July 6, 2015

Ms. Suzanne Hayes

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

| |

| Re: | Fortress Investment Group LLC (the “Company”)

Form 10-K for the fiscal year ended December 31, 2014

Form 10-Q for the quarterly period ended March 31, 2015 |

Response dated May 20, 2015

File No. 001-33294

Dear Ms. Hayes:

We have received the letter, dated June 19, 2015, from the Staff of the Division of Corporation Finance (the “Staff”) of the United States Securities and Exchange Commission (the “SEC” or “Commission”) with respect to its review of the Company’s Form 10-K for the fiscal year ended December 31, 2014 (the “Form 10-K”), Form 10-Q for the quarterly period ended March 31, 2015 and the Company’s response letter dated May 20, 2015.

For reference purposes, the text of each of the Staff’s numbered comments has been provided herein in bold. Our responses follow the Staff’s numbered comments.

Form 10-K for the Fiscal Year Ended December 31, 2014

General

| |

| 1. | We have read your responses to our comments 4, 5, and 6 of our letter dated May 7, 2015. We continue to evaluate your response at this point in time. We may have additional comments. |

Response

We acknowledge that the Staff continues to evaluate the Company’s responses to comments 4, 5, and 6 in the Staff’s letter dated May 7, 2015.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 2

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 49

| |

| 2. | We note your response to comment two. In addition to disclosing Incentive Eligible NAV, please confirm that you will discuss any material trends with respect to Incentive Eligible NAV and the expected impact of the trend. |

Response

We respectfully inform the Staff that in our future filings the Company plans to disclose in Management’s Discussion and Analysis the amount of Incentive Eligible NAV Above Incentive Income Threshold for the current period end and prior year end and discuss any material trends and their impacts. We expect the disclosure to be substantially similar to the Company’s response to the Staff’s letter dated May 7, 2015 modified as follows:

As of December 31, 2014 and 2013, the Company had $21.3 billion and $21.7 billion, respectively, of incentive eligible NAV in the Fortress Funds above their incentive income threshold which is eligible to generate future incentive income and thus potentially contribute to the Company’s earnings. The change in incentive eligible NAV in the Fortress Funds above their incentive income threshold was primarily driven by negative performance and redemptions in our liquid hedge fund business, partially offset by positive performance in our credit hedge fund, credit PE fund and permanent capital vehicle businesses. Incentive eligible NAV is dependent on the performance of our funds which in turn is dependent on a number of factors, and historical performance of our funds may not be indicative of future results. See “-Performance of Our Funds” and “-Assets Under Management-Redemptions” for additional information.

Item 10. Directors, Executive Officers and Corporate Governance, page 237

| |

| 3. | We refer to the disclosure on page 7 of the definitive proxy statement indicating that Mr. Edens served as a director at Gatehouse Media Inc. from June 2005 to November 2013. Please refer to Regulation S-K, Item 401(f)(1) and tell us why you did not disclose Gatehouse’s September 2013 bankruptcy filing in this section or on page 10 where you discuss legal proceedings involving your directors. |

Response

We respectfully inform the Staff that we did not disclose GateHouse Media Inc.’s (“GateHouse”) September 2013 bankruptcy filing because we do not believe this was an event requiring disclosure under Item 401(f)(1) of Regulation S-K, which requires disclosure of a bankruptcy petition if it was filed by or against (a) the business or property of a director, (b) any partnership in which a director was a general partner or (c) any corporation or business association of which a director was an executive officer. Although Mr. Edens was a director of GateHouse, he was not an executive officer, GateHouse is not a partnership, and the bankruptcy was not against his

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 3

business or property, and therefore, we respectfully submit that Item 401(f)(1), by its terms, is not applicable and disclosure of the GateHouse bankruptcy was not required. In addition, we did not believe the disclosure of the GateHouse bankruptcy was material to investors as part of Mr. Edens performing his duties as a director of the Company.

Item 11. Executive Compensation, page 237

| |

| 4. | We note the discussion of cash and equity based compensation payments granted pursuant to the Principal Compensation Plan on page 20 of your definitive proxy statement. However, the description does not clearly explain the bonus and stock awards. As described, it appears that the same plan applies to each principal with allowances for the level of allowance of the principal’s involvement in fund management and distributable earnings from each principal’s respective businesses. Please expand the discussion to clarify which businesses each principal is involved with and the distributions from such businesses. The discussion should provide the factual performance information that will answer the following questions in light of your Principal Compensation Plan: |

| |

| • | Why Mr. Briger’s bonus is larger than the other principals and why he is the only principal who received stock awards; |

| |

| • | Why Mr. Edens’ and Mr. Briger’s bonuses increased as compared to their bonuses in 2013 and Mr. Novogratz’s bonus decreased; and |

| |

| • | Why did Mr. Novogratz receive a stock award in 2013 but not in 2014? |

Response

We propose to revise our disclosure in future filings in substantially the manner set forth below to clarify which businesses each principal is involved with and the distributions from such businesses:

Our Compensation Goals and Philosophy - Principals

The primary goals of our compensation arrangements with our Principals are to: align their interests with the interests of our shareholders; ensure the ongoing, uninterrupted management of each of our businesses by the Principals who sponsor them and, in many cases, act as their chief investment officers; and further incentivize the Principals to raise new capital for our funds.

