1 TRISTATE CAPITAL | INVESTOR PRESENTATION TriState Capital Holdings, Inc. (NASDAQ: TSC) Fourth Quarter Ended December 31, 2020 Investor Presentation

2 TRISTATE CAPITAL | INVESTOR PRESENTATION Important Information Financial information and data: Unless noted otherwise herein, income statement data is for the trailing twelve-months ended December 31, 2020, compared to the same TTM period the year prior; and balance sheet data is as of December 31, 2020 compared to one year prior. Forward looking statements: This presentation may contain “forward- looking” statements. Such forward-looking statements are subject to risks that could cause actual results or outcomes to differ materially from those currently anticipated. TriState Capital has no duty to, and does not intend to, update or revise forward-looking statements after the date on which they are made. For further information about the factors that could affect TriState Capital’s future results, please see the company’s most recent annual and quarterly reports filed on Form 10-K and Form 10-Q. Non-GAAP measures: To the extent non-GAAP financial measures are presented herein, comparable GAAP measures and reconciliations can be found in TriState Capital’s most recent quarterly financial results news release. About this presentation

3 TRISTATE CAPITAL | INVESTOR PRESENTATION Why TSC Branchless, scalable and capital efficient model Premier private banking, commercial banking and niche investment management products and services to sophisticated corporate, institutional and high-net-worth clients Truly exceptional asset quality Unique and high quality lending relationships result in peer and industry leading asset quality metrics that keep credit costs low Fully organic revenue and balance sheet growth in 2020 with no PPP or mortgage lending Key Metrics ($000s) TTM at 12/31/20 Annual Growth Revenue1 $191,201 7% Deposits $8,489,089 28% Loans $8,237,418 25% AUM $10,263,000 6% Bank efficiency ratio 55.57% NPLs/ total loans 0.12% NCOs/ average loans —% 1 Non-GAAP financial metric reconciled on slide 36.

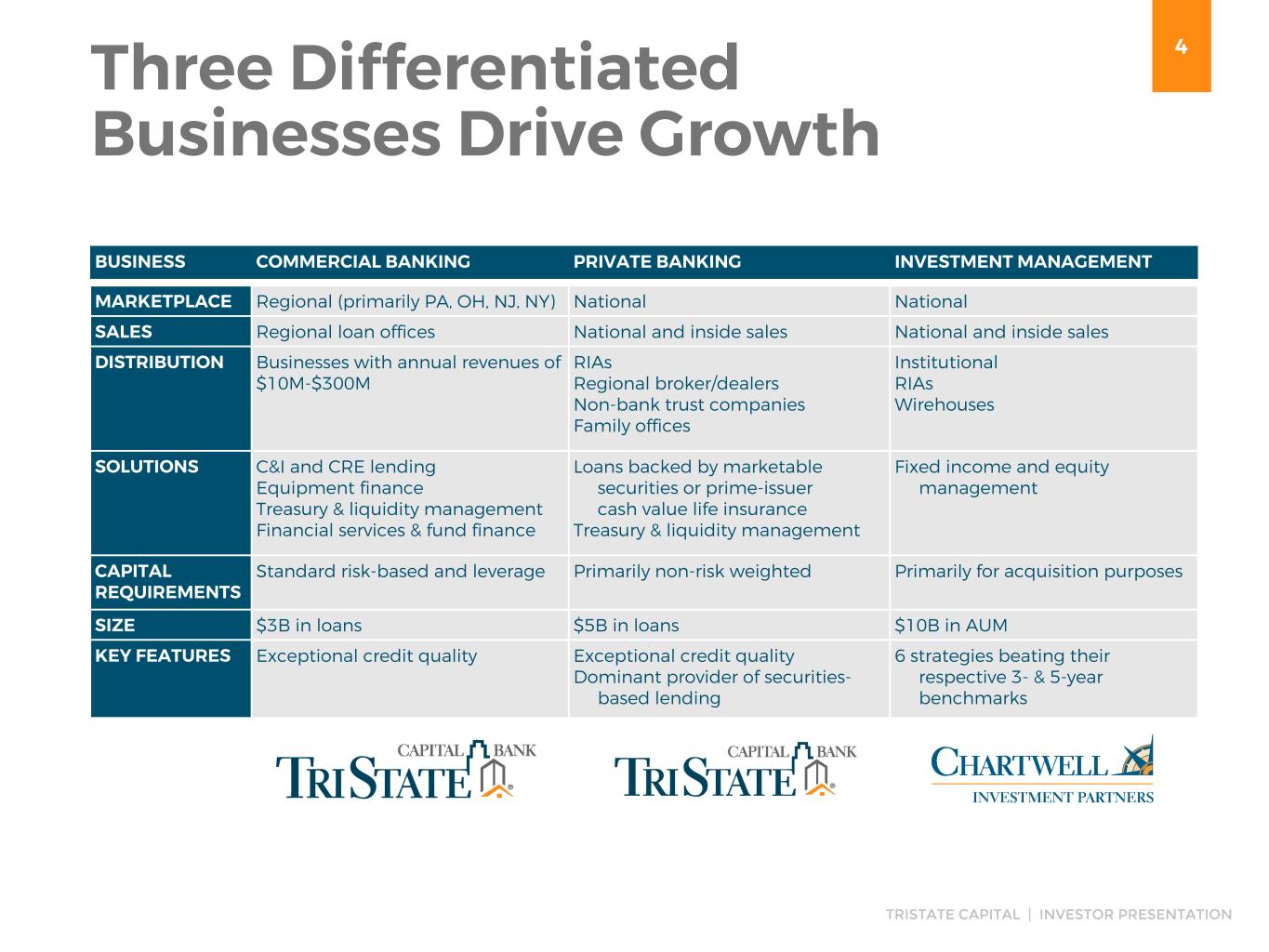

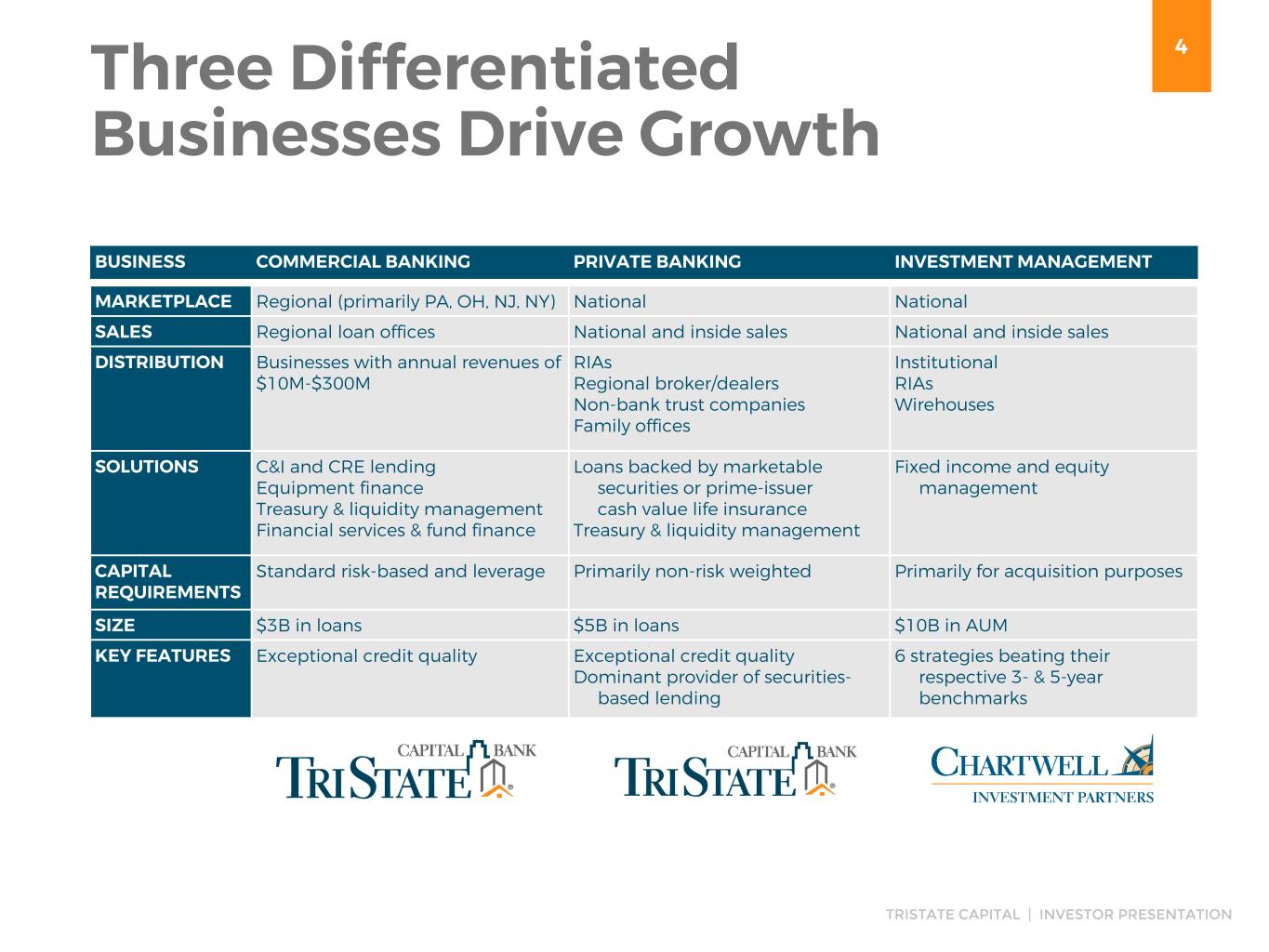

4 TRISTATE CAPITAL | INVESTOR PRESENTATION Three Differentiated Businesses Drive Growth BUSINESS COMMERCIAL BANKING PRIVATE BANKING INVESTMENT MANAGEMENT MARKETPLACE Regional (primarily PA, OH, NJ, NY) National National SALES Regional loan offices National and inside sales National and inside sales DISTRIBUTION Businesses with annual revenues of $10M-$300M RIAs Regional broker/dealers Non-bank trust companies Family offices Institutional RIAs Wirehouses SOLUTIONS C&I and CRE lending Equipment finance Treasury & liquidity management Financial services & fund finance Loans backed by marketable securities or prime-issuer cash value life insurance Treasury & liquidity management Fixed income and equity management CAPITAL REQUIREMENTS Standard risk-based and leverage Primarily non-risk weighted Primarily for acquisition purposes SIZE $3B in loans $5B in loans $10B in AUM KEY FEATURES Exceptional credit quality Exceptional credit quality Dominant provider of securities- based lending 6 strategies beating their respective 3- & 5-year benchmarks

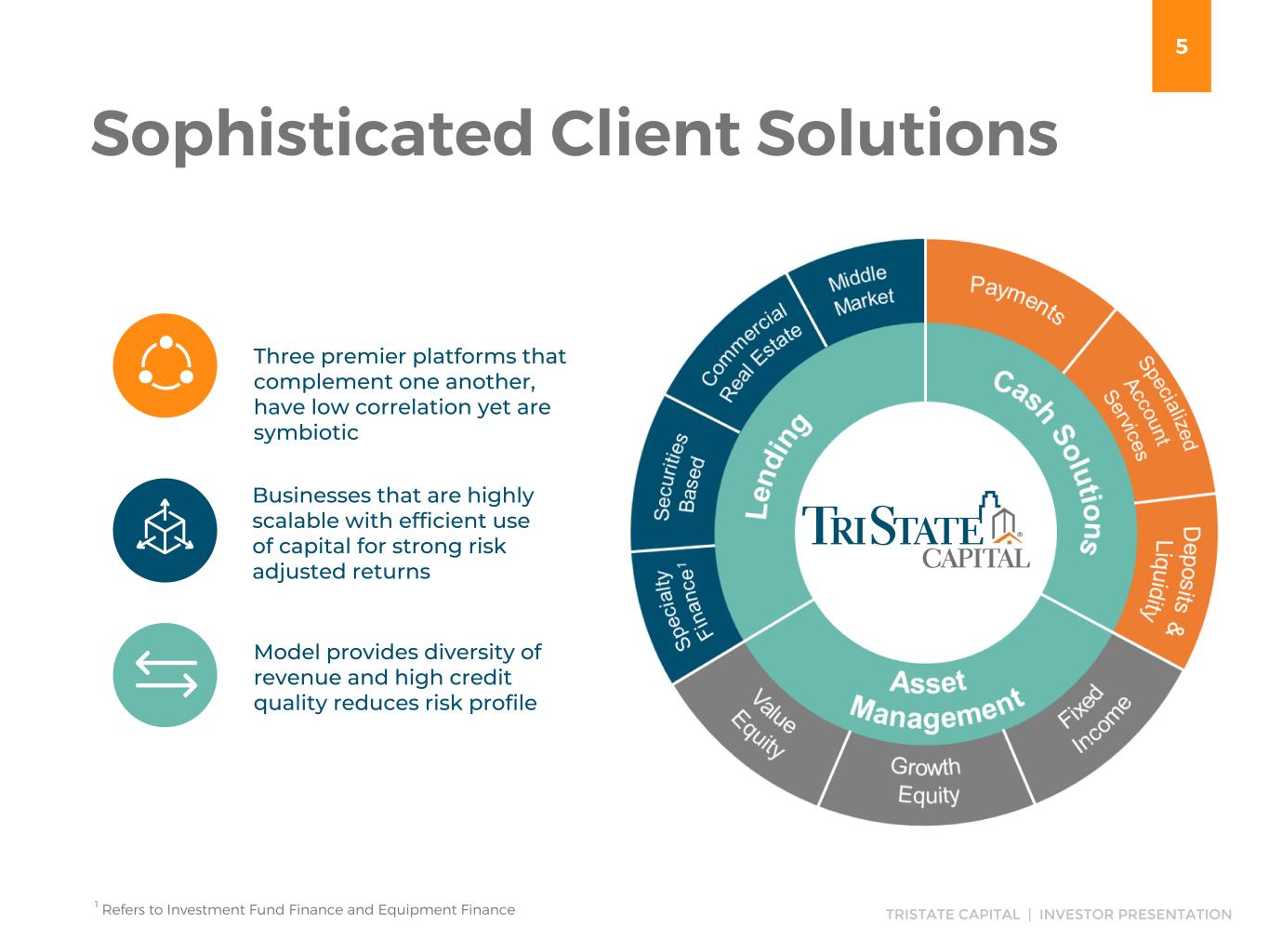

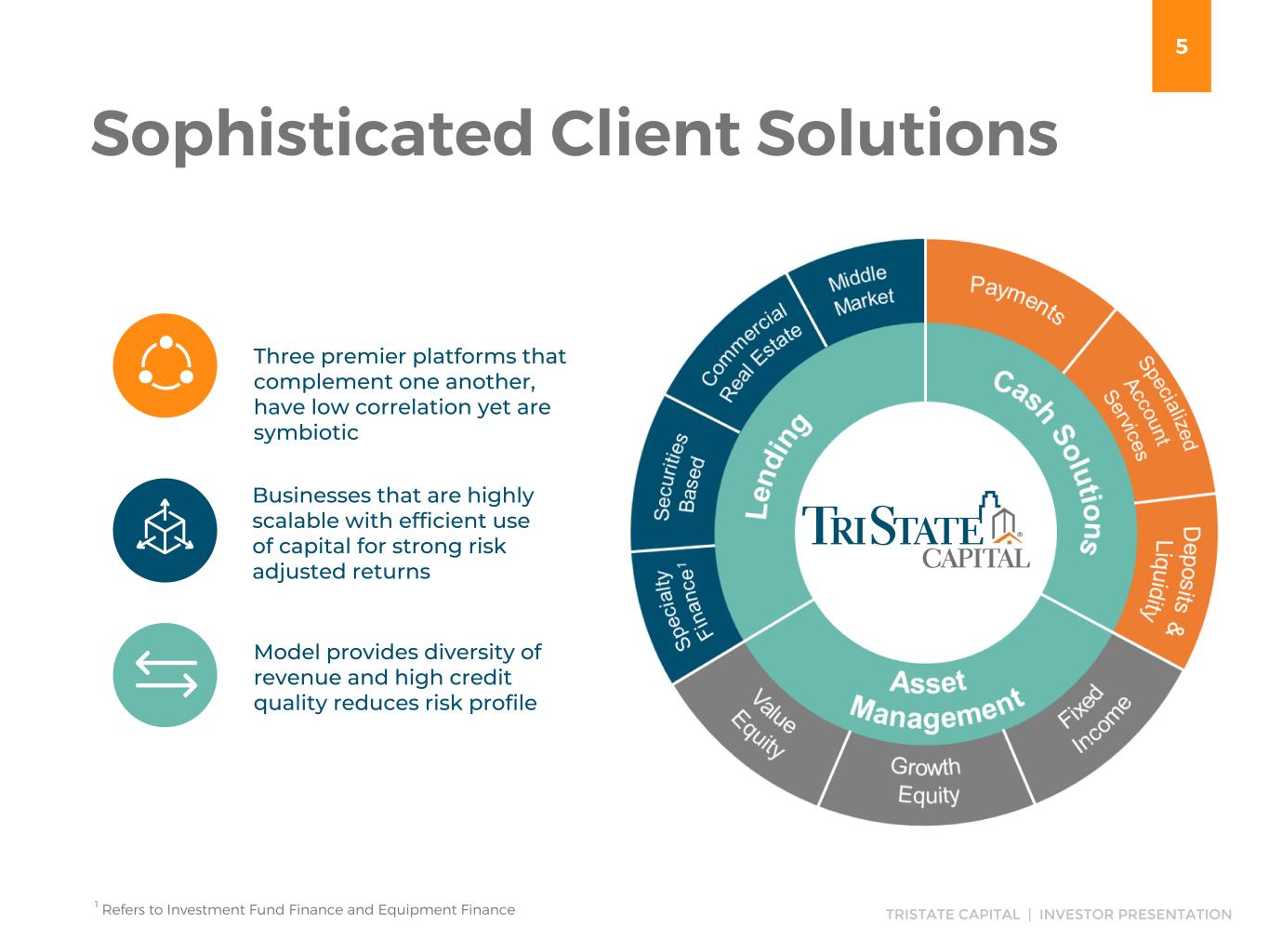

5 TRISTATE CAPITAL | INVESTOR PRESENTATION Sophisticated Client Solutions Businesses that are highly scalable with efficient use of capital for strong risk adjusted returns Model provides diversity of revenue and high credit quality reduces risk profile Three premier platforms that complement one another, have low correlation yet are symbiotic 1 1 Refers to Investment Fund Finance and Equipment Finance

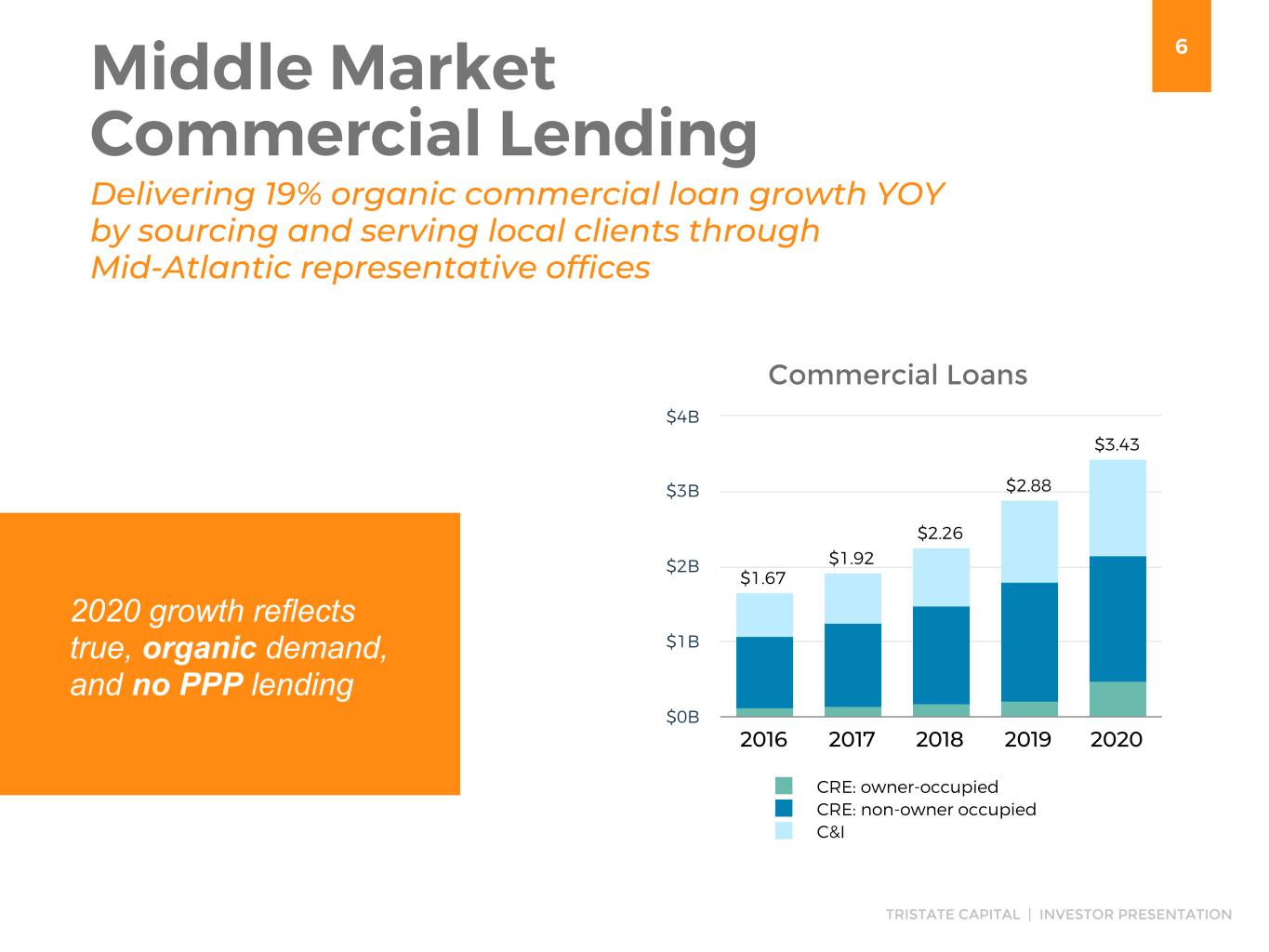

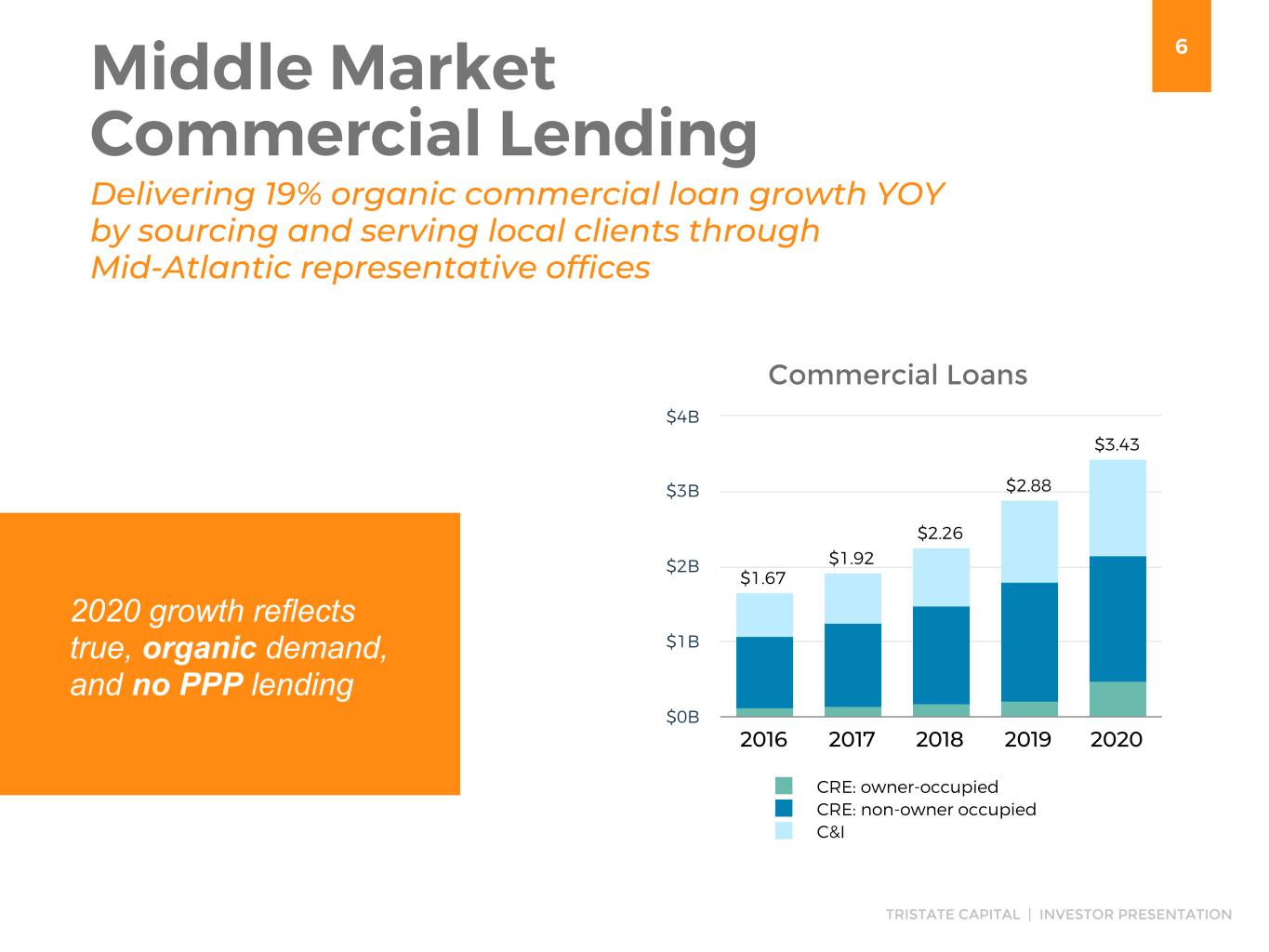

6 TRISTATE CAPITAL | INVESTOR PRESENTATION Middle Market Commercial Lending Delivering 19% organic commercial loan growth YOY by sourcing and serving local clients through Mid-Atlantic representative offices 2020 growth reflects true, organic demand, and no PPP lending B ill io ns Commercial Loans $1.67 $1.92 $2.26 $2.88 $3.43 CRE: owner-occupied CRE: non-owner occupied C&I 2016 2017 2018 2019 2020 $0B $1B $2B $3B $4B

