KBW

Annual Insurance Conference

September 5, 2007

Safe Harbor Disclosure

This slide presentation is for informational purposes only. It should be read in conjunction with our Form 10-K for the year 2006, our Form

10-Q for the second quarter 2007 and our Form 8-Ks filed with the Securities and Exchange Commission (SEC) and available in the

“Investor Relations” section of our website at www.employers.com.

Non-GAAP Financial Measures

In presenting Employers Holdings, Inc.’s (EMPLOYERSSM) results, management has included and discussed certain non-GAAP financial

measures, as defined in Regulation G. Management believes these non-GAAP measures better explain EMPLOYERS results allowing for a

more complete understanding of underlying trends in our business. These measures should not be viewed as a substitute for those

determined in accordance with GAAP. The reconciliation of these measures to their most comparable GAAP financial measures is included

in this presentation or in our Form 10-K for the year 2006, our Form 10-Q for the second quarter 2007 and our Form 8-Ks filed with the

Securities and Exchange Commission (SEC) and available in the “Investor Relations” section of our website at www.employers.com.

Forward-looking Statements

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding anticipated future results and can be identified by the fact that they do not relate

strictly to historical or current facts. They often include words like "believe”, "expect”, "anticipate”, "estimate" and "intend" or future or

conditional verbs such as "will”, "would”, "should”, "could" or "may”. Certain factors that could cause actual results to differ materially from

expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions, and

legislative and regulatory changes that could adversely affect the business of EMPLOYERS and its subsidiaries. All subsequent written and

oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by these

cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

EMPLOYERS is a service mark and trade name for a group of companies which provides workers’ compensation insurance and services. Insurance is

offered through Employers Compensation Insurance Company, except in Nevada, where insurance is offered through Employers Insurance Company of

Nevada. Employers Compensation Insurance Company does not do business in all jurisdictions. For more information please visit www.employers.com.

Copyright © 2007 EMPLOYERS. All rights reserved.

Contents Page

18

California Rates and Rate Setting

13

Customer Selection

19

Insurance Operations Summary

17

Workers’ Compensation Industry

16

Policy Count

15

Strategic Distribution Partners

14

Focused Marketing and Distribution

12

Focus on Low to Medium Hazard Groups

11

Disciplined Underwriting – Five Basic Elements

Insurance Operations

9

Seasoned Executives with Extensive Experience

8

Expanding Geographic Footprint

7

Strategies

6

Financial Snapshot

5

Key Strengths

4

Overview

Corporate Overview

31-32

Summary

28

29

Mortgage-backed Securities

Capital Management

23

Selected Operating Results

SUMMARY

27

Investment Portfolio

26

Reinsurance Program

25

Underwriting Profitability

24

Earnings and EPS

22

Loss Portfolio Transfer

21

Four Key Elements of our Financial Strength

Financial Results

Overview

Business

Specialty provider of workers’ compensation insurance

18th largest private writer in the U.S. (1)

8th largest private writer in California (1)

2nd largest writer in Nevada (1)

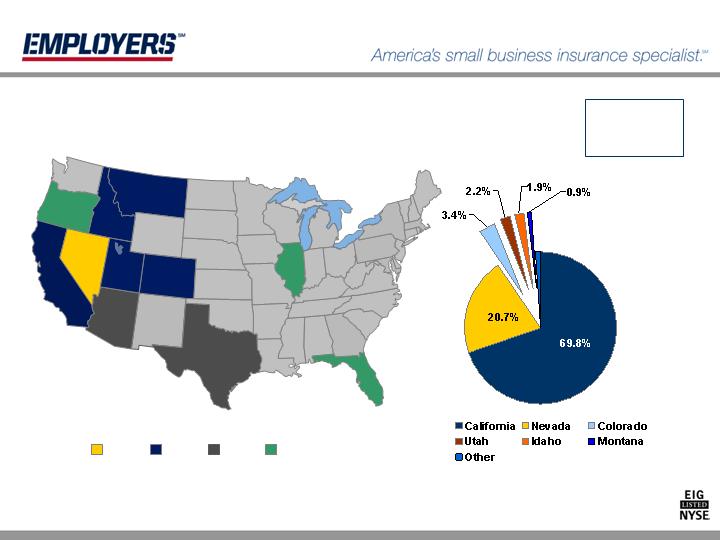

Geographic

Focused in Western U.S. – direct premiums written as of the second quarter of 2007