To achieve these goals, in August 2011 we entered into new, five-year employment agreements with each of our Principals effective January 1, 2012, on terms and conditions substantially similar to those of their previous agreements. In connection with the new employment agreements, we adopted a Principal Compensation Plan under which the Principals are entitled to receive annual payments based on their respective success in raising and investing new funds and the performance of those

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 4

new funds during a given fiscal year and, for the credit and liquid hedge fund business, on the performance of the existing assets under management (“AUM”) of Fortress’s flagship hedge funds during a given year (“Principal Performance Payments”). Messrs. Edens and Nardone are entitled to receive payments based on the performance of the private equity business, which includes the private equity funds and the permanent capital vehicles; Mr. Briger is entitled to receive payments based on the performance of the credit business, which includes credit hedge funds and credit PE funds; and Mr. Novogratz is entitled to receive payments based on the performance of the liquid hedge fund business.

Under the Principal Compensation Plan, Principal Performance Payments are comprised of a mix of cash and equity-based compensation, with the equity component becoming larger as performance, and the size of the payments, increases. Specifically, the Principal Compensation Plan calls for payments of: for the private equity business, (1) 20% of the fund management distributable earnings above a threshold for permanent capital vehicles existing at January 1, 2012, as well as (2) either 10% or 20% (based on the level of involvement of the Principal) of the fund management distributable earnings of new AUM in new businesses (formed after January 1, 2012); and for the credit business and the liquid hedge fund business, (1) 20% of the incentive income earned from existing flagship hedge fund AUM at January 1, 2012 and (2) 20% of fund management distributable earnings for new flagship hedge fund AUM and either 10% or 20% (based on the level of involvement of the Principal) of the fund management distributable earnings of new AUM in new businesses (formed after January 1, 2012). Payments of up to 10% of fund management distributable earnings before Principal Performance Payments, in each of the Principals’ respective businesses, are made in cash, and payments in excess of this threshold are made in RSUs that will vest in equal increments over three years.

As outlined above, the Principal Performance Payments for Messrs. Edens and Nardone were based on the performance of permanent capital vehicles existing at January 1, 2012, as well as new private equity funds and new permanent capital vehicles, which improved in 2014 compared to 2013. The Principal Performance Payments for Messrs. Briger and Novogratz were based on the performance of existing flagship hedge fund AUM to the extent it generated incentive income and the performance of new flagship hedge fund AUM and new funds in each of their respective businesses. In 2014, the performance of eligible credit PE funds improved, partially offset by weaker performance of eligible credit hedge funds. In 2014, eligible liquid markets hedge fund performance was weaker. A portion of Mr. Briger’s compensation was in equity because Mr. Briger’s payment exceeded 10% of the fund management distributable earnings for the credit business in 2014 and, in accordance with the Plan, such excess payment was made in RSUs. In 2014, the payments related to each of the private equity and liquid hedge fund businesses did not exceed 10% of fund management distributable earnings for each of those businesses and therefore no RSUs were awarded to Messrs. Edens, Nardone or Novogratz. For additional information on fund management distributable earnings and incentive income by segment, please see note 11 to our consolidated financial statements.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 5

Pursuant to the new employment agreements, each Principal receives annual compensation of $200,000. The Principals’ employment agreements contain customary post-employment non-competition and non-solicitation covenants. In order to ensure the Principals’ compliance with such covenants, an amount equal to 50% of the after-tax cash portion of any Principal Performance Payments are subject to mandatory investment in Fortress Funds, and such invested amounts will serve as collateral against any breach of those covenants. The Principals’ employment agreements are described in more detail below under the section “- Employment Agreements with Our Named Executive Officers.”

Prior to the adoption of the Principal Compensation Plan, the only element of the Principals’ compensation (since our initial public offering in February 2007) was an annual salary of $200,000 pursuant to employment agreements that were set to expire in February 2012. The Principals did not receive any bonus payments directly from us, although they did (and continue to) receive distributions with respect to their ownership of FOG units, in the same amount per unit and generally at the same time as distributions are made to us in respect of the FOG units we hold.

Form 10-Q for the Quarterly Period Ended March 31, 2015

Item 1. Financial Statements, page 1

Notes to Consolidated Financial Statements (unaudited), page 7

Note 1 - Organization and Basis of Presentation, page 7

| |

| 5. | We note your description of the Graticule transaction resulting in a non-cash gain of $134.4 million, non-cash expense of $101.0 million and a $33.4 million retained interest as an equity method investment. Please address the following: |

| |

| • | Explain to us in greater detail how the non-cash gain was determined. We understand the fair value of Graticule and your retained interest was determined by using an income approach fair value model. Clarify if the gain recognized was based on the fair value or carrying value of the assets transferred to Graticule. |

Response

We respectfully inform the Staff that on the date that the Company transferred control of Graticule to a former senior employee, the Company recorded an asset for the fair value of its retained equity method interest in Graticule of $33.4 million. Since the controlling interest was transferred to an individual who was a senior employee through the transfer date for no consideration, the Company determined it should record an expense of $101.0 million related to the fair value of the controlling interest in Graticule that was transferred measured using the same approach and assumptions. The transferred business did not have any carrying value on the date that control was

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 6

transferred.

