Cautionary Statement Regarding Forward-Looking Statements This presentation contains statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward looking statements.”

Discussion of risks and uncertainties that could cause actual results to differ materially from current projections, forecasts, estimates and expectations of Dynegy Inc. (“Dynegy”) is contained in Dynegy’s filings with the Securities and Exchange Commission (the “SEC”). Specifically, Dynegy makes reference and incorporates herein by reference to the section entitled “Risk Factors” in its most recent Form 10-K and subsequent reports on Form 10-Q, and the section entitled “Cautionary Statement Regarding Fo rward-Looking Statements” in its most recent definitive proxy statement filed with the SEC on October 4, 2010. In addition to the risks and uncertainties set forth in Dynegy’s SEC reports or periodic reports, the forward-looking statements described in this presentation could be affected by, among other things, (i) the timing and anticipated benefits to be achieved through Dynegy’s 2010-2013 company-wide cost savings program; (ii) beliefs and assumptions relating to liquidity, available borrowing capacity and capital resources generally; (iii) expectations regarding environmental matters, including costs of compliance, availability and adequacy of emission credits, and the impact of ongoing proceedings and potential regulations or changes to current regulations, including those relating to climate change, air emissions, cooling water intake structures, coal combustion byproducts, and other laws and regulations to which Dynegy is, or could become, subject; (iv) beliefs about commodity pricin g and generation volumes; (v) anticipated liquidity in the regional power and fuel markets in which Dynegy transacts, including the extent to which such liquidity could be affected by poor economic and financial market conditions or new regulations and any resulting impacts on financial institutions and other current and potential counterparties; (vi) sufficiency of, access to and costs associated with coal, fuel oil and natural gas inventories and transportation thereof; (vii) beliefs and assumptions about market competition, generation capacity and regional supply and demand characteristics of the wholesale power generation market, including the anticipation of a market recovery over the longer term; (viii) the effectiveness of Dynegy’s strategies to capture opportunities presented by changes in commodity prices and to manage its exposure to energy price volatility; (ix) beliefs and assumptions about weather and general economic conditions; (x) beliefs regarding the U.S. economy, its trajectory and i ts impacts, as well as Dynegy’s stock price; (xi) projected operating or financial results, including anticipated cash flows from operations, revenues and profitability; (xii) beliefs and expectations regarding the Plum Point Project; (xiii) expectations regarding Dynegy’s revolver capacity, credit facility compliance, collateral demands, capital expenditures, interest expense and other payments; (xiv) Dynegy’s focus on safety and its ability to efficiently operate its assets so as to maximize its revenue generating opportunities and operating margins; (xv) beliefs about the outcome of legal, regulatory, administrative and legislative matters; (xvi) expectations and estimates regarding capital and maintenance expenditures, including the Midwest Consent Decree and its associated costs; and (xvii) uncertainties associated with the proposed transaction between Dynegy and an affiliate of Blackstone (the “Merger”), including uncertainties relating to the anticipated timing of filings and approvals relating to the merger and the sale by an affiliate of Blackstone of certain assets to NRG Energy, Inc. (the “NRG Sale”), the outcome of legal proceedings that have been or may be instituted against Dynegy and/or others relating to the merger agreement and/or the NRG Sale, the expected timing of completion of the merger, the satisfaction of the conditions to the consummation of the merger with an affiliate of Blackstone and the NRG Sale and the ability to complete the merger. Any or all of Dynegy’s forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond Dynegy’s control. Non-GAAP Financial Measures: This presentation contains non-GAAP financial measures including Enterprise Value, EBITDA, Adjusted EBITDA, EBITDAR, Adjusted EBITDAR, Net Debt and Adjusted Net Debt, Net Debt and Other Obligations and Adjusted Debt. Reconciliations of these measures to the most directly comparable GAAP measures to the extent available without unreasonable effort are contained herein. To the extent required, statements disclosing the definitions of such non-GAAP financial measures are included herein. WHERE YOU CAN FIND MORE INFORMATION In connection with merger, Dynegy filed a definitive proxy statement with the SEC on October 4, 2010 and a definitive proxy statement and form of proxy was mailed to the stockholders of Dynegy on or about this date. BEFOR E MAKING ANY VOTING DECISION, DYNEGY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Dynegy’s stockholders are able to obtain, without charge, a copy of the definitive proxy statement and other relevant documents filed with the SEC from the SEC’s website at http://www.sec.gov. Dynegy’s stockholders are also able to obtain, without charge, a copy of the definitive proxy statement and other relevant documents by directing a request by mail or telephone to Dynegy Inc., Attn: Corporate Secretary, 1000 Louisiana Street, Suite 5800, Houston, Texas 77002, telephone: (713) 507-6400, or from the Dynegy’s website, http://www.dynegy.com. PARTICIPANTS IN THE SOLICITATION Dynegy and its directors and officers may be deemed to be participants in the solicitation of proxies from Dynegy’s stockholders with respect to the Merger. Information about Dynegy’s directors and executive officers and their ownership of Dynegy’s common stock is set forth in the proxy statement for Dynegy’s 2010 Annual Meeting of Stockholders, which was filed with the SEC on April 2, 2010. Stockholders may obtain additional information regarding the interests of Dynegy and its directors and executive officers in the Merger, which may be different than those of Dynegy’s stockholders generally, by reading the definitive proxy statement and other relevant documents regarding the Merger.

