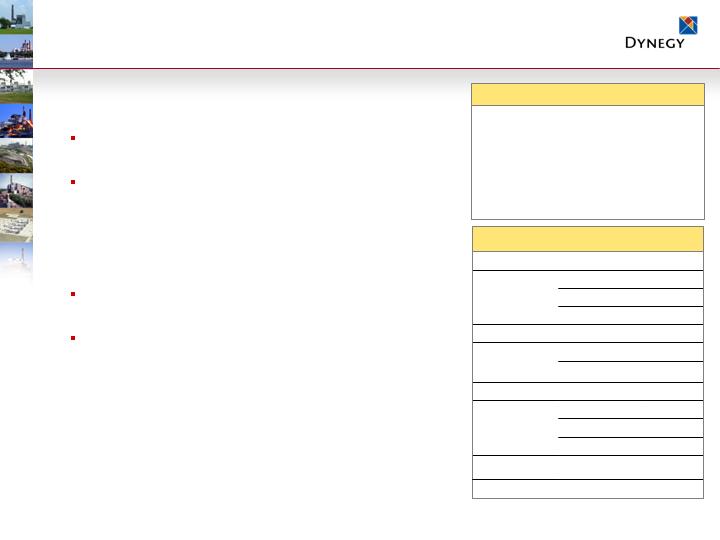

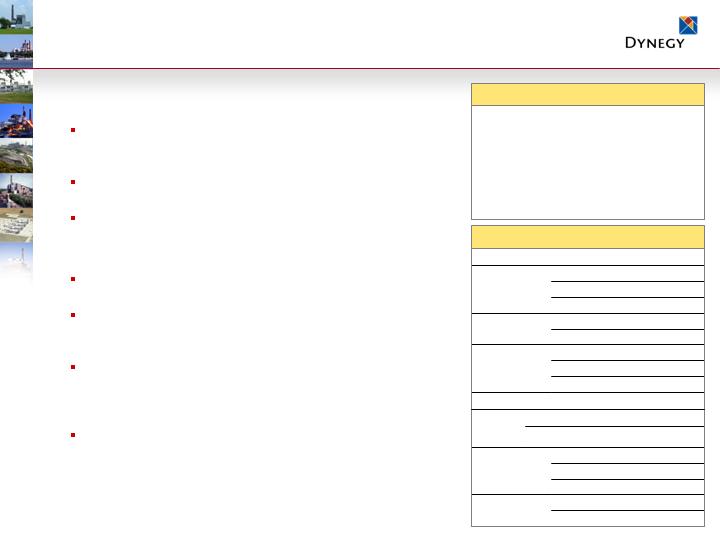

2008 Cash Flow Estimates: GAAP Basis

Note: 2008 estimates are presented on a GAAP basis and are based on quoted forward commodity price curves as of 10/30/07. Actual results may vary materially from these estimates based on

changes in commodity prices, among other things, including operational activities, legal settlements, financing or investing activities and other uncertain or unplanned items. Core business

represents continuing operating results, excluding significant items. Proceeds from the expected sale of Calcasieu are assumed to be received in first half of 2008.

45

Add Back: Discretionary Investment

(20)

(20)

-

Investment in Development Portfolio

(30)

-

(30)

CapEx – Other Environmental

(80)

(20)

(60)

CapEx – General Maintenance

(150)

-

(150)

CapEx – Consent Decree

$ 200 – 300

Free Cash Flow – Core Operating Business

(200)

Less: Proceeds from Asset Sales

(125)

Less: Change in Restricted Cash

10

Add Back: Illinois Rate Relief

220

Add Back: Plum Point Development CapEx

$ 250 – 350

Free Cash Flow

125

95

30

Change in Restricted Cash

200

200

Proceeds from Asset Sales

(220)

-

(220)

CapEx – Development (Plum Point)

(45)

-

(45)

CapEx – Discretionary Investment

(115)

-

(115)

CapEx – Outage Work

GAAP ICF:

$ 585 – 685

$ (550) – (540)

$ 1,135 – 1,225

GAAP OCF estimates as of Dec 12, 2007

2008 TOTAL

Other / CRM

Generation

Based on price curves as of October 30, 2007 ($MM)

Development CapEx related to Plum Point is 100% debt financed; therefore, $220 MM CapEx is offset in

financing cash flow

Discretionary Investments are added back as they relate to optional spending

Net proceeds from asset sales include anticipated proceeds from pending sale of Calcasieu of $57MM

Remaining proceeds expected to come from other non-core asset sales or monetization of equity interests

Change in restricted cash primarily related to return of cash collateral posted to support equity