The non-cash gain was determined based on the difference between (a) the sum of the fair value of the non-controlling equity interest in Graticule retained by the Company ($33.4 million) and the fair value of the interest in Graticule which was transferred to a former senior employee for no consideration ($101.0 million) and (b) the carrying amount of Graticule assets and liabilities on the control transfer date ($0.0 million).

| |

| • | Explain to us and revise your disclosure in future filings to clarify how the $101.0 million of non-cash expense was calculated and what this amount represents. In this regard, specify if any of the amount represents undistributed incentive income and whether it is subject to performance contingencies or clawback. |

Response

We respectfully inform the Staff that the non-cash expense represents the fair value of the controlling interest in Graticule transferred to a former senior employee for no consideration. This amount was measured at fair value using the income approach and does not represent undistributed incentive income subject to performance contingencies or clawback. We will revise our disclosure in our future filings substantially as set forth below:

During the six months ended June 30, 2015, Fortress recorded a non-cash gain of $134.4 million, non-cash expense of $101.0 million related to the fair value of the controlling interest in Graticule transferred to a former senior employee for no consideration, and $33.4 million from its resulting retained interest as an equity method investment. Fortress utilized an income approach to value Graticule, its retained interest in Graticule and the controlling interest in Graticule which was transferred.

| |

| • | Refer us to the relevant accounting literature you used to support your accounting recognition for this transaction. |

Response

We respectfully inform the Staff that on January 5, 2015, the Company transferred control of Graticule to a former senior employee. The Company applied the accounting guidance of ASC 810 - Consolidation which states that an entity should deconsolidate a subsidiary upon loss of control (ASC 810-10-40-4) provided the subsidiary meets the definition of a business under ASC 805 - Business Combinations (ASC 810-10-40-3A) to support the accounting treatment for this transaction.

We evaluated and concluded that Graticule met the definition of a business because it has inputs, processes and outputs. As Graticule met the definition of a business under ASC 805 and, prior to the transfer was a subsidiary of the Company, we

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 7

accounted for the deconsolidation in accordance with ASC 810-10-40-5 which states that a gain or loss shall be recognized, measured as the difference between:

| |

| a. | The aggregate of all of the following: |

| |

| 1. | The fair value of any consideration received - the fair value of the interest transferred to the former senior employee was $101.0 million, however no consideration was received; |

| |

| 2. | The fair value of any retained noncontrolling investment in the former subsidiary at the date the subsidiary is deconsolidated - the fair value of the Company’s retained noncontrolling equity interest was $33.4 million on the date that control was transferred; |

| |

| 3. | The carrying amount of any noncontrolling interest in the former subsidiary at the date the subsidiary is deconsolidated - which there was none; |

| |

| b. | The carrying amount of the former subsidiary’s assets and liabilities - which was zero. |

Basis of Accounting and Consolidation, page 10

| |

| 6. | Regarding your adoption of ASU 2015-02, please address the following: |

| |

| • | We reference, for example purposes, the risk factor in the first sentence on page 50 of New Senior Investment Group’s Form 10-Q for the quarterly period ended March 31, 2015, where it states “Our Management Agreement with our Manager was not negotiated at arm’s-length, and its terms, including fees payable, may not be as favorable to us if it had been negotiated with an unaffiliated third party.” Explain to us your rationale for concluding that your fee arrangement(s) includes only terms, conditions or amounts that are customarily present in arrangements for similar services, negotiated at arm’s-length pursuant to ASC 810-10-55-37 for New Senior and any other variable interest entity (VIE) that has similar disclosure. |

Response

We respectfully inform the Staff that as part of our consolidation analysis, including our analysis of whether our fee arrangements with New Senior Investment Group Inc. (“New Senior”) and other variable interest entities (“VIEs”) with similar risk factor disclosure (which include Newcastle Investment Corp., and New Residential Investment Corp.) meet the conditions of ASC 810-10-55-37, we performed a rigorous analysis which considered over 50 fee arrangements where external managers provide services similar to those the Company provides. We deemed the services to be similar in that for each arrangement we evaluated, the external manager was appointed to manage the assets and the day-to-day operations of the entity it manages. All of these arrangements were between parties that were unrelated to the Company. We performed the analysis to benchmark and compare the terms, conditions, and amounts in our fee arrangements to the fee arrangements that other companies have with the

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 8

entities that they manage or are managed on their behalf. These companies include investment managers, managers of externally managed REITs and other investment vehicles, and property operators/owners. Our analysis of the fee arrangements included a review of the fee rates and the fee bases used by these companies to compute their respective fee amounts. Our analysis also considered the terms, conditions, and amounts of expenses reimbursed pursuant to the fee arrangements.

Based on our analysis, the fee arrangement with, including expenses reimbursed by, New Senior and other VIEs with similar disclosure were in the range of (i.e., consistent with) amounts charged by other external managers we analyzed. As such, we determined that our fee arrangements with New Senior and the other VIEs with similar disclosure include only terms, conditions, and amounts customarily present in arrangements for similar services negotiated at arm’s length.

Furthermore, the independent directors of the boards of New Senior and the other VIEs with similar disclosure are responsible for approving the initial terms of each management agreement as well as overseeing an annual review of the management agreement, including consideration of the fee arrangement, upon the expiration of the applicable management agreement’s initial terms.

