Exhibit 99.2

Explanatory Note

This annual report serves to provide holders of Studio City Finance Limited’s US$825,000,000 8.50% senior notes due 2020 (the “Studio City Notes”) with Studio City Finance Limited’s audited financial statements, on a consolidated basis, in respect of the fiscal year ended December 31, 2014 together with the related information, pursuant to the terms of the indenture, dated November 26, 2012, relating to the Studio City Notes. Studio City Finance Limited is a subsidiary of Melco Crown Entertainment Limited.

i

Studio City Finance Limited

TABLE OF CONTENTS

For the Year Ended December 31, 2014

ii

INTRODUCTION

In this annual report, unless otherwise indicated:

| | • | | “Additional Development” refers to the additional second phase development project on the Studio City site, which is expected to include an additional luxury hotel and related facilities, retail, entertainment and gaming expansion capacity; |

| | • | | “China” and “PRC” refer to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan from a geographical point of view; |

| | • | | “City of Dreams” refers to a casino, hotel, retail and entertainment integrated resort located on two adjacent pieces of land in Cotai, Macau, which opened in June 2009, and currently features casino areas and three luxury hotels, including a collection of retail brands, a wet stage performance theater and other entertainment venues, and owned by Melco Crown (COD) Developments Limited; |

| | • | | “Concessionaire(s)” refers to the holder(s) of a concession for the operation of casino games in Macau; |

| | • | | “Cotai” refers to an area of reclaimed land located between the islands of Taipa and Coloane in Macau; |

| | • | | “Crown” refers to Crown Resorts Limited, an Australian-listed corporation, which completed its acquisition of the gaming businesses and investments of PBL, now known as Consolidated Media Holdings Limited, on December 12, 2007; |

| | • | | “DICJ” refers to the Direcção de Inspecção e Coordenação de Jogos (the Gaming Inspection and Coordination Bureau), a department of the Public Administration of Macau; |

| | • | | “Greater China” refers to mainland China, Hong Kong and Macau, collectively; |

| | • | | “HK$” and “H.K. dollars” refer to the legal currency of Hong Kong; |

| | • | | “HKSE” refers to The Stock Exchange of Hong Kong Limited; |

| | • | | “Hong Kong” refers to the Hong Kong Special Administrative Region of the PRC; |

| | • | | “Land Grant” refers to the land concession by way of lease, for a period of 25 years, subject to renewal, as of October 17, 2001 for a plot of land situated at the Studio City site, described with the Macau Immovable Property Registry under No. 23059 and registered in Studio City Developments’ name under inscription no. 26642 of Book F, titled by Dispatch of the Secretary for Public Works and Transportation no. 100/2001 of October 9, 2001, as amended by Dispatch of the Secretary for Public Works and Transportation no. 31/2012 of July 19, 2012, published in the Macau official gazette no. 30 of July 25, 2012 and including any other amendments from time to time to such land concession; |

| | • | | “Macau” refers to the Macau Special Administrative Region of the PRC; |

| | • | | “MCE” refers to Melco Crown Entertainment Limited, a company incorporated in the Cayman Islands whose shares are listed on both the NASDAQ Global Market and HKSE, and which, through its subsidiary MCE Cotai, owns a 60% interest in SCI; |

1

| | • | | “MCE Cotai” refers to MCE Cotai Investments Limited, a subsidiary of MCE and a shareholder of SCI; |

| | • | | “Melco” refers to Melco International Development Limited, a Hong Kong listed company; |

| | • | | “Melco Crown Macau” refers to MCE’s subsidiary, Melco Crown (Macau) Limited, a Macau company and the holder of a gaming subconcession; |

| | • | | “New Cotai Holdings” refers to New Cotai Holdings, LLC, a company incorporated in Delaware, the United States on March 24, 2006 under the laws of Delaware, primarily owned by U.S. investment funds managed by Silver Point Capital, L.P. and Oaktree Capital Management, L.P.; |

| | • | | “New Cotai” refers to New Cotai, LLC, a Delaware limited liability company owned by New Cotai Holdings; |

| | • | | “our board” refers to the board of directors of our company or a duly constituted committee thereof; |

| | • | | “Patacas” and “MOP” refer to the legal currency of Macau; |

| | • | | “PBL” refers to Publishing and Broadcasting Limited, an Australian listed corporation that is now known as Consolidated Media Holdings Limited; |

| | • | | “Project Costs” refer to the construction and development costs and other project costs, including licensing, financing, interest, fees and pre-opening costs, of the Studio City Project, as subsequently amended in accordance with the Studio City Project Facility; |

| | • | | “SCI” refers to Studio City International Holdings Limited (formerly known as Cyber One Agents Limited), a company incorporated in the British Virgin Islands with limited liability, and an indirect parent of our company; |

| | • | | “Shareholders Agreement” refers to the shareholders agreement dated July 27, 2011, by and among MCE Cotai, New Cotai, MCE and SCI (as amended from time to time); |

| | • | | “Studio City” refers to a cinematically-themed integrated entertainment, retail and gaming resort in Cotai, Macau to be developed, consisting of the Studio City Project and the Additional Development; |

| | • | | “Studio City Casino” refers to the gaming areas to be constructed or operated within the Studio City Project; |

| | • | | “Studio City Company” refers to our subsidiary, Studio City Company Limited, a British Virgin Islands company; |

| | • | | “Studio City Developments” refers to our subsidiary, Studio City Developments Limited (formerly known as MSC Desenvolvimentos, Limitada and East Asia Satellite Television Limited), a Macau company; |

| | • | | “Studio City Entertainment” refers to Studio City Entertainment Limited, our subsidiary, a Macau company; |

| | • | | “Studio City Holdings” refers to Studio City Holdings Limited, a company incorporated in the British Virgin Islands and our intermediate holding company; |

| | • | | “Studio City Holdings Two” refers to Studio City Holdings Two Limited, a company incorporated in the British Virgin Islands and our subsidiary; |

| | • | | “Studio City Hotels” refers to Studio City Hotels Limited, a company incorporated under the laws of Macau and a subsidiary of Studio City Holdings Two; |

| | • | | “Studio City Investments” refers to Studio City Investments Limited, a company incorporated in the British Virgin Islands and our subsidiary; |

2

| | • | | “Studio City Project Facility” refers to the senior secured project facility, dated January 28, 2013, entered into between, among others, Studio City Company as borrower and certain subsidiaries as guarantors for a total sum of HK$10,855,880,000 (equivalent to approximately US$1.4 billion) and consisting of a term loan facility and a revolving credit facility; |

| | • | | “Studio City Project” or the “Project” refers to the first phase of our project to develop the Studio City site into a large-scale integrated leisure resort called “Studio City” combining luxury hotel and related facilities, gaming capacity, retail, attractions and entertainment venues (including a multipurpose entertainment studio); |

| | • | | “Subconcessionaire(s)” refers to the holder(s) of a subconcession for the operation of casino games in Macau; |

| | • | | “US$” and “U.S. dollars” refer to the legal currency of the United States; |

| | • | | “U.S. GAAP” refers to the accounting principles generally accepted in the United States; and |

| | • | | “we”, “us”, “our” and “our company” refer to Studio City Finance Limited and, as the context requires, its predecessor entities and its consolidated subsidiaries. |

This annual report includes our audited consolidated financial statements for the years ended December 31, 2014 and 2013 and as of December 31, 2014 and 2013.

Any discrepancies in any table between totals and sums of amounts listed therein are due to rounding. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures preceding them.

