UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to to

OR

| | ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-33178

MELCO CROWN ENTERTAINMENT LIMITED

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

36th Floor, The Centrium, 60 Wyndham Street, Central, Hong Kong

(Address of principal executive offices)

Desmond Wong Kar Pang, Director, Financial Compliance Tel +852 2598 3600, Fax +852 2537 3618

36th Floor, The Centrium, 60 Wyndham Street, Central, Hong Kong

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| American depositary shares | | The NASDAQ Stock Market LLC |

| each representing three ordinary shares | | (The NASDAQ Global Select Market) |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,658,059,295 ordinary shares outstanding as of December 31, 2012

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

þ Large accelerated filer | | ¨ Accelerated filer | | ¨ Non-accelerated filer |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP þ | | International Financial Reporting

Standards as issued by the International

Accounting Standards Board ¨ | | Other¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

TABLE OF CONTENTS

i

ii

iii

INTRODUCTION

In this annual report on Form 20-F, unless otherwise indicated:

| | • | | “2011 Credit Facilities” refers to the credit facilities entered into pursuant to an amendment agreement dated June 22, 2011 between, among others, Melco Crown Macau, Deutsche Bank AG, Hong Kong Branch as agent and DB Trustees (Hong Kong) Limited as security agent, comprising a term loan facility and a revolving credit facility, for a total amount of HK$9.36 billion (equivalent to approximately US$1.2 billion), and which reduce and remove certain restrictions in the City of Dreams Project Facility; |

| | • | | “ADSs” refers to our American depositary shares, each of which represents three ordinary shares; |

| | • | | “Aircraft Term Loan” refers to the US$43.0 million term loan credit facility entered into by MCE Transportation in June 2012 for the purpose of the acquisition of an aircraft; |

| | • | | “Altira Developments” refers to our subsidiary, Altira Developments Limited, a Macau company through which we hold the land and building for Altira Macau; |

| | • | | “Altira Hotel” refers to our subsidiary, Altira Hotel Limited, a Macau company through which we currently operate the hotel and other non-gaming businesses at Altira Macau; |

| | • | | “Altira Macau” refers to an integrated casino and hotel development that caters to Asian rolling chip customers, which opened in May 2007 and owned by Altira Developments; |

| | • | | “China,” “mainland China” and “PRC” refer to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan from a geographical point of view; |

| | • | | “City of Dreams” refers to an integrated resort located on two adjacent pieces of land in Cotai, Macau, which opened in June 2009, and currently features a casino areas and three luxury hotels, including a collection of retail brands, a wet stage performance theater and other entertainment venues, and owned by Melco Crown (COD) Developments; |

| | • | | “City of Dreams Project Facility” refers to the project facility dated September 5, 2007 entered into between, amongst others, Melco Crown Macau as borrower and certain other subsidiaries as guarantors, for a total sum of US$1.75 billion for the purposes of financing, among other things, certain project costs of City of Dreams, as amended and supplemented from time to time; |

| | • | | “Cotai” refers to an area of reclaimed land located between the islands of Taipa and Coloane in Macau; |

| | • | | “Crown” refers to Crown Limited, an Australian-listed corporation, which completed its acquisition of the gaming businesses and investments of PBL, now known as Consolidated Media Holdings Limited, on December 12, 2007; |

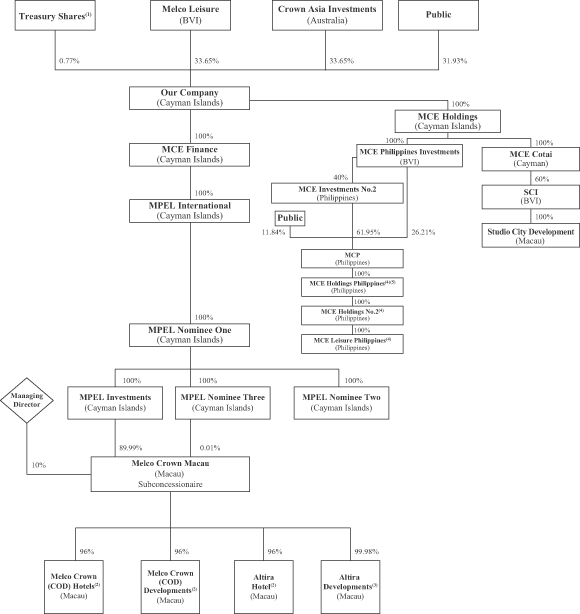

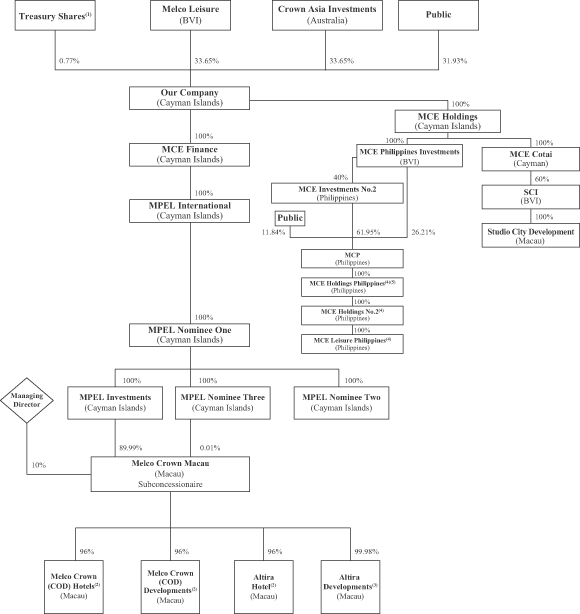

| | • | | “Crown Asia Investments” refers to Crown Asia Investments Pty, Ltd., formerly known as PBL Asia Investments Limited, which is 100% indirectly owned by Crown, and was incorporated in the Cayman Islands but is now a registered Australian company; |

| | • | | “Crown Entertainment Group Holdings” refers to Crown Entertainment Group Holdings Pty, Ltd., a company incorporated on June 19, 2007 under the laws of Australia and a subsidiary of Crown; |

1

| | • | | “Deposit-Linked Loan” refers to a deposit linked facility for HK$2.7 billion (equivalent to approximately US$353.3 million based on exchange rate on transaction date) entered into on May 20, 2011, which is secured by a deposit of RMB2.3 billion (equivalent to approximately US$353.3 million based on exchange rate on transaction date) from the proceeds of the RMB Bonds and fully repaid in March 2013; |

| | • | | “DICJ” refers to the Direcção de Inspecção e Coordenação de Jogos (the Gaming Inspection and Coordination Bureau), a department of the Public Administration of Macau; |

| | • | | “Exchange Notes” refers to approximately 99.96% of the Initial Notes which were, on December 27, 2010, exchanged for 10.25% senior notes due 2018, registered under the Securities Act of 1933; |

| | • | | “Greater China” refers to mainland China, Hong Kong and Macau, collectively; |

| | • | | “HK$” and “H.K. dollars” refer to the legal currency of Hong Kong; |

| | • | | “HKSE” refers to The Stock Exchange of Hong Kong Limited; |

| | • | | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| | • | | “Initial Notes” refers to the US$600 million aggregate principal amount of 10.25% senior notes due 2018 issued by MCE Finance on May 17, 2010 and fully redeemed on March 28, 2013; |

| | • | | “Macau” and “Macau SAR” refer to the Macau Special Administrative Region of the People’s Republic of China; |

| | • | | “MCE Finance” refers to our wholly owned subsidiary, MCE Finance Limited, a Cayman Islands exempted company with limited liability; |

