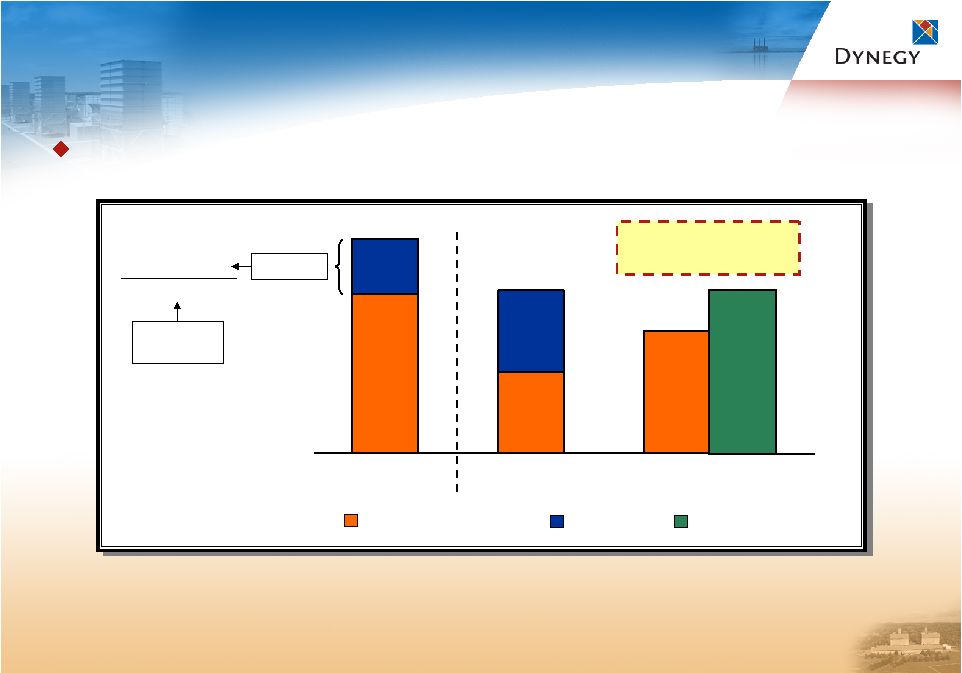

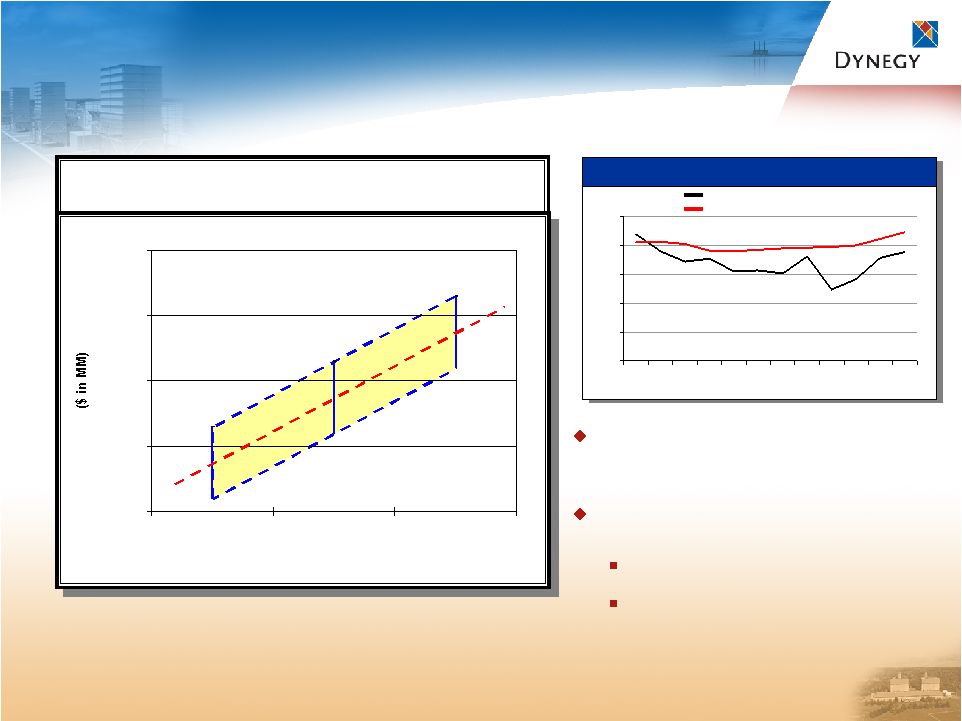

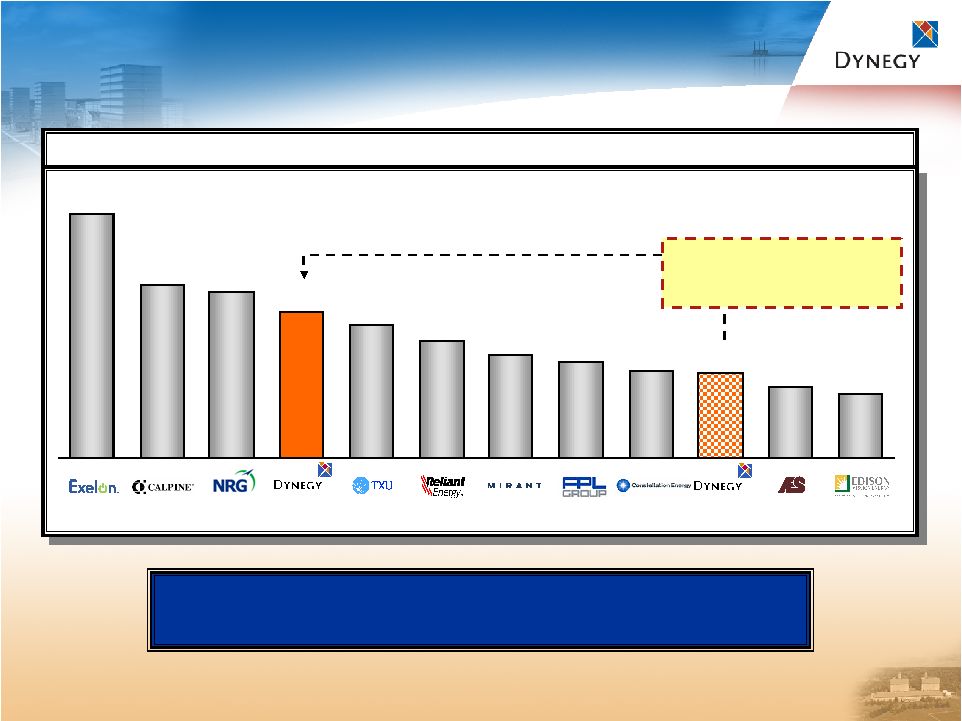

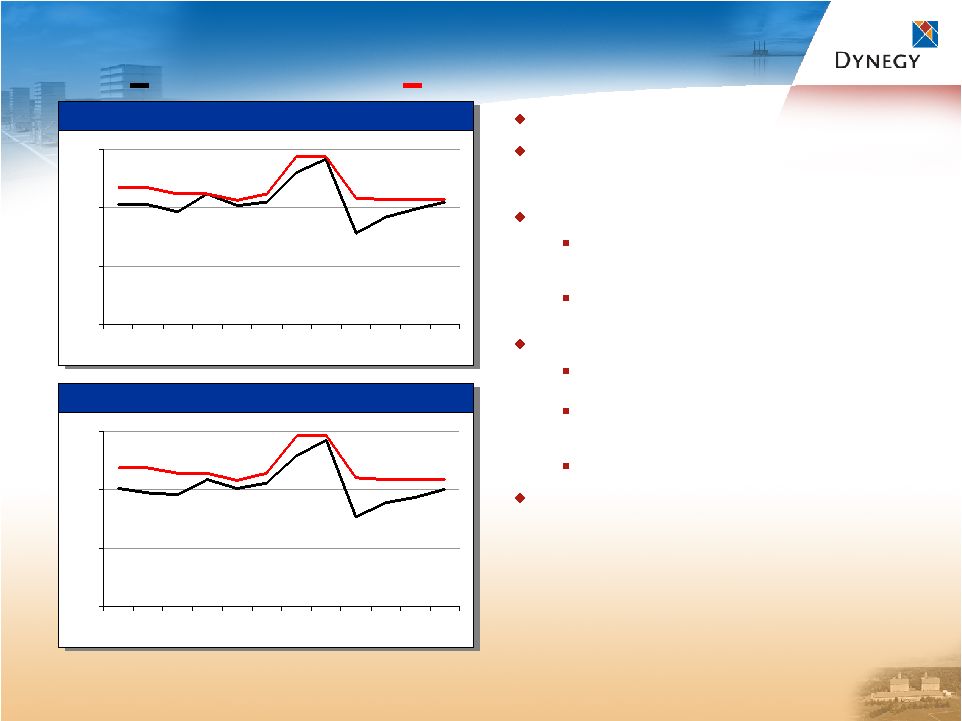

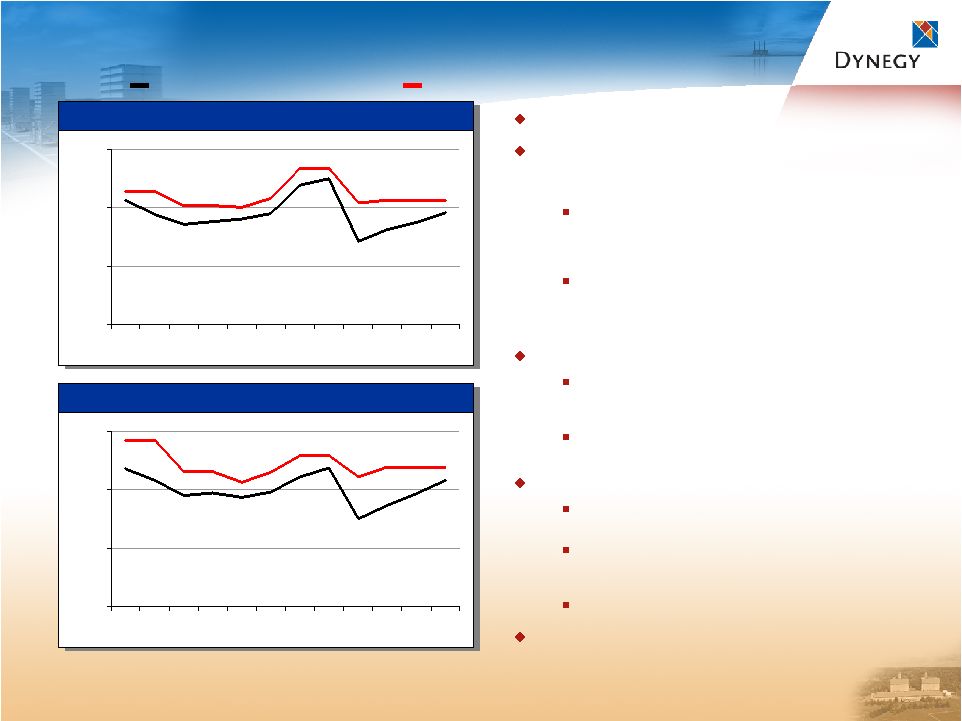

19 NORTHEAST GENERATION: 2007 NORTHEAST GENERATION: 2007 2007E sales volumes of 10-11 MM MWh EBITDA of $175-205 MM includes RMR contracts, bilateral capacity agreements and financial forward sales contracts EBITDA includes approximately $50 MM of Central Hudson lease expense, which is classified as operating expense; cash flow includes cash payments of $108 MM in 2007 Operating income from ConEd