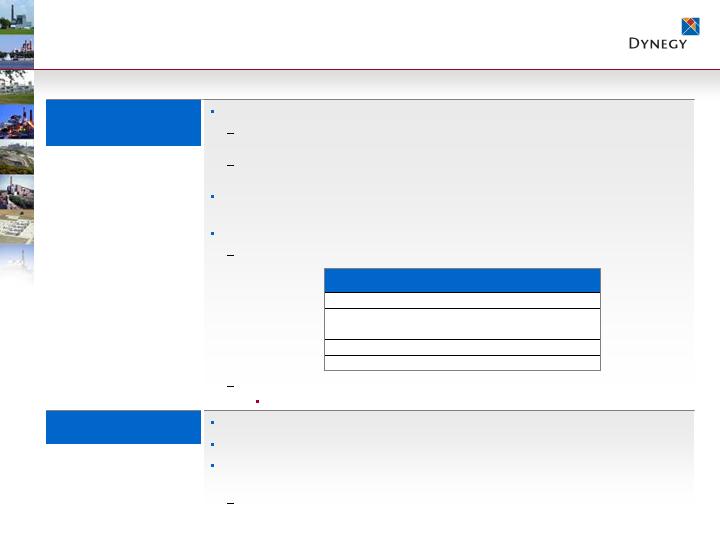

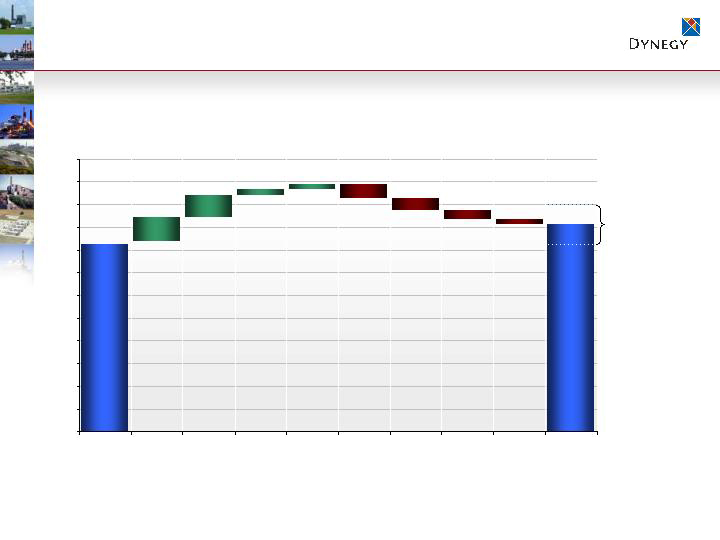

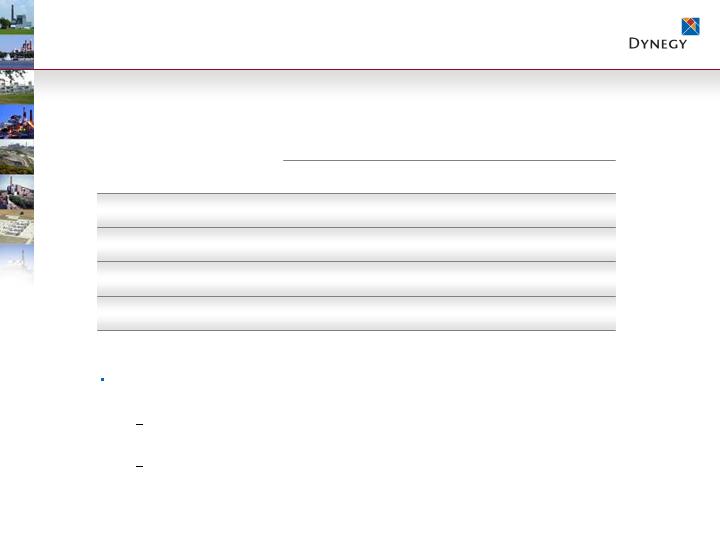

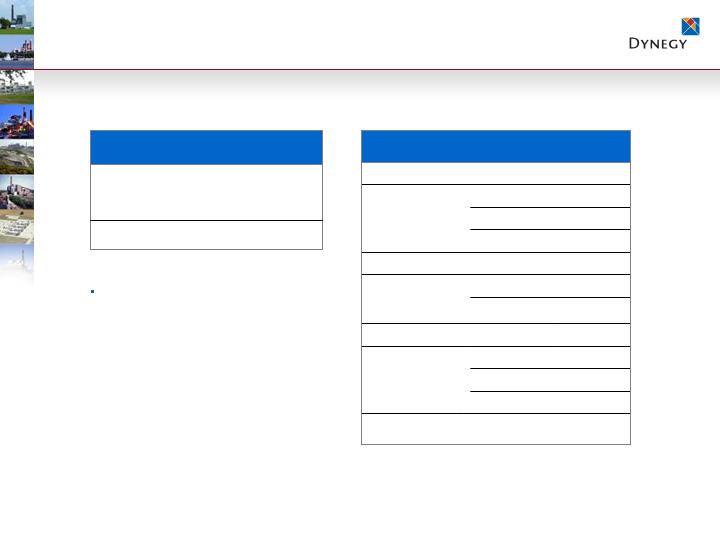

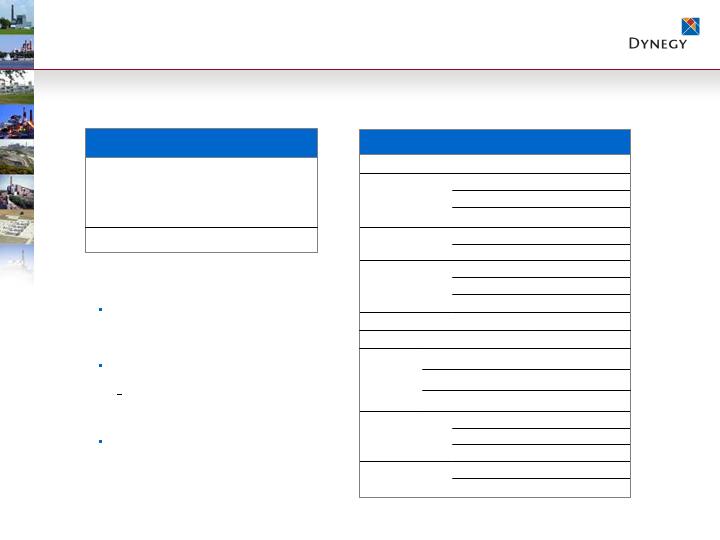

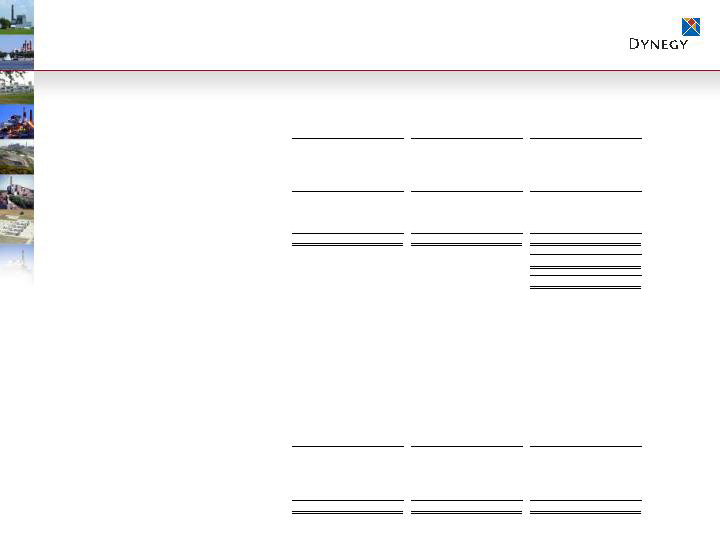

Reg G Reconciliation – 2008 Guidance

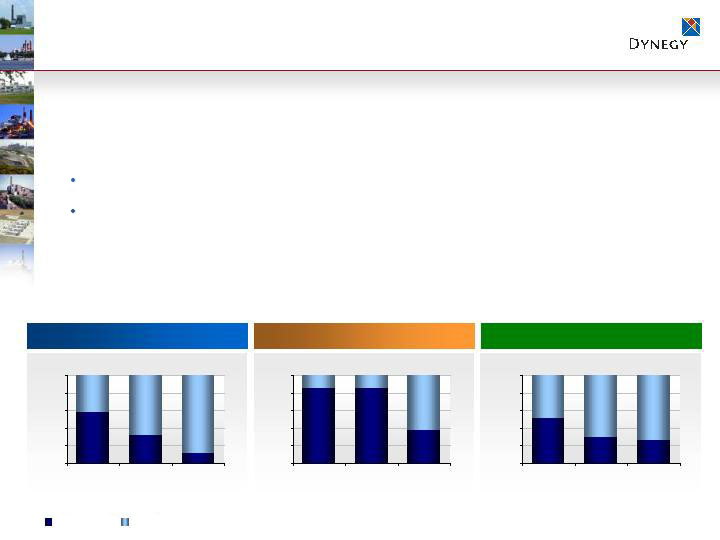

