Pioneer Flexible

Opportunities Fund

Semiannual Report | April 30, 2020

| Ticker Symbols: |

Class A | PMARX |

Class C | PRRCX |

Class K | FLEKX |

Class R | MUARX |

Class Y | PMYRX |

Beginning in April 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, bank or insurance company. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary or, if you invest directly with the Fund, by calling 1-800-225-6292.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-225-6292. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the Pioneer Fund complex if you invest directly.

visit us: www.amundipioneer.com/us

| |

|

| 2 |

| 4 |

| 10 |

| 11 |

| 12 |

| 17 |

| 19 |

| 32 |

| 41 |

| 58 |

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 1

Dear Shareholders,

The new decade has arrived delivering a first quarter that will go down in the history books. The beginning of the year seemed to extend the positive market environment of 2019. Then, March roared in like a lion and the COVID-19 pandemic became a global crisis impacting lives and life as we know it. The impact on the global economy from the COVID-19 virus pandemic, while currently unknown, is likely to be considerable. It is clear that several industries have already felt greater effects than others. And the markets, which do not thrive on uncertainty, have been volatile. Our business continuity plan was implemented given the new COVID-19 guidelines, and most of our employees are working remotely. To date, our operating environment has faced no interruption. I am proud of the careful planning that has taken place and confident we can maintain this environment for as long as is prudent. History in the making for a company that first opened its doors way back in 1928.

Since 1928, Amundi Pioneer’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the potential risks during periods of market volatility. As the first several months of 2020 have reminded us, investment risk can arise from a number of factors in today’s global economy, including slower or stagnating growth, changing U.S. Federal Reserve policy, oil price shocks, political and geopolitical factors and, unfortunately, major public health concerns such as a viral pandemic.

At Amundi Pioneer, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyze each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

2 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial advisor to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

We remain confident that the current crisis, like others in human history, will pass, and we greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of U.S.

Amundi Pioneer Asset Management USA, Inc.

April 30, 2020

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 3

Portfolio Management Discussion |

4/30/20 In the following discussion, Michele Garau and Howard Weiss review recent market events and describe the factors that affected the performance of Pioneer Flexible Opportunities Fund during the six-month period ended April 30, 2020. Mr. Garau, a senior vice president and a portfolio manager at Amundi Pioneer Asset Management, Inc. (Amundi Pioneer), is responsible for the management of the Fund, along with Mr. Weiss, CFA, a vice president and a portfolio manager at Amundi Pioneer, and Kenneth J. Taubes, Executive Vice President, Chief Investment Officer, U.S., and a portfolio manager at Amundi Pioneer.

Q How did the Fund perform during the six-month period ended April 30, 2020?

A Pioneer Flexible Opportunities Fund’s Class A shares returned -12.56% at net asset value during the six-month period ended April 30, 2020, while the Fund’s benchmark, the Bloomberg Barclays U.S. Treasury TIPS 1-10 Year Index (the Bloomberg Barclays Index), returned 3.08%. During the same period, the average return of the 251 mutual funds in Morningstar’s Tactical Allocation Funds category was -6.36%.

Q How did the financial markets perform during the six-month period ended April 30, 2020?

A Although higher-risk assets posted negative returns over the past six months, the period in fact began on a favorable note in November 2019. Markets generally marched steadily higher from the beginning of November through mid-February, thanks to the combination of steady global economic growth, accommodative central-bank policies, and progress on the U.S.-China trade dispute. The supportive environment abruptly changed in mid-February 2020 once it became clear that the spread of the COVID-19 virus was becoming a global issue and not one limited to specific regions of China. In response, officials around the world enacted virus-containment measures that shut down large swaths of the economies in the United States and other developed markets.

In response, investors quickly recalibrated their expectations to reflect a steep decline in economic growth and corporate earnings in the coming year. The sudden, adverse change in the investment backdrop led to significant market downturns across the full spectrum of riskier assets, including global equities, the credit-sensitive sectors of the bond market, and commodities. On the other hand, categories viewed as “safe havens,”

4 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

including U.S. Treasuries, gold, and the U.S. dollar (USD) performed well in the flight-to-quality market environment that took hold in February and March.

While stocks and other higher-risk asset classes recovered somewhat in April following extraordinary stimulus efforts from world governments and central banks, they nonetheless closed the full six-month period in negative territory.

Q Could you discuss some of the investment decisions that factored into the Fund’s benchmark-relative performance during the six-month period ended April 30, 2020?

A Although the Fund was positioned in a defensive manner throughout the six-month period, it underperformed the benchmark due to the broader sell-off in the financial markets. In contrast, the Bloomberg Barclays Index gained ground over the period thanks to the strong rally in government bonds. The Fund’s large weighting in equities, the returns of which lagged the benchmark by a wide margin, was the primary reason for the relative underperformance. The Fund’s fixed-income positioning was also a small detractor from benchmark-relative returns during the six-month period given that the portfolio’s holdings were tilted toward credit-sensitive issues rather than developed-market government bonds. A modest allocation to commodities further detracted from the Fund’s benchmark-relative performance.

Q Did the Fund have any exposure to derivatives during the six-month period ended April 30, 2020? If so, how did the use of derivatives affect the Fund’s performance?

A During the six-month period, we used derivatives across a broad spectrum of asset classes to establish specific market or issuer exposure in the portfolio, and to attempt to manage downside risk. The derivative instruments we used included equity, fixed-income, and commodity futures; credit-linked securities; long or short positions in exchange-traded funds (ETFs); forward foreign currency contracts; Treasury futures contracts; and options on both indices and individual securities.

The use of derivatives, after weighing on the Fund’s benchmark-relative returns when the markets were rising, subsequently contributed positively to relative performance once asset prices turned lower in February and March. Overall, however, the use of derivatives was a small minor net detractor from the Fund’s benchmark-relative performance for the six-month period.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 5

Despite the underperformance, we believe derivatives continue to offer an efficient way to manage the Fund’s allocations without our having to make material changes to the portfolio’s holdings. Since we use derivatives in an effort to achieve the Fund’s risk/return objectives, we feel they should be evaluated within the context of the entire portfolio, rather than as a stand-alone strategy.

Q Could you discuss the Fund’s positioning as of April 30, 2020?

A We have maintained a defensive portfolio posture while awaiting more clarity regarding both the virus situation and the path for economic recovery. Still, we have continued to favor equities over bonds given the unfavorable valuations in the latter category, and we sought to capitalize on the recent market sell-off by modestly increasing the Fund’s equity weighting. While the current positioning may lead to higher volatility for the Fund in the short term, we believe it is appropriate from a longer-term standpoint. A significant portion of the increase in the portfolio’s equity weighting stemmed from additional exposure to the “bond proxy” sectors – such as real estate investment trusts and utility stocks in Italy and Spain – which we believe offer more compelling yield potential and capital appreciation opportunities than what is currently available within the fixed-income markets.

The Fund’s portfolio has remained globally diversified* through investments in both the U.S. and foreign markets. As of April 30, 2020, the portfolio’s equity holdings represented approximately 80% of invested assets (excluding hedges). At the regional level, the Fund’s equity weightings stood at 36% in North America, 25% in other developed economies (ex-U.S.), and 19% in the emerging markets.

The portfolio’s equity holdings featured a continued underweight position in Europe and an overweight in China. We are certainly aware that China is likely to experience negative economic growth in the near term, but we also think the country may be among the first to recover once the threat from COVID-19 has abated enough to allow for normal or near-normal economic activity. Accordingly, we have maintained Fund allocations to domestic-oriented companies in China, Japan, Hong Kong, and Singapore. In China, the Fund’s investments have been focused on real estate

* | Diversification does not assure a profit nor protect against loss. |

6 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

developers, online teaching firms, banks, car distributors, and internet companies. The Fund’s portfolio of domestic equities has remained tilted toward defense and health care stocks. We also have continued to emphasize shares of companies with long histories of increasing their dividends**, and those that have effectively reduced their number of net shares outstanding through buybacks. We believe companies in both categories generally have offered compelling fundamental characteristics and valuations.

Fixed-income securities represented roughly 8% of the Fund’s invested assets at the end of April, with the majority of the allocation invested in the United States. Cash and cash equivalents made up the remainder of the portfolio’s investments.

