As filed with the Securities and Exchange Commission on June 28, 2007

Registration No. 0-52615

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

ATLAS AMERICA SERIES 27-2006 L.P.

(Exact Name of registrant as specified in its charter)

Delaware | 20-5242075 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification Number) |

311 Rouser Road | 15108 |

Moon Township, Pennsylvania | (Zip Code) |

(Address of principal executive offices) |

Registrant’s telephone number, including area code:

(412) 262-2830

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Units (1)

(Title of Class)

| (1) | Units means limited partner units, converted limited partner units and investor general partner units, which will be automatically converted into the converted limited partner units by our managing general partner once all of our wells are drilled and completed. |

| Item 1 Business | 1 | |||

| General | 1 | |||

| Oil and Natural Gas Properties | 4 | |||

| Production | 5 | |||

| Sale of Natural Gas and Oil Production | 5 | |||

| Major Customers | 11 | |||

| Competition | 11 | |||

| Markets | 11 | |||

| Governmental Regulation | 11 | |||

| Regulation of Production | 11 | |||

| Regulation of Transportation and Sale of Natural Gas | 12 | |||

| Crude Oil Regulation | 12 | |||

| State Regulation | 13 | |||

| Environmental Regulation | 13 | |||

| Dismantlement, Restoration, Reclamation and Abandonment Costs | 14 | |||

| Employees | 14 | |||

| Item 1A Risk Factors | 15 | |||

| Risks Relating to Our Business | 15 | |||

| Natural Gas and Oil Prices are Volatile and a Substantial Decrease in Prices, Particularly Natural Gas Prices, Would Decrease Our Revenues, Our Cash Distributions and the Value of Our Properties and Could Reduce Our Managing General Partner’s Ability to Loan Us Funds and Meet Its Ongoing Obligations to Indemnify Our Investor General Partners and Purchase Units Under Our Presentment Feature | 15 | |||

| Our Hedging Activities May Adversely Affect Our Financial Situation and Results of Operations | 17 | |||

| Drilling Wells is Highly Speculative and We Could Drill Some Wells That Are Nonproductive or That Are Productive, But Fail to Return the Costs of Drilling and Operating Them, and the Drilling of Some of Our Wells Could Be Curtailed, Delayed or Cancelled If Unexpected Events Occur | 17 | |||

| Our Managing General Partner’s Management Obligations to Us Are Not Exclusive, and if It Does Not Devote the Necessary Time to Our Management There Could Be Delays in Providing Timely Reports and Distributions to Our Participants, and Our Managing General Partner, Serving as Operator of Our Wells, May Not Supervise the Wells Closely Enough | 18 | |||

| Current Conditions May Change and Reduce Our Proved Reserves, Which Could Reduce Our Revenues | 18 | |||

| Government Regulation of the Oil and Natural Gas Industry is Stringent and Could Cause Us to Incur Substantial Unanticipated Costs for Regulatory Compliance, Environmental Remediation of Our Well Sites (Which May Not Be Fully Insured) and Penalties, and Could Delay or Limit Our Drilling Operations | 19 | |||

| Our Natural Gas and Oil Activities Are Subject to Drilling and Operating Hazards Which Could Result in Substantial Losses to Us | 21 | |||

| Our Total Annual Cash Distributions During Our First Five Years May be Less than $2,500 Per Unit | 21 | |||

| Increases in Drilling and Operating Costs Could Decrease Our Net Revenues from Our Wells | 21 | |||

| Our Limited Operating History Creates Greater Uncertainty Regarding Our Ability to Operate Profitably | 22 | |||

| Competition May Reduce Our Revenues from the Sale of Our Natural Gas | 22 |

i

| We Sell Our Natural Gas to a Limited Number of Purchasers Without Guaranteed Prices, and if the Prices Paid by the Purchasers Decrease, Our Revenues Also Will Decrease, and if a Purchaser Stops Buying Some or All of Our Natural Gas, the Sale of Our Natural Gas Could Be Delayed Until We Find Another Purchaser and the Substitute Purchaser We Find May Pay a Lower Price, Which Would Reduce Our Revenues | 23 | |||

| We Could Incur Delays in Receiving Payment, or Substantial Losses if Payment is Not Made, for Natural Gas We Previously Delivered to a Purchaser, Which Could Delay or Reduce Our Revenues and Cash Distributions | 23 | |||

| If Third-Parties Participating in Drilling Some of Our Wells Fail to Pay Their Share of the Well Costs, We Would Have to Pay Those Costs in Order to Get the Wells Drilled, and If We Are Not Reimbursed the Increased Costs Would Reduce Our Cash Flow and Possibly Could Reduce the Number of Wells We Can Drill | 24 | |||

| We Intend to Produce Natural Gas and/or Oil from Our Wells Until They Are Depleted, Regardless of Any Changes in Current Conditions, Which Could Result in Lower Returns to Our Participants as Compared With Other Types of Investments Which Can Adapt to Future Changes Affecting Their Portfolios | 24 | |||

| Since Our Managing General Partner Is Not Contractually Obligated to Loan Funds to Us, We Could Have to Curtail Operations or Sell Properties if We Need Additional Funds and Our Managing General Partner Does Not Make the Loan | 24 | |||

| Item 2 Financial Information | 25 | |||

| Selected Financial Data | 25 | |||

| Forward Looking Statements | 26 | |||

| Results of Operations | 26 | |||

| Liquidity and Capital Resources | 27 | |||

| Critical Accounting Policies | 28 | |||

| Use of Estimates | 28 | |||

| Reserve Estimates | 28 | |||

| Impairment of Oil and Gas Properties | 28 | |||

| Dismantlement, Restoration, Reclamation and Abandonment Costs | 29 | |||

| Commodity Price Risk | 29 | |||

| Item 3 Properties | 30 | |||

| Drilling Activity | 30 | |||

| Summary of Productive Wells | 30 | |||

| Production | 31 | |||

| Natural Gas and Oil Reserve Information | 31 | |||

| Title to Properties | 33 | |||

| Acreage | 34 | |||

| Item 4 Security Ownership of Certain Beneficial Owners and Management | 34 | |||

| Item 5 Directors and Executive Officers | 35 | |||

| Managing General Partner | 35 | |||

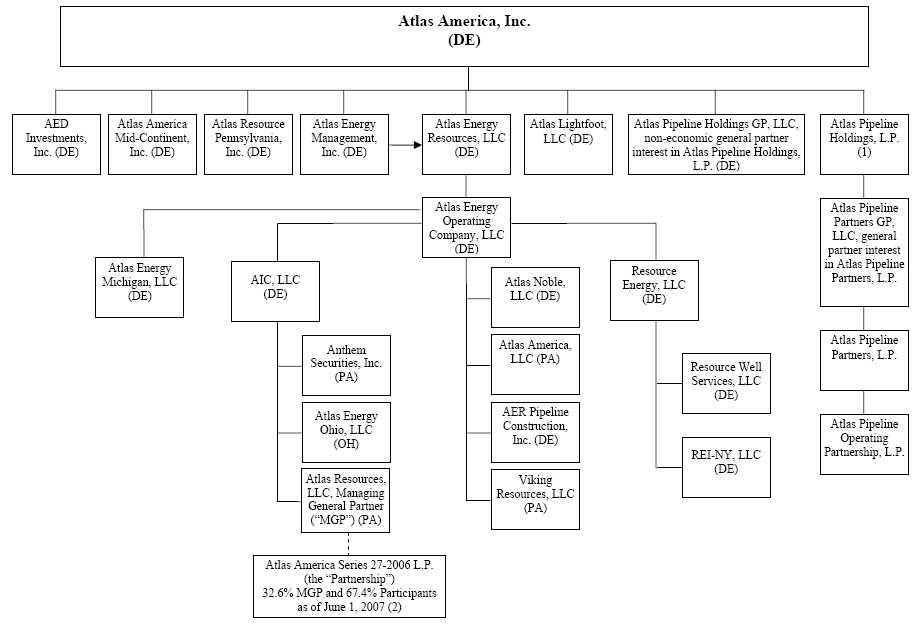

| Organizational Diagram and Security Ownership of Beneficial Owners | 38 | |||

| Officers, Directors and Other Key Personnel of Managing General Partner | 40 | |||