| | • | | “MCE Holdings Philippines” refers to our indirect subsidiary, MCE Holdings (Philippines) Corporation, a corporation incorporated in the Philippines; |

| | • | | “MCE Holdings No.2” refers to our indirect subsidiary, MCE Holdings No.2 (Philippines) Corporation, a corporation incorporated in the Philippines; |

| | • | | “MCE Leisure Philippines” refers to our indirect subsidiary, MCE Leisure (Philippines) Corporation, a corporation incorporated in the Philippines; |

| | • | | “MCE Philippines Investments” refers to our indirect subsidiary, MCE (Philippines) Investments Limited, a company incorporated under the laws of the British Virgin Islands; |

| | • | | “MCE Investments No.2” refers to MCE (Philippines) Investments No.2 Corporation, a corporation incorporated under the laws of the Philippines; |

| | • | | “MCE Transportation” refers to our subsidiary, MCE Transportation Limited (formerly known as MCE Designs and Brands Limited), a company incorporated under the laws of the British Virgin Islands; |

| | • | | “MCP” refers to Melco Crown (Philippines) Resorts Corporation (formerly known as Manchester International Holdings Unlimited Corporation), the shares of which are listed on the Philippine Stock Exchange; |

2

| | • | | “Melco” refers to Melco International Development Limited, a Hong Kong listed company; |

| | • | | “Melco Crown (COD) Developments” refers to our subsidiary, Melco Crown (COD) Developments Limited, a Macau company through which we hold the land and buildings for City of Dreams; |

| | • | | “Melco Crown (COD) Hotels” refers to our subsidiary, Melco Crown (COD) Hotels Limited, a Macau company through which we currently operate the non-gaming businesses at City of Dreams; |

| | • | | “Melco Crown Macau” refers to our subsidiary, Melco Crown (Macau) Limited (formerly known as “Melco Crown Gaming (Macau) Limited” or “Melco PBL Gaming (Macau) Limited”), a Macau company and the holder of our gaming subconcession; |

| | • | | “MPEL International” refers to our wholly owned subsidiary, MPEL International Limited, a Cayman Islands company with limited liability; |

| | • | | “Melco Leisure” refers to Melco Leisure and Entertainment Group Limited, a company incorporated under the laws of the British Virgin Islands and a wholly owned subsidiary of Melco; |

| | • | | “Mocha Clubs” collectively refers to clubs with gaming machines, the first of which opened in September 2003, and are now the largest non-casino based operations of electronic gaming machines in Macau, and operated by Melco Crown Macau; |

| | • | | “New Cotai Holdings” refers to New Cotai Holdings, LLC, a company incorporated in Delaware, the United States on March 24, 2006 under the laws of Delaware, primarily owned by U.S. investment funds managed by Silver Point Capital, L.P. and Oaktree Capital Management, L.P.; |

| | • | | “our board” refers to the board of directors of our company or a duly constituted committee thereof; |

| | • | | “our subconcession” and “our gaming subconcession” refer to the Macau gaming subconcession held by Melco Crown Macau; |

| | • | | “Patacas” and “MOP” refer to the legal currency of Macau; |

| | • | | “PAGCOR” refers to Philippines Amusement and Gaming Corporation, the Philippines regulatory body with jurisdiction over all gaming activities in the Philippines except for lottery, sweepstakes, cockfighting, horse racing and gaming inside the Cagayan Export Zone; |

| | • | | “PBL” refers to Publishing and Broadcasting Limited, an Australian listed corporation that is now known as Consolidated Media Holdings Limited; |

| | • | | “Philippine Stock Exchange” refers to The Philippine Stock Exchange, Inc.; |

| | • | | “Philippine Parties” refers to SM Investments Corporation, Belle Corporation and PremiumLeisure and Amusement, Inc.; |

| | • | | “Philippine Peso” refers to the legal currency of the Philippines; |

| | • | | “Philippines Project” refers to an integrated resort located within Entertainment City, Manila to be developed by MCE Leisure Philippines and the Philippine Parties which, when completed, is expected to be solely operated and managed by MCE Leisure Philippines; |

3

| | • | | “Renminbi” and “RMB” refer to the legal currency of China; |

| | • | | “RMB Bonds” refers to the RMB2.3 billion (equivalent to approximately US$353.3 million based on exchange rate on transaction date) aggregate principal amount of 3.75% bonds due 2013 issued by our company on May 9, 2011 and fully redeemed on March 11, 2013; |

| | • | | “SCI” refers to Studio City International Holdings Limited (formerly known as Cyber One Agents Limited), a company incorporated in the British Virgin Islands with limited liability that is 60% owned by one of our subsidiaries and 40% owned by New Cotai Holdings through its wholly owned subsidiary New Cotai, LLC; |

| | • | | “2010 Senior Notes” refers to the Initial Notes and the Exchange Notes, collectively, which were fully redeemed on March 28, 2013; |

| | • | | “2013 Senior Notes” refers to the US$1.0 billion aggregate principal amount of 5.00% senior notes due 2021 issued by MCE Finance on February 7, 2013; |

| | • | | “share(s)” and “ordinary share(s)” refer to our ordinary share(s), par value of US$0.01 each; |

| | • | | “Studio City” refers to a cinematically-themed integrated entertainment, retail and gaming resort in Cotai, Macau; |

| | • | | “Studio City Developments” refers to our subsidiary, Studio City Developments Limited (formerly known as MSC Desenvolvimentos, Limitada and East Asia Satellite Television Limited), a Macau company in which we own 60% of the equity interest; |

| | • | | “Studio City Finance” refers to Studio City Finance Limited, which is a company incorporated in the British Virgin Islands with limited liability, is also a wholly owned indirect subsidiary of SCI and the issuer of the Studio City Notes; |

| | • | | “Studio City Notes” refers to the US$825.0 million aggregate principal amount of 8.50% senior notes due 2020 issued by Studio City Finance on November 26, 2012; |

| | • | | “Studio City Project Facility” refers to the senior secured project facility, dated January 28, 2013, entered into between, among others, Studio City Company Limited as borrower and certain subsidiaries as guarantors for a total sum of HK$10,855,880,000 and consisting of a delayed draw term loan facility and a revolving credit facility; |

| | • | | “TWD” and “New Taiwan dollars” refer to the legal currency of Taiwan; |

| | • | | “US$” and “U.S. dollars” refer to the legal currency of the United States; |

| | • | | “U.S. GAAP” refers to the accounting principles generally accepted in the United States; and |

| | • | | “we,” “us,” “our company,” “our” and “MCE” refer to Melco Crown Entertainment Limited and, as the context requires, its predecessor entities and its consolidated subsidiaries. |

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2012, 2011 and 2010 and as of December 31, 2012 and 2011.

Any discrepancies in any table between totals and sums of amounts listed therein are due to rounding. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures preceding them.

