Investor Conference Call April 26, 2013

Forward-Looking Statements This presentation contains forward-looking statements, which can be identified by the use of such words as estimate, project, believe, intend, anticipate, plan, seek, expect and similar expressions. These forward-looking statements include: Statements of our goals, intentions and expectations; Statements regarding our business plans and prospects and growth and operating strategies; Statements concerning trends in our provision for loan losses and charge-offs; Statements regarding the asset quality of our loan and investment portfolios; and Estimates of our risks and future costs and benefits. These forward-looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could affect the actual outcome of future events: Significantly increased competition among depository and other financial institutions; Inflation and changes in the interest rate environment that reduce our interest margins or reduce the fair value of financial instruments; General economic conditions, either nationally or in our market areas, including employment prospects and conditions that are worse than expected; Decreased demand for our products and services and lower revenue and earnings because of a recession or other events; Adverse changes and volatility in the securities and credit markets; Legislative or regulatory changes that adversely affect our business, including changes in regulatory costs and capital requirements and changes related to our ability to pay dividends and the ability of Third Federal Savings and Loan Association of Cleveland, MHC to waive dividends; Our ability to enter new markets successfully and take advantage of growth opportunities, and the positive short-term dilutive effect of potential acquisitions or de novo branches, if any; Changes in consumer spending, borrowing and savings habits; Changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board and the Public Company Accounting Oversight Board; Future adverse developments concerning Fannie Mae or Freddie Mac; Changes in monetary and fiscal policy of the U.S. Government, including policies of the U.S. Treasury or the Federal Reserve Board and changes in the level of government support of housing finance Changes in policy and/or assessment rates of taxing authorities that adversely affect us; The timing and the amount of revenue that we may recognize; Changes in expense trends (including, but not limited to, trends affecting non-performing assets, charge offs and provisions for loan losses); The impact of the continuing governmental effort to restructure the U.S. financial and regulatory system; The extensive reforms enacted in the Dodd-Frank Act which will continue to impact us; The adoption of implementing regulations by a number of different regulatory bodies under the Dodd-Frank Act, and uncertainty in the exact nature, extent and timing of such regulations and the impact they will have on us; The continuing impact of coming under the jurisdiction of new federal regulators; Changes in our organization, or compensation and benefit plans; Inability of third-party providers to perform their obligations to us; Adverse changes and volatility in real estate markets; A slowing or failure of the moderate economic recovery; The strength or weakness of the real estate markets and of the consumer and commercial credit sectors and their impact on the credit quality of our loans and other assets; and. The ability of the U.S. Federal Government to manage federal debt limits. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward- looking statements. 2