7 TRISTATE CAPITAL | INVESTOR PRESENTATION 26% 25%16% 16% 17% Western PA Eastern PA Ohio New Jersey New York 31% 15% 22% 9% 5% 4% 14% Finance and Insurance Service Real estate Manufacturing Information Transportation All others 49% 10% 21% 1% 19% Non-owner-occupied Owner-occupied Multifamily/apartment Land Development Construction In-market relationships and diversified across industries, property type and geographies Middle Market Commercial Lending Commercial Loans $3.43B C&I Loans $1.27B CRE Loans $2.16B

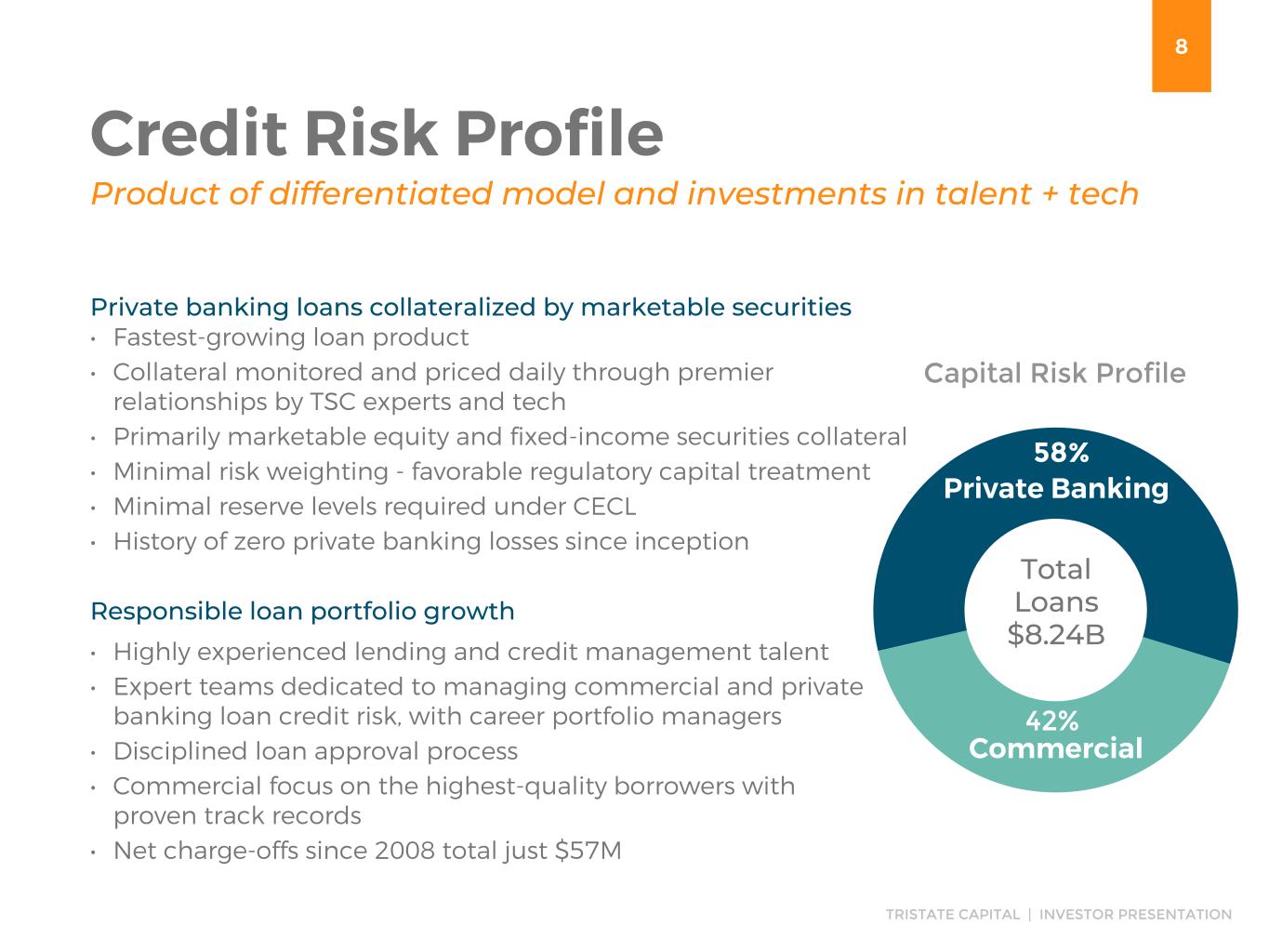

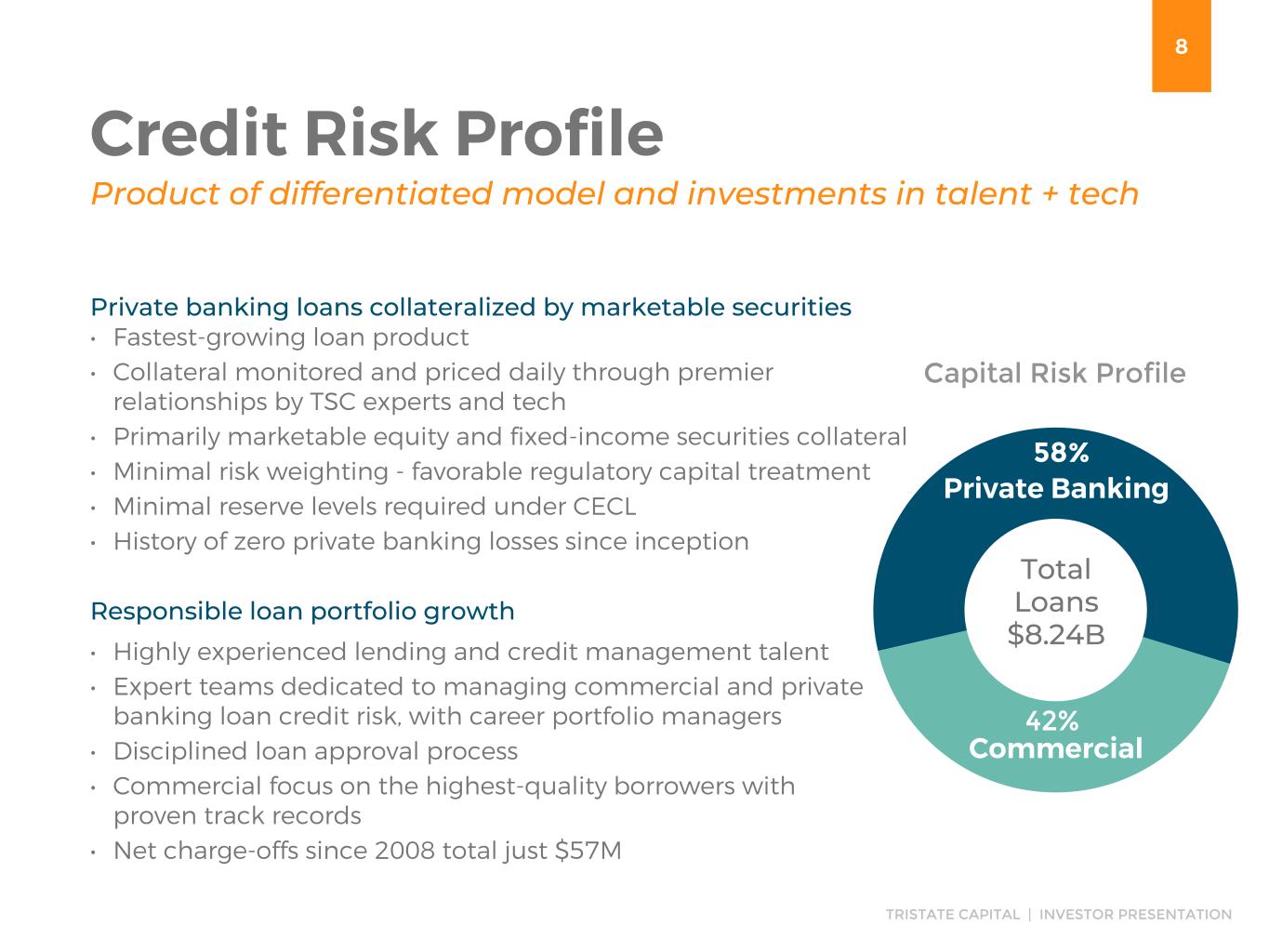

8 TRISTATE CAPITAL | INVESTOR PRESENTATION Private banking loans collateralized by marketable securities • Fastest-growing loan product • Collateral monitored and priced daily through premier relationships by TSC experts and tech • Primarily marketable equity and fixed-income securities collateral • Minimal risk weighting - favorable regulatory capital treatment • Minimal reserve levels required under CECL • History of zero private banking losses since inception Capital Risk Profile 58% 42% Credit Risk Profile Responsible loan portfolio growth • Highly experienced lending and credit management talent • Expert teams dedicated to managing commercial and private banking loan credit risk, with career portfolio managers • Disciplined loan approval process • Commercial focus on the highest-quality borrowers with proven track records • Net charge-offs since 2008 total just $57M Product of differentiated model and investments in talent + tech Total Loans $8.24B Private Banking Commercial

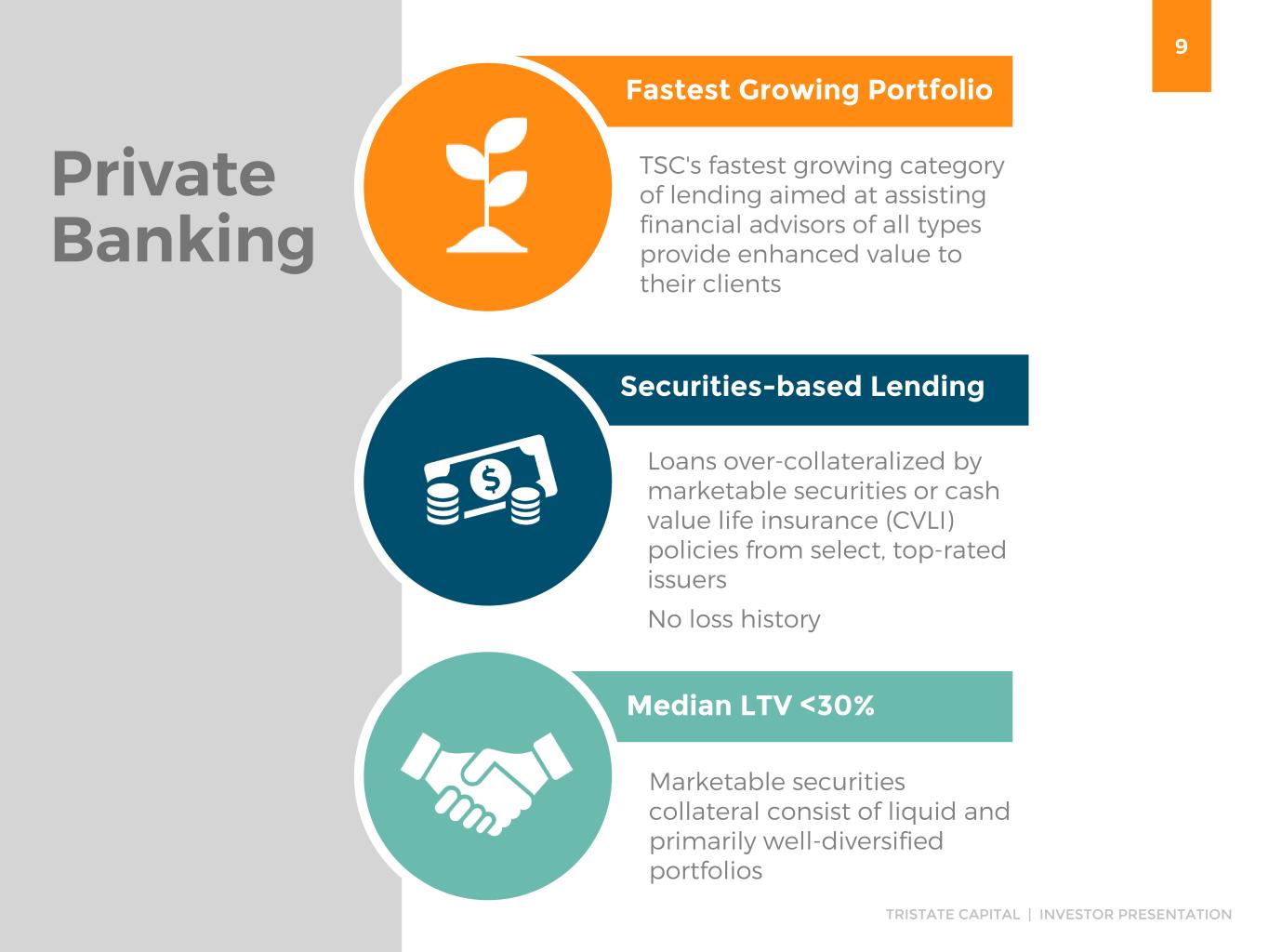

9 TRISTATE CAPITAL | INVESTOR PRESENTATION Fastest Growing Portfolio Median LTV <30% Securities-based Lending Marketable securities collateral consist of liquid and primarily well-diversified portfolios Private Banking Loans over-collateralized by marketable securities or cash value life insurance (CVLI) policies from select, top-rated issuers No loss history TSC's fastest growing category of lending aimed at assisting financial advisors of all types provide enhanced value to their clients

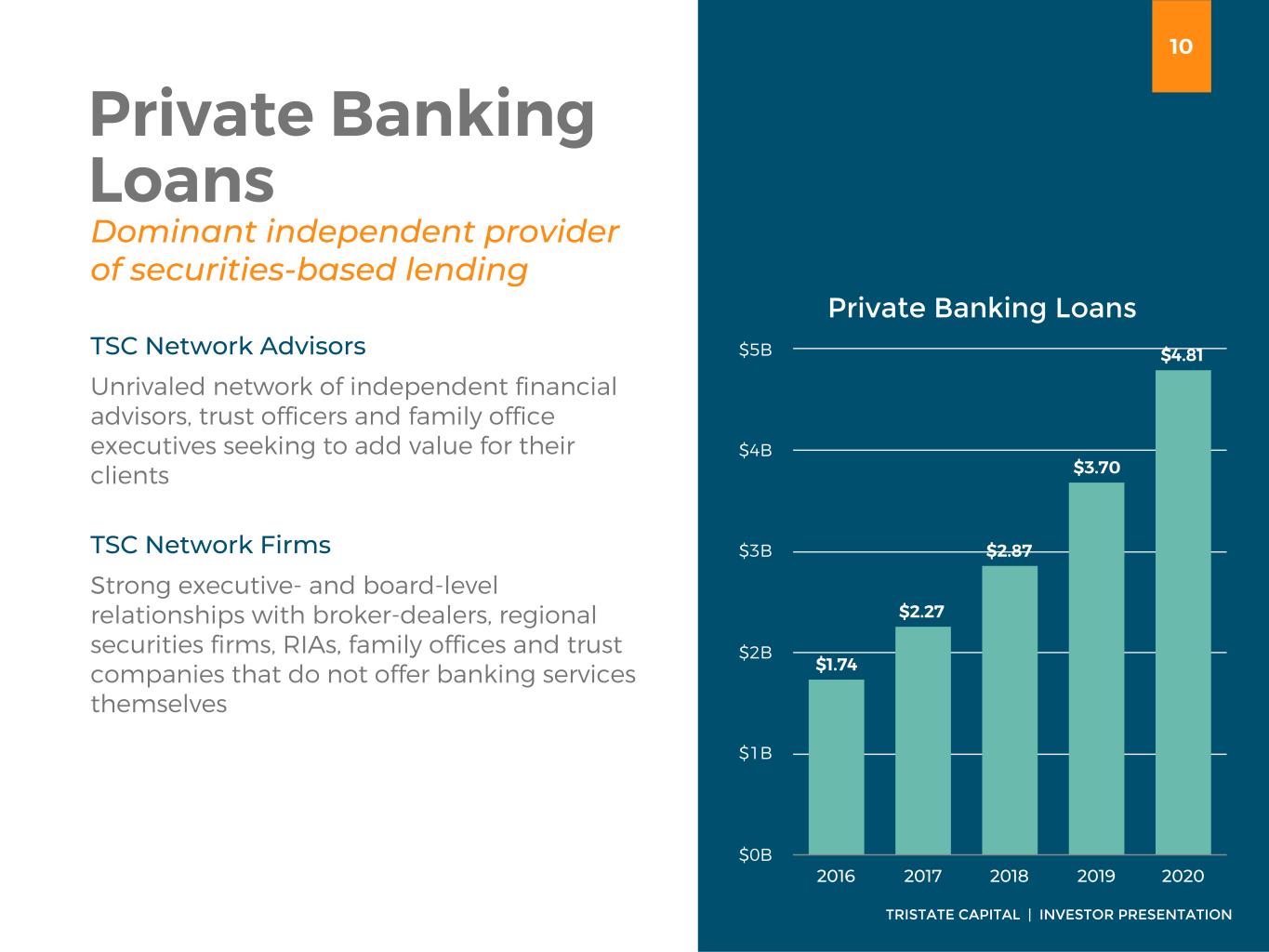

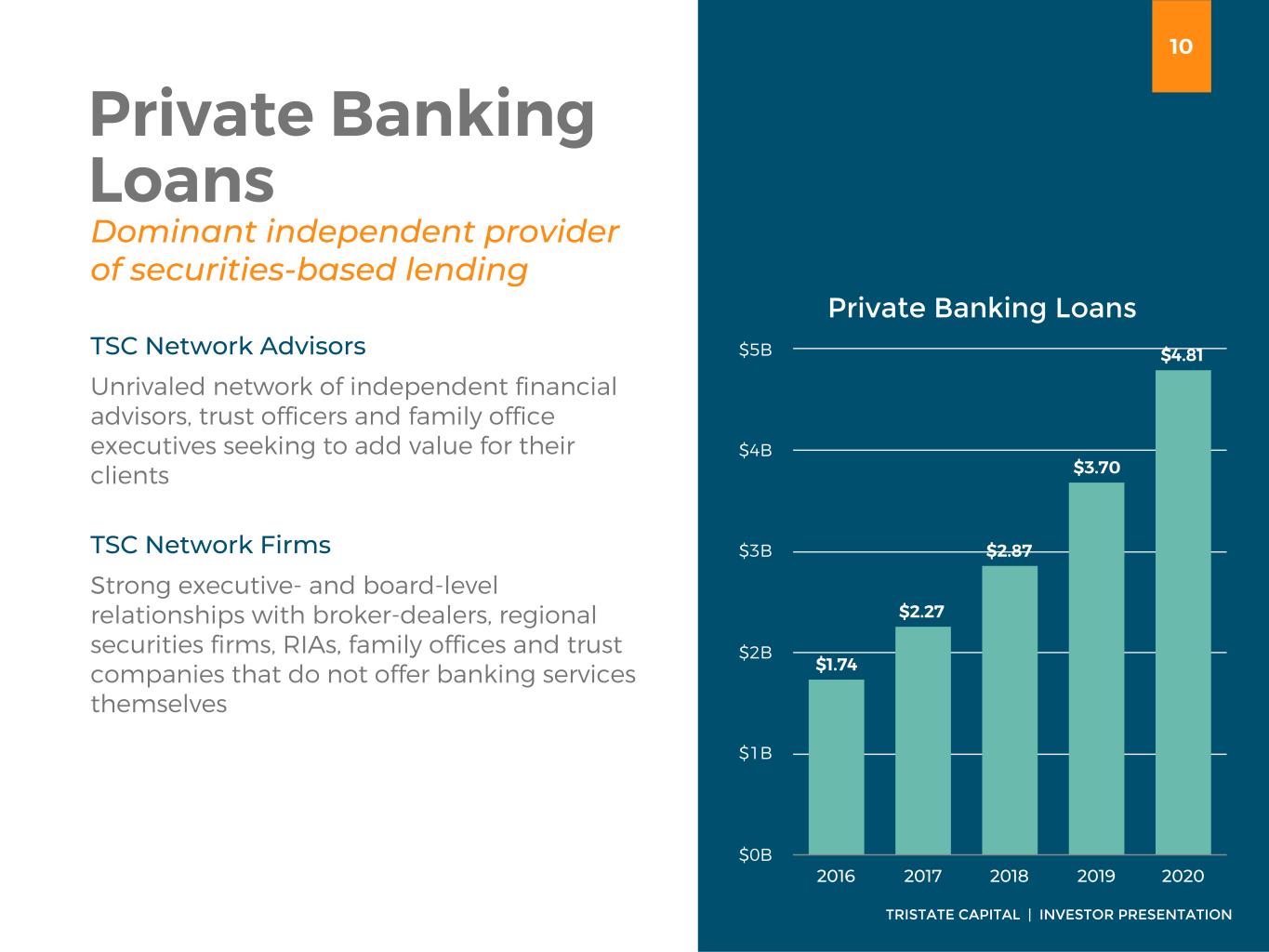

10 TRISTATE CAPITAL | INVESTOR PRESENTATION Private Banking Loans TSC Network Advisors Unrivaled network of independent financial advisors, trust officers and family office executives seeking to add value for their clients TSC Network Firms Strong executive- and board-level relationships with broker-dealers, regional securities firms, RIAs, family offices and trust companies that do not offer banking services themselves Dominant independent provider of securities-based lending Private Banking Loans $1.74 $2.27 $2.87 $3.70 $4.81 2016 2017 2018 2019 2020 $0B $1B $2B $3B $4B $5B