4

GLOSSARY

“average daily rate” or “ADR” | calculated by dividing total room revenues (less service charges, if any) by total rooms occupied, i.e., average price of occupied rooms per day |

“cage” | a secure room within a casino with a facility that allows patrons to exchange cash for chips required to participate in gaming activities, or to exchange chips for cash |

“chip” | round token that is used on casino gaming tables in lieu of cash |

“concession” | a government grant for the operation of games of fortune and chance in casinos in Macau under an administrative contract pursuant to which a concessionaire, or the entity holding the concession, is authorized to operate games of fortune and chance in casinos in Macau |

“dealer” | a casino employee who takes and pays out wagers or otherwise oversees a gaming table |

“drop” | the amount of cash to purchase gaming chips and promotional vouchers that are deposited in a gaming table’s drop box, plus gaming chips purchased at the casino cage |

“drop box” | a box or container that serves as a repository for cash, chips, chip purchase vouchers, credit markers and forms used to record movements in the chip inventory on each table game |

“gaming machine handle (volume)” | the total amount wagered in gaming machines |

“gaming promoter” or “junket representative” | an individual or corporate entity who, for the purpose of promoting rolling chip and other gaming activities, arranges customer transportation and accommodation, provides credit in its sole discretion if authorized by a gaming operator, and arranges food and beverage services and entertainment in exchange for commissions or other compensation from a gaming operator |

“integrated resort” | a resort which provides customers with a combination of hotel accommodations, casinos or gaming areas, retail and dining facilities, MICE space, entertainment venues and spas |

“junket player” | a player sourced by gaming promoters to play in the VIP gaming rooms or areas |

“marker” | evidence of indebtedness by a player to the casino or gaming operator |

5

“mass market patron” | a customer who plays in the mass market segment |

“mass market segment” | consists of both table games and slot machines played on public mass gaming floors by mass market patrons for cash stakes that are typically lower than those in the rolling chip segment |

“mass market table games drop” | the amount of table games drop in the mass market table games segment |

“mass market table games hold percentage” | mass market table games win as a percentage of mass market table games drop |

“mass market table games segment” | the mass market segment consisting of mass market patrons who play table games |

“MICE” | Meetings, Incentives, Conventions and Exhibitions, an acronym commonly used to refer to tourism involving large groups brought together for an event or specific purpose |

“net rolling” | net turnover in a non-negotiable chip game |

“non-negotiable chip” | promotional casino chip that is not to be exchanged for cash |

“non-rolling chip” or “traditional cash chip” | chip that can be exchanged for cash, used by mass market patrons to make wagers |

“occupancy rate” | the average percentage of available hotel rooms occupied during a period |

“premium direct player” | a rolling chip player who is a direct customer of the concessionaires or subconcessionaires and is attracted to the casino through direct marketing efforts and relationships with the gaming operator |

“progressive jackpot” | a jackpot for a slot machine or table game where the value of the jackpot increases as wagers are made; multiple slot machines or table games may be linked together to establish one progressive jackpot |

“revenue per available room” or “REVPAR” | calculated by dividing total room revenues (less service charges, if any) by total rooms available, thereby representing a combination of hotel average daily room rates and occupancy |

“rolling chip” | non-negotiable chip primarily used by rolling chip patrons to make wagers |

“rolling chip patron” | a player who is primarily a VIP player and typically receives various forms of complimentary services from |

6

| | the gaming promoters or concessionaires or subconcessionaires |

“rolling chip segment” | consists of table games played in private VIP gaming rooms or areas by rolling chip patrons who are either premium direct players or junket players |

“rolling chip volume” | the amount of non-negotiable chips wagered and lost by the rolling chip market segment |

“rolling chip win rate” | rolling chip table games win (calculated before discounts and commissions) as a percentage of rolling chip volume |

“slot machine” | traditional gaming machine operated by a single player and electronic multiple-player gaming machines |

“subconcession” | an agreement for the operation of games of fortune and chance in casinos between the entity holding the concession, or the concessionaire, a subconcessionaire and the Macau government, pursuant to which the subconcessionaire is authorized to operate games of fortune and chance in casinos in Macau |

“table games win” | the amount of wagers won net of wagers lost on gaming tables that is retained and recorded as casino revenues |

“VIP gaming room” or “VIP gaming area” | gaming rooms or areas that have restricted access to rolling chip patrons and typically offer more personalized service than the general mass market gaming areas |

“wet stage performance theater” | the approximately 2,000-seat theater specifically designed to stageThe House of Dancing Water show |

“win percentage-gaming machines” | gaming machine win expressed as a percentage of gaming machine handle |

7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that relate to future events, including our future operating results and conditions, our prospects and our future financial performance and condition, all of which are largely based on our current expectations and projections. The forward-looking statements are contained principally in the sections entitled “Item 3. Key Information — D. Risk Factors,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. See “Item 3. Key Information — D. Risk Factors” for a discussion of some risk factors that may affect our business and results of operations. Moreover, because we operate in a heavily regulated and evolving industry, may become highly leveraged, and operate in Macau, a market that has recently experienced extremely rapid growth and intense competition, new risk factors may emerge from time to time. It is not possible for our management to predict all risk factors, nor can we assess the impact of these factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those expressed or implied in any forward-looking statement.

In some cases, forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. We have based the forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements relating to:

| | • | | our ability to raise additional financing; |

| | • | | our future business development, results of operations and financial condition; |

| | • | | growth of the gaming market in and visitation to Macau; |

| | • | | our anticipated growth strategies; |

| | • | | the liberalization of travel restrictions on PRC citizens and convertibility of the Renminbi; |

| | • | | the availability of credit for gaming patrons; |

| | • | | the uncertainty of tourist behavior related to spending and vacationing at casino resorts in Macau; |

| | • | | fluctuations in occupancy rates and average daily room rates in Macau; |

| | • | | increased competition and other planned casino hotel and resort projects in Macau and elsewhere in Asia, including in Macau from Sociedade de Jogos de Macau, S.A., or SJM, Venetian Macao, S.A., or VML, Wynn Resorts (Macau) S.A., or Wynn Macau, Galaxy Casino, S.A., or Galaxy, and MGM Grand Paradise, S.A., or MGM Grand Paradise; |

| | • | | the formal grant of an occupancy permit for certain areas of City of Dreams that remain under construction or development; |

| | • | | the development of Studio City; |

| | • | | our entering into new development and construction and new ventures in or outside of Macau, for example, in the Philippines; |

8

| | • | | construction cost estimates for our development projects, including projected variances from budgeted costs; |

| | • | | government regulation of the casino industry, including gaming license approvals and the legalization of gaming in other jurisdictions; |

| | • | | the completion of infrastructure projects in Macau; |

| | • | | the outcome of any current and future litigation; and |

| | • | | other factors described under “Item 3. Key Information — D. Risk Factors.” |

The forward-looking statements made in this annual report on Form 20-F relate only to events or information as of the date on which the statements are made in this annual report on Form 20-F. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report on Form 20-F and the documents that we referenced in this annual report on Form 20-F and have filed as exhibits with the U.S. Securities and Exchange Commission, or the SEC, completely and with the understanding that our actual future results may be materially different from what we expect.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

9

A. SELECTED FINANCIAL DATA

The following selected consolidated statement of operations data for the years ended December 31, 2012, 2011 and 2010 and balance sheet data as of December 31, 2012 and 2011 have been derived from our audited consolidated financial statements included elsewhere in this annual report beginning on page F-1.