70% in California

21% in Nevada

9% in nine other states

Customers

Small businesses in low to medium hazard industries

Distribution through independent agents and strategic partners

31,902 policies in force at 6/30/2007

Average annual policy premium of approximately $11,000

(1) Based on “One-Year Premium and Loss Study,” U.S., California and Nevada, A.M. Best Company, 2006

4

Key Strengths

Established enterprise with 94 year operating history

Focused operations and disciplined underwriting – target an attractive

and underserved market segment with growth opportunities

Unique and long-standing strategic distribution relationships

Financial strength and flexibility - strong balance sheet and conservative

reserving

Experienced management team with deep knowledge of workers’

compensation

5

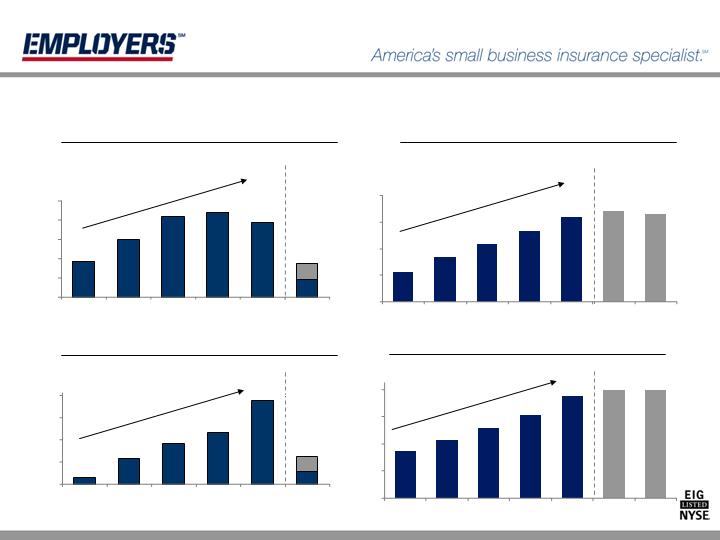

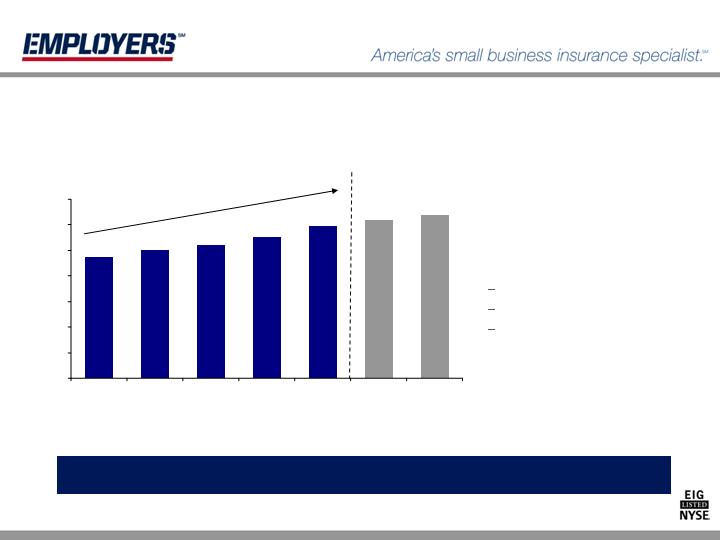

’02 – ’06 CAGR = 20%

6

Capital management plans include dividends and share

repurchases

Loss trends and investments are driving net income

Strong growth provides a solid basis for underwriting

Premium growth has reversed due to California rate

decreases

($ million)