We further advise the Staff that the risk factor in the first sentence on page 50 of New Senior’s Form 10-Q for the quarterly period ended March 31, 2015, as well as the risk factors of VIEs that have similar disclosure, was intended to identify that the management agreements were not negotiated between unaffiliated parties. This risk factor did not change our accounting conclusion as described above as the Company performed analyses and concluded that the management agreements include only terms, conditions and amounts that are customarily present in arrangements for similar services negotiated at arm’s length. This risk factor will be revised in future filings substantially as set forth below:

Our Management Agreement with our Manager was not negotiated between unaffiliated parties, and its terms, including fees payable, although approved by the independent directors of both Newcastle (our parent prior to the spin-off) and New Senior as fair, may not be as favorable to us as if they had been negotiated with an unaffiliated party.

| |

| • | We note your description of your permanent capital vehicles on page 51 (within MD&A – Understanding the Asset Management Business). You describe these vehicles as publicly traded entities which are externally managed by you and clarify that senior management is typically employed by you rather than the publicly traded vehicle. Given the more unique nature of these vehicles, tell us in more detail how you concluded the fee arrangements were consistent with ASC 810-10-55-37, including whether you considered other external fee arrangements for similar structures involving other third party decision makers for the same or similar services. |

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 9

Response

We respectfully inform the Staff that as part of our analysis under ASC 810-10-55-37 of fee arrangements with the publicly traded permanent capital vehicles, we considered the fee arrangements of over 20 external managers whose senior management is typically employed by the manager rather than the company, including investment managers and managers of externally managed REITs and other investment vehicles. All of these arrangements were between parties that were unrelated to the Company. We deemed the services to be similar in that for each arrangement we evaluated, the external manager was appointed to manage the assets and the day-to-day operations of the entity it manages. As stated in our response to the Staff’s comment in the immediately preceding bullet, our analysis included a review of the terms, conditions and amounts of the fee arrangements used by these companies.

Based on our analysis, the fee arrangements with, including expenses reimbursed by, our publicly traded permanent capital vehicles were in the range of (i.e., consistent with) amounts charged by the companies we analyzed. Additionally, we deemed the fee arrangements, including the expense reimbursements, to include terms customarily present in arrangements for similar services negotiated at arm’s length. As such, the fee arrangements for the asset management services we provide, including the expenses we are reimbursed from, our publicly traded permanent capital vehicles are commensurate with the level of effort required to provide those services and our management agreements with our permanent capital vehicles include only terms, conditions and amounts that are customarily present in arrangements for similar services negotiated at arm’s length pursuant to ASC 810-10-55-37.

| |

| • | You disclose in the last sentence on page 20 (within Note 2 - Management Agreements and Fortress Funds) that you receive both a management fee for New Senior and reimbursement of certain expenses including compensation for employees at the senior living facilities. Tell us how you considered the reimbursement arrangement(s) in your ASC 810-10-25-38A analysis and whether the reimbursements of expenses related to New Senior’s operations were considered variable interests in the VIE. Tell us if there are other VIEs with similar expense reimbursement arrangements and whether you thought about those arrangements differently than New Senior. |

Response

We respectfully inform the Staff that the Company performs its ASC 810 analyses on an entity by entity basis. With respect to New Senior, expenses are generally reimbursed pursuant to the management agreement between the Company and New Senior. As described in our response to the Staff’s comments in the immediately prior two bullets, we performed an analysis of the fee arrangements, including expense reimbursements we receive from New Senior, and we determined that these fee arrangements, including expense reimbursements, were commensurate with the level of effort required to provide those services and our management agreement included

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 10

only terms, conditions and amounts that are customarily present in arrangements for similar services negotiated at arm’s length.

With respect to senior living facilities owned by New Senior, expenses, including those related to the compensation of employees providing services to senior living facilities, are reimbursed pursuant to agreements between the Company and subsidiaries of New Senior which own the senior living facilities. There are no other VIEs in which the Company has a variable interest and receives expense reimbursements similar to those received from the senior living facilities. With respect to our evaluation of expense reimbursements for the compensation of employees providing services to the senior living facilities owned by New Senior under ASC 810-10-25-38A and ASC 810-10-55-37, we compared the terms, conditions, and amounts in these fee arrangements to those included in fee arrangements of third party property operators who operate a comparable business as well as fee arrangements that we have negotiated with third party owned properties where we provide similar services. We concluded such terms, conditions and amounts are consistent with those included in the fee arrangements of other third party operators and those we have negotiated with third parties. As a result, we determined that these fee arrangements, including the expense reimbursements, are compensation for services provided and are commensurate with the level of effort required to provide those services, and the fee arrangements, including expense reimbursement, include only terms, conditions and amounts that are customarily present in arrangements for similar services negotiated at arm’s length.

We further evaluated and concluded that the Company does not hold other interests in New Senior or its senior living facilities that individually, or in the aggregate, would absorb more than an insignificant amount of the VIE’s expected losses or receive more than an insignificant amount of the VIE’s expected residual returns (as described further in the next bullet). Therefore, we determined that the fees we earn and expense reimbursements that we receive are not a variable interest pursuant to ASC 810-10-55-37. Furthermore, we determined that the fees and expense reimbursements should be excluded for purposes of evaluating the characteristic in ASC 810-10-25-38A(b) because both conditions in ASC 810-10-25-38H were met.

| |

| • | We note your evaluation of whether Fortress’s direct and indirect economic interests would not absorb more than an insignificant amount of the entity’s losses or receive more than an insignificant amount of the entity’s benefits. From your table on page 21 (within Note 3 – Investments and Fair Value), we also note that you have direct equity method investments and options in the publicly traded permanent capital vehicles. Provide us with a qualitative and quantitative analysis supporting that Fortress’s direct and indirect economic interests (inclusive of any direct and indirect related party or de facto agent interests pursuant to ASC 810-10-55-37D and ASC 810-10-25-43) would not absorb losses or receive benefits for more than an insignificant amount of the publicly traded permanent capital vehicles. As part of your response, tell us who you considered related parties and de facto agents and the variable or other interest held by each. |

