UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

DYNEGY INC.

(Exact name of registrant as specified in its charter)

|

| | | | | |

| | Commission File Number | | State of Incorporation | | I.R.S. Employer Identification No. |

| | 001-33443 | | Delaware | | 20-5653152 |

| | | | | | |

| | 601 Travis, Suite 1400 | | | | |

| | Houston, Texas | | | | 77002 |

| | (Address of principal executive offices) | | | | (Zip Code) |

(713) 507-6400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

Dynegy’s common stock, $0.01 par value

| | New York Stock Exchange

|

| Dynegy’s warrants, exercisable for common stock at an exercise price of $35 per share | | New York Stock Exchange

|

Securities registered pursuant to Section12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer ý | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company o |

| (Do not check if a smaller reporting company) | | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

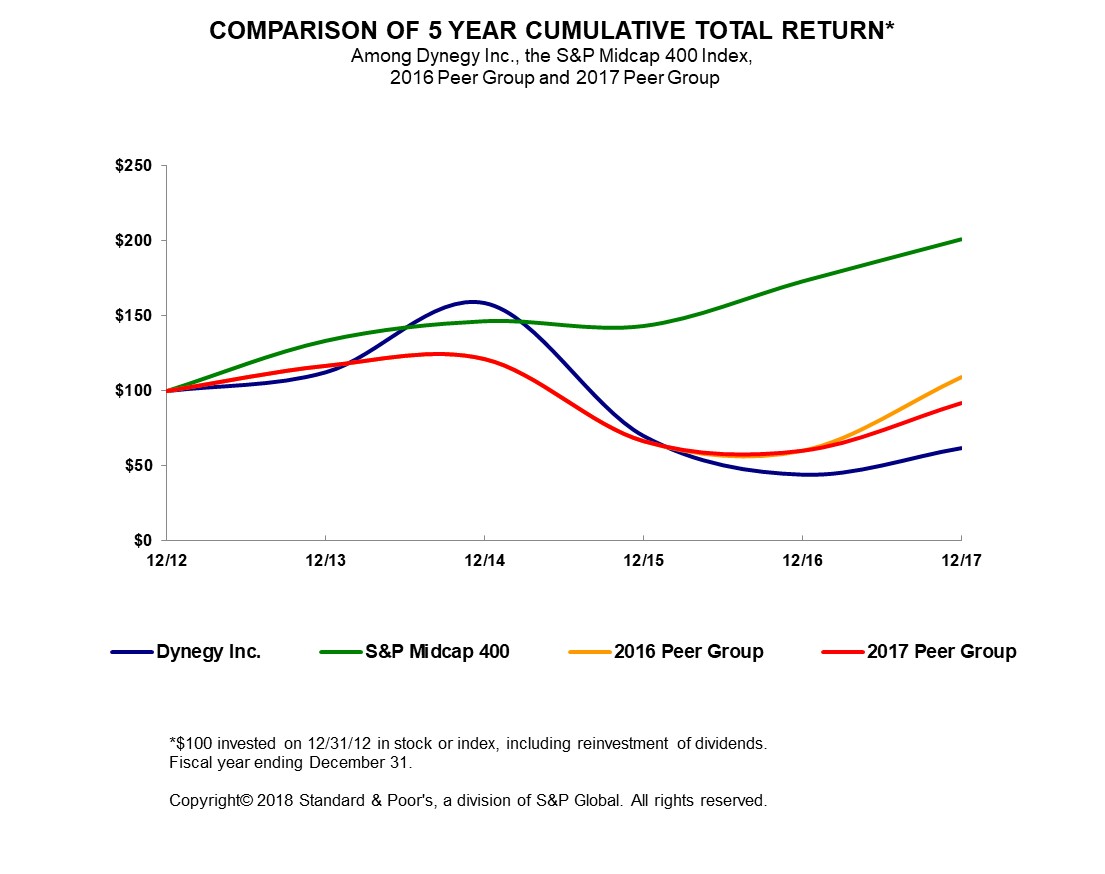

As of June 30, 2017, the aggregate market value of the Dynegy Inc. common stock held by non-affiliates of the registrant was $918,348,807 based on the closing sale price as reported on the New York Stock Exchange.

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

Number of shares outstanding of Dynegy Inc.’s class of common stock, as of the latest practicable date: Common stock, $0.01 par value per share, 144,390,952 shares outstanding as of February 8, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Part III (Items 10, 11, 12, 13 and 14) incorporates by reference portions of the Notice and Proxy Statement for the registrant’s 2018 Annual Meeting of Stockholders, which the registrant intends to file no later than 120 days after December 31, 2017. However, if such proxy statement is not filed within such 120-day period, Items 10, 11, 12, 13 and 14 will be filed as part of an amendment to this Form 10-K no later than the end of the 120-day period.

DYNEGY INC.

FORM 10-K

TABLE OF CONTENTS

|

| | |

| | Page |

| PART I |

| | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| PART III |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV |

| Item 15. | | |

| |

| | | |

PART I

DEFINITIONS

Unless the context indicates otherwise, throughout this report, the terms “Dynegy,” “the Company,” “we,” “us,” “our,” and “ours” are used to refer to Dynegy Inc. and its direct and indirect subsidiaries. Further, as used in this Form 10-K, the abbreviations contained herein have the meanings set forth below.

