due to his significant roles in helping r evitalize the marketing, supply chain and research and development departments of Steak n Shake. Mr. Dash received a B.A. in Finance from the University of Southern California. The principal business address of Mr. Dash is 9701 Wilshire Boulevard, Suite 1110, Beverly Hills, California 90212. As of the date hereof, Mr. Dash does not directly own, and has not purchased or sold during the past two years, any securities of the Company. Mr. Dash, as an affiliate of Dash Acquisitions, may be deemed to beneficially own the 1,202,300 Shares beneficially owned by Dash Acquisitions. For information regarding purchases and sales during the past two years by Dash Acquisitions of securities of the Company that may be deemed to be beneficially owned by Mr. Dash, see Schedule I.

David Makula (Age 32) is the Founder and has served as the Managing Member of Oak Street Management, an investment management firm, since March 2005. He was previously a Research Analyst with Coghill Capital Management, LLC, an investment management firm, from August 2002 to October 2004. He also served as an Investment Banker at Salomon Smith Barney, a brokerage, investment banking and asset management firm, from July 1999 to January 2002. He brings significant capital market experience that will be instrumental in addressing the Company’s capital allocation and other financial issues. Mr. Makula received a B.S. in Accountancy from the University of Illinois at Urbana-Champaign. He also holds a CPA certificate from the State of Illinois. The principal business address of Mr. Makula is 111 S. Wacker Drive, 33rd Floor, Chicago, Illinois 60606. As of the date hereof, Mr. Makula does not directly own, and has not purchased or sold during the past two years, any securities of the Company. Mr. Makula, as an affiliate of Oak Street Management, may be deemed to beneficially own the 1,928,076 Shares beneficially owned by Oak Street Management. For information regarding purchases and sales during the past two years by Oak Street Management and its affiliates of securities of the Company that may be deemed to be beneficially owned by Mr. Makula, see Schedule I.

If elected as a director of the Company, each of the Nominees would be an “independent director” within the meaning of applicable NASDAQ listing standards applicable to board composition and Section 301 of the Sarbanes-Oxley Act of 2002.

Other than as stated herein, there are no arrangements or understandings between the Nominees and any other member of the Committee or any other person or persons pursuant to which the nomination described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. In accordance with the By-Laws of the Company, each of the Nominees has delivered a letter agreement to the Company representing that he does not have and will not have any undisclosed voting commitments or other arrangements with respect to his actions as a director of the Company and agreeing to complete a nominee questionnaire, as may be provided from time to time by the Company, that relates to his independence and other information required to be included in a proxy statement of the Company pursuant to Regulation 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise reasonably requested by the Company. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

16

The Committee does not expect that the Nominees will be unable to stand for election, but, in the event that such persons are unable to serve or for good cause will not serve, the Shares represented by the enclosed GOLD proxy card will be voted for substitute nominees, to the extent this is not prohibited under the By-Laws of the Company and applicable law. In addition, the Committee reserves the right to nominate substitute persons if the Company makes or announces any changes to its By-Laws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominees, to the extent this is not prohibited under the By-Laws and applicable law. In any such case, Shares represented by the enclosed GOLD proxy card will be voted for such substitute nominees. The Committee reserves the right to nominate additional persons, to the extent this is not prohibited under the By-Laws of the Company and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of the Committee that any attempt to increase the size of the current Board constitutes an unlawful manipulation of the Company’s corporate machinery.

YOU ARE URGED TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED GOLD PROXY CARD.

17

PROPOSAL NO. 2

COMPANY PROPOSAL TO RATIFY SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has selected KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 29, 2010. The Company is submitting the selection of KPMG LLP for ratification of and approval by the stockholders at the Annual Meeting.

WE DO NOT OBJECT TO THE RATIFICATION OF THE SELECTION OF KPMG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE YEAR ENDING DECEMBER 29, 2010.

18

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Each Share is entitled to one vote. Stockholders who sell Shares before the Record Date (or acquire them without voting rights after the Record Date) may not vote such Shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such Shares after the Record Date. Based on publicly available information, we believe that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Shares.

