UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

X. | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 2012

OR

| |

. | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-53611

| | | |

THE DIGITAL DEVELOPMENT GROUP CORP. (Exact name of registrant as specified in its charter) |

| |

Nevada (State or other jurisdiction of incorporation or organization) | 98-0515726 (I.R.S. Employer Identification No.) |

6630 West Sunset Blvd., Los Angeles, California (Address of principal executive offices) | 90028 (Zip Code) |

(800) 783-3128 Registrant's telephone number |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

Title of Each Class None | | Name of Each Exchange on Which Registered None |

Securities registered pursuant to Section 12(g) of the Exchange Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes . No X.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes . No X.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X. No .

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X. No .

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer . | | Accelerated filer . |

Non-accelerated filer . (Do not check if a smaller company) | | Smaller reporting company X. |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes . No X.

The aggregate market value of the shares of common stock held by non-affiliates of the registrant, based upon the closing price of the common stock as of the last business day of the registrant's most recently completed second fiscal quarter as reported on the OTC Bulletin Board ($0.68 per share), was approximately $16,320,000. Shares of common stock held by each executive officer and director and by each person who owned 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The determination of who were a 10% stockholder and the number of shares held by such person as of June 30, 2012 is based on the information provided to the Company in connection with the filing of its Form 8K dated August 6, 2012.

As of July 15, 2013, there were 62,118,383 shares of the registrant's common stock outstanding. The common stock is the registrant's only class of stock currently outstanding.

2

Table of Contents

TABLE OF CONTENTS

3

Table of Contents

EXPLANATORY NOTE

In this report, unless the context indicates otherwise, the terms "DDG," "Company," the “Registrant,” "we," "us," and "our" refer to The Digital Development Group Corp., a Nevada corporation.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the "Securities Act," and Section 21E of the Securities Exchange Act of 1934 or the "Exchange Act." These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or anticipated results.

In some cases, you can identify forward looking statements by terms such as "may," "intend," "might," "will," "should," "could," "would," "expect," "believe," "anticipate," "estimate," "predict," "potential," or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management's current expectations and beliefs, which management believes are reasonable. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

These risks and uncertainties include such factors, among others, as market acceptance and market demand for our products and services, pricing, the changing regulatory environment, the effect of our accounting policies, potential seasonality, industry trends, adequacy of our financial resources to execute our business plan, our ability to attract, retain and motivate key technical, marketing and management personnel, and other risks described from time to time in periodic and current reports we file with the United States Securities and Exchange Commission, or the "SEC." You should consider carefully the statements under "Item 1A. Risk Factors" and other sections of this report, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements and could materially and adversely affect our business, operating results and financial condition. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements.

4

PART I

ITEM 1. BUSINESS

Background

Exchange Transaction

The Company was organized under the laws of the State of Nevada on December 11, 2006 for the purpose of acquiring and developing mineral properties. The Company was unable to generate any revenues from its business operations and unable to raise additional funds to implement its operations. As a result, on July 31, 2012 (the “Closing Date”), the Company closed a voluntary share exchange transaction with Digitally Distributed Acquisition Corp., a Delaware corporation (“DDAC”) and the shareholders of DDAC (“Selling Shareholders”) pursuant to a Share Exchange Agreement dated as of July 31, 2012 (the “Exchange Agreement”) by and among the Company, DDAC, and the Selling Shareholders.

In accordance with the terms of Exchange Agreement, on the Closing Date, the Registrant issued 20,000,000 shares of its common stock to the Selling Shareholders in exchange for 100% of the issued and outstanding capital stock of DDAC (the “Exchange Transaction”). As a result of the Exchange Transaction, the Selling Shareholders acquired 21.39% of our issued and outstanding common stock, DDAC became our wholly-owned subsidiary, and the Company acquired the business and operations of DDAC. From and after the Closing Date, our primary operations consist of the business and operations of DDAC. In the Exchange Transaction, or reverse acquisition, the Company is considered to be the accounting acquiree and DDAC is the accounting acquirer. Immediately after the Exchange Transaction, the Company had 93,500,000 shares of common stock issued and outstanding. In connection with the terms of the Exchange Transaction, certain shares of our common stock were subsequently cancelled.

Prior to the Exchange Transaction, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”). On August 6, 2012, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, the Company filed a Form 8-K (the “Super 8-K”) with the Securities and Exchange Commission containing the information that would be required if the Registrant were filing a general form for registration of securities on Form 10 under the Exchange Act, for the Registrant’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Exchange Transaction. A more detailed description of the Exchange Transaction, and the transactions contemplated thereunder, may be found in the Super 8-K.

DDAC Transaction

On July 31, 2012, DDAC acquired from Digitally Distributed, LLC, a Delaware limited liability company (“DDLLC”), certain tangible and intangible property including certain intellectual property related to a web-based multi-tiered billing infrastructure and to software and other means of syndicating and encoding media content, in exchange for the issuance by DDAC to DDLLC of 13,500,000 shares of DDAC common stock pursuant to a subscription agreement by and between DDAC and DDLLC dated July 31, 2012. DDAC’s technology and assets are focused on the opportunity presented by over-the-top (“OTT”) home entertainment media, which targets DVD players, video game consoles, Smart TVs and stand-alone internet connected devices which delivers content such as Video-on-Demand (“VOD”) services by connecting to users’ internet protocol (“IP”) services. DDAC’s technology will help content owners distribute and monetize their products by delivery to OTT devices.

OTT Market & Strategy

We are focused on the opportunity presented by OTT content, which is defined as the online delivery of video and audio to consumer devices without the Internet Service Provider (“ISP”) being involved in the control or distribution of the content itself.

OTT content is a fast growing market and one that we believe presents opportunities for technology providers that can power the necessary infrastructure. Cisco has forecast that the sum of all video will exceed 91 percent of global consumer Internet traffic by 2014. The Diffusion Group estimates that by the same year, OTT television revenues will reach $5.6 billion. This is supported by such findings as the fact that as of 2009, sixty two percent (62%) of Americans have watched online video on sites such as YouTube and Hulu, and projections that both fixed and mobile broadband subscribers on a global basis will grow from 585 million as of 2009 to more than 1 billion by 2013.