The selected consolidated statement of operations data for the years ended December 31, 2009 and 2008 and the balance sheet data as of December 31, 2010, 2009 and 2008 have been derived from our audited consolidated financial statements not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with U.S. GAAP. You should read the selected consolidated financial data in conjunction with our consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report. The historical results are not necessarily indicative of the results of operations to be expected in the future.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (In thousands of US$, except share and per share data and operating data) | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net revenues | | $ | 4,078,013 | | | $ | 3,830,847 | | | $ | 2,641,976 | | | $ | 1,332,873 | | | $ | 1,416,134 | |

Total operating costs and expenses | | $ | (3,570,921 | ) | | $ | (3,385,737 | ) | | $ | (2,549,464 | ) | | $ | (1,604,920 | ) | | $ | (1,414,960 | ) |

Operating income (loss) | | $ | 507,092 | | | $ | 445,110 | | | $ | 92,512 | | | $ | (272,047 | ) | | $ | 1,174 | |

Net income (loss) | | $ | 398,672 | | | $ | 288,844 | | | $ | (10,525 | ) | | $ | (308,461 | ) | | $ | (2,463 | ) |

Net loss attributable to noncontrolling interests | | $ | 18,531 | | | $ | 5,812 | | | $ | — | | | $ | — | | | $ | — | |

Net income (loss) attributable to our company | | $ | 417,203 | | | $ | 294,656 | | | $ | (10,525 | ) | | $ | (308,461 | ) | | $ | (2,463 | ) |

Net income (loss) attributable to our company per share | | | | | | | | | | | | | | | | | | | | |

— Basic | | $ | 0.254 | | | $ | 0.184 | | | $ | (0.007 | ) | | $ | (0.210 | ) | | $ | (0.002 | ) |

— Diluted | | $ | 0.252 | | | $ | 0.182 | | | $ | (0.007 | ) | | $ | (0.210 | ) | | $ | (0.002 | ) |

Net income (loss) attributable to our company per ADS (1) | | | | | | | | | | | | | | | | | | | | |

— Basic | | $ | 0.761 | | | $ | 0.551 | | | $ | (0.020 | ) | | $ | (0.631 | ) | | $ | (0.006 | ) |

— Diluted | | $ | 0.755 | | | $ | 0.547 | | | $ | (0.020 | ) | | $ | (0.631 | ) | | $ | (0.006 | ) |

Weighted average shares used in net income (loss) attributable to our company per share calculation | | | | | | | | | | | | | | | | | | | | |

— Basic | | | 1,645,346,902 | | | | 1,604,213,324 | | | | 1,595,552,022 | | | | 1,465,974,019 | | | | 1,320,946,942 | |

— Diluted | | | 1,658,262,996 | | | | 1,616,854,682 | | | | 1,595,552,022 | | | | 1,465,974,019 | | | | 1,320,946,942 | |

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (In thousands of US$) | |

Consolidated Balance Sheets Data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 1,709,209 | | | $ | 1,158,024 | | | $ | 441,923 | | | $ | 212,598 | | | $ | 815,144 | |

Restricted cash | | | 1,414,664 | | | | 364,807 | | | | 167,286 | | | | 236,119 | | | | 67,977 | |

Total assets | | | 7,947,466 | | | | 6,269,980 | | | | 4,884,440 | | | | 4,862,845 | | | | 4,495,442 | |

Total current liabilities | | | 1,721,666 | | | | 603,119 | | | | 675,604 | | | | 521,643 | | | | 447,289 | |

Total debts (2) | | | 3,194,864 | | | | 2,325,980 | | | | 1,839,931 | | | | 1,798,879 | | | | 1,529,195 | |

Total liabilities | | | 4,206,710 | | | | 3,082,328 | | | | 2,361,249 | | | | 2,353,801 | | | | 2,086,838 | |

Noncontrolling interests | | | 354,817 | | | | 231,497 | | | | — | | | | — | | | | — | |

Total equity | | | 3,740,756 | | | | 3,187,652 | | | | 2,523,191 | | | | 2,509,044 | | | | 2,408,604 | |

| (1) | Each ADS represents three ordinary shares. |

| (2) | Includes amounts due to shareholders within one year, loans from shareholders and current and non-current portion of long-term debt. |

10

The following events/transactions affect the year-to-year comparability of the selected financial data presented above:

| | • | | On June 1, 2009, City of Dreams opened and progressively added to its operations with the opening of Grand Hyatt Macau in the fourth quarter of 2009 and the opening ofThe House of Dancing Water in the third quarter of 2010. |

| | • | | On July 27, 2011, we acquired a 60% equity interest in SCI, the developer of Studio City. |

| | • | | On November 26, 2012, Studio City Finance issued the Studio City Notes. |

| | • | | On December 19, 2012, we completed the acquisition of a majority interest in the issued share capital of MCP. |

Exchange Rate Information

Although we will have certain expenses and revenues denominated in Patacas, our revenues and expenses will be denominated predominantly in H.K. dollars and in connection with a portion of our indebtedness and certain expenses, U.S. dollars. Unless otherwise noted, all translations from H.K. dollars to U.S. dollars and from U.S. dollars to H.K. dollars in this annual report on Form 20-F were made at a rate of HK$7.78 to US$1.00.

The H.K. dollar is freely convertible into other currencies (including the U.S. dollar). Since October 17, 1983, the H.K. dollar has been officially linked to the U.S. dollar at the rate of HK$7.80 to US$1.00. The market exchange rate has not deviated materially from the level of HK$7.80 to US$1.00 since the peg was first established. However, in May 2005, the Hong Kong Monetary Authority broadened the trading band from the original rate of HK$7.80 per U.S. dollar to a rate range of HK$7.75 to HK$7.85 per U.S. dollar. The Hong Kong government has stated its intention to maintain the link at that rate, and it, acting through the Hong Kong Monetary Authority, has a number of means by which it may act to maintain exchange rate stability. However, no assurance can be given that the Hong Kong government will maintain the link at HK$7.75 to HK$7.85 per U.S. dollar or at all.

The noon buying rate on December 31, 2012 in New York City for cable transfers in H.K. dollar per U.S. dollar, as certified for customs purposes by the H.10 weekly statistical release of the Federal Reserve Board of the United States, or the Federal Reserve Board, was HK$7.7507 to US$1.00. On April 5, 2013, the noon buying rate was HK$7.7650 to US$1.00. We make no representation that any H.K. dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or H.K. dollars, as the case may be, at any particular rate, the rates stated below, or at all.

11

The following table sets forth the exchange rate as set forth in the statistical release of the Federal Reserve Board for and as of period ends indicated through April 5, 2013.

| | | | | | | | | | | | | | | | |

| | | Noon Buying Rate | |

Period | | Period End | | | Average (1) | | | Low | | | High | |

| | | (H.K. dollar per US$1.00) | |

April 2013 (through April 5, 2013) | | | 7.7650 | | | | 7.7633 | | | | 7.7650 | | | | 7.7618 | |

March 2013 | | | 7.7629 | | | | 7.7592 | | | | 7.7640 | | | | 7.7551 | |

February 2013 | | | 7.7546 | | | | 7.7552 | | | | 7.7580 | | | | 7.7531 | |

January 2013 | | | 7.7560 | | | | 7.7530 | | | | 7.7585 | | | | 7.7503 | |

December 2012 | | | 7.7507 | | | | 7.7501 | | | | 7.7518 | | | | 7.7493 | |

November 2012 | | | 7.7501 | | | | 7.7505 | | | | 7.7518 | | | | 7.7493 | |

October 2012 | | | 7.7494 | | | | 7.7515 | | | | 7.7549 | | | | 7.7494 | |

2012 | | | 7.7507 | | | | 7.7569 | | | | 7.7699 | | | | 7.7493 | |

2011 | | | 7.7663 | | | | 7.7841 | | | | 7.8087 | | | | 7.7634 | |

2010 | | | 7.7810 | | | | 7.7692 | | | | 7.8040 | | | | 7.7501 | |

2009 | | | 7.7536 | | | | 7.7513 | | | | 7.7618 | | | | 7.7495 | |

2008 | | | 7.7499 | | | | 7.7814 | | | | 7.8159 | | | | 7.7497 | |

| (1) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

The Pataca is pegged to the H.K. dollar at a rate of HK$1.00 = MOP1.03. All translations from Patacas to U.S. dollars in this annual report on Form 20-F were made at the exchange rate of MOP8.0134 = US$1.00. The Federal Reserve Board does not certify for customs purposes a noon buying rate for cable transfers in Patacas.

