As filed with the Commission on December 2, 2008 File No. 333-154218

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment #1

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PANA-MINERALES S.A.

(Exact name of registrant as specified in its charter)

| Nevada | 1099 | 98-0515701 |

(State or jurisdiction of incorporation or organization | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employee Identification No.) |

| Primera Calle El Carmen, EDF. PH Villa Medici, Apt. 28, Torre C, Panama, Rep. of Panama |

| Telephone: (507) 391–6820 |

| (Address, including zip code, and telephone number, including area code, of principal executive offices) |

| Budget Corp. 2050 Russett Way, Carson City, Nevada, 89703 |

| Telephone: (775) 884-9380 |

| (Name, address, including zip code, and telephone number, including area code, of agent of service) |

| Copies to: |

| Lawler & Associates, 29377 Rancho California, #204, Temecula, C.A., 92592 |

| Telephone: 888-675-0888 Fax: 866-506-8877 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement of the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, an “accelerated filer”, a “non-accelerated filer”, or a “smaller reporting company” in Rule 12b-2 of the Echange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Small reporting company [X]

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Number of Shares to be Registered | Proposed maximum offering price per share (i) (ii) | Proposed maximum aggregate offering price | Amount of Registration fee (iii) |

| | | | | |

| Common stock | 10,000,000 | $0.05 | $500,000 | $54 |

| | (i) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

| (ii) | There is no public market for the Imperial Resources Inc. shares of common stock. Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the offering price for shares of Imperial Resources Inc. sold to subscribers by way of a private placement. |

| (iii) | Fee calculated in accordance with Rule 457(o) of the Securities Act of 1933. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8 (a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8 (a), may determine.

Prospectus Subject to Completion

Date: December 2, 2008

The Information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offering or sale is not permitted.

PANA-MINERALES S.A.

Offering Price: $ 0.05 per share

Offering by Selling Security Holder: 10,000,000 Shares of Common Stock

We are registering 10,000,000 common shares for resale by the Selling Security Holder identified in this prospectus. We will not receive any of the proceeds for the sale of the shares by the Selling Security Holder. The shares are being registered to permit the resale of shares owned by the Selling Security Holder named in this prospectus. The number of shares of Pana-Minerales S.A. common stock being registered by Selling Security Holder represents approximately 71.5% of our currently issued and outstanding share capital.

There is no public market for Pana-Minerales S.A.’s common stock. It is our intention to seek quotation on the OTC Bulletin Board (“OTCBB”) subsequent to the date of this prospectus. There is no assurance our application to the FINRA will be approved.

The Selling Security Holder will sell at a price of $0.05 per share, provided that if our shares are subsequently quoted on the OTC Bulletin Board (“OTCBB”) Selling Security Holder may sell at prevailing market prices or privately negotiated prices. It is our intention to find a market maker who will make an application to the FINRA to have our shares accepted for trading on the OTCBB once this registration statement becomes effective. There is no assurance our application to the FINRA will be approved. The Selling Shareholder is an underwriter, within the meaning of Section 2(11) of the Securities Act. Any broker-dealers or agents that participate in the sale of the common stock or interests therein may also be deemed to be an "underwriter" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The Selling Shareholder, who is an "underwriter" within the meaning of Section 2(11) of the Securities Act, is subject to the prospectus delivery requirements of the Securities Act.

Investing in our common stock involves a high degree of risk. A potential investor should carefully consider the factors described under the heading “Risk Factors” beginning at

Page 5.

Neither the Securities and Exchange Commission nor any State Securities Commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December, 2008.

Table of Contents

| Description | Page |

| | |

| Summary of Prospectus | 3 |

| | |

| Risk Factors | 5 |

| | |

| Use of Proceeds | 13 |

| | |

| Plan of Distribution | 14 |

| | |

| Selling Security Holder | 15 |

| | |

| Determination of Offering Price | 16 |

| | |

| Business Description | 16 |

| | |

| Description of the Property | 17 |

| | |

| Management’s Discussion and Analysis or Plan of Operations | 25 |

| | |

| Management | 29 |

| | |

| Executive Compensation | 31 |

| | |

| Principal Shareholder | 32 |

| | |

| Description of Securities | 33 |

| | |

| Market for Common Shares & Related Shareholder Matters | 33 |

| | |

| Certain Transactions | 33 |

| | |

| Legal Proceedings | 34 |

| | |

| Experts | 34 |

| | |

| Legal Matters | 34 |

| | |

| Further Information | 34 |

| | |

| Financial Statements | 35 |

Dealer Prospectus Delivery Instructions

Until , 2008 all dealers that effect transactions in these shares of common stock , whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

SUMMARY OF PROSPECTUS

This summary provides an overview of all material information contained in this prospectus. Before making a decision to purchase the shares our Selling Security Holder are offering you should very carefully and thoroughly read the more detailed information in this prospectus and review our financial statements.

As used in this prospectus, unless the context otherwise requires, "we", "us", "our", “Pana” or "Pana-Minerales" refers to Pana-Minerales S.A. "SEC" refers to the Securities Exchange Commission. "Securities Act" refers to the Securities Act of 1933, as amended. "Exchange Act" refers to the Securities Exchange Act of 1934, as amended.

Summary Information about Pana-Minerales S.A.

We were incorporated in the State of Nevada on October 4, 2006 and established a fiscal year end of August 31. We do not have any subsidiaries, affiliated companies or joint venture partners.

We are a start-up, pre-exploration stage company engaged in the search for gold and related minerals and have not generated any operating revenues since inception.

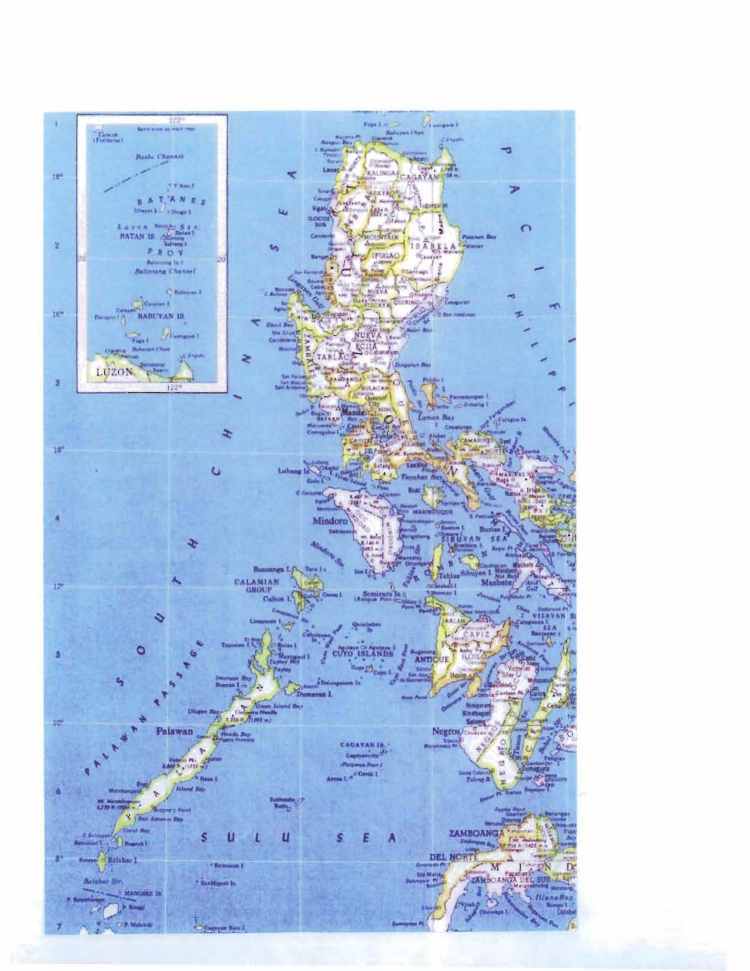

Pana-Minerales S.A (“Pana”) was formed to engage in the exploration of mineral properties in the Republic of the Philippines for gold and silver. The Company purchased, from an unaffiliated third party seller, a 100% interest in a mineral claim known as Marawi Gold Claim (“Marawi Claim”), consisting of one-9 unit claim block containing 97.4 hectares located near the town of Malaybalay in the Republic of the Philippines.