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 11

Response

Evaluation of fees as variable interests

We respectfully inform the Staff that in analyzing whether the Company’s direct and indirect economic interests would absorb more than an insignificant amount of losses or receive more than an insignificant amount of benefits from the publicly traded permanent capital vehicles, we considered the guidance in ASC 810-10-55-37D, which indicates that any interest in an entity that is held by a related party of the decision maker should be considered in the analysis. As such, we considered any interests held by our related parties, which consisted of our Principals, officers, directors, immediate family members of the Principals, officers, and directors, and Fortress Funds. Interests held by the Company’s employees were excluded for purposes of this analysis consistent with the exception provided in ASC 810-10-55-37D.

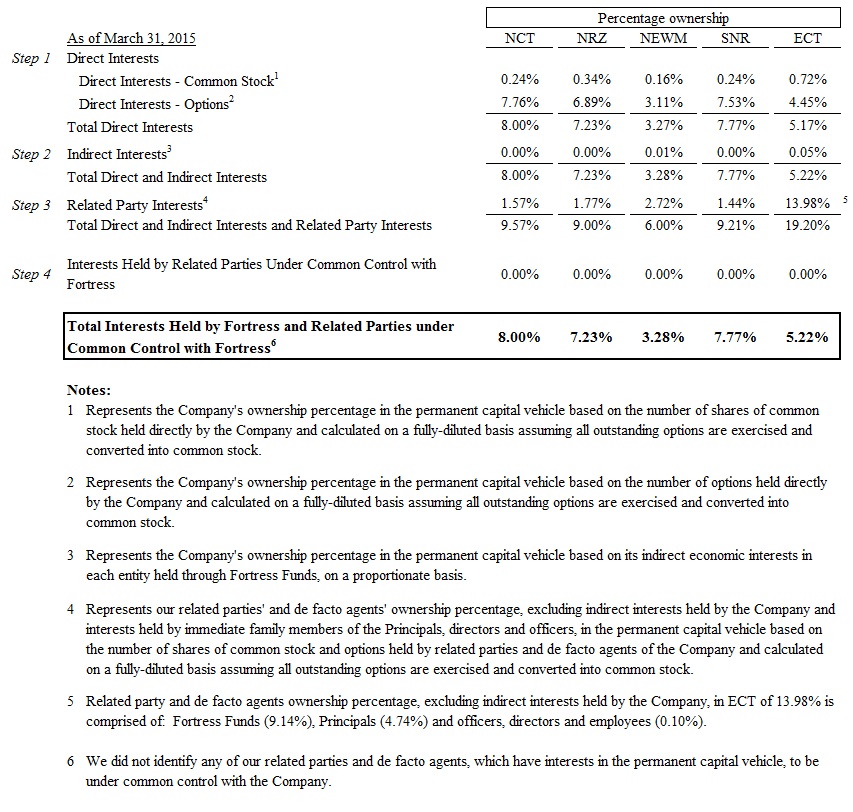

Our direct economic interests in the publicly traded permanent capital vehicles include common stock and options. Our interests in the common stock of each of the publicly traded permanent capital vehicles was less than 1% of the respective entity’s total common stock as of March 31, 2015. Our interests in options, on an as-converted basis, result in interests in the publicly traded permanent capital vehicles ranging from 3.1% to 7.8%.

Our indirect interests represent interests in Fortress Funds, considered on a proportionate basis, which have direct economic interests in the publicly traded permanent capital vehicles. Our indirect interests in the publicly traded permanent capital vehicles ranged from 0.0% to 0.1%, resulting in combined direct and indirect interests in these entities ranging from 3.3% to 8.0%.

ASC 810-10-55-37D also indicates indirect interests held through related parties that are under common control with the decision maker should be considered the equivalent of direct interests in their entirety. As of March 31, 2015, none of the Company’s related parties, including de facto agents, are under common control with the Company.

As part of our analysis, we considered the design of these entities as publicly traded companies and the nature of the interests held by the Company and our related parties and de facto agents (e.g., common stock). As a result of our analysis, we determined that the Company’s direct and indirect economic interests, including interests held by our related parties under common control with the Company (for which there were none), would not absorb more than an insignificant amount of losses or receive more than an insignificant amount of benefits from the publicly traded permanent capital vehicles. As all three of the conditions in ASC 810-10-55-37 were met, we determined that the fees we receive from the publicly traded permanent capital vehicles are not variable interests.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 12

Evaluation of whether the Company is the primary beneficiary of the publicly traded permanent capital vehicles

We performed a similar analysis in evaluating whether the Company is the primary beneficiary of the publicly traded permanent capital vehicles. We determined that the fees that we receive from these entities should be excluded for purposes of our evaluation of ASC 810-10-25-38A(b) because both conditions in ASC 810-10-25-38H were met, as further described in our response to the Staff’s comments in the prior three bullets. First, we considered whether the Company, on a direct basis, has the obligation to absorb losses or the right to receive benefits that could potentially be significant to the VIE (Step 1). Based on the direct interests held by the Company in each of the publicly traded permanent capital vehicles as described above, we concluded the Company does not have the obligation to absorb losses or the right to receive benefits from the publicly traded permanent capital vehicles that could potentially be significant to such VIEs on a direct basis.

