QuickLinks -- Click here to rapidly navigate through this documentAs filed with the United States Securities and Exchange Commission on November 13, 2006.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Edgen Murray Plc

(Exact name of registrant as specified in its charter)

| England and Wales | | 5051 | | Not applicable |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

18444 Highland Road

Baton Rouge, Louisiana 70809

(225) 756-9868

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Daniel J. O'Leary

President and Chief Executive Officer

18444 Highland Road

Baton Rouge, Louisiana 70809

(225) 756-9868

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copies to:

Bonnie A. Barsamian, Esq.

Adam M. Fox, Esq.

Dechert LLP

30 Rockefeller Plaza

New York, New York 10112

United States of America

(212) 698-3500 | |

Wayne Rapozo, Esq.

Dechert LLP

160 Queen Victoria Street

London EC4V 4QQ

United Kingdom

+44 207 184 7000 | | T. Mark Kelly, Esq.

David H. Stone, Esq.

Vinson & Elkins LLP

2300 First City Tower

1001 Fannin Street,

Suite 2300

Houston, Texas 77002

United States of America

(713) 758-2222 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered(1)

| | Proposed

Maximum

Aggregate

Offering Price(2)(3)

| | Amount of

Registration

Fee

|

|---|

|

| Ordinary Shares, nominal value UK£1 per share, represented by American Depositary Shares | | $200,000,000 | | $21,400 |

|

- (1)

- A separate registration statement on Form F-6 is being filed for the registration of the American Depositary Shares ("ADSs") evidenced by American Depositary Receipts issuable on deposit of shares registered thereby. Each ADS will represent such number of ordinary shares determined by the Registrant in connection with, and at the time the Registrant establishes, the price range or in connection with the contribution transactions described herein.

- (2)

- Estimated solely for the purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act.

- (3)

- The proposed maximum offering price for each ADS representing ordinary shares being registered hereunder will be determined in connection with, and at the time of, the Registrant establishing the price range or in connection with the contribution transactions described herein.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED , 2006

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

EDGEN MURRAY PLC

American Depositary Shares

Representing

Ordinary Shares

This is our initial public offering. We are selling American Depositary Shares, or ADSs, representing our ordinary shares. Each ADS represents ordinary shares. ADSs will be evidenced by American Depositary Receipts, or ADRs. We currently anticipate that the estimated initial public offering price per ADS will be between $ and $ .

Prior to this offering, there has been no public market for our ADSs or our ordinary shares. We intend to apply to have the ADSs approved for quotation on the NYSE under the symbol "EMY."

We intend to use a portion of the proceeds of this offering to redeem our outstanding preference shares. Accordingly, certain of our executive officers and directors and certain affiliates of Jefferies & Company, one of the underwriters, who are holders of our outstanding preference shares will receive a portion of the proceeds of this offering.

Investing in our ADSs involves risks. See "Risk factors" beginning on page 15.

|

| | | | Per ADS | | | Total |

|

| Public offering price | | $ | | | $ | |

Underwriting discount and commissions |

|

$ |

|

|

$ |

|

Proceeds to Edgen Murray Plc (before expenses) |

|

$ |

|

|

$ |

|

|

Certain of our shareholders have granted the underwriters a 30 day option to purchase up to an additional ADSs representing ordinary shares at the public offering price, less the underwriting discount, to cover overallotments, if any. We will not receive any proceeds from the sale of shares by the selling shareholders.

Neither the Securities and Exchange Commission nor any other regulatory body commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ADSs evidenced by the ADRs on or about , 2006.

| JPMORGAN | | LEHMAN BROTHERS | | JEFFERIES & COMPANY |

| MORGAN KEEGAN & COMPANY, INC. | STIFEL NICOLAUS |

, 2006

Table of contents

| |

|

|---|

| Prospectus summary | | 1 |

| Risk factors | | 15 |

| Special note regarding forward-looking statements | | 25 |

| Use of proceeds | | 26 |

| Dividend policy | | 27 |

| Capitalization | | 28 |

| Dilution | | 30 |

| Unaudited pro forma condensed combined financial statements | | 34 |

| Management's discussion and analysis of financial condition and results of operations | | 37 |

| Business | | 63 |

| Security ownership of certain beneficial owners and management | | 86 |

| Certain relationships and related party transactions | | 88 |

| Description of share capital | | 92 |

| Description of American Depositary Shares | | 97 |

| Shares eligible for future sale | | 104 |

| Income tax considerations | | 105 |

| Underwriting | | 111 |

| Legal matters | | 116 |

| Experts | | 116 |

| Enforceability of certain judgments and service of process | | 116 |

| Currency and exchange rate information | | 116 |

| Where you can find more information | | 117 |

About this prospectus

In making your investment decision, you should rely only on the information contained in this prospectus, any free writing prospectus prepared by or on behalf of us or in the business and financial information that is not included in or delivered with this prospectus to which we have referred you. See "Where you can find more information." We have not authorized anyone to provide you with information that is different. If anyone provided you with different or inconsistent information, you should not rely on it. This prospectus may only be used where it is legal to sell these securities. You should assume the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances imply that the information in this prospectus is correct as of any date subsequent to the date on the front cover of this prospectus.

Dealer prospectus delivery obligation

Through and including , 2006 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to a deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

Special note regarding industry and market data

Any market and other industry data contained in this prospectus are based on independent industry publications, reports by market research firms or other published independent sources. We have not independently verified market or other industry data from third-party sources. While we believe this information is reliable and market definitions are appropriate, this information has not been verified by independent sources. Accordingly, we cannot assure you that such market and other industry data are accurate in all material respects.

i

Prospectus summary

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by more detailed information, the consolidated financial statements and the related notes to those statements, and the condensed consolidated financial statements and related notes to those statements included elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before investing in our ADSs. You should read this prospectus carefully, including the section entitled "Risk factors," the consolidated financial statements and the related notes to those statements and the condensed consolidated financial statements and related notes to those statements included elsewhere in this prospectus.

Edgen Murray Plc is a newly formed company created to serve as a holding company for our businesses and as the issuer in this offering. In conjunction with this offering, substantially all of the assets of our parent Edgen/Murray, L.P., were contributed to us in exchange for our ordinary and preference shares. Thereafter Edgen/Murray, L.P. distributed to the holders of its common and preferred partnership interests substantially all of the ordinary and preference shares received in the exchange. We refer to these transactions as the "Contribution." As a result, the historical financial information included in this prospectus represents the consolidated financial statements of Edgen/Murray, L.P. We present certain information in this prospectus for the combined twelve months ended December 31, 2005 on a pro forma basis. See "Unaudited pro forma condensed combined financial statements" for a description of the pro forma adjustments included in such pro forma results. Unless we state otherwise, "we," "us," "our" and similar terms, refer to Edgen Murray Plc and its predecessors.

Some of the statements in this summary are forward-looking statements. For more information, see "Certain relationships and related party transactions—Formation of Edgen Murray Plc and the Contribution" and "Special note regarding forward-looking statements." Certain financial and other information has been rounded and as a result, the numerical figures and percentages shown in this offering memorandum may vary slightly from the exact arithmetic aggregation of the relevant figures.

All information in this prospectus assumes that the underwriters do not exercise their 30 day option to purchase additional ADSs from certain of our shareholders, unless otherwise indicated.

Overview

We are a leading global distributor and marketer of high performance steel products for use primarily in specialized applications in the energy infrastructure market. The products we sell are generally highly engineered prime carbon or alloy steel pipe, pipe components and high grade structural sections and plates, which are designed to withstand the effects of corrosive or abrasive materials and possess performance characteristics required in extreme operating conditions, including high pressure and high/low temperature environments.

We distribute and market products and provide comprehensive procurement and project management solutions to our customers on projects spanning the complete lifecycle of the global energy infrastructure market, including exploration and production, new rig construction, gathering and transmission, refining and processing, power generation, petrochemical and maintenance, repair and operations (MRO). Our global sales and distribution network enables us to efficiently procure and deliver these high performance products worldwide to customers who may not have the relationships, resources or logistical support or may not be willing or able to purchase in sufficient volume or on a cost-effective basis to complete procurement independently for their projects. Our customers are principally end-users that operate in or service the energy infrastructure industry and providers of MRO products. For the six months ended June 30, 2006, approximately 81% of our total revenue was attributable to customers that operate in or service the energy infrastructure market and, within that

1

market, approximately 59% of our total revenue was attributable to customers that operate in or service the oil and gas industry.