Statutory Surplus

Equity Incl. Deferred Gain - LPT

Net Premium Written

Financial Snapshot

93

387

440

418

298

187

82

0

100

200

300

400

500

2002

2003

2004

2005

2006

1st & 2nd

Qtr 2007

655

682

339

431

531

640

224

0

200

400

600

800

2002

2003

2004

2005

2006

3/31/07

6/30/07

’02 – ’06 CAGR = 30%

94

152

73

46

11

23

26

0

40

80

120

160

2002

2003

2004

2005

2006

1st & 2nd

Qtr 2007

’02 – ’06 CAGR = 93%

Net Income Before Loss Portfolio Transfer (LPT)

351

747

607

516

424

790

795

0

200

400

600

800

2002

2003

2004

2005

2006

3/31/07

6/30/07

’02 – ’06 CAGR = 21%

Strategies

Focus on

Profitability

Target attractive, underserved small business market

Maintain disciplined risk selection, underwriting and

pricing

Pursue

Organic

Growth

Opportunities

Expand in current markets and in our new states

Leverage infrastructure, technology and systems

Utilize existing and new strategic distribution partners

Optimize

Capital

Structure

Invest in operations and manage capital prudently

Return capital to shareholders

Consider opportunistic strategic transactions

7

Expanding GeographicFootprint

2000

2002

2006

2007

FL

NM

MD

TX

OK

KS

NE

SD

ND

MT

WY

CO

UT

ID

AZ

NV

WA

CA

OR

KY

ME

NY

PA

MI

NH

MA

CT

VA

WV

OH

IN

IL

NC

TN

SC

AL

AR

LA

MO

IA

MN

WI

GA

MS

VT

NJ

DE

RI

8

NEW STATES

Florida, Oregon,

Texas, Arizona

and Illinois = 1.1%

Direct Premiums Written (%) for six months ended 6/30/07

Seasoned Executives with Extensive Experience

31

EVP, Chief Financial Officer

William E. Yocke

28

SVP, Chief Underwriting Officer

Jeff J. Gans

25

SVP, Chief Claims Officer

Stephen V. Festa

19

SVP, President of Western Region

George Tway

22

SVP, President of Strategic Markets Region

David M. Quezada

16

SVP, President of Pacific Region

T. Hale Johnston

29

President and Chief Operating Officer

Martin J. Welch

22

Chief Executive Officer

Douglas D. Dirks

Experience

(Years)

Title

Name

Average experience of senior operating leadership = 24 years

9

Disciplined Underwriting

37.9% statutory loss and LAE ratio in 2006

Risk Selection

Expertise

Strong

Underwriting

Culture

Focused

Guidelines and

Consistent

Automated

Approach

Disciplined

Underwriting

Local Knowledge

Pricing of

Individual Risks

Five Basic Elements

11

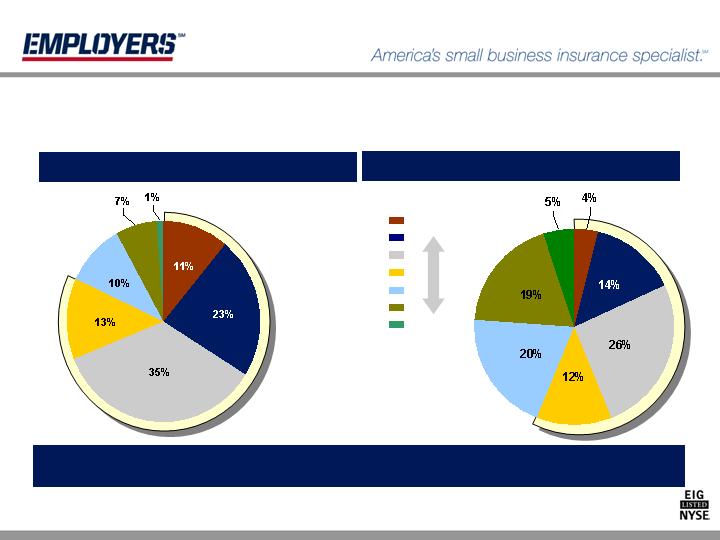

Focus on Low to Medium Hazard Groups

EMPLOYERS

Focus on low to medium hazard risks allows us to optimize risk selection and pricing adequacy