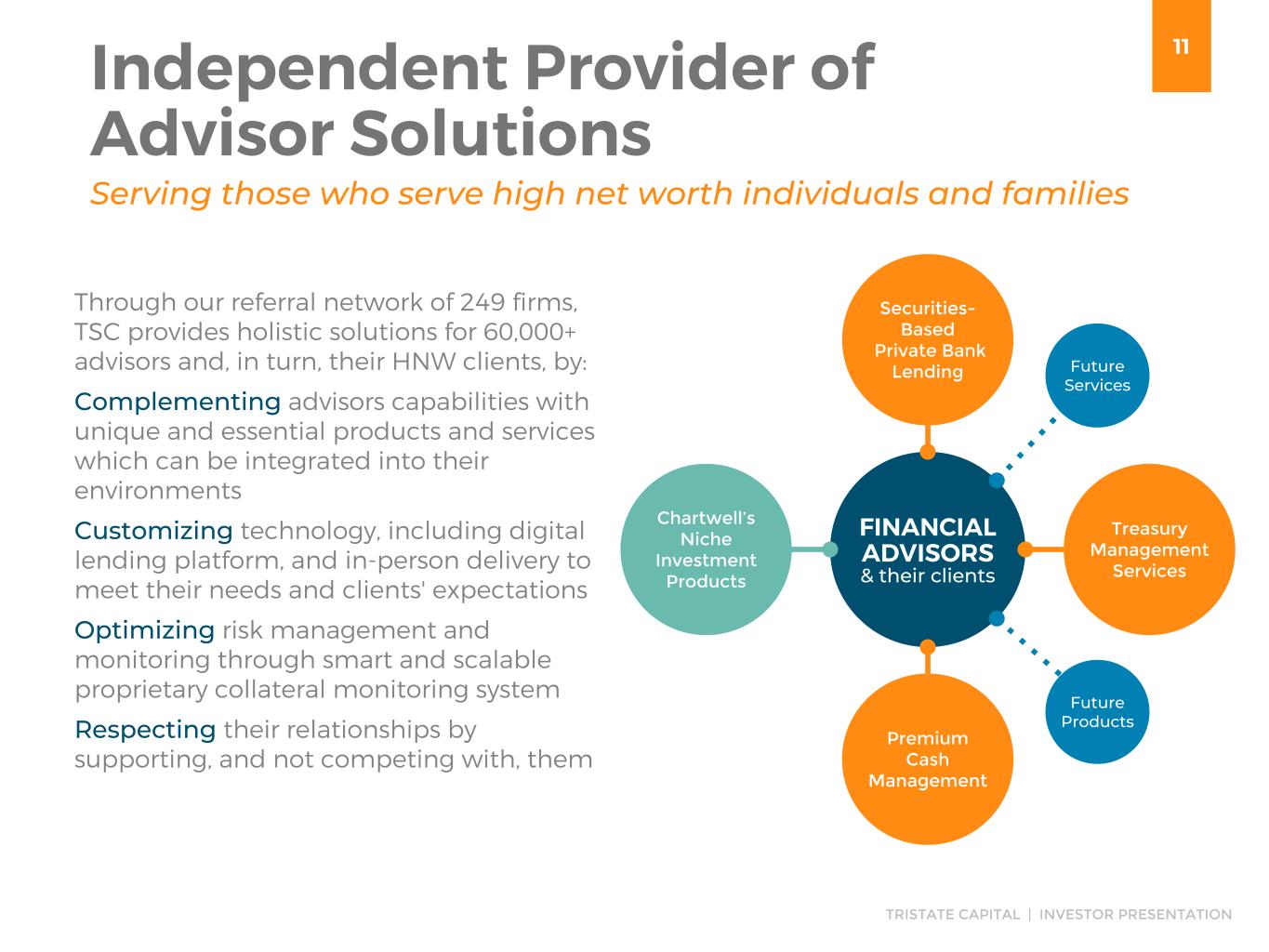

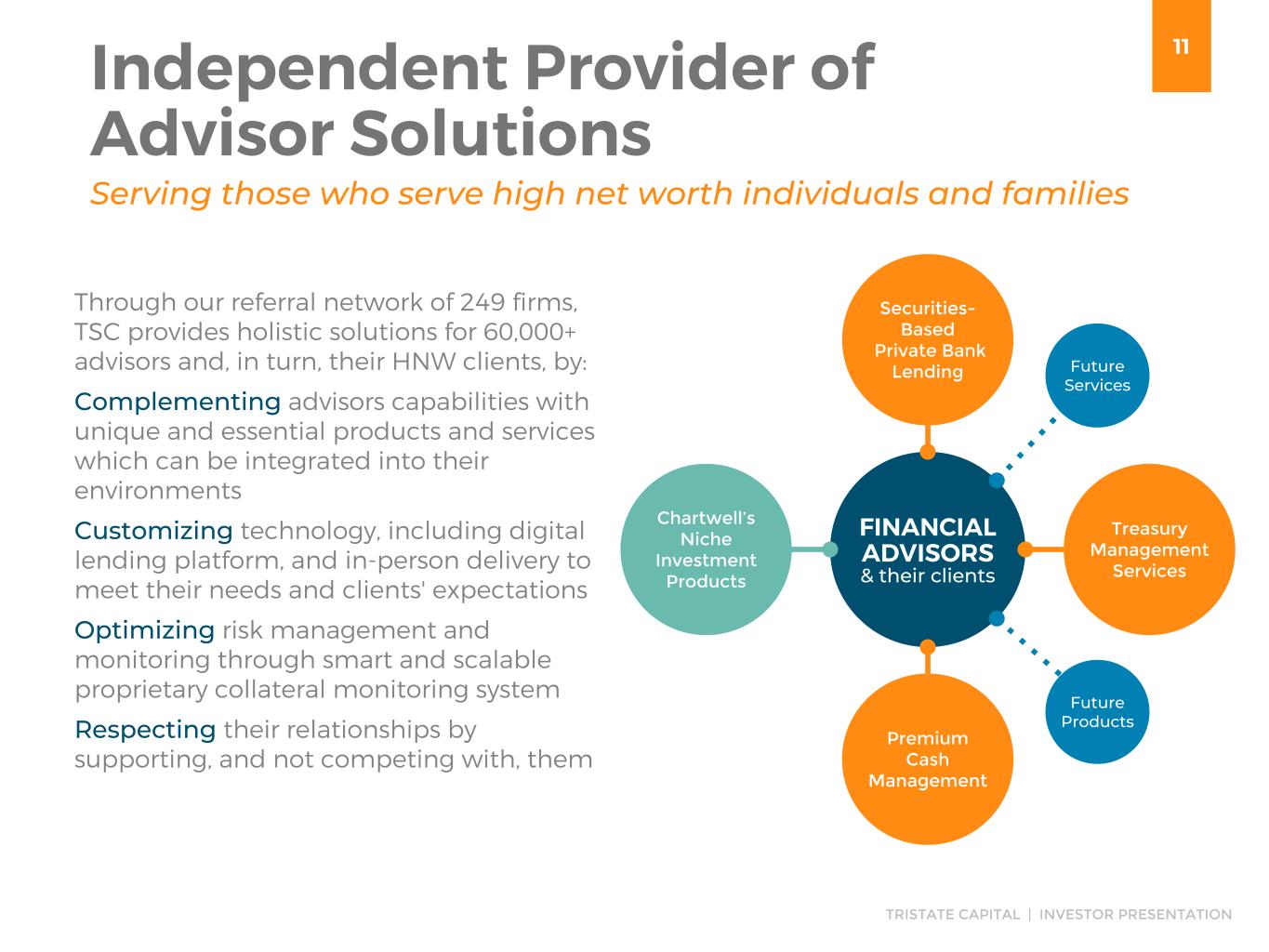

11 TRISTATE CAPITAL | INVESTOR PRESENTATION FINANCIAL ADVISORS & their clients Independent Provider of Advisor Solutions Serving those who serve high net worth individuals and families Through our referral network of 249 firms, TSC provides holistic solutions for 60,000+ advisors and, in turn, their HNW clients, by: Complementing advisors capabilities with unique and essential products and services which can be integrated into their environments Customizing technology, including digital lending platform, and in-person delivery to meet their needs and clients' expectations Optimizing risk management and monitoring through smart and scalable proprietary collateral monitoring system Respecting their relationships by supporting, and not competing with, them Chartwell’s Niche Investment Products Securities- Based Private Bank Lending Future Products Treasury Management Services Premium Cash Management Future Services

12 TRISTATE CAPITAL | INVESTOR PRESENTATION Investment Strategies 22% 6% 55% 14% Value Equity Growth Equity Conservative Allocation Fixed Income Large Cap Equity Distribution Channels 73% 7% 9% 11% Institutional Subadvisory Mutual Funds Advisory Services/ Managed Accounts Chartwell Investment Partners 50+ person boutique asset manager located outside of Philadelphia offering equity and fixed income strategies $10.26B AUM Augmenting institutional inflows while building strong Advisory Services momentum: Advisory Services up to 20% in MRQ from 8% when Chartwell was acquired in 2014 $10.26B AUM 3%

13 TRISTATE CAPITAL | INVESTOR PRESENTATION Investment Performance Investment management fees provide significant income diversification, generating over 16% of total revenue1 and over 60% of non-interest income2 Strong investment performance contributed to positive net inflows of $152M in 2020 and new-business pipeline commitments of $115M from institutional investors at year end Continue to leverage distribution synergies to expand Advisor Services capabilities Chartwell's strategies provide strong risk-adjusted returns through active management 1 TTM data. Non-GAAP financial metric reconciled on slide 36. 2 Non-interest income excludes net gains on the sale of debt securities. 3 Strategies outperforming their respective benchmarks for the 3 and 5 years ended December 31, 2020 shown in white font. strategies outperforming their respective benchmarks for 3 and 5 years3 EQUITY ORIENTED STRATEGIES Small Cap Value Smid Value Mid Cap Value Small Cap Growth Large Cap Growth Dividend Value Covered Call Intermediate High Grade Core High Grade Core Plus High Yield Short Duration BB- Rated High Yield Short Duration High Grade Corporate FIXED INCOME ORIENTED STRATEGIES Chartwell Income Fund 6

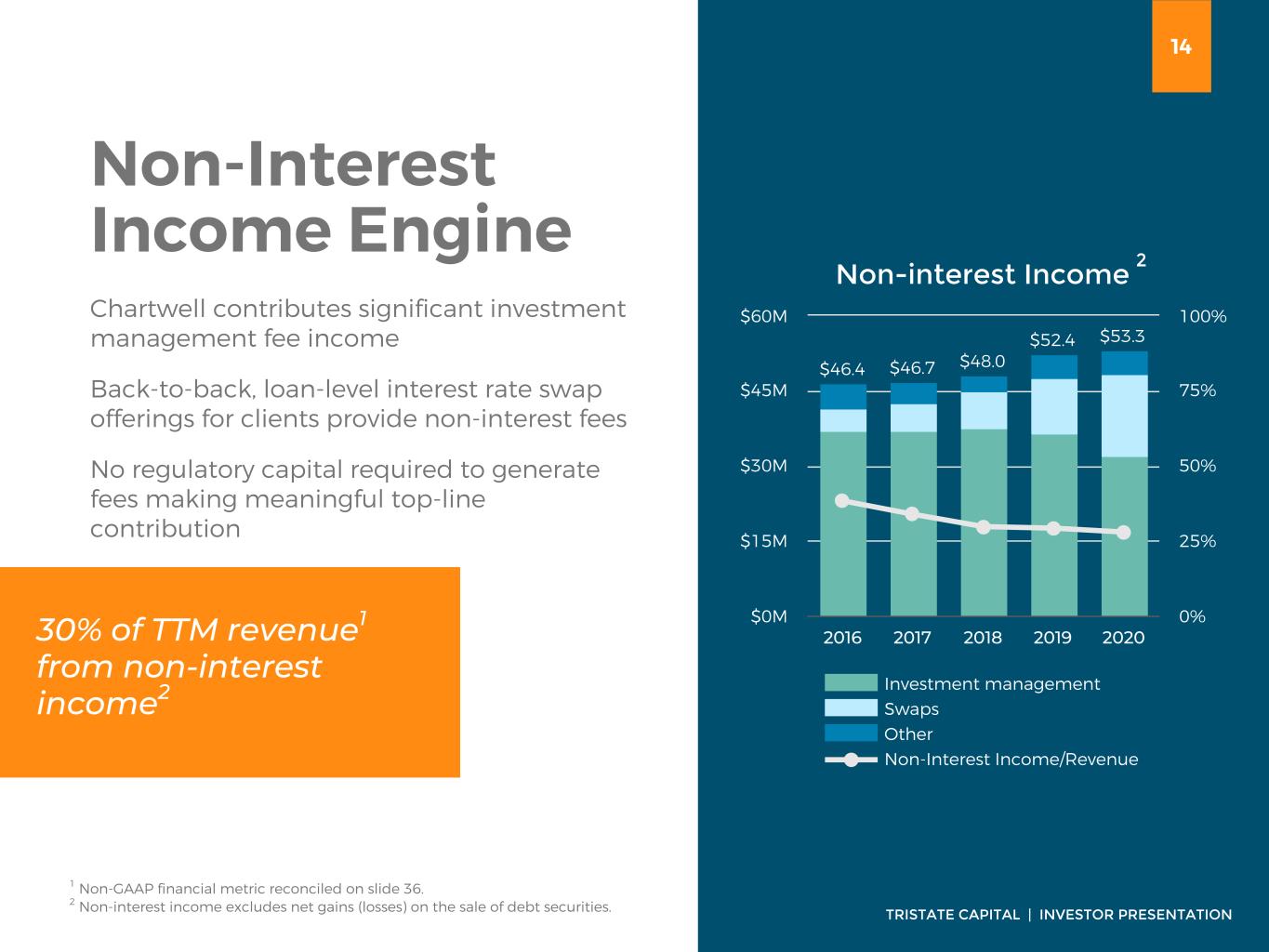

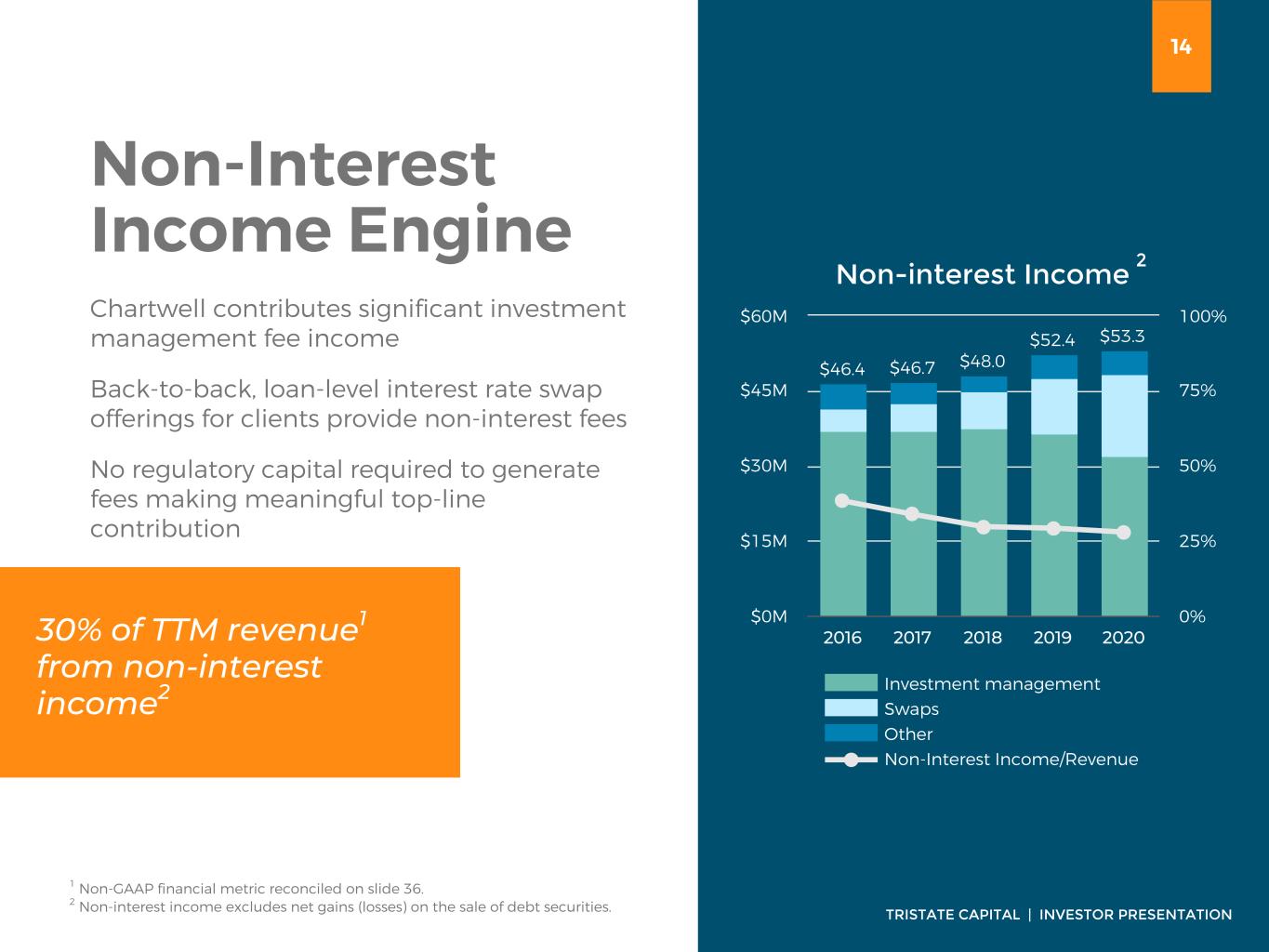

14 TRISTATE CAPITAL | INVESTOR PRESENTATION Non-Interest Income Engine 1 Non-GAAP financial metric reconciled on slide 36. 2 Non-interest income excludes net gains (losses) on the sale of debt securities. Chartwell contributes significant investment management fee income Back-to-back, loan-level interest rate swap offerings for clients provide non-interest fees No regulatory capital required to generate fees making meaningful top-line contribution 30% of TTM revenue1 from non-interest income2 Non-interest Income $46.4 $46.7 $48.0 $52.4 $53.3 Investment management Swaps Other Non-Interest Income/Revenue 2016 2017 2018 2019 2020 $0M $15M $30M $45M $60M 0% 25% 50% 75% 100% 2

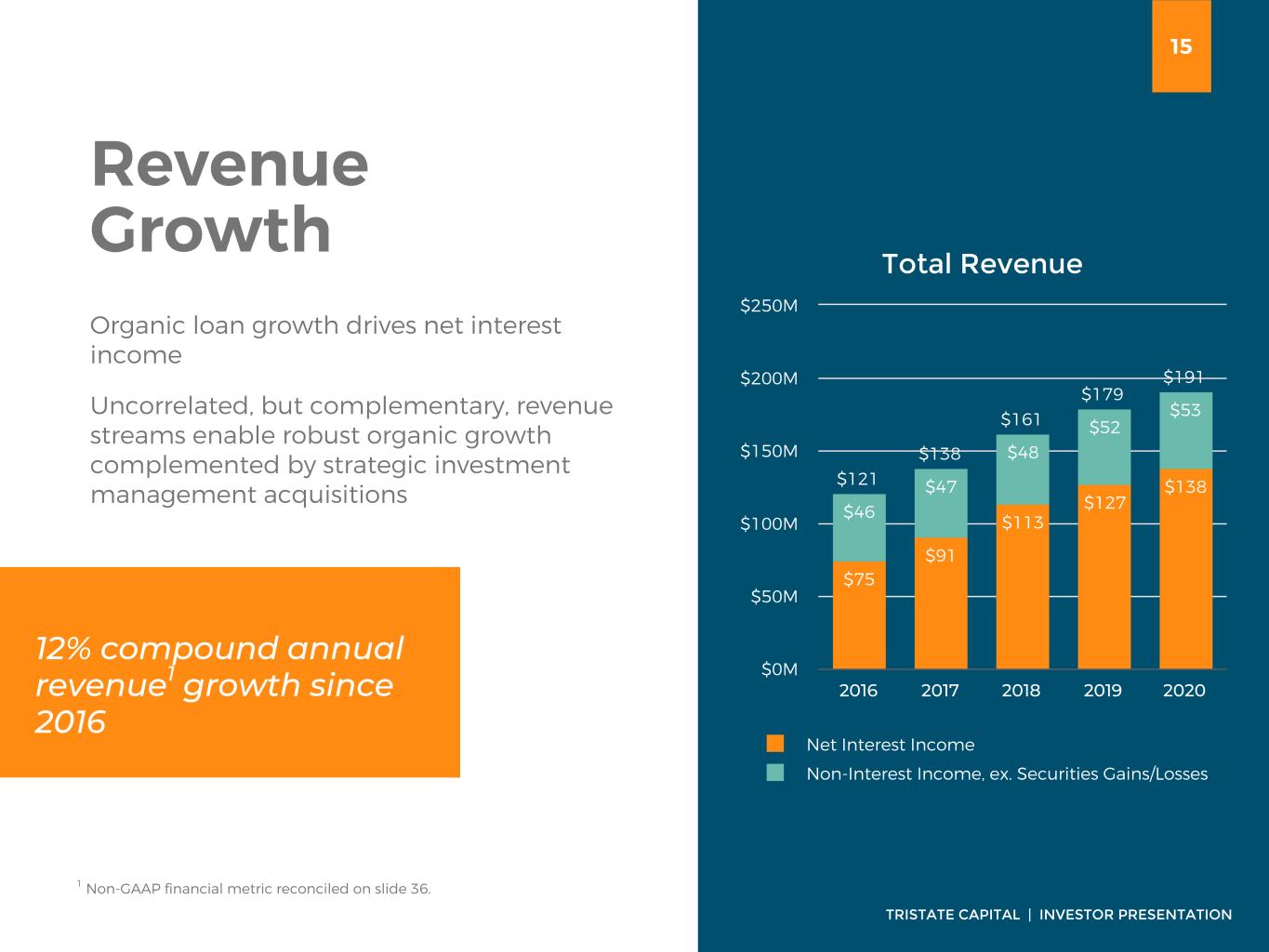

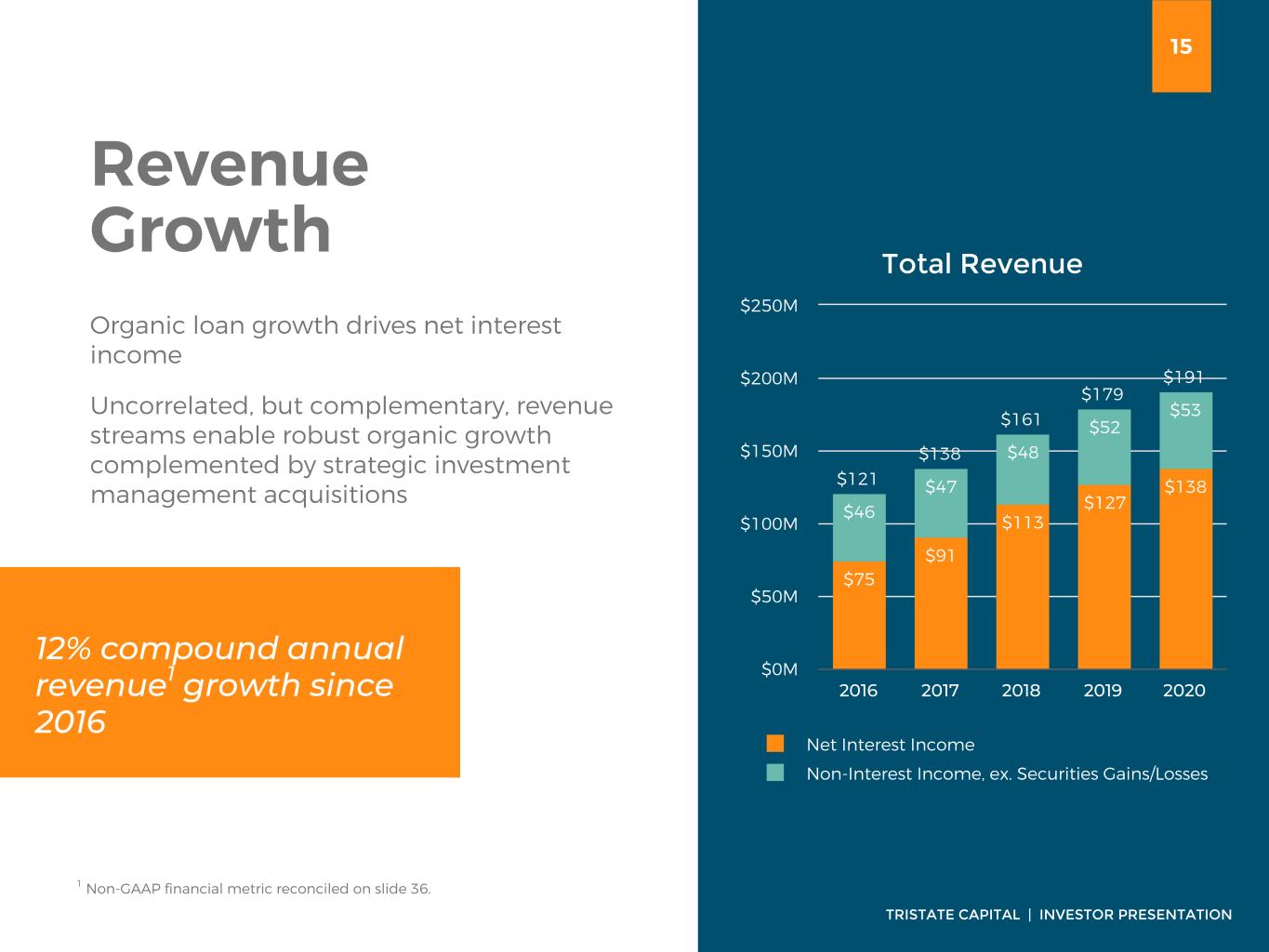

15 TRISTATE CAPITAL | INVESTOR PRESENTATION Revenue Growth 1 Non-GAAP financial metric reconciled on slide 36. Organic loan growth drives net interest income Uncorrelated, but complementary, revenue streams enable robust organic growth complemented by strategic investment management acquisitions 12% compound annual revenue1 growth since 2016 Total Revenue $121 $138 $161 $179 $191 $75 $91 $113 $127 $138 $46 $47 $48 $52 $53 Net Interest Income Non-Interest Income, ex. Securities Gains/Losses 2016 2017 2018 2019 2020 $0M $50M $100M $150M $200M $250M