We own no property other than the Marawi Claim.

There is no assurance that a commercially viable mineral deposit, a reserve, exists at our mineral claim or can be shown to exist until sufficient and appropriate exploration is done and a comprehensive evaluation of such work concludes economic and legal feasibility. Such work could take many years of exploration and would require expenditure of very substantial amounts of capital, capital we do not currently have and may never be able to raise.

We have incurred losses since inception and we must raise additional capital to fund our operations. There is no assurance we will be able to raise this capital.

As of the date of this prospectus, we have not conducted any exploration work on the Marawi Claim. We intend to complete our Phase I exploration program recommended for the Marawi Claim, at an estimated cost of $13,082.

We plan to finance our operations through a combination of equity and debt capital. As summarized below, since inception we have raised a total of $14,000 in equity while our total expense incurred since inception total $21,610 leaving us with a working capital deficit of $7,610 as of August 31, 2008. As of August 31, 2008 we had also received cash advances of $194 from our President and sole shareholder. As of October 31, 2008 such advances totaled $12,898. This debt capital advanced by our President is in the form of non interest bearing demand loans, Our President has agreed to advance to the Company, on an ‘as needed’ basis, up to an additional $27,102 on the same terms and conditions

Apart from these advances we have no funds to satisfy our cash requirements and should we be unable to raise additional capital from other sources in the future we will have to go out of business. We have no full time employees and our management devotes a small percentage of his time to the affairs of the Company.

Our administrative office is located at Primera Calle El Carmen, EDF. PH Villa Medici,Apt. 28,Torre C, Panama, Rep. of Panama. Our telephone number is (507) 391-6820 and our fax number is (507) 265-0638

On August 31, 2007 we completed a private placement pursuant to Regulation S of the Securities Act of 1933, of 1,000,000 shares of common stock sold to our sole officer and director at the price of $0.001 per share to raise $1,000. On August 23, 2008 we completed a further private placement pursuant to Regulation S of the Securities Act of 1933, whereby 13,000,000 common shares were sold at the price of $0.001per share to raise $13,000. The total cash raised from the sale of shares was $14,000.

We had no cash on hand as of August 31, 2008, the end of our most recent fiscal year.

The following financial information summarizes the more complete historical financial information found in our audited financial statements, made up to August 31, 2008 and 2007, contained elsewhere in this prospectus:

| | Since Inception to August 31, 2007 (audited) | Since Inception to August 31, 2008 (audited) |

| Statement of Expenses Information: | | |

| | | |

| Revenue | $ - | $ - |

| Net Losses | 3,940 | 21,610 |

| Total Operating Expenses | 3,940 | 21,610 |

| Exploration Costs | - | 1,843 |

| Recognition of an Impairment Loss (mineral claim) | - | 5,000 |

| General and Administrative | 3,940 | 14,767 |

| | | |

| | As at August 31, 2007 | As at August 31, 2008 |

| Balance Sheet Information: | | |

| | | |

| Cash | $ - | $ - |

| Total Assets | - | - |

| Total Liabilities | 2,940 | 7,610 |

| Stockholder Equity (Deficit) | (2,940) | (7,610) |

| | | |

Subsequent to August 31, 2008 our President advanced additional cash, in the form of non-interest bearing demand loans, to the Company totaling $12,898 as of October 31, 2008.

The Offering

Following is a brief summary of this offering:

| Common stock offered by the Selling Security Holder, Hector Francisco Vasquez Davis | 10,000,000 shares offered by our President Hector Francisco Vasquez Davis (hereinafter the “Selling Security Holder”) detailed in the section of the Prospectus entitled “Selling Security Holder” beginning on page 15. |

| Common stock outstanding as f the date of this Prospectus | 14,000,000 Shares |

| Use of proceeds | We will not receive any proceeds from the sale of shares of common stock by the Selling Security Holder. |

| Plan of Distribution | The offering is made by the Selling Security Holder named in this Prospectus to the extent they sell shares. We intend to seek quotation of our common stock on the OTCBB. However, no assurance can be given that our common stock will be approved for quotation on the OTCBB. Selling Security Holder may sell at market or privately negotiated prices. |

| Risk Factors | You should carefully consider all the information in this Prospectus. In particular, you should evaluate the information set forth in the section of the Prospectus entitled “Risk Factors” beginning below before deciding whether to invest in our common stock. |

| | |

| Lack of Liquidity in our common stock | Our common stock is not presently quoted on or traded on any securities exchange or automated quotation system and we have not yet applied for listing or quotation on any public market. We can provide no assurance that there will ever be an established public trading market for our common stock. |

Risk Factors

An investment in our common stock involves an exceptionally high degree of risk and is extremely speculative. In addition to the other information regarding Pana contained in this prospectus, you should consider many important factors in determining whether to purchase the shares being offered. The following risk factors reflect all known potential and substantial material risks which could be involved if you decide to purchase shares in this offering.

Risks Associated with our Company:

Since our auditors have issued a going concern opinion and although our sole officer and director has agreed to loan money to us, we may not be able to achieve our objectives and may have to suspend or cease exploration activity.

Our auditors have issued a going concern opinion. This means that there is doubt that we can continue as an ongoing business for the next twelve months. If we do not raise additional capital through the issuance of treasury shares or loans to Pana we will be unable to conduct exploration activity on the Marawi Claim. In addition, in the event we are unable to raise additional capital we will have to cease operations and go out of business.

Our liquidity, and thus our ability to continue to operate depends upon the continuing willingness of our President, who is also our sole stockholder, to finance the Company’s operations.

We are financing our continuing operations with cash loaned to us by our President. As at October 31, 2008 our President has loaned us $12,898. He has agreed to advance a further $27,102 on or before August 31, 2009. Without these loan advances, absent any other source of funds, we would be forced to go out of business. Even if our President advances a further $27,102 on or before August 31, 2009, we expect our cash resources to satisfy our needs only to August 31, 2009. We will have to raise additional funds in the next twelve months to satisfy our cash requirements. The loan advances made by our President are repayable on demand. Accordingly, if our President were to demand repayment of his loan advances we would not have sufficient funds to satisfy our cash requirements and would be forced to go out of business.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease exploration activity or cease operations.

We have not yet conducted any exploration activities. We have not generated any revenues. We have no exploration history upon which you can evaluate the likelihood of our future success or failure. Our net loss from inception to August 31, 2008, the date of our most recent fiscal year end, was $21,610. Our ability to achieve profitability and positive cash flow in the future is dependent upon

| | * | our ability to locate a profitable mineral property |

| | * | our ability to locate an economic ore reserve |

| | * | our ability to generate revenues |

| | * | our ability to reduce exploration costs. |

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral property. We cannot guarantee we will be successful in generating revenues in the future. Failure to generate revenues may cause us to go out of business.