Hazard Group A

Industry (1)

% of Premiums Written, 12/31/06

12

Hazard Group B

Hazard Group C

Hazard Group D

Hazard Group E

Hazard Group F

Hazard Group G

Hazard Groups A through D

Lower

Risk

Higher

Risk

(1) NCCI 2006 Premium Distribution by Hazard Group (as presented at 2007 Annual Issues Symposium).

Industry = 56%

EMPLOYERS = 82%

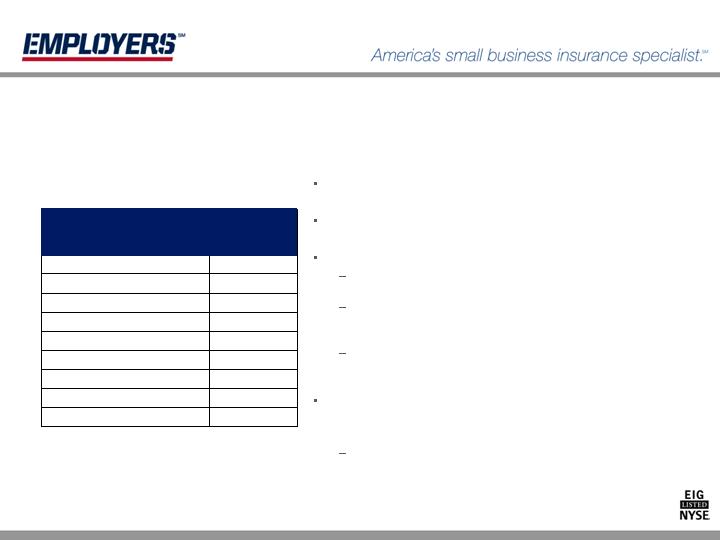

Customer Selection

35.1%

$136,883

Top 10

1.7

6,458

Automobile

D

2.0

7,939

Dentists & Dental Surgeons & Clerical

C

2.3

9,040

Clothing Manufacturers

C

2.4

9,455

Machine Shops

D

2.5

9,846

Clerical Office Employees

C

2.9

11,189

Store: Retail

B

3.0

11,590

College: Professional Employees & Clerical

B

4.8

18,854

Store: Wholesale

B

6.4

24,858

Physicians & Clerical

C

7.1%

$ 27,654

Restaurants

A

Percent of

Total

Direct Premiums

Written (000s)

Class

Hazard

Group

EMPLOYERS further differentiates risks within industry-defined customer classes

Top Ten Classes in 2006

13

Focused Marketing and Distribution

Independent Agents and Brokers

PACIFIC REGION

California

In 2006, 44% of direct

premiums written

STRATEGIC REGION

Largely ADP & Wellpoint;

added E-CHX in Qtr 4, 2006

Primarily California today

In 2006, 30% of direct premiums

written

Three business units target customer segments with a focused underwriting approach

WESTERN REGION

Nevada, Colorado, Utah,

Montana, Idaho, Texas,

Arizona, Illinois, Oregon,

Florida

In 2006, 26% of direct

premiums written

Strategic Distribution Partners

14

Strategic Distribution Partners

Largest payroll services company in the

U.S. with over 450,000 clients

Partner since entering California market

in 2002

Business originated by ADP’s field sales

staff and insurance agency

“Pay-by-Pay” premium collection

Strategic partners expand market reach and produce business with high persistency