5

| |

| Consumers may access OTT content through a variety of Internet connected devices, ranging from desktop computers to laptops, tablets, televisions with set top boxes from Roku, Google and Apple, smartphones, and gaming consoles including Microsoft’s Xbox, Sony PlayStation and Nintendo Wii. This lends itself to creating additional channels for content consumption, and additional opportunities to repackage and/or repurpose existing intellectual property to maximize its value for the rights holder(s). |

We believe that driving visitors to visit dedicated websites or even to tune in to television programming on a fixed broadcast schedule is becoming more difficult and an outdated concept, as consumers are increasingly adopting a mindset of an on-demand model - essentially, getting what they want, when they want it, and not having this dictated to them.

We intend to occupy an attractive and valuable niche as a service provider of digitization services, digital content management solutions, and distribution services. We aim to occupy a space managing the relationships between content owners and the various internet TV platforms.

Industry

According to Internet World Stats, Internet penetration in North America as of 2011 has reached 78.6 percent, with Internet service reaching more than 273 million people. The International Telecommunications Union (“ITU”) reports that as of 2010, there were more than 85.7 million fixed broadband Internet subscriptions in the U.S., ranking it second behind China (with more than 126.3 million fixed broadband subscriptions).

The rise of mobile broadband and proliferation of smartphones, tablets, laptops and other portable devices which can be used for consuming content has provided additional distribution channels and opportunities for repurposing existing content from the owner’s libraries as well as creating brand new content optimized for specific formats and delivery channels. This phenomenon, while most prevalent in developed, consumer-oriented nations, is also permeating into developing nations such as China, which now accounts for nearly 25 percent of the world’s Internet users. As of 2011, 35 percent of the global population is online (up from only 18 percent in 2006), and 45 percent of these users are under age 25, a demographic which historically has spent considerable time online and engaging with digital media. There are 5.9 billion mobile cellular subscriptions, of which more than 1.2 billion are broadband mobile as illustrated below:

6

Mobile broadband subscriptions have grown 45 percent over the past four years and exceed fixed (wired) broadband subscriptions considerably. Currently, per ITU, 45 percent of the globe has mobile 3G coverage, with 90 percent of the world covered by 2G cellular.

We believe that the opportunity for the Company is global in scale. While the United States is a leader when it comes to producing entertainment content, and that content has strong global appeal (global theatrical film box office sales equaled $32.6 billion in 2011. This increase in revenues is powered by the continuing growth in international markets, up from $22.4 billion in 2010, and increasing despite the fact the North American theatrical box office gross dropped to $10.2 billion in 2011 from $10.6 billion in 2010). The U.S. lags behind many other nations in terms of infrastructure capabilities, particularly with regard to broadband access speeds.

According to the data presented in the following chart from ITU, as of 2011, the U.S. ranked 16th for fixed broadband subscriptions per 100 inhabitants (27.6), trailing much of Scandinavia and some key European and Asian countries, and was ranked 24th for active mobile broadband subscriptions per 100 inhabitants (54.0).

7

Management understands that with a population exceeding 300 million, the U.S. is larger than other countries ranking higher in the above statistics, but it is Management’s view that the failure to continually invest in and update much of the U.S. telecommunications infrastructure is clearly risking its competitive capabilities as well as potentially limiting revenue opportunities. This is another reason why we are keeping an international perspective regarding potential customers for its technology in the future.

Keys to Success

Management has identified the following as critical to the successful execution of our vision:

| | |

| · | Leverage Business Contacts: Management has significant experience in both the entertainment and technology industries and will utilize long-standing relationships to secure beneficial deals with strategic technology partners and potential customers. |

| | |

| · | Robust and Scalable Proprietary Solution: We have developed our own proprietary system which is intentionally designed to be scalable and flexible, providing a full-service, seamless integrated content delivery, monetization, billing and administration platform that can serve the needs and budgets of small content providers and enterprise level applications. |

| | |

| · | Access to Significant Original Content Library: We own and have licensed an intellectual property portfolio of more than 10,000 hours of original and legacy content, of which we are in the process of creating niche programming for the “OTT” players, as part of a syndication strategy which will drive revenues for the Company from subscription and ad based models. |

| | |

| · | Experienced Management Team: We have a very capable senior management team with the experience and proven ability to execute in the market. |

| | |

| · | Proven Partners & Technology Flexibility: The Company’s platform was intentionally designed to support multiple media formats, with a backend that supports PHP, .NET, Python, ColdFusion, Ruby, HTML 5 and Flash; utilizes storage solutions provided by industry leaders Amazon Web Services, Mediatemple and Rackspace; and provides automated encoding of video content and allows streaming to all of the popular devices, including Apple’s suite of iPhones and iPads. |

Mission Statement

Imagine the ability to deploy any type of media content with robust campaign management to every living room set top box in the world. Package this into one single log-in account and you understand our Company.

Business Opportunity

Netflix - the leading provider of OTT content, delivered over a billion hours of content in the month of June 2012, making it a larger provider of content than any cable company in the United States.

However, Netflix has maintained its focus on studio driven films that are also available on other similar services such as Hulu. Our strategy is not to compete with these other services but offer niche content such as its recently licensed content of the “Something Weird library”. We also offer consumers and content owners the ability to monetize their content in a variety of methods.

Although Netflix and Hulu and similar providers have created a large library of content only a small percentage of has been migrated to OTT platforms. Given current Management’s history and contacts, we believe we are poised to be the leader in providing owners of niche content a robust platform to re-purpose and monetize their content on an international scale.

The “OTT” platforms like Roku, Apple TV, Boxee etc. each require a customized format for the data encryption onto the internet. Facilities may charge upwards of $800 dollars per platform to convert the digital master into the required format.

Currently, content owners are required to pay for all of these conversions in order to get distribution. Many content owners are not interested in making the large upfront investment to take niche content online. This has created the opportunity for our Company.