We have no known ore reserves and we cannot guarantee we will find any gold and/or silver mineralization or, if we find gold and/or silver mineralization, that it may be economically extracted. If we fail to find any gold and/or silver mineralization or if we are unable to find gold and/or silver mineralization that may be economically extracted, we will have to cease operations.

We have no known ore reserves. Even if we find gold and/or silver mineralization we cannot guarantee that any gold and/or silver mineralization will be of sufficient quantity so as to warrant recovery. Additionally, even if we find gold and/or silver mineralization in sufficient quantity to warrant recovery, we cannot guarantee that the ore will be recoverable. Finally, even if any gold and/or silver mineralization is recoverable, we cannot guarantee that this can be done at a profit. Failure to locate gold deposits in economically recoverable quantities will cause us to cease operations.

Because the probability of an individual prospect ever having reserves is extremely remote, in all probability our property does not contain any reserves, and any funds spent on exploration will be lost.

Because the probability of an individual prospect ever having reserves is extremely remote, in all probability our sole property, the Marawi Claim, does not contain any reserves, and any funds spent on exploration will be lost. If we cannot raise further funds as a result, we may have to suspend or cease operations entirely which would result in the loss of your investment.

Because our sole officer and director does not have technical training or experience in starting and operating an exploration company nor in managing a public company, we will have to hire qualified personnel to fulfill these functions. If we lack funds to retain such personnel, or cannot locate qualified personnel, we may have to suspend or cease exploration activity or cease operations which will result in the loss of your investment.

Because our sole officer and director is inexperienced with exploring for minerals and starting, and operating a mineral exploration company, we will have to hire qualified persons to perform surveying, exploration, and excavation of our property. Our officer and director has no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. His decisions and choices may not take into account standard engineering or managerial approaches, mineral exploration companies commonly use. Consequently our exploration, earnings and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry. Additionally, our sole officer and director has no direct training or experience in managing and fulfilling the regulatory reporting obligations of a ‘public company’ like Pana. Unless our sole part time officer is willing to spend more time addressing these matters, we will have to hire professionals to undertake these filing requirements for Pana and this will increase the overall cost of operations. As a result we may have to suspend or cease exploration activity, or cease operations altogether, which will result in the loss of your investment.

If we don't raise additional capital for ongoing exploration work, we will have to delay such exploration or go out of business, which will result in the loss of your investment.

We estimate that, with $40,000 in loan capital (non interest bearing, payable on demand) agreed to be advanced by our President (of which $12,898 had been advanced as of October 31, 2008), we will have sufficient cash to continue operations for the remainder or 2008 and into the summer of 2009 provided we carry out only the ‘Phase I’ exploration activity recommended by our engineer at an estimated cost of $17,500, see “Description of Property, Proposed Exploration Work – Plan of Operation”, page XX. We are a start-up, pre-exploration stage company. We will need to raise additional capital to undertake additional exploration activity. You may be investing in a company that will not have the funds necessary to conduct any exploration beyond the initial work noted above due to our inability to raise additional capital. If that occurs we will have to cease our exploration activity and go out of business that will result in the loss of your investment.

Since we are small and do not have much capital, we must limit our exploration and as a result may not find an ore body. Without an ore body, we cannot generate revenues and you will lose your investment.

The possibility of development of and production from our exploration property depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified professional engineers and geologists. We are small company and do not have much capital. We must limit our exploration activity unless and until we raise additional capital. Any decision to expand our operations on our exploration property will involve the consideration and evaluation of several significant factors beyond our control. These factors include, but are not limited to:

| ● | | Market prices for the minerals to be produced; |

| ● | | Costs of bringing the property into production including exploration preparation of production feasibility studies and construction of production facilities; |

| ● | | Political climate and/or governmental regulations and controls; |

| ● | | Ongoing costs of production; |

| ● | | Availability and cost of financing; and |

| ● | | Environmental compliance regulations and restraints. |

These types of programs require substantial capital. Because we may have to limit our exploration, we may not find an ore body, even though our property may contain mineralized material. Without an ore body, we cannot generate revenues and you will lose your investment.

Because our sole officer and director has other outside business activities and may not be in a position to devote a majority of his time to our exploration activity, our exploration activity may be sporadic which may result in periodic interruptions or suspensions of exploration.

Our sole officer and director will be devoting only approximately 10% of his time, approximately 16 hours per month, to our business. As a consequence of the limited devotion of time to the affairs of the Company expected from management, our business may suffer. For example, because our officer and director has other outside business activities and may not be in a position to devote a majority of his time to our exploration activity, our exploration activity may be sporadic or may be periodically interrupted or suspended. Such suspensions or interruptions may cause us to cease operations altogether and go out of business.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend exploration activity.

We have made no attempt to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials as and when we begin to undertake exploration activity. Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of equipment and/or supplies we need to conduct our planned exploration work. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

No matter how much money is spent on the Marawi Claim, the risk is that we might never identify a commercially viable ore reserve.

Over the coming years, we might expend considerable capital on exploration of the Marawi Claim without finding anything of value. It is very likely the Marawi Claim does not contain any reserves so any funds spent on exploration will probably be lost. No matter how much money is spent on the Marawi Claim, we might never be able to find a commercially viable ore reserve.

Even if our property were found to contain a deposit, since we have not put a mineral deposit into production before, we will have to acquire outside expertise. If we are unable to acquire such expertise we may be unable to put our property into production and you may lose your investment.

We have no experience in placing mineral deposit properties into production, and our ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that we will have available to us the necessary expertise when and if we place a mineral deposit into production.

Mineral exploration and development activities are inherently risky and we may be exposed to environmental liabilities. If such an event were to occur it may result in a loss of your investment.

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. The Marawi Claim, our sole property, does not have a known body of commercial ore. Should our mineral claim be found to have commercial quantities of ore, we would be subject to additional risks respecting any development and production activities. Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in extraction operations and the conduct of exploration programs. We do not carry liability insurance with respect to our mineral exploration operations and we may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards.

Even with positive results during exploration, the Marawi Claim might never be put into commercial production due to inadequate tonnage, low metal prices or high extraction costs.

We might be successful, during future exploration programs, in identifying a source of minerals of good grade but not in the quantity, the tonnage, required to make commercial production feasible. If the cost of extracting any minerals that might be found on the Marawi Claim is in excess of the selling price of such minerals, we would not be able to develop the claim. Accordingly even if ore reserves were found on the Marawi Claim, without sufficient tonnage we would still not be able to economically extract the minerals from the claim in which case we would have to abandon the Marawi Claim and seek another mineral property to develop, or cease operations altogether.

Risks Associated with this Offering:

Our sole officer and director will own a substantial amount of our common stock and will have substantial influence over our operations.

Our sole director and officer currently own 14,000,000 shares of common stock representing approximately 100% of our outstanding shares. He has registered for resale 10,000,000 of his shares. Assuming that our sole director and officer sells the 10,000,000 shares he has registered for resale, he will still own 4,000,000 shares of common stock representing approximately 28.6% of our outstanding shares. As a result, he will have the potential to continue to exercise influence over our operations. This concentration of ownership may also have the effect of delaying or preventing a change in control.

Without a public market there is no liquidity for our shares and our shareholders may never be able to sell their shares that would result in a total loss of their investment.

