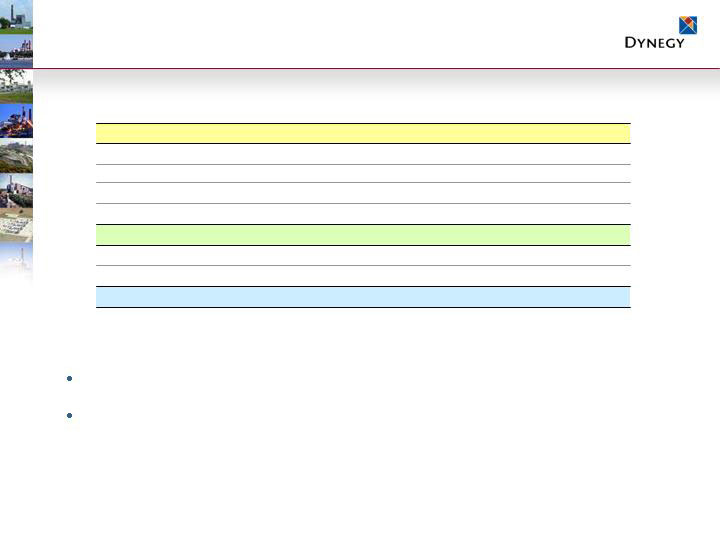

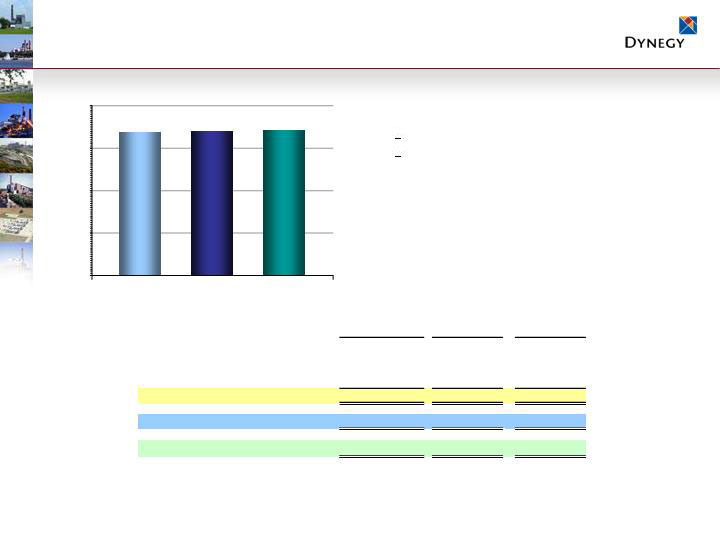

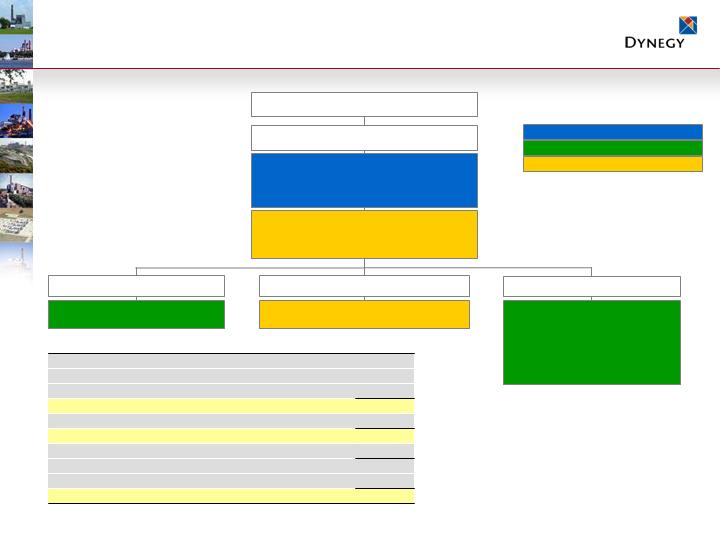

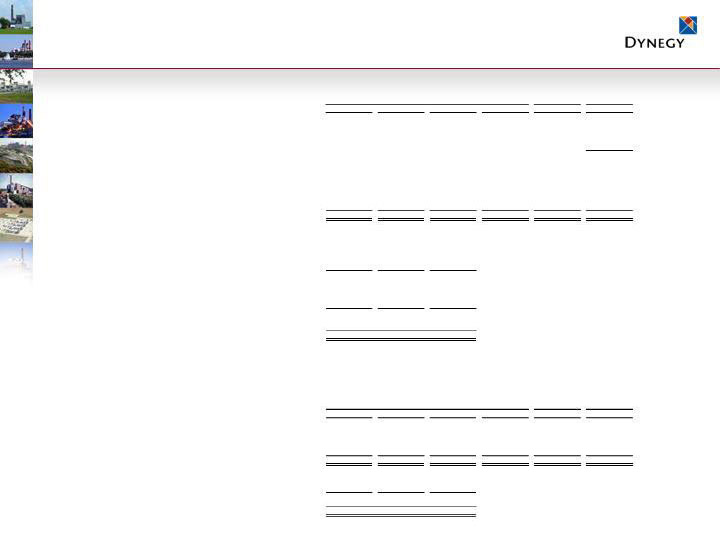

Reg G Reconciliation – 2008 Guidance

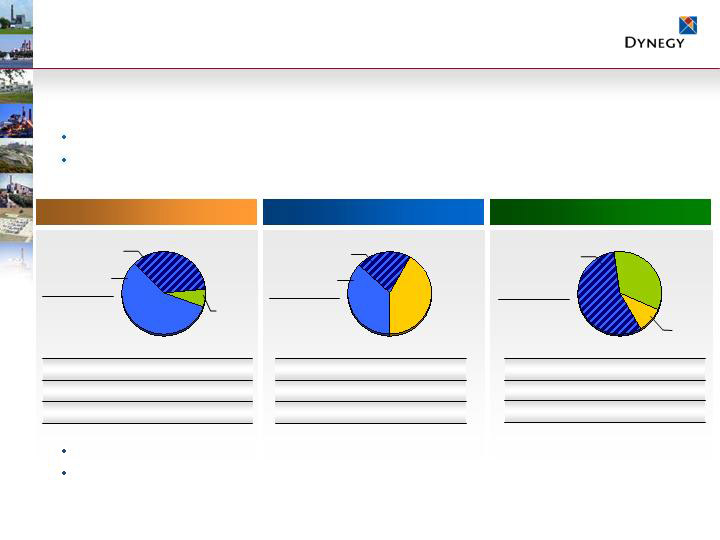

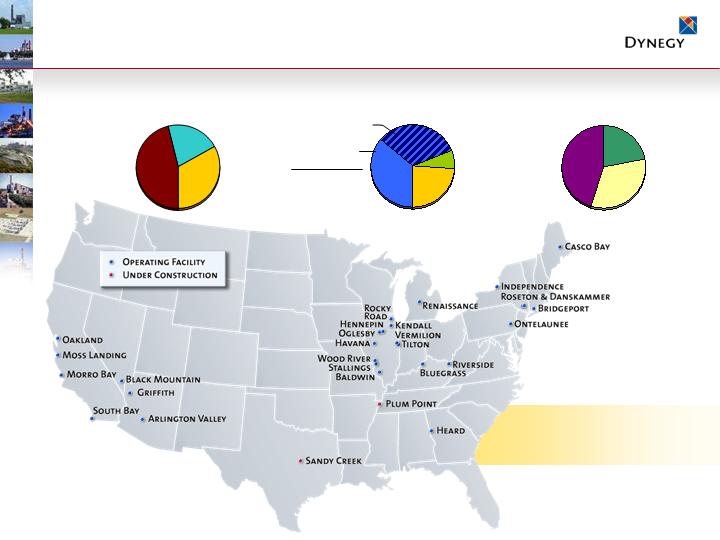

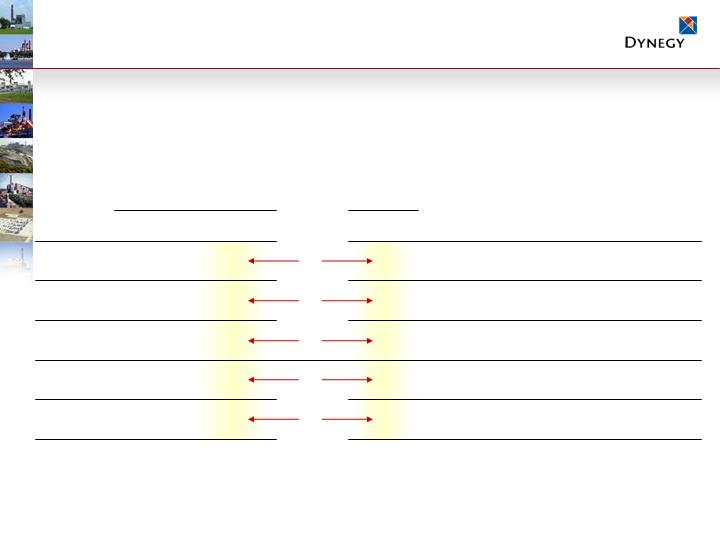

GEN - MW

GEN - WE

GEN - NE

Total GEN

OTHER

Total

Net Loss

(30)

$

Add Back:

Income tax benefit

(20)

Interest expense

430

Depreciation and amortization expense