| Atlas America, Inc., a Delaware Company | 46 | |||

| Atlas Energy Resources, LLC, a Delaware Limited Liability Company | 47 | |||

| Atlas Energy Management, Inc., a Delaware Company | 48 |

ii

| Remuneration of Officers and Directors | 48 | |||

| Code of Business Conduct and Ethics | 48 | |||

| Transactions with Management and Affiliates | 49 | |||

| Item 7 Certain Relationships and Related Transactions | 51 | |||

| Oil and Gas Revenues | 51 | |||

| Financial | 52 | |||

| Leases | 52 | |||

| Administrative Costs | 52 | |||

| Direct Costs | 52 | |||

| Drilling Contracts | 52 | |||

| Per Well Charges | 52 | |||

| Gathering Fees | 52 | |||

| Dealer-Manager Fees | 53 | |||

| Organization and Offering Costs | 53 | |||

| Other Compensation | 53 | |||

| Item 8 Legal Proceedings | 53 | |||

| Item 9 Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 53 | |||

| Item 10 Recent Sales of Unregistered Securities | 54 | |||

| Item 11 Description of Registrant’s Securities to be Registered | 55 | |||

| General | 55 | |||

| Liability of Participants for Further Calls and Conversion | 55 | |||

| Distributions and Subordination | 56 | |||

| Participant Allocations | 57 | |||

| Term, Dissolution and Distributions on Liquidation | 57 | |||

| Transferability | 58 | |||

| Presentment Feature | 59 | |||

| Voting Rights and Amendments | 61 | |||

| Books and Records | 62 | |||

| Restrictions on Roll-Up Transactions | 63 | |||

| Withdrawal of the Managing General Partner | 65 | |||

| Item 12 Indemnification of Directors and Officers | 65 | |||

| Item 13 Financial Statements and Supplementary Data | 66 | |||

| Item 14 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 83 | |||

| Item 15 Financial Statements and Exhibits | 83 |

iii

ITEM 1. BUSINESS.

THE FOLLOWING DISCUSSION CONTAINS FORWARD-LOOKING STATEMENTS REGARDING EVENTS AND FINANCIAL TRENDS THAT MAY AFFECT OUR FUTURE OPERATING RESULTS AND FINANCIAL POSITION. THESE STATEMENTS ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE OUR ACTUAL RESULTS AND FINANCIAL POSITION TO DIFFER MATERIALLY FROM THE RESULTS ANTICIPATED IN THOSE STATEMENTS. THESE RISKS INCLUDE RISKS ASSOCIATED WITH DRILLING AND OPERATING OUR WELLS, MARKETING NATURAL GAS AND OIL PRODUCTION FROM THE WELLS, AND FLUCTUATIONS IN MARKET PRICES FOR THE NATURAL GAS AND OIL PRODUCED FROM THE WELLS. FOR A MORE COMPLETE DISCUSSION OF THE RISKS AND UNCERTAINTIES TO WHICH WE ARE SUBJECT, SEE "RISK FACTORS" IN ITEM 1A. THE TERMS “WE,” “OUR”, “US,” “ITS” AND THE “COMPANY” USED IN THIS FORM 10 ARE USED AS REFERENCES TO ATLAS AMERICA SERIES 27-2006 L.P.

General

We were formed as a Delaware limited partnership on July 21, 2006, with Atlas Resources, LLC, a Pennsylvania limited liability company, as our managing general partner. Before March 2006, Atlas Resources, LLC was a Pennsylvania corporation named Atlas Resources, Inc. Our partnership operations began on our first closing on November 6, 2006. When we had our final closing on December 29, 2006, we had 1,359 investors who purchased our Units (our “participants”). “Units” means our limited partner units, our converted limited partner units and our investor general partner units that will automatically be converted by our managing general partner into the converted limited partner units once all of our wells are drilled and completed. In accordance with the terms of our offering, 2,776.079 Units were sold at $25,000 per Unit, 59.321 Units were sold at $23,250 per Unit to selling agents and their registered representatives and principals and clients of a registered investment advisor, no Units were sold to our managing general partner, and its officers, directors and affiliates, and 4.6 Units were sold at $22,125 per Unit to investors who bought Units through the officers and directors of our managing general partner.

Our participants contributed a total of $70,883,000 in subscription proceeds to us, which we paid to our managing general partner serving as our operator and general drilling contractor under our drilling and operating agreement. We used all of our subscription proceeds to drill and complete wells located primarily in western Pennsylvania and central Tennessee as described below. Under our partnership agreement, all of the subscription proceeds of our participants were used to pay the intangible drilling costs of our wells and a portion of the tangible costs. “Intangible drilling costs” generally means those costs of drilling and completing a well that are currently deductible, as compared with lease costs, which must be recovered through the depletion allowance, and equipment costs, which must be recovered through depreciation deductions. “Tangible costs” generally means the equipment costs of drilling and completing a well that are not currently deductible as intangible drilling costs and are not lease costs. Our managing general partner was required to contribute all of the leases on which our wells are situated, pay and/or contribute services towards our organization and offering costs up to an amount equal to 15% of our participants’ subscription proceeds and pay the majority of our equipment costs to drill and complete our wells. As of December 31, 2006, the aggregate amount of these contributions by our managing general partner was $9,751,300. A tabular presentation of the respective capital contributions to us of the participants and our managing general partner as of December 31, 2006 is set forth below.

Capital Contributions to Us As of 12/31/06

| Participants | $ | 70,883,300 | ||

| Managing General Partner | $ | 8,638,700(1 | ) |

| (1) | Our managing general partner’s capital contributions to us increased from $8,638,700 as of December 31, 2006 to $18,390,000 as of March 31, 2007 (unaudited) and are expected to increase further as our drilling activities are completed. Currently, our managing general partner anticipates that its total capital contributions to us eventually will be approximately $24,394,100. |

1

Our investment objectives are to:

| · | Provide monthly cash distributions from the wells drilled with our subscription proceeds until the wells are depleted, with a minimum annual return of capital of 10% aggregate cash distributions per Unit to our participants, which is equal to at least $2,500 per Unit, regardless of the actual subscription price paid, during the first five years beginning with our first distribution of production revenues to our participants. These distributions during the first five years are not guaranteed, but are subject to our managing general partner’s subordination obligation as described in Item 11 “Description of Registrant’s Securities to be Registered - Distributions and Subordination.” |

Under current conditions, and based in part on the drilling results of our 41.63 net initial wells (18% of our total estimated net wells) which were drilled in 2006, we believe that our participants will receive these minimum aggregate distributions of $2,500 per Unit per year during this five year period. See Item 3 “Properties” and Note 2 of the “Notes to Financial Statements” in Item 13 “Financial Statements and Supplementary Data.” However, we do not yet know the drilling results of all of the approximately 188.13 net wells (82% of our total estimated net wells) which we prepaid in 2006 and are currently in the process of being drilled and completed. Therefore, a participant should not place too much reliance on the results of the initial wells we drilled in 2006, until we have finished all of our drilling activities. Also, current conditions, such as prices for natural gas and our costs for operating our wells, will change during the next five years. See Item 1A “Risk Factors - Risks Relating to Our Business.”