Shares represented by properly executed GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees to the current Board, FOR the candidates who have been nominated by the Company other than Nelson J. Marchioli, Robert E. Marks and Debra Smithart-Oglesby and FOR the ratification of the selection of KPMG LLP and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate eight candidates for election as directors at the Annual Meeting. This Proxy Statement is soliciting proxies to elect not only our three Nominees, but also the candidates who have been nominated by the Company other than Nelson J. Marchioli, Robert E. Marks and Debra Smithart-Oglesby. This gives stockholders who wish to vote for our three Nominees and such other persons the ability to do so. Under applicable proxy rules we are required either to solicit proxies only for our three Nominees, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our three Nominees and for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our three Nominees to also vote for those of the Company’s nominees for whom we are soliciting proxies. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our Nominees are elected.

QUORUM

At the Annual Meeting, a quorum, consisting of a majority of the outstanding Shares as of the Record Date, represented in person or by proxy, will be required for the transaction of business by stockholders. Abstentions will be counted for purposes of determining whether a quorum has been reached.

VOTES REQUIRED FOR APPROVAL

Election of Directors. Directors will be elected by a plurality of the votes cast at the Annual Meeting. The director nominees who receive the largest number of votes cast will be elected, up to the maximum number of directors to be elected at the Annual Meeting. A vote to “withhold authority” for any director nominee will have no impact on the election of directors.

19

Ratification of Selection of KPMG LLP. The ratification of the selection of KPMG LLP will be determined by a majority of the votes cast. Abstentions will have no effect on the outcome of the vote for the ratification of the selection of KPMG LLP.

DISCRETIONARY VOTING

Shares held in “street name” and held of record by banks, brokers or nominees may not be voted by such banks, brokers or nominees unless the beneficial owners of such Shares provide them with instructions on how to vote.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to the Committee in care of MacKenzie Partners, Inc. at the address set forth on the back cover of this Proxy Statement or to the Company at 203 East Main Street, Spartanburg, South Carolina 29319-0001 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic c opies of all revocations be mailed to the Committee in care of MacKenzie Partners, Inc. at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding Shares. Additionally, MacKenzie Partners, Inc. may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF OUR THREE NOMINEES TO THE BOARD AND FOR THE RATIFICATION OF THE SELECTION OF KPMG LLP, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

20

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by the Committee. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

The Committee has entered into an agreement with MacKenzie Partners, Inc. for solicitation and advisory services in connection with this solicitation, for which MacKenzie Partners, Inc. will receive a fee not to exceed $150,000 together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. MacKenzie Partners, Inc. will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. The Committee has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the Shares they hold of record. The Committee will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that MacKenzie Partners, Inc. will employ approximately 35 persons to solicit the Company’s stockholders for the Annual Meeting.

Each of Oak Street Management, Dash Acquisitions, Soundpost Partners and Lyrical Partners have agreed to pay a specified proportional share of all expenses incurred in connection with the solicitation of proxies pursuant to the terms of a Joint Filing and Solicitation Agreement (as discussed below). Costs of this solicitation of proxies are currently estimated to be approximately $475,000. The Committee estimates that through the date hereof, its expenses in connection with this solicitation are approximately $175,000. The Committee intends to seek reimbursement from the Company of all expenses it incurs in connection with the solicitation of proxies for the election of the Nominees to the Board at the Annual Meeting. The Committee does not intend to submit the question of such reimbursemen t to a vote of security holders of the Company.

OTHER PARTICIPANT INFORMATION

Each member of the Committee is a participant in this solicitation.

Oak Street Management is the investment manager of Oak Street Master and a managed account (the “Oak Street Account”). Mr. Makula is the sole managing member of Oak Street Management. The principal business of Oak Street Master is investing in securities. The principal business of Oak Street Management is serving as the investment manager of Oak Street Master and the Oak Street Account. The principal occupation of Mr. Makula is serving as the managing member of Oak Street Management. The principal business address of each of Oak Street Master, Oak Street Management and Mr. Makula is 111 S. Wacker Drive, 33rd Floor, Chicago, Illinois 60606.

As of the date hereof, Oak Street Master owns directly 1,826,333 Shares and 101,743 Shares are held in the Oak Street Account. By virtue of their relationship with Oak Street Master and the Oak Street Account, each of Oak Street Management and Mr. Makula may be deemed to beneficially own the Shares owned directly by Oak Street Master and the Shares held in the Oak Street Account.