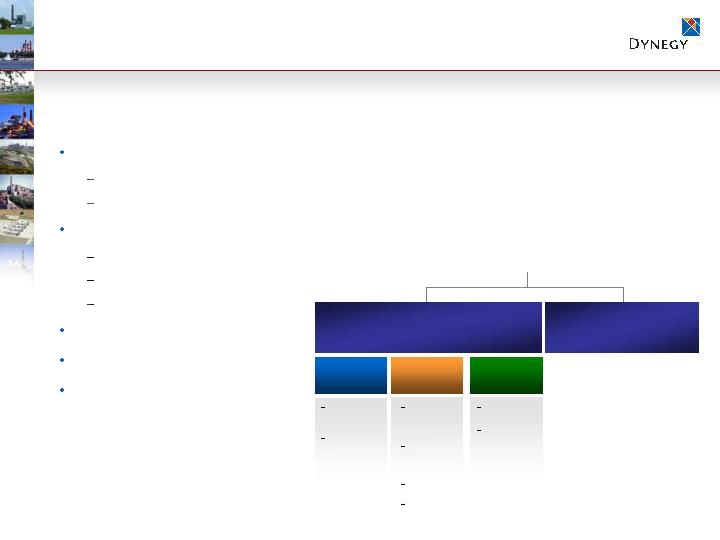

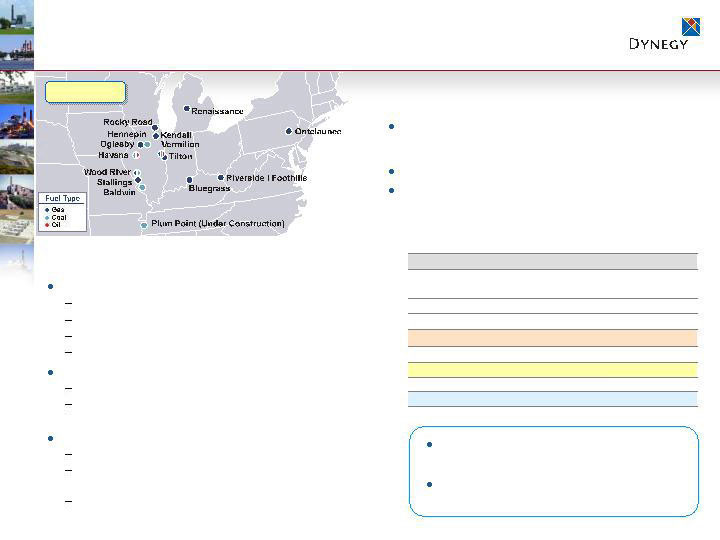

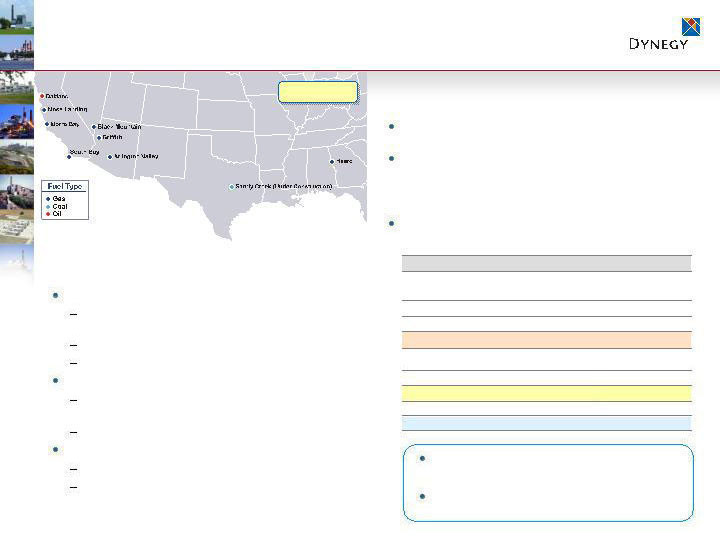

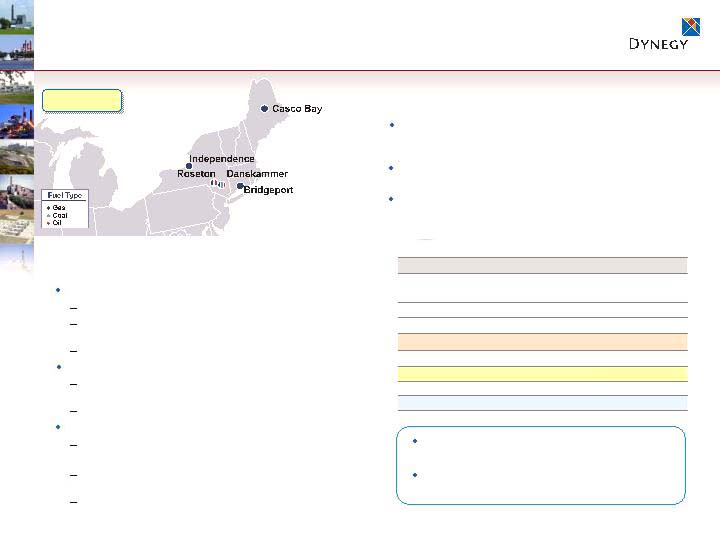

GEN - MW

GEN - WE

GEN - NE

Total GEN

OTHER

Total

Net Income

195

$

add back:

Income tax expenses

120

Interest expense

430

Deppreciation and amortization expense

380

EBITDA (2)

832

$

229

$

137

$

1,198

$

(73)

$

1,125

$

Plus/(less):

Release of state franchise tax and sales tax liabilities

-

-

-

-

(16)

(16)

Gain on liquidation of foreign entity

-

-

-

-

(26)

(26)

Gain on sale of NYMEX shares

-

-

-

-

(15)

(15)

Gain on sale of Sandy Creek ownership interest

-

(13)

-

(13)

-

(13)

Gain on sale of Oyster Creek ownership interest

-

(11)

-

(11)

-

(11)

Gain on sale of Rolling Hills

(57)

-

-

(57)

-

(57)

Mark-to-market

(105)

(45)

3

(147)

-

(147)

Adjusted EBITDA (2)

670

$

160

$

140

$

970

$

(130)