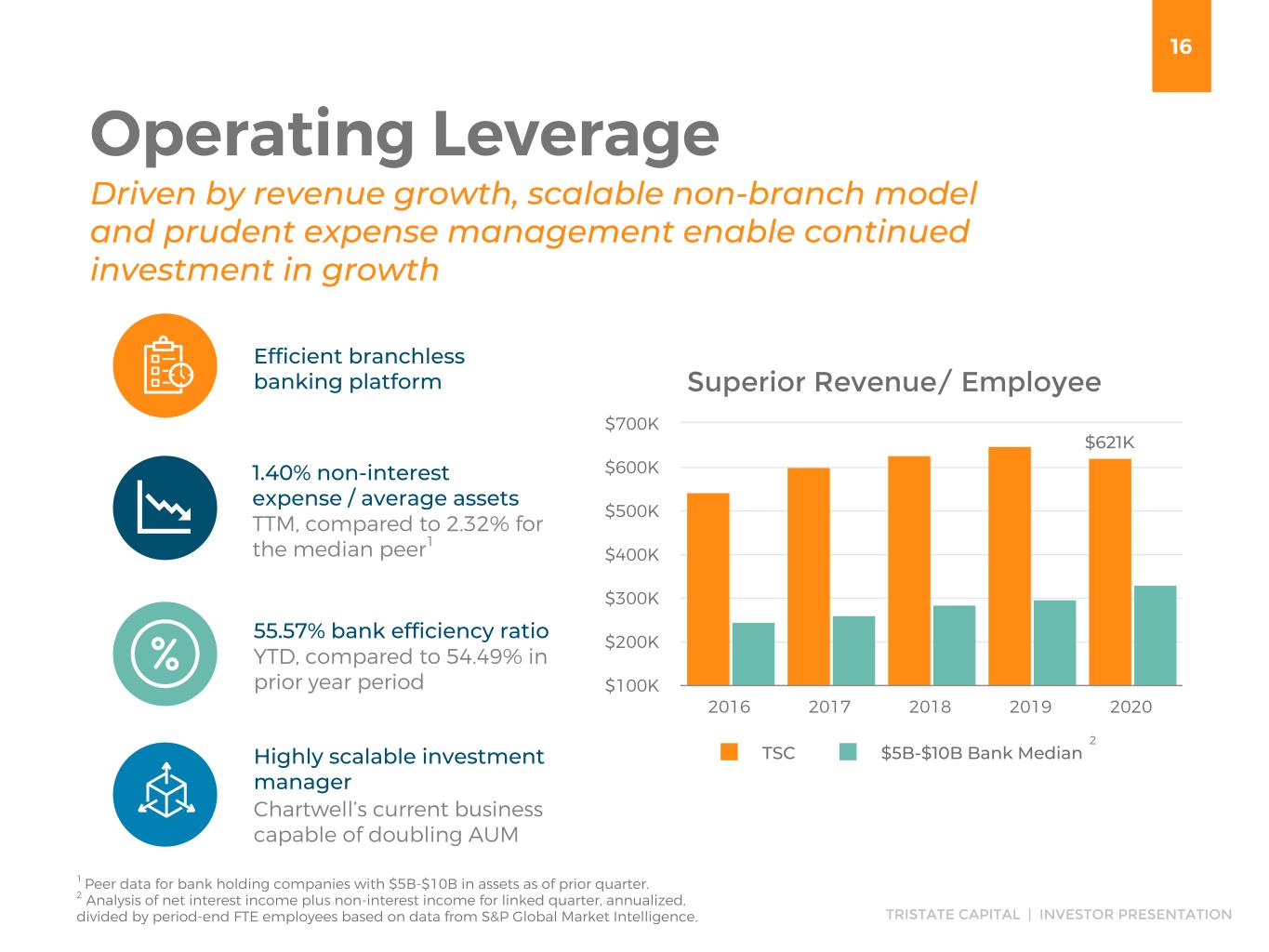

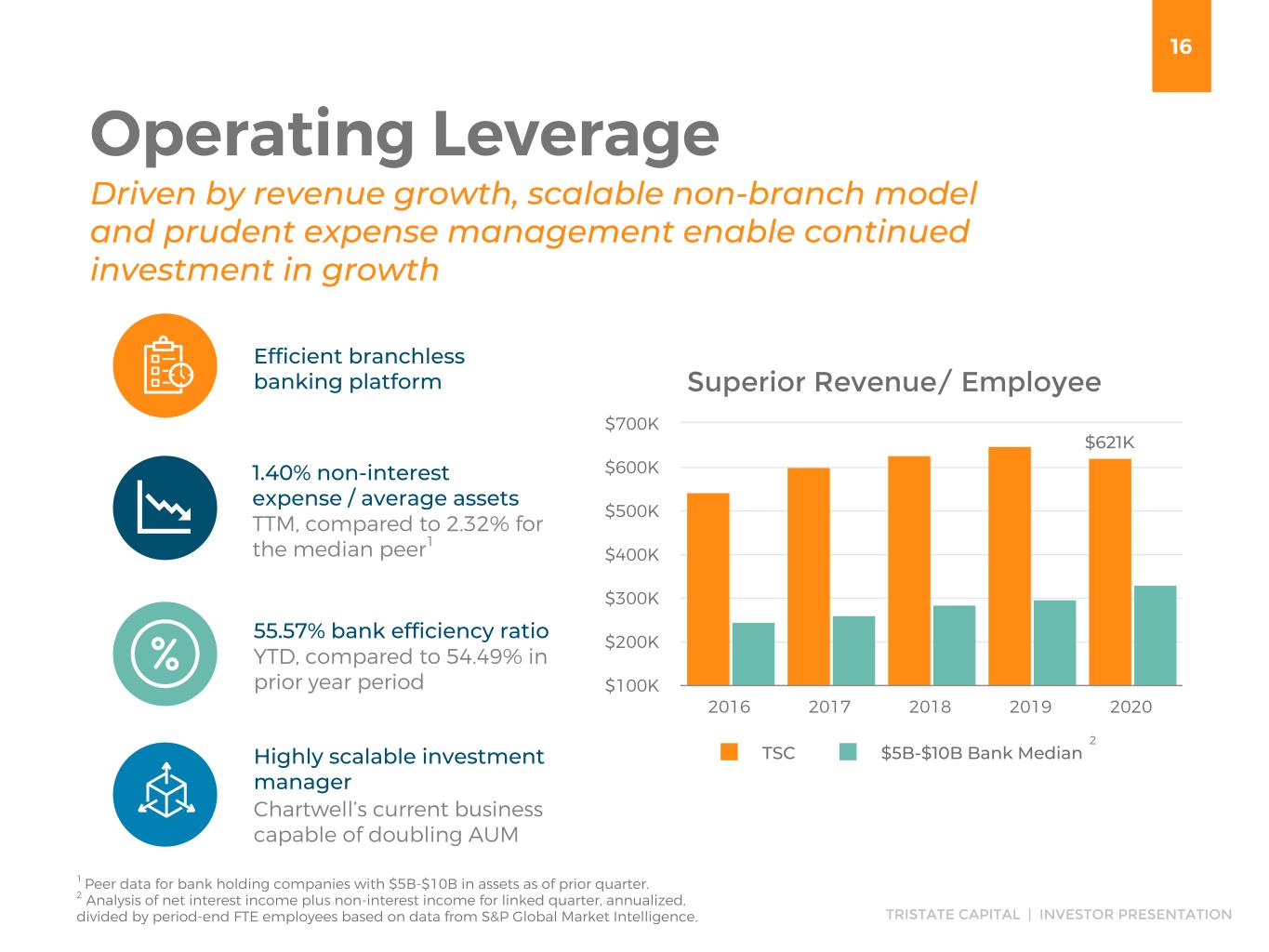

16 TRISTATE CAPITAL | INVESTOR PRESENTATION Operating Leverage Driven by revenue growth, scalable non-branch model and prudent expense management enable continued investment in growth 1.40% non-interest expense / average assets TTM, compared to 2.32% for the median peer1 55.57% bank efficiency ratio YTD, compared to 54.49% in prior year period Efficient branchless banking platform Highly scalable investment manager Chartwell’s current business capable of doubling AUM 1 Peer data for bank holding companies with $5B-$10B in assets as of prior quarter. 2 Analysis of net interest income plus non-interest income for linked quarter, annualized, divided by period-end FTE employees based on data from S&P Global Market Intelligence. Superior Revenue/ Employee $621K TSC $5B-$10B Bank Median 2016 2017 2018 2019 2020 $100K $200K $300K $400K $500K $600K $700K 2

17 TRISTATE CAPITAL | INVESTOR PRESENTATION Investments in best-in- class talent and technology beginning in 2016 are paying off for our clients and our business v v v35% 13 460 13 dedicated & experienced professionals 13 treasury management professionals providing high- touch service across regional footprint Treasury management deposits up ~35% More than 460 clients & growing Including deposit- only clients with essential need for treasury management services Treasury Management a Strategic Priority Growth in treasury management deposits to $1.46B contributed to ~20% total deposit growth, year-over- year TRISTATE CAPITAL | INVESTOR PRESENTATION

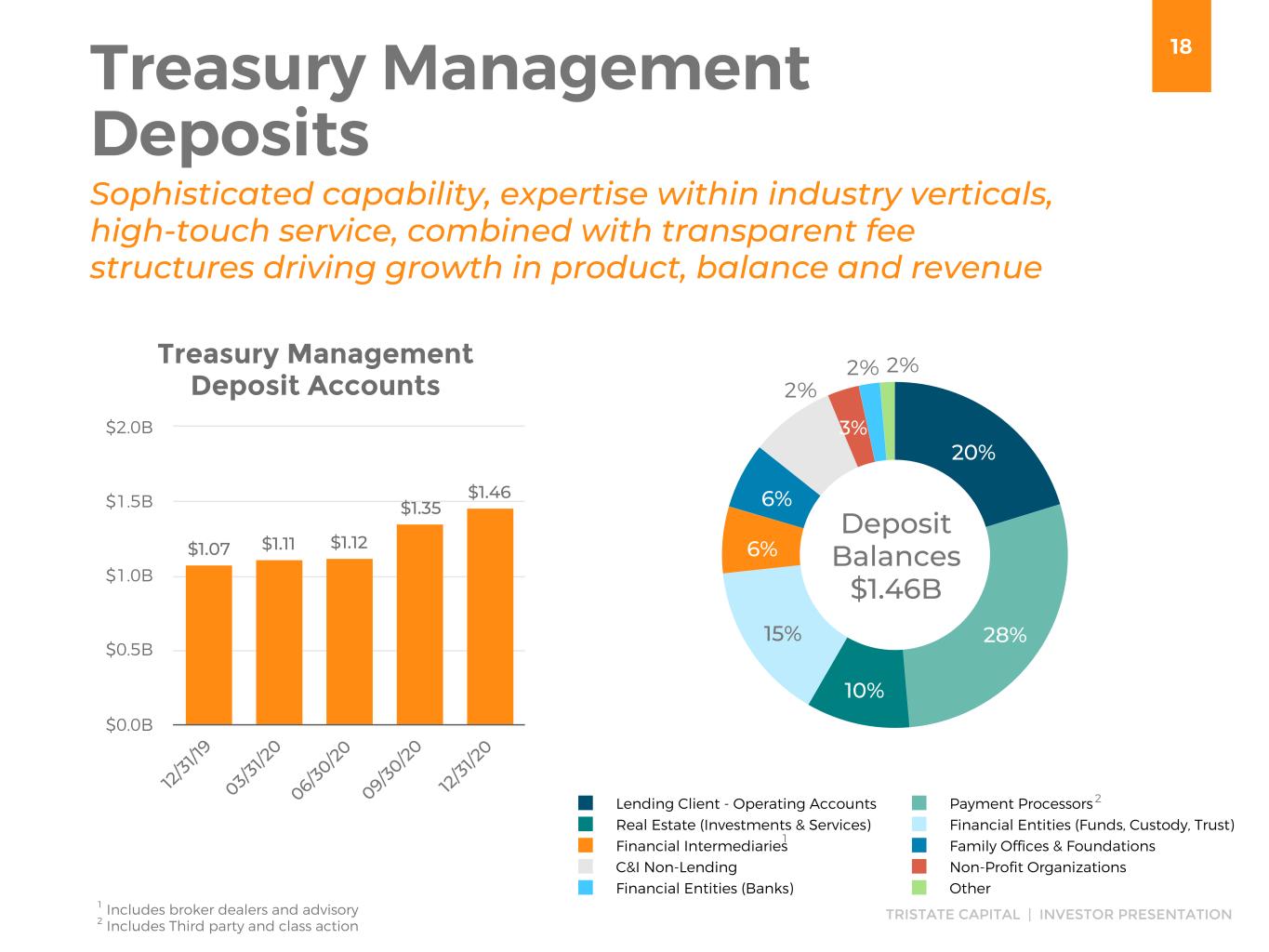

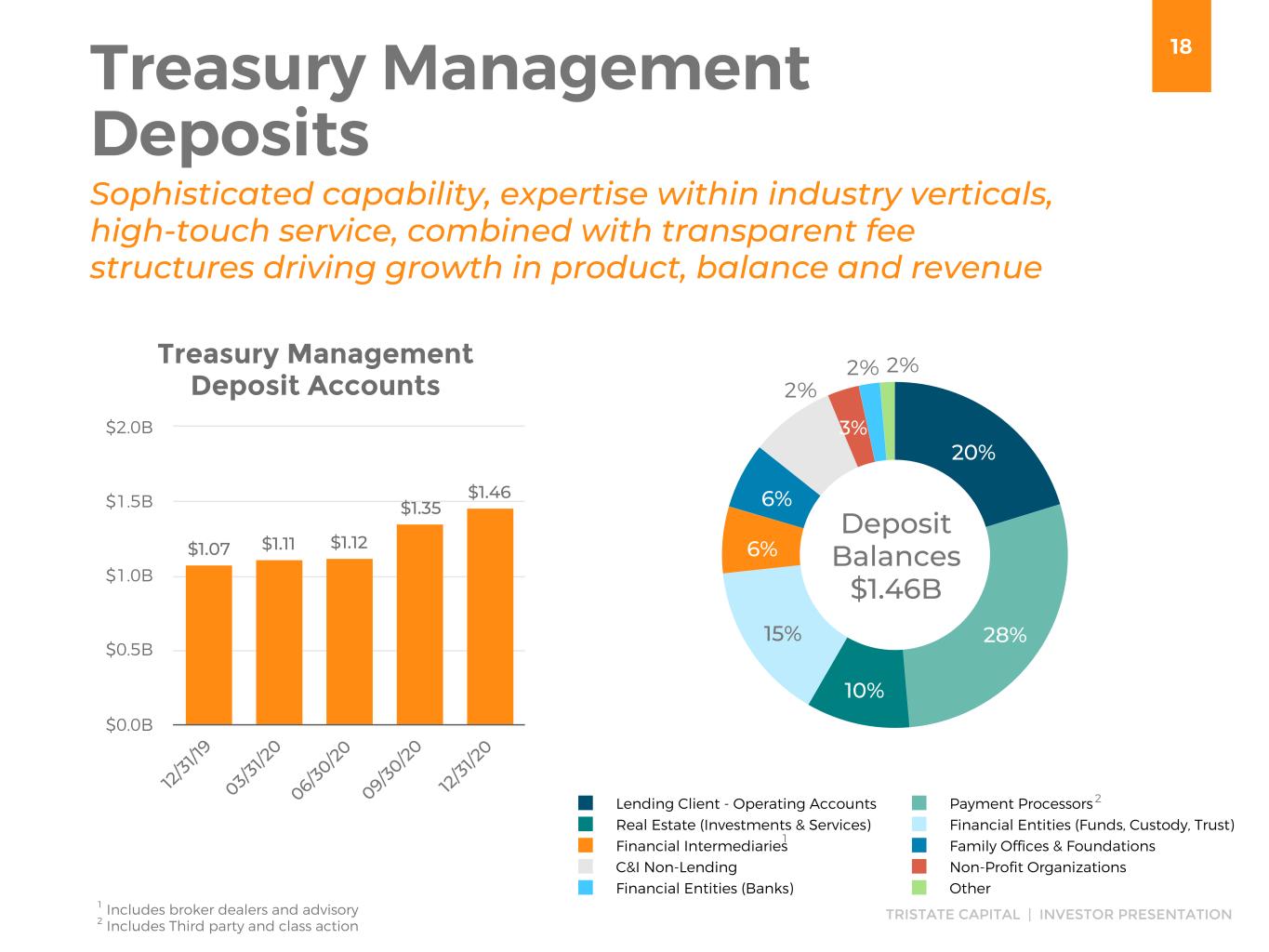

18 TRISTATE CAPITAL | INVESTOR PRESENTATION 20% 28% 10% 15% 6% 6% 3% Lending Client - Operating Accounts Payment Processors Real Estate (Investments & Services) Financial Entities (Funds, Custody, Trust) Financial Intermediaries Family Offices & Foundations C&I Non-Lending Non-Profit Organizations Financial Entities (Banks) Other Treasury Management Deposits Sophisticated capability, expertise within industry verticals, high-touch service, combined with transparent fee structures driving growth in product, balance and revenue Deposit Balances $1.46B Treasury Management Deposit Accounts $1.07 $1.11 $1.12 $1.35 $1.46 12 /3 1/1 9 03 /3 1/2 0 06 /3 0/ 20 09 /3 0/ 20 12 /3 1/2 0 $0.0B $0.5B $1.0B $1.5B $2.0B 1 Includes broker dealers and advisory 2 Includes Third party and class action 2% 2% 2% 2 1

19 TRISTATE CAPITAL | INVESTOR PRESENTATION Commercial Allowance/ Commercial Loans (Excludes Private Bank Loans) 1.04% 0.67% 0.50% 0.42% 0.95% 2016 2017 2018 2019 2020 0.0% 0.4% 0.8% 1.2% 1.6% Designed to maintain low annual credit costs relative to peers Superior Credit Quality NPLs / Total Loans $3.4 $4.2 $5.1 $6.6 $8.2 0.52% 0.08% 0.04% —% 0.12% Total Loans NPLs / Total Loans 2016 2017 2018 2019 2020 0.0% 0.2% 0.4% 0.6% 0.8% $0B $2B $4B $6B $8B NCOs / Average Loans 0.48% 0.50% 0.47% 0.47% 0.53% —% 0.10% 0.02% (0.03)% —% 2016 2017 2018 2019 2020 0.0% 0.2% 0.4% 0.6% 0.8% Allowance/ Total Loans 0.55% 0.34% 0.26% 0.21% 0.42% 2016 2017 2018 2019 2020 0.0% 0.4% 0.8% 1.2% 1.6% US Bank Aggregate

20 TRISTATE CAPITAL | INVESTOR PRESENTATION Loans with Deferral Agreements/ Total Loans Deferrals 1.0% Commercial Loan Deferrals Commercial balances with deferral agreements at December 31, 2020 totaled $84.5M, or 1% of total loans, compared to $185.9M, or 2.4%, on October 20, 2020 Category Balances at 12/31/20 Deferrals at 12/31/20 Deferrals as % of Total Deferrals Deferrals as % of Total Loans C&I Manufacturing $ 117.4 $ 2.0 2.3 % 2 bps Mining $ 22.7 $ 1.8 2.1 % 2 bps CRE Multifamily $ 625.4 $ 12.0 14.2 % 1 bps Office $ 470.2 $ 18.7 22.1 % 2 bps Retail $ 330.7 $ 12.2 14.4 % 1 bps Industrial $ 314.4 $ 6.9 8.2 % 1 bps Developed Land $ 55.0 $ 4.5 5.3 % 1 bps Self Storage $ 47.9 $ 7.9 9.3 % 1 bps Hotel $ 45.7 $ 17.9 21.2 % 2 bps Total Loans $8.24B 1 Includes approximately $9.2M of CRE loans to restaurant operations, approximately $7.0M of which has been deferred, as of December 31, 2020. 1