commitments associated with development projects

24

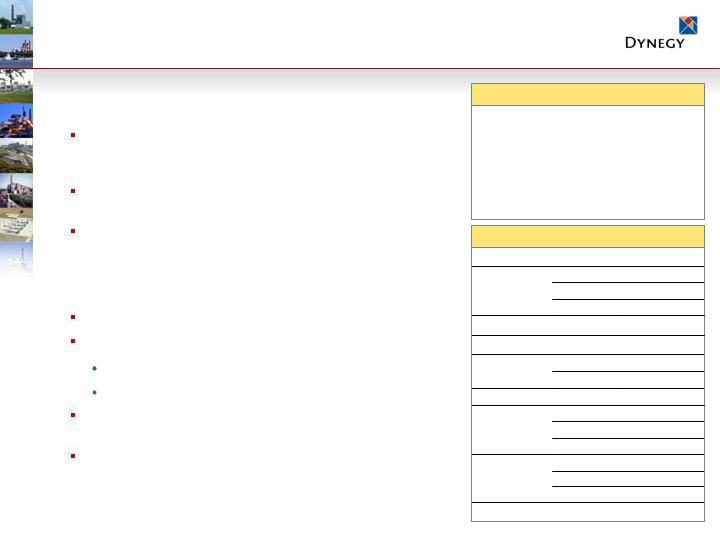

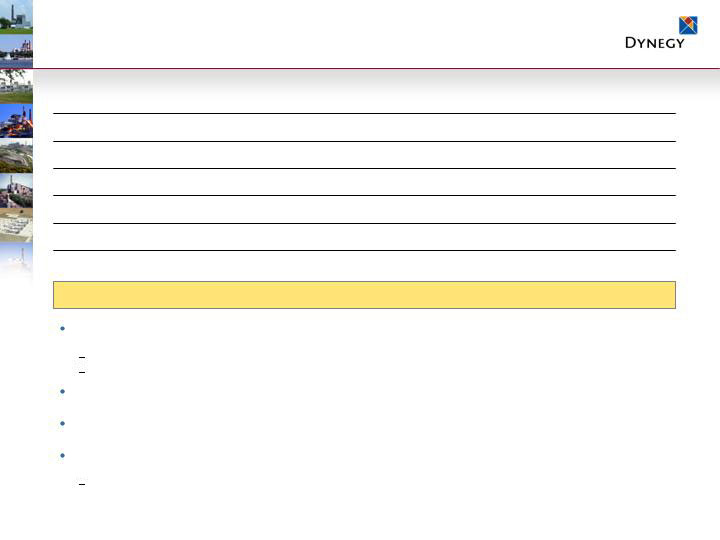

2008 Earnings Estimates: GAAP Basis

$ 140 – 200

Net Income – GAAP

(380)

(10)

(370)

(55)

(105)

(210)

Depreciation and Amortization

$ 830 - 880

Midwest

$ 180 - 200

West

$ 175 - 195

Northeast

$0.17 – 0.24

Basic EPS

(90) – (130)

Tax Expense

(440)

Interest

$ 1,050 – 1,150

$ (135) – (125)

$ 1,185 - 1,275

EBITDA estimates as of Dec 12, 2007

2008 TOTAL

Other/CRM

Total Gen

Based on price curves as of October 30, 2007 ($MM)

Note: 2008 estimates are presented on a GAAP basis and are based on quoted forward commodity price curves as of 10/30/07. Actual results may vary materially from these estimates based

on changes in commodity prices, among other things, including operational activities, legal settlements, financing or investing activities and other uncertain or unplanned items. Reduced

2008 and forward EBITDA or free cash flow could result from potential divestitures of (a) non-core assets where the earnings potential is limited, or (b) assets where the value that can be

captured through a divestiture is believed to outweigh the benefits of continuing to own or operate such assets. Divestitures could also result in impairment charges.

Northeast region EBITDA includes:

~$50 million lease expense related to Central Hudson lease obligation

~$50 million non-cash amortization of ConEd contract

Other includes general & administrative costs of ~ $175 million, primarily offset by interest income

Earnings may be volatile as many forward sales commitments are marked to market, which may create

differences between EBITDA and timing of cash received

Assumed 39% tax rate

25

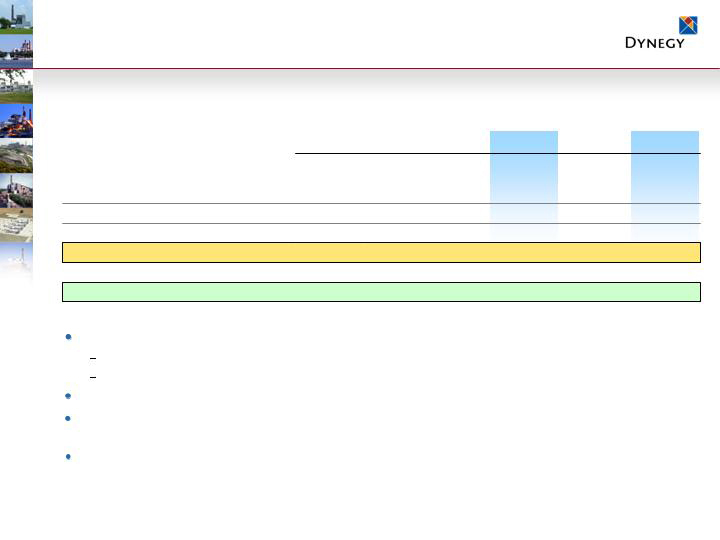

EBITDA Reconciliation: 2007 to 2008

Core Business EBITDA(1) ($MM)

$965

$1,100

$45

$15

$40

$(10)

$(15)

2007 EBITDA –

Core Business (2)

$975 – 1,035

2008 EBITDA

$1,050 – 1,150

$35

$(40)

$25

$1,005

2007 EBITDA –

Core Business

excluding MTM

$935 – 995

(1) 2007 Core Business EBITDA is adjusted for significant items. See Appendix for reconciliation. No adjustments to 2008 EBITDA have been made. (2) Core Business EBITDA as

estimated November 8, 2007.

$1,100

$965

~15%

Increase

26

EBITDA Sensitivity to Natural Gas

Sensitivities based on full-year estimates and assume natural gas price change occurs for the

entire year and entire portfolio

On-peak power prices are adjusted by holding the spark spread constant to a 7,000 Btu/KWh heat rate

Off-peak prices are adjusted holding the market implied heat rate constant

MTM accounting treatment will cause differences between EBITDA and timing of cash received

Estimates exclude potential changes in portfolio value associated with contracts beyond 2008

Note: Uncontracted portfolio assumed for illustrative purposes only.