$

840

$

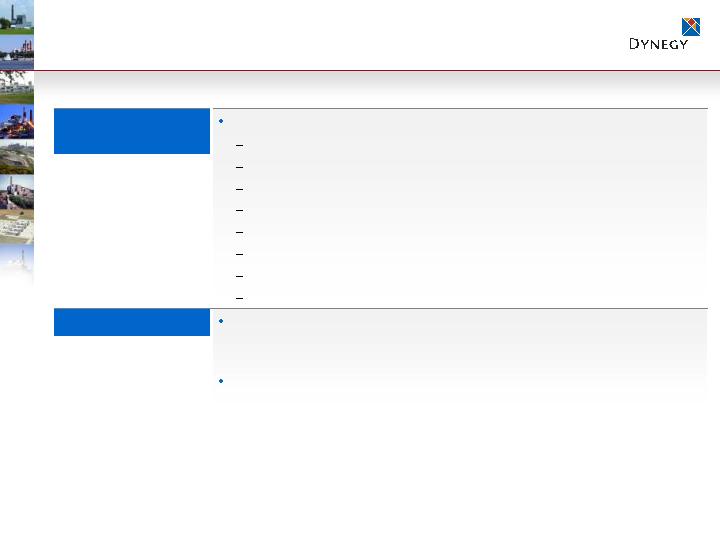

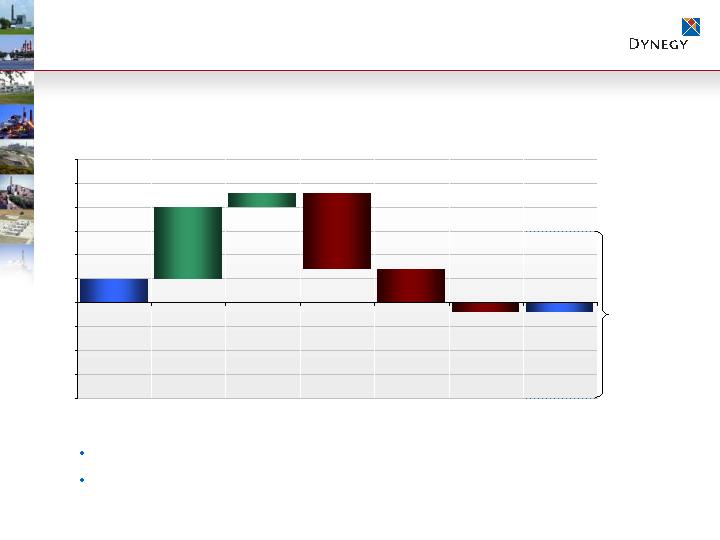

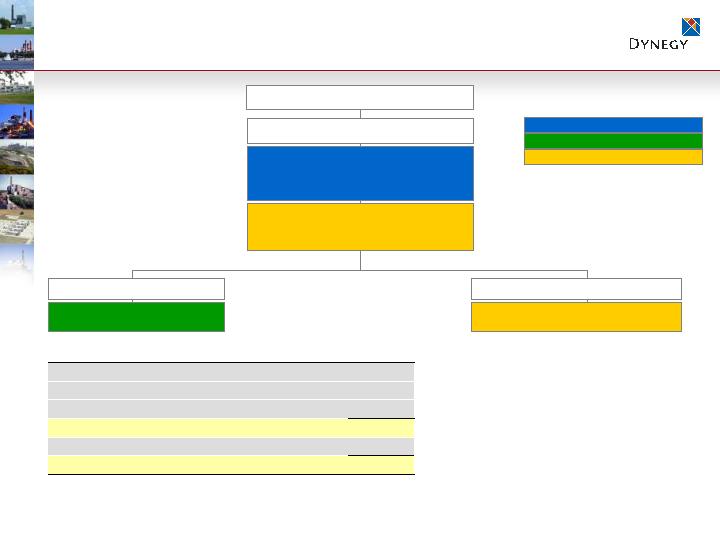

GEN

OTHER

TOTAL

Adjusted EBITDA (2)

970

$

(130)

$

840

$

Cash Interest Payments

-

(430)

(430)

Cash Tax Payments

-

(15)

(15)

Collateral

(15)

-

(15)

Working Capital/Other Changes

(25)

40

15

Adjusted Cash Flow from Operations (4)

930

(535)

395

Maintenance Capital Expenditures

(155)

(15)

(170)