3

Overview

• The Dynegy/Blackstone transaction is the result of a lengthy and extensive evaluation of

strategic alternatives by Dynegy to maximize stockholder value

– Contacted 16 parties in the two years prior to announcement of the Blackstone transaction

– Evaluated potential asset sales and other alternatives, including a business combination with a

strategic partner

– Contacted 42 parties in 2010 during the “Go-shop” process, with no superior proposal emerging

– This multi-year process has resulted in Blackstone’s current offer

• Dynegy believes Blackstone’s cash offer of $4.50 per share provides stockholders with

immediate fair value in cash and removes risks associated with market conditions, ongoing

regulatory uncertainties and Dynegy’s capitalization and cash requirements

• Dynegy’s substantial leverage and forecasted negative free cash flow creates a very

challenging liquidity position over time

• Dynegy’s Board has concluded that the risks of continuing to operate as a stand-alone public

company significantly outweigh the potential upside of doing so

An affiliate of The Blackstone Group L.P. has agreed to acquire Dynegy Inc.

in an all-cash transaction valued at ~$4.7 billion, including the assumption

of existing debt

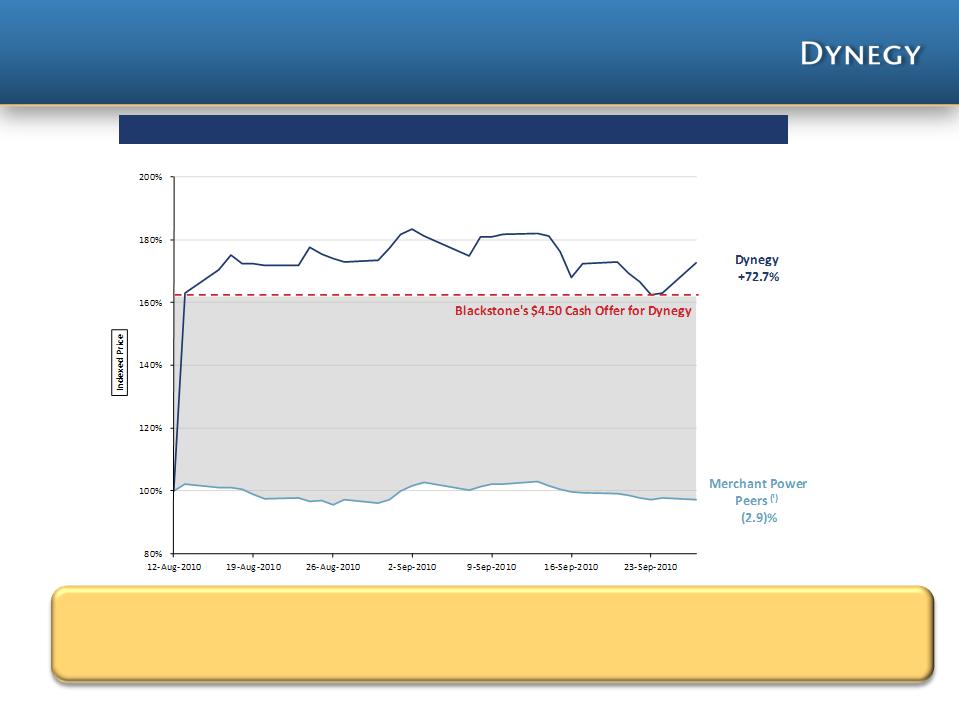

Dynegy’s stock price could trade at or below its pre-announcement

stock price if the Blackstone transaction is not completed

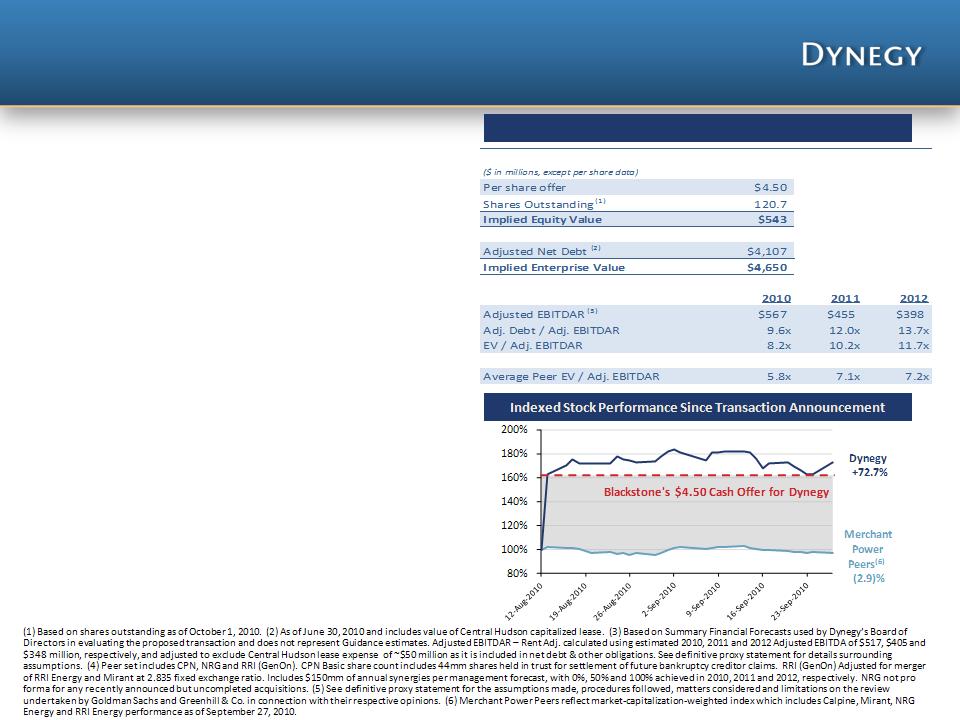

• $4.50 per share cash offer, representing a substantial

premium to pre-announcement stock price

– Transaction was announced August 13, 2010

– ~62% premium to August 12, 2010 closing price

($2.78/share)

– ~26% premium to prior 30-day average closing

price

• No financing conditions

• Board of Directors received written fairness opinions from

Goldman, Sachs & Co. and Greenhill & Co., LLC(5)

• Clear path to completion

– Hart-Scott-Rodino (received September 8-9, 2010)