15

Largest group health carrier in California

Partner since entering California market

in 2002

Business originated by Wellpoint’s health

insurance agents

Single bill to customers

16

Solid in force policy count growth

continued in the second quarter,

2007

31,902 at 6/30/07

28,294 at 6/30/06

Total increase of 3,608 or

12.8%

In Force Policy Count

Total in force policy count has grown consistently with a 2002 – 2006 CAGR of 6%

23,657

24,967

26,005

27,686

29,742

30,922

31,902

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

2002

2003

2004

2005

2006

3/31/07

6/30/07

’02 – ’06 CAGR = 6%

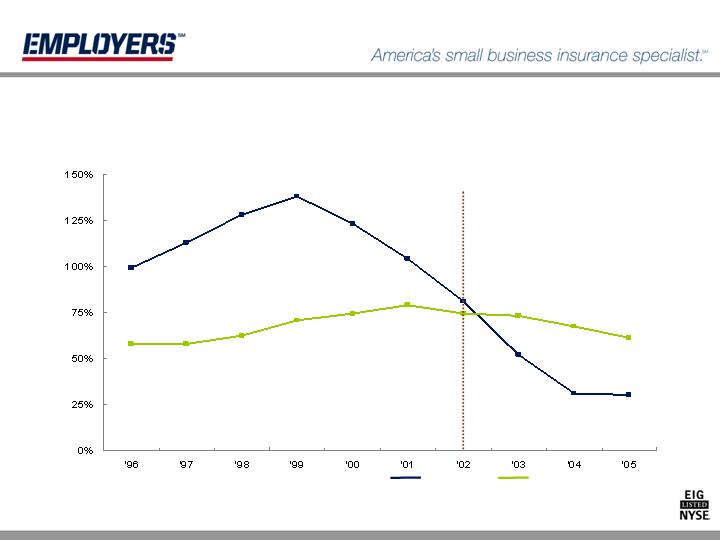

Workers’ Compensation Industry

Historical Pure Loss Ratio

California

Total U.S.

Source: WCIRB as of 09/30/06 (California); Insurance Information Institute as of 12/31/05 (Total U.S.)

2002: EMPLOYERS

entry into California

17

18

California Rates and Rate Setting

- 14.2%

July 1, 2007

- 9.5%

January 1, 2007

-65.1%

Cumulative Change

-16.4%

July 1, 2006

-15.3%

January 1, 2006

-18.0%

July 1, 2005

- 2.2%

January 1, 2005

- 7.0%

July 1, 2004

-14.9%

January 1, 2004

Workers’ Compensation Insurance Rating Bureau

(WCIRB) recommended decrease of 11.3%

Insurance Commissioner ordered decrease of 14.2% in

advisory rates

Company’s choice to implement rate changes

Internal analyses are compared to Bureau’s view of the

industry to confirm actual experience

Filed loss cost multipliers (LCMs) account for loss

adjustment, underwriting and commission expenses and

targeted unlevered return of 12% to 13%

Rate deviation plans modify full premium rates based on

individual or group risk characteristics to yield “effective

rates”

EMPLOYERS filed a 4.5% decrease premium for

California policies incepting on or after September 15,

2007

Rate filing accepted August, 2007

Recent Commissioner Ordered

Advisory Pure Premium Changes

High performing insurance operation, built upon four key

elements

A highly focused customer base

A disciplined underwriting culture

An efficient -- and scalable – infrastructure

Strong producer and strategic partner relationships, providing us

with:

broader access to markets

enhanced value delivery to our customers

more cost effective production

Insurance Operations Summary

19

Four Key Elements of Our Financial Strength

Surplus of

$640MM

at 12/31/2006

Conservative

Reserving

High Quality

Investment

Portfolio

Catastrophe

Reinsurance

Program

0.6:1 NPW / Surplus

at 12/31/2006

Over 90% fixed maturity

with average rating AA

Coverage up to

$200MM loss

Track record of

reserve strength

21

Loss Portfolio Transfer (LPT)