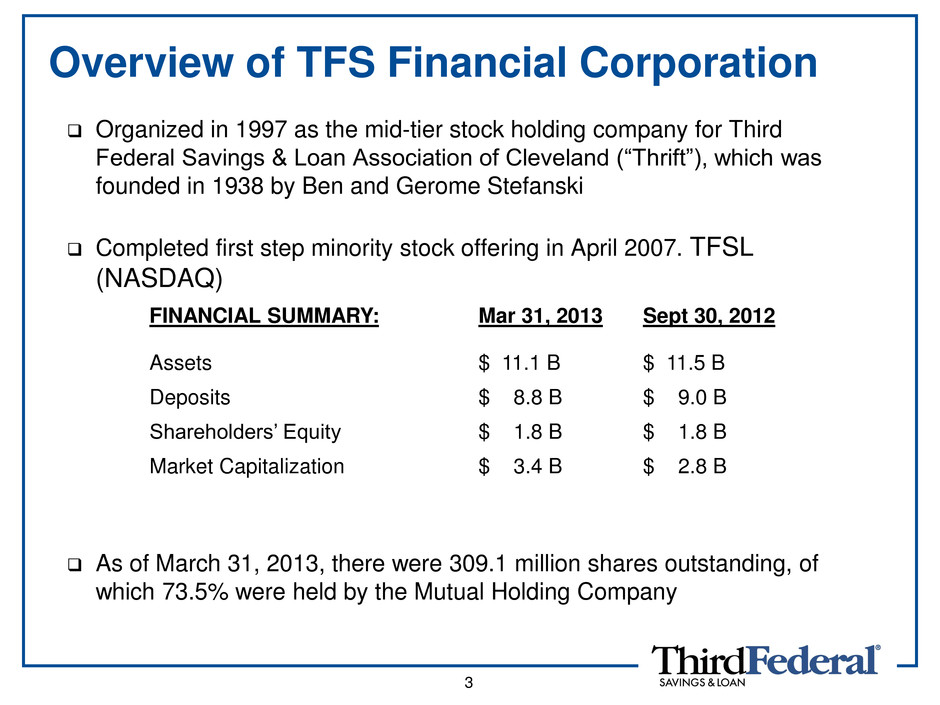

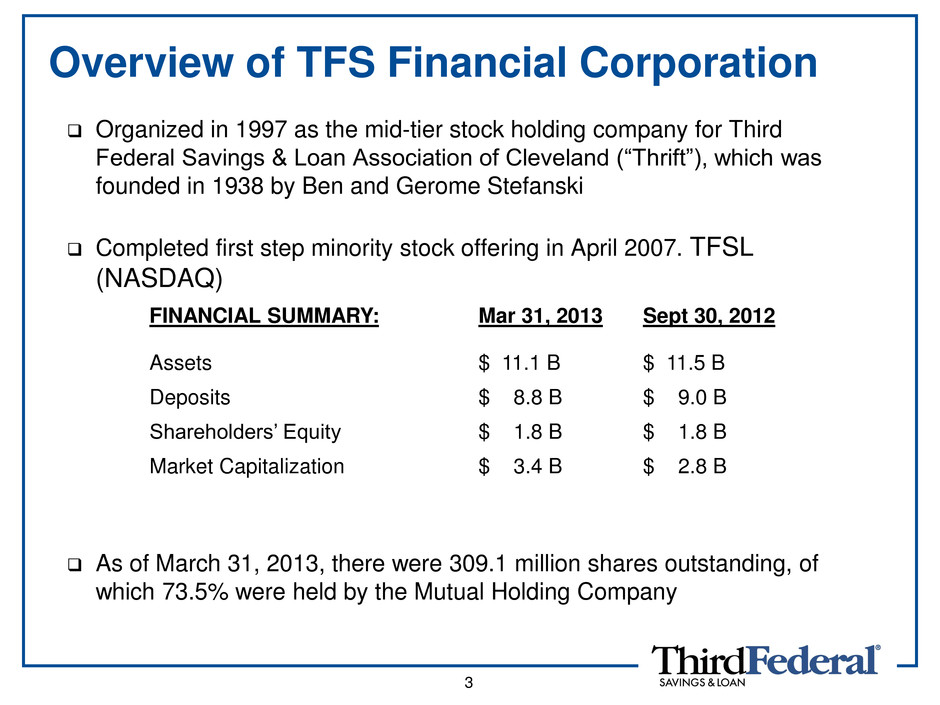

Overview of TFS Financial Corporation Organized in 1997 as the mid-tier stock holding company for Third Federal Savings & Loan Association of Cleveland (“Thrift”), which was founded in 1938 by Ben and Gerome Stefanski Completed first step minority stock offering in April 2007. TFSL (NASDAQ) As of March 31, 2013, there were 309.1 million shares outstanding, of which 73.5% were held by the Mutual Holding Company FINANCIAL SUMMARY: Mar 31, 2013 Sept 30, 2012 Assets $ 11.1 B $ 11.5 B Deposits $ 8.8 B $ 9.0 B Shareholders’ Equity $ 1.8 B $ 1.8 B Market Capitalization $ 3.4 B $ 2.8 B 3

Strategic Overview Our business model is to originate and service first mortgage loans. We also originate home equity lines to existing line customers as well as potential customers in our branch markets and we service all existing home equity lines and loans. We fund our loans primarily with core retail deposits, supplemented by FHLB advances Historically a fixed rate lender, but Smart Rate adjustable rate mortgage product has been a major part of originations since introduced to market in July 2010 Half of current mortgage loan production continues to be ARM First mortgage loans and retail deposits have been generated mainly in OH/FL footprint New state expansion began in May 2011, offering our Smart Rate adjustable rate mortgage to refinance customers through our Customer Service and Internet Channels and using underwriting standards and processing requirements of our traditional markets Only non-commissioned Third Federal associates have been and continue to be used to gather applications, underwrite and process the requests to generate mortgage loans and home equity loans and lines First mortgage originations continue to be made using stringent, conservative lending standards. For first mortgages originated during the current fiscal year, the average FICO score was 781, and the average LTV was 63%. Being a low-cost provider is a critical strategic advantage Historically, stock repurchases and dividends have supplemented shareholder returns, but are currently suspended by regulatory action 4