– FERC (no objections during public comment period;

requested approval by October 29, 2010)

– New York Public Service Commission (requested no

review and/or approval by October 29, 2010)

– California Public Utilities Commission (notice

period ends November 11, 2010)

– Stockholder approval (meeting scheduled for

November 17, 2010)

– Concurrent closing of NRG/Blackstone transaction

• Expect to close by end of November 2010

Key Transaction Terms

4

Transaction Overview

5

Blackstone Transaction Minimizes

Risk to Stockholders

Dynegy believes that while long-term fundamentals remain intact...

Anticipated timing to realize the upside of the sector has been

significantly delayed due to the recession and other factors.

There are several market and company-specific challenges in the near-

to medium-term, many of which are beyond our control, that pose a

significant risk to reaching a recovery.

• Low and declining commodity prices and a weak economy

• $1.1 billion negative cash flow through 2014 (per Summary Financial Forecasts)

• Challenging capital market conditions compound significant refinancing risk

• High leverage and fixed costs in a low commodity price environment

• Regulatory and environmental risk and uncertainty

Absent significant improvements in BOTH commodity and financial/capital

markets, operating as a stand-alone company involves substantial risk to

Dynegy stockholders

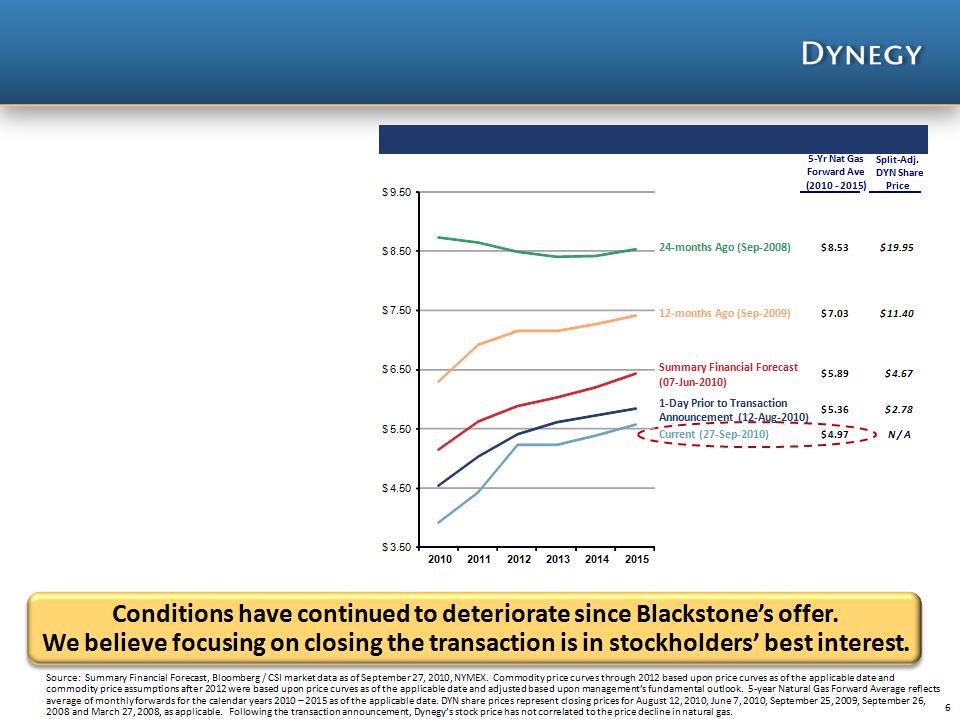

• Forward natural gas prices have

fallen consistently over the last

two years

• Decline of 42% in the 2010-2015

average forward curve since Sep

2008

• Decline of 16% since Jun 7, 2010

• Decline of 7% since transaction

announcement

• Dynegy’s stock price is highly

correlated with natural gas prices

that continue to fall

• Dynegy’s high leverage increases

its risk profile, which increases its

stock price sensitivity to natural

gas prices

Natural Gas Price (Henry Hub $/mmbtu)