The Fund’s positioning reflects our understanding of the current economic climate. That said, uncertainty persists with respect to how the economic effects of the COVID-19 pandemic will ultimately play out. We therefore have remained focused on determining whether those external considerations may have an effect on our core outlook, which would in turn affect the Fund’s investment orientation.

Please refer to the Schedule of Investments on pages 19–31 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

The Fund has the ability to invest in a wide variety of securities and asset classes.

** Dividends are not guaranteed.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 7

The Fund may invest in underlying funds (including ETFs). In addition to the Fund’s operating expenses, you will indirectly bear the operating expenses of investments in any underlying funds.

The Fund and some of the underlying funds employ leverage through the use of derivatives, which increases the volatility of investment returns and subjects the Fund to magnified losses if the Fund or an underlying fund’s investments decline in value.

The Fund and some of the underlying funds may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance.

The Fund and some of the underlying funds may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit to the amount of loss on an appreciating security that is sold short.

The Fund may invest in inflation-linked securities. As inflationary expectations increase, inflation-linked securities may become more attractive, because they protect future interest payments against inflation. Conversely, as inflationary concerns decrease, inflation-linked securities will become less attractive and less valuable.

The Fund may invest in credit default swaps, which may in some cases be illiquid, and they increase credit risk since the fund has exposure to both the issuer of the referenced obligation and the counterparty to the credit default swap.

The Fund may invest in subordinated securities, which may be disproportionately adversely affected by a default or even a perceived decline in creditworthiness of the issuer.

The Fund may invest in floating rate loans. The value of collateral, if any, securing a floating rate loan can decline or may be insufficient to meet the issuer’s obligations or may be difficult to liquidate.

The Fund may invest in insurance-linked securities. The return of principal and the payment of interest on insurance-linked bonds are contingent on the non-occurrence of a pre-defined “trigger” event, such as a hurricane or an earthquake of a specific magnitude.

The Fund may invest in commodity-linked derivatives. The value of commodity-linked derivatives may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, factors affecting a particular industry or commodity, international economic, political and regulatory developments, supply and demand, and governmental regulatory policies.

Investments in equity securities are subject to price fluctuation.

Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks.

8 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

International investments are subject to special risks, including currency fluctuations, and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Investments in fixed-income securities involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed-income securities will generally fall.

Prepayment risk is the chance that an issuer may exercise its right to repay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.

The Fund may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to prepayments.

High-yield bonds possess greater price volatility, illiquidity, and possibility of default.

These risks may increase share price volatility.

There is no assurance that these and other strategies used by the Fund or underlying funds will be successful.

Please see the prospectus for a more complete discussion of the Fund’s risks.

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or Amundi Pioneer Asset Management, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 9

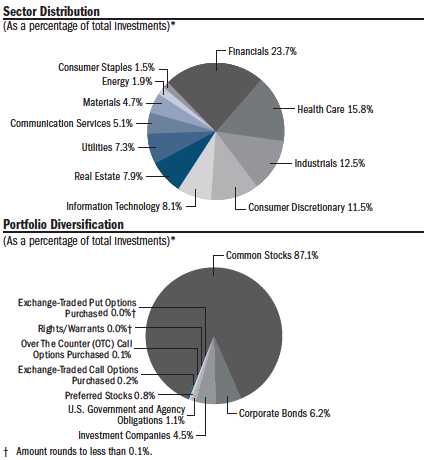

Portfolio Summary |

4/30/20 | | | |

| 10 Largest Holdings | |

(As a percentage of total investments)* | |

| 1. | ETFMG Prime Cyber Security ETF | 4.21% |

| 2. | L3Harris Technologies, Inc. | 2.28 |

| 3. | Booz Allen Hamilton Holding Corp. | 1.86 |

| 4. | Microsoft Corp. | 1.76 |

| 5. | Alibaba Group Holding, Ltd. (A.D.R.) | 1.64 |

| 6. | Abbott Laboratories | 1.58 |

| 7. | Leidos Holdings, Inc. | 1.47 |

| 8. | Iberdrola SA | 1.42 |

| 9. | AbbVie, Inc. | 1.38 |

| 10. | Snam S.p.A. | 1.37 |

* | Excludes temporary cash investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

10 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Prices and Distributions | 4/30/20 | |

|

| Net Asset Value per Share | | |

|

| Class | 4/30/20 | 10/31/19 |

| A | $10.34 | $12.04 |

| C | $10.09 | $11.75 |

| K | $10.33 | $12.03 |

| R | $10.24 | $11.75 |

| Y | $10.38 | $12.09 |

| Distributions per Share: 11/1/19 – 4/30/20 | | |

| | Short-Term | Long-Term |

| Class | Dividends | Capital Gains | Capital Gains |

| A | $0.2159 | $ — | $ — |

| C | $0.1710 | $ — | $ — |

| K | $0.2345 | $ — | $ — |

| R | $0.0080 | $ — | $ — |

| Y | $0.2341 | $ — | $ — |

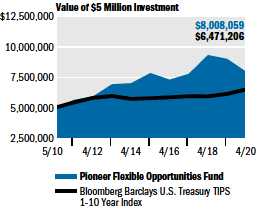

The Bloomberg Barclays U.S. Treasury TIPS 1-10 Year Index is an unmanaged index comprised of U.S. Treasury Inflation Protected Securities (TIPS) having a maturity of at least 1 year and less than 10 years. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 12–16.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 11

| | |

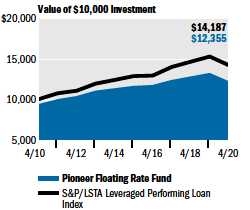

Performance Update | 4/30/20 | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Flexible Opportunities Fund at public offering price during the periods shown, compared to that of the Bloomberg Barclays U.S. Treasury TIPS 1–10 Year Index.

| Average Annual Total Returns | |

(As of April 30, 2020) | | |

|

| | | BBG |

| | | Barclays |

| Net | Public | U.S. Treasury |

| Asset | Offering | TIPS |

| Value | Price | 1-10 Year |

| Period | (NAV) | (POP) | Index |

Life of Class | | | |

(5/3/2010) | 4.77% | 4.29% | 2.60% |

5 years | 0.15 | -0.77 | 2.41 |

1 year | -11.99 | -15.95 | 6.16 |

| Expense Ratio | | |

(Per prospectus dated March 1, 2020) |

| Gross | Net | | |

1.26% | 1.23% | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. POP returns reflect deduction of maximum 4.50% sales charge. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2021, for Class A shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

12 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

| | |

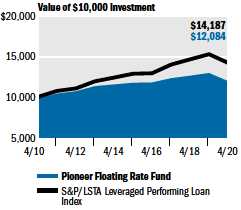

Performance Update | 4/30/20 | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Flexible Opportunities Fund during the periods shown, compared to that of the Bloomberg Barclays U.S. Treasury TIPS 1–10 Year Index.

| Average Annual Total Returns | |

(As of April 30, 2020) | | |

| | | BBG |

| | | Barclays |

| | | U.S. Treasury |

| | | TIPS |

| If | If | 1-10 Year |

| Period | Held | Redeemed | Index

|

Life of Class | | | |

(5/3/2010) | 3.97% | 3.97% | 2.60% |

5 years | -0.63 | -0.63 | 2.41 |

1 year | -12.72 | -12.72 | 6.16 |

| Expense Ratio | | |

(Per prospectus dated March 1, 2020) |

| Gross | | | |

2.00% | | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares held for less than one year are subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 13

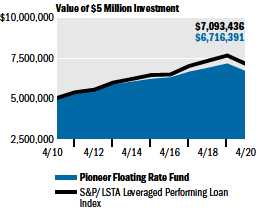

Performance Update | 4/30/20 | Class K Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class K shares of Pioneer Flexible Opportunities Fund during the periods shown, compared to that of the Bloomberg Barclays U.S. Treasury TIPS 1–10 Year Index.