$ millions

$602.5

Gain at 6/30/2007

(147.5)

Subsequent Reserve Adjustments

750

Gain at 1/1/2000

$ 775

Consideration

$1,525

Original Reserves Transferred

$2,000

Total Coverage

Contract

$ millions

$433.9

GAAP: Deferred Reinsurance

Gain – LPT Agreement

(168.6)

Cumulative Amortization To Date

$602.5

Statutory Surplus Created

Accounting at 6/30/07

Non-recurring transaction with no ongoing cash benefits or charges to current operations

Retroactive 100% quota share reinsurance coverage for all losses occurring prior to 7/1/95

Gain on transaction booked as statutory surplus; deferred and amortized under GAAP

22

Selected Operating Results

795.5

361.6

2,294.3

3,221.2

149.3

1,695.2

26.2

30.8

19.3

84.1

81.5

$84.6

746.8

303.8

2,307.8

3,195.7

80.0

1,715.7

152.2

171.6

68.2

393.0

387.2

$ 401.8

790.4

352.0

2,307.2

3,221.2

66.5

1,768.6

23.3

27.9

20.8

89.8

93.2

$ 96.5

144.6

Shareholders’ equity

Balance Sheet Data

1,595.8

Total investments

61.1

Cash and cash equivalents

3,094.2

Total assets

2,350.0

Reserves for loss & LAE

607.0

Equity including LPT deferred gain

58.7

137.6

Net Income

49.5

93.8

Net Income Before LPT

40.1

54.4

Net Investment Income

173.9

438.3

Net Earned Premium

174.7

439.7

Net Written Premium

$181.0

$ 458.7

Gross Written Premium

Income Statement Data

$ million

December 31

2005 2006

23

Q1

2007

Q2

2007

YTD

2007

Premiums are

declining due to

California rate

decreases

Loss trends and

Investments are

driving net income

While premiums have

declined in California, losses

have also declined

Portfolio re-allocation (equity

sales) in Q4 of 2006 reduced

volatility

Earnings and EPS

53,500,722

$ .49

.09

.58

--

--

--

26.2

(4.6)

$30.8

52,832,048

52,155,944

50,000,002

50,000,002

Weighted Average Shares Outstanding, pro forma (2)

$ .94

$ .45

EPS Before Impacts of the LPT, pro forma (2)

.17

$ 1.11

.97

--

--

49.5

(9.2)

$58.7

.40

EPS for Feb. 5 through the period

--

$3.43

$2.75

GAAP Pro forma EPS – assuming conversion

--

3.04

1.88

EPS (Net Income Before LPT) – assuming

conversion

.08

EPS attributable to LPT (2)

.53

EPS for the period

$27.9

$171.6

$137.6

Net Income

(4.6)

(19.4)

(43.8)

Less: LPT Deferred Gain Amortization

23.3

152.2

93.8

Net Income Before LPT

$ million, except per share data

(1)

Based on 50,000,002 shares assumed outstanding before the conversion.

(2)

Pro forma EPS computed using the actual weighted average shares outstanding as of the end of the period. This includes shares outstanding for the period after the

Company’s IPO and prior to the IPO. Options have been excluded in computing the diluted earnings per share for the period 2/5/07 through 6/30/07 because their

inclusion would be anti-dilutive.

(3)

Pro forma EPS computed using the actual weighted average shares outstanding as of 6/30/2007.