|

| | |

| ATSI | | American Transmission Service, Inc. |

| CAA | | Clean Air Act |

| CAISO | | California Independent System Operator |

| CDD | | Cooling Degree Days |

| CPUC | | California Public Utility Commission |

| COMED | | Commonwealth Edison |

| CT | | Combustion Turbine |

| DEOK | | Duke Energy Ohio Kentucky |

| EBITDA | | Earnings Before Interest, Taxes, Depreciation and Amortization |

| EGU | | Electric Generating Units |

| ELG | | Effluent Limitation Guidelines |

| EMAAC | | Eastern Mid-Atlantic Area Council |

| EPA | | Environmental Protection Agency |

| ERCOT | | Electric Reliability Council of Texas |

| FCA | | Forward Capacity Auction |

| FERC | | Federal Energy Regulatory Commission |

| FTR | | Financial Transmission Rights |

| GW | | Gigawatts |

| HAPs | | Hazardous Air Pollutants, as defined by the Clean Air Act |

| HDD | | Heating Degree Days |

| ICR | | Installed Capacity Requirement |

| IMA | | In-market Asset Availability |

| IPCB | | Illinois Pollution Control Board |

| IPH | | IPH, LLC (formerly known as Illinois Power Holdings, LLC) |

| ISO | | Independent System Operator |

| ISO-NE | | Independent System Operator New England |

| kW | | Kilowatt |

| LIBOR | | London Interbank Offered Rate |

| LMP | | Locational Marginal Pricing |

| MAAC | | Mid-Atlantic Area Council |

| MISO | | Midcontinent Independent System Operator, Inc. |

| MMBtu | | One Million British Thermal Units |

| Moody’s | | Moody’s Investors Service, Inc. |

| MSCI | | Morgan Stanley Capital International |

| MTM | | Mark-to-market |

| MW | | Megawatts |

| MWh | | Megawatt Hour |

| NERC | | North American Electric Reliability Corporation |

| NYISO | | New York Independent System Operator |

| NYSE | | New York Stock Exchange |

| PJM | | PJM Interconnection, LLC |

| PPL | | PPL Electric Utilities, Corp. |

| PRIDE | | Producing Results through Innovation by Dynegy Employees |

| RCRA | | Resource Conservation and Recovery Act of 1976 |

| RGGI | | Regional Greenhouse Gas Initiative |

| RTO | | Regional Transmission Organization |

| S&P | | Standard & Poor’s Ratings Services |

| SEC | | U.S. Securities and Exchange Commission |

| ST | | Steam Turbine |

| TWh | | Terawatt Hour |

Item 1. Business

THE COMPANY

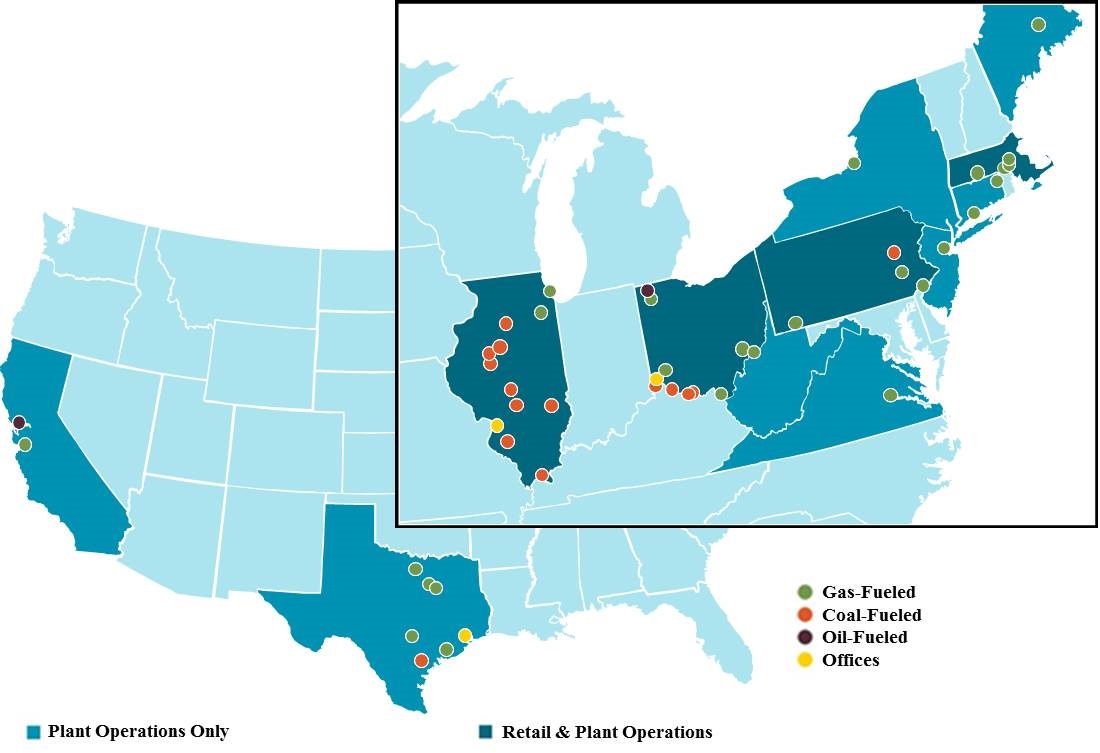

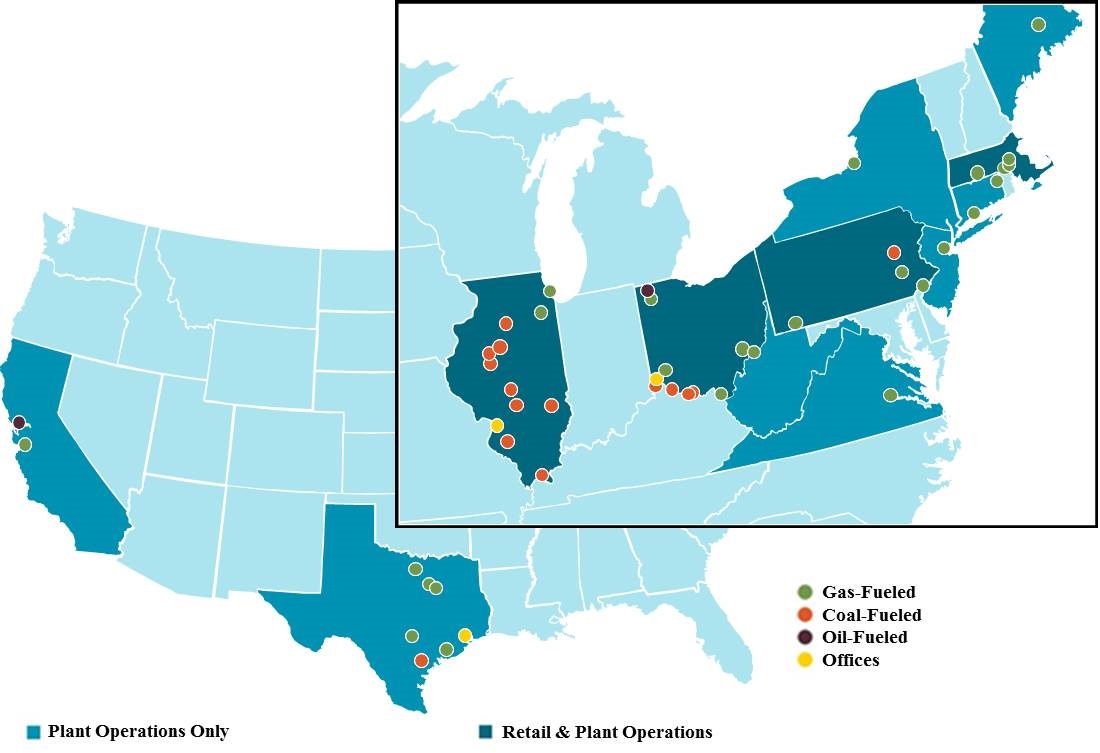

Dynegy began operations in 1984 and became incorporated in the State of Delaware in 2007. We are a holding company and conduct substantially all of our business operations through our subsidiaries. Our primary business is the production and sale of electric energy, capacity and ancillary services from our fleet of 43 power plants in 12 states totaling approximately 28,000 MW of generating capacity.

We sell electric energy, capacity and ancillary services primarily on a wholesale basis from our power generation facilities. We also serve residential, municipal, commercial and industrial customers through our Homefield Energy and Dynegy Energy Services retail businesses, through which we provide retail electricity to approximately 1,141,000 residential customers and approximately 88,000 commercial, industrial and municipal customers in Illinois, Massachusetts, Ohio and Pennsylvania. Wholesale electricity customers will primarily contract for rights to capacity from generating units for reliability reasons and to meet regulatory requirements. Ancillary services support the transmission grid operation, follow real-time changes in load and provide emergency reserves for major changes to the balance of generation and load. Retail electricity customers purchase energy and these related services in the deregulated retail energy market. We sell these products individually or in combination to our customers for various lengths of time from hourly to multi-year transactions.

We do business with a wide range of customers, including RTOs and ISOs, integrated utilities, municipalities, electric cooperatives, transmission and distribution utilities, power marketers, financial participants such as banks and hedge funds, and residential, commercial, and industrial end-users. Some of our customers, such as municipalities or integrated utilities, purchase our products for resale in order to serve their retail, commercial and industrial customers. Other customers, such as some power marketers, may buy from us to serve their own wholesale or retail customers or as a hedge against power sales they have made.

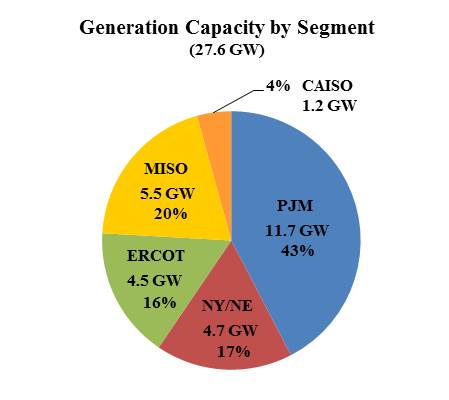

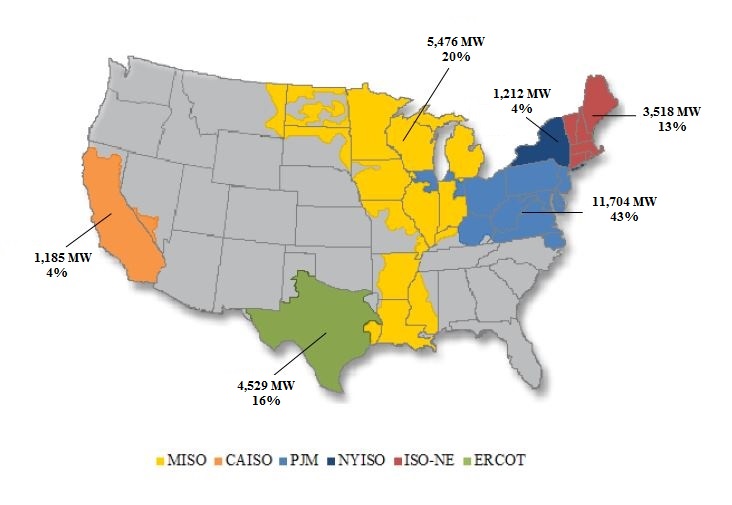

We report the results of our operations in the following five segments based upon the market areas in which our plants operate: (i) PJM, (ii) ISO-NE/NYISO (“NY/NE”), (iii) ERCOT, (iv) MISO, and (v) CAISO. Our consolidated financial results also reflect corporate-level expenses such as general and administrative expense, interest expense and income tax benefit (expense). Please read Note 21—Segment Information for further discussion. In the fourth quarter of 2017, we combined our previous MISO

and IPH segments into a single MISO segment to better align our IPH assets, which reside within the MISO market area. Accordingly, the Company has recast data from prior periods to conform to the current year segment presentation.

The charts below include our net generation capacity, wholesale generation, retail delivered volumes, and Adjusted EBITDA contribution as of December 31, 2017. Adjusted EBITDA Contribution by Segment excludes our corporate-level expenses.

Our principal executive office is located at 601 Travis Street, Suite 1400, Houston, Texas 77002, and our telephone number is (713) 507-6400. We file annual, quarterly and current reports, and other information with the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the SEC’s Public Reference Room. Our SEC filings are also available to the public at the SEC’s website at www.sec.gov. No information from such website is incorporated by reference herein. Our SEC filings are also available free of charge on our website at www.dynegy.com, as soon as reasonably practicable after those reports are filed with or furnished to the SEC. The contents of our website are not intended to be, and should not be considered to be, incorporated by reference into this Form 10-K.