3

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that relate to future events, including our future operating results and conditions, our prospects and our future financial performance and condition, all of which are largely based on our current expectations and projections. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Moreover, because we operate in a heavily regulated and evolving industry, may become highly leveraged, and operate in Macau, a high-growth market with intense competition, new risk factors may emerge from time to time. It is not possible for our management to predict all risk factors, nor can we assess the impact of these factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those expressed or implied in any forward-looking statement. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors include, but are not limited to, (i) growth of the gaming market and visitation in Macau, (ii) capital and credit market volatility, (iii) local and global economic conditions, (iv) our anticipated growth strategies, (v) the number of gaming tables ultimatelyallocated to us by the applicable regulators, and (vi) our future business development, results of operations and financial condition. In some cases, forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/are likely to” or other similar expressions.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report with the understanding that our actual future results may be materially different from what we expect.

4

EXCHANGE RATE INFORMATION

Although we will have certain expenses and revenues denominated in Patacas, our revenues and expenses will be denominated predominantly in H.K. dollars and in connection with a portion of our indebtedness and certain expenses, U.S. dollars. Unless otherwise noted, all translations from H.K. dollars to U.S. dollars and from U.S. dollars to H.K. dollars in this annual report were made at a rate of HK$7.78 to US$1.00.

The H.K. dollar is freely convertible into other currencies (including the U.S. dollar). Since October 17, 1983, the H.K. dollar has been officially linked to the U.S. dollar at the rate of HK$7.80 to US$1.00. The market exchange rate has not deviated materially from the level of HK$7.80 to US$1.00 since the peg was first established. However, in May 2005, the Hong Kong Monetary Authority broadened the trading band from the original rate of HK$7.80 per U.S. dollar to a rate range of HK$7.75 to HK$7.85 per U.S. dollar. The Hong Kong government has stated its intention to maintain the link at that rate, and it, acting through the Hong Kong Monetary Authority, has a number of means by which it may act to maintain exchange rate stability. However, no assurance can be given that the Hong Kong government will maintain the link at HK$7.75 to HK$7.85 per U.S. dollar or at all.

The noon buying rate on December 31, 2014 in New York City for cable transfers in H.K. dollar per U.S. dollar, as certified for customs purposes by the H.10 weekly statistical release of the Federal Reserve Board of the United States, or the Federal Reserve Board, was HK$7.7531 to US$1.00. On April 2, 2015, the noon buying rate was HK$7.7525 to US$1.00. We make no representation that any H.K. dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or H.K. dollars, as the case may be, at any particular rate or at all.

The Pataca is pegged to the H.K. dollar at a rate of HK$1.00 = MOP1.03. All translations from Patacas to U.S. dollars in this annual report were made at the exchange rate of MOP 8.0134 = US$1.00. The Federal Reserve Board does not certify for customs purposes a noon buying rate for cable transfers in Patacas.

5

SELECTED CONSOLIDATED FINANCIAL INFORMATION

The following summary statements of operations, balance sheet and cash flows information are derived from our audited consolidated financial statements for the year ended December 31, 2014 and 2013 and the notes relating thereto, which are included elsewhere in this annual report. These consolidated financial statements have been prepared and presented in accordance with U.S. GAAP. You should read this section in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and those consolidated financial statements and the notes to those statements included elsewhere in this annual report. Historical results are not necessarily indicative of the results that you may expect for any future period, particularly as the Studio City Project is still in the development stage.

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (In thousands of US$) | |

CONSOLIDATED STATEMENTS OF OPERATIONS: | | | | | | | | |

OPERATING REVENUE | | | | | | | | |

Other revenue | | $ | 1,767 | | | $ | 1,093 | |

| | | | | | | | |

OPERATING COSTS AND EXPENSES | | | | | | | | |

General and administrative | | | (3,161 | ) | | | (2,097 | ) |

Amortization of land use right | | | (12,104 | ) | | | (12,104 | ) |

Depreciation and amortization | | | (26 | ) | | | — | |

Pre-opening costs | | | (14,951 | ) | | | (2,856 | ) |

| | | | | | | | |

Total operating costs and expenses | | | (30,242 | ) | | | (17,057 | ) |

| | | | | | | | |

OPERATING LOSS | | | (28,475 | ) | | | (15,964 | ) |

| | | | | | | | |

NON-OPERATING INCOME (EXPENSES) | | | | | | | | |

Interest income | | | 4,707 | | | | 86 | |

Interest expenses, net of capitalized interest | | | (17,106 | ) | | | (40,129 | ) |

Amortization of deferred financing costs | | | (10,669 | ) | | | (1,530 | ) |

Loan commitment fees | | | (15,153 | ) | | | (23,190 | ) |

Foreign exchange loss, net | | | (2,178 | ) | | | (661 | ) |

| | | | | | | | |

Total non-operating expenses, net | | | (40,399 | ) | | | (65,424 | ) |

| | | | | | | | |

NET LOSS | | $ | (68,874 | ) | | $ | (81,388 | ) |

| | | | | | | | |

6

| | | | | | | | |

| | | As of December 31, | |

| | | 2014 | | | 2013 | |

| | | (In thousands of US$) | |

CONSOLIDATED BALANCE SHEETS: | | | | | | | | |

ASSETS | | | | | | | | |

CURRENT ASSETS | | | | | | | | |

Cash and cash equivalents | | $ | 3,161 | | | $ | — | |

Restricted cash | | | 1,368,390 | | | | 670,555 | |

Amounts due from affiliated companies | | | 3,874 | | | | 1,812 | |

Amount due from an intermediate holding company | | | 82 | | | | — | |

Prepaid expenses and other current assets | | | 2,999 | | | | 3,922 | |

| | | | | | | | |

Total current assets | | | 1,378,506 | | | | 676,289 | |

| | | | | | | | |

PROPERTY AND EQUIPMENT, NET | | | 1,629,803 | | | | 722,344 | |

LONG-TERM PREPAYMENTS, DEPOSITS AND OTHER ASSETS | | | 80,687 | | | | 231,268 | |

RESTRICTED CASH | | | 50,064 | | | | 98,370 | |

DEFERRED FINANCING COSTS, NET | | | 85,195 | | | | 15,129 | |

LAND USE RIGHT, NET | | | 142,227 | | | | 154,331 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 3,366,482 | | | $ | 1,897,731 | |

| | | | | | | | |

LIABILITIES AND SHAREHOLDER’S EQUITY | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | |

Accrued expenses and other current liabilities | | $ | 139,223 | | | $ | 113,138 | |

Amounts due to affiliated companies | | | 3,730 | | | | 102 | |

Amount due to ultimate holding company | | | 337 | | | | 427 | |

| | | | | | | | |

Total current liabilities | | | 143,290 | | | | 113,667 | |

| | | | | | | | |

LONG-TERM DEBT | | | 2,120,689 | | | | 825,000 | |

ADVANCE FROM IMMEDIATE HOLDING COMPANY | | | 942,779 | | | | 743,239 | |

OTHER LONG-TERM LIABILITIES | | | 57,846 | | | | 20,678 | |

LAND USE RIGHT PAYABLE | | | — | | | | 24,376 | |

SHAREHOLDER’S EQUITY | | | | | | | | |

Ordinary shares(1) | | | — | | | | — | |

Additional paid-in capital | | | 298,596 | | | | 298,596 | |

Accumulated other comprehensive losses | | | (84 | ) | | | (65 | ) |

| | | | | | | | |

Accumulated losses | | | (196,634 | ) | | | (127,760 | ) |

Total shareholder’s equity | | | 101,878 | | | | 170,771 | |

| | | | | | | | |

TOTAL LIABILITIES AND SHAREHOLDER’S EQUITY | | $ | 3,366,482 | | | $ | 1,897,731 | |

| | | | | | | | |

| (1) | The authorized share capital of Studio City Finance Limited was 50,000 shares of US$1 par value per share, as of December 31, 2014 and December 31, 2013, 1 share of US$1 par value per share was issued and fully paid. |

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (In thousands of US$) | |

CONSOLIDATED STATEMENTS OF CASH FLOWS: | | | | | | | | |

Net cash used in operating activities | | $ | (43,519 | ) | | $ | (65,041 | ) |

Net cash used in investing activities | | | (1,443,077 | ) | | | (530,114 | ) |

Net cash provided by financing activities | | | 1,489,757 | | | | 595,155 | |

| | | | | | | | |

Net increase in cash and cash equivalents | | | 3,161 | | | | — | |

Cash and cash equivalents at beginning of year | | | — | | | | — | |

| | | | | | | | |

Cash and cash equivalents at end of year | | $ | 3,161 | | | $ | — | |

| | | | | | | | |

7

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in connection with “Selected Consolidated Financial Information” and our consolidated financial statements, including the notes thereto, included elsewhere in this annual report. Our consolidated financial statements for the year ended December 31, 2014 and 2013 included in this annual report were prepared in accordance with U.S. GAAP. Certain statements in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements.

