UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| | |

o Preliminary Proxy Statement |

|

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o Definitive Proxy Statement |

|

þ Definitive Additional Materials |

|

o Soliciting Material Pursuant to Rule 14a-12 |

|

| TFS FINANCIAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | | | | | | | | | | | |

| þ | No fee required. |

| | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| | | | | | | | | | | |

| o | Fee paid previously with preliminary materials: |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

AMENDED NOTICE OF ANNUAL MEETING

To our Stockholders:

The 2023 annual meeting of stockholders of TFS Financial Corporation (the “Company”) will be held at the offices of Third Federal Savings and Loan, 7007 Broadway Avenue, Cleveland, Ohio 44105, on Thursday, February 23, 2023, at 9:00 a.m., Eastern Time. The meeting is being held for the following purposes:

1.To elect four directors, each to hold office for a three-year term and until his or her successor has been duly elected and qualified;

2.To conduct an advisory vote on the compensation of our named executive officers;

3.To ratify the selection of Deloitte & Touche LLP as the Company’s independent accountant for the Company’s fiscal year ending September 30, 2023;

4.To conduct an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; and

5.To transact all other business that properly comes before the meeting.

Only stockholders of record at the close of business on December 27, 2022, will be entitled to notice of and to vote at the meeting or any adjournment thereof. You are invited to attend the annual meeting, and we request that you vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, date and sign the available proxy card and return it to the Company. Alternatively, you may vote via telephone or over the Internet. You will need your 16-digit control number included in your Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), proxy card or other instructions accompanying your proxy materials to join the meeting and vote.

All stockholders of record entitled to vote at the annual meeting should have previously received a Notice of Internet Availability. The Notice of Internet Availability will instruct you as to how you may access and review all of the important information contained in the proxy materials. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the Notice of Internet Availability. The principal address of the Company is 7007 Broadway Avenue, Cleveland, Ohio 44105.

By order of the Board of Directors,

Marc A. Stefanski

Chairman of the Board, President and Chief Executive Officer

January 18, 2023

SUPPLEMENT TO PROXY STATEMENT

FOR

2023 ANNUAL MEETING OF STOCKHOLDERS

Unless the context otherwise requires, references in this Supplement to Proxy Statement (this “Supplement”) to “we,” “us,” “our,” or the “Company,” refer to TFS Financial Corporation.

On January 11, 2023, we filed our proxy statement (the “Proxy Statement”) relating to our annual meeting of stockholders to be held on February 23, 2023, at 9:00 a.m., Eastern Time (the “Annual Meeting”), with the Securities and Exchange Commission (the “SEC”).

Subsequent to that date, we determined that we had inadvertently omitted the required proposal to stockholders regarding the frequency of future advisory votes regarding the compensation of the Company’s named executive officers. This Supplement has been prepared to provide our stockholders with information regarding a new advisory proposal to vote on whether future advisory votes on the compensation of the Company’s named executive officers should occur every one, two or three years (the “Say-On-Frequency Proposal”).

The frequency receiving the greatest number of votes will be the frequency recommended by the stockholders. Abstentions and broker non-votes are not considered votes cast for any frequency.

This Supplement is being furnished to our stockholders of record as of the close of business on December 27, 2022, the record date for the determination of stockholders entitled to vote at the Annual Meeting or at any adjournments thereof, pursuant to the accompanying Amended Notice of Annual Meeting of Stockholders. This Supplement and the Amended Notice of Annual Meeting of Stockholders supplement and amend the Notice of Annual Meeting of Stockholders and the Proxy Statement, each dated January 11, 2023, previously filed with the SEC. This Supplement does not provide all of the information that is important to your decision to vote at the Annual Meeting. Additional information is included in the Proxy Statement that was previously made available to our stockholders. We encourage you to carefully read this Supplement together with the Proxy Statement.

Stockholders of record are receiving an updated proxy card with this Supplement that includes the Say-On-Pay Frequency Proposal under Proposal Four. Stockholders of record may vote on all four proposals by submitting the updated proxy card. Properly executed proxies that do not contain voting instructions for any item will be voted in accordance with the recommendations of the Board of Directors.

IT IS IMPORTANT TO INDICATE YOUR VOTE ON EACH PROPOSAL ON THE UPDATED PROXY CARD.

Except for the addition of Proposal Four, this Supplement does not modify, amend, supplement or otherwise affect any matter presented for consideration in the Proxy Statement.

PLEASE VOTE — YOUR VOTE IS IMPORTANT

PROPOSAL FOUR: ADVISORY VOTE ON THE FREQUENCY OF THE EXECUTIVE COMPENSATION ADVISORY VOTE

Under the Dodd-Frank Act, the Company is conducting an advisory vote on whether the advisory vote on compensation of our named executive officers should occur every one, two or three years. The final vote will not be binding on us and is advisory in nature. However, the Company has adopted a policy that it will include an advisory vote on executive compensation similar to Proposal Two consistent with the voting frequency receiving the greatest number of votes cast in its most recent advisory vote on the frequency of future advisory votes on executive compensation.

Our Board has determined that an advisory stockholder vote on executive compensation every year is the best approach for the Company and its stockholders for a number of reasons, including that it provides a consistent and clear communication channel for stockholder opinions about our executive compensation programs.

Our Board of Directors recommends that stockholders vote to recommend an advisory vote on executive compensation every year.