Our Power Generation Portfolio

Our generating facilities are as follows:

|

| | | | | | | | | | | |

| Facility | | Total Net

Generating

Capacity

(MW)(1) | | Primary

Fuel Type | | Technology

Type | | Location | | Region |

| Calumet | | 380 |

| | Gas | | CT | | Chicago, IL | | PJM |

| Dicks Creek | | 155 |

| | Gas | | CT | | Monroe, OH | | PJM |

| Fayette | | 726 |

| | Gas | | CCGT | | Masontown, PA | | PJM |

| Hanging Rock | | 1,430 |

| | Gas | | CCGT | | Ironton, OH | | PJM |

| Hopewell | | 370 |

| | Gas | | CCGT | | Hopewell, VA | | PJM |

| Kendall | | 1,288 |

| | Gas | | CCGT | | Minooka, IL | | PJM |

| Killen (2)(3) | | 204 |

| | Coal | | ST | | Manchester, OH | | PJM |

| Kincaid | | 1,108 |

| | Coal | | ST | | Kincaid, IL | | PJM |

| Liberty | | 607 |

| | Gas | | CCGT | | Eddystone, PA | | PJM |

| Miami Fort | | 1,020 |

| | Coal | | ST | | North Bend, OH | | PJM |

| Miami Fort | | 77 |

| | Oil | | CT | | North Bend, OH | | PJM |

| Northeastern | | 52 |

| | Waste Coal | | ST | | McAdoo, PA | | PJM |

| Ontelaunee | | 600 |

| | Gas | | CCGT | | Reading, PA | | PJM |

| Pleasants | | 388 |

| | Gas | | CT | | Saint Marys, WV | | PJM |

| Richland | | 423 |

| | Gas | | CT | | Defiance, OH | | PJM |

| Sayreville (2)(3) | | 170 |

| | Gas | | CCGT | | Sayreville, NJ | | PJM |

| Stryker | | 16 |

| | Oil | | CT | | Stryker, OH | | PJM |

| Stuart (2)(3) | | 679 |

| | Coal | | ST | | Aberdeen, OH | | PJM |

| Washington | | 711 |

| | Gas | | CCGT | | Beverly, OH | | PJM |

| Zimmer | | 1,300 |

| | Coal | | ST | | Moscow, OH | | PJM |

| Total PJM Segment | | 11,704 |

| | | | | | | | |

| Bellingham | | 566 |

| | Gas | | CCGT | | Bellingham, MA | | ISO-NE |

| Bellingham NEA (2)(3) | | 157 |

| | Gas | | CCGT | | Bellingham, MA | | ISO-NE |

| Blackstone | | 544 |

| | Gas | | CCGT | | Blackstone, MA | | ISO-NE |

| Casco Bay | | 543 |

| | Gas | | CCGT | | Veazie, ME | | ISO-NE |

| Independence | | 1,212 |

| | Gas | | CCGT | | Oswego, NY | | NYISO |

| Lake Road | | 827 |

| | Gas | | CCGT | | Dayville, CT | | ISO-NE |

| MASSPOWER | | 281 |

| | Gas | | CCGT | | Indian Orchard, MA | | ISO-NE |

| Milford - Connecticut | | 600 |

| | Gas | | CCGT | | Milford, CT | | ISO-NE |

| Total NY/NE Segment | | 4,730 |

| | | | | | | | |

| Coleto Creek | | 650 |

| | Coal | | ST | | Goliad, TX | | ERCOT |

| Ennis | | 366 |

| | Gas | | CCGT | | Ennis, TX | | ERCOT |

| Hays | | 1,047 |

| | Gas | | CCGT | | San Marcos, TX | | ERCOT |

| Midlothian | | 1,596 |

| | Gas | | CCGT | | Midlothian, TX | | ERCOT |

| Wharton | | 83 |

| | Gas | | CT | | Boling, TX | | ERCOT |

| Wise | | 787 |

| | Gas | | CCGT | | Poolville, TX | | ERCOT |

| Total ERCOT Segment | | 4,529 |

| | | | | | | | |

| Baldwin | | 1,185 |

| | Coal | | ST | | Baldwin, IL | | MISO |

| Coffeen | | 915 |

| | Coal | | ST | | Coffeen, IL | | MISO |

| Duck Creek | | 425 |

| | Coal | | ST | | Canton, IL | | MISO |

| Edwards | | 585 |

| | Coal | | ST | | Bartonville, IL | | MISO |

| Havana | | 434 |

| | Coal | | ST | | Havana, IL | | MISO |

| Hennepin | | 294 |

| | Coal | | ST | | Hennepin, IL | | MISO |

| Joppa/EEI (2) | | 802 |

| | Coal | | ST | | Joppa, IL | | MISO |

| Joppa units 1-3 | | 165 |

| | Gas | | CT | | Joppa, IL | | MISO |

| Joppa units 4-5 (2) | | 56 |

| | Gas | | CT | | Joppa, IL | | MISO |

| Newton | | 615 |

| | Coal | | ST | | Newton, IL | | MISO |

| Total MISO Segment (4) | | 5,476 |

| | | | | | | | |

| | | | | | | | | | | |

|

| | | | | | | | | | | |

| Facility | | Total Net Generating Capacity (MW)(1) | | Primary Fuel Type | | Technology Type | | Location | | Region |

| Moss Landing | | 1,020 |

| | Gas | | CCGT | | Moss Landing, CA | | CAISO |

| Oakland | | 165 |

| | Oil | | CT | | Oakland, CA | | CAISO |

| Total CAISO Segment | | 1,185 |

| | | | | | | | |

| Total Capacity | | 27,624 |

| | | | | | | | |

________________________________________

| |

| (1) | Unit capabilities are based on winter capacity and are reflected at our net ownership interest. We have not included units that have been retired or are out of operation. |

| |

| (2) | Co-owned with other generation companies. |

| |

| (3) | Facilities not operated by Dynegy. |

| |

| (4) | We have transmission rights into PJM for certain of our MISO plants and currently offer power and capacity into PJM. |

Business Strategies

Our business strategy is to create value through the optimization of our generation facilities, cost structure and financial resources.

Customer Focus. Our commercial outreach focuses on the needs of the customers and constituents we serve, including the end-use and wholesale customer, our market channel partners and the government agencies and regulatory bodies that represent the public interest. The insight provided through these relationships will influence our decisions aimed at meeting customer needs while optimizing the value of our business.

Currently, our commercial strategy seeks to optimize the value of our assets by locking in near-term cash flow while preserving the ability to capture higher values long-term as power markets improve. We may hedge portions of the expected output from our facilities with the goal of stabilizing near-term earnings and cash flow while preserving upside potential should commodity prices or market factors improve. Our wholesale organization and retail marketing teams are responsible for implementation of this strategy. These teams provide access to a broad portfolio of customers with varying energy and capacity requirements. There is a significant risk reduction from the relationship between our generation and our customer load which reduces the need to transact additional financial hedging products in the market.

Our wholesale origination efforts focus on marketing energy and capacity and providing certain associated services through structured transactions that are designed to meet our customers’ operating, financial and risk requirements while simultaneously compensating Dynegy appropriately. In order to optimize the value of our generation portfolio, we use a wide range of products and contracts such as tolling agreements, fuel supply contracts, capacity auctions, bilateral capacity contracts, power and natural gas swap agreements and other financial instruments.

Our retail marketing efforts focus on offering end-use customers energy products that range from fixed price and full requirements to flexible price and volume structures. Our goal is to deliver value beyond price by leveraging our experience in the energy markets to provide products that help customers make sound energy decisions. Establishing and maintaining strong relationships with retail energy channel partners is another key focus where personal service and transparent communication further build our retail brands as trusted suppliers. Our objective is to maximize the benefit to both Dynegy and our customers.

Dynegy operates in a complex and highly-regulated environment with multiple federal, state and local stakeholders, such as legislators, government agencies, industry groups, consumers and environmental advocates. Dynegy works with these stakeholders to encourage reasonable regulations, constructive market designs and balanced environmental policies. Our regulatory strategy includes a continuous process of advocacy, visibility, education and engagement. The ultimate goal is to find solutions that provide adequate cost recovery, incentives for investment, and safe, reliable, cost-effective and environmentally-compliant generation for the communities we serve.

Continuous Improvement. We are committed to operating all of our facilities in a safe, reliable, cost-efficient and environmentally compliant manner. We will continue to invest in our facilities to maintain and improve the safety, reliability and efficiency of our fleet.

We continue to employ our cost and performance improvement initiative launched in 2011, known as PRIDE, which is designed to drive recurring cash flow benefits by optimizing our cost structure, implementing company-wide process and operating improvements, and improving balance sheet efficiency. Our current 3-year PRIDE targets and results are shown below.

As shown in the table above, in 2016, we exceeded our EBITDA target of $135 million by $15 million, and exceeded our balance sheet target of $200 million by $222 million. In 2017, we exceeded our EBITDA target of $65 million by $24 million, and exceeded our balance sheet target of $100 million by $41 million.

In furtherance of our PRIDE program, in October 2017, we launched the Earnings & Cost Improvement initiative, or ECI. Similar to PRIDE, ECI is driven by our employees, but also involves assistance from a third party consultant. ECI was created to drive leading practices across key areas of our power generation fleet to ensure that the operations of our fleet as well as supporting processes are “best in class”. Key areas of ECI include:

| |

| • | Operating our power plants more efficiently and driving higher operating margins; |

| |

| • | Optimizing working capital and plant inventory levels; and |

| |

| • | Leveraging the scale of our generation portfolio to drive cost savings. |

ECI has separate targets from our current PRIDE targets and is expected to contribute more than $100 million in sustainable earnings improvements. Over the next 18-24 months we expect to identify and implement practices that drive improved operational performance across our generation fleet in a manner that provides meaningful EBITDA improvements. The primary areas of focus for enhancements include ramp rate increases, scope refinements for planned maintenance outages, heat rate improvements, auxiliary load reduction and lowering fixed O&M costs.

