Exhibit 99.1

| Vantage Energy Services Company Presentation November 14, 2007 |

| Forward-Looking Statements Some of the statements in this presentation constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. The forward looking statements contained in this presentation involve risks and uncertainties as well as statements as to: availability of investment opportunities; general volatility of the market price of our securities; changes in our business strategy; our ability to consummate an appropriate investment opportunity within given time constraints; availability of qualified personnel; changes in our industry, interest rates, the debt securities markets or the general economy; changes in governmental regulations, tax rates and similar matters; changes in generally accepted accounting principles by standard-setting bodies; and the degree and nature of our competition. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. |

| Delivering on our IPO Promise Acquire Four Baker Marine Pacific Class 375 Ultra-premium Jackups for $848 million $500 - $1,000 million initial target acquisition size Utilizing seller equity participation Utilizing credit facility Speculative newbuild market very attractive Capitalize on market expertise and expanding offshore & deepwater spending trends “Quick strike” first transaction Ability to compete against established players for acquisition opportunities Acquire Initial Platform (IPO promise) $848 million acquisition (approximately $1.5 billion including the drillship) Seller is taking $275 million in units $440 million credit facility pending Four Baker Marine Pacific Class 375 Ultra-premium Jackups; option on Ultra-deepwater drillship Professional relationships and industry contacts facilitated a quick transaction Seller refused competing bids from established players in choosing Vantage Establish strong foundation for future expansion |

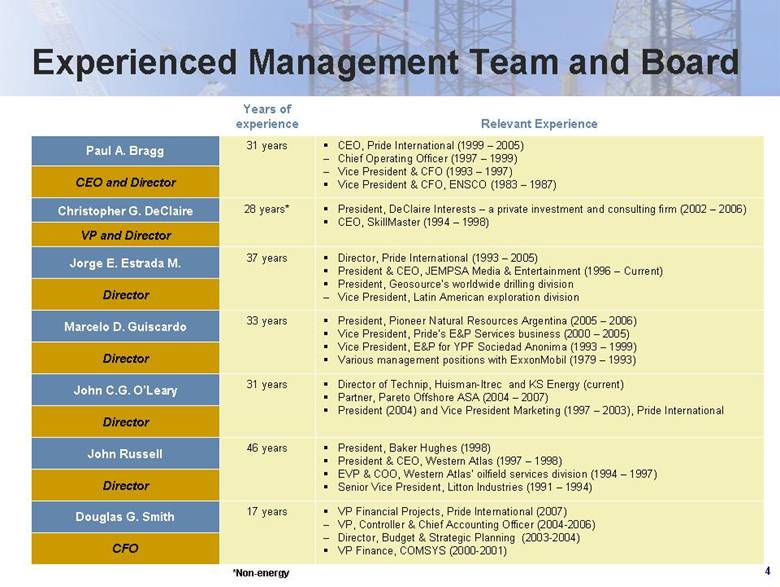

| Experienced Management Team and Board Years of experience Relevant Experience Paul A. Bragg 31 years CEO, Pride International (1999 – 2005) Chief Operating Officer (1997 – 1999) Vice President & CFO (1993 – 1997) Vice President & CFO, ENSCO (1983 – 1987) CEO and Director Christopher G. DeClaire 28 years* President, DeClaire Interests – a private investment and consulting firm (2002 – 2006) CEO, SkillMaster (1994 – 1998) VP and Director Jorge E. Estrada M. 37 years Director, Pride International (1993 – 2005) President & CEO, JEMPSA Media & Entertainment (1996 – Current) President, Geosource’s worldwide drilling division Vice President, Latin American exploration division Director Marcelo D. Guiscardo 33 years President, Pioneer Natural Resources Argentina (2005 – 2006) Vice President, Pride’s E&P Services business (2000 – 2005) Vice President, E&P for YPF Sociedad Anonima (1993 – 1999) Various management positions with ExxonMobil (1979 – 1993) Director John C.G. O’Leary 31 years Director of Technip, Huisman-Itrec and KS Energy (current) Partner, Pareto Offshore ASA (2004 – 2007) President (2004) and Vice President Marketing (1997 – 2003), Pride International Director John Russell 46 years President, Baker Hughes (1998) President & CEO, Western Atlas (1997 – 1998) EVP & COO, Western Atlas’ oilfield services division (1994 – 1997) Senior Vice President, Litton Industries (1991 – 1994) Director Douglas G. Smith 17 years VP Financial Projects, Pride International (2007) VP, Controller & Chief Accounting Officer (2004-2006) Director, Budget & Strategic Planning (2003-2004) VP Finance, COMSYS (2000-2001) CFO *Non-energy |