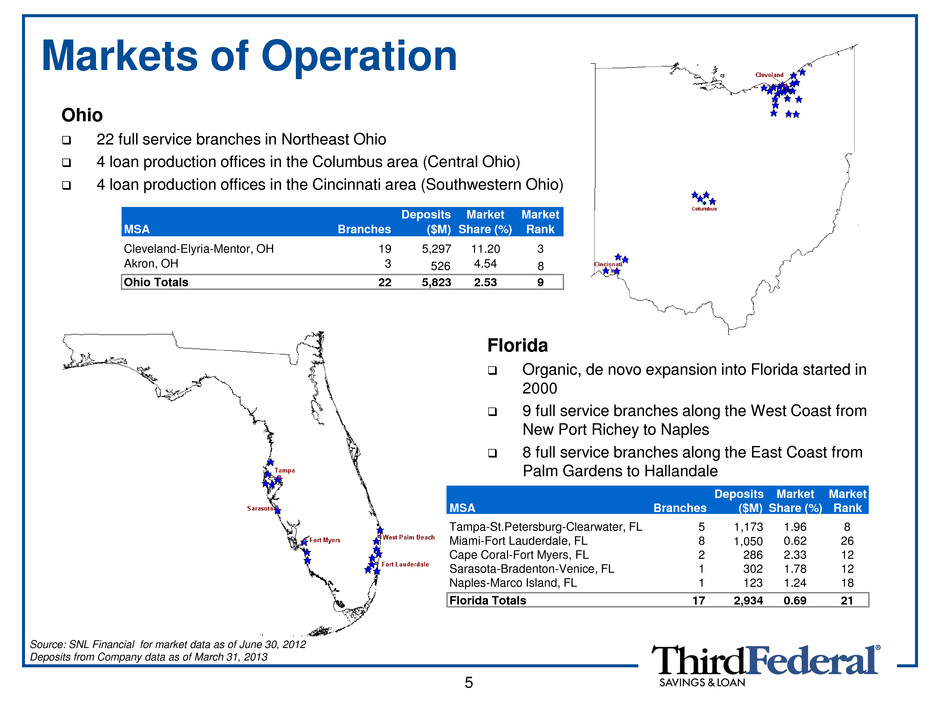

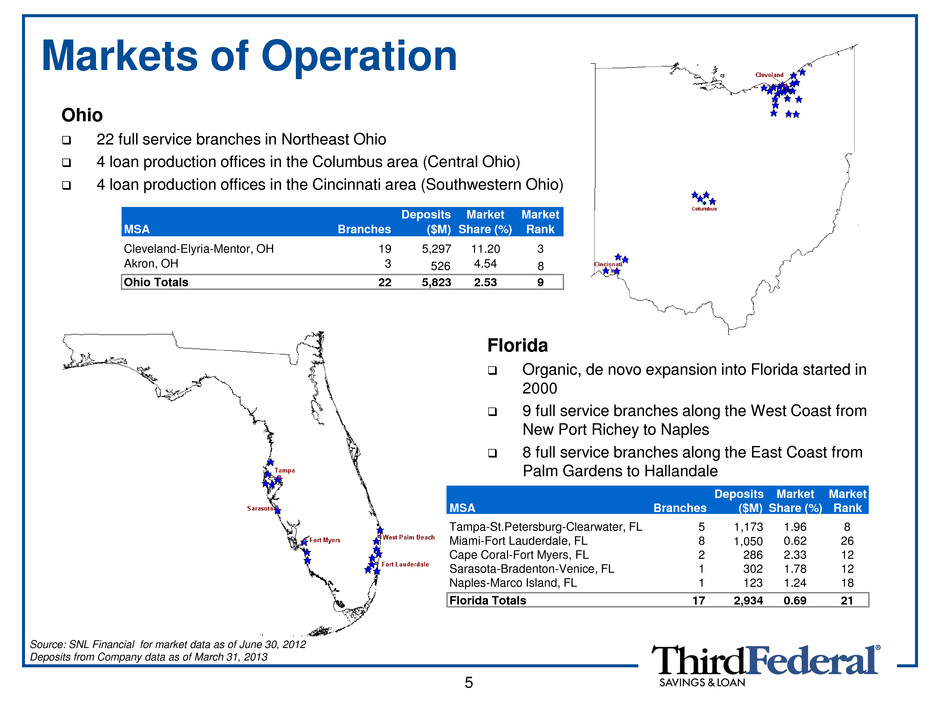

Ohio 22 full service branches in Northeast Ohio 4 loan production offices in the Columbus area (Central Ohio) 4 loan production offices in the Cincinnati area (Southwestern Ohio) Markets of Operation Florida Organic, de novo expansion into Florida started in 2000 9 full service branches along the West Coast from New Port Richey to Naples 8 full service branches along the East Coast from Palm Gardens to Hallandale Source: SNL Financial for market data as of June 30, 2012 Deposits from Company data as of March 31, 2013 Deposits Market Market MSA Branches ($M) Share (%) Rank Tampa-St.Petersburg-Clearwater, FL 5 1,173 1.96 8 Miami-Fort Lauderdale, FL 8 1,050 0.62 26 Cape Coral-Fort Myers, FL 2 286 2.33 12 Sarasota-Bradenton-Venice, FL 1 302 1.78 12 Naples-Marco Island, FL 1 123 1.24 18 Florida Totals 17 2,934 0.69 21 Deposits Market Market MSA Branches ($M) Share (%) Rank Cleveland-Elyria-Mentor, OH 19 5,297 11.20 3 Akron, OH 3 526 4.54 8 Ohio Totals 22 5,823 2.53 9 5