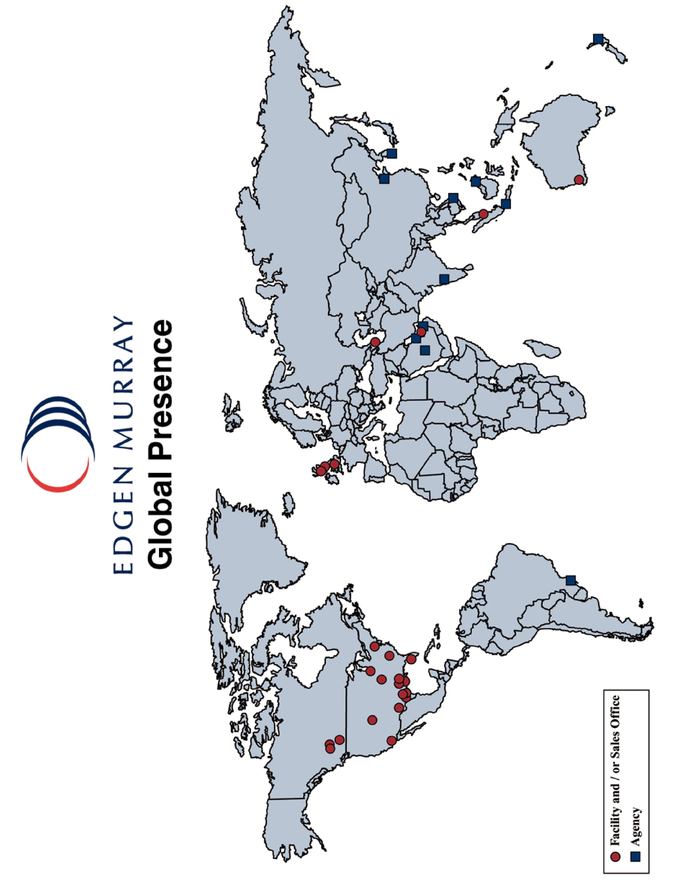

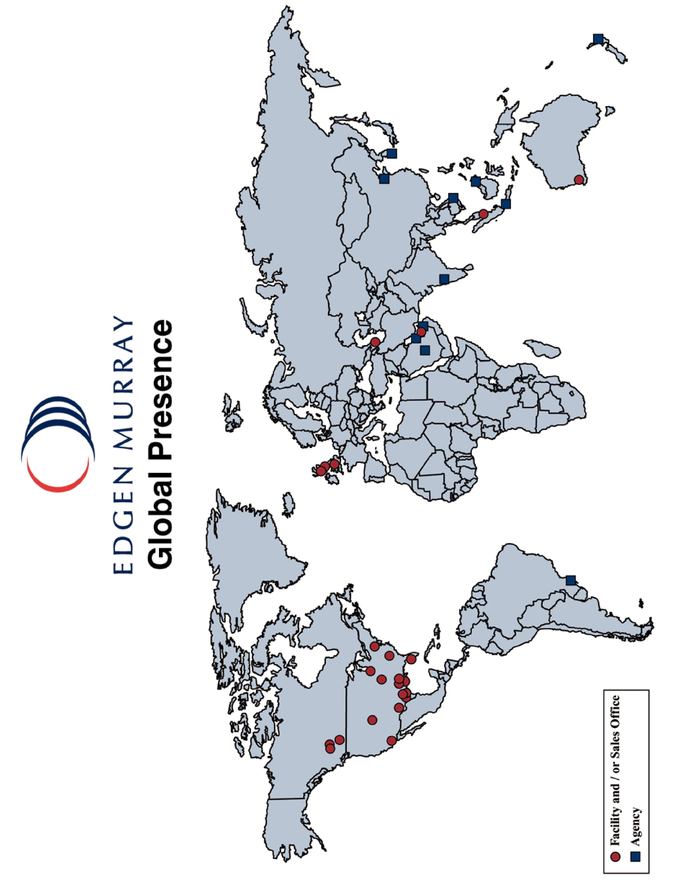

We currently manage our operations in five reporting segments: the Americas—Carbon, Americas—Alloy, UK, Singapore and the UAE. These five segments represent four geographic markets—the Americas, Europe/West Africa, Asia/Pacific and the Middle East. Our worldwide sales and distribution network enables us to promptly deliver our products and respond to our customers' needs. We currently serve customers in more than 50 countries worldwide through 23 locations internationally, including 17 in the Americas, three in Europe/West Africa, two in Asia/Pacific and one in the Middle East. For the six months ended June 30, 2006, 55% of our revenues were from the Americas, 24% from Europe/West Africa, 11% from Asia/Pacific and 10% from the Middle East. We are capable of supplying our complete product offering in all of the regions in which we operate. We stock and distribute inventory and support our customers through our global network of field locations, which are in close proximity to our customers' operations. This network allows us to service projects in remote and challenging locations, while also supporting the daily MRO requirements of installed facilities.

We are a critical link between our customers and the manufacturers from whom we purchase our products (our vendors). We use our in-depth market knowledge and our value-added vendor relationships to provide our customers with complete logistical support for their projects, including inventory management and just-in-time product delivery on a worldwide basis. We maintain a broad product offering, which includes more than 44,000 SKUs, and manage a large inventory of components and more than 100,000 tons of pipes, plates and sections. As a result, we are able to supply products that are not generally otherwise available to our customers on a quick-response basis or that cannot be purchased in the smaller quantities needed by customers for specific projects. Our global scale has allowed us to establish strong ties and preferential purchasing terms with our vendors. We also provide additional support for our vendors including sales, marketing and credit functions with respect to the products we distribute.

We employ experienced local market specialists and sales personnel in each of our geographical regions of operation, many of whom have technical backgrounds, training or relevant industry experience. Our sales personnel provide value-added customer support, including technical consultation on product selection and integration in large, complex projects. In addition to the comprehensive knowledge of our products and the industries we supply, our local market personnel understand the characteristics of the different geographies they serve. We are also well positioned to be a key vendor for our customers' greenfield projects and MRO needs because of the familiarity we have with our customers' existing infrastructure and upcoming projects.

Our total revenue, EBITDA and net loss on a pro forma basis for the twelve months ended December 31, 2005 were $600.4 million, $53.7 million and $(2.5 million), respectively. Pro forma EBITDA of $53.8 million for the twelve months ended December 31, 2005 includes $12.0 million of expenses incurred in connection with the February 1, 2005 acquisition of Edgen Corporation ("Edgen") and $5.5 million in bonus payments and applicable payroll taxes to certain employees of Murray International Metals Limited ("MIM Ltd.") prior to its acquisition. Our total revenue, EBITDA and net income for the six months ended June 30, 2006 were $340.0 million, $45.0 million and $10.1 million, respectively. EBITDA of $45.0 million for the six months ended June 30, 2006 includes the impact of a $6.1 million foreign exchange gain on outstanding debt. For our definition of EBITDA and a reconciliation of net income (loss) for the period to EBITDA, see "Summary historical consolidated and pro forma condensed combined financial data."

2

End market overview

We sell our products principally to customers who develop, service and own infrastructure that comprises much of the global energy value chain. Demand for the products we supply is generally related to overall levels of capital spending in the oil and gas exploration and production, gathering and transmission and crude oil refining markets and the energy processing and power generation industries.

We believe the following trends will drive capital investment in the end markets we serve and, in turn, demand for our highly specialized products:

- •

- Increasing global demand for crude oil and natural gas. Worldwide economic expansion, particularly in emerging economies, has resulted in growing demand for hydrocarbons. This has, in turn, resulted in an increasing investment in the development of energy infrastructure assets for the exploration for, and the production, transportation, processing and refining of, crude oil and natural gas.

- •

- Rising activity in developing international markets. Oil and gas exploration and production companies are increasingly turning to underdeveloped international markets to find new hydrocarbon reserves. In many of these markets, significant investment in production infrastructure is required to develop new discoveries. Our global network of field locations is well positioned to serve this fast growing market.