2

| · | Obtain federal income tax deductions in 2006 from intangible drilling costs in an amount guaranteed to equal not less than 90% of each participant’s subscription price for his or her Units. These deductions for intangible drilling costs may be used to offset a portion of the participant’s taxable income, subject to any objections by the IRS, each participant’s individual tax circumstances, and the passive activity rules if the participant invested in us as a limited partner. For example, if a participant paid $25,000 for a Unit the investment would produce a 2006 tax deduction of not less than $22,500 per unit, 90%, against: |

| · | ordinary income, or capital gain in some situations, if the participant invested as an investor general partner; and |

| · | passive income if the participant invested as a limited partner. |

In the first quarter of 2007, our IRS Schedule K-1’s to our participants reported a deduction for intangible drilling costs in 2006 in an amount equal to 90% of the subscription price paid by each participant. However, we do not guarantee the IRS’ treatment of our participants’ deductions for intangible drilling costs. If the IRS were to decrease the amount of the deduction, or defer part of the deduction to 2007 for wells we prepaid in 2006, for example, our participants would not be entitled to any reimbursement from us for any increase in taxes owed, penalties or interest or any other lost tax benefits.

| · | Offset a portion of any gross production income generated by us with tax deductions from percentage depletion. |

| · | Provide each of our participants with tax deductions, in an aggregate amount guaranteed to equal the remaining 10% of the participant’s initial investment in us, through annual depreciation deductions over a seven-year cost recovery period. The tax benefits of these depreciation deductions to our participants are subject to any objections by the IRS, each participant’s individual tax circumstances, and the passive activity rules if the participant invested as a limited partner or is a converted limited partner. Also, we do not guarantee the IRS’ treatment of our participants’ depreciation deductions for our equipment costs. If the IRS were to decrease the amount of the deductions, for example, our participants would not entitled to any reimbursement from us for any increase in taxes owed, penalties or interest or any other lost tax benefits. |

3

We are filing this General Form for Registration of Securities on Form 10 to register our Units pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We are subject to the registration requirements of Section 12(g) because at the end of our first fiscal year on December 31, 2006, the aggregate value of our assets exceeded the applicable threshold of $10 million and our Units of record were held by more than 500 persons. Because of our obligation to register our Units with the Securities and Exchange Commission (the “SEC”) under the Exchange Act, we will be subject to the requirements of the Exchange Act rules. In particular, we will be required to file:

| · | quarterly reports on Form 10-QSB; |

| · | annual reports on Form 10-KSB; |

| · | current reports on Form 8-K; and |

| · | otherwise comply with the disclosure obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act. |

Oil and Natural Gas Properties. We have drilled 41.63 net development wells and are in the process of completing those wells. In addition, we are drilling and completing approximately 188.13 additional net development wells, the participants’ costs of which were prepaid in 2006, but which were spudded in the first quarter of 2007. Because all of our wells have not yet been drilled and completed, our investor general partner units have not yet been converted to limited partner units. We will not drill any wells except the wells funded with our initial subscription proceeds and our managing general partner’s capital contributions to us as described above. For further information concerning our natural gas and oil properties, including our leasing practices and our reserve and acreage information, see Item 3 “Properties.”

We believe that our ongoing operating and maintenance costs for our productive wells will be paid through revenues we receive from the sale of our natural gas and oil production as discussed in Item 2 “Financial Information.” Thus, the subscription proceeds from the offering of our Units in 2006 and our ongoing natural gas and oil production revenues from our wells will satisfy all of our cash requirements and we will not seek to raise additional funds from either our participants or new investors. We pay our managing general partner a monthly well supervision fee of $362 per well, as outlined in our drilling and operating agreement, for serving as the operator of our wells. This well supervision fee covers all normal and regularly recurring operating expenses for the production and sale of natural gas and to a lesser extent oil, such as:

| · | well tending, routine maintenance and adjustment; |

| · | reading meters, recording production, pumping, maintaining appropriate books and records; and |

4

| · | preparing reports to us and to government agencies. |

The well supervision fees, however, do not include costs and expenses related to the purchase of certain equipment, materials, rebuilding of access roads and brine disposal or third-party services. If these expenses are incurred, we will pay these expenses at the invoice cost for third-party services performed and materials purchased.

Also, if our managing general partner provides equipment, supplies and other services to us, then it may do so at competitive rates. Our managing general partner will determine competitive industry rates for equipment, supplies and other services by conducting a survey of the interest and/or fees charged by unaffiliated third-parties in the same geographic areas engaged in similar business. If possible, our managing general partner will contact at least two unaffiliated third-parties; however, our managing general partner will have sole discretion in determining the amount to be charged us, subject to the foregoing.

Production. All of our wells are expected to produce, and some of our wells are currently producing, natural gas and to a far lesser extent oil, which are our only products. We do not plan to sell any of our wells and will continue to produce them until they are depleted, at which time they will be plugged and abandoned. See Item 3 “Properties” for information concerning:

| · | our natural gas and oil production quantities; |

| · | average sales prices; and |

| · | average production costs. |

Sale of Natural Gas and Oil Production. Our managing general partner is responsible for selling our natural gas and oil production. In the geographic areas where our wells are situated, our managing general partner is a party to natural gas contracts with various natural gas purchasers, each of which is paying a different price for our natural gas.

Our managing general partner is responsible for gathering and transporting the natural gas produced by us to interstate pipeline systems, local distribution companies, and/or end-users in the area (the “gathering services”). We pay our managing general partner a competitive gathering fee for this service which our managing general partner has determined is currently an amount equal to 13% of the gross sales price received by us for our natural gas. Gross sales price means the price that is actually received by us, adjusted to take into account proceeds received or payments made pursuant to hedging arrangements. However, our managing general partner from time-to-time may increase its gathering fees from 13% to a competitive rate in the geographical area, which is not subject to a ceiling. Our managing general partner will determine competitive industry rates for its gathering services by conducting a survey of gathering fees charged by unaffiliated third-parties in the same geographic areas. If possible, our managing general partner will contact at least two unaffiliated third-parties; however, our managing general partner will have sole discretion in determining the amount to be charged us, subject to the foregoing.

5

Our managing general partner anticipates that it will use the gathering system owned by Atlas Pipeline Partners for the majority of our natural gas production. Our managing general partner’s affiliate, Atlas America, Inc., which is sometimes referred to as “Atlas America,” or another affiliate, controls and manages the gathering system for Atlas Pipeline Partners. Although this management control could be lost under certain circumstances some time in the future, we do not anticipate that we would still be drilling new wells at that time. Also, Atlas America and our managing general partner’s affiliates, Resource Energy, LLC, sometimes referred to as “Resource Energy,” and Viking Resources LLC, sometimes referred to as “Viking Resources,” which are sometimes referred to collectively as the “Atlas Entities”, which do not include us, have an agreement with Atlas Pipeline Partners under which generally all of the gas produced by their affiliated partnerships, which does include us, will be gathered and transported through the gathering system owned by Atlas Pipeline Partners, and provides that the Atlas Entities must pay the greater of $.35 per mcf or 16% of the gross sales price for each mcf transported by these affiliated partnerships through Atlas Pipeline Partners’ gathering system. Subject to the agreement with Atlas Pipeline Partners described above, in providing the gathering services our managing general partner may use gathering systems owned by Atlas Pipeline Partners, independent third-parties and/or affiliates of Atlas America other than Atlas Pipeline Partners.