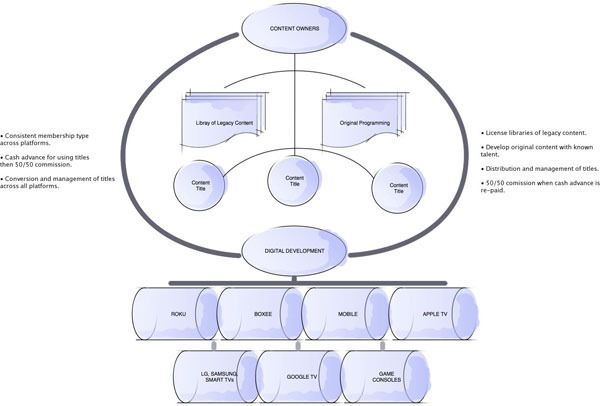

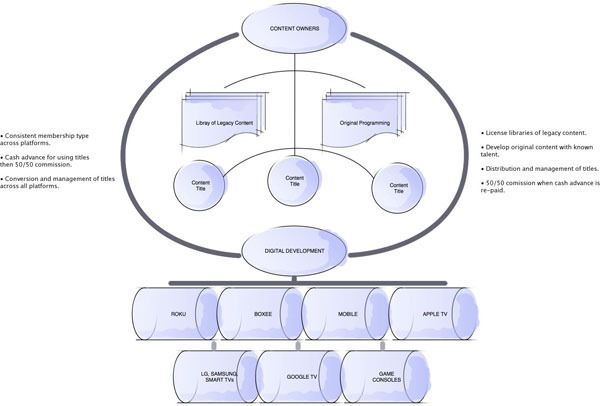

| |

Business Model We will use our team of seasoned content acquirers to offer content owners a unique partnership opportunity. We will offer the content owner a transaction whereby the content owner will be able to migrate content to OTT distribution with no upfront expenses and in some cases an advance against future revenues generated by the content. |

|

Products and Services

We have created a proprietary solution which is capable of delivering high quality OTT content across multiple platforms, and handling all billing and administrative functionality, including reporting, analytics and integrated digital rights management. Our first “channel” was launched in December 2012.

Monetization methods supported by the platform include(s):

| | |

| · | Paid Subscriptions (supporting credit card payments, PayPal, etc.) |

| · | Pay-Per-View (PPV) |

| · | Free & VIP Subscriptions |

| · | Discounts & Coupons |

| · | Video Ads in Any Format |

| · | Interactive Product Placement |

| · | SMS Competitions and Donations |

| · | Differentiated Pricing |

9

We give the power back to the content owner, as well as empower the consumers, and create a symbiotic direct-to-consumer relationship for the content owners/distributors without the involvement of other middlemen (such as ISPs or network operators) which can devalue content. Unlike the Netflix model, which essentially has a “one price fits all” mentality, our technology allows complete personalization of content delivery based on various factors. For example, on Valentine’s Day any content classified as “love interest” can be priced at special rates, or content can be designated for special promotions or even given freely to certain audience segments while others are billed for viewing.

Live, up-to-date reporting provides the content owners with important controls and metrics including:

| | | | | | | |

| o | Social media engagement |

| o | Video analytics |

| o | Financial reporting |

| o | Content syndication analysis |

| o | Digital Rights Management (DRM) |

| o | Agnostic billing system (ties into any 3rd party solution) |

We offer a proprietary secured billing application that can either “plug and play” into any existing customer billing solution or serve as a stand-alone product offering micro-payment capabilities; the ability to track and confirm orders in a real time environment; and utilize other third party billing applications such as PayPal.

Click to Buy Video Media Store Application

One of the “holy grails” for internet-delivered content has been the potential to create impulse buying opportunities for consumers when they view products featured in the online programming. This notion of “click to buy” has certainly been previously attempted, but when handled poorly tends to turn off consumers, who often wish to engage in the passive activity of simply watching their favorite film, television or other programming uninterrupted and without constant “calls-to-action” cluttering the screen. We are developing a “widget” that will enable impulse buying without overly engaging or distracting the consumer; the consumer will have the control to turn on or off this feature, which when activated, provides the customer with a personalized shopping experience. The system is intended to provide insight into consumer behavior and preferences, which may also be utilized to drive more relevant advertising and commerce opportunities.

We are in active discussions with top online retailers that deliver a wide variety of consumer products which can be readily linked to form tags embedded in the content delivered over its system. Our proprietary billing system is scalable and can interface with the retailers’ own customer billing systems, creating a seamless and effortless experience that does not detract from the user’s viewing pleasure.

Intellectual Property

We regard our trademarks, service marks, copyrights, patents, domain names, trade dress, trade secrets, proprietary technologies and similar intellectual property as important to our success. We will use a combination of patent, trademark, copyright and trade secret laws and confidential agreements to protect our proprietary intellectual property. Our ability to protect and enforce our intellectual property rights is subject to certain risks and from time to time we encounter disputes over rights and obligations concerning intellectual property. We cannot provide assurance that we will prevail in any intellectual property disputes.

Sales

We intend to use internal resources combined with commission based consultants to identify, negotiate and contract for content. Our sales team, led by our Chief Executive Officer, Martin Greenwald, has decades of experience in securing the distribution rights for content. We believe that our experienced and qualified sales force is crucial in the success of the Company and we believe that past success in securing these rights indicates a bright future. At this time, we have not achieved any sales.

Employees

The Company currently has 14 full time employees, all of whom have contracts and signed confidentiality agreements.

10

Available Information

Our annual and quarterly reports, along with all other reports and amendments filed with or furnished to the SEC are publicly available free of charge on the Investor section of our website atwww.digidev.com as soon as reasonably practicable after these materials are filed with or furnished to the SEC. Our Code of Ethics is also posted within this section of the website. The information on our website is not part of this or any other report we file with, or furnish to, the SEC. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The address of that site iswww.sec.gov. In addition the SEC maintains a Public Reference Room where you can obtain these materials, which is located at 100 F Street, N.E., Washington, D.C. 20549. To obtain more information on the operation of the Public Reference Room call the SEC at 1-800-SEC-0330.

