6

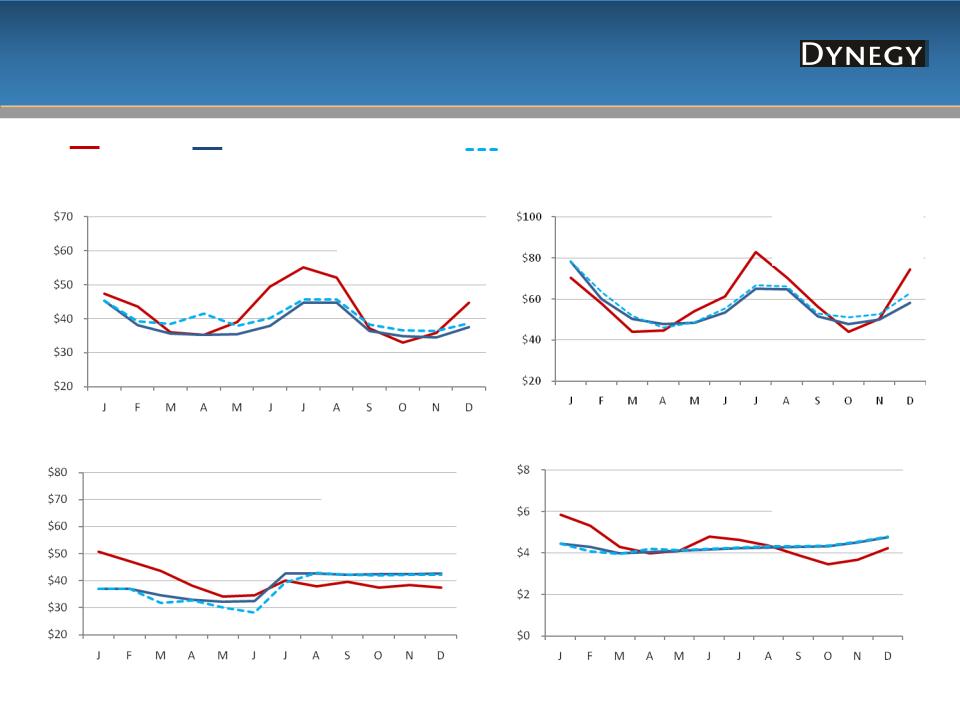

Midwest - 1Q11 Period-Over-Period

Regional Performance Drivers

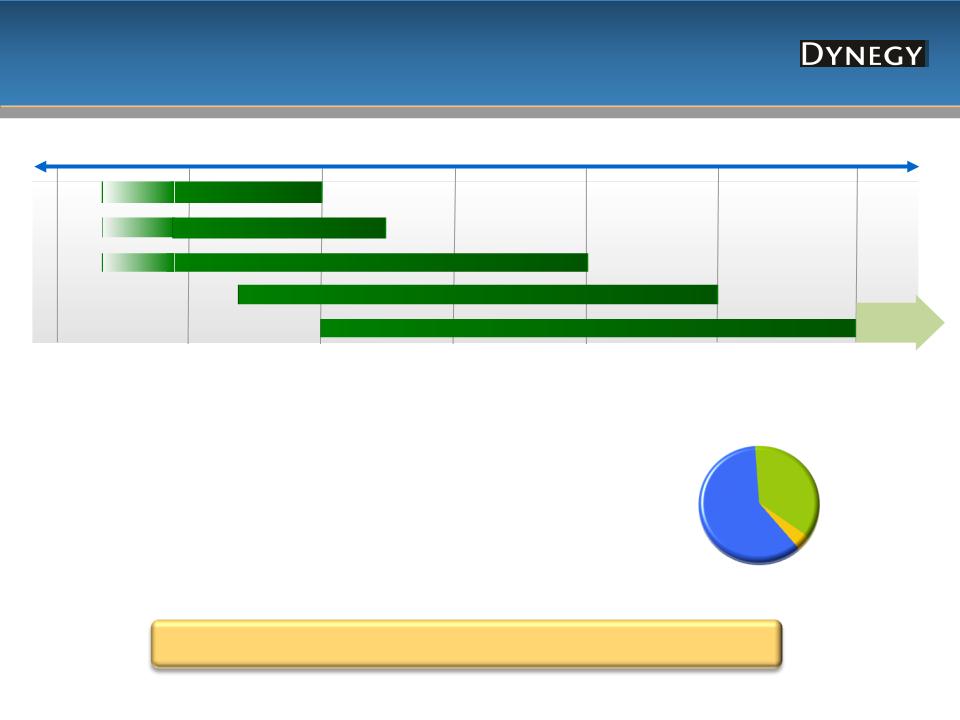

Maint.

Enviro.