380

EBITDA (2)

655

$

144

$

70

$

869

$

(109)

$

760

$

Plus / (Less):

Release of state franchise tax and sales tax liabilities

-

-

-

-

(16)

(16)

Gain on sale of NYMEX shares

-

-

-

-

(15)

(15)

Gain on sale of Sandy Creek ownership interest

-

(13)

-

(13)

-

(13)

Gain on sale of Oyster Creek ownership interest

-

(11)

-

(11)

-

(11)

Gain on sale of Rolling Hills

(50)

-

-

(50)

-

(50)

Mark-to-market

140

60

100

300

-

300

Adjusted EBITDA (2)

745

$

180

$

170

$

1,095

$

(140)

$

955

$

GEN

OTHER

Total

Adjusted EBITDA (2)

1,095

$

(140)

$

955

$

Cash Interest Payments

-

(430)

(430)

Cash Tax Payments

-

(15)

(15)

Collateral

(15)

-

(15)

Working Capital / Other Changes

(25)

40

15

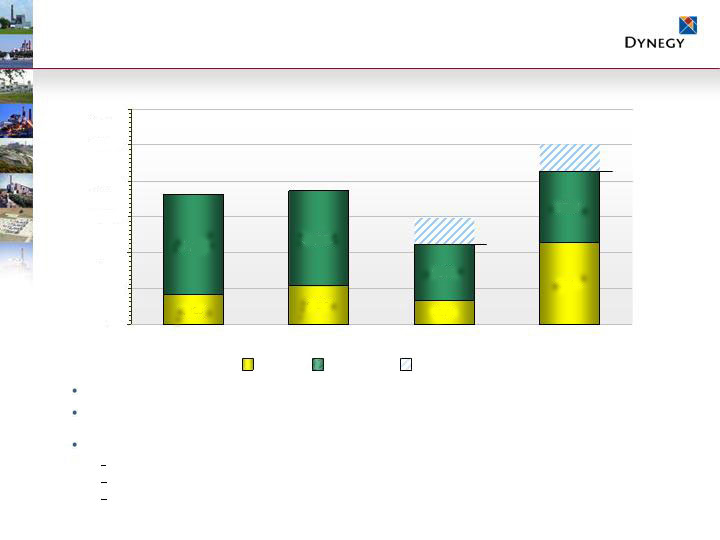

Adjusted Cash Flow from Operations (3)

1,055

(545)

510

Maintenance Capital Expenditures

(155)

(15)

(170)

Environmental Capital Expenditures

(200)

-

(200)

Adjusted Free Cash Flow (4)

700

$

(560)