Our common shares are not listed on any exchange or quotation system. There is no market for our shares. Consequently, our shareholder will not be able to sell their shares in an organized market place unless he sells his shares privately. If this happens, our shareholder might not receive a price per share which he might have received had there been a public market for our shares. Once this registration statement becomes effective, it is our intention to apply for a quotation on the OTCBB whereby:

| ● | | We will have to be sponsored by a participating market maker who will file a Form 211 on our behalf since we will not have direct access to the FINRA personnel; and |

| | | |

| ● | | We will not be quoted on the OTCBB unless we are current in our periodic reports filed with the SEC. |

From the date of this prospectus, we estimate that it will take us between twelve to eighteen weeks to be approved for a quotation on the OTCBB. However, we cannot be sure we will be able to obtain a participating market maker or be approved for a quotation on the OTCBB, in which case, there will be no liquidity for the shares of our shareholder.

Even if a market develops for our shares our shares may be thinly traded, with wide share price fluctuations, low share prices and minimal liquidity.

If a market for our shares develops, the share price may be volatile with wide fluctuations in response to several factors, including:

| ● | | Potential investors’ anticipated feeling regarding our results of operations; |

| ● | | Increased competition and/or variations in mineral prices; |

| ● | | Our ability or inability to generate future revenues; and |

| ● | | Market perception of the future of the mineral exploration industry. |

In addition, if our shares are quoted on the OTCBB, our share price may be impacted by factors that are unrelated or disproportionate to our operating performance. Our share price might be affected by general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations. In addition, even if our stock is approved for quotation by a market maker through the OTCBB, stocks traded over this quotation system are usually thinly traded, highly volatile and not followed by analysts. These factors, which are not under our control, may have a material effect on our share price.

We anticipate the need to sell additional treasury share in the future meaning that there will be a dilution to our shareholders resulting in their percentage ownership in the Company being reduced accordingly.

We may seek additional funds through the sale of our common stock. This will result in a dilution effect to our shareholders whereby their percentage ownership interest in the Company is reduced. The magnitude of this dilution effect will be determined by the number of shares we will have to issue in the future to obtain the funds required.

Since our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our shares are "penny stocks" and are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell the Company's securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. For sales of our securities, the broker/dealer must make a special suitability determination and receive from its customer a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder's ability to dispose of his stock.

Glossary of Geological and Technical Terms

The following represents various geological and technical terms used in this prospectus which the reader may not be familiar with.

| Word | Definition |

| | |

| Alteration | Any physical or chemical change to rock or mineral subsequent to its formation. Milder and more localized than metamorphism. |

| | |

| Andesite | Igneous volcanic rock, less mafic than basalt, but more mafic than dacite; rough volcanic equivalent of diorite, composed of andesine feldspar and one or more mafic constituents |

| | |

| Argilllite | A rock derived either from siltstone, claystone or shale, that has undergone a somewhat higher degree of induration than is present in those rocks |

| | |

| Caldera | A large circular volcanic depression, often originating due to collapse. |

| | |

| Chert | A member of a group of sedimentary rocks that consist primarily of microscopic silica crystals. Chert may be either organic or inorganic, but the most common forms are inorganic. |

| | |

| Claim | A portion of mining ground held under the Provincial laws by Pana-Minerales S.A., by virtue of one location and record where it has the mineral rights to all minerals thereon except coal. |

| | |

| Deposit | Mineral deposit or ore deposit is used to designate a natural occurrence of a useful mineral, or an ore, in sufficient extent and degree of concentration to invite exploration. |

| | |

| Geophysical surveys | The exploration of an area in which geophysical properties and relationships unique to the area are mapped by one or more geophysical methods (e.g. VLF-EM or P.E.M.) in boreholes, airborne or satellite platforms. |

| | |

| Granite | Highly felsic igneous plutonic rock, typically light in color; rough plutonic equivalent of rhyolite. Granite is actually quite rare in the U.S.; often the term is applied to any quartz-bearing plutonic rock. |

| | |

| Granodiorite | A group of coarse-grained plutonic rocks intermediate in composition between quartz diorite and quartz monzonite, and potassium feldspar, with biotite, hornblende, or, more rarely, pyroxene, as the mafic component. |

| | |

| Igneous rock | Any rock solidified from molten or partly molten material from far below the Earth’s surface. |

| | |

| Intrusives | A rock mass formed below earth's surface from molten magma which was intruded into a pre-existing rock mass and cooled to a solid. |

| | |

| Metamorphic | The mineralogical, chemical, and structural adjustment of solid rocks to physical and chemical conditions that have generally been imposed at depth below the surface zones of weathering and cementation, and that differ from the conditions under which the rocks in question originated. |

| | |

| Mineralization | Potential economic concentration of commercial metals occurring in nature. |

| | |

| Outcrop | A segment of bedrock exposed to the atmosphere. |

| | |

| Ore | The natural occurring mineral from which a mineral or minerals of economic value can be extracted profitable or to satisfy social or political objectives. |

| | |

| Pvrite | A yellow iron sulphide mineral, normally of little value and sometimes referred to as ‘fool’s gold’. |

| | |

| Pyrrhotite | A bronze colored, magnetic iron sulphide mineral. |

| | |

| Quartz | A common rock-forming mineral consisting of silicon and oxygen. |

| Reserve | (1) That part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve is determined. (2) Proven: Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the site for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. (3) Probable: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Vien | A fissure, fault or crack in rock filled by minerals that have traveled upward from some deep source. |

| | |

| Volcanic rocks | Igneous rocks formed from magma that has flowed out of, or has been violently ejected from, a volcano. |

| | |

| Zone | A belt, band, or strip of earth materials, however disposed; characterized as distinct from surrounding parts by some particular secondary enrichment. |

Foreign Currency and Exchange Rates

Our mineral property is located in the Republic of Philippines and costs expressed in the geological report on the Marawi Claim are expressed in Philippine Pesos. For purposes of consistency and to express United States Dollars throughout this registration statement, Philippine Pesos (“PHP”) have been converted into United States currency at the rate of US $1.00 being approximately equal to PHP 46.67228 or PHP 0.02138 being approximately equal US $1.00 which is the approximate average exchange rate during recent months and which is consistent with the incorporated financial statements.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the Selling Security Holder. We will not receive any proceeds from the sale of shares of common stock in this offering. Pana will pay all expenses of this offering. The estimated cost of $24,852 is summarized below:

| Description of Expenses | Paid to date August 31, 2008 | Future payments | Total Amount |

| | | | |

Accountant – preparation of financial statements as required (1) | $ - | $ 2,048 | $ 2,048 |

Auditors’ examination of financial statements (2) | - | 5,250 | 5,250 |

| Consulting – preparing of Form S-1 | 5,000 | 10,000 | 15,000 |

| Opinion letter from attorney | | 1,500 | 1,500 |

| Photocopying and delivery expenses | | 1,000 | 1,000 |

| SEC filing fees | - | 54 | 54 |

Estimated offering costs | $ 5,000 | $ 19,852 | $ 24,852 |

| (1) | The accountant prepared the working papers for our August 31, 2007 and 2008 financial statements. |

| (2) | The auditors have given an opinion of the August 31, 2008 financial statements included. |

PLAN OF DISTRIBUTION

We are registering on behalf of the Selling Security Holder 10,000,000 shares of our common stock which he owns. The Selling Security Holder may, from time to time, sell all or a portion of the shares of common stock in private negotiated transactions or otherwise. Such sales will be offered at $0.05 per share unless and until the offering price is changed by subsequent amendment to this prospectus or our shares are quoted on the OTCBB. If our shares become quoted on the OTCBB Selling Security Holder may then sell their shares at prevailing market prices or privately negotiated prices.