| Average Annual Total Returns | |

(As of April 30, 2020) | |

| | BBG |

| | Barclays |

| Net | U.S. Treasury |

| Asset | TIPS |

| Value | 1-10 Year |

| Period | (NAV) | Index |

Life of Fund | | |

(5/3/2010) | 4.83% | 2.60% |

5 years | 0.25 | 2.41 |

1 year | -11.75 | 6.16 |

| Expense Ratio | | |

(Per prospectus dated March 1, 2020) |

| Gross | | |

0.91% | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

The performance shown for Class K shares for the period prior to the commencement of operations of Class K shares on June 22, 2018, is the net asset value performance of the Fund’s Class A shares, which has not been restated to reflect any differences in expenses, including Rule 12b-1 fees applicable to Class A shares. Since fees for Class A shares generally are higher than those of Class K shares, the performance of Class K shares prior to their inception on June 22, 2018, would have been higher than the performance shown. For the period beginning June 22, 2018, the actual performance of Class K shares is reflected. Class K shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

14 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Performance Update | 4/30/20 | Class R Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class R shares of Pioneer Flexible Opportunities Fund during the periods shown, compared to that of the Bloomberg Barclays U.S. Treasury TIPS 1–10 Year Index.

| Average Annual Total Returns | |

(As of April 30, 2020) | |

| | BBG |

| | Barclays |

| Net | U.S. Treasury |

| Asset | TIPS |

| Value | 1-10 Year |

| Period | (NAV) | Index |

Life of Fund | | |

(5/3/2010) | 4.23% | 2.60% |

5 years | -0.74 | 2.41 |

1 year | -13.74 | 6.16 |

| Expense Ratio | | |

(Per prospectus dated March 1, 2020) |

| Gross | | |

2.94% | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

The performance shown for Class R shares for the period prior to the commencement of operations of Class R shares on September 13, 2013, is based on the performance of Class A shares, reduced to reflect the higher distribution and service fees of Class R shares. For the period beginning September 13, 2013, the actual performance of Class R shares is reflected. Class R shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 15

Performance Update | 4/30/20 | Class Y Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Flexible Opportunities Fund during the periods shown, compared to that of the Bloomberg Barclays U.S. Treasury TIPS 1–10 Year Index.

| Average Annual Total Returns | |

(As of April 30, 2020) | |

| | BBG |

| | Barclays |

| Net | U.S. Treasury |

| Asset | TIPS |

| Value | 1-10 Year |

| Period | (NAV) | Index |

Life of Class | | |

(5/3/2010) | 5.07% | 2.60% |

5 years | 0.42 | 2.41 |

1 year | -11.79 | 6.16 |

| Expense Ratio | | |

(Per prospectus dated March 1, 2020) |

| Gross | Net | |

1.00% | 0.93% | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through March 1, 2021, for Class Y shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

16 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

(1) | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and |

(2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

(1) | Divide your account value by $1,000 |

| Example: an $8,600 account value ÷ $1,000 = 8.6 |

(2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer Flexible Opportunities Fund

Based on actual returns from November 1, 2019 through April 30, 2020.

| Share Class | A | C | K | R | Y |

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 11/1/19 | | | | | |

Ending Account | $874.40 | $870.90 | $875.80 | $872.30 | $875.50 |

Value (after expenses) | | | | | |

on 4/30/20 | | | | | |

Expenses Paid | $5.59 | $9.21 | $4.20 | $8.10 | $4.20 |

During Period* | | | | | |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.20%, 1.98%, 0.90%, 1.74% and 0.90% for Class A, Class C, Class K, Class R and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the partial year period). |

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 17

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Flexible Opportunities Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from November 1, 2019 through April 30, 2020.

| Share Class | A | C | K | R | Y |

Beginning Account | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Value on 11/1/19 | | | | | |

Ending Account | $1,018.90 | $1,015.02 | $1,020.39 | $1,016.21 | $1,020.39 |

Value (after expenses) | | | | | |

on 4/30/20 | | | | | |

Expenses Paid | $6.02 | $9.92 | $4.52 | $8.72 | $4.52 |

During Period* | | | | | |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.20%, 1.98%, 0.90%, 1.74% and 0.90% for Class A, Class C, Class K, Class R and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the partial year period). |

18 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Schedule of Investments |

4/30/20 (Consolidated) (unaudited) Shares

| | | Value |

|

| | | UNAFFILIATED ISSUERS — 95.0% | |

| | | COMMON STOCKS — 82.7% of Net Assets | |

| | | Aerospace & Defense — 3.2% | |

| 9,722 | | Curtiss-Wright Corp. | $ 1,007,685 |

| 41,165 | | L3Harris Technologies, Inc. | 7,973,660 |

| 8,118(a) | | Teledyne Technologies, Inc. | 2,643,789 |

| | | Total Aerospace & Defense | $ 11,625,134 |

| | | Air Freight & Logistics — 0.8% | |

| 77,802 | | Cia de Distribucion Integral Logista Holdings SA | $ 1,385,621 |

| 59,000 | | ZTO Express Cayman, Inc. (A.D.R.) | 1,755,840 |

| | | Total Air Freight & Logistics | $ 3,141,461 |

| | | Automobiles — 0.7% | |

| 741,000 | | Geely Automobile Holdings, Ltd. | $ 1,158,582 |

| 30,222 | | Porsche Automobil Holding SE | 1,523,692 |

| | | Total Automobiles | $ 2,682,274 |

| | | Banks — 4.4% | |

| 243,830 | | Bank for Foreign Trade of Vietnam JSC | $ 707,689 |

| 69,272 | | BAWAG Group AG (144A) | 2,353,600 |

| 12,232 | | BNP Paribas SA | 384,179 |

| 457,000 | | China Construction Bank Corp., Class H | 372,597 |

| 196,331(a) | | FinecoBank Banca Fineco S.p.A. | 2,180,519 |

| 5,950 | | First Republic Bank | 620,525 |

| 29,176 | | JPMorgan Chase & Co. | 2,793,893 |

| 19,145 | | KBC Group NV | 1,033,378 |

| 3,072,000 | | Postal Savings Bank of China Co., Ltd., | |

| | | Class H (144A) | 1,842,808 |

| 241,600 | | Public Bank Bhd | 920,756 |

| 295,427 | | Sberbank of Russia PJSC (A.D.R.) | 3,104,938 |

| | | Total Banks | $ 16,314,882 |

| | | Biotechnology — 3.6% | |

| 58,899 | | AbbVie, Inc. | $ 4,841,498 |

| 14,100 | | Amgen, Inc. | 3,373,002 |

| 7,797(a) | | Biogen, Inc. | 2,314,384 |

| 3,133(a) | | Regeneron Pharmaceuticals, Inc. | 1,647,582 |

| 5,013(a) | | Vertex Pharmaceuticals, Inc. | 1,259,266 |

| | | Total Biotechnology | $ 13,435,732 |

| | | Building Products — 0.5% | |

| 1,315,000 | | China Lesso Group Holdings, Ltd. | $ 1,869,447 |

| | | Total Building Products | $ 1,869,447 |

| | | Capital Markets — 1.3% | |

| 68,283 | | AllianceBernstein Holding LP | $ 1,599,188 |

| 49,326 | | Banca Generali S.p.A. | 1,224,247 |

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 19

Schedule of Investments | 4/30/20 (Consolidated) (unaudited) (continued)