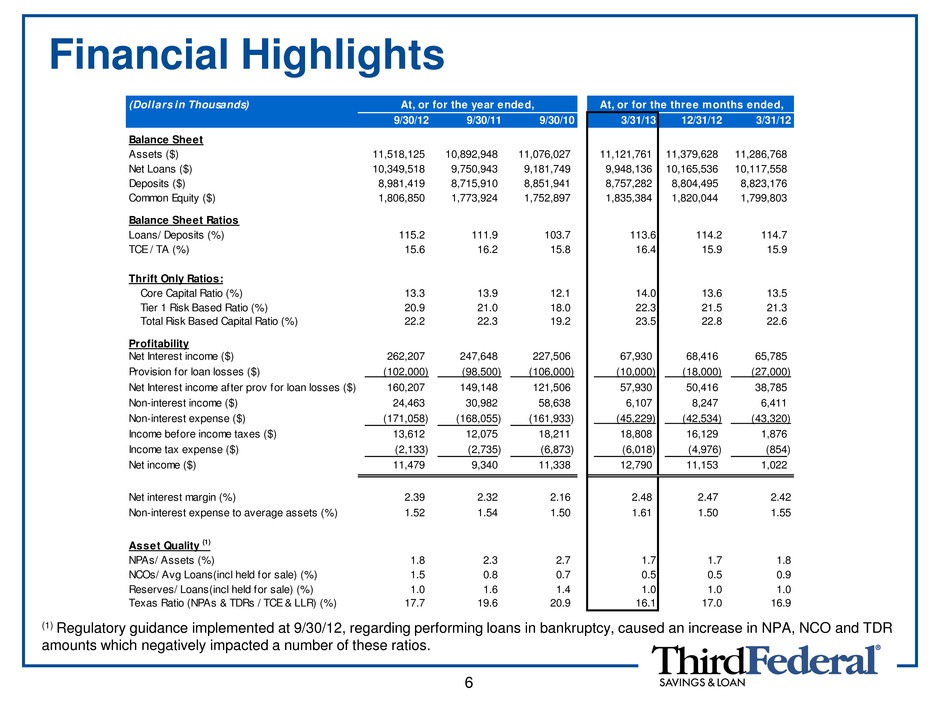

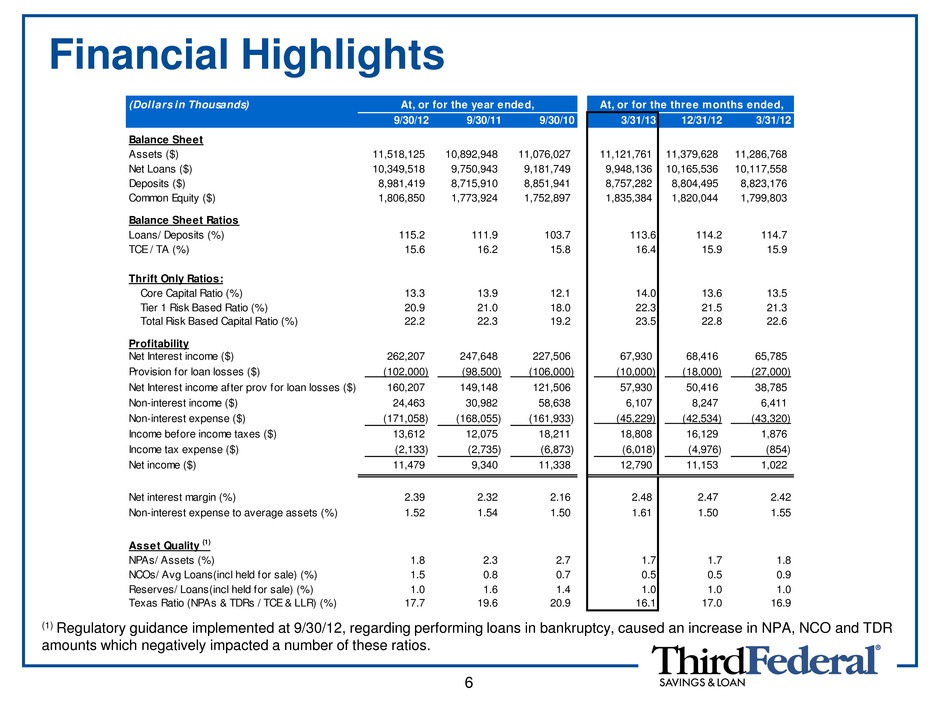

Financial Highlights (Dollars in Thousands) 9/30/12 9/30/11 9/30/10 3/31/13 12/31/12 3/31/12 Balance Sheet Assets ($) 11,518,125 10,892,948 11,076,027 11,121,761 11,379,628 11,286,768 Net Loans ($) 10,349,518 9,750,943 9,181,749 9,948,136 10,165,536 10,117,558 Deposits ($) 8,981,419 8,715,910 8,851,941 8,757,282 8,804,495 8,823,176 Common Equity ($) 1,806,850 1,773,924 1,752,897 1,835,384 1,820,044 1,799,803 Balance Sheet Ratios Loans/ Deposits (%) 115.2 111.9 103.7 113.6 114.2 114.7 TCE / TA (%) 15.6 16.2 15.8 16.4 15.9 15.9 Thrift Only Ratios: Core Capital Ratio (%) 13.3 13.9 12.1 14.0 13.6 13.5 Tier 1 Risk Based Ratio (%) 20.9 21.0 18.0 22.3 21.5 21.3 Total Risk Based Capital Ratio (%) 22.2 22.3 19.2 23.5 22.8 22.6 Profitability Net Interest income ($) 262,207 247,648 227,506 67,930 68,416 65,785 Provision for loan losses ($) (102,000) (98,500) (106,000) (10,000) (18,000) (27,000) Net Interest income after prov for loan losses ($) 160,207 149,148 121,506 57,930 50,416 38,785 Non-interest income ($) 24,463 30,982 58,638 6,107 8,247 6,411 Non-interest expense ($) (171,058) (168,055) (161,933) (45,229) (42,534) (43,320) Income before income taxes ($) 13,612 12,075 18,211 18,808 16,129 1,876 Income tax expense ($) (2,133) (2,735) (6,873) (6,018) (4,976) (854) Net income ($) 11,479 9,340 11,338 12,790 11,153 1,022 Net interest margin (%) 2.39 2.32 2.16 2.48 2.47 2.42 Non-interest expense to average assets (%) 1.52 1.54 1.50 1.61 1.50 1.55 Asset Quality (1) NPAs/ Assets (%) 1.8 2.3 2.7 1.7 1.7 1.8 NCOs/ Avg Loans(incl held for sale) (%) 1.5 0.8 0.7 0.5 0.5 0.9 Reserves/ Loans(incl held for sale) (%) 1.0 1.6 1.4 1.0 1.0 1.0 Texas Ratio (NPAs & TDRs / TCE & LLR) (%) 17.7 19.6 20.9 16.1 17.0 16.9 At, or for the three months ended,At, or for the year ended, (1) Regulatory guidance implemented at 9/30/12, regarding performing loans in bankruptcy, caused an increase in NPA, NCO and TDR amounts which negatively impacted a number of these ratios. 6

Capital Position as of March 31, 2013 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% Tangible Common Equity Ratio (TFSL) Core Capital Ratio (Thrift) Tier 1 Risk-based Ratio (Thrift) Total Risk-Based Capital Ratio (Thrift) Well Capitalized 6.00% 10.00% 5.00% TFSL/Thrift 14.0% 16.4% 23.5% 22.3% 7