Next, as there is a single decision maker for each entity, we considered whether the Company has the obligation to absorb losses or the right to receive benefits from the publicly traded permanent capital vehicles that could potentially be significant to such VIEs through our direct and indirect economic interests in each entity pursuant to ASC 810-10-25-42 (Step 2). Based on the direct and indirect economic interests held by the Company in each of the publicly traded permanent capital vehicles as described above, we concluded the Company does not have the obligation to absorb losses or the right to receive benefits from the publicly traded permanent capital vehicles that could potentially be significant to such VIEs on a direct and indirect basis.

Next, the Company considered whether it as a group, together with its related parties, including de facto agent interests, have the obligation to absorb losses or the right to receive benefits from the publicly traded permanent capital vehicles that could potentially be significant to such VIEs (Step 3). For purposes of this analysis, the related parties and de facto agents that we considered consist of our Principals, officers, directors, immediate family members of the Principals, officers, and directors, employees and Fortress Funds; however interests held by certain immediate family members of the Principals, officers and directors are not included in the percentages below. As of March 31, 2015, none of our related parties’ interests in the publicly traded permanent capital vehicles were financed by the Company.

Our related parties’ interests, including de facto agents, in the publicly traded permanent capital vehicles other than Eurocastle Investment Limited (“Eurocastle”) ranged from 1.4% to 2.7%, resulting in interests of the Company together with its related parties, including de facto agents, of 6.0% to 9.6%. For these entities the Company concluded that it together with its related parties, including de facto agents, does not have the obligation to absorb losses or the right to receive benefits from the publicly traded permanent capital vehicles that could potentially be significant to such VIEs.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 13

Our related parties’ interests, including de facto agents, in Eurocastle were 14.0%. Since the Company together with its related parties, including de facto agents, has the obligation to absorb losses or the right to receive benefits from Eurocastle that could potentially be significant to such VIE, the Company further evaluated whether it is the primary beneficiary of Eurocastle. The Company evaluated the guidance in ASC 810-10-25-44A which indicates that the guidance in ASC 810-10-25-44 (i.e., the related party tiebreaker test) shall be applied only when the single decision maker and one or more of its related parties are under common control and as a group, the single decision maker and those related parties have the characteristics in ASC 810-10-25-38A.

Therefore, the Company next considered whether any of its related parties are under common control with the Company (Step 4). None of the Company’s related parties, including de facto agents, are under common control with the Company. Therefore, pursuant to ASC 810-10-25-44A, we determined that the Company and its related parties under common control (for which there were none) do not have the characteristics in ASC 810-10-25-38A and therefore the assessment in ASC 810-10-25-44 (i.e., the related party tiebreaker test) was not applicable. Furthermore, the Company evaluated and considered the guidance in ASC 810-10-25-44B and determined that substantially all of the activities of Eurocastle were not conducted on behalf of a single variable interest holder as Eurocastle is a publicly traded company with many shareholders.

As part of our analysis, we considered the design of these entities as publicly traded companies and the nature of the interests held by the Company and our related parties and de facto agents (e.g., common stock). Based on our variable interests, we determined that the Company is not the primary beneficiary.

The following table summarizes the Company’s direct and indirect economic interests in the publicly traded permanent capital vehicles, as well as interests held by our related parties and de facto agents under common control, which as of March 31, 2015, there were none.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 14

| |

| • | Tell us whether there were any variable interests held by your related parties and de facto agents that were not considered in your above analysis. If so, please identify those parties, and the variable interests held by them, and explain your basis in the accounting literature for excluding those interests in your analysis. |

Response

We respectfully inform the Staff that there were no variable interests held by our related parties and de facto agents that were not considered in our above analysis.

We further note that the related party interests do not impact the consolidation conclusion in these analyses as none of our related parties and de facto agents are related parties under common control with the Company. Consistent with our conclusion as described in the previous bullet, we evaluated and considered the guidance in ASC 810-10-25-44A and determined that the Company and its related parties under common control (for which there were none) do not have the

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 15

characteristics in ASC 810-10-25-38A and therefore the assessment in ASC 810-10-25-44 (i.e., the related party tiebreaker test) was not applicable. Furthermore, the Company evaluated and considered the guidance in ASC 810-10-25-44B and determined that substantially all of the activities of the publicly traded permanent capital vehicles were not conducted on behalf of a single variable interest holder.

| |

| 7. | We note your adoption of ASU 2015-02 and related evaluation of the criteria to determine if fees received by Fortress represent a variable interest, including whether the service arrangement includes only terms, conditions, or amounts that are customarily present in arrangements for similar services negotiated at arm’s length. We also note that you have entered into amended management agreements with Eurocastle subsequent to March 31, 2015 (as described footnote (F) on page 19 within Note 2) and in April 2013 (as described on page 92 of Exhibit 99.1 of Form 8-K filed on May 7, 2015). Please address the following: |

| |

| • | Describe the events and reasons for entering into these amended management agreement terms with Eurocastle. |

Response

We respectfully inform the Staff that Eurocastle amended its management agreement with an affiliate of the Company (the “Manager”) in April 2013 and April 2015. The amendments were made following periodic reviews of Manager compensation pursuant to the terms of the management agreement in light of changes in Eurocastle’s investment focus and its resource needs from the Manager. In each instance, the parties amended the management agreement to recalibrate the capital base used both to calculate management fees and to establish the threshold for determining eligibility to receive incentive compensation. Each of these amendments was approved by the independent directors of Eurocastle’s board and each was intended to revise the fee terms in order for such terms to continue to be commensurate with the level of effort required to provide the services. In each instance, the Company concluded the fee arrangements under the amended agreements did not represent a variable interest.