The payment of a competitive gathering fee to our managing general partner for its gathering services is subject to the following conditions:

| · | If we use the gathering system owned by Atlas Pipeline Partners, then our managing general partner will apply the gathering fee it receives from us towards the payments owed by the Atlas Entities under their agreement with Atlas Pipeline Partners. |

| · | If we use a third-party gathering system, our managing general partner will pay a portion or all of the gathering fee it receives from us to the third-party gathering the natural gas. Our managing general partner may retain the excess of any gathering fees it receives from the partnership over the payments it makes to third-party gas gatherers. If the third-party’s gathering system charges more than an amount equal to 13% of the gross sales price, then our managing general partner’s gathering fee charged to us will be the actual transportation and compression fees charged by the third-party gathering system with respect to our natural gas in the area. |

| · | If we use both a third-party gathering system and the Atlas Pipeline Partners gathering system (or a gas gathering system owned by an affiliate of Atlas America other than Atlas Pipeline Partners), then our managing general partner will receive an amount equal to 13% of the gross sales price plus the amount charged by the third-party gathering system. For purposes of illustration, but not limitation, certain wells drilled by us in the Upper Devonian Sandstone Reservoirs in the McKean County, Pennsylvania secondary area will deliver natural gas produced in this area into a gathering system, a segment of which will be provided by Atlas Pipeline Partners and a segment of which will be provided by a third-party. In this area, our managing general partner’s competitive gathering fee will include the third-party’s fee of $.35 per mcf for transportation and compression, including any increase in the fee by the third-party gatherer from time-to-time, which it will then pay to the third-party gatherer, and our managing general partner will also receive a gathering fee equal to 13% of the gross sales price. |

6

Finally, in connection with the Knox project in the Mississippian and Devonian Shale Reservoirs in the Anderson, Campbell, Morgan, Roane and Scott Counties, Tennessee area, we will deliver natural gas into a gathering system provided by Knox Energy, which is referred to as the Coalfield Pipeline. The Coalfield Pipeline will receive gathering fees of $.55 per mcf plus fees for compression, which it may increase from time-to-time. If the Coalfield Pipeline does not have sufficient capacity to compress and transport the natural gas produced from our wells as determined by Atlas America, then Atlas America or an affiliate other than Atlas Pipeline Partners may construct an additional gathering system and/or enhancements to the Coalfield Pipeline. On completion of the construction, Atlas America will transfer its ownership in the additional gathering system and/or enhancements to the owners of the Coalfield Pipeline, which will then pay Atlas America an amount equal to $.12 per mcf of natural gas transported through the newly constructed and/or enhanced gathering system. If the events described above occur, Coalfield Pipeline will pay this amount to Atlas America from the gathering and compression fees it charges to us. Our managing general partner’s gathering fee in this area also will be 13% of the gross sales price of our natural gas, but will be increased to include the amount of the Coalfield Pipeline fees, if greater, which our managing general partner will then pay to the Coalfield Pipeline.

See Item 5 “Directors and Executive Officers - Organizational Diagram and Security Ownership of Beneficial Owners.”

We have three primary areas where we are drilling our wells. Our managing general partner anticipates that more prospects will be drilled in the Fayette County area, which is one of the primary drilling areas, than in the other areas, and the natural gas produced from the Fayette County area will be sold to UGI Energy Services, ConocoPhillips Company, Equitable Gas Corporation and Colonial Energy pursuant to contracts which end March 31, 2008, except with respect to Colonial Energy which ends March 31, 2009. The natural gas produced from north central Tennessee, which is one of the three primary areas, will be sold to Knox Energy, LLC pursuant to a contract which ends October 31, 2008. After this contract ends, it is anticipated that Atlas America will market its production in the future to purchasers which are not currently known. Before April, 2007, any natural gas produced from our wells drilled in the other primary area (Crawford County area of the Clinton/Medina geological formation in western Pennsylvania) and the secondary areas, other than Armstrong and McKean Counties, Pennsylvania, was sold to Hess Corporation (“Hess”), as discussed below. After April 1, 2007, our managing general partner anticipates that natural gas produced from the Crawford County area of the Clinton/Medina geological formation in western Pennsylvania, which is a primary area, and the Upper Devonian Sandstone Reservoirs in Armstrong and McKean County, Pennsylvania, which are secondary areas, will be sold to Interstate Gas Supply, Inc. pursuant to a contract which ends December 31, 2008. Further, all of the natural gas contracts, including those described above, are between the natural gas purchaser and Atlas America, Atlas Energy Resources, LLC and/or their affiliates. Either Atlas America, Atlas Energy Resources, LLC or their affiliates will receive sales proceeds from the natural gas purchasers and then distribute the sales proceeds to us based on the volume of natural gas produced by us. Until the sales proceeds are distributed to us, they will be subject to the claims of Atlas America’s, Atlas Energy Resources, LLC’s or their affiliates’ creditors.

7

Our managing general partner and its affiliates previously entered into a 10-year agreement with First Energy Solutions Corporation, which was sold by First Energy Solutions Corporation to Hess effective April 1, 2005. Subject to the exceptions set forth below, Hess has the right to buy all of the natural gas produced and delivered by our managing general partner and its affiliates, which includes us, at certain delivery points with the facilities of East Ohio Gas Company, National Fuel Gas Distribution, Columbia of Ohio, and Peoples Natural Gas Company, which are local distribution companies; and National Fuel Gas Supply, Columbia Gas Transmission Corporation and Tennessee Gas Pipeline Company, which are interstate pipelines. This contract, which ends April 1, 2009, is important to our managing general partner and its affiliates because as of July 31, 2006 our managing general partner and its affiliates, including its prior affiliated partnerships, were selling approximately 40.9% of their natural gas production under the agreement with Hess. However, as set forth above, we will sell a much smaller percentage of our natural gas to Hess because of certain exceptions to the agreement, including natural gas sold through interconnects established after the agreement, which includes the majority of the natural gas produced from wells in the Fayette County, Pennsylvania area and natural gas produced from well(s) subject to an agreement under which a third-party was to arrange for the gathering and sale of the natural gas such as natural gas produced from wells in north central Tennessee, one of the primary drilling areas, or in Armstrong and McKean Counties, Pennsylvania, which are both secondary drilling areas, as discussed above.

The pricing and delivery arrangements with all of the natural gas purchasers described above are tied to the settlement of the New York Mercantile Exchange Commission (“NYMEX”) monthly futures contracts price, which is reported daily in the Wall Street Journal and with an additional premium, which is referred to as the basis, paid because of the location of the natural gas (the Appalachian Basin) in relation to the natural gas market. The premium over quoted prices on the NYMEX received by our managing general partner and its affiliates has ranged between $0.51 to $1.07 per mcf during our managing general partner’s past three fiscal years. These figures are based on the overall weighted average that our managing general partner and its affiliates used in their annual reserve reports for their past three fiscal years. Generally, the purchase agreements may be suspended for force majeure, which generally means an Act of God.

8

Pricing for natural gas and oil has been volatile and uncertain for many years. To limit our managing general partner’s and its partnerships’ (including us) exposure to decreases in natural gas prices, our managing general partner and its affiliates, Atlas America and/or Atlas Energy Resources, LLC, use physical hedges through their natural gas purchasers, as discussed below, and financial hedges through contracts such as regulated NYMEX futures and options contracts and non-regulated over-the-counter futures contracts with qualified counterparties. The physical hedges require firm delivery of natural gas and, therefore, are considered normal sales of natural gas, rather than hedges, for accounting purposes. The futures contracts employed by our managing general partner are commitments to purchase or sell natural gas at future dates and generally cover one-month periods for up to 36 months in the future. To assure that the financial instruments will be used solely for hedging price risks and not for speculative purposes, our managing general partner has established a committee to assure that all financial trading is done in compliance with our managing general partner’s hedging policies and procedures. Our managing general partner does not intend to contract for positions that it cannot offset with actual production.

All of the natural gas purchasers described above and many third-party marketers use NYMEX based financial instruments to hedge their pricing exposure, and they make price hedging opportunities available to our managing general partner. The physical hedges are similar to NYMEX based futures contracts, swaps and options, but also require firm physical delivery of the natural gas. Because of this, our managing general partner limits these arrangements to much smaller quantities of natural gas than those projected to be available at any delivery point. The price paid by the natural gas purchasers for certain volumes of natural gas sold under these physical hedge agreements may be significantly different from the underlying monthly spot market value. As of March 31, 2007, none of our managing general partner’s and its affiliates’ natural gas, including our natural gas, is subject to physical hedges and our managing general partner and its affiliates anticipate using financial hedges as discussed below for all of the natural gas that is hedged, although this may change from time to time.