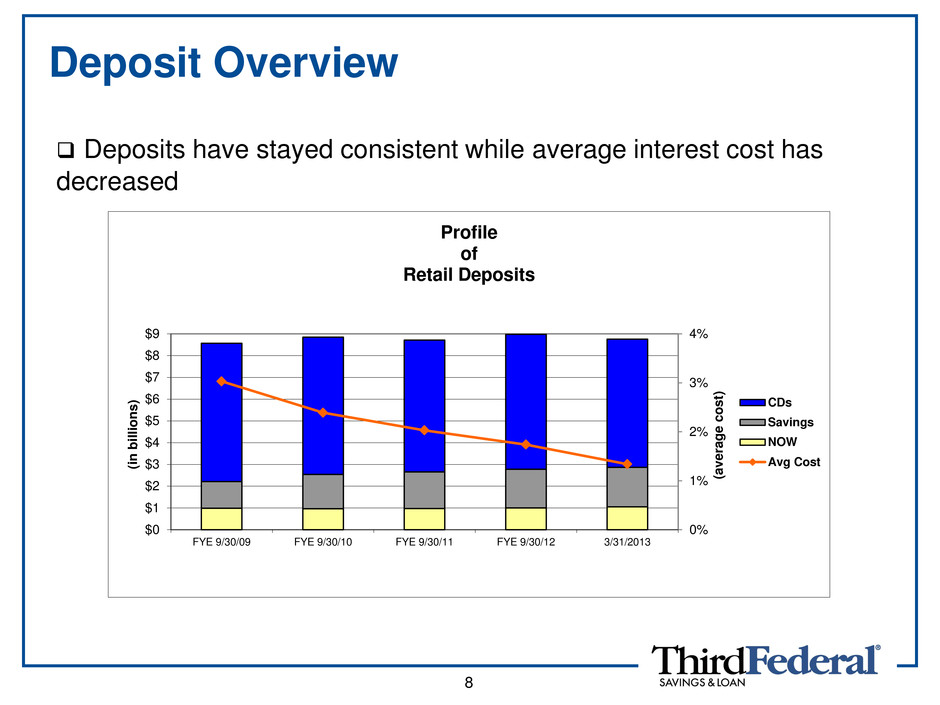

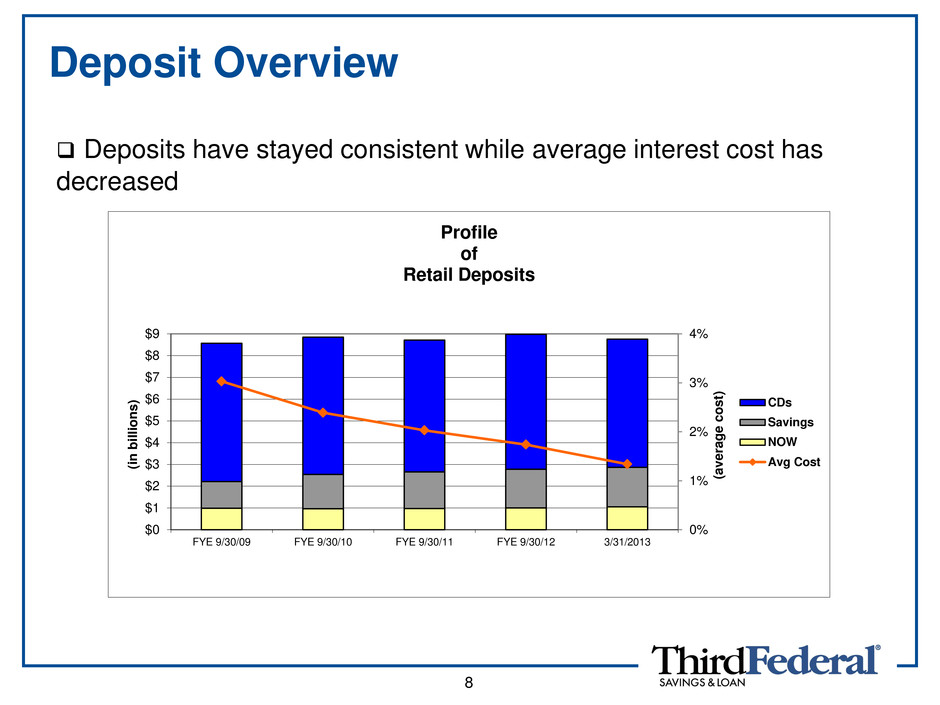

Deposit Overview Deposits have stayed consistent while average interest cost has decreased 8 0% 1% 2% 3% 4% $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 FYE 9/30/09 FYE 9/30/10 FYE 9/30/11 FYE 9/30/12 3/31/2013 (a v e rage cos t) (in b ill io n s ) Profile of Retail Deposits CDs Savings NOW Avg Cost