Commodity Prices Continue to Fall

Negative Cash Flow as a Stand-Alone Company

7

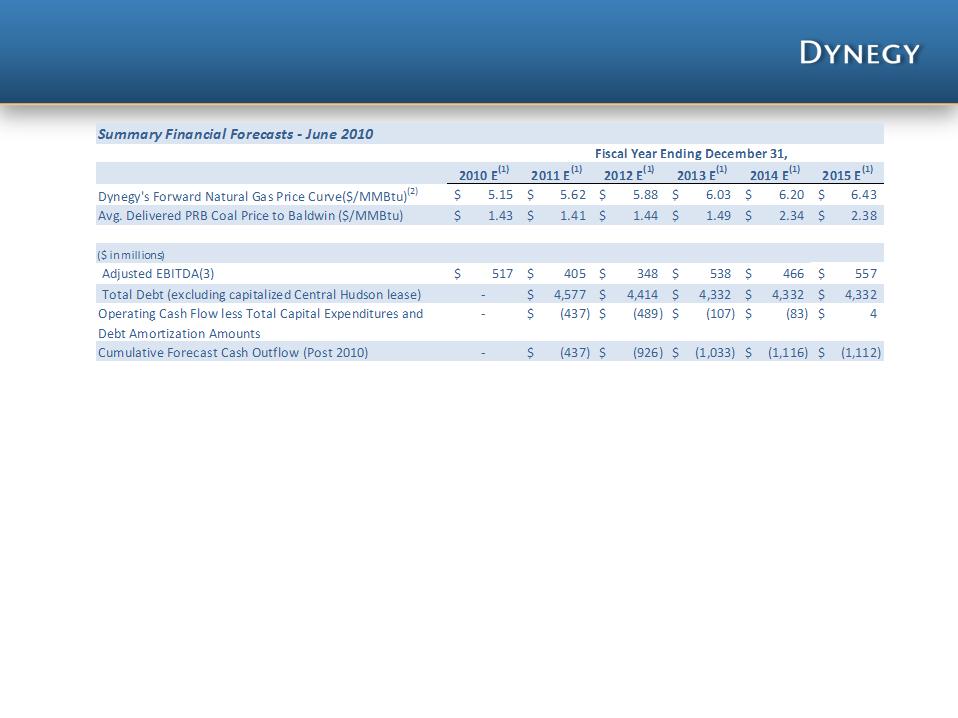

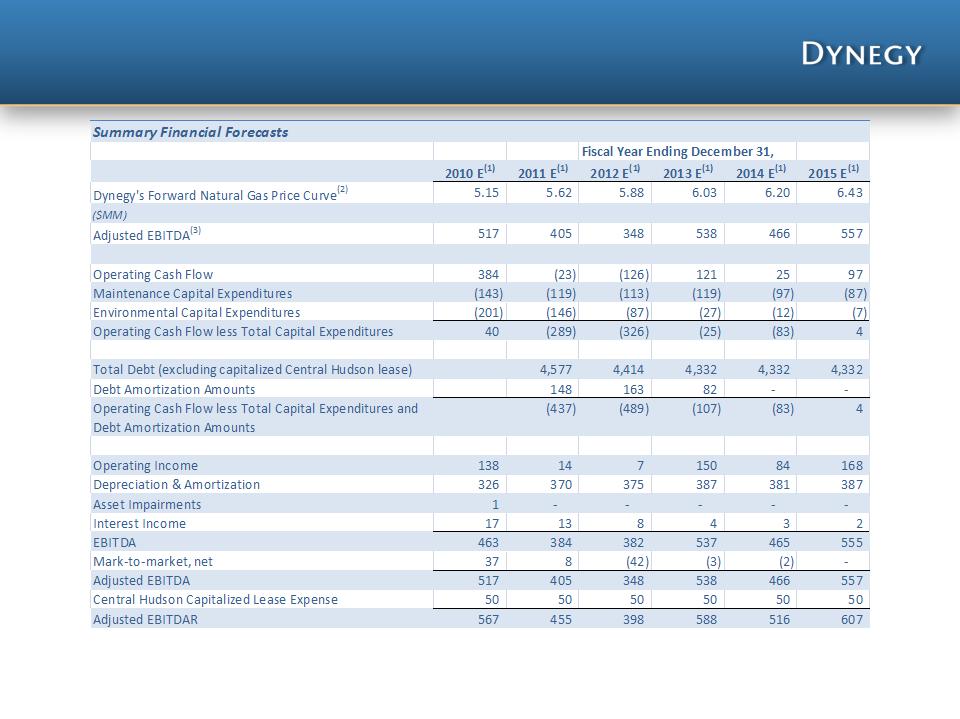

• Dynegy forecasts $1.1 billion of cumulative cash outflows in future years due to:

• Low commodity prices

• Assumed environmental investments, excluding any contingencies for future legislation/regulation, that may occur

• Assumed impact of replacing below market coal transportation contracts that expire at the end of 2013

• Assumed negative impact to Adjusted EBITDA from 2013 to 2014 is ~$140 mm, which also reflects the assumed retirement of

Hennepin and Vermillion

• High fixed costs, including items such as maintenance capital expenditures and interest expense, which will likely increase

• $1.1 billion of cumulative cash outflows significantly impairs liquidity, increasing refinancing risk and decreasing ability to react to and to

manage unplanned items

Note: The above is a summary of the financial forecasts prepared by management of Dynegy in connection with Board’s consideration of the Blackstone transaction and is not intended as a GAAP

reconciliation; reconciliation located in the Appendix. For additional information about these summary financial forecasts, including the assumptions Dynegy management made in preparing them, see the

“Summary Financial Forecasts” section of the definitive proxy statement. (1) Forecasted values. (2) Commodity pricing assumptions through 2012 were based upon June 7, 2010 price curves and

commodity pricing assumptions after 2012 were based upon June 7, 2010 price curves and adjusted based upon management’s fundamental outlook, which included the assumption of asset retirements

by which Dynegy would benefit. (3) Adjusted EBITDA means EBITDA plus other adjustments related to mark-to-market changes.

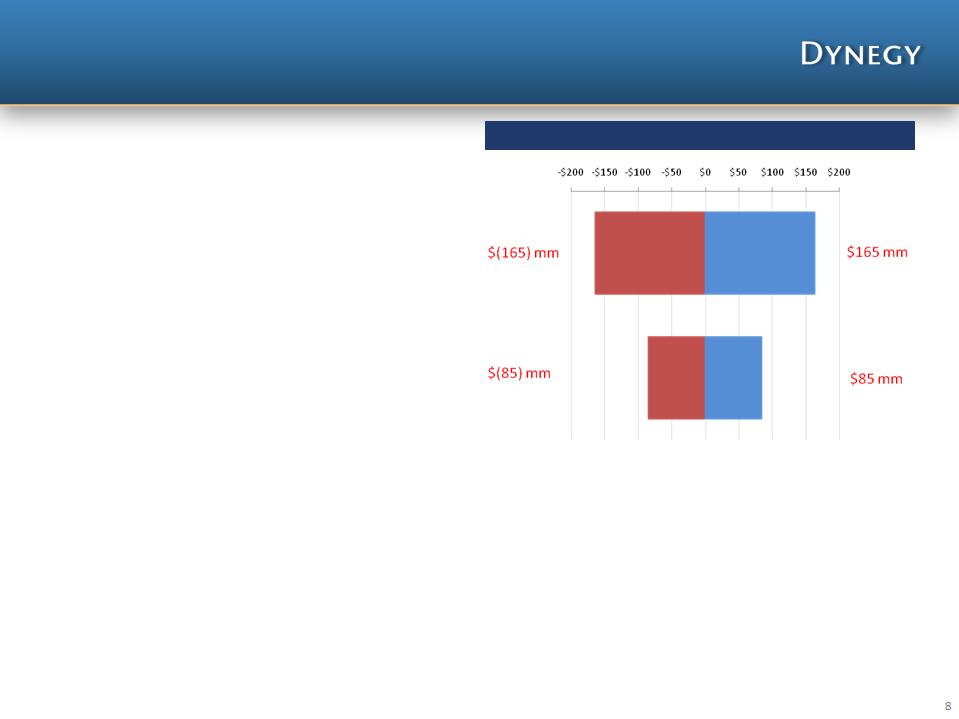

Adjusted EBITDA Highly Sensitive to Changes

in Commodity Price Environment

• Individual sensitivities are not necessarily additive

• Assumes an unhedged portfolio and is not representative of any particular year

• As hedges are not 100% perfect, and exposure post 2012 is unhedged, significant

commodity price exposure still exists

• Reflects potential impact of changes in commodity prices on Dynegy’s portfolio

+ / - $1 per MMBtu Change in Natural Gas (1)

+ / - $0.50 per MMBtu Change in Delivered PRB Coal (2)

Adjusted EBITDA Sensitivities- Unhedged Portfolio ($ mm)

Source: Management estimates (1) Assumes completely unhedged portfolio. (2) Assumes only Baldwin, Havana and Wood River in operation.