- •

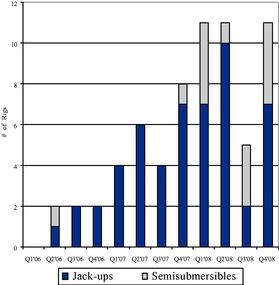

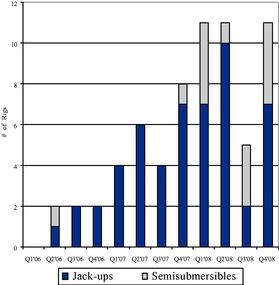

- Increasing exploration and development activity in deepwater markets. Driven by technological innovations and a strong commodity price environment, deepwater oil and gas activity has increased significantly in recent years. Drilling for and producing oil and gas reserves in remote deepwater areas requires the use of technically sophisticated assets that are in scarce supply or require long lead times and significant capital to fabricate, including deepwater drilling rigs and highly engineered floating production facilities. We expect the demand for our specialized products to continue to increase as oil and gas producers continue to invest in the infrastructure needed to commercially produce these deepwater reserves.

- •

- New rig construction. Increasing global drilling activity has driven an increase in utilization levels of offshore drilling rigs, particularly higher specification rigs capable of drilling in harsher environments, prompting the industry to invest substantial capital in maintenance, upgrades and new rig construction.

- •

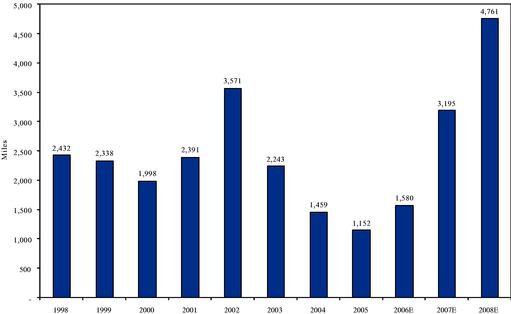

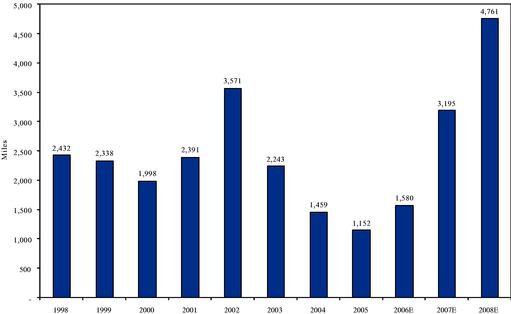

- Increasing investment in natural gas transmission capacity in under-supplied regional markets. As global energy infrastructure capacity has developed to match rising global energy demand, investment in the expansion of natural gas transmission capacity has increased commensurately.

- •

- Proliferation of natural gas monetization projects. Commercialization of remote natural gas resources is a leading industry initiative to satisfy increasing global natural gas demand. Liquefied natural gas (LNG) and gas-to-liquid (GTL) technologies are expected to grow in importance as a choice for transportation and use. We believe we are well positioned to capitalize on increasing investment in gas monetization projects as our products serve as components for the construction of these facilities.

- •

- Significant capital investment in oil sands production and conversion capacity. Oil sands resource development is a complex and capital-intensive process. The development of Canada's vast oil sands deposits is expected to make a significant contribution to future global crude oil production and, in turn, should increase demand for our products that are components of the infrastructure needed to produce, refine and transport this resource.

- •

- Global investment in power generation capacity. As developing countries continue to experience strong economic growth and as environmental regulations require or encourage the retirement or refurbishment of older facilities, demand for power generation capacity is expected to continue to

3

increase. The bulk of this incremental demand is expected to originate in countries outside the Organisation for Economic Co-operation and Development (OECD), where the power generation markets are less developed. We believe that our worldwide footprint should allow us to capitalize on this forecasted growth of capacity in the power generating industry.

- •

- Significant expansion of US ethanol production capacity. Ethanol production in the United States is expected to double by the end of the decade as high hydrocarbon prices, dependence on foreign sources of crude oil and more stringent clean air regulations have elevated focus within the industry on the development of alternative energy sources. We distribute specialty components that are required to build and operate ethanol plants as well as address the MRO requirement of existing ethanol plants.

Our competitive strengths

We consider the following to be our principal competitive strengths:

Our distribution model. Our global distribution model provides our customers with a comprehensive procurement and project management solution focused on high performance steel products. We distinguish ourselves from our competitors because we have built a global business that combines local knowledge and presence with a solution-driven approach to managing our customers' needs for design, purchase and delivery of specialized steel products. In addition, through our experienced sales force and global distribution network, we are able to execute customer orders and facilitate our customers' growth in markets worldwide.

We have a knowledgeable and experienced sales force. Our sales and support team is experienced and knowledgeable of both the design specifications of our customers' projects and facilities, as well as their ongoing needs and is able to provide valuable advisory support to our customers while meeting their product requirements. Many of our sales and support personnel have technical backgrounds and training and on average have more than 15 years of industry experience. Our sales specialists are skilled both in managing the intricate logistics inherent in complex projects and in accommodating the expedited MRO requirements of our customers.

We have strong vendor relationships. We are a volume purchaser of specialty steel products and serve as a critical link between our vendors and our customers. Many of the products we supply to our customers are difficult for individual customers to purchase on a cost-effective basis directly from manufacturers, who hold limited inventories and often require large orders and lengthy lead times for new production runs. We have demonstrated to our vendors that we are a consistent, high-volume purchaser of their products and a valuable, reliable sales channel. As a result, we have developed strong, longstanding relationships and negotiated preferred pricing arrangements with key vendors, which we believe would be difficult for others to replicate.

We command premium margins through the combination of a broad offering of specialized products and value-added customer support. We focus on products that are highly specialized and that are generally regarded as critical to our customers' operations and new projects. In addition to our product offerings, we provide technical advice in areas such as design efficiency and logistics which are valued by our customers. The specialized nature of our products, in combination with the technical support we offer, allows us to capture premium margins for the products we distribute versus those generally earned on non-specialized steel products.

We have a broad customer base. We market our products to a diverse base of more than 2,750 customers, whose operations are in geographic locations around the world and who participate in all sectors of the energy industry. Our customers are generally large, well-capitalized companies who are recognized as leaders in their respective industries.

4

Our management team is experienced and incentivized. Our senior management team has an average of 26 years of industry experience. Many of our senior managers have significant relevant experience in the industries we serve or with vendors who supply high performance steel products to the energy infrastructure market. The compensation of our senior managers is tied to financial performance measures, which we believe creates value for our shareholders. In addition, many of our senior executives have significant experience in the geographies in which we conduct business. Following the closing of this offering, our senior management will own approximately % of our ordinary shares.

Our business strategy

Increase market share among existing and new customers. We have developed strong customer relationships in the industries we serve. Given our significant international expansion, highlighted by our December 16, 2005 acquisition of MIM Ltd., we believe that there exists significant opportunities to cross-sell our combined products and procurement and distribution capabilities. Accordingly, we are strengthening our product offerings outside of the United States by augmenting our product portfolio, management expertise and sales force.

Leverage our knowledge of the energy infrastructure industry in high growth markets. We plan to leverage our experience in the energy infrastructure market to achieve greater penetration of emerging high growth regional infrastructure markets such as the Canadian oil sands and the Caspian Sea markets. We focus our product offering on specialized products that are used in the extreme environments commonly seen within the energy industry and continue to identify new uses for our products in higher growth infrastructure applications, such as LNG, GTL and alternative energy production.

Optimize our vendor relationships, purchasing and inventory levels. We have significantly consolidated our purchasing power among certain vendors, while keeping secondary vendors for all key products. By consolidating our purchasing power we believe that we have gained favored status with certain vendors that value both our global footprint and volume purchasing capabilities. Because of this, we are often considered the preferred or sole distribution channel for their specialty products. As we continue to strengthen our vendor relationships, we are able to devote greater resources to providing our customers with products that have fewer substitutes and are more critical to their business.

Pursue opportunistic strategic acquisitions and investments and continue global expansion. We intend to seek opportunities to strengthen our global franchise through selective acquisitions and strategic investments. In particular, we will consider investments that enhance our global presence in the energy infrastructure market and enable us to leverage our existing operations. In addition, we intend to selectively establish new regional offices, particularly in the Asia/Pacific region, to facilitate our expansion into emerging regional markets and to better serve our growing customer base in this region.