Overview

SCI is 60%-owned by MCE, which is a developer, owner and operator of casino gaming and entertainment resort facilities in Asia. On July 27, 2011, MCE, through its subsidiary, MCE Cotai, acquired a 60% equity interest in SCI, the developer, owner and operator of Studio City. New Cotai Holdings, an entity incorporated in Delaware and controlled by funds managed by Silver Point Capital, L.P. and Oaktree Capital Management, L.P., retains the remaining 40% interest in SCI through its wholly owned subsidiary New Cotai.

Studio City is a large-scale cinematically-themed integrated entertainment, retail and gaming resort which is expected to open in the third quarter of 2015. Studio City, upon completion, will include gaming facilities, luxury hotel offerings and various entertainment, retail and food and beverage outlets to attract a diverse range of customers. Studio City is designed to capture the attention of visitors to Macau, especially from the mass market segment, with its destination theming, unique and innovative interactive attractions, including Asia’s highest ferris wheel, a Warner Bros.-themed family entertainment center in an area of approximately 40,000 square feet, a TV broadcast studio, the world’s first Batman film franchise digital ride, a 5,000-seat multi-purpose live performance arena and a live magic venue, as well as approximately 1,600 hotel rooms, a vast array of food and beverage outlets and “The Boulevard”, which will comprise approximately 350,000 square feet of themed and innovative retail space.

Factors Affecting Our Current and Future Operating Results

Our historical operating results will not be indicative of future operating results because activities previously undertaken were related to our early development stage and our planned future activities include the construction, development and operation of the Studio City Project. Until the Studio City Project commences commercial operations in the third quarter of 2015, we will still be in the development stage and we do not expect to generate any revenue other than bank interest income from accounts in which the proceeds from the Studio City Notes, the Studio City Project Facility and other sources will be deposited. During construction, we will have substantial payment obligations relating to the design, development, construction, equipping, financing and opening of the Studio City Project pursuant to certain agreements. See “— Indebtedness and Capital Contributions — Long-term Indebtedness and Contractual Obligations.”

Following the opening of the Studio City Project, we expect to derive a majority of revenues from the Studio City Casino’s gaming operations and our remaining revenues from other operations of the Studio City Project, including the hotel, food and beverage, retail and entertainment. We expect the Studio City Casino’s gaming operations to be the primary contributor to our earnings. Following the opening of the Studio City Casino, the expenses incurred will be significantly different than those incurred during the development period.

Our expenses will relate primarily to the operation of the Studio City Project. We anticipate the operating costs will be primarily related to the payment of the Studio City Project’s (including the Studio City Casino’s) payroll, benefits and related costs of employment, gaming taxes, management fees, complementary offers and other customer incentives, daily fees and licensing fees for certain gaming equipment, costs of goods sold for food and beverage and retail operations, utility costs and other facility-related costs, including maintenance and supplies, marketing related expenses including advertising and promotion, accounting, legal, administrative and other professional and consulting services, insurance premiums, recurring fees for information systems, expenses for security, surveillance, custodial and other departments and corporate expenses.

8

Our operating expenses will also include amortization of land use right and depreciation and amortization of assets. We expect that non-operating income (expenses) will include interest (including interest rate hedging) income and expenses, amortization of deferred financing costs, loan commitment fees, foreign exchange gain and loss as well as other non-operating income and as we are currently subject to Macau complementary tax, this may result in income tax credits (expenses).

Set out below is a discussion of the most significant factors that we expect may affect our results and financial condition in future periods during the development stage and/or after the Studio City Project commences operations. Factors other than those set forth below could also have significant impact on the results of operations and financial condition in the future.

Construction and Operation of the Studio City Project

Our results of operations are, and will continue to be, significantly affected by the ongoing development, construction and eventual opening of the Studio City Project. We have incurred and expect to continue to incur significant expenses in relation to the construction of the Studio City Project, such as the payments due to various contractors in connection with the design, development and opening of the Studio City Project and payment of principal and interest on borrowings under the Studio City Project Facility. Also, our costs may be affected by volatility in the labor costs and price of construction materials such as steel and cement, which are subject to market forces. We also expect to incur significant pre-opening expenses, such as employee training and advertising costs, and when the Studio City Project commences operations, we will begin to record revenues and operating expenses in relation to Studio City Project’s operations. In addition, we may incur higher amortization and interest charges in relation to higher construction costs if Studio City Project’s opening is delayed.

Access to and Cost of Financing

Our ability to obtain financing, as well as the cost of such financing, affects our business. Although we currently expect all of our estimated expenses for the development and construction of the Studio City Project will be sufficiently funded by the Studio City Notes and the Studio City Project Facility and through the receipt of equity contributions and/or subordinated loans from our shareholders, a number of factors may cause us to seek additional financing for the ongoing construction and operations of the Studio City Project. Our ability to access such additional financing is subject to a variety of factors, including interest rates and other funding costs and market conditions. Any lack of access or higher costs in relation to additional financing that we may require could negatively impact our plans to complete, operate, expand and develop the Studio City Project.

Additional Development

We will develop the remaining land covered by the Land Grant, and are currently examining options for the Additional Development. The Additional Development is expected to include additional luxury hotel and related facilities, as well as an expansion of retail, entertainment and gaming capacity. Such project will require additional financing (which has not been obtained or committed as of the date of this annual report). To the extent that any of these plans are finalized, the associated costs of such project will have a material effect on our financial condition, including the amount of our indebtedness and results of operations.

Gaming and Leisure Market in Macau

Studio City Project’s business is and will be influenced most significantly by the growth of the gaming and leisure market in Macau. Such growth will be affected by visitation to Macau and whether Macau develops into a popular international destination for gaming patrons and other customers of leisure and hospitality services, as well as the ability to compete effectively against Studio City Project’s existing and future competitors for market share. The levels of tourism and overall leisure activity in Macau are expected to be key drivers of our business. We believe that visitation and gaming revenue for the Macau market have been, and will continue to be, driven by a combination of factors, including the PRC central and Macau government’s development plans for the region, including improved infrastructure and development of Hengqin Island, Macau’s proximity to major Asian population centers; and the level of restrictions on travel to Macau from China. However, the restrictions that govern Chinese citizens’ ability to take larger sums of foreign currency out of China when they travel and the recent initiatives and campaigns undertaken by the Chinese government have resulted in an overall dampening effect on the behavior of Chinese consumers and a decrease in their spending, particularly in luxury good sales and other discretionary spending.

9

Ability to Attract and Retain Key Customers and Maintain Relationships with Gaming Promoters

Studio City Casino’s operating performance will be influenced by the ability to attract and retain key customers and gaming promoters, which will directly impact the results of operations and cash flow. Studio City Casino’s ability to attract mass market and premium direct rolling chip customers through, among other things, the marketing strategies will impact a significant portion of our gaming revenues and profitability. Studio City Casino will likely rely on gaming promoters to source and, in most cases, provide credit to the majority of our rolling chip customers, which in turn will likely contribute a substantial portion of gaming revenues. Further, the commission structure arrangements to be agreed with gaming promoters may materially impact the gaming expenses.

