UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| x | Preliminary Proxy Statement. | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |||

| ¨ | Definitive Proxy Statement. | |||

| ¨ | Definitive Additional Materials. | |||

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |||

Horace Mann Life Insurance Company Separate Account Horace Mann Life Insurance Company Qualified Group Annuity Separate Account | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

Horace Mann Life Insurance Company | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| 5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| ||||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| 3) | Filing Party:

| |||

| ||||

| 4) | Date Filed:

| |||

| ||||

HORACE MANN LIFE INSURANCE COMPANY

September 15, 2015

Dear Contract Owner:

You are receiving this proxy statement as a Horace Mann Life Insurance Company (“Horace Mann”, “we,” “us,” “our”) variable annuity contract (“Contract”) owner. We are requesting that you vote to approve the substitutions of shares of investment portfolios referenced in the chart below as “Replacement Portfolios” for shares of investment options that are currently available under your Contract (referenced in the chart below as “Existing Portfolios”). This package contains information about the proposed substitutions and the materials to use when casting your vote.

The proposed substitutions are part of an effort by Horace Mann to make its variable annuities more efficient to administer by offering a more streamlined array of diverse and high quality investment options that is concentrated in fewer fund families. We believe that the proposed substitutions are in the best interests of Contract owners. By eliminating overlapping investment options, we can offer more attractive variable annuities that involve a more manageable investment process for Contract owners.

To make the proposed substitutions, we must obtain the approval of the U.S. Securities and Exchange Commission (“SEC”) and of a majority in interest of owners of individual Contracts and group Contract participants who have contract value invested in the Existing Portfolios as of July 31, 2015. The SEC issued an exemptive order approving the proposed substitutions on August 7, 2015.

Your vote and participation are extremely important, and voting is quick and easy.Please read carefully the enclosed Voting Information Statement for details about the proposed substitutions. For your vote to be given effect,we must receive your voting instructions by one of the methods described on the enclosed voting instructions card(s) no later than 11:59 Eastern Time on Monday November 30, 2015. Please vote on all voting instructions card(s) that you receive.

If you have any questions before you vote, please call Horace Mann at 855-806-7765. We will be happy to help you get your vote in quickly. Thank you for your cooperation in this important initiative.

| Very truly yours, |

| /s/ Matthew P. Sharpe |

| [Matthew P. Sharpe] |

| Executive Vice President |

| Horace Mann Life Insurance Company |

| EXISTING AND REPLACEMENT PORTFOLIOS FOR PROPOSED SUBSTITUTIONS | ||||

Substitution | Existing Portfolio | Replacement Portfolio | ||

| 1 | Wilshire 5000 IndexSM Fund (Institutional Class) | |||

| 2 | Wilshire 5000 IndexSM Fund (Investment Class) | |||

| 3 | Growth & Income Portfolio (Service Class 2) | |||

| 4 | Davis Value Portfolio | |||

| 5 | T. Rowe Price Equity Income Portfolio—II | |||

| 6 | Wilshire Large Company Value Portfolio (Investment Class) | |||

| 7 | Growth Portfolio (Service Class 2) | |||

| 8 | Wilshire Large Company Growth Portfolio (Institutional Class) | Index 500 Portfolio (Service Class 2) | ||

| 9 | Wilshire Large Company Growth Portfolio (Investment Class) | |||

| 10 | Delaware VIP U.S. Growth Series (Service Class) | |||

| 11 | Large Cap Growth Portfolio (Class B) | |||

| 12 | MidCap Stock Portfolio (Service Shares) | |||

| 13 | Mid Cap Portfolio (Service Class 2) | |||

| 14 | Rainier Small/Mid Cap Equity Fund (Original Class) | |||

| 15 | Ariel Appreciation Fund (Investor Class) | |||

| 16 | Goldman Sachs Mid Cap Value Fund (Service Shares) | |||

| 17 | VP Mid Cap Value Fund (Class 1) | |||

| 18 | Wells Fargo Advantage VT Opportunity Fund (Class 2) | |||

| 19 | Small/Mid Cap Value Portfolio (Class B) | |||

| 20 | Ariel Fund (Investor Class) | Calvert VP S&P MidCap 400 Index Portfolio (Class F) | ||

21 |

Growth Opportunities Portfolio (Class VC) | |||

| 22 | Putnam VT Multi-Cap Growth Fund (IB Shares) | |||

| 23 | Delaware VIP Smid Cap Growth Series (Service Class) | |||

| 24 | Goldman Sachs Small Cap Equity Insights Fund (Institutional Shares) | |||

| 25 | Lazard Retirement US Small-Mid Cap Equity Portfolio (Service Shares) | |||

| 26 | Neuberger Berman Genesis Fund (Advisor Class) | |||

| 27 | T. Rowe Price Small-Cap Stock Fund (Advisor Class) | |||

| 28 | T. Rowe Price Small-Cap Value Fund (Advisor Class) | |||

| 29 | Wilshire Small Company Value Portfolio (Investment Class) | |||

| 30 | Royce Small-Cap Portfolio (Investment Class) | Small Cap Stock Index Portfolio (Service Shares) | ||

31 |

Small Cap Growth Portfolio (Class B) | |||

| 32 | Wilshire Small Company Growth Portfolio (Investment Class) | |||

| 33 | Delaware VIP REIT Series (Service Class) | Real Estate Portfolio (Service Class 2) | ||

| 34 | High Income Portfolio (Service Class 2) | Franklin High Income VIP Fund (Class 2) | ||

| 35 | Ibbotson Conservative ETF Asset Allocation Portfolio (Class II) | FundsManager 20% Portfolio (Service Class 2) | ||

| 36 | Ibbotson Income and Growth ETF Asset Allocation Portfolio (Class II) | FundsManager 50% Portfolio (Service Class 2) | ||

| 37 | Ibbotson Balanced ETF Asset Allocation Portfolio (Class II) | FundsManager 60% Portfolio (Service Class 2) | ||

| 38 | Ibbotson Growth ETF Asset Allocation Portfolio (Class II) | FundsManager 70% Portfolio (Service Class 2) | ||

| 39 | Ibbotson Aggressive Growth ETF Asset Allocation Portfolio (Class II) | FundsManager 85% Portfolio (Service Class 2) | ||

| 40 | Emerging Markets Portfolio—Service Class 2 | New World Fund (Class 4) | ||

2

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE

PROPOSED SUBSTITUTIONS

What is happening?

Horace Mann Life Insurance Company (“Horace Mann”, “we,” “us,” “our”) is proposing to remove certain underlying investment options (“Existing Portfolios”) currently available under your variable annuity contract (“Contract”) and to replace those Existing Portfolios with other investment portfolios (“Replacement Portfolios”). Each replacement of an Existing Portfolio by a Replacement Portfolio is referred to as a “Substitution.” To make the proposed substitutions, we must obtain the approval of the U.S. Securities and Exchange Commission and of a majority in interest of Contract owners—i.e., owners of individual Contracts and group Contract participants—who have contract value invested in the Existing Portfolios as of July 31, 2015. The SEC issued an exemptive order approving the proposed substitutions on August 7, 2015.

Why is this happening?

Horace Mann strives to offer strong, attractive underlying investment options to our Contract owners, and the investment options that we offer are subject to regular review. After an extensive evaluation of all the investment options available under the Contracts, Horace Mann has determined that a more streamlined array of investment options would create a more manageable investment process for you as a Contract owner. In addition, during this evaluation Horace Mann found that the operations of certain of the Existing Portfolios were not meeting our expectations for levels of risk management and performance for investment options under the Contracts.

How does this benefit Contract owners?

After the proposed substitutions, the Contracts will offer a streamlined line-up of diverse, high-quality investment options. The streamlined line-up is designed to offer a more manageable investment process for our Contract owners.

In most cases, the Replacement Portfolio has a lower expense ratio than the corresponding Existing Portfolio. For a period of two years following the Substitution Date, Horace Mann will reimburse those who were Contract owners on the Substitution Date and who, as a result of a Substitution, had Contract value allocated to the subaccount investing in a Replacement Portfolio, such that the Replacement Portfolio’s net annual operating expenses (taking into account any fee waivers and expense reimbursements for such period) will not exceed, on an annualized basis, the net annual operating expenses (taking into account any fee waivers and expense reimbursements) of the corresponding Existing Portfolio as of the Existing Portfolio’s most recent fiscal year preceding the Substitution Date.

1

How will the substitutions be accomplished?

If the Substitutions are approved by the Contract owners through the voting process, all Contract owner assets in the existing investment options on the effective date of the substitutions will be allocated to the replacement investment options. The substitutions will take place at relative net asset value. Contract owners will not see a change in account value as a result of the substitutions, but may see a change in the number of units owned. Nor will Contract owners see a change in the amount of any Contract owner’s contract value or death benefit or in the dollar value of his or her investments in the investment options.