The common stock may be sold by the Selling Security Holder by one or more of the following methods, without limitation:

| ● | | on the over-the-counter market; |

| ● | | to purchasers directly |

| ● | | in ordinary brokerage transactions in which the broker solicits purchasers; or commissions from a seller/or the purchaser of the shares for whom they may act as agent; |

| ● | | through underwriters, dealers and agents who may receive compensation in the form of underwriting discounts, concessions and commissions from a seller/or the purchaser of the shares for whom they may act as agent; |

| ● | | through the pledge of shares as security for any loan or obligation, including pledges to brokers or dealers who may from time to time effect distribution of the shares or other interest in the shares; |

| ● | | through purchases by a broker or dealer as principal and resale by other brokers or dealers for its own account pursuant to this prospectus; |

| ● | | through block trades in which the broker or dealer so engaged will attempt to sell the shares as agent or as riskless principal but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | | in any combination of one or more of these methods; |

| ● | | in a private transaction; or |

| ● | | in any other lawful manner. |

The Selling Shareholder is an underwriter, within the meaning of Section 2(11) of the Securities Act. Any broker-dealers or agents that participate in the sale of the common stock or interests therein may also be deemed to be an "underwriter" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The Selling Shareholder, who is an "underwriter" within the meaning of Section 2(11) of the Securities Act, is subject to the prospectus delivery requirements of the Securities Act.

The Brokers or dealers may receive commissions or discounts from the Selling Security Holder, if any of the broker-dealer acts as an agent for the purchaser of said shares, from the purchaser in the amount to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with the Selling Security Holder to sell a specified number of the shares of common stock at a stipulated price per share. In connection with such re-sales, the broker-dealer may pay to or receive from the purchasers of the shares, commissions as described above. Any broker or dealer participating in any distribution of the shares may be required to deliver a copy of this prospectus, including any prospectus supplement, to any individual who purchases any shares from or through such broker-dealer.

We have advised the Selling Security Holder that while he is engaged in a distribution of the shares included in this prospectus he is required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the Selling Security Holder, any affiliated purchasers, and any broker-dealer or other person who participates in such distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered in this prospectus.

The Selling Security Holder may also elect to sell his common shares in accordance with Rule 144 under the Securities Act of 1933, rather than pursuant to this prospectus. After the sale of the shares offered by this prospectus the Selling Security Holder, our sole officer and director Hector Francisco Vasquez Davis, will hold directly an aggregate of 4,000,000 shares. The sale of these shares could have an adverse impact on the price of our shares or on any trading market that may develop.

We have not registered or qualified offers and sales of shares of common stock under the laws of any country, other than the United States. To comply with certain states’ securities laws, if applicable, the Selling Security Holder will offer and sell his shares of common stock in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the Selling Security Holder may not offer or sell shares of common stock unless we have registered or qualified such shares for sale in such states or we have complied with an available exemption from registration or qualification.

All expenses of this registration statement, estimated to be $24,852. (see “Use of Proceeds” page 13), including but not limited to legal, accounting, printing and mailing fees will, be paid by Pana. However, any selling costs or brokerage commissions incurred by each Selling Security Holder relating to the sale of his shares will be paid by him.

SELLING SECURITY HOLDER

Hector Francisco Vasquez Davis, our sole director and or officer and the Selling Security Holder, will not be engaged in any selling efforts. The Selling Security Holder is not a registered broker-dealer or an affiliate of a broker-dealer.

The Selling Security Holder has furnished all information with respect to share ownership. The shares being offered are being registered to permit public secondary trading of the shares and the Selling Security Holder may offer all or part of the shares owned for resale from time to time. The Selling Security Holder is under no obligation, however, to sell any shares immediately pursuant to this prospectus, nor is the Selling Security Holder obligated to sell all or any portion of the shares at any time. Therefore, no assurance can be given by Pana as to the number of shares of common stock that will be sold pursuant to this prospectus or the number of shares that will be owned by the Selling Security Holder upon termination of the offering.

The Selling Security Holder is resident in the Republic of Panama. He is offering for sale a total of 10,000,000 shares of common stock of the Company (representing approximately 71.5% of our issued shares). To the best of our knowledge, the Selling Security Holder beneficially owns and has sole voting and investment power over all shares or rights to his shares. We have based the percentage to be sold by the Selling Security Holder on our 14,000,000 shares of common stock outstanding as of the date of this prospectus. Of the 10,000,000 shares offered for sale (being approximately 71.5% of our issued shares) all are offered by the Company’s sole officer and director.

DETERMINATION OF OFFERING PRICE

There is no established public market for our common equity being registered. The offering price of the shares offered by Selling Security Holder should not be considered as an indicator of the future market price of the securities.

The facts considered in determining the offering price were Pana’s financial condition and prospects, its lack of operating history and general conditions of the securities market. The offering price should not be construed as an indication of, and was not based upon, the actual value of Pana. The offering price bears no relationship to Pana’s book value, assets or earnings or any other recognized criteria of value and could be considered to be arbitrary.

The Selling Security Holder is free to offer and sell his common shares at such times and in such manner as he may determine. The types of transactions in which the common shares are sold may include negotiated transactions. Such transactions may or may not involve brokers or dealers. The Selling Security Holder are expected to sell their shares at the offering price of $0.05 per share unless and until our shares are quoted on the OTCBB or the “Pink Sheets” following which Selling Security Holder may sell their shares at the market price. The Selling Security Holder has advised us that he has not entered into agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of the shares. The Selling Security Holder does not have an underwriter or coordinating broker acting in connection with the proposed sale of the common shares. We will pay all of the expenses of the Selling Security Holder, except for any broker dealer or underwriter commissions, which will be paid by the security holder.

BUSINESS DESCRIPTION

Corporate Organization and History Within Last Five years

The Company was incorporated under the laws of the State of Nevada on October 4, 2006 under the name Pana-Minerales S.A. The Company does not have any subsidiaries, affiliated companies or joint venture partners. We have not been involved in any bankruptcy, receivership or similar proceedings since inception nor have we been party to a reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business other than the Marawi Claim. We have no intention of entering into a merger or acquisition and we have a specific business plan to complete exploration work on Marawi Claim. We do not foresee any circumstances that would cause us to alter our current business plan within the next twelve months.

Business Development Since Inception

We raised $14,000 in initial seed capital with which to identify and acquire a mineral property that we consider holds the potential to contain gold and/or silver mineralization.

In February 4, 2008 we purchased, from an unaffiliated third party seller, we purchased a 100% interest in a mineral claim known as Marawi Gold Claim (“Marawi Claim”), consisting of one-9 unit claim block containing 97.4 hectares located near the town of Malaybalay in the Republic of the Philippines. The Marawi Claim is our only mineral property.

On August 31, 2007 Pana closed a private placement pursuant to Regulation S of the Securities Act of 1933, whereby 1,000,000 common shares were sold at the price of $0.001 per share to raise $1,000 and on August 23, 2008 Pana closed a further private placement pursuant to Regulation S of the Securities Act of 1933, whereby 13,000,000 common shares were sold at the price of $0.001 to raise a further $13,000.00 .

In February 2008 we engaged Frank Ngan, P. Geol., to conduct a review and analysis of the Marawi Claim and the previous exploration work undertaken on the property and to recommend a mineral exploration program for the Marawi Claim.

Subject to our ability to raise additional capital, failing which we will have no funds to satisfy our ongoing cash requirement and will have to go out of business, we intend to undertake exploration work on the Marawi Claim. We are presently in the pre-exploration stage and there is no assurance that mineralized material with any commercial value exits on our property. We do not have any ore body and have not generated any revenues from our operations. Our planned exploration work is exploratory in nature.