Natural gas sensitivity primarily impacts baseload coal-fired generation

$(280)

- $2.00

$(60)

- $2.00

$(145)

- $1.00

$(30)

- $1.00

$165

+ $1.00

$50

+ $1.00

$320

+ $2.00

$100

+ $2.00

Generation EBITDA

Sensitivity ($MM)

Change in Cost of Natural Gas

($/MMBtu)

Generation EBITDA

Sensitivity ($MM)

Change in Cost of Natural Gas

($/MMBtu)

Long-Term: Uncontracted

2008: Includes contracts as of 10/30/07

27

$(50)

$60

$120

TOTAL

$(30)

$40

$80

Natural Gas

Coal/Fuel Oil

$(20)

- 500

$20

+ 500

$40

+ 1,000

Generation EBITDA Sensitivity ($MM)

Market Implied

Heat Rate

Movement

(Btu/KWh)

2008: Includes contracts as of 10/30/07

$(135)

$175

$350

TOTAL

$(90)

$110

$225

Natural Gas

Coal/Fuel Oil

$(45)

- 500

$65

+ 500

$125

+ 1,000

Generation EBITDA Sensitivity ($MM)

Market Implied

Heat Rate

Movement

(Btu/KWh)

Long-Term: Uncontracted

Sensitivities based on “on-peak” power price changes and full-year estimates

Assumes constant natural gas price of $8.25/MMBtu(1) and heat rate changes are for

a full year

Increased run-time will result in increased maintenance costs, which are expected to

be largely offset by improved earnings

EBITDA Sensitivity to Market Implied Heat Rates

Market implied heat rates sensitivities impact entire operating fleet

Note: Spark spread value changes depend on natural gas price assumptions. Uncontracted portfolio assumed for illustrative purposes only. (1) Represents average natural

gas prices as of 10/30/07.

28

Market Implied Heat Rate Analysis

Note: Reserve margins derived from NERC 2007 Summer Assessment and regional NERC and ISO documents. Reserve margins reflect Dynegy’s projections based on assumptions as

to demand growth, new assets under construction and plant retirements, although actual reserve margins may vary materially from these projections. Market implied heat rates were

calculated using the following actual and forward price points for power and natural gas: NY/NE – NY & NE/ TETCO M3; West – NP15/PGECG; PJM – PJM West / TETCO M3; MISO –

CIN / Con App. Actual prices were used for all periods.

As reserve margins decline, market implied heat rates rise…

especially as markets reach 15-20% reserve levels

Market Implied Heat Rate (Btu/KWh)

Overbuilt

Underbuilt

Target range

for reliability

Regional Reserve Margin Projections (%)