Environmental Capital Expenditures

(200)

-

(200)

Adjusted Free Cash Flow (4)

575

$

(550)

$

25

$

Net cash used in investing Activities

(170)

$

Net cash provided by Financing Activities

150

$

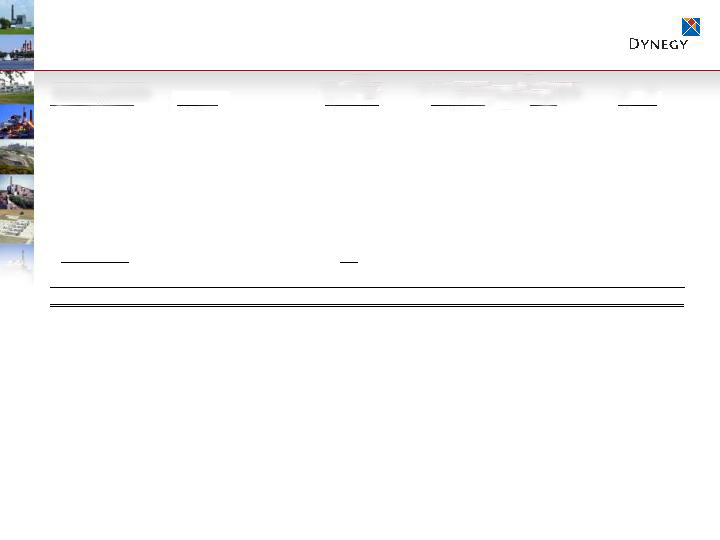

(1)

(2)

GEN - MW

GEN - WE

GEN - NE

Total GEN

OTHER

Total

Operating income (loss)

617

$

132

$

77

$

826

$

(146)

$

680

$

Losses from unconsolidated investments

-

(8)

-

(8)

(11)

(19)

Other items, net

-

5

5

10

74

84

Add: Depreciation and amortization expense

215

100

55

370

10

380

EBITDA

832

$

229

$

137

$

1,198

$

(73)

$

1,125

$

(3)

(4)

GEN

OTHER

TOTAL

Cash Flow from Operations

920

$

(550)

$

370

$

Legal and regulatory payments

10

15

25

Adjusted Cash Flow from Operations

930

(535)

395

Maintenance capital expenditures

(155)

(15)

(170)

Environmental capital expenditures

(200)

-

(200)

Adjusted Free Cash Flow

575

$

(550)

$

25

$

Adjusted Cash Flow from Operations and Adjusted Free Cash Flow are non-GAAP financial measures. Please refer to Item 2.02 of our Form 8-K filed on November 6, 2008 for definitions, utility and

uses of such non-GAAP financial measures. A reconciliation of Adjusted Cash Flow from Operations and Adjusted Free Cash Flow to Cash from Operations is presented below.

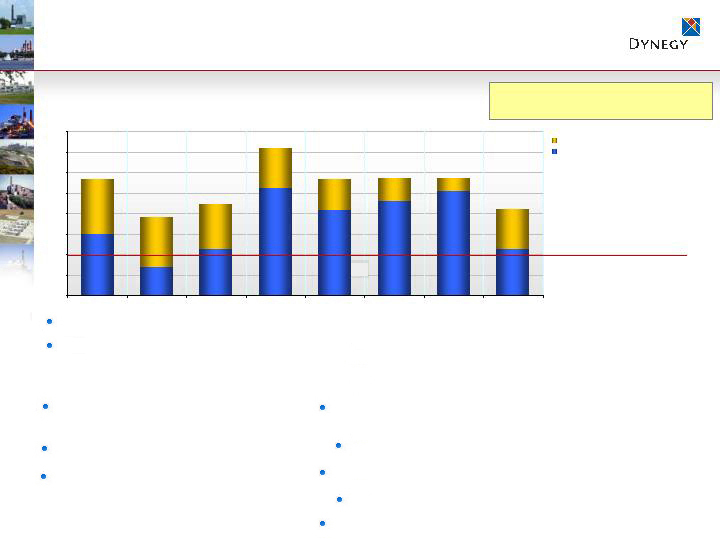

2008 CASH FLOW ESTIMATES (1) (3)

(IN MILLION)