On November 1, 2008 we formalized, in the form of a Loan Agreement, an arrangement with our President pursuant to which he has advanced $12,898 in cash to the Company as of October 31, 2008 , and will advance a further $27102 on or before August 31, 2009 in order to provide the Company with additional working capital. This loan does not bear interest and has no fixed terms of repayment. However, repayment may be demanded by the President at any time.

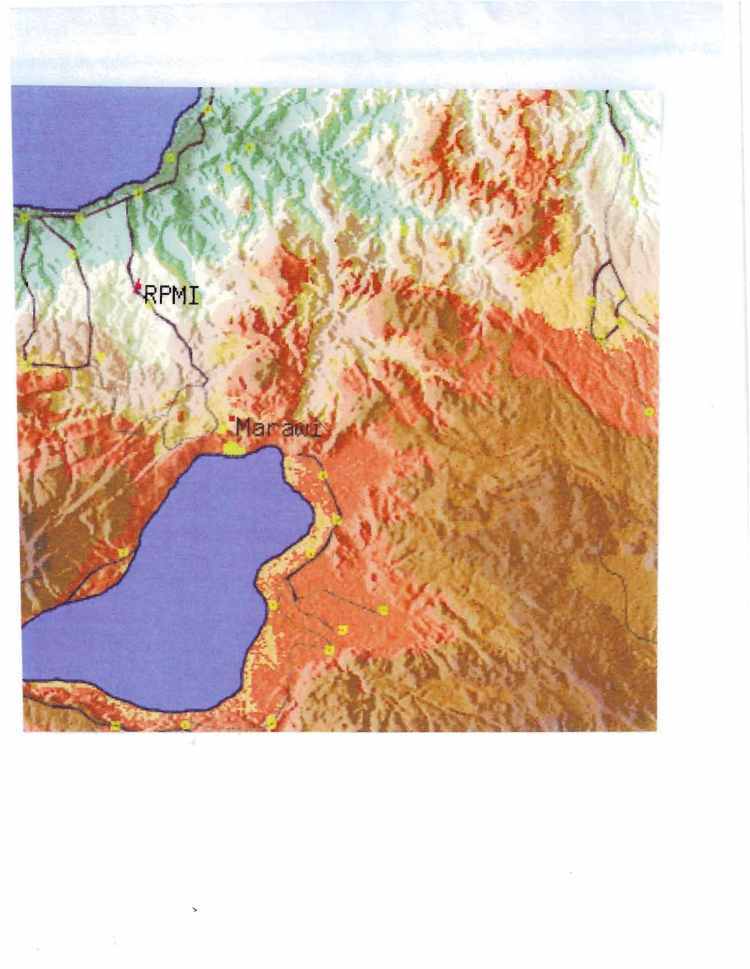

DESCRIPTION OF THE PROPERTY

We are the beneficial owner of a 100% interest in the Marawi Claim, consisting of one-9 unit claim block containing 97.4 hectares located near the town of Malaybalay in the Republic of the Philippines. We do not have any ore body and have not generated any revenues from our operations. Pana acquired the Marawi Claim because the claim area has mineral occurrences similar to those found at the Cotabatto Gold Mine (which has produced 265,000 ounces of gold), located approximately 35 kilometeres to the north of our claim.

Pana is preparing to conduct preliminary exploration work on the Marawi Claim.

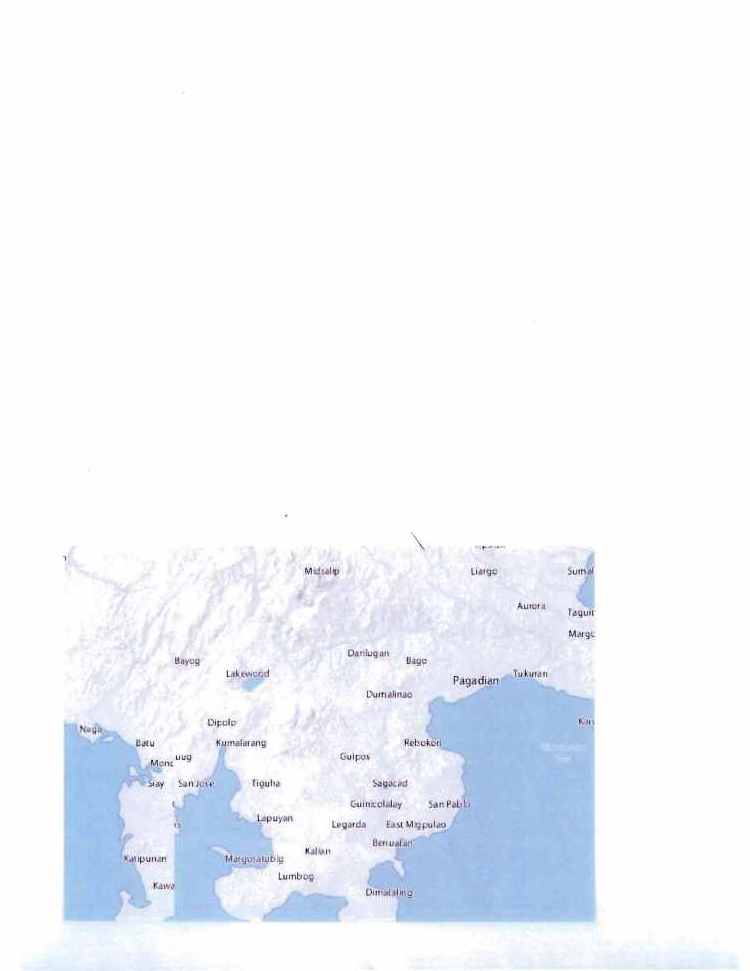

Location and Access

The Marawi Claim is a gold exploration project located approximately 55 kilometers southwest of the city of Malaybalay in the Republic of the Philippines. Access to the claim is via an all-weather government-maintained highway and all-weather gravel road. Malaybalay has an experienced work force and will provide all the necessary services needed for exploration and development operations, including groceries, fuel, helicopter service, hardware and equipment, hospitals and police.

The Marawi Claim is located in an active mining area. There are no known environmental concerns or parks designated within the claim area.

The Marawi Claim is located in the tropical climate zone, which is characterized by high temperatures year-round, high rainfall and lush vegetation. The rainy season is typically October-December. Due to steep terrain and deforested land, the claim can work year-round, including the rainy season.

No electrical power is required at this stage of exploration. Any electrical power that might be required in the foreseeable future could be supplied by gas powered portable generators.

History & Regional Geology

Deposits of shell and eroded sand formed the basis for the limestone, which makes up most of the Philippines. This limestone was, over the ages, pushed upwards, making it possible to today find sea fossils high in the country’s mountains such as those in an around the Mawawi Claim. The island has vast coal, copper and gold reserves mined mainly from the central part of the island. Numerous showings of mineralization have been discovered in the area of the Marawi Claim and six prospects have achieved significant gold production, most notably the Cotabatto Gold Mine (which is in close proximity) mentioned above.

The principal bedded rocks for the area of the Marawi Claim are Precambrian rocks that are exposed along a wide axial zone of a broad complex.

In general the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulphides. These hydrothermal solutions intrude into the older rocks as quartz veins. Recent exploration results for gold occurrences in the vicinity of the Marawi Claim are encouraging. Gold belt in sheared gneissic rocks found in sub parallel auriferous lode zones, where some blocks having 250 to 500 meter length and 1.5 to 2 meter width, could be identified as most promising.