$

140

$

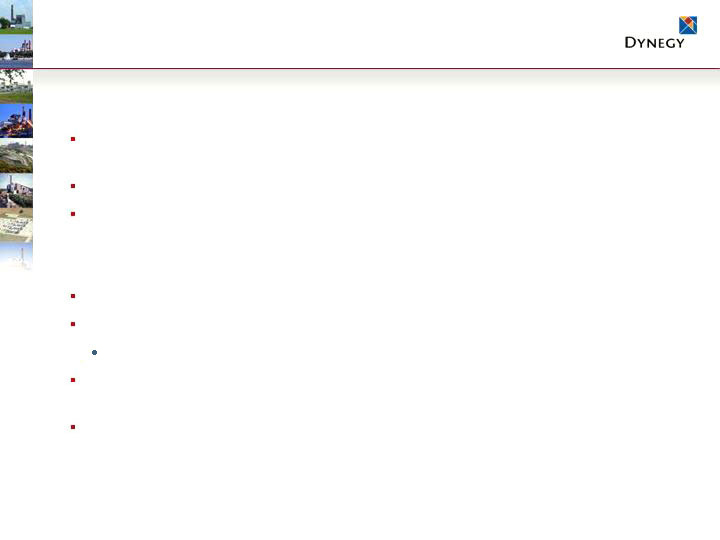

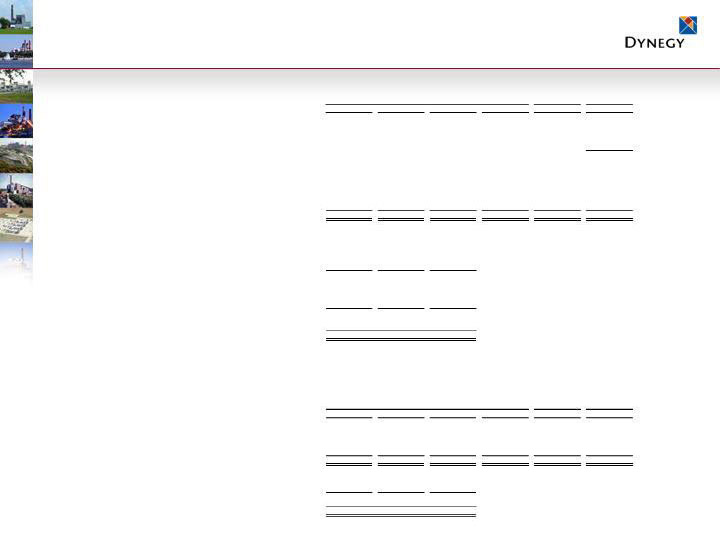

(1)

(2)

GEN - MW

GEN - WE

GEN - NE

Total GEN

OTHER

Total

Operating income (loss)

440

$

44

$

15

$

499

$

(159)

$

340

$

Losses from unconsolidated investments

-

-

-

-

(25)

(25)

Other items, net

-

-

-

-

65

65

Add: Depreciation and amortization expense

215

100

55

370

10

380

EBITDA

655

$

144

$

70

$

869

$

(109)

$

760

$

(3)

GEN

OTHER

Total

Adjusted Cash Flow from Operations

1,055

$

(545)

$

510

$

Legal and regulatory payments

(10)

(15)

(25)

Cash Flow from Operations

1,045

$

(560)

$

485

$

(4)

