Forward-Looking Statements/Additional Information/

Participants in Solicitation

2

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward looking

statements.” Discussion of risks and uncertainties that could cause actual results to differ materially from current projections, forecasts, estimates and expectations of

Dynegy is contained in Dynegy's filings with the Securities and Exchange Commission (the “SEC”). Specifically, Dynegy makes reference to, and incorporates herein by

reference, the section entitled “Risk Factors” in its most recent Form 10-K and subsequent reports on Form 10-Q, the section entitled “Cautionary Statement Regarding

Forward-Looking Statements” in its preliminary proxy statement filed with the SEC on January 10, 2011 and the section entitled “Forward-Looking Statements” in its

preliminary consent revocation statement filed with the SEC on November 26, 2010. In addition to the risks and uncertainties set forth in Dynegy's SEC filings, the

forward-looking statements described in this presentation could be affected by, among other things, (i) the timing and anticipated benefits to be achieved through

Dynegy's 2010-2013 company-wide cost savings program; (ii) beliefs and assumptions relating to liquidity, available borrowing capacity and capital resources generally;

(iii) expectations regarding environmental matters, including costs of compliance, availability and adequacy of emission credits, and the impact of ongoing proceedings

and potential regulations or changes to current regulations, including those relating to climate change, air emissions, cooling water intake structures, coal combustion

byproducts, and other laws and regulations to which Dynegy is, or could become, subject; (iv) beliefs about commodity pricing and generation volumes; (v) anticipated

liquidity in the regional power and fuel markets in which Dynegy transacts, including the extent to which such liquidity could be affected by poor economic and financial

market conditions or new regulations and any resulting impacts on financial institutions and other current and potential counterparties; (vi) sufficiency of, access to and

costs associated with coal, fuel oil and natural gas inventories and transportation thereof; (vii) beliefs and assumptions about market competition, generation capacity

and regional supply and demand characteristics of the wholesale power generation market, including the potential for a market recovery over the longer term; (viii) the

effectiveness of Dynegy's strategies to capture opportunities presented by changes in commodity prices and to manage its exposure to energy price volatility; (ix) beliefs

and assumptions about weather and general economic conditions; (x) beliefs regarding the U.S. economy, its trajectory and its impacts, as well as Dynegy's stock price;

(xi) projected operating or financial results, including anticipated cash flows from operations, revenues and profitability; (xii) expectations regarding Dynegy's revolver

capacity, credit facility compliance, collateral demands, capital expenditures, interest expense and other payments; (xiii) Dynegy's focus on safety and its ability to

efficiently operate its assets so as to maximize its revenue generating opportunities and operating margins; (xiv) beliefs about the outcome of legal, regulatory,

administrative and legislative matters; (xv) expectations and estimates regarding capital and maintenance expenditures, including the Midwest Consent Decree and its