Shares

| | | Value |

|

| | | Capital Markets — (continued) | |

| 6,472 | | DWS Group GmbH & Co. KGaA (144A) | $ 204,866 |

| 6,041 | | S&P Global, Inc. | 1,769,288 |

| | | Total Capital Markets | $ 4,797,589 |

| | | Chemicals — 0.2% | |

| 2,715 | | Ecolab, Inc. | $ 525,352 |

| 1,402,000 | | Sinopec Shanghai Petrochemical Co., Ltd., Class H | 385,242 |

| | | Total Chemicals | $ 910,594 |

| | | Commercial Services & Supplies — 3.9% | |

| 732,000 | | A-Living Services Co., Ltd., Class H (144A) | $ 4,032,225 |

| 448,000 | | Country Garden Services Holdings Co., Ltd. | 2,080,589 |

| 19,236 | | Republic Services, Inc. | 1,506,948 |

| 42,500 | | Secom Co., Ltd. | 3,570,579 |

| 34,534 | | Waste Management, Inc. | 3,454,091 |

| | | Total Commercial Services & Supplies | $ 14,644,432 |

| | | Construction Materials — 0.7% | |

| 137,316 | | Buzzi Unicem S.p.A. | $ 2,689,944 |

| | | Total Construction Materials | $ 2,689,944 |

| | | Consumer Discretionary — 1.1% | |

| 2,390,000 | | China New Higher Education Group, Ltd. (144A) | $ 1,254,868 |

| 175,118(a) | | Vipshop Holdings, Ltd. (A.D.R.) | 2,789,629 |

| | | Total Consumer Discretionary | $ 4,044,497 |

| | | | Diversified Consumer Services — 1.2% | |

| 555,000 | | China Education Group Holdings, Ltd. | $ 935,065 |

| 2,974,000 | | China Yuhua Education Corp., Ltd. (144A) | 2,992,550 |

| 1,036,000 | | Wisdom Education International Holdings Co., Ltd. | 438,369 |

| | | Total Diversified Consumer Services | $ 4,365,984 |

| | | | Diversified Financial Services — 0.2% | |

| 8,618 | | Wendel SE | $ 736,265 |

| | | Total Diversified Financial Services | $ 736,265 |

| | | Diversified Telecommunication Services — 0.1% | |

| 1,634,000 | | China Tower Corp., Ltd., Class H (144A) | $ 366,781 |

| | | Total Diversified Telecommunication Services | $ 366,781 |

| | | Electric Utilities — 4.0% | |

| 10,599 | | Duke Energy Corp. | $ 897,311 |

| 178,844 | | Endesa SA | 3,966,728 |

| 637,103 | | Enel S.p.A. | 4,351,599 |

| 495,952 | | Iberdrola SA | 4,964,996 |

| 206,137(a) | | Public Power Corp., SA | 598,322 |

| | | Total Electric Utilities | $ 14,778,956 |

The accompanying notes are an integral part of these financial statements.

20 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

| Shares | | | | Value |

|

| | | Electrical Equipment — 0.4% | |

| 9,134 | | Rockwell Automation, Inc. | $ 1,730,710 |

| | | Total Electrical Equipment | $ 1,730,710 |

| | | Equity Real Estate Investment | |

| | | Trusts (REITs) — 4.4% | |

| 957,100 | | Ascendas Real Estate Investment Trust | $ 2,016,377 |

SGD | 913,200 | | Ascott Residence Trust | 579,758 |

| 1,204,682 | | Frasers Logistics & Industrial Trust | 905,808 |

| 1,308 | | GLP J-Reit | 1,692,584 |

| 20,756 | | Healthpeak Properties, Inc. | 542,562 |

| 4,624 | | ICADE | 355,286 |

| 1,988 | | Ichigo Office REIT Investment Corp. | 1,268,640 |

| 1,335 | | Industrial & Infrastructure Fund Investment Corp. | 1,868,265 |

| 177 | | Kenedix Office Investment Corp. | 890,078 |

| 182 | | Kenedix Residential Next Investment Corp. | 289,339 |

| 488,600 | | Mapletree Industrial Trust | 883,795 |

| 385,800 | | Mapletree Logistics Trust | 492,598 |

| 82,340 | | Medical Properties Trust, Inc. | 1,411,308 |

| 600 | | Nippon Prologis REIT, Inc. | 1,654,709 |

| 147 | | NIPPON REIT Investment Corp. | 443,667 |

| 293 | | Nomura Real Estate Master Fund, Inc. | 337,872 |

| 222,000 | | Parkway Life Real Estate Investment Trust | 519,667 |

| | | Total Equity Real Estate Investment Trusts (REITs) | $ 16,152,313 |

| | | Financials — 0.2% | |

| 992,581(a) | | Alpha Bank AE | $ 725,145 |

| | | Total Financials | $ 725,145 |

| | | Food Products — 1.4% | |

| 35,497 | | Archer-Daniels-Midland Co. | $ 1,318,359 |

| 911,000 | | China Feihe, Ltd. (144A) | 1,899,178 |

| 18,282 | | Nestle SA | 1,929,304 |

| | | Total Food Products | $ 5,146,841 |

| | | Gas Utilities — 2.8% | |

| 151,228 | | Enagas SA | $ 3,526,476 |

| 181,900 | | ENN Energy Holdings, Ltd. | 2,055,619 |

| 1,068,587 | | Snam S.p.A. | 4,784,690 |

| | | Total Gas Utilities | $ 10,366,785 |

| | | Health Care Equipment & Supplies — 3.7% | |

| 60,206 | | Abbott Laboratories | $ 5,544,370 |

| 18,858 | | Danaher Corp. | 3,082,529 |

| 6,394(a) | | IDEXX Laboratories, Inc. | 1,774,974 |

| 84,800 | | Olympus Corp. | 1,365,139 |

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 21

Schedule of Investments | 4/30/20 (Consolidated) (unaudited) (continued)

| | | | | |

Shares

| | | Value |

|

| | | Health Care Equipment & Supplies — (continued) | |

| 1,400,000(a) | | PW Medtech Group, Ltd. | $ 213,116 |

| 7,985 | | Stryker Corp. | 1,488,644 |

| | | Total Health Care Equipment & Supplies | $ 13,468,772 |

| | | Health Care Providers & Services — 1.6% | |

| 6,122 | | Anthem, Inc. | $ 1,718,629 |

| 4,445 | | Cigna Corp. | 870,242 |

| 8,906 | | Humana, Inc. | 3,400,489 |

| | | Total Health Care Providers & Services | $ 5,989,360 |

| | | | Hotels, Restaurants & Leisure — 0.5% | |

| 113,000 | | Galaxy Entertainment Group, Ltd. | $ 735,437 |

| 19,880 | | Las Vegas Sands Corp. | 954,638 |

| | | Total Hotels, Restaurants & Leisure | $ 1,690,075 |

| | | Household Durables — 1.0% | |

| 18,497 | | Berkeley Group Holdings Plc | $ 974,822 |

| 95,775 | | Persimmon Plc | 2,660,706 |

| | | Total Household Durables | $ 3,635,528 |

| | | Industrial Conglomerates — 0.3% | |

| 16,200 | | Rheinmetall AG | $ 1,096,926 |

| | | Total Industrial Conglomerates | $ 1,096,926 |

| | | Industrials — 0.5% | |

| 7,994 | | Teleperformance | $ 1,790,567 |

| | | Total Industrials | $ 1,790,567 |

| | | Information Technology — 0.6% | |

| 37,375(a) | | Micron Technology, Inc. | $ 1,789,889 |

| 13,255 | | Samsung Electronics Co., Ltd. | 545,500 |

| | | Total Information Technology | $ 2,335,389 |

| | | Insurance — 4.8% | |

| 25,755 | | Allianz SE | $ 4,764,012 |

| 56,966 | | NN Group NV | 1,647,848 |

| 494,203 | | Poste Italiane S.p.A. (144A) | 4,196,162 |

| 26,918 | | Swiss Re AG | 1,941,909 |

| 87,000 | | Tokio Marine Holdings, Inc. | 4,128,208 |

| 3,076 | | Zurich Insurance Group AG | 978,930 |

| | | Total Insurance | $ 17,657,069 |

| | | | Interactive Media & Services — 2.2% | |

| 2,186(a) | | Alphabet, Inc. | $ 2,943,886 |

| 10,600 | | Dip Corp. | 232,402 |

| 11,100(a) | | LINE Corp. | 545,757 |

The accompanying notes are an integral part of these financial statements.