ITEM 1A. RISK FACTORS

This report includes forward-looking statements about our business and results of operations that are subject to risks and uncertainties. See "Forward-Looking Statements," above. Factors that could cause or contribute to such differences include those discussed below. In addition to the risk factors discussed below, we are also subject to additional risks and uncertainties not presently known to us or that we currently deem immaterial. If any of these known or unknown risks or uncertainties actually occur, our business could be harmed substantially.

Risks Related to Our Business and Industry

We are a development stage company with a limited operating history on which to evaluate our business or base an investment decision.

Our business prospects are difficult to predict because of our limited operating history, early stage of development, unproven business strategy and unproven product. We are a development stage company that has yet to generate any revenue. As a development stage company, we face numerous risks and uncertainties in the competitive markets. In particular, we have not proven that we can: develop our product offering in a manner that enables us to be profitable and meet our customers’ requirements; develop and maintain relationships with key customers and strategic partners that will be necessary to optimize the market value of our products; raise sufficient capital in the public and/or private markets; or respond effectively to competitive pressures. If we are unable to accomplish these goals, our business is unlikely to succeed and you should consider our prospects in light of these risks, challenges and uncertainties.

If we fail to raise additional capital, our ability to implement our business model and strategy could be compromised.

We have limited capital resources. To date, our operations have been funded entirely from the proceeds from equity and debt financings. We expect to require substantial additional capital in the near future to develop and market new products, services and technologies. If we are unable to raise capital when needed, our business, financial condition and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue our operations.

If we are unable to compete effectively, our business will be adversely affected.

The market for content distribution is intensely competitive and subject to rapid change. New technologies and evolving business models for delivery of entertainment video continue to develop at a fast pace. The growth of Internet-connected devices, including TV’s, computers and mobile devices has increased the consumer acceptance of Internet delivery of entertainment video. Through these new and existing distribution channels, consumers are afforded various means for consuming entertainment video. The various economic models underlying these differing means of entertainment video delivery include subscription, pay-per-view, ad-supported and piracy-based models. All of these have the potential to capture meaningful segments of the entertainment video market. Most of our competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we do. They may secure better terms from suppliers, adopt more aggressive pricing and devote more resources to technology, fulfillment, and marketing. New entrants may enter the market with unique service offerings or approaches to providing entertainment video and other companies also may enter into business combinations or alliances that strengthen their competitive positions. If we are unable to successfully or profitably compete with current and new competitors, programs and technologies, our business will be adversely affected, and we may not be able to increase or maintain market share, revenues or profitability.

11

Changes in consumer viewing habits, including more widespread usage of video-on-demand or other similar on demand methods of entertainment video consumption could adversely affect our business.

The manner in which consumers view entertainment video is changing rapidly. Digital cable, wireless and Internet content providers are continuing to improve technologies, content offerings, user interface, and business models that allow consumers to access entertainment video-on-demand with interactive capabilities including start, stop and rewind. The devices through which entertainment video can be consumed are also changing rapidly. Today, content from cable service providers may be viewed on laptops and content from Internet content providers may be viewed on TVs. Although we will provide our own Internet-based delivery of content allowing our customers to stream certain programs and movies to their Internet-connected televisions and other devices, if other providers of entertainment video address the changes in consumer viewing habits in a manner that is better able to meet content distributor and consumer needs and expectations, our business could be adversely affected.

If we are not able to manage our growth, our business could be adversely affected.

We are currently engaged in an effort to expand our operations both domestically and internationally, as well as grow our content base and develop our technology platform across more devices. Many of our systems and operational practices implemented now at our development stage with limited resources will require undertaking efforts to migrate the vast majority of our systems to cloud-based processors. As we undertake all these changes, if we are not able to manage the growing complexity of our business, including improving, refining or revising our systems and operational practices, our business may be adversely affected.

If the market segment for consumer paid commercial free Internet streaming of programs and movies saturates, our business will be adversely affected.

The market segment for consumer paid commercial free Internet streaming of programs and movies has grown significantly. Much of the increasing growth can be attributed to the ability of consumers to stream TV shows and movies on their TVs, computers and mobile devices. A decline in the rate of growth could indicate that the market segment for online subscription-based entertainment video is beginning to saturate. While we believe that this segment will continue to grow for the foreseeable future, if this market segment were to saturate, our business would be adversely affected.

If our efforts to build strong brand identity and improve customer satisfaction and loyalty are not successful, we may not be able to attract or retain customers, and our operating results may be adversely affected.

We must continue to build and maintain strong brand identity. We believe that strong brand identity will be important in attracting customers and content providers who may have a number of choices from which to obtain services we provide. If our efforts to promote and maintain our brand are not successful, our operating results and our ability to attract customers or content providers may be adversely affected. To the extent dissatisfaction with our service is widespread or not adequately addressed, our brand may be adversely impacted and our ability to attract and retain customers or content providers may be adversely affected. With respect to our planned international expansion, we will also need to establish our brand and to the extent we are not successful, our business in new markets would be adversely impacted.

The increasingly long-term and fixed-cost nature of our content acquisition licenses may adversely affect our financial condition and future financial results.

In connection with obtaining content, particularly for streaming content, we will typically enter into multi-year, fixed-fee licenses with content providers, studios and distributors. Furthermore, we plan on increasing the level of committed content licensing in anticipation of our service and customer base growing. To the extent customer and/or revenue growth do not meet our expectations, our liquidity and results of operations could be adversely affected as a result of these content licensing commitments and our flexibility in planning for, or reacting to changes in our business and the market segments in which we operate could be limited.

If we become subject to liability for content that we distribute through our service, our results of operations would be adversely affected.

As a distributor of content, we face potential liability for negligence, copyright, patent or trademark infringement or other claims based on the nature and content of materials that we distribute. If we become liable, then our business may suffer. Litigation to defend these claims could be costly and the expenses and damages arising from any liability could harm our results of operations. We cannot assure that we are insured or indemnified to cover claims of these types or liability that may be imposed on us.