Capital Allocation. The power industry is a capital intensive, cyclical commodity business with significant commodity price volatility. As such, it is imperative to build and maintain a balance sheet with manageable debt levels supported by a flexible and diverse liquidity program. Our ongoing capital allocation priorities, first and foremost, are to maintain an appropriate leverage and liquidity profile and to make the necessary capital investments to maintain the safety and reliability of our fleet and to comply with environmental rules and regulations. We also evaluate other capital allocation options including investing in our existing portfolio, making potential acquisitions, and returning capital to shareholders. Capital allocation decisions are generally based on alternatives that provide the highest risk adjusted rates of return.

We continue to focus on maintaining a diverse liquidity program to support our ongoing operations and commercial activities. This includes maintaining adequate cash balances, expanding our first lien collateral program to include additional hedging counterparties and having in place sufficient committed lines of credit and revolving credit facilities to support our ongoing liquidity needs.

Since 2013, we have increased scale and shifted our portfolio mix, which was predominately coal-based, to a predominately gas-based portfolio, through four major acquisitions. We used a significant portion of our balance sheet capacity to finance these acquisitions. Accordingly, we are focused on strengthening our balance sheet, managing debt maturities and improving our leverage profile through debt reduction primarily from operating cash flows, as well as our PRIDE and ECI initiatives.

Recent Developments

Vistra Merger

On October 29, 2017, Dynegy and Vistra Energy Corp., a Delaware corporation (“Vistra Energy”), entered into an Agreement and Plan of Merger (the ��Merger Agreement”). Under the Merger Agreement, which has been approved by the boards of directors of both companies, Dynegy will merge with and into Vistra Energy in a tax-free, all-stock transaction, with Vistra Energy continuing as the surviving corporation (the “Merger”). Under the terms of the agreement, Dynegy stockholders will receive 0.652 shares of Vistra Energy common stock for each share of Dynegy common stock they own, resulting in Vistra Energy stockholders and Dynegy stockholders owning approximately 79 percent and 21 percent, respectively, of the combined company.

We expect the transaction to close in the second quarter of 2018 after meeting the remaining customary conditions, including (a) stockholder approval and (b) regulatory approvals including FERC, the Public Utility Commission of Texas and the New York Public Service Commission. Please read Note 1—Organization and Operations for further discussion.

ENGIE Acquisition

On February 7, 2017, (“the ENGIE Acquisition Closing Date”), Dynegy acquired approximately 9,017 MW of generation, including (i) 15 natural gas-fired facilities located in Illinois, Massachusetts, New Jersey, Ohio, Pennsylvania, Texas, Virginia, and West Virginia, (ii) one coal-fired facility in Texas, and (iii) one waste coal-fired facility in Pennsylvania for a base purchase price of approximately $3.3 billion in cash, subject to certain adjustments (the “ENGIE Acquisition”). Please read Note 3—Acquisitions and Divestitures for further discussion.

Asset Divestitures

In 2017, we sold the following five generating facilities, providing approximately $773 million in proceeds which were used for debt reduction:

•On July 11, 2017, we sold our Troy and Armstrong facilities (1,269 MW);

| |

| • | On September 22, 2017, we sold our Dighton and Milford-MA facilities (356 MW) to comply with FERC mitigation requirements; and |

•On October 12, 2017, we sold our Lee facility (787 MW).

Please read Management’s Discussion and Analysis - Liquidity and Capital Resources - Liquidity Highlights and Note 3—Acquisitions and Divestitures for further discussion.

Jointly Owned Generating Facilities

During 2017, in an effort to simplify our structure and drive operating efficiencies, we acquired or exchanged ownership interests in certain of our jointly owned generating facilities. As a result, we now own 100 percent of Miami Fort and Zimmer and disposed of our full interest in Conesville. No ownership changes occurred related to the Stuart and Killen facilities, as they are scheduled to be retired mid-2018. Please read Note 9—Joint Ownership of Generating Facilities for further discussion.

Debt Restructuring, Repayments, and Repricing

During 2017 we extended our 2019 debt maturities by repaying a significant portion of existing senior notes and issuing new senior notes. In addition, we repaid $200 million and repriced our term loan. See Management’s Discussion and Analysis - Liquidity and Capital Resources - Liquidity Highlights for further discussion.

Genco Bankruptcy

On February 2, 2017, Illinois Power Generating Company (“Genco”) emerged from bankruptcy. As a result, we eliminated $825 million of Genco senior notes in exchange for approximately $122 million of cash, $188 million of new seven-year unsecured notes, and 9 million Dynegy common stock warrants. Please read Note 20—Genco Chapter 11 Bankruptcy for further discussion.

Tax Reform Act

On December 22, 2017, the President of the United States signed into law the Tax Cuts and Jobs Act (“TCJA”). Substantially all of the provisions of the TCJA are effective for taxable years beginning after December 31, 2017. The TCJA includes significant changes to the Internal Revenue Code of 1986, as amended (“the Code”), including amendments which significantly change the taxation of business entities. The more significant changes in the TCJA that impact Dynegy are:

•reductions in the corporate federal income tax rate from 35 percent to 21 percent,

•repeal of the corporate Alternative Minimum Tax (“AMT”) providing for refunds of excess AMT credits,

| |

| • | limiting the utilization of Net Operating Losses (“NOLs”) arising after December 31, 2017 to 80 percent of taxable income with an indefinite carryforward (existing NOLs can continue to be utilized at 100 percent of taxable income with a 20 year carryforward), and |

| |

| • | limiting the deduction of net business interest expense to 30 percent of adjusted taxable income as defined in the TCJA. |

We are currently in the process of finalizing and quantifying the tax effects of the TCJA, but have recorded provisional amounts based on reasonable estimates for the measurement and accounting of certain effects of the TCJA in our Consolidated Financial Statements for the year ended December 31, 2017.

As a result of the reduction in the U.S. federal corporate tax rate, Dynegy has recorded a $394 million reduction to our net deferred tax assets, including the federal benefit of state deferred taxes, which was fully offset by a decrease in our valuation allowance for the year ended December 31, 2017. Additionally, we have recorded a $223 million current tax benefit and long term tax receivable in 2017 related to the expected refund of our existing AMT credits. As prescribed by the TCJA, and unless used to offset a cash tax liability, we expect to receive the cash refunds as follows: 2019 - $112 million; 2020 - $56 million; 2021 - $28 million; 2022 - $27 million. Please read Note 14—Income Taxes for further discussion.

We expect in the near term that the unfavorable limit on deducting net business interest expense will be offset by greater utilization of our NOL’s. Any disallowed deduction of net business interest expense may be carried forward indefinitely.

MARKET DISCUSSION

Our business operations are focused primarily on the wholesale power generation sector of the energy industry. We manage and report the results of our power generation business within the following five segments: (i) PJM, (ii) NY/NE, (iii) ERCOT, (iv) MISO, and (v) CAISO. Please read Note 21—Segment Information for further information regarding revenues from external customers, operating income (loss) and total assets by segment. The discussion herein reflects generating capacity at our net ownership interest.

NERC Regions, RTOs and ISOs

In discussing our business, we often refer to NERC regions. The NERC and its regional reliability entities were formed to ensure the reliability and security of the electricity system. The regional reliability entities set standards for reliable operation and maintenance of power generation facilities and transmission systems. For example, each NERC region establishes a minimum operating reserve requirement to ensure there is sufficient generating capacity to meet expected demand within its region. Each NERC region reports seasonally and annually on the status of generation and transmission in such region.

Separately, RTOs and ISOs administer the transmission infrastructure and markets across a regional footprint in most of the markets in which we operate. They are responsible for dispatching all generation facilities in their respective footprints and are responsible for both maximum utilization and reliable and efficient operation of the transmission system. RTOs and ISOs administer energy and ancillary service markets in the short term, usually day-ahead and real-time markets. Several RTOs and ISOs also ensure long-term planning reserves through monthly, semi-annual, annual and multi-year capacity markets. The RTOs and ISOs that oversee most of the wholesale power markets in which we operate currently impose, and will likely continue to impose, bid and price limits or other similar mechanisms. NERC regions and RTOs/ISOs often have different geographic footprints, and while there may be geographic overlap between NERC regions and RTOs/ISOs, their respective roles and responsibilities do not generally overlap.

In RTO and ISO regions with centrally dispatched market structures, all generators selling into the centralized market receive the same price for energy sold based on the bid price associated with the production of the last MWh that is needed to balance supply with demand within a designated zone or at a given location. Different zones or locations within the same RTO/ISO may produce different prices respective to other zones within the same RTO/ISO due to transmission losses and congestion. For example, a less efficient and/or less economical natural gas-fired unit may be needed in some hours to meet demand. If this unit’s production is required to meet demand on the margin, its offer price will set the market clearing price that will be paid for all dispatched generation in the same zone or location (although the price paid at other zones or locations may vary because of transmission losses and congestion), regardless of the price that any other unit may have offered into the market. In RTO and ISO regions with centrally dispatched market structures and location-based marginal price clearing structures (e.g. PJM, ISO-NE, NYISO, ERCOT, MISO, and CAISO), generators will receive the location-based marginal price for their output. The location-based marginal price, absent congestion, would be the marginal price of the most expensive unit needed to meet demand. In regions that are outside the footprint of RTOs/ISOs, prices are determined on a bilateral basis between buyers and sellers.