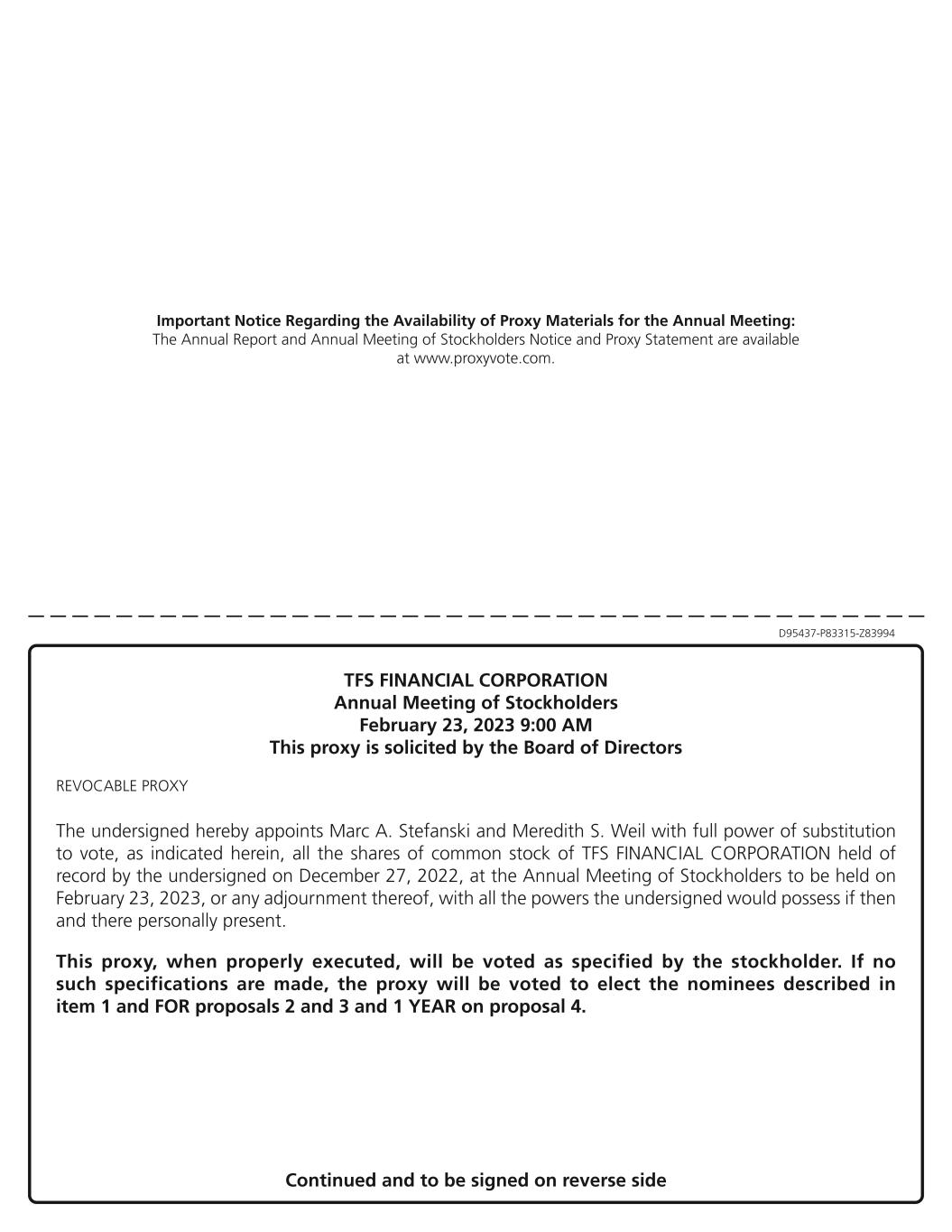

VOTING: REVOCABILITY OF PROXIES

If you sign and return the proxy card, it will revoke and replace any previous proxy you have submitted.

If the proxy card is properly signed, dated and returned and is not revoked, the proxy will be voted at the Annual Meeting in accordance with the shareholder’s instructions indicated on the proxy. If no instructions are indicated on the proxy, the persons named on the proxy card will vote FOR election of each director nominee (Proposal One), FOR the approval, on an advisory basis, of the compensation of our named executive officers (Proposal Two), FOR the ratification of the selection of Deloitte & Touche LLP as the Company’s independent accountants (Proposal Three), and FOR the frequency of the advisory vote on named executive officer compensation to be on an annual basis (Proposal Four).

If you are the beneficial owner of shares held in “street name” by a broker or other nominee, the broker or other nominee, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not provide your broker or other nominee instructions as to how your shares are to be voted, your broker or other nominee will not be able to vote your shares on any of the matters discussed in this Supplement and the Proxy Statement, and your shares will not be voted with respect to those matters. We urge you to provide instructions to your broker or nominee so that your vote may be counted on these important matters. You should direct the vote of your shares by following the instructions provided on the voting instructions card you received from your broker or other nominee and return the voting instructions card to your broker or other nominee in a timely manner to ensure that your shares are voted on your behalf.

You may revoke or change your vote at any time before your proxy has been exercised by filing a written notice of revocation or a duly executed proxy bearing a later date with the Company at the Company’s principal address indicated on the attached Amended Notice of Annual Meeting of Stockholders, by submitting another timely, later-dated vote by telephone or Internet or by giving notice of revocation to the Company in open meeting. However, your presence at the Annual Meeting alone will not be sufficient to revoke your previously-granted proxy or vote. Beneficial stockholders may revoke any prior voting instructions by contacting the broker or other nominee that holds their shares prior to the deadline provided in the voting instructions received from your broker or other nominee.