Taxes

Companies in Macau are, generally, subject to complementary tax of up to 12% of taxable income, as defined in relevant tax laws. In addition, Concessionaires and Subconcessionaires are currently subject to a 35% special gaming tax as well as other levies of up to 4% under the relevant concession or subconcession contract and may benefit from a corporate tax holiday on their gaming revenues.

Melco Crown Macau benefits from such corporate tax holiday which expires at the end of 2016. In addition, in 2014 the Macau government accepted an application by one of our subsidiaries in Macau for a corporate tax exemption through 2016 on amounts transferred to it by Melco Crown Macau, to the extent that such amounts result from gaming operations within Studio City and have been subject to gaming tax. The Macau government clarified that share dividends payment by such subsidiary would continue to be subject to complementary tax. However, there can be no assurances that the corporate tax holiday benefits will be extended beyond the applicable expiration date.

We intend for our subsidiary, Studio City Hotels, to apply for a declaration of utility purpose pursuant to which Studio City Hotels would be entitled to a property tax holiday for a period of 12 years on any immovable property it owns. Under such tax holiday, Studio City Hotels would also be allowed to double the maximum rates applicable to depreciation and reintegration for the purposes of assessment of Macau complementary tax and to apply for a vehicle tax holiday on specific vehicles purchased. However, there can be no assurances that such tax benefits will be granted to Studio City Hotels or, if granted, when such benefits will be effective.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of our results of operations and liquidity and capital resources are based on our consolidated financial statements. Our consolidated financial statements were prepared in conformity with U.S. GAAP. Certain of our accounting policies require that management apply significant judgment in defining the appropriate assumptions integral to financial estimates. On an ongoing basis, management evaluates those estimates and judgments are made based on information obtained from our historical experience, terms of existing contracts, industry trends, the prevailing regulatory environment and outside sources, that are currently available to us, and on various other assumptions that management believes to be reasonable and appropriate in the circumstances. However, by their nature, judgments are subject to an inherent degree of uncertainty, and therefore actual results could differ from our estimates. We believe that the critical accounting policies discussed below affect our significant judgments and estimates used in the preparation of our consolidated financial statements.

Construction in Progress and Other Long-lived Assets

During the construction and development stage of our integrated entertainment, retail and gaming resort facilities, direct and incremental costs related to the design and construction, including costs under the construction contracts, duties and tariffs, equipment installation, shipping costs, payroll and payroll-benefit related costs, depreciation of plant and equipment used, applicable portions of interest and amortization of deferred financing costs, are capitalized in property and equipment. The capitalization of such costs begins when the construction and development of a project starts and ceases once the construction is substantially completed or development activity is suspended for more than a brief period. Pre-opening costs, consisting of marketing and other expenses related to our new or start-up operations and resort facilities, are expensed as incurred.

10

Depreciation and amortization expense related to capitalized construction costs and other property and equipment is recognized from the time each asset is placed in service. This may occur at different stages as integrated entertainment, retail and gaming resort facilities are completed and opened.

Other long-lived assets with a finite useful life are depreciated and amortized on a straight-line basis over the asset’s estimated useful life. The estimated useful lives are based on factors including the nature of the assets, its relationship to other assets, our operating plans and anticipated use and other economic and legal factors that impose limits. The remaining estimated useful lives of assets are periodically reviewed, including when changes in our business and the operating environment could result in a change in our use of those assets.

Our land use right in Macau under the land concession contract for Studio City is being amortized over the estimated lease term of the land on a straight-line basis. The expiry date of the lease of the land use right of Studio City is October 2026. The maximum useful life of assets at Studio City is therefore deemed to be the remaining life of the land concession contract. The amortization of land use right is recognized from the date construction commences. We will evaluate whether the term of the land concession contract is to be extended when it is probable that definitive registration will be obtained prior to the end of the land grant term.

Costs of repairs and maintenance are charged to expense when incurred.

We also evaluate the recoverability of our property and equipment and other long-lived assets with finite lives whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of the carrying value of those assets to be held and used is measured by first grouping our long-lived assets into asset groups and, secondly, estimating the undiscounted future cash flows that are directly associated with and expected to arise from the use of and eventual disposition of such asset group. We define an asset group as the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities and estimate the undiscounted cash flows over the remaining useful life of the primary asset within the asset group. If the carrying value of the asset group exceeds the estimated undiscounted cash flows, we record an impairment loss to the extent the carrying value of the long-lived asset exceeds its fair value with fair value typically based on a discounted cash flow model. If an asset is still under development, future cash flows include remaining construction costs. All recognized impairment losses, whether for assets to be disposed of or assets to be held and used, are recorded as operating expenses.

Recent Changes in Accounting Standards

See note 2 to our consolidated financial statements included elsewhere in this annual report for a discussion of recent changes in accounting standards.

Results of Operations

We are currently in the development stage, and as a result there is no revenue and cash provided by our intended operations. Accordingly, the activities reflected in our consolidated statements of operations mainly relate to general and administrative expenses, amortization of land use right, interest expenses, amortization of deferred financing costs, loan commitment fees and pre-opening costs. Consequently, we have incurred losses to date and expect these losses to continue to increase until we commence commercial operations with the planned opening of the Studio City Project in the third quarter of 2015.

Year Ended December 31, 2014 compared to Year Ended December 31, 2013

For the year ended December 31, 2014, we had a net loss of US$68.9 million, a decrease of US$12.5 million from a net loss of US$81.4 million for the year ended December 31, 2013, primarily due to higher interest capitalization upon our continuous development on Studio City, higher interest income and lower loan commitment fees, partially offset by higher interest expenses and amortization of deferred financing costs arising from the drawdown of the entire term loan facility under the Studio City Project Facility on July 28, 2014 and an increase in pre-opening costs.

Amortization of land use right expenses were US$12.1 million for each of the years ended December 31, 2014 and 2013.

11

Pre-opening costs in 2014 were US$15.0 million, compared to US$2.9 million incurred in 2013. The increase in pre-opening costs of US$12.1 million was primarily due to an increase in management fee, payroll costs and the consultancy fee in connection with the start-up operations of Studio City incurred for the year ended December 31, 2014.

Interest expenses (net of capitalized interest of US$81.3 million) for the year ended December 31, 2014 were US$17.1 million, compared to US$40.1 million (net of capitalized interest of US$35.3 million) for the year ended December 31, 2013. The decrease in net interest expenses (net of capitalized interest) of US$23.0 million was primarily due to a higher interest capitalization of US$46.1 million associated with the Studio City construction and development projects, partially offset by an increase in interest expenses of US$26.3 million upon our drawdown in full of the term loan facility under the Studio City Project Facility in July 2014.

Amortization of deferred financing costs for the year ended December 31, 2014 was associated with the drawdown in full in July 2014 of the term loan facility under the Studio City Project Facility and the Studio City Notes issued in November 2012, totaling US$10.7 million. Amortization of deferred financing costs for the year ended December 31, 2013 was associated with the Studio City Notes issued in November 2012 and amounted to US$1.5 million.

Loan commitment fees associated with the Studio City Project Facility were payable from January 2013 and amounted to US$15.2 million and US$23.2 million for the year ended December 31, 2014 and 2013, respectively. The decrease in the amount of fees payable resulted from the drawdown in full of the term loan facility under the Studio City Project Facility in July 2014.

Liquidity and Capital Resources

We have relied on shareholder equity contributions and/or subordinated loans from our shareholders, net proceeds from the Studio City Notes and a portion of the Studio City Project Facility to meet our development project needs through the opening of the Studio City Project. As a development stage company relying on such financing sources, our working capital balance may be negative from time to time as the source of funds will be from long-term debt while our liabilities are current. In addition, we expect our cash outflow to increase as we will have substantial payment obligations relating to various development capital expenditure, pre-opening and working capital expenses and debt financing obligations during the construction period.