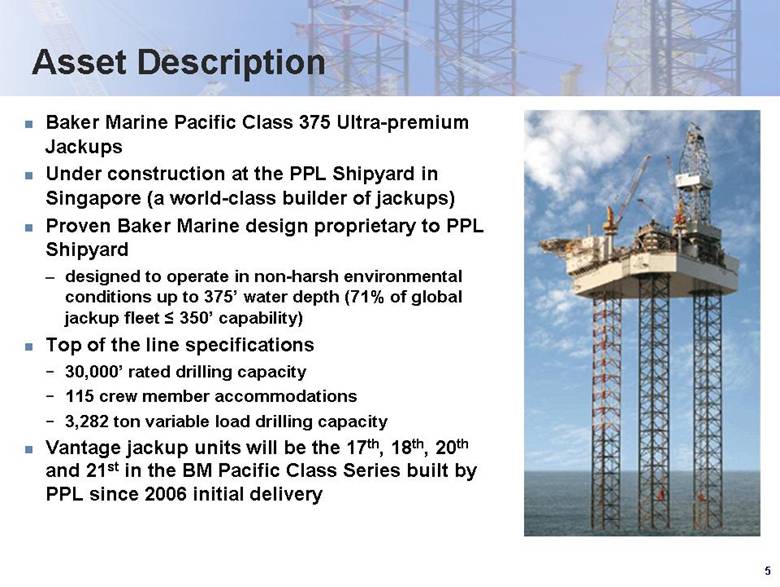

| Asset Description Baker Marine Pacific Class 375 Ultra-premium Jackups Under construction at the PPL Shipyard in Singapore (a world-class builder of jackups) Proven Baker Marine design proprietary to PPL Shipyard designed to operate in non-harsh environmental conditions up to 375’ water depth (71% of global jackup fleet ≤ 350’ capability) Top of the line specifications 30,000’ rated drilling capacity 115 crew member accommodations 3,282 ton variable load drilling capacity Vantage jackup units will be the 17th, 18th, 20th and 21st in the BM Pacific Class Series built by PPL since 2006 initial delivery |

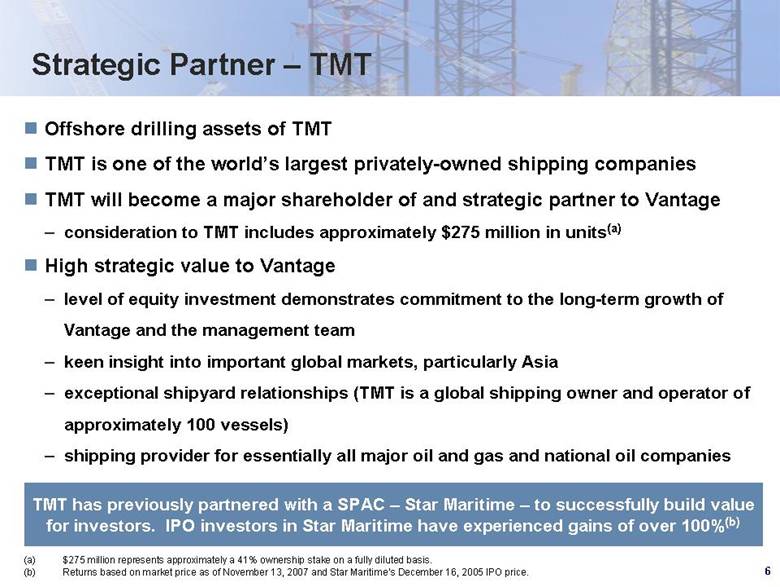

| TMT has previously partnered with a SPAC – Star Maritime – to successfully build value for investors. IPO investors in Star Maritime have experienced gains of over 100%(b) Strategic Partner – TMT Offshore drilling assets of TMT TMT is one of the world’s largest privately-owned shipping companies TMT will become a major shareholder of and strategic partner to Vantage consideration to TMT includes approximately $275 million in units(a) High strategic value to Vantage level of equity investment demonstrates commitment to the long-term growth of Vantage and the management team keen insight into important global markets, particularly Asia exceptional shipyard relationships (TMT is a global shipping owner and operator of approximately 100 vessels) shipping provider for essentially all major oil and gas and national oil companies $275 million represents approximately a 41% ownership stake on a fully diluted basis. Returns based on market price as of November 13, 2007 and Star Maritime’s December 16, 2005 IPO price. |