Atlas America implements financial hedges through its banking counter-parties, Wachovia Bank, and KeyBank. Atlas America on behalf of the partnerships, including us, expects to hedge a significant amount of the natural gas production using fixed-for-floating financial swaps. In this regard, the partnerships, including us, have confirmed their authorization to Atlas America and/or Atlas Energy Resources, LLC to enter into the hedging agreements, and have ratified all actions previously taken by Atlas America and/or Atlas Energy Resources, LLC in connection therewith. It is anticipated that since the transfer by Atlas America of our managing general partner to Atlas Energy Resources, LLC, as discussed in Item 5 “Directors and Executive Officers,” a subsidiary of Atlas Energy Resources, LLC, rather than Atlas America, will enter into these hedging arrangements.

9

The percentages of natural gas that are hedged through either financial hedges, physical hedges or not hedged at all will change from time to time in the discretion of Atlas America or Atlas Energy Resources, LLC. It is difficult to project what portion of these hedges will be allocated to us by our managing general partner and its affiliates because of uncertainty about the quantity, timing, and delivery locations of natural gas that may be produced by us. Although hedging provides us some protection against falling prices, these activities also could reduce the potential benefits of price increases and we could incur liability on the financial hedges. For example, we would be exposed to the risk of a financial loss if any of the following occur:

| · | our production is substantially less than expected; |

| · | the counterparties to the futures contracts fail to perform under the contracts; or |

| · | there is a sudden, unexpected event materially impacting natural gas prices. |

Subject to our managing general partner’s and its affiliates’ interest in their natural gas contracts or pipelines and gathering systems, all benefits and liabilities from marketing and hedging or other relationships affecting the property of our managing general partner or its affiliates or us must be fairly and equitably apportioned according to the interests of each in the property. In this regard, the benefits and liabilities of the hedging agreements will be equitably allocated by Atlas America and/or Atlas Energy Resources, LLC and our managing general partner to us and the other partnerships sponsored by our managing general partner and its affiliates pro rata based on actual production, consistent with past practice, and we and the other partnerships sponsored by our managing general partner and its affiliates will be severally liable for our respective allocated share of the liabilities under the hedging agreements, but will not be jointly and severally liable for the entire amount of the liabilities under the hedging agreements. Additionally, Atlas America and/or Atlas Energy Resources, LLC will not be liable for any of those liabilities, or be entitled to any of those benefits, to the extent they are allocated to us and the other partnerships sponsored by our managing general partner and its affiliates.

Crude oil produced from our wells will flow directly into storage tanks where it will be picked up by the oil company, a common carrier, or pipeline companies acting for the oil company which is purchasing the crude oil. Unlike natural gas, crude oil does not present any transportation problem. Our managing general partner anticipates selling any oil produced by our wells to regional oil refining companies at the prevailing spot market price for Appalachian crude oil in spot sales.

10

Major Customers. Our natural gas and oil is sold under contract to various purchasers. For the period ended March 31, 2007, sales to UGI Energy Services, Inc., Colonial Energy, Inc. and Interstate Gas Supply, Inc. accounted for 63%, 17% and 15%, respectively, of total revenues. For the period ended December 31, 2006, sales to UGI Energy Services, Inc., Dominion Field Services, Inc. and Colonial Energy, Inc. accounted for 61%, 22% and 17%, respectively, of total revenues. No other customer accounted for more than 10% of our total revenues for the periods ended March 31, 2007 and December 31, 2006. As of December 31, 2006, however, only six of the total 229.76 net wells we expect to drill and complete were online and producing natural gas. Thus, our percentages of sales to the customers set forth above should not be considered representative of our sales and customers after all of our wells are online and producing.

Competition. The energy industry is intensely competitive in all of its aspects. Competition arises not only from numerous domestic and foreign sources of natural gas and oil, but also from other industries that supply alternative sources of energy. In selling our natural gas and oil, product availability and price are our principal means of competition. We may also encounter competition in obtaining drilling and operating services from third-party providers. Any competition we encounter could delay the drilling and/or operating of our wells, and thus delay the distribution of our revenues to our participants. While it is impossible for us to accurately determine our comparative position in the natural gas and oil industry, we do not consider our operations to be a significant factor in the industry.

Markets. The availability of a ready market for natural gas and oil, and the price obtained, depend on numerous factors beyond our control as described below in Item 1A “Risk Factors - Risks Relating to Our Business.” During fiscal 2006, 2005, and 2004 our managing general partner did not experience problems in selling its and its affiliates’ natural gas and oil, although prices varied significantly during and after those periods.

Governmental Regulation

Regulation of Production. The production of natural gas and oil is subject to regulation under a wide range of local, state and federal statutes, rules, orders and regulations. Federal, state and local statutes and regulations require permits for drilling operations, drilling bonds and reports concerning operations. For example, we have currently incurred drilling permit fees of approximately $203,000, which includes related expenses for some water testing in some areas. These permit fees currently range from nothing in some counties to $1,000 per well to be drilled in Fayette County, Pennsylvania. Other than drilling permit fees, we have not incurred any other material expenses due to governmental regulations, and our managing general partner does not anticipate that we will do so in the future. However, see Item 1A “Risk Factors - Government Regulation of the Oil and Natural Gas Industry is Stringent and Could Cause Us to Incur Substantial Unanticipated Costs for Regulatory Compliance, Environmental Remediation of Our Well Sites (Which May Not Be Fully Insured) and Penalties, and Could Delay or Limit Our Drilling Operations.” All of the states in which we own and operate properties have regulations governing conservation matters, including the regulation of well spacing and plugging and abandonment of wells. The effect of these regulations is to limit the number of wells, or the locations where we can drill wells, although we can apply for exemptions to the regulations to reduce the well spacing. Also, each state generally imposes a production or severance tax for the production and sale of oil, natural gas and natural gas liquids within its jurisdiction. The failure to comply with these rules and regulations can result in substantial penalties. Our competitors in the oil and natural gas industry are subject to the same regulatory requirements and restrictions that affect our operations.

11

Regulation of Transportation and Sale of Natural Gas. Governmental agencies regulate the production and transportation of natural gas. Generally, the regulatory agency in the state where a producing natural gas well is located supervises production activities and the transportation of natural gas sold into intrastate markets, and the Federal Energy Regulatory Commission (“FERC”) regulates the interstate transportation of natural gas.

Natural gas prices have not been regulated since 1993, and the price of natural gas is subject to the supply and demand for natural gas along with factors such as the natural gas’ BTU content and where the wells are located. Since 1985 FERC has sought to promote greater competition in natural gas markets in the United States. Traditionally, natural gas was sold by producers to interstate pipeline companies that served as wholesalers and resold the natural gas to local distribution companies for resale to end-users. FERC changed this market structure by requiring interstate pipeline companies to transport natural gas for third-parties. In 1992 FERC issued Order 636 and a series of related orders that required pipeline companies to, among other things, separate their sales services from their transportation services and provide an open access transportation service that is comparable in quality for all natural gas producers or suppliers. The premise behind FERC Order 636 was that the interstate pipeline companies had an unfair advantage over other natural gas producers or suppliers because they could bundle their sales and transportation services together. FERC Order 636 is designed to ensure that no natural gas seller has a competitive advantage over another natural gas seller because it also provides transportation services.

In 2000 FERC issued Order 637 and subsequent orders to enhance competition by removing price ceilings on short-term capacity release transactions. It also enacted other regulatory policies that are intended to enhance competition in the natural gas market and increase the flexibility of interstate natural gas transportation. FERC has further required pipeline companies to develop electronic bulletin boards to provide standardized access to information concerning capacity and prices.

Crude Oil Regulation. Oil prices are not regulated, and the price is subject to the supply and demand for oil, along with qualitative factors such as the gravity of the crude oil and sulfur content differentials.