Contract owners will not incur any additional Contract fees or charges as a result of the substitutions, nor will their rights or Horace Mann’s obligations under the Contracts be altered in any way. All applicable expenses incurred in connection with the substitutions will be paid by Horace Mann. In addition, the substitutions will not subject Contract owners to any federal income tax liability.

How many votes am I entitled to cast?

Contract owners are entitled to cast one vote for every dollar of Contract value held by that Contract owner in an existing investment option.

How do I cast my votes?

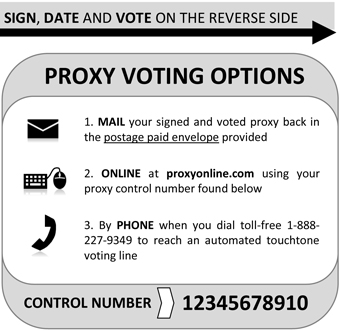

You can vote by:

| • | Completing and signing the enclosed voting instructions card, and mailing it in the enclosed postage paid envelope. |

| • | Calling toll free 1-888-227-9349. |

| • | Voting online at proxyonline.com. |

We must receive your voting instructions no later than 11:59 p.m. Eastern Time on Monday November 30, 2015.

Previously submitted voting instructions may be revoked or changed by any of the voting methods described above, subject to the voting deadline noted above.

Can I view the proxy statement online?

Yes. You can view the proxy statement at proxyonline.com/docs/horacemann2015.pdf.

How can I find more information on the proxy and the proposed substitutions?

The enclosed Voting Information Statement provides more detail about the proposed substitutions, the investment portfolios that would be removed (i.e., the Existing Portfolios), and the investment portfolios that would replace the Existing Portfolios (i.e., the Replacement Portfolios). Additional information on any of the investment options available under the Contracts—including the Existing Portfolios—can be found in the underlying fund prospectuses that are available on our website at www.horacemann.com or upon request by calling us at (855) 806-7765.

2

If you have any questions about the materials you have received in this mailing, please call Horace Mann at (855) 806-7765.

3

HORACE MANN LIFE INSURANCE COMPANY

Horace Mann Life Insurance Company Separate Account

Horace Mann Life Insurance Company Qualified Group Annuity Separate Account

One Horace Mann Plaza

Springfield, Illinois 62715

VOTING INFORMATION STATEMENT

September 15, 2015

Horace Mann Life Insurance Company (“Horace Mann”), on behalf of its separate accounts, Horace Mann Life Insurance Company Separate Account and Horace Mann Life Insurance Company Qualified Group Annuity Separate Account (collectively, the “Separate Accounts”), is furnishing this Voting Information Statement to solicit votes from owners of individual variable annuity contracts and participants of group variable annuity contracts (each a “Contract” and collectively, the “Contracts”) issued by Horace Mann having contract value allocated to the investment divisions of the Separate Accounts (“Subaccounts”) that invest in shares of one or more of the investment options available under the Contracts noted in the chart below (each an “Existing Portfolio”). (Owners of individual Contracts and group Contract participants are referred to herein collectively as “Owners,” and each as an “Owner,” “you” or “your”.) This Voting Information Statement and each accompanying voting instructions card is being furnished to Owners on or about September 15, 2015.

Horace Mann is requesting a vote to approve or disapprove the substitution of shares of the portfolios noted in the chart below (each referred to herein as a “Replacement Portfolio”) for shares of the Existing Portfolios noted in the chart below. The proposed substitutions will be referred to collectively as “Substitutions,” and each of the following proposed substitutions will be referred to as a “Substitution.” As an Owner having contract value in a Subaccount investing in shares of one or more of the Existing Portfolios as of the close of business on July 31, 2015 (the “Record Date”), you are entitled to vote such contract value on one or more of the proposed Substitutions noted in the chart below.

Horace Mann is recommending a vote to approve the proposed Substitutions.

By the terms of each Contract and as set forth in the prospectuses for those Contracts, Horace Mann has reserved the right to substitute shares of each of the investment choices under your Contract (each an “underlying fund”) for shares of another underlying fund, including an underlying fund of a different investment company. Horace Mann’s ability to carry out a proposed Substitution is conditioned on its obtaining the approval of the U.S. Securities and Exchange Commission (the “Commission” or “SEC”). The SEC issued an exemptive order approving the proposed Substitutions on August 7, 2015. The SEC’s approval of a proposed Substitution is subject to certain conditions, including that Horace Mann receives the requisite approval from Owners entitled to vote (i.e., those Owners who have contract value invested in a Subaccount investing in an Existing Portfolio as of the Record Date).

4

EXISTING AND REPLACEMENT PORTFOLIOS—SUBSTITUTION

| ||||

Substitution | Existing Portfolio | Replacement Portfolio | ||

| 1 | Wilshire 5000 IndexSM Fund (Institutional Class) | |||

| 2 | Wilshire 5000 IndexSM Fund (Investment Class) | |||

| 3 | Growth & Income Portfolio (Service Class 2) | |||

| 4 | Davis Value Portfolio | |||

| 5 | T. Rowe Price Equity Income Portfolio—II | |||

| 6 | Wilshire Large Company Value Portfolio (Investment Class) | |||

| 7 | Growth Portfolio (Service Class 2) | |||

| 8 | Wilshire Large Company Growth Portfolio (Institutional Class) | Index 500 Portfolio (Service Class 2) | ||

| 9 | Wilshire Large Company Growth Portfolio (Investment Class) | |||

| 10 | Delaware VIP U.S. Growth Series (Service Class) | |||

| 11 | Large Cap Growth Portfolio (Class B) | |||

| 12 | MidCap Stock Portfolio (Service Shares) | |||

| 13 | Mid Cap Portfolio (Service Class 2) | |||

| 14 | Rainier Small/Mid Cap Equity Fund (Original Class) | |||

| 15 | Ariel Appreciation Fund (Investor Class) | |||

| 16 | Goldman Sachs Mid Cap Value Fund (Service Shares) | |||

| 17 | VP Mid Cap Value Fund (Class 1) | |||

| 18 | Wells Fargo Advantage VT Opportunity Fund (Class 2) | |||

| 19 | Small/Mid Cap Value Portfolio (Class B) | |||

| 20 | Ariel Fund (Investor Class) | Calvert VP S&P MidCap 400 Index Portfolio (Class F) | ||

| 21 | Growth Opportunities Portfolio (Class VC) | |||

| 22 | Putnam VT Multi-Cap Growth Fund (IB Shares) | |||

| 23 | Delaware VIP Smid Cap Growth Series (Service Class) | |||

| 24 | Goldman Sachs Small Cap Equity Insights Fund (Institutional Shares) | |||

| 25 | Lazard Retirement US Small-Mid Cap Equity Portfolio (Service Shares) | |||

| 26 | Neuberger Berman Genesis Fund (Advisor Class) | |||

| 27 | T. Rowe Price Small-Cap Stock Fund (Advisor Class) | |||

| 28 | T. Rowe Price Small-Cap Value Fund (Advisor Class) | |||

| 29 | Wilshire Small Company Value Portfolio (Investment Class) | |||

| 30 | Royce Small-Cap Portfolio (Investment Class) | Small Cap Stock Index Portfolio (Service Shares) | ||

| 31 | Small Cap Growth Portfolio (Class B) | |||

| 32 | Wilshire Small Company Growth Portfolio (Investment Class) | |||

| 33 | Delaware VIP REIT Series (Service Class) | Real Estate Portfolio (Service Class 2) | ||

| 34 | High Income Portfolio (Service Class 2) | Franklin High Income VIP Fund (Class 2) | ||

| 35 | Ibbotson Conservative ETF Asset Allocation Portfolio (Class II) | FundsManager 20% Portfolio (Service Class 2) | ||

| 36 | Ibbotson Income and Growth ETF Asset Allocation Portfolio (Class II) | FundsManager 50% Portfolio (Service Class 2) | ||

| 37 | Ibbotson Balanced ETF Asset Allocation Portfolio (Class II) | FundsManager 60% Portfolio (Service Class 2) | ||

| 38 | Ibbotson Growth ETF Asset Allocation Portfolio (Class II) | FundsManager 70% Portfolio (Service Class 2) | ||

| 39 | Ibbotson Aggressive Growth ETF Asset Allocation Portfolio (Class II) | FundsManager 85% Portfolio (Service Class 2) | ||

| 40 | Emerging Markets Portfolio—Service Class 2 | New World Fund (Class 4) | ||

