alternatively rescission or rescissionary damages associated with the purchase of such certificates. On April 23, 2015, the court granted MS&Co’s motion to dismiss the amended complaint, and on May 21, 2015, the plaintiffs filed a notice of appeal of that order. Following the reversal on appeal of the Court’s order granting defendants’ motion to dismiss on November 17, 2016, on June 15, 2017, plaintiffs filed a second amended complaint. On July 7, 2017, the courtso-ordered a stipulation of partial discontinuance dismissing claims relating to certificates having an original face value of approximately $76 million.

On November 6, 2013, Deutsche Bank, in its capacity as trustee, became the named plaintiff inFederal Housing Finance Agency, as Conservator for the Federal Home Loan Mortgage Corporation, on behalf of the Trustee of the Morgan StanleyABS Capital I Inc. Trust, Series2007-NC3 (MSAC2007-NC3) v. Morgan Stanley Mortgage Capital Holdings LLC, and filed a complaint in the Supreme Court of NY under the captionDeutsche Bank National Trust Company, solely in its capacity as Trustee for Morgan Stanley ABS Capital I Inc. Trust, Series2007-NC3 v. Morgan Stanley Mortgage Capital Holdings LLC, asSuccessor-by-Merger to Morgan Stanley Mortgage Capital Inc. The complaint asserts claims for breach of contract and breach of the implied covenant of good faith and fair dealing and alleges, among other things, that the loans in the trust, which had an original principal balance of approximately $1.3 billion, breached various representations and warranties. The complaint seeks, among other relief, specific performance of the loan breach remedy procedures in the transaction documents, unspecified damages, rescission, interest and costs. On April 12, 2016, the court granted MS&Co’s motion to dismiss the complaint, and granted the plaintiff the ability to seek to replead certain aspects of the complaint. On May 25, 2016, Deutsche Bank filed a notice of appeal of that order. On January 17, 2017, the First Department affirmed the lower court’s order granting the motion to dismiss the complaint. On February 17, 2017, the plaintiff sought leave to appeal the Appellate Division’s affirmance of the partial dismissal of the complaint to the New York Court of Appeals. On April 13, 2017, the Appellate Division, First Department, denied plaintiff’s motion for leave to appeal to the New York Court of Appeals.

On December 30, 2013, Wilmington Trust Company, in its capacity as trustee for Morgan Stanley Mortgage Loan Trust2007-12, filed a complaint against MS&Co styledWilmington Trust Company v. Morgan Stanley Mortgage Capital Holdings LLC et al., pending in the Supreme Court of NY. The complaint asserts claims for breach of contract and alleges, among other things, that the loans in the trust, which had an original principal balance of approximately $516 million, breached various representations and warranties. The complaint seeks, among other relief, unspecified damages, interest and costs. On June 14, 2016, the court granted in part and denied in part MS&Co’s motion to dismiss the complaint. On August 17, 2016, plaintiff filed a notice of appeal of that order. On July 11, 2017, the Appellate Division, First Department, affirmed in part and reversed in part, an order granting in part and denying in part MS&Co’s motion to dismiss.

On April 28, 2014, Deutsche Bank National Trust Company, in its capacity as trustee for Morgan Stanley Structured Trust I2007-1, filed a complaint against MS&Co styledDeutsche Bank National Trust Company v. Morgan Stanley Mortgage Capital Holdings LLC, pending in the United States District Court for the Southern District of New York (“SDNY”). The complaint asserts claims for breach of contract and alleges, among other things, that the loans in the trust, which had an original principal balance of approximately $735 million, breached various representations and warranties. The complaint seeks, among other relief, specific performance of the loan breach remedy procedures in the transaction documents, unspecified compensatory and/or rescissory damages, interest and costs. On April 3, 2015, the court granted in part and denied in part MS&Co’s motion to dismiss the complaint. On May 8, 2017, MS&Co moved for summary judgment in the case.

On September 19, 2014, Financial Guaranty Insurance Company (“FGIC”) filed a complaint against MS&Co in the Supreme Court of NY, styledFinancial Guaranty Insurance Company v. Morgan Stanley ABS Capital I Inc. et al.relating to a securitization issued by Basket of Aggregated Residential NIMS2007-1 Ltd. The complaint asserts claims for breach of contract and alleges, among other things, that the net interest margin securities (“NIMS”) in the trust breached various representations and warranties. FGIC issued a financial guaranty policy with respect to certain notes that had an original balance of approximately $475 million. The complaint seeks, among other relief, specific performance of the NIMS breach remedy procedures in the

40

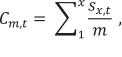

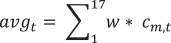

stands for the sum across the included contracts for each of the 17 commodities

stands for the sum across the included contracts for each of the 17 commodities