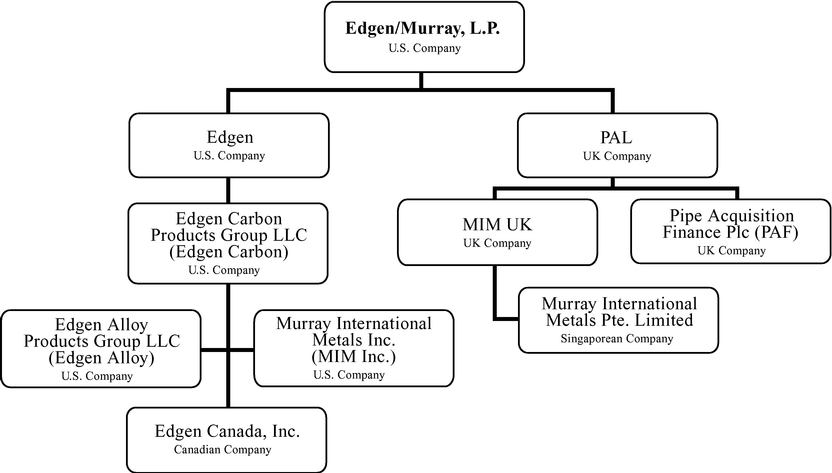

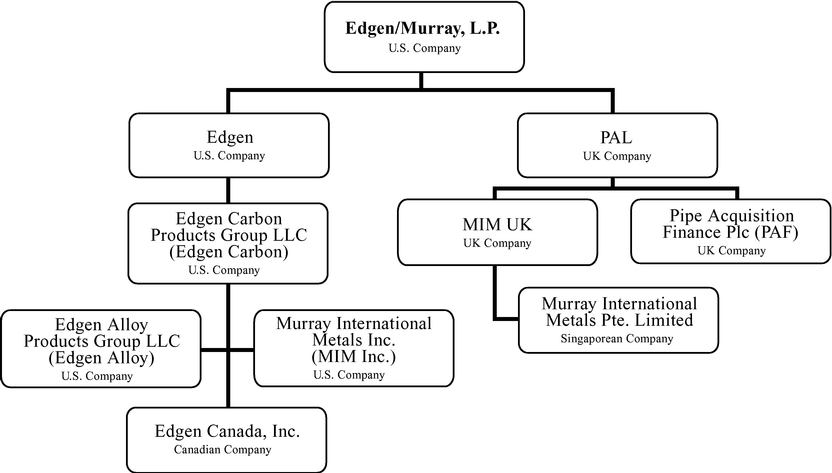

Our history and formation

Edgen Murray Plc was formed as an English public limited company in November 2006 to serve as a holding company for the assets previously held by our predecessor, Edgen/Murray, L.P., and to serve as the issuer in this offering. Substantially all the directly held assets of Edgen/Murray, L.P. were the shares of common stock of Edgen and the ordinary shares of Pipe Acquisition Limited ("PAL"), an English company organized by Jefferies Capital Partners ("JCP"), a New York-based private equity firm, and certain members of Edgen and MIM Ltd. management to effect the acquisition of MIM Ltd.

Edgen was founded in 1983 as Thomas Pipe and Steel, Inc. in Baton Rouge, Louisiana and was acquired in 1996 by an investor group. Following its acquisition in 1996, Edgen rapidly grew its business in the United States, expanding from a single location distribution business with a limited product offering, into a leading distributor with multiple distribution facilities and a broad product offering.

5

In February 2005, all of the outstanding equity interests in Edgen were acquired by certain members of Edgen management and JCP. In December 2005, Edgen's shareholders organized a new holding company, Edgen/Murray, L.P., to hold all of the outstanding equity interests of Edgen and PAL. On December 16, 2005, Edgen/Murray, L.P. through its subsidiaries acquired MIM Ltd. and its subsidiaries.

MIM Ltd. was founded in 1976 in Edinburgh, Scotland to supply the developing offshore oil and gas industry with high grade steel products, in particular oil and gas infrastructure projects located in the extreme environmental conditions of the North Sea. Following its founding in 1976, MIM Ltd. grew its business into a leading global distributor of high grade steel products supplying primarily the offshore oil and gas industry in several geographical markets worldwide, including the Caspian Sea region, West Africa, Asia/Pacific and the Middle East. MIM Ltd. achieved this growth through greenfield start-up distribution centers and by expanding its distribution capabilities worldwide through branch offices, representative offices and agencies.

The Contribution

On , Edgen/Murray, L.P. contributed the common shares of Edgen and PAL to Edgen Murray Plc and Edgen Murray Plc issued ordinary shares and preference shares to Edgen/Murray, L.P. in exchange for these shares. Following this exchange, Edgen/Murray, L.P. effected a special distribution whereby the holders of Edgen/Murray, L.P. preferred partnership interests received Edgen Murray Plc preference shares held by Edgen/Murray, L.P. and the holders of Edgen/Murray, L.P. common partnerships interests (other than the holders of restricted common partnership interests held by certain members of our management and employees under the Edgen/Murray, L.P. equity incentive plans) received Edgen Murray Plc ordinary shares held by Edgen/Murray, L.P.

As a result of the Contribution, but prior to giving effect to this offering, the equity holders of Edgen/Murray, L.P. (other than the holders of restricted common partnership interests under the Edgen/Murray, L.P. equity incentive plans) became the owners of Edgen Murray Plc. Accordingly, JCP and its affiliates beneficially own approximately % of our preference shares and % of our ordinary shares and certain members of our management and employees beneficially own approximately % of our preference shares and % of our ordinary shares. See "Security ownership of certain beneficial owners and management."

All of our preference shares will be redeemed by us with a portion of the proceeds of this offering. There will be no preference shares of Edgen Murray Plc outstanding when the redemption of the preference shares is completed. Following the consummation of this offering and the redemption of our preference shares, JCP and its affiliates will beneficially own approximately % of our ordinary shares and none of our preference shares and certain of our management and employees will beneficially own approximately % of our ordinary shares and none of our preference shares.

Company information

Edgen Murray Plc was incorporated in England on November 2, 2006 with registered number 5987010 under the UK Companies Act 1985 as a public limited company. Our registered office is located at 20-22 Bedford Row, London WC1R 4JS, our principal executive offices are located at 18444 Highland Road, Baton Rouge, Louisiana 70809 and our telephone number is (225) 756-9868. We maintain our website at www.edgenmurray.com. Information on our website does not constitute part of this prospectus.

6

The offering

The following information assumes that the underwriters will not exercise their option to purchase additional ADSs from certain of our shareholders in the offering, unless otherwise indicated. See "Underwriting."

Offering price |

|

$ per ADS. |

ADSs offered |

|

ADSs. |

Ordinary shares outstanding immediately after this offering |

|

ordinary shares. |

Ratio of ADSs to ordinary shares |

|

Each ADS represents ordinary shares. |

ADSs outstanding immediately after this offering |

|

ADSs. |

Listing |

|

We intend to apply to have our ADSs quoted on the NYSE under the symbol "EMY." The ordinary shares and the ADSs will not be listed on any other exchange or traded on any other automated quotation system. |

The ADSs |

|

The ADSs will be evidenced by ADRs. The custodian of the Depositary will hold the ordinary shares underlying the ADSs. If we declare dividends on our ordinary shares, the Depositary will pay you the cash dividends and other distributions it receives on our ordinary shares, after deducting its fees and expenses. Subject to the terms of the deposit agreement and applicable law, you may turn in your ADSs to the Depositary in exchange for ordinary shares underlying your ADSs. The Depositary will charge you fees for any such exchange. You will have rights as provided in the deposit agreement. We and the Depositary may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the deposit agreement as amended. To better understand the terms of the ADSs, you should carefully read the "Description of American Depositary Shares" section of this prospectus. You should also read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus. |

Depositary |

|

, the depositary bank (the "Depositary"). |

Custodian |

|

|

|

|

|

7

Option to purchase additional ADSs |

|

Certain of our shareholders have granted to the underwriters an option, which is exercisable within 30 days from the date of this prospectus, to purchase up to an additional ADSs. See "Underwriting" for more information. |

Timing and settlement for ADSs |

|

The ADSs are expected to be delivered against payment on , 2006. The ADRs evidencing the ADSs will be deposited with a custodian for, and registered in the name of a nominee of, The Depositary Trust Company in New York, New York. In general, beneficial interests in the ADSs will be shown on, and transfers of these beneficial interests will be effected only through, records maintained by The Depositary Trust Company and its direct and indirect participants. |

