UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

DENNY’S CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

OAK STREET CAPITAL MASTER FUND, LTD. OAK STREET CAPITAL MANAGEMENT, LLC DAVID MAKULA PATRICK WALSH DASH ACQUISITIONS LLC JONATHAN DASH SOUNDPOST CAPITAL, LP SOUNDPOST CAPITAL OFFSHORE, LTD. SOUNDPOST ADVISORS, LLC SOUNDPOST PARTNERS, LP SOUNDPOST INVESTMENTS, LLC JAIME LESTER LYRICAL OPPORTUNITY PARTNERS II, L.P. LYRICAL OPPORTUNITY PARTNERS II, LTD. LYRICAL OPPORTUNITY PARTNERS II GP, L.P. LYRICAL CORP III, LLC LYRICAL PARTNERS, L.P. LYRICAL CORP I, LLC JEFFREY KESWIN MURANO PARTNERS LP MURANO CAPITAL LLC MURANO HOLDINGS, LLC MURANO GROUP LLC JAY THOMSON TONY C. LAI PATRICK H. ARBOR |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

2

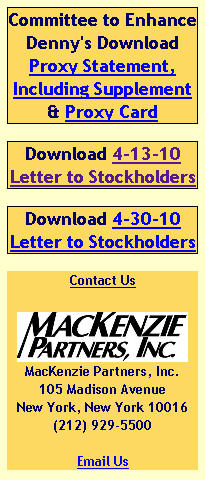

The Committee to Enhance Denny’s (the “Committee”), together with the other Participants named herein, is filing materials contained in this Schedule 14A with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the election of its slate of director nominees at the 2010 annual meeting of stockholders (the “Annual Meeting”) of Denny’s Corporation. The Committee has made a definitive filing with the SEC of a proxy statement and accompanying GOLD proxy card to be used to solicit votes for the election of its slate of director nominees at the Annual Meeting.

Item 1: On May 4, 2010, the Committee issued the following press release. The press release has also been posted to www.enhancedennys.com:

The Committee to Enhance Denny's Dispels Allegations of Intent to Convert Denny's Into a Holding Company

Companies: Denny's Corp.

Press Release Source: The Committee to Enhance Denny’s On Tuesday May 4, 2010, 12:29 pm

CHICAGO, May 4 /PRNewswire/ -- The Committee to Enhance Denny's, headed by Oak Street Capital Management, LLC and Dash Acquisitions LLC, today responded to statements made by Denny's Corporation (Nasdaq:DENN - News) suggesting that the Committee has an undisclosed intent to convert Denny's into a holding company. The Committee believes that this is a "red herring" being peddled by the Denny's board and management in order to distract shareholders from the serious operational and management issues facing Denny's. Converting Denny's into a holding co mpany is not even an option given the fact that the company has produced negative annual free cash flows during the past 9 years and currently has over $250 million in high cost debt that would take years to pay down.

The Committee believes that the only way to maximize Denny's shareholder value is by changing the composition of the existing board and then addressing the serious operational and management issues facing the company. Shareholders should ignore scare tactics being deployed by the board in an attempt to win votes at the annual meeting.

Jonathan Dash, Co-Chairman of the Committee, stated, "The members of the Committee invested in Denny's because we believe it is a terrific albeit mismanaged brand. The board must focus all its energy on fixing the company in order to maximize shareholder value."

David Makula, Co-Chairman of the Committee, stated, "Our three highly-qualified nominees are committed to working with the other directors to enhance and capitalize on the Denny's brand and to return Denny's to its rightful place as a leader in the family dining space. We urge you to ignore Denny's effort to distract shareholders from the real issues facing the company today. Vote for the election of our nominees by signing and returning the GOLD proxy today."

Item 2: Changes were made to the following web page of www.enhancedennys.com:

Press Releases o Record Date Press Release Dated March 9, 2010 [PDF] o Preliminary Proxy Press Release Dated March 16, 2010 [PDF] o Shareholder Letter Press Release Dated April 13, 2010 [PDF] o Press Release Dated April 14, 2010 [PDF] o Press Release Dated April 20, 2010 [PDF] o Press Release Dated April 30, 2010 [PDF] o Press Release Dated May 4, 2010 [PDF] |  | ||

| |||