As of December 31, 2014, a total of US$1,280 million, representing all of the capital contribution required under the Shareholders Agreement, has been funded by MCE Cotai and New Cotai. The Shareholders Agreement does not require MCE Cotai or New Cotai to make any additional capital contributions to SCI.

Cash Flows

The following table sets forth a summary of our cash flows for the years indicated:

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (In thousands of US$) | |

Net cash used in operating activities | | $ | (43,519 | ) | | $ | (65,041 | ) |

Net cash used in investing activities. | | | (1,443,077 | ) | | | (530,114 | ) |

Net cash provided by financing activities. | | | 1,489,757 | | | | 595,155 | |

| | | | | | | | |

Net increase in cash and cash equivalents | | | 3,161 | | | | — | |

Cash and cash equivalents at beginning of year | | | — | | | | — | |

| | | | | | | | |

Cash and cash equivalents at end of year | | $ | 3,161 | | | $ | — | |

| | | | | | | | |

12

Operating Activities

We are currently developing the Studio City Project, and therefore there was no revenue and cash generated from our intended operations during the periods reported herein. Net cash used in operating activities during the presented periods in this annual report mainly represents general and administrative expenses, pre-opening costs and commitment fees associated with the Studio City Project Facility paid during the year. For the years ended December 31, 2014 and 2013, net cash used in operating activities were US$43.5 million and US$65.0 million respectively. The decrease in net cash used in operating activities was primarily due to the increase in interest capitalization.

Investing Activities

Net cash used in investing activities was US$1,443.1 million for the year ended December 31, 2014, as compared to US$530.1 million for the year ended December 31, 2013, primarily due to capital expenditure payment of US$686.2 million, increase in restricted cash of US$649.5 million, advance payments and deposits for acquisition of property and equipment of US$60.4 million and land use right payment of US$47.0 million.

The increase in restricted cash of US$649.5 million for the year ended December 31, 2014 resulted primarily from the drawdown of the term loan facility under the Studio City Project Facility on July 28, 2014 of US$1,295.7 million and the transfer of funds from Studio City Holdings, our immediate holding company, of US$199.5 million as described below, partially offset by the withdrawal and payment of Project Costs and interest of US$845.7 million for the year ended December 31, 2014 from bank accounts that are restricted for Project Costs in accordance with the terms of the Studio City Notes and the Studio City Project Facility.

Net cash used in investing activities was US$530.1 million for the year ended December 31, 2013, primarily due to capital expenditure payment of US$433.5 million, advance payments for construction of US$150.1 million and land use right payment of US$44.7 million, partially offset by the decrease in restricted cash of US$98.2 million.

The decrease in restricted cash of US$98.2 million was primarily due to withdrawal and payment of Project Costs of US$680.3 million and payment of Studio City Notes interest of US$71.1 million during the year ended December 31, 2013 from bank accounts that are restricted for the Studio City Project Facility, partially offset by the funds transfer from Studio City Holdings, our immediate holding company, of US$653.2 million as described below.

Financing Activities

Net cash provided by financing activities was US$1,489.8 million for the year ended December 31, 2014, primarily from the drawdown of the term loan facility under the Studio City Project Facility on July 28, 2014 of US$1,295.7 million and advances from Studio City Holdings, our immediate holding company, which are unsecured and non-interest bearing, of US$199.5 million. The advances from Studio City Holdings of US$199.5 million were sourced through capital injections from MCE Cotai and New Cotai, shareholders of SCI. These were offset in part by the payment of debt issuance costs associated with the Studio City Notes and the Studio City Project Facility in an aggregate amount of US$5.5 million.

Net cash provided by financing activities was US$595.2 million for the year ended December 31, 2013, primarily from the advances from Studio City Holdings, our immediate holding company, which are unsecured and non-interest bearing, of US$653.2 million. The advances from Studio City Holdings of US$653.2 million were sourced through capital injections from MCE Cotai and New Cotai, shareholders of SCI. These were offset in part by the prepaid debt issuance costs of US$56.4 million associated with the Studio City Project Facility and payment of debt issuance cost associated with Studio City Notes of US$1.6 million.

13

Indebtedness and Capital Contributions

The following table presents a summary of our indebtedness as of December 31, 2014:

| | | | |

| | | As of December 31, 2014 | |

| | | (in thousands of US$) | |

Studio City Project Facility | | $ | 1,295,689 | |

Studio City Notes | | $ | 825,000 | |

| | | | |

| | $ | 2,120,689 | |

| | | | |

Except for the drawdown of the term loan facility under the Studio City Project Facility of US$1.3 billion in July 2014, there was no other change in our indebtedness during the year ended December 31, 2014.

Under the Studio City Project Facility, we have HK$10,855,880,000 (equivalent to approximately US$1.4 billion) comprising a five year HK$10,080,460,000 (equivalent to approximately US$1.3 billion) term loan facility and a HK$775,420,000 (equivalent to approximately US$100.0 million) revolving credit facility. On July 28, 2014, we drew down the entire term loan facility under the Studio City Project Facility, while the revolving credit facility under the Studio City Project Facility remains available for future drawdown, subject to satisfaction of certain conditions precedent. Certain proceeds of the term loan facility (which has been fully drawn) have been placed in a disbursement account, which is secured in favor of the security agent for the facility, and may be withdrawn to pay Project Costs, subject to the satisfaction of certain conditions and requirements pursuant to an agreed term loan facility disbursement facility agreement. Certain proceeds of the Studio City Notes have also been placed in reserved accounts, which are secured in favor of the collateral agent for the Studio City Notes, and may be withdrawn to pay the interests payable under the Studio City Notes, subject to the satisfaction of conditions and requirements as specified by the relevant security documents.

For the purpose of financing the Studio City Project, we issued the US$825.0 million Studio City Notes and drew down the term loan facility of HK$10,080,460,000 (equivalent to approximately US$1.3 billion) under the Studio City Project Facility, in November 2012 and July 2014, respectively. As of the date of this annual report, MCE Cotai and New Cotai, shareholders of SCI, have contributed US$1,250.0 million (which amount includes the completion guarantee support cash of US$225.0 million (part of which had been earmarked to partially fund the construction budget increased in June 2014) provided under the Studio City Project Facility) to the Studio City Project and US$30 million for the initial design works for the Additional Development in accordance with the Shareholders Agreement.

For further details of the above indebtedness, please also refer to note 7 to the consolidated financial statements included elsewhere in this annual report, which includes information regarding the type of debt facilities used and still available to us, the maturity profile of such debt facilities, the applicable currency and interest rate structures, the charges on our assets and the nature and extent of any restrictions on our ability, and the ability of our subsidiaries, to transfer funds as cash dividends, loans or advances. Please also refer to “— Long-term Indebtedness and Contractual Obligations” for details of the maturity profile of debt and “— Quantitative and Qualitative Disclosures about Market Risk” for further understanding of our hedging of interest rate risk and foreign exchange risk exposure.