5

GENERAL VOTING INFORMATION

An Owner is entitled to one vote for each dollar of contract value (referred to herein as a “unit”) that he or she owns in a Subaccount. As of the Record Date, the total number of units held in each Subaccount for each of the Separate Accounts funding the Contracts and entitled to vote was as follows:

| SEPARATE ACCOUNT FUNDINGTHE CONTRACTS | ||||||||||||||

| HORACE MANN LIFE INSURANCE COMPANY SEPARATE ACCOUNT (File No. 811-01343) | HORACE MANN LIFE INSURANCE COMPANY QUALIFIED GROUP ANNUITY SEPARATE ACCOUNT (File No. 811-21974) | |||||||||||||

Replacement Portfolio | SUBACCOUNT (Substitution #) | FILE NO. 2- 24256 Number of Units Eligible to Vote | FILE NO. 333- 129284 Number of Units Eligible to Vote | FILE NO. 333-138322 Number of Units Eligible to Vote | ||||||||||

| Index 500 Portfolio | Wilshire 5000 Index Fund*(1&2) | 2,003,220.017 | 500,497.364 | 33,014.867 | ||||||||||

| Growth & Income Portfolio(3) | 899,818.009 | 414,512.072 | 60,966.564 | |||||||||||

| Davis Value Portfolio(4) | 627,368.855 | 439,094.000 | 121,228.924 | |||||||||||

| T. Rowe Price Equity Income Portfolio(5) | 224,117.454 | 304,874.022 | 55,330.635 | |||||||||||

| Wilshire Large Company Value Portfolio(6) | 784,055.504 | 241,668.104 | 42,028.461 | |||||||||||

| Growth Portfolio(7) | 960,952.916 | 385,318.718 | 117,557.619 | |||||||||||

| Wilshire Large Company Growth Portfolio*(8&9) | 701,978.246 | 105,945.210 | 7,291.703 | |||||||||||

| Delaware VIP U.S. Growth(10) | 83,526.162 | 77,991.435 | 9,012.182 | |||||||||||

| Large Cap Growth(11) | 769,684.824 | 208,099.256 | 37,502.699 | |||||||||||

| Calvert VP S&P MidCap 400 Index Portfolio | MidCap Stock Portfolio (12) | 35,074.649 | 0 | 0 | ||||||||||

6

| Calvert VP S&P MidCap 400 Index Portfolio | Mid Cap Portfolio(13) | 856,943.074 | 323,016.809 | 59,862.291 | ||||||||||

| Rainier Small/Mid Cap Equity Fund (14) | 328,415.327 | 119,058.009 | 39,694.230 | |||||||||||

| Ariel Appreciation Fund (15) | 570,283.278 | 44,789.944 | 0 | |||||||||||

| Goldman Sachs Mid Cap Value Fund (16) | 47,667.641 | 36,452.977 | 5,867.226 | |||||||||||

| VP Mid Cap Value Fund(17) | 51,318.085 | 39,186.641 | 7,660.162 | |||||||||||

| Wells Fargo Advantage VT Opportunity Fund (18) | 140,128.002 | 0 | 0 | |||||||||||

| Small/Mid Cap Value Portfolio (19) | 33,677.938 | 63,607.342 | 9,198.235 | |||||||||||

| Ariel Fund (20) | 393,126.520 | 70,507.289 | 8,335.174 | |||||||||||

| Growth Opportunities Portfolio (21) | 76,273.273 | 0 | 0 | |||||||||||

| Putnam VT Multi-Cap Growth Fund (22) | 203,000.309 | 31,484.668 | 1,579.335 | |||||||||||

| Delaware VIP Smid Cap Growth Series (23) | 111,563.038 | 77,384.068 | 18,414.020 | |||||||||||

| Small Cap Stock Index Portfolio | Goldman Sachs Small Cap Equity Insights Fund (24) | 74,659.280 | 46,056.419 | 0 | ||||||||||

| Lazard Retirement US Small-Mid Cap Equity Portfolio (25) | 38,138.723 | 43,151.612 | 10,627.337 | |||||||||||

| Neuberger Berman Genesis Fund (26) | 688,398.515 | 251,562.140 | 37,292.144 | |||||||||||

| T. Rowe Price Small-Cap Stock Fund (27) | 208,726.406 | 0 | 0 | |||||||||||

7

| Small Cap Stock Index Portfolio | T. Rowe Price Small-Cap Value Fund (28) | 203,811.961 | 0 | 0 | ||||||||||

| Wilshire Small Company Value Portfolio (29) | 109,998.594 | 42,993.806 | 6,320.871 | |||||||||||

| Royce Small-Cap Portfolio (30) | 472,699.070 | 460,490.822 | 143,082.703 | |||||||||||

| Small Cap Growth Portfolio (31) | 50,095.102 | 72,344.380 | 11,726.636 | |||||||||||

| Wilshire Small Company Growth Portfolio (32) | 105,385.831 | 0 | 0 | |||||||||||

| Real Estate Portfolio | Delaware VIP REIT Series (Service Class) (33) | 325,074.832 | 506,750.609 | 132,276.744 | ||||||||||

| Franklin High Income VIP Fund | High Income Portfolio (Service Class 2) (34) | 498,264.797 | 512,742.689 | 158,146.480 | ||||||||||

| FundsManager 20% Portfolio | Ibbotson Conservative ETF Asset Allocation Portfolio (35) | 105,522.655 | 268,643.165 | 24,839.552 | ||||||||||

| FundsManager 50% Portfolio | Ibbotson Income and Growth ETF Asset Allocation Portfolio (36) | 225,117.828 | 396,854.167 | 31,271.527 | ||||||||||

| FundsManager 60% Portfolio | Ibbotson Balanced ETF Asset Allocation Portfolio (37) | 527,571.320 | 1,401,055.029 | 161,913.766 | ||||||||||

| FundsManager 70% Portfolio | Ibbotson Growth ETF Asset Allocation Portfolio (38) | 457,440.440 | 1,161,450.318 | 179,199.691 | ||||||||||

| FundsManager 85% Portfolio | Ibbotson Aggressive Growth ETF Asset Allocation Portfolio (39) | 115,165.242 | 529,056.606 | 127,989.387 | ||||||||||

| New World Fund | Emerging Markets Portfolio (40) | 251,610.902 | 385,471.789 | 61,640.546 | ||||||||||

8

| I. | Required Owner Vote |

Unless extended by Horace Mann, votes must be received from Owners by November 30, 2015 to be counted. Approval will be obtained by the affirmative vote of a majority of the outstanding interests in the Subaccount corresponding to the Existing Portfolio.

If Horace Mann does not receive Owner approval for all Substitutions, Horace Mann may decide to effect only those Substitutions that were approved by Owners. Approval will be obtained by the affirmative vote of Owners holding a majority of the outstanding interests in the Subaccount corresponding to the Existing Portfolio. Horace Mann will not effect any proposed Substitution if it does not receive approval from a majority of the outstanding interests in the applicable Subaccount investing in the relevant Existing Portfolio.

Any beneficial financial interest that Horace Mann may have in the Separate Accounts is immaterial in relation to the interests of Owners, and Horace Mann will not cast any votes. No individual who has been a director or executive officer of Horace Mann at any time since January 1, 2014, or any associate of such individual, has any substantial interest, direct or indirect, by security holdings or otherwise, in the proposed Substitutions.

| II. | How to Vote |

You may cast your vote(s) by: (1) filling out each enclosed voting instructions card and returning it to AST Fund Solutions, 55 Challenger Road, Suite 201, Ridgefield Park, NJ 07660; (2) using a toll-free telephone voting facility 888-227-9349 or (3) visiting an internet website at proxyonline.com. If you properly execute and return the enclosed voting instructions card (or cast your vote by telephone or internet) by Monday November 30, 2015, at 11:59 p.m. Eastern Time (the “Voting Deadline”), Horace Mann will count your vote when calculating the results of the solicitation. Horace Mann will disregard any voting instructions received after the Voting Deadline. Votes attributable to voting instructions cards that are properly executed and returned, but are not marked “Approve” or “Disapprove” the Substitutions or “Abstain”, will be counted as “Approve.” A vote to “Abstain” will have the effect of a vote to “Disapprove” the Substitutions.

Any Owner who has submitted voting instructions has the right to change his or her vote at any time before the Voting Deadline by: (1) submitting a letter requesting the change or a later-dated voting instructions card to AST Fund Solutions at the above listed address; or (2) casting another vote at the above listed telephone number or internet website. Any change must be received on or before the Voting Deadline. If Horace Mann does not receive sufficient votes to approve the Substitutions, it may extend the Voting Deadline and conduct a further solicitation of votes. Horace Mann will solicit votes primarily by mail. Horace Mann may supplement this effort by telephone calls, telegrams, e-mails, personal interviews, and other communications by officers, employees, and agents of Horace Mann or its affiliates, but no additional compensation will be paid by Horace Mann to such individuals for such solicitation. CSG and AST Fund Solutions will be retained by Horace Mann to assist in the solicitation process, and will be paid for its services by Horace Mann. Based on current estimates, Horace Mann anticipates that it will pay CSG and AST Fund Solutions between $343,446 and $565,132 for these services. The actual amount of these expenses will vary depending on a number of factors, such as the number of Owners contacted by CSG and AST Fund Solutions. Horace Mann will bear these costs and all other costs of soliciting votes.