Use of proceeds |

|

We estimate that the net proceeds we will receive from this offering will be approximately $ million, after deducting underwriting discount and commissions and the estimated offering fees and expenses payable by us and assuming an initial public offering price of $ per ADS, which represents the mid-point of the range set forth on the cover page of this prospectus. We intend to use such net proceeds of this offering along with available cash to repay the PAL Floating Rate Notes and to redeem our preference shares. See "Use of proceeds" for additional information. Certain of our executive officers and directors and affiliates of an underwriter who are holders of our outstanding preference shares will receive a portion of the proceeds of this offering. See "Underwriting—Relationships." We will not receive any of the proceeds from the sale of ADSs by the selling shareholders that may be sold upon exercise of the option to purchase additional ADSs. |

Lock-up |

|

We have, subject to certain exceptions, agreed with the underwriters to a lock-up of ADSs or ordinary shares or securities convertible into or exchangeable or exercisable for any ADSs or ordinary shares for a period of 180 days after the date of this prospectus. In addition, our executive officers, directors and certain existing shareholders, who collectively hold approximately % of our outstanding ordinary shares immediately before this offering, have, subject to certain exceptions, also agreed with the underwriters to a lock-up of ADSs or ordinary shares or securities convertible into or exchangeable or exercisable for any ADSs or ordinary shares for a period of 180 days after the date this prospectus. See "Shares eligible for future sale" and "Underwriting." |

Risk factors |

|

See "Risk factors" and other information included in this prospectus for a discussion of risks you should carefully consider before investing in our ADSs. |

| | | |

8

Deposit or withdrawal of ordinary shares |

|

You may deposit ordinary shares with the custodian and obtain ADSs, and may surrender ADSs to the Depositary and receive ordinary shares, subject in each case to the satisfaction of certain conditions. |

|

|

Ordinary shares underlying the ADSs offered hereby may be withdrawn from the Depositary facility established under the deposit agreement upon the surrender of the ADSs and the receipt by the Depositary of proper instructions. |

9

Summary historical consolidated and pro

forma condensed combined financial data

Background and organizational structure

Edgen was formed on November 30, 2000. On February 1, 2005, Edgen Acquisition Corporation ("Edgen Acquisition Corp."), a corporation newly formed by JCP and certain members of Edgen management, purchased all of the outstanding capital stock of Edgen from its existing shareholders. Concurrently with the acquisition and related transactions, Edgen Acquisition Corp. was merged with and into Edgen, with Edgen surviving the merger. These transactions are collectively referred to as the "Buy-out Transaction."

In December, 2005, Edgen's shareholders organized a new holding company, Edgen/Murray, L.P., to hold all of the outstanding equity interests of Edgen and a newly created holding company in the United Kingdom, PAL. On December 16, 2005, Edgen/Murray, L.P. through its subsidiaries acquired MIM Ltd. and its subsidiaries.

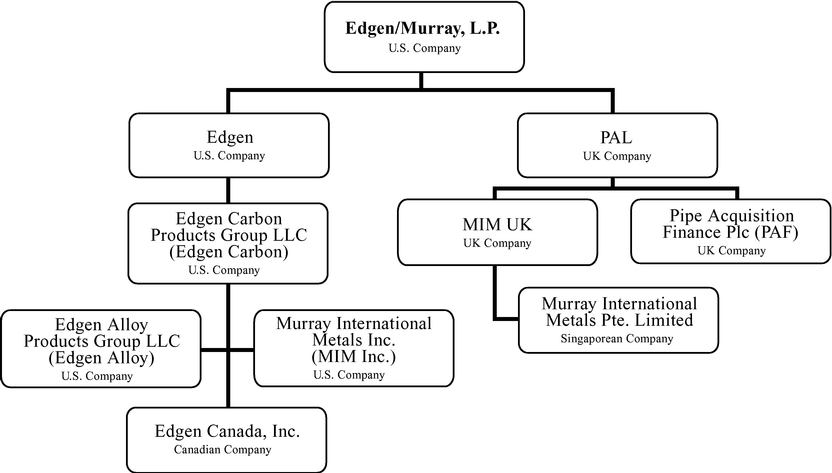

MIM Ltd. and its subsidiary Murray International Metals Pte. Limited ("MIM Singapore") were acquired by PAL (the "MIM UK Acquisition") and MIM Ltd.'s wholly owned subsidiary, Murray International Metals, Inc. ("MIM US") was acquired by Edgen Carbon (the "MIM US Acquisition"). The MIM UK Acquisition and the MIM US Acquisition are collectively referred to as the "MIM Acquisition."

References to the "Successor" in respect of the periods prior to the formation of Edgen/Murray, L.P. are references to Edgen and its subsidiaries and for periods after formation are references to Edgen/Murray, L.P. and its subsidiaries. References to the "Predecessor" in respect of the periods prior to the formation of Edgen Acquisition Corp., and the acquisition of Edgen by Edgen Acquisition Corp., are references to Edgen prior to the change in control on February 1, 2005.

Edgen/Murray, L.P. is controlled by funds managed by JCP. In connection with the MIM Acquisition, Edgen/Murray, L.P. also issued additional partnership interests to the funds managed by JCP, to certain members of management of Edgen and MIM Ltd. and to the sellers of MIM Ltd.

We are a newly formed holding company created in connection with this offering. In conjunction with the Contribution, the assets of Edgen/Murray, L.P. will be contributed to us. As a result, the historical financial information included in this prospectus represents the consolidated financial statements of Edgen/Murray, L.P. and its wholly owned subsidiaries.

Basis of presentation

Effective September 30, 2006, PAL and its subsidiaries changed their fiscal year to December 31, 2006. Prior to September 30, 2006, PAL and its subsidiaries had a fiscal year ending January 31, which differed from our fiscal year end of December 31. Our consolidated balance sheet as of December 31, 2005 includes the consolidated balance sheet of PAL and its subsidiaries as of January 31, 2006. Our consolidated statement of operations for the period February 1, 2005 to December 31, 2005 includes fifteen days of operating results of PAL and its subsidiaries, reflecting the fifteen day period Edgen/Murray, L.P. owned MIM Ltd. Due to the difference in fiscal year end periods, the financial results included in our consolidated financial statements reflects the consolidated financial results of PAL for the period January 17, 2006 to January 31, 2006. As a result, the net income of PAL for the period December 17, 2005 to January 16, 2006 has been recorded as a direct charge to the consolidated statement of partners' capital and shareholders' equity (deficit).

10

Similarly our condensed consolidated balance sheet as of June 30, 2006 includes the condensed consolidated balance sheet of PAL and its subsidiaries as of July 31, 2006 and our condensed consolidated statement of operations, statement of partners' capital and statement of cash flows for the six months ended June 30, 2006 include the consolidated financial results of PAL and its subsidiaries for the six months ended July 31, 2006.

Summary historical consolidated financial data

We have derived the summary historical consolidated financial data from:

Our summary historical consolidated statement of operations, cash flow and other financial data for the period February 1, 2005 to December 31, 2005 (Successor), the period January 1, 2005 to January 31, 2005 (Predecessor) and the years ended December 31, 2004 and 2003 (Predecessor) and our summary historical consolidated balance sheet data as of December 31, 2005 (Successor) and as of December 31, 2004 and 2003 (Predecessor) are derived from our audited consolidated financial statements prepared in accordance with US GAAP included elsewhere in this prospectus.

Our summary historical condensed consolidated statement of operations, cash flow and other financial data for the six months ended June 30, 2006 (Successor), the period February 1, 2005 to June 30, 2005 (Successor), and the period January 1, 2005 to January 31, 2005 (Predecessor) and our summary historical condensed consolidated balance sheet data as of June 30, 2006 (Successor) are derived from our interim unaudited condensed consolidated financial statements included elsewhere in this prospectus and are prepared in accordance with US GAAP for interim financial information and with the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the financial statements reflect all adjustments necessary for a fair presentation of the financial position, results of operations and cash flows of the Company on a consolidated basis, and all such adjustments are of a normal recurring nature.

Historical results are not necessarily indicative of results of future operations, and results for any interim period are not necessarily indicative of the results that may be expected for a full year.