14

Long-term Indebtedness and Contractual Obligations

Our total long-term indebtedness and other known contractual obligations are summarized below as of December 31, 2014.

| | | | | | | | | | | | | | | | | | | | |

| | | Payments Due by Period | |

| | | Less than | | | | | | | | | More than | | | | |

| | | 1 year | | | 1–3 years | | | 3–5 years | | | 5 years | | | Total | |

| | | (in millions of US$) | |

Long-term debt obligations(1): | | | | | | | | | | | | | | | | | | | | |

Studio City Project Facility | | $ | — | | | $ | 311.0 | | | $ | 984.7 | | | $ | — | | | $ | 1,295.7 | |

Studio City Notes | | | — | | | | — | | | | — | | | | 825.0 | | | | 825.0 | |

Fixed interest payments | | | 70.1 | | | | 140.3 | | | | 140.3 | | | | 64.3 | | | | 415.0 | |

Variable interest payments(2) | | | 61.3 | | | | 109.8 | | | | 3.4 | | | | — | | | | 174.5 | |

Construction costs and property and equipment retention payables | | | — | | | | 55.9 | | | | — | | | | — | | | | 55.9 | |

Other contractual commitments: | | | | | | | | | | | | | | | | | | | | |

Government annual land use fees(3) | | | 0.5 | | | | 1.0 | | | | 1.9 | | | | 7.7 | | | | 11.1 | |

Fixed interest on land premium(3) | | | 0.6 | | | | — | | | | — | | | | — | | | | 0.6 | |

Construction, plant and equipment acquisition commitments(4) | | | 560.1 | | | | — | | | | — | | | | — | | | | 560.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total contractual obligations | | $ | 692.6 | | | $ | 618.0 | | | $ | 1,130.3 | | | $ | 897.0 | | | $ | 3,337.9 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | See note 7 to the consolidated financial statements included elsewhere in this annual report for further details on these debt facilities. |

| (2) | Amounts for all periods represent our estimated future interest payments on our debt facility based upon amounts outstanding and HIBOR as at December 31, 2014 plus the applicable interest rate spread in accordance with the debt agreement. Actual rates will vary. |

| (3) | The land concession from the Macau government for the Studio City site, for a 25-year term from October 17, 2001, is renewable for further consecutive periods of ten years each until December 19, 2049. Renewal of the land concession is subject to obtaining approvals from the Macau government. See “Business” for further details of the land concession obligation. |

| (4) | See note 14(a) to the consolidated financial statements included elsewhere in this annual report for further details on construction, plant and equipment acquisition commitments. |

Off-Balance Sheet Arrangements

Except as disclosed in note 14(c) to the consolidated financial statements included elsewhere in this annual report, we have not entered into any material financial guarantees or other commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our ordinary shares and classified as shareholder’s equity, or that are not reflected in our consolidated financial statements.

Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

Distribution of Profits

All subsidiaries of our company incorporated in Macau are required to set aside a minimum of 25% of the entity’s profit after taxation to the legal reserve until the balance of the legal reserve reaches a level equivalent to 50% of the entity’s share capital in accordance with the provisions of the Macau Commercial Code. The legal reserve sets aside an amount from the subsidiaries’ statements of operations and is not available for distribution to the shareholders of the subsidiaries. The appropriation of legal reserve is recorded in the subsidiaries’ financial statements in the year in which it is approved by the board of directors of the relevant subsidiaries. As of December 31, 2014, the legal reserve was nil and no reserve was set aside during the year ended December 31, 2014.

15

Restrictions on Distributions

The indenture governing the Studio City Notes and the agreement for the Studio City Project Facility contain certain covenants that, subject to certain exceptions and conditions, restrict the payment of dividends by our company and its restricted subsidiaries.

Quantitative and Qualitative Disclosures about Market Risk

Market risk is the risk of loss arising from adverse changes in market rates and prices, such as interest rates, foreign currency exchange rates and commodity prices. We believe our primary exposure to market risk will be interest rate risk associated with our substantial indebtedness.

Interest Rate Risk

Our exposure to interest rate risk is associated with our substantial indebtedness bearing interest based on floating rates. As of December 31, 2014, we are subject to fluctuations in HIBOR as a result of the Studio City Project Facility. In addition, we entered into interest rate swaps in connection with a portion of our drawdown of the term loan facility under the Studio City Project Facility in accordance with our obligations under the Studio City Project Facility. As of December 31, 2014, we had five interest rate swap agreements with a total nominal amount of HK$1,867,199,900 (equivalent to approximately US$240.0 million) that expired in March 2015. In March 2015, we entered into another five interest rate swap agreements with a total nominal amount of HK$1,867,199,800 (equivalent to approximately US$240.0 million) that will expire in September 2015.

We attempt to manage interest rate risk by managing the mix of long-term fixed rate borrowings and variable rate borrowings and we may supplement by hedging activities in a manner we deem prudent. We cannot be sure that these risk management strategies have had the desired effect, and interest rate fluctuations could have a negative impact on our results of operations.

As of December 31, 2014 and 2013, approximately 39% and 100% (respectively) of our total indebtedness was subject to interest at a fixed rate. Based on December 31, 2014 indebtedness and interest rate swap levels, an assumed 1% increase or decrease in HIBOR would cause our annual interest cost to increase or decrease by approximately US$10.6 million.

Foreign Exchange Risk

Our exposure to foreign exchange rate risk is associated with the currency of our operations, our indebtedness and as a result of the presentation of our consolidated financial statements in U.S. dollars. The H.K. dollar is the predominant currency used in Macau and is often used interchangeably with the Pataca in Macau. A significant portion of our indebtedness, as a result of the Studio City Notes, is denominated in U.S. dollars, and the costs associated with servicing and repaying such debt will be denominated in U.S. dollars. In addition, the Studio City Project Facility is denominated in H.K. dollars, and the costs associated with servicing and repaying such debt will be denominated in H.K. dollars. The H.K. dollar is pegged to the U.S. dollar within a narrow range and the Pataca is in turn pegged to the H.K. dollar. The exchange rates between these currencies have remained relatively stable over the past several years, resulting in minimal foreign exchange exposure for us. However, we cannot assure you that the current peg or linkages between the U.S. dollar, H.K. dollar and Pataca will not be broken or modified and subjected to fluctuation as such exchange rates may be affected by, among other things, changes in political and economic conditions. Based on the balances of indebtedness denominated in currencies other than U.S. dollars as of December 31, 2014, an assumed 1% change in the exchange rates between currencies other than U.S dollars against the U.S. dollar would cause a foreign transaction gain or loss of approximately US$13.0 million for the year ended December 31, 2014. Major currencies in which our cash and bank balances (including restricted cash) were held as of December 31, 2014 included U.S. dollars, H.K. dollars and Patacas. Based on the cash and bank balances as of December 31, 2014, an assumed 1% change in the exchange rates between currencies other than U.S. dollars against the U.S. dollar would cause a maximum foreign transaction gain or loss of approximately US$13.1 million for the year ended December 31, 2014.

16

BUSINESS

Overview

We are a subsidiary of SCI, which is 60%-owned by MCE, a developer, owner and operator of casino gaming and entertainment resort facilities in Asia. On July 27, 2011, MCE, through its subsidiary, MCE Cotai, acquired a 60% interest in SCI from an affiliate of eSun Holdings Limited, an independent third party. New Cotai Holdings, an entity incorporated in Delaware and controlled by funds managed by Silver Point Capital, L.P. and Oaktree Capital Management, L.P., retains the remaining 40% interest in SCI through its wholly owned subsidiary New Cotai.

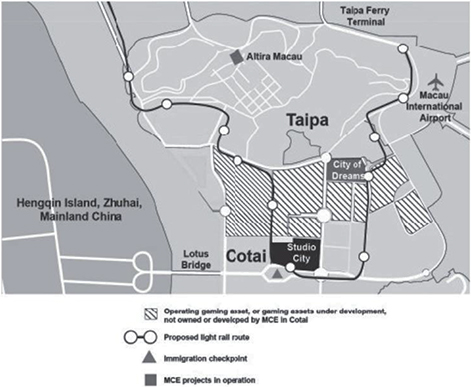

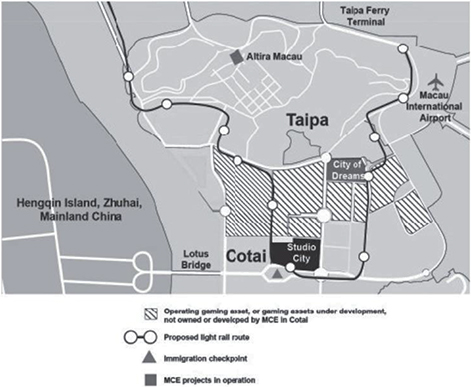

We are developing the Studio City Project to be a cinematically-themed integrated entertainment, retail and gaming resort, designed to deliver a unique entertainment proposition to visitors to Macau. We also expect the Studio City Project to capture the attention of visitors to Macau, especially from the mass market segment, with its destination theming, unique and innovative interactive attractions, and strong Asian focus. In addition to its anticipated diverse range of gaming and non-gaming offerings, we believe Studio City’s location in the fast growing Cotai region of Macau, directly adjacent to the Lotus Bridge immigration checkpoint (“Where Cotai Begins” which connects China to Macau) and a proposed light rail station, is a major competitive advantage, particularly as it relates to the mass market segment.