22 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Shares

| | | Value |

|

| | | Interactive Media & Services — (continued) | |

| 66,000 | | Tencent Holdings, Ltd. | $ 3,550,470 |

| 192,500 | | Z Holdings Corp. | 752,507 |

| | | Total Interactive Media & Services | $ 8,025,022 |

| | | Internet & Direct Marketing Retail — 3.8% | |

| 28,325(a) | | Alibaba Group Holding, Ltd. (A.D.R.) | $ 5,740,628 |

| 1,244(a) | | Amazon.com, Inc. | 3,077,656 |

| 11,300 | | ASKUL Corp. | 322,601 |

| 96,968(a) | | JD.com, Inc. (A.D.R.) | 4,179,321 |

| 43,000(a) | | Meituan Dianping, Class B | 575,800 |

| | | Total Internet & Direct Marketing Retail | $ 13,896,006 |

| | | IT Services — 3.9% | |

| 88,705 | | Booz Allen Hamilton Holding Corp. | $ 6,514,495 |

| 17,900 | | GMO internet, Inc. | 393,955 |

| 52,117 | | Leidos Holdings, Inc. | 5,149,681 |

| 2,896 | | Mastercard, Inc. | 796,313 |

| 10,541 | | Science Applications International Corp. | 860,778 |

| 5,117 | | Wirecard AG | 506,660 |

| | | Total IT Services | $ 14,221,882 |

| | | | Life Sciences Tools & Services — 2.2% | |

| 33,872 | | Agilent Technologies, Inc. | $ 2,596,627 |

| 7,686(a) | | Charles River Laboratories International, Inc. | 1,111,934 |

| 12,830 | | Thermo Fisher Scientific, Inc. | 4,293,944 |

| | | Total Life Sciences Tools & Services | $ 8,002,505 |

| | | Machinery — 1.1% | |

| 31,625(a) | | Ingersoll Rand, Inc. | $ 919,655 |

| 1,528,000 | | Sany Heavy Equipment International Holdings | |

| | | Co., Ltd. | 812,132 |

| 73,800 | | Volvo AB, Class B | 954,056 |

| 1,731,000 | | Zoomlion Heavy Industry Science & Technology | |

| | | Co., Ltd., Class H | 1,393,438 |

| | | Total Machinery | $ 4,079,281 |

| | | Media — 0.3% | |

| 13,600 | | CyberAgent, Inc. | $ 576,051 |

| 93,300 | | Macromill, Inc. | 603,227 |

| | | Total Media | $ 1,179,278 |

| | | Metals & Mining — 1.5% | |

| 23,352 | | Anglo American Platinum, Ltd. | $ 1,230,549 |

| 159,855 | | MMC Norilsk Nickel PJSC (A.D.R.) | 4,370,436 |

| | | Total Metals & Mining | $ 5,600,985 |

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 23

Schedule of Investments | 4/30/20 (Consolidated) (unaudited) (continued)

Shares

| | | Value |

|

| | | Mortgage Real Estate Investment | |

| | | Trusts (REITs) — 3.3% | |

| 320,638 | | AGNC Investment Corp. | $ 3,982,324 |

| 431,725 | | Annaly Capital Management, Inc. | 2,698,281 |

| 554,348 | | Redwood Trust, Inc. | 2,272,827 |

| 70,014 | | Starwood Property Trust, Inc. | 905,981 |

| 532,222 | | Two Harbors Investment Corp. | 2,432,254 |

| | | | Total Mortgage Real Estate Investment | |

| | | Trusts (REITs) | $ 12,291,667 |

| | | Multi-Utilities — 0.1% | |

| 101,992 | | Hera S.p.A. | $ 377,363 |

| | | Total Multi-Utilities | $ 377,363 |

| | | | Oil, Gas & Consumable Fuels — 1.9% | |

| 56,870 | | ConocoPhillips | $ 2,394,227 |

| 68,647 | | LUKOIL PJSC (A.D.R.) | 4,432,537 |

| | | Total Oil, Gas & Consumable Fuels | $ 6,826,764 |

| | | Pharmaceuticals — 3.9% | |

| 28,098 | | Johnson & Johnson | $ 4,215,824 |

| 36,200 | | Ono Pharmaceutical Co., Ltd. | 875,068 |

| 7,194 | | Roche Holding AG | 2,499,200 |

| 37,998 | | Sanofi | 3,712,017 |

| 22,446 | | Zoetis, Inc. | 2,902,492 |

| | | Total Pharmaceuticals | $ 14,204,601 |

| | | Professional Services — 0.2% | |

| 111,219 | | Applus Services SA | $ 730,909 |

| | | Total Professional Services | $ 730,909 |

| | | Real Estate — 0.2% | |

| 744,000 | | CIFI Holdings Group Co., Ltd. | $ 565,320 |

| | | Total Real Estate | $ 565,320 |

| | | Real Estate Management & Development — 3.0% | |

| 1,333,200 | | Ascendas India Trust | $ 1,201,039 |

| 314,000 | | China Resources Land, Ltd. | 1,288,139 |

| 187,800 | | City Developments, Ltd. | 1,060,392 |

| 1,566,500(a) | | KWG Group Holdings, Ltd. | 2,307,822 |

| 858,000 | | Longfor Group Holdings, Ltd. (144A) | 4,344,430 |

| 145,000 | | Shimao Property Holdings, Ltd. | 585,488 |

| 7 | | Vinhomes JSC (144A) | 19 |

| 26,000 | | Wheelock & Co., Ltd. | 190,347 |

| | | Total Real Estate Management & Development | $ 10,977,676 |

The accompanying notes are an integral part of these financial statements.

24 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

| Shares | | | Value |

|

| | | Software — 3.2% | |

| 11,391(a) | | Adobe, Inc. | $ 4,028,313 |

| 27,500 | | Infomart Corp. | 192,424 |

| 34,459 | | Microsoft Corp. | 6,175,398 |

| 14,000(a) | | Money Forward, Inc. | 656,995 |

| 7,483(a) | | Zendesk, Inc. | 575,293 |

| | | Total Software | $ 11,628,423 |

| | | Specialty Retail — 2.1% | |

| 1,594,000 | | China Meidong Auto Holdings, Ltd. | $ 2,866,533 |

| 2,398,000 | | China Yongda Automobiles Services Holdings, Ltd. | 2,431,518 |

| 620,500 | | Zhongsheng Group Holdings, Ltd. | 2,505,486 |

| | | Total Specialty Retail | $ 7,803,537 |

| | | Textiles, Apparel & Luxury Goods — 0.6% | |

| 5,723 | | LVMH Moet Hennessy Louis Vuitton SE | $ 2,209,298 |

| | | Total Textiles, Apparel & Luxury Goods | $ 2,209,298 |

| | | Wireless Telecommunication Services — 1.1% | |

| 116,500 | | China Mobile, Ltd. | $ 938,565 |

| 76,400 | | KDDI Corp. | 2,216,053 |

| 29,800 | | NTT DOCOMO, Inc. | 875,219 |

| | | Total Wireless Telecommunication Services | $ 4,029,837 |

| | | TOTAL COMMON STOCKS | |

| | | (Cost $293,923,505) | $ 304,839,806 |

| | | PREFERRED STOCKS — 0.8% of Net Assets | |

| | | | Equity Real Estate Investment Trusts | |

| | | (REITs) — 0.0%† | |

| 204^(a) | | Wheeler Real Estate Investment Trust, Inc. | $ 63,363 |

| | | Total Equity Real Estate Investment Trusts (REITs) | $ 63,363 |

| | | | Mortgage Real Estate Investment Trusts | |

| | | (REITs) — 0.8% | |

| 74,936(c)(d) | | AGNC Investment Corp., 6.125% (3 Month | |

| | | USD LIBOR + 470 bps) | $ 1,630,607 |

| 54,705(c)(d) | | AGNC Investment Corp., 7.0% (3 Month USD | |

| | | LIBOR + 511 bps) | 1,258,215 |

| | | | Total Mortgage Real Estate Investment | |

| | | Trusts (REITs) | $ 2,888,822 |

| | | TOTAL PREFERRED STOCKS | |

| | | (Cost $2,192,947) | $ 2,952,185 |

| Principal | | | |

| Amount USD ($) | | | |

|

| | CORPORATE BONDS — 5.9% of Net Assets | |

| | Banks — 1.9% | |

| 2,238,000(c)(d) | | Bank of America Corp., 4.3% (3 Month USD | |

| | LIBOR + 266 bps) | $ 2,011,402 |

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 25

Schedule of Investments | 4/30/20 (Consolidated) (unaudited) (continued)

| | | | |

| Principal | | | |

| Amount USD ($) | | | Value |

|

| | Banks — (continued) | |

| 3,216,000(c)(d) | | Intesa Sanpaolo S.p.A., 7.7% (5 Year USD Swap | |

| | | Rate + 546 bps) (144A) | $ 2,990,880 |

| 2,163,000(c)(d) | | JPMorgan Chase & Co., 4.6% (SOFRRATE + 313 bps) | 1,940,211 |