11

Summary pro forma condensed combined financial data

The summary unaudited pro forma condensed combined financial data for the year ended December 31, 2005 have been prepared to give pro forma effect to the following transactions as if they had occurred on January 1, 2005, the beginning of our 2005 fiscal year:

- •

- The Buy-out Transaction (including the 97/8% Senior Secured Notes due 2011 ("Edgen Senior Secured Notes") and preferred shares issued by Edgen and borrowings under the Edgen Credit Facility);

- •

- The acquisition of Western Flow Products, Inc. ("Western Flow") in July 2005; and

- •

- The MIM Acquisition and the related issuance of the Senior Secured Floating Rate Notes due 2010 ("PAL Floating Rate Notes"), additional Edgen Senior Secured Notes and the issuance of preferred partnership units by Edgen/Murray, L.P., and rental expense, interest expense and depreciation expense associated with the sale and leaseback of our Newbridge, Scotland facility.

In deriving the pro forma condensed combined financial data, we also obtained financial data from:

- •

- MIM Ltd.'s historical consolidated statement of operations data for the period February 1, 2005 to December 16, 2005, which has been audited and was prepared in accordance with UK GAAP and is not included elsewhere in this prospectus. The financial data from the historical consolidated financial statements have been converted to US GAAP with the application of US GAAP reconciling items, and amounts have been converted from UK pounds to US dollars; and

- •

- The Western Flow historical statement of operations for the period January 1, 2005 to July 15, 2005 which was derived from unaudited financial statements prepared in accordance with US GAAP not included elsewhere in this prospectus.

The summary unaudited pro forma condensed combined financial data presented below is for informational purposes only and should not be considered indicative of actual results that would have been achieved had the transactions described above actually been consummated on the dates indicated and do not purport to be indicative of balance sheet data or results of operations as of any future date or for any future period.

The summary historical consolidated and pro forma condensed combined financial data should be read in conjunction with, and are qualified in their entirety by reference to, the sections entitled, "Selected historical consolidated financial data of Edgen/Murray, L.P.," "Unaudited pro forma condensed combined financial statements" and "Management's discussion and analysis of financial condition and results of operations" and our audited consolidated financial statements and the related notes thereto, our unaudited condensed consolidated financial statements and the related notes thereto contained elsewhere in this prospectus.

The following tables set forth, for the periods and dates indicated, our summary historical consolidated and pro forma condensed combined financial data.

12

| |

| | Successor

| | Predecessor

| | Successor

| | Predecessor

| |

|---|

| |

| | Period

February 1,

2005 to

June 30,

2005

| | Period

January 1,

2005 to

January 31,

2005

| | Pro forma

year

ended

December 31,

2005

| | Period

February 1,

2005 to

December 31,

2005

| | Period

January 1,

2005 to

January 31,

2005

| | Year ended December 31,

| |

|---|

| | Six months

ended

June 30, 2006

| |

|---|

(dollars in thousands)

| | 2004

| | 2003

| |

|---|

| |

| Statement of operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sales | | $ | 340,020 | | $ | 120,288 | | $ | 18,945 | | $ | 600,441 | | $ | 282,925 | | $ | 18,945 | | $ | 207,821 | | $ | 147,025 | |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Cost of sales (exclusive of depreciation and amortization shown separately below) | | | 274,653 | | | 93,627 | | | 14,153 | | | 482,297 | | | 226,236 | | | 14,153 | | | 155,357 | | | 121,146 | |

| | Selling, general and administrative expense(1) | | | 26,322 | | | 13,035 | | | 14,364 | | | 64,181 | | | 28,960 | | | 14,364 | | | 32,009 | | | 29,595 | |

| | Depreciation and amortization expense | | | 12,412 | | | 1,087 | | | 201 | | | 22,648 | | | 6,226 | | | 201 | | | 2,400 | | | 2,001 | |

| | |

| |

| | Total operating expenses | | | 313,387 | | | 107,749 | | | 28,718 | | | 569,126 | | | 261,422 | | | 28,718 | | | 189,766 | | | 152,742 | |

| | |

| |

| Income (loss) from operations | | | 26,633 | | | 12,539 | | | (9,773 | ) | | 31,315 | | | 21,503 | | | (9,773 | ) | | 18,055 | | | (5,717 | ) |

Other income (expense)(2) |

|

|

5,906 |

|

|

75 |

|

|

(50 |

) |

|

(252 |

) |

|

(307 |

) |

|

(50 |

) |

|

106 |

|

|

174 |

|

Interest expense, net |

|

|

(17,169 |

) |

|

(4,958 |

) |

|

(333 |

) |

|

(33,778 |

) |

|

(12,139 |

) |

|

(333 |

) |

|

(5,163 |

) |

|

(3,122 |

) |

| | |

| |

| Income (loss) from continuing operations before income tax expense (benefit) | | | 15,370 | | | 7,656 | | | (10,156 | ) | | (2,715 | ) | | 9,057 | | | (10,156 | ) | | 12,998 | | | (8,665 | ) |

| Income tax expense (benefit) | | | 5,304 | | | 2,748 | | | (1,916 | ) | | (167 | ) | | 3,055 | | | (1,916 | ) | | (3,211 | ) | | (4,195 | ) |

| | |

| |

| Income (loss) from continuing operations | | | 10,066 | | | 4,908 | | | (8,240 | ) | | (2,548 | ) | | 6,002 | | | (8,240 | ) | | 16,209 | | | (4,470 | ) |

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from discontinued operations before income tax (benefit) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (348 | ) |

| Income tax (benefit) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (159 | ) |

| | |

| |

| Net income (loss) | | | 10,066 | | | 4,908 | | | (8,240 | ) | | (2,548 | ) | | 6,002 | | | (8,240 | ) | | 16,209 | | | (4,659 | ) |

| Preferred interest and dividend requirement | | | (2,134 | ) | | (765 | ) | | (190 | ) | | (4,524 | ) | | (1,798 | ) | | (190 | ) | | (2,206 | ) | | (2,212 | ) |

| | |

| |

| Net income (loss) applicable to common unitholders/shareholders | | $ | 7,932 | | $ | 4,143 | | $ | (8,430 | ) | $ | (7,072 | ) | $ | 4,204 | | $ | (8,430 | ) | $ | 14,003 | | $ | (6,871 | ) |

| | |

| |

Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | EBITDA(a)(3) | | $ | 44,951 | | $ | 13,701 | | $ | (9,622 | ) | $ | 53,711 | | $ | 27,422 | | $ | (9,622 | ) | $ | 20,561 | | $ | (3,731 | ) |

| | Total capital expenditures | | | 1,421 | | | 582 | | | 4 | | | 1,324 | | | 1,320 | | | 4 | | | 1,112 | | | 2,499 | |

| |

- (a)

- EBITDA for the six months ended June 30, 2006, includes a $6.1 million foreign exchange gain on the PAL Floating Rate Notes denominated in US dollars. EBITDA for the pro forma year ended December 31, 2005 and the period January 1, 2005 to January 31, 2005 period, includes $12.0 million in Buy-out Transaction related expenses and approximately $5.5 million (£3.1 million) in bonus payments and applicable payroll taxes to certain MIM Ltd. employees prior to the MIM Acquisition.

| |

| | Successor

| | Predecessor

| |

|---|

| |

| |

| | As of December 31,

| |

|---|

| | As of

June 30,

2006

| |

| |

|---|

| | As of December 31,

2005

| |

|---|

(dollars in thousands)

| | 2004

| | 2003

| |

|---|

| |

| Balance sheet data: | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | 24,259 | | $ | 41,146 | | $ | 134 | | $ | 3,125 | |

| | Working capital | | | 172,548 | | | 153,187 | | | 60,868 | | | 53,633 | |

| | Net property, plant and equipment | | | 41,072 | | | 40,940 | | | 10,423 | | | 11,668 | |

| | Total assets | | | 518,136 | | | 520,221 | | | 118,862 | | | 105,560 | |

| | Long-term debt and capital leases | | | 286,752 | | | 286,688 | | | 47,883 | | | 50,973 | |

| | Mandatorily redeemable preferred stock(4) | | | — | | | — | | | 55,979 | | | 53,918 | |

| | Preferred units included in total partners' capital(5) | | | 52,852 | | | 50,718 | | | — | | | — | |

| | Total partners' capital and shareholders equity (deficit) | | | 83,982 | | | 71,812 | | | (11,755 | ) | | (25,533 | ) |

| |

13

- (1)

- Selling, general and administrative expense for the pro forma year ended December 31, 2005 and for the period January 1, 2005 to January 31, 2005 includes $12.0 million in Buy-out Transaction related expenses and the period February 1, 2005 to December 31, 2005 includes approximately $5.5 million (£3.1 million) in bonus payments and applicable payroll taxes to certain MIM Ltd. employees prior to the MIM Acquisition, respectively.