12

State Regulation. Our oil and gas operations in Pennsylvania are regulated by the Department of Environmental Resources and our oil and gas operations in Tennessee are regulated by the Tennessee Department of Environment and Conservation. Pennsylvania, Tennessee and the other states where our wells may be situated impose a comprehensive statutory and regulatory scheme for natural gas and oil operations, including supervising the production activities and the transportation of natural gas sold in intrastate markets, which creates additional financial and operational burdens. Among other things, the regulations involve:

| · | new well permit and well registration requirements, procedures, and fees; |

| · | landowner notification requirements; |

| · | certain bonding or other security measures; |

| · | minimum well spacing requirements; |

| · | restrictions on well locations and underground gas storage; |

| · | certain well site restoration, groundwater protection, and safety measures; |

| · | discharge permits for drilling operations; |

| · | various reporting requirements; and |

| · | well plugging standards and procedures. |

Environmental Regulation. Our drilling and producing operations are subject to various federal, state, and local laws covering the discharge of materials into the environment, or otherwise relating to the protection of the environment. The Environmental Protection Agency and state and local agencies will require us to obtain permits and take other measures with respect to:

| · | the discharge of pollutants into navigable waters; |

| · | disposal of wastewater; and |

| · | air pollutant emissions. |

If these requirements or permits are violated, there can be substantial civil and criminal penalties which will increase if there was willful negligence or misconduct. In addition, we may be subject to fines, penalties and unlimited liability for cleanup costs under various federal laws such as the Federal Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Oil Pollution Act of 1990, the Toxic Substance Control Act, and the Comprehensive Environmental Response, Compensation and Liability Act of 1980 for oil and/or hazardous substance contamination or other pollution caused by our drilling activities or the well and its production.

13

Additionally, the well owners’ or operators’ liability can extend to pollution costs from situations that occurred before their acquisition of the well. Pennsylvania and Tennessee have either adopted federal standards or promulgated their own environmental requirements consistent with the federal regulations.

We believe we have complied in all material respects with applicable federal and state regulations and do not expect that these regulations will have a material adverse impact on our operations. Although compliance may cause delays in drilling our wells, which we do not anticipate, or increase our costs, currently we do not believe these costs will be substantial. However, we cannot predict the ultimate costs of complying with present and future environmental laws and regulations because these laws and regulations are constantly being revised, and ultimately they may have a material impact on our operations or costs to remain in compliance. Additionally, we cannot obtain insurance to protect against many types of environmental claims, including remediation costs.

Dismantlement, Restoration, Reclamation and Abandonment Costs. When we determine that a well is no longer capable of producing natural gas or oil in economic quantities, we must dismantle the well and restore and reclaim the surrounding area before we can abandon the well. We contract these operations to independent service providers to which we pay a fee. The contractor will also salvage the equipment on the well, which we then sell in the used equipment market. Under the partnership agreement, our managing general partner and our participants are allocated abandonment costs in the same ratio in which they share in our production revenues (currently 32.6% to our managing general partner and 67.4% to our participants) and the salvage proceeds are allocated between our managing general partner and our participants in the same ratio in which they were charged with our equipment costs, which we estimate will charged be 70% to our managing general partner and 30% to our participants.

As a consequence of the allocation provisions of the partnership agreement described above, our managing general partner generally will receive proceeds from salvaged equipment at least equal to, and typically exceeding, its share of the related equipment costs, whereas our participants may have a shortfall. To cover our participants’ potential shortfall, beginning one year after each of our wells has been placed into production our managing general partner, serving as operator, may retain $200 of our revenues per month to cover the estimated future plugging and abandonment costs of the well. See Notes to Financial Statements.

Employees. We have no employees. Instead, we rely on our managing general partner for management services, and our managing general partner relies on its indirect parent companies, Atlas America and Atlas Energy Resources, LLC and their affiliates, for certain management and administrative services and financing for capital expenditures. See Item 5 “Directors and Executive Officers.”

14

ITEM 1A. RISK FACTORS

Statements made by us that are not strictly historical facts are “forward-looking” statements that are based on current expectations about our business and assumptions made by our managing general partner. These statements are subject to risks and uncertainties that exist in our operations and business environment that could result in actual outcomes and results that are materially different than those predicted.

Risks Relating to Our Business

Natural Gas and Oil Prices are Volatile and a Substantial Decrease in Prices, Particularly Natural Gas Prices, Would Decrease Our Revenues, Our Cash Distributions and the Value of Our Properties and Could Reduce Our Managing General Partner’s Ability to Loan Us Funds and Meet Its Ongoing Obligations to Indemnify Our Investor General Partners and Purchase Units Under Our Presentment Feature. A substantial decrease in natural gas and oil prices, particularly natural gas prices, would decrease our revenues and the value of our natural gas and oil properties. Our future financial condition and results of operations, and the value of our natural gas and oil properties, will depend on market prices for natural gas and, to a much lesser extent, oil. Further, if natural gas and oil prices decrease during the first years of production from our wells, which is when the wells typically achieve their greatest level of production, there would be a greater adverse effect on our distributions to our participants than price decreases in later years when the wells have a lower level of production. Also, our participants’ return level will decrease during our term, even if there are rising natural gas prices, because of reduced production volumes from our wells.

Natural gas and oil prices historically have been volatile and will likely continue to be volatile in the future. Prices our managing general partner has received during its past three fiscal years for its natural gas have ranged from a high of $10.24 per mcf in the quarter ended December 31, 2005 to a low of $6.00 per mcf in the quarter ended March 31, 2004.

Prices for natural gas and oil are dictated by supply and demand factors and prices may fluctuate widely in response to relatively minor changes in the supply of and demand for natural gas or oil, and market uncertainty. For example, reduced natural gas demand and/or excess natural gas supplies will result in lower prices. Other factors affecting the price and/or marketing of natural gas and oil production, which are beyond our control and cannot be accurately predicted, are the following:

| · | the cost, proximity, availability, and capacity of pipelines and other transportation facilities; |

| · | the price and availability of other energy sources such as coal, nuclear energy, solar and wind; |

| · | the price and availability of alternative fuels, including when large consumers of natural gas are able to convert to alternative fuel use systems; |

| · | local, state, and federal regulations regarding production, conservation, and transportation; |

15

| · | overall domestic and global economic conditions; |

| · | the impact of the U.S. dollar exchange rates on natural gas and oil prices; |

| · | technological advances affecting energy consumption; |

| · | domestic and foreign governmental relations, regulations and taxation; |

| · | the impact of energy conservation efforts; |

| · | the general level of supply and market demand for natural gas and oil on a regional, national and worldwide basis; |

| · | weather conditions and fluctuating seasonal supply and demand for natural gas and oil because of various factors such as home heating requirements in the winter months; |

| · | economic and political instability, including war or terrorist acts in natural gas and oil producing countries, including those of the Middle East and South America; |

| · | the amount of domestic production of natural gas and oil; and |

| · | the amount and price of imports of natural gas and oil from foreign sources, including liquid natural gas from Canada and other countries (which our managing general partner believes becomes economic when natural gas prices are at or above $3.50 per mcf), and the actions of the members of the Organization of Petroleum Exporting Countries (“OPEC”), which include production quotas for petroleum products from time to time with the intent of increasing, maintaining, or decreasing price levels. |

These factors make it extremely difficult to predict natural gas and oil price movements with any certainty.

For example, the North American Free Trade Agreement (“NAFTA”) eliminated trade and investment barriers in the United States, Canada, and Mexico. From time to time since then there have been increased imports of Canadian natural gas into the United States. Without a corresponding increase in demand in the United States, the imported natural gas would have an adverse effect on both the price and volume of natural gas sales from our wells.

Price decreases would reduce the amount of our cash flow available for distribution to our participants and could make some of our reserves uneconomic to produce which would reduce our reserves and cash flow. Additionally, price decreases may cause the lenders under our managing general partner’s credit facility to reduce its borrowing base because of lower revenues or reserve values, which would reduce our managing general partner’s liquidity, and, possibly, require mandatory loan repayments from our managing general partner. This would reduce our managing general partner’s ability to loan us money or to meet its ongoing partnership obligations, such as indemnification of our investor general partners for liabilities in excess of their pro rata share of our assets and insurance proceeds and purchasing units presented by our participants.