| | | Total Banks | $ 6,942,493 |

| | | Chemicals — 0.5% | |

| 1,800,000(b) | | Braskem Finance, Ltd., 6.45%, 2/3/24 | $ 1,768,518 |

| | | Total Chemicals | $ 1,768,518 |

| | | Mining — 1.5% | |

| 1,142,000 | | Gold Fields Orogen Holdings BVI, Ltd., 5.125%, | |

| | | 5/15/24 (144A) | $ 1,166,325 |

| 3,170,000 | | Gold Fields Orogen Holdings BVI, Ltd., | |

| | | 6.125%, 5/15/29 (144A) | 3,345,143 |

| 1,039,000 | | Teck Resources, Ltd., 6.125%, 10/1/35 | 1,039,422 |

| | | Total Mining | $ 5,550,890 |

| | | Packaging & Containers — 0.8% | |

| 3,000,000 | | Sealed Air Corp., 5.125%, 12/1/24 (144A) | $ 3,135,000 |

| | | Total Packaging & Containers | $ 3,135,000 |

| | | Telecommunications — 1.2% | |

| 4,400,000 | | CenturyLink, Inc., 7.65%, 3/15/42 | $ 4,400,000 |

| | | Total Telecommunications | $ 4,400,000 |

| | | TOTAL CORPORATE BONDS | |

| | | (Cost $21,636,681) | $ 21,796,901 |

| | | U.S. GOVERNMENT AND AGENCY OBLIGATION — | |

| | | 1.1% of Net Assets | |

| 4,000,000(e) | | U.S. Treasury Bills, 5/5/20 | $ 3,999,979 |

| | | TOTAL U.S. GOVERNMENT AND AGENCY OBLIGATION | |

| | (Cost $3,999,970) | $ 3,999,979 |

| Shares | | | |

| | | INVESTMENT COMPANIES — 4.3% | |

| | of Net Assets | |

| 368,722 | | ETFMG Prime Cyber Security ETF | $ 14,752,567 |

| 78,957 | | VanEck Vectors Vietnam ETF | 983,015 |

| | TOTAL INVESTMENT COMPANIES | |

| | (Cost $15,620,816) | $ 15,735,582 |

| | RIGHT/WARRANT — 0.0%† of Net Assets | |

| | Pharmaceuticals — 0.0%† | |

| 19,289(a) | | Bristol-Myers Squibb Co., 3/31/21 | $ 86,993 |

| | Total Pharmaceuticals | $ 86,993 |

| | TOTAL RIGHT/WARRANT | |

| | (Cost $2) | $ 86,993 |

The accompanying notes are an integral part of these financial statements.

|

26 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

| Number of | | | | | Strike | | Expiration | | |

| Contracts | Description | Counterparty | Notional

| | Price | | Date | Value

|

| | | EXCHANGE-TRADED CALL OPTIONS | | | | | |

| | PURCHASED — 0.2% | | | | | |

1,470

| Booz Allen | Citibank NA | USD | 410,105 | USD | 75 | 6/19/20 | $ 543,900 |

| Hamilton | | | | | | | | |

| Holding Co. | | | | | | | | |

500

| L3Harris | Citibank NA | USD | 370,960 | USD | 220 | 5/15/20 | | 33,750 |

| Technologies, Inc. | | | | | | | | |

| | | | | | | | $ 577,650 |

| | TOTAL EXCHANGE-TRADED CALL | | | | |

| | OPTIONS PURCHASED | | | | | |

| | (Premiums paid $781,065) | | | | $ 577,650 |

| | | EXCHANGE-TRADED PUT OPTION | | | | | |

| | PURCHASED — 0.0%† | | | | | |

1,800

| 10-Year T-Note | Citibank NA | USD | 635,894 | USD | 130 | 5/22/20 | $ 28,125 |

| Futures | | | | | | | | |

| | TOTAL EXCHANGE-TRADED PUT | | | | |

| | OPTION PURCHASED | | | | | | |

| | (Premiums paid $635,894) | | | | $ 28,125 |

| | OVER THE COUNTER (OTC) CALL OPTIONS | | |

| | PURCHASED — 0.0%† | | | | | |

971,750

| Galaxy | Citibank NA | HKD | 489,901 | HKD | 57.5 | 7/30/20 | $ 165,391 |

| Entertainment | | | | | | | | |

| Group, Ltd. | | | | | | | | |

13,315

| S&P 500 | Citibank NA | USD1,507,518 | USD | 3090 | 5/15/20 | | 71,207 |

| Index | | | | | | | | |

| | | | | | | | $ 236,598 |

| | TOTAL OVER THE COUNTER (OTC) CALL | |

| | OPTIONS PURCHASED | |

| | (Premiums paid $1,997,419) | $ 236,598 |

| | TOTAL OPTIONS PURCHASED | |

| | (Premiums paid $3,414,378) | $ 842,373 |

| | TOTAL INVESTMENTS IN UNAFFILIATED | |

| | ISSUERS — 95.0% | |

| | (Cost $340,788,299) | $ 350,253,819 |

| | OTHER ASSETS AND LIABILITIES — 5.0% | $ 18,514,298 |

| | NET ASSETS — 100.0% | $ 368,768,117 |

bps | Basis Points. |

LIBOR | London Interbank Offered Rate. |

REIT | Real Estate Investment Trust. |

SOFRRATE | Secured Overnight Financing Rate. |

(144A) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers in a transaction exempt from registration. At April 30, 2020, the value of these securities amounted to $34,124,835, or 9.3% of net assets.

|

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 27

Schedule of Investments | 4/30/20 (Consolidated) (unaudited) (continued)

(A.D.R.) American Depositary Receipts.

| † | Amount rounds to less than 0.1%. |

| ^ | Security is valued using fair value methods (other than supplied by independent pricing services). |

| (a) | Non-income producing security. |

(b)

| All or a portion of this security is held by Flexible Opportunities Commodity Fund Ltd. (formerly, Pioneer Cayman Commodity Fund Ltd.). |

(c)

| The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at April 30, 2020. |

(d)

| Security is perpetual in nature and has no stated maturity date. |

(e)

| Security issued with a zero coupon. Income is recognized through accretion of discount. |

| FUTURES CONTRACTS | | | | |

| CURRENCY FUTURES CONTRACT | | | |

| Number of | | | | | | | | | | | | |

| Contracts | | | Expiration | | Notional | | | Market | | | Unrealized | |

| Short | | Description | Date | | Amount | | | Value | | | Appreciation | |

| | 139 | | Euro | 6/15/20 | | $ | 19,370,062 | | | $ | 19,046,475 | | | $ | 323,587 | |

| Number of | | | | | | | | | | | Unrealized | |

| Contracts | | | Expiration | | Notional | | | Market | | | Appreciation | |

| Short | | Description | Date | | Amount | | | Value | | | (Depreciation) | |

| | 831 | | Euro Stoxx 50 | 6/19/20 | | $ | 23,723,891 | | | $ | 26,277,309 | | | $ | (2,553,418 | ) |

| | 113 | | FTSE/JSE Top 40 | 6/18/20 | | | 2,144,749 | | | | 2,846,906 | | | | (702,157 | ) |

| | 176 | | FTSE/MIB | 6/19/20 | | | 16,587,496 | | | | 16,926,415 | | | | (338,919 | ) |

| | 125 | | IBEX 35 | 5/15/20 | | | 9,504,750 | | | | 9,470,237 | | | | 34,513 | |

| | 40 | | Nikkei 225 | 6/11/20 | | | 7,111,256 | | | | 7,486,122 | | | | (374,866 | ) |

| | 131 | | S&P 500 E-MINI | 6/19/20 | | | 15,485,615 | | | | 19,011,375 | | | | (3,525,760 | ) |

| | | | | | | $ | 74,557,757 | | | $ | 82,018,364 | | | $ | (7,460,607 | ) |

| TOTAL FUTURES CONTRACTS | | | $ | 93,927,819 | | | $ | 101,064,839 | | | $ | (7,137,020 | ) |

| SWAPS CONTRACTS | | | | | | |

| OVER THE COUNTER (OTC) TOTAL RETURN SWAPS CONTRACTS — SELL PROTECTION | |

| | | | | | | | | Unrealized | | | | |

| Notional | | | Reference | Pay/ | | Expiration | | Appreciation | | | Market | |

Amount(1) | | Counterparty | Obligation/Index | Receive(2) | Coupon | Date | | (Depreciation) | | | Value | |

| | 3,169,973 | | Goldman Sachs | Goldman Sachs | Pay | 3M LIBOR | 6/29/20 | | $ | 346,917 | | | $ | 346,917 | |

| | | | International | Total Cash | | + 39bps | | | | | | | | | |

| | | | | Return Index* | | | | | | | | | | | |

| | 4,592,565 | | Goldman Sachs | Goldman Sachs | Pay | 3M LIBOR | 9/10/20 | | | (366,969 | ) | | | (366,969 | ) |

| | | | International | Total Cash | | + 39bps | | | | | | | | | |

| | | | | Return Index* | | | | | | | | | | | |

| | 5,335,891 | | Goldman Sachs | Goldman Sachs | Pay | 3M LIBOR | 11/26/20 | | | (934,584 | ) | | | (934,584 | ) |

| | | | International | Total Cash | | + 39bps | | | | | | | | | |

| | | | | Return Index* | | | | | | | | | | | |

| TOTAL SWAPS CONTRACTS | | | | | | $ | (954,636 | ) | | $ | (954,636 | ) |

The accompanying notes are an integral part of these financial statements.