Reserve Margins

RTOs and ISOs are required to meet NERC planning and resource adequacy standards. The reserve margin, which is the amount of generation resources in excess of peak load, is a measure of resource adequacy and is also used to assess the supply-demand balance of a region. RTOs and ISOs use various mechanisms to help market participants meet their planning reserve margin requirements. Mechanisms range from centralized capacity markets administered by the ISO to markets where entities fulfill their requirements through a combination of long- and short-term bilateral contracts between individual counterparties and self-generation.

Contracted Capacity and Energy

We commercialize our assets through a combination of bilateral wholesale and retail physical and financial power sales, fuel purchases and tolling arrangements. Uncontracted energy is sold in the various ISOs’ day ahead and real-time markets. Capacity is commercialized through a combination of centrally cleared auctions and/or bilateral contracts. We use our retail activity to hedge a portion of the output from our MISO, PJM, and ISO-NE facilities.

PJM Segment

Our PJM segment is comprised of 19 power generation facilities located in Ohio (9), Pennsylvania (4), Illinois (3), Virginia (1), West Virginia (1) and New Jersey (1), totaling 11,704 MW of electric generating capacity.

RTO/ISO Discussion

The PJM market includes all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

PJM administers markets for wholesale electricity and provides transmission planning for the region, utilizing an LMP methodology which calculates a price for every generator and load point within PJM. This market is transparent, allowing generators and load serving entities to see real-time price effects of transmission constraints and the impacts of congestion at each pricing point. PJM operates day-ahead and real-time markets into which generators can bid to provide energy and ancillary services. PJM also administers a forward capacity auction, the Reliability Pricing Model (“RPM”), which establishes long-term markets for capacity. We have participated in RPM base residual auctions for years up to and including PJM’s Planning Year 2020-2021,

which ends May 31, 2021. We also enter into bilateral capacity transactions. Beginning with Planning Year 2016-2017, PJM has started to transition to Capacity Performance (“CP”) rules. These rules are designed to improve system reliability and include penalties for underperforming units and rewards for overperforming units during shortage events. Beginning in Planning Year 2018-2019, PJM introduced Base Capacity (“Base”), which, alongside its new CP product, replaced the legacy capacity product. Base capacity resources are those capacity resources that are not capable of sustained, predictable operation throughout the entire delivery year, but are capable of providing energy and reserves during hot weather operations. They are subject to non-performance charges assessed during emergency conditions, from June through September. Full transition of the capacity market to CP rules will occur by Planning Year 2020-2021. An independent market monitor continually monitors PJM markets to ensure a robust, competitive market and to identify any improper behavior by any entity.

Reserve Margins

Planning Reserve Margins based on deliverable capacity by Planning Year are as follows:

|

| | | | | | | | | | |

| | | 2017-2018 | | 2018-2019 | | 2019-2020 | | 2020-2021 | | 2021-2022 |

| Planning Reserve Margin (%) | | 15.7 | | 16.1 | | 15.9 | | 15.9 | | 15.8 |

NY/NE Segment

Our NY/NE segment is comprised of eight power generation facilities located in Massachusetts (4), Connecticut (2), Maine (1) and New York (1), totaling 4,730 MW of electric generating capacity.

RTO/ISO Discussion

The NYISO market includes the entire state of New York. The NYISO market dispatches power plants to meet system energy and reliability needs and settles physical power deliveries at LMPs. Energy prices vary among the regional zones in the NYISO and are largely influenced by transmission constraints and fuel supply. NYISO offers a forward capacity market where capacity prices are determined through auctions. Strip auctions occur one to two months prior to the commencement of a six month seasonal planning period. Subsequent auctions provide an opportunity to sell excess capacity for the balance of the seasonal planning period or the prompt month. Due to the short term nature of the NYISO-operated capacity auctions and a relatively liquid market for NYISO capacity products, our Independence facility sells a significant portion of its capacity through bilateral transactions. The balance is cleared through the seasonal and monthly capacity auctions.

The ISO-NE market includes the six New England states of Vermont, New Hampshire, Massachusetts, Connecticut, Rhode Island, and Maine. ISO-NE also dispatches power plants to meet system energy and reliability needs and settles physical power deliveries at LMPs. Energy prices vary among the participating states in ISO-NE and are largely influenced by transmission constraints and fuel supply. ISO-NE offers a forward capacity market where capacity prices are determined through auctions. ISO-NE implemented changes to its capacity market starting in FCA-8 for Planning Year 2017-2018, which include removal of the price floor and implementation of a minimum offer price rule for new resources to prevent buy-side market power. Additionally, performance incentive rules will go into effect for Planning Year 2018-2019 (FCA-9), which will have the potential to increase capacity payments for those resources that are providing excess energy or reserves during a shortage event, while penalizing those that produce less than the required level.

Reserve Margins

NYISO. Planning Reserve Margins by Planning Year are as follows:

|

| | | | |

| | | 2017-2018 | | 2018-2019 |

| Planning Reserve Margin (%) | | 18.1 | | 18.2 |

ISO-NE. Similar to PJM, ISO-NE will publish on an annual basis the installed capacity requirement, commonly referred to as the ICR. The ICR is the amount of capacity that must be procured over and above the load forecast for the applicable Planning Year. ISO-NE updates this information annually for each planning year during the Annual Reconfiguration Auctions. ICRs by Planning Year are as follows:

|

| | | | | | | | |

| | | 2018-2019 | | 2019-2020 | | 2020-2021 | | 2021-2022 |

| ICR (%) | | 15.3 | | 15.6 | | 15.3 | | 14.6 |

ERCOT Segment

Our ERCOT segment, new in 2017 as a result of the ENGIE Acquisition, is comprised of six power generation facilities located in Texas, totaling 4,529 MW of electric generating capacity. Our ERCOT fleet is comprised of 3,796 MW of natural gas powered combined-cycle generation, 650 MW of Powder River Basin coal powered generation, and 83 MW of natural gas powered peaking generation.

RTO/ISO Discussion

ERCOT serves about 90 percent of load in the state of Texas over a high-voltage transmission system of more than 46,500 circuit miles. The ERCOT system is entirely contained within the state of Texas, and thus is regulated by the Texas Public Utility Commission rather than the FERC. The ERCOT nodal market provides a transparent means to reflect the cost of congestion in nodal prices across the system. The day-ahead market and real-time markets provide generators the ability to competitively offer energy and ancillary services into the market. ERCOT is an “energy-only” market, meaning there is no capacity market. Alternatively, ERCOT has implemented the Operating Reserve Demand Curve (“ORDC”), which causes prices to rise to as much as $9,000/MWh during reserve shortage events. ERCOT has a high level of wind generation, which tends to be a source of real-time price volatility.

Reserve Margins

As contained in ERCOT’s December 2017 Capacity, Demand and Reserves (“CDR”) report, the Target Reserve Margin is 13.75 percent through 2022.

MISO Segment

Our MISO segment is comprised of eight power generation facilities located in Illinois, totaling 5,476 MW of electric generating capacity. Joppa, which is within the Electric Energy, Inc. (“EEI”) control area, is interconnected to Tennessee Valley Authority and Louisville Gas and Electric Company, but primarily sells its capacity and energy to MISO. We currently offer a portion of our MISO segment generating capacity and energy into PJM. As of June 1, 2016, our Coffeen, Duck Creek, E.D. Edwards and Newton facilities have 937 MW, or 17 percent of MISO’s current capacity and energy, electrically tied into PJM through pseudo-tie arrangements. As of June 1, 2017, Hennepin began offering 260 MW of the facility’s energy and capacity into PJM as a block schedule and will begin dispatching as a pseudo-tie unit for Planning Year 2018-2019.

RTO/ISO Discussion

The MISO market includes all or parts of Iowa, Minnesota, North Dakota, Wisconsin, Michigan, Kentucky, Indiana, Illinois, Missouri, Arkansas, Mississippi, Texas, Louisiana, Montana, South Dakota, and Manitoba, Canada.

The MISO energy market is designed to ensure that all market participants have open-access to the transmission system on a non-discriminatory basis. MISO, as an independent RTO, maintains functional control over the use of the transmission system to ensure transmission circuits do not exceed their secure operating limits and become overloaded. MISO operates day-ahead and real-time energy markets using a similar LMP methodology as described above. An independent market monitor is responsible for evaluating the performance of the markets and identifying conduct by market participants or MISO that may compromise the efficiency or distort the outcome of the markets.

MISO administers a one-year FCA for the next planning year from June 1st of the current year to May 31st of the following year. We participate in these auctions with open capacity that has not been committed through bilateral or retail transactions.

We participate in the MISO annual and monthly FTR auctions to manage the cost of our transmission congestion, as measured by the congestion component of the LMP price differential between two points on the transmission grid across the market area.

Reserve Margins

Planning Reserve Margins by Planning Year are as follows:

|

| | | | | | | | | | |

| | | 2018-2019 | | 2019-2020 | | 2020-2021 | | 2021-2022 | | 2022-2023 |

| Planning Reserve Margin (%) | | 17.1 | | 17.1 | | 17.2 | | 17.2 | | 17.2 |

CAISO Segment

Our CAISO segment is comprised of two power generation facilities located in California, totaling 1,185 MW of electric generating capacity.