9

| III. | Availability of Proxy Materials |

These proxy materials contain important information regarding the Substitutions that you should know before providing voting instructions. You should retain these proxy materials for future reference. These proxy materials will be available at www.proxyonline.com/docs/horacemann2015.pdf on or about September 15, 2015.

THE PROPOSED SUBSTITUTION

| I. | The Transaction |

Horace Mann and the Separate Accounts filed an application to the Commission seeking approval to engage in the proposed Substitutions on July 25, 2014, and an amended and restated application on May 27, 2015. On August 7, 2015, the Commission issued an order approving the proposed Substitutions. As of the effective date of each Substitution, the Separate Accounts intend to redeem shares of the Existing Portfolio in cash. To the extent that there are any “in kind” redemptions (i.e., for portfolio securities) of the Existing Portfolios, such redemptions will be effected as prescribed in the application to the Commission for approval to engage in the Substitutions noted above.

If approved by Owners, the proposed Substitutions will take place at relative net asset value with no change in the amount of any Owner’s contract value or death benefit or in the dollar value of his or her investments in the Subaccounts. Owners will not incur any additional Contract fees or charges as a result of the Substitutions, nor will their rights or Horace Mann’s obligations under the Contracts be altered in any way. All applicable expenses incurred in connection with the Substitutions will be paid by Horace Mann. In addition, the Substitutions will not subject Owners to any federal income tax liability.

According to the most current prospectuses for the Existing Portfolios and the Replacement Portfolios noted below, the total annual expenses after any fee waiver and expense reimbursement (“total net annual operating expenses”) for the Replacement Portfolio exceed the total net annual operating expenses for the Existing Portfolio. For a period of two years following the Substitution Date, Horace Mann will reimburse those who were Contract owners on the Substitution Date and who, as a result of a Substitution, had Contract value allocated to the subaccount investing in a Replacement Portfolio, such that the Replacement Portfolio’s net annual operating expenses (taking into account any fee waivers and expense reimbursements for such period) will not exceed, on an annualized basis, the net annual operating expenses (taking into account any fee waivers and expense reimbursements) of the corresponding Existing Portfolio as of the Existing Portfolio’s most recent fiscal year preceding the Substitution Date. Thereafter, expenses of the Replacement Portfolio can vary from year to year and could exceed those of the Existing Portfolio. Any adjustments will be made at least on a quarterly basis. In addition, for a period of at least two years following the Substitution Date, Horace Mann will not increase the Contract fees and charges—including asset based charges such as mortality and expense risk charges deducted from the Subaccounts—that would otherwise be assessed under the terms of Contracts that are in force on the Substitution Date. This two year limit on expenses is referred to hereinafter as the “Expense Limitation”.

10

Sub. No. | Existing Portfolio | Replacement Portfolio | ||

| 37 | Ibbotson Balanced ETF Asset Allocation Portfolio | FundsManager 60% Portfolio | ||

| 38 | Ibbotson Growth ETF Asset Allocation Portfolio | FundsManager 70% Portfolio | ||

| 39 | Ibbotson Aggressive Growth ETF Asset Allocation Portfolio | FundsManager 85% Portfolio | ||

Required Owner Vote. Owners are entitled to approve or disapprove the proposed Substitutions. A Substitution will not take place unless Horace Mann receives an affirmative vote of Owners holding a majority of the outstanding interests in the Subaccount corresponding to the Existing Portfolio as of the Record Date.

Horace Mann intends to effect the proposed Substitutions as soon as reasonably practicable following the requisite approval of Owners, and any approval required by state insurance regulators.

Transfer Rights. Redemptions and repurchases that occur in connection with effecting the proposed Substitutions will not count as a transfer for purposes of assessing transfer fees and will not be subject to any transfer limitations that may otherwise be imposed by Horace Mann under a Contract. By the terms of the Contracts (and as set forth in the prospectus for each Contract), an Owner can transfer account value among the Subaccounts during the accumulation period of the Contract. There are no limits on the number of transfers permitted each year, and Horace Mann does not assess a transfer charge on transfers among Subaccounts.

From May 1, 2015 through thirty (30) days following the Substitution Date, Owners may make one transfer of Contract value from the Subaccount investing in the Existing Portfolio (before the Substitution) or the Replacement Portfolio (after the Substitution) to any other available investment option under the Contract without charge (including any sales charges or surrender charges) and without imposing any transfer limitations. On the Substitution Date, Contract values attributable to investments in each Existing Portfolio will be transferred to the corresponding Replacement Portfolio without charge (including any sales charges or surrender charges) and without being subject to any limitations on transfers. Horace Mann will not exercise any right it may have under the Contracts to impose restrictions on transfers between Subaccounts for a period of at least thirty (30) days following the Substitution Date.

11

| II. | Reasons for the Proposed Substitutions |

The proposed Substitutions are part of an overall business goal of Horace Mann to improve the administrative efficiency and cost-effectiveness, as well as the attractiveness to investors, of its variable annuity contracts. After an extensive review of all of the investment options available under the Contracts, Horace Mann has determined that a more streamlined array of investment options would permit Horace Mann to lower its costs of administering the Contracts while increasing its operational and administrative efficiencies. Additionally, the Substitutions would create a more manageable investment process for Owners, while maintaining a high quality and diverse, yet simplified, line-up of investment options across seven (7) asset classes.

Along with its investment consultant, Wilshire Associates, Inc., Horace Mann has engaged in a thorough review of the quality of all of the investment options offered under the Contracts. This due diligence review involved an evaluation of the investment performance, the investment strategy, and the investment advisers responsible for the management of the portfolios. Horace Mann also examined the level of investment by Owners in the current array of investment options available under its Contracts, the operating expenses of the investment options currently available under the Contracts, and how those expenses compared with those of peer funds or benchmarks. Ultimately, Horace Mann concluded that certain underlying funds offered under the Contracts warrant replacement and that it would be preferable to make alternative investment options available to both current and future Owners.

Horace Mann believes that the proposed Substitutions would result in: (1) a simplified yet equally diverse array of investment options from well-known and established fund companies (as is currently available); (2) investment options that are consistent with respect to asset class, management, and investment objective, and that may be positioned to provide better risk-adjusted returns; (3) greater efficiencies in managing and administering contracts; and (4) enhanced risk management.

More specifically, the proposed Substitutions will streamline the current investment option lineup of over fifty (50) investment options by eliminating overlapping investment options, and will simplify the investment decision process for Owners by reducing the redundancy and the number of underlying fund prospectuses that an existing or prospective Contract owner must analyze to make an informed investment decision. Owners’ expectations will continue to be met following the Substitutions because each of the Replacement Portfolios has investment objectives, investment strategies, and principal risks that are similar, if not identical, to those of its corresponding Existing Portfolio.

Further, Horace Mann believes that streamlining the number of underlying funds and fund companies available through the Contracts will simplify the administration of the Contracts, particularly with regard to communications with fund companies available through the Contracts and the preparation of reports and disclosure documents. Owners would benefit by receiving fewer and clearer mailings, and Horace Mann would correspondingly benefit from the cost savings associated with scheduling and aggregating fewer mailings. Further, Horace Mann anticipates that having fewer investment options will result in lower administrative costs, which could permit Horace Mann to allocate resources to provide additional Contract owner services and support.

12

In addition, Horace Mann believes that the proposed Substitutions may enhance its ability to manage the risks associated with providing death benefits and other guarantees under the Contracts and potentially have a positive impact on Horace Mann’s profitability and financial position which, in turn would allow Horace Mann to offer more competitively priced products in the future and continue to make guaranteed benefits available under the contracts that it offers.

For the reasons discussed below, Horace Mann believes that replacing the Existing Portfolios with the Replacement Portfolios, as noted above, is appropriate and in the best interests of Owners. Each Replacement Portfolio selected by Horace Mann has been chosen to correspond as closely as possible to the investment objective, principal investment strategies, and level of risk of the corresponding Existing Portfolio.

| III. | The Company |

Horace Mann is a stock life insurance company organized under the laws of Illinois in 1949. Horace Mann is engaged in the sale of individual and group life insurance and annuity contracts on a non-participating basis. As of December 31, 2014, Horace Mann’s statutory assets were in excess of $7.8 billion. Horace Mann is licensed to do business in 48 states and the District of Columbia. Its executive office mailing address is One Horace Mann Plaza, Springfield, Illinois 62715. Horace Mann is an indirect wholly owned subsidiary of Horace Mann Educators Corporation, a publicly-held insurance holding company traded on the New York Stock Exchange.

| IV. | The Separate Accounts and Variable Contracts |

| A. | Contracts funded through the Horace Mann Life Insurance Company Separate Account |

Horace Mann established the Horace Mann Life Insurance Company Separate Account on October 9, 1965, under Illinois law. The Separate Account is registered with the Commission under the 1940 Act as a unit investment trust (File No. 811-1343). Each Existing Portfolio is an investment option available under the individual variable annuity contracts funded through Horace Mann Life Insurance Company Separate Account, and interests in the Separate Account offered through such Contracts have been registered under the Securities Act of 1933, as amended (the “1933 Act”) (File Nos. 2-24256 and 333-129284).