12

If we do not respond effectively and on a timely basis to rapid technological change, our business could suffer.

Our industry is characterized by rapidly changing technologies, industry standards, customer needs and competition, as well as by frequent new product and service introductions. We must respond to technological changes affecting both our customers and content providers. We may not be successful in developing and marketing, on a timely and cost-effective basis, new services that respond to technological changes, evolving industry standards or changing customer requirements. Our success will depend, in part, on our ability to accomplish all of the following in a timely and cost-effective manner:

| | |

| · | Effectively developing, using and integrating new technologies; |

| · | Continuing to develop our technical expertise; |

| · | Enhancing our engineering and system designs; |

| · | Developing products that meet changing customer needs; |

| · | Advertising and marketing our products; and |

| · | Influencing and responding to emerging industry standards and other changes. |

Growth of internal operations and business may strain our financial resources.

We intend to significantly expand the scope of our operating and financial systems in order to build and expand our business. Our growth rate may place a significant strain on our financial resources for a number of reasons, including, but not limited to, the following:

·

The need for continued development of our financial and information management systems;

·

The need to manage strategic relationships and agreements with content providers; and

·

Difficulties in hiring and retaining skilled management, technical and other personnel necessary to support and manage our business.

We cannot give you any assurance that we will adequately address these risks and, if we do not, our ability to successfully expand our business could be adversely affected.

Current global economic conditions may adversely affect our industry, business and result of operations.

The recent disruptions in the current global credit and financial markets has included diminished liquidity and credit availability, a decline in consumer confidence, a decline in economic growth, an increased unemployment rate, and uncertainty about economic stability. There can be no assurance that there will not be further deterioration in credit and financial markets and confidence in economic conditions. These economic uncertainties affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. The current adverse global economic conditions and tightening of credit in financial markets may lead consumers to postpone spending, which may cause our customers to cancel, decrease or delay their existing and future orders with us. We are unable to predict the likely duration and severity of the current disruptions in the credit and financial markets and adverse global economic conditions. If the current uncertain economic conditions continue or further deteriorate, our business and results of operations could be materially and adversely affected.

If we are not able to adequately protect our intellectual property, we may not be able to compete effectively.

Our ability to compete depends in part upon the strength of our proprietary rights in our technologies, brands and content. We expect to rely on a combination of U.S. and foreign patents, copyrights, trademark, trade secret laws and license agreements to establish and protect our intellectual property and proprietary rights. The efforts we have taken and expect to take to protect our intellectual property and proprietary rights may not be sufficient or effective at stopping unauthorized use of our intellectual property and proprietary rights. In addition, effective trademark, patent, copyright and trade secret protection may not be available or cost-effective in every country in which our products are made available. There may be instances where we are not able to fully protect or utilize our intellectual property in a manner that maximizes competitive advantage. If we are unable to protect our intellectual property and proprietary rights from unauthorized use, the value of our products may be reduced, which could negatively impact our business. Our inability to obtain appropriate protections for our intellectual property may also allow competitors to enter our markets and produce or sell the same or similar products and services. In addition, protecting our intellectual property and other proprietary rights is expensive and diverts critical managerial resources. If we are otherwise unable to protect our intellectual property and proprietary rights, our business and financial results could be adversely affected.

If we are forced to resort to legal proceedings to enforce our intellectual property rights, the proceedings could be burdensome and expensive. In addition, our proprietary rights could be at risk if we are unsuccessful in, or cannot afford to pursue, those proceedings. In addition, the possibility of extensive delays in the patent issuance process could effectively reduce the term during which a marketed product is protected by patents.

13

We may also need to obtain licenses to patents or other proprietary rights from third parties. We may not be able to obtain the licenses required under any patents or proprietary rights or they may not be available on acceptable terms. If we do not obtain required licenses, we may encounter delays in development or find that the development, manufacture or sale of products and services requiring licenses could be foreclosed. We may, from time to time, support and collaborate in research conducted by universities and governmental research organizations. We may not be able to acquire exclusive rights to the inventions or technical information derived from these collaborations, and disputes may arise over rights in derivative or related research programs conducted by us or our collaborators.

Assertions against us by third parties for infringement of their intellectual property rights could result in significant costs and cause our operating results to suffer.

Our industry is characterized by vigorous protection and pursuit of intellectual property rights and positions, which results in protracted and expensive litigation for many companies. Other companies with greater financial and other resources than us have gone out of business from costs related to patent litigation and from losing a patent litigation. We may be exposed to future litigation by third parties based on claims that our technologies or activities infringe the intellectual property rights of others. Although we try to avoid infringement, there is the risk that we will use a patented technology owned or licensed by another person or entity and be sued for patent infringement or infringement of another party’s intellectual property or proprietary rights. If we or our products and services are found to infringe the intellectual property or proprietary rights of others, we may have to pay significant damages or be prevented from making, using, selling, and offering for sale or importing such products or services or from practicing methods that employ such intellectual property or proprietary rights.

Further, we may receive notices of infringement of third-party intellectual property rights. Specifically, we may receive claims from various industry participants alleging infringement of their patents, trade secrets or other intellectual property rights in the future. Any lawsuit resulting from such allegations could subject us to significant liability for damages and invalidate our proprietary rights. These lawsuits, regardless of their success, would likely be time-consuming and expensive to resolve and would divert management time and attention. Any potential intellectual property litigation also could force us to do one or more of the following:

| |

· | stop selling content or services or using technology that contain the allegedly infringing intellectual property; |

· | pay damages to the party claiming infringement; |

· | attempt to obtain a license for the relevant intellectual property, which may not be available on commercially reasonable terms or at all; and |

· | attempt to redesign those products or services that contain the allegedly infringing intellectual property with non-infringing intellectual property, which may not be possible. |

The outcome of a dispute may result in our need to develop non-infringing technology or enter into royalty or licensing agreements. We may agree to indemnify certain customers for certain claims of infringement arising out of the sale of our products. Any intellectual property litigation could have a material adverse effect on our business, operating results or financial condition.

Confidentiality agreements with employees and others may not adequately prevent disclosure of our trade secrets and other proprietary information.