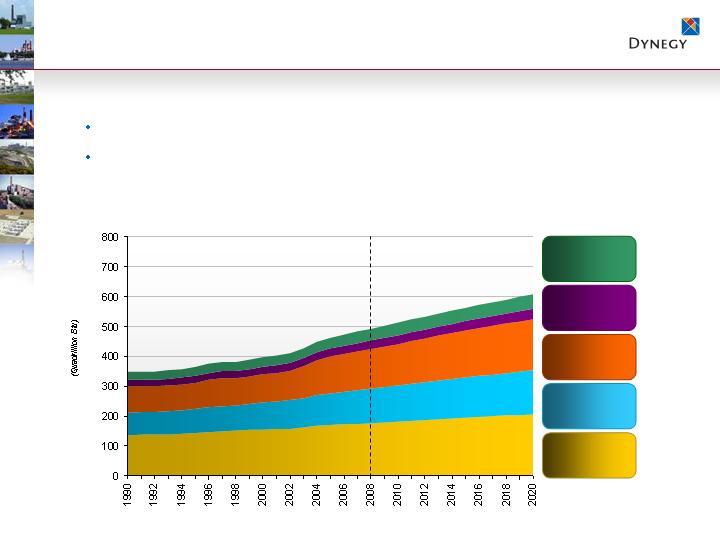

Power Generation

2008 estimates are based on quoted forward commodity price curves as of October 7, 2008. Actual results may vary materially from these estimates based on changes in commodity prices, among

other things, including operational activities, legal settlements, financing or investing activities and other uncertain or unplanned items. Reduced 2008 and forward EBITDA or free cash flow could result

from potential divestitures of (a) non-core assets where the earnings potential is limited, or (b) assets where the value that can be captured through a divestiture is believed to outweigh the benefits of

continuing to won or operate such assets. Divestitutures could also result in impairment charges.

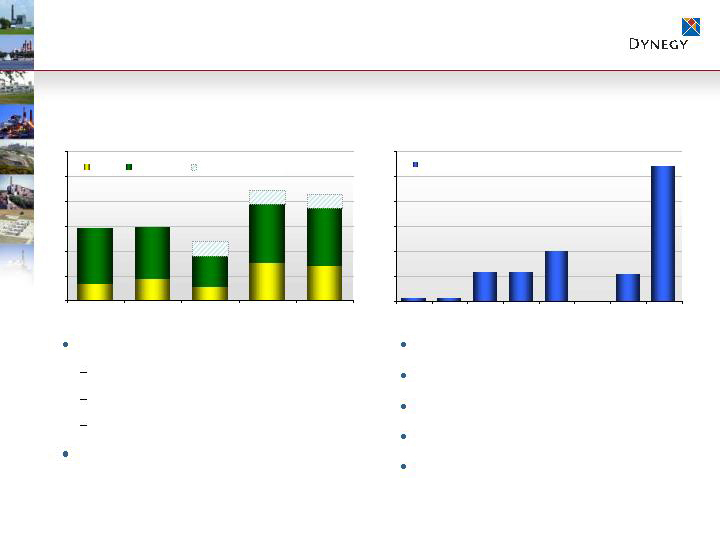

EBITDA and Adjusted EBITDA are non-GAAP financial measures. Please refer to Item 2.02 of our Form 8-K filed on November 6, 2008 for definitions, utilities and uses of such non-GAAP financial

measures. A reconciliation of EBITDA to Operating income (loss) is presented below. Management does not allocate interest expenses and income taxes on segment level and therefore uses

Operating income (loss) as the most directly comparable GAAP measure.

This presentation is not intended to be a reconciliation of non-GAAP measures pursuant to Regulation G.

2008 EARNINGS ESTIMATES (1)

(IN MILLIONS)

Power Generation

As presented November 6, 2008

44