December 31

2005 2006

24

Q1

2007

Q2

2007

YTD

2007

(2)

(2)

(3)

(1)

(1)

(1)

(1)

Underwriting Profitability

$36.0

85.7%

26.5%

13.4%

45.8%

5.3%

40.5%

$15.6

90.5%

25.9%

13.1%

51.5%

5.1%

46.4%

$20.4

$107.1

$78.1

Favorable Reserve Development ($ million)

106.4%

26.5%

13.4%

66.5%

5.3%

61.2%

Excluding

reserve

development for

6 mos., 2007 (1)

80.6%

27.0%

13.9%

39.6%

5.4%

34.2%

72.6%

84.9%

Combined Ratio (excl. LPT)

22.3%

16.0%

Underwriting & Other Expense Ratio (3)

12.3%

10.7%

Commission Expense Ratio (3)

37.9%

58.3%

Loss & LAE Ratio (excl. LPT)

4.9%

10.0%

Less: Impact of LPT (2)

33.0%

48.3%

Loss & LAE Ratio

COMBINED RATIO

(GAAP and excluding the LPT)

(1)

Excluding $36 million of favorable development in the first six months of 2007, our loss ratio before the LPT would have been 66.5% and our combined ratio would

have been 106.4%. We target a combined ratio of 100. The total combined ratio includes three items causing upward pressure: (1) one shock loss requiring

additional reserves that may run in excess of $3.5 million; (2) one-time conversion costs; and (3) decreasing earned premium.

(2)

Total deferred gain amortization and LPT reserve adjustment of $43.8 million in 2005, $19.4 million in 2006, $4.6 million in the first and $4.6 million in the second

quarters of 2007.

(3)

Our higher expense ratio is largely a function of falling California rates.