28 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

(1) | The notional amount is the maximum amount that a seller of credit protection would be obligated to pay upon occurrence of a credit event. |

(2) | Pays quarterly. |

Principal amounts are denominated in U.S. dollars (“USD”) unless otherwise noted.

HKD — Hong Kong Dollar

SGD — Singapore Dollar

* | The following table shows the individual positions and related values of the securities underlying each total return swap contract with Goldman Sachs International, as of April 30, 2020. |

| | Share | | | SECURITY | | | | |

| Name | | Allocation | | | VALUE | | | % of basket | |

AbbVie Inc | | | 1,180 | | | $ | (97,029 | ) | | | 2.56 | % |

AES Corp/The | | | 6,882 | | | | (91,185 | ) | | | 2.41 | % |

American Airlines Group Inc | | | 1,826 | | | | (21,933 | ) | | | 0.58 | % |

American International Group Inc | | | 1,278 | | | | (32,496 | ) | | | 0.86 | % |

Ameriprise Financial Inc | | | 609 | | | | (69,973 | ) | | | 1.85 | % |

AmerisourceBergen Corp | | | 949 | | | | (85,052 | ) | | | 2.25 | % |

Apple Inc | | | 542 | | | | (159,194 | ) | | | 4.21 | % |

Applied Materials Inc | | | 1,917 | | | | (95,218 | ) | | | 2.52 | % |

Archer-Daniels-Midland Co | | | 1,701 | | | | (63,186 | ) | | | 1.67 | % |

Assurant Inc | | | 809 | | | | (85,920 | ) | | | 2.27 | % |

Boeing Co/The | | | 421 | | | | (59,387 | ) | | | 1.57 | % |

Capital One Financial Corp | | | 968 | | | | (62,710 | ) | | | 1.66 | % |

Capri Holdings Ltd | | | 2,085 | | | | (31,797 | ) | | | 0.84 | % |

CenturyLink Inc | | | 3,032 | | | | (32,201 | ) | | | 0.85 | % |

Cigna Corp | | | 309 | | | | (60,466 | ) | | | 1.60 | % |

Corning Inc | | | 2,698 | | | | (59,381 | ) | | | 1.57 | % |

DENTSPLY SIRONA Inc | | | 1,231 | | | | (52,235 | ) | | | 1.38 | % |

Discover Financial Services | | | 1,244 | | | | (53,436 | ) | | | 1.41 | % |

eBay Inc | | | 2,330 | | | | (92,790 | ) | | | 2.45 | % |

Equity Residential | | | 1,205 | | | | (78,412 | ) | | | 2.07 | % |

F5 Networks Inc | | | 603 | | | | (83,939 | ) | | | 2.22 | % |

General Electric Co | | | 2,685 | | | | (18,257 | ) | | | 0.48 | % |

Gilead Sciences Inc | | | 1,135 | | | | (95,378 | ) | | | 2.52 | % |

HCA Healthcare Inc | | | 924 | | | | (101,560 | ) | | | 2.68 | % |

HP Inc | | | 4,136 | | | | (64,145 | ) | | | 1.70 | % |

LyondellBasell Industries NV | | | 918 | | | | (53,215 | ) | | | 1.41 | % |

McDonald’s Corp | | | 556 | | | | (104,329 | ) | | | 2.76 | % |

Monster Beverage Corp | | | 1,715 | | | | (106,014 | ) | | | 2.80 | % |

Motorola Solutions Inc | | | 905 | | | | (130,201 | ) | | | 3.44 | % |

Navient Corp | | | 5,121 | | | | (39,020 | ) | | | 1.03 | % |

NetApp Inc | | | 1,953 | | | | (85,491 | ) | | | 2.26 | % |

NRG Energy Inc | | | 4,606 | | | | (154,425 | ) | | | 4.08 | % |

ONEOK Inc | | | 1,479 | | | | (44,281 | ) | | | 1.17 | % |

Procter & Gamble Co/The | | | 891 | | | | (105,055 | ) | | | 2.78 | % |

PulteGroup Inc | | | 3,433 | | | | (97,061 | ) | | | 2.56 | % |

Qorvo Inc | | | 1,144 | | | | (112,159 | ) | | | 2.96 | % |

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 29

Schedule of Investments | 4/30/20 (Consolidated) (unaudited) (continued)

| | Share | | | SECURITY | | | | |

| Name | | Allocation | | | VALUE | | | % of basket | |

Quest Diagnostics Inc | | | 738 | | | $ | (81,230 | ) | | | 2.15 | % |

Seagate Technology PLC | | | 1,847 | | | | (92,282 | ) | | | 2.44 | % |

Sysco Corp | | | 1,472 | | | | (82,841 | ) | | | 2.19 | % |

Target Corp | | | 1,394 | | | | (152,936 | ) | | | 4.04 | % |

TransDigm Group Inc | | | 315 | | | | (114,538 | ) | | | 3.03 | % |

Tyson Foods Inc | | | 1,211 | | | | (75,328 | ) | | | 1.99 | % |

United Airlines Holdings Inc | | | 1,109 | | | | (32,792 | ) | | | 0.87 | % |

Valero Energy Corp | | | 1,205 | | | | (76,317 | ) | | | 2.02 | % |

ViacomCBS Inc | | | 1,169 | | | | (20,184 | ) | | | 0.53 | % |

Western Union Co/The | | | 3,919 | | | | (74,738 | ) | | | 1.97 | % |

Westinghouse Air Brake Technologies Corp | | | 14 | | | | (812 | ) | | | 0.02 | % |

Weyerhaeuser Co | | | 2,298 | | | | (50,258 | ) | | | 1.33 | % |

Williams Cos Inc/The | | | 2,541 | | | | (49,221 | ) | | | 1.30 | % |

Yum! Brands Inc | | | 1,184 | | | | (102,314 | ) | | | 2.70 | % |

| Total | | | 85,836 | | | $ | (3,784,322 | ) | | | 100.00 | % |

Purchases and sales of securities (excluding temporary cash investments) for the six months ended April 30, 2020, aggregated $521,990,970 and $566,936,746, respectively.

The Fund is permitted to engage in purchase and sale transactions (“cross trades”) with certain funds and accounts for which Amundi Pioneer Asset Management, Inc. (the “Adviser”) serves as the Fund’s investment adviser, as set forth in Rule 17a-7 under the Investment Company Act of 1940, pursuant to procedures adopted by the Board of Trustees. Under these procedures, cross trades are effected at current market prices. During the six months ended April 30, 2020, the Fund did not engage in any cross trade activity.

At April 30, 2020, the net unrealized appreciation on investments based on cost for federal tax purposes of $346,398,885 was as follows:

| Aggregate gross unrealized appreciation for all investments in which | |

| there is an excess of value over tax cost | $ 36,522,874 |

| Aggregate gross unrealized depreciation for all investments in which | |

| there is an excess of tax cost over value | (40,759,596) |

| Net unrealized depreciation | $ (4,236,722) |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

Level 1 – quoted prices in active markets for identical securities.

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A.

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A.

The accompanying notes are an integral part of these financial statements.