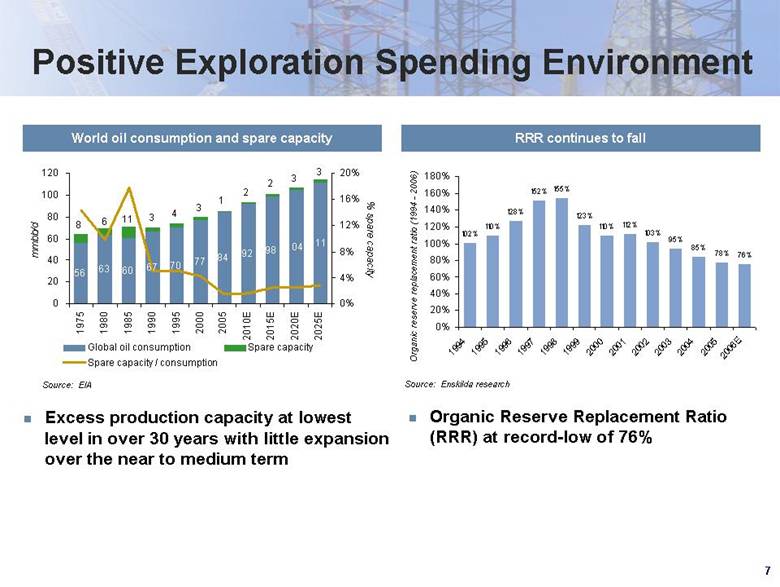

| Positive Exploration Spending Environment World oil consumption and spare capacity RRR continues to fall Source: EIA Source: Enskilda research Excess production capacity at lowest level in over 30 years with little expansion over the near to medium term Organic Reserve Replacement Ratio (RRR) at record-low of 76% 56 63 60 67 70 77 84 92 98 104 111 3 4 3 11 6 8 3 3 2 2 1 0 20 40 60 80 100 120 1975 1980 1985 1990 1995 2000 2005 2010E 2015E 2020E 2025E mmbb/d 0% 4% 8% 12% 16% 20% % spare capacity Global oil consumption Spare capacity Spare capacity / consumption |

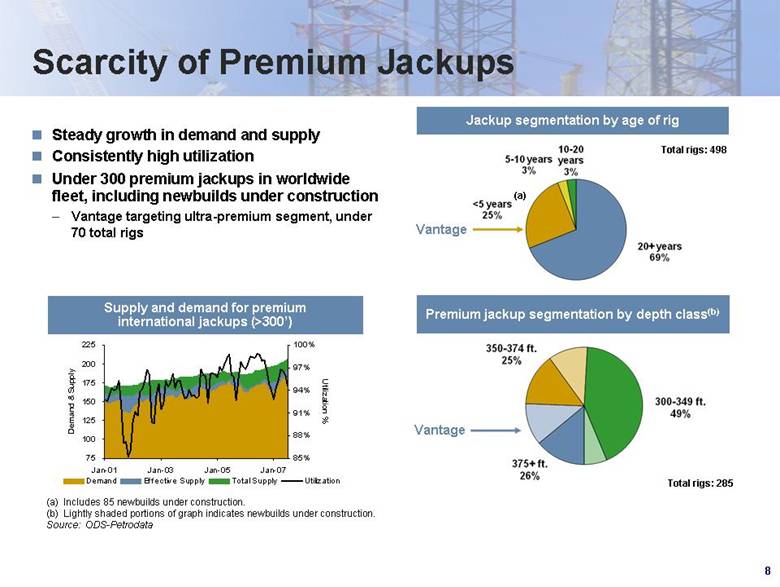

| Jackup segmentation by age of rig Scarcity of Premium Jackups Steady growth in demand and supply Consistently high utilization Under 300 premium jackups in worldwide fleet, including newbuilds under construction Vantage targeting ultra-premium segment, under 70 total rigs Premium jackup segmentation by depth class(b) (a) Includes 85 newbuilds under construction. (b) Lightly shaded portions of graph indicates newbuilds under construction. Source: ODS-Petrodata Supply and demand for premium international jackups (>300’) Total rigs: 285 Total rigs: 498 Vantage (a) 75 100 125 150 175 200 225 Jan-01 Jan-03 Jan-05 Jan-07 Demand & Supply 85% 88% 91% 94% 97% 100% Utilization % Demand Effective Supply Total Supply Utilization |