Our success depends upon the skills, knowledge and experience of our technical personnel, our consultants and advisors as well as our licensors and contractors. Because we operate in a highly competitive field, we rely almost wholly on trade secrets to protect our proprietary technology and processes. However, trade secrets are difficult to protect. We enter into confidentiality and intellectual property assignment agreements with our corporate partners, employees, consultants, outside scientific collaborators, developers and other advisors. These agreements generally require that the receiving party keep confidential and not disclose to third parties confidential information developed by us during the course of the receiving party’s relationship with us. These agreements also generally provide that inventions conceived by the receiving party in the course of rendering services to us will be our exclusive property. However, these agreements may be breached and may not effectively assign intellectual property rights to us. Our trade secrets also could be independently discovered by competitors, in which case we would not be able to prevent use of such trade secrets by our competitors. The enforcement of a claim alleging that a party illegally obtained and was using our trade secrets could be difficult, expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. The failure to obtain or maintain meaningful trade secret protection could adversely affect our competitive position.

14

If studios and other content owners or distributors refuse to license content to us upon acceptable terms, our business could be adversely affected.

Our ability to distribute content or provide our customers with content they can watch instantly depends on studios and other content owners or distributors licensing us content specifically for Internet delivery. The license periods and the terms and conditions of such licenses vary. If the studios and other content distributors change their terms and conditions or are no longer willing or able to license us content, our ability to distribute content or stream content to our customers will be adversely affected. Streaming content is not subject to the First Sale Doctrine. As such, we are completely dependent on the studio or other content distributor to license us content in order to access, distribute, sublicense and stream content. Many of the licenses provide for the studios or other content distributor to withdraw content from our service relatively quickly. Because of these provisions as well as other actions we may take, content available through our service can be withdrawn on short notice. In addition, the studios and other content distributors have great flexibility in licensing content. They may elect to license content exclusively to a particular provider or otherwise limit the types of services that can deliver streaming content. If we are unable to secure and maintain rights to streaming content or if we cannot otherwise obtain such content upon terms that are acceptable to us, our ability to distribute content will be adversely impacted, and our customer acquisition and retention could also be adversely impacted. As streaming content license agreements expire, we must renegotiate new terms which may not be favorable to us. If this happens, the cost of obtaining content could increase and our margins may be adversely affected. As we grow, we will have to spend an increasingly larger amount for the licensing of streaming content. Any failure to secure content will manifest in lower customer acquisition and retention. Given the multiple-year duration and largely fixed nature of content licenses, if we do not experience customer acquisition and retention as forecasted, our margins may be impacted by these fixed content licensing costs. To the extent that we are unable to resolve any of these issues in an amicable manner, our relationship with the studios and other content distributors or our access to content may be adversely impacted.

Any significant disruption in our technology platform or those of third-parties that we utilize in our operations could result in a loss or degradation of service and could adversely impact our business.

Customers and potential customers access our service through our Web site or their TVs, computers, game consoles or mobile devices. Our reputation and ability to attract, retain and serve our customers is dependent upon the reliable performance of our technology platform and those of third-parties that we utilize in our operations. Interruptions in our ability to deliver content, or with the Internet in general, including discriminatory network management practices, could make our service unavailable or degraded or otherwise hinder our ability to deliver streaming content. Much of our software is proprietary, and we rely on the expertise of our engineering and software development teams for the continued performance of our software and computer systems. Service interruptions, errors in our software or the unavailability of computer systems used in our operations could diminish the overall attractiveness of our service to existing and potential customers.

Our servers and those of third-parties we use in our operations are vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, which could lead to interruptions and delays in our service and operations as well as loss, misuse or theft of data. Our Web site may periodically experience directed attacks intended to cause a disruption in service. Any attempts by hackers to disrupt our service or our internal systems, if successful, could harm our business, be expensive to remedy and damage our reputation. We do not have insurance to cover expenses related to attacks on our Web site or internal systems. Efforts to prevent hackers from entering our computer systems are expensive to implement and may limit the functionality of our services. Any significant disruption to our service or internal computer systems could result in a loss of customers and adversely affect our business and results of operations.

If government regulations relating to the Internet or other areas of our business change, we may need to alter the manner in which we conduct our business, or incur greater operating expenses.

The adoption or modification of laws or regulations relating to the Internet or other areas of our business could limit or otherwise adversely affect the manner in which we currently conduct our business. In addition, the growth and development of the market for online commerce may lead to more stringent consumer protection laws, which may impose additional burdens on us. If we are required to comply with new regulations or legislation or new interpretations of existing regulations or legislation, this compliance could cause us to incur additional expenses or alter our business model.

The adoption of any laws or regulations that adversely affect the growth, popularity or use of the Internet, including laws limiting Internet neutrality, could decrease the demand for our services and increase our cost of doing business. For example, in late 2010, the Federal Communications Commission adopted so-called net neutrality rules intended, in part, to prevent network operators from discriminating against legal traffic that transverse their networks. The rules are currently subject to legal challenge. To the extent that these rules are interpreted to enable network operators to engage in discriminatory practices or are overturned by legal challenge, our business could be adversely impacted. As we expand internationally, government regulation concerning the Internet, and in particular, network neutrality, may be nascent or non-existent. Within such a regulatory environment, coupled with potentially significant political and economic power of local network operators, we could experience discriminatory or anti-competitive practices that could impede our growth, cause us to incur additional expense or otherwise negatively affect our business.

15

Our reputation and relationships with customers would be harmed if our customer data, particularly billing data, were to be accessed by unauthorized persons.

We will maintain personal data regarding our customers, including names and, in many cases, mailing addresses. With respect to billing data, such as credit card numbers, we will rely on licensed encryption and authentication technology to secure such information. We will take measures to protect against unauthorized intrusion into our customers’ data. If, despite these measures, we, or our payment processing services, experience any unauthorized intrusion into our customers’ data, current and potential customers may become unwilling to provide the information to us necessary for them to become customers, we could face legal claims, and our business could be adversely affected. Similarly, if a well-publicized breach of the consumer data security of any other major consumer Web site were to occur, there could be a general public loss of confidence in the use of the Internet for commerce transactions which could adversely affect our business.