MISO

PJM

West

Northeast

MISO

PJM

California

Northeast

29

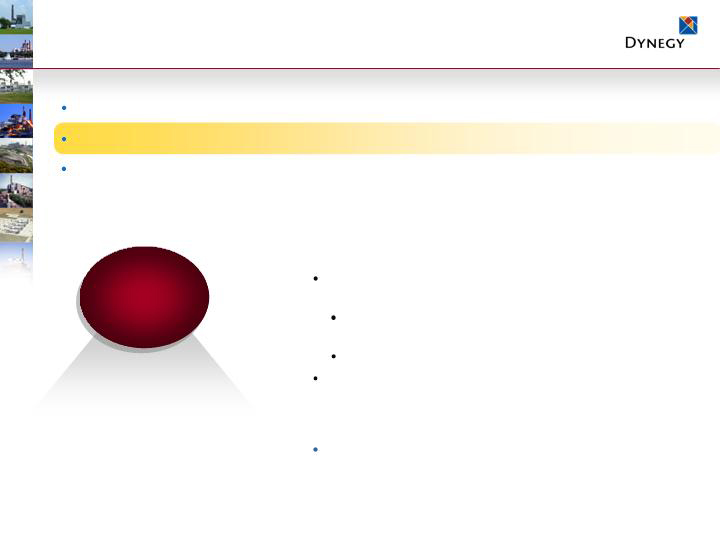

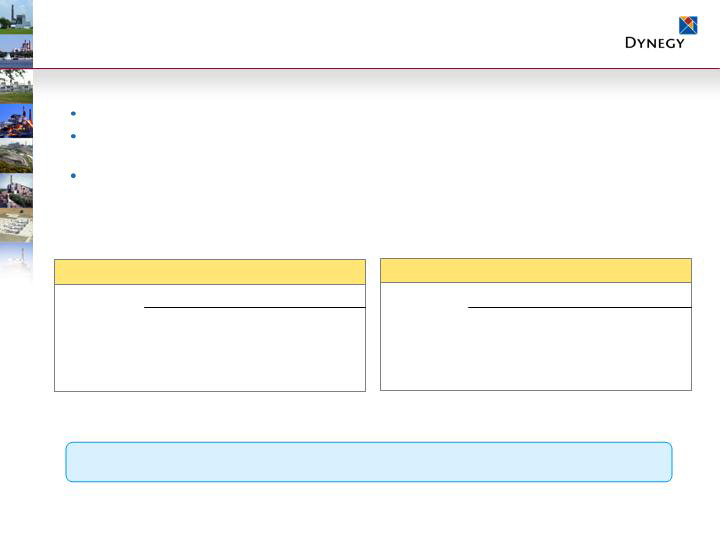

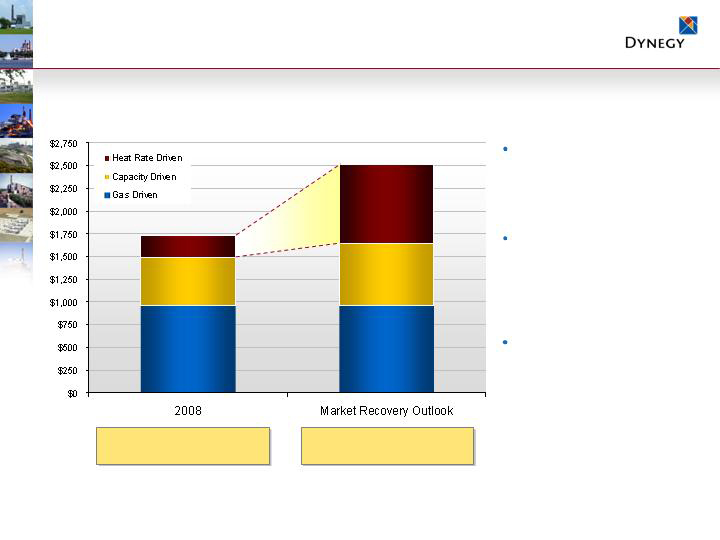

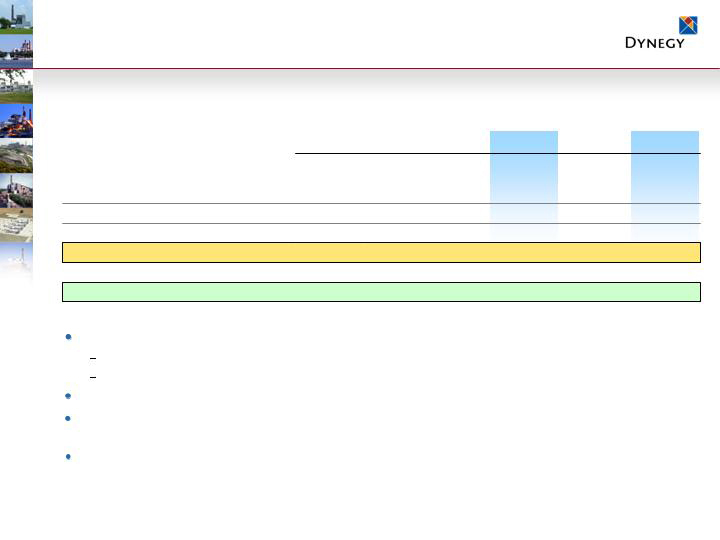

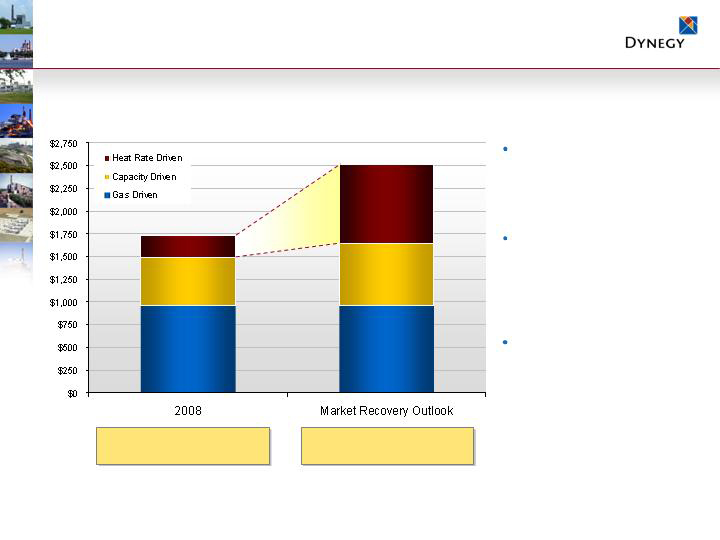

Market Recovery Outlook

Assuming Market Recovery

Outlook is applicable in 5

years, although volatile,

annual average increase in

EBITDA would be ~15%

With current operations,

Dynegy has the potential to

generate ~40% of its current

equity market cap in

cumulative annual cash flow

over ~5 years

Value of existing generation

assets & advanced

development projects should

continue to rise as barriers-

to-entry limit new supply

Total Portfolio Gross Margin ($MM)

Note: Dynegy’s Market Recovery Outlook and related estimates are provided solely as a reference point and are intended to represent a range of potential performance that could be achieved in

each of the company’s key regions at a point in time when supply and demand are in balance. The company does not intend to update this Market Recovery Outlook or the potential range of

performance provided except as otherwise required by applicable SEC rules and regulations.

EBITDA $1,050 – 1,150 MM

Core FCF $200 – 300 MM

EBITDA +/- $1,800 MM

Core FCF +/- $600 MM

30

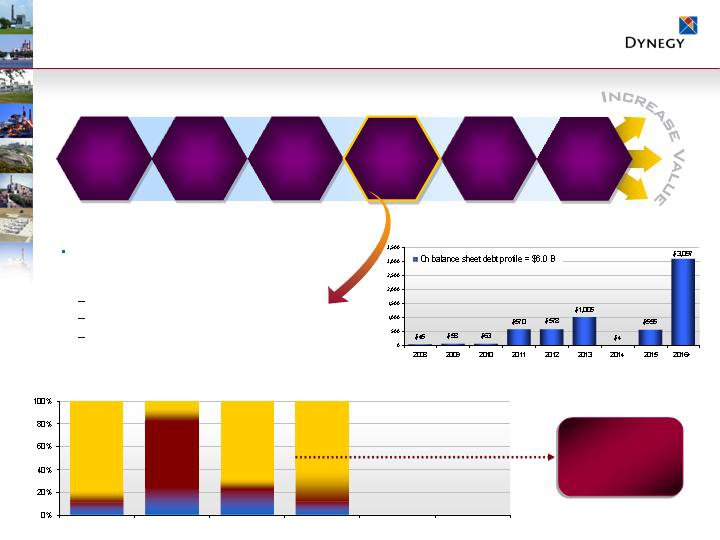

Creating & Capitalizing on Options

Bruce Williamson

Chairman & Chief Executive Officer

47%

49%

Net Debt to Capitalization

4.1x – 3.7x

$4,281

$45

$200 – $300

$1,050 – $1,150

2008

4.6x – 4.3x

$4,441

$40

$215 – $265

$975 – $1,035

2007

Net Debt / EBITDA – Core Business (3)(4)