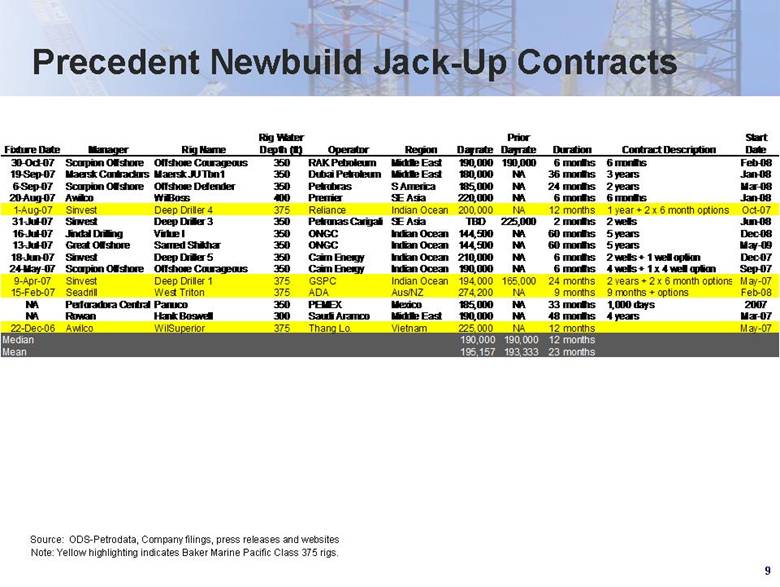

| Precedent Newbuild Jack-Up Contracts Source: ODS-Petrodata, Company filings, press releases and websites Note: Yellow highlighting indicates Baker Marine Pacific Class 375 rigs. Fixture Date Manager Rig Name Rig Water Depth (ft) Operator Region Dayrate Prior Dayrate Contract Description Start Date 30-Oct-07 Scorpion Offshore Offshore Courageous 350 RAK Petroleum Middle East 190,000 190,000 6 months 6 months Feb-08 19-Sep-07 Maersk Contractors Maersk JU Tbn1 350 Dubai Petroleum Middle East 180,000 NA 36 months 3 years Jan-08 6-Sep-07 Scorpion Offshore Offshore Defender 350 Petrobras S America 185,000 NA 24 months 2 years Mar-08 20-Aug-07 Awilco WilBoss 400 Premier SE Asia 220,000 NA 6 months 6 months Jan-08 1-Aug-07 Sinvest Deep Driller 4 375 Reliance Indian Ocean 200,000 NA 12 months 1 year + 2 x 6 month options Oct-07 31-Jul-07 Sinvest Deep Driller 3 350 Petronas Carigali SE Asia TBD 225,000 2 months 2 wells Jun-08 16-Jul-07 Jindal Drilling Virtue I 350 ONGC Indian Ocean 144,500 NA 60 months 5 years Dec-08 13-Jul-07 Great Offshore Samed Shikhar 350 ONGC Indian Ocean 144,500 NA 60 months 5 years May-09 18-Jun-07 Sinvest Deep Driller 5 350 Cairn Energy Indian Ocean 210,000 NA 6 months 2 wells + 1 well option Dec-07 24-May-07 Scorpion Offshore Offshore Courageous 350 Cairn Energy Indian Ocean 190,000 NA 6 months 4 wells + 1 x 4 well option Sep-07 9-Apr-07 Sinvest Deep Driller 1 375 GSPC Indian Ocean 194,000 165,000 24 months 2 years + 2 x 6 month options May-07 15-Feb-07 Seadrill West Triton 375 ADA Aus/NZ 274,200 NA 9 months 9 months + options Feb-08 NA Perforadora Central Panuco 350 PEMEX Mexico 185,000 NA 33 months 1,000 days 2007 NA Rowan Hank Boswell 300 Saudi Aramco Middle East 190,000 NA 48 months 4 years Mar-07 22-Dec-06 Awilco WilSuperior 375 Thang Lo. Vietnam 225,000 NA 12 months May-07 Median 190,000 190,000 12 months Mean 195,157 193,333 23 months Duration |