contract reflects approximately $50 MM net earnings; however, cash flow includes cash receipt of approximately $100 MM Primary market drivers include: NYISO – Spark spread for uncontracted combined cycle gas and fuel oil units, and outright power price for uncontracted baseload coal volumes ISO-NE – Spark spread for uncontracted combined cycle gas units Fuel supply 2007E South American coal delivered price ~$2.90/MMBtu 100% coal supply contracted at fixed price through 2007, with diversified suppliers and load ports 2007E fuel oil delivered price ~$8.85/MMBtu In-market availability assumed to be 90% $0 $35 $70 $105 J F M A M J J A S O N D $0 $40 $80 $120 J F M A M J J A S O N D New York Zone G Mass Hub 2006A/F: $75.83 2007F: $88.75 2006A/F: $70.26 2007F: $85.60 ($/MWh) 2006 Actual/Forward as of 11/01/06 (1) 2007 Forward as of 11/01/06 (2) Note: 2007 estimates are as presented 12/13/06. (1) Pricing as of 11/01/06. Prices reflect actual day ahead on-peak settlement prices for Jan.-Oct. and quoted forward on-peak monthly prices for Nov.-Dec. 2006. (2) Pricing as of 11/01/06, which was the basis for estimates as presented 12/13/06. Prices reflect quoted forward on-peak monthly prices for 2007. |