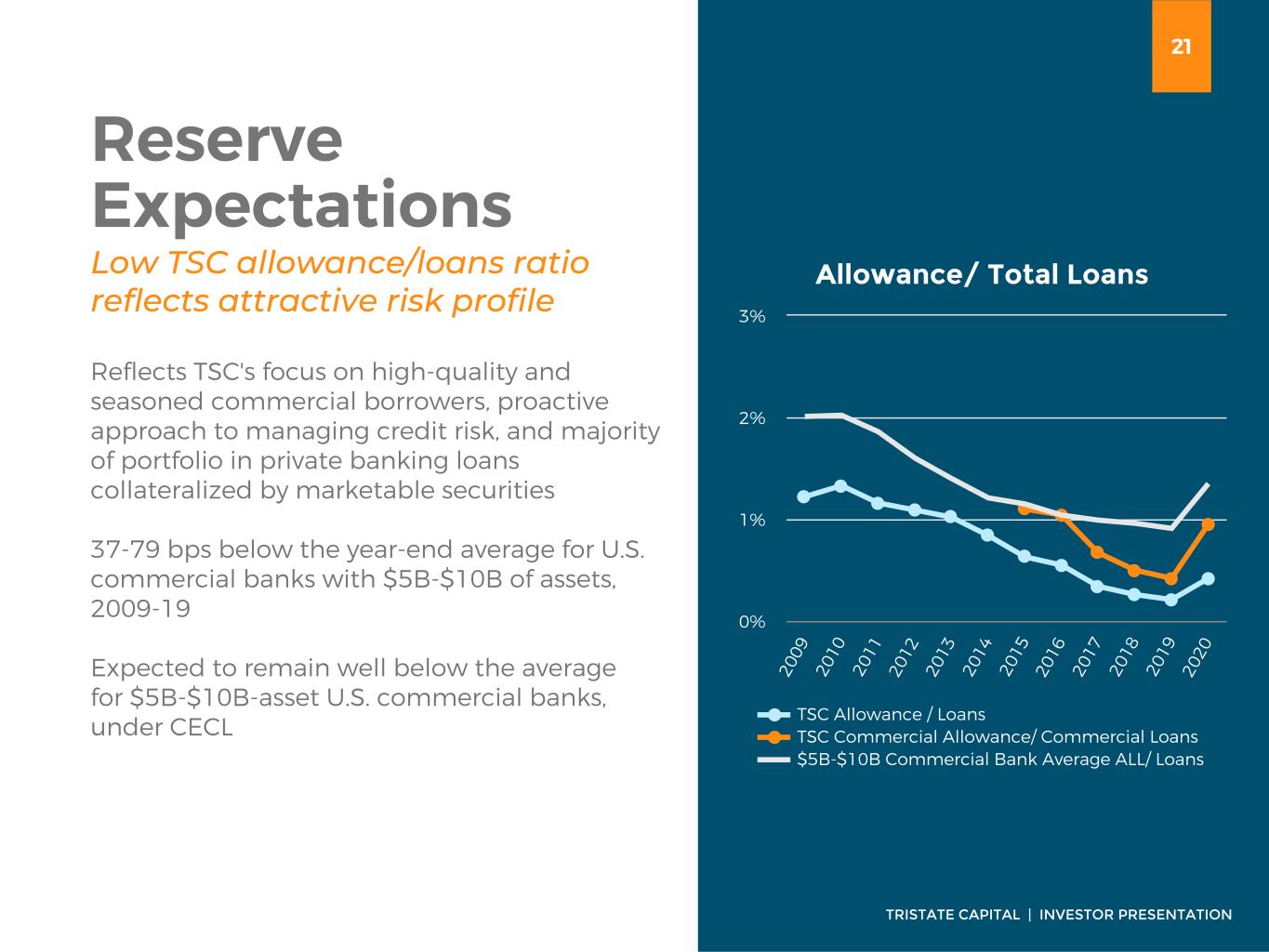

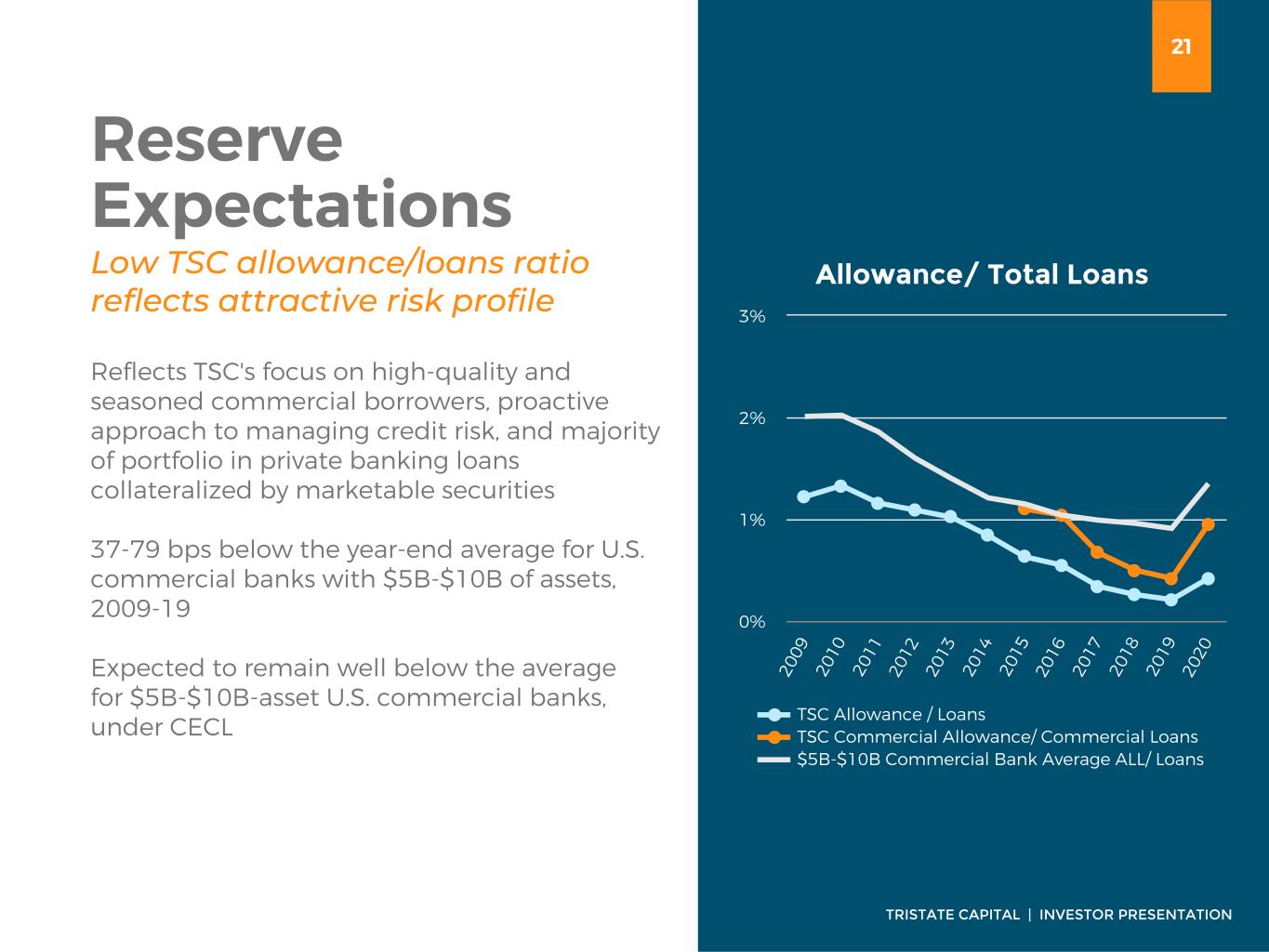

21 TRISTATE CAPITAL | INVESTOR PRESENTATION Reserve Expectations Reflects TSC's focus on high-quality and seasoned commercial borrowers, proactive approach to managing credit risk, and majority of portfolio in private banking loans collateralized by marketable securities 37-79 bps below the year-end average for U.S. commercial banks with $5B-$10B of assets, 2009-19 Expected to remain well below the average for $5B-$10B-asset U.S. commercial banks, under CECL Low TSC allowance/loans ratio reflects attractive risk profile Allowance/ Total Loans TSC Allowance / Loans TSC Commercial Allowance/ Commercial Loans $5B-$10B Commercial Bank Average ALL/ Loans 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 0% 1% 2% 3%

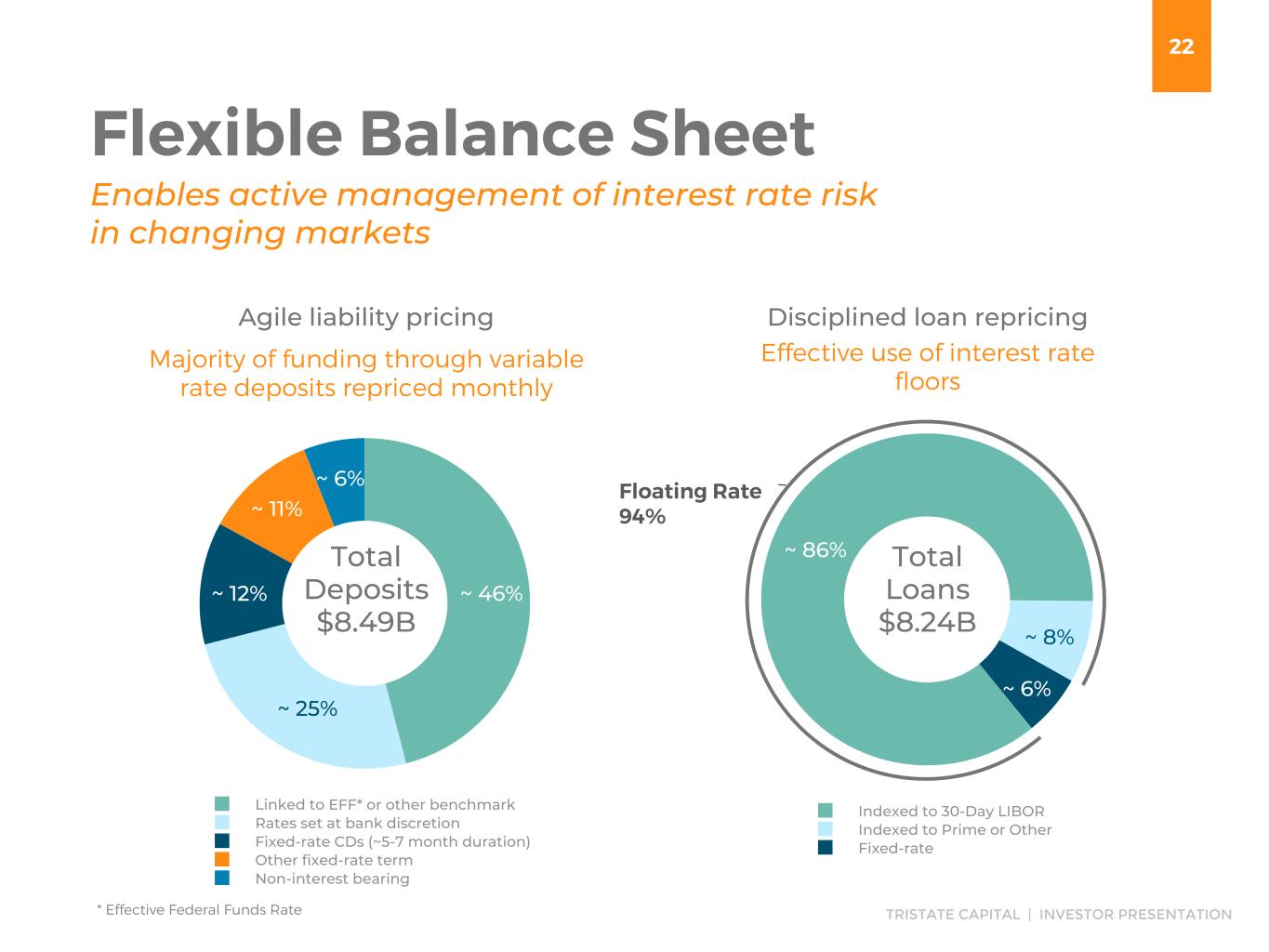

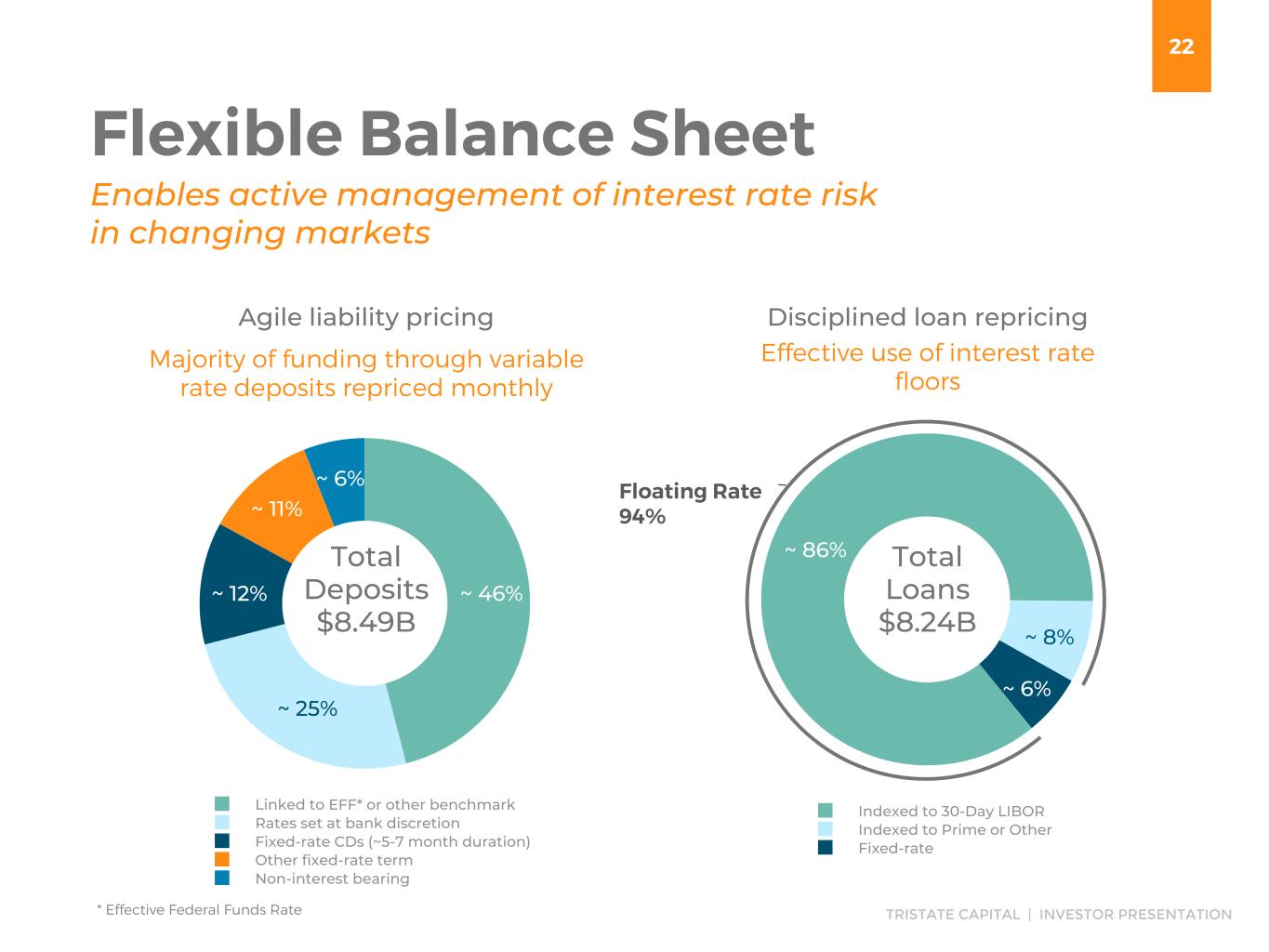

22 TRISTATE CAPITAL | INVESTOR PRESENTATION Floating Rate 94% ~ 86% ~ 8% ~ 6% Indexed to 30-Day LIBOR Indexed to Prime or Other Fixed-rate Flexible Balance Sheet Agile liability pricing ~ 46% ~ 25% ~ 12% ~ 11% ~ 6% Linked to EFF* or other benchmark Rates set at bank discretion Fixed-rate CDs (~5-7 month duration) Other fixed-rate term Non-interest bearing Enables active management of interest rate risk in changing markets Majority of funding through variable rate deposits repriced monthly Disciplined loan repricing Effective use of interest rate floors * Effective Federal Funds Rate Total Loans $8.24B Total Deposits $8.49B

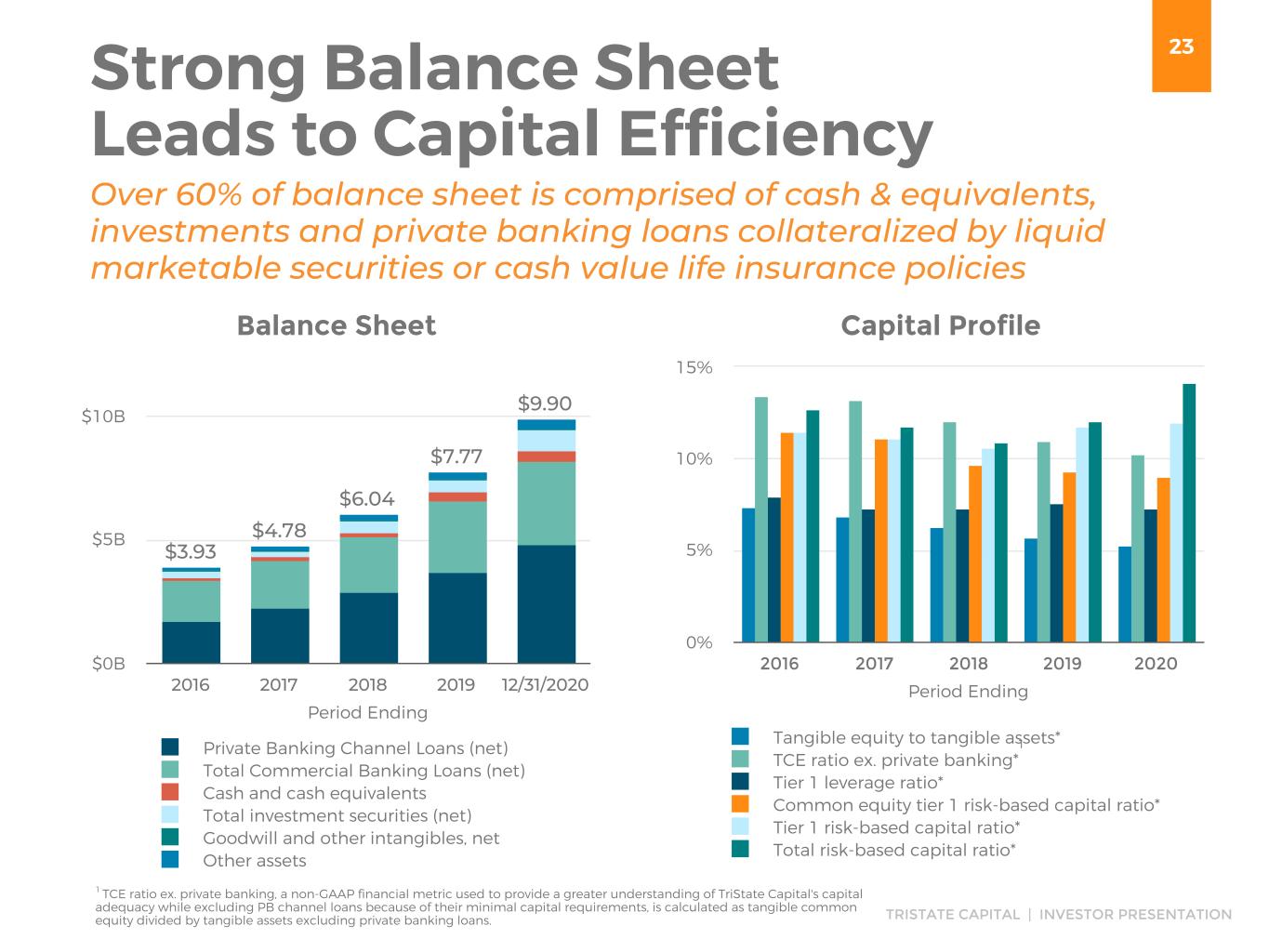

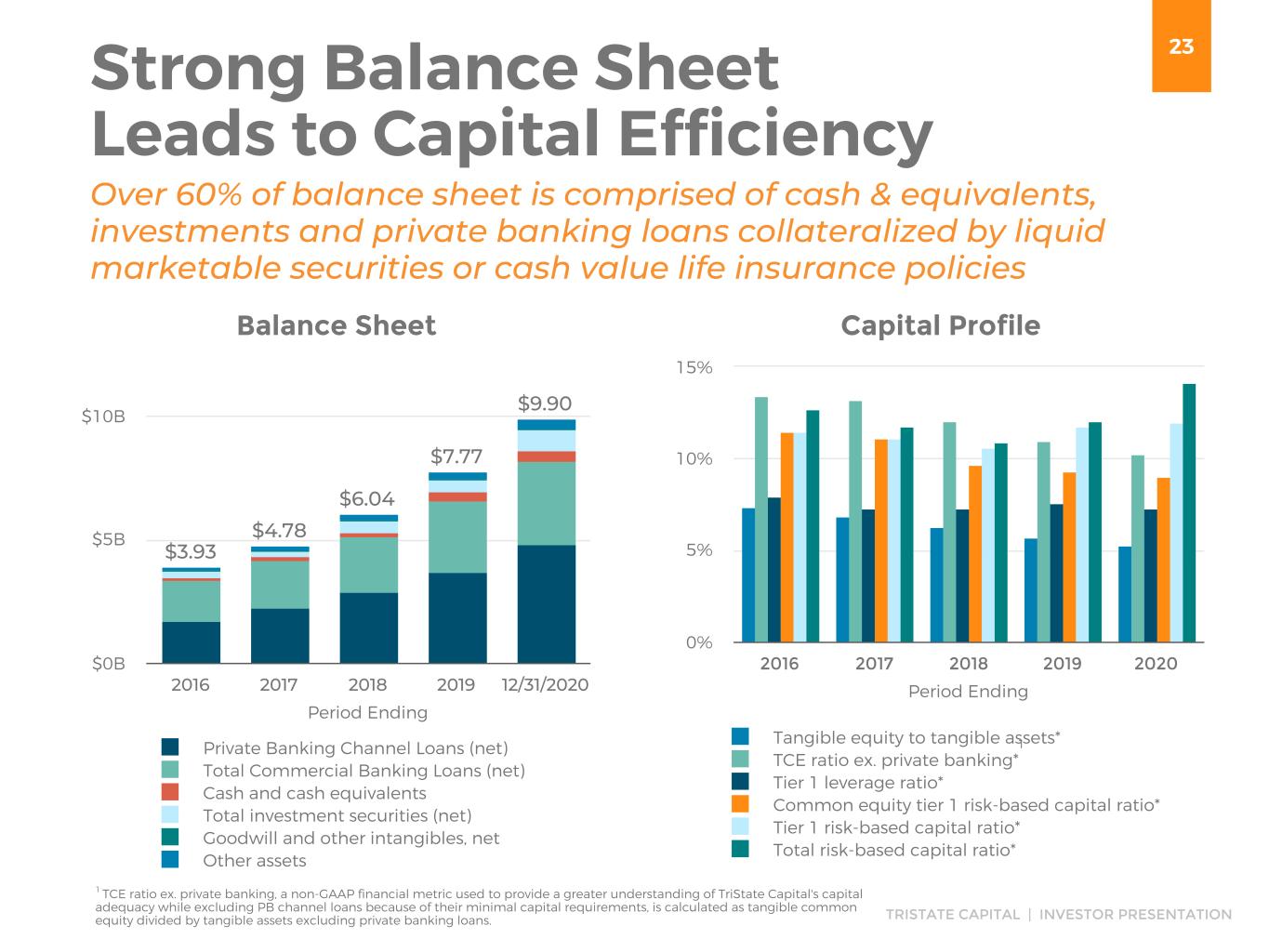

23 TRISTATE CAPITAL | INVESTOR PRESENTATION Period Ending Capital Profile Tangible equity to tangible assets* TCE ratio ex. private banking* Tier 1 leverage ratio* Common equity tier 1 risk-based capital ratio* Tier 1 risk-based capital ratio* Total risk-based capital ratio* 2016 2017 2018 2019 2020 0% 5% 10% 15% Strong Balance Sheet Leads to Capital Efficiency Period Ending Balance Sheet $3.93 $4.78 $6.04 $7.77 $9.90 Private Banking Channel Loans (net) Total Commercial Banking Loans (net) Cash and cash equivalents Total investment securities (net) Goodwill and other intangibles, net Other assets 2016 2017 2018 2019 12/31/2020 $0B $5B $10B Over 60% of balance sheet is comprised of cash & equivalents, investments and private banking loans collateralized by liquid marketable securities or cash value life insurance policies 1 1 TCE ratio ex. private banking, a non-GAAP financial metric used to provide a greater understanding of TriState Capital's capital adequacy while excluding PB channel loans because of their minimal capital requirements, is calculated as tangible common equity divided by tangible assets excluding private banking loans.

24 TRISTATE CAPITAL | INVESTOR PRESENTATION Capital Strength Supports High-Growth Strategy Raised >$300M in past two years Raised $105M in new capital in 4Q20, issuing common stock, preferred stock and warrants to funds managed by Stone Point Capital, LLC Raised >$97M in new capital in 2Q20 through registered offering of subordinated notes Non-cumulative perpetual preferred stock offerings in 2018-19 raised $116M, providing additional Tier 1 capital for holding company Deployed $66M raised in ‘13 IPO in three accretive investment management acquisitions1 while organically growing balance sheet by >$7B Capital Ratios Holding Co. Bank Tier 1 leverage 7.29% 7.83% CET 1 risk-based 8.99% 12.89% Tier 1 risk-based 11.99% 12.89% Total risk-based 14.12% 13.41% 1 Chartwell acquisition closed 3/5/2014,TKG acquisition closed 4/29/2016, and Columbia acquisition closed 4/6/2018. 2

25 TRISTATE CAPITAL | INVESTOR PRESENTATION Investment Profile TSC is well positioned to produce robust earnings as we expand each of our businesses in 2021 and beyond 1 Market data as of February 3, 2021. Investment Profile1 Closing Price $ 20.04 52-Week High $ 23.23 52-Week Low $ 7.59 Common Shares Outstanding 32.6 M Price/ LTM EPS 15.4x Price/ Book 1.1x Price/ Tangible Book 1.3x Float 27.2 M Average Daily Volume (3 mos.) ~ 109,000 Insider Ownership ~17 %

26 TRISTATE CAPITAL | INVESTOR PRESENTATION Appendix

27 TRISTATE CAPITAL | INVESTOR PRESENTATION Average Share Count Estimates For basic and diluted EPS calculations 1Q21 2Q21 3Q21 4Q21 2021 Estimating Number of Weighted Average Basic Shares Outstanding Basic common shares outstanding on 12/31/2020 31,127,022 31,127,022 31,127,022 31,127,022 31,127,022 Additional shares from Series C conversion if all preferred dividends paid in kind and reinvested 4,727,272 4,807,272 4,887,272 4,967,272 4,848,039 Additional shares from warrant exercise if TSC common above $17.50 922,438 922,438 922,438 922,438 922,438 Total for estimating percentage allocation of net income available to common holders 36,776,732 36,856,732 36,936,732 37,016,732 36,897,499 Estimating Percentage Allocation of Net Income Available: Allocation based on basic common shares outstanding on 12/31/2020 84.64% 84.45% 84.27% 84.09% 84.36% Allocation for Series C conversion if all preferred dividends paid in kind and reinvested 12.85% 13.04% 13.23% 13.42% 13.14% Allocation for warrant exercise if TSC common above $17.50 2.51% 2.50% 2.50% 2.49% 2.50% 100.00% 100.00% 100.00% 100.00% 100.00% Estimating Number of Weighted Average Diluted Common Shares Outstanding: Basic common shares outstanding on 12/31/2020 31,127,022 31,127,022 31,127,022 31,127,022 31,127,022 Restricted stock dilution in fourth quarter of 2020 390,320 390,320 390,320 390,320 390,320 Stock option dilution in fourth quarter of 2020 98,943 98,943 98,943 98,943 98,943 Warrants dilution in fourth quarter of 2020 - - - - - Estimated weighted average diluted common shares outstanding: 31,616,285 31,616,285 31,616,285 31,616,285 31,616,285 Calculating Net Income Available to Common Shareholders ($000s) Net income Less: Preferred dividends on series A and B $ 1,962 $ 1,962 $ 1,962 $ 1,962 $ 7,849 Less: Preferred dividends on series C, if all preferred dividends paid in kind and reinvested $ 1,097 $ 1,115 $ 1,134 $ 1,153 $ 4,499 Net income available to common shareholders Calculating Earnings Per Share Basic EPS = ($ net income available to common shareholders) x (% allocation based on common s/o) ÷ (number of weighted average basic common s/o) Diluted EPS1 = ($ net income available to common shareholders) x (% allocation based on common s/o) ÷ (number of weighted average diluted common s/o) (1) Warrants issued on December 30, 2020 granting the right to purchase, subject to certain adjustments, an aggregate of 922,438 shares of TSC common stock at an exercise price of $17.50 per share are antidilutive compared to the basic EPS calculation.