The gaming areas of Studio City will be operated by Melco Crown Macau pursuant to the services agreement entered into with our subsidiary, Studio City Entertainment.

The design of the Studio City Project is substantially complete. The foundation works were completed in mid-2013 and the superstructure works are well under way. The Studio City Project is expected to include a luxury hotel (which we intend to operate under our own branding) and related facilities, gaming capacity, retail, attractions and entertainment venues (including a multipurpose entertainment studio). The Studio City Project is currently targeted to open in the third quarter of 2015. Our plan for the Additional Development of the Studio City site, which is expected to include additional luxury hotel and related facilities, as well as an expansion of retail, entertainment and gaming capacity, is currently under review and remains subject to change.

Total construction and design costs for the Studio City Project, excluding the cost of land, capitalized interest and pre-opening expenses, are currently budgeted at approximately US$2.3 billion. As of December 31, 2014, we had incurred capital expenditure for construction in progress of approximately US$1.5 billion for the development of the Studio City Project. Other than utilizing equity contributions by and/ or subordinated loans from our shareholders, we have entered into financing arrangements for the Studio City Project, namely the Studio City Notes and the Studio City Project Facility.

Studio City’s site is on a plot of land of 130,789 square meters (equivalent to approximately 1.4 million square feet) in Cotai, Macau. Studio City has an approved gross construction area of 707,078 square meters (equivalent to approximately 7.6 million square feet).

We engaged Gary Goddard Entertainment as our master plan designer for the Studio City Project. In addition, we engaged several major internationally recognized consultants for the architectural, building services and structural design works, as well as for hotel interior design and planning and management of the retail area of the Studio City Project.

By the end of 2014, the design of the Project was complete and procurement of all trades was complete except for a few fit-out packages in the retail area and for a few attractions. We have entered into direct contracts with world renowned companies to construct and manage the construction of themed entertainment facilities including Asia’s highest ferris wheel attraction, the “Flying Theatre”, and magic themed entertainment.

17

Competitive Strengths

Optimal location

Studio City is located in Cotai, an area that has become the key growth driver for Macau, where major gaming operators intend to develop further integrated resorts. Branded as “Where Cotai Begins”, Studio City is strategically located directly adjacent to the Lotus Bridge immigration checkpoint and is located along one of the planned Cotai hotel-casino resort stops on the Macau Light Rail Transit line. Studio City Project’s close proximity to these two key entry and transit points is a key competitive advantage, likely making the property one of the first stops for a large number of visitors from Mainland China to Cotai. We believe that Studio City’s location as the first hotel-casino resort stop in Cotai is important in driving mass market visitation, enabling the property to capture a meaningful share of these customers’ spending.

Furthermore, we expect that Studio City’s location and Studio City Casino’s complementary mass market focus will enable significant cross-marketing and cross-promotional opportunities with MCE’s City of Dreams integrated resort, which focuses on the VIP and premium end of the market and is located only minutes by car and two stations away on a proposed light rail from Studio City.

In addition, we believe that the planned development of Hengqin Island, China, will substantially increase traffic flow over time through the Lotus Bridge immigration checkpoint, further enhancing Studio City’s access to its core mainland Chinese target market.

18

Innovative property with a focus on non-gaming entertainment attractions

We anticipate that the Studio City Project’s unique design, including its striking and iconic exterior, will enhance the appeal of the property, particularly to the mass market segment, and help capture visitors entering Macau via the Lotus Bridge.

We believe that our focus on non-gaming entertainment attractions will differentiate the Studio City Project from existing Macau resort offerings, which currently place a higher emphasis on gaming, retail and/or meeting, incentives, convention and exhibition offerings. The cinematically-themed entertainment offerings are expected to include regional pop artist concerts, Asia’s highest ferris wheel attraction, a “Flying Theatre”, magic themed entertainment as well as several other interactive rides and attractions, including a 5,000 seat multi-purpose entertainment studio, designed to cater to a broad range of customer ages, tastes and preferences.

The Studio City Project will also offer numerous casual and fine dining restaurants and bars, as well as other food and beverage outlets.

Significant Macau operational experience of our controlling shareholder

Our shareholder, MCE and its subsidiary, Melco Crown Macau, which will operate the Studio City Casino, have successfully developed and are currently operating two major Macau based casino operations, City of Dreams and Altira Macau, illustrating a thorough understanding and knowledge of the Macau gaming industry, including customer needs and preferences, regulatory processes and approvals, and the current and future competitive landscape.

We expect to leverage our relationship with MCE to maximize economies of scale through cost saving initiatives, including the centralization of shared services and support functions, such as legal services, information technology, human resources, supply chain logistics, sales and marketing, warehousing, strategic sourcing and transportation.

We believe that one of our strengths is the combined expertise of our shareholder, MCE, and Melco and Crown, major shareholders of MCE, both of which are represented on the board of directors of SCI, our parent. Melco has an established reputation and a broad network of business relationships in Macau, Hong Kong and elsewhere in other countries, and was one of the first companies to tap the rapidly growing leisure, gaming and entertainment market in Macau. Crown is one of Australia’s largest entertainment groups and is an experienced gaming company. We believe that successfully leveraging MCE’s operational experience should minimize the Studio City Project’s ramp up period after its initial opening.

Ability to leverage an established customer and international sales network and loyalty programs

We expect to leverage our relationship with MCE, which has extensive customer and sales network in Asia, as well as its well-developed and recognized customer hosting and loyalty programs, in order to build and develop our own customer base and drive visitation for the Studio City Project to achieve revenue growth. We also expect to leverage our relationship with MCE to capitalize on strategic revenue growth opportunities, including joint marketing and sales campaigns, as well as enticements at MCE properties to visit the Studio City Project and vice versa, and multi-location gaming machine jackpots.

Premier development team

Our core project management team and board of directors of SCI include various individuals with significant experience in developing multi-billion dollar integrated resort projects. These individuals have extensive experience developing integrated resorts with total construction costs of over US$10 billion. Marquee integrated resorts that they have been involved in include: Altira Macau, City of Dreams, MGM Las Vegas, Venetian Macau, Cosmopolitan Las Vegas and Marina Bay Sands Singapore.

19

Strong shareholder support and significant equity investment

As of the date of this annual report, MCE Cotai and New Cotai, shareholders of SCI, contributed a total of US$1,250 million to the Studio City Project (and US$30 million for the initial design works for the Additional Development) in accordance with the Shareholders Agreement. Out of the contribution of US$1,250 million, US$225 million was deployed as completion support (part of which had been earmarked to partially fund the construction costs increased in June 2014) in the form of cash collateral with lenders of the Studio City Project Facility. We believe that the significant equity investment of our shareholders provides us with a prudent capital structure.

Our Strategies

Differentiate the integrated resort with significant non-gaming attractions

The cinematically-themed integrated entertainment, retail and gaming resort Studio City is expected to be differentiated from existing hotel-casino integrated resorts through its destination theming, unique array of entertainment and innovative interactive attractions, which will cater to a broad range of customers in Macau and help drive diversification of the Macau economy. At the forefront of Asia’s next generation of immersive, world-leading, entertainment-driven gaming and leisure destination experiences, Studio City will offer a wide range of stunning attractions, such as Asia’s highest ferris wheel embedded in the façade of the hotel tower; “Batman Dark Flight”, the world’s first Batman film franchise digital ride; “Warner Bros. Fun Zone”, a large-scale family entertainment center enlivened by DC Comics and Warner Bros. characters; a TV broadcast studio, a 5,000-seat multi-purpose live performance arena and a live magic venue, as well as approximately 1,600 hotel rooms, a vast array of food and beverage outlets and “The Boulevard”, which will comprise approximately 350,000 square feet of themed and innovative retail space.