This annual report on Form 20-F also contains translations of certain Renminbi and New Taiwan dollar amounts into U.S. dollars. Unless otherwise stated, all translations from Renminbi to U.S. dollars in this annual report on Form 20-F were made at the noon buying rate on December 31, 2012 in New York City for cable transfers in RMB per U.S. dollar, as certified for customs purposes by the H.10 weekly statistical release of the Federal Reserve Board, which was RMB6.2301 to US$1.00. Unless otherwise stated, all translations from New Taiwan dollars to U.S. dollars in this annual report on Form 20-F were made at the noon buying rate on December 31, 2012 in New York City for cable transfers in New Taiwan dollars per U.S. dollar, as certified for customs purposes by the H.10 weekly statistical release of the Federal Reserve Board, which was TWD29.0500 to US$1.00. We make no representation that any RMB, TWD or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB or TWD, as the case may be, at any particular rate or at all. On April 5, 2013, the noon buying rate was RMB6.2005 to US$1.00 and TWD29.9500 to US$1.00.

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

12

D. RISK FACTORS

Our business, financial condition and results of operations can be affected materially and adversely by any of the following risk factors.

Risks Relating to Our Business and Operations

We have a short operating history and significant projects in an early phase of development and therefore are subject to significant risks and uncertainties. Our short operating history may not serve as an adequate basis to judge our future operating results and prospects.

We have a short business operating history compared to our global competitors and there is limited historical information available about our company upon which you can base your evaluation of our business and prospects. In particular, City of Dreams, which contributed 71.6% of our total net revenues for the year ended December 31, 2012, commenced operations on June 1, 2009, and progressively added to its operations with the opening of Grand Hyatt Macau in the fourth quarter of 2009 and the opening ofThe House of Dancing Water in the third quarter of 2010. The City of Dreams site is still under ongoing development. Melco Crown Macau acquired its subconcession in September 2006 and previously did not have any direct experience operating casinos in Macau. In addition, we have significant projects, such as the Studio City project and the Philippines Project, which are in an early phase of development. As a result, you should consider our business and prospects in light of the risks, expenses and challenges that we will face given our limited experience operating gaming businesses in an intensely competitive market. Among other things, we have continuing obligations to satisfy and comply with conditions and covenants under our existing credit facilities so as to be able to continue to roll over existing revolving loans drawn down under the facilities and to maintain the facilities.

We may encounter risks and difficulties frequently experienced by companies with early stage operations, and those risks and difficulties may be heightened in a rapidly developing market such as the gaming market in Macau and by our expansion into a new market such as the Philippines. Some of the risks relate to our ability to:

| | • | | fulfill conditions precedent to draw down or roll over funds from current and future credit facilities; |

| | • | | comply with covenants under our debt issuances and credit facilities; |

| | • | | raise additional capital, as required; |

| | • | | respond to changing financing requirements; |

| | • | | operate, support, expand and develop our operations and our facilities; |

| | • | | attract and retain customers and qualified employees; |

| | • | | maintain effective control of our operating costs and expenses; |

| | • | | maintain internal personnel, systems, controls and procedures to assure compliance with the extensive regulatory requirements applicable to the gaming business as well as regulatory compliance as a public company; |

| | • | | respond to competitive market conditions; |

| | • | | respond to changes in our regulatory environment; |

13

| | • | | identify suitable locations and enter into new leases or right to use agreements (which are similar to license agreements) for new Mocha Clubs; and |

| | • | | renew or extend lease agreements for existing Mocha Clubs. |

If we are unable to complete any of these tasks, we may be unable to operate our businesses in the manner we contemplate and generate revenues from such projects in the amounts and by the times we anticipate. We may also be unable to meet the conditions to draw on our existing or future financing facilities in order to fund various activities or may suffer a default under our existing or future financing facilities. If any of these events were to occur, it would cause a material adverse effect on our business and prospects, financial condition, results of operations and cash flows.

We are dependent upon a limited number of properties for a substantial portion of our cash flow, we are and will be subject to greater risks than a gaming company with more operating properties.

We are primarily dependent upon City of Dreams, Altira Macau and Mocha Clubs for our cash flow. We acquired a 60% equity interest in SCI, the developer of Studio City, on July 27, 2011. Studio City remains in preliminary stages of development and has not yet been constructed. Among other things, we are still in the continuous process of:

| | • | | procuring contractors and consultants for the construction and design, and seeking supply and services contracts for the development, of Studio City; and |

| | • | | obtaining applicable approvals and permits from the Macau government and other Macau authorities in relation to the construction, completion and operation of Studio City, some of which will only be granted nearer to the date of commencement of operations of Studio City. |

Given that our operations are and will be conducted based on a small number of principal properties, we are and will be subject to greater risks than a gaming company with more operating properties due to the limited diversification of our businesses and sources of revenues.

All our current and future construction projects, including the next phase of City of Dreams, Studio City and the Philippines Project, will be subject to significant development and construction risks, which could have a material adverse impact on related project timetables, costs and our ability to complete the projects.

All our future construction projects will be subject to a number of risks, including:

| | • | | lack of sufficient, or delays in availability of, financing; |

| | • | | changes to plans and specifications; |

| | • | | engineering problems, including defective plans and specifications; |

| | • | | shortages of, and price increases in, energy, materials and skilled and unskilled labor, and inflation in key supply markets; |

| | • | | delays in obtaining or inability to obtain necessary permits, licenses and approvals; |

| | • | | changes in laws and regulations, or in the interpretation and enforcement of laws and regulations, applicable to gaming, leisure, residential, real estate development or construction projects; |

| | • | | labor disputes or work stoppages; |

14

| | • | | disputes with and defaults by contractors and subcontractors; |

| | • | | personal injuries to workers and other persons; |

| | • | | environmental, health and safety issues, including site accidents and the spread of viruses such as H1N1 or H5N1; |

| | • | | weather interferences or delays; |

| | • | | fires, typhoons and other natural disasters; |

| | • | | geological, construction, excavation, regulatory and equipment problems; and |

| | • | | other unanticipated circumstances or cost increases. |

The occurrence of any of these development or construction risks could increase the total costs, delay or prevent the construction or opening or otherwise affect the design and features of any future construction projects which we might undertake. We cannot guarantee that our construction costs or total project costs for future projects will not increase beyond amounts initially budgeted.

We could encounter substantial cost increases or delays in the development of our projects, including the next phase of City of Dreams, Studio City and the Philippines Project, which could prevent or delay the opening of such projects.

We have certain projects under development or intended to be developed pursuant to our expansion plan, including the next phase of City of Dreams, Studio City and the Philippines Project. The completion of these projects is subject to a number of contingencies, such as those mentioned above in the risk factor on development and construction risks including, in particular, adverse developments in applicable legislation, delays or failures in obtaining necessary government licenses, permits or approvals. The occurrence of any of these developments could increase the total costs or delay or prevent the construction or opening of new projects, which could materially adversely affect our business, financial condition and results of operations. We will also require additional financing to develop our projects. Our ability to obtain such financing depends on a number of factors beyond our control, including market conditions, investors’ and lenders’ perceptions of, and demand for, debt and equity securities of gaming companies, credit availability and interest rates.