28 TRISTATE CAPITAL | INVESTOR PRESENTATION Key Performance Ratios (1) Net income divided by total average assets. (2) Net income available to common shareholders divided by average common equity. As of and For the Years Ended (Dollars in thousands) December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 Performance ratios: Return on average assets (1) 0.50 % 0.89 % 1.04 % 0.89 % 0.81 % Return on average common equity (2) 7.15 % 11.47 % 12.57 % 10.30 % 8.48 % Net interest margin 1.58 % 1.97 % 2.26 % 2.25 % 2.23 % Total revenue $ 191,201 $ 179,423 $ 161,391 $ 138,009 $ 121,244 Pre-tax, pre-provision net revenue $ 68,098 $ 67,274 $ 60,234 $ 46,537 $ 42,450 Bank efficiency ratio 55.57 % 54.49 % 53.09 % 57.39 % 61.17 %0 . Non-interest expense to average assets 1.35 % 1.66 % 1.93 % 2.15 % 2.23 % Asset quality: Non-performing loans $ 9,680 $ 184 $ 2,237 $ 3,183 $ 17,790 Non-performing assets $ 12,404 $ 4,434 $ 5,661 $ 6,759 $ 21,968 Other real estate owned $ 2,724 $ 4,250 $ 3,424 $ 3,576 $ 4,178 Non-performing assets to total assets 0.13 % 0.06 % 0.09 % 0.14 % 0.56 % Non-performing loans to total loan 0.12 % — % 0.04 % 0.08 % 0.52 % Allowance for loan and lease losses to loans 0.42 % 0.21 % 0.26 % 0.34 % 0.55 % Allowance for loan and lease losses to non- performing loans 357.75 % 7,667.39 % 590.43 % 452.94 % 105.46 % Net charge-offs (recoveries) $ (279) $ (1,868) $ 1,004 $ 3,722 $ 50 Net charge-offs (recoveries) to average total loans — % (0.03) % 0.02 % 0.10 % — % Investment management segment: Assets under management $ 10,263,000 $ 9,701,000 $ 9,189,000 $ 8,309,000 $ 8,055,000 EBITDA $ 5,473 $ 5,824 $ 6,900 $ 7,421 $ 13,208

29 TRISTATE CAPITAL | INVESTOR PRESENTATION Income Statement For the Years Ended (Dollars in thousands, except per share data) December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 Income statement data: Interest income $ 217,095 $ 262,447 $ 199,786 $ 134,295 $ 98,312 Interest expense 79,151 135,390 86,382 42,942 23,499 Net interest income 137,944 127,057 113,404 91,353 74,813 Provision (credit) for credit losses 19,400 (968) (205) (623) 838 Net interest income after provision for credit losses 118,544 128,025 113,609 91,976 73,975 Non-interest income: Investment management fees 32,035 36,442 37,647 37,100 37,035 Net gain (loss) on the sale and call of debt securities 3,948 416 (70) 310 77 Other non-interest income 21,222 15,924 10,340 9,556 9,396 Total non-interest income 57,205 52,782 47,917 46,966 46,508 Non-interest expense: Intangible amortization expense 1,944 2,009 1,968 1,851 1,753 Change in fair value of acquisition earn out — — (218) — (3,687) Other non-interest expense 121,159 110,140 99,407 89,621 80,728 Total non-interest expense 123,103 112,149 101,157 91,472 78,794 Income before tax 52,646 68,658 60,369 47,470 41,689 Income tax expense 7,412 8,465 5,945 9,482 13,048 Net income $ 45,234 $ 60,193 $ 54,424 $ 37,988 $ 28,641 Preferred stock dividends 7,873 5,753 2,120 — — Net income available to common shareholders $ 37,361 $ 54,440 $ 52,304 $ 37,988 $ 28,641 Earnings per common share: Basic $ 1.32 $ 1.95 $ 1.90 $ 1.38 $ 1.04 Diluted $ 1.30 $ 1.89 $ 1.81 $ 1.32 $ 1.01

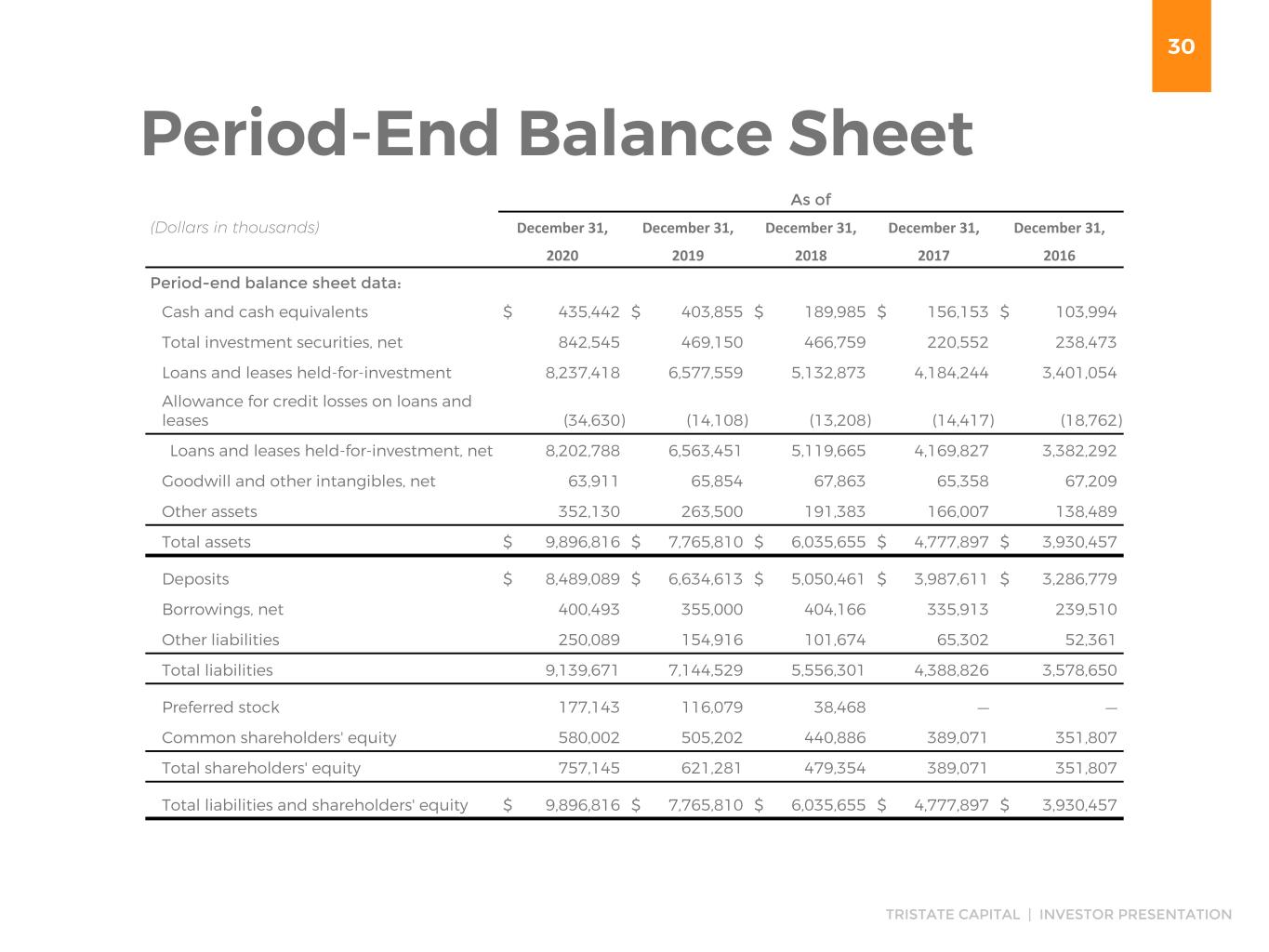

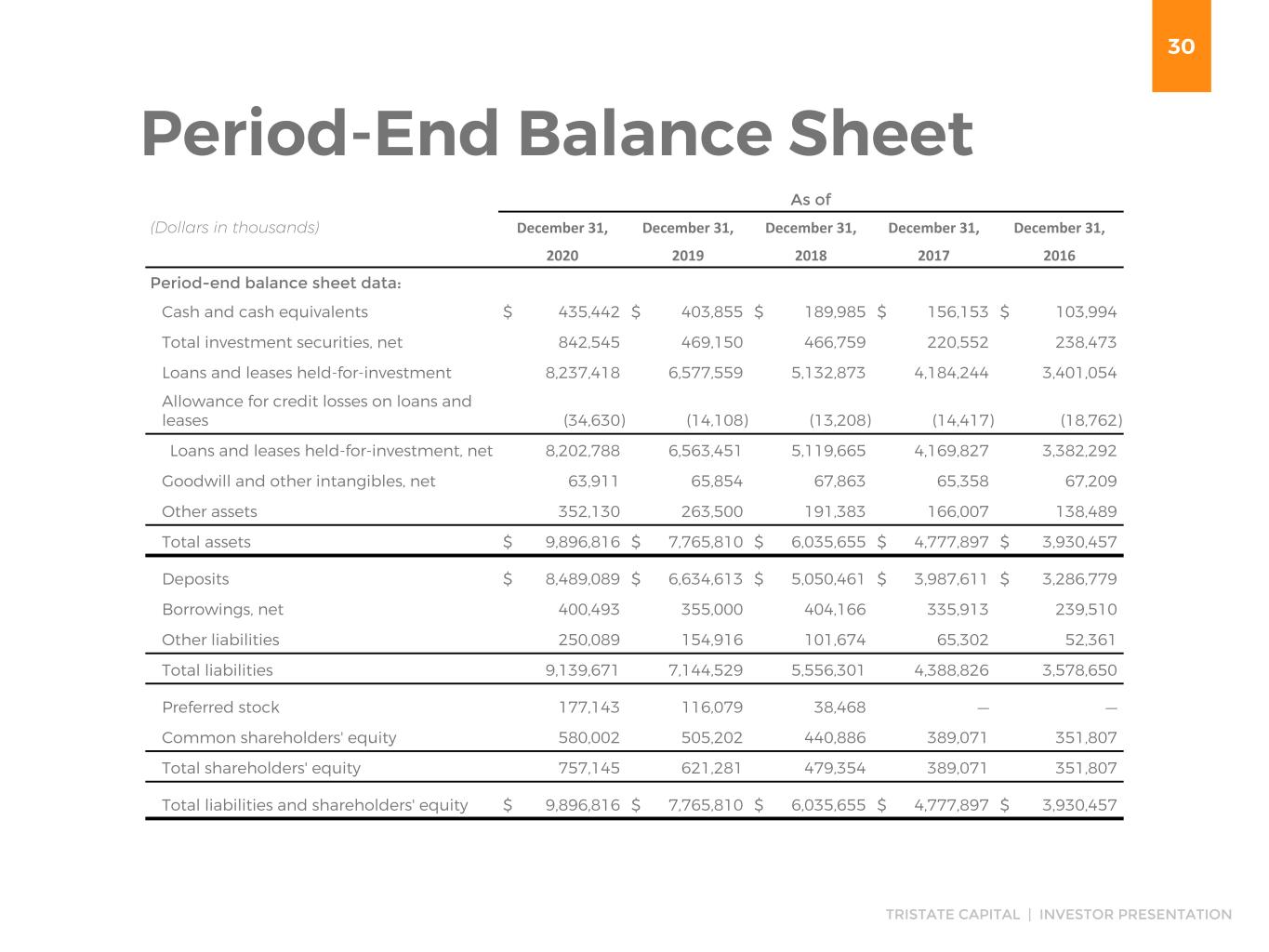

30 TRISTATE CAPITAL | INVESTOR PRESENTATION Period-End Balance Sheet As of (Dollars in thousands) December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 Period-end balance sheet data: Cash and cash equivalents $ 435,442 $ 403,855 $ 189,985 $ 156,153 $ 103,994 Total investment securities, net 842,545 469,150 466,759 220,552 238,473 Loans and leases held-for-investment 8,237,418 6,577,559 5,132,873 4,184,244 3,401,054 Allowance for credit losses on loans and leases (34,630) (14,108) (13,208) (14,417) (18,762) Loans and leases held-for-investment, net 8,202,788 6,563,451 5,119,665 4,169,827 3,382,292 Goodwill and other intangibles, net 63,911 65,854 67,863 65,358 67,209 Other assets 352,130 263,500 191,383 166,007 138,489 Total assets $ 9,896,816 $ 7,765,810 $ 6,035,655 $ 4,777,897 $ 3,930,457 Deposits $ 8,489,089 $ 6,634,613 $ 5,050,461 $ 3,987,611 $ 3,286,779 Borrowings, net 400,493 355,000 404,166 335,913 239,510 Other liabilities 250,089 154,916 101,674 65,302 52,361 Total liabilities 9,139,671 7,144,529 5,556,301 4,388,826 3,578,650 Preferred stock 177,143 116,079 38,468 — — Common shareholders' equity 580,002 505,202 440,886 389,071 351,807 Total shareholders' equity 757,145 621,281 479,354 389,071 351,807 Total liabilities and shareholders' equity $ 9,896,816 $ 7,765,810 $ 6,035,655 $ 4,777,897 $ 3,930,457

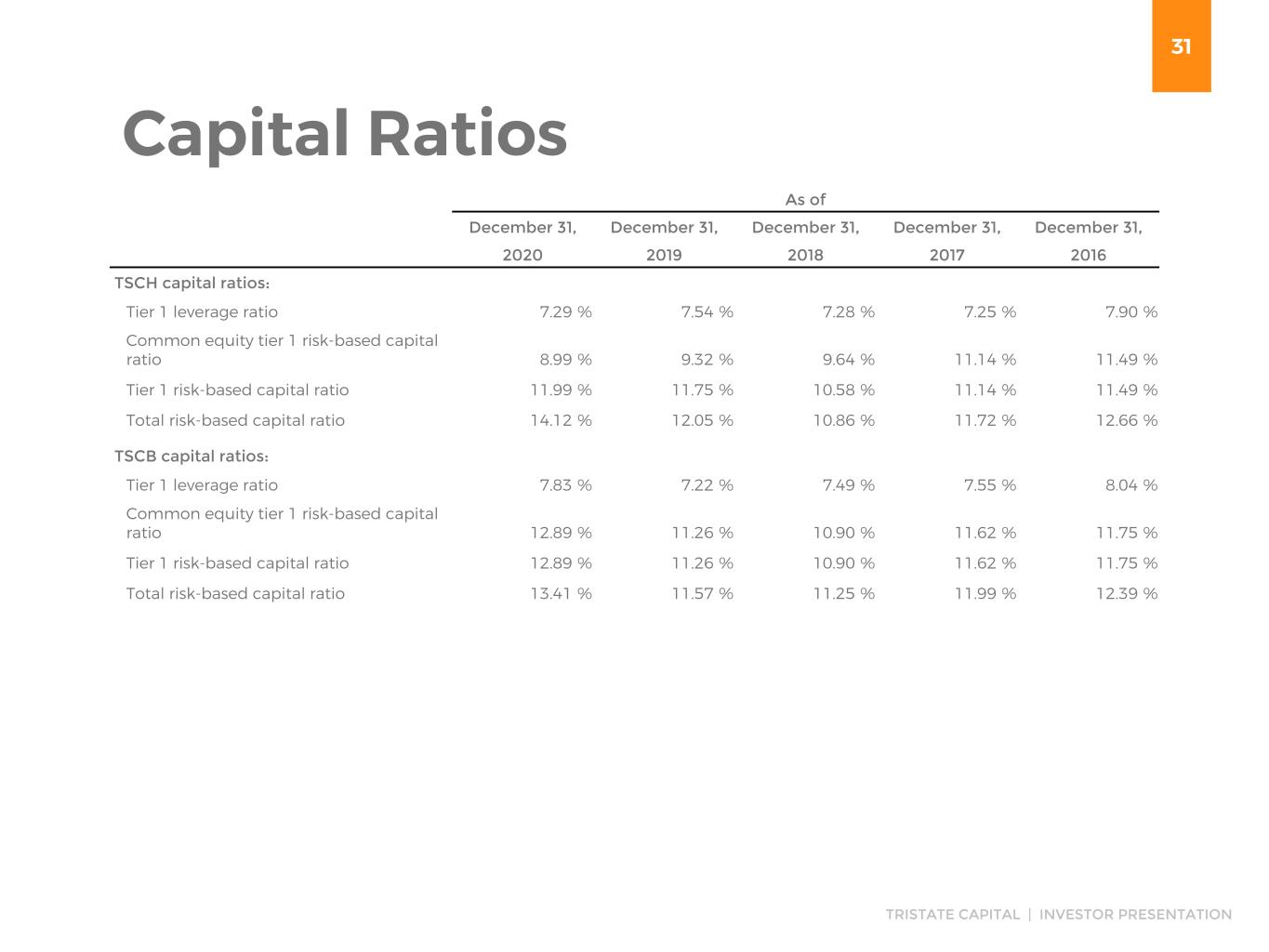

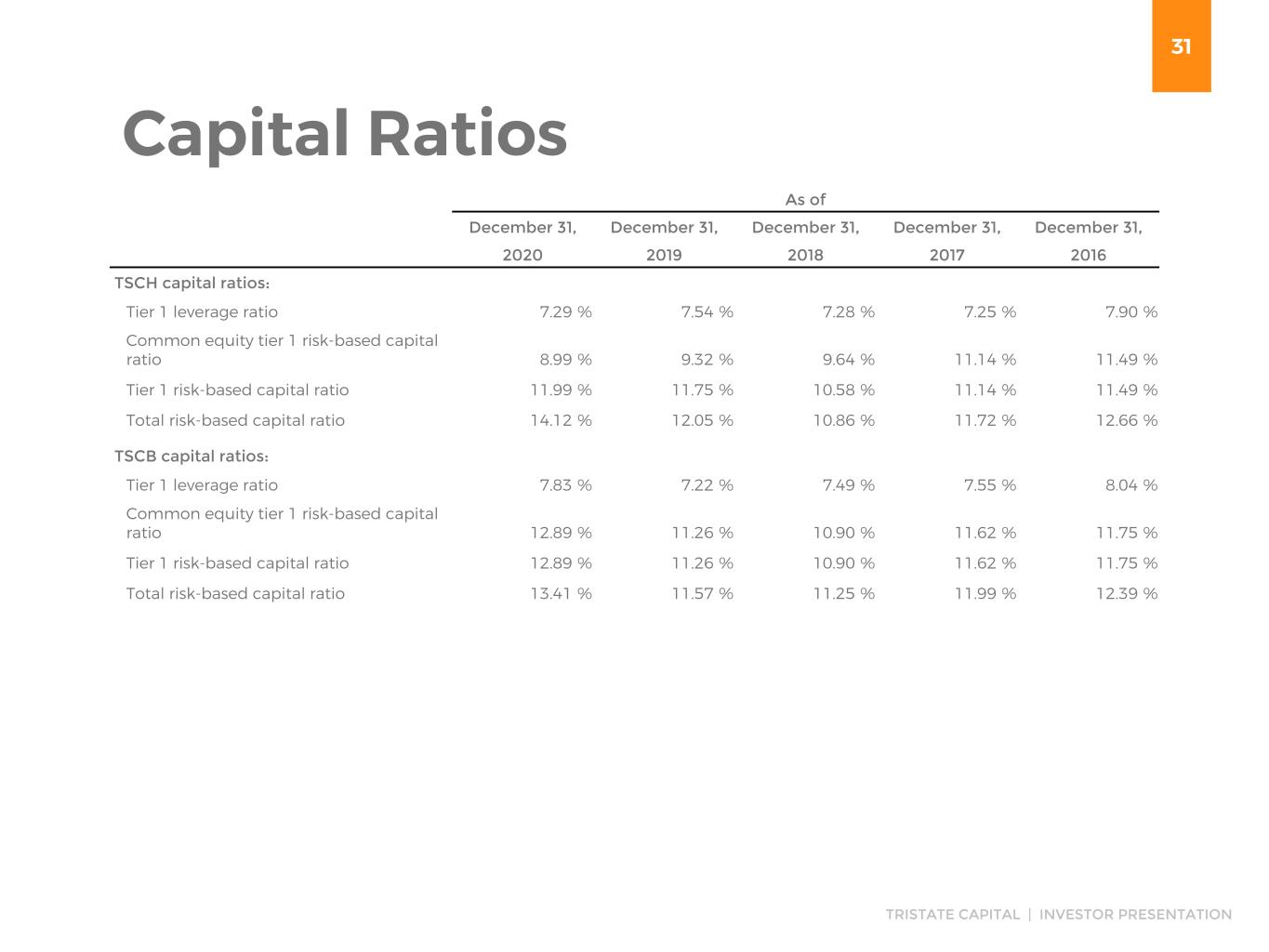

31 TRISTATE CAPITAL | INVESTOR PRESENTATION Capital Ratios As of December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 TSCH capital ratios: Tier 1 leverage ratio 7.29 % 7.54 % 7.28 % 7.25 % 7.90 % Common equity tier 1 risk-based capital ratio 8.99 % 9.32 % 9.64 % 11.14 % 11.49 % Tier 1 risk-based capital ratio 11.99 % 11.75 % 10.58 % 11.14 % 11.49 % Total risk-based capital ratio 14.12 % 12.05 % 10.86 % 11.72 % 12.66 % TSCB capital ratios: Tier 1 leverage ratio 7.83 % 7.22 % 7.49 % 7.55 % 8.04 % Common equity tier 1 risk-based capital ratio 12.89 % 11.26 % 10.90 % 11.62 % 11.75 % Tier 1 risk-based capital ratio 12.89 % 11.26 % 10.90 % 11.62 % 11.75 % Total risk-based capital ratio 13.41 % 11.57 % 11.25 % 11.99 % 12.39 %

32 TRISTATE CAPITAL | INVESTOR PRESENTATION Loan Composition (Dollars in thousands) As of Loan and Lease Composition December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 Private banking $ 4,807,800 $ 3,695,402 $ 2,869,543 $ 2,265,737 $ 1,735,928 C&I 1,274,152 1,085,709 785,320 667,684 587,423 CRE 2,155,466 1,796,448 1,478,010 1,250,823 1,077,703 Loans and leases held-for-investment $ 8,237,418 $ 6,577,559 $ 5,132,873 $ 4,184,244 $ 3,401,054 Private banking 58.4 % 56.2 % 55.9 % 54.1 % 51.0 % C&I 15.5 % 16.5 % 15.3 % 16.0 % 17.3 % CRE 26.1 % 27.3 % 28.8 % 29.9 % 31.7 % Loans and leases held-for-investment 100.0 % 100.0 % 100.0 % 100.0 % 100.0 %