RTO/ISO Discussion

The CAISO market covers approximately 80 percent of the State of California and operates a centrally cleared market for energy and ancillary services. Energy is priced utilizing an LMP methodology as described above. The capacity market is comprised of Generic and Flexible Resource Adequacy (“RA”) Capacity. Unlike other centrally cleared capacity markets, the CAISO resource adequacy market is a bilaterally traded market which typically transacts in monthly products as opposed to annual capacity products in other regions. Beginning on November 1, 2016, CAISO implemented a voluntary capacity auction for annual, monthly, and intra-month procurement to cover for deficiencies in the market. The voluntary Competitive Solicitation Process, which FERC approved on October 1, 2015, is a modification to the Capacity Priced Mechanism (“CPM”) and provides another avenue to sell RA capacity. There have been recent CPM designations through the Competitive Solicitation Process including Moss Landing Unit 1 on December 18, 2016 for 140 MW over a 30-day period and again on December 22, 2017 for 510 MW for the calendar year 2018.

Reserve Margins

The California Public Utility Commission requires a Planning Reserve Margin of at least 15 percent.

Other

Market-Based Rates. Our ability to charge market-based rates for wholesale sales of electricity, as opposed to cost-based rates, is governed by FERC. We have been granted market-based rate authority for wholesale power sales from our exempt wholesale generator facilities, as well as wholesale power sales by our power marketing entities, Dynegy Power Marketing, LLC, Dynegy Marketing and Trade, LLC (“DMT”), Illinois Power Marketing Company, Dynegy Energy Services, LLC, and Dynegy Commercial Asset Management, LLC. Every three years, FERC conducts a review of our market-based rates and potential market power on a regional basis (known as the triennial market power review). In June 2017, we filed a market power update with FERC for our PJM, ISO-NE and NYISO assets. In December 2017, we filed a market power update with FERC for our Central Region (MISO and EEI) assets.

State-based Subsidies. On August 1, 2016, the New York Public Service Commission (“NY PSC”) promulgated an Order adopting a Clean Energy Standard. The Order includes a program whereby the State will subsidize certain nuclear energy producers in New York through “zero emissions credits” (“ZECs”), which load serving entities will be required to buy, with the cost passed on to retail ratepayers. Unless enjoined or eliminated, the ZECs will result in an estimated $7.6 billion of payments over 12 years to Exelon. In October 2016, a group of generators, including Dynegy and our trade association, the Electric Power Supply Association, filed a lawsuit in the Southern District of New York challenging the NY PSC’s ruling on constitutional grounds. On July 25, 2017, the court granted the motions of the defendants and Exelon to dismiss the complaint. On August 25, 2017, we filed a notice of appeal of the July 25 Order to the United States Court of Appeals for the Second Circuit. Oral argument will be heard by the Second Circuit on March 12, 2018. We cannot predict the outcome of this litigation, but if left unchecked, we believe these subsidies will continue to adversely affect the energy and capacity markets in NYISO by artificially suppressing prices.

In December 2016, Illinois passed legislation, the Future Energy Jobs Act (“FEJA”) amending the Illinois Power Agency Act (“IPAA”) to create a ZEC program for Illinois nuclear generators. The FEJA amendments to the IPAA became effective on June 1, 2017 and, unless enjoined or eliminated, the ZECs will result in an estimated $2.35 billion of payments over 10 years to Exelon. In February 2017, a group of generators including Dynegy and our trade association, the Electric Power Supply Association, filed a lawsuit challenging the FEJA on constitutional grounds in the Northern District of Illinois, Eastern Division, followed by a Motion for Preliminary Injunction in March 2017. On July 14, 2017, the court granted the motions of defendants and Exelon to dismiss the complaint and denied the motion for preliminary injunction. On July 17, 2017, we filed a notice of appeal of the July 14th Order to the United States Court of Appeals for the Seventh Circuit. Oral argument was held before the Seventh Circuit on January 3, 2018. We cannot predict the outcome of this litigation but, if left unchecked, we believe these subsidies will continue to adversely affect the energy and capacity markets in PJM and MISO.

ENVIRONMENTAL MATTERS

Our business is subject to extensive federal, state and local laws and regulations concerning environmental matters, including the discharge of materials into the environment. We are committed to operating within these laws and regulations and to conducting our business in an environmentally responsible manner. The environmental, legal and regulatory landscape continues to change and has become more stringent over time. This may create unprofitable or unfavorable operating conditions or require significant capital and operating expenditures. Further, changing interpretations of existing regulations may subject historical maintenance, repair and replacement activities at our facilities to claims of noncompliance.

The following is a summary of (i) the material federal, state and local environmental laws and regulations applicable to us and (ii) certain pending judicial and administrative proceedings related thereto. Compliance with these environmental laws and regulations and resolution of these various proceedings may result in increased capital expenditures and other environmental

compliance costs, impairments, increased operations and maintenance expenses, increased Asset Retirement Obligations (“AROs”), and the imposition of fines and penalties, any of which could have a material adverse effect on our financial condition, results of operations and cash flows. In addition, if we are required to incur significant additional costs or expenses to comply with applicable environmental laws or to resolve a related proceeding, the incurrence of such costs or expenses may render continued operation of a plant uneconomical such that we may determine, subject to applicable laws and any applicable financing or other agreements, to reduce the plant’s operations to minimize such costs or expenses or cease to operate the plant completely to avoid such costs or expenses. Unless otherwise expressly noted in the following summary, we are not currently able to reasonably estimate the costs and expenses, or range of the costs and expenses, associated with complying with these environmental laws and regulations or with resolution of these judicial and administrative proceedings. For additional information regarding our pending environmental, judicial, and administrative proceedings, please read Note 16—Commitments and Contingencies for further discussion.

Our aggregate expenditures by segment for compliance with environmental laws and regulations were as follows for the years ended December 31, 2017 and 2016:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2017 | | 2016 |

| (amounts in millions) | | Total Expenditures | | Capital Expenditures | | Operating Expenses | | Total Expenditures | | Capital Expenditures | | Operating Expenses |

| PJM | | $ | 65 |

| | $ | 1 |

| | $ | 64 |

| | $ | 62 |

| | $ | 6 |

| | $ | 56 |

|

| NY/NE | | 10 |

| | — |

| | 10 |

| | 17 |

| | — |

| | 17 |

|

| ERCOT | | 2 |

| | — |

| | 2 |

| | — |

| | — |

| | — |

|

| MISO | | 53 |

| | 6 |

| | 47 |

| | 61 |

| | 17 |

| | 44 |

|

| CAISO | | 4 |

| | — |

| | 4 |

| | 5 |

| | — |

| | 5 |

|

| Other | | 3 |

| | — |

| | 3 |

| | 11 |

| | — |

| | 11 |

|

| Total | | $ | 137 |

| | $ | 7 |

| | $ | 130 |

| | $ | 156 |

| | $ | 23 |

| | $ | 133 |

|

Our estimated total environmental compliance expenditures by segment in 2018 are as follows:

|

| | | | | | | | | | | | |

| (amounts in millions) | | Total Environmental Expenditures | | Capital Expenditures | | Operating Expenses |

| PJM | | $ | 86 |

| | $ | 6 |

| | $ | 80 |

|

| NY/NE | | 4 |

| | — |

| | 4 |

|

| ERCOT | | 4 |

| | 1 |

| | 3 |

|

| MISO | | 73 |

| | 17 |

| | 56 |

|

| CAISO | | 3 |

| | — |

| | 3 |

|

| Other | | 4 |

| | — |

| | 4 |

|

| Total | | $ | 174 |

| | $ | 24 |

| | $ | 150 |

|

The Clean Air Act

The CAA and comparable state laws and regulations relating to air emissions impose various responsibilities on owners and operators of sources of air emissions, which include requirements to obtain construction and operating permits, pay permit fees, monitor emissions, submit reports and compliance certifications, and keep records. The CAA requires that fossil-fueled electric generating plants meet certain pollutant emission standards and have sufficient emission allowances to cover sulfur dioxide (“SO2”) emissions and in some regions nitrogen oxide (“NOx”) emissions.

In order to ensure continued compliance with the CAA and related rules and regulations, we utilize various emission reduction technologies. These technologies include flue gas desulfurization (“FGD”) systems, baghouses and activated carbon injection or mercury oxidation systems on select units and electrostatic precipitators, selective catalytic reduction (“SCR”) systems, low-NOx burners and/or overfire air systems on all units. Additionally, our MISO coal-fired facilities mainly use low sulfur coal, which, prior to combustion, goes through a refined coal process to further reduce NOx and mercury emissions.

Multi-Pollutant Air Emission Initiatives

Cross-State Air Pollution Rule. The “Cross-State Air Pollution Rule” (“CSAPR”) to reduce emissions of SO2 and NOx from EGUs across the eastern U.S. took effect in 2015. The CSAPR imposes cap-and-trade programs within each affected state that limit emissions of SO2 and NOx at levels to help downwind states attain and maintain compliance with the 1997 ozone National Ambient Air Quality Standards (“NAAQS”) and the 1997 and 2006 fine particulate matter (“PM2.5”) NAAQS. In October 2016, the EPA updated the CSAPR rule to further reduce ozone season NOx emissions beginning in 2017 to attain and maintain compliance with the 2008 ozone NAAQS. Numerous parties filed petitions for judicial review challenging the CSAPR update rule.