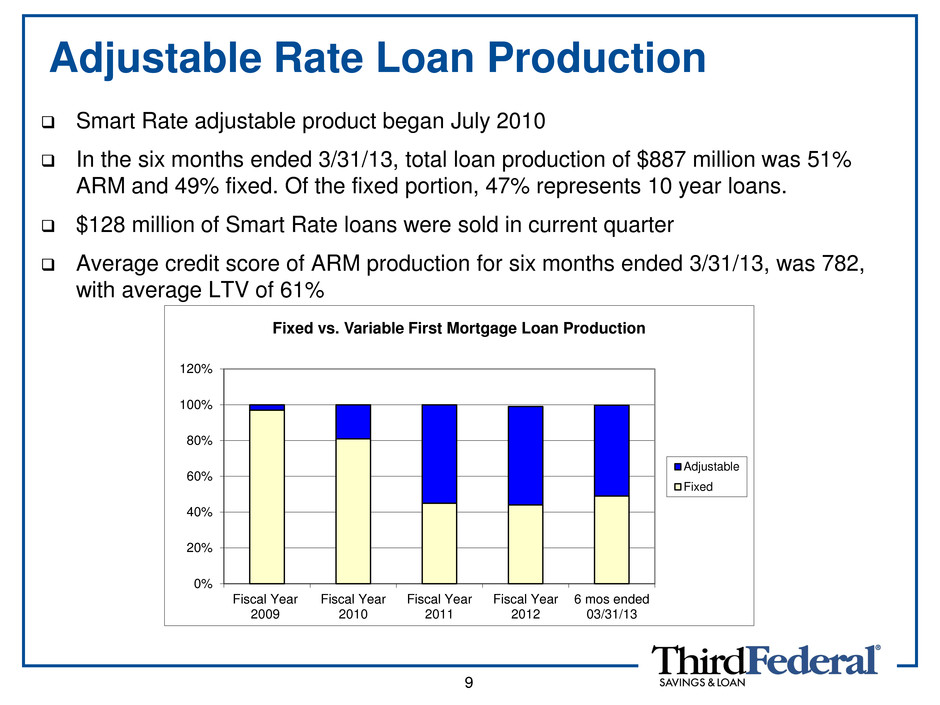

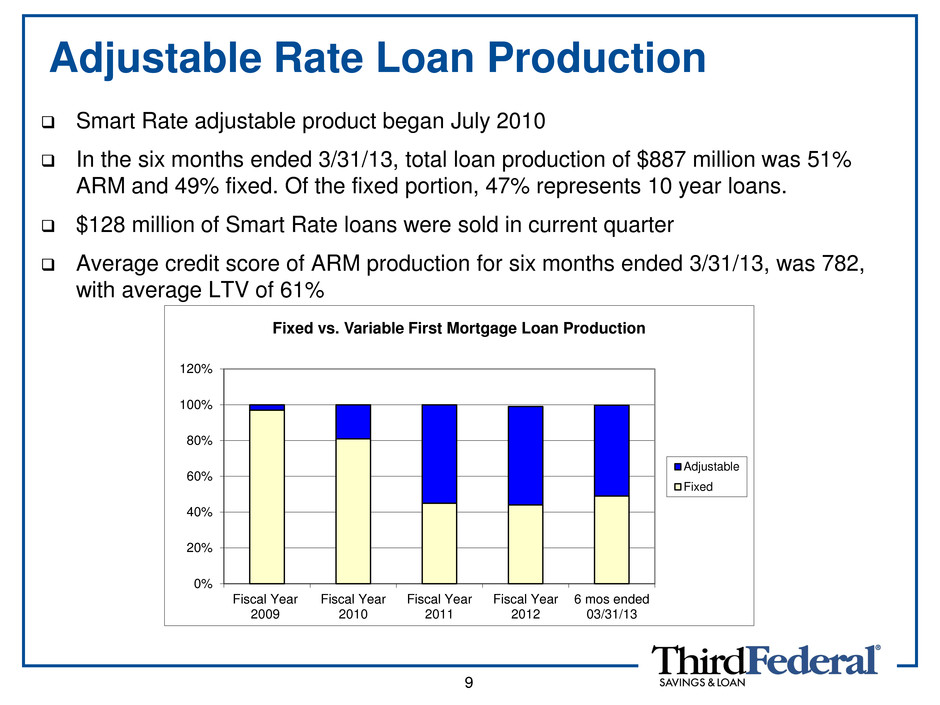

Adjustable Rate Loan Production Smart Rate adjustable product began July 2010 In the six months ended 3/31/13, total loan production of $887 million was 51% ARM and 49% fixed. Of the fixed portion, 47% represents 10 year loans. $128 million of Smart Rate loans were sold in current quarter Average credit score of ARM production for six months ended 3/31/13, was 782, with average LTV of 61% 9 0% 20% 40% 60% 80% 100% 120% Fiscal Year 2009 Fiscal Year 2010 Fiscal Year 2011 Fiscal Year 2012 6 mos ended 03/31/13 Fixed vs. Variable First Mortgage Loan Production Adjustable Fixed