• Rising CDS levels imply that the credit markets have an

increasingly negative view of Dynegy

– Rising CDS levels (blue line) are negatively correlated with the

falling stock price (red line)

– Moody’s downgraded Dynegy to Caa1 from B3 on October 1,

2010, and stated its financial profile looks extremely fragile,

especially in 2011 and 2012

• Negative free cash flows forecasted through 2014 are likely to

make it increasingly difficult and more expensive to refinance

Dynegy’s credit facilities

– Not expected to fully replace current levels under credit

facilities

– Increased all-in cost

• Potential failure of covenant compliance in the next 6 months

– Forecast suggests an inability to comply with certain financial

ratios in 2011

– Absent a waiver, the credit facilities would need to be

amended, likely with less availability and at a higher cost

Absent the Blackstone transaction, Dynegy will be forced to

seek a restructuring using multiple options that may include:

– Equity or equity-linked securities such as preferred or

convertible securities

– Asset sales which will limit recovery optionality and increase

leverage

– Other restructuring alternatives which could dilute current

holders

– Combinations of these options

Limited Access to Capital Markets

9

1. Represents rate for any drawn amount

Relationship between DYN Share Price and CDS (YTD 2010)

Source: Bloomberg market data as of September 27, 2010

Regulatory & Environmental Risks and

Uncertainties

A number of air, water, solid waste and financial reform regulations are

pending and the outcome is unknown. In many cases, the expected

outcome would likely result in a significant and adverse impact to Dynegy

in terms of capital expenditures and operating costs

• Federal Regulation of Greenhouse Gases - Pending EPA regulation of CO2 emissions; future

legislation also possible

• Coal Combustion Residuals Regulation by EPA - Decision by EPA on hazardous or non-

hazardous determination forthcoming; could impose new restrictions on coal ash disposal

• Clean Air Transport Rules - Intended to mandate new controls for the reduction of SO2,

Nox, mercury and other emissions

• Financial Reform Legislation - New requirements for over-the-counter derivatives

transactions potentially including those used by Dynegy to support risk management

practices

• California and New York Water Intake Policies - New regulations specific to power plant

once-through-cooling practices

Significant uncertainties have impacted and will likely continue to impact Dynegy’s

perceived value and will likely result in higher capital and operating costs

• In evaluating the transaction with Blackstone, Dynegy analyzed various alternatives, including remaining as a stand-alone company and the sale of

various asset packages, including the sale of the West coast assets

• In all alternative scenarios, it was determined that asset sales would not lead to greater stockholder value. Although asset sales (given a depressed

market, at low values) would buy some time to potentially get to a recovery of natural gas and electricity prices, the incremental risk to Dynegy would

be significant due to:

– Downward trajectory of commodity prices, with no clear view of a recovery, in addition to the downward effects of the shale plays on natural gas prices

– Loss of associated cash flow would make it more difficult to refinance or raise debt capital

– Uncertainty and likely negative impact of future environmental regulations on Dynegy’s portfolio, magnified by Dynegy's limited financial flexibility

– Asset sales would reduce Dynegy’s scale and opportunity to benefit from future recovery

• A sale of the West coast assets was considered an inferior alternative to the Blackstone transaction

– Transaction is not permitted under existing credit facility and, thus, Dynegy would have to apply the majority of the cash proceeds to existing collateral needs

and for liquidity purposes to cover negative cash outflows over the next several years

– Interest coverage ratios and increased leverage would further limit future access to capital markets

§ Moss Landing was projected to be Dynegy’s single largest free cash flow generator over the next several years

– Increased exposure to Midwest coal markets, magnifying risk of

§ Regulatory and environmental regulation uncertainties

§ Coal transportation pricing once below-market contracts expire

§ Basis volatility

– Lower trading multiple tied to loss of ownership of significant natural gas fleet

– In all cases, loss of “critical mass” leads to spreading fixed costs over a smaller fleet

• Any alternative to the Blackstone transaction will need to include significant restructuring actions, potentially including issuances of equity and equity-

linked securities and asset sales, which could dilute stockholders

Blackstone’s Transaction is the Best Alternative

for Dynegy Stockholders

11

We believe there is significant risk to Dynegy’s stockholders if

the Blackstone transaction is not completed

• Over the past two years, Dynegy has explored a range of strategic alternatives in an

effort to enhance value for stockholders:

– Fall 2008: Discussions with NRG Energy

– Late 2008/Early 2009: Dynegy and its advisors solicited interest from 16 potential

acquirers or merger partners. Three parties engaged in preliminary discussions

regarding a possible acquisition or merger of equals. No transaction materialized

– Summer/Fall 2009: Dynegy successfully completed the restructuring of LS Power’s

ownership and governance rights positions, including the disposition of certain assets

– Late 2009/Early 2010: Dynegy reviewed strategic alternatives with the benefit of its

simplified capital structure and governance positions, including stand-alone plans and

potential business combinations or sale transactions

– Early 2010: Dynegy re-engaged in discussions with one of the companies with which