Under the CSAPR, our generating facilities in Illinois, Ohio, New Jersey, New York, Pennsylvania, Virginia and West Virginia are subject to cap-and-trade programs for ozone-season emissions of NOx from May 1 through September 30 and for annual emissions of SO2 and NOx. Our generating facilities in Texas are subject to the CSAPR NOx ozone season cap-and trade program beginning in 2017. The CSAPR requirements applicable to SO2 emissions from our affected EGUs were implemented in two stages with fewer SO2 emission allowances allocated in the second phase, which began in 2017. We do not believe that CSAPR compliance will cause a material adverse impact on our future financial results.

Mercury/HAPs. The EPA’s Mercury and Air Toxic Standards (“MATS”) rule for EGUs, which was issued in 2011, established numeric emission limits for mercury, non-mercury metals, and acid gases as well as work practice standards for organic HAPs. Compliance with the MATS rule was required by April 16, 2015. In March 2016, the EPA finalized corrections to its November 2014 MATS rule revisions addressing startup and shutdown monitoring instrumentation.

In June 2015, the U.S. Supreme Court found that the EPA failed to properly consider costs when it promulgated the MATS rule. In response to a court ordered remand, in April 2016, the EPA issued a final finding that consideration of cost does not change the Agency’s determination that regulation of HAP emissions from coal- and oil-fired EGUs is appropriate and necessary under CAA section 112. Numerous parties filed petitions for judicial review challenging the EPA’s finding. The United States Court of Appeals for the District of Columbia Circuit is currently holding the cases in abeyance.

We continue to monitor the MATS compliance performance of our units and evaluate approaches to optimize compliance strategies.

Illinois MPS. In 2007, our MISO coal-fired facilities elected to demonstrate compliance with the Illinois Multi-Pollutant Standards (“MPS”), which require compliance with NOx, SO2 and mercury emissions limits. We are in compliance with the MPS. In October 2017, the Illinois EPA (“IEPA”) filed a proposed rule with the IPCB that would amend the MPS rule by replacing the two separate group-wide annual emission rate limits that currently apply to our eight downstate Illinois coal-fired stations with tonnage limits for both SO2 (annual) and NOx (annual and seasonal) that apply to the eight stations as a single group. Under the MPS proposal as proposed to be amended by the IEPA in February 2018, allowable annual emissions of SO2 would be 26 percent lower than under the current rule, while NOx emissions would be 24 percent lower. All other federal and state air quality regulations, including health-based standards, would remain unchanged and in place. The proposed rule also would impose new requirements to ensure the continuous operation of existing SCR control systems during the ozone season, require SCR-controlled units to meet an ozone season NOx emission rate limit, and set an additional, site-specific annual SO2 limit for our Joppa Power Station. Dynegy is supportive of the proposed rule as it would provide a number of regulatory and environmental benefits, as well as operating flexibility.

Other Air Emission Initiatives

NAAQS. The CAA requires the EPA to regulate emissions of pollutants considered harmful to public health and the environment. The EPA has established NAAQS for six such pollutants, including SO2, ozone, and PM2.5. Each state is responsible for developing a plan (a state implementation plan “SIP”) that will attain and maintain the NAAQS. These plans may result in the imposition of emission limits on our facilities.

SO2 NAAQS. The EPA’s initial area designations for the 2010 one-hour SO2 NAAQS included designating the area where our MISO segment’s Edwards facility is located as nonattainment. In January 2015, Illinois Power Resources Generating, LLC (“IPRG”) entered a Memorandum of Agreement (“MOA”) with the IEPA that voluntarily committed to early limits on Edwards’ allowable one-hour SO2 emission rate that, in conjunction with reductions to be imposed by the state on other sources, will enable the IEPA to demonstrate attainment with the one-hour SO2 NAAQS in the Edwards area. The IPCB subsequently approved an IEPA rule that included the emission limits on Edwards as agreed to in the MOA. In February 2018, the EPA approved Illinois’ attainment demonstration for the area.

The EPA will complete area designations for the 2010 one-hour SO2 NAAQS in three additional rounds before December 31, 2020. The EPA’s second and third rounds of area designations for the one-hour SO2 NAAQS in July 2016 and December 2017 did not include any nonattainment areas for our facilities.

Ozone NAAQS. The EPA issued a final rule in October 2015 lowering the ozone NAAQS from 75 to 70 parts per billion. Various parties have filed lawsuits challenging the 2015 ozone NAAQS. In November 2017, the EPA issued an initial round of area designations for the 2015 ozone NAAQS, designating most areas of the United States as attainment/unclassifiable. Several states and other groups have filed lawsuits seeking to compel the EPA to complete designations for all areas of the country. In December 2017, the EPA notified states of expected nonattainment area designations for the 2015 ozone NAAQS. Those areas include areas concerning our Dicks Creek, Miami Fort and Zimmer facilities in Ohio, our Calumet facility in Illinois, and our Wise, Ennis and Midlothian facilities in Texas. The EPA anticipates completing area designations for the 2015 ozone NAAQS in spring 2018.

In November 2017, the EPA denied a petition from nine northeastern states to add several states, including Illinois and Ohio, to the Ozone Transport Region. Eight of the northeastern states have filed a petition for judicial review challenging the EPA’s action. In January 2018, New York and Connecticut filed a lawsuit against the EPA seeking to compel the agency to issue a FIP for the 2008 ozone NAAQS that addresses sources in five upwind states, including Illinois.

In November 2016, the State of Maryland petitioned the EPA to impose additional NOx emission control requirements on 36 EGUs in five upwind states, including our Zimmer facility, that the State alleges are contributing to nonattainment with the 2008 ozone NAAQS in Maryland. In fall 2017, Maryland and several environmental groups filed lawsuits against the EPA seeking to compel the Agency to act on the State’s petition. While we cannot predict the outcome of the judicial or petition proceedings, given that the Zimmer facility utilizes SCR technology to control NOx emissions, we do not believe that the result of these proceedings will cause a material adverse impact on our future financial results.

Other. In May 2015, the EPA issued a final rule that eliminates existing exemptions in the SIPs of many states, including Illinois and Ohio, for emissions during periods of startup, shutdown or malfunction (“SSM”). Under the rule, affected states were required to submit corrective SIP revisions by November 2016. Various parties have filed lawsuits challenging the EPA’s SSM SIP rule. The D.C. Circuit Court is currently holding the cases in abeyance.

The nature and scope of potential future requirements concerning the 2010 one-hour SO2 NAAQS, ozone NAAQS and SSM SIP rule cannot be predicted with confidence at this time. A future requirement for additional emission reductions at any of our coal-fired generating facilities may result in significantly increased compliance costs and could have a material adverse effect on our financial condition, results of operations and cash flows.

New Source Review and Clean Air Act Matters

New Source Review. Since 1999, the EPA has been engaged in a nationwide enforcement initiative to determine whether coal-fired power plants failed to comply with the requirements of the New Source Review and New Source Performance Standard provisions under the CAA when the plants implemented modifications. The EPA’s initiative focuses on whether projects performed at power plants triggered various permitting requirements, including the need to install pollution control equipment.

In August 2012, the EPA issued a Notice of Violation (“NOV”) alleging that projects performed in 1997, 2006 and 2007 at the Newton facility violated Prevention of Significant Deterioration (“PSD”), Title V permitting and other requirements. The NOV remains unresolved. We believe our defenses to the allegations described in the NOV are meritorious. A decision by the U.S. Court of Appeals for the Seventh Circuit in 2013 held that similar claims older than five years were barred by the statute of limitations. This decision may provide an additional defense to the allegations in the Newton facility NOV.

Zimmer NOVs. In December 2014, the EPA issued an NOV alleging violation of opacity standards at our Zimmer facility. The EPA previously had issued NOVs to Zimmer in 2008 and 2010 alleging violations of the CAA, the Ohio SIP, and the station’s air permits involving standards applicable to opacity, sulfur dioxide, sulfuric acid mist and heat input. The NOVs remain unresolved. We are unable to predict the outcome of these matters.

Killen and Stuart NOVs. The EPA issued NOVs in December 2014 for Killen and Stuart, and in February 2017 for Stuart, alleging violations of opacity standards. In May and June 2017, we received two letters from the Sierra Club providing notice of its intent to sue various Dynegy entities and the owner and operator of the Killen and Stuart facilities, respectively, alleging violations of opacity standards under the CAA. The Dayton Power and Light Company, the operator of Killen and Stuart, is expected to act on behalf of itself and the co-owners with respect to these matters. We are unable to predict the outcome of these matters.

Texas Regional Haze/FIP/BART. The EPA issued a federal implementation plan (“FIP”) in December 2015 for the State of Texas that imposed regional haze program requirements on numerous coal-fired EGUs. The FIP would require our Coleto Creek facility to meet an SO2 emission limit of 0.04 lbs/MMBtu by February 2021, based on installation of a scrubber. Coleto Creek, other electricity generating companies and the State of Texas filed petitions for judicial review. In July 2016, the United States Court of Appeals for the Fifth Circuit stayed the FIP pending completion of judicial review. In March 2017, the court remanded the FIP to the EPA for reconsideration.

In January 2017, the EPA proposed a FIP for Texas that would impose Best Available Retrofit Technology (“BART”) emission limits for SO2 on numerous EGUs, including Coleto Creek. BART requirements for EGUs were not addressed in the EPA’s December 2015 regional haze FIP for Texas. The proposed FIP BART SO2 emissions limit for Coleto Creek is 0.04 lbs/MMBtu based on installation of a scrubber. Compliance would be required within five years from the effective date of a final rule.