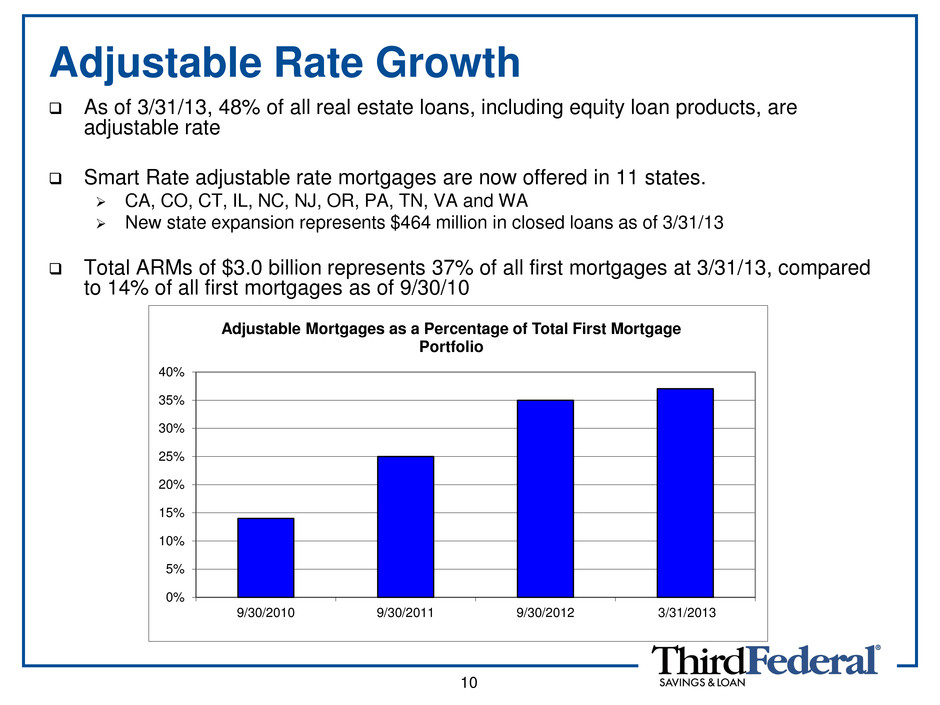

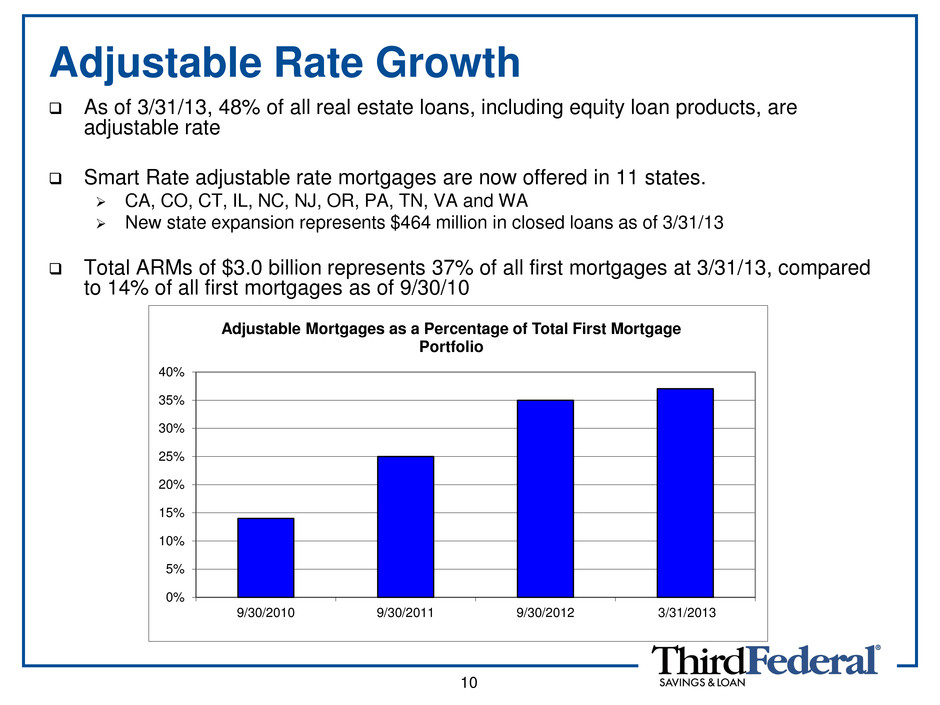

Adjustable Rate Growth As of 3/31/13, 48% of all real estate loans, including equity loan products, are adjustable rate Smart Rate adjustable rate mortgages are now offered in 11 states. CA, CO, CT, IL, NC, NJ, OR, PA, TN, VA and WA New state expansion represents $464 million in closed loans as of 3/31/13 Total ARMs of $3.0 billion represents 37% of all first mortgages at 3/31/13, compared to 14% of all first mortgages as of 9/30/10 10 0% 5% 10% 15% 20% 25% 30% 35% 40% 9/30/2010 9/30/2011 9/30/2012 3/31/2013 Adjustable Mortgages as a Percentage of Total First Mortgage Portfolio

Loan Delinquencies and Charge-offs Charge offs for the year ended 9/30/12 include $15.8 million in charge offs of mostly performing loans as a result of implementing new regulatory guidance on Chapter 7 bankruptcies and the elimination of the $55.5 million SVA. Decline in delinquencies from 9/30/11 to 9/30/12 was aided by charge off of SVA in quarter ended 12/31/11. Loan balances include loans held for sale. Dollars in millions Loan Balances 3/31/13 3/31/13 9/30/12 9/30/11 3/31/13 12/31/12 9/30/12 9/30/11 Residential non-Home Today Ohio $5,972 0.9% 1.0% 1.4% $3 $3 $26 $9 Florida 1,372 2.3% 2.6% 5.1% 2 1 29 9 Other 496 0.3% 0.1% 0.7% - - - - - Total $7,840 1.1% 1.3% 2.1% $5 $4 $55 $18 Residential Home Today Ohio $185 17.7% 20.9% 30.0% $4 $3 $41 $7 Florida 8 12.9% 17.0% 32.1% - - 2 - Total $193 17.5% 20.7% 30.1% $4 $3 $43 $7 Home Equity Loans and Lines of Credit Ohio $773 1.2% 1.3% 1.6% $1 $1 $19 $10 Florida 586 1.7% 1.6% 3.3% 3 3 26 29 California 243 0.8% 1.4% 1.4% 1 1 4 5 Other 400 1.2% 1.1% 2.1% - 1 11 5 Total $2,002 1.3% 1.3% 2.2% $5 $6 $60 $49 Other $59 0.4% 0.5% 4.3% $0 $0 $1 $1 Overall Total $10,094 1.4% 1.6% 2.9% $14 $13 $159 $75 Quarter-end Net Charge Offs Delinquencies at: FYE 11