16

Our Hedging Activities May Adversely Affect Our Financial Situation and Results of Operations. Because the majority of our proved reserves are currently natural gas reserves, we are more susceptible to movements in natural gas prices. Thus, we engage in hedging activities to help protect against falling natural gas prices. However, our hedging activities could reduce the potential benefits of price increases and we could incur liability on financial hedges. For example, we would be exposed to the risk of a financial loss if any of the following occured:

| · | our production is substantially less than expected; |

| · | the counterparties to the futures contracts fail to perform under the contracts; or |

| · | there is a sudden, unexpected event materially impacting natural gas prices. |

Drilling Wells is Highly Speculative and We Could Drill Some Wells That Are Nonproductive or That Are Productive, But Fail to Return the Costs of Drilling and Operating Them, and the Drilling of Some of Our Wells Could Be Curtailed, Delayed or Cancelled If Unexpected Events Occur. The amount of recoverable natural gas and oil reserves may vary significantly from well to well. We may drill some wells that are nonproductive (i.e.“dry holes”), or wells that are profitable on an operating basis, but do not produce sufficient net revenues to return a profit after drilling, operating and other costs are taken into account. The geologic data and technologies available do not allow us to know conclusively before drilling a well whether or not natural gas or oil is present or can be produced economically.

The cost of drilling, completing and operating a well is often uncertain. For example, the increase in natural gas and oil prices over the last several years has increased the demand for drilling rigs and other related equipment, and the costs of drilling and completing natural gas and oil wells also have increased. This has increased our well costs since our wells are drilled by our managing general partner, serving as our general drilling contractor, at cost plus a nonaccountable fixed payment reimbursement to our managing general partner for our participants’ share of our managing general partner’s administrative and oversight fee of $15,000 per well, plus 15% of the cost and the nonaccountable fee fixed payment reimbursement.

Further, some of our drilling operations may be curtailed, delayed or cancelled as a result of many factors, including:

| · | title problems; |

17

| · | environmental or other regulatory concerns; |

| · | costs of, or shortages or delays in the availability of, oil field services and equipment; |

| · | unexpected drilling conditions; |

| · | unexpected geological conditions; |

| · | adverse weather conditions; and |

| · | equipment failures or accidents. |

Any one or more of the factors discussed above could reduce or delay our receipt of natural gas and oil production revenues, thereby reducing or delaying distributions to our participants. As discussed in Item 3 “Properties,” most of our wells are not yet completed and online.

Our Managing General Partner’s Management Obligations to Us Are Not Exclusive, and if It Does Not Devote the Necessary Time to Our Management There Could Be Delays in Providing Timely Reports and Distributions to Our Participants, and Our Managing General Partner, Serving as Operator of Our Wells, May Not Supervise the Wells Closely Enough. We do not have any officers, directors or employees. Instead, we rely totally on our managing general partner and its affiliates for our management. Our managing general partner is required to devote to us the time and attention that it considers necessary for the proper management of our activities. However, our managing general partner and its affiliates currently are, and will continue to be, engaged in other natural gas and oil activities, including other partnerships and unrelated business ventures for their own account or for the account of others, during our term. This creates a continuing conflict of interest in allocating management time, services, and other activities among us and its other activities. If our managing general partner does not devote the necessary time to our management, there could be delays in providing timely annual and semi-annual reports, tax information and cash distributions to our participants. Also, if our managing general partner, serving as the operator of our wells, does not supervise the wells closely enough, for example, there could be delays in undertaking remedial operations on a well, if necessary, to increase the production of natural gas and/or oil from the well.

Current Conditions May Change and Reduce Our Proved Reserves, Which Could Reduce Our Revenues. A participant will be able to recover his investment in us only through our distribution of our net sales proceeds from the production of natural gas and oil from our productive wells. The quantity of natural gas and oil in a well, which is referred to as its reserves, decreases over time as the natural gas and oil is produced until the well is no longer economical to operate. Our proved reserves will decline as they are produced from our wells, and once all of our wells are online our distributions to our participants generally will decrease each year until our wells are depleted.

18

Our proved reserves at December 31, 2006 from the six net wells that we drilled, completed and placed online for production in 2006 of the total 229.76 net wells we anticipate are set forth in Item 3 “Properties - Natural Gas and Oil Reserve Information.” However, there is an element of uncertainty in all estimates of proved reserves, and current conditions, such as natural gas and oil prices and the costs of operating our wells and transporting our natural gas, could change in the future and could reduce the amount of our current proved reserves. Since estimated proved reserves from only six net wells are presented in Item 3 “Properties - Natural Gas and Oil Reserve Information,” our revenues from the sale of our natural gas and oil production once all of our wells have been drilled and placed online for production may vary significantly from our expectations associated with the current estimated proved reserves of the six wells we drilled and placed online for production in 2006. Also, we base our estimates of our proved natural gas and oil reserves and future net revenues from those reserves on analyses that rely on various assumptions, including those required by the SEC, as to natural gas and oil prices, taxes, development expenses, capital expenses, operating expenses and availability of funds. Any significant variance in the future in these assumptions, and, in our case, assumptions concerning future natural gas prices, could materially affect the estimated quantity of our reserves. Actual production, natural gas and oil prices, taxes, development expenses, operating expenses, availability of funds, and quantities of recoverable natural gas and oil reserves in the future will vary substantially from our estimates or the estimates contained in the reserve reports referred to in Item 3 “Properties,” as discussed above.

Our properties also may be susceptible to hydrocarbon drainage from production on adjacent properties in which we do not have an interest. In addition, our proved reserves may be revised downward in the future based on the following:

| · | the actual production history of our wells; |

| · | results of future exploration and development in the area; |

| · | decreases in natural gas and oil prices; |

| · | governmental regulation; and |

| · | other changes in current conditions, many of which are beyond our control. |

Government Regulation of the Oil and Natural Gas Industry is Stringent and Could Cause Us to Incur Substantial Unanticipated Costs for Regulatory Compliance, Environmental Remediation of Our Well Sites (Which May Not Be Fully Insured) and Penalties, and Could Delay or Limit Our Drilling Operations. We are subject to complex laws that can affect the cost, manner or feasibility of doing business. Exploration, development, production and sales of natural gas and oil are subject to extensive federal, state and local regulations. We discuss our regulatory environment in more detail in Item 1 “Business - Governmental Regulation.” We may be required to make large expenditures to comply with these regulations. Failure to comply with these regulations may result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Other regulations may limit our operations. For example, “frost laws” prohibit drilling rigs and other heavy equipment from using certain roads during winter. This is important to us, because in 2006 we prepaid the costs of most of our wells, including the currently deductible intangible drilling costs of the wells, and the drilling of each of those prepaid wells was to begin on or before March 31, 2007 under our drilling and operating agreement. Although the drilling of all of our prepaid wells did begin on or before March 31, 2007, government regulations such as the “frost laws” could delay the completion of our prepaid wells. Also, governmental regulations could change in ways that substantially increase our costs, thereby reducing our return on invested capital, revenues and net income.

19

In addition, our operations may cause us to incur substantial liabilities to comply with environmental laws and regulations. Our natural gas and oil operations are subject to stringent federal, state and local laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations may:

| · | require the acquisition of a permit before drilling begins; |

| · | restrict the types, quantities, and concentration of substances that can be released into the environment in connection with drilling and production activities; |

| · | limit or prohibit drilling activities on certain lands lying within wilderness, wetlands, and other protected areas; and |

| · | impose substantial liabilities for pollution resulting from our operations. |

Failure to comply with these laws and regulations may result in the following:

| · | assessment of administrative, civil, and criminal penalties; |

| · | incurrence of investigatory or remedial obligations; or |

| · | imposition of injunctive relief. |

Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly waste handling, storage, transporting, disposal or cleanup requirements could require us to make significant expenditures to maintain compliance or could restrict our methods or times of operation. Under these environmental laws and regulations, we could be held strictly liable for the removal or remediation of previously released materials or property contamination regardless of whether we were responsible for the release or if our operations were standard in the industry at the time they were performed. We discuss the environmental laws that affect our operations in more detail under Item 1 “Business - Governmental Regulation - Environmental Regulation.”