There is no assurance that the actual construction costs related to our projects will not exceed the costs we have projected and budgeted. In addition, construction costs, particularly labor costs, are increasing in Macau and we believe that they are likely to continue to increase due to the significant increase in building activity and the ongoing labor shortage in Macau. Immigration and labor regulations in Macau may limit or restrict our contractors’ ability to obtain sufficient laborers from China to make up for any gaps in available labor in Macau and help reduce construction costs. Continuing increases in construction costs in Macau will increase the risk that construction will not be completed on time, within budget or at all, which could materially and adversely affect our business, cash flow, financial condition, results of operations and prospects.

We have recently engaged a main construction contractor for the construction of the first phase of Studio City. Such main construction contractor may be unable to find suitable labor or subcontractors for the project or have insufficient financial resources to fund cost overruns for which it is contractually responsible, which may result in delays in completing the construction of the first phase of Studio City and subject us to other risks.

We have recently engaged a main construction contractor for the construction of the first phase of Studio City. However, no assurances can be given that our main construction contractor will be able to find

15

subcontractors or qualified laborers for the construction. Based on industry practice, a significant amount of work under the main construction contract is expected to be bid out to subcontractors. If our main construction contractor is unable to bid out its work on favorable terms, or at all, or find qualified laborers or subcontractors with requisite experience and skills, it could incur significantly increased costs and require an adjustment to be made to its contract price in certain circumstances, which may, in turn, increase our costs.

Furthermore, we cannot assure you that our main construction contractor will have sufficient financial resources to fund any cost overruns for which they are responsible under the main construction contract. If our main construction contractor does not have the resources to meet its obligations or we are unable to obtain sufficient funds under the performance and payment bonds or other insurance posted by the contractors in a timely manner, we may incur increased costs for the construction of Studio City. This may require us to raise additional funding, which may not be available on satisfactory terms or at all. Any such additional funding, if available, may not be permitted under the Studio City Project Facility or the Studio City Notes and may require us to obtain consents or waivers from the lenders under the Studio City Project Facility and/or the holders of the Studio City Notes.

In addition, no assurances can be given that our main construction contractor and its subcontractors will perform their obligations under their contracts or contractual warranties of work. If the opening of the first phase of Studio City is delayed or does not occur due to any of the above or other factors, it could materially adversely affect our construction and development plan, plan of operations, business and prospects, financial condition and cash flows.

Studio City project remains in preliminary stages of development and is subject to certain factors that could cause delays in opening of the first phase of Studio City and materially adversely affect our business, financial condition and prospects.

While the initial site preparation for the first phase of Studio City has been substantially completed, additional site preparation work for the updated design has re-commenced in the third quarter of 2012. The first phase of Studio City is currently targeted to open by mid-2015, subject to receipt of all necessary government approvals and financing. If we are unable to enter into construction contracts on terms satisfactory to us or obtain all necessary government approvals and financing, we may not be able to complete construction by the estimated construction period, or at all, and all or a portion of our investment to date could be lost, resulting in an impairment charge. If we are unable to enter into satisfactory construction contracts, or are unable to closely control the construction costs and timetables, for the development of the first phase of Studio City, our business, financial condition and prospects may be materially and adversely affected.

In addition, our subsidiary, Studio City Developments, is still in the process of selecting and appointing architectural, design and interior design consultants to design various areas of the first phase of Studio City. Once appointed, our Studio City project team will manage these consultants and design products developed by such consultants will be provided to construction contractors, including the main construction contractor, to be further developed for construction purposes. No assurances can be given that these consultants will deliver their design products in accordance with the standards required under their design contracts or in a timely manner as such design products are needed by construction contractors for construction purposes. In the event that there is any defect in such design products, we may need to engage additional consultants to rectify such defect. Furthermore, while our Studio City project team has experience managing relationships between design consultants and construction contractors, we cannot provide any assurance that we will be able to successfully manage any interface issues arising from such relationships. Our construction and development program could be adversely affected by such interface issues. The failure of design consultants or construction contractors to complete their work on time could potentially cause us to incur additional costs and delay opening of the first phase of Studio City, which could, in turn, materially adversely affect our business, financial condition and prospects.

16

Construction is subject to hazards that may cause personal injury or loss of life, thereby subjecting us to liabilities and possible losses, which may not be covered by insurance.

The construction of large scale properties such as Studio City and the Philippines Project can be dangerous. Construction workers at such sites are subject to hazards that may cause personal injury or loss of life, thereby subjecting the contractors and us to liabilities, possible losses, delays in completion of the projects and negative publicity. In 2007, there was a fatality on the Studio City site. As a result, the Studio City site was stopped for several days to allow for safety inspections and investigations. We believe that our contractors will take safety precautions that are consistent with industry practice, but these safety precautions may not be adequate to prevent serious personal injuries or loss of life, damage to property or delays. If further accidents occur during the construction of the next phase of City of Dream and Studio City, we may be subject to delays, including delays imposed by regulators, liabilities and possible losses, which may not be covered by insurance, and our business, prospects and reputation may be materially and adversely affected.

We are developing the Studio City project under the terms of a land concession contract which requires us to fully develop the Studio City site by July 24, 2018. If we do not complete development by that time and the Macau government does not grant us an extension of the development period, we could be forced to forfeit all or part of our investment in the Studio City site, along with our interest in the Studio City project.

Land concessions in Macau are issued by the Macau government and generally have terms of 25 years, with extensions of 10 years thereafter. Land concessions further stipulate a period within which the development of the land must be completed. In accordance with the Studio City land concession contract, the Studio City site must be fully developed by July 24, 2018. While the first phase of the Studio City project is expected to be completed by mid-2015, we must complete the remaining phase of Studio City by July 24, 2018 in order to comply with the terms of the Studio City land concession contract. Currently, our plan for the remaining phase is preliminary and under review. In the event that additional time is required to complete such remaining phase of Studio City, we will have to apply for an extension of the development period. While the Macau government may grant such extension if we meet certain requirements and the application for extension is made in accordance with the relevant rules and regulations, there can be no assurances that the Macau government will grant us the necessary extension of the development period or not exercise its right to terminate the Studio City land concession. In the event that no extension is granted or the Studio City land concession is terminated, we could lose all or substantially all of our investment in the Studio City project and may not be able to operate the Studio City project as planned, which will materially adversely affect our business and prospects, results of operations and financial condition.

The Philippines Project is located in an area within the city of Manila which is currently being developed and subject to certain deficiencies in transportation infrastructure.

Our Philippines Project is located in Entertainment City, Manila, an area within the city of Manila, which is currently in a preliminary stage of development. Other than Solaire, there are currently no other integrated tourism resorts which have begun operations in Entertainment City, Manila. It is unlikely that Manila’s existing transportation infrastructure is capable of handling the increased number of tourist arrivals that may be necessary to support visitor traffic to large-scale integrated resorts in Entertainment City, such the Philippines Project. Although the Philippine government is currently examining viable alternatives to ease traffic congestion in Manila, including construction of new highways and expressways, there is no guarantee that these measures will succeed or that they will sufficiently alleviate traffic congestion or other deficiencies in Manila’s transportation infrastructure. Traffic congestion and other problems in Manila’s transportation infrastructure could adversely affect tourism industry in the Philippines and reduce the number of potential visitors to the Philippines Project, which could, in turn, adversely affect our business and prospects, financial condition and results of our operations.