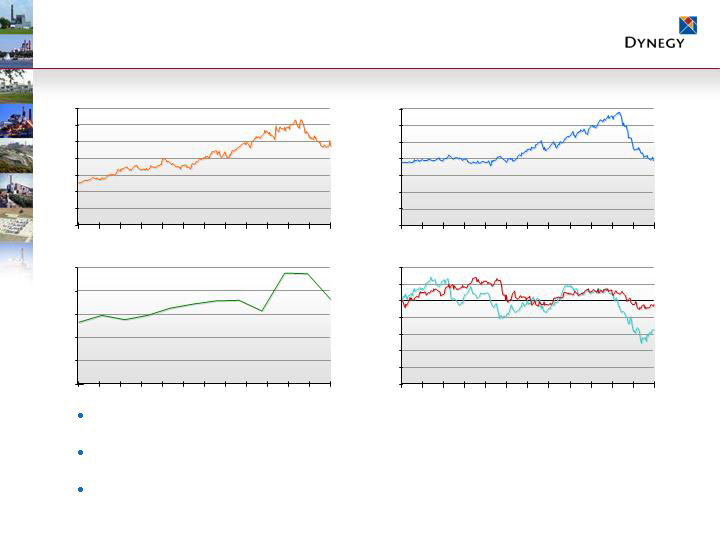

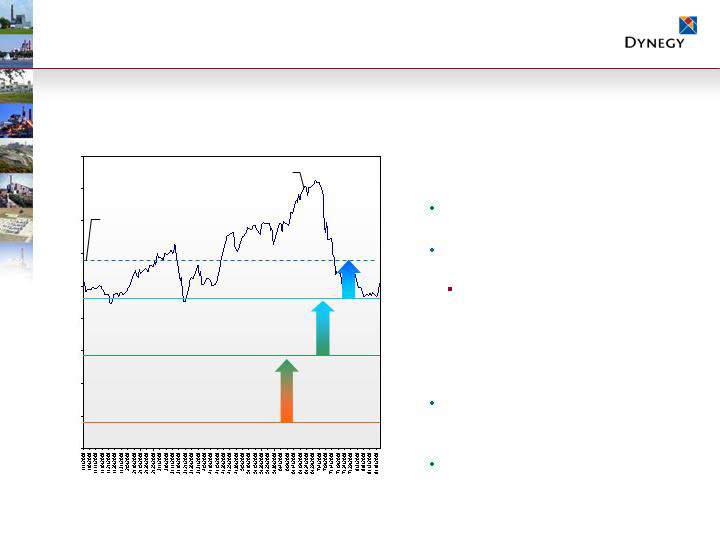

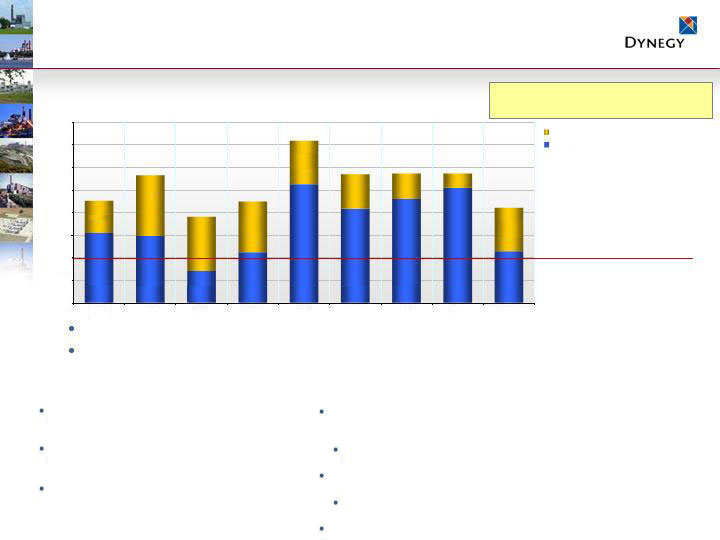

2008 EARNINGS ESTIMATES (1)

(IN MILLIONS)

Power Generation

Adjusted Cash Flow from Operations is a non-GAAP financial measure. Please see Summary Cash Flow Information for a definition.

Adjusted Free Cash Flow is a non-GAAP financial measure. Please see Summary Cash Flow Information for a definition.

2008 CASH FLOW ESTIMATES (1)

(IN MILLIONS)

Power Generation

2008 estimates are based on quoted forward commodity price curves as of 7/8/08. Actual results may vary materially from these estimates based on changes in commodity prices, among other things,

including operational activities, legal settlements, financing or investing activities and other uncertain or unplanned items. Reduced 2008 and forward EBITDA or free cash flow could result from potential

divestitures of (a) non-core assets where the earnings potential is limited, or (b) assets where the value that can be captured through a divestiture is believed to outweigh the benefits of continuing to own

or operate such assets. Divestitures could also result in impairment charges.

EBITDA and Adjusted EBITDA are non-GAAP financial measures. Please see Reported Segmented Results of Operations for the three months ended June 30, 2008 for a definition. A reconciliation of

EBITDA to Operating income (loss) by reportable segment is presented below.

32