In April 2013, Eurocastle announced a restructuring pursuant to which it would pursue a new investment focus on Italian real estate opportunities. As part of this restructuring, the parties amended the management agreement to reduce the capital base used to both calculate the management fee and establish the threshold for determining eligibility to receive incentive compensation.

In April 2015, as part of an ongoing review of Manager compensation in light of the restructuring, the parties determined that it was appropriate to further adjust the capital base used both to calculate the management fee and establish the threshold for determining eligibility to receive incentive compensation, and adjust the fee rate for the portion of the capital base consisting of net corporate cash, in order to appropriately incentivize the Manager to continue to source and make compelling investments focused on Italian real estate and to complete the liquidation of Eurocastle’s legacy real estate business.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 16

| |

| • | Tell us the number of times and for which entities that you have entered into other amended management agreements that impact the fee rates with your investment entities. |

Response

Except for the 2015 amendment of the Eurocastle management agreement discussed above, we respectfully inform the Staff that there have been no amendments to management agreements that impact the fee rates used to calculate the management fee and incentive compensation payable by each of the publicly traded permanent capital vehicles since 2010. As discussed in more detail in our response to the next bullet, certain management agreements have been amended to adjust the metrics used to determine the amount of incentive compensation the Manager may be eligible to receive. In addition, our private permanent capital vehicle (“WWTAI”) amended its organizational documents in November 2013 in preparation for a potential initial public offering ("IPO") to change its post-IPO management fee to be calculated on the basis of terms that are functionally equivalent to the pre-IPO approach to calculating fees. The amendment was approved by the WWTAI’s advisory board, which consists of third party investors.

With respect to other investment entities, we respectfully inform the Staff that the Company entered into one amendment to management agreements that impacted fee rates with an investment entity in the Company’s liquid hedge fund business since 2010. In 2013, we amended the management agreement with a single investor investment entity, which reduced the incentive compensation rate earned by the Company. This change occurred in conjunction with the investor changing its contractual ability to redeem capital less frequently from the investment entity. This amendment was negotiated directly with and agreed to by the third party investor.

In each instance described above, the Company concluded the fee arrangements under the amended agreements did not represent a variable interest. We also advise the Staff that each of the private permanent capital vehicle and the liquid hedge fund investment entity were voting interest entities at the time of the amendments.

| |

| • | To the extent that you have entered into other amendments, explain to us the substantive terms of those amendments and if they are substantively similar in nature to those with Eurocastle referenced above. |

Response

We respectfully inform the Staff that the Company has entered into other amendments to management agreements with the publicly traded permanent capital vehicles. Some of the amendments were purely technical in nature and do not substantively change the terms, conditions, or amounts in the fee arrangements. Certain other amendments address the method of calculating aspects of Manager compensation and are treated as reconsideration events by the Company for purposes of its ASC 810 analysis. In such instances, while the amendments technically differ from the amendments made

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 17

to the Eurocastle management agreement, the changes are all part of a consistent effort by both parties to review the management agreements from time to time in connection with significant events at the publicly traded permanent capital vehicles. Each of these amendments was approved by the independent directors of the board of the relevant publicly traded permanent capital vehicle. In such instances, the Company reevaluates whether such terms continue to be customary and commensurate with the level of effort required to provide the services. In each instance, the Company concluded the fee arrangements under the amended agreements did not represent a variable interest. Set forth below is additional detail regarding amendments made to the management agreements for Newcastle Investment Corp. (“Newcastle”), New Residential Investment Corp. (“New Residential”) and New Media Investment Group Inc. (“New Media”) since 2010:

| |

| ◦ | Newcastle: In April 2013, Newcastle made a technical amendment to its management agreement in preparation for its planned spin-off of New Residential. The amendment clarified that both Newcastle and New Residential could be managed by the Company and invest in certain types of credit sensitive real estate securities. The amended and restated management agreement was filed as Exhibit 10.1 to Newcastle’s Quarterly Report on Form 10-Q filed on May 3, 2013. |

| |

| ◦ | New Residential: The parties have amended the New Residential management agreement three times since the completion of New Residential’s spin-off from Newcastle in May 2013. Each amendment sought to adjust the earnings metric used to calculate potential incentive compensation in light of New Residential’s evolving asset mix and investment strategy. |

Specifically, in August 2013, the parties amended the earnings metric used to calculate incentive compensation in order to take into account the contribution of New Residential’s investments in excess mortgage servicing rights and consumer loans on a basis consistent with New Residential’s measure of operating performance, the primary effect of which was to eliminate certain unrealized gains and losses from the calculation of incentive compensation. As a result of the amendment, there is an increased correlation between the timing of any payments of incentive compensation and the realization of profit from these assets. The amended and restated management agreement was filed as Exhibit 10.2 to New Residential’s Quarterly Report on Form 10-Q filed on August 8, 2013.