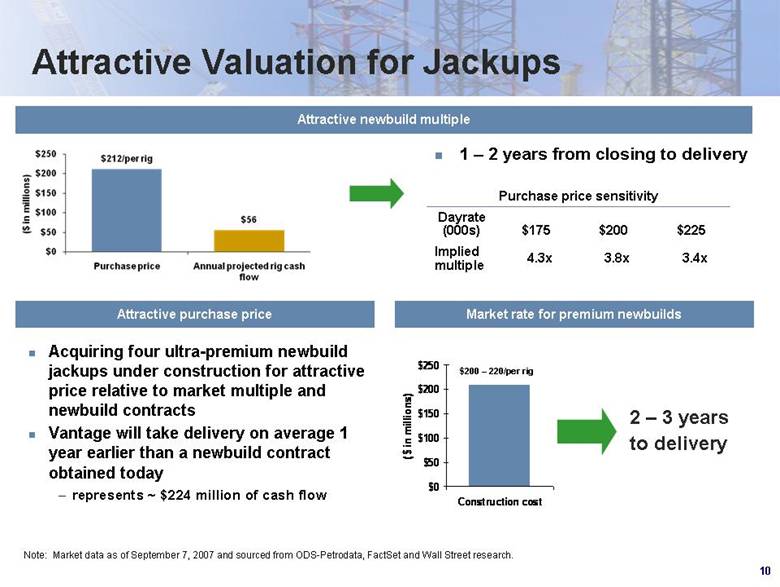

| Attractive Valuation for Jackups Attractive newbuild multiple 1 – 2 years from closing to delivery Attractive purchase price Market rate for premium newbuilds $200 – 220/per rig 2 – 3 years to delivery Note: Market data as of September 7, 2007 and sourced from ODS-Petrodata, FactSet and Wall Street research. Purchase price sensitivity Dayrate (000s) $175 $200 $225 Implied multiple 4.3x 3.8x 3.4x Acquiring four ultra-premium newbuild jackups under construction for attractive price relative to market multiple and newbuild contracts Vantage will take delivery on average 1 year earlier than a newbuild contract obtained today represents ~ $224 million of cash flow $0 $50 $100 $150 $200 $250 Construction cost ($ in millions) |

| Attractive Purchase Multiple Vantage is buying the four ultra-premium jackups at 3.8x (midpoint), well below the 2007E EBITDA trading multiples of comparable peers and at a discount to the fully deployed EBITDA multiples TEV / 2007E EBITDA multiples TEV / Fully deployed EBITDA multiples (a) Note: Market data as of November 7, 2007 and sourced from ODS-Petrodata, FactSet and Wall Street research. (a) RIG, GSF, NE and ESV based on 2009E EBITDA. SDRL and AWO based on fully-deployed EBITDA (2010E). VTG 3.4x – 4.3x purchase price multiple range |

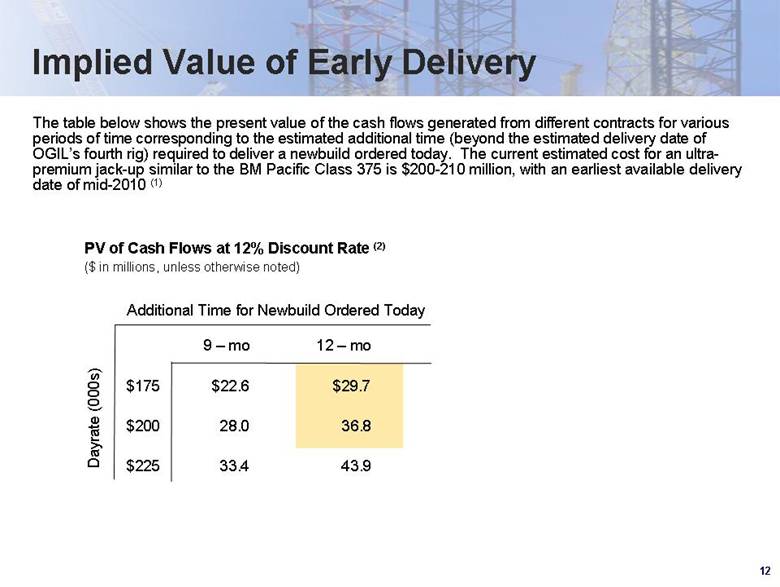

| Implied Value of Early Delivery The table below shows the present value of the cash flows generated from different contracts for various periods of time corresponding to the estimated additional time (beyond the estimated delivery date of OGIL’s fourth rig) required to deliver a newbuild ordered today. The current estimated cost for an ultra-premium jack-up similar to the BM Pacific Class 375 is $200-210 million, with an earliest available delivery date of mid-2010 (1) PV of Cash Flows at 12% Discount Rate (2) ($ in millions, unless otherwise noted) Additional Time for Newbuild Ordered Today 9 – mo $22.6 28.0 33.4 12 – mo $29.7 36.8 43.9 Dayrate (000s) $175 $200 $225 |