If we are unable to protect our domain names, our reputation and brand could be adversely affected.

We currently hold various domain names relating to our brand, including www.digidev.com. Failure to protect our domain names could adversely affect our reputation and brand and make it more difficult for users to find our Web site and our service. The acquisition and maintenance of domain names generally are regulated by governmental agencies and their designees. The regulation of domain names in the United States may change in the near future. Governing bodies may establish additional top-level domains, appoint additional domain name registrars or modify the requirements for holding domain names. As a result, we may be unable to acquire or maintain relevant domain names. Furthermore, the relationship between regulations governing domain names and laws protecting trademarks and similar proprietary rights is unclear. We may be unable, without significant cost or at all, to prevent third-parties from acquiring domain names that are similar to, infringe upon or otherwise decrease the value of our trademarks and other proprietary rights.

In the event of an earthquake or other natural or man-made disaster, our operations could be adversely affected.

Our executive offices and data centers are located in the Los Angeles area, an earthquake sensitive area. Our business and operations could be adversely affected in the event of an earthquake or other natural disaster, as well as from electrical blackouts, fires, floods, power losses, telecommunications failures, break-ins or similar events. We may not be able to effectively shift our operations to handle disruptions in service arising from these events. Because Los Angeles is located in an earthquake-sensitive area, we are particularly susceptible to the risk of damage to, or total destruction of, our executive offices and data centers. We are not insured against any losses or expenses that arise from a disruption to our business due to earthquakes and may not have adequate insurance to cover losses and expenses from other natural disasters.

We may lose key employees or may be unable to hire qualified employees.

We rely on the continued service of our senior management, including our Chief Executive Officer and Chairman, Martin Greenwald, President, Joe Bretz and members of our executive team and other key employees and the hiring of new qualified employees. In our industry, there is substantial and continuous competition for highly skilled business, product development, technical and other personnel. We may not be successful in recruiting new personnel and in retaining and motivating existing personnel, which may be disruptive to our operations.

Risks Relating to our Securities and our Status as a Public Company

The relative lack of public company experience of certain members of our management team may put us at a competitive disadvantage.

Certain members of our management team lack public company experience and are generally unfamiliar with the requirements of the United States securities laws and U.S. Generally Accepted Accounting Principles, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Some of these individuals who now constitute our senior management team have never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

16

Shares of our common stock that have not been registered under the Securities Act of 1933, as amended, regardless of whether such shares are restricted or unrestricted, are subject to resale restrictions imposed by Rule 144, including those set forth in Rule 144(i) which apply to a “shell company.” In addition, any shares of our common stock that are held by affiliates, including any received in a registered offering, will be subject to the resale restrictions of Rule 144(i).

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, we may be deemed a “shell company” pursuant to Rule 144 prior to the Exchange, and as such, sales of our securities pursuant to Rule 144 are not able to be made until a period of at least twelve months has elapsed from the date on which our Current Report on Form 8-K is filed with the Commission reflecting our status as a non- “shell company.” Therefore, any restricted securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after the date of the filing of our Current Report on Form 8-K and we have otherwise complied with the other requirements of Rule 144. As a result, it may be harder for us to fund our operations and pay our employees and consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our previous status as a “shell company” could prevent us from raising additional funds, engaging employees and consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless. Lastly, any shares held by affiliates, including shares received in any registered offering, will be subject to the resale restrictions of Rule 144(i).

We will be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with the Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. Management believes that its internal controls and procedures are currently not effective to detect the inappropriate application of U.S. GAAP rules. Management realize there are deficiencies in the design or operation of our internal control that adversely affect our internal controls which management considers to be material weaknesses including those described below:

| | |

| i) | As of December 31, 2012, the Company did not have a separate functioning audit committee. |

| | |

| ii) | Due to the significant number and magnitude of out-of-period adjustments identified during the year- end closing process, management has concluded that the controls over the period-end financial reporting process were not operating effectively. A material weakness in the period-end financial reporting process could result in us not being able to meet our regulatory filing deadlines and, if not remedied, has the potential to cause a material misstatement or to miss a filing deadline in the future. Management override of existing controls is possible given the small size of the organization and lack of personnel. |

| | |

| iii) | There is no system in place to review and monitor internal control over financial reporting. The Company maintains an insufficient complement of personnel to carry out ongoing monitoring responsibilities and ensure effective internal control over financial reporting |

Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. We cannot assure you that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year-end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

17

If we lose our key management personnel, we may not be able to successfully manage our business or achieve our objectives, and such loss could adversely affect our business, future operations and financial condition.

Our future success depends in large part upon the leadership and performance of our executive management team and key consultants. If we lose the services of one or more of our executive officers or key consultants, or if one or more of them decides to join a competitor or otherwise compete directly or indirectly with us, we may not be able to successfully manage our business or achieve our business objectives. We do not have “Key-Man” life insurance policies on our key executives. If we lose the services of any of our key consultants, we may not be able to replace them with similarly qualified personnel, which could harm our business. The loss of our key executives or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations, and financial condition.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contain a provision permitting us to eliminate the personal liability of our directors to our company and shareholders for damages for breach of fiduciary duty as a director or officer to the extent provided by Nevada law. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a shareholder’s ability to buy and sell our stock.

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

To date, we have not paid any cash dividends and no cash dividends will be paid in the foreseeable future.

We do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We presently intend to retain all earnings for our operations.

18

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.

Our common stock is currently traded under the symbol “DIDG” but currently with low volume, based on quotations on the “OTC Markets,” meaning that the number of persons interested in purchasing our common stock at or near bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is still relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our stock until such time as we became more viable. Additionally, many brokerage firms may not be willing to effect transactions in the securities. As a consequence, there may be periods of several days or more when trading activity in our stock is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that trading levels will be sustained.