Focus on the higher margin mass market customer segment

The Studio City Project aims to be a mass market focused integrated resort. Studio City Casino intends to favor the mass market segment in Macau, given the typically higher operating margins and higher expected growth rates, when compared to the rolling chip segment. Incremental costs associated with the VIP rolling chip segment, compared to the mass market segment, include gaming promoter commissions and higher customer incentives. Mass market customers will be targeted by leveraging the Studio City Project’s diversified entertainment attractions, strategic marketing and promotional campaigns, as well as through a unique and tiered customer loyalty program, which will cater to a wide range of customers.

The mass market segment is relatively more stable than the VIP rolling chip segment. During the global financial crisis in 2008 and 2009, Macau’s quarterly mass market growth remained positive despite the significant disruptions to global markets and weak global economic conditions.

Develop comprehensive marketing and customer loyalty programs

We expect to coordinate the marketing efforts for the Studio City Project with our shareholder MCE, enabling substantial cost and revenue synergies, including, among other things, joint marketing and promotional campaigns. We intend to build up an extensive sales reach throughout our core target markets, including China and Hong Kong, ensuring that we strategically target our intended customer base and increase visitation and brand recognition.

We expect that the Studio City Casino will develop strong customer loyalty programs, tailored to attract and retain key customers, with a tiered loyalty approach ensuring each customer segment is specifically recognized and incentivized in accordance with their expected revenue contribution. We anticipate that the Studio City Casino will participate in cross marketing and sales campaigns developed by Melco Crown Macau as well as participate in customer loyalty strategies, which we believe will minimize the Studio City Project’s ramp up period, reduce marketing costs through scale synergies and maximize cross-revenue opportunities through complementary marketing programs and campaigns.

20

Create a first class customer experience

We aim to provide Studio City’s customers with a high quality experience through Studio City’s product offering and service quality. We believe Studio City’s variety of gaming and non-gaming attractions will provide customers with a superior overall entertainment experience. We expect customers to be able to dine and shop and enjoy the various interactive rides and attractions while also being able to play table games and gaming machines, all without leaving our property. We believe that by leveraging MCE’s operational expertise, we will be able to provide superior customer service. For example, the Studio City Project will have access to MCE’s experienced management team and service staff and will be able to share in the extensive training and hiring programs designed by MCE.

Studio City Project

Our current plan is to develop the Studio City Project into a large-scale cinematically-themed integrated resort, consisting of a luxury hotel and related facilities, gaming capacity, retail, attractions and entertainment venues (including a multipurpose entertainment studio).

Development of the Studio City Project

The following information describes our plans for the development of the Studio City Project as of the date of this annual report. As we are continually reviewing and developing our project plans, the following description is subject to further revision and change.

Hotel and Gaming Capacity

The gross construction area for the Studio City Project is approximately 5.2 million square feet (equivalent to approximately 477,336 square meters). It is anticipated that the Studio City Project will include a high rise structure accommodating self-managed luxury hotel facilities with approximately 1,600 rooms and gaming facilities.

Retail

It is anticipated that the retail space will be located on the lower podium of an integrated superstructure. The total retail gross construction area of approximately 0.39 million square feet (equivalent to approximately 36,000 square meters) is available for the Studio City Project with net leasable area of approximately 0.24 million square feet (equivalent to approximately 22,000 square meters). The retail mall is expected to showcase a variety of shops, and food and beverage offerings.

Entertainment

At the forefront of Asia’s next generation of immersive, world-leading, entertainment-driven gaming and leisure destination experiences, Studio City will offer a wide range of stunning attractions, such as Asia’s highest ferris wheel, embedded in the façade of the hotel tower; “Batman Dark Flight”, the world’s first Batman film franchise digital ride; “Warner Bros. Fun Zone”, a large-scale family entertainment center enlivened by DC Comics and Warner Bros. characters; a TV broadcast studio, a 5,000-seat multi-purpose live performance arena and a live magic venue.

Design and Procurement Status

We engaged Gary Goddard Entertainment as our master plan designer for the Project. In addition, we have engaged the following major internationally recognized consultants for the architectural, building services and structural design works:

Executive Architect — Leigh and Orange Limited

Building Services — Meinhardt (Macau) Limited

Structural — AECOM Macau Company Limited

Hotel interior design — LTW Designworks Pte. Ltd

Retail Area Planning and Management — Taubman Asia

21

By the end of 2014, the design of the Project was complete and procurement of all trades was complete except for a few fit-out packages in the retail area and for a few attractions. As of the date of this report, procurement for the attractions was completed.

In addition, we have entered into direct contracts with world renowned companies to construct and manage the construction of themed entertainment facilities including the Asia’s highest ferris wheel attraction, the “Flying Theatre”, magic themed entertainment and a family entertainment centre.

Construction Status

Foundation works were completed in mid-2013 by Paul Y Construction, the foundations contractor. We engaged, through competitive tendering, Paul Y Construction and Yau Lee Construction as a joint venture to carry out and complete the main contract works for the Project. As of the date of this report, the construction of the Project is well under way with the reinforced concrete structure works have been completed, and fitting out of the Project is well advanced. Mechanical, electrical and plumbing works are almost complete.

Targeted Customers

The Studio City Project is expected to focus on targeting the mass market segment (non-VIP), consisting of individuals who are expected to appreciate the broad leisure and entertainment offerings featured at the Studio City Project, including interactive attractions and rides, together with significant retail and food & beverage venues. The Studio City Casino will also cater to the VIP and premium segments, which typically attract wealthy high-end patrons who seek the excitement of high stakes gaming.

The primary target market is expected to be the mid-to-high income population who are both avid players and frequent visitors, with a particular focus on the adjacent Guangdong market and the rest of Greater China. The broader Asian region will serve as secondary and tertiary target markets.

Location and description of the Land Grant

Studio City is to be developed in Cotai as an integrated resort development project under a land grant concession granted by way of lease for the site.

The Studio City site is on a plot of land of 130,789 square meters (equivalent to approximately 1.4 million square feet) in Cotai, Macau and is strategically adjacent to a projected light rail station and Lotus Bridge immigration checkpoint, “Where Cotai Begins” which connects Macau to Hengqin Island, PRC. The Studio City Project entrance will be approximately one minute’s walk from the immigration checkpoint and will be interconnected to the property via an overhead sheltered pedestrian walkway. This direct access from key entry and transit points for Macau visitors will allow Studio City to become the natural first stop in Macau and likely benefit from the largest share of spending from these customers. In addition, the Studio City Project’s architecturally striking and iconic exterior will be highly visible and prominent in a prime location, helping to generate significant foot traffic.

Studio City has a gross construction area of approximately 7.6 million square feet (equivalent to approximately 707,078 square meters). The gross construction area for the first phase is approximately 5.2 million square feet (equivalent to approximately 477,336 square meters). Under the Studio City land concession contract, the land premium is approximately MOP1,425.3 million (equivalent to approximately US$177.9 million), of which approximately MOP1,230.0 million (equivalent to approximately US$153.5 million) was paid as of December 31, 2014, and the remaining MOP195.3 million (equivalent to approximately US$24.4 million), bearing interest at 5% per annum was paid in January 2015. Under the Studio City land concession contract, Studio City Developments has provided guarantees in the total amount of MOP7.4 million (equivalent to approximately US$0.9 million). Currently, the development period under the land concession contract is for 72 months from July 25, 2012.

The Studio City land concession contract, as amended in 2012, permits Studio City Developments to build a complex comprising a luxury hotel, a facility for cinematographic industry, including supporting facilities for entertainment and tourism, parking and free area.

22