30 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

The following is a summary of the inputs used as of April 30, 2020, in valuing the Fund’s investments:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 304,839,806 | | | $ | — | | | $ | — | | | $ | 304,839,806 | |

Preferred Stocks | | | | | | | | | | | | | | | | |

| Equity Real Estate | | | | | | | | | | | | | | | | |

| Investment Trusts (REITs) | | | — | | | | — | | | | 63,363 | | | | 63,363 | |

| Mortgage Real Estate | | | | | | | | | | | | | | | | |

| Investment Trusts (REITs) | | | 2,888,822 | | | | — | | | | — | | | | 2,888,822 | |

Corporate Bonds | | | — | | | | 21,796,901 | | | | — | | | | 21,796,901 | |

U.S. Government and | | | | | | | | | | | | | | | | |

| Agency Obligation | | | — | | | | 3,999,979 | | | | — | | | | 3,999,979 | |

Investment Companies | | | 15,735,582 | | | | — | | | | — | | | | 15,735,582 | |

Right/Warrant | | | 86,993 | | | | — | | | | — | | | | 86,993 | |

Exchange-Traded Call | | | | | | | | | | | | | | | | |

| Option Purchased | | | 577,650 | | | | — | | | | — | | | | 577,650 | |

Exchange-Traded Put | | | | | | | | | | | | | | | | |

| Option Purchased | | | 28,125 | | | | — | | | | — | | | | 28,125 | |

Over The Counter (OTC) | | | | | | | | | | | | | | | | |

Call Option Purchased | | | — | | | | 236,598 | | | | — | | | | 236,598 | |

| Total Investments | | | | | | | | | | | | | | | | |

| in Securities | | $ | 324,156,978 | | | $ | 26,033,478 | | | $ | 63,363 | | | $ | 350,253,819 | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Net unrealized depreciation | | | | | | | | | | | | | | | | |

| on futures contracts | | $ | (7,137,020 | ) | | $ | — | | | $ | — | | | $ | (7,137,020 | ) |

Swap contracts, at value | | | — | | | | (954,636 | ) | | | — | | | | (954,636 | ) |

| Total Other | | | | | | | | | | | | | | | | |

| Financial Instruments | | $ | (7,137,020 | ) | | $ | (954,636 | ) | | $ | — | | | $ | (8,091,656 | ) |

The following is a reconciliation of assets valued using significant unobservable inputs (Level 3):

| | Preferred | |

| | Stock | |

Balance as of 10/31/19 | | $ | 95,372 | |

Realized gain (loss)(1) | | | — | |

Changed in unrealized appreciation (depreciation)(2) | | | (32,009 | ) |

Accrued discounts/premiums | | | — | |

Purchases | | | — | |

Sales | | | — | |

Transfers in to Level 3* | | | — | |

Transfers out of Level 3* | | | — | |

| Balance as of 4/30/20 | | $ | 63,363 | |

(1) | Realized gain (loss) on these securities is included in the realized gain (loss) from investments on the Statement of Operations (Consolidated). |

(2) | Unrealized appreciation (depreciation) on these securities is included in the change in unrealized appreciation (depreciation) from investments on the Statement of Operations (Consolidated). |

* | Transfers are calculated on the beginning of period values. During the six months ended April 30, 2020, there were no transfers between Levels 1, 2 and 3. |

| | | |

| Net change in unrealized appreciation (depreciation) of Level 3 investments still held and | |

| considered Level 3 at April 30, 2020: |

| $(32,009)

|

The accompanying notes are an integral part of these financial statements.

Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20 31

Statement of Assets and Liabilities |

4/30/20 (Consolidated) (unaudited) | ASSETS: | | | |

| Investments in unaffiliated issuers, at value (cost $340,788,299) | | $ | 350,253,819 | |

| Cash | | | 1,554,554 | |

| Foreign currencies, at value (cost $2,781,111) | | | 2,425,126 | |

| Futures collateral | | | 1,424,801 | |

| Swaps collateral | | | 5,650,000 | |

| Due from broker for futures | | | 16,902,322 | |

| Due from broker for options | | | 333,437 | |

| Variation margin for futures contracts | | | 1,297,048 | |

| Receivables — | | | | |

| Investment securities sold | | | 12,930,608 | |

| Fund shares sold | | | 199,012 | |

| Dividends | | | 1,036,129 | |

| Interest | | | 340,139 | |

| Other assets | | | 184,119 | |

| Total assets | | $ | 394,531,114 | |

| LIABILITIES: | | | | |

| Payables — | | | | |

| Investment securities purchased | | $ | 16,642,097 | |

| Fund shares repurchased | | | 749,500 | |

| Trustees’ fees | | | 900 | |

| Net unrealized depreciation on futures contracts | | | 7,137,020 | |

| Swap contracts, at value | | | 954,636 | |

| Due to affiliates | | | 59,863 | |

| Accrued expenses | | | 218,981 | |

| Total liabilities | | $ | 25,762,997 | |

| NET ASSETS: | | | | |

| Paid-in capital | | $ | 445,883,655 | |

| Distributable earnings (loss) | | | (77,115,538 | ) |

| Net assets | | $ | 368,768,117 | |

| NET ASSET VALUE PER SHARE: | | | | |

No par value (unlimited number of shares authorized) | | | | |

| Class A (based on $76,507,093/7,401,519 shares) | | $ | 10.34 | |

| Class C (based on $61,613,359/6,104,906 shares) | | $ | 10.09 | |

| Class K (based on $100,266,318/9,704,416 shares) | | $ | 10.33 | |

| Class R (based on $154,699/15,115 shares) | | $ | 10.24 | |

| Class Y (based on $130,226,648/12,541,046 shares) | | $ | 10.38 | |

| MAXIMUM OFFERING PRICE PER SHARE: | | | | |

| Class A (based on $10.34 net asset value per share/100%-4.50% | | | | |

| maximum sales charge) | | $ | 10.82 | |

The accompanying notes are an integral part of these financial statements.

32 Pioneer Flexible Opportunities Fund | Semiannual Report | 4/30/20

Statement of Operations (Consolidated) (unaudited) | |

| FOR THE SIX MONTHS ENDED 4/30/20 | | |

| INVESTMENT INCOME: | | | | | | |

| Dividends from unaffiliated issuers (net of foreign | | | | | | |

| taxes withheld $269,012) | | $ | 4,134,941 | | | | |

| Interest from unaffiliated issuers (net of foreign | | | | | | | |

| taxes withheld $5,179) | | | 746,956 | | | | |

| Total investment income | | | | | | $ | 4,881,897 | |

| EXPENSES: | | | | | | | | |

| Management fees | | $ | 1,603,094 | | | | | |

| Administrative expense | | | 81,764 | | | | | |

| Transfer agent fees | | | | | | | | |

| Class A | | | 24,970 | | | | | |

| Class C | | | 31,581 | | | | | |

| Class K | | | 53 | | | | | |

| Class R | | | 237 | | | | | |

| Class Y | | | 83,765 | | | | | |

| Distribution fees | | | | | | | | |

| Class A | | | 115,239 | | | | | |

| Class C | | | 383,736 | | | | | |

| Class R | | | 358 | | | | | |

| Shareowner communications expense | | | 17,641 | | | | | |

| Custodian fees | | | 108,934 | | | | | |

| Registration fees | | | 24,754 | | | | | |

| Professional fees | | | 55,836 | | | | | |

| Printing expense | | | 67,274 | | | | | |

| Pricing fees | | | 2,133 | | | | | |

| Trustees’ fees | | | 10,580 | | | | | |

| Insurance expense | | | 2,992 | | | | | |

| Miscellaneous | | | 84,584 | | | | | |

| Total expenses | | | | | | $ | 2,699,525 | |

| Less fees waived and expenses reimbursed by the Adviser | | | | | | | (84,306 | ) |

| Net expenses | | | | | | $ | 2,615,219 | |

| Net investment income | | | | | | $ | 2,266,678 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | $ | (25,022,453 | ) | | | | |

| Forward foreign currency exchange contracts | | | 2,241 | | | | | |

| Futures contracts | | | 15,526,349 | | | | | |

| Swap contracts | | | (4,404,889 | ) | | | | |

| Other assets and liabilities denominated | | | | | | | | |

| in foreign currencies | | | (637,496 | ) | | $ | (14,536,248 | ) |

| Change in net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers (net of foreign | | | | | | | | |