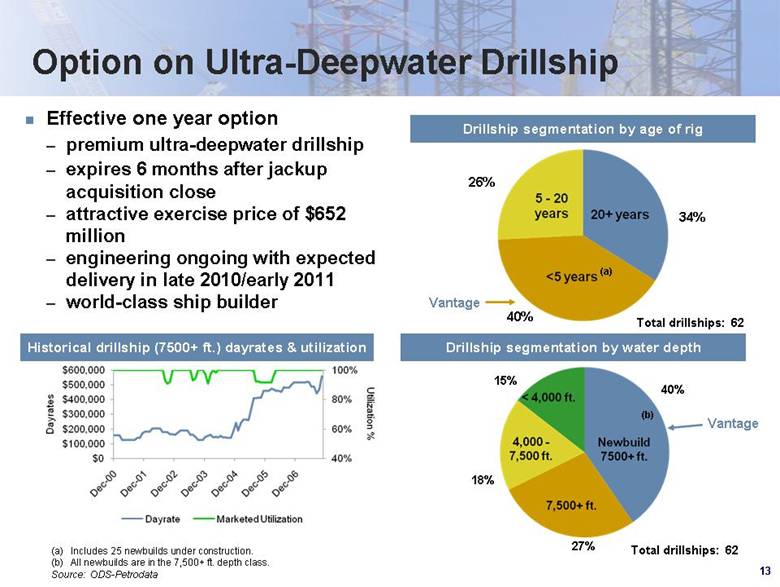

| 27% 40% 18% Vantage 15% Option on Ultra-Deepwater Drillship (a) Includes 25 newbuilds under construction. (b) All newbuilds are in the 7,500+ ft. depth class. Source: ODS-Petrodata Effective one year option premium ultra-deepwater drillship expires 6 months after jackup acquisition close attractive exercise price of $652 million engineering ongoing with expected delivery in late 2010/early 2011 world-class ship builder Historical drillship (7500+ ft.) dayrates & utilization 40% 26% 34% Vantage Drillship segmentation by age of rig (a) Total drillships: 62 Drillship segmentation by water depth Total drillships: 62 (b) |

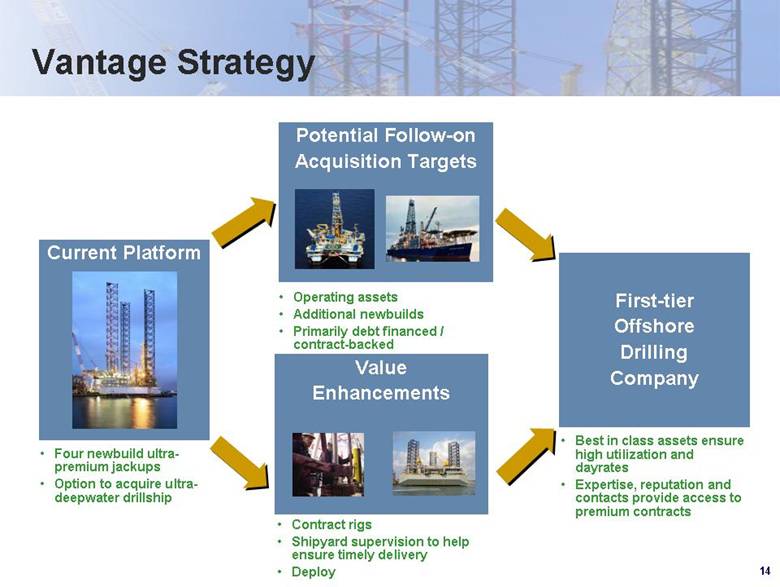

| Vantage Strategy Current Platform First-tier Offshore Drilling Company Four newbuild ultra-premium jackups Option to acquire ultra-deepwater drillship Best in class assets ensure high utilization and dayrates Expertise, reputation and contacts provide access to premium contracts Contract rigs Shipyard supervision to help ensure timely delivery Deploy Operating assets Additional newbuilds Primarily debt financed / contract-backed Value Enhancements Potential Follow-on Acquisition Targets |

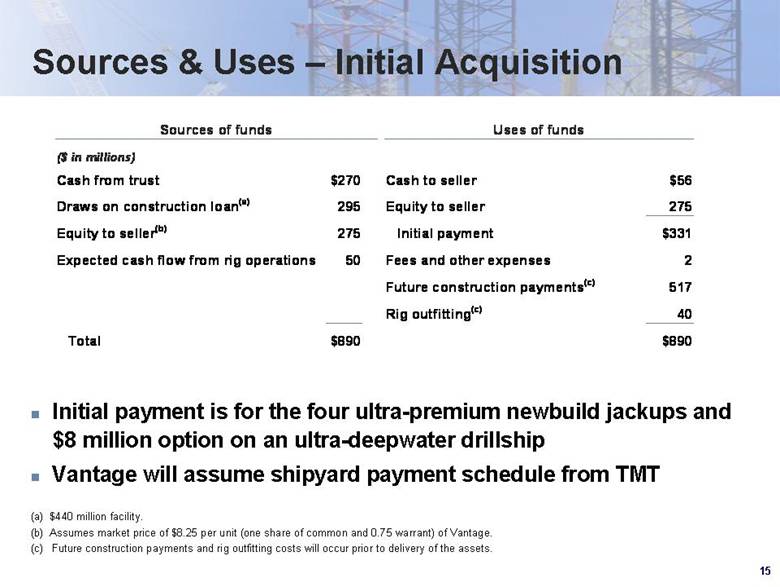

| Sources & Uses – Initial Acquisition Initial payment is for the four ultra-premium newbuild jackups and $8 million option on an ultra-deepwater drillship Vantage will assume shipyard payment schedule from TMT (a) $440 million facility. (b) Assumes market price of $8.25 per unit (one share of common and 0.75 warrant) of Vantage. (c) Future construction payments and rig outfitting costs will occur prior to delivery of the assets. Sources of funds Uses of funds ($ in millions) Cash from trust $270 Cash to seller $ 56 Draws on construction loan(a) 295 Equity to seller 275 Equity to seller(b) 275 $331 Expected cash flow from rig operations 50 Fees and other ex penses 2 Future construction payments(c) 517 Rig outfitting(c) 40 $890 $890 Total Initial payment |