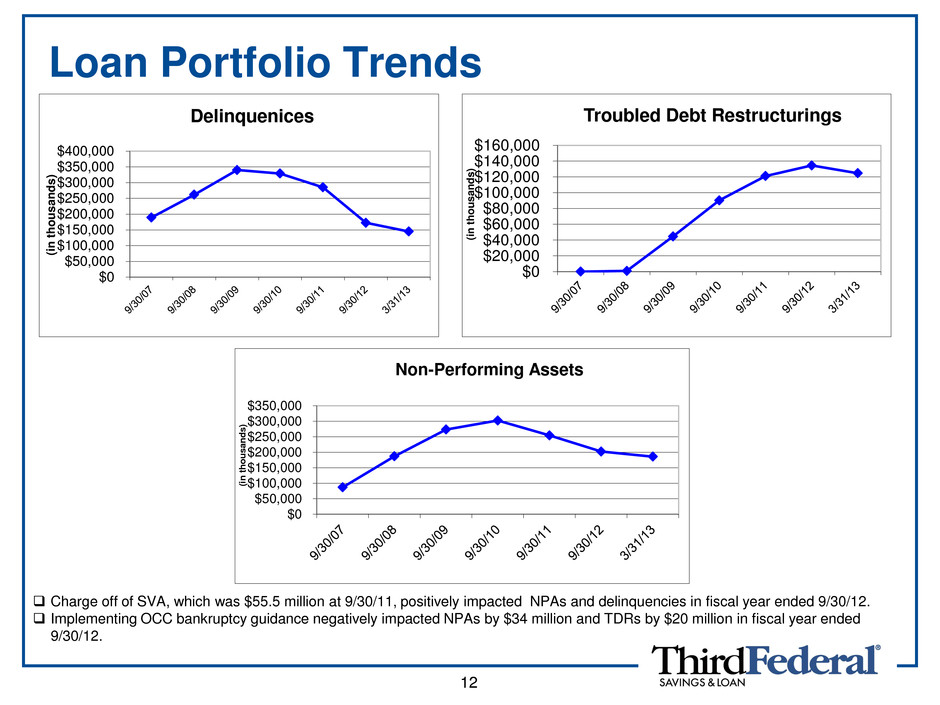

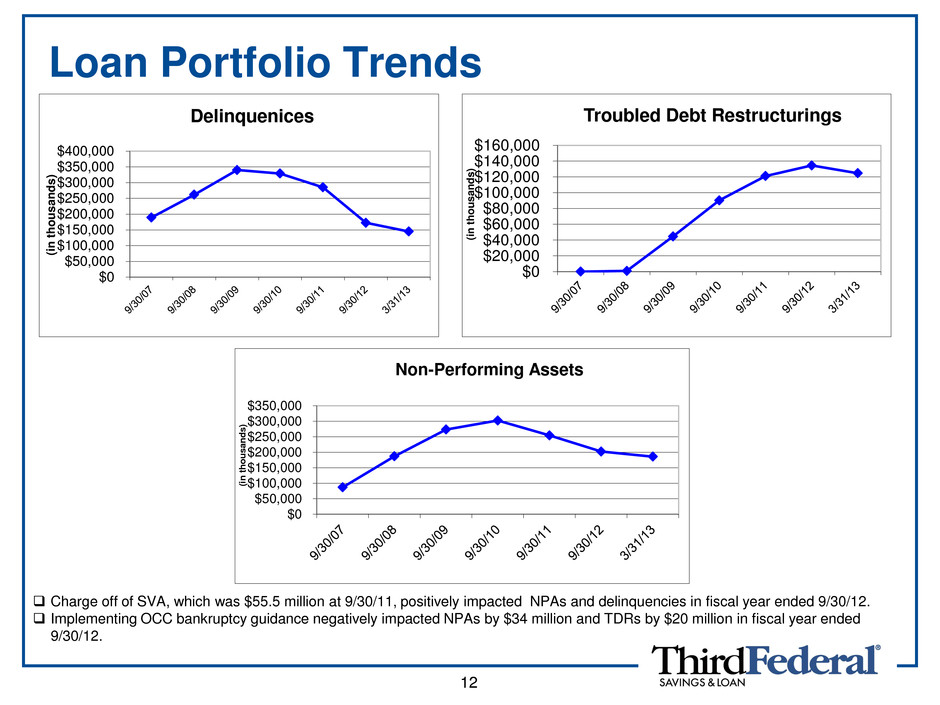

12 Loan Portfolio Trends Charge off of SVA, which was $55.5 million at 9/30/11, positively impacted NPAs and delinquencies in fiscal year ended 9/30/12. Implementing OCC bankruptcy guidance negatively impacted NPAs by $34 million and TDRs by $20 million in fiscal year ended 9/30/12. $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 (i n th o u s a n d s ) Delinquenices $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 (i n t hous a nds ) Troubled Debt Restructurings $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 (i n t h o u s a n d s ) Non-Performing Assets

Regulatory Status MOU under control of Federal Reserve for the holding company remains in effect and covers the further refinement and enhancement of our Enterprise Risk Management process. These actions will be subject to future regulatory validation. Dividends and stock buyback program continue to be subject to 45-day non-objection of the Federal Reserve. 13

Investor Conference Call April 26, 2013 Investor Questions 14