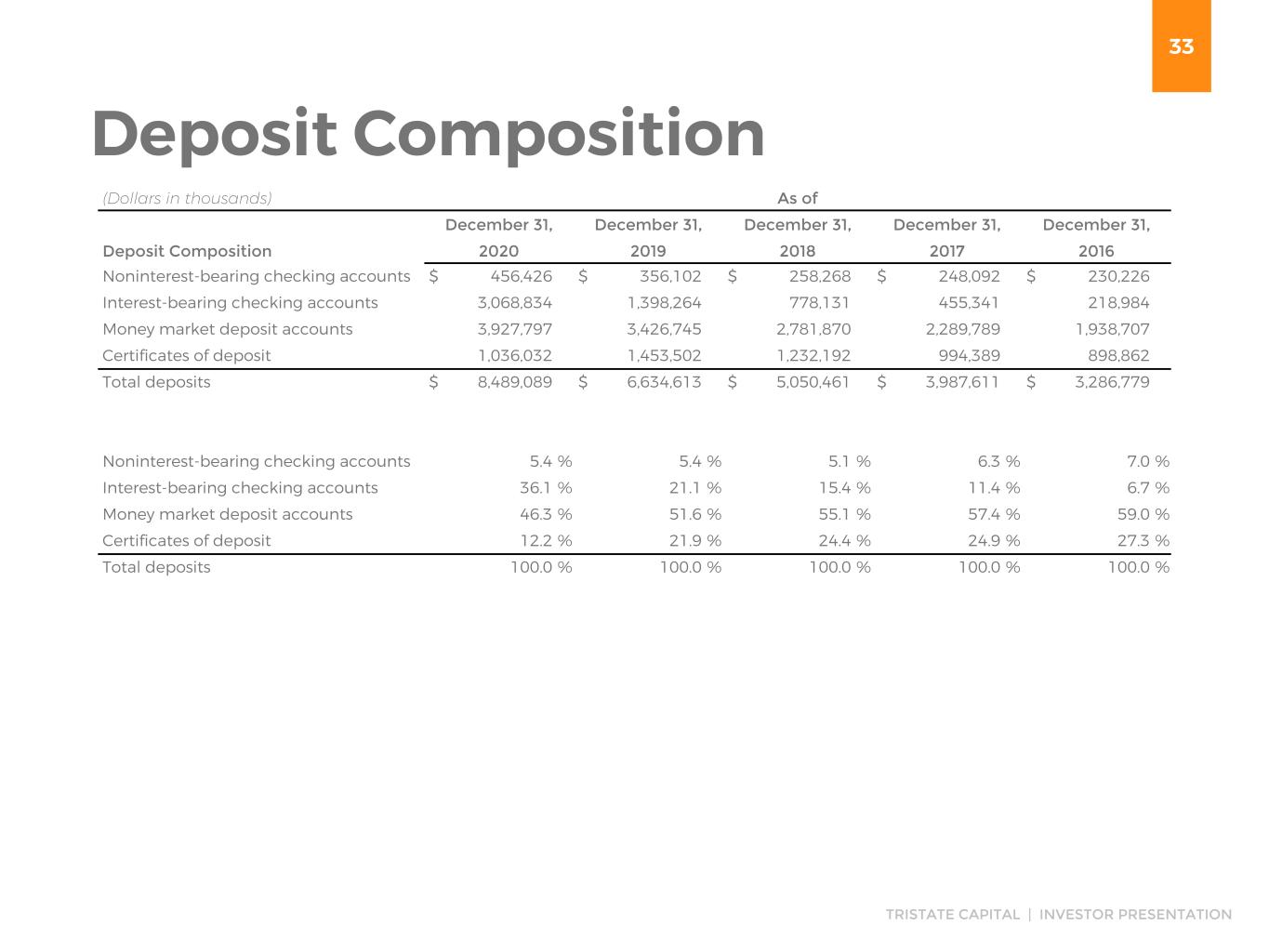

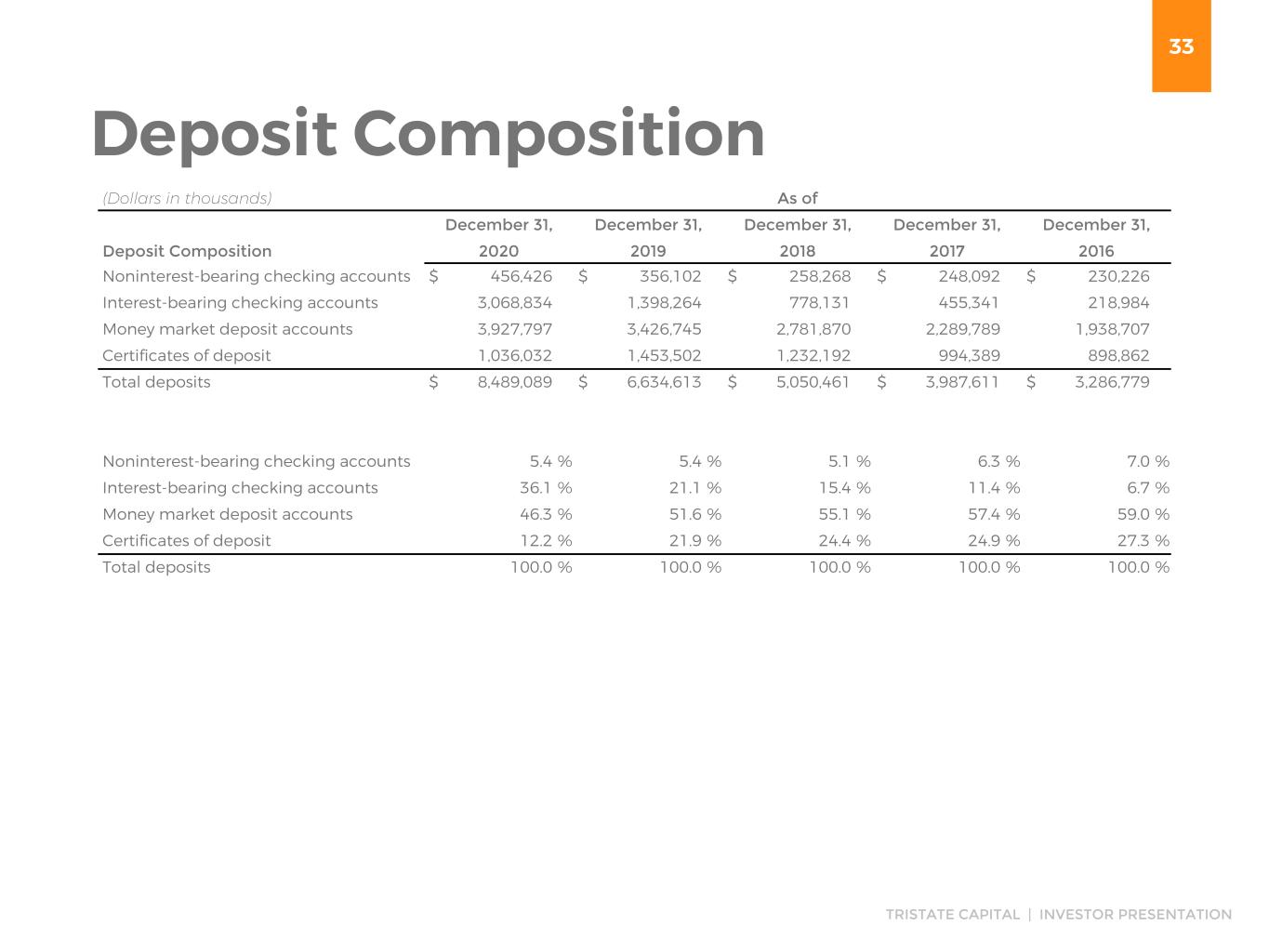

33 TRISTATE CAPITAL | INVESTOR PRESENTATION Deposit Composition (Dollars in thousands) As of December 31, December 31, December 31, December 31, December 31, Deposit Composition 2020 2019 2018 2017 2016 Noninterest-bearing checking accounts $ 456,426 $ 356,102 $ 258,268 $ 248,092 $ 230,226 Interest-bearing checking accounts 3,068,834 1,398,264 778,131 455,341 218,984 Money market deposit accounts 3,927,797 3,426,745 2,781,870 2,289,789 1,938,707 Certificates of deposit 1,036,032 1,453,502 1,232,192 994,389 898,862 Total deposits $ 8,489,089 $ 6,634,613 $ 5,050,461 $ 3,987,611 $ 3,286,779 Noninterest-bearing checking accounts 5.4 % 5.4 % 5.1 % 6.3 % 7.0 % Interest-bearing checking accounts 36.1 % 21.1 % 15.4 % 11.4 % 6.7 % Money market deposit accounts 46.3 % 51.6 % 55.1 % 57.4 % 59.0 % Certificates of deposit 12.2 % 21.9 % 24.4 % 24.9 % 27.3 % Total deposits 100.0 % 100.0 % 100.0 % 100.0 % 100.0 %

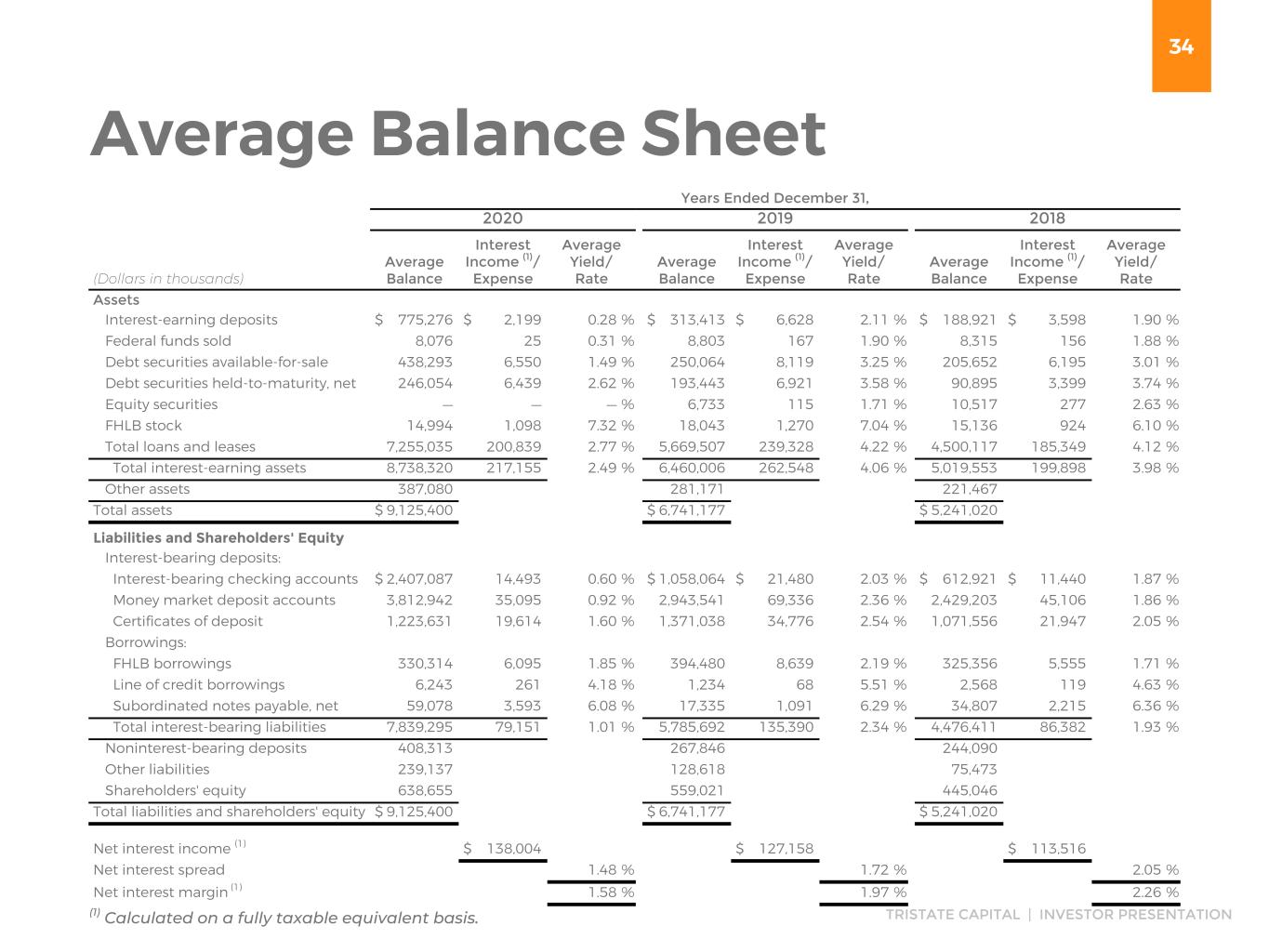

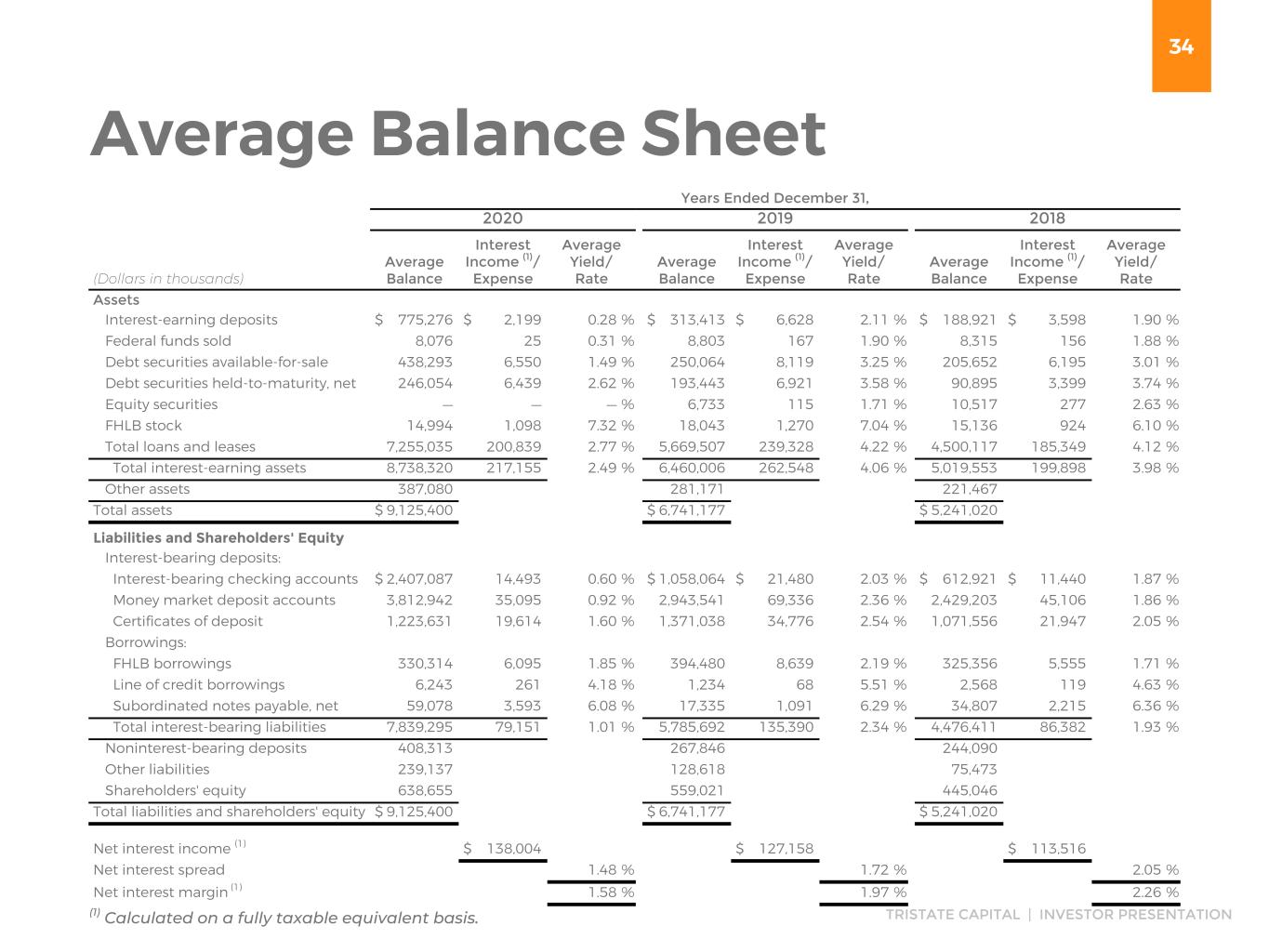

34 TRISTATE CAPITAL | INVESTOR PRESENTATION Average Balance Sheet Years Ended December 31, 2020 2019 2018 (Dollars in thousands) Average Balance Interest Income (1)/ Expense Average Yield/ Rate Average Balance Interest Income (1)/ Expense Average Yield/ Rate Average Balance Interest Income (1)/ Expense Average Yield/ Rate Assets Interest-earning deposits $ 775,276 $ 2,199 0.28 % $ 313,413 $ 6,628 2.11 % $ 188,921 $ 3,598 1.90 % Federal funds sold 8,076 25 0.31 % 8,803 167 1.90 % 8,315 156 1.88 % Debt securities available-for-sale 438,293 6,550 1.49 % 250,064 8,119 3.25 % 205,652 6,195 3.01 % Debt securities held-to-maturity, net 246,054 6,439 2.62 % 193,443 6,921 3.58 % 90,895 3,399 3.74 % Equity securities — — — % 6,733 115 1.71 % 10,517 277 2.63 % FHLB stock 14,994 1,098 7.32 % 18,043 1,270 7.04 % 15,136 924 6.10 % Total loans and leases 7,255,035 200,839 2.77 % 5,669,507 239,328 4.22 % 4,500,117 185,349 4.12 % Total interest-earning assets 8,738,320 217,155 2.49 % 6,460,006 262,548 4.06 % 5,019,553 199,898 3.98 % Other assets 387,080 281,171 221,467 Total assets $ 9,125,400 $ 6,741,177 $ 5,241,020 Liabilities and Shareholders' Equity Interest-bearing deposits: Interest-bearing checking accounts $ 2,407,087 14,493 0.60 % $ 1,058,064 $ 21,480 2.03 % $ 612,921 $ 11,440 1.87 % Money market deposit accounts 3,812,942 35,095 0.92 % 2,943,541 69,336 2.36 % 2,429,203 45,106 1.86 % Certificates of deposit 1,223,631 19,614 1.60 % 1,371,038 34,776 2.54 % 1,071,556 21,947 2.05 % Borrowings: FHLB borrowings 330,314 6,095 1.85 % 394,480 8,639 2.19 % 325,356 5,555 1.71 % Line of credit borrowings 6,243 261 4.18 % 1,234 68 5.51 % 2,568 119 4.63 % Subordinated notes payable, net 59,078 3,593 6.08 % 17,335 1,091 6.29 % 34,807 2,215 6.36 % Total interest-bearing liabilities 7,839,295 79,151 1.01 % 5,785,692 135,390 2.34 % 4,476,411 86,382 1.93 % Noninterest-bearing deposits 408,313 267,846 244,090 Other liabilities 239,137 128,618 75,473 Shareholders' equity 638,655 559,021 445,046 Total liabilities and shareholders' equity $ 9,125,400 $ 6,741,177 $ 5,241,020 Net interest income (1) $ 138,004 $ 127,158 $ 113,516 Net interest spread 1.48 % 1.72 % 2.05 % Net interest margin (1) 1.58 % 1.97 % 2.26 % (1) Calculated on a fully taxable equivalent basis.