21

The principal occupation of Mr. Walsh is serving as a Senior Partner of Oak Street Management. The principal business address of Mr. Walsh is 111 S. Wacker Drive, 33rd Floor, Chicago, Illinois 60606. As of the date hereof, Mr. Walsh owns directly 43,000 Shares.

Dash Acquisitions is the investment manager of managed accounts (the “Dash Accounts”). Mr. Dash serves as the President of Dash Acquisitions. The principal business of Dash Acquisitions is serving as the investment manager of the Dash Accounts. The principal occupation of Mr. Dash is serving as the President of Dash Acquisitions. The principal business address of each of Dash Acquisitions and Mr. Dash is 9701 Wilshire Boulevard, Suite 1110, Beverly Hills, California 90212.

As of the date hereof, 1,202,300 Shares are held in the Dash Accounts. By virtue of their relationships with the Dash Accounts, each of Dash Acquisitions and Mr. Dash may be deemed to beneficially own the Shares held in the Dash Accounts.

Soundpost Advisors is the general partner of Soundpost Onshore. Soundpost Partners is the investment manager of each of Soundpost Offshore and a managed account (the “Soundpost Account”). Soundpost Investments is the general partner of Soundpost Partners. Mr. Lester is the sole managing member of Soundpost Advisors and Soundpost Investments. The principal business of Soundpost Advisors is providing investment management services to private individuals and institutions and serving as the general partner of Soundpost Onshore. The principal business of Soundpost Partners is providing investment management services to private individuals and institutions and serving as the investment manager of each of Soundpost Offshore and the Soundpost Account. The principal business of each of Soundpost Onshore and Soundpost Offshore is investing in securities. The principal business of Soundpost Investments is serving as the general partner of Soundpost Partners. The principal occupation of Mr. Lester is serving as the managing member of Soundpost Advisors and Soundpost Investments. The principal business address of each of Soundpost Onshore, Soundpost Advisors, Soundpost Partners, Soundpost Investments and Mr. Lester is 405 Park Avenue, 6th Floor, New York, New York 10022. The principal business address of Soundpost Offshore is Gardenia Court, Suite 3307, 45 Market Street, Camana Bay, P.O. Box 896, Grand Cayman, Cayman Islands, KY1-1103.

As of the date hereof, Soundpost Onshore owns directly 1,420,959 Shares, Soundpost Offshore owns directly 578,873 Shares and 300,168 Shares are held in the Soundpost Account. By virtue of their relationships with Soundpost Onshore, each of Soundpost Advisors and Mr. Lester may be deemed to beneficially own the Shares owned directly by Soundpost Onshore. By virtue of their relationships with Soundpost Offshore, each of Soundpost Partners, Soundpost Investments and Mr. Lester may be deemed to beneficially own the Shares owned directly by Soundpost Offshore. By virtue of their relationships with the Soundpost Account, each of Soundpost Partners, Soundpost Investments and Mr. Lester may be deemed to beneficially own the Shares held in the Soundpost Account.

Lyrical Onshore GP is the general partner of Lyrical Onshore. Lyrical III is the general partner of Lyrical Onshore GP. Lyrical Partners is the investment manager of Lyrical Offshore. Lyrical I is the general partner of Lyrical Partners. Mr. Keswin is the sole managing member of Lyrical III and Lyrical I. The principal business of Lyrical Onshore GP is providing investment management services to private individuals and institutions and serving as the general partner of Lyrical Onshore. The principal business of Lyrical Partners is providing investment management services to private individuals and institutions and serving as the investment manager of Lyrical Offshore. The principal business of each of Lyrical Onshore and Lyrical Offshore is investing in secur ities. The principal business of Lyrical III is serving as the general partner of Lyrical Onshore GP. The principal business of Lyrical I is serving as the general partner of Lyrical Partners. The principal occupation of Mr. Keswin is serving as the managing member of Lyrical III and Lyrical I. The principal business address of each of Lyrical Onshore, Lyrical Onshore GP, Lyrical III, Lyrical Partners, Lyrical I and Mr. Keswin is 405 Park Avenue, 6th Floor, New York, New York 10022. The principal business address of Lyrical Offshore is c/o Ogier Fiduciary Services (Cayman) Limited, P.O. Box 1234 GT, Queensgate House, South Church Street, Grand Cayman, Cayman Islands, KY1-1108.