Q1

2007

December 31

2005 2006

25

Q2

2007

YTD

2007

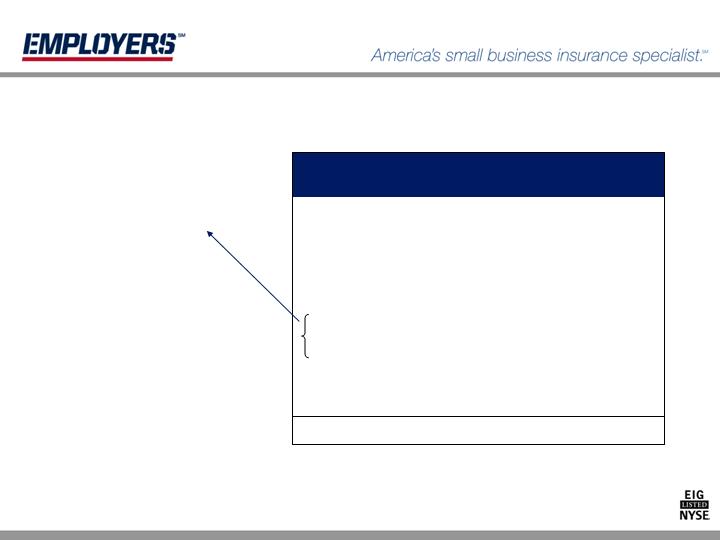

Retention

$10M xs $10M

Catastrophe per Occurrence

First Excess of Loss Layer

$30M xs $20M

Catastrophe per Occurrence

Second Excess of Loss Layer

$50M xs $50M

Catastrophe per Occurrence

Third Excess of Loss Layer

$50M xs $100M

Catastrophe per Occurrence

Fourth Excess of Loss Layer

$50M xs $150M

Catastrophe per Occurrence

Fifth Excess of Loss Layer

$5M xs $5M

$20M Aggregate

First Excess of Loss Layer

$200M

$ 5M

$10M

$20M

$50M

$100M

$150M

Expires 7/1/08

Priced annually

Includes terrorism, except nuclear,

biological, chemical and radiological

Increased retention to $5.0M

from $4.0M from previous treaty

Increased total limits by $25.0M from

previous treaty

Catastrophe Excess of Loss includes

maximum any one life of $10.0M

Reinsurance Program

26

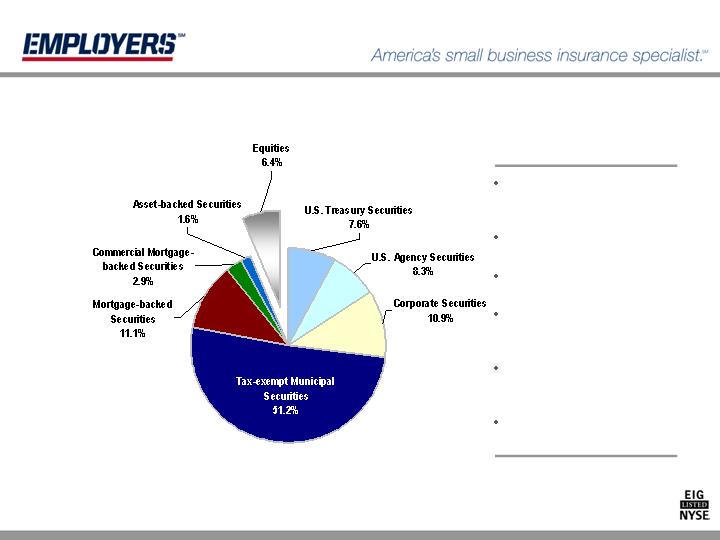

Investment Portfolio

$1.7 billion of

investment securities

Over 90% AA+ rated

Book yield of 4.3%

Tax equivalent book

yield of 5.3%

Effective duration of

5.68

Outsourced to Conning

Asset Management

Portfolio Mix at 6/30/07

27

Mortgage-backed Securities

28

Approximately 97% of

MBS are agency-backed

Of these:

Fannie Mae = 48%

Freddie Mac = 32%

Ginnie Mae = 20%

(less than .03% in three fully-

insured securities that could

be defined as sub-prime)

6.4%

107.9

Equities

100%

1,695.2

TOTAL

1.6%

27.9

Asset-backed Securities

2.9%

48.9

Commercial MB Securities

11.1%

187.7

Mortgage-backed Securities

51.2%

868.0

Tax-exempt Municipals

10.9%

184.8

Corporate Securities

8.3%

140.3

US Agency Securities

7.6%

129.7

US Treasury Securities

PORTFOLIO at 6/30/07

($ million)

Commercial mortgage-backed

securities are all AAA rated

Capital Management

$38 million ordinary

dividend capacity

(unassigned surplus at

12/31/2006), plus

$9.7 million in net proceeds

from the IPO, plus

$55 million up-streamed

extraordinary dividend

Greater than $100 million

available cash in 2007

Holding Company

Cash Flow

Strong Capital Position

$790 million GAAP

adjusted equity at

3/31/2007

0.6:1 NPW/surplus at

12/31/2006

No debt

Reserve strength

Our goal is to drive shareholder value through an improving ROE resulting from (i) profitability

consistent with historical results, (ii) disciplined growth and (iii) prudent capital management

29

Capital Management

Tools

Shareholder dividends

$0.06 per share

quarterly dividend

Two quarters

declared and paid

$3.2 million Q2, 2007

$3.1 million Q3, 2007

Share repurchase

Up to $75 million in

open market in 2007

135,716 at 6/30/07

1,618,270 at 8/10/07

Summary

Established enterprise with 94 year operating history

Focused operations and disciplined underwriting – target an attractive

and underserved market segment with growth opportunities

Unique and long-standing strategic distribution relationships

Financial strength and flexibility - strong balance sheet and conservative

reserving

Experienced management team with deep knowledge of workers’

compensation

31

Douglas D. Dirks

President & Chief Executive Officer

Employers Holdings, Inc.

William E. (Ric) Yocke

Chief Financial Officer

Employers Holdings, Inc.

Martin J. Welch

President and Chief Operating Officer

Employers Insurance Company of Nevada and

Employers Compensation Insurance Company

Analyst Contact:

Vicki Erickson

Vice President, Investor Relations

Employers Holdings, Inc.

(775) 327-2794

verickson@employers.com

9790 Gateway Drive

Reno, NV. 89521-5906

(775) 327-2700

32