Horace Mann is the legal owner of the assets in the Horace Mann Life Insurance Company Separate Account. The assets of the Separate Account may not be chargeable with liabilities arising out of any other business of Horace Mann. The income, gains, and losses (whether or not realized) from the assets of the Separate Account are credited to or charged against the amounts allocated to the Separate Account in accordance with the terms of the Contracts without regard to Horace Mann’s other income, gain, or loss.

13

| B. | Contracts funded through Horace Mann Life Insurance Company Qualified Group Annuity Separate Account |

Horace Mann established the Horace Mann Life Insurance Company Qualified Group Annuity Separate Account on October 16, 2006, under Illinois law. The Separate Account is registered with the Commission under the 1940 Act as a unit investment trust (File No. 811-21974). Each Existing Portfolio is an investment option available under group variable annuity contracts funded through Horace Mann Life Insurance Company Qualified Group Annuity Separate Account, and interests in the Separate Account offered through such Contracts have been registered under the 1933 Act (File No. 333-138322).

Horace Mann is the legal owner of the assets in the Horace Mann Life Insurance Company Qualified Group Annuity Separate Account. The assets of the Separate Account may not be chargeable with liabilities arising out of any other business of Horace Mann. Income, gains, and losses (whether or not realized) from the assets of the Separate Account are credited to or charged against the amounts allocated to the Separate Account in accordance with the terms of the Contracts without regard to Horace Mann’s other income, gain, or loss.

| V. | The Portfolios |

| A. | Wilshire Mutual Funds Inc. |

Wilshire Mutual Funds, Inc. is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Wilshire 5000 Index Fund (Substitutions 1 and 2), |

| • | Wilshire Large Company Value Portfolio (Substitution 6), |

| • | Wilshire Large Company Growth Portfolio (Substitutions 8 and 9), |

| • | Wilshire Small Company Value Portfolio (Substitution 29), and |

| • | Wilshire Small Company Growth Portfolio (Substitution 32). |

Shares of the Wilshire Mutual Funds Inc. portfolios are registered under the 1933 Act.

| B. | Variable Insurance Products Fund III |

Fidelity’s Variable Insurance Products Fund III is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Growth & Income Portfolio (Substitution 3), and |

| • | Mid Cap Portfolio (Substitution 13). |

Shares of the Variable Insurance Products Fund III portfolios are registered under the 1933 Act.

| C. | Davis Variable Account Fund, Inc. – Davis Value Portfolio |

Davis Variable Account Fund, Inc. is registered under the 1940 Act as an open-end, diversified management investment company and currently offers a number of separate investment portfolios, including theDavis Value Portfolio (Existing Portfolio, Substitution 4). Shares of the Davis Variable Account Fund, Inc. portfolios are registered under the 1933 Act.

14

| D. | T. Rowe Price Equity Securities, Inc. |

T. Rowe Price Equity Securities, Inc. is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the T. Rowe Price Equity Income Portfolio – II (Existing Portfolio, Substitution 5). Shares of the T. Rowe Price Equity Series, Inc. portfolios are registered under the 1933 Act.

| E. | Variable Insurance Products Fund |

Fidelity’s Variable Insurance Products Fund is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the following Existing Portfolios;

| • | Growth Portfolio (Substitution 7), |

| • | High Income Portfolio (Substitution 34) |

Shares of the Variable Insurance Products Fund portfolios are registered under the 1933 Act.

| F. | Delaware VIP Trust |

Delaware VIP Trust is registered under the 1940 Act as an open-end management investment company and offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Delaware VIP U.S. Growth Series (Substitution 10), |

| • | Delaware VIP Smid Cap Growth Series (Substitution 23), |

| • | Delaware VIP REIT Series (Substitution 33). |

Shares of the Delaware VIP Trust portfolios are registered under the 1933 Act.

| G. | AllianceBernstein Variable Products Series Fund, Inc. |

AllianceBernstein Variable Products Series Fund, Inc. is registered under the 1940 Act as an open-end series investment company and offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Large Cap Growth Portfolio (Substitution 11), |

| • | Small/Mid Cap Value Portfolio(Substitution 19), |

| • | Small Cap Growth Portfolio (Substitution 31). |

Shares of the AllianceBernstein Variable Products Series Fund, Inc. portfolios are registered under the 1933 Act.

| H. | Dreyfus Investment Portfolios |

Dreyfus Investment Portfolios is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the:

| • | MidCap Stock Portfolio (Existing Portfolio, Substitution 12). |

| • | Small Cap Stock Index Portfolio (Replacement Portfolio, Substitutions 24 – 32). |

Dreyfus Investment Portfolios issues shares of its portfolios, which are registered under the 1933 Act.

15

| I. | Rainier Investment Management Mutual Funds |

Rainier Investment Management Mutual Funds is registered under the 1940 Act as an open-end investment company and currently offers a number of separate investment portfolios, including theRainier Small/Mid Cap Equity Fund (Existing Portfolio, Substitution 14). Rainier Investment Management Mutual Funds issues shares of its portfolios, which are registered under the 1933 Act.

| J. | Ariel Investment Trust |

Ariel Investment Trust is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Ariel Appreciation Fund (Substitution 15) and |

| • | Ariel Fund (Substitution 20). |

Ariel Investment Trust issues shares of its portfolios, which are registered under the 1933 Act.

| K. | Goldman Sachs Variable Insurance Trust |

The Goldman Sachs Variable Insurance Trust is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Goldman Sachs Mid Cap Value Fund (Substitution 16), |

| • | Goldman Sachs Small Cap Equity Insights Fund (Substitution 24). |

The Goldman Sachs Variable Insurance Trust issues shares of its portfolios, which are registered under the 1933 Act.

| L. | American Century Variable Portfolios, Inc. |

American Century Variable Portfolios, Inc. is registered under the 1940 Act as an open-end management investment company and offers a number of separate investment portfolios, including theVP Mid Cap Value Fund (Existing Portfolio, Substitution 17).

American Century Variable Portfolios, Inc. issues shares of its portfolios, which are registered under the 1933 Act.

| M. | Wells Fargo Variable Trust |

Wells Fargo Variable Trust is registered under the 1940 Act as an open-end management investment company and offers a number of separate investment portfolios, including theWells Fargo Advantage VT Opportunity Fund (Existing Portfolio, Substitution 18). The Wells Fargo Variable Trust issues shares of its portfolios, which are registered under the 1933 Act.

| N. | Lord Abbett Series Fund, Inc. |

Lord Abbett Series Fund, Inc. is registered under the 1940 Act as an open-end management investment company and offers a number of separate investment portfolios, including theGrowth Opportunities Portfolio (Existing Portfolio, Substitution 21). Lord Abbett Series Fund, Inc. issues shares of its portfolios, which are registered under the 1933 Act.

16

| O. | Putnam Variable Trust |

The Putnam Variable Trust is registered under the 1940 Act as an open-end management investment company and offers a number of separate investment portfolios, including the:Putnam VT Multi-Cap Growth Fund (Existing Portfolio, Substitution 22). The Putnam Variable Trust issues shares of its portfolios, which are registered under the 1933 Act.

| P. | Lazard Retirement Series, Inc. |

Lazard Retirement Series, Inc. is registered under the 1940 Act as a no-load, open-end management investment company and currently offers a number of separate investment portfolios, including theLazard Retirement US Small-Mid Cap Equity Portfolio (Existing Portfolio, Substitution 25). Lazard Retirement Series, Inc. issues shares of its portfolios, which are registered under the 1933 Act.

| Q. | Neuberger Berman Equity Funds |

Neuberger Berman Equity Funds is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including theNeuberger Berman Genesis Fund (Existing Portfolio, Substitution 26). Neuberger Berman Equity Funds issues shares of its portfolios, which are registered under the 1933 Act.

| R. | T. Rowe Price Small-Cap Stock Fund, Inc. |

T. Rowe Price Small-Cap Stock Fund, Inc. is registered under the 1940 Act as an open-end management investment company and currently offers a separate investment portfolio, theT. Rowe Price Small-Cap Stock Fund (Existing Portfolio, Substitution 27). T. Rowe Price Small-Cap Stock Fund, Inc. issues shares of its portfolio, which are registered under the 1933 Act.

| S. | T. Rowe Price Small-Cap Value Fund, Inc. |

T. Rowe Price Small-Cap Value Fund, Inc. is registered under the 1940 Act as an open-end management investment company and currently offers a separate investment portfolio, theT. Rowe Price Small-Cap Value Fund (Existing Portfolio, Substitution 28). T. Rowe PriceSmall-Cap Value Fund, Inc. issues shares of its portfolio, which are registered under the 1933 Act.

| T. | Royce Capital Fund |

Royce Capital Fund is registered under the 1940 Act as an open-end management investment company and offers a number of separate investment portfolios, including theRoyce Small-Cap Portfolio (Existing Portfolio, Substitution 30). The Royce Capital Fund issues shares of its portfolios, which are registered under the 1933 Act.