Dynegy previously held preliminary discussions, but no transaction materialized

Lengthy & Extensive Board Process

12

– Spring/Summer 2010: Re-engaged with NRG, focusing on a transaction involving a

potential subsequent sale by NRG of Dynegy’s coal assets. NRG expressed concern

regarding its ability to dispose of the coal assets on acceptable terms and advised

Dynegy that it did not want to proceed with an acquisition of Dynegy

– Summer 2010: Blackstone contacted Dynegy to inquire about performing due diligence

to purchase Dynegy in an all-cash acquisition. Blackstone and NRG discussed the

acquisition by NRG of certain Dynegy gas-fired assets concurrent with the proposed

Dynegy/Blackstone transaction

– The “Background of the Merger” section of the proxy clearly demonstrates that the

Board negotiated extensively with Blackstone and Blackstone was unwilling to increase

its offer price above $4.50 per share

– Since the Board approved the transaction on August 12th:

§ Average 2010E-2015E natural gas prices are down ~16% , since June 7th natural gas price levels

§ Financing markets remain very difficult and volatile

§ Moody’s has dropped Dynegy’s credit rating

§ A broad “go shop” resulted in no alternative to the Blackstone offer

Lengthy & Extensive Board Process (cont’d)

13

• Dynegy and its financial advisors actively solicited superior offers for 40

days following the Blackstone announcement

– Solicited 42 parties and the opportunity was widely publicized

– 8 confidentiality agreements were signed and extensive data was provided

– No proposals were received

• Despite the broad solicitation of potentially interested parties, no party

made a superior proposal during the “Go-shop” process

“Go-Shop” Process to Maximize Value

14

Blackstone’s offer is the only offer received and provides immediate

stockholder value, while eliminating risk

Dynegy’s Board of Directors considered a range of financial analyses presented to

them by Dynegy’s financial advisors in connection with rendering their written

opinions to the Board, in addition to other strategic alternatives to the transaction

• Financial analyses included:

– Multiples of select companies and transactions

– Transaction premiums

– Discounted cash flow

– Sum-of-the-parts

– Research analysts’ stock price targets

– Historical share price

• Goldman, Sachs & Co. and Greenhill & Co., LLC each provided a written fairness opinion to the Board of Directors on August 13, 2010

• Other alternatives considered by Dynegy’s Board of Directors included:

– Continuing as a stand-alone company

– A sale of Dynegy

– A business combination with a strategic partner

– A sale of Dynegy’s coal generating facilities or gas-fired assets, including those gas-fired assets located in the western region

of the United States

Extensive Evaluation by Board & Advisors

15

In connection with approving the transaction with Blackstone, Dynegy’s Board

analyzed numerous strategic alternatives and received written fairness opinions

Note: See definitive proxy statement for the assumptions made, procedures followed, matters considered and limitations on the review undertaken by Goldman Sachs and Greenhill & Co. in

connection with their respective opinions.

• Commodity prices continue to decline and improved pricing is not expected to be achieved for

some time

• $1.1 billion of forecasted cumulative cash outflow through 2014 decreases financial flexibility

• Negative cash flows decrease ability to refinance maturing debt at current levels

• Lower hedged levels increase volatility of earnings

• Potential failure of covenant compliance could occur absent further financial restructuring

• Dynegy’s pre-announcement stock price was $2.78 per share on August 12, when Blackstone

confirmed its $4.50 per share offer

– Average peer stock prices have fallen ~3% since August 12, implying a potential 60% loss in value

compared to Blackstone’s offer

– Dynegy’s higher leverage tends to amplify changes in its equity value

– Natural gas prices have continued to fall and shale gas appears to be a long term driver of prices

– Given these trends, and assuming the correlation between natural gas prices and Dynegy’s stock price

returns, Dynegy’s stock price could trade at or below the pre-announcement price if the Blackstone

transaction is not completed

Significant Risk of Negative Impact on Dynegy’s

Stock Price if Transaction is not Completed

16

Blackstone’s cash offer of $4.50 per share represents a significant

premium and value to our shareholders

Note: 60% implied loss reflects assumed stock price of $2.78 per share minus 3%, compared to $4.50 per share offer.

• Timeline

– Record date for stockholder vote was October 1

– Distribution of proxy materials began on or about October 4

– Stockholder vote is scheduled for November 17

– Expect closing by the end of November 2010

• Required Approvals

– Hart-Scott-Rodino (received September 8-9, 2010)

– FERC (no objections during public comment period; requested approval by October 29, 2010)

– New York Public Service Commission (requested no review and/or approval by October 29, 2010)

– Stockholder approval (meeting scheduled for November 17, 2010)

• Other Closing Conditions

– California Public Utilities Commission (notice period expires November 11, 2010)

– Concurrent closing of NRG/Blackstone transaction (and satisfaction of conditions to the transaction)

– Accuracy of reps and warranties and performance of obligations under the Merger Agreement