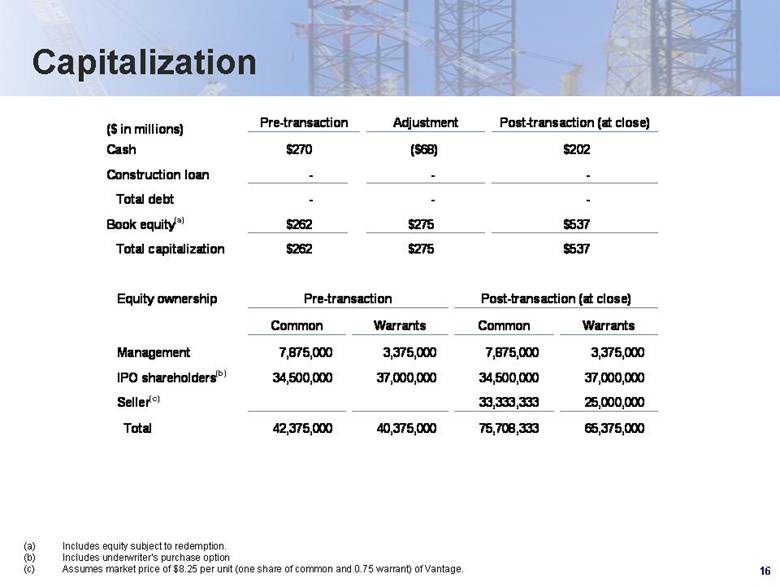

| Capitalization Includes equity subject to redemption. Includes underwriter’s purchase option Assumes market price of $8.25 per unit (one share of common and 0.75 warrant) of Vantage. ($ in millions) Pre-transaction Adjustment Post-transaction (at close) Cash $270 ($68 ) $202 Construction loan - - - - - - Book equity(a) $262 $275 $537 $262 $275 $537 Equity ownership Pre-transaction Post-tr ansaction (at close) Common Warrants Common Warrants Management 7,875,000 3,375,000 7,875,000 3,375,000 IPO shareholders(b) 34,500,000 37,000,000 34,500,000 37,000,000 Seller(c) 33,333,333 25,000,000 42,375,000 40,375,000 75,708,333 65,375,000 Total Total capitalization Total debt |