Typically veins form in high-grade dynathermal metamorphic environments where meta-sedimentary belts are invaded by igneous rocks, hosted by paragneisses, quartites clinopyroxenites, wollastonite-rich rocks, pegatites, charockites, granitic and intermediate intrusive rocks, quartz-mica schist and others.

Deposits are from a few millimeters to over a meter thick in places. Individual veins display a wide variety of forms. Mineralization is located within a large fractures block created where the prominent northwest-striking shears intersect the north striking caldera fault zone. (For example, gold at the nearby Cotabatto Gold Mine is generally concentrated within extrusive volcanic rocks in the walls of large volcanic caldera.)

The major lodes cover an area of 2 kilometers and are mostly within 400 meteres of the surface. Lodes occur in three main structural settings:

| (i) | steeply dipping northwest striking shears; |

| (ii) | flat-dipping (1040) fractures (flatmakes); and |

| (iii) | shatter blocks between shears. |

Most of the gold occurs in tellurides and there are also significant quantities of gold in pyrite.

Property Geology

No mineralization has been reported for the area of the Marawi Claim but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

While the area of our claim has been prospected in the past, to the knowledge of our Geologist, Mr. Ngan, such work has not include any drilling of the area covered by the Marawi Claim, nor do the records, which Mr. Ngan has been able to review, indicate that any detailed exploration of the claim area has ever been undertaken.

To the east of the Marawi Claim are intrusives consisting of rocks such as tonalite, monzonite, and gabbro while the property itself is inderlain by sediments and volcanics. The intrusives also consist of a large mass of grandorite towards the western-most point of the claim.

The area consists of interlayered chert, argillite and massive andesitic to basaltic volcanics. The volcanics are hornfelsed and commonly contain minor pyrite and pyrrhotite.

Proposed Exploration Work – Plan of Operation

Mr. Frank Ngan, P. Geol., authored "Summary of Exploration On the Marawi Property, Marawi Philippines” dated February 28, 2008 (the “Ngan Report”). In his report Mr. Ngan observes that the area is:

| - | well known for numerous productive mineral occurrences, including the Cotabatto Gold Mine; |

| - | the area of our claim iss underlain by units of Precambrian rocks found at those other mineral occiurences; |

| - | structures and mineral ization on our claim are associated with all the major mineral occurrences and deposits in the rea; |

| - | mineralization found on the claim is consistent with that found associated with zones of extensive mineralization and past work has been sporadic and limited and has not tested the potential of our claim; and |

| - | potential for significant mineralization to be found on thr Marawi Claim exist and it merits intensive exploration. |

Mr. Ngan has recommended a phased exploration program to evaluate the potential of the Marawi Claim.

Mr. Ngan is a registered Professional Geologist in good standing in the Geological Society of Philippines. He is a graduate of the University of Philippines, with a Bachelor of Science (1978) and Masters (1982) from the same university. Mr. Ngan has practiced his profession as a geologist continuously for over 25 years. He visited the area covered by our claim on February 18-21, 2008.

We must conduct exploration to determine what minerals exist on our property and whether they can be economically extracted and profitably processed. We plan to proceed with exploration of the Marawi Claim by undertaking work recommended in the Ngan Report, in order to begin determining the potential for discovering commercially exploitable deposits of gold on our claim.

We have not discovered any ores or reserves on the Marawi Claim, our sole mineral property. Our planned work is exploratory in nature.

The Ngan Report recommends a two-phase exploration program to further delineate the mineralized system currently recognized on the Marwai Claim, at an estimated total cost of approximately $38,732.

This two-phase program would consist of air photo interpretations of the structures, geological mapping, both regionally and detailed on the area of the main showings; geophysical survey (using both magnetic and electromagnetic instrumentation) in detail over the area of the showings and in a regional reconnaissance survey and geochemical soil surveying regionally to identify other areas on the claim that are mineralized in detail on the known areas of mineralization. Costs are estimated as follows:

| | | | Philippine Pesos | U.S. Dollars |

| Phase I | | Geological mapping | 612,000 | $ 13,082 |

| Phase II | | Geochemical surveying & sampling | 1,200,000 | 25,650 |

| | | Total | 1,812,000 | $ 38,732 |

The purpose of this exploration work is to define and enable the interpretation of a possible (which would be’Phase III’) diamond drill program.

Even if we are able raise the necessary capital and to undertake the work recommended in the Ngan Report and the results of our planned exploration work proves encouraging, there is no assurance we will be able to raise the capital necessary to conduct further exploration work on the Marawi Claim. Furthermore, even if funding is available, additional work will only be undertaken if the results of our planned work is successful in identifying target zones of gold mineralization deemed worthy, by our geologist, of drilling to determine if a gold deposit may exist. Should our initial work prove unsuccessful in identifying such drill targets, the Company will likely abandon the Marawi Claim and we may have to go out of business.

There are no permanent facilities, plants, buildings or equipment on the Marawi Claim.

Competitive Factors

The mining industry is highly fragmented. We are competing with many other exploration companies looking for gold and silver. We are among the smallest exploration companies in existence and are an infinitely small participant in the mining business which is the cornerstone of the founding and early stage development of the mining industry. While we generally compete with other exploration companies, there is no competition for the exploration or removal of minerals from our claims. Readily available markets exist for the sale of gold and silver. Therefore, we will likely be able to sell any gold or silver that we are able to recover, in the event commercial quantities are discovered on the Marawi Claims. There is no ore body on the Marawi Claims.

Government Regulation

Exploration activities are subject to various national, state, foreign and local laws and regulations in the Republic of Philippines, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in the Philippines.

Environmental Regulation

Our exploration activities are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our exploration activities are conducted in material compliance with applicable laws and regulations. Changes to current local, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain exploration activities uneconomic.

Employees

We anticipate using the services of subcontractors to conduct exploration work on our claim. At present, we have no employees as such. Our sole officer and director devotes a portion of his time to the affairs of the Company. Our sole officer and director does not have an employment agreement with us. We presently do not have pension, health, annuity, insurance, profit sharing or similar benefit plans; however, we may adopt such plans in the future. There are presently no benefits available to any employee.

We expect to hiring subcontractors on an ‘as needed’ basis. We have not entered into negotiations or contracts with any of potential subcontractors. We do not intend to initiate negotiations or hire anyone until we are nearing the time of commencement of our planned exploration activities.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

This section of our prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

We are a start-up, pre-exploration stage company. We have a limited operating history and have not yet generated or realized any revenues from our activities. We have yet to undertake any exploration activity on our sole property, the Marawi Claim. As our property is in the early stage of exploration and there is no reasonable likelihood that revenue can be derived from the property in the foreseeable future.

Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay for our operations. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals, if ever. Accordingly, we must raise cash from sources other than the sale of minerals found on the Marawi Claim.

Apart from the remaining loan advances totaling $27,102 agreed to by our President (who is also our sole stockholder) on or before August 31, 2009, our only other source of cash at this time is investment by others in the Company.

Provided our President advances the Company the additional $27,102, we estimate we will have sufficient funds to satisfy our cash requirement to August 31, 2009 only.

Accordingly, in spite of the loans from our President, we will have to raise additional funds within the next twelve months in order to satisfy our cash requirements.

Should our President fail to advance the additional $27,102 we will not have sufficient funds to satisfy our cash requirements and would have to go out of business.

Furthermore, if our President were to exercise his right to demand repayment of his loan we would have no funds to satisfy our cash requirements and would have to go out of business.

Moreover, we must raise additional cash to implement further exploration work on the Marawi Claim and stay in business.

Accordingly, we will have to raise additional funds within the next twelve months in order to satisfy our cash requirements.