$ Million

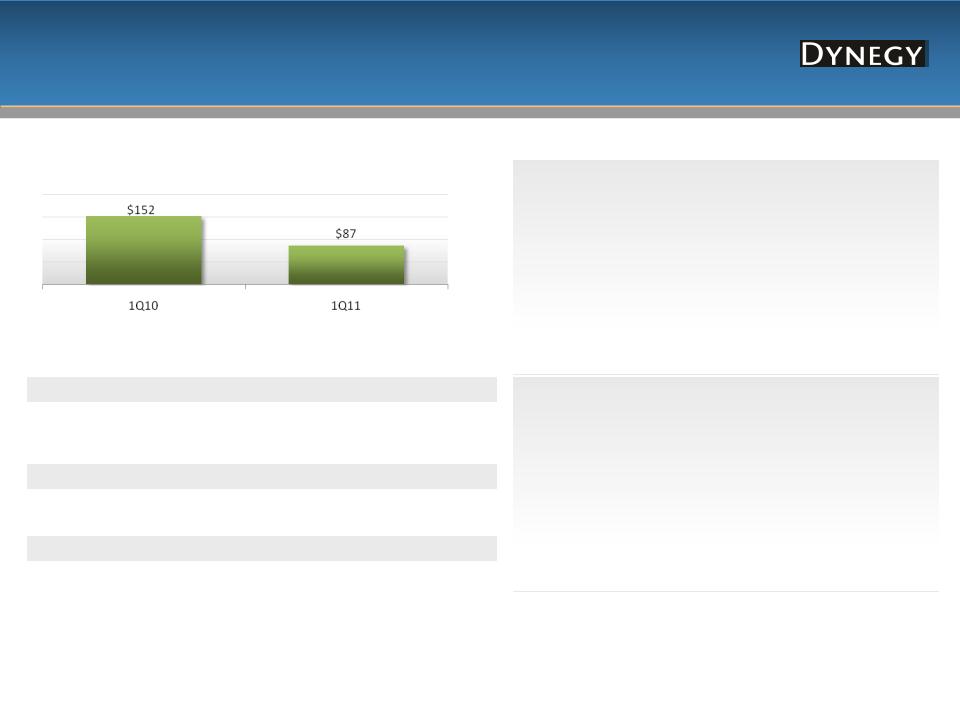

Adjusted EBITDA

CapEx

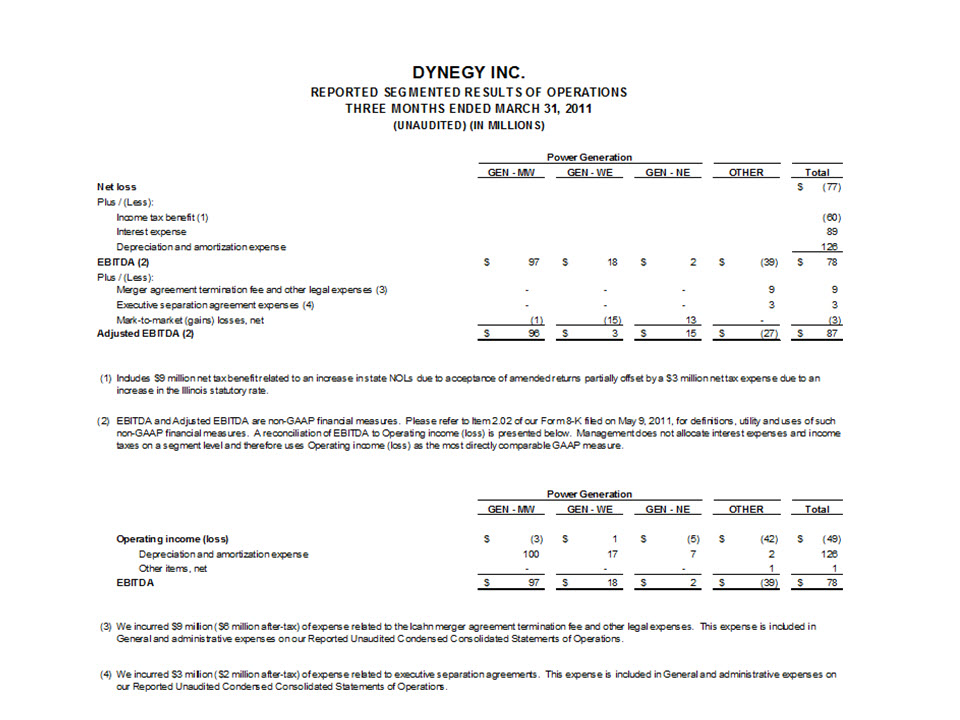

• 1Q Adjusted EBITDA decreased 25% period-over-period primarily

due to

– Energy contributions from physical transactions(1) increased due to fewer

planned outages, in addition to increased spark spreads for CCGT’s

– Energy contributions from financial transactions(1) declined due to lower

value received per MWh in 2011

– Decreased tolling revenues of ~$20MM resulting from the early termination

of a long-term toll on Kendall in 1Q2010

– Increased capacity revenues due to higher PJM capacity prices and more

capacity for sale from Kendall due to the early termination of a long-term toll,

offset by reduced capacity revenues due to lower MISO capacity prices

– Basis impact was ~$(5)MM quarter-over-quarter

– Average CIN-Avg Gen basis 1Q11 was $4.64/MWh compared to

$2.55 for 1Q10

• 1Q overall volumes increased from 6.4 MM MWhs to 7.2 MM

MWhs or 12% period-over-period primarily due to:

– Fewer planned outages and increased spark spreads for CCGT’s

– 84% , 20% and 51% capacity factors in 1Q11 compared to 86%, 9% and 29%

capacity factors in 1Q10 for the coal fleet, Kendall and Ontelaunee,

respectively

• 1Q CapEx decreased due to reduced Consent Decree spending

and fewer planned outages

• Midwest coal fleet achieved in-market-availability of 92%

GAAP Measures:

• 1Q11 Operating Loss reflects pre-tax MTM gains of $1 million

• 1Q10 Operating Income reflects pre-tax MTM gains of $179 million

$44

(1) Financial transactions refer to hedging activities that include financial swaps and options activity, while physical transactions can be defined as generation sales