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

Our articles of incorporation authorize the issuance of up to 200,000,000 shares of common stock with a par value of $0.001 per share. Our Board of Directors may choose to issue some or all of such shares to acquire one or more companies or properties and to fund our overhead and general operating requirements. The issuance of any such shares may reduce the book value per share and may contribute to a reduction in the market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will reduce the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our corporation.

We may not qualify to meet listing standards to list our stock on an exchange.

The SEC approved listing standards for companies using reverse acquisitions to list on an exchange may limit our ability to become listed on an exchange. We would be considered a reverse acquisition company (i.e., an operating company that becomes an Exchange Act reporting company by combining with a shell Exchange Act reporting company) that cannot apply to list on NYSE, NYSE Amex or Nasdaq until our stock has traded for at least one year on the U.S. OTC market, a regulated foreign exchange or another U.S. national securities market following the filing with the SEC or other regulatory authority of all required information about the merger, including audited financial statements. We would be required to maintain a minimum $4 share price ($2 or $3 for Amex) for at least thirty (30) of the sixty (60) trading days before our application and the exchange’s decision to list. We would be required to have timely filed all required reports with the SEC (or other regulatory authority), including at least one annual report with audited financials for a full fiscal year commencing after filing of the above information. Although there is an exception for a firm underwritten IPO with proceeds of at least $40 million, we do not anticipate being in a position to conduct an IPO in the foreseeable future. To the extent that we cannot qualify for a listing on an exchange, our ability to raisecapital will be diminished.

We may not have the ability to pay our convertible notes when due.The Company has issued convertible promissory notes in March and April 2013 totaling $600,000. The Company does not have sufficient capital to repay the notes as of the date of this report, and may not have sufficient capital to repay the notes when due. The Company’s inability to repay the notes when due would permit the note holders to exercise their default remedies against the Company which could have a material adverse effect on the Company.

Conversion of our convertible notes into common stock could result in additional dilution to our stockholders.Upon the occurrence of certain events of default (including conditions outside of our control) and upon maturity, the convertible notes may be converted into shares of Company common stock by the note holders, and the conversion prices are at a discount to the then current trading price of our common stock. If shares of our common stock are issued due to conversion of some or all of the convertible notes, the ownership interests of existing stockholders would be diluted.

We do not have the ability to pay the Ironridge arbitration award. On May 24, 2013, the Arbitrator in the JAMS arbitration announced an interim award to Ironridge in the amount of $850,000 plus attorney fees and costs, and on July 10, 2013 the Arbitrator ruled the interim award to be final, and awarded Ironridge an additional $110,168 in attorneys’ fees and costs. The Company does not have adequate cash to pay the arbitration award. Any judgment resulting from the arbitration award would adversely affect the business, future operations and the financial condition of the Company, and may cause the Company to default under its existing loan obligations which would provide the lenders with the right for immediate repayment, and/or cause the Company to file for protection under the United States Bankruptcy Code or similar proceedings which could cause all the shareholders to lose the entire value of their investment in the Company.

19

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our corporate offices are located at 6630 West Sunset Blvd., Los Angeles, California 90028, where we lease approximately 5,000 square feet of office space. The lease term, which began on July 1, 2012, expires on November 15, 2013, and the average monthly rental payment including utilities and operating expenses for the facility is approximately $5,935 per month. We believe the leased office space is in good condition and adequate to meet our current and anticipated requirements.

ITEM 3. LEGAL PROCEEDINGS

Effective December 19, 2012, the Company terminated the Securities Purchase Agreement, Registration Rights Agreement and Debenture dated November 6, 2012 (the “Financing Documents”) with Ironridge Media Co., a division of Ironridge Global IV, Ltd. (“Ironridge”), for the sale of up to $3,000,000 of Convertible Subordinated Debentures and Series A Preferred Stock. Subsequent to the termination, Ironridge submitted a claim with JAMS, Inc. in Santa Monica, California for binding arbitration under the Financing Documents and requested that it be awarded damages relating to the termination of the Financing Documents. The Company submitted counter-claims in the JAMS arbitration claiming that it was fraudulently induced to enter into the Financing Documents, and that a fully performed oral stock purchase agreement caused the Financing Documents to be abandoned by the parties, justifying rescission of the financing documents. On May 24, 2013, the Arbitrator in the JAMS arbitration announced an interim award to Ironridge in the amount of $850,000 plus attorney fees and costs. On July 10, 2013, the Arbitrator ruled the interim award to be final, awarded Ironridge an additional $110,168 in attorneys’ fees and costs The Company does not have adequate cash to pay the arbitration award. Any judgment resulting from the arbitration award would adversely affect the business, future operations and the financial condition of the Company, and may cause the Company to default under its existing loan obligations which would provide the lenders with the right for immediate repayment.

ITEM 4. MINE SAFETY DISCLOSURES

None.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is currently trading on the OTC Markets under the symbol “DIDG”. The table below lists the high and low closing prices per share of our common stock since our stock was first traded on April 5, 2012 through December 31, 2012, as quoted on the OTC Markets and the Over-the-Counter Bulletin Board maintained by the Financial Industry Regulatory Authority (“FINRA”). Prior to that time, there was no public market for our common stock.

| | | | | | | | |

For The Year Ended December 31, 2012 | | High | | Low |

Fourth Quarter (October 1, 2012 to December 31, 2012) | | $ | 0.43 | | | $ | 0.09 | |

Third Quarter (June 30, 2012 to September 30, 2012) | | $ | 0.87 | | | $ | 0.23 | |

April 5, 2012 to June 30, 2012 | | $ | 1.35 | | | $ | 0.45 | |

Trading in our common stock has been sporadic and the quotations set forth above are not necessarily indicative of actual market conditions. All prices reflect inter-dealer prices without retail mark-up, mark-down, or commission and may not necessarily reflect actual transactions.

Holders

As of March 29, 2013, there are approximately 37 shareholders of record of our common stock based upon the shareholders’ listing provided by our transfer agent. Our transfer agent is Action Stock Transfer Corp. located at 2469 E. Fort Union Blvd, Suite 214, Salt Lake City, Utah 84121 and its phone number is (801) 274-1088.

20

Dividends