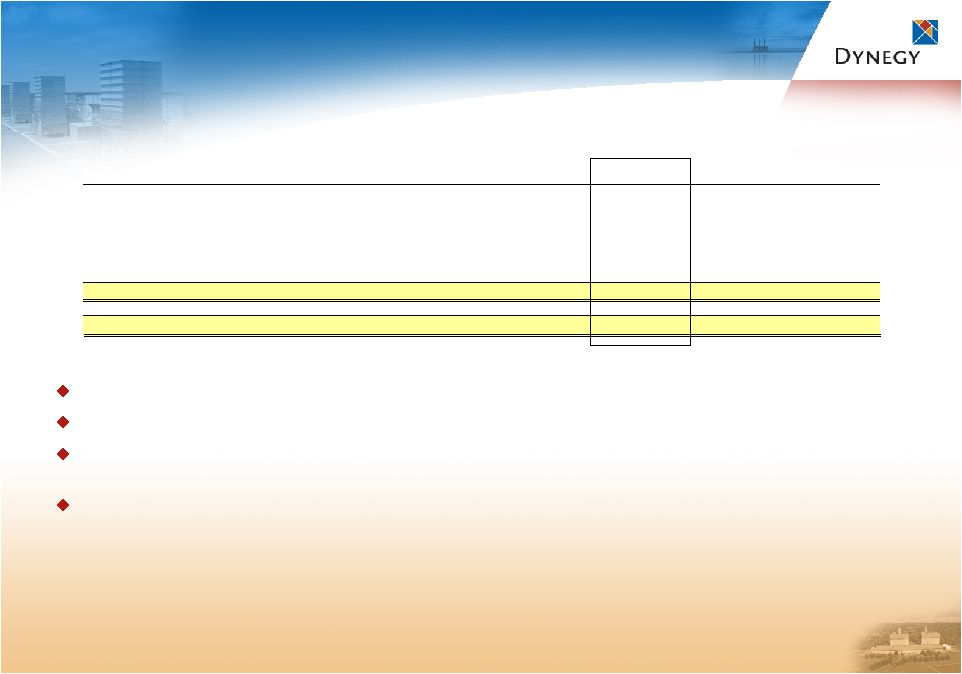

29 GENERATION ASSET LIST (CONT.) GENERATION ASSET LIST (CONT.) Net Primary Dispatch NERC Region/Facility Location Capacity (1) Fuel Type Type Region WEST Moss Landing Units 1-2 Monterrey County, CA 1,020 Gas - CCGT Baseload CAISO Units 6-7 Monterrey County, CA 1,509 Gas Peaking CAISO Morro Bay (6) Morro Bay, CA 650 Gas Peaking CAISO South Bay Chula Vista, CA 706 Gas Peaking CAISO Oakland Oakland, CA 165 Oil Peaking CAISO Arlington Valley Arlington, AZ 585 Gas - CCGT Intermediate WECC Griffith Golden Valley, AZ 558 Gas - CCGT Intermediate WECC Calcasieu (7) Sulphur, LA 351 Gas Peaking SERC Heard County (4) Heard County, GA 539 Gas Peaking SERC Black Mountain (8) Las Vegas, NV 43 Gas Baseload WECC Cogen Lyondell (4) Houston, TX 614 Gas - CCGT Baseload ERCOT West Combined 6,740 TOTAL DYNEGY GENERATION 20,044 (8) Dynegy owns a 50% interest in this facility and the remaining 50% interest is held by Chevron. Total generating capacity of this facility is 85 MW. (1) Unit capabilities are based on winter capacity. (5) DYN entered into a $920 MM sale-leaseback transaction for the Roseton facility and units 3 and 4 of the Danskammer facility in 2001. Cash lease payments extend until 2029 and include $108 MM in 2007, $144 MM in 2008, $141 MM in 2009, $95 MM in 2010 and $112 MM in 2011. GAAP lease payments are $50.5 MM through 2030 and decrease until last GAAP lease payment in 2035. (3) Under construction. Represents net 40% ownership. (2) Excludes 28 MW of capacity for Unit 3, which is not available during cold weather because of winterization requirements. (6) Represents generating capacity of units 3 and 4. Units 1 and 2, with a combined net generating capacity of 352 MW, are currently in layup status and out of operation. (4) Dynegy is conducting a portfolio review and may consider divesting certain assets that (a) are primarily peaking in nature and generally operate in locations where market recovery is projected to occur much further in the future than in other regions in which the company will have a significant asset position, or (b) could present value propositions through potential dispositions not likely to be achieved through continued ownership and operation by the company. Based on this review, the Bluegrass, Cogen Lyondell and Heard County generation facilities could be targets for sale in 2007. (7) Dynegy has entered into an agreement to sell this generation facility, the closing of which is expected in early 2008. |