In October 2017, the EPA issued a final rule BART FIP for EGUs in Texas. In contrast to the EPA’s January 2017 proposed rule, the final rule BART FIP establishes an SO2 emissions intrastate trading program for affected Texas EGUs. The FIP’s intrastate SO2 trading program will begin in 2019. The EPA final rule also approves Texas’ participation in the CSAPR ozone season NOx trading program as BART for NOx and Texas’ determination that EGUs in the State are not subject to BART for particulate matter (“PM”), and determines that the BART FIP is sufficient to address CAA interstate visibility transport requirements for six relevant NAAQS. The EPA’s final rule does not fully resolve the Agency’s obligations as a result of the Fifth Circuit’s remand of the EPA’s December 2016 regional haze FIP, which the EPA intends to address in future action. Various groups have challenged the EPA’s final rule BART FIP, including filing a petition for judicial review and filing an administrative petition with the EPA to reconsider the rule. We intervened in the judicial appeal in support of the EPA.

In a separate final rule issued in September 2017, the EPA withdrew FIP revisions requiring EGUs in Texas to participate in the CSAPR Phase 2 for annual SO2 and NOx, determined that Texas sources do not contribute significantly to nonattainment in, or interfere with maintenance by, other states regarding the 1997 NAAQS for PM2.5, and affirmed that participation in CSAPR meets BART. Various groups have filed a petition for judicial review challenging the rule. We intervened in the appeal in support of the EPA.

While we cannot predict the outcome of litigation related to these matters, a future requirement to install a scrubber at Coleto Creek as a result of either the regional haze FIP or BART FIP could have a material adverse effect on Coleto Creek. Based on the BART FIP’s annual SO2 allowance allocation for Coleto Creek and anticipated liquidity in the Texas intrastate SO2 trading program, we do not believe the BART FIP will cause any material financial, operational or cash flow issues for our Coleto Creek facility.

Edwards CAA Citizen Suit. In April 2013, environmental groups filed a CAA citizen suit in the U.S. District Court for the Central District of Illinois alleging violations of opacity and particulate matter limits at our MISO segment’s Edwards facility. In August 2016, the District Court granted the plaintiffs’ motion for summary judgment on certain liability issues. We filed a motion seeking interlocutory appeal of the court’s summary judgment ruling. In February 2017, the appellate court denied our motion for interlocutory appeal. The District Court has scheduled the remedy phase trial for March 2019. We dispute the allegations and will defend the case vigorously.

Ultimate resolution of any of these CAA matters could have a material adverse impact on our future financial condition, results of operations, and cash flows. A resolution could result in increased capital expenditures for the installation of pollution control equipment, increased operations and maintenance expenses, and penalties. At this time we are unable to make a reasonable estimate of the possible costs, or range of costs, that might be incurred to resolve these matters.

The Clean Water Act

The Clean Water Act (“CWA”) and analogous state laws regulate water withdrawals and wastewater discharges at our power generation facilities. Our facilities are authorized to discharge pollutants to waters of the United States by National Pollutant Discharge Elimination System (“NPDES”) permits, which contain discharge limits and monitoring, recordkeeping and reporting requirements. NPDES permits are issued for 5-year periods and are subject to renewal after expiration.

Cooling Water Intake Structures. Cooling water intake structures at our facilities are regulated under CWA Section 316(b). This provision generally requires that the location, design, construction and capacity of cooling water intake structures reflect best technology available (“BTA”) for minimizing adverse environmental impacts. Historically, permitting authorities have developed and implemented BTA standards through NPDES permits on a case-by-case basis using best professional judgment.

In 2014, the EPA issued a final rule for cooling water intake structures at existing facilities. The rule establishes seven BTA alternatives for reducing impingement mortality, including modified traveling screens, closed-cycle cooling, a numeric impingement standard, or a site-specific determination. For entrainment, the permitting authority is required to establish a case-by-case standard considering several factors, including social costs and benefits. Compliance with the rule’s entrainment and impingement mortality standards is required as soon as practicable, but will vary by site depending on several different factors, including determinations made by the state permitting authority and the timing of renewal of a facility’s NPDES permit. Various environmental groups and industry groups filed petitions for judicial review of the EPA’s final rule. The United States Court of Appeals for the Second Circuit held oral argument in September 2017.

At this time, we estimate the cost of our compliance with the cooling water intake structure rule will be approximately $17 million, with the majority of spend in the 2020-2023 timeframe. This estimate excludes Moss Landing, which is discussed in “California Water Intake Policy” below. Our estimate could change materially depending upon a variety of factors, including site-specific determinations made by states in implementing the rule, the results of impingement and entrainment studies required by the rule, the results of site-specific engineering studies, and the outcome of litigation concerning the rule.

California Water Intake Policy. The California State Water Board (the “State Water Board”) adopted its Statewide Water Quality Control Policy on the Use of Coastal and Estuarine Waters for Power Plant Cooling (the “Policy”) in 2010. The Policy requires existing power plants to reduce water intake flow rate to a level commensurate with that which can be achieved by a closed cycle cooling system or if that is not feasible, to reduce impingement mortality and entrainment to a level comparable to that achieved by such a reduced water intake flow rate using operational or structural controls, or both.

In 2014, we entered into a settlement agreement with the State Water Board that would resolve a lawsuit we filed with other California power plant owners challenging the Policy. In accordance with the settlement agreement, following a public rulemaking process, in April 2015, the State Water Board approved an amendment to the Policy extending the compliance deadline for Moss Landing from December 31, 2017 to December 31, 2020. Under the settlement agreement, we have implemented operational control measures at Moss Landing for purposes of reducing impingement mortality and entrainment, including the installation of variable speed drive motors on the circulating water pumps in late 2016. In addition, we must evaluate and install supplemental control technology by December 31, 2020. At this time, we preliminarily estimate the cost of our compliance at Moss Landing under the provisions of the settlement agreement will be approximately $5 million in aggregate through 2020.

Effluent Limitation Guidelines. In November 2015, the EPA revised the ELGs for Steam Electric Generating Facilities, which will impose more stringent standards (as individual permits are renewed) for wastewater streams, flue desulfurization, fly ash, bottom ash, and flue gas mercury control. In April 2017, the EPA granted petitions requesting reconsideration of the ELG final rule issued in 2015 and administratively stayed the ELG rule’s compliance date deadlines pending ongoing judicial review of the rule.

The EPA issued a final rule in September 2017 postponing the earliest compliance dates in the ELG rule for bottom ash transport water and FGD wastewater by two years, from November 1, 2018 to November 1, 2020, and the legal challenges have been suspended while EPA reconsiders and likely modifies the rules.

Given the EPA’s decision to reconsider and potentially revise the bottom ash transport water and FGD wastewater provisions of the ELG rule, the rule postponing the ELG rule’s earliest compliance dates for those provisions, and the intertwined relationship of the ELG rule with the Coal Combustion Residuals (“CCR”) rule, which is also being reconsidered by the EPA, as well as pending legal challenges concerning both rules, substantial uncertainty exists regarding our projected capital expenditures for ELG compliance, including the timing of such expenditures. As rulemaking continues to develop and planning and work progress, we continue to review the estimates and related timing of our capital expenditures. The following table presents the projected capital expenditures by period for ELG compliance as of December 31, 2017 assuming the majority of ELG compliance expenditures will be required to occur in the 2019-2023 timeframe:

|

| | | | | | | | | | | | | | | | | | | | |

| (amounts in millions) | | Less than

1 Year | | 1 - 3 Years (1) | | 3 - 5 Years | | More than

5 Years | | Total |

| ELG expenditures | | $ | — |

| | $ | 199 |

| | $ | 38 |

| | $ | 37 |

| | $ | 274 |

|

_________________________________________

| |

| (1) | Includes $52 million for 2019 and $147 million for 2020. |

Coal Combustion Residuals/ Groundwater

The combustion of coal to generate electric power creates large quantities of ash and byproducts that are managed at power generation facilities in dry form in landfills and in wet form in surface impoundments. Each of our coal-fired plants has at least one CCR surface impoundment. At present, CCR is regulated by the states as solid waste.

EPA CCR Rule. The EPA’s CCR rule, which took effect in October 2015, establishes minimum federal requirements for existing and new CCR landfills and surface impoundments, as well as inactive CCR surface impoundments. The requirements include location restrictions, structural integrity criteria, groundwater monitoring, operating criteria, liner design criteria, closure and post-closure care, recordkeeping and notification. The rule allows existing CCR surface impoundments to continue to operate for the remainder of their operating life, but generally would require closure if groundwater monitoring demonstrates that the CCR surface impoundment is responsible for exceedances of groundwater quality protection standards or the CCR surface impoundment does not meet location restrictions or structural integrity criteria. The deadlines for beginning and completing closure vary depending on several factors. Several petitions for judicial review of the CCR rule were filed. The Water Infrastructure Improvements for the Nation Act (the “WIIN Act”), which was enacted in December 2016, provides for EPA review and approval

of state CCR permit programs in lieu of the self-implementing CCR rule requirements and authorizes the EPA to institute administrative or judicial enforcement actions for violations of state or federal CCR rule requirements.