Net Debt (4)

Debt Maturities

Free Cash Flow – Core Business (3)

EBITDA – Core Business (2)(3)

Dynegy Projections(1) ($MM)

(1) See reconciliations in Appendix. (2) 2007 includes $40MM of unrealized mark-to-market earnings. (3) EBITDA and free cash flow are adjusted for significant items. See Appendix for reconciliations. No adjustments were made for 2008 EBITDA, such that EBITDA and EBITDA – Core Business are the same. (4) Net debt includes $360MM and $580MM of non-recourse project debt related to an asset under construction for 2007 and 2008, respectively.

How is Dynegy Competitively Advantaged?

Well-positioned, well-operated assets

No significant debt maturity until 2011

Credible, focused management team

Flexible capital structure

Ample liquidity

Positive free cash flow from core

operating business

Solid balance sheet

Creating & Maintaining

a Solid Foundation

32

How will it be

implemented?

When will

it begin?

Things to Consider when Looking at the Future

Unknowns will impact the company’s results, both positively and negatively, and

the outcome and/or timing is extremely difficult to predict or control, including:

What will

happen?

Industry

Issue

Focus on

core

business

Continuously

evaluate

Respond to

change with

the right

option

Maintain

discipline

throughout

cycles

Recognize

the cycles

Keep

options

open

Who will be

impacted?

Chain of Uncertainty is also a Link to Opportunity

Where will

it occur?

Global & national economics

Weather

Market design changes – change in laws

Sector consolidation

Environmental regulation &

the potential for carbon legislation

Supply/demand balance

Awareness, continuous evaluation, cultivating options and maintaining a

diverse portfolio are tools for managing the uncertainties

33

Positioned for the Future

Operate

Transact

Build

Focused on Delivering

Value to Investors

Dynegy’s bottom line:

Focus

on core

business

Keep

options

open

Continuous

evaluation

Maintain

discipline

through

cycles

Recognize

the cycles

Solid

Foundation

Respond

to change

Management team with

proven ability to operate,

execute & respond to change

As market demand increases,

our operational excellence

and reliability track record will

be key to capturing value

Anticipate average annual

EBITDA growth of ~15% as

markets reach recovery

Expect to generate

~$200 to $600MM cash flow

annually before discretionary uses

or ~$2.5B over the next 5 years

Notes: Annual cash before discretionary uses represents operating cash flows and proceeds from asset sales, less maintenance and consent decree capital expenditures. Actual cash flow may vary materially from this

estimate and is dependent on a variety of factors including weather, market conditions and future environmental regulations and refinancing of certain term debt starting in 2011.

34

Q & A

Appendix

2008 Commodity Pricing Assumptions (as of 10/30/07)

* Represents annual average

Moss Landing, Morro Bay, Oakland

$78.25

NP-15 – California

Independence

$73.78

NY – Zone A

Roseton

$11.38

Fuel Oil #6 delivered to Northeast ($/MMBtu)

Danskammer

$3.20

Colombian delivered to Northeast

Baldwin

$1.39

Powder River Basin (PRB) delivered

Coal ($/MMBtu)

Arlington Valley, Griffith

$72.75

West – Palo Verde

South Bay

$78.75

SP-15 – California

Bridgeport, Casco Bay

$86.62

NE – Mass Hub

Roseton, Danskammer

$95.60

NY – Zone G

Midwest Peakers

$67.65

Cinergy

Ontelaunee

$81.25

PJM West

Midwest Coal, Kendall

$65.40

NI Hub / ComEd

On-Peak Power ($/MWh)

$ 8.25

Natural Gas – Henry Hub ($/MMBtu)

Facilities

2008E*

37

Key Assumptions

2008 Assumptions

Commodity pricing as of October 30, 2007

$200 MM in asset sales

Proceeds can come from sale of operating or

development assets

Expect to close $57 MM sale of Calcasieu in first half of 2008

Assume assets sold at book value (i.e., no EBITDA impact)

Interest expense of $440 million and Cash interest

payments of $445 million

Sandy Creek debt is not consolidated

Current Sandy Creek equity commitment of

approximately $325 MM is cash collateralized until

offtake contracts are executed during 2008 (as

indicated by restricted cash shown in Appendix)

Taxes accrue at 39%

Minimal AMT cash taxes

Future Outlook Assumptions

Credit Facility, Term Letter of Credit Facility and

Senior Unsecured notes are refinanced at stated

maturities

Plum Point debt, which is non-recourse, is

assumed to be consolidated; balance will increase

from $419 MM at the end of 2007 to $800 MM in

2010 upon construction completion

~$50 million annual amortization included in

Northeast EBITDA through 2014 related to ConEd

contract; annual capacity payments received of

~$100 million through 2014

Shares outstanding ~840 MM

Minimal AMT cash taxes paid until 2010; full cash

tax payer beginning in 2011

~$40

NOL Asset beginning 2008

$400-500/yr.

NOL Limit

~$10-$20/yr.

AMT Cash Taxes

~$250

AMT credit carry forward, dollar for dollar

(Estimated as of Year End 2007, $MM)

38

Debt Maturity Profile ($ MM)

Note: Annual maturities reflect par value debt obligations outstanding pro forma 12/31/07. Debt as of 12/31/07 excludes $1,150 MM of revolving credit facility due 2012 as it is expected to be

undrawn. Central Hudson lease obligations are not included as debt. (1) 2013 includes an $850 million Letter of Credit Facility that is offset by restricted cash.