17

The Philippines Project is in a developmental phase and subject to certain factors that could cause delays for the Philippines Project and materially adversely affect our business, financial condition and prospects.

The Philippines Project is in a developmental phase and will not generate any revenue until its opening. While our Philippines subsidiary has entered into certain preliminary contracts for site office set-up, gaming design and other preliminary fit-out work, other definitive contracts necessary for the fit-out and development of our Philippines Project are being negotiated and have not yet been executed. We face the risk that qualified contractors, subcontractors and suppliers for the Philippines Project may not be available and all necessary government approvals for the Philippines Project may not be obtained. There can be no assurance that our Philippines subsidiary will be able to enter into definitive contracts with contractors with sufficient skill, financial resources and experience on commercially reasonable terms, or at all. In addition, the final design and development plan, funding costs and the availability of financing for the Philippines Project are subject to prevailing market conditions and other variables that are not within our control. All these factors could cause delays for the Philippines Project which could, in turn, adversely affect our business, financial condition and prospects.

The Philippines Project is located in the Philippines and subject to certain economic, political and social risks and uncertainties.

The Philippines Project is located in the Philippines and certain economic, political and social risks within the Philippines. The Philippines has from time to time experienced severe political and social instability, including acts of political violence. In December 2011, the Philippine House of Representatives initiated impeachment proceedings against Renata Corona, Chief Justice of the Supreme Court of the Philippines alleging that the Chief Justice improperly issued decisions that favored former President Arroyo as well as failure to disclosure certain properties in violation of rules applicable to all public employees and officials. These proceedings remain on-going. There is no guarantee that future events will not cause political instability in the Philippines. Any future political or social instability in the Philippines could adversely affect the business operations and financial conditions of the Philippines Project.

Economic instability could also have a negative effect on the commercial viability of our Philippines Project. Demand for and the prices of gaming and entertainment products are directly influenced by economic conditions in the Philippines, including growth levels, interest rates, inflation, levels of business activity and consumption and the amount of remittances received from overseas Filipino workers. There is also no assurance that the Philippines, China and other countries in Asia will not experience future economic downturns. Any deterioration in economic and political conditions in the Philippines or elsewhere in Asia could materially and adversely affect our company’s business in the Philippines, as well as the prospects, financial condition and results of our operations in the Philippines.

Our business in the Philippines will also depend substantially on revenues from foreign visitors and may be disrupted by events that reduce foreigners’ willingness to travel to or create substantial disruption in Metro Manila and raise substantial concerns about visitors’ personal safety, such as power outages, civil disturbances, terrorist attacks, among others. The Philippines has also experienced a significant number of major catastrophes over the years, including typhoons, volcanic eruptions and earthquakes. We cannot predict the extent to which our business in the Philippines and tourism in Metro Manila in general will be affected by any of the above occurrences or fears that such occurrences will take place. We cannot guarantee that any disruption to our Philippines operations will not be protracted, that our Philippines Project will not suffer any damages and that any such damage will be completely covered by insurance or at all. Any of these occurrences may disrupt our operations in the Philippines.

The gaming industry in the Philippines is highly regulated and competition is fierce.

The gaming industry in the Philippines is highly regulated. Our ability to operate a gaming business in the Philippines is dependent on the validity of our gaming license which contains a number of on-going

18

compliance obligations including periodic approvals from and reports to the regulator PAGCOR. Amongst other things, PAGCOR may in its sole discretion refuse to approve any such proposals by the licensees and could also exert significant control over the operational aspects of our Philippines Project such as our human resource policies particularly with respect to the qualifications and salary levels for gaming employees. Such measures could adversely affect our business, financial condition and results of operations in the Philippines.

The hotel, resort and gaming businesses are highly competitive. The competitors of our business in the Philippines internationally and within the Philippines include many of the largest gaming, hospitality, leisure and resort companies in the world.

In the Philippine gaming market, we will be competing with hotels and resorts owned by both Philippine nationals and foreigners. PAGCOR, an entity owned and controlled by the government of Philippines, also operates gaming facilities across the Philippines. We expect our operations in the Philippines to target similar pools of customers and tourists as, and therefore face competition from, gaming operators in other more established gaming centers across the region, particularly those of Macau and Singapore, and other major gaming markets located around the world, including Australia and Las Vegas. A number of such other operators have a longer track record of gaming operations and such other markets have more established reputations as gaming markets. Our operations in the Philippines may not be successful in its efforts to attract foreign customers and independent gaming promoters to our Philippines Project and to promote Manila as a gaming destination.

Any simultaneous planning, design, construction and development of the next phase of City of Dreams, Studio City and the Philippines Project may stretch our management time and resources, which could lead to delays, increased costs and other inefficiencies in the development of these projects.

We expect some portions of the planning, design and construction of the next phase of City of Dreams, the development of Studio City and the fit-out work for the Philippines Project to proceed simultaneously. There may be overlap of the planning, design, development and construction periods of these projects involving the need for intensive work on each of the projects. Members of our senior management will be involved in planning and developing both projects at the same time, in addition to overseeing our day-to-day operations. Our management may be unable to devote sufficient time and attention to our development and construction projects, as well as our operating properties, and that may delay the construction or opening of one or both of our projects, cause construction cost overruns or cause the performance of our operating properties to be lower than expected, which could have a material adverse effect on our business, financial condition and results of operations.

Our business depends substantially on the continuing efforts of our senior management, and our business may be severely disrupted if we lose their services.

We place substantial reliance on the gaming, project development and hospitality industry experience and knowledge of the Macau market possessed by members of our senior management team. The loss of the services of one or more members of our senior management team could hinder our ability to effectively manage our business and implement our growth and development strategies. Finding suitable replacements for members of our senior management could be difficult, and competition for personnel of similar experience could be intense in Macau. In addition, we do not currently carry key person insurance on any members of our senior management team.

The success of our business may depend on our ability to attract and retain adequate qualified personnel. A limited labor supply and increased competition could cause labor costs to increase.

The pool of experienced gaming and other skilled and unskilled personnel in Macau and the Philippines is limited. Many of our new personnel occupy sensitive positions requiring qualifications sufficient to meet gaming regulatory and other requirements or are required to possess other skills for which substantial

19

training and experience are needed. Moreover, competition to recruit and retain qualified gaming and other personnel is expected to continue, as well as our demand for qualified personnel. In addition, we are not currently allowed under Macau government policy to hire non-Macau resident dealers, croupiers and supervisors.

We cannot assure you that we will be able to attract and retain a sufficient number of qualified individuals to operate our properties or that costs to recruit and retain such personnel will not increase significantly. The inability to attract and retain qualified employees and operational management personnel could have a material adverse effect on our business. Further, the Macau government is currently enforcing a labor policy pursuant to which the ratio of local to foreign workers that may be recruited for construction works shall have to be at least 1:1, unless otherwise authorized by the Macau government. This could have a material adverse effect on our ability to complete future works on our properties, for example, Studio City, or the next phase of development at City of Dreams. Moreover, if the Macau government enforces similar restrictive ratios in other areas, such as the gaming, hotel and entertainment industries, this could have a materially adverse effect on the operation of our properties.