If we cannot raise additional funds will not have sufficient funds to satisfy our cash requirements and would have to go out of business.

Moreover, we must raise additional cash to implement further exploration work on the Marawi Claim and stay in business.

Since our business activity is related solely to the exploration and evaluation of the Marawi Claim, it is the opinion of management that the most meaningful financial information relates primarily to current liquidity and solvency. As at August 31, 2008, we had no working capital.

Our future financial success will be dependent on the success of the exploration work on the Marawi Claim. Such exploration may take years to complete and future cash flows, if any, are impossible to predict at this time. The realization value from any mineralization which may be discovered by us is largely dependent on factors beyond our control such as the market value of metals produced, mining regulations in the Philippines and foreign exchange rates.

Liquidity and Capital Resources

Since inception to October 31, 2008 we have raised capital through private placements of common stock aggregating $14,000 with our sole officer, director and shareholder, Hector Francisco Vasquez Davis. In addition Mr. Davis had advanced loan capital of $12,898 as of October 31, 2008, out of a total of $40,000 he has agreed to advance to the Company on or before Augsut 31, 2009.

We currently have no working capital and we will have to draw down additional funds from the loan facility provided by our President and/or raise capital from other sources within the next twelve months, and in order to satisfy our cash requirements.

As of August 31, 2008 our total assets were $Nil and our total liabilities were $7,610 including $194 to our sole director.

Our capital commitments for the coming nine months consist of administrative expenses together with expenses associated with the completion of our planned exploration program. Including this exploration work, we estimate that we will have to incur the following expenses during the next nine months:

| Expenses | Amount | Description |

| | | |

| Accounting | $ 5,500 | Fees to the independent accountant for preparing the quarterly and annual working papers for the financial statements for the calendar year ended 2009. |

| Audit | 8,000 | Review of the quarterly financial statements and audit of the annual financial statements. |

| Consulting and legal fees | 10,000 | Balance of fees related to the preparation of this registration statement. |

| Exploration | 13,082 | Per Ngan Report |

| Filing fees | 200 | Annual fee to the Secretary of State for Nevada |

| Office | 1,000 | Photocopying, delivery and fax expenses |

| Transfer agent’s fees | 1,500 | Annual fee of $500 and estimated miscellaneous charges of $1,000 |

| Estimated expenses | $ 39,282 | |

Since our initial share issuances, the Company has been unable to raise additional cash apart from the $40,000 loan facility provided by our President. As noted as above, of October 31, 2008 our President had advanced $12,898 under the loan facility to defray some of the expense noted above, and he has agreed to advance up to an additional $27,102 on or before August 31, 2009, which funds we estimate will be sufficient to satisfy the estimated expenses enumerated in the table above.

We have no plant or significant equipment to sell, nor are we going to buy any plant or significant equipment during the next twelve months. We will not buy any equipment until we have located a body of ore and we have determined it is economical to extract the ore from the land.

We may attempt to interest other companies to undertake exploration work on the Marawi Claim through joint venture arrangement or even the sale of part of the Marawi Claim. Neither of these avenues has been pursued as of the date of this prospectus.

Our engineer has recommended an exploration program for the Marawi Claim. However, even if the results of this work suggest further exploration work is warranted, we do not presently have the requisite funds and so will be unable to complete anything beyond the exploration work recommended in the Ngan Report until we raise more money or find a joint venture partner to complete the exploration work. If we cannot find a joint venture partner and do not raise more money, we will be unable to complete any work beyond the exploration program recommended by our engineer. If we are unable to finance additional exploration activities, we do not know what we will do and we do not have any plans to do anything else.

We do not intend to hire any employees at this time. All of the work on the Marawi Claim will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for supervision, surveying, exploration, and excavation. We may engage a geologist to assist in evaluating the information derived from the exploration and excavation including advising us on the economic feasibility of removing any mineralized material we may discover.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance as an exploration corporation. We are a pre-exploration stage company and have not generated any revenues from our exploration activities. Further, we have not generated any revenues since our formation on October 4, 2006. We cannot guarantee we will be successful in our exploration activities. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we must invest into the exploration of our property before we start production of any minerals we may find. We must obtain equity or debt financing to provide the capital required to fully implement our phased exploration program. We have no assurance that financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to commence, continue, develop or expand our exploration activities. Even if available, equity financing could result in additional dilution to existing shareholder.

Results of Operations – Year Ended August 31, 2008.

We incurred a net loss of $17,670 (2007: $3,940) for the year ended August 31, 2008, resulting in a loss per share of $0.013 (2007: $0.004). The loss was attributable to an aggregate of administrative expenses of $10,827, $1,843 in exploration expenses and $5,000 for acquisition of the Marawi Claim.

Our Planned Exploration Program

We must conduct exploration to determine what, if any, amounts of minerals exist on the Marawi Claim and if such minerals can be economically extracted and profitably processed.

Our planned exploration program is designed to efficiently explore and evaluate our property.

Our anticipated exploration costs for Phase I work on the Marawi Claim are approximately $13,082. This figure represents the anticipated cost to us of completing only Phase I work recommended in the Ngan Report. With funds to be advanced by our President under the loan facility he has agreed to provide, we will have funds available to undertake Phase I exploration work. However, should the results of this work be sufficiently encouraging to justify our undertaking Phase II work recommended in the Ngan Report, at an estimated cost of $25,650, we will have to raise additional investment capital. Regardless, we will have to raise additional funds within the next twelve months in order to satisfy our ongoing cash requirements and finance anything beyond Phase I work on the Marawi Claim.

Balance Sheet

Total cash as at August 31, 2008 and August 31, 2007 were respectively $Nil and $Nil. Our working capital deficiency as at August 31, 2008 and August 31, 2007 were respectively $(7,510) and $(2,940).

Our lack of working capital since inception (October 4, 2006) and for the years ended August 31, 2007 and 2008 is attributable to our incurring administrative and exploration expenses aggregating $17,670 for the year ended August 31, 2008 and $3,940 for the year ended August 31, 2007. Our working capital was derived from the completion of an initial seed capital offering on August 31, 2007 which raised $1,000 and a private placement completed on August 23, 2008 which raised a further $13,000. No revenue was generated during these periods.

Total shareholder’s equity (deficit) as at August 31, 2008 was ($7,610) versus ($2,940) as at August 31, 2007. Total shares outstanding as at August 31, 2008 were 14,000,000.

Trends

We are in the pre-explorations stage, have not generated any revenue and have no prospects of generating any revenue in the foreseeable future. We are unaware of any known trends, events or uncertainties that have had, or are reasonably likely to have, a material impact on our business or income, either in the long term of short term, other than as described in this section or in ‘Risk Factors’, page xxx

Critical Accounting Policies

Our discussion and analysis of its financial condition and results of operations, including the discussion on liquidity and capital resources, are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, management re-evaluates its estimates and judgments.

The going concern basis of presentation assumes we will continue in operation throughout the next fiscal year and into the foreseeable future and will be able to realize our assets and discharge our liabilities and commitments in the normal course of business. Certain conditions, discussed below, currently exist which raise substantial doubt upon the validity of this assumption. The financial statements do not include any adjustments that might result from the outcome of the uncertainty.

Our intended exploration activities are dependent upon our ability to obtain third party financing in the form of debt and equity and ultimately to generate future profitable exploration activity or income from its investments. As of the date of this registration statement we have not generated revenues, and have experienced negative cash flow from minimal exploration activities. We may look to secure additional funds through future debt or equity financings. Such financings may not be available or may not be available on reasonable terms.

MANAGEMENT