17

| U. | ALPS Variable Investment Trust |

ALPS Variable Investment Trust is registered under the 1940 Act as anopen-end, diversified management investment company and currently offers a number of separate investment portfolios, including the following Existing Portfolios:

| • | Ibbotson Conservative ETF Asset Allocation Portfolio (Substitution 35) |

| • | Ibbotson Income and Growth ETF Asset Allocation Portfolio (Substitution 36) |

| • | Ibbotson Balanced ETF Asset Allocation Portfolio (Substitution 37) |

| • | Ibbotson Growth ETF Asset Allocation Portfolio (Substitution 38) |

| • | Ibbotson Aggressive Growth ETF Asset Allocation Portfolio (Substitution 39) |

Shares of the funds offered through the ALPS Variable Investment Trust are registered under the 1933 Act.

| V. | Variable Insurance Products Fund II |

Fidelity’s Variable Insurance Products Fund II is registered under the 1940 Act as anopen-end management investment company and currently offers a number of separate investment portfolios, including the:

| • | Emerging Markets Portfolio (Existing Portfolio, Substitution 40). |

| • | Index 500 Portfolio (Replacement Portfolio, Substitutions 1 – 11). |

Shares of the portfolios of Variable Insurance Products Fund II are registered under the 1933 Act.

| W. | Calvert Variable Products, Inc. |

Calvert Variable Products, Inc. is registered under the 1940 Act as an open-end management investment company and currently offers a number of separate investment portfolios, including theCalvert VP S&P MidCap 400 Index Portfolio (Replacement Portfolio, Substitutions 12 – 23). Calvert Variable Products, Inc. issues shares of its portfolios, which are registered under the 1933 Act.

| X. | Variable Insurance Products Fund IV |

Fidelity’s Variable Insurance Products Fund IV is registered under the 1940 Act as anopen-end management investment company and currently offers a number of separate investment portfolios, including theReal Estate Portfolio (Replacement Portfolio, Substitution 33). Shares of the portfolios of Variable Insurance Products Fund IV are registered under the 1933 Act.

| Y. | Franklin Templeton Variable Insurance Products Trust |

The Franklin Templeton Variable Insurance Products Trust (“Trust”) is registered under the 1940 Act as anopen-end management investment company and currently offers a number of separate investment portfolios, including theFranklin High Income VIP Fund (Replacement Portfolio, Substitution 34). Shares of the portfolios of the Trust are registered under the 1933 Act).

18

| Z. | Variable Insurance Products Fund V |

Fidelity’s Variable Insurance Products Fund V is registered under the 1940 Act as an open-end investment management company and currently offers a number of separate investment portfolios, including the following Replacement Portfolios:

| • | FundsManager 20% Portfolio (Substitution 35) |

| • | FundsManager 50% Portfolio(Substitution 36) |

| • | FundsManager 60% Portfolio (Substitution 37) |

| • | FundsManager 70% Portfolio(Substitution 38) |

| • | FundsManager 85% Portfolio (Substitution 39) |

Shares of the funds offered through Fidelity’s Variable Insurance Products Fund V are registered under the 1933 Act.

| AA. | American Funds Insurance Series® |

American Funds Insurance Series (“AFIS”) is registered under the 1940 Act as anopen-end investment company and currently offers a number of separate investment portfolios (referred to as “funds”), including theNew World Fund (Replacement Portfolio, Substitution 40). Shares of the funds of the Trust are registered under the 1933 Act.

| VI. | Management of the Portfolios |

| A. | Wilshire Associates Incorporated |

Wilshire Associates Incorporated (“Wilshire Associates”) serves as the investment adviser to, and receives a management fee from, the following Existing Portfolios:

| • | Wilshire 5000 Index Fund(Substitutions 1 and 2), |

| • | Wilshire Large Company Value Portfolio (Substitution 6), |

| • | Wilshire Large Company Growth Portfolio (Substitutions 8 and 9), |

| • | Wilshire Small Company Value Portfolio (Substitution 29), and |

| • | Wilshire Small Company Growth Portfolio (Substitution 32). |

Wilshire Associates Incorporated’s principal business address is 1299 Ocean Avenue, Floor 7, Suite 700, Santa Monica, CA 90401-1085.

Pursuant to an exemptive order from the SEC, Wilshire Associates, without shareholder approval, can replace, add or remove subadvisors that are not “affiliated persons” of Wilshire Associates, as defined in the 1940 Act, and enter into sub-advisory agreements with such subadvisors, upon approval of the board of trustees of the Wilshire Mutual Funds, Inc. (forWilshire 5000 Index Fund, Wilshire Large Company Value Portfolio, Wilshire Large Company Growth Portfolio, Wilshire Small Company Value Portfolio and Wilshire Small Company Growth Portfolio).

Los Angeles Capital Management and Equity Research, Inc. (“Los Angeles Capital”) is a subadvisor to theWilshire 5000 Index Fund, the Wilshire Large Company Value Portfolio, and the Wilshire Large Company Growth Portfolio. Los Angeles Capital’s principal business address is 11150 Santa Monica Boulevard, Los Angeles, CA 90025.

19

Pzena Investment Management, LLC (“Pzena”) and Systematic Financial Management, L.P. (“SFM”) also serve as subadvisors to theWilshire Large Company Value Portfolio. Pzena’s principal business address is 120 West 45th Street, 20th Floor, New York, NY 10036. SFM’s principal business address is 300 Frank W. Burr Boulevard Glenpointe East, 7th Floor, Teaneck, NJ 07666.

Cornerstone Capital Management LLC (“Cornerstone”) and Victory Capital Management Inc. (“Victory”) also serve as investment subadvisors to theWilshire Large Company Growth Portfolio. Cornerstone’s principal business address is 3600 Minnesota Drive, Suite 70, Edina, MN 55435. Victory’s principal business address is 2900 Tiedeman Road, Brooklyn, Ohio 44141.

Los Angeles Capital Management and Equity Research, Inc. and NWQ Investment Management Company, LLC serve as subadvisors to theWilshire Small Company Value Portfolio. Los Angeles Capital Management and Equity Research, Inc.’s principal business address is 11150 Santa Monica Blvd., Suite 200, Los Angeles, CA 90025. NWQ Investment Management Company, LLC’s principal business address is 2049 Century Park East, 16th Floor, Los Angeles, California 90067.

Los Angeles Capital Management and Equity Research, Inc. also serves as subadvisor, along with Ranger Investment Management, L.P., to theWilshire Small Company Growth Portfolio. Ranger Investment Management, L.P.’s principal business address is 2828 N. Harwood Street, Suite 1600, Dallas, Texas 75201.

| B. | Fidelity Management & Research Company |

Fidelity Management & Research Company (“FMR”) serves as the investment manager to, and receives a management fee from, the:

| • | Index 500 Portfolio (Replacement Portfolio, Substitutions 1 – 11), |

| • | Growth & Income Portfolio (Existing Portfolio, Substitution 3), |

| • | Growth Portfolio (Existing Portfolio, Substitution 7), |

| • | Mid Cap Portfolio (Existing Portfolio, Substitution 13), |

| • | High Income Portfolio (Existing Portfolio, Substitution 34), |

| • | Emerging Markets Portfolio (Existing Portfolio, Substitution 40). |

FMR’s principal place of business is 245 Summer Street, Boston, MA 02210.

Among the subadvisors to theGrowth & Income Portfolio and theGrowth Portfolio is FMR Co., Inc. Its principal business address is 82 Devonshire Street, V10G, Boston, MA 02109.

FMR Co., Inc., an affiliate of FMR, and other investment advisers serve as the subadvisors to theMid Cap Portfolio, High Income Portfolio and Emerging Markets Portfolio. The principal business address of FMR and FMR Co., Inc. is 245 Summer Street, Boston, MA 02210. Other affiliates of FMR, located in the United Kingdom, Hong Kong, and Japan assist FMR with foreign investments. Other affiliates of FMR located in Bermuda also assist FMR with foreign investments in relation to theEmerging Markets Portfolio.