Furthermore, the Macau government enacted legislation, which came into effect on November 1, 2012, under which the minimum age required for entrance into casinos in Macau was raised from 18 to 21 years of age. The legislation did not affect the employees under 21 years of age who were already employed when the new law came into effect and had maintained their positions. In addition, the director of the DICJ may authorize employees under 21 years of age to temporarily enter casinos, after considering their special technical qualifications. Notwithstanding such provisions, however, the implementation of this law could adversely affect Melco Crown Macau’s ability to engage sufficient staff for the operation of our casinos and have a material adverse effect on our future operations.

Our insurance coverage may not be adequate to cover all losses that we may suffer from our operations. In addition, our insurance costs may increase and we may not be able to obtain the same insurance coverage in the future.

We currently have various insurance policies providing certain coverage typically required by gaming and hospitality operations in Macau. In addition, we plan to maintain various types of insurance coverage as customary in the Philippine gaming industry. Such coverage includes property damage, business interruption and general liability. We also maintain certain liability insurance coverage as customary in the pharmaceutical industry, in respect of MCP’s previous business in that industry. These insurance policies provide coverage that is subject to policy terms, conditions and limits. There is no assurance that we will be able to renew such insurance coverage on equivalent premium cost, terms, conditions and limits upon policy renewals. The cost of coverage may in the future become so high that we may be unable to obtain the insurance policies we deem necessary for the operation of our projects on commercially practicable terms, or at all, or we may need to reduce our policy limits or agree to certain exclusions from our coverage.

We cannot assure you that any such insurance policies we may obtain will be adequate to protect us from material losses. For example, our property insurance coverage is in an amount that may be less than the expected full replacement cost of rebuilding properties if there was a total loss. If we incur loss, damage or liability for amounts exceeding the limits of our current or future insurance coverage, or for claims outside the scope of our current or future insurance coverage, our financial conditions and business operations could be materially and adversely affected. For example, certain casualty events, such as labor strikes, nuclear events, acts of war, loss of income due to cancellation of conventions or room reservations arising from fear of terrorism, contagious or infectious disease, deterioration or corrosion, insect or animal damage and pollution may not be covered under our policies. As a result, certain acts and events could expose us to significant uninsured losses. In addition to the damages caused directly by a casualty loss such as fire or natural disasters, we may suffer a disruption of our business as a result of these events or be subject to claims by third parties who may be injured or harmed. While we intend to carry business interruption insurance and general liability insurance, such insurance may not be available on commercially reasonable terms, or at all, and, in any event, may not be adequate to cover all losses that may result from such events.

20

There is limited available insurance in Macau and our insurers in Macau may need to secure reinsurance in order to provide adequate cover for our property and development projects. Our credit agreements, Melco Crown Macau’s subconcession contract (the “Subconcession Contract”) and certain other material agreements require a certain level of insurance to be maintained, which must be obtained in Macau unless otherwise authorized by the Macau government. Failure to maintain adequate coverage could be an event of default under our credit agreements or the Subconcession Contract and have a material adverse effect on our business, financial condition, results of operations and cash flows.

Conducting business in Macau has certain political and economic risks that may lead to significant volatility and have a material adverse effect on our results of operations.

All of our operations are in Macau. Accordingly, our business development plans, results of operations and financial condition may be materially adversely affected by significant political, social and economic developments in Macau and China and by changes in government policies or changes in laws and regulations or the interpretations of these laws and regulations. In particular, our operating results may be adversely affected by:

| | • | | changes in Macau’s and China’s political, economic and social conditions; |

| | • | | tightening of travel restrictions to Macau which may be imposed by China; |

| | • | | changes in policies of the government or changes in laws and regulations, or in the interpretation or enforcement of these laws and regulations, particularly exchange control regulations, regulations relating to repatriation of capital or measures to control inflation; |

| | • | | measures that may be introduced to control inflation, such as interest rate increases or bank account withdrawal controls; and |

| | • | | changes in the rate or method of taxation. |

Our operations in Macau are also exposed to the risk of changes in laws and policies that govern operations of Macau-based companies. Tax laws and regulations may also be subject to amendment or different interpretation and implementation, thereby adversely affecting our profitability after tax. Further, certain terms of our gaming subconcession may be subject to renegotiations with the Macau government in the future, including amounts we will be obligated to pay the Macau government in order to continue operations. Melco Crown Macau’s obligations to make certain payments to the Macau government under the terms of its subconcession include a fixed annual premium per year and a variable premium depending on the number and type of gaming tables and gaming machines that we operate. The results of any renegotiations could have a material adverse effect on our results of operations and financial condition.

As we expect a significant number of patrons to come to our properties from China, general economic conditions and policies in China could have a significant impact on our financial prospects. A slowdown in economic growth and tightening of credit availability or restrictions on travel imposed by China could adversely impact the number of visitors from China to our properties in Macau as well as the amounts they are willing to spend in our casinos, which could have a material adverse effect on the results of our operations and financial condition.

The winnings of our patrons could exceed our casino winnings at particular times during our operations.

Our revenues are mainly derived from the difference between our casino winnings and the winnings of our casino patrons. Since there is an inherent element of chance in the gaming industry, we do not have full control over our winnings or the winnings of our casino patrons. If the winnings of our patrons exceed our casino winnings, we may record a loss from our gaming operations, and our business, financial condition and results of operations could be materially and adversely affected.

21

Win rates for our casino operations depend on a variety of factors, some beyond our control, which, at particular times, adversely impact our results of operations.

In addition to the element of chance, theoretical win rates are also affected by other factors, including players’ skill and experience, the mix of games played, the financial resources of players, the spread of table limits, the volume of bets placed by our players and the amount of time players spend on gambling — thus our actual win rates may differ greatly over short time periods, such as from quarter to quarter, and could cause our quarterly results to be volatile. Each of these factors, alone or in combination, have the potential to negatively impact our win rates, and our business, financial condition and results of operations could be materially and adversely affected.

Our gaming business is subject to the risk of cheating and counterfeiting.

All gaming activities at our table games are conducted exclusively with gaming chips which, like real currency, are subject to the risk of alteration and counterfeiting. We incorporate a variety of security and anti-counterfeit features to detect altered or counterfeit gaming chips. Despite such security features, unauthorized parties may try to copy our gaming chips and introduce, use and cash in altered or counterfeit gaming chips in our gaming areas. Any negative publicity arising from such incidents could also tarnish our reputation and may result in a decline in our business, financial condition and results of operation.

Our existing surveillance and security systems, designed to detect cheating at our casino operations, may not be able to detect all such cheating in time or at all, particularly if patrons collude with our employees. In addition, our gaming promoters or other persons could, without our knowledge, enter into betting arrangements directly with our casino patrons on the outcomes of our games of chance, thus depriving us of revenues.

Our operations are reviewed to detect and prevent cheating. Each game has a theoretical win rate and statistics are examined with these in mind. Cheating may give rise to negative publicity and such action may materially affect our business, financial condition, operations and cash flows.

We are exposed to certain risks in respect of the industry and business activities that MCP operated in prior to our acquisition.

Prior to our acquisition of the majority share interest in MCP, it was primarily engaged in the manufacturing and processing of pharmaceutical products. The pharmaceuticals industry is subject to strict regulation in the Philippines and abroad, particularly with respect to, among others, product liability for defective pharmaceutical products. There can be no assurance that we will not be involved in, or subject to claims, allegations or suits with respect to, MCP’s previous activities in the pharmaceutical industry, which may not be covered by any related insurance policies or indemnity fully or at all. Any such claims, allegations or suits could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Because we currently depend upon our properties in Macau for all of our cash flow, we will be subject to greater risks than a gaming company that operates in more than one market.