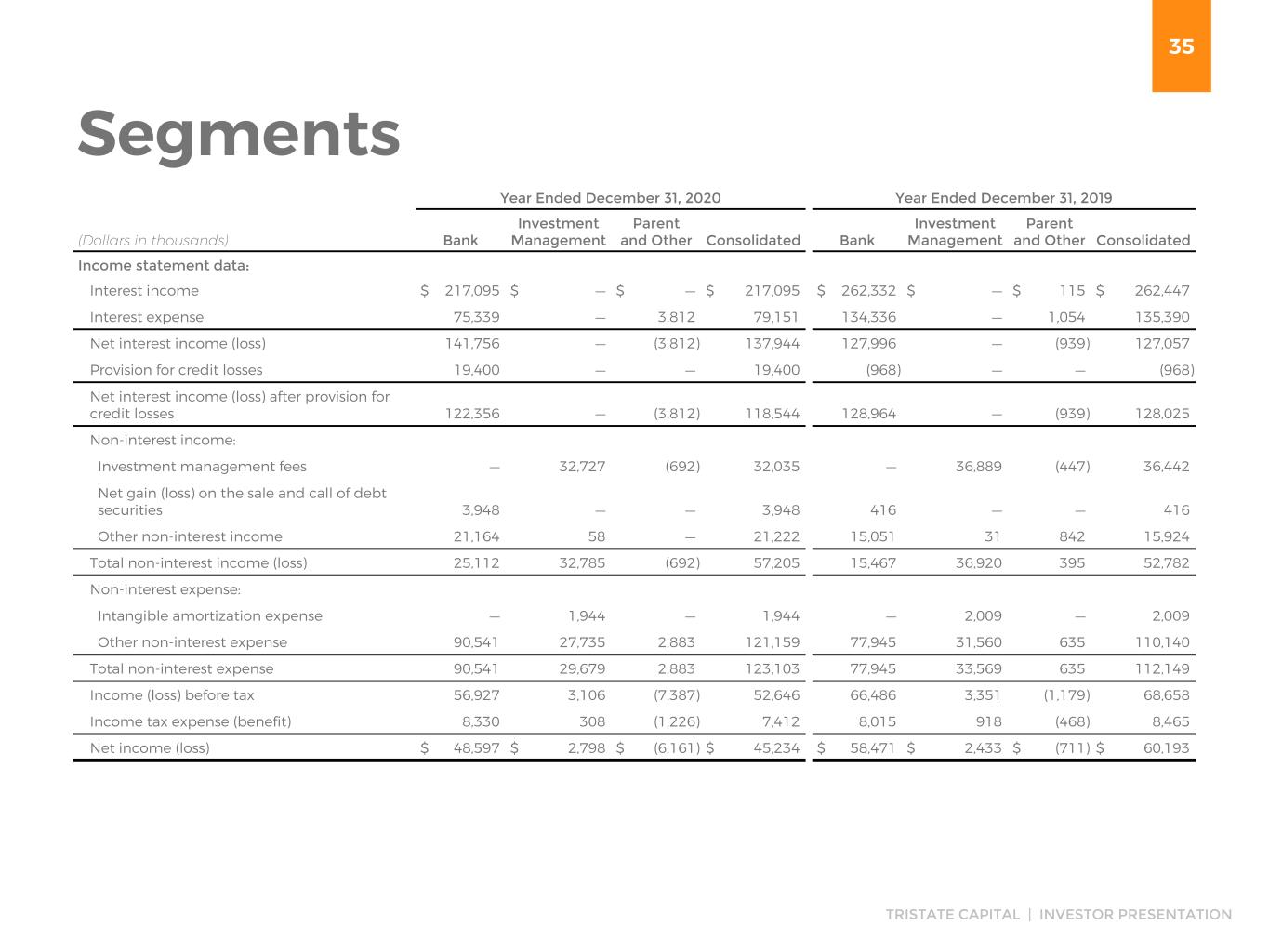

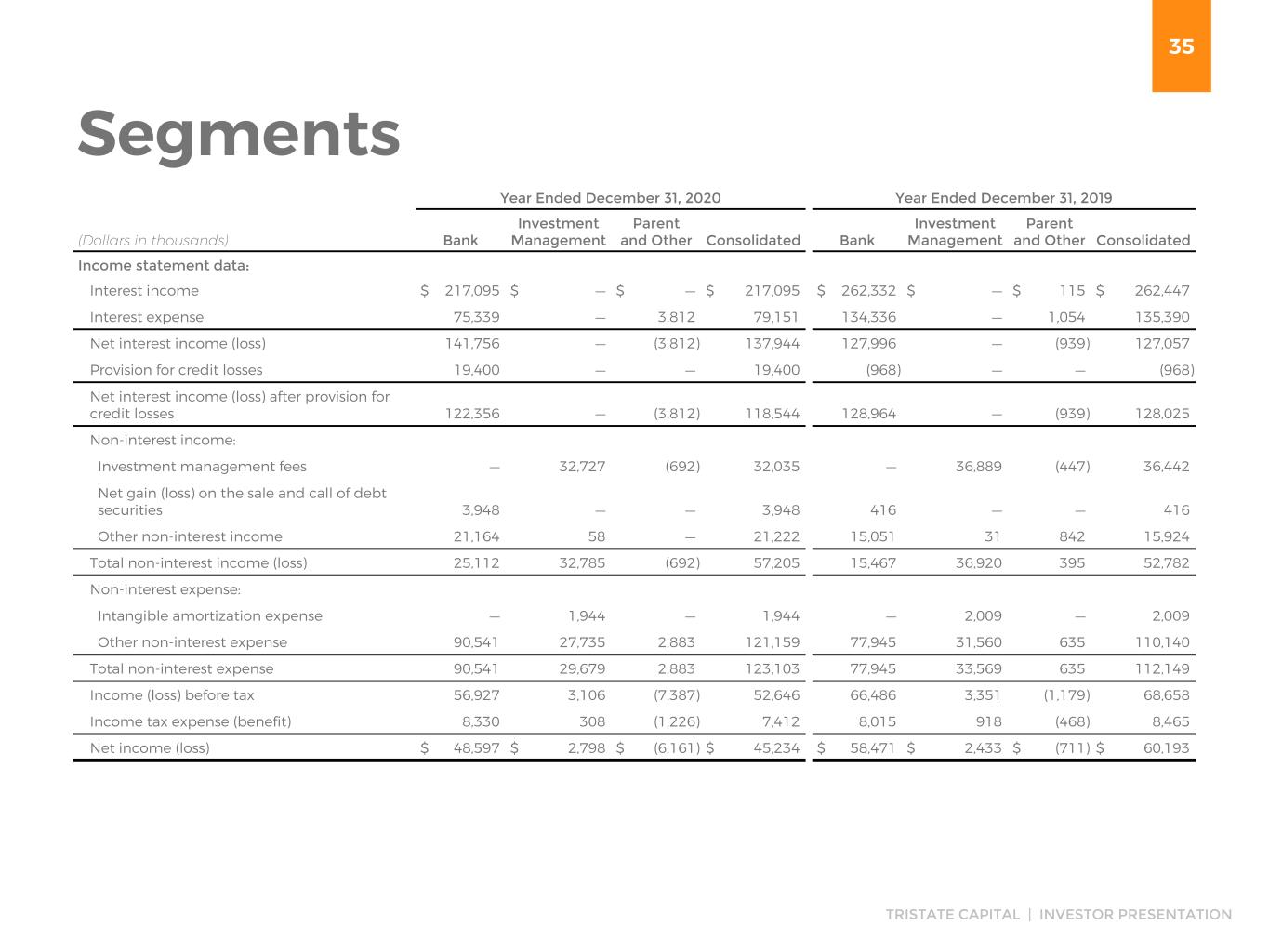

35 TRISTATE CAPITAL | INVESTOR PRESENTATION Segments Year Ended December 31, 2020 Year Ended December 31, 2019 (Dollars in thousands) Bank Investment Management Parent and Other Consolidated Bank Investment Management Parent and Other Consolidated Income statement data: Interest income $ 217,095 $ — $ — $ 217,095 $ 262,332 $ — $ 115 $ 262,447 Interest expense 75,339 — 3,812 79,151 134,336 — 1,054 135,390 Net interest income (loss) 141,756 — (3,812) 137,944 127,996 — (939) 127,057 Provision for credit losses 19,400 — — 19,400 (968) — — (968) Net interest income (loss) after provision for credit losses 122,356 — (3,812) 118,544 128,964 — (939) 128,025 Non-interest income: Investment management fees — 32,727 (692) 32,035 — 36,889 (447) 36,442 Net gain (loss) on the sale and call of debt securities 3,948 — — 3,948 416 — — 416 Other non-interest income 21,164 58 — 21,222 15,051 31 842 15,924 Total non-interest income (loss) 25,112 32,785 (692) 57,205 15,467 36,920 395 52,782 Non-interest expense: Intangible amortization expense — 1,944 — 1,944 — 2,009 — 2,009 Other non-interest expense 90,541 27,735 2,883 121,159 77,945 31,560 635 110,140 Total non-interest expense 90,541 29,679 2,883 123,103 77,945 33,569 635 112,149 Income (loss) before tax 56,927 3,106 (7,387) 52,646 66,486 3,351 (1,179) 68,658 Income tax expense (benefit) 8,330 308 (1,226) 7,412 8,015 918 (468) 8,465 Net income (loss) $ 48,597 $ 2,798 $ (6,161) $ 45,234 $ 58,471 $ 2,433 $ (711) $ 60,193

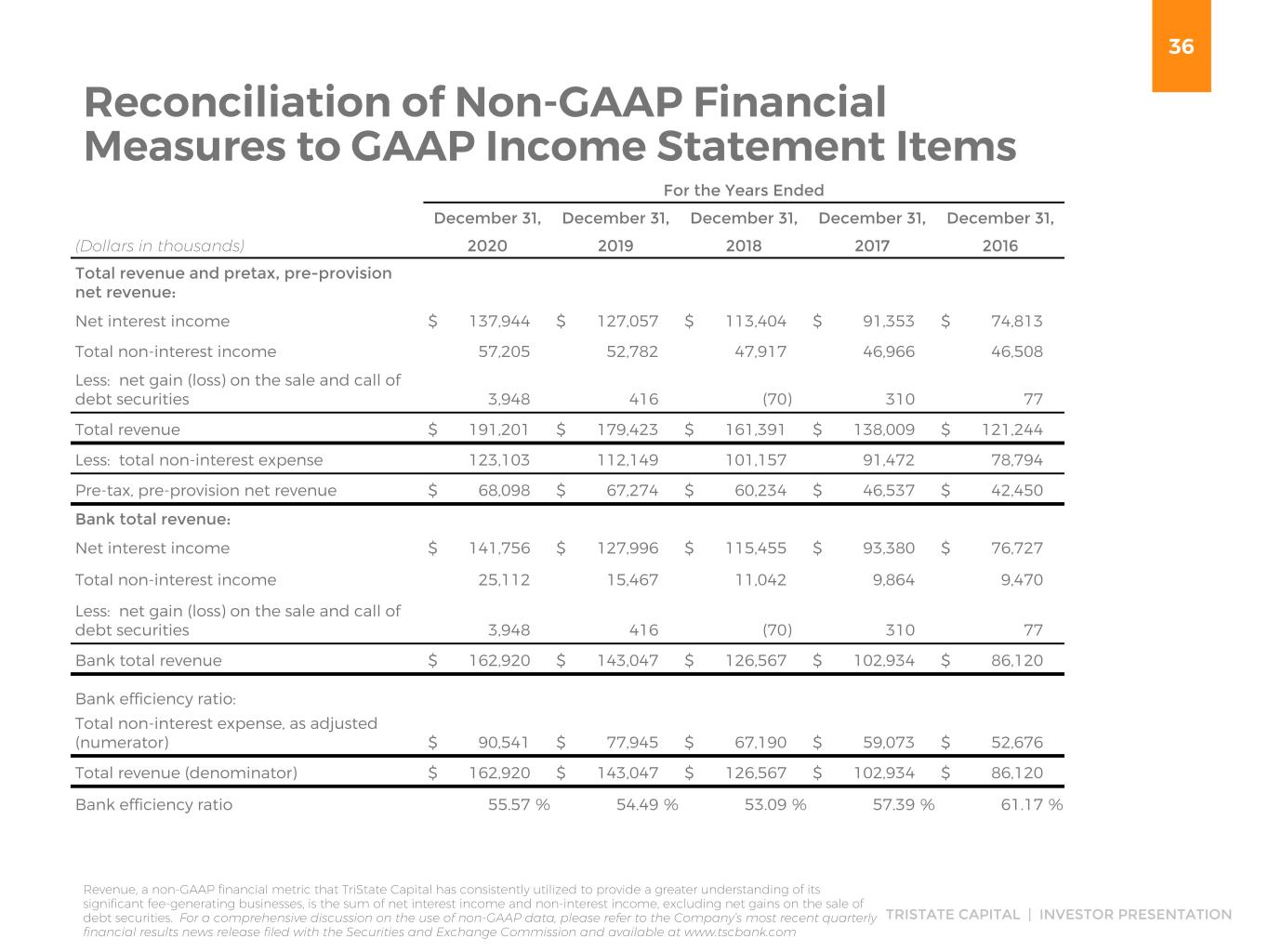

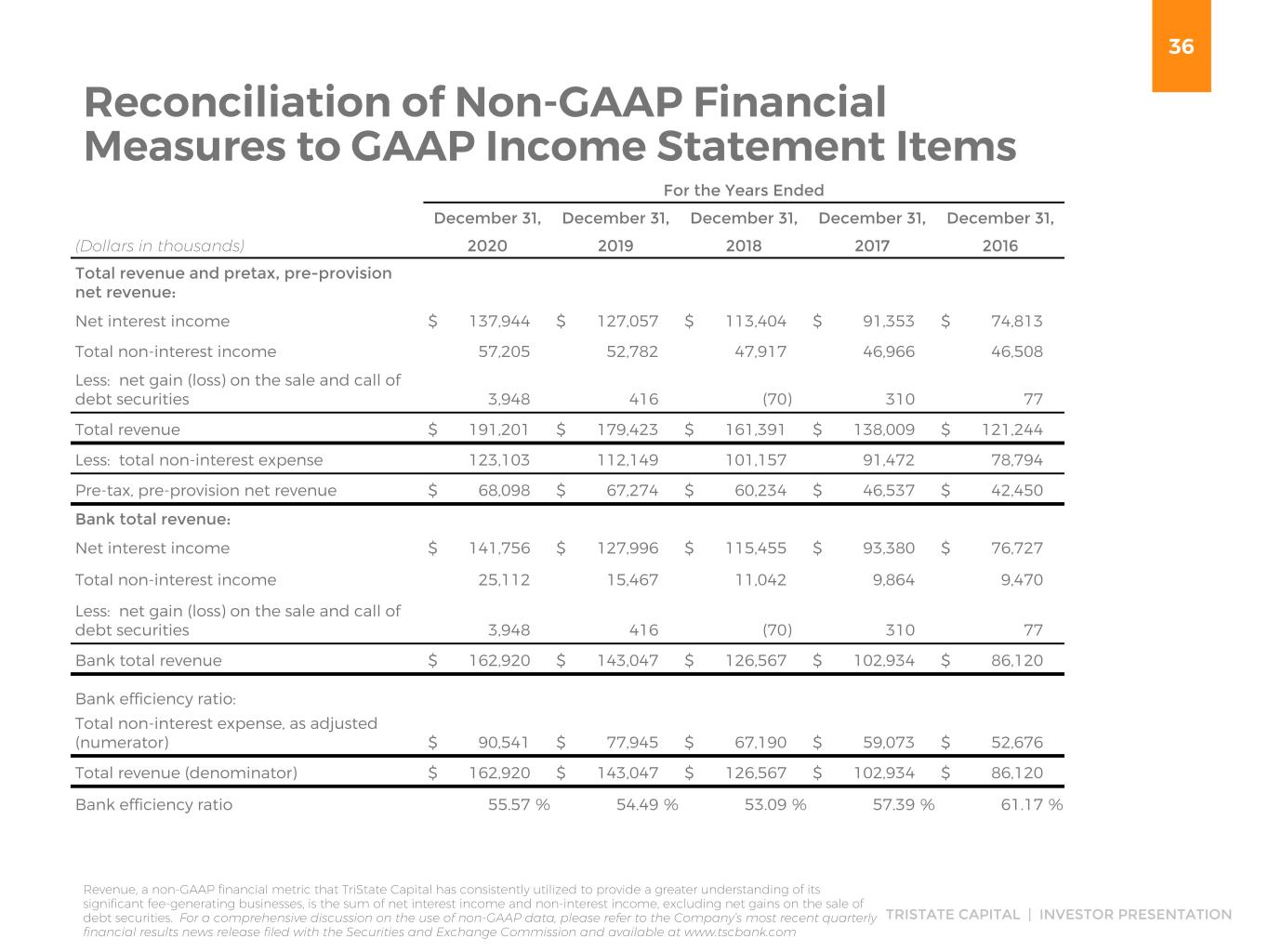

36 TRISTATE CAPITAL | INVESTOR PRESENTATION Reconciliation of Non-GAAP Financial Measures to GAAP Income Statement Items Revenue, a non-GAAP financial metric that TriState Capital has consistently utilized to provide a greater understanding of its significant fee-generating businesses, is the sum of net interest income and non-interest income, excluding net gains on the sale of debt securities. For a comprehensive discussion on the use of non-GAAP data, please refer to the Company’s most recent quarterly financial results news release filed with the Securities and Exchange Commission and available at www.tscbank.com For the Years Ended December 31, December 31, December 31, December 31, December 31, (Dollars in thousands) 2020 2019 2018 2017 2016 Total revenue and pretax, pre-provision net revenue: Net interest income $ 137,944 $ 127,057 $ 113,404 $ 91,353 $ 74,813 Total non-interest income 57,205 52,782 47,917 46,966 46,508 Less: net gain (loss) on the sale and call of debt securities 3,948 416 (70) 310 77 Total revenue $ 191,201 $ 179,423 $ 161,391 $ 138,009 $ 121,244 Less: total non-interest expense 123,103 112,149 101,157 91,472 78,794 Pre-tax, pre-provision net revenue $ 68,098 $ 67,274 $ 60,234 $ 46,537 $ 42,450 Bank total revenue: Net interest income $ 141,756 $ 127,996 $ 115,455 $ 93,380 $ 76,727 Total non-interest income 25,112 15,467 11,042 9,864 9,470 Less: net gain (loss) on the sale and call of debt securities 3,948 416 (70) 310 77 Bank total revenue $ 162,920 $ 143,047 $ 126,567 $ 102,934 $ 86,120 Bank efficiency ratio: Total non-interest expense, as adjusted (numerator) $ 90,541 $ 77,945 $ 67,190 $ 59,073 $ 52,676 Total revenue (denominator) $ 162,920 $ 143,047 $ 126,567 $ 102,934 $ 86,120 Bank efficiency ratio 55.57 % 54.49 % 53.09 % 57.39 % 61.17 %

37 TRISTATE CAPITAL | INVESTOR PRESENTATION For the Years Ended December 31, December 31, December 31, December 31, December 31, (Dollars in thousands) 2020 2019 2018 2017 2016 Investment Management EBITDA: Net income $ 2,798 $ 2,433 $ 3,851 $ 4,551 $ 6,933 Interest expense — — — — — Income tax expense 308 918 579 522 4,357 Depreciation expense 423 465 502 497 165 Intangible amortization expense 1,944 2,009 1,968 1,851 1,753 EBITDA $ 5,473 $ 5,824 $ 6,900 $ 7,421 $ 13,208 Reconciliation of Non-GAAP Financial Measures to GAAP Income Statement Items For a comprehensive discussion on the use of non-GAAP data, please refer to the Company’s most recent quarterly financial results news release filed with the Securities and Exchange Commission and available at www.tscbank.com

38 TRISTATE CAPITAL | INVESTOR PRESENTATION Reconciliation of Non-GAAP Financial Measures to GAAP Balance Sheet Items As of (Dollars in thousands, except per share data) December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 Tangible book value per common share: Common shareholders' equity $ 580,002 $ 505,202 $ 440,886 $ 389,071 $ 351,807 Less: goodwill and intangible assets 63,911 65,854 67,863 65,358 67,209 Tangible common equity (numerator) $ 516,091 $ 439,348 $ 373,023 $ 323,713 $ 284,598 Common shares outstanding (denominator) 32,620,150 29,355,986 28,878,674 28,591,101 28,415,654 Tangible book value per common share $ 15.82 $ 14.97 $ 12.92 $ 11.32 $ 10.02 For a comprehensive discussion on the use of non-GAAP data, please refer to the Company’s most recent quarterly financial results news release filed with the Securities and Exchange Commission and available at www.tscbank.com

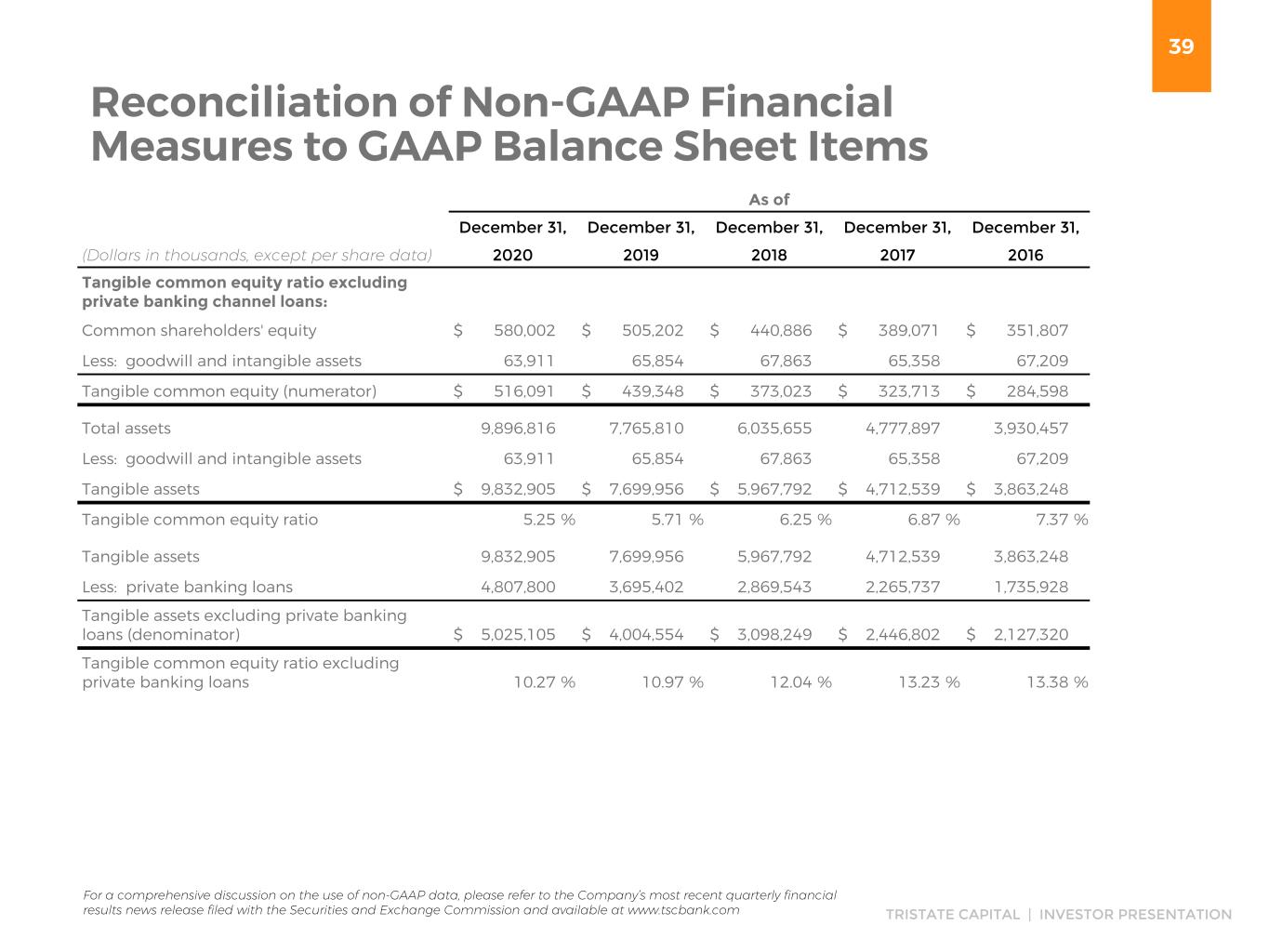

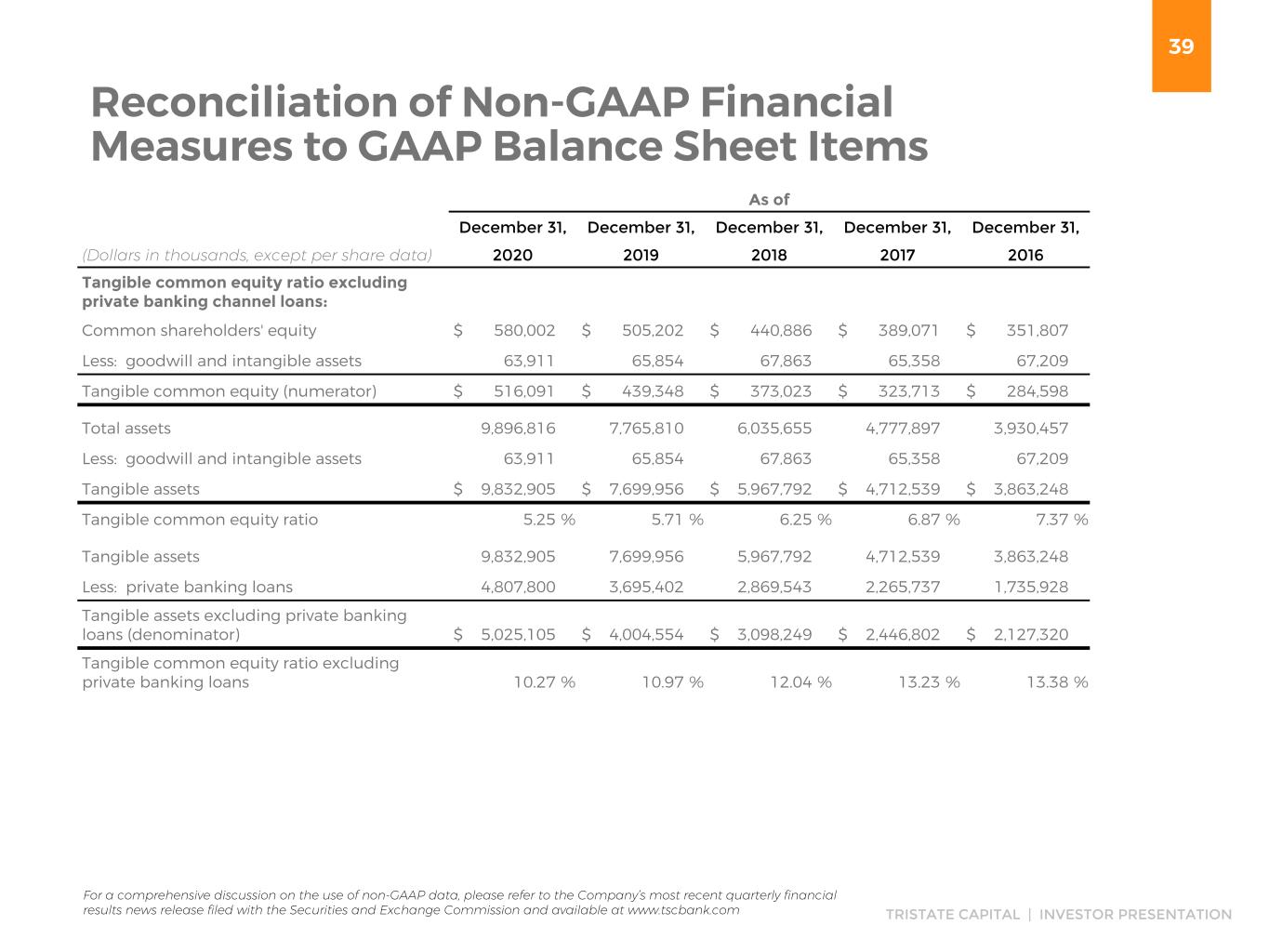

39 TRISTATE CAPITAL | INVESTOR PRESENTATION Reconciliation of Non-GAAP Financial Measures to GAAP Balance Sheet Items As of (Dollars in thousands, except per share data) December 31, December 31, December 31, December 31, December 31, 2020 2019 2018 2017 2016 Tangible common equity ratio excluding private banking channel loans: Common shareholders' equity $ 580,002 $ 505,202 $ 440,886 $ 389,071 $ 351,807 Less: goodwill and intangible assets 63,911 65,854 67,863 65,358 67,209 Tangible common equity (numerator) $ 516,091 $ 439,348 $ 373,023 $ 323,713 $ 284,598 Total assets 9,896,816 7,765,810 6,035,655 4,777,897 3,930,457 Less: goodwill and intangible assets 63,911 65,854 67,863 65,358 67,209 Tangible assets $ 9,832,905 $ 7,699,956 $ 5,967,792 $ 4,712,539 $ 3,863,248 Tangible common equity ratio 5.25 % 5.71 % 6.25 % 6.87 % 7.37 % Tangible assets 9,832,905 7,699,956 5,967,792 4,712,539 3,863,248 Less: private banking loans 4,807,800 3,695,402 2,869,543 2,265,737 1,735,928 Tangible assets excluding private banking loans (denominator) $ 5,025,105 $ 4,004,554 $ 3,098,249 $ 2,446,802 $ 2,127,320 Tangible common equity ratio excluding private banking loans 10.27 % 10.97 % 12.04 % 13.23 % 13.38 % For a comprehensive discussion on the use of non-GAAP data, please refer to the Company’s most recent quarterly financial results news release filed with the Securities and Exchange Commission and available at www.tscbank.com