- (2)

- Other income (expense) for the six months ended June 30, 2006 includes a $6.1 million foreign exchange gain on the PAL Floating Rate Notes denominated in US dollars.

- (3)

- We define EBITDA as net income (loss) before net interest expense, income taxes and depreciation and amortization. We use EBITDA in our business operations to, among other things, evaluate the performance of our operating segments, develop budgets and measure our performance against those budgets. We find it a useful tool to assist us in evaluating performance because it eliminates items related to corporate overhead (depreciation) and capital structure, taxes and other non-cash charges. However, EBITDA, which does not represent operating income as defined by US GAAP, should not be considered by prospective investors to be an alternative to operating income. EBITDA is not a measure of profitability because it does not include costs and expenses for depreciation and amortization, interest and related expenses and income taxes. Also, because EBITDA is not calculated in the same manner by all companies, it may not be comparable to other similarly titled measures used by other companies. In addition, this definition of EBITDA differs from the definition of EBITDA in the indentures governing our notes.

Set forth below is a reconciliation of net income (loss) to EBITDA for the periods presented.

| |

| | Successor

| | Predecessor

| | Successor

| | Predecessor

| |

|---|

| |

| | Period

February 1,

2005 to

June 30,

2005

| | Period

January 1,

2005 to

January 31,

2005

| |

| | Period

February 1,

2005 to

December 31,

2005

| | Period

January 1,

2005 to

January 31,

2005

| | Year ended

December 31,

| |

|---|

| | Six months ended

June 30,

2006

| | Pro forma

year ended

December 31,

2005

| |

|---|

(dollars in thousands)

| | 2004

| | 2003

| |

|---|

| |

| | Net income (loss) | | $ | 10,066 | | $ | 4,908 | | $ | (8,240 | ) | $ | (2,548 | ) | $ | 6,002 | | $ | (8,240 | ) | $ | 16,209 | | $ | (4,659 | ) |

| | Income tax expense (benefit) | | | 5,304 | | | 2,748 | | | (1,916 | ) | | (167 | ) | | 3,055 | | | (1,916 | ) | | (3,211 | ) | | (4,195 | ) |

| | Interest expense, net | | | 17,169 | | | 4,958 | | | 333 | | | 33,778 | | | 12,139 | | | 333 | | | 5,163 | | | 3,122 | |

| | Depreciation and amortization | | | 12,412 | | | 1,087 | | | 201 | | | 22,648 | | | 6,226 | | | 201 | | | 2,400 | | | 2,001 | |

| | |

| |

| EBITDA(a) | | $ | 44,951 | | $ | 13,701 | | $ | (9,622 | ) | $ | 53,711 | | $ | 27,422 | | $ | (9,622 | ) | $ | 20,561 | | $ | (3,731 | ) |

| |

- (a)

- EBITDA for the six months ended June 30, 2006, includes a $6.1 million foreign exchange gain on the PAL Floating Rate Notes denominated in US dollars. EBITDA for the pro forma year ended December 31, 2005 and the period January 1, 2005 to January 31, 2005 period, includes $12.0 million in Buy-out Transaction related expenses, and approximately $5.5 million (£3.1 million) in bonus payments and applicable payroll taxes to certain MIM Ltd. employees prior to the MIM Acquisition.

- (4)

- Mandatorily redeemable preferred stock was replaced by redeemable preferred stock on February 1, 2005 in connection with the Buy-out Transaction.

- (5)

- In connection with the formation of Edgen/Murray, L.P. in 2005, preferred partnership units were issued to existing Edgen shareholders and certain members of management of MIM Ltd. See "Management discussion and analysis of financial condition and results of operations—Formation of holding company and acquisitions."

14

Risk factors

An investment in the ADSs involves a significant degree of risk, including the risks described below. You should carefully consider the following risk factors and the other information in this prospectus before deciding to invest in the ADSs. The risks described below are not the only ones facing us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially and adversely affect our business, financial condition, results of operations or liquidity. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks relating to our business

Volatility in the global energy infrastructure market, and in particular oil and gas prices and refining margins, could reduce demand for our products, which could cause our sales to decrease.

Proceeds from the sale of specialty steel pipe, pipe components and high grade structural steel sections and plates to the global energy infrastructure market constitute a significant portion of our sales. As a result, we depend upon the global energy infrastructure market, and in particular the oil and gas and refining industries, and the ability and willingness of industry participants to make capital expenditures to explore for, develop and produce, transport, process and refine oil and gas. If these expenditures decline, our business will suffer. The industry's willingness to explore, develop, produce, transport, process and refine depends largely upon the availability of attractive drilling prospects and the prevailing view of future oil and gas prices and refinery margins and general economic conditions. Many factors affect the supply and demand for oil and gas and refined products and therefore influence our product prices, including:

- •

- the level of domestic and worldwide oil and natural gas production;

- •

- the level of domestic and worldwide supplies of, and demand for, oil and natural gas and refined products;

- •

- the expected cost of delivery of new reserves;

- •

- the availability of attractive oil and gas fields for production, which may be affected by governmental action or environmental policy and which may restrict drilling prospects;

- •

- domestic and worldwide refinery overcapacity or undercapacity and utilization rates;

- •

- changes in the cost or availability of transportation infrastructure;

- •

- levels of drilling activity;

- •

- national, governmental and other political requirements, including the ability of the Organization of the Petroleum Exporting Countries ("OPEC") to set and maintain production levels and pricing;

- •

- the impact of political instability or armed hostilities involving one or more oil and gas producing nations;

- •

- pricing and other actions taken by competitors that impact the market;

- •

- failure to implement successfully planned capital projects or to realize the benefits expected for those projects;

- •

- changes in fuel specifications required by environmental and other laws, particularly with respect to oxygenates and sulfur content;

15

- •

- aggregate refinery capacity to convert heavy sour crude oil into refined products;

- •

- the cost of developing alternate energy sources;

- •

- domestic and foreign governmental regulations, especially environmental regulations, trade laws and tax policies; and

- •

- the overall global economic environment.

Oil and gas prices and processing and refining margins have been and are expected to remain volatile. This volatility causes our customers to change their strategies and expenditure levels. We have experienced in the past, and we may experience in the future, significant fluctuations in operating results based on these changes. In particular, such volatility in the oil and gas and refined products margins and markets more generally could adversely affect our business, consolidated financial condition, results of operations and liquidity.

The supply of steel and the price we pay for steel products may fluctuate due to a number of factors beyond our control, which could adversely affect our operating results.

We purchase large quantities of steel from our vendors which we sell to a variety of end-users, who are primarily involved in servicing the energy infrastructure market and providers of MRO products. The prices we pay for these products and the prices we charge for our products may change depending on many factors outside of our control, including general economic conditions, competition, production levels, import duties and other trade restrictions, currency fluctuations and surcharges imposed by our vendors. We seek to maintain our profit margins by attempting to increase the price of our products in response to increases in the prices we pay for our inventories. If, however, we are unable to pass on higher costs to our customers in a timely manner, or not at all, or if our supply of products is delayed or curtailed, this could have a material adverse effect on our business, financial condition, results of operations and liquidity. Alternatively, significant steel price decreases could have a material adverse effect on our business, financial condition, results of operation and liquidity if decreases in steel prices necessitate us to reduce product pricing, especially to the extent inventory has been purchased by us prior to the steel price decreases.

We have a limited financial history reflecting our combined operations, and our historical and pro forma financial information is not necessarily representative of our current or future results of operations.

The historical financial information included in this prospectus does not reflect the financial condition, results of operations or cash flows that we would have achieved through the combined operations of our businesses or those that may be achieved in the future. Because of the significance of the MIM Acquisition, the financial statements for periods prior to the acquisition are not comparable with those after the acquisition, and the lack of comparable data may make it difficult to evaluate our results of operations and future prospects. The pro forma financial statement included in this prospectus is not necessarily indicative of our financial position or results of operations that would have occurred had the transactions described therein been consummated as of the dates indicated, nor is it indicative of our future financial position or results of operation.