– Absence of law or injunction prohibiting the merger

Roadmap to Completion

18

Dynegy has worked to structure a transaction with manageable closing

risk to stockholders, despite continued deteriorating market conditions

• EBITDA Measures. We believe that EBITDA and Adjusted EBITDA provide a meaningful representation of our operating performance. We

consider EBITDA as a way to measure financial performance on an ongoing basis. Adjusted EBITDA is meant to reflect the true operating

performance of our power generation fleet; consequently, it excludes the impact of mark-to-market accounting and other items that

could be considered “non-operating” or “non-core” in nature, and includes the contributions of those plants classified as discontinued

operations. Because EBITDA and Adjusted EBITDA are two of the financial measures that management uses to allocate resources,

determine Dynegy’s ability to fund capital expenditures, assess performance against its peers and evaluate overall financial performance,

we believe they provide useful information for our investors. In addition, many analysts, fund managers and other stakeholders that

communicate with us typically request our financial results in an EBITDA and Adjusted EBITDA format.

– “EBITDA” - We define “EBITDA” as earnings (loss) before interest, taxes, depreciation and amortization.

– “Adjusted EBITDA” - We define “Adjusted EBITDA” as EBITDA adjusted to exclude (1) gains or losses on the sale of assets, (2) the impacts of mark-to-market

changes and (3) impairment charges.

– “Adjusted EBITDAR” - We define “Adjusted EBITDAR” as Adjusted EBITDA adjusted to exclude operating lease commitments.

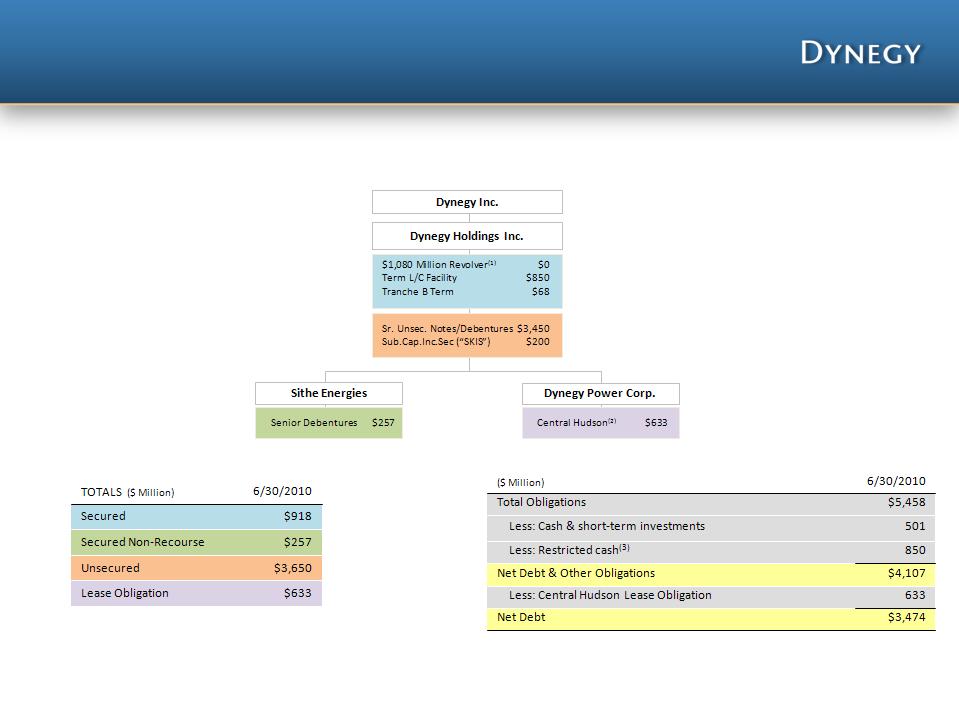

• Debt Measures. We believe that our debt measures are useful because we consider these measures as a way to re-evaluate our progress

toward our strategic corporate objective of reducing our overall indebtedness. In addition, many analysts and investors use these

measures for valuation analysis purposes. The most directly comparable GAAP financial measure to the below measures is GAAP debt.

– “Net Debt” - We define “Net Debt” as total GAAP debt less cash and cash equivalents and restricted cash. Restricted cash in this case consists only of collateral

posted for the credit facility at the end of each period, and the Sithe debt reserve, at the end of each period where applicable.

– “Net Debt and Other Obligations” or “Adjusted Net Debt”- We define “Net Debt and Other Obligations” or “Adjusted Net Debt” as total GAAP debt plus

certain operating lease commitments less cash and cash equivalents and restricted cash. Restricted cash in this case consists only of collateral posted for the

credit facility at the end of each period.

– “Adjusted Debt” - We define “Adjusted Debt” as total GAAP debt plus certain operating lease commitments.

• Enterprise Value - We believe enterprise value is a common value used when evaluating transactions and also in comparing current and

future value to peer companies.

– “Enterprise Value” - We define “Enterprise Value” as Adjusted Net Debt plus an implied equity value, which is calculated based on the transaction offer price.

Definitions

21