22

As of the date hereof, Lyrical Onshore owns directly 338,500 Shares and Lyrical Offshore owns directly 368,600 Shares. By virtue of their relationships with Lyrical Onshore, each of Lyrical Onshore GP, Lyrical III and Mr. Keswin may be deemed to beneficially own the Shares owned directly by Lyrical Onshore. By virtue of their relationships with Lyrical Offshore, each of Lyrical Partners, Lyrical I and Mr. Keswin may be deemed to beneficially own the Shares owned directly by Lyrical Offshore.

The principal occupation of Mr. Arbor is serving as a director of Macquarie Futures USA Inc., a Futures Commission Merchant and clearing member of the Chicago Mercantile Exchange and other exchanges. The principal business address of Mr. Arbor is c/o Chicago Board of Trade, 141 West Jackson Boulevard, Suite 300, Chicago, Illinois 60604. As of the date hereof, Mr. Arbor owns directly 65,000 Shares.

As of the date hereof, the members of the Committee collectively own an aggregate of 6,245,476 Shares, constituting approximately 6.3% of the Shares outstanding. Each member of the Committee, as a member of a “group” with the other Committee members, for purposes of Rule 13d-5(b)(1) of the Exchange Act, may be deemed to beneficially own the Shares owned by the other Committee members. Each Committee member specifically disclaims beneficial ownership of the Shares disclosed herein that he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the members of the Committee, see Schedule I.

The Shares owned collectively by the members of the Committee are held primarily in margin accounts maintained with prime brokers, which may extend margin credit as and when required to open or carry positions in the margin accounts, subject to applicable federal margin regulations, stock exchange rules and the prime brokers’ credit policies. In such instances, the positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the accounts.

On March 2, 2010, the members of the Committee entered into a Joint Filing and Solicitation Agreement pursuant to which, among other things, (i) the parties agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Company; (ii) the parties agreed to solicit proxies or written consents to elect the Nominees and to take all other action necessary or advisable to achieve the foregoing; (iii) the parties agreed on procedures for notifying Oak Street Management of transactions in securities of the Company; (iv) the parties agreed on procedures for approving filings with the SEC, press releases and stockholder communications proposed to be made or issued by the parties; (v) each of Oak Street Management, Dash Acquisitions, Soundpost Partners and Lyrical Partners agreed to pay a specified proportional share of all expenses incurred by the parties in connection with their activities that have been approved by Oak Street Management and Dash Acquisitions; and (vi) the parties agreed that they shall be referred to as “The Committee to Enhance Denny’s”.

23

Oak Street Management, Dash Acquisitions, Soundpost Partners and Lyrical Partners have entered into letter agreements pursuant to which they have agreed to indemnify the Nominees and Patrick Walsh against claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi ) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting. There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

24

OTHER MATTERS AND ADDITIONAL INFORMATION

Other Matters

Other than as discussed above, the Committee is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which the Committee is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GOLD proxy card will vote on such matters in their discretion.

Stockholder Proposals and Nominations

In order for stockholder proposals intended to be presented at the 2011 Annual Meeting of Stockholders of the Company (the “2011 Annual Meeting”) to be eligible for inclusion in the Company’s proxy statement and the form of proxy for such meeting, they must be received by the Company at its corporate address no later than December 15, 2010. Regarding stockholder proposals intended to be presented at the 2011 Annual Meeting but not included in the Company’s proxy statement, including stockholder nominations of directors, pursuant to Article II, Sections 2 and 3 of the Company’s By-Laws, written notice of such proposals, to be timely, must be received by the Company no earlier than February 19, 2011 and no later than March 20, 2011 (i.e., no more than 90 days and no less than 60 days prior to Ma y 19, 2011, the first anniversary of the preceding year’s annual meeting). In the event that the date of the 2011 Annual Meeting is advanced more than 30 days prior to such anniversary date or delayed more than 60 days after such anniversary date, then to be timely such notice must be received by the Company no later than the later of (i) 70 days prior to the date of the meeting or (ii) the 10th day following the day on which public announcement of the date of the meeting was made. All such proposals for which timely notice is not received in the manner described above will be ruled out of order at the meeting, resulting in the proposal’s underlying business not being eligible for transaction at the meeting. Such notices must contain the information specified in the Company’s By-Laws, including information concerning the proposal or nominee and information about the stockholder 217;s ownership of Shares.