Our business is sensitive to economic downturns, which could cause our revenues to decrease.

The demand for our products is dependent on the general economy and the energy infrastructure market and other factors. Downturns in the general economy or in the energy infrastructure market may cause demand for our products to materially decrease. In 2003, the specialty steel products industry experienced softness principally due to weak economic conditions in general and reduced spending on expansion and development projects by end-users. During 2003, we experienced a significant decline in sales and profitability, primarily as a result of a severely depressed power

16

generation market and reduced spending in the processing and oil and gas industries, and an internal decision to liquidate inventory of certain low-margin products. In addition, if we are not adequately able to predict demand and if our inventories (or the inventories of manufacturers, other distributors or our customers) become excessive, there could be a material adverse effect on price levels for our products, the quantity of products sold by us and our revenues.

Loss of key vendors or reduced product availability could decrease our sales and earnings.

For the six months ended June 30, 2006, our ten largest vendors accounted for approximately 45% of our purchases and our single largest vendor accounted for approximately 11% of our total purchases. The loss of any of these vendors—or a reduction in purchases by us from these vendors that results in the loss of volume discounts—could result in a decrease in our sales, operating results and earnings by decreasing the availability, or increasing the prices, of products we distribute, which could limit our ability to satisfy our customers' product needs. Such reduced product availability could put us at a competitive disadvantage.

In addition, particular products or product lines may not be available to us, or not available in quantities sufficient to meet our customer demand. A substantial decrease in the availability of these products or product lines could result in a decrease in our sales, operating results and earnings as we might not be able to satisfy our customers' product needs. Such reduced product availability could put us at a competitive disadvantage.

Significant competition from a number of companies could reduce our market share and have an adverse effect on our selling prices and sales volume.

We operate in a highly competitive industry and compete against a number of companies, some of which have significantly greater financial, technological and marketing resources than we do. We believe that our ability to compete depends on high product performance, short lead-time and timely delivery, competitive pricing and superior customer service and support. We might be unable to compete successfully with respect to these or other factors. If we are unsuccessful, we could lose market share to our competitors. Moreover, actions by our competitors could have an adverse effect on our selling prices and sales volume.

The development of alternatives to steel product distributors in the supply chain in the industries in which we operate could cause a decrease in our sales and operating results and limit our ability to grow our business.

If our customers were to decide to purchase products directly from manufacturers, it could negatively affect our sales and earnings. Our vendors also could expand their own local sales force and inventory stocking capabilities and sell more products directly to our customers. These or other actions that remove us from, or limit our role in, the distribution chain, may harm our competitive position in the marketplace and reduce our sales and earnings.

Increases in customer, manufacturer and distributor inventory levels could reduce our sales and profit.

Customer, manufacturer and distributor inventory levels of specialty steel pipe, pipe components and high grade structural steel products can change significantly from period to period. Increases in our customers' inventory levels can have a direct adverse effect on the demand for these products when customers utilize existing inventory rather than purchase new products. Reduced demand, in turn, would likely result in reduced sales volume and overall profitability.

Increased inventory levels by manufacturers or other distributors can cause an oversupply of steel products in our markets and reduce the prices that we are able to charge for our products. Reduced prices, in turn, would likely reduce our margins and overall profitability.

17

We rely on our information technology systems to manage numerous aspects of our business and customer and vendor relationships and a disruption of these systems could adversely affect our business.

We depend on our information technology (IT) system to process orders, track credit risk, manage inventory and accounts receivable collections. Our IT system also allows us to efficiently purchase products from our vendors and ship products to our customers on a timely basis, maintain cost-effective operations and provide superior service to our customers. Our IT system is an integral part of our business and growth strategies, and a serious disruption to our IT system could significantly limit our ability to manage and operate our business efficiently, which, in turn, could cause our business and competitive position to suffer and cause our results of operations to be reduced.

Loss of third-party transportation providers upon whom we depend or conditions negatively affecting the transportation industry could increase our costs or cause a disruption in our operations.

We depend upon third-party transportation providers for delivery of products to our customers. Strikes, slowdowns, transportation disruptions or other conditions in the transportation industry, including, but not limited to, shortages of truck drivers, disruptions in rail service, increases in fuel prices and adverse weather conditions, could increase our costs and disrupt our operations and our ability to service our customers on a timely basis. We cannot predict whether or to what extent recent increases or anticipated increases in fuel prices may impact our costs or cause a disruption in our operations going forward.

Our ten largest customers account for a substantial portion of our sales and profits, and the loss of these customers could result in materially decreased sales and profits.

Our ten largest customers accounted for approximately 35% of our overall sales for the six months ended June 30, 2006. We may lose a customer for any number of reasons, including as a result of a merger or acquisition, the selection of another provider of high grade steel products, business failure or bankruptcy or our performance. We do not have contracts with all of our major customers. Moreover, to the extent we have contracts with our major customers, these contracts generally may be discontinued with 30 days' notice by either party, are not exclusive and do not require minimum levels of purchases. To the extent we do not enter into formal written contracts with our customers, we instead establish the terms and conditions of sales to our customers through purchase orders and other trade practices and informal correspondence. We may not retain long-term relationships or secure renewals of short-term relationships with our major customers in the future.

We may need additional capital in the future and it may not be available on acceptable terms.

We may require more capital in the future to:

- •

- fund our operations;

- •

- finance investments in equipment and infrastructure needed to maintain and expand our distribution capabilities;

- •

- enhance and expand the range of products we offer; and

- •

- respond to potential strategic opportunities, such as investments, acquisitions and international expansion.

We cannot assure you that additional financing will be available on terms favorable to us, or at all. The terms of available financing may place limits on our financial and operating flexibility. If adequate funds are not available on acceptable terms, we may be forced to reduce our operations or delay, limit or abandon expansion opportunities. Moreover, even if we are able to continue our operations, the failure to obtain additional financing could reduce our competitiveness.

18

We are a holding company, with no revenue generating operations of our own. We depend on the performance of our subsidiaries and their ability to make distributions to us.

We are a holding company with no business operations, sources of income, indebtedness or assets of our own other than our ownership interests in our subsidiaries. Because all our operations are conducted by our subsidiaries, our cash flow and our ability to repay debt that we may incur after this offering and our ability to pay dividends to our shareholders are dependent upon cash dividends and distributions or other transfers from our subsidiaries. Payment of dividends, distributions, loans or advances by our subsidiaries to us are subject to restrictions imposed by the current and future debt instruments of our subsidiaries. The debt instruments of each of our principal operating subsidiaries, Edgen and MIM Ltd., limit our ability to allocate cash flow or resources from one subsidiary, and its related group of subsidiaries, to another subsidiary group or to us. In addition, payments or distributions from our subsidiaries could be subject to restrictions on dividends or repatriation of earnings under applicable local law, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which our subsidiaries operate.

Our subsidiaries are separate and distinct legal entities. Any right that we have to receive any assets of or distributions from any of our subsidiaries upon the bankruptcy, dissolution, liquidation or reorganization of any such subsidiary, or to realize proceeds from the sale of their assets, will be junior to the claims of that subsidiary's creditors, including trade creditors and holders of debt issued by that subsidiary.

Risks generally associated with acquisitions, including identifying and integrating future acquisitions, could adversely affect our business.

An element of our growth strategy has been and is expected to continue to be the pursuit of acquisitions of other businesses that either expand or complement our existing product lines. We cannot assure you, however, that we will be able to identify additional acquisitions or that we would realize any anticipated benefits from such acquisitions. Integrating businesses involves a number of special risks, including the possibility that management may be distracted from regular business concerns by the need to integrate operations, unforeseen difficulties in integrating operations and systems, problems concerning assimilating and retaining the employees of the acquired business, accounting issues that arise in connection with the acquisition, challenges in retaining customers and potential adverse short-term effects on operating results. Acquired businesses may require a greater amount of capital, infrastructure or other spending than we anticipate. In addition, we may incur debt to finance future acquisitions, which could increase our leverage. We cannot assure you that we will be successful in consummating future acquisitions on favorable terms or at all. If we are unable to successfully complete and integrate strategic acquisitions in a timely manner, our growth strategy could be adversely impacted.

War, other armed conflicts or terrorist attacks could result in a material adverse effect on our business.