|

|

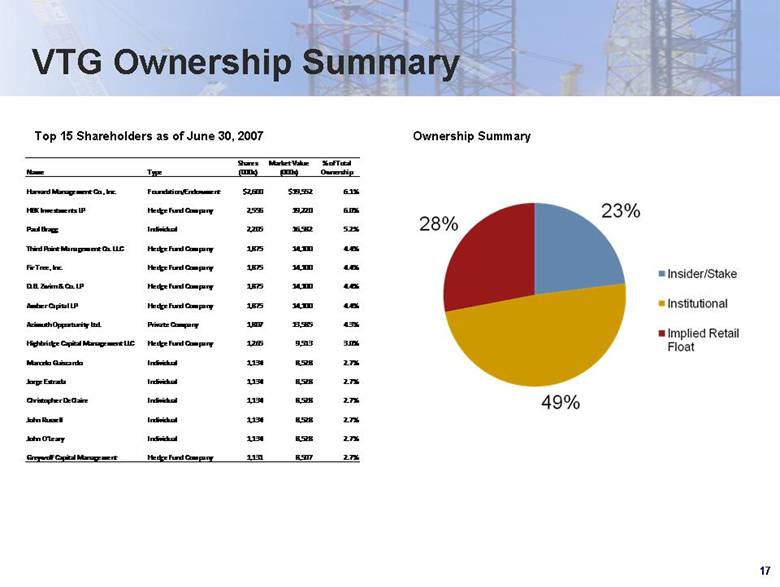

| VTG Ownership Summary Top 15 Shareholders as of June 30, 2007 Ownership Summary Shares Market Value % of Total Name Type (000s) (000s) Ownership Harvard Management Co., Inc. Foundation/Endowment $2,600 $19,552 6.1% HBK Investments LP Hedge Fund Company 2,556 19,220 6.0% Paul Bragg Individual 2,205 16,582 5.2% Third Point Management Co. LLC Hedge Fund Company 1,875 14,100 4.4% Fir Tree, Inc. Hedge Fund Company 1,875 14,100 4.4% D.B. Zwirn & Co. LP Hedge Fund Company 1,875 14,100 4.4% Amber Capital LP Hedge Fund Company 1,875 14,100 4.4% Azimuth Opportunity Ltd. Private Company 1,807 13,585 4.3% Highbridge Capital Management LLC Hedge Fund Company 1,265 9,513 3.0% Marcelo Guiscardo Individual 1,134 8,528 2.7% Jorge Estrada Individual 1,134 8,528 2.7% Christopher DeClaire Individual 1,134 8,528 2.7% John Russell Individual 1,134 8,528 2.7% John O'Leary Individual 1,134 8,528 2.7% Greywolf Capital Management Hedge Fund Company 1,131 8,507 2.7% |

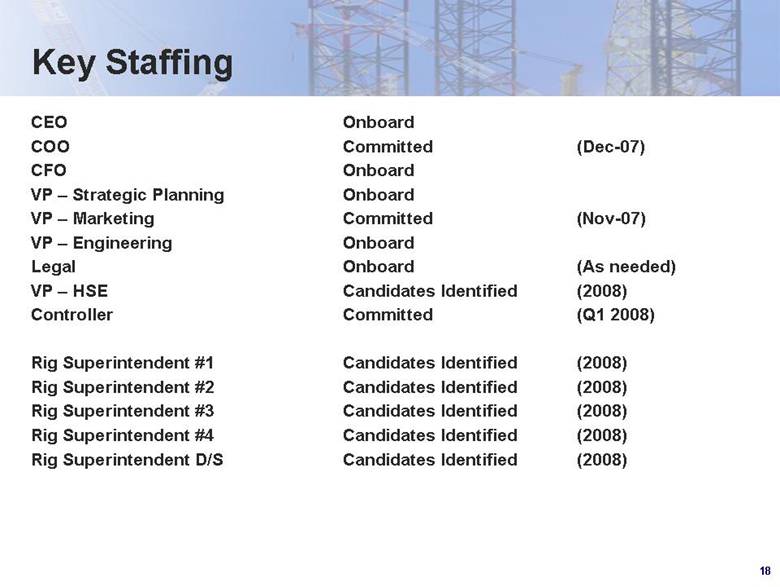

| Key Staffing CEO Onboard COO Committed (Dec-07) CFO Onboard VP – Strategic Planning Onboard VP – Marketing Committed (Nov-07) VP – Engineering Onboard Legal Onboard (As needed) VP – HSE Candidates Identified (2008) Controller Committed (Q1 2008) Rig Superintendent #1 Candidates Identified (2008) Rig Superintendent #2 Candidates Identified (2008) Rig Superintendent #3 Candidates Identified (2008) Rig Superintendent #4 Candidates Identified (2008) Rig Superintendent D/S Candidates Identified (2008) |

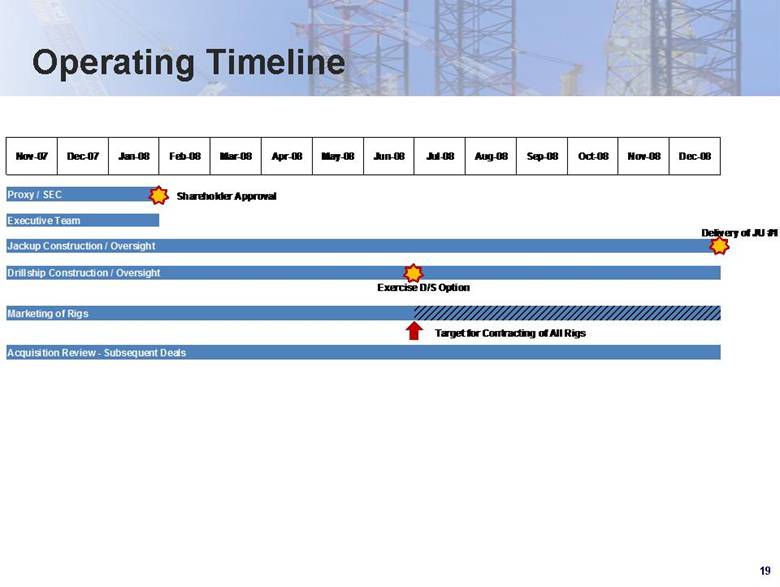

| Operating Timeline Marketing of Rigs Acquisition Review - Subsequent Deals Dec-08 Proxy / SEC Nov-08 Delivery of JU #1 Oct-08 Executive Team Jackup Construction / Oversight Drillship Construction / Oversight Jul-08 Aug-08 Sep-08 Nov-07 Dec-07 Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Target for Contracting of All Rigs Exercise D/S Option Shareholder Approval |