The information set forth above regarding the procedures for submitting stockholder proposals and nominations for consideration at the 2011 Annual Meeting is based on information contained in the Company’s proxy statement. The incorporation of this information in this Proxy Statement should not be construed as an admission by the Committee that such procedures are legal, valid or binding.

Incorporation by Reference

The Committee has omitted from this Proxy Statement certain disclosure required by applicable law that is already included in the Company’s proxy statement relating to the Annual Meeting. This disclosure includes, among other things, current biographical information on the Company’s directors, information concerning executive compensation, and other important information. Although the Committee does not have any knowledge indicating that any statement made by it herein is untrue, the Committee does not take any responsibility for the accuracy or completeness of statements taken from public documents and records that were not prepared by or on the Committee’s behalf, or for any failure by the Company to disclose events that may affect the significance or accuracy of such inform ation. See Schedule II for information regarding persons who beneficially own more than 5% of the Shares and the ownership of the Shares by the directors and management of the Company.

25

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

| The Committee to Enhance Denny’s |

April [__], 2010 |

26

SCHEDULE I

TRANSACTIONS IN SECURITIES OF DENNY’S CORPORATION

DURING THE PAST TWO YEARS

Class of Security | Securities Purchased/(Sold) | Price Per Share ($) | Date of Purchase/Sale |

| OAK STREET CAPITAL MASTER FUND, LTD. |

| Common Stock | 32,726 | 2.5850 | 08/27/09 | |

| Common Stock | 2,000 | 2.5850 | 08/27/09 | |

| Common Stock | 47,310 | 2.6268 | 08/28/09 | |

| Common Stock | 16,700 | 2.5500 | 09/01/09 | |

| Common Stock | 23,655 | 2.6940 | 09/08/09 | |

| Common Stock | 27,534 | 2.7218 | 09/09/09 | |

| Common Stock | 23,655 | 2.7378 | 09/11/09 | |

| Common Stock | 189 | 2.7814 | 09/14/09 | |

| Common Stock | 9,273 | 2.7276 | 09/16/09 | |

| Common Stock | 4,731 | 2.5310 | 09/23/09 | |

| Common Stock | 18,924 | 2.5551 | 09/23/09 | |

| Common Stock | 4,731 | 2.5168 | 09/23/09 | |

| Common Stock | 4,731 | 2.4110 | 09/24/09 | |

| Common Stock | 4,731 | 2.2870 | 09/24/09 | |

| Common Stock | 4,731 | 2.3410 | 09/24/09 | |

| Common Stock | 28,386 | 2.3092 | 10/30/09 | |

| Common Stock | 494,890 | 2.1811 | 11/03/09 | |

| Common Stock | 94,500 | 2.2577 | 11/04/09 | |

| Common Stock | 5,954 | 2.2500 | 11/06/09 | |

| Common Stock | 40,730 | 2.2683 | 11/10/09 | |

| Common Stock | 155,642 | 2.2833 | 11/11/09 | |

| Common Stock | 47,500 | 2.2814 | 11/12/09 | |

| Common Stock | 23,625 | 2.2380 | 11/13/09 | |

| Common Stock | 94,500 | 2.3393 | 11/18/09 | |

| Common Stock | 118,750 | 2.2358 | 11/20/09 | |

| Common Stock | 47,500 | 2.2286 | 11/23/09 | |

| Common Stock | 21,375 | 2.4300 | 12/15/09 | |

| Common Stock | 11,685 | 2.4155 | 12/16/09 | |

| Common Stock | 9,310 | 2.4402 | 12/17/09 | |

| Common Stock | 95,000 | 2.2875 | 12/23/09 | |

| Common Stock | 47,500 | 2.2800 | 12/24/09 | |

| Common Stock | 95,000 | 2.2153 | 12/28/09 | |

| Common Stock | 47,500 | 2.1899 | 12/29/09 | |

| Common Stock | 23,750 | 2.1600 | 12/31/09 | |

| Common Stock | 380 | 2.4138 | 02/16/10 | |

| Common Stock | 13,015 | 2.5950 | 02/19/10 | |

| Common Stock | 19,208 | 2.6939 | 02/24/10 | |

| Common Stock | 17,512 | 2.7264 | 02/25/10 | |

| Common Stock | 47,500 | 2.7502 | 02/26/10 |

I-1