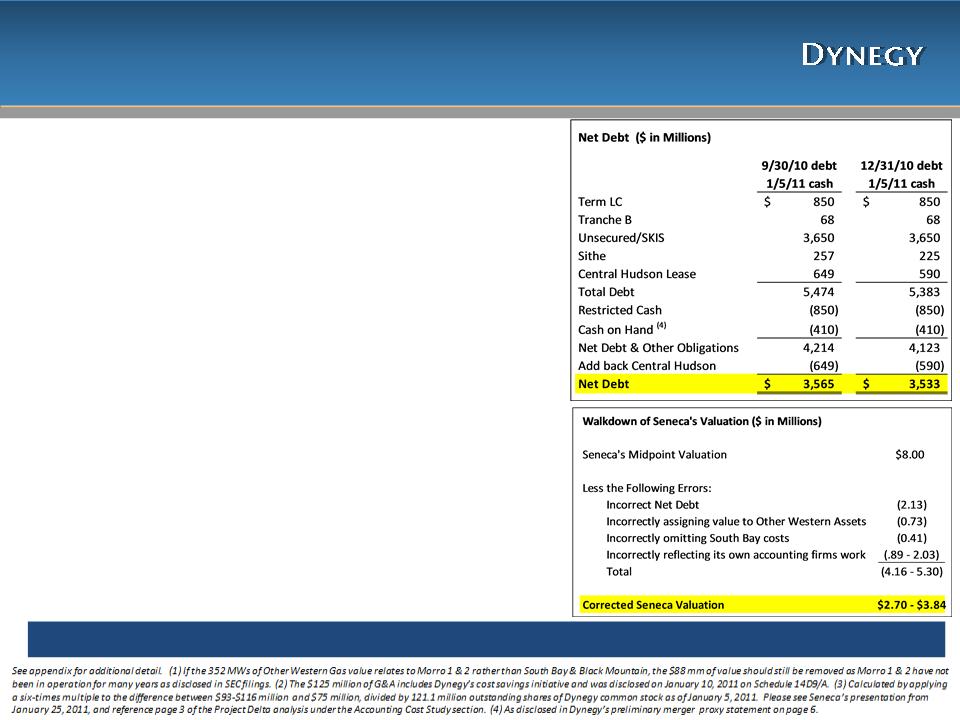

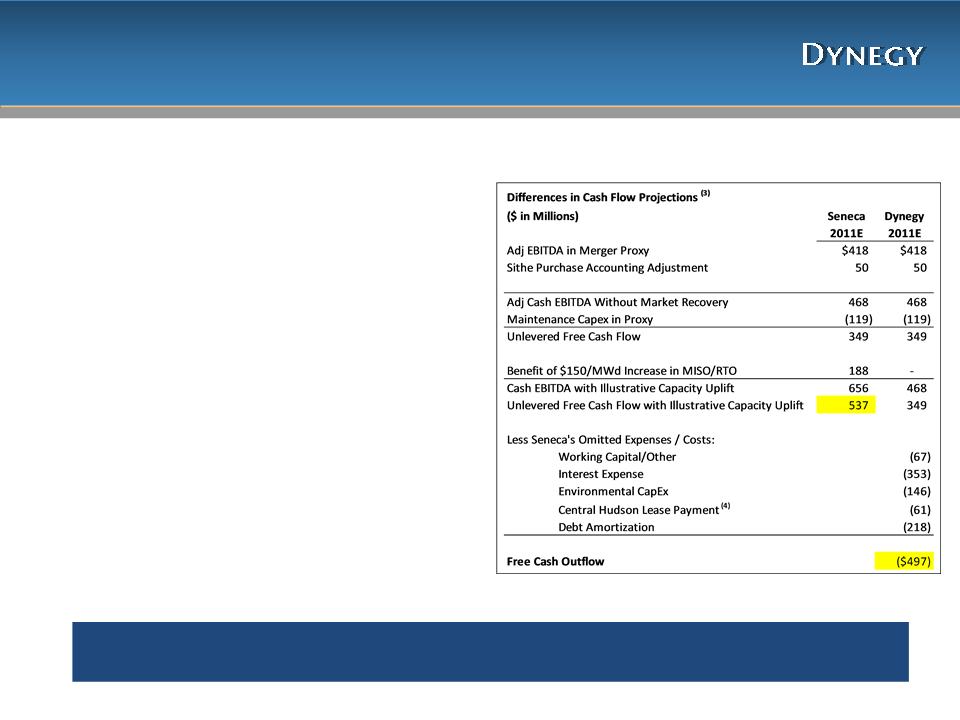

associated costs; (xvi) uncertainties associated with the consent solicitation (the “Seneca Capital Solicitation”) engaged in by Seneca Capital International Master Fund,

L.P., Seneca Capital, L.P., Seneca Capital Investments, L.P., Seneca Capital Investments, LLC, Seneca Capital International GP, LLC, Seneca Capital Advisors, LLC and

Douglas A. Hirsch (“Seneca Capital”) and (xvii) uncertainties associated with the proposed acquisition of Dynegy by an affiliate of Icahn Enterprises LP (the

"Transaction"), including uncertainties relating to the anticipated timing of filings and approvals relating to the Transaction, the outcome of legal proceedings that may

be instituted against Dynegy and/or others relating to the Transaction, the expected timing of completion of the Transaction, the satisfaction of the conditions to the

consummation of the Transaction and the ability to complete the Transaction. Any or all of Dynegy's forward-looking statements may turn out to be wrong. They can be

affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond Dynegy's control.

This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, many of which are beyond

our ability to control or predict. Forward-looking statements may be identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “will” or words of similar meaning and include, but are not limited to, statements about the expected future business and financial performance of Icahn

Enterprises L.P. and its subsidiaries. Among these risks and uncertainties are risks related to economic downturns, substantial competition and rising operating costs;

risks related to our investment management activities, including the nature of the investments made by the private funds we manage, losses in the private funds and loss

of key employees; risks related to our automotive activities, including exposure to adverse conditions in the automotive industry, and risks related to operations in

foreign countries; risks related to our railcar operations, including the highly cyclical nature of the railcar industry; risks related to our food packaging activities, including

the cost of raw materials and fluctuations in selling prices; risks related to our scrap metals activities, including potential environmental exposure and volume

fluctuations; risks related to our real estate activities, including the extent of any tenant bankruptcies and insolvencies; risks related to our home fashion operations,

including changes in the availability and price of raw materials, and changes in transportation costs and delivery times; and other risks and uncertainties detailed from

time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or review any forward-looking information,

whether as a result of new information, future developments or otherwise.