(1)

Pro Forma 12/31/07

39

Debt & Other Obligations Capital Structure –

Pro Forma 12/31/07

Dynegy Power Corp.

Central Hudson(2) $770

Dynegy Holdings Inc.

$1,150 Million Revolver(1) $0

Term L/C Facility $850

Tranche B Term $70

Sr. Unsec. Notes/Debentures $4,047

Sub.Cap.Inc.Sec (“SKIS”) $200

Secured = $920

Key:

Secured Non-Recourse = $808

Unsecured = $5,017

Dynegy Inc..

Senior Debentures $389

Plum Point Energy Assoc.

PP 1st Lien $319

Tax Exempt 100

Gross Debt $419

Restricted Cash 59

Total, Net Debt $360

(1) Represents drawn amounts under the revolver. (2) Represents PV (10%) of future lease payments. Central Hudson lease payments are unsecured obligations of Dynegy Inc., but are a

secured obligation of an unrelated third party (“lessor”) under the lease. DHI has guaranteed the lease payments on a senior unsecured basis. (3) Restricted cash includes $850MM related

to the Synthetic Letter of Credit facility, $325MM for Sandy Creek Letter of Credit which is used in lieu of cash on hand and $59MM related to Plum Point.

($ MM)

Sithe Energies

360

Less: Net Non-recourse Project Debt, under construction

$4,441

Net Debt

$5,211

Net Debt and Other Obligations

770

Less: Central Hudson Lease Obligation

1,234

Less: Restricted cash (3)

$4,081

Net Debt associated with Operating Assets

300

Less: Cash on hand

$6,745

Total Obligations

12/31/07

($ Million)

40

Debt & Other Obligations Capital Structure –

Pro Forma 12/31/08

Dynegy Power Corp.

Central Hudson(2) $700

Dynegy Holdings Inc.

$1,150 Million Revolver(1) $0

Term L/C Facility $850

Tranche B Term $69

Sr. Unsec. Notes/Debentures $4,047

Sub.Cap.Inc.Sec (“SKIS”) $200

Dynegy Inc..

Senior Debentures $345

Plum Point Energy Assoc.

PP 1st Lien $509

Tax Exempt 100

Gross Debt $609

Restricted Cash 29

Total, Net Debt $580

(1) Represents drawn amounts under the revolver. (2) Represents PV (10%) of future lease payments. Central Hudson lease payments are unsecured obligations of Dynegy Inc., but are a

secured obligation of an unrelated third party (“lessor”) under the lease. DHI has guaranteed the lease payments on a senior unsecured basis. (3) Restricted Cash includes $850 million

related to the Synthetic Letter of Credit Facility, $225 million for Sandy Creek Letter of Credit which is used in lieu of cash on hand and $29 million related to Plum Point.

($ MM)

Sithe Energies

580

Less: Net Non-recourse Project Debt, under construction

$4,281

Net Debt

$ 4,981

Net Debt and Other Obligations

700

Less: Central Hudson Lease Obligation

1,104

Less: Restricted cash (3)

$3,701

Net Debt associated with Operating Assets

735

Less: Cash on hand

$6,820

Total Obligations

12/31/08

($ Million)

Secured = $919

Key:

Secured Non-Recourse = $954

Unsecured = $4,947

41

Market Recovery Outlook (1)

$3.00

N/A

N/A

Avg Colombian Coal ($/MMBtu)

Peaking

CC

Baseload

Fuel Oil ($/MMBtu)

Natural Gas ($/MMBtu) Henry Hub

PRB Coal ($/MMBtu)

0%-10%

20%-30%

0%-10%

40%-50%

60%-70%

20%-30%

80%-90%

N/A

80%-90%

Average

Capacity Factors

$10.40

N/A

N/A

~$8.25

~$8.25

~$8.25

N/A

N/A

$1.39

Fuel

9.90

10.40

9.70

Average Market-Implied Heat Rate (MMBtu/MWh)

12.3

17.1

29.1

Volumes (MM MWh)

Northeast

West

Midwest

(1) Dynegy’s Market Recovery Outlook and related estimates are provided solely as a reference point and are intended to represent a range of potential performance that could be achieved in

each of the company’s key regions at a point in time when supply and demand are in balance. The company does not intend to update this Market Recovery Outlook or the potential range

of performance provided except as otherwise required by applicable SEC rules and regulations.

(2) Represents uncontracted volumes.

(3) Excludes ConEd capacity contracted on Independence. Approximately 75% of the facility’s capacity is obligated under a capacity sales agreement, which is effective through 2014.

Revenues from this agreement are largely fixed at approximately $100MM/year, or approximately $11.20/KW-Mo.

NE

MISO

RTO

MAAC+APS

$3-$4

580

$3-$4

3,165

PJM

Midwest

$2-$3

4,619

$4-$5

1,067

Northeast

West

Capacity Revenues

$4-$5

1,958

NYISO (3)

165

Locational RA

14,083

TOTAL

$2-$3

2,529

System RA

Price ($/kW-mo)

Dynegy MWs Available (2)

EBITDA +/- $1,800 MM

Core FCF +/- $600 MM

42

Equity Value Calculations

(5.2)

(5.2)

(5.2)

(5.2)

Net Debt and Other

Obligations(2)

$ 10.12

$ 15.36

Average Implied

Value per Share ($)

$ 12.14

$ 8.10

$ 18.10

$ 12.62

Implied Value per Share ($)

840

840

840

840

Million Shares Outstanding

$ 10.2

$ 6.8

$ 15.2

$ 10.6

Equity Value

0.4

0.4

0.4

0.4

Net Non-recourse Project

Debt (under construction)

$ 15.0

$ 11.6

$ 20.0

$ 15.4

Enterprise Value Estimate (1)

High

Low

High

Low

($B)

60% Replacement

80% Replacement

(1) Market value estimate derived from 19,165MW of operating assets, which excludes 140MW for Plum Point and 337MW for Sandy Creek, multiplied by indicated percentages of

applicable replacement cost ranges shown on slide 14. Estimates exclude any value associated with development opportunities. (2) Pro forma 12/31/07.