20

Geode Capital Management, LLC (“Geode”) and FMR Co., Inc. are the subadvisors to theIndex 500 Portfolio. Geode’s principal business address is 1 Post Square, Boston, MA 02109. FMR Co., Inc.’s principal business address is 82 Devonshire Street, V10G, Boston, MA 02109.

Under the management agreement and pursuant to an exemptive order issued by the Commission, FMR also acts as a manager of managers for the Index 500 Portfolio, meaning that FMR has the responsibility to oversee sub-advisers for the Index 500 Portfolio and recommend the hiring, termination and replacement of suchsub-advisers. Subject to the approval of the Variable Insurance Products Fund II board of trustees, but without a shareholder approval, FMR may replace or hire unaffiliated sub-advisers or amend the terms of their existing sub-advisory agreements.If you approve the proposed Substitution, then that means you approve the Replacement Portfolio’s reliance on this Manager of Managers Order.

| C. | Davis Selected Advisers, L.P. |

Davis Selected Advisers, L.P. serves as the investment adviser to, and receives a management fee from, theDavis Value Portfolio (Existing Portfolio, Substitution 4). Davis Select Advisers, L.P. principal business address is 2949 East Elvira Road, Suite 101, Tucson, Arizona 85756.

Davis Selected Advisers-NY, Inc., a wholly owned subsidiary of Davis Selected Advisers, L.P., is the subadvisor to the Davis Value Portfolio. Davis Selected Advisers-NY, Inc.’s principal business address is 620 Fifth Avenue, 3rd Floor, New York, New York 10020.

| D. | T. Rowe Price Associates, Inc. |

T. Rowe Price Associates, Inc. serves as the investment adviser to, and receives an investment management fee from, the following Existing Portfolios:

| • | T. Rowe Price Equity Income Portfolio – II (Substitution 5), |

| • | T. Rowe Price Small-Cap Stock Fund (Substitution 27), and |

| • | T. Rowe Price Small-Cap Value Fund (Substitution 28). |

T. Rowe Price Associates, Inc.’s principal business address is 100 East Pratt Street, Baltimore, MD 21202.

| E. | Delaware Management Company |

Delaware Management Company (“DMC”), a series of Delaware Management Business Trust, serves as the investment adviser to, and receives an investment management fee from, the following Existing Portfolios (collectively, the “Series”):

| • | Delaware VIP U.S. Growth Series (Substitution 10), |

| • | Delaware VIP Smid Cap Growth Series (Substitution 23), and |

| • | Delaware VIP REIT Series (Substitution 33). |

Delaware Management Company’s principal business address is 2005 Market Street, Philadelphia, PA 19103-7094.

The Series and the DMC have received an exemptive order from the U.S. Securities and Exchange Commission (SEC) to operate under a manager of managers structure that permits

21

DMC, with the approval of the board of trustees of the Delaware VIP Trust, to appoint and replace sub-advisors, enter into sub-advisory agreements, and materially amend and terminate sub-advisory agreements on behalf of each of the Series without shareholder approval. While DMC does not currently expect to use the manager of managers structure with respect to the Series, DMC may do so in the future.

Jackson Square Partners, LLC (“JSP”), located at 101 California Street, Suite 3750, San Francisco, CA 94111, is the sub-advisor to theDelaware VIP Smid Cap Growth Series.

| F. | Lazard Asset Management LLC |

Lazard Asset Management LLC serves as the investment adviser to, and receives a management fee from, theLazard Retirement US Small-Mid Cap Equity Portfolio (Existing Portfolio, Substitution 25). Lazard Asset Management LLC’s principal place of business is 30 Rockefeller Plaza, New York, New York 10112-6300.

| G. | Neuberger Berman Management LLC |

Neuberger Berman Management LLC serves as the investment adviser to, and receives an investment management fee from, theNeuberger Berman Genesis Fund (Existing Portfolio, Substitution 26). Neuberger Berman Management LLC’s principal business address is 605 Third Avenue, 2nd Floor, New York, New York 10158-0180.

Neuberger Berman LLC serves as the subadvisor to theNeuberger Berman Genesis Fund. Neuberger Berman LLC’s principal business address is 605 Third Avenue, 2nd Floor, New York, New York 10158.

| H. | Royce & Associates, LLC |

Royce & Associates, LLC serves as the investment adviser to, and receives an advisory fee from, theRoyce Small-Cap Portfolio (Existing Portfolio, Substitution 30). Royce & Associates, LLC’s principal business address is 745 Fifth Avenue, New York, New York 10151.

| I. | AllianceBernstein L.P. |

AllianceBernstein L.P. serves as the investment adviser to, and receives an investment advisory fee from, the following Existing Portfolios:

| • | Large Cap Growth Portfolio (Substitution 11), |

| • | Small/Mid Cap Value Portfolio (Substitution 19) and |

| • | Small Cap Growth Portfolio (Substitution 31). |

AllianceBernstein L.P.’s principal business address is 1345 Avenue of the Americas, New York, New York 10105.

| J. | The Dreyfus Corporation |

The Dreyfus Corporation serves as the investment adviser to, and receives a management fee from, the:

| • | MidCap Stock Portfolio (Existing Portfolio, Substitution 12) and |

| • | Small Cap Stock Index Portfolio (Replacement Portfolio, Substitutions 12 – 32). |

22

The Dreyfus Corporation’s principal business address is 200 Park Avenue, New York, New York 10166.

Investment decisions for theMidCap Stock Portfolio are made by the Active Equity Team of Mellon Capital Management Corporation, an affiliate of the Dreyfus Corporation.

| K. | Rainier Investment Management, Inc. |

Rainier Investment Management, Inc. serves as the investment adviser to, and receives an investment advisory fee from, theRainier Small/Mid Cap Equity Fund(Existing Portfolio, Substitution 14). Rainier Investment Management, Inc.’s principal business address is 601 Union Street, Suite 2801, Seattle, WA 98101.

| L. | Ariel Investments, LLC |

Ariel Investments, LLC serves as the investment adviser to, and receives an investment advisory fee from, the following Existing Portfolios:

| • | Ariel Appreciation Fund (Substitution 15) and |

| • | Ariel Fund (Substitution 20). |

Ariel Investments, LLC’s principal business address is 200 East Randolph Street, Suite 2900, Chicago, Illinois 60601.

| M. | Goldman Sachs Asset Management, L.P. |

Goldman Sachs Asset Management, L.P. serves as the investment adviser to, and receives an investment advisory fee from, the following Existing Portfolios:

| • | Goldman Sachs Mid Cap Value Fund (Substitution 16) and |

| • | Goldman Sachs Small Cap Equity Insights Fund(Substitution 24). |

Goldman Sachs Asset Management, L.P.’s principal business address is 200 West Street, New York, New York 10282.

| N. | American Century Investment Management, Inc. |

American Century Investment Management, Inc. serves as the investment adviser to, and receives a management fee from, theVP Mid Cap Value Fund(Existing Portfolio, Substitution 17). American Century Investment Management’s principal business address is 4500 Main Street, Kansas City, Missouri 64111.

| O. | Wells Fargo Advantage VT Opportunity Fund |

Wells Fargo Funds Management, LLC (“Funds Management”) serves as the investment adviser to, and receives an advisory fee from, theWells Fargo Advantage VT Opportunity Fund(Existing Portfolio, Substitution 18). Funds Management’s principal business address is 525 Market Street, San Francisco, California 94105.

Funds Management has received an exemptive order from the SEC that permits Funds Management, subject to the approval of the Wells Fargo Variable Trust board of directors, to select or replace certain sub-advisers to manage all or a portion of the assets of the separate investment portfolios of the Wells Fargo Variable Trust (including theWells Fargo AdvantageVT Opportunity Fund) and enter into, amend or terminate a sub-advisory agreement with certain sub-advisers without obtaining shareholder approval.

23

Wells Capital Management Incorporated is the subadvisor to theWells Fargo Advantage VT Opportunity Fund. Wells Capital Management Incorporated’s principal business address is 525 Market Street, San Francisco, California 94105.

| P. | Lord, Abbett & Co., LLC |

Lord, Abbett & Co., LLC serves as the investment adviser to, and receives a management fee from, theGrowth Opportunities Portfolio (Existing Portfolio, Substitution 21). Lord, Abbett & Co., LLC’s principal business address is 90 Hudson Street, Jersey City, NJ 07302-3973.

| Q. | Putnam Investment Management, LLC |

Putnam Investment Management, LLC serves as the investment adviser to, and receives an investment management fee from, thePutnam VT Multi-Cap Growth Fund (Existing Portfolio, Substitution 22). Putnam Investment Management, LLC’s principal business address is 90 Hudson Street, Jersey City, New Jersey 07302-3973.

| R. | ALPS Advisors, Inc. |

ALPS Advisors, Inc. serves as the investment adviser to, and receives an investment management fee from, the following Existing Portfolios:

| • | Ibbotson Conservative ETF Asset Allocation Portfolio (Substitution 35), |

| • | Ibbotson Income and Growth ETF Asset Allocation Portfolio (Substitution 36), |

| • | Ibbotson Balanced ETF Asset Allocation Portfolio (Substitution 37), |

| • | Ibbotson Growth ETF Asset Allocation Portfolio (Substitution 38), and |

| • | Ibbotson Aggressive Growth ETF Asset Allocation Portfolio (Substitution 39). |

ALPS Advisors, Inc. is a registered investment adviser. Its principal business address is 1290 Broadway, #1100, Denver, CO 80203.

| S. | Calvert Investment Management, Inc. |

Calvert Investment Management, Inc. serves as the investment adviser to, and receives an investment advisory fee from, theCalvert VP S&P MidCap 400 Index Portfolio (Replacement Portfolio, Substitutions 12 – 23). Calvert Investment Management, Inc.’s principal place of business is 4550 Montgomery Avenue, Suite 1000N, Bethesda, Maryland 20814.