20

Pollution and environmental risks generally are not fully insurable. The occurrence of an event that is not covered, or not fully covered, by insurance could reduce our revenues and the value of our assets.

Our Natural Gas and Oil Activities Are Subject to Drilling and Operating Hazards Which Could Result in Substantial Losses to Us. Well blowouts, cratering, explosions, uncontrollable flows of natural gas, oil or well fluids, fires, formations with abnormal pressures, pipeline ruptures or spills, pollution, releases of toxic gas and other environmental hazards and risks are inherent drilling and operating hazards for us. The occurrence of any of those hazards could result in substantial losses to us, including liabilities to third-parties or governmental entities for damages resulting from the occurrence of any of those hazards and substantial investigation, litigation and remediation costs.

Our Total Annual Cash Distributions During Our First Five Years May be Less Than $2,500 Per Unit. If our participants’ cash distributions from us are less than a 10% return of their capital (which is $2,500 per Unit based on a $25,000 Unit regardless of the actual price paid) for each of the first five 12-month periods beginning with our first cash distributions from operations, then our managing general partner has agreed to subordinate a portion of its share of our net production revenues. However, if our wells produce only small natural gas and oil volumes, and/or natural gas and oil prices decrease, then even with subordination our participants may not receive the 10% return of capital for each of the first five years as described above. Also, at any time during the subordination period our managing general partner is entitled to an additional share of our revenues to recoup previous subordination distributions to the extent our participants’ cash distributions from us exceed the 10% return of capital described above. A more detailed discussion of our managing general partner’s subordination obligation is set forth in Item 11 “Description of Registrant’s Securities to be Registered - Distributions and Subordination.” Also see “- Current Conditions May Change and Reduce Our Proved Reserves, Which Could Reduce Our Revenues,” above.

Increases in Drilling and Operating Costs Could Decrease Our Net Revenues from Our Wells. The unavailability or high cost of additional drilling rigs, equipment, supplies, personnel and oil field services, such as increased costs for tubular steel, have increased our drilling, completing and operating costs to some degree as compared to those well costs in our managing general partner’s prior partnerships, and could decrease our net revenues from our wells. Also, shortages of drilling rigs, equipment, supplies or personnel could delay completing some of our wells or connecting them to gathering lines, which would delay our receipt of production revenues from the wells.

21

Our Limited Operating History Creates Greater Uncertainty Regarding Our Ability to Operate Profitably. Our limited history of operating our wells may not indicate the results that we may achieve in the future. Our success depends on generating sufficient revenues by producing sufficient quantities of natural gas and oil from our wells and then marketing that natural gas and oil at sufficient prices to pay the operating costs of our wells and our administrative costs of conducting business as a partnership, and still provide a reasonable rate of return on our participants’ investment in us. If we are unable to pay our costs, then we may need to:

| · | borrow funds from our managing general partner, which is not contractually obligated to make any loans to us; |

| · | shut-in or curtail production from some of our wells; or |

| · | attempt to sell some of our wells, which we may not be able to do on terms that are acceptable to us. |

Also, the events set forth below could decrease our revenues from our wells and/or increase our expenses of operating our wells:

| · | decreases in the price of natural gas and oil, which are volatile; |

| · | changes in the oil and gas industry, including changes in environmental regulations, which could increase our costs of operating our wells in compliance with any new environmental regulations; |

| · | an increase in third-party costs for equipment or services, or an increase in gathering and compression fees for transporting our natural gas production; and |

| · | problems with one or more of our wells, which could require repairing or performing other remedial work on a well or providing additional equipment for the well. |

Competition May Reduce Our Revenues from the Sale of Our Natural Gas. Competition from other natural gas producers and marketers in the Appalachian Basin, as well as competition from alternative energy sources, may make it more difficult to market our natural gas. Our competitors may be able to offer their natural gas to natural gas purchasers on better terms, such as lower prices or a greater volume of natural gas that can be delivered to the purchaser, which we cannot match. Also, other energy sources such as coal may be available to the purchasers at a lower price. As a result, we may have to seek other natural gas purchasers and we may receive lower prices for our natural gas and incur higher transportation and compression fees if we sell our natural gas to these other natural gas purchasers. In this event, our revenues from the sale of our natural gas would be reduced.

22

We Sell Our Natural Gas to a Limited Number of Purchasers Without Guaranteed Prices, and if the Prices Paid by the Purchasers Decrease, Our Revenues Also Will Decrease, and if a Purchaser Stops Buying Some or All of Our Natural Gas, the Sale of Our Natural Gas Could Be Delayed Until We Find Another Purchaser and the Substitute Purchaser We Find May Pay a Lower Price, Which Would Reduce Our Revenues. We will depend initially on a limited number of natural gas purchasers to purchase the majority of our natural gas production as described in Item 1 “Business - General - Sale of Natural Gas and Oil Production” and “- General - Major Customers,” and we will not be guaranteed a specific natural gas price, other than through hedging. Thus, if our current purchasers, including those listed above, were to pay a lower price for our natural gas in the future, our revenues would decrease. Also, if our current purchasers, including those listed above, began buying a reduced percentage of our natural gas, or stopped buying any of our natural gas, the sale of our natural gas could be delayed until we found another purchaser, and the substitute purchaser or purchasers we found may pay lower prices for our natural gas, which would reduce our revenues.

Also, our managing general partner anticipates that it will use the gathering system owned by Atlas Pipeline Partners for the majority of our natural gas as described in Item 1 “Business - General - Sale of Natural Gas and Oil Production.” Atlas Pipeline Partners GP, LLC, which is a wholly-owned subsidiary of Atlas Pipeline Holdings, L.P., an affiliate of Atlas America, and the indirect parent company of our managing general partner, controls and manages the gathering system for Atlas Pipeline Partners. (See Item 5 “Directors and Executive Officers - Organizational Diagram and Security Ownership of Beneficial Owners.”) Atlas Pipeline Holdings, L.P., as a public company, may be more susceptible to a change of control from Atlas America’s affiliates to independent third-parties. Also, if Atlas Pipeline Partners GP, LLC were removed as general partner of Atlas Pipeline Partners without cause and without its consent the amount of gathering fees required to be paid by us for natural gas transported through Atlas Pipeline Partners’ gathering system could increase, because Atlas Pipeline Partners GP, LLC would no longer receive revenues from Atlas Pipeline Partners. However, Atlas America and its affiliates would still be obligated to pay the difference between the amount in the master natural gas gathering agreement and the amount paid by us, except with respect to new wells drilled after the removal of the general partner. Thus, if that situation ever occurred, our managing general partner and its affiliates may have an incentive to increase the gathering fees we pay, which would reduce our cash distributions.

We Could Incur Delays in Receiving Payment, or Substantial Losses if Payment is Not Made, for Natural Gas We Previously Delivered to a Purchaser, Which Could Delay or Reduce Our Revenues and Cash Distributions. There is a credit risk associated with a natural gas purchaser’s ability to pay. We may not be paid or may experience delays in receiving payment for natural gas that has already been delivered. In this event, our revenues and cash distributions to our participants also would be delayed or reduced. In accordance with industry practice, we typically will deliver natural gas to a purchaser for a period of up to 60 to 90 days before we receive payment. Thus, it is possible that we may not be paid for natural gas that already has been delivered if the natural gas purchaser fails to pay for any reason, including bankruptcy. This ongoing credit risk also may delay or interrupt the sale of our natural gas.

23