43

Reconciliations –

Gross Margin, EBITDA and Core EBITDA ($MM)

GEN-WE

GEN-MW

GEN-NE

Total GEN

Other/CRM

Total

Revenue

470

$

1,310

$

1,075

$

2,855

$

40

$

2,895

$

Cost of sales

(185)

(440)

(680)

(1,305)

(10)

(1,315)

Gross margin

285

870

395

1,550

30

1,580

Operating expense

(95)

(200)

(190)

(485)

(5)

(490)

General and administrative expense

-

-

-

-

(205)

(205)

Gain on sale

-

80

-

80

-

80

Depreciation expense

(65)

(190)

(45)

(300)

(15)

(315)

Operating income

125

560

160

845

(195)

650

Other income and expense, net

10

-

-

10

40

50

EBITDA from discontinued operations

215

-

-

215

20

235

Plus: Depreciation expense

65

190

45

300

15

315

EBITDA

415

750

205

1,370

(120)

1,250

Less: Depreciation expense

(315)

Less: Interest expense

(385)

Less: Income tax expense

(240)

Net income

310

$

GEN-WE

GEN-MW

GEN-NE

Total GEN

Other/CRM

Total

Revenue

850

$

1,535

$

1,000

$

3,385

$

-

$

3,385

$

Cost of sales

(525)

(490)

(635)

(1,650)

(5)

(1,655)

Gross margin

325

1,045

365

1,735

(5)

1,730

Operating expense

(135)

(190)

(180)

(505)

-

(505)

General and administrative expense

-

-

-

-

(175)

(175)

Depreciation expense

(105)

(210)

(55)

(370)

(10)

(380)

Operating income

85

645

130

860

(190)

670

Other income and expense, net

-

-

-

-

50

50

Plus: Depreciation expense

105

210

55

370

10

380

EBITDA

190

855

185

1,230

(130)

1,100

Less: Depreciation expense

(380)

Less: Interest expense

(440)

Less: Income tax expense

(110)

Net income

170

$

Reconciliation of Gross Margin and EBITDA

Year Ending 12/31/08

Year Ending 12/31/07

EBITDA

$ 1,250

Legal and settlement, net

30

Illinois rate relief

25

Purchasing accounting adjustments

(30)

Gain on sale - CoGen Lyondell

(210)

Gain on sale - Percent ownership of Plum

Point & Sandy Creek

(80)

Change in fair value of interest rate swaps

and minority interest

20

Core Business EBITDA

$ 1,005

Reconciliation of 2007 Core Business EBITDA

Total

Revenue

5,000

$

Cost of sales

(2,500)

Gross margin

2,500

Operating expense

(650)

General and administrative expense

(225)

Depreciation expense

(530)

Operating income

1,095

Other income and expense, net

175

Plus: Depreciation expense

530

EBITDA

1,800

Less: Depreciation expense

(530)

Less: Interest expense

(470)

Less: Income tax expense

(265)

Net income

535

$

Market Recovery Outlook

44

Reconciliations –

Free Cash Flow & Net Debt and Other Obligations ($MM)

Market Recovery

Outlook

GEN

Other

Total

GEN

Other

Total

Operating Cash Flows

1,030

$

(635)

$

395

$

1,180

$

(545)

$

635

$

880

$

General maintenance

(125)

(15)

(140)

(60)

(20)

(80)

-

Outage work

-

-

-

(115)

-

(115)

-

Consent decree

(70)

-

(70)

(150)

-

(150)

-

Other environmental

-

-

-

(30)

-

(30)

-

Organic development

-

-

-

(45)

-

(45)

-

Plum Point development

(160)

-

(160)

(220)

-

(220)

-

Total Capital Expenditures

(355)

(15)

(370)

(620)

(20)

(640)

(280)

Investment in development portfolio

-

(10)

(10)

(20)

(20)

-

Proceeds from asset sales

560

(130)

430

200

-

200

-

Change in restricted cash

25

(975)

(950)

30

95

125

70

Investing Cash Flows

230

(1,130)

(900)

(390)

55

(335)

(210)

Free Cash Flow

(505)

300

670

Plus: Illinois rate relief / Legal settlements

50

10

-

Plus: Cash taxes on asset sales

10

-

-

Plus: Organic development

-

45

-

Plus: Plum Point development

165

220

-

Less: Proceeds from asset sales

(430)

(200)

-

Plus/(Less): Change in restricted cash

950

(125)

(70)

Free Cash Flow - Core Operating Business

240

$

250

$

600

$

12/31/07

12/31/08

Debt per pro-forma balance sheet

5,975

$

6,120

$

Less:

Cash and cash equivalents

(300)

(735)

Restricted cash - LC/Sandy Creek

(1,175)

(1,075)

Restricted cash - Plum Point

(59)

(29)

Net Debt

4,441

$

4,281

$

Plus:

Central Hudson Imputed Principal

770

700

Net Debt & Other Obligations

5,211

$

4,981

$

12/31/07

12/31/08

Net Debt

4,441

$

4,281

$

Equity

4,558

4,733

Total Capitalization

8,999

$

9,014

$

Net Debt / Capitalization

49%

47%

Reconciliation of Free Cash Flow and Free Cash Flow - Core Operating Business

Capitalization

Reconciliation of Net Debt and Net Debt & Other Obligations

Year Ending 12/31/07

Year Ending 12/31/08

45

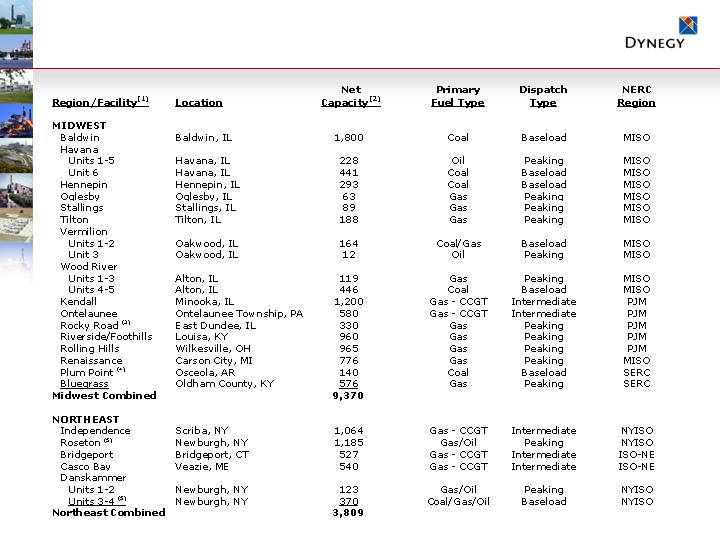

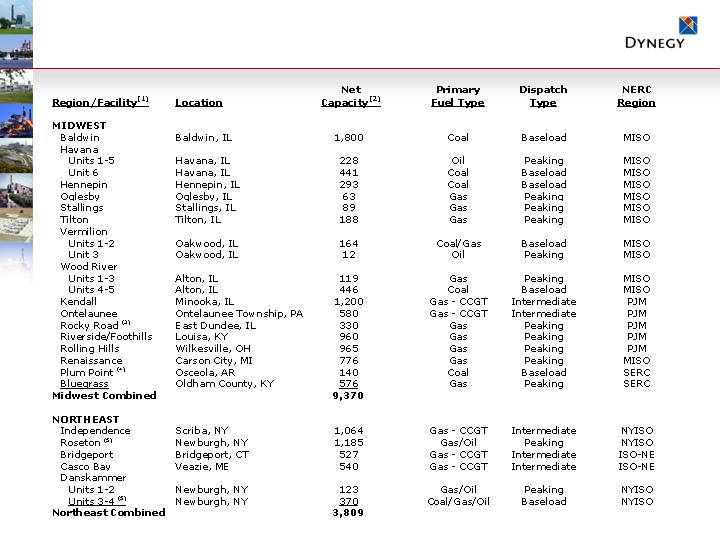

Generation Assets – Midwest & Northeast

46

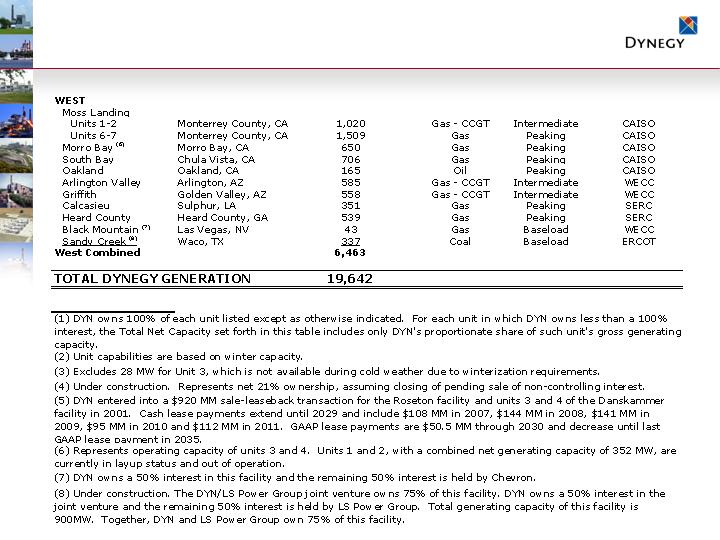

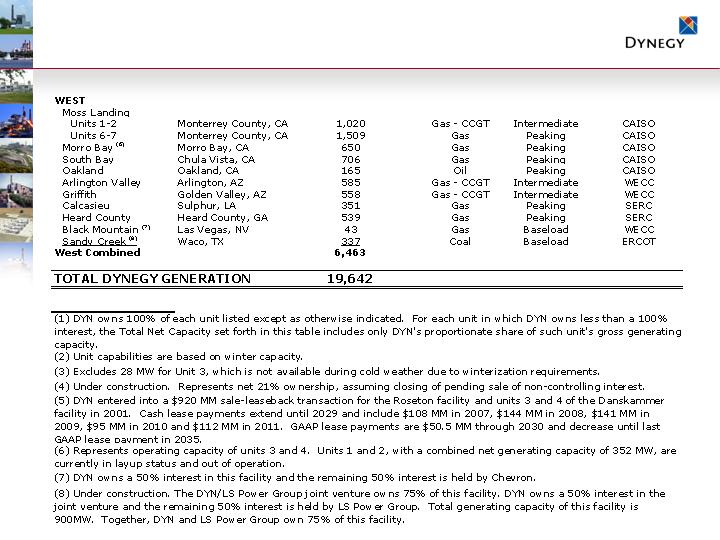

Generation Assets – West & Notes

47