Ameritas Investment Partners, Inc. (“AIP”) is the subadvisor to theCalvert VP S&P MidCap 400 Index Portfolio. AIP’s principal business address is 390 North Cotner Blvd., Lincoln, Nebraska 68505.

| T. | Fidelity SelectCo, LLC |

Fidelity SelectCo, LLC (“SelectCo”), an affiliate of FMR, serves as investment adviser to, and receives a management fee from, theReal Estate Portfolio (Replacement Portfolio, Substitution 33). FMRC and other investment advisers serve as sub-advisers for the fund. The principal place of business of SelectCo is 1225 17th Street, Denver, Colorado 80202-5541. The principal

24

business address of FMRC is 245 Summer Street, Boston, Massachusetts 02210. Other affiliated investment advisors, located in the United Kingdom, Hong Kong and Japan, assist FMR with foreign investments.

| U. | Franklin Advisers, Inc. |

Franklin Advisers, Inc. serves as the investment adviser to, and receives a management fee from, theFranklin High Income VIP Fund (Replacement Portfolio, Substitution 34). The principal business address of Franklin Advisers, Inc. is One Franklin Parkway, Suite 2100, San Mateo, CA 94403-1906.

| V. | Strategic Advisers, Inc. |

Strategic Advisers, Inc., an affiliate of Fidelity Management & Research Company, serves as the investment manager of, and receives a management fee from, the following Replacement Portfolios:

| • | FundsManager 20% Portfolio (Substitution 35) |

| • | FundsManager 50% Portfolio (Substitution 36) |

| • | FundsManager 60% Portfolio (Substitution 37) |

| • | FundsManager 70% Portfolio (Substitution 38) |

| • | FundsManager 85% Portfolio (Substitution 39) |

The principal business address of Strategic Advisers, Inc. is 245 Summer Street, Boston, Massachusetts 02210.

| W. | Capital Research and Management CompanySM |

Capital Research and Management CompanySM serves as the investment adviser to, and receives a management fee from, theNew World Fund (Replacement Portfolio, Substitution 40). The principal business address of Capital Research and Management Company is 333 South Hope Street, 55th Floor, Los Angeles, CA 90071.

Although Capital Research and Management Company (“CRMC”) has received an exemptive order from the Commission that allows CRMC, subject to the approval of the American Funds Insurance Series board of directors, to materially amend subadvisory agreements without shareholder approval, there is no assurance that CRMC will exercise any authority granted to it under the exemptive order.

| VII. | Comparison of the Portfolios |

The following discussions are primarily a summary of certain parts of the current prospectuses for each Existing Portfolio and each Replacement Portfolio. This Voting Information Statement is accompanied by the current prospectuses for the Existing Portfolios and the Replacement Portfolios, or Owners will have previously received such prospectuses. The most recent annual shareholder report and semi-annual shareholder report for the Replacement Portfolios are available, without charge, upon request. As an Owner with contract value allocated to an Existing Portfolio, you should have received the most recent annual shareholder report and semi-annual shareholder report for that Existing Portfolio. Information contained in this Voting Information Statement is qualified by the more complete information set forth in such prospectuses and reports, which are incorporated by reference herein.

25

As noted below, the investment objectives and principal investment strategies of each Existing Portfolio and its corresponding Replacement Portfolio are substantially similar, and the types of investment advisory and administrative services provided to each Replacement Portfolio are comparable to the types of investment advisory and administrative services provided to the corresponding Existing Portfolio.

Substitutions 1 and 2:

Wilshire 5000 Index Fund (Institutional Class and Investment Class), replaced by Index 500 Portfolio (Service Class 2)

| A. | Comparison of Investment Objectives and Principal Investment Strategies |

Existing Portfolio | Replacement Portfolio | |

| Investment Objective | Investment Objective | |

| To replicate as closely as possible the performance of the Wilshire 5000 IndexSM (the “Index”) before the deduction of Index Fund expenses. | Seeks investment results that correspond to the total return of common stocks publicly traded in the United States, as represented by the S&P 500® Index. | |

| Principal Investment Strategies | Principal Investment Strategies | |

• Invests at least 80% of its assets in the common stock of companies included in the Index that are representative of the Index

• Normally holds stocks representing at least 90% of the total market value of the Index

• May invest in the common stock of companies of any size, includingsmall-cap companies

• Uses enhanced “stratified sampling” techniques—involving sector weighting and portfolio characteristics profiling—in an attempt to replicate the performance of the Index | • Normally invests at least 80% of assets in common stocks included in the S&P 500® Index

• May lend securities to earn income for the fund | |

The Wilshire 5000 Index Fund (Existing Portfolio) and the Index 500 Portfolio (Replacement Portfolio) have similar investment objectives in that each seeks results that correspond to the performance of an index that consists at least principally of equity securities of U.S.-headquartered issuers. The Wilshire 5000 Index Fund and the Index 500 Portfolio also have similar principal investment strategies, concentrating their investments inlarger-capitalization companies.

26

| B. | Comparison of the Portfolios’ Fees and Other Expenses |

The following chart compares the total operating expenses for the year ended December 31, 2014, expressed as an annual percentage of average daily net assets, of the Existing Portfolio and the Replacement Portfolio. It is anticipated that, after the proposed Substitution, the total annual operating expenses of the Replacement Portfolio will be lower than those of the Existing Portfolio (the Institutional Class and the Investment Class). Expenses of the Replacement Portfolio can vary from year to year, however, and could (in the future) exceed those of the Existing Portfolio (the Institutional Class and/or the Investment Class).

| Wilshire 5000 Index Fund (Institutional Class) | Wilshire 5000 Index Fund (Investment Class) | Index 500 Portfolio (Service Class 2) | ||||||||||

Management Fees | 0.10 | % | 0.10 | % | 0.045 | % | ||||||

12b-1 Fees | None | 0.25 | % | 0.25 | % | |||||||

Other Expenses | 0.34 | % | 0.30 | % | 0.055 | % | ||||||

Total Operating Expenses | 0.44 | % | 0.65 | % | 0.35 | % | ||||||

Less Expense Waivers and Reimbursements | N/A | N/A | N/A | |||||||||

Net Operating Expenses | 0.44 | % | 0.65 | % | 0.35 | % | ||||||

| C. | Comparison of Management Fees |

The following charts compare the management fees paid for the fiscal year ending December 31, 2014, expressed as an annual percentage of average daily net assets, by the Existing Portfolio and the Replacement Portfolio.

Existing Portfolio (Wilshire 5000 Index Fund—Institutional and Investment Classes) | Replacement Portfolio (Index 500 Portfolio) | |

0.10% | 0.045% | |

|

|

27

| D. | Comparison of Performance |

The following chart compares the average annual total returns for the Existing and Replacement Portfolios for the one-year, five-year, and ten-year periods for the fiscal year ending December 31, 2014.

Portfolio | 1 Year | 5 Years | 10 Years | |||||||||

Existing Portfolio | ||||||||||||

Institutional Class | 12.60 | % | 15.10 | % | 7.51 | % | ||||||

Investment Class | 12.38 | % | 14.85 | % | 7.29 | % | ||||||

Wilshire 5000 Index (reflects no deduction for fees, expenses, or taxes) | 12.73 | % | 15.56 | % | 8.00 | % | ||||||

Replacement Portfolio | ||||||||||||

Service Class 2 | 13.29 | % | 15.07 | % | 7.35 | % | ||||||

S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 13.69 | % | 15.45 | % | 7.67 | % | ||||||

| E. | Comparison of Principal Investment Risks |

Existing Portfolio (Wilshire 5000 Index Fund—Institutional Class and Investment Class) | Replacement Portfolio (Index 500 Portfolio) | |

• Equity risk

• Index risk

• Small-cap risk | • Stock market volatility

• Issuer-specific changes

• Correlation to index |