In August 2014, the parties amended the earnings metric used to calculate incentive compensation to eliminate all unrealized gains and losses from the calculation, as well as any related deferred tax liability or asset, so that the Manager is compensated based on actual, realized results. As a result of the amendment, and similar to the prior amendment, there is an increased correlation between the timing of any payments of incentive compensation and the realization of profit from these assets. The amended and restated management agreement was filed as Exhibit 10.3 to New Residential’s Quarterly Report on Form 10-Q filed on August 7, 2014.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 18

In May 2015, the parties amended the earnings metric used to calculate incentive compensation to amortize certain non-capitalized transaction-related expenses over time rather than expensing them immediately. As a result of the amendment, and similar to the prior amendments, there is an increased correlation between the timing of any payments of incentive compensation and the benefits related to these transactions. The amended and restated management agreement was filed as Exhibit 10.4 to New Residential’s Quarterly Report on Form 10-Q filed on May 11, 2015.

| |

| ◦ | New Media: The parties have amended the New Media management agreement two times. First, in February 2014, in preparation for New Media becoming a publicly traded, externally managed company, the parties made a technical amendment to the management agreement to provide that New Media’s Chief Executive Officer’s compensation review process given that the Chief Executive Officer would become an employee of, and be compensated by, the Manager. The amended and restated management agreement was filed as Exhibit 10.37 to New Media’s Annual Report on Form 10-K filed on March 19, 2014. In March 2015, the parties amended the earnings metric used to calculate incentive compensation to amortize certain non-capitalized transaction-related expenses over time rather than expensing them immediately. As a result of the amendment, there is an increased correlation between the timing of any payments of incentive compensation and the benefits related to these transactions. The amended and restated management agreement was filed as Exhibit 10.39 to New Media’s Annual Report on Form 10-K filed on March 6, 2015. |

With respect to other investment entities, we respectfully inform the Staff that the Company entered into an amendment to a management agreement with an investment entity in the Company’s liquid hedge fund business since 2010. In 2015, at the request of the investor, we amended the management agreement with a liquid hedge fund single investor entity which reduced the amount of expenses that could be charged to the investment entity to better align such terms with our efforts to service that investor due to changes in that business. This amendment was negotiated directly with and agreed to by the third party investor.

In addition, from time to time, we make technical or clarifying amendments to management agreements with our investment entities that are required for regulatory, tax, legal or administrative purposes that do not significantly impact the asset management services the Company provides or the compensation it receives.

| |

| • | As a result of the amendment in April 2013, we note that the AUM used to compute Eurocastle’s management fees was reduced from €1.5 billion to €0.3 billion. Explain to us how you have considered these amended terms to be commensurate with the level of effort required to provide the services. Additionally, tell us in more detail how you concluded that this revised fee arrangement is similar to arm’s-length, including whether you considered |

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 19

other external fee arrangements involving other third party decision makers for the same or similar services.

Response

We respectfully inform the Staff that this revised fee arrangement represented a reconsideration event that required us to reevaluate whether the fees continued to meet the conditions in ASC 810-10-55-37. As described in our response to the first bullet in this comment, the April 2013 amendment to the Company’s management agreement with Eurocastle reduced the capital base used to both calculate the management fee and establish the threshold for determining eligibility to receive incentive compensation. Given Eurocastle’s changing investment focus and resource needs from the Manager, we determined that the fees continued to be compensation for services provided and commensurate with the level of effort required to provide those services and the fee arrangement continued to include only terms, conditions and amounts that are customarily present in arrangements for similar services negotiated at arm’s length. In addition, the amendment was approved by the independent directors of Eurocastle’s board.

As described in our response to Comment 6, as part of our analysis of ASC 810-10-55-37 for this revised fee arrangement and our fee arrangements with the other publicly traded permanent capital vehicles, we considered the fee arrangements of multiple other external managers whose senior management is typically employed by the manager rather than the company, including investment managers and managers of externally managed REITs and other investment entities. Our analysis included a review of the terms, conditions and amounts of the fee arrangements used by these companies.

Based on our analysis, we noted that the fee arrangements with, including expenses reimbursed by, our publicly traded permanent capital vehicles were in the range of amounts charged by the companies we analyzed. Additionally, we deemed that the fee arrangements, including expense reimbursements, included terms that are customarily present in arrangements for similar services negotiated at arm’s length. As such, the fees arrangements for the asset management services we provide, including the expenses we are reimbursed from our publicly traded permanent capital vehicles, are commensurate with the level of effort required to provide those services and our management agreements with our publicly traded permanent capital vehicles include only terms, conditions and amounts that are customarily present in arrangements for similar services negotiated at arm’s length pursuant to ASC 810-10-55-37.

Furthermore, the independent directors of Eurocastle’s board are responsible for approving the initial terms of each management agreement as well as overseeing an annual review of the Manager, including confirmation that the continued appointment of the Manager is in the best interests of the shareholders.

Ms. Suzanne Hayes

Securities and Exchange Commission

July 6, 2015

Page 20

As such, we determined that our fee arrangements with Eurocastle include only terms, conditions, and amounts customarily present in arrangements for similar services negotiated at arm’s length.

In connection with our response to the Staff’s comments, we acknowledge that:

| |

| • | The Company is responsible for the adequacy and accuracy of the disclosure in its filings; |

| |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| |

| • | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should you have any additional questions or comments, please contact me at 212‑798-6081.

Sincerely,

/s/ Daniel N. Bass

Daniel N. Bass

Chief Financial Officer

| |

| cc: | Hugh West, Securities and Exchange Commission |

Robert Klein, Securities and Exchange Commission

Joseph McCann, Securities and Exchange Commission